#Cash App tax refund time

Explore tagged Tumblr posts

Text

Expert Guidance for Pending Tax Refunds on Cash App

Receiving a tax refund is often an eagerly awaited moment for many individuals, providing a much-needed financial boost. However, if you expect your IRS deposit and notice it's pending on Cash App, it can lead to understandable concerns and questions. In this detailed guide, we'll delve into why tax refund pending on Cash App and offer practical solutions to address the issue.

Unraveling the Mystery of Pending IRS Deposits on Cash App:

Cash App has become a popular platform for managing finances, including receiving direct deposits such as tax refunds from the Internal Revenue Service (IRS). While the process is generally seamless, there are instances where tax refunds may show as pending on Cash App, causing uncertainty and inconvenience for users.

Why Is My Tax Refund Pending on Cash App?

Processing Time: Tax refunds, like other direct deposits, can take 1-5 business days to process. If your refund is pending, it may be undergoing the standard processing period required by financial institutions.

Verification Procedures: Cash App may need to verify your account information or the validity of the deposit before releasing the funds. This verification process can contribute to Cash App tax refund pending issues.

Bank Holidays and Weekends: Direct deposits initiated during weekends or bank holidays may experience delays in processing, resulting in a pending status for your tax refund.

Account Verification Issues: Any discrepancies or issues with your Cash App account, such as incorrect account details or verification problems, can delay the processing of your tax refund.

How to Resolve Pending Tax Refunds on Cash App?

Verify Account Information: Double-check the accuracy of your account details, including the routing number and account number provided for the tax refund. Ensuring the information is correct can expedite the processing of your refund.

Contact Cash App Support: If your tax refund remains pending beyond the expected processing time, don't hesitate to contact Cash App support for assistance. They can provide insights into the status of your refund and help resolve any underlying issues.

Update Cash App: Ensure you're using the latest version of the Cash App to avoid any potential bugs or glitches that may be causing delays in processing your tax refund.

Complete Identity Verification: If you still need to do so, complete the identity verification process within Cash App. This can help streamline transactions and reduce the likelihood of delays with your tax refund.

FAQs:

Q: How long does it take for a tax refund to show as pending on Cash App?

A: Tax refunds are typically pending for 1-5 business days on Cash App, depending on processing time, verification procedures, and bank holidays.

Q: Can I cancel a pending tax refund deposit on Cash App?

A: Once a tax refund deposit is initiated, it cannot be canceled. However, contact Cash App support for assistance if you encounter any issues or delays.

Q: Will my tax refund continue if it's pending on the Cash App?

A: Yes, pending tax refunds will eventually be processed and deposited into your Cash App account once they are verified and approved by the IRS and Cash App.

Conclusion:

While it can be concerning to see your Cash App pending direct deposit tax refund, understanding the reasons behind it and taking proactive steps can help alleviate worries and expedite the processing of your refund. By following the tips and solutions outlined in this guide, you can confidently navigate through pending tax refunds on Cash App, ensuring timely access to your much-awaited funds. Remember to stay patient and proactive, and don't hesitate to seek assistance from Cash App support if needed.

#How Long Does It Take to Get a Tax Refund on Cash App#Cash App tax refund#Cash App tax refund time#Cash App taxes#Cash App tax refund pending#cash app tax refund accepted#cash app tax refund deposit#What Time Does Cash App IRS Direct Deposit Hit#Cash App tax refund deposit#Cash App direct deposit pending#Cash App IRS deposit pending

0 notes

Text

Why is My Tax Refund Deposit Pending on Cash App?

As tax season approaches, many individuals eagerly await their tax refunds, which are often deposited directly into their bank accounts. Cash App users may choose to have their tax refunds deposited into their Cash App account for added convenience. However, there are instances where these deposits may be rejected or delayed. In this blog, we'll explore the reasons why Cash App direct deposit tax refund pending and what you can do to resolve the issue.

Why is My Tax Refund Deposit Being Rejected on Cash App?

Reasons due to which tax refund pending Cash App:

Incorrect Account Information:

One of the most common reasons for a tax refund deposit rejection is incorrect account information provided to the IRS.

Double-check the account and routing numbers you provided to ensure they match the information linked to your Cash App account.

Bank Account Closed or Inactive:

If the bank account linked to your Cash App account is closed or inactive, the deposit will be rejected.

Ensure that your bank account is active and able to receive deposits.

Insufficient Funds:

If there are sufficient funds in your Cash App account to cover the tax refund deposit, the transaction may be accepted.

Make sure you have enough funds in your account to receive the deposit.

IRS Errors:

In some cases, the IRS may make errors when processing tax refunds, leading to rejections.

Contact the IRS or check your tax return status online to verify the status of your refund.

How to Resolve Tax Refund Deposit Rejection on Cash App?

Update Account Information: If you believe the Cash App direct deposit tax refund pending due to incorrect account information, update your account details with the correct information.

Contact Cash App Support: If you need clarification on why your deposit was rejected or need assistance, contact Cash App support for help. Please provide them with any relevant information or documentation they may require to resolve the issue.

Verify Account Status: Ensure that your Cash App account is in good standing and that there are no issues that may be preventing the deposit from being processed.

FAQs About Cash App Tax Refund Deposits:

Q1: How long does it take for a tax refund deposit to be processed on Cash App?

A: The processing time for a tax refund deposit on Cash App can vary. It may take up to 5 business days for the deposit to be credited to your Cash App account.

Q2: Can I receive my tax refund on Cash App if I have a pending direct deposit?

A: Yes, you can receive your tax refund on Cash App even if you have a pending direct deposit. However, the pending deposit may delay the processing of your tax refund deposit.

Q3: What should I do if my tax refund deposit is rejected on Cash App?

A: If your tax refund deposit is rejected on Cash App, check the account information you provided to ensure it is correct. If the information is correct, contact Cash App support for assistance in resolving the issue.

Conclusion:

Receiving your tax refund on Cash App can be a convenient option, but it's essential to ensure that your account information is correct and that your account is in good standing. By addressing any issues promptly and following the steps outlined in this guide, you can resolve tax refund deposit rejections on Cash App and receive your refund without delay.

#How Long Does It Take to Get a Tax Refund on Cash App#Cash App tax refund#Cash App tax refund time#Cash App taxes#Cash App tax refund pending#cash app tax refund accepted#cash app tax refund deposit#What Time Does Cash App IRS Direct Deposit Hit#Cash App tax refund deposit#Cash App direct deposit pending#Cash App IRS deposit pending

0 notes

Text

Why Your IRS Tax Refund May be Pending on Cash App- Complete Guide

Are you eagerly awaiting your IRS tax refund, only to find it pending on your Cash App account? It's not uncommon for taxpayers to experience delays or pending status when receiving their tax refunds through Cash App. In this comprehensive guide, we'll delve into the reasons why IRS tax refund pending on Cash App. Whether you're curious about "Cash App tax refund pending" or seeking insights into the process, we've got you covered.

