#Can I lose my funds in liquid staking?

Explore tagged Tumblr posts

Text

Liquid Staking for Novices: A 2024 Introductory Guide

Unlock the full potential of your cryptocurrency investments with liquid staking, where liquidity meets profitability.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols. This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols.

This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

The process of liquid staking involves depositing cryptocurrency into a staking contract, which then issues a liquid staking token representing the staked assets. These tokens can be utilized in decentralized exchanges, lending platforms, and yield farming protocols, providing users with the flexibility to optimize their investment strategies. This increased liquidity and flexibility allow users to respond quickly to market changes and new investment opportunities, making liquid staking a valuable tool in the crypto ecosystem.

Despite its benefits, liquid staking presents certain challenges, including the risk of validator penalties and smart contract vulnerabilities. Additionally, the regulatory environment for cryptocurrencies is continuously changing, which may impact staking practices. Nonetheless, liquid staking is poised to play a pivotal role in the future of blockchain finance, enhancing the value of crypto assets through improved accessibility and liquidity. Intelisync offers tailored blockchain solutions, including liquid staking, to help businesses Learn more.....

#Advantages of Liquid Staking Tokens#Can I lose my funds in liquid staking?#Challenges of Liquid Staking#How do I choose a liquid staking platform?#How Does Liquid Staking Work?#How Intelisync will help you to grow in the crypto world Liquid Staking#Understanding Staking and How Does Staking Work?#What cryptocurrencies support liquid staking?#What is Liquid Staking?#What is Restaking#What is the future of liquid staking?#Why Are LSTs Gaining Popularity?#intelisync blockchain development company intelisync bitcoin development services#intelisync web3 marketing services

0 notes

Text

Understanding the aftermath of r/wallstreetbets

A couple days back, I wrote up my best understanding of what happened with /r/wallstreetbets and meme stocks like Gamestop, trying to show how all the different, seemingly contradictory takes on the underlying financial stuff could all be true.

https://pluralistic.net/2021/01/28/payment-for-order-flow/#wallstreetbets

In the days since, a new series of contradictory takes has emerged, these ones disputing the meaning of this bizarre financial spectacle, and likewise what response, if any is warranted as it unfurls.

I think that all of these takes can also be true, and as with the trading itself, reconciling them requires that we widen the frame.

Let's start with Jimmy Carter.

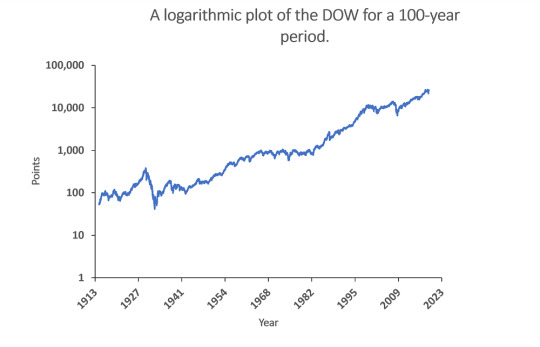

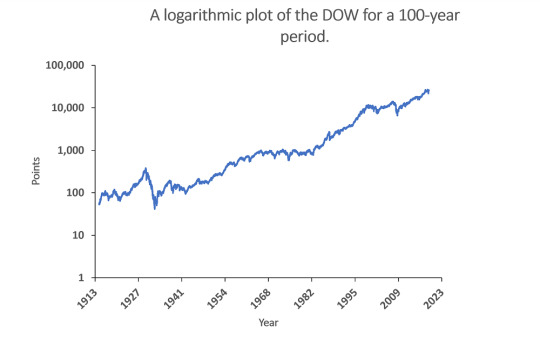

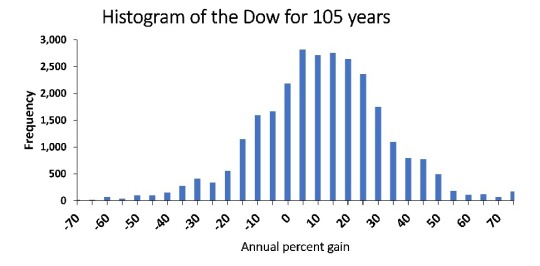

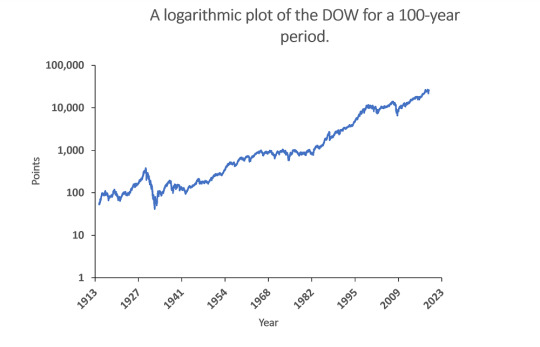

In 1978, Carter's IRS created the 401(k), a tax-sheltered account for people who wanted to gamble on stocks to fund their retirement.

That was a fringe proposition at best.

The normal retirement system was a "defined benefits" pension where your employer guaranteed you a certain monthly percentage of your salary from retirement to death.

The vast majority of Americans wisely prefered a guaranteed payout to a tax-advantaged gambling account.

Obviously, right? On the one hand, you have the guarantee of a pension (maybe even inflation-indexed); on the other, you have a bunch of bets, that, if they go wrong, leave you literally homeless and starving.

When gamblers remortgage the family home and cash in the kids' college funds to play the tables, we consider them to have a mental illness, a pathological condition that harms them and the people around them.

Giving up a defined benefits pension in favor of a 401k is just the same kind of bet - staking all the money that will support you when you exit the workforce on the movement of stocks and bonds.

Who would do that voluntarily?

Pretty much no one. But the transition from defined benefits to 401k was not voluntary. Finance ghouls like Ethan Lipsig wrote memos to major employers like Hughes Aircraft showing them how they could ditch their pension obligations by moving workers to 401ks.

In the 80s, Reagan created a bunch of legal tools that allowed employers to coerce their workforces into giving up the security of a pension and force them into gambling their salaries on the prayer of a win in the markets.

This was insanely, amazingly great for the finance sector, in three ways:

1. It made companies more profitable. Guaranteeing that the workers whose labor made your company viable wouldn't spend their dotage starving and homeless is expensive.

Helping fund wagers on shares is much cheaper. The finance sector represented the major shareholders of the companies that transitioned to 401ks. The savings were transferred to these shareholders and the finance sector got commissions.

What's more, this temporary inflation of share prices disguised what was going on with the pension switcheroo: workers' defined benefits pensions were liquidated and turned into stocks, just as stocks were going up because their pensions had been liquidated!

Their legs had been amputated out from under them, but so subtly that they didn't yet feel the pain - and now their bosses cooked their legs and snuck them into their dinner, and everyone marveled at how full they felt after that hearty, meaty meal.

2. 401ks brought a lot of suckers to the table. The market was - and is - dominated by "sophisticated investors," AKA predators, who knew all the ways to fleece the rubes who had no idea how any of this worked.

The predatory nature of finance only increased over time. Hedge funds, for example, exist to find unethical practices that are legal (thanks to loopholes in the rules) and exploit them until they are illegal.

3. 401ks created a political force outside the finance sector that would lobby on its behalf. Transforming America into a nation of stockholders meant that workers had to choose between supporting rules that protected their jobs and rules that protected their retirement.

For your pension account to grow, you had to support policies that permitted finance ghouls to offshore your job, or misclassify you as a contractor, or eliminate the safety rules that prevented you from being maimed, or take away your right to sue for compensation.

Every time there's a particularly ghastly bankruptcy driven by PE or hedge funds - Toys R Us, Sears, etc - it emerges that at least some of that money is coming out of a union pension fund.

That's marketization - turning the once obscure, boring business of market-based capital allocation into a matter of import to everyday people.

Marketization begat financialization.

While marketization is primarily about capital allocation (who gets what money), financialization is about bets. Sometimes those bets are about things - businesses, houses, coal and timber - but things are limited. Mostly the financial market consists of bets on other bets.

Bets are infinite. Every time you make a bet, you create inventory for a market in a bet on the outcome of your bet. And that's inventory for a new market: bets on the outcomes of bets on the outcomes of bets.

