#Decentralized Exchange Software

Explore tagged Tumblr posts

Text

Why White Label Crypto Exchange Is a Preferred Choice for Startups?

The cryptocurrency market continues to expand at an extraordinary pace, making it an attractive opportunity for startups to carve out a niche in the digital finance world. However, launching a crypto exchange from scratch comes with a host of challenges, including high costs, extended development timelines, and the need for technical expertise. This is where white-label crypto exchange solutions come into play.

White-label platforms offer pre-built, customizable solutions that help startups enter the market quickly and efficiently. These solutions enable businesses to focus on growth, branding, and user acquisition without the technical hurdles of development. Let’s dive into why startups are increasingly opting for white-label crypto exchanges and how they pave the way for success.

What is a White-Label Crypto Exchange?

A white-label crypto exchange is a ready-to-deploy platform developed by a third-party provider, complete with essential features like trading engines, wallets, and security protocols. Startups can customize these platforms to align with their branding and business goals, enabling them to launch a fully functional crypto exchange without the need for extensive technical development.

Why White-Label Solutions Appeal to Startups

Startups often operate with limited resources and tight timelines, making white-label solutions an ideal choice. Here’s why they are so appealing:

1. Speed to Market

White-label crypto exchanges significantly reduce the time required to launch a platform. With pre-built infrastructure in place, startups can focus on customization and branding, allowing them to launch in weeks instead of months.

Early market entry positions startups to capitalize on emerging trends.

Startups can quickly adapt to market demands and user expectations.

2. Affordable Entry Point

Building a custom crypto exchange requires significant financial investment in development, testing, and infrastructure. White-label solutions eliminate these costs, offering an affordable alternative.

Startups can allocate their budgets to marketing and user acquisition rather than technical development.

Flexible pricing models allow businesses to choose solutions that fit their financial constraints.

3. Customization and Branding

White-label platforms offer a high degree of flexibility, allowing startups to create a unique user experience that reflects their brand identity.

Modify the interface, color schemes, and logos to differentiate your platform.

Add specific features like staking, NFTs, or multi-currency wallets to cater to your target audience.

4. Advanced Security Features

Security is a critical aspect of any crypto exchange. White-label solutions come pre-equipped with robust security measures, ensuring the safety of user funds and data.

Features like two-factor authentication (2FA), encryption, and DDoS protection are standard.

Cold wallet storage minimizes risks associated with hacking.

5. Compliance and Regulation Support

Navigating the regulatory landscape can be daunting for startups. Many white-label providers include compliance tools to help businesses adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) standards.

Built-in regulatory modules simplify the process of meeting legal requirements.

Providers often offer updates to keep platforms compliant with changing regulations.

6. Scalability for Growth

A successful crypto exchange must be able to scale with its user base and trading volume. White-label solutions offer the infrastructure needed to grow seamlessly.

Platforms are designed to handle high transaction volumes without compromising performance.

Startups can add new features or expand services as their business evolves.

7. Integrated Liquidity Options

Liquidity is crucial for a smooth trading experience. White-label solutions often include liquidity integration, ensuring users can execute trades without delays.

Access to global liquidity pools ensures seamless transactions.

Liquidity options make platforms more attractive to traders and investors.

Features to Look for in a White-Label Crypto Exchange

To maximize the benefits of a white-label solution, startups should prioritize the following features:

User-Friendly Interface: A clean, intuitive design to attract and retain users.

Multi-Currency Support: Enabling trades in a wide range of cryptocurrencies, including altcoins and stablecoins.

Mobile Compatibility: Mobile apps for iOS and Android to cater to on-the-go traders.

Advanced Trading Tools: Features like margin trading, stop-loss orders, and real-time analytics.

Robust Security: End-to-end encryption and multi-signature wallets.

Scalability: Infrastructure capable of handling rapid growth.

Choosing the Right White-Label Provider

Not all white-label providers are created equal. Selecting the right partner is critical to the success of your crypto exchange. Here are some tips:

Check Their Track Record: Choose a provider with a history of delivering secure, reliable platforms.

Ensure Customization: Make sure the platform allows extensive branding and feature modifications.

Evaluate Security Measures: Confirm that the provider offers cutting-edge security features.

Ask About Support: Post-launch technical support is essential for smooth operations.

Why White-Label Crypto Exchanges are the Future for Startups

White-label solutions are shaping the future of cryptocurrency exchanges by making them accessible to businesses of all sizes. Here’s why this trend will continue:

DeFi Integration: White-label platforms increasingly support decentralized finance (DeFi) features, attracting new user segments.

AI and Analytics: Advanced tools provide traders with actionable insights, enhancing user experience.

NFT Support: The rising popularity of NFTs is driving demand for exchanges that support NFT trading.

By leveraging these innovations, startups can create versatile platforms that cater to diverse user needs.

Conclusion

For startups aiming to enter the cryptocurrency market, white-label crypto exchange solutions offer a practical, cost-effective, and efficient path to success. With their quick deployment, advanced features, and customizable options, these platforms allow businesses to focus on growth rather than development.

Choosing the right white-label provider ensures that your exchange is secure, compliant, and ready to scale. As cryptocurrency adoption continues to grow, startups leveraging white-label solutions are well-positioned to thrive in this dynamic industry.

#P2P Cryptocurrency Exchange Development Company#White Label Crypto Exchange Development#Decentralized exchange software#Decentralized Exchange Development Service#Centralized Crypto Exchange Development Company#crypto exchange platform development#Cryptocurrency Exchange Development Service#crypto exchange development company

0 notes

Text

Unveil Immutable Smart Contract Powered DEX with Trading Protocols

In the rapidly evolving world of cryptocurrency, decentralized exchanges (DEXs) have emerged as a cornerstone of secure and transparent trading. Unlike centralized exchanges, DEXs allow users to trade directly with one another without the need for an intermediary, making them a powerful tool in the pursuit of financial sovereignty. With the rise of DeFi (Decentralized Finance), the demand for robust and secure Decentralized Exchange Software has never been greater. At the heart of this revolution is the concept of immutable smart contracts, which power the next generation of DEXs, ensuring security, transparency, and efficiency.

The Power of Immutable Smart Contracts in DEXs

A decentralized exchange is only as strong as the technology that underpins it. Immutable smart contracts are self-executing contracts with the terms of the agreement directly written into code. Once deployed on a blockchain, these contracts cannot be altered or tampered with, providing a level of security and trust that is unparalleled in traditional financial systems. For traders, this means that transactions are executed precisely as intended, with no risk of interference from external parties.

Immutable smart contracts play a crucial role in the functioning of decentralized exchanges by automating the trading process, reducing the need for manual intervention, and eliminating the possibility of fraud. These contracts ensure that trades are executed at the agreed-upon terms, and once a trade is completed, it is recorded permanently on the blockchain. This not only enhances security but also fosters a high level of transparency, as all transactions are visible to the public.

Plurance: A Pioneer in Decentralized Exchange Development

As the demand for decentralized trading platforms continues to grow, Plurance has established itself as the predominant Decentralized Exchange Development Company. With years of experience in the blockchain and cryptocurrency space, Plurance has been at the forefront of creating innovative Decentralized Exchange Software that meets the needs of modern traders.

