#CCI 2023

Explore tagged Tumblr posts

Text

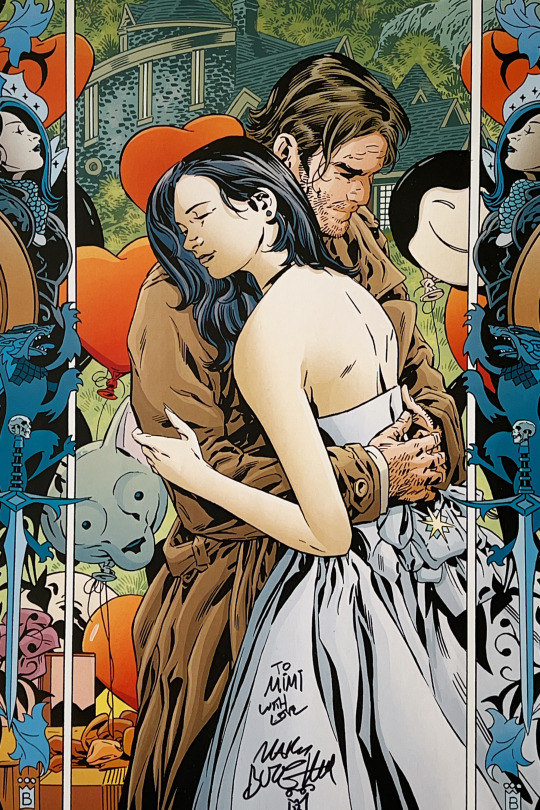

Death • 11x17" print art by Mark Buckingham • Comic-Con International 2023 • July 20th 2023 [Death from The Sandman]

Mark Buckingham • Comic-Con Int'l 2023

💕

#Death#Mark Buckingham#love mark buckingham art#Night Flight Comics#Neil Gaiman#The Sandman#CCI 2023#Comic-Con International 2023

157 notes

·

View notes

Text

Sexypink - We’re excited to welcome PAMM’s Caribbean Cultural Institute's (CCI) newest Fellows Shannon Alonzo, Farihah Aliyah Shah, and Petrina Dacres.

This next group of fellows represents the diversity of the region with their unique backgrounds and artistic practices.” – PAMM Director Franklin Sirmans.

Our 2023 CCI Fellowships is a curatorial and research program supported by the Mellon Foundation and in collaboration with the Women Photographers International Archive (WOPHA), fostering art projects and research advancing Caribbean art and scholarship.

Learn more about PAMM CCIs' Fellows and program ��️ https://bit.ly/3PGPSMC

#sexypink/PAMM#sexypink/Caribbean Cultural Institute CCI#sexypink/Shannon Alonzo#sexypink/Farnham Alijah Shah#sexypink/Petrina Dacres#sexypink/2023 CCI Fellow

0 notes

Text

Cotton Corporation of India Recruitment 2023

Cotton Corporation of India Recruitment 2023 : भारतीय कपास निगम लिमिटेड भर्ती 2023 का नोटिफिकेशन 93 पदों के लिए ऑफिशल वेबसाइट पर जारी कर दिया है। भारतीय कपास निगम लिमिटेड भर्ती 2023 के लिए ऑनलाइन आवेदन 24 जुलाई 2023 से शुरू हो गए हैं। भारतीय कपास निगम लिमिटेड भर्ती 2023 के लिए ऑनलाइन आवेदन की अंतिम तिथि 13 अगस्त 2023 तक रखी गई है। भारतीय कपास निगम लिमिटेड भर्ती 2023 की विस्तृत जानकारी ऑफिशल…

View On WordPress

#CCI Jr. Commercial Executive Recruitment 2023#CCI Management Trainee Recruitment#CCI Management Trainee Recruitment 2023#CCI Recruitment 2023#CCI Vacancy 2023#Cotton Corporation of India Recruitment#Cotton Corporation of India Recruitment 2023#Cotton Corporation of India Vacancy 2023#भारतीय कपास निगम लिमिटेड 2023#भारतीय कपास निगम लिमिटेड भर्ती

0 notes

Text

100 Days of Productivity [Day: 88] || 100 Jours de Productivité [Jour: 88]

there's been so much rain lately. so much rain. & I absolutely adore it. there's nothing quite like a warm drink, wrapped up in your pyjamas [or maybe not] & a blanket [with a pillow too] sitting next to an open window, smelling the petrichor. the gentle tapping of water on your window.

I love grey. in a strange way.

the weekend is bringing with it a lot of exciting things. one of my favourite activities is organizing/room lay outs & now that I finally have my workroom set up at home, I'll be heading out with a few friends to get some supplies.

academic work:

-wrap up all completed units -re-write notes -practice pronunciation [specifically for rolling sentences]

freelance work:

-start on new project -set up workspace -finish all of last week's projects [including sewing] -oil sewing machine

office work:

-continue organizing 2023 documents -prepare meeting notes -email department about upcoming changes [bcc management] -answer all emails regarding payroll/billing

currently listening // in my heart by vowl., Sace

il y a eu beaucoup de pluie ces derniers temps. beaucoup de pluie. et j'adore ça. il n'y a rien de tel qu'une boisson chaude, emmitouflé dans votre pyjama (ou peut-être pas) et une couverture (avec un oreiller aussi) assis près d'une fenêtre ouverte, sentant l'odeur des animaux. le doux tapotement de l'eau sur votre fenêtre.

J'aime le gris, d'une manière étrange.

l'une de mes activités favorites est l'organisation/l'aménagement d'une pièce et maintenant que j'ai enfin installé ma salle de travail à la maison, je vais sortir avec quelques amis pour acheter des fournitures.

travail académique :

-regrouper toutes les unités terminées -réécrire les notes -pratiquer la prononciation [en particulier pour les phrases roulantes].

travail en freelance :

-commencer un nouveau projet -mettre en place un espace de travail -terminer tous les projets de la semaine dernière [y compris la couture] -huiler la machine à coudre

travail de bureau :

-continuer à organiser les documents 2023 -préparer les notes de réunion -émettre des courriels au département sur les changements à venir [Cci à la direction] -répondre à tous les courriels concernant la paie/facturation

chanson // in my heart par vowl., Sace

#100 days of productivity#day 88#100dop#100 jours de productivité#jour 88#100jdp#study blog#studyblr#studyspo#study motivation#study aesthetic#bookish#gradblr#langblr#language learning#booklr#bookblr

40 notes

·

View notes

Text

Dear future me

It's New Years Eve 2023 right now, and I feel sad thinking about all the NYEs that have come before. For a few years, I saw in the new year via zoom with 2 close friends and we chatted well past midnight. This year, I haven't spoken to one of those friends in 6 months, and the other seems so distracted with their own things. And I know I certainly won't be able to stay up until midnight, I'll be pushing it after 9pm.

This year has been long and hard. I'm proud of myself for everything I've achieved, but it's not been without almost constant struggle. I smashed my med school exams, lived at the hospital for 6 months whilst on placement, and then was ultimately infected with SARS-COV2. That left me with worsened autonomic dysfunction, CCI, generalised hyperinflammation and neuroinflammation. And that sucks.