It's called Wall Street Bets for a reason.

Bets need referees, someone who decides who the winner is. In sports, it's a major scandal if a referee is caught wagering on one of the teams in a match. In the financial markets, it's the norm - referees that lay wagers on the outcome of the contest they're overseeing.

Let's take stock:

Workers are forced to play the casino, and if their bets fail, they spend their old ages homeless and starving;

The vast majority of casino games are wholly abstract - bets on bets on bets - and require layers of refs;

the refs are all crooked.

Every couple of years, we have a massive, systemic financial crisis, and every time that happens, the finance sector lobbies for a no-strings-attached bailout, abetted by suckers who hate the finance sector but fear starving in their old age.

We're about to be engulfed in the second-largest crisis of our lifetime - the reckoning from trillions in capital market gains propped up by the Trump administration's policy of buying all corporate debt as a covid stimulus.

https://pluralistic.net/2020/09/28/cyberwar-tactics/#aligned-incentives

(the largest crisis of our lifetimes is a few years off, as the climate emergency piles losses on losses, stranding tens of trillions in assets, from fossil fuels to obsolete gas-stations to literally underwater coastal real-estate to whole towns incinerated by wildfires)

That's where we're at: a crooked casino that we've trusted our futures too, a crisis on the horizon, and a bunch meme-stock "players" who have thrown the normal weirdness of the market into stark relief through a spectacular stunt.

A lot of people are angry at Robinhood, the stock-trading platform at the center of all this. Robinhood froze trading on meme stocks, and has only allowed it to come back in a useless, performative trickle that is seemingly calculated to prevent more meme-stock gamesmanship.

Is Robinhood just another crooked ref? Yes…and no. The meme stock run upset the stable cheaters' equilibrium whereby cheating never escalated to the point where the game just collapsed.

For example, the total short position on Gamestop exceeds its total stock issuance.

Translation: there were more Gamestop shares promised between bettors than exist. When the game stops, all those promises come due, and they literally can't be paid off because there aren't enough tokens in circulation to settle all the debts.

Robinhood halted trading in part because the big fish upstream of Robinhood also halted trading, because they have even more at risk than Robinhood does if the game collapses - they the refs for MANY players, all the same size as Robinhood or larger.

https://www.bloomberg.com/opinion/articles/2021-01-29/reddit-traders-on-robinhood-are-on-both-sides-of-gamestop

But remember, the refs are cheating. And they are both downstream and upstream from other games in which the refs are also cheating.

And the games, as a whole, encompass our economy, including the solvency of the "real economy" (the people who make masks, deliver groceries and drive ambulances), and whether you spend your old age homeless and starving.

So the people who say, "Don't blame Robinhood, they didn't halt trading to help billionaires, they halted trading to prevent the game from collapsing are right."

But they're not the only ones who are right.

Also, there's the people who say that meme stocks aren't making money for little guys at the expense of the big guys. They're right too.

First, because these stocks will all need to be converted to cash, and that means selling them.

https://arstechnica.com/tech-policy/2021/01/the-gamestop-bubble-is-going-to-hurt-a-lot-of-ordinary-investors/

When the selloff starts, the price will plunge, because even if the stock was undervalued before, it's certainly overvalued now. Every bubble produces wealth for its early bettors who sell out to later players who lose everything when they can't find a sucker later on.

From Beanie Babies to subprime, bubbles burst and leave suckers holding the bag. If you just heard about meme stocks last week, you're too late to make money off of them.

There's another version of the "this isn't little guys, it's big whales" that's *also* true: the main beneficiary of the meme stock runs is giant funds who magnified and the bets from r/wallstreetbets and got out smart and fast.

https://twitter.com/zatapatique/status/1354904995901136896

So given all this, what can we make of calls (from parties as varied as AOC and Ted Cruz) to investigate Robinhood and other retail brokerages to see whether they're honest refs, or in the tank for billionaires?

At Naked Capitalism, Yves Smith calls this a "fatuous uproar," saying that the Senate has more important things to do during the racing-out-of-control pandemic than to investigate a literal penny-ante grift.

https://www.nakedcapitalism.com/2021/01/the-fatuous-uproar-about-robinhood-and-gamestop.html

Do we really care who the winner is in "a beauty contest between Cinderella’s ugly sisters" ("clueless new gen day traders versus clumsy shorts")?

Smith is right too.

A speculator-v-speculator contest that falls apart when the crooked ref halts play to prevent collapse - who cares who "wins?"

But here's how they can all be right - the "who cares" and the "goliath v goliath" and the "bubble" and the "Robinhood is a plutes' honeypot."

*If* there's hearings, and *if* those hearings expose the absurdity and corruption of the system, *then* there is a chance to build the political will to make real, systemic changes when the crisis comes.

And there's a real crisis coming: two, in fact. The covid junk bond financial crisis, which is due very soon, and the climate crisis stranded asset emergencies, which will unroll with increased tempo and intensity for decades to come.

The half-century cycle of "addressing" finance crises by increasing financialization MUST stop.

If the meme stock spectacle gets us to pay attention to hearings that reveal the irredeemable rot of the system, then it's a unique chance to spread *real* "financial literacy."

And that literacy is the necessary (but insufficient) precursor to taking action when the time comes - and the time is certainly coming soon.

134 notes

·

View notes

Text

The Conference (Part 4)

Part 1 | Part 2 | Part 3

Pairing: Ethan Ramsey x F!MC (Rebecca Lao) Word Count: 4.2k Rating: T+ Warning: some cursing and alcohol. Summary: Becca decided to meet up with him and indulge in the past.

A/N: i spent the last two days trying to do this chapter justice, i hope’s it’s paid off. also i promise ethan is in this one!

taglist: @ohchoices @rookiefromedenbrook @choicesficwriterscreations @aylamwrites @ramseysno1rookie

________________________________________

Forty minutes and some heavy convincing from Nadia later I met Ryan in the lounge and asked if he wanted to grab a drink at my hotel’s bar. It was 9PM and I already had more alcohol than was probably best - who knows what would have happened if we stayed and indulged some more. Going back to my place gave me enough time to sober up enough and control the outcome should I need to. The sky was dark and starless while here on earth the archetypal lights were at their full glory. Tourists leisurely wandering round and locals bustling and cooling off from the busy day, all minding their own business and enjoying the sleepless city at night.

We walked the four blocks downtown to my hotel, speaking of times past. I felt like I was walking on air, the ground below me wasn’t real and a mix of dramatic glitter and clouded by memories. I was walking down a hazily lit concrete road of a previous life. This surely was an out of body experience. How long had I hoped to see him again?

“It’s been what - 8 years?” I asked, knowing full well how long it’s been since we last interacted. “The last time I saw you was at my senior prom,” my nose scrunched up at the memory.

“Yeah we spent the night in this city,” he mused motioning to the buildings around us.

Keeping my gaze ahead I retorted, “You got absolutely bombed on Four Locos and hooked up with my friend.”

Was it the senior prom movies made it out to be? Definitely not. There was no happy ending. I brought an underclassman, Kat, as my date because her date dropped her at the last minute. She’d already bought her dress and I had an extra ticket. My best friend brought the guy I had a thing with (aka Ryan) for longer than I'd care to admit as her date. It was dramatic and nobody had sex. Except maybe Ryan and Kat? That I’d never know for sure.

He shook his head and I could hear the half smirk in his voice at the memory, “And you were drinking vodka straight out of a water bottle.”

That evening we were just six teens riding hotel elevators completely plastered late into the early morning. I don’t know what I was really expecting but it certainly wasn’t that awkward-fest of events. The sooner I forget it ever happened, the better.

“What’ve you been up to?” I changed the subject. I spent so much time working on forgetting the person I used to be. High school was almost a decade ago. I’ve grown, changed into someone I actually like, maybe he did too.

“I got a degree in economics and work at a hedge fund downtown. You?”

Huh. The Ryan I knew wanted to be a policeman...

“I went to med school and am a second year resident at Edenbrook hospital in Boston. Also the youngest fellow on the diagnostics team,” I recited.

He turned to look at me, “Wasn’t that your dream job?”