Plurance’s Decentralized Exchange Development services are designed to provide businesses with the tools they need to launch secure, efficient, and user-friendly DEXs. By leveraging immutable smart contracts, Plurance ensures that the decentralized exchanges they develop are not only secure but also capable of handling high volumes of trades without compromising on performance. This makes Plurance a trusted partner for businesses looking to enter the competitive world of decentralized finance.

Decentralized Exchange Script: The Key to Quick Deployment

One of the standout offerings from Plurance is its Decentralized Exchange Script. This script is a ready-made solution that allows businesses to quickly deploy their own DEX without having to build it from scratch. The Decentralized Exchange Script is highly customizable, allowing businesses to tailor the platform to their specific needs while ensuring that it adheres to the highest standards of security and performance.

The Decentralized Exchange Script from Plurance is built with scalability in mind. As the user base grows and trading volumes increase, the platform can be easily scaled to accommodate these changes. Moreover, the integration of immutable smart contracts ensures that all trades are executed seamlessly, with no risk of fraud or manipulation.

Embrace the Future of Trading with Plurance

The future of trading lies in decentralization, and Plurance is leading the charge with its cutting-edge Decentralized Exchange Development services. By harnessing the power of immutable smart contracts, Plurance is creating DEXs that are not only secure and transparent but also efficient and user-friendly. Whether you’re a startup looking to enter the DeFi space or an established business seeking to expand your offerings, Plurance provides the tools and expertise needed to succeed.

With Plurance, you can trust that your Decentralized Exchange Software is built to last, providing a solid foundation for your trading platform. Embrace the future of trading with Plurance, the leading Decentralized Exchange Development Company, and unveil a world of opportunities with your own immutable smart contract-powered DEX.

#plurance#Decentralized Exchange Script#Decentralized Exchange Software#Decentralized Exchange Development#Decentralized Exchange Development Company#DEX Script#DEX Software

0 notes

Text

#Decentralized Cryptocurrency Exchange Development#dex development#Decentralized Exchange Software#Decentralized Crypto Exchange Software#Decentralized Exchange Software Development#defi exchange development company

0 notes

Text

Unleash the Future of Trading with Our Decentralized Exchange Software!

🚀 Are you tired of the limitations and risks posed by centralized exchanges? Ready to embrace the next evolution in trading? Look no further! Our Decentralized Exchange Software empowers you with unprecedented control over your assets, a transparent trading environment, and a seamless user experience.

🔒 Security Redefined: Say goodbye to sleepless nights worrying about exchange hacks. Our software employs state-of-the-art security measures, leveraging blockchain technology to safeguard your funds. Your private keys remain exclusively in your hands, ensuring unparalleled protection.

🔑 Ownership & Control: Retain complete ownership of your assets. No more reliance on third parties – you're the sole custodian. Trade directly from your wallet and experience the true essence of decentralization.

📈 Transparent Trading: Every transaction is permanently etched onto the blockchain, fostering a culture of trust and transparency. Bid farewell to manipulative practices often associated with centralized platforms.

🌍 Global Accessibility: We're erasing borders and bridging gaps. Our software grants you access to the world of decentralized finance, irrespective of your geographic location. No more navigating through regulatory mazes.

📱 User-Centric Interface: Whether you're a seasoned trader or a crypto newbie, our intuitive interface ensures a smooth experience for everyone. Enjoy hassle-free trading with a platform designed with you in mind.

💰 Liquidity Pools & Passive Income: Looking to earn while you trade? Our software supports liquidity pools, enabling you to contribute assets and earn rewards. Enjoy trading opportunities while your funds work for you.

🤝 Community-Driven Development: We believe in the power of collaboration. Our software is open-source, inviting developers and enthusiasts to contribute to its growth. Together, we shape the future of decentralized exchanges.

🌐 Join the Decentralized Revolution: Ready to break free from the limitations of traditional exchanges? Eager to embrace a future where you control your financial destiny?

0 notes

Text

Decentralised Exchange Development in 2025: Build Smarter, Trade Better

A decentralised exchange (DEX) is a p-to-p marketplace that allows users to trade crypto without requiring custody. Remove the middleman from the money transfer process. Traditionally, banks, brokers, payment processors, and others function as intermediaries facilitating the exchange of assets through secure blockchain smart contracts. Businesses can create blockchain-based platforms under their own branding and with their own customisations with the assistance of our decentralised exchange development company. Everything can be altered to meet the needs of our clients. Even after the job is completed, we provide round-the-clock assistance and support.

For more details - https://www.clarisco.com/decentralized-exchange-development

Book a Free Demo - https://www.clarisco.com/contact

#decentralized exchange development company#decentralized exchange application development#decentralized exchange development services#decentralized exchange software development company#decentralized exchange software development services#defi exchange development company#defi exchange development services#defi exchange platform development company#decentralized exchange development

0 notes

Text

Defi lending borrowing platform development Services Discover financial empowerment with Mobiloitte's DeFi Lending and Borrowing Platform Development. Our expert team crafts decentralized solutions using smart contracts and DApps, revolutionizing lending and borrowing. Seamlessly merge blockchain and finance, creating secure, efficient, and market-leading platforms that redefine traditional financial transactions.

#defi lending and borrowing platform development company#amm defi app#decentralized finance on binance smart chain#goose defi#what is defi crowdfunding#defi lending & borrowing software#decentralized finance development#defi exchange development#defi lending and borrowing platform development#defi staking platform development#defi token development company#defi token development#decentralized finance platforms#defi development#defi wallet development solutions#defi crowdfunding platform development#benefits of defi crowdfunding#defi development company#defi lending and borrowing platform#DeFi Lending / Borrowing Platform Concept#DeFi Lending Platform Services#DeFi Lending and Borrowing Software#DeFi lending platforms

0 notes

Text

MLM Software & mlm software demo

MLMYug is a leading provider of MLM software that offers a comprehensive range of features to help businesses manage their multi-level marketing operations. The company has been in the MLM software business for many years and has helped numerous clients grow their business with its innovative solutions.

The MLMYug software is designed to streamline MLM operations and make it easier for businesses to manage their sales, commissions, and payouts. The software comes with a user-friendly interface and can be customized to meet the unique needs of each business.

One of the key features of MLMYug software is its ability to track and manage sales. The software allows businesses to monitor the performance of their distributors and track their sales in real-time. This helps businesses identify their top performers and incentivize them accordingly.

The MLMYug software also comes with a powerful commission management system. The software automates the commission calculation process and ensures that distributors are paid accurately and on time. This helps businesses maintain transparency and build trust with their distributors.

Another important feature of MLMYug software is its ability to manage payouts. The Mlm software Demo allows businesses to process payouts quickly and efficiently, which helps them maintain good relationships with their distributors. The software also provides detailed payout reports, which can be used for accounting and auditing purposes.

MLMYug software is also highly secure and reliable. The software uses advanced encryption and authentication protocols to protect sensitive data and prevent unauthorized access. The software also comes with robust backup and disaster recovery mechanisms, which ensure that businesses can recover quickly in case of any data loss or system failure.

In addition to its software offerings, MLMYug also provides excellent customer support. The company has a team of experienced professionals who are available round-the-clock to assist clients with any issues they may face. The company also provides training and consultation services to help businesses get the most out of their MLMYug software.