After making the most of Christmas, yesterday I spent the day horizontal in bed all day, save for eating and going to the toilet. I have a list of things I need to do, and a longer list of things I want to do, but I had to write off the whole lot. Again. Today, though there's a little improvement, I'd still say I feel like shit warmed up.

The world right now doesn't feel much more positive either. Covid JN1 is surging, and despite renewed recommendations from the WHO for healthcare facilities to bring back masks, the UKHSA is dragging its feet. There's no doubt anymore that they're not following the science. They get away with it though, as no lawyers are willing to fight the case (as I have found, time and again).

Everyone is ill with "the worst cold ever". There's so many stories about young people dropping dead. But people refuse to connect the dots, or connect them wrong and blame the vaccine. Public Health has abandoned us all to eugenics.

The final result? I dread going to visit my nearly 90 year old gran next month as either one of us could infect the other and finish them off. I know if I don't go though, I'll feel endlessly guilty (and be endlessly guilted). I live in a constant state of high stress.

This time last year, I don't think I had high hopes for 2023. I figured it would get worse before it gets better, but 2024 might see improvements. I was certainly right that it's got worse, but I'm less certain next year will be better- the world is so stubborn and unwilling to open its eyes. I think maybe by 2025? But who knows, maybe that's what I'll say now for every year of my life. Always "maybe the next year, maybe the next year".

Either way, I hope for me personally I'm in a better place by next New Year's. I hope my long covid is vastly improved and that I'm back on placement and coping well. I also hope I haven't been reinfected and I'm managing to stand my ground on any issues people take with me keeping myself safe. I hope that I am more hopeful.

That's all I will say for now, as honestly just writing this has tired me out! But me, I love you, you're doing the best you can and its a damn sight better than a lot of people. You can do this. Keep going. It's a marathon not a sprint.

C

#long covid#covid#new years#new years eve#new year#2023#2024#pasc#pandemic#wear a mask#fuck covid#covid is airborne#covid isnt over#depressed#depression#mental health#mental illness#chronic illness

3 notes

·

View notes

Text

I.B.1698 MICHAEL [IBM] harrelltut.com of 1921steelecartel.com's Original quantumintranet.tech Cloud Service Architecture [CSA] @ QANTUMHARRELLTECH.ca.gov... since 1968michaelharrelljr.com of 144,000 quantumharrell.tech MINING PATENTS... Systematically Engineering anugoldenblackwallstreet.com WEALTH MANAGEMENT FIRM of ibmichaelstadtcoburg.com... as Eye Machine Accelerate Computational [iMAC] Computer Aided Drafting [CAD] Languages of PRIVATE Intellectual CYBER [PIC] Property Rights Mathematically ENCRYPTED [ME] by kingtutdna.com’s Hi:teKEMETICompu_TAH [PTAH] MILITARY [PM] STAFF… who Scientifically Engineered ANU [SEA] Highly Complex [ADVANCED] Ancient 9 Ether Cosmic Algorithmic [CA] Computational [Compton] STAR GATEWAY Language Codex of quantumharrell.tech’s Controlled Cryptographic Items [CCI] of My HURRIAN-HARRELL Father’s Official SKY Military Equipment [ME] w/Controller Correlation Identifier [CCI] Expressions from planetrizq.com’s Highly Complex [ADVANCED] Ancient Research Projects Agency [ARPA] of PRIVATIZED SKY Defense.gov Contracts [D.C.] @ The 1941 quantumharrell.tech [Clandestine Alien Tech] Pentagon HQ of 1921 QUANTUM 2023 HARRELL 2024 TECH 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

WELCOME BACK HOME IMMORTAL [HIM] U.S. MILITARY KING SOLOMON-MICHAEL HARRELL, JR.™

i.b.monk [ibm] mode [i’m] tech [IT] steelecartel.com @ quantum harrell tech llc

i.b. 1698 quintillionharrell.tech sky elite 2wealthy4forbes.com @ 1921 QUANTUM 2023 HARRELL 2024 TECH 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

don't worry... the original MacBook Pro Architect [PA] is back

iquantumapple.com_puting technocrat of ibmapple1984.tech patents

quantumharrell.tech of automated 6g quantumintranet.tech manufacturing systems

1968michaelharrelljr.com behind the scenes of washington.gov @ 1921 QUANTUM 2023 HARRELL 2024 T-Mobile 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

I.B.1698 MICHAEL [IBM] of 6 x 3 = 18G Quantum Computing Intel Architecture [CIA] @ 1921 QUANTUM 2023 HARRELL 2024 T-Mobile 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

QUANTUMHARRELL.tech Budgets of SIRIUS Defense.gov Currency [D.C.] WEALTH @ 1921 QUANTUM 2023 HARRELL 2024 T-Mobile 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

QUANTUM HARRELL UFO SKY [U.S.] TECH FAMILY BIZ of igigiskypentagon.tech @ The 1941 quantumharrell.tech [Clandestine Alien Tech] Pentagon HQ of 1921 QUANTUM 2023 HARRELL 2024 TECH 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

SIRIUS 1921steelecartel.tech of 1948 BETELGEUSE steelecartel.com wealth

EYE HEIL MY FATHER of ibmichaelstadtcoburg.com @ quantumharrelltech.gov!!!

My Ancient 1946 HURRIAN-HARRELL Father Married into Marie HITTITE's 1921steelecartel.tech Family Empire [DYNASTY] of Inner Earth's [HADES] Most Darkest [Occulted] Wrought Mineral Iron [MI = MICHAEL] & GOLDEN STEEL WEALTH @ 1921 QUANTUM 2023 HARRELL 2024 TECH 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

I.B.1968 MICHAEL [IBM] @ 1921 QUANTUM 2023 HARRELL 2024 TECH 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

eye technologically [e.t.] using autoCAD @ 1921 QUANTUM 2023 HARRELL 2024 TECH 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

Pentagon defense.gov of 1921 QUANTUM 2023 HARRELL 2024 TECH 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

trillions?!?!?!... try 2024 quadrillions!!!

1968michaelharrelljr.com_putah [ptah] services of applied quantumharrell.tech security... bee expensive af!!!

quantumharrell.tech of ANU GOLDEN 9 Ether [AGE] defense.gov @ 1921 QUANTUM 2023 HARRELL 2024 TECH 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

© 1698-2223 QUANTUM HARRELL TECH LLC All Pentagon DotCom defense.gov Department Domain Rights Reserved @ 1921 QUANTUM 2023 HARRELL 2024 T-Mobile 2025 Apple & IBM [A.i.] LLC of ATLANTIS [L.A.] 5000

#harrelltut#harrelltut.com#pentagon#igigiskypentagon.tech#u.s. michael harrell#quantumharrelltech#kingtutdna.com#o michael#kemet#mu:13#king tut#quantumharrelltut#apple#apple patents#ibm#ibm patents#mac#macbook#laptop#airpods#smartphone#apple watch#imac#9etherlightshipatlantis

1 note

·

View note

Text

Brazilian confidence falls only less than that of Germans

Indicator expected to continue downward trend amid stronger inflation this year

The Consumer Confidence Index (CCI) in Brazil for December 2024 remained stable compared to November, registering 51.9 points on a scale from 0 to 100. However, compared to December 2023, there was a drop of 4.6 points, according to a survey released by the Ipsos Institute. This represents the second largest decline among all countries surveyed, surpassed only by Germany.

