#Brisbane Business

Explore tagged Tumblr posts

Text

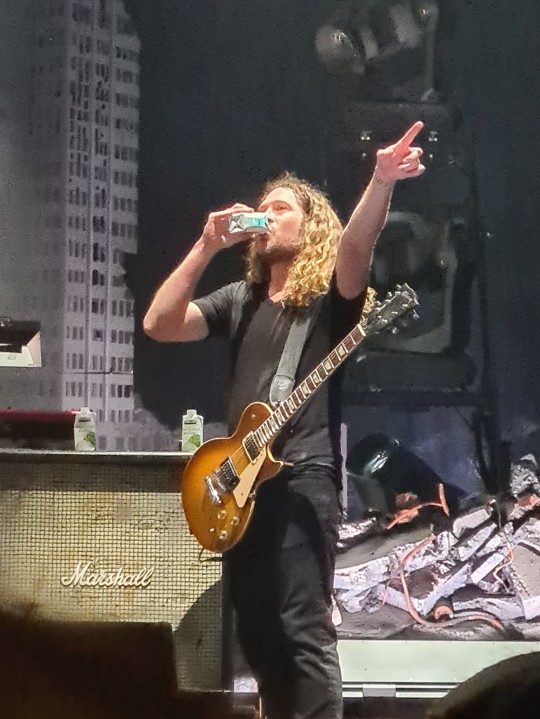

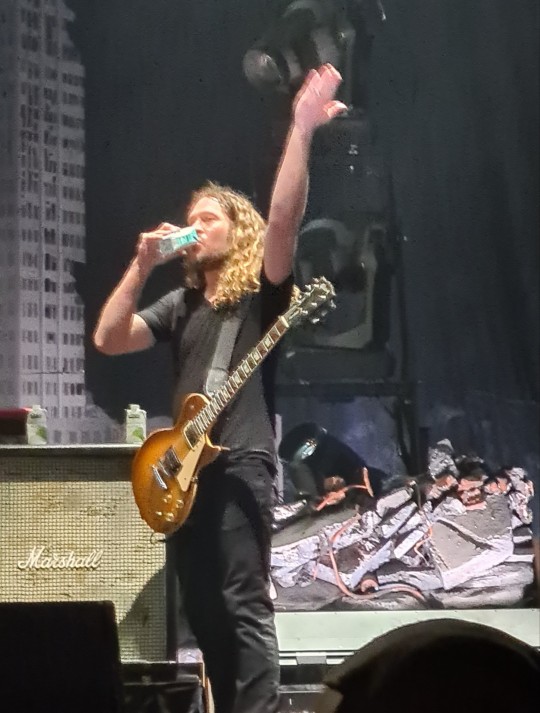

could anyone tell wtf ray was drinking instead of wine it looks like a fkn popper (juice box) akskdksjdjsjsj

#this was so fucking cute he was singing along with his hands while he was busy drinking 🥺🥺#ray toro#mcrbrisbane#my show#**#brisbane