In conclusion, MLMYug is a leading provider of MLM softwarethat offers a wide range of features to help businesses manage their multi-level marketing operations. The company's software is user-friendly, customizable, and comes with advanced features for sales tracking, commission management, and payouts. With its excellent customer support and commitment to innovation, MLMYug is the ideal choice for businesses looking to grow their MLM operations.

#mlm software demo#MLM Software#latest mlm plan#matrix mlm plan#Smart Contract Development in India#Crypto Token Development#blockchain development services in jaipur#mlm software company jaipur rajasthan#Binance Token Development in India#Decentralized Cryptocurrency Exchange Development#mlm software in kolkata#mlm software in chandigarh#mlm software company in hyderabad#MLM Smart Contract Development Company

0 notes

Text

Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025

In thi Article about Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025, Read it out.

What is Cryptocurrency Exchange

To purchase, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin, you go to an online marketplace called a cryptocurrency exchange. Cryptocurrency exchanges work much like stock exchanges, except instead of issuing or trading stocks, you trade digital currencies.

In simple terms, it’s where Buyers and sellers meet to exchange cryptocurrencies. You can buy cryptocurrency with ordinary money (such as dollars or euros) or swap one cryptocurrency for another. Some exchanges allow you to store your crypto in secure wallets held on the platform.

There are two main types:

Centralized exchanges (CEX)

Decentralized exchanges (DEX)

What is Cryptocurrency Exchange Clone Script

The Cryptocurrency Exchange Clone Script is a ready-made program that simulates the technical features and functionality of popular cryptocurrency exchanges such as Binance, Coinbase, Kraken, or Bitfinex. Compared to developing from scratch, the clone scripts significantly ease and shorten the time required to set up a cryptocurrency exchange network for an aspiring entrepreneur and firms.

These sort of scripts are somewhat equipped with all the basic features to run a cryptocurrency exchange, like user account management, wallet integration, order book, trading engine, liquidity management, and options for secure payment gateways. The whole idea of a clone script is to give you something out-of-the-box that can be customized, thus allowing you to skip the whole painful development process but still be able to modify the script to suit your needs.

Top 6 Cryptocurrency Exchange Clone Scripts

There are many clone scripts for cryptocurrency exchange development, but here are the top 6 of the cryptocurrency exchange clone script.

Binance clone script

Coinbase Clone Script

Kucoin Clone Script

Paxful Clone Script

WazirX clone script

FTX Clone Script

Binance clone script

A Binance clone script is a Pre-made software that is almost ready for use to create your own cryptocurrency exchange platform, along the way simulating Binance, one of the largest and most popular exchanges in the world. This “clone” is a reapplication of some of the features and functionality of Binance, but it can allow for some level of customization depending upon your particular brand and need.

Key Features:

User Registration and Login

Multi-Currency Support

Trading Engine

Multi-Layer Security

Admin Dashboard

Wallet Integration

KYC/AML Compliance

Liquidity Management

Mobile Compatibility

Referral and Affiliate Program

Trading Fees and Commission Management

Live Market Charts and Trading Tools

Coinbase clone script:

The Coinbase clone script is a ready-made solution that allows you to set up a cryptocurrency exchange platform exhibiting features and functionalities similar to the world’s most popular and user-friendly crypto exchange, Coinbase. These scripts are bundled with all the necessary features to run an exchange while still offering ample customization to cater to your branding and business requirements.

Key Features:

User Registration and Account Management

Fiat and Crypto Support

Secure Wallet Integration

Quick Buy/Sell Functionality

Multiple Payment Methods

P2P Trading

Admin Dashboard

Launchpad Functionality

Staking Feature

KYC/AML Compliance

API Integration

Kucoin Clone Script

A KuCoin clone script is a ready-made software solution replicating all functional attributes and operational features of the KuCoin, which can also be customized according to your brand name and business requirement specifications. Fast and feasible for launching your crypto exchange, the idea is to save yourself from the headaches of developing everything from scratch.

Key Features:

Spot trading

Margin trading

Future trading

Crypto derivatives

Advanced security transactions

Escrow protection

User registration

Wallet integration

Advanced analytics

Currency converter

Paxful clone script

A Paxful clone script is a ready-Made platform for opening a peer-to-peer cryptocurrency exchange for users to trade Bitcoin and other cryptocurrencies directly among themselves without any intermediaries. The script replicates the core features of Paxful operated using its server; you can customize it to your brand and business needs.

Key Features:

Secured Escrow Service

Multi Payment Processing

BUY/SELL Ad posting

Real-Time Data

Referrals & Gift Card options

Multi Language Support

Online/Offline Trading

Cold/Offline Wallet Support

FTX Clone Script

An FTX clone script is a ready-made software solution that will allow you to set up your own cryptocurrency exchange like FTX, which was formerly one of the largest crypto exchanges globally before going under in 2022. This script mimics the core features of FTX, such as spot trading, derivatives, margin trading, token offering, etc., so that you can fast-track the launch and operations of your own exchange with customizable branding and features.

Key Features:

Derivatives Trading

Leveraged Tokens

Spot Trading

User-Friendly Interface

KYC/AML Compliance

Staking Functionality

WazirX clone script

A WazirX Clone Script is a pre-made software solution for the creation of your cryptocurrency exchange platform akin to WazirX, one of the top cryptocurrency exchanges in India. The clone script replicating the essential elements, functionality, and WazirX’s user experience enables you to swiftly put together a fully fledged cryptocurrency exchange that would accept a number of digital assets and trading features.

Key Features:

Escrow protection

KYC approval

Trading bots

User-friendly interface

Stunning User Dashboard

SMS Integration

Multiple Payment Methods

Multiple Language Support

Benefits of Using Cryptocurrency Exchange Clone Scripts

The use of a cryptocurrency exchange cloning script entails great advantages, particularly if one is keen on starting an exchange without having to do the full development from scratch. Below, I have listed the primary advantages of using cryptocurrency exchange cloning scripts:

Cost-Effective

Quick and Profitable Launch

Proven Model

Customizable Features

Scalability

Multi-Currency and Multi-Language Support

Low Development Cost

Continuous Support and Updates

Why Choose BlockchainX for Cryptocurrency Exchange clone script

In the opinion of an entrepreneur set to develop a secure, scalable, and feature-loaded cryptocurrency exchange clone script, BlockchainX is the best bet. Since BlockchainX provides a full-fledged solution that replicates the features of flagship cryptocurrency exchanges such as Binance, Coinbase, and WazirX, the entrepreneur gets all the additional features required practically out of the box. With the addition of certain basic offerings such as spot trading, margin trading, and peer-to-peer (P2P) capabilities along with more advanced ones like liquidity management and derivatives trading, BlockchainX provides a holistic set of solutions to carve out an exchange rightly fitted for newbies and pros alike.

Conclusion:

In conclusion, the Top 6 Cryptocurrency Exchange Clone Scripts in 2025 are high-powered and feature-rich solutions which any enterprising spirit would find indispensable if they were to enter the crypto market very quickly and efficiently. Whether it be a Binance clone, Coinbase clone, or WazirX clone-these scripts offer dynamic functionalities that enhance trading engines, wallets, KYC/AML compliance, and various security attributes.

