#Binary Network Marketing

Explore tagged Tumblr posts

Text

Unlocking the Power of Affiliate Network Software for Business Success: A Journey into the Unknown

In today's fast-paced business environment, entrepreneurs need efficient tools to scale their operations. Multi-Level Marketing (MLM) software has emerged as a game-changer in this regard. It streamlines operations, enhances growth opportunities, and provides valuable insights. In fact, companies using MLM software have reported up to a 30% increase in sales due to better tracking and engagement. Let’s explore the essential features of MLM software and how a thoughtful development process can lead to significant business growth.

Understanding MLM Software

MLM software is specifically designed to ease the management of multi-level marketing structures. This software simplifies various aspects, such as recruitment, sales tracking, and commission management. For example, a direct selling company might find it challenging to manage three levels of sales agents, especially when they have different commission rates. MLM software automates these complicated calculations, personalizing support for each agent and allowing the company to focus on broader growth strategies.

This software is crucial for achieving higher profitability while ensuring transparency and accountability. It helps track sales, manage commissions, and communicate effectively across different levels of the organization.

If you want to try our software, please click on the Affiliate network software.

#Software affiliate network#affiliate network tracking software#affiliate network programs#affiliate network website#list of all affiliate networks#affiliate network management software#best affiliate network software#free#affiliate network tool#Network Marketing#MLM#Multi-level marketing#Direct selling#Affordable#Budget#Cheap#Free demo#Binary#MAtrix#Unilevel#Step up plan

0 notes

Text

#Best Multi Marketing Software#network marketing software#Best Binary Plan MLM Software in Patna#Best Mlm Software Development Company.#Best MLM Software Provider in Patna

0 notes

Text

1 note

·

View note

Text

New SpaceTime out Friday

SpaceTime 20241227 Series 27 Episode 156

The threat of superflares from the Sun could be as high one per century

New observations suggest the Sun may be far more violent than previously thought and capable of erupting massive superflares capable of irradiating the Earth.

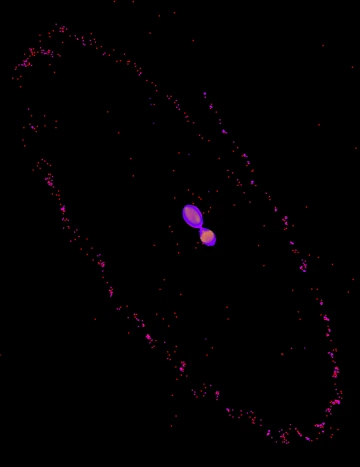

First ever binary star found near our galaxy’s supermassive black hole

Astronomers have detected a binary star system orbiting close to Sagittarius A*, the supermassive black hole at the centre of our galaxy.

NASA's Lucy spacecraft swoops past the Earth

NASA's Lucy spacecraft has successfully undertaken its second close flyby of the Earth as it continues to build up speed for its journey to study Jupiter’s trojan asteroids.

The Science Report

Sea-ice levels in the oceans surrounding Antarctica reach new lows.

Men with enlarged breast tissue at heightened risk of dying before the age of 75.

More evidence that drinking a small or moderate amount of wine could help ward off heart disease.

Skeptics guide to becoming less stressed.

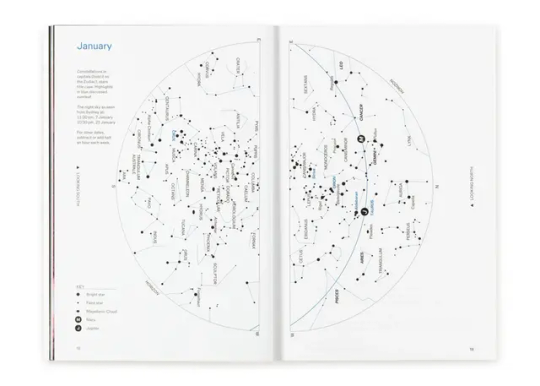

SpaceTime covers the latest news in astronomy & space sciences.

The show is available every Monday, Wednesday and Friday through Apple Podcasts (itunes), Stitcher, Google Podcast, Pocketcasts, SoundCloud, Bitez.com, YouTube, your favourite podcast download provider, and from www.spacetimewithstuartgary.com

SpaceTime is also broadcast through the National Science Foundation on Science Zone Radio and on both i-heart Radio and Tune-In Radio.

