#Business Insurance Australia

Explore tagged Tumblr posts

Text

The Importance of Public Liability

Public liability Sydney protects individuals and businesses from financial losses resulting from property damage or personal injury. This type of insurance covers a wide range of incidents, including slips and falls.

There is a huge range of businesses that require public liability, from sole trader cleaners to large national companies. Many are required by government contracts to have cover. To know more about Public Liability, visit the Arc Insurance Brokers website or call 0468848642.

Many tradesmen work on site at client locations, which puts them at risk of property damage and personal injury. While not mandatory in Australia, it is wise for tradies to take out public liability insurance to cover their business against the risks of an incident.

It covers any damages your business is liable for caused by your business activities, such as third-party property damage, personal injury and accidental damage to goods. Without public liability, a single incident could bankrupt your business.

The cost of public and product liability will vary between insurers. It will also depend on your occupation and how much of the risk is carried by your business. For example, electricians will pay higher premiums than plumbers due to the more hazardous nature of their jobs. Other factors that will affect the price include your turnover and the number of people in your business. Some insurers may measure these by revenue, while others use staff numbers.

Whether you operate as an independent contractor or work for a company, public liability and workers compensation are important requirements to meet. Failure to have the required insurance policies can result in hefty fines from the NSW government and a loss of reputation.

Subcontractors are usually specialists hired by a principal contractor to carry out a particular task or function on a jobsite. While this is a common practice in many industries, it’s vital that businesses ensure their subcontractors have the right insurance coverage in place before accepting their services.

If damage or injury is caused by a subcontractor, the injured person or business will likely sue everyone involved. This includes the principle contractor, the head contractor and any other subcontractors or employees. This is why it’s vital for subcontractors to have their own public liability policy. They should also request a copy of the policy from any principal contractors they work with to ensure their policy is current.

Australian law deems importers as manufacturers of the goods they bring in, meaning if these imported goods cause injury or damage to someone then you may be held liable. This can be a substantial claim as insurance policies typically cover compensation payable to the injured party, and also your defence costs.

Whether you’re a graphic designer in Burwood or a hair and beauty salon in Thredbo public liability is something every NSW small business should consider. As a professional it’s likely you interact with your clients in many different ways from visiting their workplace to meeting them at their home, work or at third party locations.

All of these scenarios are a potential risk for your business as it’s not always possible to be with your clients and control their actions at all times. That’s why it’s important to be covered with a comprehensive Public Liability policy.

As a small business owner in NSW, you have plenty on your plate. There are marketing campaigns to manage, staff salaries to pay and Zoom calls to make. But don’t underestimate the importance of securing public liability insurance.

Just one claim could be financially crippling and destroy your reputation. That’s why public liability is a must for any business that interacts with customers, clients or the general public.

Whether it’s a child injures themselves at your children’s play centre, or your employee damages customer property at their workplace, public liability covers compensation claims and reasonable legal fees incurred to defend the claim. It also includes a range of other expenses, like cleaning costs and repairs to third party property. This type of cover is not mandatory, but many organisations you work with may ask that you carry a certain level of public liability cover. If you’re unsure about what cover you need, talk to a licenced insurance broker or business adviser. To know more about Public Liability, visit the Arc Insurance Brokers website or call 0468848642.

#personal insurance#insurance brokers australia#personal insurance kellyville bridge#personal insurance sydney#insurance brokers sydney#business insurance kellyville ridge#insurance brokers#Sydney Insurance Broker#Insurance Brokers Australia#Business Insurance Australia#public liability#public liability insurance#public liability insurance for business#public liability insurance price#public liability insurance cost

0 notes

Text

#motor insurance in australia#event insurance australia#business insurance australia#marine transit insurance#farm insurance australia#business insurance consulting#home and contents insurance australia

0 notes

Text

Which Is Better: Mortgage Broker Or Banks & Their Pros And Cons

Most people get home loans when buying a home, and for this, they either hire a finance broker or consult directly with the bank or lender. When buying a home, there are multiple things you need to look after, such as finding the lender, comparing costs, and additional expenses. These additional costs include stamp duty, council fees, mortgage registration fees and home insurance, for which you can hire the best insurance broker in Brisbane

3 notes

·

View notes

Text

Buy and Sell Insurance | Stratagem Wealth Management Discover the best way to Buy and Sell Insurance with Stratagem Wealth Management. Our expert guidance ensures you make informed decisions for your financial future. Start securing your assets today!