The Process of Receiving Tax Refunds on Cash App:

Before we delve into why your IRS tax refund may be pending on Cash App, let's first understand the process of receiving tax refunds through the platform.

IRS Direct Deposit: Many taxpayers opt to receive their tax refunds via direct deposit from the IRS. When selecting this option, you provide the IRS with your Cash App routing and account numbers for deposit.

Notification from Cash App: Once the IRS initiates the deposit, Cash App sends you a notification indicating that a direct deposit is pending. This notification typically includes the expected deposit amount and the date it will become available in your Cash App account.

Deposit Processing: Cash App processes the direct deposit from the IRS, and the funds are credited to your Cash App balance on the scheduled date.

Why Your IRS Tax Refund May be Pending on Cash App?

Now, let's explore some common reasons why your IRS tax refund may be pending on Cash App:

Processing Time: Cash App may take some time to process incoming direct deposits, including IRS tax refunds. This processing period can vary depending on factors such as the volume of transactions and the efficiency of the banking system.

Verification Checks: Cash App conducts verification checks on incoming direct deposits to ensure they meet security and compliance standards. These checks may cause a delay in the availability of your tax refund funds.

Banking Holidays: If your scheduled deposit date coincides with a banking holiday or weekend, the processing time may be extended. Banking holidays can impact the availability of funds and cause delays in receiving your tax refund.

IRS Processing Time: Before the Cash App can credit your account with the tax refund, the IRS must first initiate the deposit. Delays in IRS processing, such as errors on your tax return or issues with your banking information, can result in a pending status for your tax refund.

FAQ

Q: What time does the Cash App IRS direct deposit hit?

A: The timing of IRS Cash App tax return can vary, but they typically occur early in the morning on the scheduled deposit date. However, it's essential to note that the exact timing may depend on various factors, including the IRS processing schedule and Cash App's internal processes.

Q: How long does it take for Cash App to process an IRS tax refund deposit?

A: Cash App aims to process IRS tax refund deposits promptly, but the exact processing time may vary. In most cases, you can expect the funds to be available in your Cash App account within one to three business days from the scheduled deposit date.

Conclusion: While it can be frustrating to see that your Cash App tax refund pending, it's essential to understand that delays can occur due to various factors. By familiarizing yourself with the potential reasons behind pending status and staying informed about the deposit process, you can better manage your expectations and navigate the situation effectively. If you have concerns about your tax refund, don't hesitate to reach out to Cash App support for assistance.

#How Long Does It Take to Get a Tax Refund on Cash App#Cash App tax refund#Cash App tax refund time#Cash App taxes#Cash App tax refund pending#cash app tax refund accepted#cash app tax refund deposit#What Time Does Cash App IRS Direct Deposit Hit#Cash App tax refund deposit#Cash App direct deposit pending#Cash App IRS deposit pending

0 notes

Text

How Long Does It Take to Get a Tax Refund on Cash App- Update Guide

Tax season is upon us, and for many individuals, the anticipation of receiving a tax refund is high. With the convenience of digital banking solutions like Cash App, users often wonder, "How long does it take to get a tax refund on Cash App?" In this detailed guide, we'll explore the ins and outs of receiving tax refunds through Cash App, shedding light on the process, timing, and frequently asked questions to ensure you have all the information you need.

Understanding Cash App Tax Refunds:

Cash App has become a popular choice for managing finances, offering a range of services, including direct deposits, peer-to-peer payments, and investment options. When it comes to tax refunds, Cash App provides users with a convenient way to receive their refunds directly into their Cash App accounts, eliminating the need for paper checks or lengthy bank transfers.

How Long Does It Take to Get a Tax Refund on Cash App?

The timing of receiving a tax refund on Cash App can vary based on several factors:

IRS Processing Time: The Internal Revenue Service (IRS) typically processes tax refunds within 21 days of receiving a tax return. However, the exact timing may vary depending on factors such as the accuracy of the return and any issues that may arise during processing.

Direct Deposit Option: Opting for direct deposit when filing your taxes can expedite the refund process. When selecting Cash App as your direct deposit option, the refund is typically deposited into your Cash App account within 1-5 business days after the IRS processes your return.

Banking Institution Policies: While Cash App strives to process tax refunds promptly, the timing may also depend on the policies of your bank or financial institution. Some banks may require additional processing time before the funds are made available in your Cash App account.

FAQs about Cash App Tax Refunds:

How Long Does It Take to Get a Tax Refund on Cash App?

Tax refunds deposited into Cash App accounts typically take 1-5 business days after the IRS processes the return. However, the exact timing may vary based on factors such as IRS processing times and banking institution policies.

Can I Track the Status of My Tax Refund on Cash App?

Cash App does not provide a specific tool for tracking the status of tax refunds. To check the status of your refund, you can use the IRS "Where's My Refund?" tool or contact the IRS directly for assistance.

What Should I Do If My Tax Refund Is Delayed on Cash App?

If your Cash App tax refund pending, it's essential to check the status of your refund first using the IRS "Where's My Refund?" tool. If the IRS indicates that the refund has been issued, but you haven't received it in your Cash App account within the expected timeframe, you may contact Cash App support for further assistance.

Conclusion

In conclusion, receiving a tax refund on the Cash App offers users a convenient and efficient way to access their funds. While the Cash App tax refund time may vary based on IRS processing times and banking institution policies, Cash App strives to process refunds promptly to ensure timely access for users. By understanding the process and staying informed about the status of their refunds, Cash App users can make the most of this convenient feature during tax season.

#How Long Does It Take to Get a Tax Refund on Cash App#Cash App tax refund#Cash App tax refund time#Cash App taxes#Cash App tax refund pending#cash app tax refund accepted#cash app tax refund deposit

1 note

·

View note

Text

How Long Does It Take To Get a Tax Refund on The Cash App?

The Cash App offers various services like transferring money, paying bills, buying stocks, and receiving tax refunds. Many users wonder how long it takes to get a +1(909) 610-3890 Cash App Tax Refund. The answer can vary depending on multiple factors.

Firstly, the timing of the tax refund depends on how you filed your taxes. If you filed your taxes online, the Internal Revenue Service (IRS) sends a confirmation stating the acceptance of the tax return. If you filed with an online tax filing service, the confirmation message is usually within 24 hours of submitting the return. However, if you filed by mail, it takes around four to six weeks to receive the confirmation message.

Once the IRS accepts your refund, it processes the refund and sends it to your bank account or Cash App. The time taken to get a cash app tax refund depends on the payment mode you select. If you choose to have it deposited directly into your bank account, it takes around 2 to 5 business days for the refund to show up in your account. However, Cash App Direct Deposit option takes about 1-5 business days, and it can take less than a day if you opt for a standard instant deposit.

However, it is essential to remember that Cash App does not have any control over when the IRS sends the tax refund. The refund timeline is entirely dependent on how the IRS processes the refund. Sometimes, if the tax return has a mistake, it can take longer to process. In such cases, the refund is sent only after resolving the issue that caused the delay.