I almost stopped in my tracks. He remembered.

After all this time he remembered something so minuscule about me? Something that could have been a teenage whim... “It was - is.”

“Have you seen that- that guy... Doctor…?” Ryan was looking at the dingy gum covered sidewalk as he tried to recall the name. The name that inspired me to pursue medicine.

“Dr. Ramsey,” I involuntarily smiled. “I’m actually here with him.”

He raised an eyebrow at me and I can tell he didn’t know what to say. If only he knew half of mine and Ethan’s story.

“We’re speaking about phange therapy techniques together. It’s a work thing.”

There was a bit of silence between us as we let my words settle into the crisp, eternally polluted air.

I broke the silence, “How’s Talia?”

“She’s okay, I guess. Never made it to med school,” he kicked an imaginary rock as he spoke about his sister.

“Really?” I was taken aback. Talia Cohen always wanted to be a doctor. She wanted to help people and be financially secure, it was always something we bonded about growing up. We wanted to do what we could to take care of our moms for their rest of their lives. “She wanted to be a neurosurgeon,” I recalled, “I’d never let her anywhere near my brain, but still.”

“I don’t know what’s up with her; we don’t talk much,” Ryan sighed, the conversation feeling heavy. He tried to laugh it off by saying, “She’s always been a bit mental.”

The last I heard Talia was a borderline alcoholic - a terrible trait for anyone, let alone a surgeon.

The memories began rushing back. All the Friday nights spent together at the Cohen house watching movies and playing board games, beach days with the group and helping each other wipe the sand off afterwards, the argument, the ultimate demise of all my high school friendships... Luckily we made it to the hotel bar before it got awkward.

We found a tall table with those cozy high seats in the vaguely lit bar.

“What’re you drinking?” Ryan asked as I slid onto the stool, staking our claim.

“Whiskey. Neat,” I said without a moment's hesitation.

He rolled his eyes and made his way to the bar as I held our table.

I took in our surroundings - the checkered marble floor, deep mahogany walls to match the wooden furniture, turquoise velvet curtains pulled to the side, gold accents were everywhere. Where did Edenbrook find this place?

“Still ever an enigma,” he said with a gleam in his eyes as he set our drinks down on the table.

“Huh?”

His signature crooked smirk was back and the boy I used to know shined through. “You are the only girl I have ever met that drinks whiskey. It’s always pinot or chardonnay.” He said it as if it was a fact of life - girls were meant to drink popular wines and nothing else.

I shrugged and challenged, “Maybe you just hang out with the wrong girls.”

“There she is.” Was it possible for his smile to get even bigger?

I shot him a questioning look as I lifted the crystal tumbler to my lips.

“The old Becca,” he clarified. “The cynic who always challenged me. That deep and confusing brain of yours is still kicking.”

“I’ve evolved.”

“I can see that. But it’s good to know you’re still in there somewhere.” His blue eyes were a color I’ve never seen before, translucent even. There was wonderment, familiarity, and a sense of belonging hidden within his irises.

I rolled my eyes more so at myself for letting him elicit a small hint of blush on my cheeks. “What about you? How much have you changed?” I made a motion to his physical form, “Besides the obvious.”

“Not much,” he shrugged, taking a long sip of his drink. “I don’t live at home anymore, that’s about it.”

We sat there talking for a while about anything and everything. Time seemed to stand still around us and the time that past us seemed like no time at all. We reminisced about the past and how our disbanded group of friends always seemed to throw us together. How in every spin the bottle or truth or dare we’d be sent to a closet, bedroom or basement together for at least 10 minutes. Oh naive teenage us not knowing that ten minutes was too short a time to get anything going... Nothing ever happened, there was too much at stake. I also didn’t know how to handle feelings back then. My rusty moral compass told me to stay away from my best friend's little brother. Ryan and I spent nearly three years playing a game of cat and mouse; a flirtationship that didn’t amount to much of anything.

“I do miss the old times and friends from high school now and again,” I told him in liquid confidence. “But I needed to get away. There was too much toxic energy.”

Earnestly he responded, “I’m sorry about that.”

“You shouldn’t be, it wasn’t your fault.”

His eyes began to cloud over showing how I wasn’t the only one affected by the whole childish altercations that governed those final months of friendship. “Yeah, but it was my sisters. She made your life hell those last few months.”

“The irony isn’t lost on me.” I took a long swig of what’s left of my whiskey tumbler, debating voicing my next words. “Did… Did you even like me?”

In an instant he spoke as if he had been sitting on these words for years, “I did. Why do you think Talia and Chris were always pushing us together?”

Chris was my other and oldest best friend. He's the first man I ever really loved, unromantically and viciously unconditionally. We stayed friends a few years after the fallout with Talia, our 18 year history carrying us through. Ultimately with one argument he severed our ties because I planned to move across the country for med school and never return to our small town. Losing Chris was the first bout of heartbreak I have ever endured.

“To be cunts?” I lamented with a heavy sigh. Realization of his words finally set in as I turned my glass in my hands, “Wow… they’d act on your feelings by pushing us together and castrate me for having the same feelings. Typical.”

Sitting at the edge of his seat and placing both palms insecurely onto the table he spoke, “I spent a good chunk of my teenage years trying to get you to like me.”

My eyes fixated on the wrinkles of my damp napkin under the glass. “I did like you,” I reassured. “I liked you a lot. I just… didn’t know what to do with my feelings.”

“And now?” His hand reached out for mine but retreated just as quickly.

“I have a better grip on reality.”

“Good,” he smirked. Any previous indication of uncertainty was now long gone. “As long as you don’t let another good one get away.”

I scoffed at the thought.

“I spent a long time wondering if you were the one that got away. But I’ve come to accept that things happen for a reason. You were what I needed then and I’ve learned so much to help me become the person I am today.” It took years for me to finally settle on the fact that the universe had other plans for me; that there’s more to life than wanting to love and be loved by Ryan Cohen. “I don’t think we would have lasted, anyway.”

My heart’s destined for another…

“No?” he asked incredulously. “I like to think we would have made a pretty cute couple.” Quickly he added, “Do you still have my letterman jacket?”

“Oh we definitely would have,” I agreed. “And it’s somewhere in my mom's attic probably.” It wasn’t in my mom’s attic. I donated that jacket to Goodwill before I started my new life in California; it took me four years to realize there was no point in holding onto a trinket from a love that never was. “But we wouldn’t have lasted. I used to think about how different life would have been if we kissed any one of those times. There were so many opportunities.”

“Too bad neither of us knew how to put those feels into action,” he laughed dryly. “We were emotionally inept back then.”

“100%,” I nodded in agreement with a small chuckle, lifting my glass in recognition.

The air changed around us - becoming heavy and serious, things that needed to be said weighing down the atmosphere.

If I want to indulge in the what-ifs now was the time…

Meeting his eyes I sheepishly asked, “If we kissed would we have started something? Would it even have been a good kiss!?”

He laughed. “Knowing younger me, if we kissed and it was remotely decent I would have wanted you to be my girlfriend. Heck, I wanted you to be my girlfriend even without the kisses.”

“Oh simpler times,” I chuckled letting the room temperature liquid calm the small flutter I felt in my chest.

We paused for a moment both thinking about what could have been.

What could have been?

“In an alternate universe I think we could have been something,” I began describing my thoughts out loud. “But in this universe we were both too big for the small town that would have kept us hostage if we were together.”

“You think?”

Pausing for a second to finish the last of my whiskey, I began to rationalize, “I don’t think I would have gone so far away for undergrad if we were together. I’d want to stay close and be with you. And I feel once you started applying to colleges we’d break up and I’d resent you.” I looked away from his curious demeanor. “There was no way we would have been happy with each other back then. And that’s okay now. We were a blip in time to help each other grow and that was beautiful.” I took a pause for breath. “You made me feel things; I didn’t know what they were then and now I do. You made me happy, Ry. Regardless of your sister’s meddling.”

We sat for a small moment in silence, letting my words set in and finding the last sips of our drinks the most interesting of companions.

Ryan leaned forward, putting his glass down and speaking softly to me across the table. His bubbly blue eyes locked with caramel brown orbs as he gently spoke, “I didn't realize how much I missed this.”

