#Component DRAM

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/semiconductors--memory--RAM--dram--component-dram/as4c16m16sa-6tin-alliance-memory-5055557

Dram chip manufacturers, dram chip, dram memory cell, suppliers for memories

AS4C4M16S Series 256 Mb (16 M x 16) 166 MHz CMOS SDRAM - TSOP II-54

#RAM#DRAM#(Dynamic RAM)#Component DRAM#AS4C16M16SA-6TIN#Alliance Memory#dram chip#dram memory cell#suppliers for memories#DRAM suppliers#random access memory#chip manufacturer

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--RAM--dram--component-dram/as4c16m16sa-6bin-alliance-memory-8054874

Types of DRAM, dynamic random access memory, dram chip manufacturers,

AS4C4M16S 256-Mbit (16 M x 16) 3.6 V High-Speed CMOS Synchronous DRAM - TFBGA-54

#Alliance Memory#AS4C16M16SA-6BIN#RAM#DRAM#Component DRAM#DRAM suppliers#dram memory cell#Types of DRAM#dynamic random access memory#dram chip manufacturers#chip#High-Speed CMOS Synchronous DRAM#dram chip

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--RAM--dram--component-dram/d2516ecmdxgjdi-u-kingston-9123747

High-Speed DRAM memory, Memory Organization, Dual Ports memory, PSD, FIFO's

DRAM Chip DDR3/3L SDRAM 4Gbit 256M X 16 96-Ball FBGA

#Kingston#D2516ECMDXGJDI-U#RAM#DRAM (Dynamic RAM) Component DRAM#High-Speed#Memory Organization#Dual Ports memory#PSD#FIFO's#chip#Nominal Supply Voltage#Flash#CMOS Synchronous DRAM#Dram suppliers#Programming#Volatile Memory#Memory chips

1 note

·

View note

Text

DRAM Module and Component: Powering High-Performance Computing and Electronics

Dynamic Random-Access Memory (DRAM) modules and components are integral to modern computing and electronic devices, providing essential memory storage for data processing and system operations. DRAM is a type of volatile memory that requires constant power to maintain stored information, and it is widely used in computers, servers, smartphones, and other electronic devices. DRAM modules come in various configurations and capacities, designed to meet the performance and memory needs of different applications. The ongoing advancements in DRAM technology continue to enhance speed, capacity, and energy efficiency.

The DRAM Module and Component Market, valued at USD 97.24 billion in 2022, is projected to reach USD 108.68 billion by 2030, growing at a compound annual growth rate (CAGR) of 1.4% during the forecast period from 2023 to 2030.

Future Scope

The future of DRAM modules and components is characterized by significant advancements aimed at increasing memory density, speed, and energy efficiency. Innovations include the development of new DRAM architectures, such as DDR5 and beyond, which offer higher data transfer rates and improved power efficiency. The integration of DRAM with emerging technologies like artificial intelligence (AI) and machine learning is expected to drive demand for specialized memory solutions that support high-performance computing. Additionally, advancements in memory stacking and 3D DRAM technologies will enable more compact and high-capacity memory solutions for a wide range of applications.

Trends

Key trends in the DRAM market include the transition to higher-speed memory standards, such as DDR5, which offers significant improvements in data transfer rates and overall performance. The focus on energy efficiency is driving the development of low-power DRAM solutions that reduce power consumption in mobile and embedded devices. The growing demand for high-performance computing and data centers is influencing the development of high-capacity and high-bandwidth DRAM modules. Additionally, advancements in memory technology, such as 3D DRAM stacking, are enabling the creation of more compact and efficient memory solutions.

Applications

DRAM modules and components are used in a wide range of applications, including personal computers, servers, smartphones, and tablets. In computing systems, DRAM provides fast and temporary storage for data being processed by the CPU. Servers and data centers rely on high-capacity DRAM to handle large volumes of data and support demanding applications. In mobile devices, DRAM supports smooth and responsive operation by providing quick access to frequently used data. Additionally, DRAM is used in gaming consoles, automotive systems, and industrial electronics to enhance performance and functionality.

Solutions and Services

Manufacturers and service providers offer a range of solutions and services for DRAM modules and components. Solutions include the design and production of DRAM modules with various capacities, speeds, and configurations to meet different application requirements. Services encompass memory testing, validation, and integration support to ensure optimal performance and compatibility with other system components. Customization options are available for specialized memory needs, and companies provide research and development support to advance DRAM technology and explore new applications. Additionally, technical support and consulting services help optimize memory solutions for specific use cases.

Key Points

DRAM modules and components provide essential memory storage for computing and electronic devices.

Future advancements focus on higher-speed memory standards, energy efficiency, and memory stacking technologies.

Trends include the adoption of DDR5, energy-efficient solutions, high-performance computing demand, and 3D DRAM.

Applications span personal computers, servers, smartphones, tablets, gaming consoles, and industrial electronics.

Solutions and services include DRAM module design, memory testing, integration support, customization, and R&D support.

0 notes

Text

Navigating the Global DRAM Module and Component Market: Trends and Insights

The global DRAM module and components market, valued at USD 94.9 billion in 2021, is projected to witness steady growth, reaching USD 110.7 billion by 2027, with a compound annual growth rate (CAGR) of 1.2% during the forecast period from 2022 to 2027. This comprehensive analysis, compiled in a research report by MarketsandMarkets, delves into key market dynamics, growth drivers, and regional trends shaping the trajectory of the DRAM industry.

Download PDF Brochure:

Key Market Dynamics:

Emergence of 5G Technology: The advent of 5G technology is a significant driver fueling the demand for DRAM module and components. The rollout of 5G networks necessitates enhanced data processing capabilities, driving the need for high-performance memory solutions across various end-user industries.