#smsf#buy sell insurance#key man insurance australia#buy and sell insurance#key person insurance australia#best debt consolidation in australia#financial management#advice on finances#finance financial management#superannuation investment#financial financial services#control of finance#financial planning and services#insurance for a small company#business continuity insurance#self managed super fund set up#australia retirement fund#money and investment#australia superannuation rate

0 notes

Text

Business & Personal Loans | Mortgage Broker - Fundrr Australia

Welcome to Fundrr, your trusted partner for all your vehicle and personal loan needs.

Fundrr Australia

At Fundrr, we understand that life's journey often requires financial support, whether you're looking to hit the open road in your dream car or need some extra funds for those important personal milestones. That's why we're here to make your dreams a reality.

Fundrr Australia offers a wide range of financial solutions, including consumer car loans, commercial car loans, personal loans, refinancing options, insurance, and more.

At Fundrr, we understand that life's journey often requires financial support, whether you're looking to hit the open road in your dream car or need some extra funds for those important personal milestones. That's why we're here to make your dreams a reality.

Our mission is simple: to provide you with hassle-free access to affordable and flexible financing solutions tailored to your unique needs. With years of experience in the industry, our team of experts is dedicated to helping you navigate the complex world of loans and financing, ensuring you make informed decisions that align with your financial goals.

Services:

Consumer Car Loan, Personal Loan, Commercial Car Loan, Refinancing Services, Insurance Services, Financing Solutions, Mortgage Broker

#Fundrr Australia#Vehicle & Personal Loan Australia#Vehicle & Personal Loan Melbourne#Vehicle & Personal loan Tarneit#Personal Loan Australia#Personal Loan in Victoria#Personal Loan Melbourne#Personal Loan in Tarneit#Personal Loan in Truganina#Consumer Car Loan Melbourne#Commercial Car Loan Melbourne#Business Car Loan Tarneit#Refinance Services Australia#Refinance Services Melbourne#Business Loan Melbourne#Mortgage Broker in Australia#Online Insurance in Australia#Loan & Financing Services Truganina#Financing Solutions Melbourne#Business Financing Partner

1 note

·

View note

Text

Discover how Insurance for Tradesmen and Business Contents Insurance can unlock business success with optimal coverage minimal cost Read our detailed guide now.

0 notes

Text

Maximising Protection: Benefits of a Business Insurance Broker

In the unpredictable world of business, safeguarding your company against potential risks is paramount. One of the most effective ways to ensure comprehensive protection is by enlisting the expertise of a business insurance broker.

These professionals serve as invaluable partners, guiding you through the complex landscape of insurance options and helping you secure the coverage best suited to your unique needs.

The Role of a Business Insurance Broker

Before delving into the benefits of working with a Business Insurance Broker Melbourne, let's first clarify what they do. Essentially, these professionals act as intermediaries between businesses and insurance providers.

They possess in-depth knowledge of various insurance products and can navigate the intricacies of policy terms and conditions with ease. By leveraging their expertise, you gain access to a tailored insurance solution that aligns perfectly with your business objectives.

Tailored Solutions for Every Business

One of the standout advantages of partnering with a business insurance broker is the personalised approach they offer. Unlike off-the-shelf insurance packages, which may not fully address your specific requirements, brokers take the time to understand the nuances of your business.

Whether you operate a small startup or a large corporation, they can tailor a solution that provides optimal coverage without unnecessary expenses.

Access to a Wide Range of Policies

Navigating the multitude of insurance options available can be overwhelming for business owners. However, with a business insurance broker by your side, you gain access to a vast array of policies from multiple providers. This ensures that you have ample choices and can select the most suitable coverage for your company.

