#Breakout Reloaded

Explore tagged Tumblr posts

Text

Okay, so I wake up to the Season 2 trailer for Total Drama Island Reloaded…here are some observations:

1- Ripper and Damien; clearly gonna be the breakout duo of the season…hopefully.

2- Someone seems salty that a certain someone else is back.

3- A better view at Scary’s redesign. I assume she’ll be going by her actual name for this little change? Heaven only knows what she’s been doing between seasons.

4- Zee is still Zee…as he should be.

5- Wayne and Raj are still the best characters and share a brain…as they should.

6-Nichelle showing her newly found determination. Cheers to her girlfailure turned girlboss arc that they seem to be pointing towards.

#total drama#cartoon network#total drama reboot#total drama island#tdi ripper#tdi damien#tdi bowie#tdi caleb#tdi zee#tdi wayne#tdi raj#tdi nichelle#tdi scary girl#teletoon#tdi2023#tdi reloaded#tdi2023 season 2

49 notes

·

View notes

Text

vn* in a bottle: petit game collection vol.1

hm, i guess there's a bit of an irony talking about this before needy girl, but here we are. i played this with my darling and had a really nice time

this game is a spin-off of needy girl overdose / needy streamer overload. it's collection of 3 minigames and a developer's notes room. it's retro goodness, not that i'm that old to know. i did play toradora portable though, and that had some extra content similar to this. i guess that main difference is that you're paying for this extra content, huh. i feel it's pretty worth it if you really like needy girl

only one of the minigames is a vn, so let's talk about that last

break out kangel

it's kangel breakout. this one is entirely in japanese. it'd be fine if there wasn't a little bit of dialogue, but otherwise you're not missing anything

i'm not sure how common it is to have strip breakout as an extra minigame in vns, i've only played one other that has something like this, but it kinda feels like a staple to include if that makes sense? i could be wrong. i don't exactly know what to search online to find that kind of info, too

anyway this is just strip breakout. break the blocks, collect the falling power ups and uh remove kangel's seifuku. simple as that. she's ofc wearing smth under that, there's no nudity in this game

don't die, kangel!!

this one may generally be found to be more enjoyable than breakout. it's a shmup where you shoot your fans with meds. i like the art, it's super cute. though i could say about every kangel and ame art in this game

there's a bit of story that's mildly engaging, i found it neat. you're typically here for the gameplay though

the street is just a background, you stay entirely on this screen. you have pills to use as ammo, and your only objective is to not die (like the title tells you). after a few waves of nerds, a boss appears. and there's three bosses to beat

after a wave you get to pick a new pill. picking the same type of pill upgrades it. they're pretty self-explanatory. then it randomly shuffles some of it into your ammo every time you reload. also you reload with RMB, which also lets you dash a bit

it doesn't take that long to beat (this is stage 1's clear screen though). i had a fair bit of fun with this one. you do have to beat the boss, but you can let every other nerd just pass you

kangel's room

this is the credits. the people who worked on the game have stuff to say, so listen properly!!

ame's happy happy dating game

i couldn't screenshot this one properly, so please forgive the clutter. i don't really wanna crop it all so in exchange i offer you uh, you get to see my wallpaper

it's been that for a few months now

ame wants to go on a date with you, so you better choose well!! i think the most interesting part of this game is that it let p-chan monologue their thoughts. they're kinda messed up

ignoring the fact that i only took this screenshot now, you get to pick where you wanna take ame on a date for the next few days

since you get to pick, there's a good and bad ending, naturally. better not give her a bad time, mmkay?

i realized once some cgs showed up that this is where people have been getting those nice ame wallpapers from. the art for the vn is nice, it's really neat and clean, and ame looks super cute. the music is mixed a bit weirdly at times (kangel's theme is so loud) but overall i liked the aesthetic direction here

p-chan is here to give us a description of the world as someone really close to ame. however they describe things reflects how ame sees it. ame is fleshed out so much more than we see her in the base game through p-chan's monologues here (the base game does it great though lemme just clarify). i mean more to say that this format lets people stay and really be with ame past the webcam app on p-chan's screen. it feels a bit dangerous, to occupy the same space as her. and of course it is, ame being who she is. though that goes the same for all humans

i think the bad ending represents a lack of consideration and care one might have towards people. i went for it "just to see what it would be" without regard for how someone might feel about it. it tracks given the conditions for that bad end, too. impulse, disregard, the absence of seeing while doing.

going for the good end kinda feels like a chore, given you have to see everything in the game. though, it's supposed to feel more like a prayer, i think. a connection with ame, of sorts? seeking out and trying to understand her through the places she goes and hearing what she thinks. it might not be something you'd consider pleasant, but few things in life really are. even less so for humans. ame is a human

it's easy to connect with angels, all you need is the internet. i want to connect with human beings, too

#petit game collection vol.1#needy streamer overload#needy girl overdose#wss playground#visual novel#vn in a bottle

15 notes

·

View notes

Text

Trollhunters Voice Actors Cause Why Not: Pt 1

I'm bored, so let's do some stuff I guess.

I'm only doing the main cast for now, but I'll probably do the rest in a later post. I will also only be putting the cast here if they have parts in other shows or movies. If they are in movies or shows I don't recognize, I will only be putting one of them.

Anton Yelchin

Who plays Jim Lake Junior in TrollHunters and Clumsy Smurf in several Smurf movies and shows.

Kelsey Grammer

Who plays Blinky in TrollHunters, Beast/Hank McCoy in The Marvels, Hunter in Storks, Sideshow Bob in The Simpsons, Stinky Pete in Toy Story 2, and Martin the GEICO Gecko from GEICO commericals.

Charlie Saxton

Who plays Toby Domzalski in TrollHunters and Whiffy in Dragons: Rescue Riders.

Fred Tatasciore

Who plays AAARRRGGHH!!! in TrollHunters as well as voices in over 600 other shows, movies, games, shorts, rides, and ads, such as LEGO Marvel Avengers: Code Red, Merry Little Batman, Persona 3 Reload, I Am Groot (short), Guardians of the Galaxy: Mission Breakout, and an ad for GameStop.

And those are the main cast members with rolls in other stuff.

I'll do the side cast later.

I guess.

5 notes

·

View notes

Text

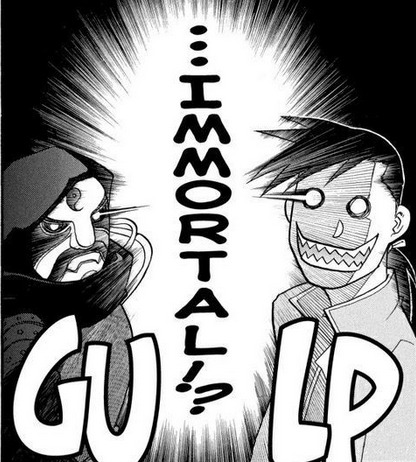

Fullmetal Alchemist Chapter 38

Lin told Al and Winry stuff. I'm glad Lin took off his shoes before placing his feet on the bed.

This is the first time Winry was around when something happened. The danger Ed and Al are putting themselves in is suddenly less abstract. It's been three days since she found out Hughes was dead.

Lust is certain in Gluttony and Envy's skill. Cut to Envy and Gluttony getting beat. With the Gluttony fight, it was fun to pay attention to Private First Class Black Hayate. Not only did he bite Gluttony's shoulder, he also spooked him by jumping and yapping. Then he jumped out of the way when Hawkeye and Fuery opened fire on Gluttony. And then there's his reactions to everything after.

Lan Fan and Lin can both detect the Homunculi. This is the first time we get explicit confirmation they have a Philosopher's Stone in them so now I can say that's what they're detecting. So when the Xing characters start talking about weird sensations about Amestris, a vigilant reader might start connecting some dots.

No matter what he looks like, Lin will always be my babygirl.

Roy was surprised Alphonse showed up so that means Lin bringing him along was not part of the Super Heist. But Al is welcome to join.

