#Business & Individual Tax Planning

Explore tagged Tumblr posts

Text

#Accounting & Tax Advisory#Accounting Services#Tax Advisory Services#Tax Planning Services#Tax Filing Assistance#Tax Consultant Services#Tax Compliance Services#Tax Preparation Services#Tax Return Services#Tax Filing for Individuals#Tax Filing for Businesses#Tax Filing for Freelancers

0 notes

Text

Cash Flow Forecasting and Management, by Jones Advisory LLC

Cash flow forecasting is an integral part of financial management, providing businesses with valuable insights into their future cash flow projections and allowing them to make informed decisions about resource allocation, investment opportunities, and strategic planning.

#business & individual tax planning#certified public accountants#outsourced cfo services#accounting#finance#investing

0 notes

Text

Expert Taxation Services in Australia | Collab Accounting

Simplify your tax obligations with Collab Accounting's expert taxation services. We offer personalized advice and solutions for individuals and businesses across Australia. Maximize your refunds and stay compliant with our experienced team.

#taxation services Australia#tax compliance#tax advice#individual tax#business tax solutions#tax planning Australia#Collab Accounting#expert tax consultants#maximize tax refunds#Australian tax specialists

0 notes

Text

Business Finance Supervisor in Kolkata: Surana Consultancy

Looking for a reliable business finance supervisor in Kolkata? Surana Consultancy offers expert financial supervision services to ensure your business's financial health.

#Best tax planning services for individuals#Affordable tax planning and advisory services#Expert tax planning advice for small businesses#Professional tax planning consultancy near me#Top-rated personal income tax planning advisors

0 notes

Text

Tax Planning Opportunities For Individuals

Tax planning is a critical aspect of financial management that enables individuals to minimize their tax liabilities legally and maximize their savings. By understanding and utilizing various tax planning strategies, individuals can effectively reduce their taxable income, benefit from tax credits and deductions, and optimize their overall financial situation. Here are several key tax planning opportunities for individuals:

Retirement Account Contributions:

401(k) and 403(b) Plans: Contributions to employer-sponsored retirement plans like 401(k) or 403(b) are made with pre-tax dollars, reducing your taxable income. The 2024 contribution limit is $23,000, with an additional $7,500 catch-up contribution for those aged 50 and above.

Traditional IRA: Contributions to a Traditional IRA may be tax-deductible, depending on your income and participation in an employer-sponsored retirement plan. The contribution limit for 2024 is $7,000, with a $1,000 catch-up contribution for those 50 and older.

Health Savings Accounts (HSAs):

Contributions to an HSA are tax-deductible, and withdrawals used for qualified medical expenses are tax-free. For 2024, the contribution limit is $4,150 for individuals and $8,300 for families, with an additional $1,000 catch-up contribution for those aged 55 and older. HSAs also offer tax-free growth on investments within the account.

Tax-Efficient Investments:

Municipal Bonds: Interest income from municipal bonds is typically exempt from federal taxes and may also be exempt from state and local taxes if the bonds are issued by entities within your state.

Qualified Dividends and Long-Term Capital Gains: Qualified dividends and long-term capital gains are taxed at lower rates than ordinary income, with rates ranging from 0% to 20% depending on your taxable income.

Charitable Contributions:

Donations to qualified charitable organizations can be deducted from your taxable income if you itemize deductions. Consider donating appreciated assets like stocks, which can also help you avoid paying capital gains taxes on the appreciation.

Education Savings:

529 Plans: Contributions to 529 college savings plans grow tax-free, and withdrawals used for qualified education expenses are also tax-free. Some states offer tax deductions or credits for contributions to in-state 529 plans.

Lifetime Learning Credit and American Opportunity Credit: These credits can reduce your tax bill based on eligible education expenses, with specific income limits and conditions.

Tax-Loss Harvesting:

Offset capital gains with capital losses from investments. You can deduct up to $3,000 of capital losses against ordinary income each year, with any remaining losses carried forward to future years.

Flexible Spending Accounts (FSAs):

Contributions to FSAs are made with pre-tax dollars, reducing your taxable income. FSAs can be used for qualified medical and dependent care expenses, though funds generally must be used within the plan year.

Standard vs. Itemized Deductions:

Evaluate whether taking the standard deduction or itemizing deductions provides a greater tax benefit. For 2024, the standard deduction is $14,600 for single filers and $29,200 for married couples filing jointly. Itemized deductions include mortgage interest, state and local taxes (up to $10,000), charitable contributions, and certain medical expenses.

Income Shifting:

Shift income to family members in lower tax brackets through gifts or employing family members in a family business. The annual gift tax exclusion for 2024 is $17,000 per recipient.

By leveraging these tax planning opportunities, individuals can significantly enhance their financial efficiency and reduce their tax burdens, allowing for greater savings and investment potential. Consulting with a tax professional from tax planning for companies in Fort Worth TX can further optimize these strategies based on your specific financial situation and goals.

0 notes

Text

The Upside of Filing Your Taxes Early as a Self-Employed Individual

Filing taxes is a task that many individuals, especially self-employed ones, may find daunting. However, there are several upsides to filing your taxes early, and as a self-employed individual, taking this proactive approach can bring numerous benefits.

Here's a look at the upside of filing your taxes early when you are self-employed:

Avoid Last-Minute Rush and Stress: Filing your taxes early allows you to avoid the stress and rush that often accompanies last-minute tax preparation. Instead of scrambling to gather documents and complete your return as the deadline approaches, filing early gives you ample time to carefully review your financial records and ensure accuracy.