From general liability and property insurance to cyber liability and professional indemnity, brokers can source policies that comprehensively protect your business from various risks.

Expert Guidance Every Step of the Way

Choosing the right insurance coverage involves more than just comparing premiums and deductibles. Policy exclusions, coverage limits, and claim processes are equally important factors to consider. Here's where the expertise of a business insurance broker Melbourne truly shines.

They provide invaluable guidance throughout the entire insurance lifecycle, from initial consultation and policy selection to claims assistance and renewal reviews. With their support, you can make informed decisions and navigate potential pitfalls with confidence.

Cost-Effective Solutions

Contrary to popular belief, enlisting the services of a business insurance broker doesn't necessarily translate to higher costs. In fact, brokers can often negotiate competitive premiums on your behalf by leveraging their industry relationships and market knowledge.

Additionally, they can identify areas where you may be overinsured or underinsured, helping you strike the right balance between comprehensive coverage and affordability.

Peace of Mind for Business Owners

Ultimately, the primary goal of any insurance policy is to provide peace of mind, allowing you to focus on growing your business without constantly worrying about unforeseen risks. By partnering with a business insurance broker, you can rest assured knowing that your company is adequately protected against potential liabilities.

Whether it's mitigating the financial impact of a lawsuit or recovering from property damage, having the right insurance coverage in place can mean the difference between business continuity and closure.

Conclusion

The benefits of working with a business insurance broker Melbourne are undeniable. From tailored solutions and access to a wide range of policies to expert guidance and cost-effective solutions, these professionals play a crucial role in maximising protection for businesses of all sizes.

If you haven't already, find a reliable business insurance broker, visit their Website, and safeguard the future of your company.

Source: Maximising Protection: Benefits of a Business Insurance Broker

#business insurance broker#insurance broker Melbourne#business insurance broker australia#insurance broker#Best Insurance Brokers in Melbourne#Melbourne insurance broker

0 notes

Text

A Complete Guide to Individual Health Insurance In 2024

Individual health insurance plays a vital role in providing financial protection and access to healthcare services for individuals and families. Whether you’re self-employed, not covered by an employer’s plan, or seeking additional coverage, understanding individual health insurance is essential. In this guide, we’ll explore the key aspects of individual health insurance, including its…

View On WordPress

#best health insurance#health#health insurance#health insurance 101#health insurance deductible explained#health insurance exchange#health insurance explained#health insurance for entrepreneurs#health insurance for self employed#health insurance for small business#health insurance marketplace#how to apply for individual health insurance#individual health insurance coverage#insurance#private health insurance#private health insurance australia

0 notes

Text

Your Valuables Deserve Protection! Our Removals Insurance in Brisbane Ensures Peace of Mind During Your Move. Safeguard Your Belongings with Our Trusted Coverage. Move Confidently, We've Got You Covered! 📦🔒

#houseInsurance#australia#insuranceagent#insurancebroker#insurance#team#business#homeinsurance#finance#insuranceclaim#protection#money#financialfreedom#insurancepolicy#realestate#Movinginsurance#Removals#Removalinsurance#movingin#movingout#movingon#movinghouse#movingoverseas#besecure#security

0 notes

Text

At selectinsure, we strive to provide excellent customer service and make the claims process as easy and stress-free as possible. We have a team of experienced professionals ready to assist you with any questions or concerns you may have. Protect your vehicle and yourself with selectinsure Personal Motor Vehicle insurance.

#selectinsure#business insurance broker Sydney#business insurance broker perth#business insurance broker#selectinsure Australia#best insurance broker Adelaide#best insurance broker Melbourne#selectinsure Brisbane

0 notes

Text

upcoming store stuff & why we're doing a super sale

omg hiiii it's devin again, and this time i'm bringing store news

the short version: we're moving ourselves back to minnesota, and we're moving order fulfillment to a fulfillment center

wow, that's big news! maya and i are so so so excited to be closer to our minnesota friends (and also my family lol). i'm hoping to be back in northeast minneapolis, but let's be real we're probably gonna get priced out and into the suburbs

in addition to that, due to a variety of reasons i'll explain in more detail below, we're transitioning from in-house fulfillment to working with a fulfillment center (or 3pl, short for third-party logistics). we're at an awkward size that makes staffing difficult and have had issues with extended processing time. the 3pl should be set up by september, and we're working on the back end to have fulfillment centers in australia, canada, the UK, and eventually the EU. if tax authorities work with us we should have all that ready by december 2024!

