#Companies (Amendment) Act 2017

Explore tagged Tumblr posts

Text

0 notes

Text

As president of the United States, Donald Trump threatened the federally issued licenses of television broadcast outlets that displeased him. In 2017, after NBC News reported a dispute between the president and his military advisors about the size of the nuclear arsenal, the president launched a series of tweets:

These 2017 tweets did not specifically suggest that he would have the Federal Communications Commission (FCC), which issues the airwave licenses, revoke them on his order. Instead, they appear to echo the 1972 tactics of Richard Nixon, who, displeased by coverage from the Washington Post, encouraged a third party to file a challenge at the FCC (which ultimately went nowhere).

In response to the 2017 tweets, the Trump-appointed chairman of the FCC, Ajit Pai, took a firm stand. “I believe in the First Amendment,” he said. “Under the law, the FCC does not have the authority to revoke a license of a broadcast station based on a particular newscast.”

Now, in 2024, as a presidential candidate, Donald Trump has reasserted that broadcasters who displease him should lose their federal airwave licenses. A September 2023 post on Truth Social accused NBC of “Country Threatening Treason.” He added, “Why should NBC, or any of the other corrupt & dishonest media companies, be entitled to use the very valuable Airwaves of the USA, FREE?”

The current Chair of the FCC, Jessica Rosenworcel, responded, “the First Amendment is a cornerstone of our democracy. The FCC does not and will not revoke licenses for broadcast stations simply because a political candidate disagrees with or dislikes content or coverage.”

However, the ability of future FCCs to stand up to such instructions could be at risk. Candidate Trump has promised, “I will bring the independent regulatory agencies, such as the FCC and the FTC, back under Presidential authority, as the Constitution demands.” While the Constitution never mentions regulatory agencies, bringing the FCC under direct presidential control would surely undercut its independent decision-making.

But a president of the United States already has powers beyond coercing the FCC. These powers could be exercised not only against broadcasters, but also against those who operate the internet.

The “Doomsday Book”

During his presidency, Donald Trump asserted, “When somebody’s president of the United States, the authority is total.” Whether or not presidential authority is “total,” there does already exist a compendium of presidential powers that have been enacted by Congress for use in extreme circumstances.

Reportedly locked in a White House safe are the secret “Presidential Emergency Action Documents” (PEADs). Colloquially known as the “Doomsday Book,” they are a collection of powers authorized by Congress for the president to use in emergencies. Included in this compendium is Section 706 (codified as 47 USC 606), titled, “War Emergency – Powers of the President,” that is tucked away at the end of the Communications Act of 1934, the statute that created the FCC.

TIME Magazine reports, “When Donald Trump was in the Oval Office, members of the national security staff actively worked to keep him from learning the full extent of these interpretations of presidential authority, concerned he would abuse them.”

Here is what Section 706 authorizes:

(c) Upon proclamation by the President that there exists war or a threat of war, or a state of public peril or disaster or other national emergency… the President, if he deems it necessary in the interest of national security or defense, may suspend or amend, for such time as he may see fit, the rules and regulations applicable to any or all stations or devices capable of emitting electromagnetic radiations within the jurisdiction of the United States as prescribed by the Commission, and may cause the closing of any station for radio communication…

The next subsection, using similar “national security” criteria, gives the president authority over the wired networks, such as those that carry telephone and internet service. Section 706(d), in pertinent part, authorizes the president to “suspend or amend the rules and regulations applicable to any or all facilities or stations for wire communication… cause the closing of any facility or station for wire communication… [or] authorize the use or control of any such facility or station… by any department of the Government under such regulations as he may prescribe…”

The terms “war or a threat of war, or a state of public peril or disaster or other national emergency” are not defined by the Communications Act. Such declarations of national emergency were, however, a go-to solution when Donald Trump was in office. The effort to restrict travel from majority-Muslim countries was justified on national security grounds. Tariffs were levied on foreign steel and aluminum as a national security threat based on their impact on domestic production. When Congress would not give him the funding he wanted for the Mexican border wall, the president simply used a national emergency declaration to reallocate Defense Department funds to build the wall. Reportedly, he even considered declaring that the use of natural gas for electricity production was a national security risk because the gas pipelines could become terrorist targets.

The power of the Chief

Candidate Trump, in September 2023, posted that NBC and other “corrupt & dishonest media companies” are “a true threat to democracy and are, in fact, THE ENEMY OF THE PEOPLE!” He declared, “The Fake News Media should pay a big price for what they have done to our once great Country.”

A 2021 report by the nonpartisan Congressional Research Service (CRS) concluded, “in the American governmental experience, the exercise of emergency powers has been somewhat dependent on the Chief Executive’s view of the presidential office.” When he was Chief Executive, Donald Trump explained how he viewed the office: “I have Article II [of the Constitution], where I have the right to do whatever I want as president.”

The tools to do whatever the president wants—whether at the FCC or in the Doomsday Book—are at hand. As the CRS report concluded, such decisions are dependent “on the Chief Executive’s view of the presidential office.”

The institution that created these broad powers, the Congress, has an important role as overseer of the authority they have delegated to the executive. Congress constantly holds oversight hearings on the agencies of the executive branch; hearings on the unilateral powers granted to the president are warranted. The threshold question for such hearings should be whether there are sufficient guardrails in place to protect against their abuse, and what such protections should look like. Regardless of who wins the election—Congress should review whether the unilateral powers granted to the president in the 20th century need updating for the 21st century.

140 notes

·

View notes

Text

The Best News of Last Week - March 20, 2023

🌱 - Okra to the Rescue and Other News You Can't 'Lettuce' Miss This Week

1. 4 day work week being pushed in Congress

Progressive Democrats, led by Rep. Mark Takano of California, are pushing for a four-day workweek to give Americans more time for leisure outside of work. The proposed Thirty-Two Hour Workweek Act would amend the Fair Labor Standards Act of 1938 to require overtime pay for any employee working more than 32 hours in a week at a rate of time and a half.

More than 70 British companies have started to test a four-day workweek, and halfway through the six-month trial, most respondents reported there has been no loss in productivity.

2. Governor Walz signs universal school meals bill into Minnesota law

Minnesota just became the fourth state in the US to provide breakfasts and lunches at no charge to students at participating schools! The bill was signed into law by Governor Tim Walz on Friday, and it's set to ease the burden on parents who struggle to provide meals for their children.

The new legislation will cover the cost of meals for all students, regardless of household income. This means that families who don't qualify for free and reduced meals but who struggle to pay for food will also be covered. The bill is also meant to prevent "lunch shaming" practices, where children are denied food or given substitutes that indicate their family is struggling financially.

3. Texas Researchers Use Okra to Remove Microplastics from Wastewater

Researchers from Tarleton State University in Fort Worth, Texas discovered that food-grade plant extracts from okra have the power to remove microplastics from wastewater. Polysaccharide extracts from plants like fenugreek, cactus, aloe vera, tamarind, and okra were found to be effective non-toxic flocculant alternatives to remove microplastics from water.

Polysaccharides from okra and fenugreek were best for removing microplastics from ocean water, while a combination of okra and tamarind worked best for freshwater. Furthermore, plant-based flocculants can be easily implemented in existing water treatment facilities.