Choosing the right clone script, such as those provided by BlockchainX or other reputable providers, will give you a strong foundation for success in the dynamic world of cryptocurrency exchanges.

#cryptocurrency#cryptocurrency exchange script#exchange clone script#binance clone script#clone script development#blockchainx

2 notes

·

View notes

Text

In the fall of 2020, as crypto scammers and thieves began to realize the full potential of a financial privacy tool called Tornado Cash—a clever new system capable of shuffling users' funds to cut the trail of crypto transactions recorded on the Ethereum blockchain—Alexey Pertsev, one of the creators of that service, sent a note to his fellow cofounders about this growing issue. He suggested crafting a standard response to send to victims pleading with Tornado Cash for help with stolen funds laundered through their service. “We must compose a message that we will send to everyone in similar cases,” Pertsev, the then-27-year-old Russian living in the Netherlands, wrote to his colleagues.

Tornado Cash cofounder Roman Semenov answered three minutes later with a draft of their stock response—essentially pointing to the fact that the service's novel design meant it ran on the Ethereum blockchain, not on any server they owned, and was thus out of their hands. “It is a decentralized software protocol that no one entity or actor can control,” the message read. “For that reason, we are unable to assist with respect to any issues relating to the Tornado Cash protocol.”

That statement would remain Tornado Cash's position two days later when hackers affiliated with the North Korean government stole roughly $275 million worth of coins from the crypto exchange KuCoin and funneled a portion of the loot through Tornado Cash to cover their tracks. Tornado Cash would maintain that stance as, according to Dutch prosecutors, a billion-plus dollars more of stolen funds flowed through the service over the next two years, part of at least $2.3 billion in total funds from criminal and sanctioned sources that made up more than 30 percent of the service's overall transactions from 2019 to 2022.

Now, two years after Pertsev's arrest and indictment for money laundering, that “out-of-our-hands” decentralization defense has become one of the central arguments for his innocence. On Tuesday, it will be put to the test when a panel of three Dutch judges rules on the criminal charges that could send Pertsev to prison for years. Privacy advocates believe the result of the case—the first of two, as the New York prosecution of another Tornado Cash cofounder, Roman Storm, is expected to go to trial this coming September—could also shape the future of cryptocurrency privacy and may determine the limits of services like Tornado Cash or other open source software creations to offer a safe haven from financial surveillance.

Dutch prosecutors have accused Pertsev of essentially creating the perfect money laundering machine by designing Tornado Cash to work as a set of “smart contracts”—a type of decentralized service made possible by Ethereum's unique features, in which code is copied to the thousands of Ethereum nodes that store the cryptocurrency's blockchain—and thus preventing Tornado Cash's creators from identifying or controlling who used the service to hide the origins and destinations of their funds.

Pertsev's defenders, on the other hand, point out that those properties are also exactly what makes Tornado Cash such a powerful tool for privacy. “This is the entire point of a decentralized system,” says Sjors Provoost, a Dutch cryptocurrency developer and author of Bitcoin: A Work in Progress, who attended Pertsev's trial. “These are completely clashing worldviews. There's the worldview of privacy and decentralization, and there's the government worldview of surveillance, in which you need to be able to check every transaction.”

Since US and Dutch prosecutors indicted Tornado Cash's cofounders and the US Treasury sanctioned the service in 2022, the case has become a cause célèbre in some cryptocurrency circles, many of whose adherents argue that a guilty verdict could not only damage financial privacy but also set a dangerous precedent that developers of open source software can be held liable for the actions of those who use their tools. Ethereum's inventor, Vitalik Buterin, has noted publicly that he used Tornado Cash to anonymize a donation to Ukraine following Russia's invasion, as an example of the service's legitimate use for privacy. US National Security Agency whistleblower Edward Snowden has compared Tornado Cash's functioning on the Ethereum's blockchain to a water fountain built in a park—a kind of public utility where “you push a button and privacy comes out”—and has called the crackdown on Tornado Cash and its cofounders “deeply illiberal and profoundly authoritarian."

Yet the Dutch prosecutors and Netherlands' financial law enforcement agency, known as FIOD, which led the investigation of Pertsev, argue that the case isn't actually about a fundamental conflict between privacy and security, or liability for open source code, or any other larger principle. Instead, they say, it's about Pertsev's specific, informed decisions to enable thieves on an enormous scale. “It's all about the choices of our suspect,” M. Boerlage, the case's lead prosecutor, tells WIRED in an interview. “He made choices writing the code, deploying the code, adding features to the ecosystem. Choice after choice after choice, all while he knew that criminal money was entering his system. So it's not about code. It's about human behavior.”

A Room Without a Lock—or Walls

Dutch prosecutors contend that, despite the Tornado Cash creators' claims, they did exert control over it. Aside from its decentralized “smart contract” design, they point to Tornado Cash's web-based user interface for interacting with its blockchain-based smart contract: a fully centralized tool running on infrastructure the creators built and managed, which nonetheless had no monitoring or safeguards to prevent its abuse by criminals for money laundering. In fact, prosecutors found that during the time of their investigation, 93.5 percent of users sent their transactions to Tornado Cash through that web interface, which was far simpler to use than directly interacting with the blockchain-based service.

Pertsev's defense didn't respond to WIRED's repeated requests for an interview. But his lead defense attorney, Keith Cheng, has countered that there would have been no point in monitoring or blocking users on that web interface when anyone could circumvent the website altogether to interact directly with the smart contract or even to build their own interface. “The Tornado Cash smart contracts could be accessed directly at any point of time,” Cheng told an audience at the ETHDam cryptocurrency conference in Amsterdam last year. “Implementing checks within the surrounding infrastructure is akin to adding extra locks to a door that lacks surrounding walls.”

The prosecution points out that Tornado Cash could have at least tried to put locks on that door, given that the vast majority of their users, both legitimate and criminal, were walking through it. More fundamentally, they argue that it was Pertsev's decision to put into place a system that he knew from the start would include basic elements he couldn't control. “Building and deploying something unstoppable is also a decision,” says Boerlage.

That question of decentralization and control nonetheless makes the Tornado Cash case a far less straightforward prosecution than those against the founders of simpler bitcoin-based “mixer” services like Bitcoin Fog or Helix, which were similarly intended to prevent cryptocurrency tracing. In each of those earlier cases, the administrators—now both convicted of money laundering conspiracy—hid their connections to the services. By contrast, Pertsev and his cofounders appear to have been confident enough in their remove from the money launderers who used Tornado Cash that they operated fully in the open, under their real names. “This complete transparency does not exactly indicate criminal activity,” Pertsev's attorney Cheng told ETHDam.

At the same time, the prosecution argues that Pertsev was both aware of and untroubled by the millions and ultimately billions of dollars in stolen cryptocurrency flowing through Tornado Cash, which reached a peak in the spring of 2022. They argue that Pertsev continued to maintain and develop pieces of the system—such as its centralized frontend—even as the service was used to launder the stolen funds from 36 distinct cryptocurrency heists, many of which prosecutors say he and his cofounders discussed in their communications. In the meantime, he also profited handsomely, in part from Tornado Cash's issuing its own crypto token, ultimately making more than $15 million and buying himself a Porsche.

