#Advantages of Liquid Staking Tokens

Explore tagged Tumblr posts

Text

Liquid Staking for Novices: A 2024 Introductory Guide

Unlock the full potential of your cryptocurrency investments with liquid staking, where liquidity meets profitability.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols. This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols.

This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

The process of liquid staking involves depositing cryptocurrency into a staking contract, which then issues a liquid staking token representing the staked assets. These tokens can be utilized in decentralized exchanges, lending platforms, and yield farming protocols, providing users with the flexibility to optimize their investment strategies. This increased liquidity and flexibility allow users to respond quickly to market changes and new investment opportunities, making liquid staking a valuable tool in the crypto ecosystem.

Despite its benefits, liquid staking presents certain challenges, including the risk of validator penalties and smart contract vulnerabilities. Additionally, the regulatory environment for cryptocurrencies is continuously changing, which may impact staking practices. Nonetheless, liquid staking is poised to play a pivotal role in the future of blockchain finance, enhancing the value of crypto assets through improved accessibility and liquidity. Intelisync offers tailored blockchain solutions, including liquid staking, to help businesses Learn more.....

#Advantages of Liquid Staking Tokens#Can I lose my funds in liquid staking?#Challenges of Liquid Staking#How do I choose a liquid staking platform?#How Does Liquid Staking Work?#How Intelisync will help you to grow in the crypto world Liquid Staking#Understanding Staking and How Does Staking Work?#What cryptocurrencies support liquid staking?#What is Liquid Staking?#What is Restaking#What is the future of liquid staking?#Why Are LSTs Gaining Popularity?#intelisync blockchain development company intelisync bitcoin development services#intelisync web3 marketing services

0 notes

Text

Understanding Liquidity Provision, Farming, and Staking

If you’ve been exploring the crypto world, you’ve probably come across terms like liquidity provision, farming, and staking. They might sound intimidating at first, but they’re actually simpler than they seem. These activities allow you to grow your assets while supporting decentralized finance (DeFi). Let’s break them down in a way that makes sense for everyone, no matter your experience level.

Liquidity Provision: Being the Backbone of DeFi

Imagine a marketplace where traders exchange apples for oranges. For this to work, there must always be enough apples and oranges available. In the world of DeFi, liquidity pools are like these marketplaces. They hold two tokens in equal value (e.g., ETH and USDT), ensuring smooth trades at any time.

When you contribute tokens to a liquidity pool, you’re helping keep that marketplace stocked. In return, you earn a share of the transaction fees every time someone trades using the pool. Platforms like STON.fi make it easy for users to contribute liquidity and earn passive income.

Here’s how it works:

You deposit tokens into the pool.

Traders use those tokens for their exchanges.

You earn a percentage of the trading fees based on how much liquidity you provided.

It’s a straightforward way to make your assets work for you while enabling the broader crypto ecosystem.

Farming: Think of It as a Rewards Program

If liquidity provision is like running a marketplace, farming is like getting bonus rewards for being a loyal vendor. Once you’ve added liquidity to a pool, you receive LP (Liquidity Provider) tokens. These tokens represent your share in the pool.

Here’s where farming comes in:

You "lock" your LP tokens into a farm.

The farm rewards you with additional tokens over time.

Let’s put this in perspective. Imagine a coffee shop offering points for every cup you buy. Over time, those points can be redeemed for free drinks or other perks. Farming operates similarly—your LP tokens earn you extra rewards while you keep the liquidity pool thriving.

Projects often use farming to incentivize liquidity, and platforms like STON.fi offer various farming opportunities to grow your earnings.

Staking: A Commitment with Unique Perks

Staking is about locking up your tokens to gain benefits, but it’s not tied to liquidity pools like farming is. Think of staking as planting a tree in your backyard. You’re not expecting instant fruit, but over time, the rewards become significant.

When you stake tokens on STON.fi, here’s what you get:

ARKENSTON: A unique NFT permanently tied to your wallet. This isn’t just a collectible—it’s your ticket to the STON.fi DAO, a private community where you can have a say in the project’s future.

GEMSTON: A community token with utility decided by the DAO.

Unlike farming, staking focuses on long-term value. You’re not just earning rewards—you’re becoming part of a forward-thinking community that’s shaping DeFi’s future.

Bringing It All Together

These three activities—liquidity provision, farming, and staking—work in harmony to enhance your crypto experience. Here’s how:

1. Provide liquidity to keep decentralized trading alive.

2. Use your LP tokens for farming to earn extra rewards.

3. Stake tokens for long-term benefits and governance rights.

Each step offers unique advantages, and you can choose what fits your goals. Whether you’re looking for short-term rewards or a deeper role in a DeFi project, these tools give you the flexibility to grow.

Why Should You Care

Think of DeFi as an opportunity to build wealth in a decentralized way. You’re not relying on banks or middlemen—your assets are working for you directly. By participating in liquidity provision, farming, or staking, you’re not only earning but also supporting the crypto community.

However, it’s important to stay informed. Prices can fluctuate, and like any investment, these activities come with risks. Start small, learn as you go, and only invest what you’re comfortable with.

Final Thoughts

The world of DeFi might seem complex at first, but it’s all about making your assets work smarter, not harder. Whether you’re adding liquidity, farming for rewards, or staking for long-term benefits, you’re contributing to a financial system that puts power back in your hands.

If you’re curious or have questions, let’s discuss in the comments. I’m here to make your journey in DeFi as smooth and rewarding as possible!

4 notes

·

View notes

Text

Introducing Sonicxswap & Sonicx.fun: First Dex & Launchpad on Sonic Blockchain

The Dawn of a New Era in DeFi

Decentralized Finance (DeFi) has transformed the financial landscape, offering users global access to financial tools without intermediaries. However, challenges like high fees, limited scalability, and lack of innovation continue to plague the ecosystem. Enter Sonicxswap and Sonicx.fun — two revolutionary platforms built on the cutting-edge Sonic blockchain. Together, they aim to redefine the DeFi experience by empowering users, developers, and communities like never before.

In this blog, we’ll explore how these platforms work, their unique features, and why they are set to lead the next wave of blockchain innovation.

What is Sonicxswap?

Sonicxswap is a next-generation decentralized exchange (DEX) built on the Sonic blockchain. Designed to provide lightning-fast transactions, ultra-low fees, and seamless user experience, Sonicxswap offers a comprehensive suite of DeFi tools, including:

Token Swapping: Effortless and secure trading of tokens with minimal fees.

Yield Farming: Earn rewards by providing liquidity to the platform.

Staking Pools: Lock your tokens to earn high annual percentage returns (APRs) while supporting network security.

Launchpad Integration: A direct connection to Sonicx.fun for early access to high-potential projects.

Why Sonicxswap Stands Out

Deflationary Tokenomics: Sonicxswap uses 80% of all fees collected to buy back and burn its native token, $SX, creating a constant upward pressure on its value.

User-Focused Features: From prediction markets to limit orders, Sonicxswap is designed with users in mind.

Cross-Chain Compatibility: Future expansions include bridging to Ethereum and Solana, making Sonicxswap a truly versatile platform.

Sonicx.fun: The Launchpad for Innovation

Every groundbreaking project needs a launchpad, and Sonicx.fun serves exactly that purpose. This decentralized platform is built for developers looking to launch their tokens with ease and transparency.

Key Features of Sonicx.fun

Token Creation Made Simple: Developers can launch tokens in minutes with low fees.

Liquidity Solutions: Automatic liquidity addition ensures a strong market foundation.

Deflationary Mechanisms: Fees collected are used to buy back and burn $SX, reducing the overall supply.

For investors, Sonicx.fun offers early access to promising projects, ensuring they are always ahead of the curve.

Why Sonic Blockchain?

Both Sonicxswap and Sonicx.fun are powered by the Sonic blockchain, a high-performance network designed to solve the key limitations of existing blockchains. Here’s why Sonic is the perfect foundation:

Scalability: Process thousands of transactions per second without network congestion.

Low Transaction Fees: Affordable fees make DeFi accessible to everyone.