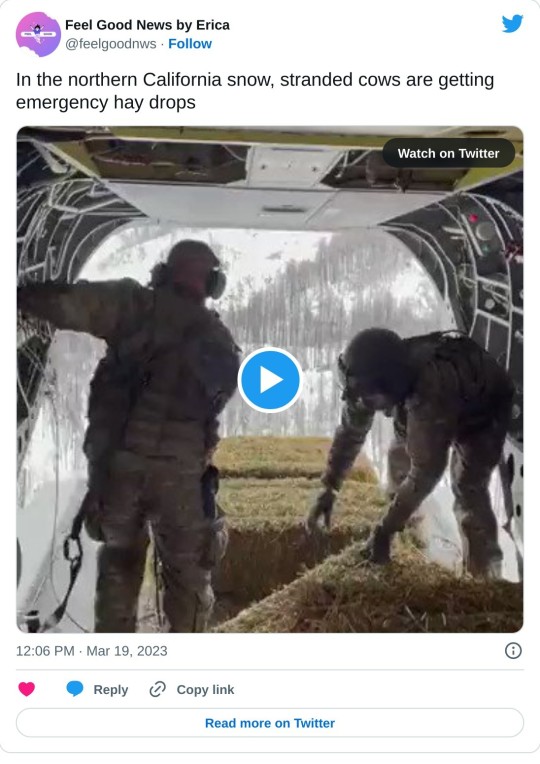

4. In the northern California snow, stranded cows are getting emergency hay drops

The recent wave of unprecedented snowfall in California has left cattle stranded and starving. When rancher Robert Puga ran out of hay, neighboring Humboldt County officials put together an emergency rescue operation called "Operation Hay Drop." State, federal, and local officials airdropped stranded cattle bales of hay to feed them.

Humboldt County Sheriff William Honsal went to the Coast Guard with the idea of a helicopter rescue, and by midday Sunday, March 5, Operation Hay Drop was underway. So far, Operation Hay Drop has been a success, said rancher Puga. The mission covers about 2,500 head of cattle over several miles.

5. Make-A-Wish Foundation no longer considers Cystic Fibrosis to be automatically qualifying due to improvements in life outcomes for patients

Given the ongoing life-changing advances in cystic fibrosis, beginning in January 2024, cystic fibrosis will no longer automatically qualify for a wish.

6. 1st woman given stem cell transplant to cure HIV is still virus-free 5 years later

In 2017, a woman known as the "New York patient" underwent a stem cell transplant to treat both her cancer and HIV. Now, about 30 months later, she has been virus-free and off her HIV medication, leading some researchers to suggest that she may have been cured of HIV.

The New York patient, received stem cells taken from umbilical cord blood that also had the HIV-resistance genes. However, it's important to note that there is no official distinction between being cured and being in long-term remission, and the medical team is waiting for longer-term follow-up before making any definitive statements.

7. Cheetahs Back in Wild in India After Seven Decades

Namibian cheetahs have been successfully reintroduced to India after the world's fastest land animal was declared extinct in the South Asian country more than 70 years ago. Two cheetahs, Obaan and Asha, were released into the wild of Kuno National Park after being brought to India last September.

The species is being reintroduced on an experimental basis as part of a major prestige project for Prime Minister Narendra Modi. India aims to bring in about 100 of the big cats over the next decade. The African cheetah is a different subspecies from the extinct Asiatic cheetah, which once roamed the sub-continent in great numbers.

Lastly, I recently opened a Youtube channel. Subscribe for a weekly compilation of feel good videos.

- - -

That's it for this week :) If you liked this post you can support me with a small kofi donation:

Buy me a coffee ❤️

Let's carry the positivity into next week and keep spreading the good news!

640 notes

·

View notes

Text

Alt National Park Service

People often ask, “What exactly are we resisting?” So, we decided to keep a detailed list. From 2017 to 2021, the Trump administration reversed over 100 environmental regulations, affecting climate policy, air, water, wildlife, and chemical safety. Additionally, more than a dozen other rollbacks were in progress but not finalized by the end of the term, prompting questions about the potential impact of another four years. You might wonder what another four years could look like. Here's a summary of Trumps last four years in office:

- Weakened fuel economy and greenhouse gas standards.

- Revoked California's stricter emissions standards.

- Withdrawn legal basis for limiting mercury from coal plants.

- Exited the Paris climate agreement.

- Altered Clean Air Act cost-benefit analysis methods.

- Canceled methane emissions reporting for oil and gas companies.

- Revised rules on methane emissions from drilling on public lands.

- Eliminated methane standards for oil and gas facilities.

- Withdrew rule limiting toxic emissions from industrial polluters.

- Eased pollution safeguards for new power plants.

- Changed refinery pollution monitoring rules.

- Reversed emissions reduction during power plant malfunctions.

- Weakened air pollution rules for national parks and wilderness areas.

- Loosened state air pollution plan oversight.

- Established minimum threshold for regulating greenhouse gases.

- Relaxed pollution regulations for waste coal plants.

- Repealed hydrofluorocarbon leak and venting rules.

- Ended use of social cost of carbon in rulemaking.

- Allowed increased ozone pollution from upwind states.

- Stopped including greenhouse gas emissions in environmental reviews.

- Revoked federal greenhouse gas reduction goal.

- Repealed tailpipe emissions tracking on federal highways.

- Lifted ban on higher ethanol gasoline blends in summer.

- Extended deadlines for methane emissions plans for landfills.

- Withdrew rule reducing pollutants at sewage plants.

- Dropped tighter pollution standards for offshore oil and gas.

- Amended emissions standards for ceramics manufacturers.

- Relaxed leak monitoring at oil and gas facilities.

- Cut two national monuments in Utah.

- Ended freeze on new coal leases on public lands.

- Permitted oil and gas development in Arctic Refuge.

- Opened land for drilling in National Petroleum Reserve, Alaska.

- Lifted ban on logging in Tongass National Forest.

- Approved Dakota Access pipeline near Sioux reservation.

- Rescinded water pollution rules for fracking.

- Withdrawn rig decommissioning cost proof requirement.

- Moved cross-border project permits to presidential office.

- Altered FERC's greenhouse gas considerations in pipelines.

- Revised ocean and coastal water policy.

- Loosened offshore drilling safety regulations post-Deepwater Horizon.

- Weakened National Environmental Policy Act.

- Revoked flood standards for federal projects.

- Eased federal infrastructure project environmental reviews.

- Ended financing for overseas coal plants.

- Revoked directive to minimize natural resource impacts.

- Revoked climate resilience order for Bering Sea.

- Reversed public land-use planning update.

- Withdrawn climate change consideration in national park management.

- Limited environmental study length and page count.

- Dropped Obama-era climate change and conservation policies.

- Eliminated planning system to minimize oil and gas harm on sensitive lands.

- Withdrawn policies for improving resources affected by federal projects.

- Revised Forest Service project review process.

- Ended natural gas project environmental impact reviews.

- Rolled back migratory bird protections.

- Reduced habitat for northern spotted owl.

- Altered Endangered Species Act application.

- Weakened habitat protections under the Endangered Species Act.

- Ended automatic protections for threatened species.

- Reduced environmental protections for California salmon and smelt.

- Removed gray wolf from endangered list.

- Overturned bans on lead ammo and fishing tackle on federal lands.

- Reversed ban on predator hunting in Alaskan refuges.

- Reversed rule against baiting grizzly bears for hunting.

- Amended fishing regulations.

- Removed commercial fishing restrictions in marine preserve.

- Proposed changes to endangered marine mammal injury limits.

- Loosened fishing restrictions for Atlantic Bluefin Tuna.

- Overturned migratory bird handicrafts ban.

- Reduced Clean Water Act protections for tributaries and wetlands.

- Revoked stream debris dumping rule for coal companies.

- Weakened toxic discharge limits for power plants.

- Extended lead pipe removal time in water systems.

- Eased Clean Water Act for federal project permits over state objections.

- Allowed unlined coal ash ponds to continue operating.

- Withdrawn groundwater protections for uranium mines.

- Rejected chlorpyrifos pesticide ban.

- Declined financial responsibility rules for spills and accidents.

- Opted against requiring mining industry pollution cleanup proof.

- Narrowed toxic chemical safety assessment scope.

- Reversed braking system upgrades for hazardous material trains.

- Allowed liquefied natural gas rail transport.

- Rolled back hazardous chemical site safety rules.

- Narrowed pesticide application buffer zones.

- Removed copper filter cake from hazardous waste list.

- Limited use of scientific studies in public health regulations.

- Reduced corporate settlement funding for environmental projects.

- Repealed light bulb energy-efficiency regulation.

- Weakened dishwasher efficiency standards.

- Loosened efficiency standards for showerheads and appliances.