Growth in Automotive Sector: The automotive industry's increasing reliance on advanced electronics and connectivity features is propelling the demand for DRAM module and components. From in-vehicle infotainment systems to advanced driver assistance systems (ADAS), DRAM plays a vital role in powering next-generation automotive technologies.

Adoption of High-End Smartphones: The proliferation of high-end smartphones and tablets is driving demand for LPDRAM module and components. As consumers seek devices with enhanced processing power and multitasking capabilities, the demand for efficient and high-capacity memory solutions continues to rise.

Market Segmentation and Analysis:

LPDRAM Module and Component Segment: LPDRAM dominates the market share, driven by its widespread adoption in battery-operated devices such as smartphones and tablets.

Servers Application: Servers segment holds the largest market share, fueled by the increasing demand for data centers and network infrastructure to support the growing digital ecosystem.

APAC Market Dominance: APAC emerges as the largest and fastest-growing market for DRAM module and components, driven by the region's technological advancements, early adoption of advanced technologies, and growing demand for high-performance devices.

Impact of COVID-19: The COVID-19 pandemic has had a significant impact on the global economy, including the DRAM module and components market. Disruptions in manufacturing and supply chains, coupled with fluctuating demand, have influenced market dynamics across regions. However, strategic collaborations, research, and development activities continue to drive innovation and resilience in the industry.

Key Market Players:

Leading companies in the DRAM module and components market include Samsung Electronics Co., Ltd., SK Hynix Inc., Micron Technology, Inc., Nanya Technology Corporation, and others. These players are actively engaged in research and development initiatives to address evolving market demands and capitalize on growth opportunities.

As the global demand for high-performance memory solutions continues to escalate, the DRAM module and components market present lucrative opportunities for stakeholders across industries. By leveraging technological advancements and strategic partnerships, market players can navigate the evolving landscape and drive innovation in memory technologies.

0 notes

Text

https://www.futureelectronics.com/p/semiconductors--memory--storage--embedded-storage/emmc04g-wt32-01g10-kingston-6179835

eMMC components, NAND Flash Memory, eMMC modules, storage capacity

EMMC 5.1 INTERFACE,153-BALL FBGA,3.3V,-25C-+85C

#Kingston#EMMC04G-CT32-01G10#Memory ICs#Flash Memory#Nand Flash Memory#Data transfer speeds#DRAM Memory#drives#NAND flash controller#emmc storage capacity#embedded Multimedia Card#eMMC components#NAND Flash Memory#modules#storage capacity

1 note

·

View note

Text

South Korea's semiconductor exports in December 2023 hit a new high YoY growth

January 2, 2024 /SemiMedia/ — According to South Korea’s Ministry of Trade, Industry and Energy, South Korea’s semiconductor exports reached US$11 billion in December 2023, a significant year-on-year increase of 21.8%, the highest annual growth rate in history. South Korea’s semiconductor exports have been declining since August 2022, and rebounded in November 2023, with an increase of 12.9%,…

View On WordPress

#DRAM market#electronic components news#Electronic components supplier#Electronic parts supplier#NAND market#semiconductor market

0 notes

Text

Alchemy, the untouched friend of Witchcraft

If there is something interesting that is nearly not used on mostly of the witch community, is Alchemy, and is something from which we could take some few useful stuffs.

As always, disclaimer first, I’m not an expert on the subject and I barely if I read a couple of books about the topic (from another 10 untouched ones lol), so as always in life, take what I say with tweezers. This is meant to be a light superficial view to open a door of possibilities in a mix of Witchcraft and Alchemy, is not a thesis. Saying that, to the core of the question.

Alchemy use elements. A lot of them.

The three primes or Tria Prima (the basic 3 materials): Sulfur (Related to the Soul and the principle of combustibility, so it has volatility, can burn, explode, combust), Mercury (Related to the Spirit, the principle of fusibility so the material can be fused together and volatility so a substance vaporizes), and Salt (Relate to the Body, the principle of non-combustibility and non-volatility).

Our beloved Four basic Elements: Air, Earth, Fire, Water.

The Seven Metals associated with the seven classical planets: Lead, corresponding with Saturn. Tin, corresponding with Jupiter. Iron, corresponding with Mars. Gold, corresponding with the Sun. Copper, corresponding with Venus. Mercury, corresponding with Mercury. Silver, corresponding with the Moon.

The 13 Mundane Elements and Later Metals: Antimony, Arsenic, Bismuth, Cobalt, Magnesium, Manganese, Nickel, Oxygen, Phlogiston, Phosphorus, Platinum, Sulfur, Zinc (All of them with a lot of interesting properties and functions, in and out the alchemy world).

The 10 Alchemical Compounds: Acid, Sal ammoniac, Aqua fortis, Aqua regia, Aqua vitae, Amalgam, Cinnabar, Vinegar, Vitriol, Brimstone (All of them also with amazing properties).

And what interesting me the most (at least to my way to do witchcraft), The 12 Alchemical Processes:

Calcination (Aries): The thermal treatment of a solid to removing impurities or volatile substances.

Congelation (Taurus): Term used in medieval and early modern alchemy for the process known today as crystallization. Process by which a solid form into a structure known as a crystal, by precipitating from a solution or freezing.

Fixation (Gemini): Process by which a previously volatile substance is "transformed" into a form (often solid) that is not affected by fire.

Solution (Cancer): Homogeneous mixture composed of two or more substances. In such a mixture, a solute is a substance dissolved in another substance, known as a solvent.

Digestion (Leo): A process in which gentle heat is applied to a substance over a period of several weeks.

Distillation (Virgo): Separating the components or substances from a liquid mixture by using selective boiling and condensation.

Sublimation (Libra): The transition of a substance directly from the solid to the gas state, without passing through the liquid state.