SpaceTime daily news blog: http://spacetimewithstuartgary.tumblr.com/

SpaceTime facebook: www.facebook.com/spacetimewithstuartgary

SpaceTime Instagram @spacetimewithstuartgary

SpaceTime twitter feed @stuartgary

SpaceTime YouTube: @SpaceTimewithStuartGary

SpaceTime -- A brief history

SpaceTime is Australia’s most popular and respected astronomy and space science news program – averaging over two million downloads every year. We’re also number five in the United States. The show reports on the latest stories and discoveries making news in astronomy, space flight, and science. SpaceTime features weekly interviews with leading Australian scientists about their research. The show began life in 1995 as ‘StarStuff’ on the Australian Broadcasting Corporation’s (ABC) NewsRadio network. Award winning investigative reporter Stuart Gary created the program during more than fifteen years as NewsRadio’s evening anchor and Science Editor. Gary’s always loved science. He studied astronomy at university and was invited to undertake a PHD in astrophysics, but instead focused on his career in journalism and radio broadcasting. Gary’s radio career stretches back some 34 years including 26 at the ABC. He worked as an announcer and music DJ in commercial radio, before becoming a journalist and eventually joining ABC News and Current Affairs. He was part of the team that set up ABC NewsRadio and became one of its first on air presenters. When asked to put his science background to use, Gary developed StarStuff which he wrote, produced and hosted, consistently achieving 9 per cent of the national Australian radio audience based on the ABC’s Nielsen ratings survey figures for the five major Australian metro markets: Sydney, Melbourne, Brisbane, Adelaide, and Perth. The StarStuff podcast was published on line by ABC Science -- achieving over 1.3 million downloads annually. However, after some 20 years, the show finally wrapped up in December 2015 following ABC funding cuts, and a redirection of available finances to increase sports and horse racing coverage. Rather than continue with the ABC, Gary resigned so that he could keep the show going independently. StarStuff was rebranded as “SpaceTime”, with the first episode being broadcast in February 2016. Over the years, SpaceTime has grown, more than doubling its former ABC audience numbers and expanding to include new segments such as the Science Report -- which provides a wrap of general science news, weekly skeptical science features, special reports looking at the latest computer and technology news, and Skywatch – which provides a monthly guide to the night skies. The show is published three times weekly (every Monday, Wednesday and Friday) and available from the United States National Science Foundation on Science Zone Radio, and through both i-heart Radio and Tune-In Radio.

#science#space#astronomy#physics#news#nasa#astrophysics#esa#spacetimewithstuartgary#starstuff#spacetime#cosmology#cosmos#void#time#universe#hubble space telescope#hubble#hubble tension#hubble telescope#edwin hubble#jwst#james webb space telescope#astrophotography

21 notes

·

View notes

Text

Guys, please. I answer this at least once a month.

BL is 'boys love', the Japanese term for m/m content marketed at a presumed female audience.

(Like, it's literally loan words from English, "boizu rabu", not native Japanese words.)

It's the industry term in Japan and has spread to a lot of other Asian countries (though China uses 'danmei'). It's one of the only good terms we have for neutrally indicating m/m content but female audience.

Japan also has geikomi ('gay comics', another loan from English), which are aimed at a presumed cis gay male audience. They tend to be stylistically different, but like BL, they're defined by the target market, not by specific mandatory genre elements aside from m/m.

(Obviously, binary trans people and local versions of nonbinary identity exist in Japan. Actual humans and marketing categories aren't a perfect fit there, just like anywhere else.)

--

Now, Heartstopper does not exist in a market where BL is a developed niche that publishers/studios/networks understand, but it's pretty clearly on the BL side of things, not the cis gay male culture side of things.

232 notes

·

View notes

Text

Resisting Project 2025's Attacks Queer and Trans Students

What is Project 2025? Project 2025 is a document produced by The Heritage Foundation, an American right-wing think tank, outlining a conservative political plan they hope to see implemented by the next Republican president (now President-Elect Donald Trump).

What does Project 2025 say about education broadly? Project 2025 suggests a wide variety of extreme measures to be taken against progressive values in public schools from promoting "school choice" (policies that, in reality, do not improve student outcomes and make education into a competitive market rather than a public good) to rolling back nondiscrimination regulations to dissolving the Department of Education entirely. Many of Project 2025's proposed policies would leave minoritized students more vulnerable to discrimination in schools and some policies support discrimination against them outright (see below).

What does Project 2025 say about queer and trans rights in school? Project 2025 makes a few proposals and claims regarding gender and sexuality:

Schools should "[reject] gender ideology" in the name of "safeguarding civil rights" (page 322)

Title IX protections (which are in place to prevent discrimination on the basis of sex in educational environments) should be rolled back (page 331)

The attempt to add a "non-binary" option when collecting school data should be rescinded (page 322)

"Sex" under Title IX should be defined to mean "only biological sex recognized at birth" (page 333)

There is "no scientific basis" for the idea that sex should be "redefin[ed]" as "sexual orientation and gender identity," a claim which they don't even attempt to cite a source for (page 333)

Being trans is a "social contagion" that causes young AFAB people to want to mutilate their bodies (pages 345-346)

Schools should forbid public education employees from using their students' preferred names and pronouns without parental consent (page 346)

We might expect to see some sources cited for these bold claims and proposals, but for all forty-five pages of the "Department of Education" section of this document, there are only 19 footnotes.