When North Korean hackers stole more than $600 million from the blockchain-based game Axie Infinity in March of 2022, Tornado Cash cofounder Semenov wrote anxiously to Pertsev and Storm that “the fucking disaster is about to begin,” perhaps fearing that their service would be used by the perpetrators of that massive heist, as it already had been in well over a dozen others. Pertsev weighed in 10 minutes later, writing “noticed after 5 days, lol," an apparent reference to how long it seemed to have taken Axie Infinity to discover the theft. Sure enough, less than a week later, hundreds of millions of dollars in stolen Axie Infinity funds began to pour into Tornado Cash.

Prosecutors have pointed to Pertsev's “lol” as a sign of his flippant disregard for the victims whose funds, they argue, he was helping to launder. His defense has countered that he was merely expressing surprise.

That same month, perhaps in response to the growing spotlight on Tornado Cash's use by criminals, Pertsev and his cofounders did, in fact, implement a free tool from blockchain analysis firm Chainalysis that would block transactions from sanctioned Ethereum addresses via their web interface. The prosecution has pointed out that the free tool was easily circumvented—hackers could merely move their stolen coins to a different address before sending them into Tornado Cash—and described the effort as “too little and too late."

In their statement to the court, Dutch prosecutors suggest a different solution, if Pertsev had actually cared about Tornado Cash's exploitation by criminals. “What was the simplest option? Take the UI offline and stop advertising. Plain and simple,” they write. “Stop offering the service.”

In the conclusion of that same statement to the court, they point out that under Dutch law the maximum prison sentence for money laundering at the scale Pertsev allegedly committed is eight years, and they ask that Pertsev be sentenced to five years and four months if he's found guilty.

The Tornado Rolls On

Cryptocurrency advocates focused on privacy and civil liberties will be closely watching the outcome of Pertsev's case, which many see as a bellwether for how Western law enforcement and regulators will draw the line between financial privacy and money laundering—including in some immediate cases to follow.

The US trial of Tornado Cash's Storm in a New York court later this year, as well as the US indictment last month of the founders of Samourai Wallet, which prosecutors say offered similar privacy properties to Tornado Cash's, are more likely to directly set precedents in US law. But Pertsev's case may suggest the direction those cases will take, says Alex Gladstein, the chief strategy officer for the Human Rights Foundation and an advocate of bitcoin's use as a human rights tool.

“What happens in the Netherlands will color the New York case, and the Tornado Cash cases are really going to color the outcome of the Samourai case,” Gladstein says. “These cases are going to be historic in the precedents they set.”

Gladstein, like many crypto privacy supporters, argues that anyone weighing the value of tools like Tornado Cash should look beyond its use by hackers to countries like Cuba, Venezuela, and India, where activists and dissidents need to hide their financial transactions from repressive governments. “For human rights activists, it’s essential that they have money the government can’t surveil,” Gladstein says.

Regardless of the verdict in Pertsev's case or that of his cofounder Roman Storm in the fall, Tornado Cash's founder's core argument—that Tornado Cash's underlying infrastructure has always been out of their hands—has proven to be correct: Tornado Cash lives on.

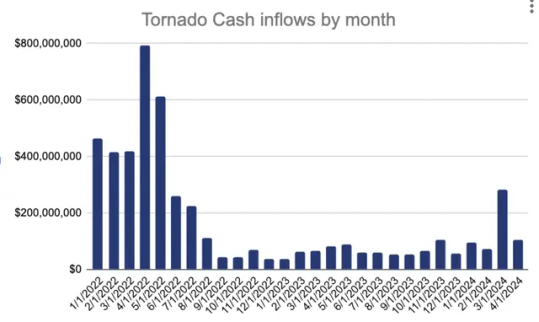

True to its promise of decentralization, Tornado Cash still persists after its cofounders indictment in the fall of last year—and is now out of their control. In March, $283 million flowed into the service. Courtesy of Chainalysis

When the tool's centralized web-based interface went offline last year in the wake of US sanctions and the two cofounders' arrests—Roman Semenov, for now, remains free—Tornado Cash transactions dropped by close to 90 percent, according to Chainalysis. But Tornado Cash has remained online, still functioning as a decentralized smart contract. In recent months, Chainalysis has seen its use tick up again intermittently. More than $283 million flowed into the service just in March.

In other words, whether it represents a public utility for financial privacy and freedom or an uncontrollable money laundering machine, its creators' claim has borne out: Tornado Cash remains beyond their control—or anyone's.

9 notes

·

View notes

Text

STON.fi: The Future of Decentralized Trading on TON Blockchain

In a world where control over your finances is more important than ever, STON.fi steps up as the leading decentralized exchange (DEX) on The Open Network (TON) blockchain. It’s not just about trading; it’s about empowering you to take full control of your digital assets. Let’s break it down into simple, relatable terms.

What Makes STON.fi Special

Have you ever traded crypto and worried about losing access to your funds? Or felt frustrated by slow, costly transactions? STON.fi solves these problems by letting you trade directly without intermediaries. You control your private keys, ensuring your funds are always safe.

With advanced tech like Request for Quote (RFQ) protocols and Hashed Timelock Contracts (HTLC), STON.fi guarantees quick, transparent, and secure transactions. You’re either getting exactly what you agreed on, or the trade doesn’t happen. No middlemen, no surprises.

Trade Made Simple: Swapping TON-Based Tokens

Imagine swapping one crypto for another without the hassle of converting to fiat first. That’s what STON.fi offers. You can trade $TON for other TON-based tokens with ease, all while enjoying low fees (just 0.3% per trade).

Here’s the kicker: when you trade, part of the fee goes back to liquidity providers, meaning the community benefits as a whole.

Earning Opportunities on STON.fi

Who doesn’t love making their money work for them? STON.fi offers several ways to earn:

1. Provide Liquidity: By adding your tokens to liquidity pools, you earn rewards based on your contribution.

2. Farming: Stake LP tokens to get even more rewards from specific pools.

3. STONbassador Program: Promote STON.fi and earn for helping the platform grow.

Meet the $STON Token

Think of $STON as the backbone of the STON.fi ecosystem. It’s used for governance, gas fees, and transactions. Plus, it has a limited supply of 100 million, making it a valuable asset over time.

STON.fi takes community seriously. That’s why half of all $STON tokens are reserved for the DAO (Decentralized Autonomous Organization). This means you get a say in how the platform evolves, from deciding new features to choosing supported assets.

For Builders: The STON.fi SDK & Grants

Are you a developer? STON.fi has something for you too. Their SDK (Software Development Kit) makes it easy to integrate wallets, exchanges, and games into the platform. And if you have a great idea, the STON.fi grant program can fund you with up to $10,000 USDT.

The Future: STON.fi V2

STON.fi isn’t just about today; it’s building for tomorrow. Here’s what’s coming:

Multi-Chain Integration: Trade across networks like Polygon and EVM-compatible chains.

Telegram Bot for Cross-Chain Swaps: Trade assets directly from your Telegram app.

Margin Trading: Use borrowed funds to amplify your trades.

STON.fi is committed to staying ahead of the curve, making it the go-to platform for traders, developers, and crypto enthusiasts alike.