The time it takes to get a cash app tax refund entirely depends on how quickly the IRS processes your return, any possible issues with the tax returns, and which payment mode you choose. If you filed your taxes online and selected a direct deposit to your bank account or Cash App, it typically takes about 2-5 business days to show up in your Cash App account. However, the refund can take a week or two or sometimes longer periods based on the processing time taken by the IRS. It is always best to be patient and wait for the refund to arrive since it is a significant amount of money and requires a lot of processing.

How Long Does it Take For Cash App Taxes?

Cash App has become a popular option for people who want a simple and convenient way to pay their bills, rent, or make purchases online. However, some users of Cash App may be confused about how the app handles taxes. In this essay, we will explore +1(909) 610-3890 How long does it take for cash app taxes?

First and foremost, it is important to understand that Cash App is not responsible for cash app taxes or tax filings. As an individual using the app, it is your responsibility to report your earnings and pay taxes on them. Cash App does not withhold any taxes from payments made through the app. It is up to each user to keep accurate records of their transactions and report them appropriately.

If you use Cash App for business purposes, you may need to report your earnings to the IRS. Business owners are required to report and pay taxes on any income they receive, regardless of the form of payment. You should keep accurate records of your transactions and consult with a tax professional if you have any questions or concerns about filing your taxes.

Individuals who use Cash App for personal transactions may not need to report their earnings to the IRS, depending on the amount of money they receive. If you receive more than $600 in payments through Cash App in a calendar year, you will receive a Form 1099-K from the app. This form reports the amount of cash app taxes you have received through the app and is sent to the IRS. You can expect to receive your Form 1099-K by January 31st of the following year.

Cash App does not handle taxes directly but relies on individual users to report their earnings appropriately. If you receive payments through Cash App for business purposes, you will need to report them to the IRS. If you receive more than $600 through Cash App in a calendar year, you will receive a Form 1099-K from the app, which will be sent to the IRS. It is important to keep accurate records of your transactions and consult with a tax professional if you have any questions or concerns about your cash app taxes status.

#how long does it take to get tax refund on cash app#how long does it take for cash app taxes#how long does it take for your cash app tax#cash app tax refund#cash app tax refund hit#cash app tax refund time#cash app tax refund deposit

0 notes

Text

[COMMISSIONS OPEN]

!!Emergency!!

But also, no pressure! - A friend from work and his mom are having a hard time keeping a roof over their heads. They have have opened a GoFundMe, however sharing this link would doxx both him and myself. So, I've decided to open commissions to raise some money to help them out :]

Disclaimer; Due to my tight schedule, I will not be able to fulfill commissions as quickly as I have in the past. And, because of the sensitive time frame of this fundraising, I have not been able to make a fancy commission info sheet(s) like last time, so we're doing this old fashioned text; Apologies for the long read in advance. For more information about expected timeframe to receive your commission, please read through to the bottom.

What do you charge?

Headshot/Icon (from collarbone area and up): $25 USD Flat color, $45 USD Full shaded

Half body (from the waist up): $50 USD flat color, $75 USD Full shaded - Not available for ponies

Full body: $75 USD flat color, $100 USD Full shaded

Additional characters can be added for additional 75% of the original single character cost. (Example; 2 characters in a pic fully shaded will be $100 for one, and $75 for the other making the total price $175)

May charge extra for complex or busy designs that take longer to draw :(

Simple backgrounds (color, pattern, shapes) are no added cost, however Full background requests will be an additional $15 USD.

I do take style requests, but only with the understanding that I might not copy the style 100%

If you want something done but is not listed (Like turning a human character into a pony, a pony into a doll, character redesign, etc.) feel free to still contact me and we can discuss the logistics of fulfilling such commission!

I do not issue refunds

Commission Boundaries:

Will do:

Humans

Ponies

Fan art or OC

Context dependent:

Turning real people into styled portraits

Anthro (Its not my strong suit, but I can do some)

Special commission requests not listed

Hard No:

Heavy gore (a little blood or bruising is fine, but beyond that is forbidden)

Anything sexual or related to kink/fetish, nudity, lewd, or otherwise NSFW

I do not do realism, though I doubt anyone stumbling to my page will ask for that.

Anything that promotes a hateful message.

Money will be asked for UPFRONT - I know some will be sketched out by this. Please rest assured, I am not a con artist - only a broke artist trying to help another broke service worker out.

Money will be sent through CashApp - No clue if it's weird for online commissions to use CashApp, but it's what I'm used to and I will not be accepting other payment types. I will send my cash tag when it comes time to pay up.

If you want to post commissioned work from me on this platform or elsewhere, I only ask that you credit back to this tumblr blog and provide link where possible (I know some apps don't allow links though.)

For tax reasons, I will be putting a cap on raised money at $400 - All money will be going towards helping my Coworker/Friend out. If you'd like to see proof of your money going toward his fundraiser I can provide screenshots with censored personal information. I will be allowing commission slots until that $400 is as close to maxxed out as I can get it, starting at 4 commission slots and will provide updates if I can open any additional slots.

Slot 1: [OPEN] Slot 2: [OPEN] Slot 3: [OPEN] Slot 4: [OPEN]

I will be sharing blog names of those who are booking their commission slot, as well as posting finished commissions here on my artist blog - UNLESS otherwise requested. You may ask to stay anonymous and/or not have your finished commission posted on Tumblr/Discord, or anywhere else public.

Time frame expectations:

In the past I have been able to do commissions within a few weeks of receiving the DM regarding it - I will not be able to work that quickly this time. Due to a large project I'm preoccupied with until the end February, I will not be starting on these commissions until the beginning of March. Despite the delay on starting the art, I will ask that payment be sent ahead of time, with the trust in me that I will fulfill your order when March comes around. Pinkie promise!

I will work in order of when I received Payment, and thus as your name is numbered in the Slot list. I will work on them (ideally) one or two at a time. I do not do commissions with due dates unless the due date is far out. This will likely take several weeks before I finish the last commission, but I will do what I can to fulfill each one in a timely manner and communicate progress as we go forth with the creative process.

I will send you a message when starting the drawing, as well as sending progress pics after rough sketch, line work, and after flat colors. I can also provide additional progress pics upon request within reason. I only ask for patience and understanding of my circumstances, and a willingness to communicate back and forth through the process. :]

If for any reason you do not want me to message you with progress updates, please let me know.

All that being said, you can contact me through DMs to place an order and I will work with you from there.

Thank you for any and all contributions to this fundraiser! Reminder that there is no pressure to donate at all, I just know I've been asked about commissions lately and this is the least I could do to help a friend out. ^^

-Mod Bee 🐝

#commissions open#art commissions#furry commissions#emergency commissions#commission sheet#open commissions#art commission#commission art#art commisions#pony commission#oc

16 notes

·

View notes

Text

Y'all, St. Expedited really comes through when you need that extra push and rapid response. Tax refunds aren't the only things that have to be rapid and no I'm not referring to that one (minute) and done person you're sleeping with either. Spells require work, trust, and detachment, but sometimes we are on a time crunch. This is a saint that you can HIRE! He's not working for free but he does work. HODIE!!!