to prepare for that we're doing a super sale. ash told me not to call it liquidation but she said that like 30 seconds after i hit send on the marketing email, sorry about that. items that we don't want to pay to move to the 3pl are discounted by 25-70%, with some of them priced at cost. under no circumstances will anything ever be 70% off again

if you're nosy you can read the q&a i made up in my head while eating pigs in a blanket:

how are the labor protections at the 3pl?

pretty good! we were shocked to find anything even halfway decent in the US; we went looking for a fulfillment center in the EU to handle all international fulfillment, and the one we found just so happened to have bought a US location two years ago.

they're located in ohio, pay $19/hr, and provide health insurance and 401k matching. that seemed too good to be true so we dug through employee reviews on places like glassdoor, and while there were some bad reviews those were all dated prior to when the facility was purchased by this new company. they also have a very low turnover rate which is a HUGE green flag

why are you transferring to a 3pl?

the serious

sometimes we have a high volume of sales, and it makes sense to have two full-time employees plus a part timer! but usually we have a low-to-medium volume of sales. we can float by on that, but it gets risky, and the economy is in a bad enough state that we're concerned about the longevity

related, the 2023 holiday sale showed us some major flaws in our fulfillment process. if the same issues were to happen this year the business probably wouldn't survive

we're moving cross-country in early 2025 and would've had to close this location anyway

the dumb:

i'm sick of dealing with commercial landlords and if i have one more wall leak i'm going to throw it into the river brick by brick

what about your staff?

unfortunately we will have to say goodbye to our office staff. they have been given 3.5 months notice and no-questions-asked PTO for interviews with a small severance

why are you moving back to minnesota?

troy was always meant to be a temporary move. initially the plan was to move to vermont or massachusetts, but after being out here for 7 years we just kinda want to go home. the weather in troy is perfect for us, we love the mountains, and we have some great friends here, but for some goddamn reason we want our eyelashes to freeze together.

will you be returning to midwest cons?

if we return to cons at all it will be with ariel and/or ash running the booth, maya will not be involved. this would likely be in california and/or in the northeast US.

my friends are begging me to go to CONvergence as an attendee so ig you might see me there? maya has pledged death before crowded venues tho

will you do any local events in minnesota?

we might do sample sales. honestly idk what we're gonna do with the samples we have in troy, most of them are terrible. do you want samples of the strangest low rise bell bottom pants ever created? please take them from me. my bush hangs out

also my kid brother has gotten really into library events and if he asks nice enough we might do some of those

is there anything else?

i mean probably, but i started this last week and i haven't had any other ideas on what to include

135 notes

·

View notes

Text

The Importance of Public Liability

If you have been injured in a public place such as a supermarket or office building, you may be able to make a public liability claim. Compensation payouts typically include pain and suffering.

Having public liability Sydney can protect a wide range of businesses from the costs associated with a compensation claim. Insurance brokers can help you find the right cover for your business needs.

As a business owner, public liability insurance provides peace of mind in case a customer or event attendee claims that your negligence has resulted in them suffering a loss. Policies typically have limits of $10 million or $20 million, which will cover the cost of compensation as well as legal costs incurred in defence of such a claim.

As an added bonus, most policies will also include pain and suffering coverage. This is a lump sum that’s paid out in the event of injury and covers the impact on your quality of life. If the injuries are significant, they may also include a lump sum for permanent impairment.

It’s little wonder that the Australian government strongly recommends most businesses hold public liability. After all, the consequences of a minor oversight – like a customer tripping over a drain cover in your car park – can easily escalate into a multi-million-dollar settlement. The same goes for damage caused by your products or services.

