#Buy Sports NFTS

Explore tagged Tumblr posts

Text

How To Buy Sports NFTS And Make Your Investment Count?

Investing in sports NFTS (Non-Fungible Tokens) is all the rage these days. But do you know how to make your money count with this new form of investing? We will provide you with the information and tips you need to invest smartly in sports NFTS and maximize your returns. Read this article till the end to also know how to collect and trade safe sports NFTs in India.

How To Buy Sports NFTS?

When it comes to investing in sports NFTS, there are a few things you need to keep in mind in order to make the most of your investment. Here are a few tips on how to buy sports NFTS:

1. Do your research — Before investing in any NFT, you must do your research and understand what you’re investing in. With sports NFTS, this means familiarizing yourself with the team or player you’re buying an NFT for. 2. Consider the secondary market — Once you’ve decided which sports NFT you want to invest in, take some time to research the secondary market for that particular NFT. This will give you a better idea of what the NFT is currently worth and how much it could potentially be worth in the future.

3. Buy from a reputable source — When purchasing an NFT, be sure to buy from a reputable source such as an exchange or marketplace. This will help ensure that you’re getting a genuine NFT and not a fake or counterfeit one.

4. Hold onto your NFT — Once you’ve purchased your sports NFT, you must hold onto it for long-term investment purposes. Don’t sell it too soon after buying it as you may miss out on potential profits down the road.

Trading in Sports NFTs is thrilling and presents a huge scope of profitability at the same time.

Upgrade your Trading experience with Upcric — the best platform to collect and trade safe sports NFT in India 1) Signup on upcric.io 2) Explore multiple trading options (across sporting events) & their respective payout 3) Make use of your sports acumen & start trading in NFTs of your favorite sport, events, players 4) See your NFT trade get published on the blockchain

Risks Involved With Investing In Sports NFTS

When it comes to investing in sports NFTS, many risks need to be considered. Perhaps the biggest risk is that the underlying asset (in this case, a professional athlete’s future earnings) may never materialize. For example, a young player could get injured and never play a professional game, or an older player could retire before their NFTS contract expires.

Other risks include the potential for fraud or mismanagement by the NFTs issuer, as well as general market risks such as interest rate changes or economic recession.

Investors need to carefully consider all of these risks before investing in any sports NFTS. As with any investment, there are no guarantees of success and investors could lose some or all of their original investment.

Strategies For Making Your Investment Count

Many strategies can be employed to make sure your investment in sports NFTS pays off.

Firstly, it is important to do your research and invest in a team or player you believe in.

Secondly, don’t put all your eggs in one basket; investing in multiple teams or players will help to spread the risk.

Finally, keep an eye on the market and cash out when the time is right. By following these simple tips, you can maximize your chances of making a profit from your investment in sports NFTS.

Conclusion

By familiarizing yourself with strategies such as diversifying your portfolio and focusing on specific markets, you can maximize your return on investment while reducing the risk of loss. Now that you have all this information at hand, why not take advantage of it and start making smart decisions when it comes to investing in sports NFTS?

Read more: https://upcric.io/

0 notes

Text

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days. ‘ They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

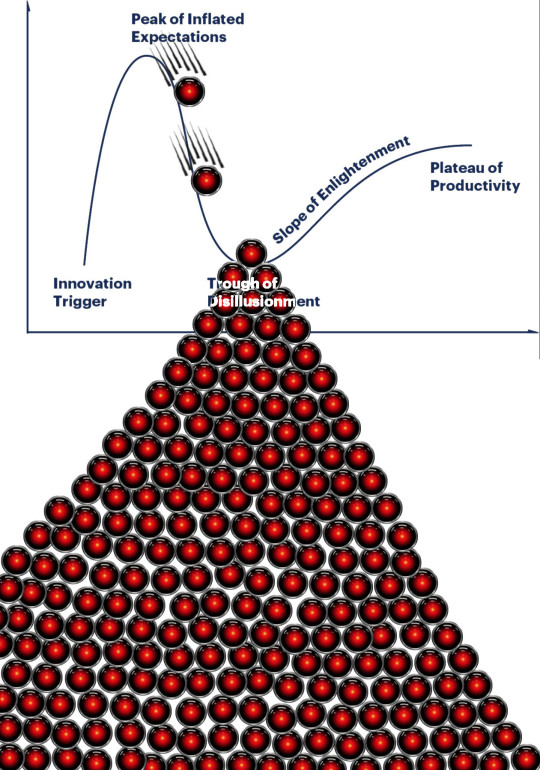

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

unbelievably specific modern things the crows would love. too bad they live in a late-1800s fantasy world

Kaz: screenshotting nfts, those web weaving posts about dog metaphors, leaving people on read, stealing from the self checkout in supermarkets, emo phases, wearing headphones but not actually listening to anything so they're just there just as a conversation deterrent, winding up scam callers, escape rooms, pretending to know nothing about pop culture in order to annoy people, playing solitaire online, Knowing A Guy for everything

Inej: social media sleuthing, posting goodreads quotes, strictly come dancing, snoopy, easily accessible climbing shoes, mr darcy, shouting at the screen when someone's judged incorrectly on a competition show, getting unbelievably competitive about wii sports/duolingo scoreboards/goodreads goals/animal crossing islands/air hockey, texting..... With loads of elipses... Like your parents.... and dropping unprompted wisdom in them.....