Developer Incentives: Attractive rewards encourage developers to build on the Sonic ecosystem.

With the mainnet launch scheduled for December 2024, early adopters of Sonic-based platforms are positioned to gain significant advantages.

Tokenomics: $SX, The Backbone of Sonicxswap

The native token $SX powers both Sonicxswap and Sonicx.fun, enabling governance, rewards, and ecosystem participation. Here’s the breakdown of its allocation:

Presale (4%): Early investors can purchase $SX at a discounted rate.

Farm & Staking (45%): Rewards to incentivize user participation.

Liquidity (12%): Ensures stability and seamless trading.

Team (8%): Reserved for development and operations.

Exchange Listings (5%): Liquidity for centralized exchanges.

Audit & Marketing (6%): Builds trust and promotes adoption.

Airdrop & Bounty Program (5%): Rewards for community engagement.

Partner Funding (6%): Supports ecosystem partnerships.

Future Development (9%): Funds long-term platform upgrades.

This balanced allocation ensures sustainability and growth while prioritizing community rewards and long-term value creation.

Why Sonicxswap & Sonicx.fun Are Poised for Success

Both platforms have a robust roadmap and a vision that aligns with the future of blockchain. Here’s why they are destined to thrive:

Innovative Ecosystem: Combining a DEX and launchpad creates a seamless user experience.

Deflationary Model: Constant buybacks and burns of $SX ensure scarcity and value appreciation.

Community-Driven Governance: Token holders play a pivotal role in decision-making.

First-Mover Advantage: As one of the first projects on the Sonic blockchain, SonicxSwap is well-positioned to dominate.

Comprehensive Roadmap: From high-APR pools to cross-chain bridges, the platforms have ambitious plans for growth.

What’s Next for Sonicxswap and Sonicx.fun?

The journey is just beginning, and there’s much to look forward to. Here’s what’s on the horizon:

$SX Token Presale: A chance for early investors to secure tokens at discounted rates.

Mainnet Launch: Both platforms will go live when the Sonic blockchain launches in December 2024.

Airdrops & Partnerships: Rewarding the community and forming strategic collaborations.

Expansions: Bridging to Ethereum and Solana, and introducing prediction markets and perpetual trading.

Join Us on This Revolutionary Journey

Sonicxswap and Sonicx.fun are more than just platforms; they are a movement toward a decentralized, community-driven financial future. Whether you’re an investor, developer, or DeFi enthusiast, now is the time to get involved.

Get Started Today

Visit our websites: Sonicxswap and Sonicx.fun.

Follow us on social media for updates.

Linktree : https://linktr.ee/sonicxswap

Participate in the $SX presale to become a part of this transformative journey.

The future is Sonic. The future is decentralized. Join us today.

2 notes

·

View notes

Text

Introducing Sonicxswap & Sonicx.fun: First Dex & Launchpad on Sonic Blockchain

SonicxSwap

Follow on X https://x.com/SonicXswap

Join Telegram https://t.me/SonicxSwap

The Dawn of a New Era in DeFi

Decentralized Finance (DeFi) has transformed the financial landscape, offering users global access to financial tools without intermediaries. However, challenges like high fees, limited scalability, and lack of innovation continue to plague the ecosystem. Enter Sonicxswap and Sonicx.fun — two revolutionary platforms built on the cutting-edge Sonic blockchain. Together, they aim to redefine the DeFi experience by empowering users, developers, and communities like never before.

In this blog, we’ll explore how these platforms work, their unique features, and why they are set to lead the next wave of blockchain innovation.

What is Sonicxswap?

Sonicxswap is a next-generation decentralized exchange (DEX) built on the Sonic blockchain. Designed to provide lightning-fast transactions, ultra-low fees, and seamless user experience, Sonicxswap offers a comprehensive suite of DeFi tools, including:

Token Swapping: Effortless and secure trading of tokens with minimal fees.

Yield Farming: Earn rewards by providing liquidity to the platform.

Staking Pools: Lock your tokens to earn high annual percentage returns (APRs) while supporting network security.

Launchpad Integration: A direct connection to Sonicx.fun for early access to high-potential projects.

Why Sonicxswap Stands Out

Deflationary Tokenomics: Sonicxswap uses 80% of all fees collected to buy back and burn its native token, $SX, creating a constant upward pressure on its value.

User-Focused Features: From prediction markets to limit orders, Sonicxswap is designed with users in mind.

Cross-Chain Compatibility: Future expansions include bridging to Ethereum and Solana, making Sonicxswap a truly versatile platform.

Sonicx.fun: The Launchpad for Innovation

Every groundbreaking project needs a launchpad, and Sonicx.fun serves exactly that purpose. This decentralized platform is built for developers looking to launch their tokens with ease and transparency.

Key Features of Sonicx.fun

Token Creation Made Simple: Developers can launch tokens in minutes with low fees.

Liquidity Solutions: Automatic liquidity addition ensures a strong market foundation.

Deflationary Mechanisms: Fees collected are used to buy back and burn $SX, reducing the overall supply.

For investors, Sonicx.fun offers early access to promising projects, ensuring they are always ahead of the curve.

Why Sonic Blockchain?

Both Sonicxswap and Sonicx.fun are powered by the Sonic blockchain, a high-performance network designed to solve the key limitations of existing blockchains. Here’s why Sonic is the perfect foundation:

Scalability: Process thousands of transactions per second without network congestion.

Low Transaction Fees: Affordable fees make DeFi accessible to everyone.

Developer Incentives: Attractive rewards encourage developers to build on the Sonic ecosystem.

With the mainnet launch scheduled for December 2024, early adopters of Sonic-based platforms are positioned to gain significant advantages.

Tokenomics: $SX, The Backbone of Sonicxswap

The native token $SX powers both Sonicxswap and Sonicx.fun, enabling governance, rewards, and ecosystem participation. Here’s the breakdown of its allocation:

Presale (4%): Early investors can purchase $SX at a discounted rate.

Farm & Staking (45%): Rewards to incentivize user participation.

Liquidity (12%): Ensures stability and seamless trading.

Team (8%): Reserved for development and operations.

Exchange Listings (5%): Liquidity for centralized exchanges.

Audit & Marketing (6%): Builds trust and promotes adoption.

Airdrop & Bounty Program (5%): Rewards for community engagement.

Partner Funding (6%): Supports ecosystem partnerships.

Future Development (9%): Funds long-term platform upgrades.

This balanced allocation ensures sustainability and growth while prioritizing community rewards and long-term value creation.

Why Sonicxswap & Sonicx.fun Are Poised for Success

Both platforms have a robust roadmap and a vision that aligns with the future of blockchain. Here’s why they are destined to thrive:

Innovative Ecosystem: Combining a DEX and launchpad creates a seamless user experience.

Deflationary Model: Constant buybacks and burns of $SX ensure scarcity and value appreciation.

Community-Driven Governance: Token holders play a pivotal role in decision-making.

First-Mover Advantage: As one of the first projects on the Sonic blockchain, SonicxSwap is well-positioned to dominate.

Comprehensive Roadmap: From high-APR pools to cross-chain bridges, the platforms have ambitious plans for growth.

What’s Next for Sonicxswap and Sonicx.fun?

The journey is just beginning, and there’s much to look forward to. Here’s what’s on the horizon:

$SX Token Presale: A chance for early investors to secure tokens at discounted rates.

Mainnet Launch: Both platforms will go live when the Sonic blockchain launches in December 2024.

Airdrops & Partnerships: Rewarding the community and forming strategic collaborations.

Expansions: Bridging to Ethereum and Solana, and introducing prediction markets and perpetual trading.

Join Us on This Revolutionary Journey

Sonicxswap and Sonicx.fun are more than just platforms; they are a movement toward a decentralized, community-driven financial future. Whether you’re an investor, developer, or DeFi enthusiast, now is the time to get involved.

Get Started Today

Visit our websites: Sonicxswap and Sonicx.fun.

Follow us on social media for updates.

Linktree : https://linktr.ee/sonicxswap

Participate in the $SX presale to become a part of this transformative journey.

The future is Sonic. The future is decentralized. Join us today.