Anyone who interacts with clients face-to-face, either in their own premises or out and about, should consider public liability insurance. This includes tradesmen, who will usually be required to have public liability before they can work on certain projects - and many cleaners as well. In addition, many businesses that import products into Australia need to include products liability coverage in their public liability policy.

Whether you are an IT contractor in Burwood or a dog groomer in Thredbo, business owners have a lot on their plate – never-ending to-do lists, marketing campaigns, staff to pay and Zoom calls to make. However, it is important to find time to review the insurance coverage you have in place, particularly your public liability. It could be the difference between a successful claim and an expensive legal battle. You can read more about insurance packages, including the inclusions, exclusions and claim process, here. You can also compare business insurance policies online or by calling a friendly Australian-based customer service team.

Businesses that interact with customers and members of the public in person should consider taking out public liability insurance. This can include tradespeople who visit their clients' premises, or any business that has an office, showroom or shop. This insurance can help to cover compensation for injury or damage to a customer's property caused by the activities of the business. It may also cover legal costs and defence expenses.

Depending on the nature of the injury, a public liability claim payout can be quite substantial. This includes compensation for pain and suffering (also known as general damages) which is paid as a lump sum based on the extent of the injuries. It can also include compensation for future losses if the injuries result in permanent impairment.

A reputable insurance broker can provide detailed information about the coverage available under public liability. They can also offer a variety of options such as yearly or monthly payments and tailored coverage for different types of businesses.

The coverage available under public liability Sydney can include a range of things such as medical expenses, compensation for the injury or death of third parties and damage to their property. It also covers the legal costs incurred in defending a liability claim. This is important for any business that may come into contact with members of the public, whether it is selling goods or services to them.

Whether you’re an IT wizard from Burwood, a dog groomer in the Blue Mountains or a cafe owner in Thredbo, you can benefit from having a public liability policy. This is because a claim could be financially devastating for a small business without adequate cover.

The amount of cover required can vary between businesses, and it is usually based on the type of work you do. For example, some tradesmen require public liability insurance before they can go to certain sites, and cleaners will need it to be let into offices.

#Travel Insurance#Insurance Brokers#Insurance Brokers Sydney#public liability#Business Insurance Kellyville Ridge#Professional Insurance Kellyville Ridge#Business Insurance Australia#Sydney Insurance Broker#Arc Insurance Brokers

0 notes

Text

5 Things You Need to Know About Home and Contents Insurance in Australia

Introduction:

Your home is more than just a place to live; it’s a sanctuary where cherished memories are made and treasured belongings are kept. However, unforeseen events such as natural disasters, theft, or accidents can pose a threat to the safety and security of your home and its contents. That’s where Home and Contents Insurance from Business Insurance Consulting comes to your rescue. With our comprehensive insurance coverage, you can safeguard your home, its valuable contents, and enjoy peace of mind knowing that you are protected against unexpected losses. Let’s explore the benefits and importance of having Home and Contents Insurance.

Protect Your Home:

Your home is one of the most significant investments you’ll make in your lifetime. Home Insurance from Business Insurance Consulting provides coverage for the structure of your home, protecting it against damage caused by fire, storm, flood, or other covered events. Whether it’s repairing a damaged roof or rebuilding your entire home, our insurance policy ensures that you are financially secure in the face of such unfortunate circumstances.

2. Safeguard Your Belongings:

Your personal belongings hold sentimental value and are essential for your daily life. Contents Insurance from Business Insurance Consulting offers coverage for your valuable possessions, including furniture, appliances, electronics, jewelry, and more. In the event of theft, accidental damage, or loss, our insurance policy provides financial assistance to repair or replace your belongings, helping you get back on your feet quickly.

3. Financial Protection:

Unexpected events can lead to significant financial burdens. Home and Contents Insurance from Business Insurance Consulting acts as a safety net, protecting you from bearing the full cost of repairing or replacing your home and belongings. By paying a relatively small premium, you can mitigate the financial impact of unforeseen circumstances and avoid potential financial strain.