Jesper: neon clothes, the 💯 emoji, making everyone as miis on tomodachi life but being so bad at it that kaz and nina's miis end up getting married, lisa frank art, scamming people on depop, cheap jewellery that makes you go green, complaining about how cottagecore videos don't correctly represent the Rural Farm Life, shitty 2000s club bangers, the kitsch movement, giving your car a name, hoiking your novelty socks really high so everyone can see them, shitty christmas films, first person shooters

Wylan: speedpaint videos, joe hisaishi, being judgemental about other people's spotify wrappeds, djungelskog, that gif of the japanese mascot costume running through a bunch of explosions, watching weird low-budget adaptations of shakespeare plays with kaz, those arcade crane games, piercing your own ears with a needle and a lighter then being somehow surprised when it gets infected

Matthias: making an instagram account in-character for your dog, posting low-quality graphics of inspirational or biblical quotes on facebook (yk the ones w the landscape or sunset behind them), taking frowning selfies from below like your granddad does, viking media of any sort, buying dozens of identical t-shirts from big tesco, mixing up celebrities all the time, perpetually caving and giving the scouts/guides/youth groups/football clubs/carollers/etc money for their fundraisers

Nina: making bait posts online in the style of 'why can't we just print more money', period dramas, wearing huge mother of the bride style hats to weddings, saving recipes/crafts/art ideas on tiktok and then never actually doing them, pink gin, tiktok edits of fit celebs/characters, 3 hour video essays abt pop culture, saying 'break up with him' in response to every relationship woe, buying cheerful tat from flying tiger

#the reason I say mr darcy is bc he's a big bitch who does grand gestures at the eleventh hour and Works To Deserve Her. familiar no?#six of crows#crooked kingdom#soc#grishaverse#my post#long post

379 notes

·

View notes

Text

Since I've been posting daily on my art accounts for art fight, I've had several NFT bros message me trying to buy my art for NFTs. I'm against that kind of shit anyway, but every single one has misgendered me? Unless these "alpha men" are going around calling everyone "sweety" and "babe" lol.

If they're real people, why would they come onto pages where my pronouns are the first thing you see and misgender me in a message where you're trying to butter me up so I'll sell to you? Like, if youre trying to be an asshole, im not going to do shit with/for you? If they're bots, what about my page is flagging me as a woman to them? I could understand if it was on this account on Tumblr since I talk about gender and formally being on women's sport teams before I came out, but this is happening on platforms where I only post my art and I'm a lot more private lol

25 notes

·

View notes

Text

On the one hand EA putting NFTs into the new Madden game because sport gamers will swallow fucking any slop put in front of them is really gross and disgusting.

on the OTHER hand the fact that EA cannot even CALL them "NFTs" and had to make up a fake bullshit name for them because the word "NFT" is absolute POISON is really funny and pretty encouraging.

Do this to "AI Art" as well and make it so unpalatable that companies become literally unable to use the word because it would have such an adverse affect on their profits.

Also don't buy EA sport games

31 notes

·

View notes

Text

An In-depth Analysis of Digital Ownership and Value | Vladimir Okhotnikov

In the rapidly evolving world of digital assets, non-fungible tokens (NFTs) have sparked curiosity and controversy. In this extensive blog post, we delve into the insights of Vladimir Okhotnikov, an analytical article author who skillfully connects complex technology concepts with practical financial applications. His work sheds light on the motivations behind NFT purchases, their value, and the implications of decentralization in the digital world. Just as people collect stamps, buy expensive paintings, or own cars for various reasons, NFT buyers have their motivations. Some enjoy collecting unique digital items, while others find the excitement similar to sports. Increasing one's status in a narrow circle, feeling a connection to a celebrity, or keeping up with modern trends are also factors driving NFT purchases. The Amazon Kindle Incident and the Power of Decentralization — Vladimir Okhotnikov Vladimir Okhotnikov references an article from 2009 titled 'Why 2024 Will Be Like Nineteen Eighty-Four,' which discussed Amazon randomly deleting books from users' Kindle devices. This incident highlighted the legal differences between purchasing paper and electronic books and the control large technology companies wield over digital content. Okhotnikov draws parallels between this event and the emergence of blockchain and NFTs, which offer decentralized protection against arbitrary changes or deletion of content. Despite criticism towards NFTs, Vladimir Okhotnikov argues that they share common features with traditional collectibles, making them a viable option in the digital world. The value of digital collectibles is symbolic and not tied to functionality, and physical ownership is not a critical factor in status. As technology and infrastructure develop, the speculative nature of the NFT market may give way to a more sustainable ecosystem. Critics argue that NFTs do not provide real ownership rights, but Okhotnikov questions whether other digital goods offer genuine ownership. When purchasing games on Steam or content from Amazon, users are subject to the whims of these companies, which can remove access to digital goods at any time. In contrast, NFTs provide a level of ownership and control that is otherwise lacking in the digital realm. The Amazon Scam and the Need for Decentralized Solutions — Vladimir Okhotnikov The ability of companies like Amazon to delete digital content without user consent highlights the need for decentralized solutions. NFTs, built on blockchain technology, offer a way to protect digital ownership rights and prevent unilateral actions by corporations or third parties.

NFTs represent a shift in the way we perceive ownership and value in the digital world. While they may not be a foolproof tool for making money, they do provide a technology that grants absolute rights to own a digital asset. As we navigate the complexities of digital ownership, NFTs offer a decentralized solution that protects users from the arbitrary decisions of corporations and third-party actors. By understanding the insights provided by Vladimir Okhotnikov, readers can gain a deeper appreciation for the potential of NFTs and their role in shaping the future of digital collectibles.

3 notes

·

View notes

Text

𝙍𝙚𝙖𝙨𝙤𝙣𝙨 𝙩𝙤 𝙏𝙧𝙖𝙙𝙚 𝙉𝙁𝙏𝙨 𝙤𝙣 𝘽𝙞𝙣𝙖𝙣𝙘𝙚 𝙉𝙁𝙏 𝙈𝙖𝙧𝙠𝙚𝙩𝙥𝙡𝙖𝙘𝙚.

Binance, one of the largest cryptocurrency exchanges in the world, has recently launched its own NFT (non-fungible token) marketplace, called"Binance NFT" or simply "BNFT". The marketplace allows creators to tokenize and sell their digital artworks, collectibles, and other forms of digital assets on the blockchain.

𝘽𝙞𝙣𝙖𝙣𝙘𝙚 𝙉𝙁𝙏𝙨 𝙈𝙖𝙧𝙠𝙚𝙩𝙥𝙡𝙖𝙘𝙚

Binance NFT offers a user-friendly interface with a smooth browsing experience"Binance NFT". It aims to be a one-stop-shop for buying and selling NFTs, featuring everything from digital artwork and collectibles to music and gaming assets.