2 notes

·

View notes

Text

SOURCE PROTOCOL

SOURCE is building limitless enterprise applications on a secure and sustainable global network. Defi white-labelled services, NFT markets, RWA tokenization, play-to-earn gaming, Internet of Things, data management and more. SOURCE is providing blockchain solutions to the real world and leveraging the power of interoperability.

SOURCE competitive advantages over other blockchain projects

For builders & developers — Source Chain’s extremely high speeds (2500–10000+ tx / per second), low cost / gas fees ($0.01 average per tx), and scalability (developers can deploy apps in multiple coding languages using CosmWasm smart contract framework), set it apart as a blockchain built to handle mass adopted applications and tools. Not to mention, it’s interoperable with the entire Cosmos ecosystem.

For users — Source Protocol’s DeFi suite is Solvent and Sustainable (Automated liquidity mechanisms create a continuously self-funded, solvent and liquid network), Reduces Complexity (we’re making Web 3.0 easy to use with tools like Source Token which automate DeFi market rewards), and we’ve implemented Enhanced Security and Governance systems (like Guardian Nodes), which help us track malicious attacks and proposals to create a safer user environment.

For Enterprises — Source Protocol is one of the first to introduce DeFi-as-a-Service (DaaS) in order for existing online banking and fintech solutions to adopt blockchain technology with ease, and source also provides Enterprise Programs which are complete with a partner network of OTC brokerages, crypto exchanges, and neobanks that create a seamless corporate DeFi experience (fiat onboarding, offboarding, and mutli-sig managed wallets)

Why Source Protocol

Firstly, many protocols are reliant on centralized exchanges for liquidity, limiting their ability to scale independently. This creates a lot of the same issues traditional finance has been plagued with for decades.

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

Source Protocol’s ecosystem

Source Protocol’s ecosystem includes a full DeFi Suite, a members rewards program and white-label integration capabilities with existing online Web 2.0 enterprises:

Source Swap — An Interchain DEX & AMM built on Source Chain for permission-less listing of $SOURCE-based tokens, native Cosmos SDK assets, cw-20’s, and wrapped Binance Smart Chain (BEP-20) assets.

Source One Market — A peer to peer, non-custodial DeFi marketplace for borrowing, lending, staking, and more. Built on Binance Smart Chain with bridging to Source Chain & native Cosmos SDK assets.

Source Token $SRCX (BEP-20) — the first automated liquidity acquisition and DeFi market participation token built on Binance Smart Chain.

Source One Token $SRC1 (BEP-20) — a governance and incentivized earnings token that powers Source One Market.

Source USX $USX (BEP-20) — Source One Market stablecoin backed and over collateralized by a hierarchy of blue chip crypto assets and stablecoins.

Source Launch Pad — Empowering projects to seamlessly distribute tokens and raise liquidity. ERC-20 and BEP-20 capable.

Source One Card & Members Rewards Program — users can earn from a robust suite of perks and rewards. In the future, Source One Card will enable users to swipe with their crypto assets online and at retail locations in real time.

DeFi-as-a-Service (DaaS) — Seamless white-label integration of Source One Market, Source Swap, Source Launch Pad, and/or Source One Card with existing online banking and financial applications, allowing businesses to bring their customers DeFi capabilities.

Source Protocol Key Components

Sustainable Growth model built for enterprise involvement and mass application adoption

Guardian Validator Nodes for enhanced network security

Integration with Source Protocol’s Binance Smart Chain Ecosystem and Decentralized Money Market, Source One Market

Source-Drop (Fair community airdrop and asset distribution for ATOM stakers and SRCX holders)

Interoperable smart contracts (IBC)

High speed transaction finality

Affordable gas fees (average of $0.01 per transaction)

Highly scalable infrastructure

Open-source

Permission-less Modular Wasm + (EVM)

Secured on-chain governance

Ease of use for developers

conclusion

SOURCE is a comprehensive blockchain technology suite for individuals, enterprises and developers to easily use, integrate and build web3.0 applications. It is a broad-spectrum technology ecosystem that transforms centralized web tools and financial instruments into decentralized ones. Powering the future of web3,

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

For More Information about Source Protocol

Website: https://www.sourceprotocol.io

Documents: https://docs.sourceprotocol.io

Twitter: https://www.twitter.com/sourceprotocol_

Instagram: https://www.instagram.com/sourceprotocol

Telegram: https://t.me/sourceprotocol

Discord: https://discord.gg/zj8xxUCeZQ

Author

Forum Username: Java22

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443255

SOURCE Wallet Address: source1svnzfy5fafuskeaxmf2sgvgcn6k3sggmssl8d7

2 notes

·

View notes

Text

Solana’s Surge: Navigating the Path to Profit Amidst Volatility

Solana, the high-performance blockchain platform known for its fast transaction speeds and low fees, has experienced a remarkable surge in recent months, capturing the attention of investors and traders alike. However, amidst the excitement surrounding Solana's meteoric rise, navigating the path to profit requires careful consideration of the opportunities and challenges presented by volatility in the cryptocurrency market.

Solana's surge in popularity can be attributed to several key factors. Its robust infrastructure, capable of processing thousands of transactions per second, has positioned Solana as a promising platform for decentralized applications (dApps) and decentralized finance (DeFi) projects seeking scalability and efficiency. Moreover, Solana's vibrant ecosystem, supported by a growing community of developers and users, has fueled innovation and adoption across various sectors.

The surge in Solana's price has created significant opportunities for investors seeking to capitalize on its growth potential. However, it has also introduced heightened volatility, with sharp price fluctuations occurring within short time frames. Navigating this volatility requires a strategic approach and a thorough understanding of Solana's fundamentals and market dynamics.

One strategy for profiting from Solana's surge is to adopt a long-term investment mindset. Despite short-term price fluctuations, Solana's strong fundamentals and growing ecosystem suggest that it has the potential for sustained growth over the long term. By accumulating Solana tokens and holding them through market cycles, investors can position themselves to benefit from the platform's continued expansion and adoption.

Another approach is to actively trade Solana in response to short-term price movements. This strategy requires a deep understanding of technical analysis, market sentiment, and trading psychology. Traders can capitalize on Solana's volatility by buying low and selling high, taking advantage of price swings to generate profits through strategic trading strategies.

Additionally, investors can explore yield-generating opportunities within the Solana ecosystem. With the rise of DeFi protocols built on Solana, such as decentralized exchanges (DEXs), lending platforms, and liquidity pools, investors can earn passive income by providing liquidity, staking their Solana tokens, or participating in yield farming strategies. These opportunities offer an alternative way to profit from Solana's growth while mitigating some of the risks associated with direct token investment.

However, it is essential to approach investing and trading in Solana with caution, as volatility can lead to substantial gains or losses. Risk management strategies, such as setting stop-loss orders, diversifying portfolios, and conducting thorough research, are crucial for navigating the inherent uncertainties of the cryptocurrency market.

Furthermore, investors should stay informed about developments within the Solana ecosystem, including protocol upgrades, partnerships, and regulatory developments, as these factors can influence Solana's price dynamics and market sentiment.

In conclusion, Solana's surge presents exciting opportunities for investors seeking to profit from the platform's growth and innovation. However, navigating the path to profit amidst volatility requires careful consideration of investment strategies, risk management techniques, and market dynamics. By adopting a strategic approach and staying informed, investors can position themselves to capitalize on Solana's potential while managing the inherent risks of the cryptocurrency market.

2 notes

·

View notes

Text

Spookyswap is a decentralized exchange built on the Fantom blockchain that offers a wide range of trading opportunities for users. Understanding the different strategies for trading on Spookyswap can help you maximize your profits and minimize risks.

One popular strategy on Spookyswap is liquidity farming. By providing liquidity to the trading pairs on Spookyswap, users can earn rewards in the form of the native token, BOO. Liquidity farming involves depositing assets into liquidity pools, which are then used for trading on the platform. The more liquidity you provide, the higher your potential rewards. However, it's important to consider the risks associated with impermanent loss when participating in liquidity farming.

