#Debt Negotiation in Calgary

Explore tagged Tumblr posts

Text

Hollywood is the single best example of mature labor power in America

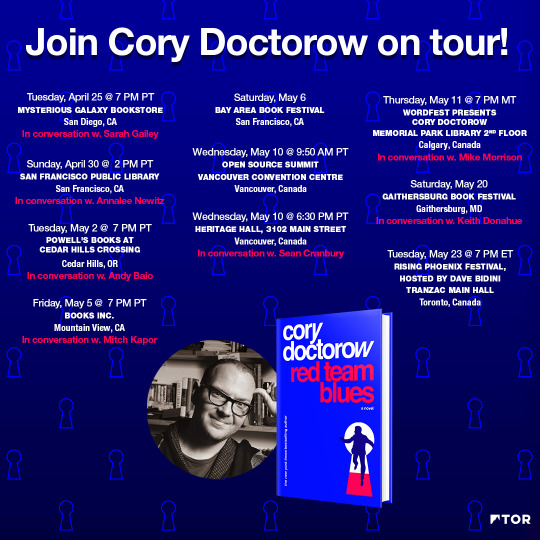

This afternoon (May 6), I’ll be in Berkeley at the Bay Area Bookfest for a 3:30PM event with Glynn Washington for my book Red Team Blues; tomorrow (May 7), it’s an 11AM event with Wendy Liu for my book Chokepoint Capitalism.

Weds (May 10), I’m in Vancouver for a keynote at the Open Source Summit and a book event at Heritage Hall and Thu (May 11), I’m in Calgary for Wordfest.

The Writers Guild is on strike. Hollywood is closed for business. The union’s bargaining documents reveal a cartel of studios that refused to negotiate on a single position. This could go on for a long-ass time:

https://www.wga.org/uploadedfiles/members/member_info/contract-2023/WGA_proposals.pdf

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/06/people-are-not-disposable/#union-strong

The writers are up for it. A lot of people are saying this is the first writers’ strike since 2007/8, but that’s not quite right. That was the last time the writers went on strike against the studios, but in 2019, the writers struck against their own talent agents — within the space of a week, all 7,000 writers in Hollywood fired their agents. They struck against the agencies for 22 months.

https://deadline.com/2023/04/hollywood-strike-writers-guild-studios-talent-agencies-1235333516/

The agencies had consolidated down to four major firms, two backed by private equity who loaded them up with debt that could only be repaid if the agencies figured out how to vastly increase their profits. They did so, by unilaterally switching the way they did business with their clients. Instead of taking a 10% commission on the creative wages they bargained for, the agencies started to take “packaging fees” from the studios for putting together a writer, director, stars, etc. These fees came out of the same budget that the talent got paid from, so the higher the fee was, the less the talent made. Soon, some showrunners were discovering that they were getting 10% and their agents were getting 90%!

The agencies weren’t done, either: they were building their own studios, and planning to negotiate with themselves on behalf of their clients. The writers said fuck this shit. They issued a code of conduct ordering the agencies to knock all that shit off. The agencies swore they’d never do it. Why should they? Every job these writers had ever done came through an agency, and the agencies were staffed with the toughest, most obnoxious negotiators on the planet.

They were sure the writers would cave. After all, the top tier of writers had been handled with kid gloves by the agencies and not ripped off to the same extent as their jobbing, workaday peers. They’d break solidarity and the union would collapse, right?

Wrong. Twenty-two months later, every one of the agencies caved on every single point. Bam. Union strong.

(Want to learn more? Check out Chokepoint Capitalism, Rebecca Giblin’s and my book about creative labor markets:)

http://chokepointcapitalism.com

Now the writers are back on strike and it’s triggered a predictable torrent of anti-worker nonsense (“striking writers will lead to public indifference to torture!) (no, really) (ugh):

https://www.readtpa.com/p/on-the-tv-writers-strike-dont-fall

One common theme in these bad takes is that writers aren’t real workers, like, you know, coal miners or Starbucks baristas. They’re coddled intellectuals, and haven’t the intelligentsia been indifferent to proletarian struggle since, you know, time immemorial?

This is wrong in every conceivable way. For starters, it’s ahistorical. Lord Byron and innumerable other toffs and poets and such were right there with the Luddites, demanding labor justice during the Industrial Revolution, as Brian Merchant writes in his outstanding, forthcoming history of the Luddites, Blood in the Machine:

https://pluralistic.net/2023/03/20/love-the-machine/#hate-the-factory

But you don’t have to look back to the stocking frame to find this kind of solidarity. As Hamilton Nolan writes in his newsletter, “Hollywood is the single best example of mature labor power in America”:

https://www.hamiltonnolan.com/p/the-coral-reef-of-humanity-encircling

The entire Hollywood workforce, from grips to carpenters, costumers to plumbers, teamsters to medics, is unionized. That includes writers and actors (I’m a member of IATSE Local 839, AKA The Animation Guild). I live in Burbank, the entertainment industry’s company town (fun fact! The “Hollywood” studios are largely over the city line, in Burbank). Walk down Burbank Boulevard, Magnolia Boulevard, or any of the other major roads, and you’ll pass many union halls.

