#Covid 19 Insurance for Employees

Explore tagged Tumblr posts

Text

Raising the Minimum Wage and Its Effects

Ko-fi prompt from [name redacted]:

So, what does raising the minimum wage really do to the rest of the economy?

Hecking Complicated! I think I might need a doc of just. References for this one. But here are a few elements!

(Also, the Congressional Budget Office has an interactive model of how different changes to the minimum wage could affect various parts of the economy, like poverty rates and overall employment. Try it out!)

Reduction of Benefits

A common claim that is used to argue against the minimum wage is that it will result in companies cutting hours for their employees in order to recoup losses by having to provide benefits to fewer employees. This isn't 'the minimum wage is bad' so much as 'corporations are assholes,' but it is unfortunately still a thing that happens. (Harvard Business Review)

This is not a problem with the minimum wage itself, in my opinion, but these issues are emblematic of the weight that self-serving elements of capitalism carry. The low minimum wage is just one part of many that contribute to the current wealth disparity; if things like health insurance were universal, then bosses wouldn't be as able to cut them to employees in order to save money. Current regulations incentivize companies to hire more part-time workers than full-time, in order to avoid paying out benefits. Some cities have enacted Fair Workweek Laws in order to combat these approaches, though the impact is as of yet uncertain (Economic Policy Institute, 2018). Early reports, like the Year Two Worker Impact Report on Seattle’s Secure Scheduling Ordinance, do seem to indicate positive results, though:

In addition, the SSO led to increases in job satisfaction and workers’ overall well-being and financial security. In particular, the Secure Scheduling Ordinance had the following impacts for Seattle workers: - increased work schedule stability and predictability - increased job satisfaction and satisfaction with work schedules - increased overall happiness and sleep quality, and reduced material hardship. (direct quote from the Year Two Eval)

Unfortunately, these were approved at the earliest in 2015 (San Francisco's Formula Retail Employee Rights Ordinances, which went into effect in March 2016), which means that none of them were in play for longer than five years before COVID-19 ground the planet's economy to a near halt. I tried to find results for the San Francisco laws, but I couldn't find any studies for it; I did find an article from March 2023 that summarized which cities in California have brought in fair workweek laws, though, so maybe someone could use that as a jumping off point (What Retailers Should Know About California Scheduling Ordinances).

Companies prevented from cutting benefits by cutting hours would probably find another way to do the same thing, but let's be real: keeping the minimum wage low won't stop them from cutting every corner possible. EPI has some articles, like "The role of local government in protecting workers’ rights," that talk about how these measures can be, and have been, implemented to protect workers from cost-cutting employers.

Cutting the hours and benefits of part-time employees is a real, genuine concern to have about raising the minimum wage, and those need to be anticipated and combated in concert with raising the minimum wage. However, it is not a reason to keep the minimum wage depressed. It's just a consequence to be aware of and plan for.

Passing Costs On To Customers

A common argument against raising the minimum wage is that companies will raise costs in order to cover the raise in expenses, to a degree that nullifies the wage hike. This is, um. Uh.

Really easily debunked?

Like, really easily.

Over a ten-plus year period, research found that a 10 percent increase in the minimum wage resulted in just a 0.36 percent increase in prices passed on to the consumer at grocery stores. A similar Seattle-based study showed that supermarket food prices were not impacted by their minimum wage increase. - (Minimum Wage is Not Enough, Drexel U.)

I've talked about it before, but in some cases it's just a matter of how US-based labor is such a comparatively small portion of costs for medium-to-large businesses that raising wages doesn't raise corporate expenditures that much.

That said, some companies rely on drastically underpaying their employees, like Walmart. Walmart's revenue in 2020 was approximately $520 billion (Walmart Annual Report, page 29). Now, this report doesn't actually tell us what amount is spent on labor, but it does give us the "Operating, selling, general and administrative expenses, as a percentage of net sales." This is, to quote BDC, "[including] rent and utilities, marketing and advertising, sales and accounting, management and administrative salaries."

So, wages are just part of the (checks) 20.9% of revenue that is operating SG&A expenses. But maybe I'm being mean to Walmart! After all, the gross profit margin is only 24.1%, so only 3.2% is left for those poor shareholders!

Oh, oh, that means the profit is still over 16billion USD? And Walmart cites having 2.2 million associates in that same report? And that's about $7,500 per employee per year that's being withheld? And that's before we take costs up by like three cents per product?

Which, circling back: A study from Berkeley by the name of "The Pass-Through of Minimum Wages into US Retail Prices: Evidence from Supermarket Scanner Data" found that

a 10% minimum wage hike translates into a 0.36% increase in the prices of grocery products. This magnitude is consistent with a full pass-through of cost increases into consumer prices.

Of course, Walmart does sell more than just groceries, but isn't it interesting that raising a minimum wage resulted in such a small cost increase? If we assume this is linear (it's probably not, but I have so many numbers going on already), then doubling wages from 7.25 to 14.50 would still mean only a 3.6% increase costs! Your $5 gallon of milk would go up to [checks] $5.18.

Hm. Those 18 cents might be meaningful to our poorest citizens, but if those poorest citizens are more likely to be raised out of poverty by raising the minimum wage, then it might just be the case that they too can afford the new price of milk, and have more money left over for things like... rent. Or education. Or healthcare.

Maybe even a cost cutting loss leader like Walmart can reasonably increase its wages. After all, they still have 13 stores on Long Island, where the minimum wage is $15, and has been since 2021.

(I could have just cited the Berkeley study and moved on, but after a certain point I was too deep in parsing the Walmart report to not include it.)

But also... minimum wage increases are often staggered. They start out on the bigger companies, which have the resources to accommodate those changes (unless they've been doing stock buybacks), and then later on the smaller businesses, now that a portion of the economy (those working for the big companies) has the spare change to spend money at those smaller businesses that are raising their prices by a little more than the corporations.

And at that point, all I can really say is, well.

If you can't afford to pay your employees a living wage, you're not an oppressed company. You're just a failing company. Sorry, Walmart&Co, your business model is predicated on fucking over poor people, and so it's a bad business model.

Being a dickhead, while successful, is not actually 'smart' business practice.

(This doesn't even get into the international impacts, like what an "American companies should pay higher wages abroad, especially if they charge higher-than-American pricing for their products, but also at factories where we know they're committing human rights abuses" approach could be but this is already long as fuck so that'll have to wait for another post.)

Anyway.

Inflation

This one is tied into the cost argument above, but like...

Inflation is already a thing? Inflation is happening whether we raise the minimum wage or not. Costs go up whether we raise the minimum wage or not. Who is this argument serving? Not the people who can't afford rent, surely.

Quoting the earlier-mentioned Drexel report (red highlights mine):

While the minimum wage has been adjusted numerous times since its implementation in 1938, it has failed to keep up with inflation and the rising cost of living. The purchasing power of minimum wage reached its peak in 1968 and steadily declined since. If it had kept up with inflation from that point it would have reached at least $10.45 in 2019. Instead, its real value continues to go down, meaning minimum wage employees are essentially being paid less each year. Additionally, some economists argue if minimum wage increased with U.S. productivity over the years, it would be set currently at $26 per hour today and poverty rates would be close to non-existent with little negative impact on the economy. However, because gradual change was avoided, the extra funds were instead shifted to CEO compensation. A sudden change in wages now could possibly make a more noticeable impact on the economy, which is often cited as reasoning for a slower increase over time moving forward. Gradual increases with inflation and productivity could have avoided any potential economic ripple effects from wage increases and should be considered in ongoing plans.

Increasing Unemployment

A common argument is that the unemployment rate would jump as employers were forced to let employees go. Assuming they didn't just hire more employees so they could give them less hours in order to cut benefits... not really!