Another strategy is arbitrage trading, which involves taking advantage of price differences between different exchanges. Since Spookyswap is connected to other decentralized exchanges through cross-chain bridges, there can sometimes be price discrepancies between different platforms. By buying assets on one exchange and selling them on another at a higher price, traders can profit from these price differences.

Swapping tokens is another fundamental trading strategy on Spookyswap. The platform supports a wide range of tokens, including stablecoins, governance tokens, and tokens from different blockchain networks. By swapping tokens on Spookyswap, traders can take advantage of market movements and access different assets efficiently.

Lastly, yield farming is another strategy that allows users to earn additional rewards by staking their tokens in specific pools. By providing liquidity or staking their tokens, users can earn additional rewards in the form of BOO tokens. Yield farming can be a profitable strategy, but it's important to carefully consider the risks and rewards o

2 notes

·

View notes

Text

NFT Analytics 2.0: The Tools, Metrics, and Techniques Shaping Tomorrow’s Market

In the ever-evolving world of Non-Fungible Tokens (NFTs), a new chapter of analytics, often called “NFT Analytics 2.0,” is emerging. From simple dashboards that track sales volume to sophisticated platforms leveraging artificial intelligence (AI) and machine learning (ML), the analytics surrounding NFTs are becoming more advanced and critical for both seasoned investors and curious newcomers. Whether your goal is to discover undervalued digital art, gauge community sentiment, or identify the next big NFT trend, understanding how data and analytics fit into this rapidly changing landscape is crucial.

In this in-depth blog, we’ll explore the latest news, research, and trends in NFT analytics, providing an educational, informational perspective on how these tools, metrics, and techniques are shaping tomorrow’s market. We’ll delve into key NFT metrics, advanced analytic tools, on-chain and off-chain data, AI-driven insights, and best practices for navigating the next generation of NFT analytics.

1. The Rise of NFT Analytics 2.0

From Simple Dashboards to Advanced Analytics

When NFTs first made waves around 2020–2021, analytics platforms were relatively simple. They provided basic metrics—sales volumes, floor prices, and recent transactions—that helped early collectors and traders gauge market sentiment. However, over the past few years, NFT analytics have transformed into multi-dimensional ecosystems, leveraging large datasets, real-time wallet tracking, and advanced computational models to forecast trends.

Latest News and Trends

Growing Institutional Interest: According to a late 2024 report by DappRadar, institutional investors and major brands (such as Nike, Disney, and Starbucks) have begun integrating NFTs into loyalty programs and collectibles. This has spurred the need for deeper data insights—NFT Analytics 2.0—to track consumer behavior and forecast project viability.

Evolution of Utility NFTs: As more projects emphasize utility—such as staking, revenue sharing, or metaverse integrations—the complexity of analyzing such NFTs has grown. Metrics now must incorporate game mechanics, governance participation, and usage statistics.

Layer-2 and Multi-Chain Expansion: NFTs are no longer confined to Ethereum; they now thrive on chains like Polygon, Solana, Tezos, and BNB Chain. This multi-chain expansion has necessitated cross-chain analytics solutions capable of aggregating and interpreting data from multiple sources.

Why It Matters

NFT Analytics 2.0 is more than just a buzzword; it represents a paradigm shift in how data is gathered, interpreted, and acted upon in the NFT space. With the rise of multi-chain ecosystems, complex utility tokens, and sophisticated AI-driven analysis, the next generation of NFT analytics will dictate how quickly and effectively market participants can identify the “next big thing.”

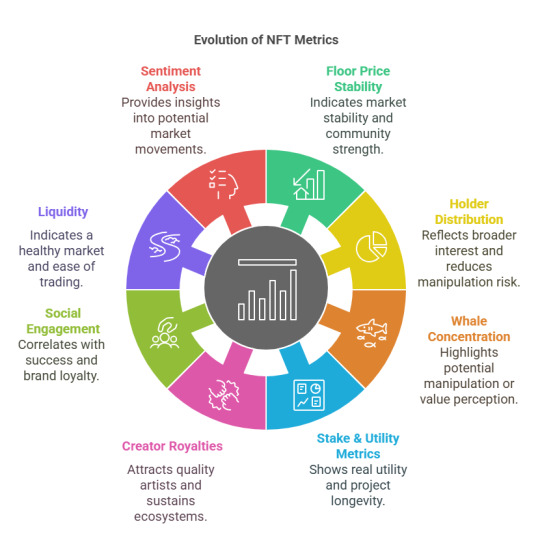

2. Key Metrics Defining the Future of NFT Analysis

The metrics that once dominated NFT data—floor price, volume, market capitalization—still matter. However, NFT Analytics 2.0 goes deeper. Below is a table outlining key metrics that define the new generation of NFT analysis and why they matter.

The Shift to Utility and Engagement

Modern NFTs are more than static collectibles. They can be gamified, integrated into DeFi protocols, or serve governance roles in decentralized autonomous organizations (DAOs). Thus, metrics such as staking rates, in-game utility, and community-driven governance participation are increasingly vital.

3. On-Chain vs. Off-Chain Data: Why Both Matter

On-Chain Data

On-chain data refers to all the information on the blockchain—transaction histories, wallet addresses, mint dates, contract interactions, etc. On-chain data is immutable, transparent, and often available in real-time. Analysts can leverage on-chain data to track who buys or sells, the timing of transactions, and overall liquidity.

Advantages: Transparency, immutability, real-time updates

Limitations: Requires specialized tools to parse blockchain records; raw data can be overwhelming

Off-Chain Data

Off-chain data includes social media chatter (Twitter, Reddit, Telegram, Discord), Google search trends, news articles, and any external factor influencing the NFT’s perceived value.

Advantages: Captures user sentiment, community engagement, market hype, and brand collaborations

Limitations: Data can be manipulated by bot activity or paid promotions; requires robust sentiment analysis to glean meaningful insights

Bridging the Gap

In NFT Analytics 2.0, the best tools seamlessly integrate on-chain and off-chain data for a holistic market view. For instance, a spike in on-chain trading volume combined with a surge in positive social media sentiment can be an early indicator of an NFT collection about to trend upwards. Conversely, if trading volume is stagnating but social engagement is skyrocketing, it might mean hype is primarily speculative and not necessarily backed by genuine investor interest.

4. AI and Machine Learning in NFT Analysis

Why AI Matters in NFT Analytics 2.0

Manual data analysis becomes increasingly unsustainable as the complex NFT market grows—spanning multiple chains, social platforms, and cultural niches. This is where AI and ML come in, automating the sifting, sorting, and interpreting of vast data sets. AI tools can detect emerging trends and flag suspicious activity by identifying patterns, correlations, and outliers more quickly than humans.

Use Cases

Price Prediction Models: AI can forecast short-term price fluctuations and longer-term valuation trends by leveraging historical data.

Sentiment Analysis: Natural Language Processing (NLP) algorithms can rapidly process tweets, Discord messages, and Reddit posts to gauge public sentiment at scale.

Fraud Detection: Machine-learning anomaly detection makes spotting wash trading, bot activity, and other manipulative behaviors much more manageable.

Personalized Recommendations: Like streaming services suggest shows based on your history, some NFT analytics platforms can recommend collections that align with your trading or collecting style.

Ongoing Research

Recent academic papers and industry reports (including some from the Crypto Valley Association in early 2025) highlight how machine learning can dramatically reduce the time between identifying and capitalizing on new NFT trends. Neural network models—trained on past bull and bear markets—promise to predict which newly minted NFTs will likely experience sustained growth.

5. Integrating Social Media and Community Insights

The Power of Community in NFTs

Unlike traditional stocks or commodities, NFTs thrive on community engagement. Whether it’s a PFP (Profile Picture) collection or a metaverse gaming asset, the project’s success often hinges on the enthusiasm of its holders and fans. Therefore, measuring social metrics is a crucial aspect of NFT Analytics 2.0.

Advanced Methods of Community Analysis

Discord and Telegram Bot Analysis: Advanced bots now scrape thousands of channels to identify real conversation depth versus automated spam, helping to filter out synthetic hype.