Burbank is a prosperous place. That’s thanks, in part, to the studios, whose entertainment products are very profitable. But working in a profitable industry is not, in and of itself, a guarantee that you will get a share of those profits. Some of the most profitable industries in the world — e-commerce, fast food, logistics — have the lowest paid workforces.

Burbank is prosperous because the unions made sure that everyone — the grips, the costumers, the animators, the actors, the writers, the teamsters and the pipefitters — gets a decent wage, decent health care and a decent retirement. My pal the set-dresser who worked crazy hours shlepping furniture around sitcom sets for decades? All that work did bad stuff to his joints, which meant that he needed a hip replacement in his forties — which was 100% covered, including his sick leave while he recovered. He was able to take early retirement in his late fifties, with a solid pension, with his health in excellent shape and many years of happiness with his partner stretching before him.

That’s what unions get you: a good job that might be hard at times, and the costs of your work are borne by the employer who profits from your labor. As Nolan writes, the point of unions is to “make sure that people! Are! Not! Disposable!”

Unions deliver the American dream. As Pete Seeger sang in “Talking Union Blues”:

Now, if you want higher wages let me tell you what to do You got to talk to the workers in the shop with you You got to build you a union, got to make it strong But if you all stick together, boys, it won’t be long You get shorter hours, better working conditions Vacations with pay. Take your kids to the seashore

http://www.protestsonglyrics.net/Labor_Union_Songs/Talking-Union.phtml

We tend to focus on wages in union discussions, but unions aren’t merely about getting better pay, it’s about making better jobs. When LA teachers went out on strike in 2019, wages weren’t at the top of their list — they bargained for greenspace for every school, replacing rotting portables with permanent buildings, ending ICE entrapment of parents at the school gates, social workers and counselors for schools…and wages.

I really like how Nolan puts this. The way that the studios make money has changed: streaming is clobbering ad-supported TV and movie theater tickets. The studios are adapting. The workers want to adapt, too. The studios would rather “treat[] their work force as a disposable natural resource to be mined, used up, and then abandoned, as business dictates.”

A union gives workers “the same ability to adapt to changing industries that companies already have.” The studios want to leave workers behind. Unions give workers the collective power to say, “No. You’re taking us with you.”

Union workers are wealthier than their non-union counterparts, but that’s not just because of higher wages. As Nolan writes, “Unions make sure that the people get to adapt to changing industries, and not just the investors and the business owners.”

[Union workers] have a far greater ability to build coherent, long-term careers, as opposed to a constant treadmill of unstable short-term gigs. In non-union industries, businesses can just act like ships cutting through a desperate sea of workers, scooping up whoever they want and then tossing them overboard as soon as it’s convenient. In a union industry, though, the companies are forced to deal with the labor force as an equal. The workers have their own damn boat.

Advocates for market capitalism insist that market forces increase prosperity for everyone. They say that, in the end, having corporations serve their shareholders results in corporations serving everyone.

But a comparison of unionized and nonunionized industries reveals the hollowness of that prospect. Hollywood is wildly profitable and it pays every kind of worker well. That’s because workers have solidarity across sectors and trades. Striking writers like jonrog1 are calling on supporters to donate to the Entertainment Community Fund:

https://twitter.com/jonrog1/status/1654168529728307204

The Entertainment Community Fund supports everyone else who is affected by the work-stoppage, all the other creative and craft trades whose work has been halted by the writers’ struggle. If you want to support these workers, make sure you select “Film and TV” from the drop-down menu when you donate (we gave $100):

https://entertainmentcommunity.org/

Because all the workers are in this together. As Adam Conover explains in this amazing CNN clip, David Zazlav, the head of CNN parent-company Warner-Discovery, made a quarter of a billion dollars last year, enough to pay all the demands of all the writers:

https://www.youtube.com/watch?v=aL-YwKO81go

And Carol Lombardini, spokesvillain for the studio cartel AMPTP, told the press that “”Writers are lucky to have term employment.” As John Rogers says, she “wiped out the doubt of every writer who wasn’t sure this negotiation really IS so important, that it actually IS about turning us into gig workers.”

https://twitter.com/jonrog1/status/1654506611086606336

The stakes in this strike are the same as the stakes in every strike: will workers get a fair share of the value their labor creates, or will that value be piled up in the vaults of $250,000,000/year CEOs? It’s not like the studios especially hate writers — like all corporations, they hate all their workers. The same tactics that they’re using to make it so writers can’t pay the rent today will be turned on every other kind of Hollywood worker tomorrow — and when the writers win this one, they’ll support those workers, too.