Separation (Scorpio): Converts a mixture or solution of chemical substances into two or more distinct product mixtures. Process of distinguishing to two or more substance in order to obtain purity.

Ceration (Sagittarius): Chemical process, by continuously adding a liquid by imbibition to a hard, dry substance while it is heated. Typically, this treatment makes the substance softer.

Fermentation/ Putrefaction (Capricorn): A metabolic process that produces chemical changes in organic substrates through the action of enzymes/ Decomposition of organic matter by bacterial or fungal digestion.

Multiplication (Aquarius): Process to increase the potency of the elixir or projection powder, in order to increase the gains in the subsequent projection.

Projection (Pisces): Process to transmute a lesser substance into a higher form; often lead into gold.

Damn, alchemy even have symbols to Units: Month, Day, Hour, Dram (Unit of mass between 1 and 3 grams), Half Dram, Ounce (Unit of mass, weight or volume of 28 grams, Half Ounce, Scruple (1 grams), Pound (500 grams).

So just with this simple 2 pages of basic Wikipedia info, we have a ton of new things to use. Everything here has specific properties, some more physical and chemical oriented, but others (like the 3 Tria Prima and The 12 Alchemical Processes) have a lot of correspondences with the witch life itself.

The 12 Alchemical Processes could be absolutely used to represent an desired outcome.

Calcination uses thermal treatment, so it can boost the Fire element of a spell. It also “removing impurities or volatile substances”, so can be applied to generate a mild fever to get rid off the flu, or to boost the organs that clean the body (kidneys and liver mostly)

Congelation turns a solid by freezing, can boost the Water element, so all the “freezer spells” can be boosted with this.

Fixation? A volatile substance is transformed into a solid form? Sound pretty much to grounding, or to help to focus an ADHD head as mine, or to put down to earth someone who is VOLATILE AND VIOLENT. Also, Earth element.

Solution? Homogeneous mixture of two or more substances? It sounds like an aid to make two people on conflict to get into an agreement, or to boost a new business by mixing the opportunities with the action. Air element.

Digestion. A process in which gentle heat is applied to a substance over a period of several weeks? It sounds like something that can help any process that need digestion (bad news must be “digested”, hard choices must be “consulted with the pillow”), and the “gentle heat” sounds comforting. Someone is grieving? Maybe Digestion can help them to overcome the awful times.

Distillation. Separating the components or substances. Anything that need to be separated can be helped with this. Relationships that must end, breakups, cut the ties with older things or habits.

Sublimation. The transition of a substance. I heard trans rights? Can this maybe help with your hormones? Or even to transition from what you previously left behind with the distillation, to focus in a new better future.

Separation. Process of distinguishing to two or more substance in order to obtain purity. How to choose from two or more choices? How to pick the better one? The one with purity? Separation maid aid.

Ceration. A hard, dry is heated to make it softer. Make that person less frigid, make the boss less bitchy, make your chronic pain less hurtful, make your bills less heavy, all that you can think in make softer.

Fermentation/ Putrefaction. I personally love this one. Produces changes in organic substrates and decomposition of organic matter by bacterial or fungal digestion. Prime element to curses. All what you want to rid off in the most disgusting way. May their flesh get rotten under a car in a hot summer.

Multiplication. Process to increase the potency of the elixir in order to increase the gains in the subsequent projection. MONEY MONEY MAKE MORE MONEY, all what need to be increased and all what you want to multiply, go go go!

Projection. Transmute a lesser substance into a higher form “lead into gold”. Perfect to get better as a person, to learn to adapt, accept, to grow compassion, love, etc.

At this you can add the Units, the metals and mundane elements, the 4 elements, the tria prima, your crystals and herbs and sigils and all. And your spells will be filled with components and correspondences.

What’s better, a lot of the physical elements are not too hard to get (some yes, they are, but you are not here to make lead into gold with a full set of chemistry), but alchemy use a lot of symbology, so even if you don’t have the physical element, you can use their properties with the symbol, just as any other sigil.

Salt is easy. Tin in a food can. Antimony in mostly all the rocks. Arsenic in apple seeds (technically no but still). Cobalt and Manganese basically everywhere. Magnesium in your own body. Nickel in coins. Oxygen in the air., Phosphorus, Zinc and Sulfur in food. Acid in anything acid lol. Aqua vitae in alcohol (especially Whisky). Vinegar in vinegars.

Long story short, if you feel that maybe you are lacking something, check some books about alchemy would maybe help. Don’t pick super chemical specific pro books and don’t be discouraged by the terms, pick what can be useful to you, and I hope this open some doors and bring more curiosity about this amazing topic.

260 notes

·

View notes

Text

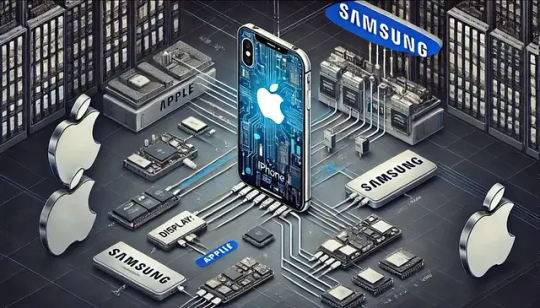

How Apple Relies on Samsung for iPhone Production

Apple and Samsung are two big rivals in the technology industry, and are often portrayed as rivals in the smartphone market. Behind the scenes, however, Apple relies on Samsung for key components used in its flagship product, the iPhone. This relationship may seem odd, but it illustrates the complex nature of global supply chains in the technology sector. In this blog we will examine how Apple trusts Samsung and why this relationship is so important to the creation of the iPhone.