Twitter Topic Clustering: Using AI to group tweets by topic, sentiment, or influencer. This helps identify micro-communities and sub-trends within the larger NFT ecosystem.

Influencer Mapping: Platforms that can show you the key influencers in a particular project and how their endorsement affects price and volume.

Incorporating Human Touch

While AI-driven sentiment analysis is robust, combining it with human interpretation remains vital. A sudden spike in negative sentiment might be triggered by legitimate issues (e.g., a hack, rug pull, or leadership scandal) or a competitor’s smear campaign. Human analysts, or at least well-designed double-check protocols, are crucial for validating machine-generated insights.

6. Practical Use Cases: Real-World Scenarios

Use Case 1: Identifying an Early Gem

On-Chain Indicators: A small but steadily increasing number of unique holders and stable floor price growth.

Social Sentiment: Positive Twitter chatter from niche communities; no evidence of bots amplifying.

Development Roadmap: Clear timeline for game integration, staking, or other added utility.

By combining these factors, an investor might spot a still-undervalued collection before a price surge.

Use Case 2: Avoiding a Rug Pull

On-Chain Red Flags: Disproportionate token holdings by a small number of wallets.

Off-Chain Red Flags: Discord growth is suspiciously significant quickly, with repeated spam messages or automated tweets lacking genuine engagement.

Team Transparency: Lack of clear documentation about the founding team or roadmap.

A robust NFT Analytics 2.0 platform with whale monitoring and advanced sentiment analysis could warn users of potential risks.

Use Case 3: Monitoring a High-Profile Brand Entry

Cross-Chain Volume: Tracking adoption on multiple blockchains if the brand launches on various networks (e.g., Ethereum, Polygon).

Social Media Impact: Analyzing how brand collaborations or celebrity endorsements correlate with immediate and long-term price fluctuations.

Utility and Merch: Many brands tie NFTs to physical merchandise or real-world events. Analytics must track redemption rates, community satisfaction, and secondary market prices.

7. Challenges and Considerations for NFT Analytics 2.0

Data Overload

As analytics become more complex, information overload is a genuine concern. Not all metrics are created equal, and too much data can lead to analysis paralysis.

Quality Control

Wash Trading: Some marketplaces have seen “wash trading,” in which participants trade NFTs among themselves to artificially inflate prices or volume.

Bots: Automated bots can generate misleading social media engagement, complicating sentiment analysis.

Regulatory Uncertainty

The regulatory landscape for NFTs continues to evolve, whether in the U.S., Europe, or Asia. Platforms must adapt to ensure compliance and secure user data. For example, royalty enforcement controversies in late 2024 forced specific marketplaces to overhaul their fee structures, impacting data on creator earnings.

Technological Complexities

Multi-Chain Interoperability: Tools must integrate with multiple blockchains, each with unique standards, leading to inconsistent data formats.

Security Vulnerabilities: Smart contract exploits can compromise data integrity and trust in analytics platforms, especially if the exploit leads to false transaction reporting or manipulative data logs.

8. Future Outlook: From Data to DAO Governance

Data-Driven DAOs

DAOs are expected to become more data-driven in the coming years. Some communities already use voting mechanisms tied to NFT holdings. The next generation might tie voting power not just to ownership but to active contributions and analytics-driven insights—for instance, awarding greater governance weight to those who stake their NFTs or participate in project development.

Metaverse Integration

The rise of the metaverse, where NFT assets such as virtual land, avatars, and wearables play significant roles, will demand real-time analytics on usage, foot traffic, and user engagement. Property value in a virtual world will hinge on metrics like daily visitors, event frequency, and brand sponsorships.

AI-Enhanced Marketplaces

Future NFT marketplaces could become intelligent platforms that provide recommended purchases, real-time risk assessments, and even automated negotiation or auctioning based on user-defined parameters. As the marketplace and analytics platforms converge to more comprehensively serve user needs, the line between them may blur.

Education and Accessibility

As more mainstream users enter the NFT space—through collaborations with major sports leagues, fashion brands, and entertainment companies—user-friendly analytics will be paramount. Expect simplified dashboards, in-app analytics tutorials, and natural language queries (e.g., “Show me NFTs with rising floor prices in the last 24 hours, with at least 1,000 holders”) to become commonplace.

9. Conclusion

NFT Analytics 2.0 represents a significant leap forward in understanding and navigating the digital collectible and asset space. Gone are the days when a simple view of floor prices and trading volumes sufficed. Today’s—and tomorrow’s—NFT enthusiasts, investors, and creators need a multidimensional approach that seamlessly weaves on-chain and off-chain data, employs AI-driven insights, measures community engagement, and keeps pace with multi-chain ecosystems.

Key Takeaways:

Holistic View: Metrics such as whale concentration, social sentiment, staking utility, and cross-chain volume provide a more holistic view than traditional volume and floor price metrics alone.

AI Integration: Machine learning algorithms can sift through vast data sets, offering predictive analytics, fraud detection, and personalized recommendations.

Community-Driven Success: The success of any NFT project hinges on its community. Tools that accurately gauge sentiment and engagement are vital for spotting sustainable opportunities.

Complex Regulation & Data Integrity: Wash trading, bots, and uncertain regulations pose significant challenges. Constantly scrutinize the quality and sources of your data.

Looking Ahead: The evolution of data-driven governance in DAOs, metaverse integration, and AI-powered marketplaces suggests that NFT Analytics 2.0 is only the beginning.

As the industry matures, analytics will play a central role in bridging the gap between speculation and value creation, between short-lived hype and enduring utility. Whether you’re an artist, investor, developer, or simply a curious observer, staying informed about the tools, metrics, and techniques driving NFT analytics forward will be indispensable. In a rapidly transforming ecosystem, knowledge is power—and in the NFT world, data-driven knowledge might be the ultimate superpower.

Disclaimer: This blog is for informational purposes only and does not constitute financial or investment advice. Always do your own research and consult professionals before making any significant financial decisions.

1 note

·

View note

Text

How Web3 Gaming is Transforming Monetization and Creating New Revenue Opportunities

Introduction

The gaming industry has undergone a massive transformation over the years, and Web3 technology is at the forefront of this evolution. Traditional gaming monetization relied on one-time purchases, in-game ads, or subscription models. However, Web3 gaming is revolutionizing monetization strategies by integrating blockchain, NFTs, and decentralized economies, paving the way for new revenue opportunities.

In this blog, we explore how Web3 gaming is reshaping the industry and why businesses should collaborate with a Web3 game development company to capitalize on these advancements.

The Shift from Traditional Monetization to Web3 Models

The traditional gaming industry has relied on centralized servers, where game developers and publishers control assets, transactions, and monetization strategies. This model often limits players’ ownership and revenue-generating potential. Web3 gaming introduces blockchain-based ownership models, allowing players to truly own in-game assets, trade them freely, and even earn passive income.

Some of the most effective Web3 monetization strategies include:

✅ Play-to-Earn (P2E) Mechanics: Players can earn digital assets, cryptocurrencies, or NFTs by participating in games and completing challenges. ✅ NFT-Based Economies: Unique digital assets, such as weapons, skins, and virtual land, can be minted as NFTs and traded in secondary marketplaces. ✅ Decentralized Autonomous Organizations (DAOs): Players can participate in decision-making processes and receive incentives for governance contributions. ✅ Staking and Yield Farming: Games allow players to stake in-game tokens and earn rewards over time.

To fully leverage these opportunities, businesses need the expertise of a Web3 game development company in the USA to build secure, scalable, and engaging Web3 gaming experiences.

New Revenue Streams in Web3 Gaming

Web3 gaming opens up multiple revenue streams that benefit both developers and players. Here are some key ways in which Web3 is reshaping revenue generation:

🔹 Tokenized In-Game Assets: Unlike traditional games where assets are restricted to one ecosystem, Web3 games enable cross-platform asset trading. 🔹 GameFi and DeFi Integration: Web3 games are merging with decentralized finance (DeFi) to offer staking, lending, and liquidity pools. 🔹 Virtual Real Estate: Developers and players can monetize virtual land through renting, selling, and advertising. 🔹 Metaverse Economy: The rise of the metaverse is driving new monetization strategies, including digital merchandise and branded experiences.