Prompt Access to Refunds: If you anticipate receiving a tax refund, filing early means you can get your hands on that money sooner. The sooner you file, the earlier the processing of your return begins, potentially resulting in a quicker refund. Early refunds can be especially beneficial for addressing financial needs or investing in opportunities.

More Time for Planning and Adjustments: Filing early provides you with more time for tax planning and making adjustments to your financial strategy. By knowing your tax liability early in the year, you can plan your budget, set financial goals, and make informed decisions about savings, investments, or business expenses for the coming year.

Avoid Late Filing Penalties: Filing your taxes after the deadline can lead to late filing penalties and interest charges on any taxes owed. By filing early, you eliminate the risk of missing the deadline and incurring unnecessary financial penalties. This proactive approach ensures compliance with tax regulations and helps you avoid additional fees.

Opportunity for Professional Guidance: Tax professionals offering services of tax planning for self-employed in Mayfield Heights OH tend to be less busy earlier in the tax season. Filing your taxes early allows you to consult with tax professionals, ask questions, and seek guidance without the time constraints they may experience closer to the filing deadline. This can be particularly valuable for self-employed individuals with complex financial situations.

Early Resolution of Issues: Filing early allows you to address any potential issues or discrepancies promptly. If there are errors or missing information, you have ample time to rectify the situation before the tax deadline. This proactive approach minimizes the risk of facing challenges or delays in the tax filing process.

Time for Retirement Contribution Planning: Self-employed individuals often contribute to retirement accounts, such as Simplified Employee Pension (SEP) IRAs or solo 401(k)s. Filing your taxes early provides you with more time to assess your financial situation and make contributions to these accounts before the tax deadline. This can maximize your retirement savings and potentially reduce your tax liability.

Peace of Mind and Reduced Anxiety: Filing taxes can be a source of anxiety for many individuals. Filing early provides peace of mind, knowing that your taxes are taken care of well before the deadline. This sense of accomplishment and financial organization can positively impact your overall well-being.

Early Notice of Potential Issues: Filing early allows you to receive any notices from tax authorities, such as the IRS, well in advance. If there are questions or concerns about your return, you can address them early on, avoiding potential complications or audits down the line.

In conclusion, as a self-employed individual, filing your taxes early offers numerous advantages, including reduced stress, quicker access to refunds, and more time for financial planning. By taking a proactive approach, you can enjoy the peace of mind that comes with timely and accurate tax filing, setting the stage for a financially well-managed year ahead.

0 notes

Text

Ajeh Business Solutions, Inc. is a one-stop shop for small businesses looking to grow and succeed.

We offer a wide range of services, including bookkeeping and tax preparation, web development and hosting, and digital tech solutions.

Our in-house team of experts are passionate about helping our clients achieve their goals, and we work closely with them to develop customized solutions that meet their unique needs.

#web development#Tax Filing#Start-Up Business Consulting#Small Business Consulting#Past Tas Return Review#individual tax return preparation#Graphic design#Financial Planning Services#E-Commerce Website Development#Business Technology Consulting#Business tax return preparation#Business Risk Management#business planning#business marketing consulting#Business Financial Consulting#Business Development Consulting

1 note

·

View note

Text

Looking for expert tax planning services in Canada? At TaxReturnFilers, we offer comprehensive tax planning solutions for businesses and individuals. Our seasoned tax professionals are dedicated to helping you navigate the complexities of the Canadian tax system while optimizing your financial strategies.

#Businesses Tax Planning Services#corporation Tax Planning Services#Individual Tax Planning Services#corporation Tax Planning Services Canada#personal tax planning services canada

0 notes

Text

Trying to choose Pretax vs. Roth 401(k)? Why it's trickier than you think, experts say

Prostock-Studio | Istock | Getty Images If you have a 401(k), one of the big questions is whether to make pretax or Roth contributions — and the answer may be complicated, experts say. While pretax 401(k) contributions reduce your adjusted gross income, you’ll owe levies on growth upon withdrawal. By comparison, Roth 401(k) deposits won’t provide an upfront tax break, but the money can grow…

View On WordPress

#401(k) plans#business news#Financial Advisors#Financial planners#Financial planning#Government taxation and revenue#Individual retirement accounts#Labor economy#National taxes#Personal finance#Personal saving#Retirement planning#Roth 401(k) plans#Social issues#Tax planning#Taxes#Wealth

0 notes

Text

Reflections on building a better me

Exercise is not optional. Mental satisfaction from completing yet another workout cannot be overstated. Physical satisfaction from feeling good and enjoying your body in clothes, the mirror, and photos cannot be overstated. Stop messing around, stop info hoarding, go exercise. And tomorrow. And the next day. And the next day. And the next day.

Looking your best depending on circumstances (ie, casual, dressy, bedtime, etc) is not optional. External confidence from taking care of your appearance top to bottom and loving what you see in the mirror is highly valuable.

You feel better when you eat better. You’re proud of yourself when you eat better.

Hobbies, hobbies, hobbies. Do you feel embarrassed when someone asks what you do all day and you can’t come up with an honest answer that doesn’t make you sound like a loser with no life? You need hobbies. Some that are outdoors, some that are indoors. Some that are taxing, some that are relaxing. You will enjoy life more, become a more well-rounded individual, and have positive ways to spend your time rather than racking up more hours on your phone. Get some hobbies. Plural.