- Altered energy efficiency standard-setting process.

- Blocked efficiency standards for furnaces and water heaters.

- Simplified appliance efficiency test exemption process.

- Limited environmentally focused investments in 401(k) plans.

- Changed policy on using sand from protected ecosystems.

- Halted contributions to the Green Climate Fund.

- Reversed national park plastic bottle sale restrictions.

5 notes

·

View notes

Text

SESSION 5. COMPUTER CRIME

READ: ICTL TEXTBOOK CHAPTER 4

OPTIONAL REFERENCE: L&T BOOK CHAPTER 19

‘Computer Crime’ v. ‘Cybercrime’: Computer and internet usage is on the rise due to lower costs and easier accessibility. As it is another mode of transaction and one that is heavily dependent on the interaction through computers and automatic agents rather than face-to-face meetings, it is another avenue for crimes to perpetuate. What we call “cybercrime” largely consists of common crime, the commission of which involves the use of computer technology, and for which penalties already exists under the Penal Code. Substantively, there is no difference between generic individual crimes such as fraud, theft, extortion, harassment, forgery, impersonation, etc. and their cyber-analogues. Only those that relate specifically to computer usage and materials, etc. are specialized offences for which the Computer Misuse Act (CMA) was specifically enacted to tackle. What is the difference between “Computer Crime” and “Cybercrime” and how are they treated under Singapore’s criminal law?

The Computer Misuse and Cybersecurity Act: The original Computer Misuse Act (CMA) arose directly out of the increased usage of computers and the internet as well as to protect certain features from objectionable activities. We will be generally considering the Act, its coverage and effect, and some cases illustrating the offences committed thereunder. To deal with new potential abuses of computer systems, the Computer Misuse Act entered into force in 1993. Thereafter, the CMA was amended from time to time to keep up with the changes in technology and to addresses new potential computer abuses such as denial or interruption of computer services and unauthorised disclosure of access codes. The Act was renamed in 2013 as the Computer Misuse and Cybersecurity Act (Cap 50A, 2013 Rev Ed) (CMCA), and provided for penalties proportionate to the different levels of potential and actual harm that may be caused by an offence. For example, it defines a class of critical computer systems (“protected computers”) and provides them with enhanced punishment in case of an offence. This applies to computers used by important institutions including the police, civil defence force, the military, national utilities companies, telecommunications companies, transportation services, major banks, and various emergency services. The CMCA also sought to enhance security, deter computer criminals with harsh penalties, and broaden the powers of the police to investigate such misdeeds. The CMCA was amended in 2017 with additional provisions to deal more with cybersecurity concerns; however, in 2018, after the enactment of the Cybersecurity Act (CA), the CMCA reverted to CMA with the security provisions moved to the CA.

Computer Crime Offences: The offences under the CMA are found in Part II of the Act, from sections 3 to 10. All the provisions provide for enhanced penalties when damage is caused, but the question is damage to what, and in what form? Also, under section 11, there is further enhanced punishment if the computer concerned is a “protected computer” (e.g. computers used for public safety, national defence, hospitals, etc.). The abetment and attempt of any of the CMA offences also constitutes the offence abetted or attempted and is punishable as that offence under section 12. The extra-territorial scope of the CMA is provided for under section 13. What is its effect and how effective can it be in the cyberspace where many actors can be sited, and acts can be committed, in other countries?

Consider the following:

Unauthorised Access to computer material (s.3 CMA): Mainly enacted to deal with hacking, it has since shown that it can extend to other forms of modus operandi. Present some reported cases and scenarios to explain how the provision works and what is required to make out a case under this provision. Do the “knowledge” relate only to the act of securing access or does it also relate to the lack of authorisation? What constitutes “unauthorized access”?

Access to computer material to commit/facilitate the commission of other offences (s.4 CMA): Examples are fraud, impersonation/identity theft or theft of finances such as credit card skimming, Phishing, Carding, Pharming. Explain the statutory limitations/conditions to the scope of this provision and the need to read/couple it with a substantive provisions in other criminal law statutes (esp. the Penal Code). Which offences/provisions in the Penal Code are relevant here. What are the differences between ss.3 & 4 of the CMA?

(a) Unauthorised Modification of computer material (s.5 CMA): The usual cases involve the defacing of websites through the use of computer viruses or worms, etc. Explain the elements of the provision and provide real world examples of such offences. (b) Unauthorised Use or Interception of computer services (s.6 CMA): The cases often involve phone/pager cloning and the tapping of cable broadcast service for free usage or mischief. Explain the elements of the provision and provide real world examples of such offences.

(a) Unauthorised Obstruction of computer usage (s.7 CMA): This will apply, for example, to system attacks, e-mail bombing and denial of service attacks. Explain the elements of the provision and provide real world examples of such offences. (b) Unauthorised Disclosure of access codes (s.8 CMA): An example is the transfer of one’s password to another to gain access to a computer or network without permission. What constitutes “wrongful gain”, “unlawful purpose” and “wrongful loss”? Explain these elements of the provision and provide real world examples of such offences.

(a) What is the objective and effect of the new provisions of the CMA in relation to the use of personal data obtained through existing offences and the act of obtaining tools to commit CMA offences (new ss.9 & 10 CMA). Compare these provisions to the existing provisions of the Act (e.g. the current provision on abetment and attempted (s.12 CMA). (b) What is the purpose and effect of the changes to the jurisdictional provision, particularly from the cybersecurity standpoint? (amended s13 CMA).

Future of Cybersecurity: Cybersecurity is increasingly an issue that the government is concerned with. Although the CMA contained provisions for the Minister to act and for investigations into cybersecurity issues, the Act was amended in 2013 to give the Minister even stronger powers to prevent or counter threats to national security, etc. by taking any measures necessary to prevent or counter any threat to a computer or computer service or any class of computers or computer services. These may cover the “cyberterrorism” phenomenon. Due to the heightened concerns with cybersecurity, the Act contained interim provisions on the issue until a standalone Cybersecurity Act was enacted in 2018. Nevertheless, the CMA provisions continues to be relevant as a part of the arsenal against cyber attacks and to address security concerns.

Cybersecurity Act: The 2018 Act is mainly procedural and relates to CIIs, empowering the Cybersecurity Commissioner to investigate and prevent breach/leak incidents, certification of service providers as well as breach reporting obligations. The approach is one of ‘light touch’ and can overlap with the work of the PDPC and the police under the CMA.

Reference: (optional)

Gregor Urbas, An Overview of Cybercrime Legislation and Cases in Singapore, ASLI Working Paper Series No. 001, December 2008

Cases:

Lim Siong Khee v Public Prosecutor [2001] 2 SLR 342; [2001] SGHC 69 [ss 2(2), (5), 3(1), 8(1)]

Public Prosecutor v Muhammad Nuzaihan bin Kamal Luddin [2000] 1 SLR 34; [1999] SGHC 275 [ss 3(1), 5(1), 6(1)(a)]

Statutes: (for reference in class, important provisions will be highlights during class)

Computer Misuse Act (2020 Rev. Ed.)

Cybersecurity Act (No. 9 of 2018)

CoE Cybercrime Convention

3 notes

·

View notes

Text

BIPV Market: Trends Supplement Large-Scale Solar Systems Adoption

As per the International Energy Outlook, the global power demand is expected to rise by 80%, requiring an investment of around $19.7 trillion by 2040. Also, the Paris Agreement set a target of limiting global warming temperature below 2° Celsius, preferably 1.5° Celsius. This has influenced governments to seek innovative ways to reduce emissions while meeting energy demand, which has paved the way for photovoltaic materials in buildings. Triton’s analysis estimates that the global building integrated photovoltaics market will propel at a CAGR of 17.31% during the forecast period 2023-2030.

Building integrated photovoltaics serves the dual purpose of being the outer layer of a building and a power generator. This, in turn, has opened a new frontier in green infrastructure, influencing architects to develop energy-efficient and aesthetically appealing buildings. For instance, Ubiquitous Energy’s transparent solar window panels, UE Power, have emerged as an aesthetically appealing power-generating alternative to conventional windows.