4. Additional Coverage Options:

Business Insurance Consulting understands that every homeowner’s needs are unique. That’s why we offer additional coverage options to tailor your Home and Contents Insurance to your specific requirements. You can opt for extras such as accidental damage cover, personal valuables cover, or even cover for home office equipment, ensuring that your policy meets your individual needs.

5. Expert Guidance and Support:

Navigating the world of insurance can be overwhelming. Business Insurance Consulting provides you with the expertise and support you need to make informed decisions. Our dedicated team of insurance professionals will guide you through the insurance process, help you assess your risks, and recommend the most suitable coverage options for your home and belongings.

Conclusion:

Protecting your home and belongings is not just a smart decision; it’s a vital step towards ensuring your peace of mind. With Home and Contents Insurance from Business Insurance Consulting, you can safeguard your investment, secure your valuables, and mitigate the financial risks associated with unexpected events. Don’t leave the safety and security of your home and belongings to chance. Take the proactive step of securing comprehensive insurance coverage and enjoy the confidence that comes with knowing you are protected. Contact Business Insurance Consulting today to explore our Home and Contents Insurance options and start protecting what matters most to you.

#business insurance australia#motor insurance in australia#event insurance australia#business insurance consulting#farm insurance australia

0 notes

Text

How Peter Duton has consistently Voted in parliament

Spoiler: He hates you Not everything is terrible, but holy shit it gets bad and a lot of it is bad (Source at the bottom)

Voted for:

A citizenship test

A plebiscite on the carbon pricing mechanism (Remove the tax on carbon)

A same-sex marriage plebiscite (plebiscite means to get rid of)

An Australian Building and Construction Commission (ABCC)

Carbon Farming Initiative Amendment Bill 2014

Charging postgraduate research students fees

Civil celebrants having the right to refuse to marry same-sex couples

Compensating victims of overseas terrorism since the September 11 attack

Decreasing availability of welfare payments

Deregulating undergraduate university fees (Removing any restrictions on the amount that universities can charge students for tuition)

Drug testing welfare recipients

Getting rid of Sunday and public holiday penalty rates

Greater control over items brought into immigration detention centres

Having a referendum on whether to create an Indigenous Voice to Parliament (To be fair he also did recently have a trantrum because he didn't want to stand infrount of the Aboriginal flag, so)

Increasing eligibility requirements for Australian citizenship

Government administered paid parental leave

Increasing indexation of HECS-HELP debts (HECS-HELP is basically student loans)

Increasing state and territory environmental approval powers

Increasing the cost of humanities degrees (Humanities include: History, Geography, Philosophy, Religion, Citizenship, Economics, Business, ect)

Increasing the price of subsidised medicine

Prioritising religious freedom

Privatising government-owned assets

Putting welfare payments onto cashless debit cards (or indue cards) on a temporary basis as a trial

Recognising local government in the Constitution

Reducing the corporate tax rate

Senate electoral reform

Stopping people who arrive by boat from ever coming to Australia

Temporary Exclusion Orders

Temporary protection visas

The territories being able to legalise euthanasia

Turning back asylum boats when possible

A combined Federal Circuit and Family Court of Australia

Banning mobiles and other devices in immigration detention

Increasing scrutiny of unions

Implementing refugee and protection conventions

Putting welfare payments onto cashless debit cards (or indue cards) on an ongoing basis

Privatising certain government services

Voluntary student union fees

Increasing funding for road infrastructure

Increasing the initial tax rate for working holiday makers to 19%

Increasing the Medicare Levy to pay for the National Disability Insurance Scheme

Making more water from Murray-Darling Basin available to use

The Coalition's new schools funding policy ("Gonski 2.0")

The Intervention in the Northern Territory

Voted against:

A carbon price

A minerals resource rent tax

A Royal Commission into Violence and Abuse against People with Disability

A transition plan for coal workers

Banning pay secrecy clauses

Capping gas prices

Carbon farming

Considering legislation to create a federal anti-corruption commission (procedural)

Considering motions on Gaza (2023-24) (procedural)