Procrastination and laziness should disgust you. You shouldn’t be able to relate. You should strive to be above that. You like yourself better when you complete your tasks and get things done in a timely manner. You’re proud of yourself when you’re on a roll and have a productive streak. You’re impressed by productive people and no one likes a lazy bum.

Decide what you want from life and pursue it ruthlessly. Don’t take advice from people who don’t have the life you want, unless they were once on your desired path and fell off. Even then, you listen to them when they say what NOT to do (learning from their mistakes) but clearly they don’t know what TO do bc they didn’t make it to the finish line. Take “do this” advice from people who crossed the finish line and have what you want. You’ll find that the amount of input that is actually valuable to you has suddenly dwindled. Good. Less chatter in your ears.

Get yourself in order before you go around critiquing everyone else. Get YOUR face in order. Get YOUR body right. Get YOUR money up. Get YOUR style in order. Get YOUR relationship together.

Stop coming to everyone for validation like a toddler. Validate yourself. Do you like it? Okay then. Are you over it? Okay then. Stop being so weak. Stand tall, lead yourself. Stop being such a follower.

Be a good person. Help your family, lend a hand to strangers, give back, say sorry, do things for loved ones just because, show affection, work things out, watch your mouth, speak respectfully, remember that the world owes you nothing. Stop being an insufferable freak.

You can’t change anyone but yourself. Get yourself in order and be a good role model. That’s all you can do. Give people advice when they want it and then go about your business. Get yourself in order. Get yourself in order.

Outrage content is the lowest form of entertainment. Engage in things that make you happy or educate you. Doom scrolling only leads to doom. Don’t like this person? Don’t click on their articles or videos. Unfollow and block. Don’t like these people? Leave their spaces. You don’t have to be outraged every day.

Always keep your word to yourself. Make a plan, stick to the plan, always deliver. If you can’t be reliable for yourself then who can you be reliable for?

7K notes

·

View notes

Text

Lina Khan’s future is the future of the Democratic Party — and America

On OCTOBER 23 at 7PM, I'll be in DECATUR, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

On the one hand, the anti-monopoly movement has a future no matter who wins the 2024 election – that's true even if Kamala Harris wins but heeds the calls from billionaire donors to fire Lina Khan and her fellow trustbusters.

In part, that's because US antitrust laws have broad "private rights of action" that allow individuals and companies to sue one another for monopolistic conduct, even if top government officials are turning a blind eye. It's true that from the Reagan era to the Biden era, these private suits were few and far between, and the cases that were brought often died in a federal courtroom. But the past four years has seen a resurgence of antitrust rage that runs from left to right, and from individuals to the C-suites of big companies, driving a wave of private cases that are prevailing in the courts, upending the pro-monopoly precedents that billionaires procured by offering free "continuing education" antitrust training to 40% of the Federal judiciary:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

It's amazing to see the DoJ racking up huge wins against Google's monopolistic conduct, sure, but first blood went to Epic, who won a historic victory over Google in federal court six months before the DoJ's win, which led to the court ordering Google to open up its app store:

https://www.theverge.com/policy/2024/10/7/24243316/epic-google-permanent-injunction-ruling-third-party-stores

Google's 30% App Tax is a giant drag on all kinds of sectors, as is its veto over which software Android users get to see, so Epic's win is going to dramatically alter the situation for all kinds of activities, from beleaguered indie game devs:

https://antiidlereborn.com/news/

To the entire news sector:

https://www.eff.org/deeplinks/2023/06/save-news-we-must-open-app-stores

Private antitrust cases have attracted some very surprising plaintiffs, like Michael Jordan, whose long policy of apoliticism crumbled once he bought a NASCAR team and lived through the monopoly abuses of sports leagues as an owner, not a player:

https://www.thebignewsletter.com/p/michael-jordan-anti-monopolist

A much weirder and more unlikely antitrust plaintiff than Michael Jordan is Google, the perennial antitrust defendant. Google has brought a complaint against Microsoft in the EU, based on Microsoft's extremely ugly monopolistic cloud business:

https://www.reuters.com/technology/google-files-complaint-eu-over-microsoft-cloud-practices-2024-09-25/

Google's choice of venue here highlights another reason to think that the antitrust surge will continue irrespective of US politics: antitrust is global. Antitrust fervor has seized governments from the UK to the EU to South Korea to Japan. All of those countries have extremely similar antitrust laws, because they all had their statute books overhauled by US technocrats as part of the Marshall Plan, so they have the same statutory tools as the American trustbusters who dismantled Standard Oil and AT&T, and who are making ready to shatter Google into several competing businesses:

https://www.theverge.com/2024/10/8/24265832/google-search-antitrust-remedies-framework-android-chrome-play

Antitrust fever has spread to Canada, Australia, and even China, where the Cyberspace Directive bans Chinese tech giants from breaking interoperability to freeze out Chinese startups. Anything that can't go on forever eventually stops, and the cost of 40 years of pro-monopoly can't be ignored. Monopolies make the whole world more brittle, even as the cost of that brittleness mounts. It's hard to pretend monopolies are fine when a single hurricane can wipe out the entire country's supply of IV fluid – again:

https://prospect.org/health/2024-10-11-cant-believe-im-writing-about-iv-fluid-again/

What's more, the conduct of global monopolists is the same in every country where they have taken hold, which means that trustbusters in the EU can use the UK Digital Markets Unit's report on the mobile app market as a roadmap for their enforcement actions against Apple:

https://assets.publishing.service.gov.uk/media/63f61bc0d3bf7f62e8c34a02/Mobile_Ecosystems_Final_Report_amended_2.pdf

And then the South Korean and Japanese trustbusters can translate the court documents from the EU's enforcement action and use them to score victories over Apple in their own courts:

https://pluralistic.net/2024/04/10/an-injury-to-one/#is-an-injury-to-all

So on the one hand, the trustbusting wave will continue erode the foundations of global monopolies, no matter what happens after this election. But on the other hand, if Harris wins and then fires Biden's top trustbusters to appease her billionaire donors, things are going to get ugly.