Why STON.fi

STON.fi isn’t just a DEX; it’s a complete ecosystem designed to make trading simple, secure, and rewarding. Whether you’re looking to trade, earn, or build, STON.fi has the tools and opportunities you need to thrive in the decentralized world.

Ready to take control of your crypto journey? Explore STON.fi today and see the difference.

#Crypto #DeFi #STONfi #TONBlockchain

2 notes

·

View notes

Text

AML and KYC Guidance for Crypto Exchanges and Wallets

As cryptocurrency adoption grows, so does the scrutiny from regulators worldwide. For crypto exchanges and wallet providers, adhering to Anti-Money Laundering (AML) and Know Your Customer (KYC) guidelines is not just a regulatory requirement but a critical factor in building trust and credibility with users. AML and KYC measures are essential for preventing fraud, money laundering, and other illicit activities in the crypto space. In this guide, we’ll explore key AML and KYC principles for crypto platforms and how partnering with the best crypto exchange platform development company can help implement effective compliance solutions.

Why AML and KYC Are Essential for Crypto Exchanges and Wallets

Cryptocurrencies offer a high degree of privacy and freedom, making them appealing for legitimate users and, unfortunately, for those seeking to carry out illicit activities. AML and KYC measures play a crucial role in mitigating risks such as:

Preventing Money Laundering and Terrorist Financing: AML regulations are designed to stop the flow of illicit funds through crypto exchanges by verifying users’ identities and monitoring transactions.

Building User Trust: KYC protocols establish a secure environment by verifying user identities, creating a sense of security that encourages more users to engage with the platform.

Regulatory Compliance: Most jurisdictions now require crypto exchanges to implement AML and KYC protocols to operate legally. Non-compliance can lead to fines, loss of licenses, and reputation damage.

By integrating robust AML and KYC systems, crypto exchanges and wallets not only meet regulatory requirements but also position themselves as safe and trustworthy platforms in an increasingly competitive market.

Key AML and KYC Measures for Crypto Platforms

AML and KYC involve a series of checks and processes to verify user identities and monitor transactions. Here are the key measures every crypto exchange and wallet provider should implement:

1. Identity Verification

Identity verification is the cornerstone of KYC compliance. It ensures that each user’s real identity is verified before they can transact on the platform. This process often involves:

Document Verification: Users submit government-issued identification documents, such as a passport or driver’s license, to verify their identity. Automated tools use AI to check document authenticity and speed up the verification process.

Biometric Verification: Facial recognition or fingerprint scans are increasingly used for additional security, ensuring the user is who they claim to be.

These checks prevent anonymous users from accessing the platform, reducing the risk of fraud and illegal activity.

2. Address Verification

In certain jurisdictions, verifying the physical address of users is mandatory. This can involve submitting a recent utility bill or bank statement that confirms the user’s address. Address verification adds an extra layer of KYC compliance, helping to ensure that users meet regulatory requirements and preventing access from restricted locations.

3. Transaction Monitoring

Transaction monitoring is a critical AML measure that involves tracking user transactions to identify and flag suspicious activity. Key components include:

Pattern Analysis: Algorithms analyze user transactions to detect unusual behavior, such as large withdrawals or rapid trades, which could indicate money laundering.

Real-Time Alerts: Real-time alerts notify compliance officers of suspicious transactions, allowing for swift investigation and intervention.

Behavioral Analysis: Behavioral patterns, such as location changes and frequent large transactions, are monitored to detect any unusual activities.

This continuous monitoring process enables exchanges to detect and prevent potential money laundering or other illicit activities before they escalate.

4. Risk Assessment and Customer Due Diligence (CDD)

Risk assessment categorizes users based on factors such as transaction volume, trading patterns, and geographic location to assess their risk level. Customer Due Diligence (CDD) includes measures like verifying identity and assessing the risk of individual users. Higher-risk users, such as those from regions with weak AML regulations, may require Enhanced Due Diligence (EDD), which includes additional checks and monitoring.

5. Ongoing Monitoring and Updating Records

AML and KYC compliance isn’t a one-time process. Platforms must regularly review and update user records, especially when a user’s risk profile changes. This can involve updating KYC data annually or conducting spot checks based on user activity. Ongoing monitoring keeps user records up to date and ensures compliance as regulations evolve.

Best Practices for AML and KYC Compliance

Implement Automated Solutions: Manual KYC processes can be time-consuming and prone to errors. Automated tools speed up document verification, pattern analysis, and other checks, improving efficiency and accuracy.

Stay Updated on Global Regulations: AML and KYC regulations differ by region. The best crypto exchange platform development company will ensure your platform remains compliant with regulations across jurisdictions, including US FinCEN, EU AMLD5, and FATF guidelines.

User Education and Transparency: Inform users about the importance of KYC and AML measures. Transparency about security practices builds trust and encourages users to complete verification processes.

Partner with a Reputable Development Company: Building and maintaining an AML and KYC-compliant platform is complex. Partnering with an experienced development company ensures that your crypto exchange or wallet has the tools necessary for secure and compliant operations.

The Role of a Crypto Exchange Platform Development Company

The technical requirements for AML and KYC compliance are complex and continually evolving. Partnering with the best crypto exchange platform development company can help exchanges and wallet providers implement compliant, scalable solutions while focusing on the user experience. Here’s how a reputable development partner can help:

Customizable KYC and AML Solutions: An experienced development company can create KYC and AML protocols tailored to your specific regulatory requirements. They can integrate various identity checks, transaction monitoring systems, and automated alerts into your platform.

Advanced Security Protocols: Security is a top priority in crypto exchange development. Development companies can implement data encryption, secure data storage, and two-factor authentication to protect sensitive user information.

Compliance Updates: Regulations change frequently, and crypto platforms need to stay compliant. A development partner ensures your platform’s compliance features stay up-to-date, minimizing legal risks.

User-Friendly Design: KYC processes should be secure yet user-friendly. An experienced development company designs platforms with an easy-to-follow KYC journey, ensuring a seamless experience while maintaining high-security standards.

Challenges and Future Trends in AML and KYC for Crypto

As the crypto landscape evolves, so will AML and KYC practices. Potential future trends include:

Blockchain-Based Digital IDs: Blockchain-driven digital identities could streamline KYC processes across platforms, allowing users to complete KYC once and share verified data across multiple exchanges.

AI-Powered Compliance Tools: Artificial intelligence could enhance AML monitoring by learning from patterns and identifying complex fraudulent behaviors in real time.

Regulatory Convergence: As crypto becomes mainstream, regulations are expected to become more unified across regions, making global compliance slightly easier for crypto exchanges and wallets.

Conclusion

For crypto exchanges and wallet providers, AML and KYC compliance is essential for preventing fraud, building user trust, and adhering to regulatory standards. Implementing robust identity verification, transaction monitoring, and risk assessment processes helps ensure a secure environment for users. Partnering with the best crypto exchange platform development company can simplify compliance by providing the tools, technology, and expertise needed to build a secure, user-friendly, and compliant platform.

As AML and KYC standards evolve, staying proactive in compliance is key. Crypto exchanges and wallets that prioritize these practices protect their users and establish themselves as trustworthy players in the rapidly growing digital finance space.