A 2021 article from Berkeley News summarizes the issue, along with several others, covering some thirty years of research that started with "Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania," published in 1993. They also touch on the issue of subminimum wages for tipped workers, though they do not address the subminimum wages set for underage and disabled workers.

“A minimum wage increase doesn’t kill jobs,” said Reich, chair of UC Berkeley’s Center on Wage and Employment Dynamics (CWED) . “It kills job vacancies, not jobs. The higher wage makes it easier to recruit workers and retain them. Turnover rates go down. Other research shows that those workers are likely to be a little more productive, as well.” - Berkeley News article, "Even in small businesses, minimum wage hikes don’t cause job losses, study finds"

Lower turnover rates also save money for employers, as it causes them to have much lower HR expenses. How much money do you think large employers spend on using sites like Indeed or Glassdoor to find new employees?

This article from Richmond Fed does, admittedly, encourage a slightly grayer analysis:

In a 2021 review of some of the literature, [researchers] reported that 55.4 percent of the papers that they examined found employment effects that were negative and significant. They argued that the literature provides particularly compelling evidence for negative employment effects of an increased minimum wage for teens, young adults, the less educated, and the directly affected workers. On the other hand, in a 2021 Journal of Economic Perspectives article that analyzed the effect of the minimum wage on teens ages 16-19, Alan Manning of the London School of Economics and Political Science wrote that although the wage effect was sizable and robust, the employment effect was neither as easy to find nor consistent across estimations. Thus, although the literature supports an effect on employment among the most affected workers, it does not appear to be as sizable as theory might suggest.

The International Labor Organization has a similarly mixed result when taking a variety of studies into account. (I left in their own reference links.)

In high-income countries, a comprehensive reviews of about 70 studies, shows that estimates range between large negative employment effects to small positive effects. But the most frequent finding is that employment effects are close to zero and too small to be observable in aggregate employment or unemployment statistics (1). Similar conclusions emerge from meta-studies (quantitative studies of studies) in the United States (2), the United Kingdom (3), and in developed economies in general (4). Other reviews conclude that employment effects are less benign and that minimum wages reduce employment opportunities for less-skilled workers (5).

And there's the 60-page "Impacts of minimum wages: review of the international evidence" from University of Massachusetts Amherst, which looks at data from both the US and UK. I'll admit I didn't read this one beyond the introduction, because this is very long already.

Not all US studies suggest small employment effects, and there are notable counter examples. However, the weight of the evidence suggests the employment effects are modest. Moreover, recent research has helped reconcile some of the divergent findings. Much of this divergence concerns how different methods handle economic shocks that affected states differently in the 1980s and early 1990s, a period with relatively little state-level variation in minimum wages.

I'd encourage you to think of it this way:

Employer A pays $7.25/hr. Employer B also pays $7.25/hr. An employee works 25hrs/week for Employer A, and 20hr/wk for Employer B. The minimum wage goes up to $15/hr. Employer B cuts the employee. Employer A cuts employees as well, but not this one, and instead increases their hours to 30/wk for greater coverage.

The employee has gone from just under $400/wk to $450/wk. They lost a job, sure, but the end result... They have an extra fifteen hours of free time per week! Or more! With time to level out, you have less jobs, but more employment, because people aren't taking up multiple jobs (that someone else could have) just to survive.

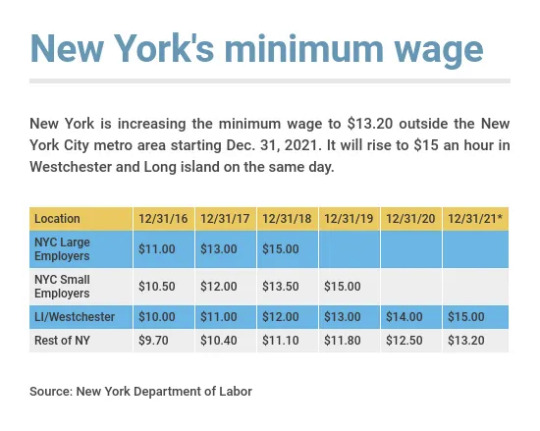

This is a very, very simplified example, which doesn't take into account graduated wage increases (see the NYS labor table) or the benefits issue from before, but it does show the reality that "less jobs" doesn't necessarily mean "less pay" or "fewer employed" people, when so many of those employed at this pay are working multiple jobs.

Even the Washington Post agrees that the wage hike wouldn't cost as many jobs as conventional wisdom claims, and they're owned by Bezos. (Though I recognize the name of the article's author as the same person behind that 60-page Amherst report, so there's that to consider.)

The Kellogg Institute also points out that individual workers were, on average, more productive after receiving the pay increase, so the drop in the bottom line was softened. This is a bit debatable; the results varied based on the level of monitoring, but it's worth noting that most minimum wage jobs are pretty high-intensity, high-monitoring. Goodness knows you don't get a whole lot of time to yourself outside of the critical eye of your shift lead or customers if you're working fast food. They also note a decrease in profits, but I'd point out that they speak specifically of profits, not share of revenue.

To explain the difference: imagine you sell $100 of product in a day. The product cost you $50. Overhead (rent, utilities, taxes) cost you $10. Labor cost you $15. Profit, then, was $25, or $25.

A 16% reduction in the profit does not mean you now retain $11. It means that you retain 16% less of the $25. You now retain $21.

(This is, as with many of my examples, INCREDIBLY simplified, but I need to illustrate what the article's talking about, and I don't have infographics.)

Some other articles on the topic are from The Quarterly Journal of Economics, Business for a Fair Wage, The Federal Reserve Bank of San Francisco (more critical), the Center on Wage and Employment Dynamics, the Center for Economic and Policy Research, UCLA Anderson, Vox, and The Intelligencer, which cites another Berkeley article. I do not claim to have read all of these, especially the really long ones, but the links are there if you want to look into them.

In the interest of showing research from groups that do not serve my own political views, I'm going to link an article from the Cato Institute; I do encourage you to read that one with a grain of salt, given that it's written by a libertarian thinktank, and they are just as dedicated to hunting for research that serves their political views as I am. There were a few other libertarian articles I came across, but the way they presented information kept feeling really duplicitous so I just... am not linking those, or the leftist ones I am also uncomfortable with due to the whole "I'm totally not tricking you" vibes. Also eventually I just got tired, there are so many articles on this and I am just one blogger who is not actually working for a magazine or thinktank, I am working for my own personal tumblr.

Negatively Impacting Slightly-Higher Paid Employees

Did you know that raising the minimum wage affects more than just those making minimum? It affects those just above as well. It's referred to as the ripple effect of minimum wage hikes by this Brookings article. They estimate that a wage hike would affect nearly 30% of the country's workforce.

"Price adjustments provide the principal adjustment mechanism for minimum wage increases: higher labor costs are passed through to consumers, mainly for food consumed away from home. Such an increase does not deter restaurant customers. Price increases are also detectable for grocery stores (Leung 2018; Renkin, Montialoux and Siegenthaler 2019), but not more generally. The effect on inflation is therefore extremely small." - "Likely Effects of a $15 Federal Minimum Wage by 2024," Testimony prepared for presentation at the hearing of the House Education and Labor Committee, Washington, DC (2019)

This overlaps with general criticisms of widening income equality, citing an AEA article I cannot access since it's behind a paywall. I wonder if it touches on companies like Amazon being headquartered in the city and manipulating the job market by sheer size? I can only speculate.

Plus, there are the health benefits! Which are mostly connected to lessening poverty, and through that lessening stress and increasing healthcare access, but still! Some of these results are debated, but I'd need to know more about the details to know how they're related (University of Washington).

------

I've spent most of the day on this, so if you guys have made it this far and are interested in supporting me, please donate to my ko-fi or commission an article. (Preferably for more than the base price; I'm effectively working at a fraction of minimum wage myself, which is ironic considering the theme of this post.)