1K notes

·

View notes

Text

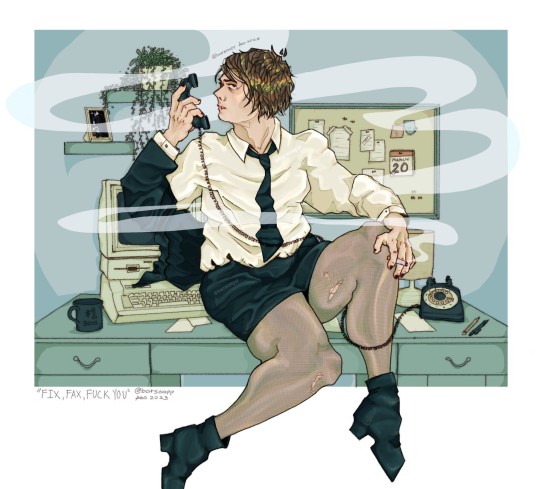

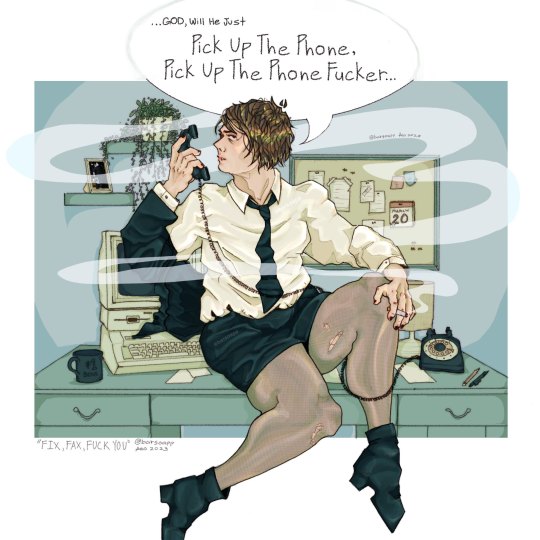

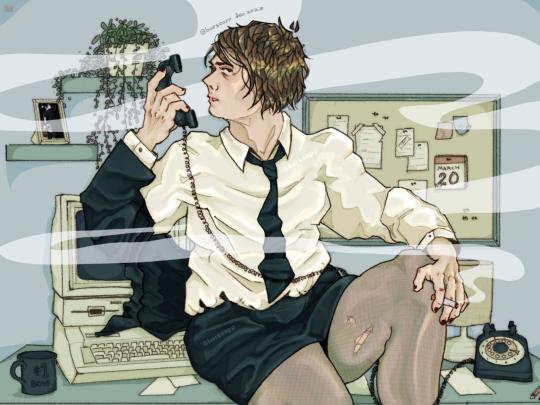

Do not disturb, business is at hand

Close up + one with text

#drawing#digital art#fanart#procreate#my art#mcr fanart#mcr#mcr art#gerard way fanart#gerard way#mcr melbourne#mcr brisbane#mcr sydney#secretary gerard#business gerard#gerard way skirt#skirt Gerard#swarm tour#my chemical romance fanart#This outfit has been on my mind 24/7

835 notes

·

View notes

Text

every day I can't post on Tumblr an angel dies

#I'm busy af wth#busy day#light academia#dark academia#desiblr#gaslight gatekeep girlblog#romantic academia#brisbane#desi girl#queensland#manic pixie dream girl#hell is a teenage girl#my quotes#quotes#spilled words#this is a girlblog

22 notes

·

View notes

Photo

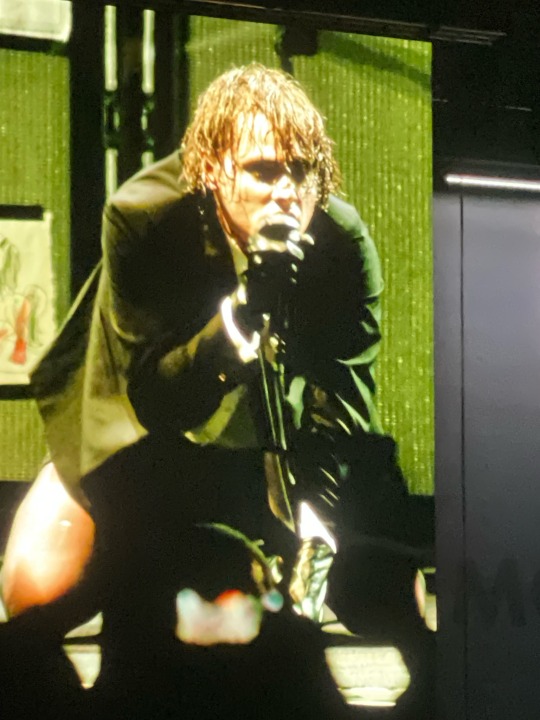

Gerard Way composing thou self after some headbanging (x)

#Brisbane Australia II 03/14/2023#actually it's out of order but whatever#gerard way#mcr#my chemical romance#tw: flashing lights#decay era#or maybe it' swarm era whatever#rubbish78gifs#my gifs#business hot lady

399 notes

·

View notes

Text

High Performance Coaching with Catherine | Business Coaching

Catherine Connolly is a leading authority in transformational coaching and training for business leaders, coaches, and trainers. With a focus on enhancing skills in influencing, facilitating teams, and empowering others. Catherine's work is designed to unlock your full potential and elevate your leadership capabilities.

2 notes

·

View notes

Text

Navigating the Landscape of Tax Preparation and Bookkeeping Services- A Guide to Choosing the Best Agencies

Tax preparation and bookkeeping are integral parts of running a successful business. However, for many entrepreneurs and business owners, these tasks can be daunting and time-consuming. That's where professional services come in handy. In cities like Perth, Brisbane, Sydney, Melbourne, Adelaide, and NSW, agencies like Account Cloud offer comprehensive tax preparation and bookkeeping services to alleviate the burden on businesses. But with so many options available, how do you choose the best agency for your needs? Here's a guide to help you navigate the landscape:

1. Assess Your Needs: Before you start your search for a tax preparation and bookkeeping service agency, it's essential to assess your needs. Determine the scope of services you require, such as tax filing, payroll processing, financial reporting, or general bookkeeping. Understanding your requirements will help you narrow down your options and find agencies that specialize in the services you need.