Project 2025 is an under-researched, ultra-conservative playbook that lays out the groundwork for how we can best discriminate against the most vulnerable members of our communities.

Now that Trump has been elected, what can we do to prepare for and resist Project 2025's proposals for education?

Understand what we're up against: Reading through the document itself is a disheartening process, but if you're in a place to do so, it's worth a try. The authors of Project 2025 tend to be pretty mask-off---they'll tell you all about the harm they intend to do. If you'd prefer not to waste hours of your life reading a document that periodically drops phrases so cringy they might make your soul leave your body (see: "woke diversicrats"), you can just read a summary. The ACLU has a good one that can be accessed here.

Teachers, get active in your union: Project 2025 is explicitly anti-union. It even accuses two of the US's biggest teachers' unions of "promot[ing] radical racial and gender ideologies in schools" (page 342). Working class solidarity is how we achieve the collective power we'll need to fight these policies in our schools. (Here is how the Chicago Teacher's Union is practicing resistance---a case study!)

Build community and support networks: This could mean making a point to talk to a few new people while you're attending a protest, attending school meetings with a group of fellow progressives, breaking up capitalist markets by planning/attending a mutual aid fair, or just chatting and laughing with some friends. The goal of fascism is to make us feel isolated. Don't let them succeed.

Take care of yourself: Project 2025's proposals are scary, especially for people whose very identities are being targeted. Don't let anyone tell you that you're "failing at activism" if you need to take a step back.

Teachers (and parents of minoritized students), assure your students and kids that you are on their side: If you're able, hang up a pride flag in your classroom/house, include an optional question about students' preferred pronouns on your introduction survey, and/or include minoritized authors and history in your classes. Have your students learn about Stonewall, read some short stories by James Baldwin, analyze Audre Lorde's poems, and/or introduce them to your favorite queer/BIPOC/disabled/immigrant authors and thinkers. Representation matters!

Sign the ACLU's petition to stop Project 2025: It's important to show lawmakers that Project 2025's radical and dangerous ideas do not represent what we want for our country.

Donate: The Southern Poverty Law Center, ACLU, and lots of other civil rights organizations are fighting hard against Project 2025 and the Trump Administration's policy proposals. Consider sending a donation to an organization that aligns with your values.

No matter how hard Trump and his cronies fight, LGBTQ+ people will always exist in our schools. They will never get rid of us and they will never drown out our voices. We will always demand to be safe, accepted, and included and we will win.

#project 2025#lgbtq#trans#queer#donald trump#fuck trump#resistance#leftism#resisting project 2025#info

14 notes

·

View notes

Text

The Old GMMTV Challenge: The Master Post and Explainer

Updated: February 13, 2025

Hello! Welcome to The Old GMMTV Challenge (OGMMTVC), my personal syllabus and journey through the most important, and/or impactful, and/or seminal of Boys Love (BL)/Series Y dramas from Thailand.

I started watching Thai BL series in 2022 with the airing of KinnPorsche. From there, I dallied with shows that were referenced across Tumblr -- but I didn't dig into learning about the genre as a whole until I watched 2021-22's Bad Buddy, and was thoroughly moved by it in countless ways.

I subsequently learned that Bad Buddy was, in large part, constructed to communicate with tropes and expectations established previously by the genre. In order to get to a point where I could appreciate Bad Buddy in all of its historic glory, I therefore decided to start from the top -- to watch Thai BLs in chronological order so as to help me better understand the tentacles of this young genre. I was also impacted by a post from a BL Tumblr lifer, @absolutebl, who talked in 2022 about current shows by the GMMTV network, the biggest producer of BL dramas in Thailand, that were answering for mistakes made in the early Thai BL days.

Bad Buddy is a GMMTV show -- but in order to learn fully about the genre, I've created a syllabus of shows and movies that spans well outside the GMMTV network and sphere of influence. In the spring of 2023, I crowdsourced information about Thai BLs from the INCREDIBLE BL community on Tumblr, and came up with the syllabus below.

This syllabus is ever changing, especially as this young genre (which was arguably born in 2014 with the airing of Love Sick) continues to explore itself outside of its male-and-male romance genre boundaries, by centering women and/or non-binary individuals, and even leaving romance behind for horror, suspense, mystery, crime, and more.

Besides watching dramas on this syllabus, I'm also in the process of reading English-language books and articles about the Thai BL genre and its influences in Thailand and across Asia on queer and non-queer communities, as well as on the most marketed-to BL audience in young women. Links to reading materials are below the syllabus.

If you're looking to learn more about BL, this is but one resource to use. There's an incredible community of bloggers here with vastly more knowledge than me about the history of this genre. This is only my path, and I encourage you to explore the corners of Tumblr to create your own Thai BL journey!