(I realistically shouldn't have spent more than two or three hours on this, but I have so many strong opinions on the subject that I couldn't stop.)

(Also: There were so many more sources I didn't even get to read the basic premise of because it was so repetitive after a while.)

#economics#stock market#capitalism#phoenix talks#ko fi#ko fi prompts#minimum wage#minimum wage increase#research

206 notes

·

View notes

Text

A jury on Friday said Blue Cross Blue Shield of Michigan discriminated against a woman who refused the COVID-19 shot for religious reasons and awarded her $12.6 million in both compensatory and punitive damages.

The insurance company denied Lisa Domski’s request for a religious exemption from its requirement of COVID-19 injection. According to her attorneys, since Domski worked from home as an information technology specialist, Blue Cross Blue Shield could have easily accommodated her request.

“Lisa is so thankful that a diverse jury of her peers saw through the company’s bogus decision to terminate her after 38 years of service,” Noah S. Hurwitz, an attorney who represented Domski, told The Epoch Times. “Clearly, the religious accommodation process was meant to stamp out religious beliefs of employees and promote COVID-19 vaccination within the company.”

The civil case was filed in U.S. District Court Eastern District of Michigan in August 2023.

According to the complaint, on January 5, 2022, Blue Cross Blue Shield “terminated approximately 250 employees who requested a religious accommodation” to the COVID shot requirement. The company also “touted on job recruiting websites that it required COVID-19 vaccination with ‘no exemptions.’”

8 notes

·

View notes

Text

Please stop with the takes on Concord

There's a famous quote by Karl Valentin, which roughly translates to "Everything has been said already, but not everyone has said it yet."

Yes, Concord has flopped. The game was in development for 8 years. The team had dozens of veteran game designers and developers who had worked on very successful, very famous, culturally relevant, well-reviewed games. It came out; too few people bought it; almost nobody played it; then it was pulled off the shelves. So it goes.

Either nobody noticed the problems, or nobody said anything, or these people were powerless to do anything. There must be a culture problem, and organisational problem, or a management problem. Too many cooks, too long, no marketing, worst thing since E.T. and Duke Nukem Forever, et cetera...

I would have been really impressed if anybody had predicted this in advance, if anybody had said look at the org chart, no way this studio can make a good game or listen to all these stories from the employees, they can't produce good work due to pervasive workplace culture problems. I am not impressed with these takes now – now that Concord has failed with critics, failed to impress audiences, failed commercially, and finally existentially. It's an extremely easy observation to make that there must be a cause to this level of failure, because the game is not just mediocre.

Concord failed on multiple levels. There are probably multiple reasons. We might as well blame insurance fraud, COVID-19 and interest rates. Unless you have some real inside information, please stop with the speculation.

10 notes

·

View notes

Text

50+ Good Things from the Biden Administration

Just a list of 50+ good things the Biden Administration has done in the last 4 years because I’ve been hearing too much rhetoric that it doesn’t matter who you vote for. It does make a difference.

Increased access to healthcare and specifically codified protections for LGBTQ+ patients against discrimination. (x)

Strengthened women's reproductive rights by increasing access to reproductive health care, improving confidentiality to protect against criminalization for patients receiving reproductive care, and revoked Medicaid waivers from states that would exclude providers like Planned Parenthood, and more. (x)

Expanded healthcare and benefits for veterans through the PACT Act (x)

Cemented protections for pregnant and postpartum workers through the Pregnant Workers Fairness Act and PUMP for Nursing Mothers Act.

Improved access to nursing homes for those who receive Medicaid services and established, for the first time, a national minimum staffing requirement for nursing homes to ensure those in their care receive sufficient support. (x)

Lowered healthcare costs for those with Medicare which capped insulin for seniors at $35 a month, made vaccines free, and capped seniors’ out of pocket expenses at the pharmacy through the Inflation Reduction Act.

Fully vaccinated 79% of American adults against COVID-19 (I know this is old news now this is a big deal)

Banned unfair practices that hide housing fees from renters and homebuyers when moving into a new home (x)

Reduced the mortgage insurance premium for Federal Housing Administration (FHA) mortgages and clarified that inflated rents caused by algorithmic use of sensitive nonpublic pricing and supply information violate antitrust laws. (x)

Increased protections for those saving for retirement from predatory practices. (x)

Helped millions of households gain access to the internet through the Affordable Connectivity Program. (x)

Restored net neutrality (net neutrality is a standard which ensures broadband internet service is essential and prohibits interna providers from blocking, engaging in paid prioritization, and more.) (x)

Increased protections for loan holders as well as increased access to loans (x)

Cut fees that banks charge consumers for overdrawing on their accounts. (x)

Reaffirmed HUD’s commitment to remedy housing discrimination under the Fair Housing Act (which was– surprise, surprise– halted under the Trump administration). (x)

Rejoined the Paris Climate Accords.

Listed more than 24 million acres of public lands across the country as environmentally protected and has channeled more than $18 billion dollars toward conservation projects. (And revoked the permit for the Keystone XL pipeline amongst others).

Invested $369 billion to reduce greenhouse emissions and promote clean energy technologies through the Inflation Reduction Act. Through the tax incentives under the Inflation Reduction Act, renewable energy (such as wind, solar, and hydropower) has surpassed coal-fired generation in the electric power sector for the first time, making it the second-biggest source of energy behind natural gas. (x)

Strengthened protections against workplace assault through the Speak Out Act. (x)

Increased protections for workers during the union bargaining process (x)

Is making it easier for passengers to obtain refunds when airlines cancel or significantly change their flights, significantly delay their bags, or fail to provide extra services when purchased. (x)

Invested $1.2 trillion into roads, waterlines, broadband networks, airports and more allowing for more bridges, railroads, tunnels, roads, and more through the Inflation Reduction Act (which also added 670,000 jobs). (idk about you but I like driving on well maintained roads and having more rail options).

Strengthened overtime protections for federal employees (x)

Raised the minimum wage for federal workers and contractors to $15. (x)

Strengthened protections for farmworkers by expanding the activities protected from retaliation by the National Labor Relations Act and more. (Previously anti-retaliation provisions under the National Labor Relations Act applies mostly to only U.S. citizens) (x)

Invested $80 billion for the Internal Revenue Service to hire new agents, audit the wealth, modernize its technology, and more. Additionally, created $300 billion in new revenue through corporate tax increases. (x)

Lowered the unemployment rate to 3.5% — the lowest in 50 years.

Canceled over $140B of student debt for nearly 40 million borrowers. (x)

Strengthened protections for sexual assault survivors, pregnant and parenting students, and LGBTQ+ students in schools through an updated Title IX rule. This updated rule strengthens sexual assault survivors rights to investigation– something that had been gutted under the Trump administration, strengthens requirements that schools provide modifications for students based on pregnancy, prohibits harassment based on sexual orientation or gender identity, and more. (x)

Revoked an order that limited diversity and inclusion training. (x)

Cracked down on for profit colleges. (x)

Reaffirmed students’ federal civil rights protections for non-discrimination based on race, national origin, disability, religion, sexual orientation, gender in schools. Specifically, the Department of Education made clear students with disabilities’ right to school, limiting the use of out of school suspensions and expulsions against them. (x) (x)

Enhanced the Civil Rights Data Collection, a national survey that captures data on students’ equal access to educational opportunities. These changes will improve the tracking of civil rights violations for students, critical for advocates to respond to instances of discrimination.