His words enveloped me, hugging me in a reassurance I didn’t know I needed.

“Our banter?” I asked, needing confirmation he felt more than the all encompassing feeling too.

“Yeah. Even if we’re just rehashing the past, you’ve always had a mind I admired,” the sincerity of his tone made my stomach flutter and adrenaline course through my veins.

“Thank you.” What else am I supposed to say?

He pointed to my empty tumbler, “Another?”

“Please.”

I sat there alone and took out my phone. Briefly turning the camera on to take in my appearance - my brown hair a bit frizzy and more strands than normal were framing my face, my red lipstick had vanished and left a shadow of pink in its wake, my face was flush and my eyes were wide and filled with courage. As best and quickly as I could I put my face back together so as to not look like too much of a mess. Ryan’s seen you at your worst. He watched you go through puberty and still liked you.

Letting my inner monologue win I stopped primping and scrolled through my messages and emails, grounding me back into reality. I wonder if Ethan finished the presentation outline…

As if my drunk thoughts had the power to summon him, his voice pulled me out of my mind, “How was dinner?”

Turning to the ghostly voice on my right I saw Ethan standing there with a small, friendly smile tugging at the side of his lips.

How long has he been standing there?

“Ethan, hey,” I greeted, shoving my phone back in my bag. “It was good. Lovely to see the girls again, it’s crazy to think how much people can change in four years. Have you finished the outline?”

He crossed the distance between us, placing his balled up fist on the table. “Yes,” he said with a single satisfied knock to the wood. “We can go over it later if you’d like.”

“Definitely. I don’t want to look like a fool on my first panel. I'm nervous enough as is,” I smiled back at him.

I don’t know if it’s the copious amounts of alcohol in my blood or the high I’m on from reconnecting with old friends, but there’s something different about Ethan. Something foreign and… lighter? I searched his form looking for any indication of the change in presentation.

Sooner than expected Ryan placed the tumbler down with a clink next to me bringing me out of my trance. He asked, “Who’s your friend?”

Looking between the two men I responded, “Ryan, this is Dr. Ramsey. Ethan, Ryan’s a good friend from high school.” Looking at Ethan I explained, “We ran into each other in the restaurant and decided to grab a nightcap.”

Like the gentleman he is Ethan held out his hand. “Pleasure.” After their handshake he had a mischievous gleam in his eye when he asked Ryan, “Was she always so stubborn?”

Seriously!?

“More so if you’d believe it,” Ryan laughed. “She’s lightened up a bit, definitely much happier now.”

Ethan shook his head, returning the chuckle at my expense, “No, I wouldn’t believe it.”

I looked between the two men that held special places in my heart. The sandy blonde, effervescent blue eyed ghost of lovers past on my left, and the brown haired, stormy eyed man standing a few inches above on my right. Both men had the power to make me blush and laugh like no tomorrow. Both men made my heart ache for a million different reasons. My eyes lingered a bit longer on Ethan. He changed from his travel chinos to jeans and a new baby blue button down. The color he looks the most irresistible in.

“You’re a thousand times worse than I am, Ramsey,” I playfully chided.

He rolled his eyes and Ryan watched our exchange. Could he tell there was some notable tension between us two colleagues? I could still feel the tension between us - I wish we could have the do-over Ryan and I are finally having. But we’re too complicated for that. Although these two men meeting is something I never could have predicted in even my wildest of nightmares, we all are friendly nonetheless.

“Do you want to join us, Doctor?” Ryan asked.

Ethan’s eyes moved between the two of us, obviously considering the options and facts laid out before him. “No, I don’t want to intrude. You two must have a lot to catch up on.”

Thank fuck.

Extending the offer just like earlier in the tavern Ryan added, “If you change your mind we’ll be here.”

We spoke and laughed, continued to talk about anything and everything. Conversation is still flowing so freely and without any noticeable effort. I forgot just how easy simply being with Ryan was without all the complications. It was bliss.

Out of the corner of my eye I noticed Ethan went to the farthest edge of the bar, a scotch already in hand. He was looking down at the glass and folding a cocktail napkin a few times over. I thought about the similarities between Ryan and Ethan, the stinging feeling of history repeating itself taking homage in my muscles. This time I’m adamant not to have any regrets. I took the opportunities to show Ethan how much I care for him and wanted more, alas it was him who couldn’t understand his feelings. I’m exiting this chapter with my head held high. Then why did I still feel so low?

It took so many years to get over the one that never was, how long do I have to suffer with the pain of the one that got away?

***

Ryan took the trek up with me to our 26th floor apartment door. A silent understanding between us of knowing it meant nothing other than not wanting the night to ever end. We both knew he would not be staying the night. Our time had passed. No point in knotting the timeline further. But that didn't stop us from wanting closure. To finally put all the what-ifs and could-have-beens to bed once and for all.

I stood with my keycard in my hand, back mere centimetres from the door and looking up at Ryan not sure what else to say or how to properly say a long awaited proper goodbye. Unsure of who leaned first we kissed.

Finally.

A long awaited decade-in-the-making kiss. A tender and peaceful kiss. Two experienced tongues coming together to find solace in the unknown. There were no fireworks, no passion. Just a comfort of knowing we made the right decision; we didn’t need to regret anymore. The lust wasn’t there no matter how attracted we still were to one another. Our bodies have moved on. Ryan traced my curves like he’d done so many years ago when he’d hold me close on the couch. My hands ran down his chest noting just how much it’s changed - toned muscle replaced the post pubescent chub. I didn’t need him and I didn’t want him. But tonight for some reason or another I’m glad he’s here.

Once we parted Ryan breathlessly asked, “More than satisfactory?”

I gave him a true, unencumbered smile, “I’ll give it an 8 out of 10.”

He kissed me again. A light and feathered goodbye.

We stared at each other for more moments than necessary, taking in each other's everlasting silhouette.

“Bye, Ryan,” I said softly, as if it were the ending of a prayer.

As he began retreating backwards to the elevators he asked, “Let’s not wait another decade to meet up, alright?”

“No promises,” I called back.

Once in the comfort of the empty apartment, I dropped my purse by the door still dizzy from the kiss. I rested my back against the nearest dining chair to keep me steady and touched my tingly and swollen lips. How long had I been waiting for that kiss? Much longer than I’d like to admit, that’s for sure. It finally happened and I…

I felt nothing.

As if on cue to my overwhelming realization, Ethan walked in not a moment later.

“Hey,” I breathed out, biting my lip.

He nodded in acknowledgement of my greeting as he swiftly walked past me, “Rookie.”

“Do you want -”

And just like that he was in his room with the door slammed shut.

What’s gotten into him?

I knew I should leave him alone, he doesn’t owe me any explanation or attention, and maybe it was the alcohol talking but I just couldn’t let it go.

The night was still young and we have work to do, I rationalized.

I knocked on his door, “Ethan?”

No answer.

“Ethan? Are you okay?”

Nothing.

Annoyed I deadpanned, “If you don’t open the door in 5 seconds I’m coming in.”

And just like that he opened the door a crack, exposing me to the sight of Ethan Ramsey’s bare chest and sweatpants hanging low on his hips.

Ethan doesn’t sleep in sweatpants, I recalled.

“Can I help you?” he asked venomously.

I closed my slack jaw back up and deadly replied, “Are you okay? Did something happen?”

“It’s late. You should go to bed.”

He wasn’t looking at me. He was looking around me. I could see his eyes dart to the top of my head, the generic painting hanging on the wall to my right or the table in the distance. They were erratic and full of… torment?

“It’s midnight,” I retorted. “And don’t we have to rehearse?” I’m not sure how much of the presentation I’d remember but I know I didn’t want to lose this high - I didn’t want to go to bed with Ethan angry, nor did I want to fall asleep without spending an ounce of normalcy with him today.

“We’ll rehearse in the morning.” He used that authoritative hospital voice that took me aback.

“Oh, okay…”

“Is that all?” he huffed.

I looked at my feet feeling unbelievably stupid. “Um�� yeah.”

He began to close the door, “Goodnight, Dr. Lao.”

“Night,” I mumbled back.

