#CashFlowForecasting

Explore tagged Tumblr posts

Text

Effective Cash Flow Forecasting Provides Vital Insights Into An Organisation's Financial Health

0 notes

Text

Cash Flow Management Tips for SMBs

Effective cash flow management is key to your business’s success. Even profitable businesses can fail without proper cash flow control. Here are 5 essential tips to keep your finances in check:

#CashFlowForecast#SmallBusinessFinance#CashFlowManagement#FinancialManagement#BookkeepingExperts#BusinessGrowth#SMBSuccess

0 notes

Text

Cash Sheet: A Comprehensive Guide

View On WordPress

0 notes

Photo

One common problem for small business owners is cash flow management. Many small businesses struggle to maintain a steady flow of income, which can make it difficult to pay bills, invest in growth, and keep the business running smoothly.

One effective solution to this problem is to implement a cash flow forecasting system. This involves projecting the cash inflows and outflows of the business over a certain period of time, typically a few months or a year.

By doing so, the business owner can anticipate when they may experience cash shortfalls and take proactive measures to address the issue before it becomes a crisis.

For example, if the cash flow forecast shows that the business will have a shortfall in a particular month, the owner can take steps to increase sales or cut costs in advance.

This could include launching a targeted marketing campaign, negotiating better terms with suppliers, or reducing unnecessary expenses. By having a plan in place, the business owner can better manage their cash flow and ensure that the business stays financially stable.

_____________________

Let's connect on SOCIAL!

Facebook Page: https://www.facebook.com/thewritersperspective

Instagram: @theperspectiveofthewriter https://www.instagram.com/theperspectiveofthewriter/

LinkedIn Profile: https://www.linkedin.com/in/writers-perspective/

LinkedIn Page: https://www.linkedin.com/company/the-writer-s-perspective/

LinkedIn Newsletter: https://www.linkedin.com/newsletters/7035283578129182720/

Twitter: https://twitter.com/writrsprspectve

Pinterest: https://www.pinterest.ph/thewritersperspective/ Join our Private

Facebook Group: https://www.facebook.com/groups/2622007584597846

If you need help bringing your business to your audience with the right strategy, send us a direct message, and let's start from there.

_____________________

0 notes

Video

tumblr

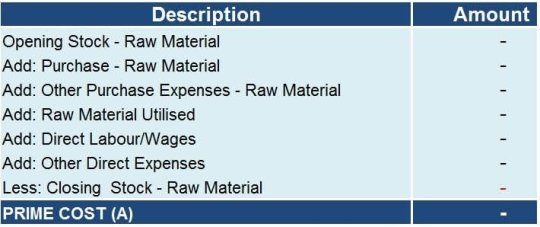

Accurate financial and cost accounting

A business can go out of control without strict fiscal discipline. Quantitative analysis of all the financial details and accounting of all the costs is a crucial element in the smooth running of the business. The entire life cycle from budgeting to spending till reconciling is a complex process that is automated in almost all companies. Integrated analytical tools solve the challenges of maintenance and aid in strategic decisions. Atlantis Worksware provides the systems to manage and exchange financial data across departments to ensure smooth functioning of all arms of the business and maintain agility in the organization. Some key features include: • Accounting for multiple companies culminating into final financial statements • Create budgets • Customized balance sheet views drilled down to transaction account • Periodic Expenses and Incomes • Cash flow forecasting based on orders received and issued

Contact mail id : [email protected] Call us : +1.833.561.3093

#atlantis#accuratefinancial#costaccounting#quantitative analysis#financialstatements#cashflowforecasting#financial data#workswareerp#cashflowstatement#consolidatedfinancialstatements#personalfinancialstatement#costandmanagementaccounting#commonsizeanalysis#qualitativeandquantitativeanalysis#basicfinancialstatements#erp#erpsystem#erpsoftware#enterpriseresourceplanningsystem#clouderp

1 note

·

View note

Text

3 Financial Tips for Young and Aspiring Small Business Entrepreneurs

Becoming your own boss and starting your dream business can be intimidating, especially when you’re a novice and just entering the industry. Young and aspiring entrepreneurs face a lot of challenges like creating a business plan, managing time, hiring employees, delegating tasks, finding markets, marketing products, and more.