The Drama Syllabus and Review/Meta Links

1) The Love of Siam (2007) (movie) (review here) 2) My Bromance (2014) (movie) (review here) 3) Love Sick and Love Sick 2 (2014 and 2015) (review here) 4) Love Songs Love Stories: Pae Jai (2015) (Thailand’s first serialized GL) (to be reviewed with GAP the Series) 5) Gay OK Bangkok Season 1 (2016) (a non-BL queer series directed by Jojo Tichakorn and written by Aof Noppharnach) (review here) 6) Make It Right (2016) (review here) 7) SOTUS (2016-2017) (review here) 8) Gay OK Bangkok Season 2 (2017) (a non-BL queer series directed by Jojo Tichakorn and written by Aof Noppharnach) (review here) 9) Make It Right 2 (2017) (review here) 10) Together With Me (2017) (review here) 11) SOTUS S/Our Skyy x SOTUS (2017-2018) (review here) 12) Love By Chance (2018) (review here) 13) Kiss Me Again: PeteKao cuts (2018) (no review) 14) He’s Coming To Me (2019) (review here) 15) The Fallen Leaf (2019) (not a BL; adjacent to the project as Thailand’s first lakorn featuring a queer/transgender main character) (review here) 16) Dark Blue Kiss (2019) and Our Skyy x Kiss Me Again (2018) (review here) 17) TharnType (2019-2020) (review here) 18) Senior Secret Love: Puppy Honey (OffGun BL cuts) (2016 and 2017) (no review) 19) Theory of Love (2019) (review here) 20) 3 Will Be Free (2019) (a non-BL and an important harbinger of things to come in 2019 and beyond re: Jojo Tichakorn pushing queer content at GMMTV) (review here)

21) Dew the Movie (2019) (review here) 22) Until We Meet Again (2019-2020) (review here) (and notes on my UWMA rewatch here) 23) 2gether (2020) and Still 2gether (2020) (review here) 24) I Told Sunset About You (2020) (review here) 25) YYY (2020, out of chronological order) (review here) 26) Manner of Death (2020-2021) (review here) 27) A Tale of Thousand Stars (2021) (review here) 28) A Tale of Thousand Stars (2021) OGMMTVC Fastest Rewatch Known To Humankind For The Sake Of Rewatching Our Skyy 2 x BBS x ATOTS (re-review here) 29) Lovely Writer (2021) (review here) 30) Last Twilight in Phuket (2021) (the mini-special before IPYTM) (review here)

31) I Promised You the Moon (2021) (review here) 32) Not Me (2021-2022) (review here) 33) Bad Buddy (2021-2022) (thesis here) 34) 55:15 Never Too Late (2021-2022) (not a BL, but a GMMTV drama that features a macro BL storyline about shipper culture and the BL industry) (review here) 35) Bad Buddy (2021-2022) and Our Skyy 2 x BBS x ATOTS (2023) OGMMTVC Rewatch (Links to the BBS OGMMTVC Meta Series are here: preamble here, part 1, part 2, part 3a, part 3b, and part 4) 36) Secret Crush On You (2022) (review here) 37) The Miracle of Teddy Bear (2022) (review coming) 38) KinnPorsche (2022) (tag here) 39) KinnPorsche (2022) OGMMTVC Fastest Rewatch Known To Humankind For the Sake of Re-Analyzing the KP Cultural Zeitgeist (part 1 and part 2) 40) Triage (2022) (review coming)

41) Honorable Mention: War of Y (2022) (for the sake of an attempt to provide meta BL commentary within a BL in the modern BL era), with a complementary watch of Aam Anusorn’s documentary, BL: Broken Fantasy (2020) (thoughts here) 42) The Eclipse (2022) (tag here) 43) The Eclipse OGMMTVC Rewatch to Reexamine "Genre BLs," Along With a Critical Take on Branded Ships (review here) 44) Khun Chai/To Sir, With Love (2022) (watching) 45) Love of Secret (2022) (a GL that preceded GAP) (I will not be watching this, but it's on the list to precede GAP) 46) GAP (2022-2023) (Thailand’s first GL with a branded pair and ship) (review coming) 47) My School President (2022-2023) and Our Skyy 2 x My School President (2023), Coupled with a Speed-Watch of My Love Mix-Up Thailand (2024) to Comment on GMMTV Trying to Make Magic Happen Twice 48) Moonlight Chicken (2023) (tag here) 49) Bed Friend (2023) (tag here) 50) La Pluie (2023) (review coming) 51) Be My Favorite (2023) (tag here) (I’m including this for BMF’s sophisticated commentary on Krist’s career past as a BL icon) 52) Wedding Plan (2023) (Recommended as an important trajectory in the course of MAME’s work and influence from TharnType) 53) Only Friends (2023) (tag here) (not technically a BL, but it certainly became one in the end) 54) Last Twilight (2023-24) (tag here) (on the list as Thailand’s first major BL to center disability, successfully or otherwise) 55) Cherry Magic Thailand (2023-24) (tag here) (on the list as the first major Japanese-to-Thai drama adaptation, featuring the comeback of TayNew) 56) Ossan’s Love Returns (Japan, 2024) (adding for the EarthMix cameo and the eventual Thai remake) 57) 23.5 (2024) (GMMTV’s first GL) (thoughts here) (I am not finished with this show; I will finish it when I get to it on this list) 58) Spare Me Your Mercy (2024) (thoughts here) (added as the finale of Sammon's medical trilogy in Manner of Death and Triage, and as a major lakorn starring two of Thailand's biggest actors in Tor Thanapob and Jaylerr)