BIPV Revolution: Trends Reshape Energy Landscape

According to the International Renewable Energy Agency (IRENA) , around 90% of the world’s power can be generated with renewable energy by 2050. Since buildings consume high amounts of energy, BIPV integration will facilitate their transition from energy users to producers. On that note, the notable trends reshaping the market are:

Governments perceive investing in green energy solutions as an opportunity to attain GHG reduction targets. Hence, over the past few years, authorities worldwide have employed various measures to stimulate the adoption of sustainable technologies, including BIPV modules, across residential, commercial, and industrial sectors. For example:

As per the Indian Ministry of New & Renewable Energy (MNRE) , the government has implemented the production-linked incentive (PLI) scheme for high-efficiency solar PV modules with an outlay of INR 24,000 crore, to achieve domestic manufacturing capacity of solar PV cells and modules.

In 2021, the German government amended the Renewable Energy Act by establishing grid priority to drive the onshore wind, solar PV, and biogas growth. The government proposed to increase its solar capacity installations to 100 GW by 2030.

The Chinese government also formulated a policy that requires all new buildings to conform to energy guidelines modeled after LEED specifications. This policy combines a recent initiative to reconstruct 50% of residential high-rise buildings. The country is anticipated to add more than 600 GW of solar power by 2030.

Reaping the benefits from such incentives, the industrial sector leads the BIPV market at 39.54%. However, over the forecast period 2023-2030, the commercial sector is expected to witness the fastest growth at 17.38%.

As per IEA, the global solar PV generation reached around 821 TWh in 2020, a whopping 23% increase from 2019. The energy association also stated that next to utility-scale deployment, distributed applications on buildings contribute to around 40% of PV use globally. In this regard, rooftop-based applications are alleviating the burden on the distribution grids, enabling companies and households to pay lesser energy bills while reducing emissions. Moreover, the cost of installing rooftop PV systems reached around $1 per watt. Hence, roofing captures the majority of the market share at 55.69% in terms of application.

China drives the global market, followed by the US, European nations, and Japan playing a major role. The rise in installations from around 19.4 GW in 2017 to 27.3 GW in 2021 was the key aspect that made China a leader in rooftop installations. For instance, Shanghai and Dezhou have acquired the title of ‘Solar City’, which features a large fleet of rooftop solar water heaters. Besides, the Net Zero Energy Building mandate across China is expected to accelerate the PV roofing segment, with solar tiles gaining major traction. Hence, these developments are expected to widen the scope of the Asia-Pacific BIPV market over the forecast period 2023-2030.

IEA projects that photovoltaic systems are estimated to account for approximately 14% of the total power generation by 2050, owing to the rising detrimental impact of fossil fuels. In fact, the organization stated that PV systems saved more than 860 million tons of C02 in 2020. The construction industry is highly innovative in the commercial sector owing to the development of cost-effective zero-emission green facilities.

As per IRENA, Germany ranks fourth in solar energy production globally. In 2021, the nation installed solar capacities of almost 60 GW, an increase of 5.3 GW from 2020. These actions are based on the country’s aim to obtain a 65% share of the renewable energy sector by 2030. Moreover, the Energy Efficiency Strategy for Building suggested advanced technology development to achieve the goal of a virtually climate-neutral building stock by 2050. Hence, the growing focus on sustainable energy sources fuels the overall Europe BIPV market, spearheaded mainly by Germany.

PV Cost Reduction: A Driving Force for Market Players

Since photovoltaic systems generate energy with around 42% efficiency using multi-junction cells, they have emerged as an ideal alternative over complex installations, such as wind turbines. As per the UN, between 2010 to 2020, the cost of power from solar systems plummeted by around 85%. This highlights the question:

What induced PV cost reduction?

The significant cost decline is mainly because of overproduction and higher investment in PV modules. Another factor is the efforts by Chinese suppliers and wholesalers to reduce the stock held in European warehouses to prevent anti-dumping and anti-subsidy tariffs. This oversupply, from China to Europe thus shrunk the cost of silicon. Such developments led energy solutions supplier Sungrow to supply products to the world’s largest BIPV plant (120 MW) in Central China’s Jiangxi Province. Therefore, the increasing efficiency, ease of installation, and decreasing cost of PV modules over conventional sources like coal and natural gas are expected to open new avenues for players in the building integrated photovoltaics market.

#building integrated photovoltaics market#bipv market#bipv#energy industry#power industry#market research report#market research reports#triton market research

2 notes

·

View notes

Text

The op's post isn't accurate and it misrepresents the reporting provided by Agência Pública. I know I'm being a stickler, but this issue is complex enough that it I feel like it's important to clarify things that could misinform.

I'll try to be as brief as possible, but this is still going to get a bit long.

The first article discusses the ongoing discussion surrounding a proposed amendment to the Brazilian constitution, No. 10/2022.

Currently, private blood banks are required to sell their blood components to Hemobrás, a state-owned company that processes all plasma in Brazil. The amendment would give those blood banks the ability to sell excess plasma to other blood processing companies. It would also allow companies to pay people for their blood draws, instead of relying on volunteer blood donation.

Among the supporters of this change are several pharmaceutical companies, only one of which is a Brazilian company, Blau Farmaceutica SA.

The pro argument is that this change is necessary to provide blood products for Brazil. Agência Pública reports their points:

Hemobrás cannot meet Brazil's current need for blood product supply and will not be able to even after their current production facility is completed in 2025.

The lack of in-country blood processing capability means that a large amount of plasma collected by private blood banks is destroyed as Hemobrás lacks the capacity to process it and the blood banks are not allowed to sell it to anyone else.

The national shortage in blood products in the wake of the COVID-19 pandemic will continue because of these limitations.

The change would initially make Blau Farmaceutica SA the only company able to engage in this market, the implication that it would be protected from international competition for some time.

The opposing argument is that this change would open Brazil's blood product supply to exploitation and corruption. Agência Pública reports their points:

Brazil's blood supply is protected by the 1988 Citizen Constitution and that policy is strong and has led to excellent blood health security in the country.

They link the collection of blood for profit to the spread of disease like Hepatitis and AIDS due to the lack of quality controls see in Brazil's pre-1988 for-profit blood market.

The companies on the pro side are ultimately interested in finding a way to sell Brazilian plasma for profit and are clearly not interested in the public good.

As further background, the Swiss company referred to above is Octopharma, who were contracted by Hemobrás to process blood components stored between 2016 and 2020, which were going unused because Hemobrás did not have the capacity to process them. The processing of these blood components is what led to the immunoglobulin discovery, showing that Brazilian blood components measured 4.8g per liter as compared to 3.5g per liter from European blood component supplies.

It's a complex discussion because there are valid points both for and against this kind of change and it can't really be summed up as a simple case of colonialist exploitation. There are interests in Brazil fighting for and against and interests outside of Brazil doing the same.

Right now, I don't think you can summarize this as an example of outside interests trying to exploit a national resource for export to the rest of the world. Some of this isn't exploitation, some of it is, while some of the people and orgs involved are in Brazil, while some aren't.

--------------------

The second article discusses Bill 7082 from 2017 (PL 7082/2017), which would allow for the creation of independent research ethics committees that are not under the direct control of the current oversight model.

Brazil's National Research Ethics Commission, CONEP, currently controls the creation and registration of all CEPs, the research ethics committees, and acts as a central body that provides oversight to the entire system.

The pro and opposing sides are a little simpler in this case, and likely what you'd expect.

The pro side argues that this system is slow and bureaucratic and that independent CEPs would improve the speed at which research is approved.

The opposing side argues that allowing for the creation of independent CEPs opens the system to corruption, as independent CEPs are much more vulnerable to harassment and manipulation by financial interests.

Also, as one last opposing side argument, this would change the Brazilian model to more closely follow the US, which already operates in this manner.