Besides these hurdles, it’s critical that you build a robust financial life and establish your financial goals so you can take control of your financial life as a young business owner. Here are seven of the best financial tips that entrepreneurs can apply to their journey.

Plan for Raising Capital

If you’re planning to start your new venture, you may need extra working capital to cover various business costs to successfully run and grow your startup. If you don’t have sufficient funds to start your business, you need to find out where you can raise money from.

Today there are a plethora of options available for aspiring entrepreneurs to obtain capital, from traditional banks to credit unions, online alternative lenders, and other non-banking financial institutions. You can also use an online lending marketplace to find and compare a variety of startup loan offers from multiple lenders and choose one that best fits your current financial needs and budget.

Determine how much money you need, how you’ll use it, and what are your plans to repay the borrowed funds. When determining how much capital you need, it’s always a great idea to take twice as long as you originally think.

Develop Your Financial Goals

When you are a novice entrepreneur, it is easy to waste time daydreaming about your idea instead of setting clear financial and business goals. You need to set strong financial goals that drive your young business forward. Your mission and vision should have a clearly stated purpose when developing your business plan as well as your business goals and objectives.

Read Also: 5 Financial Resolutions for Small Businesses in 2021

Here are some valuable tips to develop financial goals for your new venture.

Make a realistic budget to know your financial limits

Save an emergency fund to cover differential costs during an unexpected time

Spend your money wisely

Stay focused on your business goals to make smarter financial decisions

Pay off your debt on time

Set smaller financial goals to achieve bigger financial goals

Manage Your Business Cash Flow

For startups, running out of money can be catastrophic. Poor cash flow is one of the most common reasons for startup failure. If you fail to manage cash flow within the first year, you will most likely not survive past the second year, so it’s extremely important for all businesses.

Here are some of the many important tips to manage cash flow for startups

Use cash flow forecasting and management software to get a real-time picture of your past, present, and future cash flow

Smartly manage your accounts receivables - encourage customers to pay up faster so you can control and close the gap between invoicing and payment

Keep your books accurate and up to date

Keep your personal and business expenses separate

Build a cash reserve

Consider adequate small business financing to solve cash flow issues in your startup

Final Thoughts

Though becoming an entrepreneur can be difficult, following these tips will help you get your business off the ground. By planning, organizing, tracking your purchases, spending money wisely, working with a professional, and learning new things, you’ll be ahead of the game as a new and aspiring entrepreneur.

#BusinessCashFlow#BusinessLoans#CashFlowForecasting#FinancialTips2021#BusinessEntrepreneurs#PlanforRaisingCapital#DevelopFinancialGoals#ManageCashFlowTips

0 notes

Photo

Case Study 1 - Our client was aged 53 when he came to discuss his retirement plans. Take a look at our case studies with in real time with existing clients. Link in Bio 👆🏻#casestudies #pensions #retirement #retirementplanning #cashflowforecasting #fundperformance #investing #charges #pensionconsolidation #drawdown #taxfreelumpsum #successionplanning #gifting #inheritancetax (at Pension Advice UK) https://www.instagram.com/p/CEtVxSegWzf/?igshid=1w0vdaqfiv9g8

#casestudies#pensions#retirement#retirementplanning#cashflowforecasting#fundperformance#investing#charges#pensionconsolidation#drawdown#taxfreelumpsum#successionplanning#gifting#inheritancetax

0 notes

Photo

Revise your 2020 budget in line with recent events. Do your cashflow. Plan ahead! Your accounting software may have this function, there are apps you can use, or just a good old excel spreadsheet will do. If your cashflow shows that you might have to go overdrawn - just make sure that the overdraft can cover it! Avoid unnecessary bank charges that come about due to lack of planning. Check out: https://www.udemy.com/course/cashflow-management-and-forecasting for specific training on how to do a cashflow on excel #cashflowmanagement #cashflow #cashisking #2020budget #nottodaycovid19 #planningahead #cashflowforecasting #cashflowforentrepreneurs #cashflowforeveryone #cashflowtrain #cashflows #cashfloww #budgeting #budgetplanner #budgetfriendly #budgetlife #planahead #planaheadandprepare #planningahead #planningaheadpaysoff #planningaheadiskey #planningaheadworks #planningaheadhelps https://www.instagram.com/p/CBLa-EyBtOq/?igshid=4ytgu2zoanw5