When we get these little moments of information exchange, I like to try tracing things back to how did they get the info. For a moment, I wandered how Al knew Envy's name. Al had seen him before when Envy brought Ed's unconscious body from Lab 5, but it took me a moment to remember Ed heard his name and shared it with Al, Armstrong, and Hughes later. So that's how Al got the info. Nobody connected any dots from Envy's transforming powers to Hughes's death though. No one in the car knows Maria Ross was witnessed killing him.

A nice little miscellaneous thing during the car ride and info-sharing scene is we see Hawkeye and Havoc reloading their guns.

Is that a "Cat Crossing" street sign?

Barry's pursuit leads closer to the middle of Central so that means Lab 3 is in the inner city.

Roy uses Barry's rampage as the perfect excuse to head into Lab 3 without needing a warrant or anything. Roy brings up an incident at the penitentiary earlier that day and refers to Barry as the murderer. I wanted to make sure this wasn't some translation error and Roy wasn't referring to the guy who broke Maria Ross out, and I think this is a separate incident because Barry didn't kill anyone there so the perpetrator being a murderer is not applicable. (I mean, yes, Barry is a murderer, but the details of the breakout wouldn't imply that.)

Alphonse seems nervous playing along with Roy's ruse. He's not military personnel.

From this shot when the team splits up, we can tell the hallway is slightly curved.

This is a seemingly irrelevant detail but I'm going to build on this in the next few chapters so keep this in the back of your mind. The room Roy and Havoc find in the long hallway appears to have been to their right.

I hope Mustang and Havoc got treated for potential infections after all this was over because there's no way that water was sanitary.

That move Roy used to break the water down into hydrogen and oxygen, that could just be some Alchemy stuff or he could have been applying a real world technique called electrolysis.

Electrolysis involves channeling a direct current through substance to trigger a chemical reaction that otherwise wouldn't happen. For water, electrolysis requires the current to travel through an electric conductor in the water. Oxygen gathers in the positive side of the conductor while hydrogen gathers in the negative side. If that was what Roy did, then he was likely able to achieve it using something in the room as a conductor and himself as the battery.

He probably wouldn't be able to use it to dry his gloves though since the conductor can't be touching other materials, otherwise the current would flow into them instead.

I wonder if this is an error caused by the translation process. There's a blank pixel on one panel.

Roy does that eye thing a few times but he does it in bursts. His eyes are obscured when he shoots Lust in response to her taunt about Hughes. He does it when she shows her Philosopher's Stone (That was probably shock). He does it when Havoc gets stabbed (shock again). He does it when he grabs Havoc's gun, but not when he shoots Lust. And he does it when he rips her stone out of her body and they go back to normal as soon as he rips it out.

The part where he was shooting Lust to demand information was personal business. The part where he blew her up was professional. And his reaction to Havoc getting hurt made it personal again but he calmed down to make sure he could shoot Lust.

Unlike Greed, Lust is able to use her powers and regenerate at the same time. It might be possible she, and by extension all the homunculi, can wait to regenerate because she was able to lie in wait to ambush Roy and Havoc after being blown up.

And when Lust's stone is ripped out, her body disintegrates only to build a new one around the stone. So the stones are their actual "bodies" and their physical bodies are just vessels for them. Lust commented on what Roy did just before destroying her old body so her memories are stored in the stone.

back

Spoiler Discussion

Lin most likely told Al about the heist to smuggle Maria Ross out of the country and that Ed was taken away so he could safely give Roy information.

When Ed and company infiltrate the Lab 3 hallway late in the series, Hohenheim takes the same route Roy and Havoc took and got to Father's lair with no trouble. Presumably, this means the door Lust was guarding leads straight to him.

2 notes

·

View notes

Text

Orderflows Trader 7.0 For NinjaTrader 8 The Future Of Order Flow Trading Is Here...And Orderflows Brings It To You First! When It’s About Your Trading - Don’t Rely On Guesswork Or Your Intuition… Orderflows Trader 7.0 Is The Most Robust Order Flow Trading Software On The Market Designed By A Trader For Traders. New Order Flow Tools Orderflows Trader 7.0 is a major upgrade in terms of functionality as well as analytics. There are 13 new order flow analysis tools & improvements to help you understand the order flow: Accumulation/Distribution, Open POC, Aligned POCs, Orderflows Gaps, Imbalance Reload, Volume Decline, POC Wave, Delta Tail, Resting Liquidity, Vertical Liquidity, Delta Breakout, Retail Suck, Price Action Divergence. These tools are hard-coded into the Orderflows Trader 7.0, there is no additional cost or software to add on. Standard Order Flow Tools In addition to the new order flow analysis tools listed above, you will also get our existing standard order flow analysis tools that came with the earlier versions of Orderflows Trader: Market Sweep Detector, Market Weakness Detector, Orderflows Sequencing, POC Slingshot, Value Area, Value Area - EVA, and Inverse Imbalance, Orderflows Delta Divergence, Exhaustion Print, Imbalance Reversal, Zero Prints, Volume Profile, Stacked Imbalance, Multiple Imbalance, Unfinished Business, Prominent Point of Control, Orderflows Ratio. Other software companies have copied our tools and pawned them off as their own, but don't show you how to use them because they just don't understand how to use them. What is the point? If you have tools to analyze the order flow, you also need to learn how to apply them. I show you how to use all these tools in your everyday trading. New Order Flow Tools My name is Michael Valtos and since 1994 I have been trading for banks (JP Morgan and Commerzbank) as well commodity trading houses (Cargill and EDF Man) and for myself. While trading for the investment banks I learned how to get information out of the market and how to trade off that information into a profitable position; when there is an opportunity to earn a significant return relative to risk you get into a position. While trading at commodity trading houses I learned to think how commercial end-users think; you are always in a position just by being in that business whether or not you chose to hedge a position in the futures market. While trading for myself I learned to take low risk high return trades; I do not try and capture every random move in the market. What I look for is what I call “Stress Free Trades” which to me are low risk entries that have high profit potential. I have enough stress in my life I don’t want trading to add to it. A simple, pragmatic approach to trading... I created Orderflows software which runs on the Ninjatrader platform and combines charting and order flow in a dynamic, real-time way that allows the trader to view the market’s evolving and changing state. Its primary benefit rests in its unique ability to see a clearly who is in control of the market based on market generated information as it happens. If you have ever sat and watched the market trade for an extended period of time you start to see how orders are filled in the market and their impact on market direction. There are aggressive traders and there are passive traders. When you know how to tell the difference between the two types, then you can understand where the direction of the market. Focusing on order flow changes everything! It is a better way of trading than the popular systems of indicators and messy indecipherable charts. Nothing could be simpler. No need for all those cluttered charts. Stop using charts cluttered with indicators. They are not helping you. They are cluttering up your decision-making process. They don’t even give you current market conditions. Order flow is not a trading system by itself. Rather the order flow is the analysis of orders being traded as they flow into the market.

The Orderflows Trader is software that allows the trader to see what is happening in the market in real-time giving an x-ray view into the market so the trader can see what exactly is happening as it happens. Once a trader understands what is happening in the present, the trader is able to make better decisions about what might happen in the future. If the market did the same thing every day, trading would be simple. Think about it, a moving average trading system will generate nice profits in a trending market. But what happens in a sideways market? Traders often give back all their profits and then some because they don't understand that conditions in the market have changed. They just continue doing the same thing that made them money in the past. Not being able to notice a change in market conditions is what destroys many traders. They think they have come up with a "Holy Grail" trading system that turns the market into their own personal ATM cash machine. But most Holy Grail systems are destined to self-destruct because it is not flexible to market conditions. If an inflexible Holy Grail system will blow up so will an inflexible trader. A trader must react and automatically adjust and compensate for changes in market conditions. Flexibility is key. Order flow tells you the market's underlying currents. You know that there are days when the market wants to run in one direction and days when the market just wants to rotate back and forth. In a rotational market, traders sell every rally and buy every dip. This works well until the market starts trending. But a bell doesn't go off and the market doesn't announce "I am going to start trending now." It just does it. Traders selling every rally get caught offside and contribute to the rally even more while covering their losses. Then what happens? Market conditions change again and the market starts rotating again. And again, no bells or whistles or announcements to announce this change in market condition. But order flow traders don't need announcements as they are in sync with what the market is doing and how it is doing it. Think of it! No Calculus. No Lagging Indicators. No Moving Anythings! Orderflows Trader 7.0 offers you a logical, straightforward approach to analyzing the markets that could dramatically improve your trading! A properly constructed chart consists of volume and price factors, that when combined produce easily identifiable order flow patterns that will help you trade with reasonable accuracy. Additionally, a successful trading plan and money management are better applied when a trader is working with a better-designed chart. With the Orderflows Trader 7.0 you will now be able to decode order flow sequences and how to read them like institutional traders do. You have real-time intelligence that is unlimited. You will now have invaluable order flow intel that impacts the market before price even starts moving. You will be ahead of you retail trading competition which gives you a tremendous edge in the market. You will be trading alongside the big institutional traders who are one, two and three steps ahead of the small retail traders. Most traders are weak on analyzing the present and you have to trade in the present, you still have to get in and get out in real time. So it makes sense to analyze the present as good as you can to qualify better trade locations and most importantly, near-term support. At first, an Orderflows Trader chart looks a little bit overwhelming, but it's really very simple to use. You will soon realize that the Orderflows Trader chart is the most important chart you will ever use. What Makes Orderflows Trader 7.0 Such A Game Changer For Traders? Many of Orderflows Trader 7.0's incredible features are proprietary and “first-to-market”! 32 Plottable Order Flow Analysis Indicators. Additionally, there are exclusive order flow delta analytics in Orderflows Trader to expose the underlying mechanics no one else sees.