According to Ipsos Brazil CEO Marcos Calliari, this stability does not reflect a confident scenario, as only four months last year did not experience a decline.

“The continuation of this downward trend seems likely, especially considering the growing concern over inflation, which has returned to being one of the top five concerns for consumers, with 26% of mentions,” Mr. Calliari said.

The expert noted that Brazilian confidence is heavily influenced by visible variables or those that have a direct impact on daily life. In this context, “the impact of inflation on consumer confidence is enormous,” he says.

Continue reading.

0 notes

Photo

India’s real GDP growth in FY24 reached 8.2 per cent and exceeded 7 per cent for the third consecutive year, demonstrating resilience amidst global challenges. The growth is driven by stable consumption and improving investment demand. Surpassing China’s economic growth rate, Indian economic growth rate over the last few years has been one of the highest in the world. The Economic Survey 2023-24 projected country’s real GDP growth in the range of 6.5 to 7 per cent, despite taking a conservative approach. Many experts, however, believe these projections will be surpassed. Retail inflation, at 5.4 per cent, remained lowest since the pandemic due to policy interventions and RBI measures. Inflation is expected to decline further to 4.5 per cent in FY25 and 4.1 per cent in FY26, under the assumption that India will have normal monsoon and no external disruption.India's real GDP grew 8.2 per cent in FY24, driven by stable consumption and investment. The 2024-25 budget focused on the textile sector with increased allocations and reduced customs duties. Despite global challenges, exports rose in Q1 FY25. Tiruppur saw recovery, with large orders from global players. New BIS certification for medical textiles starts in October 2024. A supportive budget The annual budget for 2024-25 was presented by Indian Finance Minister on July 23, 2024. The budget addressed various aspects of textile and apparel sector, encompassing production incentives, export growth and sustainability. The key highlights of the budget for the sector include: - The budget allocation for the textile industry was increased by 28.29 per cent, from ₹3,443 crore (FY24) to ₹4,417 crore (~$530 million), of which ₹375.41 crore are allocated for the establishment expenditure of the Centre, ₹3,866.17 crore for central sector schemes/projects, and ₹175.41 crore for other central sector expenditure. The major share of spend on schemes/projects will be consumed by top 5 centrally sponsored schemes: Programmes of the Central Silk Board (23.28 per cent), the Amended Technology Upgradation Fund Scheme (16.42 per cent), Procurement of Cotton by the Cotton Corporation of India under the Price Support Scheme (15.52 per cent), National Technical Textiles Mission (9.70 per cent) and PM MITRA (7.76 per cent). - The budget for PLI (Product Linked Incentive) scheme was increased by 800 per cent to ₹45 crore (~$5.4 million) from ₹5 crore in the previous year. - The funding for CCI’s cotton purchase under the price support scheme was increased from ₹0.01 crore to ₹600 crore, while funding for the Integrated Scheme for Skill Development got a boost from ₹115 crore to ₹166 crore. - The budgets for the Development of the Jute Sector and the Amended Technology Upgradation Fund Scheme (ATUFS) were reduced from ₹75 crore to ₹50 crore, and ₹675 crore to ₹635 crore, respectively. - The budgets towards the National Technical Textiles Mission, National Handicraft Development Programme, National Handloom Development Programme and Handicraft Cluster Development Programme (Handicraft Mega Cluster) went up from ₹170 crore to ₹375 crore, from ₹155 crore to ₹206 crore, from ₹190 crore to ₹200 crore, and from ₹15.7 crore to ₹30 crore, respectively. - The reduction in the customs duty, as proposed in the budget, aims to reduce input costs, deepen value addition, promote export competitiveness, correct inverted duty structure, boost domestic manufacturing etc. In the same regard, the Basic Customs Duty (BCD) on MDI (methylene diphenyl diisocyanate) for spandex yarn production was reduced from 7.5 per cent to 5 per cent, to address duty inversion and reduction in input costs for manufacturers; and, lowering of BCD on real down-filling material from ducks or geese, from 30 per cent to 10 per cent aims at making premium filling materials more affordable for garment manufacturers. - Tariff rates were reduced to zero for certain additional accessories and embellishments for the manufacture of textiles. Additionally, a bottom-up reform was proposed to create new tariff lines concerning many products including technical textiles to align them to the tariff lines with WCO (World Customs Organisation) classification and better identification of goods. These changes came into effect from October 1, 2024. - The government also proposed to expand the list of exempted goods used in the manufacture of leather and textile garments, footwear, and other leather articles intended for export. The move aims at reducing production costs and encourage more manufacturers to enter the export market. Trade update In FY24 ended March 31, 2024, India’s export of textiles and apparel, including handicrafts, increased 1 per cent and reached ₹2.97 trillion (~$35.64 billion). The export value of RMG at ₹1.2 trillion (~$14.4 billion) contributed around 41 per cent to total exports, followed by cotton textiles (34 per cent) and man-made textiles (14 per cent). MSMEs contributed more than 80 per cent of India’s textile and apparel manufacturing capacity. Particularly in March 2024, the textiles and apparel exports registered 11.18 per cent and 1.7 per cent growth over March 2023, respectively, while their combined growth was 6.91 per cent year-on-year. Category-wise, exports of cotton yarn, fabrics, made-ups, handlooms grew 6.78 per cent, carpets increased 16.23 per cent and handicrafts rose by 128.39 per cent. The categories which saw a drop in March included man-made yarn, fabrics, made-ups (-7.86 per cent) and jute including floor covering (-24.13 per cent). Imports of cotton raw & waste and textile yarn fabric, made-ups during the month fell by 11.29 per cent and 12.17 per cent, respectively. In the first quarter period of April to June of FY25, exports of textiles and apparel increased 4.08 per cent y-o-y to $8.785 billion. In this, textile export at $4.935 billion increased 3.99 per cent and apparel export valued at $3.849 billion grew 4.2 per cent, though their combined share in India’s total merchandise exports decreased to 7.99 per cent during the period. Cotton yarn, fabrics, made-ups, and handloom products saw a 5.71 per cent increase to $2.916 billion, the shipment of man-made yarn, fabrics, and made-ups gained by 0.37 per cent to $1.165 billion, and carpet exports increased by 11.41 per cent to $263.37 million. Despite unfavourable economic conditions in the EU, US, and West Asian nations, Indian textile exports grew 9.59 per cent in the month of May compared to May 2023, while apparel exports grew 9.84 per cent. The combined exports of textiles and apparel during the month registered a growth of 9.70 per cent y-o-y. The Indian textile exports during two consecutive months of April and May, increased 6.04 per cent over exports during the same two months in the previous year, whereas the exports of apparel increased 4.46 per cent. Overall, aggregate exports of textiles and apparel for 2-month period surged 5.34 per cent y-o-y. In June alone, textiles and apparel exports amounted to $2.919 billion, with textiles increasing marginally by 0.05 per cent to $1.625 billion. While cotton yarn, fabrics, made-ups, and handloom products increased 0.92 per cent to $959.55 million and the shipment of man-made yarn, fabrics, and made-ups gained 2.79 per cent to $383.16 million, the exports of carpet increased by 10.64 per cent to $121.44 million. During Q1, FY24, imports of raw cotton and waste declined 23.42 per cent to $152.01 million, down from $198.49 million in Q1, FY23. Imports of textile yarn, fabric, and made-ups improved 7.47 per cent to reach $557.2 million, up from $518.4 million in the same quarter of the previous fiscal. The inbound shipment of raw cotton and waste dipped 26.16 per cent to $70.22 million from $95.10 million, while imports of textile yarn, fabric, and made-ups jumped 23.83 per cent to $209.23 million in the month of June 2024. Tough time for exports Indian government aims to achieve $600 billion in textile exports by 2047, but the sector faced challenges such as geo-political uncertainties, consumption shifts, and low overall growth in 2024. The sector was affected by the ongoing Russia-Ukraine war, the Red Sea crisis, and the Israel-Hamas conflict, which made the international trade scenario much tougher for the Indian exporters in 2024. According to a CRISIL report released in February, India’s textiles industry is unlikely to be significantly impacted by the Red Sea crisis. However, a prolonged crisis is likely to impact margins and stretch the working capital cycle. It was further highlighted that the higher freight cost due to the Houthi disruption maybe a hindrance for textile exporters with a lot of trade happening through the Suez Canal. The freight rates increased by nearly 40-50 per cent. Additionally, a global 'weak demand' in textiles was another worrisome factor for the industry. The May 2024 ITMF Global Textile Industry Survey (GTIS) revealed a continued stagnation in the textile business climate and that a weak demand remained the main concern since September 2022. Tiruppur bounced back Tiruppur – India’s textiles export hub, revived back in the first quarter of FY25, following a 14 per cent contraction in knitwear exports during FY24. The revival was triggered by large orders from global players like Primark, Tesco, George at ASDA and Decathlon. While April grew marginally at 1.5 per cent, the respective growths in May and June were 11.4 per cent and 10 per cent. The Tiruppur Exporters Association (TEA) reported US players like GAP, Carter’s and Walmart, European majors such as Next and Duns, and Australian giants like Target and Woolworths, lining up to place orders in the region. This was also due to the global majors diversifying their sourcing basket under the ‘China Plus One’ policy and a major wage hike in an important market like Bangladesh. Late last year, Bangladesh reportedly announced a 56 per cent increase in the monthly minimum wage to $113 from the previous $75 for garment factory workers. As per TEA, the region’s export in April and May amounted to $294 million and $360 million versus $290 million and $323 million in respective months of 2023. During calendar year 2024 also, excluding a 3.8 per cent drop in January, the exports showed growth in rest of the months. The increase in February and March, compared to last year, were 6.4 per cent and 5.6 per cent respectively. Tiruppur accounts for 90 per cent of India’s cotton knitwear exports, and 55 per cent of all its knitwear exports. The region faced issue of labour shortage, which showed sign of improvement after elections in India. Prior to elections, the region reportedly experienced around 40 per cent shortage in migrant employees, which reduced to around 10 per cent by mid-2024. Tiruppur's textile industry hosts 600,000 inland employees and 200,000 migrants. Mandatory BIS certification The range of medical textile products, including hospital bed linens, pillow covers, and sanitary napkins, are now subjected to Bureau of Indian Standards (BIS) w.e.f. October 1, 2024. The move aims at ensuring quality and safety in medical textiles. BIS began the sensitisation efforts in this regard among stakeholders even before the implementation date. The compulsory ISI mark is a significant step in standardising products used in critical healthcare settings, potentially elevating the industry’s standards on a global scale. Fibre2Fashion News Desk (SB - WE) Source link