With the right approach, businesses can take advantage of these opportunities by working with an experienced Web3 game development company to create successful blockchain-based games.

The Future of Web3 Gaming and Its Impact on the Industry

As blockchain technology continues to evolve, the Web3 gaming landscape will expand even further. Emerging trends such as AI-powered NFTs, multi-chain interoperability, and advanced smart contracts will enhance gaming experiences and create even more innovative revenue models. The demand for decentralized and player-centric games is growing, making it imperative for businesses to invest in Web3 gaming solutions.

To stay ahead of the competition, businesses should consider partnering with a Web3 game development company in USA to build state-of-the-art Web3 gaming ecosystems. By embracing blockchain technology, they can unlock limitless revenue potential and redefine gaming experiences.

Conclusion

Web3 gaming is more than just a trend—it’s a paradigm shift in how games are developed, played, and monetized. With the integration of blockchain, NFTs, and decentralized finance, developers and players can explore new economic opportunities that were previously impossible in traditional gaming.

Whether you’re an investor, developer, or entrepreneur, now is the time to collaborate with a Web3 game development company to capitalize on this booming industry.

0 notes

Text

*Vyxia Token (VYXT) : The Future of Crypto Investment Poised for a Massive Surge*

Vyxia Token (VYXT) is a cryptocurrency designed to support the global blockchain ecosystem. With cutting-edge technology and the BEP-20 standard on Binance Smart Chain (BSC), Vyxia Token offers fast, secure, and highly efficient transactions. Its goal is to provide a universal payment solution accessible to anyone worldwide.

*Key Advantages of Vyxia Token*

1. *Fast Transactions & Low Fees*

Vyxia Token transactions are completed within seconds and incur significantly lower fees than traditional methods or other cryptocurrencies.

2. *Lucrative Staking & Farming Opportunities*

Users can stake their tokens to earn attractive rewards or participate in liquidity pool farming, increasing their earning potential.

3. *High-Level Blockchain Security*

Every transaction using Vyxia Token is protected by the latest blockchain encryption, making it a secure choice for global users.

4. *Airdrop & Incentive Programs*

Vyxia Token frequently conducts airdrop campaigns to boost user adoption and strengthen its global community.

5. *Integrated with the TON Network & Telegram Wallet*

Vyxia Token is now integrated with the TON network, allowing users to access and utilize it directly through their Telegram wallets. This integration enhances Vyxia Token's adoption by leveraging the growing TON ecosystem.

*Vyxia Token's Vision*

Vyxia Token aspires to be the leading solution in the digital payments space. By harnessing blockchain technology, Vyxia Token aims to create an inclusive, efficient, and decentralized ecosystem, enabling individuals and businesses to transact without geographical barriers.

*How to Get Started with Vyxia Token?*

1. *Register on an Official Platform* – Create an account on a reputable crypto platform that supports Vyxia Token.

2. *Purchase Vyxia Token* – Use fiat currency or other cryptocurrencies to buy VYXT.

3. *Start Transacting* – Use Vyxia Token for staking, farming, or trading on supported platforms.

*Why Choose Vyxia Token?*

With its advanced technology, low costs, and strong growth potential, Vyxia Token is an ideal choice for those looking to invest in cryptocurrency with long-term prospects. Its integrated ecosystem ensures that Vyxia Token is not just a payment tool but also a gateway to various modern blockchain applications.

Join the digital revolution and be part of the future of crypto with Vyxia Token. For more information, visit the official website at [vyxia.world](https://vyxia.world/).

#cryptocurrency#vyxia#blockchain#crypto#vyxiatokens#cryptotrading#altcoin#crypto token#ethereum#token#Vyxia Tokens

0 notes

Text

Exploring Real Estate Tokenization

The real estate industry benefits from blockchain technology through tokenization, which alters property ownership dynamics and operational management. Real estate tokenization enables property ownership conversion into digital tokens, creating fresh solutions for real estate market investment and liquidity.

Defining Real Estate Tokenization: How It Works

Users use blockchain networks to create digital tokens to tokenize property assets and their related income streams. Real estate tokens can be fungible representations of ownership shares or represent distinct non-fungible assets. The process typically includes:

Property Assessment determines the property worth and sets up the tokenization structure.

Real Estate Tokenization requires regulatory compliance checks and protection measures to define how token holders can exercise their rights.

Smart contracts let users create automated agreements that deploy Brno Token functionality through self-executing code.

The system generates digital tokens to represent the ownership stakes of properties in the program.

The digital platform serves as a platform for investors to acquire and trade the tokens through Platform Integration.

Real estate tokenization simplifies investments while eliminating intermediaries and operators and welcomes more participants into the investment pool.

Real-World Examples of Tokenized Real Estate

Real estate tokenization has been successful through various completed projects.

St. Regis Aspen Resort raised $18 million by selling ownership tokens, which represented fractional stakes in the Colorado resort property.

The Colombian property firm LaProp utilized Chainlink Automation to assist in automated rental disbursements to real estate token proprietors through fractionalized property ownership.

Through Lofty, users can acquire tokens showing fractional ownership positions in rental homes as they seek access to information to information on ownership opportunities from smaller capital investments.

Major Advantages of Real Estate Tokenization

When real estate goes through tokenization processes, it brings the following essential advantages:

Real estate traditionally demonstrates low liquidity because purchasing or selling real estate properties requires extensive time and substantial financial resources.

Fractional ownership lets people participate in high-value properties through partial property ownership, thus expanding real estate investment opportunities for those with limited capital.

Blockchain technology operates with transparency and an unalterable transaction log, which establishes secure deals by increasing investor trust.

Through smart contracts and reduced intermediary involvement, tokenization allows businesses to achieve enhanced efficiency by cutting operational costs.

Potential Risks in Real Estate Tokenization

Even though tokenization has benefits, it introduces particular risks to the process:

Market participants who involve tokenized assets face regulatory uncertainty because the legal structures for tokenized assets remain in development, creating potential obstacles for issuers and investors to comply with the rules.

The adoption rate of tokenization techniques struggles with traditional market investors due to its recent entry into the market, affecting asset liquidity and depth.

The dependency on blockchain technology exposes investors to technical risks because hackers' software defects and system breakdowns represent possible dangers.

Evaluating tokenized assets isles, given the difficulty of valuing property assets that are standard market evaluation examples.

Comparing Tokenization and Fractional Ownership

Traditional fractional ownership and tokenization enable several investors to part-own properties but have distinct operational characteristics.

The tokenization model creates better investment liquidity because its secondary markets enable smooth trading of tokens compared to classic fractional property ownership approaches.

Electronic tokens allow worldwide investor groups to acquire ownership, while traditional fractional property shares often face restrictions due to geography and local regulations.

Because blockchain maintains an immovable ledger system, it enhances visibility better than standard approaches that store limited or inaccessible information.

Is Real Estate Tokenization a Passing Trend or the Future?

Real estate tokenization development is demonstrating rising popularity, indicating its significant potential to shape the property investment trends of tomorrow. DAMAC Group has linked with blockchain platform MANTRA to turn $1 billion worth of Middle Eastern assets into digital tokens, thereby signaling rising institutional adoption.

However, extensive adoption will rely upon elements such as regulatory traits, technological advancements, and market reputation. As the regulatory and technological frameworks mature, tokenization may become a mainstream approach for real estate funding.

Final Thoughts

Real property tokenization represents a transformative approach to asset investment, imparting elevated liquidity, accessibility, and efficiency. While challenges continue, especially in regulatory and technological domains, the potential advantages make it a compelling development within the real estate enterprise. As the marketplace evolves, tokenization should redefine how we understand and engage with actual estate belongings.

0 notes

Text

Building Trust in DeFi: Exploring Buidl's Unique Approach to Transparency, Governance, and High Returns

Unlike traditional investment avenues, which might often be shrouded in complexity and opaqueness, Buidl introduces an ecosystem where trust and innovation are seamlessly blended. This revolutionary approach, fueled by the Buidl Autostaking Protocol (BAP), offers a sustainable fixed Annual Percentage Yield (APY) of 526.5%, presenting crypto enthusiasts with a compelling, predictable, and decentralized alternative for lucrative investment.