Feel free to message me if you have any questions about using St. Expeditus or anything else on my page, maybe even something you'd like to see.

And of course, if you like being here, you are more than welcome to send gifts through my cash app $BlancaBitchcraft

#bitchcraft#witches#witchcraft#witchblr#wizard#witch#crystals#love spell#voodoo#pagan wicca#st. Expeditus#st. expedite#coven goals#coven#power of three#powerful#super powers#power of belief#laws of universe#law of the universe#lawsofattraction#universal law#law of attraction#law of assumption#369 manifestation#369 method

9 notes

·

View notes

Text

6 Doable Resolutions To Help You Save For A Down Payment on A Home

6 Doable Resolutions To Help You Save For A Down Payment on A Home | The Listing Team

Having enough money to put as a down payment is one of the biggest roadblocks to purchasing a house, especially to first time buyers. If you're one of the many people who aspire to turn their homeownership dream into a reality, you probably know that among the many things you need to start doing is to save money for a down payment.

However, it’s easier said than done and may be dependent on many factors, such as your income, current debt, responsibilities, etc. Even your current savings play a huge role in how much you still have to save.

So whether you're planning to buy a home this year or even in 2022, here are six savvy ideas—you can even think of them as new year’s resolutions—to help you achieve your savings goals to buy your dream home sooner.

If you're having a hard time sticking to your budget, start by seeing where your money goes to each month. Keep track of your daily purchases and payments through a spreadsheet or an expense tracker app, then review them at the end of each month. You may be surprised how much of your budget goes toward non-essential expenses that are making little dents in your account.

Since the pandemic started, many of us may have already been conscious about our spending habits. This time around, figure out how you can tighten up your spending by limiting or reducing your expenses. By making these small cuts or sacrifices in your daily routine, you'll be amazed at how much money you can save, which is a huge deal if you really want to make your dream home a reality.

Here are some ideas to reduce spending, depending on what applies to you and your lifestyle:

Minimize eating out and take out, and save them only for special occasions.

Review and limit your monthly subscription services. Is your cable bill costing you hundreds of dollars a month, but you’re more of a Netflix guy? It might be time to totally cut it out.

Cut down on designer coffee and other expensive beverages. Also limit your alcoholic beverages whenever you eat out.

Reduce your clothing budget, especially if you’ve already been working frequently from home.

Speaking of reducing your expenses, there are ways to slash some dollars off your grocery bill and get huge savings. Shop smarter by sticking to your grocery list to avoid any impulse buys. It might also be helpful not to buy on an empty stomach. Choose to shop at grocery stores with cheap prices or at local farmer markets, rather than at an upscale grocer. Lastly, make an effort to switch to cheaper but quality store brand labels.

Any unexpected money that isn't part of your monthly income are known as “windfalls” in the financial industry. These windfalls could be an annual bonus at work, inheritance, cash gifts, tax refund, a birthday check you received from your parents or grandparents, and any other instances in which you get extra money. Instead of spending them on a new gadget, appliance, or on a shopping splurge, stash them away as part of your down payment savings.

It might not look fun, yes, but remember that you're working towards a more ambitious goal. That extra money is a surefire way to fast-track that goal. Likewise, it will be crucial just in case you encounter an unexpected expense and you can’t afford to deposit your usual savings. So if you’ve been itching to buy that latest big-screen TV using that holiday bonus, tell yourself that it can wait. Besides, chances are it will suit your new home better.

Challenge yourself to go on a spending freeze or a spending “diet”. Let's say for two weeks or even a month, you will drastically cut your spending to only your living expenses and necessities—no new clothing, no dining out, no new gadgets, no adding to cart, etc. At the end of the month, review what areas of your budget are you willing to forgo to keep up with your new spending habits that will eventually increase your savings.

Creating a separate account for your down payment savings, with no linking debit card or checks, will help you keep your finances in order and track your progress. It will also discourage you from spending your hard-earned money on other things other than its purpose, which is to achieve your dream of becoming a homeowner.

Bottom Line

Saving for a down payment isn't something that can be done overnight. It’s a huge, collective effort that can be achieved with enough determination and the right circumstances. To help you set a clear goal and determine how much you really need for a down, it’s better to talk with a local and knowledgeable real estate professional who will help you get started.

0 notes

Text

Considerations To Know About 45 Cash com

We won't connect with the server for this app or Web-site at the moment. There could possibly be a lot of visitors or a configuration mistake. Try once more later on, or Make contact with the app or Web site proprietor.

By clicking "Request Loan", you consent to the Conditions & Ailments, Privateness Coverage, Credit score Authorization, E-Consent, and you are delivering written instructions beneath the Reasonable Credit score Reporting Act authorizing us and our Network Partners or approved 3rd functions on their behalf with whom your request is shared to get your shopper credit score report, and to contact you at the information on file to get offers for monetary goods or solutions. Additionally you provide your Specific composed consent to receive phone calls and text messages, like for marketing needs, from FastLoanDirect, its Network Partners, and any licensed third parties contacting or texting on their own behalf to Make contact with you at , created by means of automated suggests, for example autodialers and prerecorded or synthetic voices although your quantity is mentioned in any Federal, State or internal DNC record. Consent isn't expected like a condition to use our expert services. You could get in touch with (805) 429-6064 to speak with a purchaser treatment agent. By clicking "Ask for Loan", you consent to the Phrases & Situations, Privateness Policy, Credit score Authorization, E-Consent, and you are delivering written Recommendations beneath the Good Credit rating Reporting Act authorizing us and our Community Companions or authorized third events on their behalf with whom your request is shared to obtain your consumer credit score report, and to Make contact with you at the information on file to obtain features for economic solutions or expert services.

forty five cash is made up of a few hyperlinks to a different Web-sites generally consisting of 3rd parties. Nevertheless, we urge you to bear in mind simply because forty five cash just isn't answerable for other Internet websites and their privacy procedures. We check with our people to remember when leaving our Internet site to generally read through the privacy statements of each Web page which collects data from them. This current privacy assertion applies only to the data which is collected by forty five cash even in occasions in which other web sites could be in body with ours.

Federal tax refund early availability will depend on timing of Internal Earnings Support payment Directions and fraud prevention constraints could apply. As a result, The provision or timing of early direct deposit within your federal tax refund might fluctuate.

Information with reference towards your Personal computer’s hardware plus the software that operates on Additionally it is collected by 45 cash and could be shared in aggregate with other 3rd functions whose solutions we use for mostly targeted visitors analysis. Laptop or computer linked facts will consist of your browser type, IP handle, referring Web page handle, accessibility occasions, area names etcetera.

Supplying an employer phone number drastically increases your odds of obtaining a loan. For anyone who is on benefits, You may use the cell phone number of the government office that provides your Gains. Enter Employer Phone

The lender gives prequalification and promises aggressive prices for anyone with sturdy credit rating. New financial institution clients have to implement around the phone or in person.

As soon as authorised, you'll be able to end up your acceptance With all the lender and have your resources deposited directly to your bank account.