A new, excellent long-form Bloomberg article by Josh Eidelson and Max Chafkin gives a sense of the battle raging just below the surface of the Democratic Power, built around a superb interview with Khan herself:

https://www.bloomberg.com/news/features/2024-10-09/lina-khan-on-a-second-ftc-term-ai-price-gouging-data-privacy

The article begins with a litany of tech billionaires who've gone an all-out, public assault on Khan's leadership – billionaires who stand to personally lose hundreds of millions of dollars from her agency's principled, vital antitrust work, but who cloak their objection to Khan in rhetoric about defending the American economy. In public, some of these billionaires are icily polite, but many of them degenerate into frothing, toddler-grade name-calling, like IAB's Barry Diller, who called her a "dope" and Musk lickspittle Jason Calacanis, who called her an all-caps COMMUNIST and a LUNATIC.

The overall vibe from these wreckers? "How dare the FTC do things?!"

And you know, they have a point. For decades, the FTC was – in the quoted words of Tim Wu – "a very hardworking agency that did nothing." This was the period when the FTC targeted low-level scammers while turning a blind eye to the monsters that were devouring the US economy. In part, that was because the FTC had been starved of budget, trapping them in a cycle of racking up easy, largely pointless "wins" against penny-ante grifters to justify their existence, but never to the extent that Congress would apportion them the funds to tackle the really serious cases (if this sounds familiar, it's also the what happened during the long period when the IRS chased middle class taxpayers over minor filing errors, while ignoring the billionaires and giant corporations that engaged in 7- and 8-figure tax scams).

But the FTC wasn't merely underfunded: it was timid. The FTC has extremely broad enforcement and rulemaking powers, which most sat dormant during the neoliberal era:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The Biden administration didn't merely increase the FTC's funding: in choosing Khan to helm the organization, they brought onboard a skilled technician, who was both well-versed in the extensive but unused powers of the agency and determined to use them:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

But Khan's didn't just rely on technical chops and resources to begin the de-olicharchification of the US economy: she built a three-legged stool, whose third leg is narrative. Khan's signature is her in-person and remote "listening tours," where workers who've been harmed by corporate power get to tell their stories. Bloomberg recounts the story of Deborah Brantley, who was sexually harassed and threatened by her bosses at Kavasutra North Palm Beach. Brantley's bosses touched her inappropriately and "joked" about drugging her and raping her so she "won’t be such a bitch and then maybe people would like you more."

When Brantley finally quit and took a job bartending at a different business, Kavasutra sued her over her noncompete clause, alleging an "irreparable injury" sustained by having one of their former employees working at another business, seeking damages and fees.

The vast majority of the 30 million American workers who labor under noncompetes are like Brantley, low-waged service workers, especially at fast-food restaurants (so Wendy's franchisees can stop minimum wage cashiers from earning $0.25/hour more flipping burgers at a nearby McDonald's). The donor-class indenturers who defend noncompetes claim that noncompetes are necessary to protect "innovative" businesses from losing their "IP." But of course, the one state where no workers are subject to noncompetes is California, which bans them outright – the state that is also home to Silicon Valley, an IP-heave industry that the same billionaires laud for its innovations.

After that listening tour, Khan's FTC banned noncompetes nationwide:

https://pluralistic.net/2024/04/25/capri-v-tapestry/#aiming-at-dollars-not-men

Only to have a federal judge in Texas throw out their ban, a move that will see $300b/year transfered from workers to shareholders, and block the formation of 8,500 new US businesses every year:

https://www.npr.org/2024/08/21/g-s1-18376/federal-judge-tosses-ftc-noncompetes-ban

Notwithstanding court victories like Epic v Google and DoJ v Google, America's oligarchs have the courts on their side, thanks to decades of court-packing planned by the Federalist Society and executed by Senate Republicans and Reagan, Bush I, Bush II, and Trump. Khan understands this; she told Bloomberg that she's a "close student" of the tactics Reagan used to transform American society, admiring his effectiveness while hating his results. Like other transformative presidents, good and bad, Reagan had to fight the judiciary and entrenched institutions (as did FDR and Lincoln). Erasing Reagan's legacy is a long-term project, a battle of inches that will involve mustering broad political support for the cause of a freer, more equal America.

Neither Biden nor Khan are responsible for the groundswell of US – and global – movement to euthanize our rentier overlords. This is a moment whose time has come; a fact demonstrated by the tens of thousands of working Americans who filled the FTC's noncompete docket with outraged comments. People understand that corporate looters – not "the economy" or "the forces of history" – are the reason that the businesses where they worked and shopped were destroyed by private equity goons who amassed intergenerational, dynastic fortunes by strip-mining the real economy and leaving behind rubble.