At the heart of Buidl’s transformative model is the promise of not just potential returns but also a robust framework for investor empowerment through decentralized governance. By leveraging blockchain technology and smart contracts, Buidl facilitates investor participation in decision-making processes, rendering traditional financial gatekeepers obsolete. As crypto investments continue to garner mainstream traction, the inherent advantages offered by Buidl's staking mechanism, risk mitigation strategies, and transparent operations pave the way for a redefined narrative in decentralized investing, setting a new benchmark for the industry.

Transforming the Crypto Landscape: How Buidl’s Innovative Protocols are Setting New Industry Standards

What Makes Buidl Unique?

Buidl encapsulates the essence of financial transformation by offering an innovative ecosystem where traditional constraints are replaced with modern, automated solutions. Its role as a forerunner in the decentralized finance (DeFi) space is cemented by the groundbreaking Buidl Autostaking Protocol (BAP). BAP is a user-friendly system that facilitates a seamless buy-hold-earn cycle, ensuring that investors naturally grow their portfolios by simply holding the native $BUIDL token in their wallets. This method offers not just ease of use but aligns with the current appetite for low-effort, high-reward investment strategies.

Unveiling Buidl's Tokenomics

At the nexus of Buidl’s ecosystem is its utilitarian and deflationary token, $BUIDL. Unlike many cryptos, the supply begins at a mere 21,000 tokens, thereby cultivating scarcity and value appreciation in a manner analogous to Bitcoin, but on a larger scale. With tokenomics designed meticulously to incentivize holding and active participation, $BUIDL incorporates various fees such as buy and sell taxes that contribute to liquidity and the Buidl Insurance Fund (BIF), ensuring the project's long-term sustainability and resilience against market volatility.

Leveraging Advanced Governance to Foster Decentralized Investment

Decentralized Governance: A Community-Driven Approach

By putting governance in the hands of its community, Buidl redefines ownership and engagement within its ecosystem. Decentralized governance is not simply a buzzword but the nucleus of Buidl’s operational framework. Holders of the $BUIDL token are empowered to participate in decision-making processes, exploring avenues ranging from project enhancements to strategic partnerships. This collaborative approach not only bolsters community trust but aligns the ecosystem’s growth trajectory with the interests of its stakeholders.

Insurance and Risk Mitigation

Security in cryptocurrency investments remains a significant concern for many investors, and Buidl addresses this through its dedicated Buidl Insurance Fund (BIF). A set percentage of each transaction goes into this fund, designed to safeguard investors’ holdings against drastic markdowns and flash crashes. By minimizing downside risks, BIF plays a pivotal role in stabilizing the project and assuring long-term confidence among participants.

Implementing Automatic Rebase and Compounding for Maximum Returns

Harnessing Positive Rebase for Growth

One of Buidl’s standout features is its positive rebase formula, reshaping conventional views on token inflation. By automatically adjusting the total token supply to provide consistent rewards to its holders, Buidl ensures that the value of $BUIDL continues to grow incrementally. This allows holders to realize maximum returns without the need for manual intervention or re-staking, thus making the journey of crypto investments straightforward and promising.

The Magic of Compounding Interest

Through the integration of revolutionary auto-compounding functionalities, Buidl caters to an investment strategy that is both patient and rewarding. By and large, compounding interest serves as a stalwart financial principle that Buidl has elegantly embedded into its ecosystem. Token holders automatically receive increased token balances every 60 minutes, highlighting the power of sustained growth and maximizing the potential for wealth accumulation over time.

Ensuring Ecosystem Longevity and Market Competitiveness

Sustaining Ecosystem Health through Automatic LP and Burns

To maintain a healthy ecosystem, Buidl implements automatic liquidity provisioning, essential in preserving the token’s market stability and price sustainability. A predefined percentage of transaction fees is allocated towards liquidity, ensuring a balanced and continuously evolving market. Parallelly, Buidl embeds an automatic burn function, ceasing excess supply on every transaction. This controlled inflation model lays a strong foundation for competitive market economics and token valorization.

Strategic Partnerships and Future Prospects

Buidl's strategic partnerships further augment its market presence and operational potential. By aligning with other innovative projects and thought leaders within the blockchain arena, Buidl is poised to continually expand its influence and adaptability within the evolving DeFi sector. Each collaboration brings about new opportunities for ecosystem enhancement and fosters a robust network of shared success, ensuring Buidl remains at the forefront of decentralized investing innovation.

learn more by visiting Website and stay connected through Twitter, Telegram Group, Telegram Channel, and Whitepaper.

AUTHOR:

Username: aufarazyta Profile Link Wallet Address: 0x4Fd9cBAa3434296d42990Bac018d27816167AC17

0 notes

Text

Are Cryptocurrency a Good Investment

Cryptocurrency has become a hot topic in the financial world, attracting both seasoned investors and newcomers. With its potential for high returns and decentralized nature, many wonder if cryptocurrency is a good investment.

Benefits of Investing in Cryptocurrency

Cryptocurrency vs. Traditional Investments

Cryptocurrency

The debate between cryptocurrency vs. traditional investments has gained significant attention in recent years, with each option offering distinct advantages and challenges for investors. One of the most important factors to consider is the risk and volatility associated with these investment types. Cryptocurrencies, like Bitcoin and Ethereum, are known for their price fluctuations, which can lead to high short-term gains but also significant losses. Traditional investments, such as stocks or bonds, tend to offer more stability and predictability, especially for long-term investors.

Traditional Investments

Another difference is liquidity. Cryptocurrencies can be traded 24/7 on various online platforms, providing investors with the flexibility to buy or sell at any time. In contrast, traditional investments are usually restricted to regular market hours and may require longer processing times, especially with physical assets like real estate. The regulatory environment is also a key distinction. While traditional investments are heavily regulated by government authorities, cryptocurrencies operate in a more decentralized space with fewer regulations. This presents both opportunities and risks, as investors in crypto markets may face uncertainty about future regulations.

Finally, diversification plays a major role in traditional investing. Stocks, bonds, and real estate offer investors multiple ways to diversify their portfolios. Cryptocurrencies, while still a developing market, can also serve as a diversification tool for risk-tolerant investors seeking exposure to digital assets.

How People Invest in Crypto

Investing in cryptocurrency has become a mainstream financial strategy for many people, thanks to its potential for high returns. How people invest in crypto can vary greatly, depending on their goals, risk tolerance, and knowledge of the market. Below are the common ways people approach crypto investments:

Buying and Holding (HODLing): Many investors choose to buy established cryptocurrencies like Bitcoin or Ethereum and hold onto them for the long term, expecting their value to appreciate over time. This strategy is known as HODLing, and it’s particularly popular among those who believe in the long-term growth of the crypto market.

Crypto Trading: Some investors actively trade cryptocurrencies to capitalize on market volatility. These traders buy low and sell high, sometimes using technical analysis and charting tools to predict price movements. Crypto trading can be done on various online exchanges, and strategies like day trading or swing trading are commonly used to make short-term profits.

Staking and Yield Farming: Staking involves locking up your cryptocurrency in a blockchain network to earn rewards, while yield farming is a form of earning passive income by providing liquidity to decentralized finance (DeFi) platforms. Both methods allow people to earn additional tokens while holding onto their original investments.

Investing in Crypto Funds and ETFs: For those who prefer a more hands-off approach, crypto investment funds or exchange-traded funds (ETFs) offer a way to invest in a diversified portfolio of cryptocurrencies. These funds allow people to gain exposure to the crypto market without needing to manage individual coins directly.

ICO and Token Sales: Some people choose to invest in new projects by participating in Initial Coin Offerings (ICOs) or token sales. This strategy involves purchasing tokens early in a project’s lifecycle, often before the cryptocurrency is listed on major exchanges.