There’s a lot of concern about AI displacing creative labor, but the only entity that can take away a writer’s wage is a human being, an executive at a studio. As has been the case since the time of the Luddites, the issue isn’t what the machine does, it’s who it does it for and who it does it to.

After all, as Charlie Stross points out, a corporation is just a “Slow AI,” remorselessly paperclip-maximizing its way through the lives and joy of the flesh-and-blood people who constitute its inconvenient gut-flora:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future#video&t=3478

Catch me on tour with Red Team Blues in Berkeley, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: Animators walk the picket-line during the Disney Animator's Strike in 1941.]

Image: LA Times https://commons.wikimedia.org/wiki/File:Screen_Cartoonist%27s_Guild_strike_at_Disney.jpg

CC BY 4.0 https://creativecommons.org/licenses/by/4.0/deed.en

262 notes

·

View notes

Text

How Can a Consumer Proposal Help Manage Debt in Calgary

Managing debt can feel overwhelming, especially for consumers in Calgary. A consumer proposal allows individuals to settle their debts by making a formal agreement to pay only a portion of what they owe. This often eases the stress of financial burdens while helping maintain your dignity. With the support of a licensed insolvency trustee, we can create a plan tailored to your situation.

Our team understands the challenges you face, and we’re here to provide guidance through the Consumer Proposal Process in Calgary. A consultation can give you clarity about your options for handling debt. We focus on helping you manage your financial situation responsibly, ensuring you feel empowered to take the next steps.

Connecting with a professional can make a significant difference. Our expertise in Calgary ensures that you receive the best possible advice and support. Working with us means you are taking a vital step toward regaining control over your finances. You don’t have to face this alone; together, we can explore viable solutions like a consumer proposal.

Understanding Consumer Proposals

Navigating financial troubles can be daunting, but consumer proposals offer a structured way to manage debt. We can settle a portion of what we owe while keeping our valuable assets intact. This legal agreement allows us to regain control over our finances without severe consequences.

What Is a Consumer Proposal?

A consumer proposal is a legal process that allows us to make a formal agreement with our creditors to pay back a portion of our unsecured debts. Governed by the Bankruptcy and Insolvency Act, this option is available to individuals with debts under $250,000, excluding home loans.

We propose a repayment plan that outlines how much we can afford and for how long, typically up to five years. This arrangement reduces our debt load, making it easier to manage while providing protection from creditor action. The agreement is legally binding, meaning once we finalize it, creditors must adhere to the terms and cannot pursue us for more.

The Role of a Licensed Insolvency Trustee

A licensed insolvency trustee (LIT) plays a crucial role in the consumer proposal process. They help us understand our options and guide us through the proposal steps. The LIT assesses our financial situation, negotiates with creditors, and prepares the necessary paperwork.

By engaging a professional, we ensure that the proposal is fair and realistic. The trustee also monitors our payments and ensures compliance with the agreed terms. Their support can alleviate the stress of dealing with creditors directly and helps us focus on regaining our financial footing.

Legally Binding Agreements

The consumer proposal serves as a legally binding agreement between us and our creditors. Once accepted, it prevents creditors from taking further action, such as wage garnishment or legal suits.

This legal protection allows us the space to meet our obligations without constant pressure. If any creditor tries to pursue us after the proposal is filed, we can inform our LIT, who will handle the situation. This assurance can be incredibly relieving, enabling us to focus on our repayment plan and improving our financial health.

Benefits Over Bankruptcy

Choosing a consumer proposal often comes with several advantages compared to declaring bankruptcy. We can keep most of our assets, including our home and car, which is not usually the case in bankruptcy. This path tends to have a less severe impact on our credit score as well.

After completing the consumer proposal, we can rebuild our financial reputation more quickly. Moreover, consumer proposals generally offer a more manageable repayment plan, allowing us to pay only a fraction of what we owe.

By selecting this option, we not only address our debts but also maintain our dignity and control throughout the process.

For more information on how a consumer proposal can assist us in Calgary, check out this resource on Consumer Proposal Calgary: Your Step-by-Step Guide to Debt Relief.

Navigating the Consumer Proposal Process

Navigating the consumer proposal process can seem complex, but we aim to simplify it. Understanding the steps involved, how to work with creditors, the impact on credit scores, and life after debt relief is key for anyone considering this option.