2. Experience and Expertise: When entrusting your financial matters to a third-party agency, it's crucial to ensure they have the necessary experience and expertise. Look for agencies with a proven track record in tax preparation and bookkeeping services. Consider factors such as the number of years in business, client testimonials, and the qualifications of their team members.

3. Industry Specialization: Different industries have unique tax and accounting requirements. Whether you're in retail, hospitality, healthcare, or any other sector, consider choosing an agency that specializes in serving businesses similar to yours. Industry-specific knowledge can ensure compliance with relevant regulations and optimize tax strategies tailored to your business.

4. Technology and Innovation: The accounting landscape is continually evolving, with advancements in technology reshaping how financial tasks are performed. Seek out agencies that embrace technology and leverage innovative solutions to streamline processes and enhance accuracy. Cloud-based accounting platforms, automation tools, and data analytics can significantly improve efficiency and decision-making.

5. Communication and Accessibility: Effective communication is key to a successful partnership with a tax preparation and bookkeeping agency. Choose an agency that prioritizes clear and transparent communication, keeping you informed about your financial status and any regulatory changes that may affect your business. Additionally, consider their accessibility and responsiveness to inquiries or concerns.

6. Compliance and Security: Compliance with tax laws and regulations is non-negotiable when it comes to financial matters. Ensure that the agency you choose adheres to the highest standards of compliance and stays updated with the latest regulatory changes. Moreover, prioritize security measures to protect sensitive financial information against unauthorized access or data breaches.

7. Scalability and Flexibility: As your business grows, your accounting needs may evolve as well. Select a tax preparation and bookkeeping agency that can scale its services according to your business growth. Whether you're a small startup or a large enterprise, flexibility in service offerings and pricing structures ensures that you receive tailored solutions aligned with your current and future needs.

8. Cost and Value: While cost is undoubtedly a factor in the decision-making process, it's essential to consider the value proposition offered by the agency. Instead of solely focusing on the lowest price, evaluate the services, expertise, and support provided in relation to the cost. A higher upfront investment in quality services can often yield long-term benefits and cost savings through improved financial management.

Choosing the best tax preparation and bookkeeping services agency requires careful consideration of various factors, including your specific needs, the agency's experience and expertise, industry specialization, technology adoption, communication practices, compliance standards, scalability, and cost-effectiveness. By conducting thorough research and due diligence, you can find a trusted partner like Account Cloud to handle your financial affairs efficiently, allowing you to focus on growing your business with peace of mind.

#Bookkeeping Services Melbourne#Bookkeeping Services Brisbane#Bookkeeping Services Perth#Perth Bookkeeping Services#Adelaide Bookkeeping Services#Online Bookkeeping and Accounting Perth#Online Bookkeeping Services Melbourne#Small Business Bookkeeping Services Brisbane#Small Business Bookkeeping Services Sydney#Small Business Bookkeeping Services Perth#Small Business Bookkeeping Services NSW#Premier Tax and Bookkeeping Adelaide#Tax and Accounting Services Brisbane#Tax and Accounting Services Sydney#Tax and Accounting Services Perth#Personal Tax Accountant Brisbane

3 notes

·

View notes

Text

Sleep Token 20/04/24 Brisbane, Take Me Back To Eden

#i only got one video cause i was too busy ascending#i am forever changed#sleep token#sleep token brisbane

3 notes

·

View notes

Text

Inside the life of an Emirates flight attendant

Alexandra Cosoff hasn’t paid for accommodation for the past 10 years after joining Emirates as a flight attendant and living in Dubai. The 33-year-old from the Sunshine Coast in Queensland is currently a cabin supervisor after climbing her way to the top where she gets to enjoy the perks of her “generous benefit package”. “Our accommodation is provided and salary is tax free – and not just that,…

View On WordPress

#accommodation allowance#Asia#attendant#Australia#Australia and New Zealand#aviation industry#brisbane#business promotions events#cabin crew#cabin crew recieve#cabin supervisor#dream life#Dubai#economy class#economy grade#Emirates#Europe#females hair#flight#flight attendant#generous benefit package#life#London#makeup artist#meal allowances#night stops#Northern Europe#Oceania#presentation cabin crew#promotions events team

9 notes

·

View notes

Text

14/3/2023

#mcr#my chemical romance#gerard way#gerard mcr#mcrbrisbane2#mcrbrisbane#mcr brisbane#brisbane entertainment centre#business gerard

12 notes

·

View notes

Text

youtube

Discover the road to enhancing your business's value with these tried-and-true strategies. Collaborating with an experienced business consultant in Brisbane can provide invaluable guidance. Prioritize customer satisfaction, leverage technology, invest in your team, build strategic partnerships, and ensure long-term sustainability. Executing these steps can significantly amplify your business's overall value.