This information can make the transfer of funds towards your account in the situation of a loan offer more rapidly and safer. Will this data be accustomed to get funds out of my account?

Cash during the Vault can't be expended on buys or cash withdrawals and doesn't get paid interest. Card stability boundaries apply.

We will likely advise you of new fiscal expert services that we predict you may be interested in via our publication. All examples contained while in the Privacy Policy are merely illustrative and they are not special.

Curiosity is paid out every year on the typical everyday harmony of discounts 45 cash of your prior 365 days, up to a greatest common each day harmony of $ten,000 and Should the account is in great standing. Costs on the Key deposit account could minimize earnings with your financial savings account.

Opt-in expected. Account should be in good standing and chip-enabled debit card activated to opt in. Initial and ongoing direct deposits are expected for overdraft protection. Supplemental conditions may apply that may impact your eligibility along with your overdraft coverage. Overdrafts are paid at our discretion. Overdraft fees may trigger your account to become overdrawn by an quantity that is bigger than your overdraft protection.

The identify and Social Stability range on file with the employer or Rewards service provider have to match your Environmentally friendly Dot account to avoid fraud limits around the account.

0 notes

Text

Why Is My Cash App Direct Deposit Tax Refund Pending ?

The anticipation of receiving a tax refund can quickly become frustrating when it's delayed, especially if you expect the funds to arrive promptly. In today's digital age, many individuals rely on platforms like Cash App for the convenience of direct deposits, including tax refunds. However, if you wonder, "Why is my tax refund still pending on Cash App?" you're not alone. In this comprehensive guide, we'll delve into the common reasons behind tax refund delays on Cash App and provide actionable solutions to expedite the process.

Unpacking Tax Refund Delays on Cash App:

Tax refunds are typically processed by the Internal Revenue Service (IRS) and disbursed to taxpayers via direct deposit or paper check. While direct deposit offers faster access to funds, delays can still occur for various reasons. Understanding these factors is crucial for managing expectations and effectively navigating the tax refund process.

Common Causes of Tax Refund Delays on Cash App:

IRS Processing Times: The IRS processes millions of tax returns each year, and the volume of requests can lead to delays in refunding. Depending on factors such as filing method, tax credits, and errors on the return, it may take additional time for the IRS to process and approve refunds.

Incomplete or Incorrect Information: Errors or discrepancies on your tax return, such as incorrect bank account information or missing documents, can delay receiving your refund. It's essential to double-check your tax return for accuracy before submitting it to the IRS.

Verification and Review Processes: Sometimes, the IRS may flag certain tax returns for additional verification or review. This can happen if your return triggers red flags, such as substantial deductions or discrepancies in income reported. As a result, your refund may be delayed while the IRS conducts further investigation.

Bank Processing Times: Once the IRS releases your tax refund, it must be processed by your bank or financial institution before it can be deposited into your Cash App account. Bank processing times can vary, and delays may occur depending on factors such as weekends, holidays, and your bank's policies.

Technical Glitches or Network Issues: Occasionally, technical glitches or network disruptions on Cash App's end can also contribute to delays in receiving tax refunds. These issues may arise due to server maintenance, software updates, or other unforeseen circumstances.

Solutions to Address Tax Refund Delays on Cash App:

Verify Tax Return Information: Double-check your tax return for accuracy, ensuring that all information provided is correct and up-to-date. Verify your bank account details, including account numbers and routing numbers, to prevent delays due to incorrect information.

Monitor Your Bank Account: Keep an eye on your bank account linked to the Cash App to track the status of your tax refund. Once the refund is processed by the IRS and deposited into your bank account, it should appear in your Cash App account shortly after that.

Contact the IRS: If you suspect your tax refund is delayed due to an issue with your tax return, contact the IRS for assistance. The IRS can provide information on the status of your refund and offer guidance on any necessary steps to resolve the issue.

Contact Cash App Support: If your Cash App tax refund pending, contact Cash App support for assistance. The support team can provide insights into your transaction's status and offer guidance on potential solutions.

FAQs:

Q: How long does it take for a tax refund to show up on Cash App?

A: Once the IRS releases your tax refund, it typically takes 1-5 business days for the funds to be deposited into your Cash App account, depending on bank processing times and network conditions.

Q: Can I cancel a pending tax refund on Cash App?

A: A tax refund on the Cash App cannot be cancelled once a tax refund is pending. However, you can contact Cash App support for assistance in resolving any issues or concerns related to the refund.

Q: Will I be notified if my tax refund is delayed on Cash App?

A: Cash App may send notifications or updates regarding the status of your tax refund. However, if you're concerned about a delay, check your transaction history or contact customer support for more information.

Conclusion:

While waiting for a tax refund can be an anxious time, understanding the common causes of delays and taking proactive steps can help expedite the process. By verifying tax return information, monitoring bank account activity, and seeking assistance from the IRS or Cash App support, users can confidently navigate the tax refund process and ensure timely receipt of their funds. Remember, patience and proactive communication are critical when dealing with tax refund delays, and staying informed about the Cash App tax return status can help alleviate concerns and facilitate a smooth transaction experience on Cash App.

#How Long Does It Take to Get a Tax Refund on Cash App#Cash App tax refund#Cash App tax refund time#Cash App taxes#Cash App tax refund pending#cash app tax refund accepted#cash app tax refund deposit#What Time Does Cash App IRS Direct Deposit Hit#Cash App tax refund deposit#Cash App direct deposit pending#Cash App IRS deposit pending

0 notes

Text

How To Build A Cash Reserve For Buying A Home?

Building a cash reserve for buying a home is a crucial step in the home-buying process. Having a solid financial cushion not only prepares you for the down payment but also ensures you can cover additional costs associated with homeownership. Here’s how to build a cash reserve effectively:

Set a Clear Goal

Begin by determining how much you want to save for your cash reserve. This should include your down payment, closing costs, and any immediate expenses related to moving in, such as furniture or repairs. A common recommendation is to aim for at least 20% of the home’s purchase price for the down payment, but even a smaller percentage can help you avoid private mortgage insurance (PMI).

Create a Budget

Once you have a savings goal, create a budget that outlines your monthly income and expenses. Identify areas where you can cut back on discretionary spending—such as dining out, entertainment, or subscriptions—to redirect those funds toward your cash reserve. Apps and tools for budgeting can simplify tracking your expenses and savings goals.

Open a Dedicated Savings Account

Consider opening a high-yield savings account specifically for your cash reserve. This account should be separate from your everyday checking and savings accounts to avoid the temptation to dip into your reserve for non-emergencies. A high-yield account can help your savings grow faster due to better interest rates.

Automate Your Savings

To ensure consistency in your saving efforts, set up automatic transfers from your checking account to your dedicated savings account. Automating your savings allows you to prioritize your cash reserve without having to think about it. Treat your savings like a recurring expense to help you stay disciplined.

Look for Additional Income Sources

Increasing your income can significantly accelerate your ability to build a cash reserve. Consider taking on a part-time job, freelancing, or monetizing a hobby. Even a small additional income can make a difference in your savings over time. Use any bonuses, tax refunds, or gifts towards your reserve.