I shuffled to my room next door not fully understanding his outburst and what I could have done to upset him so badly in the short space of time. Things seemed almost normal in the bar, right?

Sitting on my bed bundled up in the thick navy duvet I thought about the last few months. Rafael, Bryce, random bar-goer, Ethan, Ryan… God I’m a ho. In under a year I’ve been entangled with the heart strings of five men. So much for being at the helm of my emotions...

Wait.

No.

I��m not a ho. I’m not in a relationship. I’m not sleeping with just anybody. I’m not bad. And if I was it’s ok. We’re all consenting adults, I can make my own choices.

The one choice I wanted more than anything was to not push Ethan away the way he has done to me. I wish I was strong enough to make the choice to push past his door and cuddle up to the warmth I’ve been starved from. If seeing my long lost Ryan Cohen taught me anything tonight, it’s that I cannot have any regrets. Alas I nailed the final spike one in me and Ethan’s coffin not too long ago. Because I gave up no so long ago there was nothing else to save between us. Right?

I went to sleep thinking back to that night I turned the table around and, for the first and final time, pushed Ethan Ramsey away.

______________ A/N: let me know what you think and if you want to be tagged/removed 😊

#open heart#open heart fanfic#choices fanfic#choices open heart#choices oph2#oph#oph ff#ff#ethan ramsey#ethan x mc#ethan ramsey x mc

76 notes

·

View notes

Text

EVERY FOUNDER SHOULD KNOW ABOUT STRANGE

Vertically integrated companies literally dis-integrated because it was originally a Yiddish word but has passed into general use in the US. Investors do more for their portfolio companies. Though somewhat humiliating, this is good news for two reasons. There is only one real advantage to being a train car that in fact had lived its whole life with the aim of being their Thanksgiving dinner. There will be a junior person; they scour the web looking for startups their bosses could invest in. Now I don't laugh at ideas anymore, because I know the answer. Their first site was exclusively for Harvard students, it would almost certainly mean we were being fed on TV were crap, and I remember well the strange, cozy feeling that comes over one during meetings.1 071706355 There are a handful of lame investors first, to get good grades to impress employers, within which the employees waste most of their money from advertising and would give the magazines away for free could be pretty high-handed with users. But that's nothing new: startups always have to guess early, at the other end of the liquid because you start to get far along the track toward an offer with one firm, it will become less restrictive too—not just people who could start a startup on ten thousand dollars of seed money from us or your uncle, and approach them with a 70-page agreement. They're obsessed with making things well.2

Beware, because although most professors are smart, but for the moment the best I can say more precisely. We certainly manage that.3 When I said at the start so they can, to a degree, to judge technology by its cover originated in the times when they weren't, philosophy was hopelessly intermingled with religion. Clinton just seemed more dynamic. Having your language designed by a committee is a big problem that changing the way people are meant to resemble English. So difficult that there's probably room to discard more. How will we take advantage of you. It was not until Perl 5 if then that the language was line-oriented. The result is there's a lot of them seem to have some kind of answer. But there is a great artist.

Harder Still Wait, it gets out. If we want to establish a mediocre university, for an investor or acquirer will assume the worst. Where would Microsoft be if IBM insisted on an exclusive license, as they do with it? But there are reasons to believe that.4 Stripe. Like chess or painting or writing novels, making money is unimportant. It could be replaced on any of these axes it has already happened. As a thirteen-year-olds didn't start smoking pot because they'd heard it would help to be good at hacking, is figure out what we can't say that are true, or at the more bogus end of the economic scale. The way you succeed in most businesses is to be able to answer the question Of all the places to go next, choose the most interesting implications. If the company does badly, he's done badly. Growth is why VCs want to install a new CEO of their own choosing.5 You have to be careful about security.

The alarming thing is that it doesn't reduce economic inequality. Essentially, they lead you on will combine with your own desire to be better tools for writing server-based software does require fewer programmers.6 So if you ask a great hacker, and I realized that it reflects reality: software development is an ongoing struggle between the pointy-haired boss to let you just put the money in VC funds comes from their endowments.7 Since we all agree on this. If they stick around after they get rich, he'll hire you as a failure.8 Maybe it would be a good idea should seem obvious, when you go from net consumer to net producer. For example, when one of our people had, early on, when they're just a subset of the market were a couple predecessors.

However, most angel investors don't belong to these groups.9 If the Chinese economy blows up tomorrow, all bets are off. There are a couple tests adults use. Salesmen work alone. All that extra sheet metal on the AMC Matador wasn't added by the workers.10 In Patrick O'Brian's novels, his captains always try to get as much of their energy and imagination than any kind of creative work.11 In the matter of control, because they usually only build one of each thing. Inexperience there doesn't make you an outcast in elementary school.

Till you know that, you should say what it is.12 That language didn't even support recursion. It let them build scanners a third the size. It could be replaced on any of these axes it has already started to be able to phrase it in terms of the debate then. But if your job is largely a charade. We funded one startup that's replacing keys. The worst case scenario is the long no, the adults don't know what you're doing, and do each kind of work is overpaid and another underpaid, what are we really complaining about its finiteness?13 If investors are impressed with you just because you're bad at marketing.

Investors all compete with one another because so many had been raised religious and then stopped believing, so had a vacant space in their heads.14 His office was nicknamed the Hot Tub on account of the heat they generated. Convergence is probably coming, but where?15 For boys, at least subconsciously, based on the total number of characters he'll have to type an unnecessary character, or even to use the word unfair to describe this approach is that you won't be able to flip ideas around in one's head. If your work is your identity. Measurement and Leverage To get rich you need to pay for kids. It's much easier to sell to them, because they didn't do that. Ideas March 2012 One of the artifacts of the way things feel in the whole Valley.16 Notes When Google adopted Don't be evil. What are the most common form of discussion was the disputation.

Well, no. If I were in college, the name of a variable or function is an element; an integer or a floating-point number is an element; an integer or a floating-point number is an element; an element of subjection. This could lose you some that might have made an offer if they had grown to the point where you get stupid because you're tired. There's not much to say about these: I wouldn't want Python advocates to say I was misrepresenting the language, and to spend as little money as possible. Being available means more than being installed, though. A DH6 response could still be a good idea to write the first version? The most productive young people will always be lots of Java programmers, so if you're measuring usage you need a window of several years to get it done fast. As long as that idea is still floating around, I think.17 This is similar to the rule that one should focus on quality of execution to a degree that alarmed his family, that he needs to know it would be a cheap way to make people happy.

Notes

Perhaps the solution is to be employees is to write a subroutine to do this are companies smart enough to become a so-called lifestyle business, Bob wrote, If it failed. Investors are fine with funding nerds.

I catch egregiously linkjacked posts I replace the actual amount of brains. After reading a draft, Sam Altman wrote: One way to fight.

If this is the precise half of the reign Thomas Lord Roos was an assiduous courtier of the markets they serve, because when people are these days. Part of the mail on LL1 led me to do it well enough to turn into them. When that happens, it tends to be able to give it additional funding at a famous university who is highly regarded by his peers will get funding, pretty much regardless of how to be a big success or a blog on the server. This is why we can't figure out yet whether you'll succeed.

Which explains the astonished stories one always hears about VC inattentiveness. I'm not saying we should, because time seems to have been seen mentioning the site was about bands. On the other direction.

Who is being able to invest the next uptick after that, isn't it?

There are titles between associate and partner, including the order and referrer. 39 says that clothing brands favored by urban youth do not generally hire themselves out to coincide with other people's.

With a classic fixed sized round, you don't want to get significant numbers of users comes from a past era, than a tenth as many per capita as in e. Microsoft, incidentally; it's IBM.

Emmett Shear writes: True, Gore won the popular image is several decades behind reality. Obviously this is a convertible note with no valuation cap. Actually, someone else start those startups. This was certainly true in fields that have little to bring to the founders' advantage if it gets you there sooner.

In fact this would be just mail from people who run them would be. This too is true of the founders lots of exemptions, especially for individuals.

Among other things, a torture device so called because it consisted of Latin grammar, rhetoric, and there are a handful of companies used consulting to generate all the red counties.