Like the billionaires publicly demanding that Harris fire Khan, private equity bosses can't stop making tone-deaf, guillotine-conjuring pronouncements about their own virtue and the righteousness of their businesses. They don't just want to destroy the world - they want to be praised for it:/p>

"Private equity’s been a great thing for America" -Stephen Pagliuca, co-chairman of Bain Capital;

"We are taught to judge the success of a society by how it deals with the least able, most vulnerable members of that society. Shouldn’t we judge a society by how they treat the most successful? Do we vilify, tax, expropriate and condemn those who have succeeded, or do we celebrate economic success as the engine that propels our society toward greater collective well-being?" -Marc Rowan, CEO of Apollo

"Achieve life-changing money and power," -Sachin Khajuria, former partner at Apollo

Meanwhile, the "buy, strip and flip" model continues to chew its way through America. When PE buys up all the treatment centers for kids with behavioral problems, they hack away at staffing and oversight, turning them into nightmares where kids are routinely abused, raped and murdered:

https://www.nbcnews.com/news/us-news/they-told-me-it-was-going-be-good-place-allega-tions-n987176

When PE buys up nursing homes, the same thing happens, with elderly residents left to sit in their own excrement and then die:

https://www.politico.com/news/magazine/2023/12/24/nursing-homes-private-equity-fraud-00132001

Writing in The Guardian, Alex Blasdel lays out the case for private equity as a kind of virus that infects economies, parasitically draining them of not just the capacity to provide goods and services, but also of the ability to govern themselves, as politicians and regulators are captured by the unfathomable sums that PE flushes into the political process:

https://www.theguardian.com/business/2024/oct/10/slash-and-burn-is-private-equity-out-of-control

Now, the average worker who's just lost their job may not understand "divi recaps" or "2-and-20" or "carried interest tax loopholes," but they do understand that something is deeply rotten in the world today.

What happens to that understanding is a matter of politics. The Republicans – firmly affiliated with, and beloved of, the wreckers – have chosen an easy path to capitalizing on the rising rage. All they need to do is convince the public that the system is irredeemably corrupt and that the government can't possibly fix anything (hence Reagan's asinine "joke": "the nine most terrifying words in the English language are: 'I'm from the Government, and I'm here to help'").

This is a very canny strategy. If you are the party of "governments are intrinsically corrupt and incompetent," then governing corruptly and incompetently proves your point. The GOP strategy is to create a nation of enraged nihilists who don't even imagine that the government could do something to hold their bosses to account – not for labor abuses, not for pollution, not for wage theft or bribery.

The fact that successive neoliberal governments – including Democratic administrations – acted time and again to bear out this hypothesis makes it easy for this kind of nihilism to take hold.

Far-right conspiracies about pharma bosses colluding with corrupt FDA officials to poison us with vaccines for profit owe their success to the lived experience of millions of Americans who lost loved ones to a conspiracy between pharma bosses and corrupt officials to poison us with opioids.

Unhinged beliefs that "they" caused the hurricanes tearing through Florida and Georgia and that Kamala Harris is capping compensation to people who lost their homes are only credible because of murderous Republican fumble during Katrina; and the larcenous collusion of Democrats to help banks steal Americans' homes during the foreclosure crisis, when Obama took Tim Geithner's advice to "foam the runway" with the mortgages of everyday Americans who'd been cheated by their banks:

https://www.salon.com/2014/05/14/this_man_made_millions_suffer_tim_geithners_sorry_legacy_on_housing/

If Harris gives in to billionaire donors and fires Khan and her fellow trustbusters, paving the way for more looting and scamming, the result will be more nihilism, which is to say, more electoral victories for the GOP. The "government can't do anything" party already exists. There are no votes to be gained by billing yourself as the "we also think governments can't do anything" party.

In other words, a world where Khan doesn't run the FTC is a world where antitrust continues to gain ground, but without taking Democrats with it. It's a world where nihilism wins.

There's factions of the Democratic Party who understand this. AOC warned party leaders that, "Anyone goes near Lina Khan and there will be an out and out brawl":

https://twitter.com/AOC/status/1844034727935988155

And Bernie Sanders called her "the best FTC Chair in modern history":

https://twitter.com/SenSanders/status/1843733298960576652

In other words: Lina Khan as a posse.

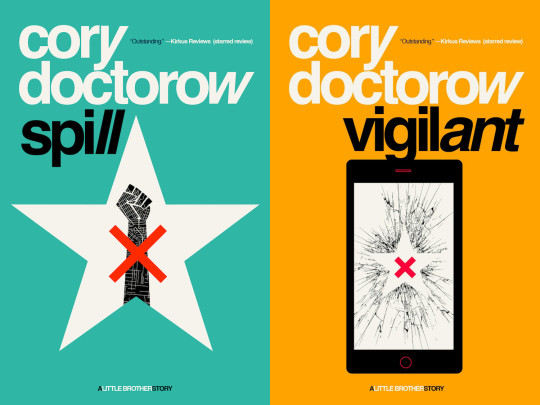

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/11/democracys-antitrust-paradox/#there-will-be-an-out-and-out-brawl

#pluralistic#ftc#lina khan#democratic party#elections#kamala harris#billionaires#trustbusting#competition#labor#noncompetes#silicon valley#aoc

407 notes

·

View notes

Note

Can u do gp assassin minji x reader where minji was tasked to take down an important person but as she was observing he

Pairings: G!p Assasin Minji x f!reader!