Reduce Debt

Paying down high-interest debt can free up more of your income for saving. Focus on paying off credit cards, personal loans, and other debts, which will not only improve your financial health but also enhance your credit score. A better credit score can lead to more favorable mortgage rates when it’s time to buy.

Track Your Progress

Regularly review your savings progress to stay motivated. Use spreadsheets or savings apps to visualize how close you are to your goal. Celebrate small milestones along the way to maintain motivation. Adjust your budget and savings plan as needed to keep your goal within reach.

Prepare for Unexpected Expenses

While building your cash reserve, consider setting aside an additional buffer for unexpected expenses related to homeownership. This could include home repairs, maintenance, or emergencies that arise after you purchase your home. Aim for at least 3-6 months’ worth of living expenses to provide peace of mind.

Stay Disciplined

Building a cash reserve requires discipline and commitment. Stay focused on your goal and remind yourself of the benefits of homeownership. When tempted to spend, think about your long-term financial goals and how close you are to achieving them.

Conclusion

Building a reserve for cash purchasing a house is a step-by-step process that involves setting clear goals, budgeting, and maintaining discipline. With a dedicated savings approach, you can position yourself to make a significant down payment, cover closing costs, and manage the responsibilities of homeownership. By planning and following these strategies, you can achieve your dream of owning a home while ensuring financial stability.

0 notes

Text

TurboTax Live Full Service vs. H&R Block

TurboTax vs. H&R Block is a big battle in the for-profit tax preparation field. Each has its distinct strengths and drawbacks, so it's worth investigating which option is best for you.

TurboTax vs. H&R Block: Which is Better?

The right tax software for you varies depending on your preferences. If you're looking for the most time-tested and simple do-it-yourself option -- and don't mind paying a little more -- TurboTax might be the right choice. However, tax filers who prefer less expensive software or personalized assistance should consider H&R Block.

Whichever option you choose, don't put it off; the longer you wait, the greater the chance for mistakes and stress.

About TurboTax

TurboTax offers plenty of tax preparation options, covering different filing situations and varying levels of tax expert support. This platform primarily has a do-it-yourself (DIY) route that asks straightforward questions to determine which tax forms you need and how to fill them out.

However, among DIY tax software, TurboTax is quite expensive and constantly tries to upsell products while you fill out paperwork. Other platforms are generally less expensive and some, like Cash App Tax, are free.

About H&R Block

H&R Block has do-it-yourself software and is known for its physical branches. It has thousands of offices across the U.S. so you can easily get started or upgrade for in-person assistance if needed.

TurboTax vs. H&R Block: Key Features

Both tax preparation giants offer online and downloadable software, a full-service option, expert human support, and several guarantees including accurate calculations, maximum refunds, and audit assistance. Both also have time-saving features that allow you to snap a photo of your W-2 instead of manually entering numbers line-by-line.

TurboTax Key Features

Simple questionnaire. TurboTax asks you a series of questions about your income and life events so you can fill out the correct tax form.

Donation calculator and tracker. You can enter your donations into TurboTax so you can figure out their value and record them during the year.

In-person option. If you want one-on-one help, you can find a “TurboTax Verified Pro” through the platform and meet with them in person. Availability and pricing may vary.

H&R Block Key Features

Transparent pricing. H&R Block has a no-surprise guarantee: If you pay more than the originally quoted price, you'll get a 20% discount on your next year's filing.

Personal assistance. With branches in every state, you can meet with a tax face-to-face.

Tax Review Double Check. You can have H&R Block look at your last three years of tax returns to confirm you haven't missed out on a big tax refund.

AI Tax Assist. H&R Block has developed an artificial intelligence (AI) to serve as a resource and it's included in all online versions at no additional cost.

TurboTax vs. H&R Block: Usability

Both companies give you the option to automatically fill in some of your information by uploading photos of your income tax forms. And, while Users can use a computer, both offer highly-rated mobile apps for iOS and Android to make their lives simpler.

Still, TurboTax shines with an easy-to-use platform. You'll get a series of jargon-free questions that make the process feel more like sitting down with a tax preparer.

H&R Block's setup isn't questionnaire-style. Instead, you'll get a series of forms to fill out. But, like TurboTax, the platform provides explanations and tips for a streamlined process.

TurboTax vs. H&R Block: Customer Service

It's natural to encounter questions when filing your taxes or helping someone else file taxes. Both platforms also offer expert assistance to help you navigate the process, although you'll likely have to pay more.

The exception is TurboTax Live Assisted Basic Edition, which features free live support for those filing simple returns. Plus, if you add the Live Assisted service (pricing for which starts at $99), you can get in touch via live chat, seven days a week.

With H&R Block, you'll have more options for personalized assistance due to a larger network of stores. Although hours vary, you can generally expect these retail locations to be open during regular business hours and possibly a little late for the convenience of tax filers after work.

Neither company has a great Trustpilot rating; both earned 1.2 out of 5 stars.

H&R Block vs. TurboTax: Comparing Free Options

TurboTax's Deluxe option is a more comprehensive option for the average filer, but let's briefly consider the free options again.

Both H&R Block and TurboTax offer free options for filers with simple returns. You can often use those options if you don't own a home, you have no investment income other than ordinary dividends or interest and you don't have rental property or business expenses.

You can't use any of the forms if you itemize deductions. However, there are some deductions available with the free plans. Specifically, you can claim the EIC and the Additional Child Tax Credit. H&R Block also includes Schedules 1 through 6, unlike TurboTax.

So if your finances are simple, the biggest consideration is which forms you need to file, since H&R Block includes more forms and schedules with its free plan.

Which Online Tax Software is Right for You?

Start by thinking about what you want from tax prep software. If you're hoping for a jargon-free experience, TurboTax may be right for filers with a simple tax situation. If you're looking for personalized help or appreciate transparent pricing, H&R Block may be the right choice for you.

Of course, other tax services may be a good fit for you. Aside from the free government programs listed earlier, you can go for lower-cost software if you don't mind a clunky user interface and fewer support options.

0 notes

Text

Cash App Limits: How Much Can You Withdraw, Send and Receive Daily?

Cash App is a payment app available for iOS and Android that is used to send and receive money, as well as make purchases and invest. Cash App, like similar payment apps, has limits for all of its transactions.

Cash App limits vary based on the transaction type and identity verification status. For example, unverified accounts have a 30-day sending and receiving limit of $1,000. However, that limit can be increased by meeting Cash App identity verification requirements.

Keep reading to learn more about Cash App’s sending and spending limits, and find out how you can increase yours.

What Is Cash App?

Cash App is a platform that allows you to send and receive money, make purchases, invest in stocks, buy and sell bitcoin, and complete other financial transactions. Cash App also partners with other financial institutions and banks to provide debit cards and brokerage services. You can even use Cash App to file your taxes and have your refund sent directly to your Cash App account.

Cash App Limits

Cash App limits apply to all accounts, and generally depend on whether the account is verified.