3 notes

·

View notes

Note

Does Melanie have a stable relationship with anyone in the group besides Sienna? 😭

not really lmao, she's okay with not being super close with any of the others bc she's so busy outside of the group and only has to see them during comebacks. and considering they haven't had a comeback in over two years, yeah she's not going out her way to keep up with them.

# ⋆⠀⠀ʬ.ʬ.⠀⠀٬⠀⠀(⠀⠀&.⠀⠀)⠀...⠀MISC.#melanie doesn't even live in korea fully too lmfao#she primarily travels around between#la brisbane nyc and seoul#la and nyc are mainly business#seoul is solely for group activities#bc she hates doing solo stuff in korea#and then brisbane for family + her god awful bf#more on him later :)

2 notes

·

View notes

Text

How Video Production is Helping Businesses in a Competitive Landscape

If you were into thinking that business video production is not a healthy idea; and is only going to turn out as a waste of money, think again. Video marketing is literally making news everywhere. It is a massive approach for businesses nowadays.

A New Take on Video Production to Attract Audience If you give it a shot, even your business could benefit from high turnovers because there are over billions and billions of viewers watching videos on the internet and businesses are considering this as a perk to get their messages through.

Gone are times when the audience would sit back and watch advertisements or read text ads on newspapers and magazines. Today, a huge population from the business world has switched to video production services in Brisbane. As per records a whopping 87% of marketers are of the opinion that marketing videos are directly adding to their sales.

When it comes to captivating the audience, there is no other means as engaging as videos; and it is true that videography gives an edge to it. However, as the scenario goes, these businesses are constantly digging into ideas to make their video content more meaningful and engaging. It is not that they must use the same strategy for over and again. Marketers are brainstorming new ideas and following trends to roll out captivating content for viewers, so that they stay glued to the screen and are ultimately driven to take an action. Indeed, business video production houses in Brisbane are targeting videos that redefine brands and help a business connect with their customer base.

They use storytelling that are more visually immersive and interactive in impactful micro-videos. Thus, modern video production trends are all about unfolding the power of videography and building a sense of trust between a business and its customer base.

0 notes

Text

Choosing the Right Business Broker: A Guide to a Successful Sale

Selling a business is one of the most significant decisions a business owner can make. Whether you are retiring, pursuing new ventures, or simply deciding to move on, the process requires careful planning, strategic thinking, and expertise. One of the most important steps in this process is choosing the right business broker. A skilled broker can significantly affect the outcome of the sale, ensuring that you achieve the best price and that the process is smooth. Baton Advisory, a leading firm in the field, has helped many business owners navigate the complexities of selling their companies. This guide will provide you with valuable insights on how to choose the right business broker to successfully sell a business Brisbane.

What Does a Business Broker Do?

A business broker acts as an intermediary between the business owner and potential buyers. They help facilitate the sale process, from valuing the business to finding qualified buyers and managing negotiations. The broker’s role is not only to ensure the business sells for the best price but also to streamline the process, ensuring both parties meet their goals.

The services offered by a business broker include:

Valuation of the Business: A broker will assess the value of your business, considering assets, earnings, market conditions, and other key factors.

Buyer Search: A business broker uses their network and industry connections to find qualified buyers for your business.

Marketing: The broker will market your business in a way that attracts serious buyers and presents the company in its best light.

Negotiation: Business brokers manage the negotiation process to ensure that both parties agree on a fair price and terms.

Due Diligence and Paperwork: Brokers handle the necessary paperwork, ensuring that all legal and financial documentation is in order.

Why Choosing the Right Business Broker Matters

Choosing the right business broker is a critical decision when selling a business. Your broker will be your trusted advisor throughout the process, guiding you through each step and ensuring the sale goes smoothly. Below are a few reasons why the right broker is key to a successful sale:

Maximizing the Sale Price: A business broker with experience can help position your business in a way that attracts top-dollar offers. They know how to market your business effectively, highlighting its strengths and making it appealing to prospective buyers.