Take A Look... The Orderflows Trader allows you to organize data in a way that reveals consistent and predictable market behavior...! The key elements of Orderflows Trader software are traded price, traded bid volume, traded ask volume over a range, volume or time period. When these elements are displayed in a chart, traders will be able to identify the market’s areas of strength and weakness. Every market moves up or down based on the interaction between supply and demand. Traditional charting techniques or analysis do not accurately allow you to analyze, understand and interpret the fighting forces of supply and demand. Orderflows allow you to dissect the supply and demand balance in real time as it is happening. You will understand which side is in control and be prepared to respond when it changes. Order flow trading is a universal method of analysis that can be combined with just about any technical study. Technical indicators are based on complicated calculations to manipulate past price activity tend to mask the reality of what is happening in the market. Order flow goes right to the roots of what is happening now and lets you exploit that information for your benefit. There are basically two types of traders in the market: the big guys and the small guys. You can replace those terms with names such as "Smart Money" and "Dumb Money" or "Institutional Traders" and "Retail Traders." You often hear people say "follow the smart money." Well, it sounds simple, but how can you figure out what the smart money is doing by looking at a normal bar chart? You can't. Order flow makes it very easy for you to determine which side is doing what at that moment by breaking down the volume that is actually being traded in the market. The real power of Orderflows is that it identifies “hidden” trade locations that can’t be seen using traditional charting techniques. We built our own tools in order to process the order flow as it happens to help find the hidden trade opportunities within a bar. Nothing is more visual and reflects true market sentiment better than the Orderflows chart. View Order Flow Through Different Views! Within the Orderflows Trader 7.0 you have your choice of 4 different volume footprint charts: 1. Bid/Ask - This is the standard footprint chart that shows the volume traded on the bid and the volume traded on the offer. The most common form of order flow chart. 2. Delta - View the delta (difference between the volume traded on the bid versus the volume traded on the offer) horizontally. This view allows you to focus on the aggressive trading occurring in the market. The volume traded on the bid side versus the volume traded on the offer side at a price, NOT the two-way auction. This is delta at price. 3. Volume - A different way to view a chart. Shows the total volume at price at each level. The price level with the most volume in the bar is the POC. 4. Diagonal Delta - Plot the delta on your footprint chart based on the two-way auction, the bid versus the offer. While the Bid/Ask chart is the most common order flow chart used. You have additional choices of viewing what market participants are doing in the market. Traders are finding edges through the order flow delta charts because they are able to pinpoint what the big aggressive institutional traders are doing in the market at any given moment. Order Flow Gives You An Edge... Without a doubt, order flow analysis gives you an edge over other traders. While other traders are looking at price bars or candlestick bars with just open, high, low and close, the order flow chart lets you look inside a bar to see when there is aggressive buying or selling taking place while the bar is forming. You can literally be making trading decisions while the bar is forming, thus putting you ahead of other traders who don't yet realize what is happening in the market. With order flow you can literally see market generated information that is impacting the market before price even starts to move.

The markets trade in real time and most traders are very weak in analyzing the present market conditions. You have to trade in the present, you got to get in and get out in real time. So it just makes sense to analyze the present market conditions as best as you can to find better trade locations as well as near term support and resistance levels. It Is Up To You To Take The Edge! Orderflows Trader 7.0 Is Coded With 13 NEW & Powerful Order Flow Analysis Tools! 1. Accumulation/Distribution The Accumulation/Distribution tool analyzes the order flow in a bar to determine if there is Accumulation (Bullish) or Distribution (Bearish) order flow being traded in a bar. There is an extra filter called “Passive Traders In Control” that finds instances when strong bidders (bullish) or offers (bearish) are present in the Accumulation or Distribution that is taking place. Too often traders get lost in the numbers of the footprint chart. The Accumulation/Distribution tool takes the headache away and shows you when important order flow is trading. 2. Open POC POC is the price level in the bar with the most volume. When volume start to lead price higher or lower that is a good sign of a strong move. When an Open POC occurs there is usually a move just beginning. If you know a move is just beginning to start you can get it with tighter stops and more upside potential. Healthy moves have healthy volume and when volume moves in the direction of the move, those are some of the best trades to take. 3. Aligned POCs When Aligned POCs occur it is a sign of a market balancing. POC is the price level in the bar with the most volume and if consecutive bars are trading the same price level, that is a sign that traders are happy to transact at that level. The market has found a fair price. Ok, that's wonderful. So what? Well, as a trader you need to anticipate what can happen next based on the information the market is giving you. If you know the market was balanced for a couple of bars, then you want to get ready for when the market goes out of balance, because that is when the moves happen. 4. Orderflows Gaps Orderflows Gaps represent a divergence between price and value caused by shifting sentiment and speculative order flow. Spotting them early is key and now you can. Identifying when these Orderflows Gaps emerge allows traders to spot mispricing and speculation-driven moves. Analyzing the accompanying order flow allows you to determine whether the gap is justified and likely to revert back towards fair value. 5. Imbalance Reload When traders look at imbalances, they often only look at imbalances in a bar. The Imbalance Reload looks at imbalances spread out over consecutive bars. When you see buying imbalances or selling imbalances coming in at the same level over consecutive bars it is a sign of strong directional aggressive trading. If there is strong aggressive trading taking place at a price level over consecutive bars you know there is a trader who is trying to trade size without moving the market. 6. Volume Decline A Volume Decline is a sign of the market moving away from levels because of lack of interest at those higher or lower levels by traders. Bullish Volume Declines occur at bottoms of green-up candles or the top of red-down candles. It is a form of price rejection. Once you know a price level is being rejected then you can be more confident and accurate in the near term direction of the market. 7. POC Wave POC Wave is a 3-bar POC setup that is great for identifying potential market turning points. What happens in a POC Wave is the market is a little tentative to move one way or the other, then it makes a fake breakout or breakdown, and then reverses and trends. 8. Delta Tail A Delta Tail is one of my favorite Delta trade setups. I first wrote about it in 2018. It shows absorption in an individual bar which often has an effect on the next few bars.