Cash App Sending and Receiving Limits

Unverified Cash App accounts can send and receive up to $1,000 within 30 days. When you reach these limits, Cash App will ask you to verify your identity right in the app. You will need to provide your full name, date of birth, and your Social Security number to increase your limits. Verifying your account may significantly increase your limits, potentially allowing transactions up to $7,500 weekly.

Cash App Withdrawal Limits and Spending

If you use the Cash App Cash Card a debit card that is connected to your Cash App balance — you may be subject to spending limits, similar to other debit cards. The Cash App limit per day and transaction for Cash Card users is $7,000. Daily limits reset at 6 p.m. Central Standard Time each day.

The Cash Card also has weekly and monthly limits. You can spend up to $10,000 per week and $15,000 per month. Weekly limits reset at 6 p.m. CST on Saturdays, while monthly limits reset at 6 p.m. on the last day of the month.

The Cash Card daily limitations cover all types of transactions. This includes purchases made in-store or online, ATM withdrawals, and even transactions that are declined. Essentially, any activity with your Cash Card counts towards this daily limit.

Cash App Limits for Users Under 18

With a Cash App family account, users under 18 will automatically have access to borrow money, make deposits via check, and contact phone support. With consent from a parent or guardian, these younger users can also send and receive money — up to $1,000 within 30 days — as well as have a personal debit card and transfer funds between Cash App and a linked bank account.

They can also transfer up to $7,500 per 30 days into their Cash App account and move up to $25,000 per seven days out of their Cash App account. In addition, users under 18 can make paper money deposits of up to $250 within seven days and $1,000 within 30 days.

Users under 18 who have a Cash Card are subject to the same spending and withdrawal limits as users over 18.

How To Increase Your Cash App Daily and Weekly Limits

Increasing your Cash App limits is relatively simple. After setting up your Cash App account, you just need to verify the following information to confirm your identity:

Your full name

Your date of birth

Your Social Security number

If you’re under 18, a parent or guardian must give consent to access certain features and increase your limits. In some cases, Cash App may need to request additional information if they are unable to verify your identity with just the information listed above.

How To Send Cash App Payments?

The Cash App platform is designed with ease in mind, so sending money to another Cash App user just takes a handful of simple steps:

Open the app and enter the amount you want to send.

Tap “Pay.”

Search for the recipient using an email address, phone number, or Cashtag.

Add a note describing the purpose of the payment.

Tap “Pay” again to complete the transaction.

Is Cash App Safe To Send and Receive Money?

Cash App has many security features to keep your money safe. In addition to using top-tier data encryption, Cash App accounts can be locked using a PIN, Touch ID, or Face ID, and users can enable account notifications to monitor activity. Cash Card users can disable their cards at any time, and Cash App also has security features specific to Bitcoin storage and fraud protection.

It’s important to note that Cash App sending limits are relatively low, especially compared to traditional bank accounts and some other money apps. If you send or receive money regularly, you should compare your options to make sure your transaction limits are high enough to meet your needs.

0 notes

Text

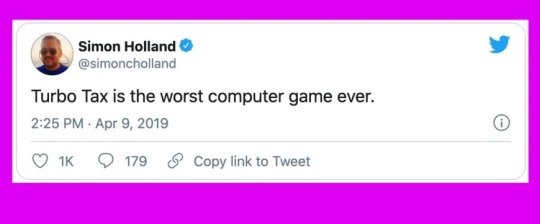

tl;dr I have a love-hate relationship with TurboTax.

TurboTax is sleek and auto-imports forms, but be ready to pay. I suggest you try other websites like FreeTaxUSA or Cash App if you want to shop around your tax filing fee.

---

A letter to TurboTax and anyone who uses online tax software,

I remember when you were on a CD. Every January during my formative years, my dad would wait until the coupons came out and we ventured to Office Max to buy our annual tax software. We even filled out the mail-in rebate forms, because that's what good taxpayers do. How else were we going to fund the Beanie Baby investment strategy I was pitching?

Fast forward, TurboTax is now a sleek website that tricks you for a moment into thinking taxes may be cool. After asking for an EIN and Document number from your annual tax statements, your 1099-B and 1099-DIV are automatically imported (including all those numbers in a tiny font like 199A Dividends or Foreign Tax Credit.)

Just like TurboTax grew up, your taxes just sprouted 3 more forms, and that's going to cost you in software fees. I'd be curious to run a poll: Did you pay any foreign tax this year? Most folks would be surprised to know that their answer is 'Yes' due to their investments in mutual funds or indexed investments.

All of a sudden, now your easy 1040 tax return needs to claim a foreign tax credit, and you feel like a CD in an Airdrop world.

TurboTax fees are a source of moral dilemma for me every tax season. I've seen returns that had 0.59 cents in foreign taxes trigger an $80 add-on to the TurboTax return fee. Also, I hope you didn't pick up that side hustle to crawl out of poverty; this adds a Schedule C and will cost you. TurboTax charges by type of form, and certain "extra" forms bring you to the next level of pricing. I especially find issue with this when the form is the Retirement Savings Credit, which is a tax credit for low-mid-income people who save for retirement via an IRA or 401k. If you are filing this form, chances are good your finances aren't in great shape. And here comes TurboTax, charging you extra.

I get it, I'm a for-profit corporate accountant. On paper, this is a great revenue strategy because you can advertise that a simple federal return is free. To be fair, if you are someone who has a 1040 and applies for the Earned Income Credit (tax credit for the poorest who have jobs), you can file for free (if you're lucky enough to get past all of TurboTax's tricks to get you to upgrade).

It feels like whack-a-mole trying to click through to file without accidentally upgrading. Every third page TurboTax asks, "ARE YOU SURE YOU DON'T WANT TO PAY MORE?" effectively negging you with the words 'audit defense' while filling out your tax return. As If my palms aren't sweating enough, bring up the idea of an IRS audit and see if I want 'protection'. It feels like I'm hiring TurboTax to be my heavy.

God forbid you make a mistake and upgrade; it's going to be a challenge to go back. TurboTax makes you delete your entire return if you want to downgrade.

So why the letter? Because taxes are intimidating, and you simultaneously make it much easier to complete them with your sleek, well-designed software, but then you add a layer of mind games with the constant pop-ups to upgrade.

What is the solution? TurboTax remains the sleekest tax software out there, but it comes at a high and misleading cost. I recommend trying some other websites to calculate your taxes. It may be an adjustment and take more time to input all of your personal details up front, but you may be saving money in the long run by switching software now.

Hot Tip: do your taxes in TurboTax anyway and see what their fee is. Then, do your taxes again in the second software. You know you're right if the tax due/refund on both is the same. Then you can feel confident filing in the cheaper program.

Further Reading:

This is not tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. This is a personal opinion only, and not one representative of any other party's opinions.

0 notes

Text

How to Ensure Your Cash App Direct Deposit Hits Every Time?