Binance NFT offers both fixed-price and auction-style sales, with the option for creators to set a reserve price or minimum bid for their items. It also supports both Binance's own Binance Coin (BNB) cryptocurrency and major credit cards as payment methods.

Binance NFT also aims to be a platform for creators, offering various tools and services for artists and other content creators to mint and sell their own NFTs. This includes easy-to-use NFT creation tools, customizable storefronts, and access to Binance's large user base and marketing resources.

Overall, Binance's entry into the NFT market is a major development in the world of blockchain-based digital assets and could have significant implications for the growth and mainstream adoption of NFTs.

Why i prefer to buy NFTs on Binance NFT

# Wide Selection of NFTs :- Binance NFT offers a vast collection of NFTs from various popular artists, celebrities, and brands. Buyers can choose from a wide range of NFTs on Binance NFT.

Wide Range of NFTs : Binance NFT offers a wide range of NFTs to choose from, including artwork, sports collectibles, gaming items, and more. This ensures that buyers have a diverse range of options to choose from based on their interests.

# Secure Platform :- Binance NFT is a secure platform, offering users the peace of mind that their transactions and artwork are protected. This is particularly important for those looking to invest significant amounts in NFTs.

# User-Friendly :- Binance NFT is user-friendly, making it easy for users to browse and buy NFTs. The platform also offers features such as auctions and exclusive drops, making it an exciting place to discover new NFTs.

# Low Fees :- Binance NFT charges low fees for buying and selling NFTs, making it an affordable option for both buyers and sellers. This ensures that users get the best value for their money.

# Integration with Binance :- Binance NFT is integrated with the Binance ecosystem, which means that users can easily buy and sell NFTs using their existing Binance account. This makes it a convenient option for those who already use Binance for cryptocurrency trading.

Overall, Binance NFT offers a secure, user-friendly, and affordable platform for buying and selling NFTs. Its wide range of NFT options, low fees, and integration with Binance make it a popular choice for NFT enthusiasts.

Here are the steps that you can follow to buy NFTs on Binance NFT Marketplace:

1. Go to the Binance NFT marketplace 👇👇👉👉👉

2. Create an account or log in if you already have one.

3. Browse through the available NFT collections or use the search function to find specific NFTs.

4. Once you find an NFT that you like, click on it2. Click on the NFT that you want to buy. This should take you to the item page.

3. On the item page, you can view the item details, such as the name, description, price, and the number of items available.

4. If you intend to buy the NFT immediately, click the “Buy Now” button. If you want to bid on the NFT, click the “Place a Bid” button instead.

5. If you clicked the “Buy Now” button, confirm the purchase by clicking the “Confirm” button.

6. If you clicked the “Place a Bid” button, enter your bid amount and click the “Place Bid” button.

7. Once you’ve completed either of the above steps, the NFT should automatically be added to your Binance NFT wallet.

8. To view your NFT collection, go to your Binance NFT wallet and check your NFT holdings.

9. You can also sell your NFTs on the Binance NFT Marketplace by listing them for sale. To do this, go to your wallet, click on the NFT you want to sell, click on the “Sell” button, and set your price.

10. Lastly, keep in mind that some NFTs are only available to certain users or are part of exclusive drops. Check the eligibility requirements before attempting to purchase an NFT.

In summary, Binance NFT offers a user-friendly platform that provides a diverse range of NFTs, low transaction fees, and high security measures, making it an excellent choice for anyone looking to invest in NFTs.

4 notes

·

View notes

Text

Virtual Currency Games

Every little boy's (and plenty of grown guys's) dream of making a dwelling by way of gambling video video games is edging closer to truth. The recent launch of HunterCoin and the in-improvement VoidSpace, video games which reward players in virtual currency in preference to virtual princesses or gold stars point closer to a destiny in which one's ranking on a scoreboard might be rewarded in dollars, and sterling, euros and yen.

The tale of the millionaire (virtual) real property agent…

Digital currencies have been slowly gaining in maturity both in terms of their capability and the financial infrastructure that enables them for use as a credible alternative to non-virtual fiat currency. Though Bitcoin, the 1st and most widely recognized of the crypto-currencies was created in 2009 there were sorts of digital currencies utilized in video video Top NFT Games for extra than 15 years. 1997's Ultima Online was the first exceptional try to comprise a big scale virtual financial system in a recreation. Players may want to collect gold cash by way of venture quests, fighting monsters and locating treasure and spend those on armour, guns or real property. This became an early incarnation of a virtual forex in that it existed only within the game though it did replicate real global economics to the volume that the Ultima foreign money experienced inflation because of the game mechanics which ensured that there was a in no way finishing deliver of monsters to kill and therefore gold coins to acquire.

Released in 1999, EverQuest took virtual currency gaming a step in addition, allowing players to alternate virtual goods among themselves in-recreation and although it become prohibited with the aid of the game's clothier to also promote virtual objects to each other on eBay. In a actual global phenomenon which became entertainingly explored in Neal Stephenson's 2011 novel Reamde, Chinese game enthusiasts or 'gold farmers' have been employed to play EverQuest and different such video games complete-time with the intention of gaining revel in points with the intention to degree-up their characters thereby making them more effective and favourite. These characters would then be bought on eBay to Western game enthusiasts who have been unwilling or unable to put in the hours to degree-up their own characters. Based at the calculated alternate rate of EverQuest's foreign money due to the real international buying and selling that happened Edward Castronova, Professor of Telecommunications at Indiana University and an professional in virtual currencies anticipated that in 2002 EverQuest become the 77th richest usa inside the international, somewhere among Russia and Bulgaria and its GDP per capita was more than the People's Republic of China and India.

Launched in 2003 and having reached 1 million everyday users by using 2014, Second Life is perhaps the most whole example of a digital economy thus far wherein it is virtual forex, the Linden Dollar which can be used to shop for or promote in-recreation goods and services can be exchanged for real international currencies through market-based totally exchanges. There were a recorded $3.2 billion in-sport transactions of digital goods inside the 10 years among 2002-13, Second Life having end up a marketplace where gamers and organizations alike have been able to design, promote and promote content material that they created. Real estate became a specifically beneficial commodity to exchange, in 2006 Ailin Graef have become the 1st Second Life millionaire whilst she grew to become an initial funding of $9.95 into over $1 million over 2.5 years via buying, promoting and trading digital actual estate to different players. Examples inclusive of Ailin are the exception to the rule of thumb but, simplest a recorded 233 customers making greater than $5000 in 2009 from Second Life activities.