Provided guidance on how colleges and universities can still uphold racial diversity in higher education following the Supreme Court decision overturning affirmative action. (x)

Issued a federal pardon to all prior Federal offenses of simple possession of marijuana. Additionally, the DEA is taking steps to reclassify marijuana as a Schedule III substance instead of a Schedule I, limiting punishment for possession in the future. (x)

Changed drug charges related to crack offenses, now charging crack offenses as powder cocaine offenses. This is a big step towards ending the racial disparity that punishes crack offenses with greater severity than offenses involving the same amount of powder cocaine. (x)

Lowered the cost of local calls for incarcerated people through the Martha Wright-Reed Just and Reasonable Communications Act as well as increased access for video calls (especially impactful for incarcerated people with disabilities). (x)

Enacted policing reforms that banned chokeholds, restricted no-knock entries, and restricted the transfer of military equipment to local police departments. (x)

Established the National Law Enforcement Accountability Database (NLEAD) which will better track police officer misconduct. This database will vet federal law enforcement candidates who have a history of misconduct from being rehired and will make it easier and faster to charge police officers under the Death in Custody Reporting Act. (x)

Added disability as a protected characteristic alongside race, gender, religion, and sexual orientation. Under the law, police officers are prohibited from profiling people based on these characteristics. …It sadly happens anyway but now there’s an added legal protection which means a mechanism to convict police officers should they break the law. (x)

Required federal prisons to place incarcerated individuals consistent with their chosen pronouns and gender identity. (x)

Expanded gun background checks by narrowing the “boyfriend” loophole to keep guns out of the hands of convicted dating partners, strengthening requirements for registering as a licensed gun dealer (closing the “gun show loophole”), and more through the Bipartisan Safer Communities Act. (x)

Increased mental health programs within police departments to support officers experiencing substance use disorders, mental health issues, or trauma from their duties. (x)

Lifted Trump era restrictions on the use of consent decrees. The Justice Department uses consent decrees to force local government agencies (like police departments) to eliminate bad practices (such as widespread abuse and misconduct) that infringe on peoples’ civil rights. (x)

Improved reporting of hate crimes through the COVID-19 Hate Crimes Act (x)

Nominated the first Black woman to sit on the Supreme Court

Confirmed 200 lifetime judges to federal courts, confirming historic numbers of women, people of color, and other judges who have long been excluded from our federal court system. (64% are women, 63% are people of color)

Designated Temporary Protected Status (TPS) status for immigrants from Cameroon, Haiti, El Salvador, Haiti, Honduras, Nepal, Nicaragua, Sudan, and more. (x)

Ended the discriminatory Muslim and African bans (x).

Provided a pathway to citizenship for spouses of U.S. citizens that have been living in the country without documentation. (x)

Expanded healthcare to DACA recipients (x)

This one is… barely a win but not by fault of the Biden Administration. The Department of Homeland Security as of Feb 2023 has reunited nearly 700 immigrant children that were separated from their families under Trump’s Zero Tolerance Policy. From 2017-2021, 3,881 children were separated from their families. About 74% of those have been reunited with their families: 2,176 before the task force was created and 689 afterward. But that still leaves nearly 1,000 children who remain tragically separated from their families from under the Trump Administration. (x)

(okay this one is maybe only exciting for me who’s a census nerd) Revised federal standards for the collection of race and ethnicity data, allowing for federal data that better reflect the country’s diversity. Now, government forms will include a Middle Eastern/ North African category (when previously those individuals would check “white”). Additionally, forms will now have combined the race & ethnicity question allowing for individuals to check “Latino/a” as their race (previously Latine individuals would be encouraged to check “Latino” for ethnicity and “white” for race… which doesn’t really resonate with many folks). (x) (I know this sounds boring but let me tell you this is BIG when it comes to better data collection�� and better advocacy!).

Rescinded a Trump order that would have excluded undocumented immigrants from the 2020 Census which would have taken away critical funds from those communities.

Required the U.S. federal government and all U.S. states and territories to recognize the validity of same-sex and interracial civil marriages by passing the Respect for Marriage Act, repealing the Defense of Marriage Act.

Reversed Trump’stransgender military ban.

Proposed investments in a lot of programs including universal pre-k, green energy, mental health programs across all sectors, a national medical leave program for all workers and more. (x)

Last… let’s also not forget all the truly terrible things Trump did when he was in office. If you need a reminder, scroll this list, this one mostly for giggles + horror, for actual horror about what a Trump presidency has in store, learn about ‘Project 2025’ from the Heritage Foundation. I know this post is about reasons to vote FOR Biden but let’s not forget the many, many reasons to vote for him over Trump.

So, there it is, 50+ reasons to vote for Biden in the 2024 Election.

Check your voter registration here, make a plan to vote, and encourage your friends to vote as well.

All in all, yeah… there’s a lot of shitty things still happening. There’s always going to be shit but things aren’t going to change on their own. And that change starts (it certainly doesn’t end) with voting.

Go vote in November.

#politics#us politics#election 2024#2024 elections#joe biden#biden#get out the vote#vote biden#(I say somewhat begrudgingly tbh but you better believe I'm voting)#posting this one more time#because I think it's important and I have no shame when it comes to talking politics into an abyss

6 notes

·

View notes

Text

Life insurance actuaries are reporting that many more people are dying – still – than in the years before the pandemic. And while deaths during COVID-19 had largely occurred among the old and infirm, this new wave is hitting prime-of-life people hard.

No one knows precisely what is driving the phenomenon, but there is an inexplicable lack of urgency to find out. A concerted investigation is in order.

Deaths among young Americans documented in employee life insurance claims should alone set off alarms. Among working people 35 to 44 years old, a stunning 34% more died than expected in the last quarter of 2022, with above-average rates in other working-age groups, too.

“COVID-19 claims do not fully explain the increase,” a Society of Actuaries report says.

14 notes

·

View notes

Text

MOSCOW, Idaho — A settlement has been reached in a civil lawsuit between the City of Moscow and several city employees. The lawsuit was filed by a group of people arrested during the height of the pandemic for gathering at city hall and violating a public health order.

Under the terms of the settlement Moscow's liability insurance provider and Idaho Counties Risk Management Program will pay a total of $300,000 to Gabriel Rench and Sean and Rachel Bohnet. All claims against the City and the named employees will be dismissed with prejudice, releasing them from any liability.

"This settlement provides closure of a matter related to the unprecedented COVID-19 pandemic and the City’s efforts to protect the public during an exceptionally trying time," Bill Belknap, Moscow city supervisor, said.

In September 2020, the Christ Church in Moscow planned a "Psalm Sing" event despite previous citations and arrests related to violating a public health order put in place to prevent the spread of COVID-19. At the time, Moscow required people who are not members of the same household to maintain six feet of physical distance from one another or wear a face covering while they are in public. Organizers requested attendees to avoid wearing masks.

The city provided an empty parking lot for the event, marked for social distancing, but many attendees did not wear masks.

Law enforcement approached individuals in violation of the public health order, resulting in citations, arrests and release on the same day.

A video of Gabriel Rench's arrest at the event was released.

7 notes

·

View notes

Text

Bella Adama ??? — November 24, 2022

Bella, thirteen to possibly fourteen years of age, passed at home on Thanksgiving night. Originally from parts unknown and returned to the pound no fewer than three times, she lived the best life a goblin disguised as a dog could ask for after being rehomed to the nanny (Leah) in the aftermath of a divorce. She is survived by her caretakers and moms, Leah and Emily Adama, in addition to her sister Lady Adama, her beloved Not-Mom Not-Dog, Mira Adama, her favorite auntie and dogsitter, Layla, her begrudging grandfather, Lou, and doting grandmother/insurance agent Jody. She is predeceased by her grandmother, Sharon, her sister, Luna, and the many birds that she hunted and killed over the course of her lifetime.