#cashflowmanagement#cashflow#cashisking#2020budget#nottodaycovid19#planningahead#cashflowforecasting#cashflowforentrepreneurs#cashflowforeveryone#cashflowtrain#cashflows#cashfloww#budgeting#budgetplanner#budgetfriendly#budgetlife#planahead#planaheadandprepare#planningaheadpaysoff#planningaheadiskey#planningaheadworks#planningaheadhelps

0 notes

Link

Read on to find out the differences between a purchase order and an invoice and how these two are used for a small business.

#cashflow#cashflowforecast#Cashflowforecasting#cashflowprojection#cashflowprojectiontemplateforbusinessplan#cashflowprojectionstemplate#creatingacashflowprojection#forecastcashflow#howtodoacashflowprojection

0 notes

Link

Here is everything you need to know about cash flow projections and step by step process to help you create them in order to manage cash flow.

#cashflow#cashflowforecast#Cashflowforecasting#cashflowprojection#cashflowprojectiontemplateforbusinessplan#cashflowprojectionstemplate#creatingacashflowprojection#forecastcashflow#howtodoacashflowprojection

0 notes

Text

How to do a cash flow forecast?

Poor cash flow is one of the biggest contributors to small business failure. To beat the odds and succeed in business, it pays to conduct regular cash flow forecasts. Here’s what it should include.

What is your anticipated income? This figure is an estimate of what you expect to bring in from sales.

Make sure you:

Use sales data from a comparable period (e.g. use June 2019 figures for June 2020 forecast) as a guide Take into account seasonality or one-off events (e.g. conventions) Factor in current market issues (e.g. a recession or a pandemic) Monitor your competition. If a new competitor is taking some of your regular clientele, you may need to factor in lost market share

What are your other cash inflows? Depending on your business, sales won’t be the only contributor to company profits. Cash inflows can include: Government grants Proceeds from insurance Tax refunds GST rebates Funds from asset divestment

When will you receive payments? This will differ from industry to industry – a retail business will have vastly different payment terms from an IT company. If you have 30-day terms, you may expect to receive payments one month after invoicing or later.

What are your expenses? Both direct and indirect expenses should be factored into this figure. Make sure you also consider the timing of each payment, as you probably won’t pay all outgoings on the same day. Expenses may include: Employee wages and super Payments to suppliers New assets Overhead (ie. rent, utilities, office supplies Insurance Repairs and Maintenance Franchise fees

WHAT IF…? Most businesses are in a constant state of flux. Even if your cash flow remains steady for several months, an unexpected event can affect your best-laid plans. So include ‘what-if’ scenarios in your forecasting. What if scenarios may include: Loss of key staff Rent increase Recession Damage to your physical business (ie. flood, fire, etc) Damage to your brand (e.g. poor reviews) Sudden shutdown of brick-and-mortar businesses (e.g. COVID-19)

With Axia, not only will you have a professional bookkeeper look after your accounts, you will receive regular, simple-to-understand business reports giving you a better insight into how well your business is performing. In addition, all clients have access to our cash flow prediction and strategies to make their business more profitable. For more details Contact us now. https://www.axiaaccounts.com.au/services/

0 notes

Text

Effective Cash Flow Forecasting Provides Vital Insights Into An Organisation's Financial Health

A business needs to be aware of its liquidity status at different times, as investors and lenders depend upon the projected and current cash flows of businesses to decide whether they should invest in the business. The cash situation of a business must be made readily available for businesses to make accurate business decisions. An apt parameter to be considered to determine the same is the Cash flow forecast, which refers to the cash and cash equivalents that go in and out of business. A positive cash flow signifies increasing liquidity assets and the ability of a business to create value for shareholders. Several methods can be used to analyse the cash flow within a business, including free cash flow, unlevered cash flow, and debt service coverage ratio. Let us analyse the importance of cash flow and how cash flow forecasting can help businesses do better financially.

Why are cash flows essential to a business's health?