Additional Reading Material

Dr. Thomas Baudinette, Boys Love Media in Thailand

Dr. Peter Jackson, Queer Bangkok

Intersections: Gender and Sexuality in Asia and the Pacific -- Issue 49, Thai Boys Love (BL)/Y(aoi) in Literary and Media Industries: Political and Transnational Practices, June 2023

(Fandom reference) "Fan Leaders' Control on Xiao Zhan's Chinese Fan Community," Transformative Works and Cultures

(Fandom reference) "Xi Jingping Versus the Stans," Vox

#the old gmmtv challenge#ogmmtvc#i needed to make this post because my pinned drama accountability post is almost at its link limit lol#turtles catches up with thai BLs#turtles catches up with the essential BLs

35 notes

·

View notes

Text

Sourcing food in biotech factories requires a reorganization of the food system to be highly centralized, arranged into corporate-mediated value chains flowing from industrial processing facilities. To my mind that is exactly the corporate industrial food chain model at the root of so many of our current problems. We don’t want the food system concentrated in the hands of less and bigger corporations. Such a concentrated food system is unfair, extractive, easy to monopolize and very vulnerable to external shocks - which we are going to see more of in our unfolding century of crisis. Consider which food system is more likely to fall over in the face of climate catastrophe, dictatorship or cyberattack: - a handful of large electrically dependent food brewers or a distributed network of millions of small farms and local food relationships spread across diverse landscapes? Which brings us to Chris’s other central premise in ‘Saying No to a Farm-free Future’ - the one that George does attempt a partial response to. Chris argues that the way to organise food to survive in the face of climate crisis is to withdraw away from the corporate controlled industrial agrifood chain and attempt instead to put power back into the distributed local ‘food web’ of small growers, local markets and peasant-type production . This ‘food web’ may sound ‘backwards’ to modernist global north sensibilities of someone like George but it is what still characterizes much of the food systems of the global South. It is also better suited to our times of crisis and challenge. Strengthening food webs is not a “one stop” bold breakthrough. Rather its a distributed social process of ‘muddling through’ together in diverse and different ways that are at best agroecological and collective, culturally and ecologically tailored to different geographies. The food web (or ‘agrarian localism’ as Chris terms it) can’t be summed up in one shiny totemic widget. It doesn’t fit a formulaic “stop this, go that” campaign binary (“stop eating meet , go plant-based”). Leaning into the complexities of local agroecological diverse food webs is maddeningly unsellable as a soundbite. George presents agrarian localism as a ‘withdrawal’ but its more in the gesture of “staying with the trouble” - a phrase feminist scholar Donna Harraway so brilliantly coined to dismiss big, male, over simplistic technocratic solutionists who claim to have the ‘one big answer’ to our global polycrisis. (sound familiar?). Staying with the trouble and leaning into food webs means embracing a messy politics of relationship, nuance, context, complexity and co-learning. It means a single clever journalist sitting in Oxford can’t dream up a cracking saviour formula all by himself in the space of a 2 year book project. . its why (and how) we build movements - to figure this stuff out collectively. So relax - take off the armour - make friends.

25 notes

·

View notes

Text

This reminds me that I have to answer @wintercorrybriea’s ask which was brilliant and very perceptive, linking Vincent in Collateral to a destructive instrument of light in the post-industrial network of global cities whose neon frontier has eroded at the very boundary between Day and Night, Form and Content. If there is no longer a shadow in which to retreat, one can stay hidden only by continuing to move; if the only binding text is the black market contract, illumination (interpretation) is achieved not by exegesis so much as imposed via laser sight. Mann loves symbolically fulminating on the immobility of people relative to the the limitless playgrounds of capital that have, by way of this Faustian market transaction, imprisoned them. And how better to represent that visually than with the digital medium and the intrinsic irony of its capture, sharpening the suffusions and diffusions of photochemistry into binary data points, the perennial glow of LA’s headlights and sodium lamps into a series of ones and zeroes.