Criminalising wage theft

Decreasing the private health insurance rebate

Doctor-initiated medical transfers for asylum seekers

Ending illegal logging

Ending immigration detention on Manus Island

Extending government benefits to same-sex couples

Federal action on public housing

Federal government action on animal & plant extinctions

Increasing availability of abortion drugs

Increasing consumer protections

Increasing funding for university education

Increasing housing affordability

Increasing investment in renewable energy

Increasing legal protections for LGBTI people

Increasing marine conservation

Increasing penalties for breach of data

Increasing political transparency

Increasing protection of Australia's fresh water

Increasing restrictions on gambling

Increasing scrutiny of asylum seeker management

Increasing support for the Australian film and TV industry

Increasing support for the Australian shipping industry

Increasing the diversity of media ownership

Increasing trade unions' powers in the workplace

Increasing transparency of big business by making information public

Market-led approaches to protecting biodiversity

Net zero emissions by 2035

Re-approving/ re-registering agvet chemicals (Agvet chemicals protect crops and livestock)

Removing children from immigration detention

Reproductive bodily autonomy

Requiring every native title claimant to sign land use agreements

Restricting donations to political parties

Restricting foreign ownership

Same-sex marriage equality

Stem cell research

Stopping tax avoidance or aggressive tax minimisation

The Australian Renewable Energy Agency (ARENA)

The Carbon Pollution Reduction Scheme

The Paris Climate Agreement

Tobacco plain packaging

Transgender rights

Treating the COVID vaccine rollout as a matter of urgency

Mix

Reducing tax concessions for high socio-economic status

Increasing competition in bulk wheat export

Mostly Yes

Speeding things along in Parliament (procedural)

Unconventional gas mining

A character test for Australian visas

Increasing or removing the Government debt limit

Regional processing of asylum seekers

Mostly No

Increasing the age pension

Net zero emissions by 2050

Suspending the rules to allow a vote to happen (procedural)

Vehicle efficiency standards

Increasing support for rural and regional Australia

Letting all MPs or Senators speak in Parliament (procedural)

Source

https://theyvoteforyou.org.au/people/representatives/dickson/peter_dutton

#peter dutton#aus pol#australian politics#auspol#australian election#election#election 2025#politics#australia

25 notes

·

View notes

Text

Anyone who can’t see that MAGA is a christian nationalist, fascist, racist, homophobic oligarchy are insane. my heart is with the trans people and POC and immigrants who are mostly affected by this white rich white men who’s only concern is putting money in their pockets.

The defunding important programs and agencies such as USAID, DEI programs, department of education and Head Start programs for children in low income families, Environmental and Housing, Foreign said, and non governmental organisations is an extreme warning sign that things WILL get worse for Americans. As well as the complete ignoring and lack of respect for trans and genderqueer people.

While i am an Australian and am not directly impacted by these things, sitting here and watching it all unfold is terrifying. Australian politicians such as Peter Dutton and Clive Palmer (who literally named his new political group the TRUMPet of patriots) are inspired by trump and his band of asshats, wanting to create a similar political environment for Australia.

however, polls show Dutton is most likely to become our next prime minister. I suspect that this is due to Australia's mindset in voting being "oh well this current party in office isn't doing well, lets give the others a turn" rather than reading up on policies that the liberal and right leaning governments want to introduce and put in place. All Politicians lie and make empty promises to manipulate voters, but it is always imperative to do YOUR OWN RESEARCH instead of listening to them. This is what happened with "The Voice Act" as the entire campaign of the no vote was telling people not to do their own research. "if you dont know, vote no".

Dutton has consistently voted against:

legal protection for LGBTQI people and same sex marriage equality

transgender rights

cutting back on emissions

renewable energy

capping gas prices

royal commissions into violence against people with disablities

motions on gaza

criminalising wage theft

decreasing health insurance rebate

ending illegal logging

increasing availability of abortion drugs

increasing housing and uni affordability

marine conservation

restrictions on gambling

transparency of big business by making information public

removing children from immigration detention centres

reproductive bodily autonomy

We CAN NOT Dutton and the liberals win this upcoming election as it is VERY evident he does not have anyones interest in mind but his own and all of his rich friends.