Warnings: dub-con, somno,slight non-con at first, Assasin minji, knife play, degrading, pet names, p in v, unprotected sex (don’t be silly wrap your Willy), slight breeding at the end, cervix fucking, mention of pregnancy, kinda kidnapping at the end, not proofread, just filthy smut!!

Word count: 1,6k

Jwans note: huh😮💨 after a month of not posting, it was difficult to actually start writing and I felt ashy and dry.🫣 but my long ass summer break started, so I will be posting more (yayy), I’m going to a trip with my friends in few days so YIPPEEEEE😍😍I’m so excited (uwu)👁️👅👁️

—————————————————————————

Minji was good at her job, or that’s what she could say, extremely good. Don’t you get fooled by the sweet plump lips, gorgeous smile that made everyone forget about their worries or the eyes that stared at you so delicately. To say that at first when you meet her you’d think she’d work on those cat cafes, kindergarten teacher or a major that inquired art would be an understatement.

The plot twist is that the most innocent and dreamy looking people turn into the most twisted and full of secrets individuals. The ones that you’d look at and think ‘no way they would do that?!’. But like the famous George Eliot said “don’t judge a book by its cover.” applied in most situations.

Minji worked as a professional assasin, she took 47 people down without an ounce of effort, the police tried to investigate those cases, but the outcome would always be a hair gripping disappointment. Nonetheless the only hope the police always had was the small ‘Mj’ that was slowly tatted into the victim’s skin with probably a dagger or an extremely sharp blade. They tried to see possible nail scratches, DNA, fingerprints, they even tried to look at the security cameras but there was no sign of anyone entering or leaving, it was like she appeared out of nowhere and disappeared into thin air.

Minji did not like the idea of being under someone's authority or taking orders from anyone. She preferred to work for herself and to be her own boss. However, on occasions, she would consider offers that came with a filthy payment. And that’s what happened with you.

There was this guy who came to Minji and told her he will give her a horrible amount of money if she can take you down. From what she heard from that guy is that you were some really famous and wealthy man’s daughter, and an only child. Your father had a company and by that company he hid his illegal business like money laundering, drug producing, tax evasion and bribery. And to what she also heard is that your dad had stolen money and refuses to give it back to the guy who came to her and that’s why he wanted to get a revenge from your father.

Minji has figured out your schedule with her ways and planned a day when you'll be very busy and tired, so you'll go straight to bed. This will make Minji's job much easier.

Minji wore baggy jeans and a long sleeved black shirt to avoid any suspicion. She let her hair loose to make her features appear more unrecognizable and she had black mask in her black tote bag to wear once she’s in your apartment and in case you’ll wake up.

She tip toed to your apartment building. The building was very minimalistic compared to what she heard who your dad was and how filthy rich you are. She expected a whole apartment building just for you to live in. But it turned out that you lived in an apartment which had families, students and office workers, like any apartment.

She pressed the elevator button and soon she stepped inside. She looked for number ‘12’ and soon she found it. The elevator was pretty fast and it wasn’t long till she was in her desired floor.-Her eyes traveled to all of the doors, in search for the apartment ‘47’. She later stood in front of the door, the lock getting destroyed by her and the door opening. A dark hall getting exposed to her eyes. She timidly and slowly walks in, taking in every little detail.

The hall was soon done and she was met with a closed door by her right, this was where your room could be since all of the other doors of the apartment were open and this was the only door closed.

She quietly opened the door being met with a laying figure, blanket draped over your thighs and lower abdomen while your upper body was exposed to cold air. The moon shining through the window making a dainty and delicate silhouette appear on the wall.

You were in a deep void, so out of this world, too deep in sleep to wake up anytime soon. Your breathing was soft and almost soundless while your chest was inhaling and exhaling slowly.

She was so fascinated by the sight she almost forgot her mission, she felt a rush of blood down her member, her pants feeling way too tight for her liking. She was ripped back to reality when you changed your position, now laying on your back.

She walked closer to your bed, admiring you now from so close. Taking in the little details, she couldn’t adore from far there. She noticed how the cold air made your nipples poke from your silky black night gown. The way the blanket was so down that your thighs were bare till the knees.

Since she already came all the way here, why can’t she have you at least once or maybe twice and then murder you? It would be fast and beside who can stop her, you are asleep and even if you did wake up. Would you fight her back? You can’t. She can just end you with a second. You were basically under her mercy.

She placed her bag on the nightstand before hovering over you. Her legs straddling your thighs. She slid down her slacks before tossing them across the bedroom. You had easy clothing, fast to remove or even rip. She took the hem of the night gown and lifted it till your breasts. She groaned at the sight, you had no panties on, just so easy and beautiful to use. Your perky mounds were soft and so plushy begging to be sucked and worshipped. While the hips to waist ratio was absolutely perfect.

Fuck, she had to kill such a precious and beautiful doll.

Her length was at this point so upwards, the tip angry red while spilling creamy white substance and her balls heavy and almost purple-ish.-Without any prepping or anything she slammed herself in, immediately groaning at the suck of your cunt. Your walls hugging her so tightly, almost too hard to move.

Her both hands went to your breasts, cupping them, while the pad of her thumb started toying with your nipples. Twisting and squeezing the hardened bud.

Your cunt got wetter with every thrust of her hips which made her pace pick up even more, her tip kissing your cervix with every single thrust.