#this is why people who say collateral looks ugly because it’s digital are stupid! anyway#collateral 2004#michael mann

35 notes

·

View notes

Text

Unraveling the Potential of MLM Software for Business Growth: A Closer Look at Our Development Process

In today's fast-paced business environment, entrepreneurs need efficient tools to scale their operations. Multi-Level Marketing (MLM) software has emerged as a game-changer in this regard. It streamlines operations, enhances growth opportunities, and provides valuable insights. In fact, companies using MLM software have reported up to a 30% increase in sales due to better tracking and engagement. Let’s explore the essential features of MLM software and how a thoughtful development process can lead to significant business growth.

Understanding MLM Software

MLM software is specifically designed to ease the management of multi-level marketing structures. This software simplifies various aspects, such as recruitment, sales tracking, and commission management. For example, a direct selling company might find it challenging to manage three levels of sales agents, especially when they have different commission rates. MLM software automates these complicated calculations, personalizing support for each agent and allowing the company to focus on broader growth strategies.

This software is crucial for achieving higher profitability while ensuring transparency and accountability. It helps track sales, manage commissions, and communicate effectively across different levels of the organization.

If you want to try our software, please click on the MLM software developers.

#Affordable MLM software developers#MLM developers#Affiliate marketing#Direct selling#Network Marketing#Free demo#Services#Binary#Matrix#Unilevel

0 notes

Text

Professional MLM Software Provider.

Professional MLM Software Provider. Camwel Solution LLP provides professional MLM software solutions with real-time tracking of sales, commissions, and member activities, streamlining direct selling for growth. Contact No = +91 9570444888 / 7765818988

#binary plan software#it company#mlm software#software#website#Best Multi Marketing Software#network marketing software#Best Binary Plan MLM Software in Patna

1 note

·

View note

Text

The Royal Blue Network

The Royal Blue Network is an LGBTQIA story telling site with the main objective of inspiring the creation of quality queer content. For to long, thanks to how expensive it is to make television shows, LGBT content has been forced into a box to appease non-LGBT folks. Quality Queer content has been canceled due to poor marketing, low ratings, and Hollywood’s failure to see the potential in catering to the LGBT+ community. But RBN knows better, RBN understands the need for quality, queer representation, and how impactful such content can be. So RBN has taken it upon itself to create that content; quality queer content that will go on to inspire even more queer content. RBN seeks to tell stories of Women Loving Women and Men Loving Men relationships. RBN seeks to tell stories with queer and trans/non binary folks as main characters, and experiences of the queer community as main storylines. So if this sounds like something you’d enjoy!

Click the title, and check out The Royal Blue Network today!

#Queer Fiction#LGBTQIA Fiction#Trans Fiction#Trans Stories#Trans Tales#Quality Queer Content#lgbt+#fiction#lgbtqia#queer story#Short Queer Stories#Queer Stories#Queer Main Characters#The Royal Blue Network#Short Stories#Trans Main Characters#Non Binary Main Characters#Women Loving Women#Short Story#Queer Story#Trans Partner#Touring artist#Trans Tale#a royal blue tale#short story#free to read short story#Short Queer Story

2 notes

·

View notes

Text

So I'm pretty sure Leonard McCoy hasn't reappeared much in modern Star Trek is that they genuinely don't know how to handle his and Spock's acrimonious relationship in the Current Racial Climate.

Or, well. They don't know how to handle it in an appropriately marketable way.

I can appreciate that TPTB are in an awkward position with him. I'd say they were deranged if they tried to transplant the original scripts 1:1. The original Star Trek was written in a fever dream of homage, creativity, and network meddling that you'd be hard-pressed to recreate today. It was also created for a completely different audience. Continuity was more of a suggestion and worldbuilding was largely sketched in by feelings over fact.

For example--there is the distinct feeling throughout TOS that Vulcans are superior to humans. How else could the identity of the Romulans be a secret, or basic Vulcan cultural practices? How else could T'Pau elbow into Starfleet command with one word? But that doesn't quite square up with the other actual facts--Starfleet is clearly not prepared for non-human crewmembers and doesn't support them. Spock's isolation speaks for itself. Later Trek canon establishing things like Section 31 only tightens the focus on humans.

Now, we know that out-of-universe factors like budget or the need for quick weekly drama (or deus ex machina) dictated this. They didn't have the budget for other alien regulars, they needed to produce an episodic series where you could drop right in and know who was what in five minutes, etc. We know all this. Undeniably, though, it helps shape a setting where McCoy sniping at Spock feels more sinister.

Personally (and I stress me, personally, and I fully expect other people to feel differently) when it comes to series that have had some kind of large cultural shift over time I like to favor original intent. With that one episode with the racism anger machine, the writers (awkwardly) made it clear that racism is something different from whatever the fuck McCoy and Spock have going on. That it was written by white guys in the 60s projecting a binary fairy tale version of racism is...not to be forgotten, let's say, but I don't think it entirely defeats the point here, either.