We are so lucky to have Preferential voting in Australia, it is not one or the other. If your first chosen party does not get enough votes, your vote will count to second chosen.

So please, for the love of god do NOT vote liberal.

16 notes

·

View notes

Text

Offer and demand

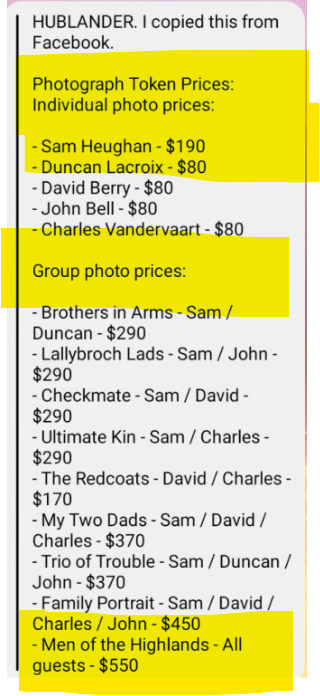

For comparison purposes, kindly find below what a devoted Ozzie fan will have to be prepared to pay for a pic with one or several of the participants to the Hublander Australia 'A Visit to The Highlands' event, this week-end, in Sydney and Melbourne:

On top of that, there is an extra option I have never seen for European events (and correct me if I am wrong). You can buy signed personal items and autographed pics for somebody who cannot attend (personal items cost a little extra, no idea why). Here is an example, for S:

Just to have an idea, remember (I will always LOL at this word, from now on, and that's really a shame, because I use it a LOT, irl) these are the prices in Australian dollars. A pic with S would cost you around 115 euros or 125 USD and the most expensive group pic would lighten your purse by around 360 USD or 333 euros.

All this, like for the Paris Landcon, are on top of what you pay for access and the rest of the side gigs, depending of your tier of choice. Those can set you anywhere from 200 Australian dollars for the standard entry ticket to 1800 Australian dollars for the Platinum Tier, where I hope S will pour you a dram or something - nope, not really, that was really a cheap joke, forget about it. You do the math, it's easy.

If you take the time to compare with the Paris Landcon, the discrepancies are clear. The Australian Lollapalooza easily costs the double. But before you screech and wail, do remember two things:

Prices in Australia and France are not really the same. Same goes for the disposable wages of the people buying these tickets. Same goes for the logistical costs (venue rent, talent accommodation and fee, insurance - very important!, other administrative expenditures like legal costs: never forget these people also sell licensed merchandise, which comes at an extra cost itself, etc).

Also, event organization is a business in itself. There is a market and a pool of potential clients for this type of business. Demand and offer meet (or should do so) on that market and the result of this encounter of sorts should reasonably reflect what the people are willing to pay for whatever you peddle around, from bagels to Scottish fantasies. Too expensive - nobody will come. Too cheap - the talent you hope to attract would, in all likelihood, not show up, especially if it takes 10 to 20 hours of flight to get there.

Now add to this the need to satisfy just about everyone in the room. The simple need to make sure that the person who paid 200 dollars for the basic ticket would not feel left behind those who paid nine times (yes, nine times, for Australia, land of plenty) more. That is not an easy task and those figures you have seen are not what you may think they do represent, on face value.

Last, but not least, a wee secret: the bulk of the talent's fee comes from those autographed pics you bought extra, the Q&A sessions and the Platinum Meet and Greets - isn't that a strange form of Marxist distribution circuit (but I digress, forgive the scholar). The rest is probably going to cover operational costs.

Nobody robbed you. Nobody forced you or hypnotized you. You will meet the real people, not some denizen of Abuja who pretends he is Mr. Blue Eyes. And S will not get richer after Melbourne, only more tired.

You're welcome.

PS: merci à toi; chérie, pour l'info and also a heartfelt thank you to you, New Friend on the Block. You know who you are! 😘😘😘😘❤️❤️❤️

[Edit]: @joey-baby tells me the Oz fans can buy the recording of both days. That is a local exclusive and I surely hope we'd see some of it in here. Thank you! 🙌

91 notes

·

View notes