As for access to medications, research sponsors currently have to provide the medication free of charge to any Brazilian citizens that participate in such studies. If PL 7082/2017 is passed, research sponsors would be allowed to stop providing the drug to study participants 5 years after the drug entered availability in either the national health market or the public health network.

So apparently some Swiss company found out that Brazilian blood has more immunoglobulin (which is used in some medications made by pharma companies) than European blood, and now international pharma companies are lobbying to change Brazilian law to allow them to use our blood as a resource

There is no current evidence that those things are related, but it just so happens that at the same time there is also another law being discussed that would get rid of "bureaucracy" when it comes to ethics analyses of trials on humans. It would also remove the right, which all brazilians currently have, to access to the medication resulting from the trials they participated in

Both sources are in Portuguese because both news have been recently broke by a Brazilian investigative news agency, but if you don't speak it, you can always use automatic translation

I know there's a lot of fucked up shit happening in the world right now, but please pay attention to medical rights in Brasil right now. Especially if you're European, because virtually every company related to this is from your continent and plans to benefit you above all

20K notes

·

View notes

Text

A State Department group engaged in censoring conservatives online was set to be shut down in only a few days, but House Republicans wrested defeat from the jaws of victory by extending the office’s authorization for another year in an omnibus spending package disguised as a “continuing resolution.”

Hidden in a one-paragraph item on the 139th page of the gargantuan 1,547-page pork-barrel bill is a one-year extension of the State Department’s Global Engagement Center (GEC), originally a counterterrorism tool that has been used to help Big Tech companies engage in industrial-scale censorship.

The move comes almost immediately after the censorship office was snubbed in the 2025 National Defense Authorization Act (NDAA), and the State Department informed Congress its intention to shutter the office by Dec. 24 after intense scrutiny. That means House Republicans, many of whom have claimed to be up-in-arms about the federal censorship, actively found a work-around to keep the office alive for one more year by amending the 2017 NDAA’s language.

In a statement to the Washington Examiner earlier this month, the State Department said of the GEC that is “remains hopeful that Congress extends this important mandate through other means before the Dec. 24th termination date.” It appe

0 notes

Text

Events 12.9 (after 1940)

1940 – World War II: Operation Compass: British and Indian troops under the command of Major-General Richard O'Connor attack Italian forces near Sidi Barrani in Egypt. 1941 – World War II: China, Cuba, Guatemala, and the Philippine Commonwealth declare war on Germany and Japan. 1941 – World War II: The American 19th Bombardment Group attacks Japanese ships off the coast of Vigan, Luzon. 1946 – The subsequent Nuremberg trials begin with the Doctors' Trial, prosecuting physicians and officers alleged to be involved in Nazi human experimentation and mass murder under the guise of euthanasia. 1946 – The Constituent Assembly of India meets for the first time to write the Constitution of India. 1948 – The Genocide Convention is adopted. 1950 – Cold War: Harry Gold is sentenced to 30 years in jail for helping Klaus Fuchs pass information about the Manhattan Project to the Soviet Union. His testimony is later instrumental in the prosecution of Julius and Ethel Rosenberg. 1953 – Red Scare: General Electric announces that all communist employees will be discharged from the company. 1956 – Trans-Canada Air Lines Flight 810-9, a Canadair North Star, crashes near Hope, British Columbia, Canada, killing all 62 people on board. 1960 – The first episode of Coronation Street, the world's longest-running television soap opera, is broadcast in the United Kingdom. 1961 – Tanganyika becomes independent from Britain. 1965 – Kecksburg UFO incident: A fireball is seen from Michigan to Pennsylvania; with witnesses reporting something crashing in the woods near Pittsburgh. 1968 – Douglas Engelbart gave what became known as "The Mother of All Demos", publicly debuting the computer mouse, hypertext, and the bit-mapped graphical user interface using the oN-Line System (NLS). 1969 – U.S. Secretary of State William P. Rogers proposes his plan for a ceasefire in the War of Attrition; Egypt and Jordan accept it over the objections of the PLO, which leads to civil war in Jordan in September 1970. 1971 – Indo-Pakistani War: The Indian Air Force executes an airdrop of Indian Army units, bypassing Pakistani defences. 1973 – British and Irish authorities sign the Sunningdale Agreement in an attempt to establish a power-sharing Northern Ireland Executive and a cross-border Council of Ireland. 1979 – The eradication of the smallpox virus is certified, making smallpox the first of only two diseases that have been driven to extinction (with rinderpest in 2011 being the other). 1987 – Israeli–Palestinian conflict: The First Intifada begins in the Gaza Strip and West Bank. 1992 – American troops land in Somalia for Operation Restore Hope. 1996 – Gwen Jacob is acquitted of committing an indecent act, giving women the right to be topless in Ontario, Canada. 2003 – A blast in the center of Moscow kills six people and wounds several more. 2006 – Space Shuttle program: Space Shuttle Discovery is launched on STS-116 carrying the P5 truss segment of the International Space Station. 2008 – Governor of Illinois Rod Blagojevich is arrested by federal officials for crimes including attempting to sell the U.S. Senate seat being vacated by President-elect Barack Obama. 2012 – A plane crash in Mexico kills seven people including singer Jenni Rivera. 2013 – At least seven are dead and 63 are injured following a train accident near Bintaro, Indonesia. 2016 – President Park Geun-hye of South Korea is impeached by the country's National Assembly in response to a major political scandal. 2016 – At least 57 people are killed and a further 177 injured when two schoolgirl suicide bombers attack a market area in Madagali, Adamawa, Nigeria in the Madagali suicide bombings. 2017 – The Marriage Amendment Bill receives royal assent and comes into effect, making Australia the 26th country to legalize same-sex marriage. 2019 – A volcano on Whakaari / White Island, New Zealand, kills 22 people after it erupts. 2021 – Fifty-five people are killed and more than 100 injured when a truck with 160 migrants from Central America overturned in Chiapas, Mexico.

0 notes

Text

During the 1st Trump administration, the national parks were commenting negatively on his Park plans. They were informed they couldn't post on their official pages without getting permission from him first. They made alt pages instead.

“What exactly are we resisting?” So, we decided to keep a detailed list. From 2017 to 2021, the Trump administration reversed over 100 environmental regulations, affecting climate policy, air, water, wildlife, and chemical safety. Additionally, more than a dozen other rollbacks were in progress but not finalized by the end of the term, prompting questions about the potential impact of another four years. You might wonder what another four years could look like. Here's a summary of Trumps last four years in office:

Weakened fuel economy and greenhouse gas standards.

Revoked California's stricter emissions standards.

Withdrawn legal basis for limiting mercury from coal plants.

Exited the Paris climate agreement.

Altered Clean Air Act cost-benefit analysis methods.

Canceled methane emissions reporting for oil and gas companies.

Revised rules on methane emissions from drilling on public lands.

Eliminated methane standards for oil and gas facilities.

Withdrew rule limiting toxic emissions from industrial polluters.

Eased pollution safeguards for new power plants.

Changed refinery pollution monitoring rules.

Reversed emissions reduction during power plant malfunctions.

Weakened air pollution rules for national parks and wilderness areas.

Loosened state air pollution plan oversight.

Established minimum threshold for regulating greenhouse gases.

Relaxed pollution regulations for waste coal plants.

Repealed hydrofluorocarbon leak and venting rules.

Ended use of social cost of carbon in rulemaking.

Allowed increased ozone pollution from upwind states.

Stopped including greenhouse gas emissions in environmental reviews.

Revoked federal greenhouse gas reduction goal.

Repealed tailpipe emissions tracking on federal highways.

Lifted ban on higher ethanol gasoline blends in summer.

Extended deadlines for methane emissions plans for landfills.

Withdrew rule reducing pollutants at sewage plants.

Dropped tighter pollution standards for offshore oil and gas.

Amended emissions standards for ceramics manufacturers.

Relaxed leak monitoring at oil and gas facilities.

Cut two national monuments in Utah.

Ended freeze on new coal leases on public lands.

Permitted oil and gas development in Arctic Refuge.