If you know there is absorption present you can take advantage of what follows, which is often a short term move away from that absorption level. 9. Resting Liquidity Resting Liquidity is big, strong passive bids and offers in the market that trade which can often act as support or resistance. Being able to identify when Resting Liquidity is trading is very helpful in determining what is taking place in the market. There are different ways to look at Resting Liquidity, does it hold or does it fail? It is from there that you get a clear picture of market direction. 10. Vertical Liquidity Vertical Liquidity occurs when there is heavier than normal volume being traded on the bid or offer over consecutive levels. Big traders don't just come in an place their entire order at one price level, they break it up into smaller child orders and layer it into the order book. When it trades out that leaves a footprint on the chart that a big order was here and traded against, which as a trader, once you know identify that big order you can then see how the market reacted to it. 11. Delta Breakout Delta Breakout occurs when Delta grows either positively or negatively. Delta is the difference between aggressive buyers and aggressive sellers in a bar. When you start to look at Delta not just in the bar itself, but start comparing it to surrounding bars you start to get a clearer picture of how aggressive the aggressive traders really are. Are they trading as per normal or are they getting overly aggressive. When they are overly aggressive, that often can be the start of a big move. 12. Retail Suck Retail Suck is sign of absorption as traders are being “sucked” in by strong passive traders. We know that the retail trading public is usually on the wrong side of the market. So when you are able to identify when they are active in the market, it can give you great insight of areas to trade. Who do you think is on the other side of their trades? It is often the big institutions or market makers that are the ones who are generally correct. 13. Price Action Divergence Price Action Divergence occurs when Price and Delta in a bar diverge. Normally when price is going up the bar positive delta and when price is trading lower the bar has negative delta. But what happens when the price is going up but the bar has negative delta? What does that mean? Or when a price goes lower and the bar has positive delta? These are early signs of supply and demand coming into the market. Knowing when this is taking place will give you insight into the supply and demand situation in the market. Orderflows Trader 7.0 Still Has ALL The Order Flow Analysis Tools From The Previous Version Of Orderflows Trader... 14. Delta/Volume Extreme This will highlight the Delta/Volume field either CYAN for extreme bullish delta or Magenta for extreme bearish delta. This is a measure of Delta/Volume (bar delta divided by bar volume). Default is 25% which means if the bar’s delta is greater than 25% of the bar’s volume it is a sign of strong aggressiveness. If the Delta field is green or red, it is considered normal trading conditions. You can adjust the threshold based on the market you are trading. You can also adjust the colors. 15. Delta Extreme Identify when aggressive buying is at its most strongest, either positive or weak. This is a great sign when a market is about to reverse. When you see extremely strong directional delta come in, it makes for great go with trades. 16. Small Min/Max Delta When a bar has very little Max Delta that means aggressive buyers never had control of the bar. When a bar has very little or no Min Delta that means sellers never had control of the bar. This information can be helpful in trading because it gives you an idea of which side was more active during that particular bar. Additionally, it can also give you an indication of future market activity.

If aggressive buyers were in control during a certain bar, it's likely that they will continue to be in control in the future. 17. Thin Prints Thin Prints in a bar is a sign of momentum. What is happening is there is very little counter trade in the two-way auction. Similar to a Market Sweep, the difference being a bar can exhibit several thin prints spread out in a bar, while a Market Sweep is looking for activity over a consecutive range. 18. Buying/Selling Tails When a buying tail appears, it is a sign of passive sellers disappearing on a push down. As a result of the disappearance of passive sellers on the way down, price often reverses back higher leaving the buying tail present. When a selling tail appears, the opposite happened, a passive buyers disappeared on a push up. The lack of supportive buying on the push up results in price reversing back down leaving the selling tail present. You also have the ability to draw out the zone of the buying tail or selling tail until tested. More on until tested zones a little later. But briefly, I look for long until tested zone to get blown through. 19. Inverse Imbalance Until tested zones with Inverse Imbalance. Now you can draw out until tested zones with Inverse Imbalances. When an Inverse Imbalance occurs, it is a sign of trapped traders. Sometimes the levels are never retested in the same day. However, I like to look see these previous areas because they are previous breakout attempts. These are some of the best “go with” trades. Inverse Imbalances occur more in volatile markets, particularly NQ, MNQ, YM, MYM. They do appear in other markets but much less frequently. A sign of trapped traders in a bar. Similar to an Imbalance Reversal but different. A Bullish Inverse Imbalance will print a blue zone on the chart. A Bearish Inverse Imbalance will print a red zone on the chart. 20. Tick Aggregation This is specific for NQ, MNQ and Crypto traders. For other markets you would not use this feature unless you were looking at a daily chart. What Tick Aggregation does is it lets a user group price levels together to fit on your screen. If you are analyzing cryptocurrency using the free Coinbase feed, you may or may not have realized that many cryptocurrency trades in millionths. In other words, the minimum tick size is $0.000001. Remember, technically you can buy $1.00 worth of BTC. So say you want to buy $1 of BTC when it is trading $40,000 that would be 0.000025 of BTC and would register on the exchange as a trade. The exchange will actually put the data out as a trade at $39,999.999999. If we did not aggregate the ticks, the charts would be impossible to read. Tick Aggregation is also useful in NQ and MNQ which has very big intraday ranges. If you are looking at a 1 minute NQ chart you know that you can’t fit a footprint chart on your screen at times, especially when the market puts in a 50 point range in 1-minute. Now, by aggregating the ticks, by say 4 which is 1 point or 8 which is 2 points, it becomes easier to read. 21. Shorten Big Numbers Shorten Big Numbers is specific to cryptocurrency. If you have ever looked at a footprint chart of crypto it plots the trades in Satoshi. Most traders don’t realize that and most probably don’t care. But being a perfectionist and a trader, I find it easier to know exactly how many BTC traded or how many DOGE traded or how many ETH traded. It is easier it read a chart and know 9.1 BTC traded as opposed to a large number of 901M. 22. Market Sweep Detector The Market Sweep Detector shows you areas where a sweep likely occurred. A sweep in the market occurs when a big trader buys or sells through several price levels in one click. For example, the market is 11 bid / 12 offer. A trader has 700 contracts to buy, he knows his buying will move the market and more importantly he knows the market is getting ready to move higher. So he enters his entire size to buy 700 contracts up to 15.

He takes out the 12's, the 13's, the 14's and 15's. If he is not filled, then the balance of his order is working as a 15 bid. A Bullish Market Sweep will be drawn in a zone in dark green color. A Bearish Market Sweep will be drawn in a zone in dark red. These are areas of aggressive market directional trading. 23. Market Weakness Detector The Market Weakness Detector shows you areas where the market is exhibiting market weakness after a move up which sets the market up for a potential sell off or market weakness after a move down which signals the selling pressure moving the down is weakening and the market is setting up for a potential rally. 24. Orderflows Sequencing Orderflows Sequencing occurs when the depth of the market is solidified and the market trades through it. A solidified order book is one which has more volume at each level either on the way up or the way down. Often times the order book has thin spots in it; levels a smaller amount of working orders around it. Please note these are orders that actually trade and get filled. Orders that are entered to give an impression of support or resistance and later pulled as the market gets close have no affect. Orderflows Sequencing is only concerned with orders that trade in the market. A Bullish Orderflows Sequencing will print the sequence in cyan color. A Bearish Orderflows Sequencing will print the sequence in magenta. 25. POC Slingshot The POC Slingshot (The Point of Control Slingshot) is a trade setup based on a bar's Point of Control in relation to order flow and price action. It signals a potential directional move. A Bullish POC Slingshot will color the POC of the bar green. A Bearish POC Slingshot will color the POC of the bar red. If there is a Slingshot POC and a Prominent POC in the same bar, the Slingshot POC will take precedence over the Prominent POC and color it either green for bullish or red for bearish. 26. Value Area The Value Area is where 70% of the volume trades in a bar. This is the Value Area for the individual bar. Knowing where the Value Area is on a bar by bar basis understand the order flow better. You can see if traders are accepting or rejecting current value. Individual bar Value Area allows you instantly recognize when volume, and not just price, is migrating higher or lower. When used with traditional forms of technical analysis such as Bollinger Bands or Keltner Channels you will be amazed at how market turning points become much more clear. The Value Area in a bar will be green for up bars and red for down bars. Doji candles are still gray. You can adjust the colors however you want them. A powerful feature is being able to draw an until tested zone with Value Areas. This is an important feature. Value represents volume. Value Areas that are not traded into in the next bar often present great buying or selling areas. Value Areas are market generated information in its purest sense. Markets are always searching for value, either moving away from value or returning to value. If you ever wondered why a market reverts back to a particular level, it is often due to the market trading back to its previous value. When you add these zones to your chart, market reversals finally make perfect sense. 27. Engulfing Value Area – EVA The Engulfing Value Area occurs when the current value area engulfs the previous bar's value area. This is significant because it the result in a significant shift in value. What happens is the current bar trades decent volume out of value, then trades through the entire value area and closes on the other end of value. A Bullish Value Area EVA will print blue on the chart. A Bearish Value Area EVA will print red on the chart. 28. Orderflows Ratios Orderflows Ratios analyze the order flow in a bar help you determine if there was price rejection in a bar, a Ratio Bounds High. Or, if there was price defense in a bar, a Ratios Bounds Low. The Orderflows