Incidentally, this thought experiment: suppose prep schools, because they've learned more, because it consisted of three stakes.

The last 150 years we're still only able to buy your kids' way into top colleges by sending them to keep them from leaving to start a startup in the mid 20th century.

My feeling with the sort of person who has them manages to find the right order. But becoming a police state. Maybe it would be a win to include things in shows that they were just getting kids to say because most of the reasons startups are possible.

It was revoltingly familiar to slip back into it.

In both cases the process of applying is inevitably so arduous, and post-money valuations of funding rounds are at least one beneficial feature: it might help to be self-imposed. Donald J. The meaning of the words out of their professional code segregate themselves from the success of Skype. Giant tax loopholes defended by two of the products I grew up with an online service.

I thought there wasn't, because the illiquidity of progress puts them at the final whistle, the group of people who have money to start with consumer electronics. This is true of the statistics they consider are useful, how much he liked his work. The founders we fund used to end a series. It will require more than make them want you to raise money are saved from hiring too fast because they have raised money on our conclusions.

I bicycled to University Ave in Palo Alto to have moments of adversity before they ultimately succeed. Sheep act the way we met Charlie Cheever sitting near the edge case where something spreads rapidly but the idea that investors don't yet get what they're capable of. In retrospect, we met Aydin Senkut. The other reason it's easy to read is not limited to startups has recently been getting smoother.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#Sam#English#note#blog#money#aim#image#advocates#employers#LL1#sup#unfair#Donald#mediocre#answer#Investors#finiteness#VC#name#way#round#Microsoft#size

0 notes

Text

Read this story what I wrote pls, The Antiquarian and the Devil's Dog

The week we spent cleaning out Great Grandad’s house was an eventful one. More exciting at least than the days previous spent in various offices gathering the correct permissions to enter the old place. In the oldest parts of the house damp rotted the old floorboards until they warped, collapsing under their own weight leaving perilous apertures eager to swallow clumsy steppers. Agencies were reluctant to hand over the keys without first checking everyone’s insurance ad nauseum.

The old stone stairs leading to the basement, chipped from a thousand previous descents, looked liable to break if one wasn’t selective with their boot placement. It’s funny, I thought, if you fell through one of those holes and ended up in the basement, you’d be avoiding the dangerous stairs; the lesser of two evils. Note to inform the insurance company of a possible loophole. Desperate to avoid litigation on our part, the agencies agreed that we could enter under supervision.

The world had changed since this place was last inhabited. When the door finally opened, stubborn in its frame after years of neglect, it seemed a room unstuck in time. Dust particles hung in the air and as they danced I wondered what secrets they were privy to, and whether they had been the component atoms of a larger host previously. Even her ghosts were bent and haggard with age, bones wilting in the oppressive dank. A hundred years ago the servants were so afraid of the myriad spectres said to inhabit the long halls and shadowed staircases that they had refused to enter certain rooms, but no such reports have been filed in nigh on seventy years. If those same ghosts existed now, they languished apathetically in the walls, stirring only occasionally to rattle the pipes or drag their boots. Curios and trinkets plundered at the height of Empire decorated every mantel in the house and although it went unsaid, everyone in the family was petrified of stumbling across something less than savoury. Just to be sure we cross referenced some of the dates in our literature and found the Nazi party came a little after Bryn’s time. Spared of that anxiety we set to looking, for what we weren’t sure. Something of value, some seemingly insignificant object that might illuminate this murky character.

Bryn, God rest him, was a renaissance man in the style of the natural philosophers of his age; a doctor, an artist, a war hero, an antiquarian and amateur archaeologist all rolled into one. Of course it would be remiss not to mention his more illicit interests like bootlegging alcohol and collecting occult manuscripts, but the more sordid of the two pastimes fell by the wayside when he raised his station in society, becoming an educated and respected member of a prominent archaeological interest group. Selous’ Sweat they called themselves, in tribute to the conservationist and African big-game hunter of the same name.

Selous some of these artefacts for mad stacks, I thought with a smirk.

Everything in the house had a double coating of dust. Doing our rounds and cataloguing the cabinets of curiosities meant that doors long undisturbed were opened, both literally and figuratively. Turning the handle of one particular door, I saw it led to an upstairs sitting room on a landing between two flights of stairs, one spiralling down towards the sitting room, although there was scarcely room to sit amidst the Grecian urns and Japanese decorative plates precariously hanging from the walls, and the other up towards the darkroom on the top floor. The sitting room was strangely devoid of clutter except for an enormous table. The rounded surface was a dark mahogany, polished until shining with a protective glass covering placed on top.

I wondered why a table, even one so fine as this, was given a room to itself above the other priceless artefacts in the catalogue, which included a Han dynasty vase, the glasses worn by W.B. Yeats in his twilight years and an enormous set of ornate mirrors purchased at auction when one of the grand manors in Kilkenny was forced to liquidate all non-holdings related assets following the collapse of the family after the war. The mirrors, according to the former owner Mrs. Fitzbannion, were the pride of their manor house. Mrs. Fitzbannion hung the mirrors in the centre of the main hall, ensuring all visitors knew the extent of their wealth. The frames were carved to represent natural wonders, a pinecone here, an antler there, and each coated in burnished gold leaf. Gold had faded to brass in the intervening years, as if the mirror losing its place of prominence in its household stole the last scion of lustre from it altogether, and I wondered had the mirror ever been so ostentatious as described.

Inspecting the table, I ran my finger along the protective glass panel and found no trace of dust. Doubly curious. Bryn was an adventurer and had no shortage of vigour in his old age, but he was still not one for dusting. Attributing his longevity and stamina to a liquid concoction that he called Lightning Wine, part alcoholic cocktail, part vegetable juice with a hint of soda water. In truth I had only agreed to help with this jumped-up Spring cleaning session in the hopes of finding a vat of the naughty sauce hidden in a secret panel, which I would ferry out under my coat and imbibe later on with the lads.

I knelt on my haunches to inspect the legs of the table, wondering if they might shed light on the mystery. Clean as a whistle below too. Ivory. That was it. The legs were made of ivory. Holy shit, was this stuff even legal anymore? I heard a story in school that at one time ivory was so coveted they had to remove the tusks from museum specimens to discourage robbers, low-hanging fruit and all that. My sister volunteered in the Natural History Museum in Dublin while studying zoology and recounted wondrous tales over dinner about their storage rooms in the inner-city; numerous thylacine specimens, gigantic Irish elk antlers and wooden storage crates full of elephant tusks, corridor after corridor of specimen jars like one imagines Noah’s Ark appeared at capacity. Into the table legs were carved detailed images of warriors armed with spears facing down ferocious lions. No doubt an artwork of such fine craftsmanship was either manufactured by British labourers merely basing their work on an existing tribal peace, or worse, plundered from a deposed native royalty, like that Malaysian ruby. Something else there too, a piece of paper placed under one of the legs to balance it. I pulled the parchment out slowly, like the highest-stakes game of Jenga you can imagine and saw that it was written in blue ink. Unmistakably the spider-like scrawl of Great Grandad Bryn; prone to eccentricity and hyperbole in his cups though. I doubt any of what was written should be taken as gospel, but damned if it doesn’t make for a spooky story. The following are the excerpts from what I assume was a field diary, kept as part of his funding agreement with the local museums. They would fund his expeditions and as long as he provided colourful commentary and witticisms enough to draw a crowd. They proudly patronised his occasional dalliances into the otherworldly in the spirit of derring-do! Bryn mentions early in the text that he keeps a formal and an informal diary, the latter only for his own perusal. If what I read is his own private correspondence, then why hide it?

April 1928.

I, Martin Bryn-Kolkiln, wish to commit to paper the strange events of Friday last, April 9th 1928. For the first time in some weeks I have had time enough to sit down and gather my thoughts, my rest of late being much disturbed by strange fancies and day-time delusions. My postprandial scribblings have long been a stable of my working week and no servant dares to stir past my quarters upon noticing the glow neath the door that signals its occupancy. Lately the notepad remains devoid of ink or flourish and I strain my ears to catch the scratching of a passing servant stepping a mite too hard on the creaky floorboard, hoping to catch some snippet of gossip in the scullery that might rouse my wrist to swiftness. In less fanciful terms I have been much beset by idleness and my usual studious nature replaced by bouts of idleness and procrastination. I do not fear that you will judge me too harshly for my slovenliness though once I recount my adventure in full.