Strategies For Smart Crypto Investing

Cryptocurrency investing can be highly rewarding, but it also comes with significant risk due to its volatile nature. To make the most of the opportunities in the market, it’s essential to employ smart crypto investing strategies. Here are some key approaches:

Risk Management: Crypto markets can be unpredictable, so it’s crucial to have risk management strategies in place. Use stop-loss orders, don’t invest more than you can afford to lose, and regularly reassess your portfolio to mitigate potential risks.

Diversify Your Portfolio: One of the smartest strategies for crypto investing is diversification. Just like in traditional investing, spreading your investments across different cryptocurrencies can reduce risk. Don’t just focus on well-known coins like Bitcoin and Ethereum; consider altcoins with strong potential as well.

Do Your Research: Before investing in any cryptocurrency, take the time to thoroughly research the project behind it. Look at the development team, use case, community support, and overall market trends. Fundamental analysis will help you assess which cryptocurrencies are more likely to succeed in the long term.

Adopt a Long-Term Perspective (HODL): While short-term trading can be profitable, it’s often risky and requires substantial market knowledge. Many successful crypto investors prefer the HODL strategy—holding onto assets for the long haul, betting on the long-term value of the cryptocurrency market as a whole.

Set Realistic Goals and Stay Disciplined: Establishing clear investment goals helps maintain focus and discipline. Define your risk tolerance and set targets for profits or loss limits. Avoid being swayed by market hype or emotional trading decisions, as they can lead to impulsive actions that may result in losses.

Leverage Staking and Passive Income: Crypto offers opportunities for passive income through staking and yield farming, where you lock up your assets in blockchain networks to earn rewards. This strategy is beneficial for investors looking for a steady income stream while maintaining long-term exposure to their assets.

Keep an Eye on Regulation: The regulatory landscape for cryptocurrencies is constantly evolving. Stay informed about changes in regulations that might affect your investments. Regulatory clarity can provide a sense of security and open new investment opportunities.

Future of Cryptocurrency Investments

The future of cryptocurrency investment is evolving rapidly, promising exciting opportunities while also posing unique challenges. Here’s a step-by-step guide to understanding the trends that will shape the future of this digital asset class:

1. Institutional Adoption

In the coming years, we can expect institutional adoption of cryptocurrencies to continue expanding. Major financial players, like banks, hedge funds, and corporations, are increasingly investing in crypto assets. This involvement brings much-needed liquidity, credibility, and stability to the market, making crypto investments more accessible to mainstream investors.

2. Regulatory Frameworks

A crucial factor in the future of cryptocurrency investment is the development of clear regulatory frameworks. As governments around the world begin to regulate cryptocurrencies more effectively, investors will feel more secure, knowing there is a legal structure in place to protect their assets. This will likely lead to fewer market manipulations and greater market confidence.

3. Rise of Decentralized Finance (DeFi)

DeFi is another major component that is reshaping the investment landscape. This new financial ecosystem allows individuals to lend, borrow, and stake cryptocurrencies without intermediaries. In the future, DeFi platforms will likely attract more investors who are looking for passive income opportunities and want to diversify their portfolios.

4. Expansion of Crypto-Based Financial Products

The introduction of crypto-based financial products, such as exchange-traded funds (ETFs), crypto savings accounts, and even crypto retirement plans, will make it easier for traditional investors to get involved in the crypto market without directly handling cryptocurrencies. These products will play a significant role in bridging the gap between traditional finance and digital assets.

5. NFTs and Digital Ownership

Non-fungible tokens (NFTs) are already gaining momentum in the art and entertainment industries, but in the future, they will likely expand into other sectors, including real estate and collectibles. As the market for NFTs grows, digital ownership will become a more mainstream concept, integrating cryptocurrencies into everyday life. Read More

#crypto#cryptocurrency#investing#future of cryptocurrency#invest in cryptocurrency#Cryptocurrency a Good Investment#blockchain#cryptotrading#bitcoin#stock market#Benefits of Investing#Investing in Cryptocurrency

1 note

·

View note

Text

BUIDL Makes DeFi Easy: Stake, Earn, and Compound Directly in Your Wallet

Introduction

Decentralized Finance (DeFi) has disrupted traditional financial systems, offering users greater control over their assets and investment opportunities. However, many DeFi staking models suffer from high volatility, unpredictable returns, and complex user interfaces. Enter BUIDL, a game-changer in the DeFi space. With its BUIDL Autostaking and Auto-Compounding Protocol (BAP), BUIDL provides an industry-leading fixed APY of 526.5%, offering a seamless buy-hold-earn mechanism that eliminates the need for manual staking.

This article explores how BUIDL is transforming DeFi by addressing these challenges and offering sustainable, high-yield returns in a simple and automated way.

What is BUIDL?

BUIDL is a next-generation financial protocol designed to make staking effortless while offering the highest sustainable returns in the crypto market. Through BAP, BUIDL token holders benefit from automatic staking and compounding, ensuring a steady passive income stream without needing technical knowledge or active management.

Key features of BUIDL Autostaking Protocol (BAP) include:

Fixed APY of 526.5% (0.504% daily ROI)

Rebasing rewards every 60 minutes (24 times daily)

Auto-compounding mechanism for continuous earnings growth

Sustainable tokenomics that prevent inflation and devaluation

Liquidity and insurance fund mechanisms to maintain price stability

Why BUIDL Stands Out in DeFi

Unlike traditional staking models that require users to lock up assets manually and claim rewards periodically, BUIDL automates the entire process, making it more efficient and user-friendly. Below are some of the core advantages that set BUIDL apart from competitors:

1. Auto-Staking and Auto-Compounding

BUIDL ensures that all token holders automatically stake their holdings without needing a separate platform or manual action. As long as users hold $BUIDL in their wallets, they continue to earn rewards through the rebasing mechanism. This makes earning passive income in DeFi easier than ever.

2. Fixed APY of 526.5%

Many DeFi protocols offer variable APYs that can fluctuate dramatically, leading to uncertain and inconsistent returns. BUIDL eliminates this issue with its fixed 0.504% daily ROI, ensuring stability and predictability for investors.

3. Hourly Rebasing Rewards

Most staking protocols distribute rewards every 8 hours or longer, forcing users to wait to maximize earnings. BUIDL rebases every 60 minutes, allowing 24 compounding cycles per day, ensuring maximum growth potential for token holders.

4. Risk-Free Value (RFV) Fund

To maintain price stability and sustain staking rewards, 5% of buy fees and 6% of sell fees are redirected to the RFV fund, which acts as a financial safety net. This ensures long-term sustainability and reduces the risk of rapid devaluation.

5. Automatic Liquidity Provision (ALP)

Liquidity is crucial for a token's health and sustainability. BUIDL allocates 5% of trading fees to its liquidity pool, ensuring a steady market and reducing price volatility.

6. Deflationary Mechanism (Auto-Burn)

Inflation can quickly diminish the value of a token. To counteract this, 1% of all transactions are automatically burned, gradually reducing the total supply and increasing scarcity, benefiting long-term holders.

7. BUIDL Insurance Fund (BIF)

2% of purchases and 3% of sales are allocated to the BUIDL Insurance Fund, which mitigates risk by preventing sudden crashes and ensuring price stability during market downturns.

How BUIDL Works

BUIDL simplifies DeFi investing with its intuitive and automated system. Here’s how it works:

Buy $BUIDL tokens – Once purchased, tokens are automatically staked in the user’s wallet.

Earn rewards every 60 minutes – The rebasing mechanism increases token holdings 24 times per day.

Compounding APY of 526.5% – Rewards are automatically compounded, accelerating portfolio growth.

Benefit from risk-free value, liquidity provision, and insurance mechanisms – These features maintain token value and protect users against volatility.

Tokenomics: A Sustainable Ecosystem

BUIDL operates with carefully designed tokenomics to ensure long-term sustainability and fairness.

Initial Supply: 21,000 (1000x lesser than Bitcoin)

Max Supply: 21,000,000

Presale: 40%

Liquidity: 20%

LP Staking Rewards: 20%

Burn: 10%

Presale Bonus: 4%

Strategic Partnerships: 3%

Airdrop & Bounty: 3%

Why Invest in BUIDL?