Expert Guidance and Advice: Selling a business is a complex process, and having a knowledgeable broker ensures that you make informed decisions. They can help you understand the market, assess offers, and navigate any legal or regulatory challenges.

Streamlined Process: Selling a business can be a lengthy and time-consuming process, often involving mountains of paperwork. A professional broker like Baton Advisory can manage these details, saving you time and effort while ensuring everything runs smoothly.

Access to a Network of Buyers: One of the greatest advantages of working with a business broker is their access to a vast network of qualified buyers. They can help you sell business Brisbane more quickly by reaching buyers who might not be accessible through traditional channels.

Confidentiality: Throughout the selling process, confidentiality is crucial. A skilled business broker will ensure that sensitive information is shared only with serious, qualified buyers, protecting your business’s reputation and operations.

How to Choose the Right Business Broker

Now that you understand the importance of selecting the right business broker, it’s time to look at the key factors to consider when choosing the best fit for your needs:

Experience in Your Industry

Every industry has its own unique challenges, and selling a business in a specific sector requires an understanding of those nuances. When you decide to sell a business Brisbane, it's crucial to find a broker who has experience in your specific industry. Whether you are in retail, construction, hospitality, or another field, having an experienced broker who understands the market dynamics will greatly benefit your sale.

Baton Advisory, for instance, offers extensive experience working with businesses across various industries, providing tailored solutions for each client.

Reputation and Credentials

Before hiring a broker, take time to research their reputation. Look for brokers who are licensed, certified, and have a track record of successful sales. Ask for testimonials from previous clients and check their credentials to ensure they are qualified to handle your business sale.

Baton Advisory is a trusted name in the business brokerage field, with a strong reputation for professionalism and successful business transactions.

Knowledge of the Local Market

When you decide to sell your business Brisbane, working with a broker who understands the local market is essential. Local brokers are familiar with the economic climate, market trends, and potential buyers in your area. They can help you navigate any challenges specific to the Brisbane market and ensure a smoother process.

Strong Communication Skills

Effective communication is essential when selling a business. A business broker should be able to clearly explain complex concepts, keep you informed throughout the process, and provide regular updates. Strong negotiation skills are also crucial, as the broker will be your representative in dealing with potential buyers.

Fee Structure and Transparency

Before committing to a broker, make sure you understand their fee structure. Most business brokers work on a commission basis, taking a percentage of the final sale price. Ensure that the terms are clear and that you fully understand what services are included in the fee.

Baton Advisory, for example, offers transparent pricing, ensuring that clients are fully aware of the costs involved before moving forward.

How Baton Advisory Can Help You Sell Business Brisbane

When you’re ready to sell business Brisbane, Baton Advisory can offer the expertise and support you need to achieve a successful sale. Baton Advisory’s team is experienced in helping business owners navigate every aspect of the sale process, from valuation and marketing to negotiations and paperwork.

With a deep understanding of the Brisbane market, Baton Advisory has access to a wide network of qualified buyers. They will work with you to position your business in the best possible light, helping you secure the highest possible price.

Additionally, Baton Advisory’s team is dedicated to providing personalized services, ensuring that each client’s unique needs and goals are met throughout the sale process.

Final Thoughts

Choosing the right business broker is one of the most important decisions you’ll make when deciding to sell a business Brisbane. A knowledgeable, experienced broker can help you maximize the value of your business, streamline the process, and ensure that you reach a successful sale.

Baton Advisory is a trusted partner for business owners looking to sell their businesses in Brisbane. With expert guidance, a vast network of potential buyers, and a proven track record of successful sales, Baton Advisory can help you sell your business Brisbane quickly, efficiently, and for the best price.

If you’re ready to sell your business Brisbane, partnering with the right broker can make all the difference.

0 notes

Photo

Divine sight is meant to fill us with—awe!

#i stole that quote from a christian site idk i was looking for joan of arc quotes but i saw this one#gerard way#shitty gifs#Brisbane Australia II 03/14/2023#mcr#my chemical romance#decay era#or maybe it' swarm era whatever#rubbish78gifs#my gifs#tw: flashing lights#ground man#business hot lady

276 notes

·

View notes

Text

https://webvideodigital.com.au/digital-marketing/

#digital marketing agency sydney#best digital marketing company#digital marketing company in australia#marketing agency near me#best digital marketing agencies#online advertising for small business#digital marketing agency Brisbane#best digital marketing agency sydney

0 notes