Opened land for drilling in National Petroleum Reserve, Alaska.

Lifted ban on logging in Tongass National Forest.

Approved Dakota Access pipeline near Sioux reservation.

Rescinded water pollution rules for fracking.

Withdrawn rig decommissioning cost proof requirement.

Moved cross-border project permits to presidential office.

Altered FERC's greenhouse gas considerations in pipelines.

Revised ocean and coastal water policy.

Loosened offshore drilling safety regulations post-Deepwater Horizon.

Weakened National Environmental Policy Act.

Revoked flood standards for federal projects.

Eased federal infrastructure project environmental reviews.

Ended financing for overseas coal plants.

Revoked directive to minimize natural resource impacts.

Revoked climate resilience order for Bering Sea.

Reversed public land-use planning update.

Withdrawn climate change consideration in national park management.

Limited environmental study length and page count.

Dropped Obama-era climate change and conservation policies.

Eliminated planning system to minimize oil and gas harm on sensitive lands.

Withdrawn policies for improving resources affected by federal projects.

Revised Forest Service project review process.

Ended natural gas project environmental impact reviews.

Rolled back migratory bird protections.

Reduced habitat for northern spotted owl.

Altered Endangered Species Act application.

Weakened habitat protections under the Endangered Species Act.

Ended automatic protections for threatened species.

Reduced environmental protections for California salmon and smelt.

Removed gray wolf from endangered list.

Overturned bans on lead ammo and fishing tackle on federal lands.

Reversed ban on predator hunting in Alaskan refuges.

Reversed rule against baiting grizzly bears for hunting.

Amended fishing regulations.

Removed commercial fishing restrictions in marine preserve.

Proposed changes to endangered marine mammal injury limits.

Loosened fishing restrictions for Atlantic Bluefin Tuna.

Overturned migratory bird handicrafts ban.

Reduced Clean Water Act protections for tributaries and wetlands.

Revoked stream debris dumping rule for coal companies.

Weakened toxic discharge limits for power plants.

Extended lead pipe removal time in water systems.

Eased Clean Water Act for federal project permits over state objections.

Allowed unlined coal ash ponds to continue operating.

Withdrawn groundwater protections for uranium mines.

Rejected chlorpyrifos pesticide ban.

Declined financial responsibility rules for spills and accidents.

Opted against requiring mining industry pollution cleanup proof.

Narrowed toxic chemical safety assessment scope.

Reversed braking system upgrades for hazardous material trains.

Allowed liquefied natural gas rail transport.

Rolled back hazardous chemical site safety rules.

Narrowed pesticide application buffer zones.

Removed copper filter cake from hazardous waste list.

Limited use of scientific studies in public health regulations.

Reduced corporate settlement funding for environmental projects.

Repealed light bulb energy-efficiency regulation.

Weakened dishwasher efficiency standards.

Loosened efficiency standards for showerheads and appliances.

Altered energy efficiency standard-setting process.

Blocked efficiency standards for furnaces and water heaters.

Simplified appliance efficiency test exemption process.

Limited environmentally focused investments in 401(k) plans.

Changed policy on using sand from protected ecosystems.

Halted contributions to the Green Climate Fund.

Reversed national park plastic bottle sale restrictions.

1 note

·

View note

Text

Peer to Peer Lending and its Regulation in India

INTRODUCTION

The advent of technology has led to various changes in the traditional ways of conducting business operations. One such change has been the emergence of Peer to Peer (hereinafter “P2P”) lending platforms for raising loans by businesses and individuals. The P2P lending platforms provide an alternative to traditional banks and societies for obtaining finances.

P2P lending is essentially a way in which businesses and individuals acquire required funds from online platforms. The route enables fundraising directly without the presence of financial institutions as intermediaries. The P2P lending platforms act as marketplaces or aggregators bringing together lenders/ investors and borrowers on online channels. Under the arrangement, the lenders are benefited by availing loans with shorter repayment terms and need for security. It has become a widely acceptable and preferred way of raising finances due to the lower interest rates, easier approval, and minimal documentation involved.

Legal framework for P2P lending platforms

The regulation of P2P lending platforms is governed by the Reserve Bank of India (hereinafter “RBI”) vide the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017[1]. The Master Directions under Section 4 (1) (v) define P2P lending Platform in the following manner:

“Peer to Peer Lending Platform” means an intermediary providing the services of loan facilitation via online medium or otherwise, to the participants as defined at item (iv) of sub-paragraph (1) of paragraph 4 of these directions;”[2]

The Master Directions provides that apart from a company, no non-banking institution can undertake the business of P2P lending platform[3]. Further, any NBFC intending to carry out the business of P2P (hereinafter “NBFC-P2P) lending is to do the same by obtaining a Certificate of Registration (hereinafter “CoR”) from the RBI.[4] The Master Directions also provide for the conditions for obtaining a CoR, eligibility for registration of an NBFC-P2P, the necessary financial capital structure, the scope and extent of activities, operational guidelines etc. Additionally, the Master Directions are accompanied by Annexures which have other elaborate detailing of the technical aspects of the above-mentioned rules.

In addition to these Directions, the RBI regularly updates the framework by the way of the circulars that are released for the purpose of monitoring and regulating the activities of the P2P lending Platforms. For instance vide a recent update to the Master Directions was brought vide an amendment in December 2019.[5]

Compliance requirements before raising P2P loans

NBFC-P2P

The Master Directions expressly provide the obligations of the NBFC-P2P towards the lenders and borrowers. The Directions state that the NBFC-P2P is to undertake due diligence on the borrowers and lenders[6]. The NBFC-P2P is further obligated to undertake credit assessment and risk profiling of the borrowers and disclose the same to their prospective lenders.[7] They must require the prior and explicit consent of the borrowers and lenders to access their credit information.

The Master Directions under its scope of activities provides that it is the responsibility of the NBFC-P2P to undertake documentation of loan agreements and other related documents, provide assistance in disbursement and repayments of loan amount and render services for recovery of loans originated on the platform. The Master Direction specifically mandates the maintenance of a minimum Leverage Ratio[8] of 2[9]. The NBFC-P2P are restricted from accepting deposits, lending its fund, providing any credit guarantee[10], allowing the international flow of funds,[11] and trading of any products except loan specific insurance products[12]and trading in securities.

The NBFC-P2P is expected to follow the Fair Practices Code, as prescribed by RBI from time to time, to maintain utmost confidentiality with respect to the transactions as undertaken through the platform and maintain a grievance redressal mechanism at all times for the internal as well as outsourced activities.

Borrowers

The Master Directions do not contain any specific requirements as to compliances to be observed by the borrowers. However, there are certain practical considerations to be kept in mind of the borrowers before availing a loan through P2P lending Platforms. It is recommended that the genuineness of the P2P Platform should be adequately checked. The borrowers as per the prudential norms are required not to taken aggregate loans exceeding Rs. 10,00,00/- (Rupees Ten Lakhs) across all P2P lending Platforms at any point in time.[13] The prudential norms also state that the maturity of the loans shall not exceed thirty six (36) months.[14]

Additionally, it is also recommended that the borrower should furnish all the required details by the platform, and ensure the complete truth in every piece of furnished information to the P2P lending Platforms. It is also recommended that due diligence is conducted on their part before investing and at the time of repayment.

Lenders

The Master Directions state that an aggregate exposure of a lender to all borrowers at any point of time, across all P2P platforms, shall be subject to a cap of Rs. 50,00,000/- (Rupees Fifty Lakhs) provided that such investments of the lenders on P2P platforms are consistent with their net-worth.[15] The Directions further state that a lender investing more than Rs. 10,00,000/- (Rupees Ten Lakhs) is required to produce a certificate to P2P platforms from a practicing Chartered Accountant certifying a minimum net-worth of Rs. 50,00,000 (Rupees Fifty Lakhs).

Other guidelines/ regulations with respect to P2P lending Platforms

Apart from the above mentioned considerations to be ensured for transacting through P2P lending Platforms are the following:

Fund Transfer Mechanism: All the fund transfer between participants is to take place through escrow accounts operated by a bank promoted trustee.