0 notes

Photo

India’s real GDP growth in FY24 reached 8.2 per cent and exceeded 7 per cent for the third consecutive year, demonstrating resilience amidst global challenges. The growth is driven by stable consumption and improving investment demand. Surpassing China’s economic growth rate, Indian economic growth rate over the last few years has been one of the highest in the world. The Economic Survey 2023-24 projected country’s real GDP growth in the range of 6.5 to 7 per cent, despite taking a conservative approach. Many experts, however, believe these projections will be surpassed. Retail inflation, at 5.4 per cent, remained lowest since the pandemic due to policy interventions and RBI measures. Inflation is expected to decline further to 4.5 per cent in FY25 and 4.1 per cent in FY26, under the assumption that India will have normal monsoon and no external disruption.India's real GDP grew 8.2 per cent in FY24, driven by stable consumption and investment. The 2024-25 budget focused on the textile sector with increased allocations and reduced customs duties. Despite global challenges, exports rose in Q1 FY25. Tiruppur saw recovery, with large orders from global players. New BIS certification for medical textiles starts in October 2024. A supportive budget The annual budget for 2024-25 was presented by Indian Finance Minister on July 23, 2024. The budget addressed various aspects of textile and apparel sector, encompassing production incentives, export growth and sustainability. The key highlights of the budget for the sector include: - The budget allocation for the textile industry was increased by 28.29 per cent, from ₹3,443 crore (FY24) to ₹4,417 crore (~$530 million), of which ₹375.41 crore are allocated for the establishment expenditure of the Centre, ₹3,866.17 crore for central sector schemes/projects, and ₹175.41 crore for other central sector expenditure. The major share of spend on schemes/projects will be consumed by top 5 centrally sponsored schemes: Programmes of the Central Silk Board (23.28 per cent), the Amended Technology Upgradation Fund Scheme (16.42 per cent), Procurement of Cotton by the Cotton Corporation of India under the Price Support Scheme (15.52 per cent), National Technical Textiles Mission (9.70 per cent) and PM MITRA (7.76 per cent). - The budget for PLI (Product Linked Incentive) scheme was increased by 800 per cent to ₹45 crore (~$5.4 million) from ₹5 crore in the previous year. - The funding for CCI’s cotton purchase under the price support scheme was increased from ₹0.01 crore to ₹600 crore, while funding for the Integrated Scheme for Skill Development got a boost from ₹115 crore to ₹166 crore. - The budgets for the Development of the Jute Sector and the Amended Technology Upgradation Fund Scheme (ATUFS) were reduced from ₹75 crore to ₹50 crore, and ₹675 crore to ₹635 crore, respectively. - The budgets towards the National Technical Textiles Mission, National Handicraft Development Programme, National Handloom Development Programme and Handicraft Cluster Development Programme (Handicraft Mega Cluster) went up from ₹170 crore to ₹375 crore, from ₹155 crore to ₹206 crore, from ₹190 crore to ₹200 crore, and from ₹15.7 crore to ₹30 crore, respectively. - The reduction in the customs duty, as proposed in the budget, aims to reduce input costs, deepen value addition, promote export competitiveness, correct inverted duty structure, boost domestic manufacturing etc. In the same regard, the Basic Customs Duty (BCD) on MDI (methylene diphenyl diisocyanate) for spandex yarn production was reduced from 7.5 per cent to 5 per cent, to address duty inversion and reduction in input costs for manufacturers; and, lowering of BCD on real down-filling material from ducks or geese, from 30 per cent to 10 per cent aims at making premium filling materials more affordable for garment manufacturers. - Tariff rates were reduced to zero for certain additional accessories and embellishments for the manufacture of textiles. Additionally, a bottom-up reform was proposed to create new tariff lines concerning many products including technical textiles to align them to the tariff lines with WCO (World Customs Organisation) classification and better identification of goods. These changes came into effect from October 1, 2024. - The government also proposed to expand the list of exempted goods used in the manufacture of leather and textile garments, footwear, and other leather articles intended for export. The move aims at reducing production costs and encourage more manufacturers to enter the export market. Trade update In FY24 ended March 31, 2024, India’s export of textiles and apparel, including handicrafts, increased 1 per cent and reached ₹2.97 trillion (~$35.64 billion). The export value of RMG at ₹1.2 trillion (~$14.4 billion) contributed around 41 per cent to total exports, followed by cotton textiles (34 per cent) and man-made textiles (14 per cent). MSMEs contributed more than 80 per cent of India’s textile and apparel manufacturing capacity. Particularly in March 2024, the textiles and apparel exports registered 11.18 per cent and 1.7 per cent growth over March 2023, respectively, while their combined growth was 6.91 per cent year-on-year. Category-wise, exports of cotton yarn, fabrics, made-ups, handlooms grew 6.78 per cent, carpets increased 16.23 per cent and handicrafts rose by 128.39 per cent. The categories which saw a drop in March included man-made yarn, fabrics, made-ups (-7.86 per cent) and jute including floor covering (-24.13 per cent). Imports of cotton raw & waste and textile yarn fabric, made-ups during the month fell by 11.29 per cent and 12.17 per cent, respectively. In the first quarter period of April to June of FY25, exports of textiles and apparel increased 4.08 per cent y-o-y to $8.785 billion. In this, textile export at $4.935 billion increased 3.99 per cent and apparel export valued at $3.849 billion grew 4.2 per cent, though their combined share in India’s total merchandise exports decreased to 7.99 per cent during the period. Cotton yarn, fabrics, made-ups, and handloom products saw a 5.71 per cent increase to $2.916 billion, the shipment of