The uncomfortable feeling in your lower region made your eyes flutter open, slightly contemplating is this a dream or the reality. But with every passing second the feeling got even more real and you were getting conscious back again.

When you were fully aware. You were going to let out a bloody scream but before you could even open your mouth, her hand found it way above your mouth. She didn’t stop her hips movements instead, getting even more faster.

Her other hand went to the nightstand, she was rummaging through her back and you were trying to see what she was trying to find. Your curiosity was soon replaced with fear when you saw what she was looking for.

She was looking for one of those kitchen knives in every typical horror movies.-There was soon a sinister evil smile across her face. Her dark eyes looked at your fear full ones.

“I’m not stopping doll, so you better also enjoy this, don’t cause me trouble and if you do..you know your faith.” She said while the tip of the knife was running across your skin. Hard enough to make a small scratch, but not hard enough to let out blood.

Her movements were in halt but soon she started again. She was ramming your insides, you hated to admit that it felt good, way too good.

She was pounding you like there was no tomorrow, well it kinda is true. Her hands let go from your mouth and you wish she didn’t. Now she has to hear the sounds you let for her. Then she thinks you are enjoying this.

With another hit of her tip on your cervix, you let out a loud moan, a pressure on your lower abdomen lingering there.

She chuckled darkly at the sound her tip taking the knife in her grasp.

“Turned out you were enjoying this, huh? Such a pretty little slut!” The sharp blade was running across your inner thighs the fear turning into pleasure. She slightly made the blade sink into your skin, a small bloody cut was now on your inner thighs.

The pain turned you even more on. The pain making your walls clasp around her uncontrollably. Nonetheless she continued her ramming, her tip was completely out before slamming with full force in. The cycle continued.

With the last womb fucking of her cock you reached your climax. Pleasure running through your body while squirming now underneath her.

Your pussy was squeezing her cock after your release and that made her reach her own high, she fucked you faster and with more passion now that she was close.

Without warning her essence painted your walls white, splashing right into your womb. She fucked harder through her high, you were whining and moving under her, the overwhelming feeling of overstimulation hitting you harder than ever. Her cum was now deeper, leaving you with a risk of pregnancy.

“Maybe I should keep you and just tell them I killed you? You would be my personal fuck doll!” She said before wrapping a tape right on top of your mouth, not even waiting to hear your answer.

#kim minji smut#kim minji x female reader#kim minji x reader smut#kim minji x fem reader#kim minji x reader#minji new jeans#new jeans minji smut#minji smut#new jeans minji x reader#minji x reader smut#minji x reader#minji x fem reader#new jeans x fem reader#new jeans x reader#kim minji#new jeans smut

857 notes

·

View notes

Text

Outsourced CFO services by Jones Advisory LLC

As your trusted partner, we offer outsourced CFO services designed to provide experienced insight, strategic guidance, and a comprehensive view of your company’s financial health.

What exactly is an outsourced CFO?

What exactly is an outsourced CFO? An outsourced CFO, or chief financial officer, serves as a valuable resource for businesses by offering experienced financial expertise when critical decisions are at stake. Our outsourced CFO services go beyond providing ad-hoc advice; we step back to assess your company’s financial landscape every month, ensuring that you have a clear understanding of your financial standing.

Strategic Financial Leadership: Tailored Outsourced CFO Services for Your Evolving Business

Outsourced CFO Excellence: Strategic Support for Your Business Goals

Our outsourced CFO services encompass a wide range of strategic functions, including business development, exit planning, risk mitigation, audit support, board presentations, raising capital, and overseeing due diligence on the purchase or sale of a business. Whether you need support with day-to-day financial management or guidance on long-term strategic initiatives, our team of experienced professionals is here to help.

CFO Excellence: Your Path to Financial Success with Jones Advisory

At Jones Advisory, we understand that the duties of a CFO vary depending on the needs of your business. From providing ongoing strategic development and support to delivering monthly consulting services and leading complex negotiations, our outsourced CFOs are dedicated to helping you achieve your financial goals. With our outsourced CFO services, you can expect to save money, save time, gain access to industry-leading expertise, scale your business, and ensure compliance with regulatory guidelines.

Partner with Jones Advisory: Turbocharge Your Business with Outsourced CFO Services.

0 notes

Text

Wealth Building: What Rich People Do Differently

Wealthy people prioritize learning about personal finance, investing, and wealth building strategies. They always strive to gain more knowledge in these areas.

They maintain a long term perspective when setting financial goals and are patient in their pursuits.

Wealthy people diversify their investments across various asset classes to manage their risk.

Many of them are entrepreneurs who create and manage businesses as a means to build wealth.

They build and nurture professional networks opens doors to opportunities for investments, partnerships, and business growth.

They set clear, specific financial goals and regularly review and adjust their strategies to stay on track.

Wealthy individuals exercise discipline in their spending habits, avoiding impulse purchases and consistently saving and investing.

They assess and manage investment risks carefully, often with the guidance of financial advisors.

Many engage in philanthropy and charitable giving, recognizing the importance of supporting their communities and causes they care about.

Wealthy people invest in their personal development, acquiring new skills and knowledge to increase their earning potential or make better investment decisions.

They use legal tax strategies to minimize tax liabilities, such as tax advantaged accounts and tax efficient investments.

Legal structures like trusts and estate planning are employed to safeguard assets and facilitate smooth wealth transfer.