1. The OLED Displays: Samsung’s Technological Edge

One of the most critical components in modern iPhones is the OLED (Organic Light-Emitting Diode) display. These displays are known for their vibrant colors, deep blacks, and energy efficiency, significantly enhancing the user experience compared to older LCD technology. Samsung Display, a subsidiary of Samsung Electronics, is the world’s leading manufacturer of OLED screens.

When Apple transitioned to OLED screens with the iPhone X in 2017, it turned to Samsung due to the company’s unparalleled expertise and production capacity in OLED technology. While Apple has since diversified its suppliers, with LG Display and others entering the fray, Samsung remains the largest provider of OLED screens for iPhones. Samsung’s dominance in this sector gives Apple little choice but to collaborate with its competitor.

2. Chips and Semiconductors: More Than Just Displays

Apple designs its own A-series chips, but the actual production of these chips relies on external manufacturing. While companies like TSMC (Taiwan Semiconductor Manufacturing Company) handle most of Apple’s chip production, Samsung has also played a role in this arena. Samsung is one of the few companies with the technological prowess and manufacturing capabilities to produce advanced semiconductor components.

In previous iPhone generations, Samsung produced the A-series chips that powered these devices. Although TSMC has since become Apple’s primary chip manufacturer, Samsung’s semiconductor division remains a key player in the global chip market, offering Apple an alternative supplier when needed.

3. Memory and Storage: Another Piece of the Puzzle

In addition to displays and semiconductors, Samsung provides memory components such as DRAM (Dynamic Random-Access Memory) and NAND flash storage for the iPhone. These memory components are essential for the smooth operation and storage capacity of iPhones. With its dominance in the memory market, Samsung is one of Apple’s main suppliers, providing the high-quality memory needed to meet the iPhone’s performance standards.

Apple has worked to reduce its reliance on Samsung for memory, but the reality is that Samsung’s market share in the memory and storage sectors is so substantial that avoiding them entirely is nearly impossible. Furthermore, Samsung’s advanced manufacturing techniques ensure that its memory components meet the rigorous standards required for the iPhone.

4. Why Apple Sticks with Samsung Despite the Rivalry

Given their rivalry in the smartphone market, one might wonder why Apple doesn’t completely break away from Samsung. The answer lies in the intricate balance between quality, capacity, and supply chain stability.

Quality: Samsung’s components, particularly OLED displays and memory, are some of the best in the industry. Apple has always prioritized quality in its products, and Samsung’s technological capabilities align with Apple’s high standards.

Capacity: Samsung has the production capacity to meet Apple’s enormous demand. With millions of iPhones sold each year, Apple needs suppliers that can manufacture components at scale without compromising quality. Samsung’s factories are among the few capable of handling such volume.

Supply Chain Risk: Diversifying suppliers is a strategy Apple uses to reduce risk. However, removing Samsung from the supply chain entirely would expose Apple to greater risk if another supplier fails to meet production needs or quality standards. By maintaining Samsung as a key supplier, Apple can ensure a more stable and reliable supply chain.

5. Apple’s Efforts to Reduce Dependency

While Apple remains dependent on Samsung in several areas, the company has made moves to reduce this reliance over the years. For instance, Apple has invested in alternative display suppliers such as LG Display and BOE Technology, as well as expanded its collaboration with TSMC for chip production. Additionally, Apple has explored developing its own in-house components, such as its rumored efforts to create proprietary display technology.

Despite these efforts, it’s unlikely that Apple will be able to completely eliminate Samsung from its supply chain in the near future. Samsung’s technological leadership in key areas, especially OLED displays and memory, ensures that Apple will continue to rely on its competitor for critical components.

Conclusion: A Symbiotic Rivalry

The relationship between Apple and Samsung is a fascinating example of how competition and collaboration can coexist in the tech industry. While they are fierce competitors in the smartphone market, Apple depends on Samsung’s advanced manufacturing capabilities to produce the iPhone, one of the most iconic devices in the world. This interdependence shows that even the most successful companies cannot operate in isolation, and collaboration between rivals is often necessary to bring cutting-edge products to market.

For Apple, the challenge lies in maintaining this balance — relying on Samsung for essential components while exploring new avenues to reduce dependency. For now, however, Samsung remains a crucial partner in the making of the iPhone, demonstrating how complex and interconnected the global tech supply chain has become.

4 notes

·

View notes

Text

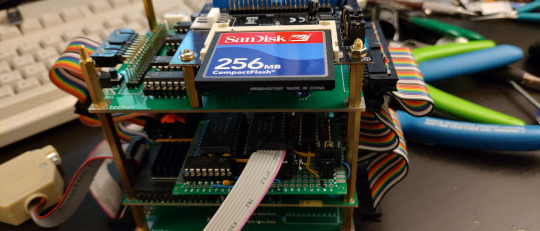

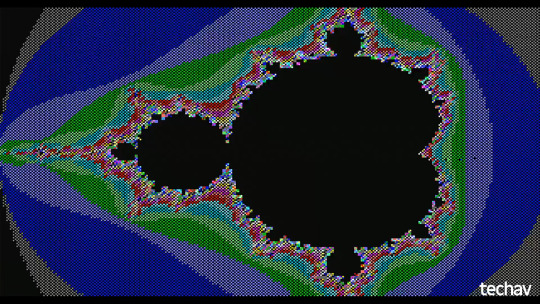

More Speed, More Power, Pretty Pictures

I added some crude functions to the ROM monitor on my Wrap030 project to read the root directory of a FAT16-fomatted disk and load binary files into memory to execute. This opens up a new option for developing programs and running them on the computer, and makes it easier to keep programs on-hand for loading when I demonstrate the computer.

So what new program do I build first for running from disk? The same Mandelbrot renderer I've been using all along, of course! All I needed to do to get it running from disk was adjust a few load instructions to use PC-relative addressing and then change the vasm output to raw binary.