Steps to Filing a Consumer Proposal

The first step in filing a consumer proposal is to consult with a Licensed Insolvency Trustee (LIT). They will review your financial situation and determine if a consumer proposal is suitable for you. We gather details about your debts, income, and living expenses.

Next, we prepare a formal proposal, which outlines how much of your debt you can pay back. This proposal is then filed with the Office of the Superintendent of Bankruptcy. Creditors receive the proposal and have 45 days to respond. If the majority accept it, the proposal becomes legally binding, allowing us to start making one monthly payment towards our debts.

Working with Creditors

Working with creditors is a crucial part of the consumer proposal process. We negotiate with them to settle for a lower amount than what is owed. During this time, creditors cannot take legal action or contact you for payments.

It’s important to remain open and communicative with creditors. They want to resolve the situation as much as we do. A successful negotiation can lead to a manageable repayment plan and help us avoid bankruptcy.

Having a trusted LIT can make a big difference here. They act as an intermediary, ensuring that our interests are represented throughout the process.

Impact on Credit Score

Filing a consumer proposal affects our credit score, but it may not be as severe as we fear. A consumer proposal itself is noted on our credit report and typically rated as a "R7" for the duration of the repayment period. This rating remains for up to three years after we finish paying off our proposal.

Unlike bankruptcy, which has a longer-lasting negative impact, a consumer proposal allows for quicker recovery. After completing our payments, we can start rebuilding our credit score much sooner. Following good financial habits, such as making timely payments, is essential for regaining financial stability.

Life After Debt Relief

After successfully completing a consumer proposal, our journey toward a debt-free future begins. We have the opportunity to regain control over our finances. We may want to create a budget to ensure we live within our new means.

Not only do we relieve the burden of debt, but we also improve our financial literacy. Understanding how to manage our finances prepares us for the future.

As we embrace this new chapter, we remember that assistance is still available. We can reach out to financial advisors or services like BNA Debt Solutions for ongoing guidance. They can help us navigate any challenges that come our way. For many Calgarians, a consumer proposal is not just a way to avoid bankruptcy; it is a pathway to a more secure financial future.

Frequently Asked Questions

We often receive questions about consumer proposals and their effects on debt management in Calgary. Here are some of the most common inquiries we encounter.

What are the potential disadvantages of entering into a consumer proposal?

While a consumer proposal can offer relief, it does come with some downsides. One key concern is the impact on your credit rating. Additionally, you may be required to pay a portion of your debt, which means you won't be completely debt-free after the proposal is accepted.

In what ways does a consumer proposal impact your credit score in Alberta?

In Alberta, entering a consumer proposal negatively affects your credit score. The credit reporting agencies will show a record of the proposal, which can stay on your credit report for up to three years after completion. This can influence your ability to secure loans in the future.

How does the process of a consumer proposal work in Calgary?

The process starts with a licensed insolvency trustee. We work with you to assess your financial situation and propose a plan to creditors. Once we submit the proposal, creditors have a chance to approve or reject it. If approved, we manage the payments according to the agreed terms.

What factors determine the reduction in debt through a consumer proposal?

Several factors influence how much debt can be reduced through a consumer proposal. These include your total outstanding debt, your income, and your ability to make payments. Ultimately, the goal is to reach a fair settlement that you can afford.

Can you explain the difference between a consumer proposal and bankruptcy in Alberta?

A consumer proposal allows you to pay back a portion of the debt over time, while bankruptcy typically discharges most debts without payment. However, bankruptcy can have more severe long-term consequences for your credit and assets.

Are there alternatives to consumer proposals for managing significant debt in Canada?

Yes, there are alternatives. Options include debt consolidation loans and credit counselling services. Each option has different terms and impacts, so it’s important to evaluate what fits best with our financial situation. More details about these options can be found in the Complete Guide to Consumer Proposals in Calgary.

#debt#debt assistance#debt consolidation#debt relief#debtcollection#debtfreejourney#debtmanagement#debthelp

1 note

·

View note

Text

Credit Consolidation in Calgary: Regain Control of Your Finances

Managing debt can be overwhelming, especially when you're juggling multiple credit cards, loans, and other financial obligations. If you’re looking for a way to streamline your payments, reduce interest rates, and ultimately regain control of your finances, credit consolidation in Calgary may be the solution you need. By combining your various debts into a single, manageable loan, credit consolidation offers a simpler way to tackle your financial obligations. In this blog post, we’ll dive into the benefits, options, and steps involved in credit consolidation in Calgary, as well as provide expert advice on how to choose the best strategy for your unique situation.

What is Credit Consolidation in Calgary?