Rumored to have been a criminal turned into a dog as punishment for misdeeds, Bella never completed the requisite number of good deeds to turn back into a human. Instead, she extended her sentence as a mutt through endless garbage crimes, destruction of property, numerous instances of tearing curtains off the wall and placemats off of tables, and more than one noise complaint from the neighbors. On one notable occasion, she rammed her stubby little body repeatedly into an HVAC duct under the house, tearing it from its fittings and sending it crashing to the ground. She escaped the backyard more times than anyone may ever know. She was a bully and a terror, opinionated and forceful, and made sure no one in the house ever missed a meal. Her mothers regret never getting her DNA tested to see what mix of breeds would result in such demonic behavior. She was the worst.

Over the course of the eleven documented years of her life, Bella never met anyone she didn’t want to make into a friend. This included every PetSmart employee, vet techs, contractors, neighbors, visitors, and the mail carrier. Unfortunately, Bella never developed a single manner or sign of good breeding. But those who could tolerate her absolutely unhinged idea of affection could rely on her to headbutt them repeatedly should they dare stop petting her before she was done. By February 2019, she was fed up with only having one mom to give her attention, and threw herself into Emily’s lap during her first visit to South Carolina and acted like a normal dog one whole time. Leah was so shocked at the sight that she immediately called her father. Leah and Emily would wed later that year, Emily being successfully suckered by Bella’s con.

The last few years of Bella’s life, she enjoyed constant snacks and affection. When the COVID-19 pandemic hit, both Leah and Emily started working from home. The conditions of the pandemic brought her precious Not-Mom Not-Dog into the home as well, and between the various insomnia episodes and wfh schedules of Leah, Emily, and Mira, Bella was never without a human to accost into giving into her will.

In the end, despite facing many health scares (many eaten and vomited up socks and plastic grocery bags, garbage heists, containment breaches, a chronic pancreatitis diagnosis, possible liver cancer, and one notable incident with an entire roll of Christmas ribbon which resulted in surgery) over the yawning chasm of a decade of chaos and bad behavior, death came as a friend. She spent her last weeks pampered at home, and passed in the laps of those who loved her the most.

There will never be another dog as perfect as she was.

In lieu of cards or flowers, please make a donation to your local humane society or give your dog a piece of cheese.

27 notes

·

View notes

Text

I'm so glad my employer recently allowed me to permanently transition to being full-time work from home following my diagnosis (auto-immune disorder) and recommendation from my doctors (I feel incredibly fortunate because this allows me to stay employed and I know many others aren't so lucky). I've pretty much turned into a hermit for the season as I'm avoiding even going to stores and such unless absolutely necessary. I took issue with people coming into the office sick before because I'd always end up catching something and being miserable. And now I have a very weak immune system (medically enforced because otherwise it literally eats my muscles away) and catching something can be so much worse and potentially deadly very quickly.

My disorder was triggered by a very mild case of covid-19 a year ago. It can happen to anyone. I was early 30s, active, and otherwise healthy. I slowly got worse over several months (while seeing doctors trying to figure out wtf was happening) until I ended up in the ER unable to move and struggling to breathe. I've spent the last 7 months trying to get my strength and ability to walk back and it's only improving little by little because I'm now on medication typically used for cancer and transplant patients to suppress the immune system. But my insurance thinks I don't need to be, so every month my doctor and I get to fight them.

I don't understand why it's so seemingly okay for illness to just cycle through a work place. It's so irresponsible and helps no-one. I know a good chunk of the blame is on work place policies penalizing employees for being sick/not coming into the work place and that's part of our employer culture that desperately needs to change. But my employer gladly lets employees work from home when sick without penalty or even a doctor's note in most cases. There's no reason anyone should be coming in sick, and yet they still do constantly. We work in close quarters in cubicles and I've had coworkers joke and be like, "Haha, my kid and spouse have the flu and I think I might be getting it." while sounding like they're hacking up a damn lung. >:( Use common sense! I'm obviously not going to be able to avoid everything but so many people just don't even try to be respectful of others in this capacity.

I've been to two small get togethers with a handful of friends in the last two months and I'm incredibly thankful for the ones that have communicated that they won't be able to make it or ask about rescheduling because they're ill. And masking or being asked to mask has never been anything made a big deal of.

Be safe, conscientious of others, and keep UTD on your health and vaccines!

we are on like covid variant #100037 and rsv/flu/pneumonia cases are rising and people will show up unmasked and be like “yeah i’ve been sick for days :/” like. ok. Get the fuck away from me then? why are you out here breathing on everything. the very least you could be doing is masking. NOT hacking into open air every two seconds.

59K notes

·

View notes

Text

Rising Costs of Health Insurance Premiums in 2024

The rising costs of health insurance premiums in 2024 have become a significant concern for individuals and families alike. With healthcare expenses already a major financial burden, the increasing premiums are putting additional pressure on household budgets. Understanding the reasons behind this trend is crucial for navigating these challenges effectively.

Factors Behind Rising Premiums

Several factors contribute to the rising costs of health insurance premiums in 2024. One key reason is inflation within the healthcare sector. Medical services, medications, and hospital stays continue to see price hikes, directly affecting the cost of insurance. Additionally, advancements in medical technology, while beneficial for patient outcomes, come at a high price, which insurers pass on to policyholders.

Moreover, the long-term effects of the COVID-19 pandemic have left healthcare systems struggling to recover. Insurers are adjusting premiums to account for increased demand for services and higher claims. Changes in regulations and policy frameworks may also play a role in driving up costs, as they often alter the dynamics of coverage and pricing.

Impact on Policyholders

The rising costs of health insurance premiums in 2024 are forcing many individuals to reconsider their options. Some are opting for higher deductibles to reduce monthly premiums, while others are downgrading their coverage to save money. Unfortunately, these compromises can leave policyholders vulnerable to unexpected medical expenses.

Employers, too, are feeling the strain as they face higher group health insurance rates. Many businesses are passing on a portion of these costs to employees or reducing the scope of coverage in company-provided plans.

Coping Strategies

To manage these rising costs, individuals should actively compare plans during open enrollment periods. Exploring options such as high-deductible health plans paired with health savings accounts (HSAs) can provide some financial relief. Additionally, leveraging preventive care and wellness programs can help reduce long-term healthcare expenses.

Advocating for transparency in healthcare pricing and supporting initiatives aimed at controlling medical costs can also contribute to tackling this issue on a broader scale.In conclusion, the rising costs of health insurance premiums in 2024 are a complex challenge influenced by economic, technological, and regulatory factors. While the road ahead may be tough, informed decisions and proactive planning can help individuals and families mitigate the impact of these escalating expenses.

0 notes

Text

Also preserved in our archive

By Lauren Clason

Brandi Goodwin caught Covid-19 while tending to patients as a point-of-care technician at a Norwalk, Ohio, hospital in December 2020. When body aches and headaches lingered after she returned to work, she attributed it to stress from college exams.

But when her symptoms morphed into the multisystem disorder POTS and other related conditions, Goodwin was denied long-term disability from Unum Life Insurance Co. of America and eventually fired from her job. It took weeks of frantic searching to find a lawyer to take her case. Four years later, Goodwin is still fighting Unum in court.

Her administrative record spans 7,000 pages, according to a filing at the US Court of Appeals for the Sixth Circuit, and documents multiple emergency visits along with tests and attestations from long Covid specialists, cardiologists, neurologists, pulmonologists, and physical therapists.

Getting long-term disability benefits can be an uphill battle for the 5% of the US adult population CDC data shows is still affected by long Covid in 2024. Private insurers often push back heavily on long-term disability claims, and the unique pitfalls of appealing their decisions under the Employee Retirement Income Security Act create additional hurdles for plaintiffs.

“The laws are so different that it was just really, really, really hard to find a lawyer,” said Goodwin, now 30.

“Nobody wanted to take my case because it’s Covid,” she added. “It’s not a guaranteed win. It’s new territory.”

Most patients resolve their cases outside of court, and the ones that do move to litigation are typically settled, plaintiffs’ lawyers said. Just a handful of long Covid patients have secured victories in court—and the insurance company usually appeals.