Wealthy people can adapt to changing economic conditions and market trends by diversifying income sources and investments.

Building wealth often involves overcoming setbacks and failures, and the wealthy demonstrates the result of persistence in their pursuit of financial success.

They have a positive and growth oriented mindset drives their belief in their ability to succeed and willingness to take calculated risks.

They prioritize acquiring and growing assets, emphasizing that assets generate income and wealth over time.

They are cautious about spending in liabilities (Things that do not make you money) and maximize their assets (add value) and those that detract from wealth (liabilities).

Instead of working solely for money, they make money work for them.

When they indulge in luxury purchases, they do so using returns on their investments rather than the money they earn or have saved.

#finance#investment#financial planning#investing#entrepreneur#girl math#generationalwealth#rich#success mindset#wealth

1K notes

·

View notes

Text

Trump and Musk Are Pushing the U.S. Toward a Shutdown—Here’s What That Means for You

Once again, the U.S. is on the brink of a government shutdown. But this time, it’s not just political infighting—tech billionaire Elon Musk is playing a role, too. By leveraging his influence and platform, Musk has joined forces with Donald Trump to push for chaos, blocking a budget plan that would keep the government running.

What’s Happening?

A government shutdown occurs when Congress fails to pass a budget. Without funding, federal agencies shut down, leaving millions of workers unpaid and essential services suspended. Trump has been pressuring Republicans to reject the current spending plan, while Musk has amplified right-wing voices that oppose it, turning a routine budget negotiation into a high-stakes political crisis.

How This Affects You

A government shutdown doesn’t just impact politicians—it hits everyday Americans hard. Here’s what you need to know:

Federal Workers & Military Personnel: Over 4 million federal employees, including service members, could be forced to work without pay or be furloughed entirely. Many live paycheck to paycheck and would struggle to cover rent, utilities, or groceries.

Social Security & Medicare: While benefits continue, customer service lines and claims processing could be severely delayed, making it harder for seniors and disabled individuals to access their payments or healthcare services.

Food Assistance Programs: Families relying on the Supplemental Nutrition Assistance Program (SNAP) could see delays in benefits, and funding for food banks may dry up, exacerbating food insecurity.

National Parks, Museums, and Public Services: Expect closures of national parks, Smithsonian museums, and other federally funded sites. This affects not only visitors but also the small businesses that rely on tourism revenue.

Air Travel Disruptions: TSA agents and air traffic controllers will be required to work without pay, increasing the risk of flight delays and staff shortages that could create chaos at airports.

Housing & Small Business Loans: FHA-backed home loans could be delayed, making it harder for people to buy homes. Small businesses relying on federal grants or loans may also face significant funding gaps.

Economic Instability: The uncertainty and disruption from a shutdown can rattle financial markets, leading to job losses, increased inflation, and setbacks for businesses large and small.

Why Are Trump and Musk Doing This?

The Democrats argue that the budget proposal favored by Trump is nothing more than a disguised tax cut that would primarily benefit the ultra-wealthy—people like Musk. Additionally, they refuse to support a plan that would burden the U.S. with trillions of dollars in additional debt. Notably, alongside the Democrats, 38 Republican members of Congress also voted against Trump’s proposal.

The Bigger Picture

This isn’t just a budget dispute. It’s an alarming sign of how billionaires and political extremists can manipulate the system for their own gain. When an unelected tech mogul like Musk and a former president under multiple indictments can grind the government to a halt, it raises serious concerns about power, accountability, and the future of democracy.

What Can You Do?

Stay informed and share credible news sources.

Contact your representatives and demand they stand up to political obstruction.

Support journalism that holds those in power accountable.

Most importantly: Vote. A government shutdown is a preview of the dysfunction that could become permanent if Trump and his allies regain full control.

This is bigger than one political battle—it’s a fight for the stability of the country. And the outcome depends on all of us.

Source:

https://www.reuters.com/world/us/us-senate-democrats-debate-path-forward-government-funding-bill-2025-03-12/

#president trump#trump is a threat to democracy#us politics#elon musk#white house#usa news#donald trump#government shutdown#shutdown#american politics#politics#usa politics#political#us government#trump administration#economy#washington

141 notes

·

View notes

Text

The IRS plans to end a major tax loophole for wealthy taxpayers that could raise more than $50 billion in revenue over the next decade, the U.S. Treasury Department says. The proposed rule and guidance announced Monday includes plans to essentially stop “partnership basis shifting” — a process by which a business or person can move assets among a series of related parties to avoid paying taxes. Biden administration officials said after evaluating the practice that there are no economic grounds for these transactions, with Deputy Treasury Secretary Wally Adeyemo calling it “really just a shell game.” The officials said the additional IRS funding provided through the 2022 Inflation Reduction Act had enabled increased oversight and greater awareness of the practice. “These tax shelters allow wealthy taxpayers to avoid paying what they owe,” IRS commissioner Danny Werfel said. Due to previous years of underfunding, the IRS had cut back on the auditing of wealthy individuals and the shifting of assets among partnerships and companies became common. The IRS says filings for large pass-through businesses used for the type of tax avoidance in the guidance increased 70% from 174,100 in 2010 to 297,400 in 2019. However, audit rates for these businesses fell from 3.8% to 0.1% in the same time frame. Treasury said in a statement announcing the new guidance that there is an estimated $160 billion gap between what the top 1% of earners likely owe in taxes and what they pay.

301 notes

·

View notes