It ran without issue ... mostly. I had been noticing some instability with the system in general. It's not really related to the programming work I've been doing, it just tended to show itself more when doing the kind of FPU-intensive processing required for the Mandelbrot program. Sometimes the system wouldn't boot at all, sometimes it would continually reset. Other times it would run fine for a while, but randomly throw a coprocessor protocol exception (especially when using double- or extended-precision floating point values).

I had a pretty good idea of where this instability was coming from ...

As someone on Discord put it, that's a pretty little antenna I've got there.

High speed computers don't like excessively-long wiring between components. I made the ribbon cables long because there were other boards I developed for this system. But, I'm only using the CPU board, the FPU + IDE mezzanine board, and the video generator board. All that extra wire is just making things more difficult.

A year ago, when I first put these three boards together, I had to bump the bus speed down to 25MHz to get it to run. I could run the CPU board up to 56MHz by itself, and I could get it to run with one expansion board or the other up to 40MHz, but with all three boards, 25MHz was the best I could do (out of the oscillators I had on hand). I have some 33MHz oscillators now, and while I could get it to run sometimes, it was obviously far more unstable.

It was time to trim those pretty little antennas.

I left room for one more card, in case I can get my DRAM card working later, but trimmed a few inches off. The result? Rock solid at 25MHz now.

... and at 32MHz.

... but 40MHz still doesn't run.

I am quite pleased with that result. My target for this system in the beginning was 25MHz. That extra 30% speed increase is very noticeable, especially when running a program like the Mandelbrot renderer.

But I had a thought.

My FPU is rated for 25MHz, and here it's running solid at 32MHz along with the rest of the system. But my FPU board was designed to support the FPU running at a separate clock speed from the rest of the system (the 68881/68882 FPU is actually designed to support this, so I implemented it when I built my mezzanine board).

What would happen if I tried running the FPU even faster? Perhaps using that 40MHz oscillator that I couldn't use for the complete system?

Surprisingly, not a problem running the CPU at 32MHz and the FPU at 40MHz.

... or 50MHz

... or 55MHz

... or 67MHz!

Once again, I've run out of faster oscillators. This computer is running stable with its FPU clocked at over two and a half times its rated speed.

The video above is a real-time capture of the VGA output of this machine running that Mandelbrot renderer (now modified to use 96-bit extended-precision floating-point arithmetic!) with the CPU & main bus clocked at 32MHz and the FPU clocked at 67MHz. Some frames take minutes to render. Some complete in as little as seven seconds.

I am in awe. While I had big dreams when I first started working on this project six years ago, I never could have imagined it running this well at that kind of speed. I am very happy with how this project has turned out so far, and can't quite believe I actually built something like this.

I typically wrap up these posts with a plan of where to take the project next, but the project has already exceeded my expectations. There is so much it is already capable of now that I have a permanent storage option available. I guess I could try getting that DRAM card running to expand the main memory beyond 2MB, or try adding a keyboard and some text routines to complement the video card. Both are good options towards getting a proper operating system running, which has always been a goal of the project.

Either way, I'm sure I'll have fun with it.

#wrap030#mc68030#homebrew computing#retrocomputing#mandelbrot#motorola 68k#motorola 68030#homebrew computer#assembly programming#motorola 68882

18 notes

·

View notes

Text

Arcane Elixir

Difficulty:

Artisan alchemy. Alchemy trainers in major faction cities will teach this recipe to their most senior of students who have proven themselves worthy of such knowledge.

You Will Need:

One cup of juice from the roots of a mature Blindweed plant.

One dram of Goldthorn extract.

One wide-mouthed glass beaker.

One sterile, glass stirring rod.

Recipe:

1. Prepare a jar of Goldthorn extract.

Goldthorn extract is derived from the Goldthorn plant, a hardy herb that thrives in the rugged, mineral-rich cliffs and hillsides of the Arathi Highlands. At first glance, Goldthorn appears unremarkable, with its dry base and tangle of thin, prickly vines. However, upon closer inspection, one can discern its namesake feature - the luminous, golden thorns adorning the vines, their luster and sharpness reminiscent of an eagle's formidable talons. Harvesting Goldthorn requires great skill and caution due to the unyielding nature of these thorns, which are as robust as the very bedrock from which the plant emerges.

Modern alchemical practices dictate that the herb be pulverized using a hammer forged from steel or a comparably sturdy material; anything less resilient will likely shatter against the resolute thorns. The resulting pulverized substance, often referred to as "Goldthorn dust," is a crucial component in the crafting of Goldthorn extract. For optimal results, it is strongly recommended that alchemists undertake the crushing process themselves whenever feasible.

Once the Goldthorn has been reduced to a fine dust, the alchemist must meticulously gather all residual particles from the work surface. Instead of the usual straining method, the crushed Goldthorn should be steeped in a clear alcohol for several days. When the tincture has reached its ideal potency, the alcohol will take on a shimmering, golden hue, signifying that the Goldthorn extract is ready for use in various alchemical applications.

2. Collect and prepare Blindweed root.

Blindweed, a perennial herbaceous plant thought to be native to ancient Kalimdor, is characterized by its distinctive morphology and potent alchemical properties.

The plant's basal rosette consists of deeply lobed, dark green leaves with a slightly waxy cuticle, which gives way to multiple slender, spindly stems. These stems are topped with small, radially symmetrical flower heads reminiscent of daisies. The ray florets undergo a striking color transformation as they mature, initially emerging as a rich, dusky purple before gradually fading to a delicate, pale blue. A unique feature of Blindweed is the simultaneous presence of both flower buds and fully developed blooms on the same plant. The buds exhibit an unusual optical property, reflecting light in a manner that resembles the cloudy appearance of cataracts. As the flowers reach maturity, their stems often buckle under the weight, causing the blooms to droop towards the ground.