Cash flow forecasts are essential to a business as they signify its financial health and ability to meet financial obligations. A positive cash flow signifies a profitable business model, allowing the business to pay its suppliers and workers on time. Businesses survive off of their financial prowess and reputation, and it is essential for businesses to maintain both. As stated earlier, a positive cash flow helps maintain economic prowess, leading to a good reputation. You can hire professionals that provide online accounting services to However, these are not its only benefits, as timely payment of dues helps businesses avoid penalties imposed upon parties that make late payments. In addition, cash availability can help you expand without depending on high-interest loans, making things better for the business in the long term. Hiring new employees, upgrading instruments, and sourcing financing opportunities becomes more straightforward when you’ve sorted your cash flow. Therefore, it is safe to say that an accurate idea of the Current and Forecasted cash flow allows businesses to thrive.

How can Cash Flow Forecasting (CFF) assist in making clear business decisions?

Accurate Cash Flow Forecasts allow businesses to make crucial decisions, such as when to invest in new products and how much inventory should be maintained, among other decisions affecting the company's cash situation. It is an integral part of business risk management. It can also point towards potential problems before they occur so businesses can appropriately plan and manage the risks. Businesses need accurate CFF to avoid financial distress or even bankruptcy if the cash outflow trumps the cash inflow for the long term, which is undesirable for any business. The business might find it helpful to have accurate cash flow information as it allows them to make well-informed and crucial decisions. In fact there are online accounting service providers that can use analytical tools to predict cash flow and expected cash flow forecast.

Benefits of CFF

There are many benefits that are achieved by accurately understanding a company’s cash flow. As the forecast provides insight regarding the availability of financial resources at hand, the management can make informed decisions regarding project management, capital asset planning, investment planning, working capital management, and financial planning, which are explained as follows:

The first one is better cash flow management, which allows the management to understand whether a business can meet all the financial obligations it is entitled to.

Cash flow shortages can be predicted and planned around. An accurate cash flow can help the management decide when it is the right time to apply for a loan without obstructing the flow of operations because of cash shortage.

Project management requires a good understanding of cash at hand. Cash flow forecasting allows the management to decide whether the business should hire more resources, or let go of some, to maintain optimal financial health. Businesses decide to facilitate expansion when they have ample cash surplus at hand.

Capital Asset Planning depends majorly upon cash flow forecasts as upgradation of available machinery/tools required for business operations, as paying for new assets with cash is preferred over loans.

Better investment planning is another one of cash flow or accounts forecasting, as a high surplus in cash can be estimated beforehand, making it possible for businesses to plan investments.

Several scenarios can be simulated and planned with a good understanding of the cash flow. For example, you can predict how a supply bottleneck can affect the cash flow and how a business can handle low customer demands cautiously.

A good understanding of cash inflow and outflow can help businesses understand what they are spending money on and manage costs in a better way.

Businesses often need to pay more attention to receivables management, and this is something cash flow forecasting can help with. Businesses can analyse frequent cash flow problems and determine their reasons so they can be dealt with appropriately.

How CFF can be used in CAPEX planning (IRR for returns)

The CFF obtained for a business can help the management plan Capital expenditures in a better way by deciding the CF/CapEX ratio. This ratio determines whether it is a good choice for a business to acquire long-term assets or not. A higher CF/CapEX ratio implies it is more than capable of investing in long-term assets. It provides information regarding the amount of cash a company generates for every dollar invested in capital expenditures, including PPE (Property, Plant, and equipment). A higher ratio generally signifies good financial health of the business and interests investors. A high CF/CapEX ratio also implies that the business would not need to take a loan out for CapEX as they can pay it straight out of their cash reserves, saving the business from paying loan interests.

Things you need to know about DCF (Discounted Cash Flow)

The DCF (Discounted Cash Flow) helps determine whether a business is worth investments based on future cash flows. As it depends upon cash flows in the future, it can be stated that Cash Flow Forecasting needs to be done. The DCF allows companies to decide whether the acquisition or a merger with a company is sensible. DCF Valuation also holds weight in the real estate industry, as well. A single analogy can explain the central concept behind DCF: The value of $10, as of today, is bound to be higher than what it would be a year down the line, thanks to high inflation rates. Therefore, the value of $10 in cash is significantly higher right now than what it would be if you received it a year later. Therefore, to accurately estimate projected cash flow, future cash flows must be discounted to a certain extent. DCF Valuation can be done by following the following formula: r stands for the discount rate, n stands for the number of periods, and CF stands for the cash flows.