1 note

·

View note

Text

Bored Ape NFT Prices Soar: What's Driving the Surge?

Bored Ape NFT Prices Soar: What's Driving the Surge?

The world of digital assets has been in a state of rapid evolution, and one of the most talked-about trends in recent times is the surge in prices of Bored Ape NFTs. These unique digital artworks have captured the imagination of collectors, investors, and celebrities alike, driving their prices to unprecedented heights. But what exactly is fueling this meteoric rise in value? Let’s delve into the factors behind the soaring prices of Bored Ape NFTs and explore the dynamics at play.To get more news about bored ape nft price, you can visit our official website.

The Allure of Exclusivity One of the primary drivers behind the soaring prices of Bored Ape NFTs is their exclusivity. The Bored Ape Yacht Club (BAYC) comprises 10,000 unique Bored Ape NFTs, each with its own distinct traits and characteristics. This limited supply creates a sense of rarity and desirability among collectors, making them highly sought after. In the world of collectibles, scarcity often translates to higher value, and the Bored Ape NFTs are no exception.

Community and Membership Perks Owning a Bored Ape NFT is more than just owning a digital artwork—it’s also a ticket to an exclusive club. Membership in the Bored Ape Yacht Club comes with a host of perks, including access to private events, virtual meetups, and exclusive merchandise. This sense of community and belonging adds significant value to the NFTs, as members are not just buying an artwork, but also gaining entry into a prestigious and tight-knit community. The added social and experiential value enhances the overall appeal of Bored Ape NFTs.

Celebrity Endorsements The influence of celebrities on the value of NFTs cannot be underestimated. High-profile endorsements and purchases by celebrities have played a crucial role in driving up the prices of Bored Ape NFTs. When well-known figures from the entertainment, sports, and tech industries publicly endorse or buy these NFTs, it generates significant buzz and attracts more attention from the general public. This increased visibility and perceived endorsement of value contribute to the rising prices.

The Rise of Digital Collectibles The broader trend of digital collectibles has also fueled the surge in Bored Ape NFT prices. As more people become interested in owning and trading digital assets, the demand for NFTs has skyrocketed. Digital collectibles offer a new way for individuals to express their identity, showcase their interests, and invest in unique assets. The Bored Ape NFTs, with their distinct and playful designs, align perfectly with the growing appetite for digital collectibles.

Technological Advancements Advancements in blockchain technology and the growing adoption of decentralized platforms have made it easier for people to buy, sell, and trade NFTs. Platforms like Ethereum provide the underlying infrastructure for NFTs, ensuring their authenticity, provenance, and transferability. The ease of access and the ability to securely own and trade digital assets have contributed to the overall growth of the NFT market, including the Bored Ape NFTs.

Investment Potential Another factor driving the surge in Bored Ape NFT prices is their perceived investment potential. Many collectors view NFTs as a new asset class with the potential for significant returns. The ability to resell NFTs on secondary markets at higher prices has attracted investors looking to capitalize on the trend. This speculative aspect of the market has further fueled demand and driven up prices.

Cultural Impact The Bored Ape NFTs have also become a cultural phenomenon, representing a blend of art, technology, and community. They have captured the zeitgeist of the digital age, where virtual identities and online communities play an increasingly important role. The cultural significance of Bored Ape NFTs adds an intangible value that resonates with a wide audience, further driving their popularity and price.

Conclusion The soaring prices of Bored Ape NFTs can be attributed to a combination of factors, including exclusivity, community perks, celebrity endorsements, the rise of digital collectibles, technological advancements, investment potential, and cultural impact. As the NFT market continues to evolve, the value of Bored Ape NFTs is likely to be influenced by these dynamics and more. Whether you’re a collector, investor, or simply an observer, the story of Bored Ape NFTs offers a fascinating glimpse into the future of digital assets and the ever-changing landscape of the digital art world.

0 notes

Text

How Are NFTs Impacting the Sports Industry?

Non-fungible tokens (NFTs) have recently taken the sports world by storm. From collectibles to memorabilia and even game tickets, NFTs are revolutionizing how athletes, teams, and fans interact. Find out how this new technology is changing the industry, what it could mean for the future of sports, and how to make the best Investment in cricket NFT in India!

How NFTs Are Revolutionizing Professional Sports

Since the launch of the NBA Top Shot, a digital collectibles platform built on the blockchain, Non-Fungible Tokens (NFTs) have been thrust into the spotlight. NFTs are advanced resources that are extraordinary and can't be recreated, making them ideal for collectibles. The NBA Top Shot has been hugely successful, with some individual moments selling for over $100,000.

Other sports leagues are now looking to get in on the action. The NFL recently announced that it is partnering with Dapper Labs, the company behind the NBA Top Shot, to create its blockchain-based collectibles. Major League Baseball is also considering launching an NFT platform.

The appeal of NFTs for sports fans is prominent. They offer a new way to engage with and show support for their favorite teams and players. For athletes and celebrities, NFTs provide a new revenue stream. But there are also some concerns about the impact of NFTs on the sports industry.

Benefits of NFTs for Sports Fans and Players

NFTs are a new technology that is quickly gaining popularity in the sports world. Here are some benefits of NFTs for sports fans and players:

1. NFTs offer a new way for fans to show support for their favorite teams and players.

2. NFTs can be used to buy, sell, or trade collectibles and memorabilia.

3. NFTs provide a new way for fans to interact with their favorite teams and players.

4. NFTs can be used to access exclusive content and experiences.

5. NFTs offer a new way for players to connect with their fans.

6. NFTs can help athletes build their personal brands.

Challenges Faced by the Sports Industry

The sports industry is facing several challenges in the current climate. The coronavirus pandemic has significantly impacted the sector, with many events being canceled or postponed. This has led to a decrease in revenue for many organizations and clubs.