man-made yarn, fabrics, and made-ups gained by 0.37 per cent to $1.165 billion, and carpet exports increased by 11.41 per cent to $263.37 million. Despite unfavourable economic conditions in the EU, US, and West Asian nations, Indian textile exports grew 9.59 per cent in the month of May compared to May 2023, while apparel exports grew 9.84 per cent. The combined exports of textiles and apparel during the month registered a growth of 9.70 per cent y-o-y. The Indian textile exports during two consecutive months of April and May, increased 6.04 per cent over exports during the same two months in the previous year, whereas the exports of apparel increased 4.46 per cent. Overall, aggregate exports of textiles and apparel for 2-month period surged 5.34 per cent y-o-y. In June alone, textiles and apparel exports amounted to $2.919 billion, with textiles increasing marginally by 0.05 per cent to $1.625 billion. While cotton yarn, fabrics, made-ups, and handloom products increased 0.92 per cent to $959.55 million and the shipment of man-made yarn, fabrics, and made-ups gained 2.79 per cent to $383.16 million, the exports of carpet increased by 10.64 per cent to $121.44 million. During Q1, FY24, imports of raw cotton and waste declined 23.42 per cent to $152.01 million, down from $198.49 million in Q1, FY23. Imports of textile yarn, fabric, and made-ups improved 7.47 per cent to reach $557.2 million, up from $518.4 million in the same quarter of the previous fiscal. The inbound shipment of raw cotton and waste dipped 26.16 per cent to $70.22 million from $95.10 million, while imports of textile yarn, fabric, and made-ups jumped 23.83 per cent to $209.23 million in the month of June 2024. Tough time for exports Indian government aims to achieve $600 billion in textile exports by 2047, but the sector faced challenges such as geo-political uncertainties, consumption shifts, and low overall growth in 2024. The sector was affected by the ongoing Russia-Ukraine war, the Red Sea crisis, and the Israel-Hamas conflict, which made the international trade scenario much tougher for the Indian exporters in 2024. According to a CRISIL report released in February, India’s textiles industry is unlikely to be significantly impacted by the Red Sea crisis. However, a prolonged crisis is likely to impact margins and stretch the working capital cycle. It was further highlighted that the higher freight cost due to the Houthi disruption maybe a hindrance for textile exporters with a lot of trade happening through the Suez Canal. The freight rates increased by nearly 40-50 per cent. Additionally, a global 'weak demand' in textiles was another worrisome factor for the industry. The May 2024 ITMF Global Textile Industry Survey (GTIS) revealed a continued stagnation in the textile business climate and that a weak demand remained the main concern since September 2022. Tiruppur bounced back Tiruppur – India’s textiles export hub, revived back in the first quarter of FY25, following a 14 per cent contraction in knitwear exports during FY24. The revival was triggered by large orders from global players like Primark, Tesco, George at ASDA and Decathlon. While April grew marginally at 1.5 per cent, the respective growths in May and June were 11.4 per cent and 10 per cent. The Tiruppur Exporters Association (TEA) reported US players like GAP, Carter’s and Walmart, European majors such as Next and Duns, and Australian giants like Target and Woolworths, lining up to place orders in the region. This was also due to the global majors diversifying their sourcing basket under the ‘China Plus One’ policy and a major wage hike in an important market like Bangladesh. Late last year, Bangladesh reportedly announced a 56 per cent increase in the monthly minimum wage to $113 from the previous $75 for garment factory workers. As per TEA, the region’s export in April and May amounted to $294 million and $360 million versus $290 million and $323 million in respective months of 2023. During calendar year 2024 also, excluding a 3.8 per cent drop in January, the exports showed growth in rest of the months. The increase in February and March, compared to last year, were 6.4 per cent and 5.6 per cent respectively. Tiruppur accounts for 90 per cent of India’s cotton knitwear exports, and 55 per cent of all its knitwear exports. The region faced issue of labour shortage, which showed sign of improvement after elections in India. Prior to elections, the region reportedly experienced around 40 per cent shortage in migrant employees, which reduced to around 10 per cent by mid-2024. Tiruppur's textile industry hosts 600,000 inland employees and 200,000 migrants. Mandatory BIS certification The range of medical textile products, including hospital bed linens, pillow covers, and sanitary napkins, are now subjected to Bureau of Indian Standards (BIS) w.e.f. October 1, 2024. The move aims at ensuring quality and safety in medical textiles. BIS began the sensitisation efforts in this regard among stakeholders even before the implementation date. The compulsory ISI mark is a significant step in standardising products used in critical healthcare settings, potentially elevating the industry’s standards on a global scale. Fibre2Fashion News Desk (SB - WE) Source link

0 notes

Text

Fables • Bigby Wolf • Snow White • print art by Mark Buckingham • Comic-Con International 2023 • July 20th 2023

💕

Mark Buckingham • Comic-Con Int'l 2023

#Fables#Mark Buckingham#Snow White#Bigby Wolf#Bill Willingham#Comic-Con International 2023#CCI 2023#Love Mark Buckingham art

125 notes

·

View notes

Text

Open Your Career Potential: Top Phlebotomy Training Programs in Bakersfield for 2023

Unlock Your Career Potential: Top Phlebotomy Training Programs in Bakersfield for 2023

If you’re looking to kickstart a rewarding career in the healthcare industry, phlebotomy offers a fantastic possibility. As a critical role in patient care, phlebotomists draw blood for tests, transfusions, donations, or research. In this article, we’ll explore the top phlebotomy training programs in Bakersfield for 2023, providing you with everything you need to know to make an informed decision.