Unum, which declined to comment, says Goodwin can work, citing evidence of improvement from her doctors. The company also argues that her problems are attributable to pre-existing conditions and not eligible for coverage, pointing to a note from one doctor detailing a previous case of vertigo caused by a sinus infection.

Tough to Measure Individuals with disabilities like long Covid have a number of options under state, federal, and private assistance programs, but that doesn’t mean they’re easy to obtain. Only a handful of states offer benefits, while just 39% of Social Security disability applications were accepted in 2023—with another 15% accepted on appeal. Lawyers estimate that denial rates for private insurance are even higher.

Insurance companies walk a fine line, since policies must be affordable to the average person yet pricey enough to cover the expenses of potentially millions of people. Miscalculating that risk could bankrupt the company and leave enrollees without promised payouts.

Disability policies that would cover long-term benefits for long Covid are often broadly written because the range of underlying medical conditions are hard to pin down, said Daniel Schwarcz, an insurance law professor at the University of Minnesota. Insurance companies say they must identify the people who are able to work even though an illness “makes it harder” in order to keep premiums low, he said.

“The real difficulty here is that disability is defined pretty universally in ways that are not objective,” he said.

Long Covid is notoriously hard to measure objectively. Two major characteristics of the disease are chronic fatigue and brain fog, both of which are hard to capture on paper.

Brain fog was just one of software engineer Christine Ward’s symptoms when Reliance Standard Life Insurance Co. denied her long-term disability claim. The 67-year-old had a prescription to help with cognition, but Reliance still argued she was capable of performing a “sedentary occupation.”

Reliance did not respond to a request for comment.

Ward’s cognitive trouble made her quit driving after she said she made a wrong turn into oncoming traffic.

“What if I caused an accident?” she said. “I would never be able to forgive myself.”

Ward won her initial case, but chose to settle afterward to avoid a lengthy appeal.

Legal Limitations Nothing in the law itself restricts how the cases are treated in court, but a series of legal decisions has turned ERISA lawsuits into a functional extension of the administrative appeal with the insurance company.

Judges in ERISA disability cases like Ward’s typically don’t allow any new evidence outside of the insurer’s existing document record, which prevents lawyers from submitting new medical evidence or deposing company doctors who deny claims. That means patients’ best shot of overturning a disability denial is getting a lawyer to handle the internal appeal before it gets to court.

The general prohibition on discovery in many ERISA cases stems from the Sixth Circuit’s 1990 decision in Perry v. Simplicity Engineering, which said allowing new evidence would turn courts into “substitute plan administrators” and prevent both parties from resolving disputes “inexpensively and expeditiously.”

Plaintiffs are also usually denied jury trials and judges can remand cases back to the insurance company for another review. And while many states ban contract clauses that direct judges to give deference to insurers’ decisions on claims denials, not all do. Patients in those instances must clear a higher bar by showing the insurance company’s decision was not only wrong, but “arbitrary and capricious.”

“The federal judges have completely ignored the Federal Rules of Civil Procedure when it comes to ERISA cases,” said Mark DeBofsky, a disability lawyer with DeBofsky Law and attorney for Ward. Lawyers can sometimes score some wiggle room. Edward Dabdoub, founder of Florida-based Dabdoub Law Firm, said he is able to build on small wins “one case at a time.” Convincing a judge to allow a deposition in one case might sway another judge in a similar case later.

“It is a process of chipping away and reversing the last 40 years of what has happened in the federal courts,” said Dabdoub, who largely works within the Eleventh Circuit.

Packing the administrative insurance appeal with supporting evidence is critical, because that evidence is usually excluded in court otherwise, benefits lawyers said. Mitre Corp. engineer Heather Cogdell’s recent victory against Reliance, for example, included scientific articles and character reference letters from friends and family.

Cogdell’s victory ironically hinged on the ERISA limits that typically favor insurance companies. Reliance initially denied her claim based on one nurse’s review, and was unable to present reviews from external physicians after it missed the 45-day deadline to issue Cogdell a final decision. The company has appealed.

Her attorney Damon Miller at Virginia-based BenGlassLaw tries to fill appeals with so much evidence that it’s “almost absurd” for the insurer to deny it.

“Making sure to get all the relevant medical records, making sure to get any additional testing that might be needed, getting doctors to write well thought out, well-reasoned letters” are essential, he said.

Tide Turning? Several appeals court judges across the Sixth, Fourth, and Second circuits in recent years have leaned heavily on a close reading of the law’s text to question the way courts treat ERISA lawsuits.

None of those questions have yet surfaced in majority opinions, DeBofsky said, but he expects the issue will eventually end up at the US Supreme Court.

In the Sixth Circuit’s 2023 decision in Tranbarger v. Lincoln Life & Annuity Co. of N.Y., Judge John Nalbandian argued current ERISA case law violates the Supreme Court’s holding in US v. Tsarnaev, which “prevents lower courts from creating prophylactic rules that contradict federal statutes or rules.”

“In short, we told district courts not to consider new evidence,” Nalbandian wrote in a concurring opinion.

“In doing so, we failed to consider the text of the statute—the only clear indication of what Congress wanted,” he added.

In the 2021 decision Card v. Principal Life Insurance Co., Sixth Circuit Judge Eric Murphy similarly called the practice of remanding a decision back to the insurance company “quite an unusual thing.”

“Why shouldn’t the district courts instead oversee any additional litigation compelled by an arbitrary-and-capricious finding using the normal rules of civil procedure?” While treatment has stabilized Goodwin enough to keep her out of the ER, her overall physical condition has declined as her appeal continues. A recent heart and lung test showed a drop in function compared to 2022, she said.

Goodwin said she is still unable to work and has been relying on family, church, and community aid programs for financial help.

“I feel like I cannot heal fighting these people,” she said.

#mask up#public health#wear a mask#pandemic#wear a respirator#covid#covid 19#still coviding#coronavirus#sars cov 2#long covid#covid is airborne#covid is not over#covid conscious

1 note

·

View note

Text

Hiring a Commercial Cleaning Company for Office Deep Cleaning

Before hiring a commercial cleaning company, you need to understand a few things regarding deep cleaning an office. As the world grapples with the aftermath of the COVID-19 pandemic, cleanliness and health have become important, particularly in the workplace. Deep cleaning the office is no longer a luxury, but a necessity. Before hiring a commercial cleaning company, you need to understand the basics of thorough cleaning to ensure your workplace is safe and hygienic. BFA Cleaning offers the best Commercial Cleaning Services London.

What exactly does "deep cleaning" mean?

Deep cleaning is a more thorough approach to cleaning than simply putting things away. It entails cleaning and disinfecting office areas that are sometimes overlooked during routine cleaning, such as air vents, under carpets, behind appliances, and so on.

Why is it necessary to perform a deep clean?

Improved Hygiene and Health

The COVID-19 pandemic has demonstrated the need to maintain a clean and germ-free environment. Even if you clean your office every day, you may not eliminate germs and vermin. Deep cleaning, on the other hand, employs specialised tools and cleaning solutions to eliminate these hazardous microorganisms. This increased level of hygiene is critical in preventing infections like COVID-19 from spreading.

Employee Safety and Wellbeing

Deep cleaning is an important component of ensuring your staff's safety and wellness. A clean and sanitary office reduces the likelihood of employees becoming ill and infecting others. It can help reduce allergy reactions caused by dust mites and mould, which is beneficial to employees' overall health.

Enhanced Productivity

A clean and healthy work environment might also help you complete more tasks. Employees are more likely to focus on their task when they are in a clean and pleasant environment. In the aftermath of a pandemic, knowing that their workplace has been adequately cleaned and sanitised might alleviate workers' worries, making it easier for them to work.