Interest Rate: The interest rate should be in annualized percentage rate format.

Conclusion The fintech space is an ever-expanding and in the wake of the covid-19 pandemic the movement to the digital space from the traditional ways of lending and borrowing is inevitable. The preference of P2P lending platforms due to the easy availability of loans and negligible requirements as to collaterals have increased the market players in the field and borrowers in these platforms. However, the activities in the platforms have to be carried out in a way to be complaint with the all the guidelines including the ones mentioned in the proceeding paragraphs provided in the Master Directions. The P2P platforms with its growth bring along with them various governing issues and increase a need to regulate such platforms with more laws and rules.

References

Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017, RBI/DNBR/2017-18/57, October 4, 2017. Updated on December 23, 2019

Section 4 (1) (iv) “Participant” means a person who has entered into an arrangement with an NBFC-P2P to lend on it or to avail of loan facilitation services provided by it.

Section 5 (1) (i) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section 5 (1) (ii) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

RBI Circular, DOR.NBFC(PD) CC.No.106/03.10.124/2019-20, dated December 23, 2019, retrieved from: https://m.rbi.org.in/Scripts/BS_CircularIndexDisplay.aspx?Id=11764

Section 6 (2) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section 6 (2) (ii) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section (4)(ii) as “Leverage Ratio” means the Total Outside Liabilities divided by Owned Funds, of the NBFC-P2P”

Section 7 (1) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section 6 (1) (iv) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section 6 (1) (viii) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section 6 (1) (vii) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section 7 (3) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section 7 (5) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

Section 7 (2) of the Master Directions – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

0 notes

Text

Model GST Law – A Tax Law Transformation

The much awaited reform Goods and Service Tax Act 2016 will change the fundamental of Indian Taxation. The state wise VAT, the central excise, the service tax, all will be integrated into one legislation, known as Goods and Service Tax Act, 2016 (‘GST Act 2016’). The GST Act 2016 has been for the first time made public in June 2016 by the Indian Government. The government is planning to introduce the Act w.e.f. 1st April, 2017 and proposes to pass the 122nd Constitutional Amendment bill, 2014 in the upcoming monsoon session of the parliament. By amalgamating a large number of Central and State taxes into a single tax, it would mitigate cascading or double taxation in a major way and pave the way for a common national market.

The framework of GST is characterized by a marked shift from the present origin based taxation to that of consumption based. It is proposed to be levied on a wide base of goods and services and is likely to subsume a majority of existing taxes — excise duty, service tax, VAT, Central Sales Tax (CST), purchase tax, octroy, local body tax etc. Only few services of public importance are kept outside the purview of GST. The regime is expected to have an equally conducive regulatory effect on Foreign Direct Investment (FDI), allowing foreign manufacturing companies to also be able to reap benefits and thereby, steadily build confidence in investing in India. The transition to GST may change the way business is done in India and is widely expected to boost the country’s economy.

Background

The Constitution (122nd Amendment) bill, 2014 was introduced in Lok Sabha on December 19, 2014 and was passed in the House on May 6, 2015. Further, it was referred to a Select Committee of Rajya Sabha on May 14, 2015. The Bill amends the Constitution to enable Parliament and State legislatures to frame laws on the imposition of the Goods and Service Tax (GST). Consequently, the GST subsumes various central indirect taxes including the Central Excise Duty, Countervailing Duty, Service Tax, etc. It also subsumes state value added tax, octroi and entry tax, luxury tax etc.

The idea behind GST is to subsume all existing central and state indirect taxes under one value added tax, which will be levied on all goods and services. No good or service is exempt, and there is no differentiation between a good or service, whether as an input or as finished product. Under GST, tax paid on inputs is deducted from the tax payable on the output produced. This input credit set off operates through the manufacturing and distribution stage of production. The tax is collected only at the place of consumption. This design addresses cascading of taxes.

“Implementation of GST in India will integrate the existing line of taxes like Central Excise, Service Tax, Sales Tax, Value Added Tax etc. into one tax i.e. GST. Thus it will help to reduce or eliminate the multiple taxes currently being levied on products and services.”

Key Features

GST will create a single, unified Indian market to make the economy stronger. The basic aim of GST is to benefit the consumers as well as the Government, thus creating a win win situation for both. Some of the important features are-

The GST shall have two components: one levied by the Centre (Central Goods and Service Tax) and other levied by States (State Goods and Service Tax). Rates for Central GST and Sate GST would be prescribed appropriately, reflecting revenue considerations and acceptability. This dual GST model would be implemented through multiple statutes. However, the basis features of law such as chargeability, definition of taxable event and taxable person, measure of levy including valuation provisions, basis of classification etc. would be uniform across these statutes as far as practicable.

Ending of Multiple Layer of taxes — Implementation of GST in India will integrate the existing line of taxes like Central Excise, Service Tax, Sales Tax, Value Added Tax etc. into one tax i.e. GST. This will help in avoiding multiple taxes currently being levied on products and services.

Alleviation of Cascading taxation — Under the GST regime, the final tax would be paid by the consumer of the goods/services but there would be an input tax credit system in place to ensure that there is no cascading of taxes. GST would be levied only on the value added at every stage, unlike the present scenario wherein tax is also required to be paid on Tax in a few cases i.e. VAT is payable on Excise Duty.

Development of National Economy — With the introduction of a uniform taxation law across states and different sectors in respect to indirect taxes under GST, would make it easier to supply goods and services hassle-free across the country. This will not only help in removing economic distortions, promote exports and bring about development of a common national market but will also enhance tax — to — gross domestic product ratio and thus help in promoting economic efficiency and sustainable long term economic growth.

Increase in voluntary compliance — Under the GST regime, the process will be simple and articulate with a lessor scope for errors. As all the information will flow through the common GST network, it would make tax payment and compliances a regular norm with lessor scope for mistakes. It will only be upon the payment of tax, that the consumer will get credit for the taxes they pay on inputs. This will generate an automatic audit trail of value addition and income across the production chain, creating a unified base of tax…

Read More: https://www.acquisory.com/ArticleDetails/17/Model-GST-Law-%E2%80%93-A-Tax-Law-Transformation

#model gst law#gst law#gst law transformation#tax law transformation#tax law#indian tax bill#taxation services in india#taxation services

0 notes

Text

How Tax Consultancy Help Navigate Complex Tax Laws and Compliance

In today’s dynamic and ever-evolving tax environment, navigating the complex world of taxation can be daunting for businesses and individuals alike.

Tax laws in India are subject to frequent updates and amendments, making it challenging for companies and taxpayers to remain compliant without expert guidance. This is where tax consultancy services in Delhi come into play, offering specialized expertise to help businesses and individuals manage their tax obligations efficiently.

Delhi, being one of India’s largest commercial and financial hubs, is home to a wide array of industries ranging from small businesses to large multinational corporations. With its fast-paced growth, the city faces a rapidly changing tax landscape that requires constant attention.

Tax consultants in Delhi provide invaluable support to their clients by ensuring compliance with tax regulations, optimizing tax liabilities, and offering strategic advice tailored to each client’s specific needs. In this article, we explore how tax consultancy services in Delhi help businesses and individuals navigate the complexities of tax laws and ensure smooth compliance.

1. Understanding the Complexity of Tax Laws in India

India’s tax system is known for its complexity. The introduction of the Goods and Services Tax (GST) in 2017, followed by various amendments to the Income Tax Act, has created a layered structure of compliance requirements.

Businesses in Delhi must not only comply with GST but also handle corporate taxes, TDS (Tax Deducted at Source), and indirect taxes. Additionally, individuals must manage their personal income taxes, property taxes, and capital gains taxes.

Keeping up with these constantly changing laws can be overwhelming for business owners, especially those without a dedicated finance team.

Tax consultants in Delhi are well-versed in these regulations and stay updated on the latest changes in tax policies. They help businesses and individuals understand how specific laws apply to their situation, ensuring compliance while identifying opportunities for tax savings.