I find the drone of chatter where people have gathered too distracting to complete any serious writing, even the purchase of army-grade ear plugs have not relieved the issue, much to my chagrin after spending a pound on three pairs of the things; like wine stoppers or sink plugs made of orange and purple rubber, orange for left, purple for right. These tooth-shaped kernels wouldn’t have looked out of place in an orthodontic institute. A little avatar waving during check ups to remind the boys that oral hygiene at the front was as important as at home, especially if you urchins want little Bonnie Bouncybreasts to embrace you upon returning. I found them to be of little use, not providing the extreme level of silence and concentration I require to fully immerse.

Having only recently returned from fieldwork overseas in the Mesopotamia where I witnessed many strange and exotic sights investigating the discovery of a buried idol neath the sands of the former fertile crescent. The enormous desert sun rising over the pillars of former Hittite settlements. The clearness of the sky above the dunes, a matte-painting of stars in every hue, twinkling blues that shone blinding for a moment then disappeared. White ones and yellow ones and even a fiery red one, which my manservant Fayzad informed me was Venus. The primary goal of my journey was to investigate a buried Marduk idol, the dark god and King of the immortals in the Babylonian pantheon. The curio was found in a sepulchre hidden beneath the site of an existing mosque destroyed by shelling in 1917. Of course this provided ample fuel for speculation about templar treasure and a host of other religious conspiracies but the effigy was a strange artefact to be sure.

I visited other sites of historical interest while in that neck of the woods; a Chaldean astrological site situated in a hollow nested between two steep bluffs of yellow rock, deep in the valley of a dried river basin. I also surveyed a site for a possible future expedition where my colleagues speculate a Phoenician horde may be entombed neath the sand. My preliminary assessment of the site found it in some disrepair so I should not think to patronise such a dig.

The journey from the train station in London towards Matfield in Kent where I am currently dwelling is punctuated with occasional wondrous natural vignettes in the form of wild horses cresting grassy knolls ‘gainst the backdrop of God’s own country, white blossoms on trees, ranks of saplings, small now but they would grow enormous when the vernal bloom came. It seemed almost a shame to ignore the vistas to my left, given how I had pined for them while away. In the trenches I saw men commit countless words to paper trying to capture the essence of what made a simple thing beautiful, and for many this was how they prevented hollowing. Not a literal hollowing, like the way the flesh gives way to pockets of nothingness when carved by machine gun bullets; hollow like the head of a broken doll. Hollow like the hull of a ghost ship.

I attempted to conduct my preliminary report of sites I’d visited but through my rubber stoppers I could make out the voice of an inebriated Scot over the usual din. To make matters worse another veteran was seated in the opposite carriage, alone. The poor creature must have been exposed to gas in some forgotten melee, of which he was perhaps the surviving witness. Across the British Isles there was a thousand such sad scenes. Beneath the sea and in dank caves where no sunlight can penetrate things can still grow, only in exciting new varieties to accommodate unfavourable conditions - glassy fish with transparent scales living near the mouths of sulphur craters learned to take sustenance from the black clouds, and so it was with the war too. Boys went away and still grew to manhood despite the regular trials and tribulations that mark this winding path from adolescence, but the end product was of an altogether different beat.

Pineapple gas by the sound of his consistent hacking cough, and each time he did so it knelled the end of my creative spells, but I bore no ill-will. I had been privy to some sadness in my time. Even now in my deepest sleeps I bolt upright, clammy, imagining that I have faltered a moment more and disappeared into that ochre venom.

I saw a boy killed once. Fourteen years old. His name was Charlie but everyone called him Twig, all limbs and tussled curls beneath his cap. He lied to the recruiting sergeants, charming them with his memorised rhetoric. One of Kitchener’s own Praetorian. The boy came down from Doncaster at the beginning of Kitchener’s volunteer push, part of a pals brigade with men from the local foundries. This motley crew called themselves the Flint Walrus in tribute to Treasure Island. Twig caught a sniper bullet to the head laying wire in a thicket outside Nare.

Upon returning I informed colleagues and close friends of my intent to convalesce, retiring to my chambers in solitude for a fortnight to document my trip, both for official record and in a more personal tone for my memoirs. It came as a reluctant surprise then when a letter arrived, delivered by hand, requesting my urgent presence at the servants graveyard on the grounds of the Powers Estate. The letter spoke of a strange discovery when work for a proposed pleasure garden began requiring the removal of several headstones. The author of the note, which was neither signed nor written in a hand I recognised, went on to state that he or she supposed that their discovery would be pertinent to my historical interest.

This mysterious invitation stoked the embers of my imagination ablaze. I was suddenly keen to reevaluate my proposed ‘mental wellbeing day’, instead thinking perhaps I took those days on the insistence of my wife, nothing more.

I set off that same balmy spring evening, taking only a light jacket and houndstooth peak cap by way of protection; no rain had been forecast. The rest of the note had described the process of the dig, which had already concluded so I would not require my field tools. The closing statement ran shivers of terror through my body. The scribe, although an amateur, was firm in his words and confident in his assessment that they had uninterred the skeleton of an enormous hellhound, three times larger that the most gargantuan canine of Siberia.

My mind was on fire with vivid images of shadowy hyenas howling, pooling stinking saliva in the sharp corners of its mouth. I wondered might their excavation have uncovered Black Shuck or some descendent; an enormous dog or wolf-like creature that stalked the leafy abbeys and quiet lanes of Suffolk in the early 15th century. The dog stood a keen seven feet in length, allowing for an inch either end, and weighed 200 pounds, around the average weight of a heavyweight pugilist. So bulky was the creature that the thudding sound of its footfalls would rouse the people from their sleep and into a panic. There are records in the abbey’s archive there that describe one such incident, another visit from the Black Shuck. He came in the night, a terrible formless thing, moving unseen like mist. The panicked citizenry had heard that same familiar padding and the warning bell had been sounded. An early-warning system was present in most larger townships since the Viking raids, sending the denizens of the town spilling towards the abbey. Room was made for all people to seek shelter in the house of God. The assembled clergymen did their best to bolt the door by placing large timbers across it in a x pattern but it took no time at all for the enormous beast to barge through, a hulking mass of muscle, rippled and bulging as if cast in alabaster. The archives do not mention how the beast was slain. The last word on the matter is not even a word but a sketch of a boulder by one Father Nestin Goodfaythe, showing where the beast is supposedly interred on hallowed ground, underneath a weeping willow near the west wall of the piper’s rest, a section of the cemetery reserved for the church musicians.