Another challenge facing the sports industry is the increasing popularity of digital entertainment. This includes e-sports, which are becoming more popular with younger audiences. This threatens traditional sports, as they compete for attention and investment.

Finally, the sports industry is also facing pressure to become more sustainable. There is an increasing focus on the environment and social issues, and sports organizations are being asked to do more to reduce their carbon footprint and improve their social impact.

These are just some of the challenges faced by the sports industry at present. It is an exciting time for the sector, but some challenges need to be addressed.

Upcric’s Sports NFTs

Upcric have decided to use their expertise to create the best and safest Sports NFT Trading platform in India to enhance the match-watching experience for fans of the sport. While you back your favorite team, or player, to perform and win, you can buy NFT Units, which are customized and curated across categories like player NFTs, Team NFTs, and NFTs for events within each game.

Upcric, basically, allows a user to not only own some extremely cool NFTs but also allows the user to place trades and earn a profit on different events within the match, using their knowledge of sports. Users can invest, and trade across different categories within each game, depending on their opinion, and they are rewarded with NFTs which are automatically sold back to Upcric, at a profit (which is also called potential payout), if their opinion is correct. Or it remains stored in their account, in case the opinion and the outcome of the specific trading market are different from your opinion.

Much like the trading cards and other collectibles from the past, users will have the option to actually play around with their assets with one key difference. They will not have to worry about the asset losing its value because of not being in mint condition later on.

Hence sign up with Upcric today and make your best Investment in cricket NFT in India.

Conclusion

NFTs are revolutionizing the sports industry, providing a way for teams, fans, and athletes to come together in exciting new ways. The possibilities of NFTs are endless and they have the potential to change how we interact with our favorite teams or athletes forever. As more leagues continue to embrace this technology, there is no doubt that it will continue to evolve and offer even more innovative solutions. We can’t wait to witness what comes next! For more info visit our website: upcric.io/

#best investment in cricket nft in india#buy sports nft in india#sports nft platform in india#upcric

0 notes

Text

Crypto Trading Cards: The Future of Digital Collectibles

Crypto trading cards are revolutionizing the collectibles market by combining blockchain technology with the excitement of traditional card trading. These digital collectibles, often designed as NFT cards, are built on blockchain networks, ensuring unique ownership and verifiable authenticity. With their growing popularity, crypto trading cards have become a bridge between gaming, art, and investment, offering both emotional and monetary value. Whether used in gaming ecosystems, showcased as rare items, or traded as digital assets, they represent the next step in the evolution of collectibles.

The Evolution of Trading Cards: From Physical to Digital

Trading cards have a rich history, from physical sports and fantasy cards to their modern digital versions. The shift to digital began with online platforms but was truly transformed by blockchain technology, which introduced the concept of tokenization. By creating tokenized collectibles, blockchain ensures that each card has a unique identifier, making it rare and tamper-proof. Unlike traditional digital assets, these cards allow true ownership, as the blockchain ledger confirms their authenticity and scarcity, making them valuable in ways physical cards could never be.

How Crypto Trading Cards Work

Crypto trading cards leverage blockchain to function as unique and secure assets. Each card is stored on a blockchain, providing transparency and immutability. Smart contracts automate functions like ownership transfers, rarity assignment, and in-game usability. These cards are often integrated with marketplaces like OpenSea and Rarible, enabling users to buy, sell, or trade seamlessly. Beyond trading, these cards shine in play-to-earn games, where players use them in battles or challenges to earn rewards, blending fun with financial opportunities.

Benefits of Crypto Trading Cards

Crypto trading cards offer unparalleled advantages for collectors and investors. With true ownership, users have full control over their assets, unlike traditional in-game items. The scarcity of cards drives up their value, particularly for limited-edition releases. Many cards are cross-platform, usable across multiple games, further enhancing their utility. Additionally, the market for crypto trading cards is an emerging investment opportunity, with the potential for significant value appreciation. These benefits, coupled with a vibrant collector community, make crypto trading cards a compelling asset class.

Popular Crypto Trading Card Platforms

Several platforms are at the forefront of the crypto trading card revolution. Sorare focuses on fantasy football cards tied to real-world player performance. Gods Unchained offers strategic card-based gameplay where users own and trade unique cards. Splinterlands combines play-to-earn mechanics with a robust card economy. Emerging platforms like PrimeTrader are also making waves, expanding into tokenized digital assets and creating secure, user-friendly ecosystems for collectors and traders.

Challenges in Crypto Trading Cards

Despite their appeal, crypto trading cards come with challenges. The volatility of the crypto market can affect card values, making them unpredictable as investments. Additionally, blockchain technology faces environmental concerns due to its energy usage, though efforts are being made to address this. Scams and counterfeit cards are potential risks, emphasizing the need for verification through blockchain tools. For newcomers, the technical barriers, such as setting up wallets and understanding NFT ecosystems, can be daunting.

The Role of Gamification in Crypto Cards

Gamification has transformed crypto trading cards into interactive experiences. Play-to-earn models reward players with cryptocurrency for achievements in card-based games. Seasonal challenges and exclusive events keep users engaged, while strategic gameplay enhances the value of owning rare cards. This gamification not only attracts players but also fosters loyalty and builds thriving communities around platforms that offer these features, ensuring long-term engagement.

The Future of Crypto Trading Cards

The future of crypto trading cards is brimming with possibilities. Advancements like augmented reality (AR) could make cards interactive in real-world settings, while interoperability will allow cards to move seamlessly between games and platforms. Collaborations with major brands, artists, and gaming companies are likely to create high-demand, exclusive collections. As blockchain technology evolves, crypto trading cards are set to become even more valuable as both collectibles and functional digital assets.

Tips for Getting Started with Crypto Trading Cards

Choose a Platform: Research user-friendly platforms like PrimeTrader for reliable services.

Build a Collection: Start with affordable cards to understand market dynamics.

Secure Your Assets: Use trusted wallets and stay vigilant against scams.

Trade Strategically: Monitor market trends to maximize your collection’s value.