2. Ensuring Compliance and Avoiding Penalties

One of the biggest challenges for businesses in Delhi is staying compliant with tax laws and filing requirements. Non-compliance can result in severe penalties, including hefty fines and interest on unpaid taxes, not to mention damage to a company’s reputation.

Tax consultancy services in Delhi play a vital role in ensuring that businesses meet all regulatory deadlines and file accurate tax returns.

For instance, GST compliance involves filing monthly, quarterly, and annual returns, depending on the type and size of the business. Missing any of these deadlines can lead to penalties.

Similarly, businesses must comply with TDS regulations, ensure that taxes are deducted at source on applicable payments, and submit timely TDS returns.

Tax consultants assist clients by preparing and filing their tax returns on time, reducing the likelihood of errors and omissions.

They also conduct regular compliance checks to ensure that all necessary documents are in order, minimizing the risk of audits or investigations by tax authorities.

3. Tax Planning and Optimization

In addition to ensuring compliance, tax consultancy services in Delhi focus on tax planning and optimization. Tax consultants evaluate a company’s financial structure and identify opportunities to minimize tax liabilities. By offering tailored tax-saving strategies, consultants help businesses and individuals save money while staying compliant with the law.

Effective tax planning involves considering the timing of income, purchases, and other transactions to take full advantage of deductions and exemptions available under the tax laws.

For example, consultants might advise businesses on how to structure transactions to benefit from lower GST rates or how to claim deductions on depreciation, investments, or employee benefits.

Individuals, too, can benefit from tax consultants’ expertise in areas such as retirement planning, estate management, and investment strategies.

Tax consultants in Delhi help individuals optimize their tax liabilities by making use of available exemptions under sections like 80C and 80D, and by advising on capital gains tax management, real estate transactions, and tax-efficient investment options.

4. Handling GST Compliance in Delhi

One of the most significant challenges for businesses in Delhi is managing GST compliance. The implementation of GST consolidated multiple indirect taxes into one, but the system remains intricate due to frequent updates in the GST rate, rules, and filing requirements.

Businesses need to keep track of multiple GST filings, reconcile input tax credits, and adhere to reverse charge mechanisms when applicable.

Tax consultancy services in Delhi provide specialized GST-related support, helping businesses navigate these complexities with ease. GST consultants assist in:

Filing Returns: Ensuring timely and accurate filing of GSTR-1, GSTR-3B, and annual GSTR-9 returns.

GST Reconciliation: Matching sales and purchase data with the GSTR-2A report to claim input tax credit correctly.

Addressing Notices: Responding to queries, notices, or discrepancies raised by GST authorities.

E-Way Bills: Managing the generation and tracking of e-way bills for the movement of goods.

By outsourcing GST compliance to professional tax consultants, businesses can focus on their core operations while staying fully compliant with GST laws.

5. Audit and Assurance Services

For larger corporations, tax audits are a routine requirement under Indian law. Companies with turnover exceeding a certain threshold must undergo tax audits to ensure that their financial statements reflect a true and fair view of their financial position.

Tax consultancy services in Delhi offer audit and assurance services to ensure that businesses meet their audit obligations.

During an audit, tax consultants review the company’s books, analyze its financial transactions, and ensure that all necessary filings are completed accurately.

This process not only ensures compliance but also provides valuable insights into potential areas for improving financial efficiency and reducing tax liabilities.

Consultants also assist with handling scrutiny assessments and represent businesses in front of tax authorities in case of disputes. Their expertise helps businesses mitigate risks and ensures that audits are completed smoothly without triggering penalties or further investigations.

6. Navigating International Taxation and Transfer Pricing

For businesses in Delhi with international operations, complying with international tax regulations can be highly complex. India has tax treaties with several countries, and navigating these agreements requires a deep understanding of international tax laws.

Tax consultancy services in Delhi offer expert advice on transfer pricing, cross-border transactions, and tax treaties to ensure compliance and avoid double taxation.

Transfer pricing regulations are particularly critical for companies with global operations. Consultants help ensure that all related-party transactions are conducted at arm’s length and that the necessary documentation is maintained for audits by Indian tax authorities.

7. Dealing with Tax Disputes and Litigation

Inevitably, some businesses and individuals may face tax disputes, whether due to audits, investigations, or notices from tax authorities. Handling tax disputes requires expertise in tax law and negotiation skills. Tax consultancy services in Delhi offer representation services for businesses and individuals facing disputes with tax authorities.

Consultants provide legal guidance and assist in preparing and submitting documents required for litigation.

They also represent clients in hearings before tax tribunals, helping resolve disputes in a favorable manner. Whether it’s responding to income tax assessments or GST notices, tax consultants ensure that clients’ interests are protected throughout the litigation process.

Conclusion

The complexities of tax laws in India make it challenging for businesses and individuals in Delhi to stay compliant and optimize their tax liabilities.

Tax consultancy services in Delhi play a crucial role in simplifying this process, offering expert advice on compliance, tax planning, GST management, and audit preparation. By working with experienced tax consultants, businesses can not only avoid costly penalties but also benefit from tailored tax-saving strategies that enhance their financial efficiency.

In a fast-growing business environment like Delhi, partnering with a tax consultant can make all the difference in staying competitive and compliant in an ever-changing tax landscape.

0 notes

Text

Why GST Compliance Solutions Are Crucial for Business Growth

The Goods and Services Tax (GST) is an integral part of the Indian tax system, affecting almost every business, large or small. Since its implementation in July 2017, GST has not only simplified the tax regime but also posed new challenges especially in terms of compliance In this competitive environment, compliance with GST rules is not only an obligation but rather a key factor in improving productivity Known in depth.

1. Understanding GST Compliance

GST compliance refers to compliance with the rules and regulations laid down by the government under the GST Act. This period includes filing paperwork, keeping accurate records, submitting the correct invoices, and paying the correct amount of taxes. Non-compliance can result in fines, lawsuits and loss of reputation, which can significantly affect business operations.

2. Role of GST in Modern Business

GST is not just a tax; It is a system that affects the entire supply chain of goods and services. It also affects prices, buying, selling, and customer satisfaction. Simplified tax breaks under the GST regime ensure that businesses can run smoothly, reducing the overall tax burden. However, this efficiency can only be achieved if businesses comply with GST rules.

3. GST Compliance Challenge

GST has simplified the tax regime, especially for businesses that operate in multiple countries or deal in a variety of goods and services Some common challenges are:

Frequent Legislative Changes: GST laws are dynamic, and are frequently updated and amended. Staying up-to-date on these changes is critical to compliance.

Complex Return Submission Schedule: Companies are required to submit multiple returns periodically. The process can be tedious and errors are common, leading to non-compliance.

Classification Issues: Misclassification of goods and services may result in the application of unfair taxation, which may result in penalties.

Input Tax Credit (ITC) Discrepancy: Improper reconciliation of ITC can result in credit disapproval, affecting the revenue of the business.

4. The Impact Of Non-Compliance On Business Growth

Non-compliance with GST can have severe consequences for the growth of a business. Penalties and lawsuits can erode financial resources, while reputational damage can lead to loss of customers and business opportunities. Additionally, non-compliance may result in excise tax withholding, increasing operating costs. In extreme cases, it can also stop working.

5. Benefits of GST Compliance Solution

Implementing a robust GST compliance solution offers several benefits that can boost productivity:

Accuracy And Operational Efficiency: Automated GST compliance solutions help deliver accurate returns, reduce the chances of errors and ensure timely compliance.

Cost Savings: Companies can save significant costs by ensuring excise tax is used efficiently while avoiding penalties.

Improved Cash Flow: Timely and accurate compliance ensures that cash flow is not wasted, allowing companies to invest in growth opportunities.

Reputation Enhancement: GST compliant companies build trust among customers, suppliers and regulators, giving them a better reputation in the market.

6. Key Features of Effective GST Compliance Solutions

When choosing a GST compliance solution, businesses should look for the following key factors.