Blindweed has a storied history in folklore, with tales suggesting that the plant commonly grew near bodies of water and possessed the ability to rescue drowning victims at the cost of their eyesight. Those who consumed the plant were said to develop a sickly appearance and spread a mysterious fever to anyone they touched. In modern times, Blindweed is primarily found in the region of Feralas, particularly in the vicinity of the ancient ruins known as Dire Maul. This distribution pattern is thought to be linked to the historical presence of numerous pools and potential flooding events in the once-thriving night elven city of Eldre'Thalas.

The plant's bulbous, garlic-like roots contain a potent juice renowned for its magic-amplifying and conducting properties, making it a highly sought-after ingredient in various alchemical preparations. To harness these properties, the roots must be carefully harvested, cleaned of any adhering soil particles, and then gently crushed or grated to extract the valuable juice. This juice can then be further processed or incorporated into a wide range of elixirs, potions, and other magical concoctions to enhance their efficacy and potency.

3. Combine the Blindweed root juice and Goldthorn extract precisely.

The brewing of an Arcane Elixir requires precise measurements and careful technique to achieve the desired magical potency. In a clean, glass beaker, combine the Blindweed root juice with a small quantity of Goldthorn extract, with the ideal ratio being one dram of the shimmering tincture per every cup of Blindweed juice. The Goldthorn serves as an important catalyst in the brewing process, amplifying the latent magical properties of the Blindweed root.

Stir the mixture slowly and methodically with a glass rod, watching as the pale, cloudy Blindweed juice swirls and blends with the glistening, golden Goldthorn extract. As the two alchemical components combine and react, the liquid will take on a vivid, striking pink color that seems to glow with arcane energy.

Results & Effects

The resulting Arcane Elixir is a potent alchemical concoction that imbues the imbiber with enhanced magical abilities. The elixir's enchanted liquid shimmers with an ethereal, lavender-magenta hue, casting an otherworldly glow even in the dimmest of environments. Swirling within the lustrous, milky substance are the essence of Blindweed root, lending it a subtle, earthy undertone, and a whisper of Goldthorn extract, its presence nearly imperceptible to the palate yet integral to catalyzing the elixir's arcane properties.

Deceptively light and silken in texture, the Arcane Elixir belies its true potency. As the potion suffuses through the imbiber's body, it amplifies their innate magical conductivity, attuning them to the flows of arcane energy permeating their own body and the world. The mind sharpens to a keen, heightened acuity, endowing the mage with clarity of thought and precision of action. Spells surge forth with remarkable force and unerring accuracy, striking their targets with a greatly increased propensity for critical impact. Emboldened by the Arcane Elixir's power, the imbiber becomes a conduit of magical might, capable of feats beyond the scope of lesser practitioners.

"The juice from its bulbous, garlic-like root has strong magic-amplifying and conducting properties." - A Roleplaying Resource to the Herbs of Warcraft

#I used both herbalcompendium and the wowhead herb roleplaying resource for this one!#normally herbalcompendium is my go-to but the blindweed entry was all about the gift of arthas elixir so i had to elaborate#check the link attached to blindweed for the wowhead source :>#world of warcraft#alchemy#roleplay#wowrp#warcraft#moonguard rp#wyrmrestaccord rp#classic alchemy#elixir#intellect#critical strike#battle elixir#arcane

2 notes

·

View notes

Text

Fault injection can take many forms, including data corruption, power glitches, and electromagnetic pulses. In Buchanan’s case, he cleverly used a piezo-electric BBQ lighter to create the necessary electromagnetic interference. The lighter’s clicking mechanism proved instrumental in this unique hacking method.

After evaluating the device’s vulnerabilities, Buchanan identified the double data rate (DDR) bus, which connects dynamic random-access memory (DRAM) to the system, as the most susceptible component.

To exploit this vulnerability, Buchanan focused on injecting faults into one of the 64 data queue (DQ) pins on the memory module. His strategy involved soldering a resistor and wire to DQ pin 26, effectively creating a simple antenna capable of capturing nearby electromagnetic interference.