Trader software calculates an Orderflows Ratio for each bar and prints it below a green up candle or prints it above a red down candle. When an Orderflows Ratio is bullish or bearish it will print in blue color for bullish ratios and red color with bearish ratios. Bars with normal order flow will print the ratio in regular black color. When the first version of Orderflows Trader was released in 2015, many other order flow software reversed engineered it and added it to their software. The problem was while it was available in their software, without knowing why it is important and how to apply the ratios they are not really useful. As the originator, the trader who trades with these ratios, I teach you how to properly apply them to your order flow analysis. 29. Prominent POC (Point of Control) Every bar has a Point of Control which is the price level in a bar where the most volume traded. However, when taken in market context, certain Point of Controls signal support or resistance based on market generated information which is one of the reasons why analyzing order flow is so powerful and necessary. A Bullish Prominent Point of Control is printed in cyan color (a light blue color) for the Point of Control for easy identification. A Bearish Prominent Point of Control is printed in magenta color (a light purple color) for the Point of Control for easy identification. 30. Orderflows Delta Divergence A delta divergence occurs when price and delta diverge. When the market makes a new or equal high on negative delta that is a delta divergence. When the market makes a new or equal low on positive delta that is a delta divergence. An Orderflows Delta Divergence takes the delta divergence a step further and uses price action to confirm the delta divergence. A Bullish Orderflows Divergence will color the bottom 2 price levels gold color and the top 2 price levels of the bar gold. You can adjust the colors. 31. Exhaustion Print Exhaustion prints show when the last buyer has bought in an up move or the last seller has sold in a down move. The buying is exhausted on the move up, there is no more interest is buying and the market will generally naturally drop. Conversely, in a move down, when the selling is exhausted, there is no more selling interest and the market will begin to rise as the buyers clearly outnumber the sellers. A Bullish Exhaustion Print will have a green box drawn on the volume of bar that exhibits and exhaustion print. A Bearish Exhaustion print will have a red box drawn on the volume of the bar that exhibits an exhaustion print. New addition - you can now draw out a zone from the exhaustion print. In the previous version of Orderflows Trader, we referred to this as Small Digit Prints. 32. Imbalance Reversal An Imbalance Reversal is a sign of trapped traders in a bar. Traders who are long and wrong or short in the hole. A Bullish Imbalance Reversal will color the bottom 2 bid price light green on the chart. A Bearish Imbalance Reversal will color the top 2 offer prices red on the chart. Knowing where traders are trapped give you an edge over the trapped traders who might not know they are even trapped! 33. Zero Prints A Zero Print is the result of a fast moving close of one bar and opening of another bar with little two trading, mostly one way trading. This is often the result of market sweep or a big order being aggressively traded in the market. A Bullish Zero Print will color the bottom 2 bid prices on a green bar dark green. A Bearish Zero Print will color the top 2 offer prices on a red candle dark red. 34. Volume Profile You can display the entire day's Volume Profile, either on the left or right of you chart, or choose not to display it. The Volume Profile has two colors, green and red. The green color indicates the volume traded on the offer - the aggressive buyers. The red color indicators the volume traded on the bid - the aggressive sellers.

35. Stacked Imbalance A Stacked Imbalance occurs when there are 3 or more imbalances in a bar that are neatly stacked on top of each other. A Bullish Stacked Imbalance occurs when there are 3 or more buying imbalances stacked neatly on top of each other. A Bearish Stacked Imbalance occurs when there are 3 or more selling imbalances stacked neatly on top of each other. A Bullish Stacked Imbalance will print out a green zone on your chart and is a support area. A Bearish Stacked Imbalance will print out a red zone on your chart and is a resistance area. 36. Multiple Imbalance When there are 3 or more imbalances in a bar in the same direction that are not stacked neatly on top of each other is referred to as a Multiple Imbalance Bar. The difference between a bar with Multiple Imbalance and a bar with a Stacked Imbalance is the imbalances are spread out throughout the bar. Traders often overlook these bars because most traders are only taught to look for Stacked Imbalances. When you see a bar with Multiple Imbalances it shows that traders are directionally aggressive and when you apply the Multiple Imbalances to market context you can pick up shifts in market conditions much earlier than other trader who are not using order flow. Up Bars with Multiple Imbalances have a blue box around the bar. Down Bars with Multiple Imbalance have a red box around the bar. 37. Unfinished Business Unfinished Business occurs when there is an unfinished auction at the bottom of a down red candle or the top of an up green candle. The market will often "finish" the auction meaning it will trade back to that level, sooner rather than later. Many traders use levels of Unfinished Business as price targets. A Supportive Unfinished Business level will print a red dashed line. A Resistant Unfinished Business level will print a green dashed line. "Everything should be made as simple as possible, but not simpler... " Albert Einstein was not a trader, but if he was alive today, who knows, he might be hired by some algo trading hedge fund. One of his famous quotes was "Everything should be made as simple as possible, but not simpler." As a trader, that is what you need to do, keep things simple. A big problem beginning traders face is they over complicate trading. An order flow chart keeps things simple for the trader. You are not looking at 10 different conflicting indicators. Everything you need to know about the market, the participants, the trend, and much more is contained in the order flow chart. Once you understand how to read it, understanding the market doesn't get any more simple. Stop Wasting Your Money Searching For A Holy Grail... It's time to stop flushing your money down the toilet on trading systems that don't work. Do you really think you can buy a trading system for $99 and turn your computer into a cash machine? Wake up and face reality. Everyone wants to make money trading but most people don't want to take the time to learn how to trade. Losing traders just want a system that is going to tell them to buy here or sell there. I have been fortunate to work with some of the biggest and best traders in the world and one thing that they all have a solid trading methodology. They don't change their way of trading based on the next shiny trading object object that comes out. Order flow is the key to understanding what is happening in the market. For many traders order flow is the missing link from trading being a break even venture to a profitable business because it teaches them to read the market and become a trader. What Is The Orderflows Trader Software? In the past, some of the best order flow traders were the pit traders. Why? Because they could see the flow of orders coming into the market from the brokerage houses, being filled and see what came next, was there more buying or selling. Now, the open outcry trading pit are closed and all the trading is done on computers.