Conclusion and Call to Action

Crypto trading cards are a game-changer in the world of collectibles, blending blockchain technology, art, and gamification into an innovative and rewarding experience. These cards offer true ownership, investment potential, and exciting gameplay opportunities. As the market grows, now is the perfect time to explore this space.

0 notes

Text

Exploring the Most Expensive Items Ever Sold in Online Auctions

Online auctions have redefined how we buy and sell valuable items, pushing the limits of what people are willing to pay for exclusive and rare collectibles. From multi-million-dollar artwork to rare collectibles, online platforms have become a hotspot for jaw-dropping sales. Here, we explore some of the most expensive items ever sold in online auctions, showing how online auctions and online liquidation sales have impacted the high-stakes world of rare collectibles.

1. Fine Art and Digital Art: The Rise of NFTs

One of the priciest items ever sold in an online auction is Beeple’s digital artwork, Everyday: The First 5000 Days, which sold for $69.3 million at Christie’s in 2021. This sale marked a new era in the art world by bringing non-fungible tokens (NFTs) into the spotlight. Unlike traditional art, NFTs are digital assets verified using blockchain technology, allowing unique ownership of digital media. Beeple’s sale underscored the growing demand for digital collectibles and highlighted the influence of online auction platforms in diversifying art sales.

2. A Billionaire’s Luxuries: The Record-Breaking Yacht

Another fascinating example is the 405-foot luxury yacht, The GigaYacht, which sold for $168 million on eBay in 2006. This yacht was customized with everything a billionaire could dream of, including a cinema, swimming pool, and helipad. The GigaYacht is not only the most expensive item ever sold on eBay but also a testament to how luxury goods are increasingly being sold through online auctions. This sale exemplifies the appeal of online auctions for high-net-worth individuals who want to bid on exclusive items from the comfort of their homes.

3. Historical Artifacts: The Declaration of Independence

One might not expect an important historical artifact to sell online, but in 2000, a rare, original print of the Declaration of Independence sold for $8.1 million at Sotheby’s. This copy was one of 24 known copies from the original 1776 print. The sale was especially notable because it occurred during the early days of online auctions, showcasing the potential of auction platforms to reach history enthusiasts willing to spend millions to own a piece of American history.

4. Sports Memorabilia: Honus Wagner T206 Baseball Card

The world of sports memorabilia also boasts record-breaking online sales. The Honus Wagner T206 baseball card is one of the most valuable sports cards in history. In a 2021 auction hosted by Goldin Auctions, a 1909 Honus Wagner card sold for $6.6 million, setting a record for online sports memorabilia. The appeal of this card lies in its rarity and the legend surrounding Wagner himself. The record-breaking sale highlights the allure of online liquidation sales in the sports industry, as collectors hunt for the rarest items to enhance their collections.

5. Comic Books: Action Comics 1

When it comes to comic books, Action Comics 1, the debut of Superman, holds the record for the highest sale price online. In 2014, a copy of this comic in pristine condition sold for $3.2 million on eBay. This sale demonstrated the enduring popularity of classic superheroes and the role online auction platforms play in helping comic book collectors access rare and valuable comics. With only a handful of these comics in existence, the price reflects both the scarcity and cultural significance of Superman’s first appearance.

6. Rare Wines and Whiskies

For the connoisseur with an eye for investment, rare wines, and whiskies are often among the top items sold at high prices in online auctions. A collection of rare Macallan whiskies, for example, sold for over $2 million at Sotheby’s. These auctions attract a global audience of collectors, many of whom view wine and whisky collections as both a luxury and an investment. With online auctions, these enthusiasts have access to rare collections that would otherwise be unattainable, further driving up demand and prices.

How Online Liquidation Sales Fuel the Auction Market

Online liquidation sales have emerged as an important factor in driving auction markets, offering both buyers and sellers unique opportunities. While high-profile items grab the spotlight, online liquidation sales provide a platform for other valuable goods to be sold at competitive prices. Through these sales, individuals and businesses can access items such as designer fashion, electronics, and even luxury vehicles at significant discounts. In addition to giving high-end collectors a chance to access exclusive items, liquidation sales also serve as a way for budget-conscious buyers to acquire premium goods.

In recent years, online auctions have benefited from the reach and transparency provided by online liquidation sales, attracting a global audience and fueling demand for everything from rare collectibles to unique luxury items. For buyers, these sales present a unique opportunity to own items that might not otherwise be within reach, and for sellers, it opens a vast marketplace with unprecedented potential for high returns.

Conclusion

From record-breaking art sales to exclusive collectibles, online auctions have become the go-to venue for selling the world’s most valuable items. As online platforms continue to innovate, the trend is only expected to grow, with online liquidation sales bringing even more excitement and accessibility to the world of online auctions. Whether one is seeking investment pieces or unique finds, the online auction marketplace offers an extensive, varied inventory that attracts collectors, investors, and enthusiasts alike.

0 notes

Text

Today’s Digital Frontier: Crypto, NFTs, and AI

Cryptocurrency has become a household name, and Bitcoin, the pioneer of digital currencies, continues to lead the charge. However, the crypto landscape is rapidly evolving with new coins, tokens, and blockchain-based solutions emerging to address real-world problems.

Key Trends in Crypto:

Mainstream Adoption: The widespread adoption of cryptocurrencies is becoming a reality. From institutional investors to everyday users, crypto is being integrated into traditional finance systems. Companies like PayPal, Square, and Tesla now accept Bitcoin, and countries like El Salvador are leading the way in making Bitcoin legal tender.

DeFi (Decentralized Finance): DeFi platforms are disrupting traditional finance by enabling peer-to-peer transactions without intermediaries like banks. These platforms offer services like lending, borrowing, and trading, all powered by blockchain technology.

Crypto Regulation: Governments around the world are taking steps to regulate cryptocurrencies, ensuring their security and preventing misuse. While regulation brings legitimacy, it also raises concerns about stifling innovation.

NFTs and Blockchain: The rise of NFTs (discussed below) has expanded the use of blockchain beyond cryptocurrencies, creating new opportunities for ownership and digital assets.

Cryptocurrency continues to revolutionize how we think about money, investment, and financial services, opening up new opportunities for decentralization and democratized finance.