2 notes

·

View notes

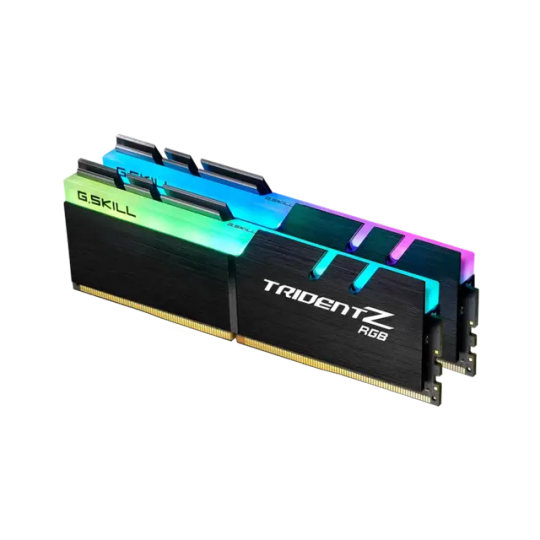

Photo

G.Skill Trident Z RGB 2x8 3000MHz Featuring the award-winning Trident Z heatspreader design, the Trident Z RGB memory series combines vivid RGB lighting with awesome DDR4 DRAM performance. Memory Type: DDR4 Capacity: 16GB (8GBx2) Multi-Channel Kit: Dual Channel Kit Tested Speed (XMP/EXPO): 3000 MT/s Tested Latency (XMP/EXPO): 16-18-18-38 Tested Voltage (XMP/EXPO): 1.35V Registered/Unbuffered: Unbuffered Error Checking: Non-ECC SPD Speed (Default): 2133 MT/s SPD Voltage (Default): 1.20V Fan Included: No Warranty: Limited Lifetime Features: Intel XMP 2.0 (Extreme Memory Profile) Ready Additional Notes If used with 11th Gen Intel Core processors, 10th Gen Intel Core non-K processors, or AMD Ryzen processors, DDR4-3000 is not supported, so memory frequency may be limited to DDR4-2933 or lower when XMP is enabled. Do not mix memory kits. Memory kits are sold in matched kits that are designed to run together as a set. Mixing memory kits will result in stability issues or system failure. Memory kits will boot at the SPD speed at default BIOS settings with compatible hardware. For memory kits with XMP, enable XMP/DOCP/A-XMP profile in BIOS to reach the rated potential XMP overclock speed of the memory kit, subject to the use of compatible hardware. Please refer to the "How to Enable XMP/EXPO" guide. Reaching the rated XMP overclock speed and system stability will depend on the compatibility and capability of the motherboard and CPU used. Usage in any manner inconsistent with manufacturer specifications, warnings, designs, or recommendations will result in lower speeds, system instability, or damage to the system or its components. Memory module height can be found in the FAQ, under the question "How tall are the memory modules?". For product support and related questions, please contact the G.SKILL technical support team via email.

#COMPUTERS#DESKTOPS#DESKTOP_COMPONENTS#MEMORY#3000MHZ#COMPONENT#COMPUTER#F4_3000C16D_16GTZR#G_SKILL#INTEL#RAM#RAM_MEMORY#TRIDENT_Z_RGB

2 notes

·

View notes

Text

The Philosophy of Drama

Drama, one of the most ancient and profound forms of human expression, has been a central component of culture and art for millennia. The philosophy of drama delves into the nature, purpose, and impact of theatrical performance, exploring how drama reflects and shapes human experience. By examining the elements of storytelling, the role of the audience, and the ethical and social dimensions of theatrical art, this philosophical inquiry seeks to uncover the deeper meanings embedded in dramatic works.

Key Themes in the Philosophy of Drama

Nature of Drama:

Drama, in its essence, is a form of storytelling that uses dialogue, action, and performance to convey a narrative.

Philosophical inquiries explore the fundamental components of drama, such as plot, character, and setting, and how these elements combine to create a compelling story.

Mimesis and Representation:

Rooted in Aristotelian thought, mimesis refers to the imitation of life in art. Drama, as a mimetic art form, seeks to represent reality, human emotions, and social conditions.

The philosophy of drama examines how accurately or interpretively drama reflects real-life experiences and truths.

Role of the Audience:

The interaction between performers and audience is a crucial aspect of drama. The philosophy of drama explores how audience perception and interpretation influence the overall impact of a performance.

The concept of the "willing suspension of disbelief," where audiences accept the reality of the fictional world on stage, is central to understanding this relationship.

Catharsis and Emotional Impact:

Aristotle introduced the concept of catharsis, suggesting that drama, particularly tragedy, purges the audience of emotions like pity and fear.

Philosophical discussions focus on the therapeutic and transformative effects of drama on both individuals and society.

Ethical Dimensions of Drama:

Drama often tackles complex ethical dilemmas and moral questions. The philosophy of drama investigates how these narratives influence audience attitudes and societal norms.

The responsibility of playwrights, directors, and actors in representing ethical issues accurately and sensitively is a key consideration.

Cultural and Social Reflection:

Drama serves as a mirror to society, reflecting cultural values, social issues, and historical contexts.

Philosophical analysis explores how drama both shapes and is shaped by the cultural and social milieu in which it is created and performed.

Aesthetics of Performance:

The aesthetics of drama encompass the visual and auditory elements that contribute to the overall experience, including set design, costumes, lighting, and sound.

Philosophical inquiry into these aspects considers how aesthetic choices enhance or detract from the narrative and emotional impact of a performance.

Dramatic Genres and Forms:

Drama encompasses various genres, such as tragedy, comedy, melodrama, and farce, each with its own conventions and philosophical implications.

The philosophy of drama explores the characteristics and purposes of these different forms and how they contribute to the diversity of theatrical expression.

Theatre as a Collaborative Art:

Unlike solitary art forms, drama is inherently collaborative, involving playwrights, directors, actors, designers, and technicians.

Philosophical discussions examine the dynamics of this collaboration and how it affects the creation and reception of dramatic works.

Impact of Modern and Postmodern Drama:

Modern and postmodern movements in drama have introduced new approaches to storytelling, performance, and audience engagement.

The philosophy of drama explores these innovations and their implications for understanding and experiencing theatre.

The philosophy of drama provides a comprehensive framework for understanding the multifaceted nature of theatrical art. By exploring the interplay of narrative, performance, and audience engagement, this field of inquiry reveals the profound impact of drama on individuals and society. Drama, as both a reflection and a shaper of human experience, continues to hold a vital place in the cultural and philosophical landscape.

#philosophy#epistemology#knowledge#learning#chatgpt#education#Philosophy of Drama#Theatrical Performance#Mimesis in Drama#Role of the Audience#Catharsis in Theatre#Ethical Dimensions of Drama#Cultural Reflection in Drama#Aesthetics of Performance#Dramatic Genres#Collaborative Art in Theatre

2 notes

·

View notes

Text

Dell OneFS: Improved Performance, Security, and Scalability

Dell PowerScale OneFS improves enterprise data storage performance, security, and scalability.

AI drives digital transformation waves that revolutionise operations and stimulate innovation across industries. AI must upgrade its support systems to reach its full potential. This transition is driven by modern data centres. Efficiency, scalability, and flexibility are essential in the age of AI, HPC, and huge data generation.

The fast-paced world of AI and HPC today shows that data drives innovation. Businesses generate and analyse massive amounts of data daily, allowing cutting-edge AI models and scientific research. Leaders can manage, protect, and profit from this ocean of data. Static repositories no longer store enough. Expanding networked data requires efficiency and flexibility.