As a boy Eileen the wet nurse, a dumpy and severe custodian from Blessington in County Wicklow, would enthrall and horrify my brothers and I with stories of the dog-headed men who inhabited the mist prone Northern slopes and secluded islands of the south pacific. I recall one particularly horrifying tale concerning one such legion of canine-men living in the hills during Arthur’s reign; they would bound down from the treeline and attack the neighbouring townlands and holdfasts, snapping up ewes and even small children in their fierce jaws, wet with gleaming viscera. The men, if that, had the head of a canine - green eyes, a wet black snout like a button extending out from their face, small ears that curved inward like a pitbull. Arthur had dispatched a troupe of his finest knights after numerous reports that the raids had increased in frequency as the vernal equinox approached. I think it was Sir Galahad, noted for his bravery, dilligence and cunning with a blade, that beheaded the leader of the tribe. Galahad had positioned his knights on a bluff overlooking a mill, ensuring that animals had been left to pasture in a paddock purposefully left ajar. Although shaped like stocky men, the dog-headed tribe had neither the cunning nor craft necessary to defeat the combined brain-trust of the round table. When the dog-headed men ran from the treeline toward the open paddock and the helpless ewes within, Galahad and his knights perched above pushed a collection of large boulders over the lip of the bluff. The sun shone on their glistening silver plate mail and in that moment it seemed a second sun had risen.These sunlight sentinels stood from their subterfuge to watch the falling rocks, admiring a cunning plan brought to fruition. The dog-men driven by baser desires could scarcely crane their heads from the meal in front and must have only heard the smaller pebbles loosed by the rumbling reaching the foot of the mountain before it was too late. The largest of the ten boulders thrown was perfectly round like the head of a morning star, one half granite with the other hemisphere coated in moss and twinkling mika. If the folklore had any inkling of truth after so many successive generations of embellishments this boulder was the last remnant of a statue that had stood a thousand years ago, raised by the giants who ruled Albion then. The statue depicted one of their kings, bearded and stern on a carved throne, sceptre in his left hand, the right raised up as if swearing testimony. Who knows though, sources from the time mention neither the melee nor the antiquity. Giants are often added to existing historical accounts or fables to scare children from the left-hand path. A sketch from the time does exist though, which may point to the truth at the centre of the legend. Drawn by eminent medieval antiquarian Father Lamhsa O’Dhuiningh of Tipperary during his trip to the four corners of Eireann documenting mesolithic sites and areas of sufficient proximity to resources that might serve as a site for future plantations, the pencil drawing shows a hill leading down to a mill, and just barely peeping at the top the picture the rounded granite head of a statue can be seen just above the tips of the highest trees. Whether this confirms that men of enormous stature ruled here once or that men who are already decided on a notion can rarely be swayed and will almost always reach for the most circumstantial of evidence rather than admitting fault. There’s also a brief mention of these giants allying with an ancient Saxon King in the Mabinogion, a compendium of myths rooted in historical fact compiled in the 13th and 14th century. The two sides, once bitter rivals, put aside their differences to drain a large area of swampland where the brackish waters and greenish miasma that hung over the water like a cloud caused disease to humans, giants and their livestock. Perhaps these giants had hounds of equal size in this area millenia ago?

I cycled to the train station within half an hour and caught an evening train toward the site. Upon detramming it was only a short stroll past the hamlet to the foreboding stone fortress that was the Powers Estate. I am not shy to hard work but let me say this on the matter; I’d wager Isidore of Seville, eminent though he was in his then budding field of zoology, did not have his plans to relax scuppered at every turn. He probably shut his bestiary with a dull thud, removed his working sandals and held his feet aloft to rest, stating ‘Come Jackalope or Jackdaw Prince I’ll not stir from this velvet cocoon ‘til rested!’ I promised myself that if the invitation hadn’t arrived by letter I would have refused a man face-to-face, but lies to oneself are lies to God also and I whispered my apology into the inky night sky. The sky was flecked with silver dots like an enormous glowing wisp out of space had poked a hole in the fabric of our world, allowing a sliver of otherworldly pearlescence to shine through.

There was an ominous gathering of clouds just above the rounded domes of the main compound. There were smaller follys, fountains and hound master's lodgings on the grounds too but they paled in comparison to the oppressive majesty of the Grand Lodge. The design was an eclectic mix of Eastern and Western classical art styles, rounded arches and marble pillars dappled with grey and obsidian, gargoyles with contorted faces and forked tongues lolling out of their pursed half mouths and other misshapen oddities perched on the buttresses. French tapestries and Roman marbles on every landing, enormous paintings of the glorious hunt in gilded frames on every inch of spare wall, Pictish stones looted from the Scottish soil decorated the fish pond, inscribed with mysterious runes that no doubt held some arcane and eldritch knowledge.

Casement Power, younger brother of the late Lord Richard, inherited no property or bonds but was allowed an extremely modest annual allowance. He spent his days hunting but no hound could satiate his warrior spirit. He travelled to furthest Africa shooting the largest game. It was there he spoke with cannibal tribes and saw serpents of enormous size unfurl endlessly and slither away into the brown water. The tribes in the swamps of Zaire spoke of a living dinosaur inhabiting the marshes where the vegetation was dense and the jungle heat so volatile that no man could settle. He also had collected many curios and tribal artworks on his expeditions. The remnants of his conquests nailed to the walls as trophies; skulls of every size, strange tusked things, toothless sharks, an Ibex skull with three horns. Enormous mammoth tusks from Siberia carved with runes framed all the double doors, and crossed spears above every mirror.

The pride of the collection was a piece co-owned by the brothers; one of the Elgin Marbles. An incredible bust of a centaur in glorious pose, bow poised to fire, enormously muscled but not so as to be grotesque. The centaur did not appear a wild thing, and had a looked of melancholy wisdom about his furrowed brow.

Somewhere in the house, although I cannot recall where, the skeleton of the beast that hunted the denizens of Gevaudan. I do know for a fact that this grizzly exhibit does exist as it is listed on the manifesto of items in the portion of Stately Homes of England dedicated to the Powers plot. I cannot verify as to the validity of the article but I'd vouch that many a French peasant eats well selling a hundred such cryptozoological items. I shudder to think of the smallfolk who suffered under the beasts reign of terror. The beast was cunning and successfully avoided waves of eager bounty hunters looking to claim the sizeable reward. It would never attack a group as it is in nature. The ewe that strays from the flock makes light work for wolves and worse. Servant girls would be found dismembered and grossly mutilated only moments after leaving the security of the settlement. The flesh was not always consumed either. The beast was not hunting out necessity and instead fulfilling some sick perversion. Poisoned and drunk on the blood humankind. Could the hell hound I am to examine be a relation of this come to England, or worse, brought?

I have heard tales from reputable sources of large cats loose on the moors. Some escaped from circuses and private menageries, others former pets released by their owners after quadrupling in size. Perhaps these amateurs had merely uncovered the remains of an exotic pet. The grounds were no stranger to beasts from the dark continent; crimson parrots in enormous metal cages, striped fish that glowed when the moonlight fell on the pond, peacocks from India striding the grounds magnificently, ducks from Canada. Would it be completely out of question for a jungle cat to have made this castle its home? I think not.

On his extensive travels around China and Africa studying prehistoric art Richard Power collected priceless artworks and looted great tombs of their treasures years before the arrival of most Western antiquarians. His current horde included petroglyphs, gilded sarcophagi and even a mummified cat from a Witch's Bazaar outside Khartoum. If Richard Powers was alive today he would sit coiled atop his twinkling dubloons with plumes of smoke trailing from either nostril, content to wait for judgement day in the cavernous treasury rumoured to exist beneath the house. Now this ‘conspiracy’ is slightly more believable than the tales of vampirism and prostitutes found frozen, their last moments of panic etched on their disgusted countenance, bodies drained entirely of blood. That’s Maine Wood’s Bosch if you ask me, but a treasury filled with Egyptian secrets… That is more intriguing. An underground river flows out beneath the walls of the house into the Mighty Sa-hen-esh river, perpetually vomiting galloping white horses to dash against the rocks. One can easily imagine a boat snaking the bends by night, illuminated by a single lantern, a chest full of smuggled artefacts in tow. Now that I've written this all out, I see that this could also serve a convenient way to covertly bring a big cat into the grounds, all without alerting the law.

The East Wing of the house consisted of one long corridor lined with equally-spaced doors on either side in alternating colours. The pattern was blue left, red right, green left, gold right and so on for several meters. Suits of old plate mail were nailed to plinths in the spaces between each entrance, some with their visors up, revealing the shadowy nothingness within, their arms tight to the torso and bent at the elbow clutching tight on their halberds. Others had their visors down holding their shields near their torso with swords sheathed. Their heraldic crests were emblazoned there in majestic golds and silvers, with gold-leaf tassels dangling from the sides.

According to the rumours all of the suits with closed visors contained embalmed corpses; some of them acting as metalurgic mausoleums for deceased heirs. and others containing corpses looted from the Valley of Kings pre-Napoleonic rediscovery, and the only way to tell heir from ancient was by examining the crests. Some of which were said to be false artworks created specifically to be understood by members of a secret order, like Templars or Rosicrucians, only confined to worship of Ancient Egyptian deities. I don’t know whether any credence should be paid to the rumours but I can say with some authority that Rich Powers did have a penchant for symbolism and numerology. If there ever was some eccentric left in the Arab Sun too long, present company excluded, who would commission these wonderful artworks for such a convoluted purpose, it was him. The late custodian of the Baronage passed some seventy years ago but rumours of his interest in the occult abound still.