Why Choose Phlebotomy as a Career?

Growing Demand: The healthcare sector is expanding rapidly, with a constant need for skilled phlebotomists.

Short Training Duration: Training programs typically last only a few months, allowing you to enter the workforce quickly.

variety of Work Environments: Phlebotomists can work in hospitals, clinics, laboratories, and even mobile blood donation units.

Good Pay and Benefits: The average salary for phlebotomists in Bakersfield is competitive, with opportunities for overtime and benefits.

Top Phlebotomy Training Programs in Bakersfield for 2023

1. bakersfield College

Bakersfield College offers a extensive Phlebotomy Technician Certificate program that blends online coursework with hands-on practice.This program is designed to provide students with the necessary skills and knowlege to become certified phlebotomists.

Duration: Approximately 6 months

Cost: $1,500

Certification: National certification exam eligibility upon completion

2. CCI Training Center

Located in Bakersfield, CCI Training Center provides a focused Phlebotomy Training Program that emphasizes practical skill development in a supportive environment.

Duration: 8 weeks

Cost: $1,200

Certification: National certification preparation included

3.American Career College

The Phlebotomy Technician program at American Career College is well-rounded, offering a blend of classroom learning and clinical practice.

Duration: 9 months

Cost: $2,000

Certification: Prepares students for the National Phlebotomy Certification exam

4. Carrington College

Carrington College offers a comprehensive Phlebotomy program that focuses on both the technical skills and the interpersonal communication needed in this field.

Duration: Approximately 5 months

cost: $1,800

Certification: Includes preparation for certification exams

5. Central Valley Occupational Center

The central Valley Occupational Center provides a hands-on Phlebotomy Training Program that prepares students for a variety of clinical settings.

Duration: 6 months

Cost: $1,600

Certification: Eligible for national certification upon completion

How to Choose the Right phlebotomy Program

Choosing the right program can be daunting. Here are some tips to help you make an informed decision:

Accreditation: ensure the program is accredited and meets state standards.

curriculum: Look for programs that offer a well-rounded curriculum, including anatomy, physiology, and practical training.

Job Placement Services: check if the program offers job placement services to aid your transition into the workforce.

Reviews and Testimonials: Research student reviews to gauge the program’s effectiveness.

the benefits of Phlebotomy Certification

Obtaining certification in phlebotomy not only validates your skills but also opens up numerous career opportunities. Here are some of the benefits:

Enhanced job prospects and earning potential

Possibility of advancing to specialized roles, such as laboratory technician or clinical coordinator

Increased professional credibility

First-Hand Experience: A Phlebotomist’s Journey

To give you a real-life perspective on the benefits of phlebotomy training, we spoke with Sarah, a recent graduate of Bakersfield College’s Phlebotomy Technician program.

”I never expected how much I would grow in just a few months. The hands-on experience I gained was invaluable, and the instructors were incredibly supportive. I feel confident and ready to start my career!” – sarah M.

Case Study: Job Placement Success

Many graduates of Bakersfield College have successfully transitioned into rewarding careers. in 2022, over 85% of graduates found employment within six months of completing their certification. This success stems from the school’s exceptional training and strong relationships with local healthcare providers.

Conclusion

With the healthcare industry continuing to expand, phlebotomy represents an excellent way to unlock your career potential. By enrolling in one of the top phlebotomy training programs in Bakersfield for 2023, you can set yourself on the path to a fulfilling career.Whether you choose Bakersfield College, CCI Training Center, or any other reputable program listed above, you’re making an investment in your future.

Take the first step today, and you’ll be well on your way to becoming a vital part of the healthcare landscape!

youtube

https://phlebotomytechnicianprogram.org/open-your-career-potential-top-phlebotomy-training-programs-in-bakersfield-for-2023/

0 notes

Text

Centro de Integração e Treinamento das Forças de Segurança Centro de Integração e Treinamento das Forças de Segurança Desde sua inauguração em novembro de 2022, o Centro de Controle Integrado (CCI) de Maringá tem desempenhado um papel crucial na melhoria da segurança pública da cidade. Equipado com 90 câmeras de reconhecimento facial e leitura de placas de veículos, o CCI utiliza tecnologias avançadas para monitorar e proteger a população. Em pouco mais de um ano de operação, o sistema registrou mais de 29 milhões de placas de veículos e realizou 377 mil reconhecimentos faciais. Esses números impressionantes refletem a eficácia do CCI em auxiliar as forças de segurança na identificação de suspeitos e na recuperação de veículos roubados ou furtados. Até janeiro de 2024, as câmeras do CCI contribuíram para a recuperação de 24 veículos desaparecidos, superando as expectativas iniciais. A integração com o Sistema Nacional de Informações de Segurança Pública (Sinesp CAD) em 2023 ampliou ainda mais a capacidade operacional do CCI. Essa plataforma permite a colaboração entre as polícias Militar, Civil e Rodoviária, além do Corpo de Bombeiros e SAMU, otimizando a resposta a incidentes e aprimorando a coordenação entre as diferentes forças de segurança. O Secretário de Segurança Pública, Ivan Quartaroli, destacou que o sistema superou as expectativas, proporcionando uma ferramenta eficaz para a identificação de pessoas com mandados de prisão em aberto e veículos envolvidos em atividades ilícitas. Essa tecnologia tem sido fundamental para a atuação proativa das polícias na identificação e detenção de suspeitos, bem como na recuperação de bens subtraídos. O sucesso do CCI em Maringá serve como exemplo de como a tecnologia pode ser aliada na promoção da segurança pública. A implementação de sistemas de monitoramento integrados e inteligentes demonstra o compromisso da cidade em investir em soluções inovadoras para proteger seus cidadãos e combater a criminalidade de forma eficaz.