Direct deposit is convenient and safe to receive your paychecks. It gives you peace of mind that your money will be deposited instantly and securely. Cash App deposits can be processed in as little as one hour, compared to the 24 hours it takes to process a direct deposit through a traditional bank. Cash App is a great alternative to traditional banking because of its speedy processing. You should also know When Does Cash App Direct Deposit Hit so that you may plan accordingly. Direct deposits can take different time frames to reach your Cash App account. This includes the policies of your company or another entity that sends payments to you, bank holidays, and times when financial transactions are at their peak.

These timing differences are essential to know to avoid potential delays and issues with your deposit. In most cases, your Cash App account will receive a direct deposit within 24 hours from the time and date that it was sent by your employer or another entity that sends regular payments to you. Cash App may also send you a confirmation that the deposit was processed. You can check to see if you have received a confirmation if you do not receive one. If you want your Cash App direct deposit to arrive on time, you need to take a few steps. Let's start by learning more.

What is direct deposit on Cash App, and how do you receive it?

Cash App, a popular mobile payment service, is a secure and safe way to send money. The company also offers direct deposit services, which allow users to receive their paycheques and other recurring payments via the app instead of a traditional bank. Direct deposits to Cash App allow you to receive money directly into your account. This feature is handy for those who need quick access to money without having to visit a bank. Direct deposits include tax refunds, government benefits, and salary.

Follow the steps below to receive direct deposit through Cash App:-

• Sign in to Cash App and enter your username and password.

• After you log in, click on the "Banking Tab" and then "Direct Deposit."

• Follow the instructions to create an account. Then, provide your employer or benefits provider with the Cash App account number as well as the routing number. Double-check that the routing and account numbers are accurate and current. Errors can cause direct deposit delays or rejections.

• Cash App will automatically transfer money to your account every business day once you have set up direct deposits. The "Deposits tab" allows you to check the status of the deposit. You

What happens when a direct deposit does not hit on time?

Cash App direct deposit hit within 1-5 business days of the date that they were sent. If your funds do not arrive when you expect them to, it could be that there is a problem at your bank or with the person who sent the payment. Cash App's customer service team suggests contacting your employer to find out what might be wrong.

You can also use Cash App's Early Payment Service to receive your direct deposit faster. The app will make the deposits available as soon as the sender releases them. You can receive your money up to two days sooner than you would with most banks. This allows you to spend it faster.

How to ensure that your Cash App direct deposit hits on time?

If you are an employee with a W-2 or receive regular payments from a side job, Cash App's direct deposit feature is the easiest way to get your paycheck. You can avoid the hassle of going to your bank and cashing a check. Your money is also more secure when deposited in an account you control. It can be frustrating if a direct deposit does not occur at the time expected.

Here are some tips on how to make sure Cash App direct deposits hit every time:-

• Verify your Cash App Account- It is essential to verify that the Cash App account you have is verified. This will ensure a smooth experience with direct deposits. Verify your identity with the information and documentation requested. Verified accounts often have higher deposit limits and are more trustworthy. This makes them more attractive to employers and depositing institutions.

• Give Accurate Information- Check your Cash App account number and routing number before you share them with your employer. It is essential to provide accurate information to avoid any delays or mistakes when processing your direct deposits.

• Verify your Direct Deposit Status- After you have initiated a direct deposit, check its status regularly in the app. This can be done by looking at your transaction history in the "Funds section." This allows you to track the progress of your deposit and be aware of any issues.

• Confirm the timing of your deposit- Different employers and depositing institutions may have different deposit schedules. Verify the Cash App direct deposit time with your employer or the entity that is responsible for directly depositing your funds. Understanding your employer's schedule can help you predict when funds will be deposited into your Cash App account.

• Cash App Support is Available- Contact them if you need to. If there are any problems with your direct deposit, or if the payment fails to arrive in time, do not hesitate to contact Cash App support. They can offer guidance and help in solving any problems.

FAQs:-

When does Cash App direct deposit hit?

Cash App processes direct deposits in a matter of days. Funds are available the day after the deposit date.

What time does Cash App direct deposit hit?

Most Cash App direct deposits are available before 9 AM Eastern Time on the scheduled deposit date.

Can I receive direct deposits on weekends?

Cash App does process direct deposits on weekends, allowing users to access their accounts throughout the weekend.

Is there a maximum limit for Cash App direct deposits?

Cash App has deposit limits that can change depending on the status of your account. Verify your account to increase your deposit limits.

0 notes

Text

What Does the 1099-K Mean for Your Tax Season?

Have you seen the new 1099-K form floating around? As a premier tax service in Atlanta, ATC Income Tax is here to clear things up so you are well-prepared and confident when it's time to file.

What Is a 1099-K?

The 1099-K form plays a crucial role for the IRS, helping to track payments received through cash apps, online marketplaces, and payment processors like PayPal and Venmo. This form becomes relevant for businesses or individuals who've completed over 200 transactions or surpassed $20k in payments using these platforms since 2020. If you've dabbled in selling goods or services online, you must have received this form.

Why It Matters?

Receiving a 1099-K indicates that your online transactions have been reported to the IRS, requiring you to declare this income on your tax return. However, receiving this form doesn't necessarily mean your tax bill will increase. Understanding how to report this income correctly is essential to avoid potential issues.

Why You Need Professional Tax Service in Atlanta

This is where the expertise of a tax service in Atlanta becomes invaluable. Filing taxes can be complex, especially with the addition of forms like the 1099-K. ATC Income Tax professionals are adept at handling these complexities, ensuring your taxes are filed accurately and efficiently. They specialize in:

Identifying eligible business expenses and write-offs,

Maximizing deductions through the Qualified Business Income (QBI) deduction,

and Ensuring you pay only what is necessary.

Attempting to tackle the 1099-K on your own could lead to overlooked deductions or errors, potentially resulting in penalties. You can avoid these pitfalls by leveraging the expertise of a seasoned tax service in Atlanta.

Additional Tax Services in Atlanta Provided by ATC Income Tax

ATC Income Tax offers a comprehensive suite of tax services and financial products to help clients, such as

Their Refund Advance allows quick access to up to $6,000 of an anticipated refund in as little as 10 minutes.

Interest may apply for larger loans deducted from the refund, but 0% APR is deducted on portions up to $2,500.

Through Refund Transfer, clients can expect to check the delivery of their refund amount within 8-15 days of IRS acceptance.

ATC also provides a FasterMoney prepaid Visa card for fast, safe, and fee-free tax refund deposits.

For fast filing, clients can utilize E-File IRS Direct or download a W2 early through ATC's connections with major payroll providers.

These solutions empower clients to manage tax obligations and cash flow with maximum convenience and support.

Wrapping Up

If you've received a 1099-K, don't let it intimidate you. ATC Income Tax, a trusted tax service in Atlanta, is equipped to handle your unique tax situation. Bring us your 1099-K and other tax documents, and we'll ensure your side gig income is reported accurately. We aim to secure the most significant refund possible, demonstrating the tangible benefits of partnering with a knowledgeable tax service in Atlanta, like ATC Income Tax.

1 note

·

View note