Credit consolidation in Calgary refers to the process of combining multiple debts, such as credit cards, personal loans, and lines of credit, into a single loan with a lower interest rate and one easy-to-manage monthly payment. This helps you simplify your financial situation by eliminating the need to track multiple payments and due dates. Additionally, credit consolidation can save you money by reducing the overall interest you pay on your debts.

At Prets Rapides, we specialize in helping individuals in Calgary find the right credit consolidation options to improve their financial health. Our team of experts is here to guide you through the process, ensuring you make informed decisions that align with your goals.

Benefits of Credit Consolidation in Calgary

Simplified Payments: Instead of keeping track of various due dates and payment amounts, credit consolidation combines your debts into one monthly payment, making it easier to manage your finances.

Lower Interest Rates: By consolidating your debts, you can often secure a loan with a lower interest rate than what you’re currently paying. This can reduce the overall cost of your debt and help you pay it off faster.

Improved Cash Flow: Reducing your interest rates and consolidating your debt typically results in lower monthly payments, freeing up cash for other expenses or savings.

Better Credit Score: Regular, on-time payments on a consolidation loan can help improve your credit score over time. By paying off high-interest debt and reducing your credit utilization, your score can gradually rise.

Stress Reduction: Managing multiple debts can cause stress. With credit consolidation, you’ll have just one loan to focus on, making your financial situation more manageable.

Flexible Repayment Terms: Credit consolidation loans often come with flexible repayment options that can be tailored to fit your budget.

Types of Credit Consolidation in Calgary Options

There are several options available for credit consolidation in Calgary. The right choice for you will depend on your debt situation, credit score, and financial goals. Let’s take a closer look at the most common types of credit consolidation options:

Personal Loans: A personal loan from a bank or credit union can be used to pay off your existing debts. Personal loans typically come with fixed interest rates and repayment terms, making them a predictable option for consolidation.

Balance Transfer Credit Cards: If you have credit card debt, you can use a balance transfer credit card to move your existing balances to a new card with a lower interest rate, often with an introductory 0% APR for a set period. This can help you save money on interest, especially if you can pay off the balance within the introductory period.

Home Equity Loans or HELOCs: If you own a home, you may be able to use the equity in your property to consolidate your debt through a home equity loan or line of credit (HELOC). These options typically offer lower interest rates but carry the risk of losing your home if you default on the loan.

Debt Management Plans: If you’re struggling with unsecured debt, a credit counseling agency can help you create a debt management plan. The agency will negotiate with your creditors to secure lower interest rates and consolidate your payments into a single monthly payment.

Debt Settlement: Debt settlement involves negotiating with creditors to pay off a portion of your debt for less than what you owe. This option can significantly reduce your debt, but it may hurt your credit score.

Who is Eligible for Credit Consolidation in Calgary?

Credit consolidation is available to a wide range of individuals, particularly those with manageable levels of debt and a steady income. If you have good to fair credit, you’ll likely qualify for a consolidation loan with favorable terms. However, even if your credit is less than perfect, there are still consolidation options available, especially if you own a home or have a reliable income.

At Prets Rapides, we work with individuals in various financial situations, helping them find the best credit consolidation option for their needs.

Choosing the Right Credit Consolidation Option for You

Choosing the right credit consolidation option is crucial for your financial success. Start by evaluating your total debt, interest rates, and monthly payments. From there, you can explore different consolidation methods to determine which one offers the best benefits for your situation.

For example, if you have high-interest credit card debt, a balance transfer credit card might be the right choice. If you own a home and need to consolidate larger amounts of debt, a home equity loan or HELOC may be more suitable. Additionally, if you’re dealing with unsecured debts and need professional help, a debt management plan could provide the structure and support you need.

At Prets Rapides, we’re here to help you assess your options and guide you toward the best solution for your financial future.

Steps to Consolidate Your Credit

If you’re ready to take the step toward credit consolidation in Calgary, here’s a quick guide to the process:

Assess Your Debt: Make a list of all your outstanding debts, including balances, interest rates, and monthly payments. This will give you a clear picture of your financial situation.

Research Your Options: Explore different consolidation methods and determine which one offers the best interest rates and terms for your needs.

Check Your Credit Score: Your credit score will impact the terms of your consolidation loan. Obtain a copy of your credit report to understand your current standing.

Apply for a Loan: Once you’ve decided on the best consolidation option, apply for a loan or credit product that fits your needs.

Pay Off Your Debts: Use the consolidation loan to pay off your existing debts, ensuring that all your creditors are satisfied.

Stick to a Budget: To avoid accumulating new debt, create a budget and stick to it. Make sure you continue making on-time payments on your new consolidation loan.