(Or rather, I don't think it entirely defeats the point in a way that's not consistent with the rest of Star Trek as a whole. If you like Star Trek at all you've probably come to some complex middle ground in your head where you enjoy it by reminding yourself, "it was 60/30/20 years ago, standards were different then.")

I'm on the record of thinking that this is a solvable dilemma; you just need a writer with a deft hand who understands the thorny waters they're navigating here. You could foreground that Spock and McCoy mutually talk the most deranged shit to one another (remember that Spock frequently accuses McCoy of killing crewmembers in their bitch sessions), re-center McCoy's trash talk to be more methods-focused than something that reads as racial hate, make it a plot point that neither of them talks to anyone else like this--it's a solvable problem.

But you know what's way easier, cheaper, and less risky? Mothballing the character, which is more or less what they have done since 2009.

And honestly, from what I've seen of modern Trek, I kinda don't trust them with the necessary delicacy here...

#tfw i am suffering for more mccoy content but i absolutely do not want the new show to touch him#this is just a stream of consciousness ramble#yes i am judging new show without watching it all myself but is that not my god-given right as a trekkie?#we didn't earn this frothing reputation by being level-headed

18 notes

·

View notes

Text

Monday SpaceTime 20250113 Series 28 Episode 6

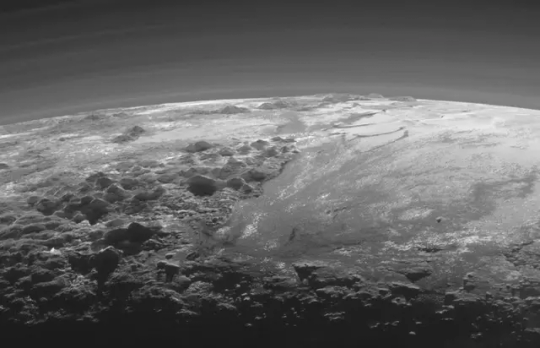

How the Pluto-Charon dwarf planet binary formed

A new study suggests that the formation of Pluto—Charon dwarf planet binary system may parallel that of the Earth-Moon system.

BepiColombo swoops low over the planet Mercury

The BepiColumbo spacecraft has undertaken a close flyby of Mercury swooping down to within 295 kilometres of the Sun scorched planet’s grey crater covered surface.

Taking a look at the year ahead in astronomy

2025 promises to be another big year in astronomy and space sciences with the Sun’s 11 year solar cycle destined to reach its peak at solar max – assuming it hasn’t just happened already.

The Science Report

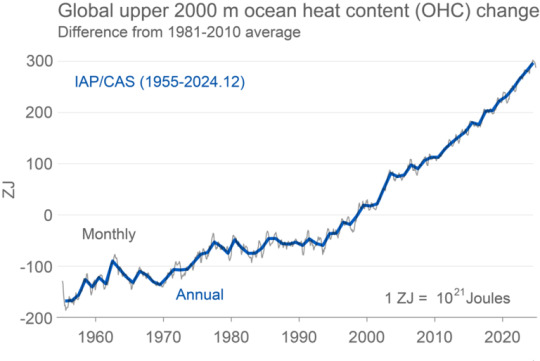

The World Meteorological Organization has confirmed that 2024 is the warmest year on record.

Study shows people who drink coffee in the morning have a lower risk of dying.

New computer modelling suggests that indoor vertical farming could help future-proof food demands.

Sequencing the genetics of Australia’s marsupial mole.

Skeptics guide to the Hexham Heads

SpaceTime covers the latest news in astronomy & space sciences.

The show is available every Monday, Wednesday and Friday through Apple Podcasts (itunes), Stitcher, Google Podcast, Pocketcasts, SoundCloud, Bitez.com, YouTube, your favourite podcast download provider, and from www.spacetimewithstuartgary.com

SpaceTime is also broadcast through the National Science Foundation on Science Zone Radio and on both i-heart Radio and Tune-In Radio.