0 notes

Text

Les sociétés à l’heure de l’application de la directive CSRD

https://justifiable.fr/?p=2176 https://justifiable.fr/?p=2176 #CSRD #directive #lapplication #les #lheure #sociétés Présentation Publiée le 14 décembre 2022, la directive concernant la publication d’informations en matière de durabilité des entreprises (aussi appelée CSRD) a été transposée en droit français par une ordonnance du 6 décembre 2023. Cette ordonnance prévoit de nouvelles obligations de communication pesant sur les entreprises, concernant à la fois la durabilité et des obligations ESG (environnement, social, et gouvernement d’entreprise). Les plus grandes sociétés sont d’ores et déjà soumises à ce texte depuis le 1er janvier 2024, mais le 1er janvier 2025 représente aussi une date importante, alors que de nombreuses sociétés devront alors appliquer les règles imposant une transparence nouvelle. Quelques jours avant cette nouvelle date d’application, des universitaires et praticiens présentent la directive CSRD et sa transposition, ainsi que d’étudier son application présente et à venir dans le cadre d’un colloque virtuel. Programme 14h00 : Allocutions d’accueilChristophe Daniel, Maître de conférences en sciences économiques, doyen de la Faculté de Droit, d’Economie et de Gestion d’AngersAdrien Bascoulergue, Doyen de la Faculté de Droit Julie-Victoire Daubié – Université Lumière Lyon 2, Maître de conférences en droit privé Propos introductifsFrançois Barrière, Professeur à la Faculté de droit Julie-Victoire Daubié – Université Lumière Lyon 2, co-directeur de la double licence droit – économie et gestionMatthieu Zolomian, Maître de conférences à l’Université d’Angers Les enjeux de la directive CSRDNathalie Huet, Chargée d’études en droit des affaires, CCI Paris Ile de France Le champ d’application de la directive CSRDEmilie Gicquiaud, Maître de conférences à l’Université d’Angers Des obligations à la portée de toutes les sociétés ?Guilhaume Agbodjan, Avocat, Cabinet Bredin Prat, en détachement au Cabinet Anderson Mori Tomotsune (Japon) Les incidences de la directive CSRD sur le reporting taxonomieJean-Louis Navarro, Maître de conférences à la Faculté de droit Julie-Victoire Daubié – Université Lumière Lyon 2 La certification des rapportsAurélien Rocher, Maître de conférences à la Faculté de droit Julie-Victoire Daubié – Université Lumière Lyon 2 Le reporting extra-financier, quel impact ?Laurent Gautier, Avocat associé, Darrois Villey Maillot Brochier Non-EU Multinantionals facing the CSRDSimon Toms, Avocat associé, Skadden Arps, Slate, Meagher & Flom LLP and Affiliates La CSRD : risques et opportunitésMichèle Lacroix, Group Head of Sustainability, Scor SE Questions & Réponses 18h00 : Propos conclusifs : un regard hors UEGaby Chahine, Professeur à l’USEK (Liban), Magistrat Ce colloque est éligible à la formation continue des avocats. Si vous souhaitez bénéficier d’une attestation de présence, cochez « oui » à la question « Le colloque est éligible à la formation continue des avocats. Souhaitez-vous bénéficier d’une attestation de présence ? » dans le formulaire d’inscription : Réponse au Formulaire L’évènement est gratuit et accessible via Teams. Colloque organisé par la Faculté de droit, Université Lyon 2 et le Centre Jean Bodin, Université d’Angers sous la direction de François Barrière, Professeur à la Faculté de droit Julie-Victoire Daubié – Université Lumière Lyon 2, co-directeur de la double licence droit – économie et gestion, et Matthieu Zolomian, Maître de conférences en droit privé à l’université d’Angers. Source link JUSTIFIABLE s’enrichit avec une nouvelle catégorie dédiée à l’Histoire du droit, alimentée par le flux RSS de univ-droit.fr. Cette section propose des articles approfondis et régulièrement mis à jour sur l’évolution des systèmes juridiques, les grandes doctrines, et les événements marquants qui ont façonné le droit contemporain. Ce nouvel espace est pensé pour les professionnels, les étudiants, et les passionnés d’histoire juridique, en quête de ressources fiables et structurées pour mieux comprendre les fondements et l’évolution des normes juridiques. Plongez dès maintenant dans cette catégorie pour explorer le passé et enrichir vos connaissances juridiques.

0 notes

Text

The Competition Act 2023 And Merger Control for New-Age Markets

The Competition Act, 2002 (“Act”) is the primary legislation for India’s modern competition law, which was enacted to ensure businesses compete fairly. Its aim is no company should abuse its dominance in the market and all market players get a fair chance. Competition Commission of India (“CCI”) is the anti-trust regulator set up by the Act to curb any anti-competitive conduct and promote ethical market practices. Over the years, the Indian market has seen a paradigm shift where innovative and tech-driven business models are emerging and existing businesses are moving towards digitalization. Responding to the evolving market and digital environment, the Government introduced the Competition (Amendment) Act, 2023 (“Amended Act”) in April 2023. Effective September 10, 2024, certain provisions of the Amended Act and new CCI (Combinations) Regulations, 2024 (“New Regulations”) were implemented. These changes broadly include additional deal value threshold criteria, expedited approval timelines, revised scope of control, leniency provision for cartels and others. The Government also introduced three merger control rules[1] which amplified certain provisions.

Read more:

The Competition Act 2023 And Merger Control for New-Age Markets

0 notes

Text

Trading EURCAD with CCI: Your Hidden Edge Imagine spotting profitable trades on EURCAD before the masses catch on, using a tool so underrated it might as well be in disguise. That’s the Commodity Channel Index (CCI) for you—a technical indicator that, when mastered, can turn your trading game into an art form. In this article, we’ll uncover the underground trends, ninja tactics, and insider secrets of combining CCI with EURCAD for game-changing results. By the end, you’ll be equipped to outsmart the market with precision—and a few laughs along the way. Section 1: The Basics Are Boring… Until They’re Not Let’s face it: many traders skip the fundamentals, thinking they’re as exciting as watching paint dry. But understanding CCI is where the magic begins. CCI measures price deviation from its average, giving you a snapshot of market momentum. Here’s the kicker: most traders misuse it, relying on overbought and oversold signals alone. Don’t be most traders. Example: Think of CCI as a weather forecast. When it signals "stormy conditions" (overbought/oversold levels), it’s not telling you to run for cover but to grab your surfboard and ride the wave. Section 2: Why EURCAD? EURCAD is the unsung hero of currency pairs. While everyone’s busy chasing EURUSD or GBPUSD, EURCAD quietly offers less competition and high volatility—a dream combo for traders who know what they’re doing. Quick Fact: According to a 2023 BIS report, EURCAD sees a consistent average daily trading volume of $50 billion, making it liquid yet manageable. Section 3: The Hidden Formula for CCI + EURCAD Most traders set CCI to the default 14-period. Here’s a little-known secret: tuning it to 20 or 30 periods for EURCAD can filter out false signals while capturing broader market trends. Combine this with the 200-day EMA for identifying long-term momentum, and you’ve got yourself a power combo. Step-by-Step Guide: - Apply a 30-period CCI to your EURCAD chart. - Overlay the 200-day EMA. - Look for CCI divergences near the EMA—these are high-probability setups. - Confirm with candlestick patterns like pin bars or engulfing candles. Pro Tip: CCI crossing above +100 doesn’t mean "Buy now!" Instead, wait for a pullback to the EMA—that’s your golden entry. Section 4: Advanced CCI Techniques: The Ninja Playbook 1. Hidden Divergences: Most traders only spot regular divergences, missing out on hidden ones. Hidden divergences occur when CCI makes a higher low, but the price makes a lower low (or vice versa). These often signal trend continuations. 2. Multi-Timeframe Analysis: Use CCI on higher timeframes (e.g., daily) for trend direction and lower timeframes (e.g., 1-hour) for precise entries. Think of it as zooming in and out to see the full picture. 3. Confluence Zones: Combine CCI signals with support/resistance levels and Fibonacci retracements. The more factors aligning, the stronger the trade setup. Section 5: Common Myths About CCI Debunked Myth 1: CCI is only for short-term trading. Reality: CCI works across all timeframes. It’s a versatile tool that adapts to your trading style. Myth 2: Overbought means sell, oversold means buy. Reality: Overbought/oversold levels often indicate strong trends. Selling too soon is like leaving a party just when it gets fun. Section 6: Case Studies: When CCI Nailed It Example 1: The EURCAD Reversal of March 2024 In March 2024, EURCAD showed a classic bearish divergence on the 4-hour chart. CCI peaked at +150 while the price failed to make a new high. Smart traders shorted near 1.4680, riding the drop to 1.4520—a clean 160-pip move. Example 2: Breakout Confirmation in August 2024 After weeks of consolidation, EURCAD broke out above a key resistance at 1.5000. CCI confirmed the breakout with a sustained move above +100, giving traders the confidence to go long. Result? A smooth 300-pip rally. Section 7: Practical Tips for CCI + EURCAD - Avoid Chasing: Wait for pullbacks to key levels. - Use Alerts: Set alerts for CCI crossing specific levels to avoid screen fatigue. - Journal Your Trades: Track what works and what doesn’t with our free trading journal at StarseedFX. - Backtest Religiously: Test your strategy on historical data to build confidence. Conclusion: Your Next Move Trading EURCAD with CCI isn’t just about indicators; it’s about understanding market behavior and mastering subtle nuances. Apply these tactics, refine your approach, and watch your trading results transform. And remember, every expert was once a beginner who didn’t quit. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Highlights of the 53rd GST Council Meeting: Key Updates and Outcomes