Mistakes to Avoid in Credit Consolidation

While credit consolidation can be a great solution, there are several common mistakes to avoid:

Neglecting Other Debts: Don’t ignore other financial obligations after consolidating. Make sure to keep up with any remaining payments.

Using Credit Cards Again: Avoid the temptation to rack up new credit card debt after consolidating. This can undo the progress you’ve made.

Not Researching Options: Take the time to fully understand your consolidation options and compare rates before committing to a loan.

Missing Payments: Missing payments on your consolidation loan can negatively affect your credit score. Set up automatic payments to avoid this issue.

At Prets Rapides, we’ll help you avoid these common mistakes and ensure that your credit consolidation journey is as smooth as possible.

Conclusion

Credit consolidation in Calgary can be a powerful tool to help you regain control of your finances, lower your interest rates, and simplify your monthly payments. Whether you choose a personal loan, balance transfer credit card, or home equity loan, consolidating your debts can provide long-term financial relief. At Prets Rapides, we are committed to helping you find the right consolidation solution for your situation. Contact us today to learn more about how we can assist you on your path to financial freedom.

0 notes

Text

Emergency Loans: A Lifeline in Times of Need

In today’s fast-paced world,urgent loans for bad credit canada financial emergencies can strike at any moment, leaving individuals and families scrambling for solutions. Whether it’s a sudden medical expense, car repair, or unexpected job loss, emergency loans can provide crucial support. This article explores the essentials of emergency loans, their benefits, and important considerations to keep in mind.

What Are Emergency Loans?

Emergency loans are short-term financial products designed to help individuals cover unexpected expenses. They typically have quick approval processes, allowing borrowers to access funds rapidly. These loans can come from various sources, including banks, credit unions, and online lenders.

Types of Emergency Loans

Personal Loans: Unsecured personal loans are a popular choice for emergencies. They don’t require collateral and often have fixed interest rates.

Payday Loans: These are small, high-interest loans intended to be repaid by the borrower’s next paycheck. While easy to obtain, they can lead to a cycle of debt if not managed carefully.

Credit Card Cash Advances: Credit cards allow cardholders to withdraw cash up to a certain limit. However, interest rates on cash advances can be steep.

Title Loans: These loans use the borrower’s vehicle as collateral. They can offer quick cash but come with the risk of losing the vehicle if the loan isn’t repaid.

Benefits of Emergency Loans

Quick Access to Funds: One of the most significant advantages is the speed at which money can be accessed, often within a day.

Flexibility: Emergency loans can be used for various purposes, allowing borrowers to address multiple financial challenges.

Improved Credit Options: Successfully repaying an emergency loan can positively impact a borrower’s credit score, improving future borrowing options.

Important Considerations

While emergency loans can be a lifesaver, it’s essential to approach them with caution:

High Interest Rates: Many emergency loans, especially payday loans, come with high interest rates. Borrowers should carefully assess their ability to repay.

Loan Terms: Understanding the terms and conditions, including repayment timelines and any fees, is crucial.

Alternatives: Before taking out an emergency loan, consider other options such as borrowing from friends or family, negotiating payment plans with creditors, or exploring local assistance programs.

Emergency loans can serve as a vital resource during financial crises, providing quick access to funds when they are most needed.urgent loans in calgary However, borrowers must weigh the benefits against the potential pitfalls, ensuring they make informed decisions that won’t lead to further financial strain. By understanding the types of emergency loans available and approaching them responsibly, individuals can navigate financial emergencies more effectively.

0 notes

Text

Houses for Sale: How can Buyers Find the Ideal One?

Are you looking to buy your dream home but are getting lost among the plethora of choices? If you answer yes, then you're on the right website. In the vast and often overwhelming world of real estate, finding the ideal abode among houses for sale in Calgary can feel like searching for a needle in a haystack. However, with the right approach and knowledge, buyers can simplify their search and increase their chances of discovering the perfect property. Here are some critical strategies for buyers to consider when embarking on their house-hunting journey:

1. Define Your Needs and Wants: Define Your Needs and Wants: Before diving into the market, take some time to outline your priorities clearly. What are your non-negotiables? How many bedrooms and bathrooms do you need?

Are you looking for a specific neighborhood or school district? By identifying your must-haves and nice-to-haves, you can focus your search and avoid wasting time on houses for sale that doesn't meet your benchmarks.

2. Set a Realistic Budget: Determine how much you can afford to spend on a home and stick to it. Consider factors such as your income, existing debt, and ongoing expenses.

Remember to account for additional costs such as property taxes, homeowner's insurance, and maintenance. Getting pre-approved for a mortgage can also give you a clearer picture of your purchasing power and make you a more competitive buyer.