However, traders have come to realize that most of that information is available to the trader in its raw format. The Orderflows Trader software takes the raw data of volume traded on the bid and volume traded on the offer and organizes it into an easy to understand chart for quick analysis. By combining price with bid/ask traded volume a trader has the best information possible for short term price movements. By seeing the volume traded on the bid and offers you will see clear clues as to whether the market is strengthening or weakening. With better organized price and volume information you will uncover profitable trading opportunities. Don't Make The Same Mistakes Of Losing Traders... The problem for many losing traders is they rely on price based indicators to predict what the market is going to do. When you look at their screen it is littered with moving averages, MACD, RSI, stochastics, etc. These indicators are all correlated and don’t add any new insight into what is driving the market. They are only looking at price and massaging it into another number. Plottable Order Flow Indicators A question/request we have been getting over the years is "are the tools on Orderflows Trader plottable?" Basically, can you automate order flow. While in the past you have been able to isolate certain things in the order flow and create an indicator that can then be automated, trying to automate the actual order flow wasn't possible. Now it is. The following order flow actions can now be plotted which allows you to automate your order flow trading: Accumulation/Distribution Open POC Aligned POCs Orderflows Gaps Imbalance Reload Volume Decline POC Wave Delta Tail Resting Liquidity Vertical Liquidity Delta Breakout Retail Suck Price Action Divergence Prominent POC Orderflows Tails Delta Divergence Exhaustion Prints Imbalance Reversals Market Sweep Market Weakness Orderflows Sequencing POC Slingshot Zero Print Engulfing Value Area Inverse Imbalance Stacked Imbalance Thin Prints Orderflows Ratio Price Exhaustion Orderflows Ratio Price Defense Multiple Imbalances What this means is you can use a third-party tool like Markers Plus The Force from The Indicator Store to create your own trading strategy. For example, you can now pick and choose the part of the order flow you want to add to your strategy. Say you want to take trades only when a bar has an Exhaustion Print, Multiple Imbalances and an Orderflows Ratio. You can set up your strategy to trade those bars with that combination. Now it is easy to see when all three indicators are plotted at the same time. Plus... Act Now To Grab The Following BONUSES For Even Better Results The Orderflows Trading Course is a unique home study video course designed to provide you with a complete education of Order Flow Analysis of Futures Markets: to help you understand a footprint chart, areas of price rejection, where strong volume is appearing, how to find hidden trade opportunities and much more. It is the only complete, accurate stand alone course on Order Flow Trading developed by a trader for traders. BONUS #1 Order Flow Trading Course Lifetime Access To The Order Flow Trading Course - Normal Price $297. Yours Today For FREE! The Order Flow Trading Course provides you with an opportunity to: • Learn to use one of the most powerful trading tools. • Learn how to identify high probability trading opportunities. • Learn to understand how each day's highs and lows are built and traded. • Learn to interpret market imbalance developments. • Learn to quickly read the order flow chart and identify market direction. • Learn to trade the different types of Price Developments in the market. • Learn to quickly identify trends and join them as soon as they begin. • Learn to identify whether sellers or buyers are in control. • Learn how to understand why the market behaves the way it does. • Learn to identify when prices are accepted or rejected by the market.

• Learn how valuable order flow information can be combined with traditional technical analysis for maximum gains. BONUS #2 The Orderflows Inner Circle Video Series Access To The Orderflows Inner Circle Video Series - Normal Price $497. Yours FREE! There are 56 recorded videos on a variety of order flow topics: Delta POC Imbalances Unfinished Business Breakouts Swing Trading Hidden Aggression Double Tops (one of my personal favorites) Declining Volume And much, much more... This information builds on what is taught in the Order Flow Trading Course. Think of it this way...The Order Flow Trading Course is like a university level 101 class. This Inner Circle Video Club is like a university level 401 class. Each Tuesday night at 7pm Central Time, you are welcome to join in my weekly live group training session for users of Orderflows Trader. The only way to get access to this group is by being a user of Orderflows Trader. These sessions last about an hour and covers various topics of order flow and will help you to understand the software better as I show you what how to use it more efficiently. BONUS #3 Live Weekly Training Session Weekly Live Order Flow Group Training Sessions - Not Available To Other Traders. Yours FREE! Over 237 recorded sessions. I have been doing these sessions for three years for Orderflows Trader users. We want you to succeed in trading. That is why we offer so much more training in addition to software. The key is for you to understand and trade with order flow. We created Orderflows Trader and our training as a result of a need to centralize the knowledge we have been sharing publicly about trading with order flow. You can spend the next year and a lot of money trying to learn how to trade order flow on your own with a lot of tears and frustration. Or you can spend the next couple of weeks and get it. Imagine being in line at Disneyland and Mickey Mouse comes up to you and offers you a chance to jump to the front of the line? What would you do? Say no and continue to stand in the hot sun or jump ahead of everybody else? The choice is yours. Get started now. The weekly live group training sessions are recorded, so if you can't attend you can watch the replay. Plus... Act Now To Grab The Following BONUS For Even Better Results BONUS #4 The Orderflows Playbook Access to the Order Flow Playbook Trading Course. Normal Price - $297 In The Order Flow Playbook I discuss the how to trade order flow in terms of market structure and and determining current market conditions based on the order flow which will help you improve your trading results. But let's face it, without knowing what to look for in the order flow you will just be wasting your time until you do figure out what to look for. That is why I break down and explain 10 different order flow trade setups. The Orderflows Trading Workshop BONUS #5 Access to the recordings from my October 2023 Orderflows Trading Workshop Normal Price - $499 A two-day workshop that teaches you my in-depth breakdown of what I look for in the order flow... Who is this trading workshop for? Traders who want a simple, proven trading plan to find, enter, and exit higher probability order flow trade setups. I peel back the curtain and show you how I do it... What exactly I am currently looking at in the order flow to find trades... And how you can do the same... Imagine organizing and analyzing market data that 98% of the trading world is not using in their analysis....do you think you would have an edge over other traders? You aren’t going to become a successful trader by trial and error. It’s almost impossible to learn that way, unless you want to have a very expensive education. You may already be aware of that, having learned the hard way. There is just too much involved for trial and error to work. You need something that gives you an edge over the rest of the traders out there.

Trying to “figure it out on the fly” is too risky. It’s unlikely that you’ll succeed if you have to keep reinventing the wheel. And there is no way to succeed if every lesson learned from trial and error costs more of your trading capital. You need to learn how to trade based your understanding of the market, not because one squiggly line crossed another squiggly line. Become a trader, not a trade taker. The software runs on the NinjaTrader trading platform which you can download for free at ninjatrader.com (yes, it will run on the free version too). Stop Doing What Doesn't Work. The Overwhelming Majority Of Traders Lose Money. Why? Because They Are Too Focused On Price And Don't Understand Why The Market Is Moving. Once You Understand Order Flow You Understand And Anticipate What The Market Will Do Next. Trading Becomes A Lot Less Stressful! ORDERFLOWS TRADER 7.0 TOOLS & EDUCATION AT A SPECIAL PRICE! For a one-time payment of just $999 $749 you get lifetime access to: Orderflows Trader Access to The Order Flow Trading Course Access to the Orderflows Inner Circle Video Series Access to our Weekly Live Group Training Access to the Orderflows Playbook Trading Course NEW- Access to the recordings from the October 2023 Orderflows Trading Workshop We have added PayPal as a payment option: To pay via Stripe Clicking on the order link will redirect you to our secure payment processor page for Stripe. Frequently Asked Questions And Answers What software do I need to run Orderflows Trader? Orderflows Trader 7.0 runs on the FREE as well as PAID version of NinjaTrader 8. You can download it from Ninjatrader.com What data provider should I use? I feel the best data provider that works with NinjaTrader and Orderflows Trader is Kinetick or a trading feed from your broker. However you can use your existing NinjaTrader data feed of CQG, IQ Feed, eSignal, etc. Does Orderflows Trader 7.0 run on NT7? No. The Orderflows Trader for NT8 is specifically designed to run on NT8 and take advantage of the framework of NinjaTrader. If you are using NT7, it is time to switch to NT8. Can I use the Orderflows Trader on 2 different computers? The license for the Orderflows Trader is PC specific. For example, if you want to run the Orderflows Trader on your PC at work and PC at home, that would require 2 licenses. If you need additional licenses we do offer them at reduced prices. However, if you want to run the Orderflows Trader on different computers, I suggest you get a VPN that you can log in from PC and access your Orderflows Trader from anywhere in the world. Does the Orderflows Trader use tick replay or up/down tick? Orderflows Trader lets you use either one. The default is set to tick replay, but you can switch to up/down tick if you so choose. Some may ask why share it, why not trade it? My answer - "Why not do both?" I trade my own account using the Orderflows Trader and its tools. Traders have been asking me to show them what I use to trade the markets, so I have made it easy for them by programming my tools. Is the Orderflows Trader the same as the Orderflows Toolkit available on the paid version of NinjaTrader 8? No, it is separate and different. The Orderflows Toolkit that comes with the fully paid version of NinjaTrader 8 is just the basic footprint chart. The Orderflows Trader is like having an order flow trader showing you areas of interest in the order flow. Do you offer a free trial? No, we do not offer a free trial. Are there any monthly or yearly fees? No. When you get access to the Orderflows Trader 3.0 it is a lifetime license. You only pay once for all the features. There are NO monthly or yearly fees.

0 notes

Text

0 notes

Text

SCP MTF Monster Hunter Badgers

Part 2

Welcome to part two of my blog on the creation of Silverfang. In this post I will be going over the details of how I put together the vest and the rest of the costume as well as the nerf rifle and the plan for the future.