The difficulty is handled by PowerScale. It helps IT decision-makers and data scientists remain ahead of the curve and meet their data needs while solving today's difficulties. Last year, PowerScale announced AI-optimized all-flash portfolio for 99% faster data retrieval and 220% faster data intake. PowerScale exceeds NVIDIA DGX SuperPOD, Cloud Partner, and Storage program standards to assist clients of all sizes scale AI workloads. One more thing. We're moving towards future-proof data centre architecture with new technologies that can adapt to your demands.

PowerScale's Latest OneFS Release: New Innovations

The latest PowerScale announcements target system flexibility, operational economy, and storage density. helping companies succeed in a data-driven environment.

Doubling AI workload storage density with 122TB SSDs

Optimising storage efficiency and minimising costs is crucial to modernising data infrastructure. Dell Technologies introduced the first 122TB QLC SSD corporate storage solution. For all-flash PowerScale F910 and F710 nodes, 122TB Solidigm QLC SSDs effectively access approximately 6 PBs of storage per node, reducing hardware, operational costs, and energy use. This lowers storage and improves performance by providing quick data access to GPUs for AI model training. Environmentally conscious data centres can enter.

Improve Cluster Performance with Compute Flexibility

PowerScale is also releasing the PA110 Accelerator Node to enhance CPU bottlenecks and cluster performance. It replaces P100 and B100 performance and backup accelerators.

The latest 1U accelerator node provides flexible scaling in single node increments for organisations looking to boost compute performance without capacity growth. Your storage environment's cost/performance ratio drops. With more cluster frontend ports, the PA110 boosts connection and bandwidth for faster task optimisation.

The PA110 helps IT managers optimise data centre resource allocation, ensuring an efficient workflow that improves a modern, adaptive data centre.

Scaling Wisely with an Optimised Portfolio Mix

The latest OneFS version updates the hardware in hard drive-based H710, H7100, A310, and A3100 nodes. These systems offer low-cost tiering for high-performance applications across PowerScale and are node pool compatible with older hybrid and archive platforms. The TCO-optimized A-Series and balanced cost/performance H-Series nodes extend PowerScale's range and demonstrate its flexibility to meet your storage demands.

The revised nodes have these features:

Fourth-generation Intel Xeon Sapphire Rapids CPUs

DDR5 DRAM with 75% faster bandwidth and speed

Persistent NVMe M.2 flash vault drives accelerate cache recovery and destage.

Higher thermal performance reduces component stress and heat.

A 100% faster SAS drive carrier has been upgraded.

Support for the industry-leading 32 TB HAMR technology will be implemented in 2025, increasing density and lifespan.

Businesses must look beyond their immediate needs more than ever. Due to the rapid expansion of AI applications and their costs, flexible infrastructure is essential for enterprise IT. PowerScale, the most flexible scale-out NAS, is the foundation of modern data centres.

With PowerScale's latest offerings, organisations can focus on AI innovation without rigidity or operational inefficiencies. The PowerScale All-Flash nodes, new Accelerator nodes, and revised HDD-based portfolio work together to fulfil evolving storage needs more intelligently and economically. PowerScale securely scales AI data for backups or regular use.

PowerScale may help your company future-proof its infrastructure and enable AI, HPC, and other capabilities.

#technology#technews#govindhtech#news#technologynews#OneFS#AI#artificial intelligence#AI workloads#PowerScale#PA110#data center#Portfolio Mix

0 notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] SAMSUNG 980 PRO SSD with integrated heatsink disperses heat to maintain speed, power efficiency, and thermal control, preventing downtime from overheating on Playstation 5 and PCs. Powered by an in-house controller designed to harmonize the flash memory components and the interface for top speed – with a PCIe 4.0 interface that’s 2x faster than PCIe 3.0 SSDs and 12x faster than Samsung SATA SSDs. Achieve fully immersive gameplay with sustained high-performance bandwidth and throughput for heavy-duty applications in gaming, graphics, data analytics, and more. The 980 PRO with Heatsink uses Samsung's own nickel-coated high-end controller to deliver effective thermal control of the NAND chip. With the added heatsink, play confidently on PS5 gaming consoles and PC systems without worries of sudden performance drops from overheating. The 980 PRO with Heatsink has a thin 8.6mm housing, which perfectly fits the PlayStation5. Its slim size and optimized power efficiency are also ideal for building high-performance PC computing and gaming systems. Monitor drive health, optimize performance, protect valuable data, and receive important updates with Samsung Magician to ensure you're always getting the best performance out of your SSD. All firmware and components, including Samsung's world-renowned DRAM and NAND, are produced in-house, allowing end-to-end integration for quality you can trust. Results are based on a comparison with Samsung PCIe 3.0 NVMe SSDs and SATA SSDs. NEXT-LEVEL PERFORMANCE W/MAXIMUM HEAT CONTROL: The integrated heatsink disperses heat to maintain speed, power efficiency, and thermal control, preventing downtime from overheating on Playstation 5 and PCs.Computer Platform:PC MAXIMUM SPEED: Powered by an in-house controller designed to harmonize the flash memory components and the interface for top speed – with a PCIe 4.0 interface that’s 2x faster than PCIe 3.0 SSDs and 12x faster than Samsung SATA SSDs A WINNING COMBINATION: Achieve fully immersive gameplay with sustained high-performance bandwidth and throughput for heavy-duty applications in gaming, graphics, data analytics, and more SMART THERMAL CONTROL: 980 PRO with Heatsink uses Samsung's own nickel-coated high-end controller to deliver effective thermal control of the NAND chip; With the added heatsink, play confidently on PS5 gaming consoles and PC computers without performance drops from overheating [ad_2]

0 notes