3. Research Neighbourhoods: Explore different neighborhoods to find one of the houses for sale that best fits your lifestyle and priorities. Consider safety, proximity to amenities, property values, and community vibe.

Online tools and resources, such as real estate websites and neighborhood guides, can provide valuable insights into local market trends and amenities.

4. Work with a Knowledgeable Real Estate Agent: A reputed real estate agent can be invaluable in your home search. Look for an agent who specializes in the neighborhoods you're interested in and has a track record of success. They can provide expert guidance, help you navigate the complexities of the buying process, and negotiate on your behalf.

5. Attend Open Houses and Virtual Tours: Take advantage of open houses and virtual tours to explore houses for sale firsthand. It will give you a sense of the home's structure, condition, and overall feel. Be bold ask questions, and take notes during your visits.

6. Be Flexible: Keep an open mind and be willing to compromise on certain features if necessary. It's rare to find a property that checks every box on your wishlist, so focus on the most important elements. Remember that cosmetic changes can often be made after purchase, so focus on the property's bones and potential.

7. Conduct Due Diligence: Once you've found a potential home, conduct thorough due diligence before making an offer. This may include hiring a home inspector to evaluate the property's condition, researching zoning laws and property taxes, and reviewing relevant homeowners association documents. The more information you have, the better equipped you'll be to make an informed decision when choosing from houses for sale.

8. Consider Long-Term Value: Look beyond the present and consider the property's long-term value and potential resale prospects.

Assess factors such as appreciation rates, economic trends, and planned developments in the area. A home that fulfills your needs now and holds promise for the future can be a wise investment.

9. Trust Your Instincts: Trust your instincts when choosing the right home. If a property feels the perfect fit and meets your criteria, don't hesitate to make an offer.

On the other hand, if something doesn't feel quite right, listen to your gut and keep searching for houses for sale. Patience and persistence are essential in the real estate game.

In conclusion, finding the ideal home requires careful planning, research, and patience. By defining your priorities, setting a budget, working with a knowledgeable agent, and conducting thorough due diligence, you can navigate the real estate market with confidence and increase your chances of finding the perfect property. Happy house hunting! Contact UDO & COMPANY to simplify your task of purchasing your dream home from houses for sale in Calgary.

0 notes

Text

A Step-by-Step Guide to Achieve Your Dream Home In Canada

Realtor Advertising

For many individuals, it is a dream come true to have their own house. Whether you are a first-time buyer or thinking of an upgrade, Canada's real estate market is quite varied enough with lots of offerings.

With so much realtor advertising going on, it often becomes hard to know what’s the right way to get your dream home. Worry not in this guide, we are going through the steps of fulfilling your dream of owning your own home.

1. Financial Preparation

Budget: Decide on how much you are able to pay. Consider your income, current debts and monthly expenses. Utilize online calculators to compute your mortgage amortisation.

Credit Score: Credit score is a pivotal factor for getting a mortgage. Make sure you check your credit rating and rectify any issues.

Down Payment: Putting money aside for a down payment. In Canada, the minimum set for a home cost up to $500,000 is 5%. However, for the homes with the cost higher than that, the down payment will be increased.

2. Research and Location

Explore Cities: Canada has lively cities including cities like Toronto, Vancouver, Montreal, and Calgary. Research their real estate market, employment possibilities, and scenarios of life there.

Neighbourhoods: Choose the neighbourhoods which match your specific predilections, like nearby workplaces, schools, parks, and amenities.

Market Trends: Analyze local real estate trends. Is it a seller's or a buyer's market? Visit the agents and market reports.

3. Mortgage Pre-Approval

Lenders: To start the process, approach banks, credit unions, or brokers for pre-approval. They’ll scrutinize your financials and issue a pre-approval letter.

Interest Rates: Evaluate the interest rates and mortgage terms.Fixed or variable?Short-term or long-term?

4. Search for a Real Estate Agent

Expertise: A real estate agent knows the market, acts as your rep, and leads you to the destination.

Interview: Meet the potential agents. Ask them about their accomplishments, the stories they have to tell, and how they deal with people

5. House Hunting

Wishlist: Develop a list of must-haves and would-be nice-to-have items. Always look at the size, the plan, and the finish of the bedroom.

Viewings: Attend open houses and spend some time on site. Take notes on features, do a comparison, and contrast different brands.

6. Make an Offer

Negotiation: Together with your agent, prepare to make an offer. Since price, conditions (e.g. home inspection) and closing date are involved, reflect on them carefully.

Deposit: Suggest a deposit (normally it would be from 1 to 5% of the sale price when having the agreement) with the offer in.