Before hiring a commercial cleaning firm, it's vital to consider factors such as COVID-19 and the importance of deep cleaning in the office.

Protocols and Standards for Covid-19

Ensure that the company adheres to the most recent COVID-19 standards and protocols, both locally and internationally. They should be equipped with the necessary gear to clean and sanitise in a certain manner to prevent the virus from spreading.

The Services Offered

The company should provide a comprehensive range of deep cleaning services, including cleaning air ducts, high-level dusting, and disinfection, all of which are critical in the fight against COVID-19.

Knowledge and experience

The provider should have extensive experience with deep cleaning and understand how to prevent illnesses from spreading. They should be able to tailor their services to your requirements and provide guidance on how to maintain your workplace clean and safe.

Safety and Long-term Sustainability

The cleaning firm should use environmentally friendly cleansers. They should also have insurance in case of harm during cleaning.

Reviews & Reputation

Always check the company's reviews and image. Clients' previous experiences can provide insight on the company's reliability and efficiency.

Value and Cost

Price is vital, but service quality should not be compromised. The firm should provide you with excellent value for money by providing high-quality deep cleaning services that will keep your office clean and last longer.

Overall, deep cleaning is more vital than ever in today's environment. It is a crucial aspect of maintaining the workplace safe and healthy, which is beneficial to employee health and productivity. Understanding deep cleaning and what to look for in a commercial cleaning firm is vital to protecting your employees and your organisation.

BFA Cleaning delivers that level of protection through their environmentally friendly services of office and commercial cleaning London. Request a quote today, or contact +44 (0) 207 118 1748 if you have any questions.

0 notes

Text

holy fuck

if you/someone you know use UHC, makes sure whoever pays for your/their healthcare - you/them, a spouse, family, whatever - knows about this because to quote a content creator i follow called liv pearsall, "what in, and i do not say this lightly, fresh hell"

also, if you're like me (in my case it's autism but it could be something else for you) and struggle with understand big, fancy words (like the article) i ran the article through this informalizer to make a more simple version. it's under the cut! :)

Yo, so here's the deal. UnitedHealthcare, the biggest health insurance company in the US, is supposedly using this totally messed up AI algorithm to screw over old folks and deny them the coverage they really need. It's a total mess. These elderly patients are getting booted out of rehab and care facilities way too early, and they're being forced to drain their savings just to get the care that should be covered by their Medicare Advantage Plan.

And get this, someone actually filed a lawsuit about it. It's going down in the US District Court for the District of Minnesota. The lawsuit is all about how UnitedHealth denied health coverage to two people who eventually died. But it's not just about them — there could be thousands of other people in similar situations.

This lawsuit lines up with an investigation by Stat News that basically supports all the claims. Stat got their hands on internal documents and talked to former employees of NaviHealth, which is a subsidiary of UnitedHealth that created this messed up AI algorithm called nH Predict.

One former employee, Amber Lynch, spilled the tea to Stat. She used to work for NaviHealth and said that the whole company cared more about money than actually helping patients. She hated how they treated patients like data points instead of human beings.

Here's the deal with nH Predict. It started being used by UnitedHealth back in November 2019, and they're still using it. Basically, this algorithm tries to guess how much care a patient on Medicare Advantage will need after they have, like, a big injury or illness. Stuff like therapy and skilled care in hospitals and nursing homes.

No one really knows how nH Predict works exactly, but it apparently takes info from a database with cases from 6 million patients. The case managers at NaviHealth put in some details about a patient, like age and living situation, and the algorithm spits out estimates based on similar patients in the database. It tries to figure out stuff like how long the patient will need care and when they can be discharged.

But here's the problem — the algorithm doesn't take a bunch of important factors into account, like other medical issues the patient might have or if they catch something like pneumonia or COVID-19 during their stay. It's a mess.

According to the investigation and the lawsuit, the estimates the algorithm gives are usually way off. With nH Predict, patients are hardly ever getting the full 100 days of covered care they're supposed to get in a nursing home. Usually, they only get like 14 days before UnitedHealth denies payment.

And get this, when patients or their doctors ask to see the algorithm's reports, UnitedHealth just says no and claims it's top secret. And if the doctors try to disagree with UnitedHealth's decision, tough luck. UnitedHealth just overrides them.

This whole thing is messed up, but sadly it's not the first time the healthcare industry has screwed up with AI. They've been doing this racist algorithm stuff for a while now. But what makes this situation even worse is that it seems like UnitedHealth is deliberately denying coverage to save money.

Ever since UnitedHealth bought NaviHealth, former employees say the company cares more about hitting targets and making post-acute care as short and cheap as possible. They even have requirements for case managers to follow the algorithm's predictions. If they don't, they could get in trouble or even lose their jobs.

Apparently, case managers are trained to defend the algorithm's estimates to patients and their caregivers. They use all these tactics to shut down any objections. Like, if a nursing home doesn't want to let a patient leave, the case manager will say the patient doesn't need certain care because of some calorie rule. It's like they don't even care about the patients.

And even if patients manage to win an appeal and get the denial overturned, UnitedHealth just comes right back with another denial a few days later. It's a never-ending cycle.

The lawsuit is fighting back against UnitedHealth and NaviHealth for all this shady behavior. They're accusing them of breaking contracts, not acting in good faith, unfairly getting rich, and violating insurance laws in a bunch of states. They want damages, emotional distress compensation, and for UnitedHealth to stop using the AI-based claims denials.

We don't know exactly how much money UnitedHealth saves with nH Predict, but it's gotta be a crazy amount. Last year, the CEO made almost $21 million, and other execs made millions too.

In the end, it's just a messed up situation. These elderly people are getting screwed over by an AI algorithm that values money over their health. It's not cool, and something needs to change.

UnitedHealthcare, the largest health insurance company in the US, is allegedly using a deeply flawed AI algorithm to override doctors' judgments and wrongfully deny critical health coverage to elderly patients. This has resulted in patients being kicked out of rehabilitation programs and care facilities far too early, forcing them to drain their life savings to obtain needed care that should be covered under their government-funded Medicare Advantage Plan.

It's not just flawed, it's flawed in UnitedHealthcare's favor.

That's not a flaw... that's fraud.

45K notes

·

View notes

Text

The Future of Employee Benefits and Compensation

In the ever-evolving world of work, employee benefits and compensation have seen significant changes in recent years, with the future promising even more transformation. As organizations strive to meet the expectations of an increasingly diverse workforce, the future of employee benefits and compensation is becoming more complex and individualized. Technological advancements, shifting employee expectations, demographic changes, and the rise of new business models are driving these changes. The future of compensation and benefits will likely emphasize flexibility, inclusivity, personalization, and a stronger focus on employee well-being.

1. Personalization and Flexibility

As employees increasingly seek tailored experiences, organizations are recognizing that a one-size-fits-all approach to benefits and compensation is no longer sufficient. Future benefits packages will offer employees more control and flexibility in how they structure their benefits, enabling them to select the perks that best align with their individual needs.

This flexibility can take many forms. For example, employees may choose between different types of healthcare plans based on their personal or family needs, or opt for various retirement savings options that better suit their financial goals. Beyond traditional benefits like health insurance and retirement contributions, flexible benefits packages may also include options for wellness programs, professional development, and even sabbaticals or extended leave. The rise of flexible spending accounts (FSAs) and health savings accounts (HSAs) allows employees to allocate funds for medical expenses in a way that works best for them.

With personalization at the forefront, employers will increasingly provide platforms and tools that allow employees to customize their benefits. These digital platforms can give employees the ability to adjust their benefits year-round, rather than during an annual open enrollment period. In doing so, employees can adapt their benefits to life changes such as marriage, childbirth, or even pursuing further education.