Here, CF equals the earnings and dividends a business receives, while the number of periods (n) stands for the number of years the cash flow is expected to sustain, and r stands for the discount rate or the the company’s cost of capital.

Moreover, Discounted Cash Flows also help estimate future cash flows, which in turn allows the management to plan out it's future course of action. Businesses that plan upcoming moves well before their execution manage risks better, therefore allowing a smoother flow of business operations.

Calculating the cash flow can be overwhelming for businesses that do not have a dedicated accounting team to follow through with such extensive procedures. To make a nearly accurate cash flow prediction, a business must have a good idea about the factors that affect the cash flow while staying on top of the inflow and outflow of cash through the bank account registered for the business, as well as other factors that affect the DCF. An accurate DCF estimate allows the management to plan future course of actions, while managing risks efficiently. Therefore, it is suggested that businesses keep performing Cash Flow Forecasting on regular intervals. Businesses with dedicated accounting teams find it easier to access these forecasts while smaller, and growing businesses miss out on their benefits. However, the online accounting services provided by NSKT Global allow smaller businesses to carry out these processes without having to worry about human errors or hiring an in-house team of accountants, as most of these processes are automated. The dedicated and well-trained team of accounts professionals housed by NSKT Global specialise in handling intricate and crucial financial parameters. Click here to land on the home page of NSKT Global and learn more about the company's services and how you can leverage these services to benefit your business!

Schedule a Free Consultation

0 notes

Link

Cash flow forecasting and budgeting models are becoming increasingly important, not only to help you plan your finances but they are commonly requested by banks and other providers of finance. In addition, external auditors are increasingly requesting forecasts to support directors assertion on going concern.

0 notes

Link

Here is everything you need to know about cash flow projections and step by step process to help you create them in order to manage cash flow.

#cashflow#cashflowforecast#Cashflowforecasting#cashflowprojection#cashflowprojectiontemplateforbusinessplan#cashflowprojectionstemplate#creatingacashflowprojection#forecastcashflow#howtodoacashflowprojection

0 notes

Text

Cash Flow Forecasts in London for Individuals and Business

Cash flow forecasts in London by London Accounting and Tax Services is one of the most reliable forecasting to make investment decision easy. It is always very important for business owners to look forward financial numbers to get the most important information for investment. London Accounting and Tax Services offer a transparent service at affordable price to make sure your investment decision easy every time. To make sure that a business can afford to pay suppliers a Cash Flow Forecast is needed, usually require by lenders to assure their investments. Financial planning has always been a most important discipline for a business and for that cash flow forecast is require. As cash flow forecast is an important business management process it is require every time.

One of the best cash flow forecasts in London to avoid cash flow problems and for taking better operational decisions. Forecasting provides you the information that you to need to make the decision confidently. Cash flow forecasting directly implies that what impact they will have on your business. To get better investments if you want to approach investors, there has to be some evidence of your fiscal management to show transparency.

Cash flow forecasts in London to satisfy investors and bank managers if you are seeking funding for individual or business. Cash flow forecasting is most important to identify cash gaps and surpluses. Forecasting report helps you to track your spending periodically and also helps you to staying in budget. It is always a good idea to track your expenditure and gains. You can proactively manage cash shortage and manage budget. A cash flow fore casting ensures you can pay our supplier on time which is a key responsible for your reputation.

For more information visit the URL given below

http://accountant-in-london.co.uk/cash-flow-forecasts/

0 notes

Text

RT https://t.co/g2EsegPzQG #payroll #managmentaccounts #cashflowforecast #buisness #money #finance #… https://t.co/QkzYyz8hxY

RT https://t.co/g2EsegPzQG #bookkeeping #payroll #managmentaccounts #cashflowforecast #buisness #money #finance #… https://t.co/QkzYyz8hxY

— BookkeepingGoldCoast (@BookkeepingQLD) March 13, 2017

Source: @BookkeepingQLD March 13, 2017 at 04:52PM More info Bookkeeping in Gold Coast

0 notes