7. House Condition and Valuation

Inspection: Get in touch with a thorough professional inspector. They will look at the state and condition of the property. They will check the structural elements, plumbing and electrical components.

Appraisal: But the lender needs to find out the exact worth of the property by hiring the appraisers.

8. Finalize Financing

Mortgage Approval: Once the offer of your purchase is accepted, the loan you have chosen should be finalised with the lender.

Legal Representation: Find a real estate attorney whom you can trust to take care of the legal matters in the sale/purchase of your home.

9. Closing Day

Paperwork: Make sure the dealing is registered, money is transferred, and you pay the closing costs required (e.g., land transfer fee, legal fees).

Possession: Get behind the wheel and start your amazing homeownership journey!

10. Post-Purchase Considerations

Utilities and Services: Use electricity, water, and gas facilities at your service and change your address.

Home Insurance: The best protection against the risks associated with home ownership is home insurance.

Enjoy!: Celebrating your accomplishment is the culmination of a long and hard journey, the easiest part is finally settling home.

Conclusion

Buying your dream house in Canada is a matter of considering and analyzing the options and engaging professional help when needed. Finally, follow through these steps. Within days you will be sipping coffee on your patio with a view of the Canadian countryside.

0 notes

Text

Comprehensive Debt Assistance in Calgary: Reduce Your Debt

Calgary residents, learn valuable debt negotiation tips in our comprehensive guide. Take the first step towards financial relief now.

0 notes

Text

#Debt Consolidation Calgary#Debt Consolidation Edmonton#Credit Counselling Service#Debt Negotiations#Bankruptcy Service#Debt Consolidation Loan#Consumer Proposal Service Edmonton#Debt Consolidation Red Deer#Consumer proposal Services Red Deer#Debt Settlement Red Deer#Debt Negotiation in Calgary#Credit Consolidation Calgary#Debt Management Services in Calgary#Debt Assistance in Calgary#Money Management Service in Calgary

0 notes

Text

Bankruptcy's Impact on Home: Managing Financial Struggles

Bankruptcy's influence on homeownership explained. Learn effective strategies for managing financial struggles while safeguarding your home.

#Advantages Of Consumer Proposal#Credit Counselling Service#Debt Negotiations#Consumer Proposal Service#Bankruptcy Service#Debt Consolidation Loan#Personal Debt Counselling Services Calgary#Debt Negotiations Calgary#Advantages Of Consumer Proposal Edmonton#Debt settlement Edmonton#Debt Consolidation Red Deer#Consumer proposal Services Red Deer#Debt Negotiation in Calgary#Money Management Service in Calgary

0 notes

Text

#Bankruptcy service in Calgary#Debt Negotiation Services in Calgary#Money Management Service in Calgary#Financial Debt Counseling in Calgary#Credit Rebuilding Service in Calgary#Debt Assistance in Calgary#Financial Debt Help in Calgary#Debt Negotiation in Calgary#Consumer proposal Services Red Deer#Debt Consolidation Red Deer#Personal Debt Counselling Services Edmonton#Bankruptcy Service#Advantages Of Consumer Proposal#Credit Counselling Service

0 notes

Text

#Credit Rebuilding Service in Calgary#Financial Debt Help in Calgary#Debt Negotiation in Calgary#Debt Settlement Red Deer

0 notes

Link

As the name suggests, debt negotiation is an agreement between borrowers and lenders to settle a debt for a lower sum. However, it is not as simple as you might think.

#Debt Negotiations Edmonton#Debt Negotiation Red Deer#Debt Negotiation in Calgary#Debt Negotiation Services in Calgary#Debt Negotiation in Edmonton#Debt Negotiation Services in Edmonton#Debt Negotiation in Lloydminster#Debt Negotiation Services in Lloydminster

0 notes

Text

Overdraft Lines of Credit: Debt Relief for Canadian Businesses

Dealing with consumer debt in Canada, whether it's overdraft, credit lines, or business debt, can be stressful. But with the right debt relief solutions, you can take control of your finances. Discover the options available to you in our latest blog!

Get on the road to financial recovery—read the full blog here: https://www.credit720.ca/consumer-debt-relief-canada-overdraft-lines-business/

#debt consolidation calgary#debt negotiations#debt settlement edmonton#debt consolidation companies Toronto#financial debt help in alberta

0 notes

Text

#debt consolidation calgary#debt consolidation red deer#debt negotiations#financial debt help in alberta#budgeting service edmonton#debt settlement edmonton#debt negotiation red deer

0 notes

Text

Bad Credit Help & Money Management: Unlock Financial Stability

Discover how to break free from bad credit and master money management in Lloydminster. Intensify your financial journey now.

0 notes