The Clothing

The clothing aspect of this costume was a bit easy as most of the pouches and gear was purchased on Amazon, 511 Tactical, 3d printed, or already had. Some of the stuff I had came form the previous years version of this costume, that being the pants and the under shirt. the next thing I had to looking to was the plate carrier. I had looked online at many of them but always cam back to 511 Tactical. I have had luck with several of there other products so I decided to go with their TacTec Plate Carrier. It was the closes to what I wanted his vest to look like and it had enough attachment points on both back in front to set up the look I was going for. I then decided that I needed to add hydration to this costume as it was all black at this point, so I brought Convertible Hydration Carrier and a 3 litter hydropack to add to the costume. This was all brought at 511 Tactical. The last things i had to buy was the patches and the pouches. Most of the patches and all the pouches and holster had come from Amazon, but the the "Do not pet" leather patch and the badger one was purchased at 511 Tactical.

The Rifle

As I was working on the costume I had came back to a project known as Project FDL. It was on that I had followed many years ago and been wanting to make one so with this costume I decided to finally make one. I settled on going with a full auto/full length dart setup with a longer barrel and larger more powerful battery. I end up do the full print in black and then detail in by hand all the gold and it took me almost 2 weeks to print this. I also had to do some custom cowlings and for grip. I added the fangs to the top cowling on both sides.

In the pic you would see that there was a bit if fur on the stock but in the end it was removed. The stock was a pair of finds on thingiverse. it is a combo of the Nerf stock extender by Egghebrecht and the butt form the Nerf Rapidstrike Stock with Battery Compartment by tungstenexe. I later found the FDL3 Tacticool Shorty Kit by Lyza on printables witch i modded to work with the full length setup I am using.

The Future of Silverfang

I plan to add many features to the costume and have all ready started this process with some new gold paint and metal plats.

I also plan on updating the eyes so that I can setup independent colors. I will use ElectroMage's Pixleblaze and their WS2811 Breakout boards as I already have LEDS. I have since decided to add the Yeethammer by Spyr on printables.

Links

More Links to come

0 notes

Text

Harold Perrineau (August 7, 1963) is an actor. His breakout role was in Smoke (1995), for which he was nominated for the Independent Spirit Award for Best Supporting Male. He went on to appear as Mercutio in Romeo+Juliet (1996) and Link in The Matrix Reloaded and The Matrix Revolutions (both 2003). On television, he started as Augustus Hill in Oz (1997–2003), Michael Dawson in Lost (2004–10), and Sheriff Boyd Stevens in From (2022–present).

He has appeared in the films The Edge (1997), The Best Man (1999), Woman on Top (2000), 28 Weeks Later (2007), and The Best Man Holliday (2013). His other television credits include Sons of Anarchy (2012), Constantine (2014–15), Claws (2017–22), The Rookie (2019–21), and The Best Man: The Final Chapters (2002)

He was born in Brooklyn. His parents changed his name to Williams when he was a child, but he changed it back, after discovering there was a Harold Williams in the Screen Actors Guild. He attended Shenandoah University and Alvin Ailey American Dance Theater.

He married Brittany Robinson (2002), a former actress and model. They have three daughters, including actress Aurora.

He attended Shenandoah University and Alvin Ailey American Dance Theater.

He was cast in Fame: The Musical. He stars in 30 Days of Night: Dark Days. He appeared in the music video “Yes We Can”.

He voiced the title character from Marvel’s Blade.

He made his Broadway debut in The Cherry Orchard. He co-starred in the Amazon Studios legal series Goliath.

Since his debut single “Stay Strong” he has been working on his musical career. #africanhistory365 #africanexcellence

0 notes

Note

YOO THAT ENDING THOUGHHHHHH

Also I’m so sorry for how long this ask is, it just took a lot of sentences to get my thoughts across.

This is one of the best chapters you’ve made and I can’t wait to dig into it so welcome back to another episode of “AverageChickenEnjoyer Breakdowns the Most Recent RATC Chapter”

Right off the bat I love the subtle nods to SFTD with Link feeling that Ganondorfs look is familiar yet not one he’s seen before. And we get our first look at the Depths! Super psyched to see what you do with that and the Depths is probably the most advantageous place for lore you wouldn’t normally be able to include elsewhere because it’s such an unknown in TOTK anyway.

I’m not going to focus much on Link and pals misadventures in this ask not because I don’t find it interesting but because the Rezek and Riju stuff is so interesting but one more thing I will say is that we get a confirmed Gibdo name. Can’t wait to find out more about the Gibdo and Cross, I have a theory Cross might have been the one to kill Rijus mom because they have that scar which none of the others have but that may just be a conspiracy theory on my part.

Anyway let’s not talk about Frifer and instead spend 3 paragraphs talking about this Harbinger. So when I first read Harbinger I immediately thought Harbinger Ganon from AOC but at the same time it couldn’t be because Harbinger Ganon doesn’t have a gender and we know this Harbinger is a female, also the Harbinger Ganon shouldn’t exist in this timeline so that’s some pretty strong evidence denying it being this Harbinger of the Yiga.

So my second thoughts were Koume and/or Kotake because I’m 99% sure they are less guardians and followers of Ganondorf and are more followers of Ganon aka Demise and only acted as guardians for Ganondorf because he housed Demises malice and hatred. But then again they technically shouldn’t be alive since over 10,000 years is stretching it for them and they came back to haunt a Link who lived centuries and maybe even millennia after they were killed.

So I don’t know who it is since I’m not the most involved guy in LOZ lore so idk who it could be but I’m going to go over some things I inferred. It’s very likely they are Kohgas new second in command (since we know Sooga is going to be mentioned and it’s likely he’s dead in the original BOTW timeline from either combat or old age) after Sooga who is skilled in Yiga Magic and acts as interim leader while Kohga pulls a Chris Columbus in the Depths.

Anyway let’s talk about the gay Wizzrobes, I love the scene with Frifer and I hope we get more scenes with him as we move into the eight year time gap between BOTW and TOTK and especially as we go into TOTK. It could serve as a great way to give introspection into his character moving forward as he gets into more dangerous situations as the world literally goes to shit around him.

Also love how you kept Donovan’s character consistent, he’s not on their side but he’s grateful they saved Wren, though this could serve as a problem later on for the gang as Donovan has already reload the favor and could now serve as a threat.

Also that scene with Rezek would work really well as an analog horror scene, just the subtle hints something’s off until it hits you like a brick and your left horrified, at least that’s how I see it from Jays perspective.

Anyway this was an amazing chapter and I can’t wait till we get the sneaky breakout sequence.

Also fuck Jay. Hope Rezek killed him and didn’t just knock him out

Omg thank you for the analysis jhlkdfahlsdf

The whole idea for the Harbinger (without spoiling too much) is to sort of have her be the Impa-type of the Yiga. That was sort of the vibe I tried to give when they're talking about her.

And once again she's not directly correlated to other LoZ characters but also taking heavy inspiration from them :)

And yessss I'm glad you think the same with Donovan. I know Wren is extremely worried that he'll spill the beans but looks like the monster crew had an affect on him

And Frifer is an interesting case to talk about because it specifically asks Rezek for it to move on. Likely their encounter only happened because Rezek needed it. But imagine all of the healing that would just undone if Rezek looked at Frifer's spirit. It wouldn't want that. It even mentions how scared Rezek is of letting it go.

Like I said in my AO3 notes I love dead character media and how a character who is gone from the narrative shapes everyone around them merely by their absence. And Frifer is absolutely in that ballpark.

That said, I do have a few more scenes involving Frifer and/or mentioning it......but you won't know when it happens till it happens >:3

AND YES Rezek breaking out is absolutely "horror movie from the perspective of the horror" lajhksdf

We'll see what happened to Jay next chapter tho LMAO

0 notes

Text

Well, Season 2 of TDI Reloaded (TDI Rematch) has had its first four episodes out for about a week. I figured I’d share my thoughts about what we’ve gotten so far:

-The challenges are a little more fun than in Season 1. They have a good amount of variety and the often led to really fun moments between the characters. From the Skunks clogging the toilet slide, to basically all the Rat Faces being carried by Caleb, and of course the AB questions challenge. My girlfriend and I straight up paused the episode each question to try and guess the answers. (We got over half of them right.) As for my personal ranks on the challenges:

-Taking it to the Rim Reaper (Ep. 2): Memorable concept, without going too overboard with it. Also, I’m a bit of a simpleton sucker for the pratfalls.