2. NFTs: Digital Ownership Redefined

NFTs, or Non-Fungible Tokens, are unique digital assets that represent ownership of a specific item, piece of art, or collectible. Unlike cryptocurrencies, which are interchangeable, NFTs are one-of-a-kind, making them perfect for representing ownership in digital and physical items. The booming NFT market has taken the art, entertainment, and gaming industries by storm, unlocking new ways for creators and collectors to interact with digital content.

Key Trends in NFTs:

Art and Creativity: NFTs have democratized the art world, allowing artists to tokenize their work and sell it directly to buyers. Digital art, music, and even tweets have been sold as NFTs for millions, empowering creators and disrupting traditional art markets.

Gaming and Metaverse: NFTs are transforming the gaming world by enabling players to own, trade, and sell in-game assets. The concept of the Metaverse, a virtual world where users interact with each other and digital environments, is also being built on NFTs, allowing users to buy, sell, and trade digital land, clothing, and more.

Celebrity and Brand Involvement: Celebrities, sports figures, and brands are entering the NFT space, launching their own tokenized products and creating exclusive experiences for fans. This trend is driving mass-market interest in NFTs and attracting a broader audience to the space.

NFT Marketplaces: The growth of NFT marketplaces like OpenSea, Rarible, and Foundation is making it easier for creators to monetize their work and for buyers to find unique digital assets. These platforms are becoming hubs for NFT trading and fostering a vibrant community of collectors and creators.

NFTs are redefining digital ownership, offering unprecedented opportunities for creators, collectors, and investors alike.

3. Artificial Intelligence (AI): Powering the Future

Artificial Intelligence (AI) has moved beyond science fiction into the realm of real-world applications. From chatbots to autonomous vehicles, AI is transforming industries and automating tasks that were once done by humans. As machine learning, natural language processing, and computer vision continue to advance, AI is enabling smarter, more efficient ways to work, live, and solve complex problems.

Key Trends in AI:

AI in Crypto and NFTs: AI is helping enhance cryptocurrency trading by providing predictive analytics and real-time market insights. AI-driven trading bots are becoming increasingly popular among traders to automate the buying and selling process. Similarly, AI is playing a role in NFT creation, with algorithms being used to generate digital art and assist artists in designing unique pieces.

AI and Automation: AI is driving automation in various industries, from healthcare to finance. Machine learning algorithms are used to automate tasks, improve efficiency, and reduce human error. In the financial sector, AI is powering algorithmic trading, fraud detection, and risk analysis.

AI-Powered Personalization: In consumer-facing industries, AI is revolutionizing how brands engage with their customers. Machine learning algorithms analyze data to provide personalized recommendations in real-time, from content suggestions on streaming platforms to product recommendations in e-commerce.

Ethics and Regulation of AI: As AI technologies evolve, so do concerns about their ethical implications. Bias in algorithms, data privacy, and the potential for job displacement are important issues that are being addressed by policymakers and developers. Creating frameworks for the ethical use of AI is essential for ensuring that these technologies benefit society.

AI is not only improving the efficiency of industries but is also driving new innovations across various sectors. As AI continues to evolve, its impact on crypto and NFTs will only increase, bringing new ways to automate, secure, and personalize digital experiences.

4. The Intersection of Crypto, NFTs, and AI: A New Digital Ecosystem

While crypto, NFTs, and AI are transformative on their own, together they are creating a new digital ecosystem where these technologies work in synergy to unlock new possibilities. The integration of blockchain with AI and NFTs is reshaping how we perceive digital ownership, investment, and innovation.

Key Trends in the Intersection:

AI-Driven Crypto Trading: Machine learning algorithms are being used to predict market trends and automate crypto trading. These algorithms can analyze vast amounts of data to identify patterns and make decisions in real-time, helping traders make more informed and profitable choices.

Blockchain-Powered AI Models: Blockchain can provide decentralized data storage and transparent auditing for AI models, ensuring data privacy and reducing the risk of bias. This combination has the potential to revolutionize industries like healthcare and finance, where trust and transparency are crucial.

NFTs as AI Art: AI is also contributing to the creation of NFTs by generating digital art, music, and content. Artists are using AI tools to create unique pieces of art that are then tokenized as NFTs and sold on platforms, pushing the boundaries of creativity in the digital art world.

Decentralized Autonomous Organizations (DAOs): DAOs, which are powered by blockchain technology, use AI to manage decision-making processes. By leveraging AI, DAOs can automate governance and financial decisions, creating more efficient and transparent systems for decentralized communities.

The convergence of crypto, NFTs, and AI is giving birth to new business models, opportunities, and innovations, shaping a future where digital ownership, decentralized finance, and intelligent systems work seamlessly together.

5. Looking Ahead: The Future of the Digital Frontier

As we look toward the future, the synergy between crypto, NFTs, and AI will continue to drive the digital economy forward. Here are some key areas to watch:

Wider Adoption of NFTs: As the NFT market matures, more industries—such as real estate, fashion, and entertainment—will explore the potential of NFTs for digital ownership and trade.

Mainstream AI Integration: AI will become more embedded in everyday products and services, from smarter virtual assistants to AI-powered devices and applications.

Regulation and Security: As these technologies grow, the need for robust regulation and security measures will become more pressing to ensure safe, ethical, and transparent use.

The digital frontier is rapidly unfolding, and staying ahead of these trends will be key for businesses and individuals looking to capitalize on the future of crypto, NFTs, and AI.

Final Thoughts: Embrace the Digital Future

The rise of cryptocurrency, NFTs, and AI is not just changing industries—it’s shaping the very way we live and work. As these technologies evolve, they will continue to revolutionize our digital world, offering new opportunities for innovation, investment, and creative expression. The future is digital, and those who embrace these technologies today will be well-positioned to thrive in tomorrow's world.

0 notes

Text

Collect and Trade Sports NFTs at Upcric | Best NFT Platform in India

Upcric - Buy, Sell and Trade the most affordable NFTs on India’s Leading & Safest NFT Platform. Buy Sports NFT Under Rs.500. Click above to capture the deal.