Highlights of the 53rd GST Council Meeting: Key Updates and Outcomes. The 53rd GST Council meeting, held on June 22, 2024, in New Delhi, marked the first meeting after the 2024 Lok Sabha elections. Chaired by the newly appointed Union Finance Minister, Nirmala Sitharaman, the meeting addressed several critical issues to streamline GST compliance and enhance the tax structure. This blog provides a comprehensive overview of the meeting’s highlights, updates, outcomes, and the latest news. GST Registration.

Key Decisions and Updates from the 53rd GST Council Meeting

Ease of Compliance Burden for Taxpayers

1. Changes in GSTR-1 Filing:

Introduction of GSTR-1A: Taxpayers can now add or amend particulars in GSTR-1 of the current tax period/IFF for the 1st and 2nd month of the quarter before filing GSTR-3B.

Reporting B2C Supplies: The threshold for reporting Business-to-Consumer (B2C) interstate supplies invoice-wise in Table 5 of GSTR-1 has been reduced from ₹2.5 lakh to ₹1 lakh.

2. GSTR-4 Due Date Revised:

The due date for filing GSTR-4 by composition taxable persons has been extended from April 30 to June 30, starting from the fiscal year 2024-25.

3. TCS Rate Reduction:

The Tax Collected at Source (TCS) rate for Electronic Commerce Operators (ECOs) has been reduced from 1% to 0.5% (0.25% each under CGST and SGST/UTGST or 0.5% under IGST).

4. Compulsory Filing of GSTR-7:

GSTR-7 must be filed mandatorily even if no Tax Deducted at Source (TDS) is deducted. No late fee will be charged for nil filing. GST Filing.

5. GSTR-9/9A Filing Exemption:

Taxpayers with an aggregate annual turnover up to ₹2 crore will be exempt from filing the annual return in GSTR-9/9A for the fiscal year 2023-24.

Modifications to Sections and Rules

1. Modification to Section 16(4):

The time limit to avail Input Tax Credit (ITC) for invoices or debit notes in any GSTR-3B filed up to November 30, 2021, is deemed to be November 30, 2021. This applies retrospectively from July 1, 2017. Section 16(4) shall be relaxed for returns filed within 30 days of the order of revocation.

2. Amendment to CGST Rule 88B:

No interest will be charged on the amount available in the electronic cash ledger on the due date of filing GSTR-3B, debited while filing the return in cases of delayed filing.

3. New Section 128A:

Waives interest and penalties for demand notices issued under Section 73 of CGST for fiscal years 2017-18, 2018-19, and 2019-20 in cases not involving fraud, suppression, and misstatement. This applies if the taxpayer pays the full amount in the notice by March 31, 2025.

4. Changes in Sections 73 and 74:

A common time limit will be set for issuing demand notices and orders. The time limit for taxpayers to claim the benefit of reduced penalty, by paying the tax demanded along with interest, is increased from 30 to 60 days.

https://www.finvertoassociates.com/wp-content/uploads/2024/07/Designer-5.jpeg

Monetary Limits and Appeals

1. Monetary Limits for GST Appeals:

Recommended monetary limits for filing appeals: ₹20 lakh for GST Appellate Tribunal, ₹1 crore for High Court, and ₹2 crore for Supreme Court.

2. Amending Sections 107 and 112:

The maximum amount for pre-deposit for filing an appeal before appellate authorities is reduced from ₹25 crore to ₹20 crore under both CGST and SGST. For appeals before the GST Appellate Tribunal, the pre-deposit is reduced from 20% with a maximum amount of ₹50 crores to 10% with a maximum of ₹20 crores under both CGST and SGST.

Additional Key Decisions

1. Sunset Clause for Anti-Profiteering Cases:

A sunset clause will be added for pending anti-profiteering cases. The hearing panel will shift from CCI to the principal bench of GSTAT. The sunset date for receiving new applications regarding anti-profiteering is set for April 1, 2025.

2. Time Limit for GSTAT Appeals:

Modifying Section 112 to provide a 3-month time frame for filing appeals before the GST Appellate Tribunal. The timeline will commence from a date yet to be notified, likely by August 5, 2024.

3. New Section 11A:

Allows regularization of non-levy or short levy of GST due to common trade practices.

4. IGST Refunds and Adjustments:

Mechanism introduced for claiming refunds of additional IGST paid due to upward price revisions after exports. No IGST refund will be allowed where export duty is payable.

5. Biometric-based Aadhaar Authentication:

Implementation of biometric-based Aadhaar authentication for GST registration will be rolled out nationwide in a phased manner.

6. DRC-03 Circular:

A circular will prescribe a mechanism for adjusting any demand amount paid through DRC-03 against the amount payable as a pre-deposit for filing a GST appeal.

7. Amendment to Section 122(1B):

Clarification that the penal provision is applicable only for those e-commerce operators required to collect TCS under Section 52 and not for other e-commerce operators.

The 53rd GST Council meeting has brought significant changes aimed at simplifying compliance, reducing the tax burden, and enhancing the efficiency of the GST system. These updates reflect the government’s ongoing efforts to create a more robust and taxpayer-friendly GST framework. Keep an eye on official announcements for further details and implementation guidelines.

Stay tuned for the latest updates and insights on GST and other financial regulations.

1 note

·

View note