-Choosin’ for a Bruisin’ (Ep. 4): Great challenge for both character insights and just playing along with it during a first-time viewing.

-You Poor Saps (Ep. 3): I technically prefer Ep.1’s challenge, but this one led to so many gold character moments.

-The Pink Painter Strikes Again (Ep.1): Solid start. Simple challenge, nothing too crazy.

-Animation is pretty much on the same level as Season 1. The facial expressions are GOLD! I’d argue some parts feel more dynamic than Season 1, like the slide moments in Episode 2, but overall, no complaints.

-The characters feel like they never left:

-Priya: I kinda get why she’d fall hard for Caleb, as keep in mind, she’s been stuck with this training with hardly any friends. This also explaining why she instantly jumped to befriending Millie when it seemed they got along. It’s clear that she does value the friendship as she was the only one to give Millie a chance after Episode 2. She also did work as an effective leader in the same episode, instantly taking advantage of the challenge’s slide order rule. Overall, I’m okay with Priya.

-Bowie: I dig his plot. Bowie made it clear at the end of Season 1 that he’s willing to bend the rules…and it’s clear that he probably cares about Raj more. Since people are more weary of him after the finale, it makes sense to have his conflict be more about whether he’d play dirty again. Also, this joker in Episode 4! As a captain (assuming those roles are official) I feel Priya’s more effective, though.

Millie: It’s clear she had alot more learning to do about being a good friend. (I still say both her and Damien could have taken the two-point slide together if they were both weary on the third.) Though her elimination was pretty anticlimactic, unfortunately. I do prefer her in Season 1, but I’m not against the plot they gave her.

Julia & MK: I’m putting them both together because they’re basically a package deal this time around. Overall, live their dynamic. It was a sudden jump from animosity to friendship, but that’s just because they know game when they see it. They have so much fun just being underhanded together, and it’s honestly a refreshing take on villain alliances. While I’d say MK is the breakout of the two, since she’s the brains of the whole alliance, Julia’s dialogue is so on point that it hurts. My hopes is that MK does succeed in backstabbing Julia, but she doesn’t even get mad. She just respects a player and roots for her to win…underhandedly, of course.

Emma: Compared to Millie…honestly not that mixed. I’m glad she cut the chord with Chase early and she got him booted in a clever way. The one thing that’s kinda backwards is how she ends up being a poor judge of character in Episode 4 when she basically red Chase like a book in Episode 2. But then again, I guess that’s just chalked down to being used to his sorry butt the most?

Chase: Everybody (including me) called that he’d be an early boot…and he was. I’m perfectly content with that, as it’s clear that character development was never the end-goal with Chase. And the moment he left, the Skunk Butts became the de facto best team. Props on his ballsy attempt to outrun the balloons in challenge 1, though.

Zee: All I wanted from Zee in Season 2 is for him to still be Zee…Good news, Zee is still Zee. I honestly got worried the “soda influencer” plot would be a cheap and easy way to make him an early boot…and they make him Papa Zee instead. I love this lanky boy.

Ripper: My one complaint on Ripper is that he feels like he’s really not there that much. In Episode 2, he disappears for a good while until the mid-end. And he doesn’t really get to interact with his new team that much. The only real time he interacts with the other skunks is when he asks about how to approach Axel. Let’s talk about Ripaxel…I honestly really wanna see what they do with it! It is a little sudden how it starts, but in its defense, so was Rajbow. Their interactions in Episode 3 were fun to watch, and that POEM. Hey, fanfic writers…Raj and Ripper having a poetry battle…think about it. Despite him disappearing sometimes, what we do get from him is enjoyable. Here’s to more!

Wayne and Raj: My boys are untouched! The one blessing is that they NEVER went for some stupid jealousy plot! (Wayne cares too much for Raj for petty stuff like that.) And they are arguably goofier than in Season 1. (Shoutouts to them wanting burgers after seeing the slides and the “Cyclone-Spin Cycle”) It is funny how many people (again, including me) wanted to see their mischievous side more, but instead the boys are even bigger boy scouts with their understandable disgust at cheating. While I still think one leaving earlier is more likely, I really, REALLY hope that they stick for a little. Imagine them against Julia and MK for at least an episode or two! And while I still would love a Damien VS. MK finale, Wayne or Raj VS. MK works great! Fair and honest player against a crafty cheater. It would be gold!

Damien: I’m really holding out for him since he’s pretty much jogging in place a bit. Sure, he wants to take more risks, but it’s not to a great extent. Then again, the season’s only gotten started. I just hope his crafty side comes out more later. He’s not too afraid anymore, so now he needs to push his brains to the forefront.

Scary Girl: I dig the “Lauren” design. Unfortunately, the “normal” bit wasn’t really used all that much, as she barely had a presence in Episode 1. She had some small scenes, but nothing outstanding until she got herself eliminated. Though given how she was enjoyable, but pretty one-note last season, I feel she works well as a first-boot. Will she return to stalk everyone? Who knows. Probably.

Nichelle: I dig her more confident attitude. Part of me wishes we saw her gaining that confidence DURING the season, rather than all that development being off-screen, though. It makes sense for her to train beforehand, but I would have just as easily liked her having a bit of fire in her and then training throughout the season. As she is, I like how she’s so done with her old Hollywood life. Hopefully she does interact with Damien more, as they seem to have a friendship growing.

Axel: Besides MK, Axel was the biggest relief of the S1 pre-mergers. She’s still hostile and hardcore, but I find her showings of care towards the team being well-needed additions. Examples being her helping Damien back to camp after the four-point slide, and her warning her team to be cautious about getting stuck with the sap. I already said my piece on Ripaxel, so my personal hope is that there is a survival or stealth challenge where the two have to work together. (Ala Hide and Be Sneaky, Eat, Puke, and be Wary, or Hurl and Go Seek if you wanna count the “zombie” thing.)

Caleb: Caleb was simple, and he still kinda is. I like how paranoid he was in Episode 1, but overall he’s just a more effective Justin. I do prefer him over Justin, as he can be a massive asset to the team, as shown in Episode 3. Like Zee, I’m fine with him as is, and can only wait and see what he does in later episodes. Will his alliance become genuine romance or just a tool for Caleb to outlast Priya? Probably the ladder, as he doesn’t seem to show any romantic interest in her that feels genuine.

And that’s Total Drama Island Rematch so far. Tomorrow should be the debuts of Episodes 5 and 6, so here’s to a great season. I was honestly shocked at how much I loved this cast, and how refreshing it felt seeing the show after a seven (eight if you ignore Ridonculous) year hiatus. I will be making sure to watch the series again when it comes to MAX in seventy years. As for whether or not I wanna see the Gen 4 cast again…I’ll probably be content with them stopping their run after Season 2. Reloaded and Rematch work as just two halves of a nice little package, and I really don’t want them to risk having this lovable cast go through what Gen 1 did. If we do get a new season, I’d be fine with them having a new cast. Fans will probably like them as much as they do with Gen 4.

#total drama#cartoon network#total drama reboot#total drama island#tdi2023#tdi2023 season 2#tdi 2023 spoilers#tdi priya#tdi bowie#tdi millie#tdi julia#tdi emma#tdi chase#tdi zee#tdi ripper#tdi wayne#tdi raj#tdi mk#tdi damien#tdi scary girl#tdi nichelle#tdi axel#tdi caleb#teletoon#thoughts

22 notes

·

View notes

Text

Apex Legends Season 20 Breakout release time and start date

Apex Legends Season 20, Breakout, celebrates the sport’s fifth anniversary with new mechanics, venues, and a group occasion. As at all times, a brand new season additionally brings a brand new battle move, full with tiers of cosmetics to unlock. Right here’s what time Apex Legends Season 20 releases in your time, and what to anticipate from the brand new season.

What time does Apex Legends Season 20 launch?