2. Holistic Well-Being: Mental Health and Beyond

The future of employee benefits is increasingly focused on holistic well-being, going beyond traditional physical health benefits to address mental, emotional, and financial health. The COVID-19 pandemic accelerated the recognition of mental health challenges in the workplace, and employers are responding with programs aimed at providing support for mental health, stress management, and emotional resilience.

Organizations are offering mental health days, counseling services, and access to apps or platforms for meditation and stress relief. Flexible schedules and remote work policies also contribute to reducing workplace stress, giving employees more control over their work-life balance. Furthermore, mental health benefits are no longer seen as a luxury; they are becoming an essential part of employee well-being and are increasingly expected by workers, especially among younger generations.

Financial wellness is another growing trend. Employers are beginning to offer benefits like financial counseling, student loan repayment assistance, and budgeting tools. With the rising costs of living and student debt, these benefits are particularly valuable to younger employees. Employers are recognizing that employees who feel financially secure are more likely to be productive and satisfied with their jobs.

3. Technology Integration and Data-Driven Decision Making

Advancements in technology are reshaping the landscape of employee benefits and compensation. Human Resource (HR) software and digital platforms allow organizations to track employee preferences, performance, and engagement in real-time. This data is being used to design more effective and targeted benefits packages that align with the needs and preferences of employees.

For example, data analytics can help companies identify trends in employee behavior, such as the types of benefits that lead to higher retention or engagement. HR platforms that integrate artificial intelligence (AI) and machine learning can predict which benefits will appeal to different demographic groups, from younger workers who prioritize student loan assistance to older employees interested in retirement planning tools.

Moreover, technology facilitates the administration of compensation and benefits programs. Automation can simplify processes such as payroll, performance evaluations, and benefits enrollment, making these systems more efficient and less prone to errors. As companies collect more data on employee satisfaction, they can continuously fine-tune benefits and compensation offerings to ensure they meet the evolving needs of their workforce.

4. Equity and Inclusivity in Compensation

Another key trend in the future of employee benefits and compensation is the focus on equity and inclusivity. As organizations place more emphasis on diversity and inclusion, compensation practices will reflect a more equitable approach. Employers are increasingly looking at pay equity and taking steps to ensure that there is no discrimination based on gender, race, or other factors.

Pay transparency is likely to become more common, with employers sharing salary ranges and benefits information upfront, making it easier for employees to compare compensation packages and understand how their pay is determined. This transparency helps to build trust between employers and employees and reduce disparities in compensation across different groups.

Inclusive benefits packages will also become the norm. Companies will be expected to provide benefits that cater to diverse populations, including LGBTQ+ employees, employees with disabilities, and those from different cultural backgrounds. For instance, offering parental leave that includes both maternity and paternity leave, or providing health coverage for fertility treatments and gender-affirming care, is becoming a standard expectation. Flexibility in work arrangements will also be increasingly important for employees with caregiving responsibilities, whether for children, aging parents, or other loved ones.

5. Sustainability and Corporate Social Responsibility (CSR)

As environmental consciousness grows, employees are increasingly interested in working for companies that align with their values. In response, employers are incorporating sustainability into their benefits offerings. For example, companies might offer benefits such as subsidized public transportation passes, electric vehicle charging stations at the workplace, or contributions to green initiatives that allow employees to contribute to sustainability goals.

Additionally, many companies are adopting corporate social responsibility (CSR) programs that allow employees to volunteer for causes they care about. Paid volunteer time off (VTO) or company-sponsored charity events may become standard components of benefits packages in the future. By aligning their compensation and benefits packages with sustainability and social responsibility goals, employers are demonstrating their commitment to ethical practices and attracting socially conscious employees.

Conclusion

The future of employee benefits and compensation will be shaped by the growing demand for flexibility, inclusivity, and holistic well-being. Employers will need to rethink traditional benefit models and embrace new approaches that reflect the changing needs and values of the workforce. Personalization and technology will play a critical role in offering tailored benefits, while mental health and financial wellness will become increasingly prioritized. Equity, inclusivity, and sustainability will define compensation practices, ensuring that organizations can attract and retain a diverse, engaged, and satisfied workforce.

As the workforce continues to evolve, companies must remain agile and responsive to these changes. The future of employee benefits and compensation is not just about staying competitive in the marketplace; it’s about creating an environment where employees feel valued, supported, and empowered to thrive both professionally and personally.

0 notes

Text

Cloud Computing Industry - Overview, Trends, Key Drivers and Growth Forecasts Till 2030

The global cloud computing market was valued at USD 602.31 billion in 2023, with an anticipated growth at a compound annual growth rate (CAGR) of 21.2% from 2024 to 2030. This rapid expansion is driven by multiple factors, including the increasing recognition among large enterprises of the transformative capabilities of cloud computing. Migration to cloud platforms allows these enterprises to streamline their operations, enhance flexibility, and improve efficiency, all of which contribute to performance gains across entire organizations.

A significant factor driving cloud computing's popularity is the rise of hybrid and multi-cloud solutions, which offer businesses the flexibility to select multiple cloud providers to create a tailored infrastructure solution that aligns with their unique requirements. This setup enables organizations to capitalize on the specialized strengths of different providers. Additionally, the pay-as-you-go pricing models in cloud computing eliminate the need for large, upfront investments typically associated with traditional IT infrastructure. This is particularly advantageous for businesses in developing economies, where digital transformation initiatives are accelerating as companies seek cost-effective ways to enhance their digital capabilities and compete globally.

Gather more insights about the market drivers, restrains and growth of the Cloud Computing Market

Governments worldwide are also contributing to the momentum behind cloud adoption by implementing data security regulations that strengthen trust within the cloud ecosystem. These regulations are designed to create a more secure environment for cloud operations, addressing concerns that might otherwise hinder adoption. The COVID-19 pandemic further accelerated the adoption of cloud computing as organizations needed to adapt to remote work environments quickly. Cloud solutions provided the necessary scalability and accessibility to support a distributed workforce, making it possible for employees to stay connected and productive regardless of location.

However, as cloud adoption grows, concerns about data privacy and security remain a critical obstacle. Businesses are understandably cautious about storing sensitive information with third-party providers due to risks like data breaches and unauthorized access. To ensure the long-term success of the cloud market, addressing these security concerns with stringent protection measures will be essential for building trust and driving continued growth.

The market expansion is also fueled by adoption among small and medium-sized organizations (SMOs) and governments in developing countries. SMOs are increasingly aware of the benefits of cloud-based solutions, which offer a cost-effective and scalable alternative to traditional on-premise infrastructure. This model allows SMOs to access enterprise-level computing power without incurring high initial costs or managing complex IT systems. Additionally, cloud technology enhances operational efficiency and agility, enabling SMOs to respond to market changes quickly and compete more effectively.

End-use Segmentation Insights:

In terms of end-use industries, the Banking, Financial Services, and Insurance (BFSI) segment dominated the cloud computing market in 2023, capturing the largest share of revenue. Cloud solutions provide significant cost savings for BFSI firms by reducing reliance on expensive, on-premise infrastructure and IT personnel. Financial institutions use the cloud's scalability to manage increases in data processing and transaction volumes efficiently. Cloud technology also enables quicker launch times for new financial products and services, enhancing agility within the sector. Moreover, cloud-based analytics tools help financial institutions extract valuable insights from large volumes of customer data, allowing them to personalize offerings and improve the customer experience.

The manufacturing segment is expected to experience the highest growth rate in cloud adoption over the forecast period. By leveraging scalable, on-demand cloud resources, manufacturers can streamline operations, optimize production workflows, and improve collaboration across the supply chain. These improvements translate into cost savings by reducing IT infrastructure requirements and allowing for automation of routine tasks. Furthermore, cloud computing enables manufacturers to harness data analytics for real-time insights, facilitating better decision-making and accelerating the time-to-market for new products.