#P2P Cryptocurrency Exchange Development Company#crypto exchange development company#White Label Crypto Exchange Development#Cryptocurrency Exchange Development Service#decentralized crypto exchange development#Decentralized exchange software#crypto exchange platform development

0 notes

Text

How businesses can earn revenue by launching a Perpetual Exchange?

In the world of cryptocurrency, perpetual exchanges have emerged as a lucrative avenue for businesses to generate revenue. But what exactly is a perpetual exchange, and how can businesses benefit from launching one? Let's delve into the basics.

A perpetual exchange, in simple terms, is a platform where traders can buy and sell cryptocurrencies without an expiration date. Unlike traditional exchanges where trades are executed within a set timeframe, perpetual exchanges allow for continuous trading, hence the term "perpetual." This flexibility attracts traders who seek round-the-clock access to the crypto market.

For businesses looking to capitalize on this growing trend, launching a perpetual exchange can be a strategic move. By leveraging decentralized crypto perpetual exchange software, provided by leading crypto perpetual exchange development company, Plurance, businesses can establish their own decentralized exchange platform tailored to their specific needs.

So, how exactly can businesses earn revenue through a perpetual exchange?

Trading Fees: One of the primary revenue streams for perpetual exchanges is through trading fees. Every trade executed on the platform incurs a small fee, which accumulates over time. By attracting a large user base and facilitating high trading volumes, businesses can generate substantial revenue from these fees.

Leverage Trading: Perpetual exchanges often offer leverage trading options, allowing traders to amplify their positions with borrowed funds. While this increases the risk for traders, it also presents an opportunity for businesses to earn revenue through interest on leveraged trades.

Market Making: Businesses can act as market makers on their own exchange, providing liquidity by continuously buying and selling assets. In return for this service, market makers earn a spread on each trade, contributing to the exchange's revenue.

Listing Fees: Cryptocurrency projects seeking exposure often pay listing fees to have their tokens listed on popular exchanges. By offering a platform for token listings, businesses can earn revenue through these fees while also expanding their exchange's asset offerings.

Token Sales and IEOs: Perpetual exchanges can host token sales or initial exchange offerings (IEOs) for new cryptocurrency projects. By facilitating these fundraising events, businesses can earn revenue through participation fees or a percentage of the tokens sold.

Conclusion:

Launching a perpetual exchange presents businesses with a lucrative opportunity to tap into the growing crypto market. Plurance provides the best crypto perpetual exchange software that helps businesses to create a decentralized exchange tailored to their needs and capitalize on various revenue streams. By staying innovative and responsive to market demands, businesses can position themselves for long-term success in the dynamic world of cryptocurrency exchanges.

Contact us to get a free demo of Decentralized Perpetual Exchange Software!

#Crypto Perpetual Exchange Development Company#Crypto Perpetual Exchange Development#Crypto Perpetual Exchange Development Services#Decentralized Perpetual Exchange Software#Crypto Perpetual Exchange Software

0 notes

Text

#Decentralized Exchange Development#Decentralized Crypto Exchange Software#Decentralized Exchange Software

0 notes

Text

Why Bitcoin Over Others?

In a world where thousands of cryptocurrencies seem to appear overnight, it’s easy to lump them all together and label them “just another digital coin.” But doing so misses a crucial point: not all digital assets are created equal. Bitcoin, the original cryptocurrency, stands distinctly apart from the rest. Its history, security, decentralization, and unwavering principles set it on a pedestal far above the flood of imitators. Today, we’ll explore what makes Bitcoin so special—and why it remains the cornerstone of the entire crypto movement.

1. Immaculate Conception and Fair Launch Bitcoin emerged during the aftermath of the 2008 financial crisis, introduced by an unknown individual or group under the pseudonym Satoshi Nakamoto. Unlike many cryptocurrencies that began with pre-mines, venture capital backing, or a charismatic founder front and center, Bitcoin was offered to the world at large with no special advantages for early insiders. Its code was released as open-source software, and anyone could join, mine, and participate. This clean, decentralized birth means there’s no central authority pulling the strings—just a global, diverse community contributing to its growth.

2. Proven Security and Longevity One of the greatest strengths of Bitcoin is its track record. For over a decade, it has operated without needing to “restart” or rewrite its ledger, all while withstanding countless hacking attempts and periods of extreme volatility. Its security model, powered by a vast network of miners performing billions of computational operations per second, has made it incredibly resistant to attacks. This longevity and resilience place Bitcoin in a unique category—no other digital asset has maintained such unshakeable network security for so long.

3. True Decentralization Decentralization is a buzzword often tossed around, but few truly deliver. Bitcoin’s network is spread across the entire globe, with miners, node operators, and developers from all walks of life. No government, company, or consortium controls the network; transactions require no permission and no central gatekeeper. Other cryptocurrencies frequently rely on small teams, foundation boards, or single points of failure. Bitcoin’s decentralized architecture ensures it remains censorship-resistant, neutral, and truly belongs to everyone and no one.

4. Predictable Monetary Policy At the heart of Bitcoin’s monetary policy is a simple but powerful principle: scarcity. There will never be more than 21 million bitcoins, a limit enforced by Bitcoin’s code. This fixed supply contrasts sharply with fiat currencies, which central banks can inflate at will, and with many cryptocurrencies that tweak their monetary policy mid-flight. The reliability of Bitcoin’s halving cycles—where the reward for mining new coins is cut in half roughly every four years—imposes discipline and predictability. This scarcity and transparency help position Bitcoin as “digital gold,” a store of value that transcends borders and politics.

5. Network Effects and Brand Recognition Bitcoin’s first-mover advantage has allowed it to capture the imagination of individuals, institutions, and even some governments. Over time, it has built an unparalleled brand, becoming shorthand for the very concept of digital money. As a result, infrastructure—from exchanges and custodial services to payment processors and lending platforms—has matured around Bitcoin first. Its network effects are self-reinforcing: the more people use and trust Bitcoin, the more robust and valuable it becomes, further attracting new users.

6. Conservative Upgrades and Steady Evolution Unlike many projects that chase trends, implement flashy features prematurely, or pivot narratives every few months, Bitcoin evolves slowly and deliberately. Changes to the Bitcoin protocol undergo intense scrutiny and thorough debate before being adopted. This conservative approach preserves the network’s stability and reliability. Instead of overhauling the system haphazardly, Bitcoin relies on Layer 2 solutions like the Lightning Network to improve efficiency and speed without compromising core principles.

7. A Cultural and Philosophical Touchstone Beyond technology, Bitcoin represents an idea—a rejection of the status quo of endless money printing, centralized oversight, and financial exclusion. It’s a rallying point for those who value privacy, autonomy, sound money, and freedom from the arbitrary decisions of central authorities. This cultural and philosophical dimension is something many altcoins lack. While others may attempt to graft meaning onto their projects, Bitcoin naturally embodies these principles through its origin story, infrastructure, and committed global community.

Conclusion: The Gold Standard of Digital Assets As the cryptocurrency landscape continues to expand, it’s crucial to separate substance from hype. While plenty of coins promise faster transactions, flashy features, or quick gains, few can claim the foundation of trust, resilience, and true decentralization that Bitcoin offers. Bitcoin isn’t just another coin; it’s the benchmark by which all other digital assets are measured.