Read more: https://upcric.io/

#Collect and Trade Sports NFTs#Collect and Trade Sports NFT in India#Buy Sports NFT in India#Best NFT Platform in India

1 note

·

View note

Text

Unlock new opportunities with House of Craven's digital and NFT auctions

House of Craven, a leader in the digital collectible’s revolution, stands out in the rapidly evolving digital world. We offer unique opportunities for collectors and investors, with our digital and NFTs online auctions providing a seamless and secure platform. You can explore, buy, and sell digital assets, from digital art to sports memorabilia. Whether you're a seasoned collector or new to digital investments, House of Craven offers an innovative way to diversify your portfolio.

Our online auction platform is designed with the user in mind, providing a secure and transparent environment where buyers and sellers can connect. With blockchain technology ensuring authenticity and provenance, you can trust that our collection's digital asset or NFT is genuine and unique. The ease of online access allows participants worldwide to engage with our auctions, making digital collectibles accessible to a global audience. From rare digital art pieces to exclusive NFTs, our catalog is continuously updated, catering to a wide range of interests and investment appetites.

At House of Craven, we are not just an auction house. We are a vibrant community of enthusiasts, creators, and investors united by a shared passion for the future of digital assets. Our team is dedicated to curating a diverse range of high-quality digital collectibles and NFTs that offer both aesthetic appeal and investment potential.

Explore our platform today and discover the opportunities in the digital collectibles market. With House of Craven, you're not just buying an asset but investing in a new frontier of creativity and innovation. Start your journey with us and become a part of the digital revolution.

0 notes

Text

Understanding The NFT Market And The Importance Of NFT Analytics

The Non-Fungible Token (NFT) market has seen unprecedented growth and attention in recent years. These unique digital assets, authenticated via blockchain technology, have revolutionized the way we perceive ownership and value in the digital world. From art and music to virtual real estate and sports memorabilia, NFTs are creating new paradigms of digital ownership. However, navigating the NFT Market requires a deep understanding of its dynamics and a keen insight into NFT analytics. At Degenz Finance, based in the United States, we are committed to providing our clients with the tools and knowledge needed to thrive in this burgeoning market.

The NFT Market: An Overview

The NFT market is a digital ecosystem where unique digital assets are bought, sold, and traded. Each NFT is distinct, with its own metadata and value, making it different from cryptocurrencies like Bitcoin or Ethereum, which are fungible and identical to each other. The uniqueness of NFTs is what drives their value, allowing creators to monetize digital works in ways previously unimaginable.

Growth and Trends

The NFT market has experienced explosive growth. In 2021 alone, NFT sales surpassed $2 billion in the first quarter, a testament to their increasing popularity. This growth is fueled by several factors:

Digital Transformation: As the world becomes increasingly digital, the concept of owning and collecting digital assets has gained acceptance.

Blockchain Technology: The transparency and security provided by blockchain technology ensure that ownership and authenticity of NFTs are indisputable.

Celebrity Endorsements: High-profile endorsements and participation from celebrities and influencers have brought mainstream attention to NFTs.

Understanding NFT Analytics

As the NFT market expands, so does the need for sophisticated tools and methodologies to analyze it. Nft ANALYTICS involves the study of various data points related to NFTs to make informed decisions about buying, selling, and holding these assets.

Key Metrics in NFT Analytics

Sales Volume: This metric indicates the total number of NFTs sold within a specific period. Analyzing sales volume helps understand market demand and popularity of certain NFTs.

Price Trends: Tracking the price trends of NFTs over time provides insights into their value fluctuations. This is crucial for identifying potential investment opportunities.

Ownership Distribution: Understanding how NFTs are distributed among owners can reveal patterns of concentration and diversity in the market.

Marketplaces Performance: Analyzing the performance of various NFT marketplaces helps identify the best platforms for buying and selling NFTs.

Why NFT Analytics Matter

NFT analytics are vital for several reasons:

Informed Decision Making: With accurate data and insights, investors can make better decisions about which NFTs to buy or sell, maximizing their returns.

Market Trends: By analyzing market trends, investors can anticipate shifts and adjust their strategies accordingly.

Risk Management: Understanding the risks associated with NFT investments, such as market volatility and liquidity, allows investors to mitigate potential losses.

Valuation Accuracy: Accurate valuation of NFTs ensures fair pricing and helps in negotiating better deals.

Tools and Platforms for NFT Analytics

At Degenz Finance, we leverage cutting-edge tools and platforms to provide comprehensive NFT analytics. Here are some of the essential tools:

Blockchain Explorers: Tools like Etherscan provide detailed information about NFT transactions, including ownership history and transaction amounts.

Marketplaces Data: Platforms like OpenSea and Rarible offer data on sales volume, price trends, and other vital metrics.

NFT Analytics Platforms: Specialized platforms like NonFungible.com and CryptoSlam provide in-depth analytics on various aspects of the NFT market.

Social Media Analytics: Monitoring social media platforms helps gauge public sentiment and hype around specific NFTs, influencing their value.

The Future of NFT Analytics

The future of NFT analytics looks promising as the market continues to evolve. With advancements in artificial intelligence and machine learning, predictive analytics will play a significant role in forecasting market trends and identifying lucrative investment opportunities.

Moreover, as regulatory frameworks around NFTs become clearer, analytics will help ensure compliance and transparency in transactions. Enhanced data analytics will also drive innovation in NFT valuation models, making them more accurate and reliable.

Conclusion

The NFT market presents immense opportunities for investors and creators alike. However, navigating this complex landscape requires a thorough understanding of market dynamics and robust analytical tools. At Degenz Finance, we are dedicated to empowering our clients with the knowledge and resources needed to succeed in the NFT market.

By leveraging advanced NFT analytics, we help our clients make informed decisions, manage risks, and capitalize on emerging trends. Whether you are a seasoned investor or a newcomer to the NFT space, our expertise and insights will guide you toward achieving your financial goals in this exciting digital frontier.

As the NFT market continues to grow and mature, staying ahead of the curve with accurate and actionable analytics will be crucial. Trust Degenz Finance to be your partner in navigating the ever-evolving world of NFTs.

0 notes