In choosing Bitcoin over others, you aren’t merely picking a cryptocurrency—you’re aligning yourself with a robust, time-tested network built on transparency, fairness, and sound monetary principles. Amidst an ever-growing sea of digital assets, Bitcoin remains the unwavering beacon lighting the way toward financial sovereignty.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#DigitalGold#CryptoEducation#BitcoinOverAltcoins#CryptoCommunity#FinancialFreedom#Decentralization#BlockchainTechnology#SoundMoney#CryptoRevolution#Altcoins#BitcoinStandard#HODL#FutureOfFinance#DigitalCurrency#BitcoinAdvocate#CryptoBlog#WhyBitcoin#BitcoinVsAltcoins#financial empowerment#globaleconomy#unplugged financial#blockchain#financial education#finance#financial experts

4 notes

·

View notes

Text

From La Stampa (translated from Italian):

“Make Finance Great Again,” Trump family makes its own cryptocurrency and allies with Silicon Valley It will be called “World Liberty Financial,” will have tech investors and real estate developers from Chase Herro and Zak Folkman to Steve Witkoff inside. Sons Eric and Donald Jr. will coordinate. And his backer Tyler Winklevoss jokes, “Donald has been orange-pilled, indoctrinated.” Jacopo Iacoboni Sept. 17, 2024 Updated 11:00 a.m. 3 minutes of reading

They want to do a kind of “make finance great again,” along the lines of MAGA, the election slogan and the Make America Great Again campaign. Donald Trump's sons, Don Jr. and Eric, of course with their father's imprimatur, are about to launch a new cryptocurrency platform that will be called “World Liberty Financial,” and will allow users to make even massive transactions without a bank getting in the way and extracting fees (and with a very low level of tax tracking, it should be added). A couple of concepts familiar to bitcoin fans, for example, but which the Trump family now has ambitions to decline on a large scale. It is not certain that this marriage between Trumpism and decentralized finance, DeFi, is a harbinger of only positive developments. The board of “World Liberty Financial” will also consist of former crypto investors such as Chase Herro and Zak Folkman, and Steve Witkoff, a real estate developer and old friend of Trump. But thanks to documents filed with the U.S. Federal Election Commission that we have been able to read we know that in general the entire Trump campaign - Make America Great Again Inc. - received money not only from Musk, but cryptocurrency from billionaire twins Cameron and Tyler Winklevoss, who lead the cryptocurrency company Gemini: about $3.5 million in Bitcoin on July 19, the day after Trump's speech at the Milwaukee convention. The Winkelvosses also poured in money to America PAC, the tech investor-backed group that Musk helped launch in 2024 (Trump had bragged that Musk was giving him $45 million a month; Musk said his contribution is “at a much lower level”). Another co-founder of a cryptocurrency exchange, Jesse Powell, boss of Kraken, and venture capitalists Marc Andreessen and Ben Horowitz (who created a16z) who have invested billions of dollars in cryptocurrency startups, have also made endorsements and poured money into Trump. In short, for the Trump family to embark on this big cryptocurrency project is a natural consequence of the fact that these are almost becoming a Republican asset in the campaign, and the “libertarian” wing of the old Gop is now a kind of very, very rampant ideologized “cyberlibertarianism.” The real boss of the “tech bros” according to many is not Elon Musk, but Peter Thiel. Zuckerberg's longtime partner in Facebook, co-founder of PayPal, Thiel's fortune has at least doubled during the Trump presidency. Palantir-a much-discussed software company variously accused of extracting data from Americans and profiling them-has managed to get a contract from the Pentagon. Other donors to MAGA Inc include Jacob Halberg, Palantir's princely analyst, and Trish Duggan, a wealthy Scientology funder and friend of the tech bros. Trump's vice presidential candidate, J. D. Vance, traveled to Silicon Valley and the Bay Area, celebrating a dinner at the home of BitGo CEO Mike Belshe, 100 people each pouring in between $3,300 a plate and a $25,000 roundtable. Trump in 2021 called bitcoin a “fraud against the dollar.” A few weeks ago, speaking in Nashvill at the bitcoin fan conference, he promised, “The United States will become the crypto capital of the planet.” Better than his friend Putin's Russia, although this Trump did not say so explicitly. The fact is that after his speech, Tyler Winklevoss ran on X (now the realm of cyberlibertarians) and joked that Donald had been “orange-pilled,” making a Matrix analogy, had been “indoctrinated,” or had finally seen the real reality behind the appearances.

4 notes

·

View notes

Text

Launch Your Own Crypto Platform with Notcoin Clone Script | Fast & Secure Solution

To launch your own cryptocurrency platform using a Notcoin clone script, you can follow a structured approach that leverages existing clone scripts tailored for various cryptocurrency exchanges.

Here’s a detailed guide on how to proceed:

Understanding Clone Scripts

A clone script is a pre-built software solution that replicates the functionalities of established cryptocurrency exchanges. These scripts can be customized to suit your specific business needs and allow for rapid deployment, saving both time and resources.

Types of Clone Scripts

Centralized Exchange Scripts: These replicate platforms like Binance or Coinbase, offering features such as order books and user management.

Decentralized Exchange Scripts: These are designed for platforms like Uniswap or PancakeSwap, enabling peer-to-peer trading without a central authority.

Peer-to-Peer (P2P) Exchange Scripts: These allow users to trade directly with each other, similar to LocalBitcoins or Paxful.

Steps to Launch Your Crypto Platform

Step 1: Define Your Business Strategy

Market Research: Identify your target audience and analyze competitors.

Unique Value Proposition: Determine what sets your platform apart from others.

Step 2: Choose the Right Clone Script

Evaluate Options: Research various clone scripts available in the market, such as those for Binance, Coinbase, or P2P exchanges. Customization: Ensure the script is customizable to meet your specific requirements, including branding and features.

Step 3: Development and Deployment

Technical Setup: Collaborate with developers to set up the necessary infrastructure, including blockchain integration and wallet services.

Security Features: Implement robust security measures, such as two-factor authentication and encryption, to protect user data and transactions.

Step 4: Compliance and Regulations

KYC/AML Integration: Ensure your platform complies with local regulations by integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Step 5: Testing and Launch

Quality Assurance: Conduct thorough testing to identify and fix any bugs or vulnerabilities.

Launch: Once testing is complete, launch your platform and start marketing it to attract users.

Advantages of Using a Notcoin Clone Script

Cost-Effective: Using a pre-built script is generally more affordable than developing a platform from scratch.

Faster Time to Market: Notcoin Clone scripts are ready to deploy, significantly reducing development time.

Customization Options: Most scripts allow for extensive customization, enabling you to tailor the platform to your needs.

Conclusion

Launching your own cryptocurrency platform with a Notcoin clone script is a viable option that can lead to a successful venture in the growing crypto market. By following the outlined steps and leveraging the advantages of Notcoin clone scripts, you can create a robust and secure trading platform that meets user demands and regulatory requirements.

For further assistance, consider reaching out to specialized development companies that offer Notcoin clone script and can guide you through the setup process

#cryptotrading#notcoin#notcoinclonescript#cryptocurrencies#crypto exchange#blockchain#crypto traders#crypto investors#cryptonews#web3 development

3 notes

·

View notes