SpaceTime daily news blog: http://spacetimewithstuartgary.tumblr.com/

SpaceTime facebook: www.facebook.com/spacetimewithstuartgary

SpaceTime Instagram @spacetimewithstuartgary

SpaceTime twitter feed @stuartgary

SpaceTime YouTube: @SpaceTimewithStuartGary

SpaceTime -- A brief history

SpaceTime is Australia’s most popular and respected astronomy and space science news program – averaging over two million downloads every year. We’re also number five in the United States. The show reports on the latest stories and discoveries making news in astronomy, space flight, and science. SpaceTime features weekly interviews with leading Australian scientists about their research. The show began life in 1995 as ‘StarStuff’ on the Australian Broadcasting Corporation’s (ABC) NewsRadio network. Award winning investigative reporter Stuart Gary created the program during more than fifteen years as NewsRadio’s evening anchor and Science Editor. Gary’s always loved science. He studied astronomy at university and was invited to undertake a PHD in astrophysics, but instead focused on his career in journalism and radio broadcasting. Gary’s radio career stretches back some 34 years including 26 at the ABC. He worked as an announcer and music DJ in commercial radio, before becoming a journalist and eventually joining ABC News and Current Affairs. He was part of the team that set up ABC NewsRadio and became one of its first on air presenters. When asked to put his science background to use, Gary developed StarStuff which he wrote, produced and hosted, consistently achieving 9 per cent of the national Australian radio audience based on the ABC’s Nielsen ratings survey figures for the five major Australian metro markets: Sydney, Melbourne, Brisbane, Adelaide, and Perth. The StarStuff podcast was published on line by ABC Science -- achieving over 1.3 million downloads annually. However, after some 20 years, the show finally wrapped up in December 2015 following ABC funding cuts, and a redirection of available finances to increase sports and horse racing coverage. Rather than continue with the ABC, Gary resigned so that he could keep the show going independently. StarStuff was rebranded as “SpaceTime”, with the first episode being broadcast in February 2016. Over the years, SpaceTime has grown, more than doubling its former ABC audience numbers and expanding to include new segments such as the Science Report -- which provides a wrap of general science news, weekly skeptical science features, special reports looking at the latest computer and technology news, and Skywatch – which provides a monthly guide to the night skies. The show is published three times weekly (every Monday, Wednesday and Friday) and available from the United States National Science Foundation on Science Zone Radio, and through both i-heart Radio and Tune-In Radio.

#science#space#astronomy#physics#news#nasa#astrophysics#esa#spacetimewithstuartgary#starstuff#spacetime

15 notes

·

View notes

Text

Launch Your Crypto MLM Business in Just 5 Days!

In today’s fast-evolving digital world, cryptocurrency-based multi-level marketing (MLM) models are gaining immense popularity. Entrepreneurs are increasingly embracing these models to create sustainable revenue streams. However, the key to staying ahead in this competitive space lies in executing a well-structured, technology-driven plan. With Crypto MLM Software, business owners can set up their MLM operations smoothly and efficiently within a few days. In fact, Plurance, a top-rated cryptocurrency MLM software development company, offers tailored solutions to launch your business in just five days.

The Advantage of Crypto MLM Platforms

Crypto MLM platforms combine the power of network marketing with blockchain technology, offering transparency, security, and quick transactions. Entrepreneurs leveraging ready-made cryptocurrency MLM software avoid the risks and complications associated with building platforms from scratch. Instead, they can focus on market penetration and team-building strategies, ensuring rapid scaling.

In a fast-paced sector like cryptocurrency, time is money. The ability to deploy a robust MLM platform in a matter of days gives businesses a significant edge, especially as early market entry can attract users looking for trustworthy opportunities.

Why Choose Plurance for Cryptocurrency MLM Software Development?

Building a sustainable MLM business requires more than just an idea—it demands a technology partner capable of understanding the intricacies of the crypto world. This is where Plurance excels. As an industry-leading cryptocurrency MLM software development company, Plurance combines expertise with cutting-edge technology to deliver feature-rich, scalable, and customizable solutions.

Here’s why Plurance stands out:

Customizable Plans and Smart Contracts

Plurance integrates flexible compensation structures such as binary, matrix, or unilevel plans with blockchain-based smart contracts. This ensures automated payouts and reduces human intervention, increasing trust and efficiency within the MLM ecosystem.

Quick Deployment with Ready-Made Cryptocurrency MLM Software

For entrepreneurs on a tight timeline, Plurance offers ready-made cryptocurrency MLM software. These plug-and-play solutions are pre-tested, secure, and come with all essential features, enabling you to launch your platform within five days.

User-Friendly Dashboards

A smooth user experience is crucial to retaining members in MLM businesses. Plurance provides interactive dashboards for both administrators and users, simplifying everything from membership tracking to commission distribution.

Advanced Security Features

Plurance places a premium on security. Its MLM software includes multi-factor authentication (MFA), anti-fraud mechanisms, and encrypted wallets, ensuring your business and users are protected from malicious activities.

Scalability and Future-Readiness

Plurance’s development approach ensures that your MLM platform can grow along with your business. Whether you need to add new features or integrate additional cryptocurrencies, the software is built to handle future upgrades seamlessly.

The 5-Day Launch Blueprint

Day 1: Initial Consultation and Requirement Gathering

Day 2: Platform Customization and Integration of Smart Contracts

Day 3: Quality Testing and Security Assessment

Day 4: User Onboarding and Training

Day 5: Final Launch and Go-Live Support

By the fifth day, you are ready to manage and grow your network with a platform that offers unparalleled reliability and performance.

Conclusion

The world of MLM is transforming with the rise of cryptocurrencies, and fast execution is the key to staying competitive. With Plurance’s cryptocurrency MLM software development solutions, businesses can achieve a hassle-free launch within five days. The combination of blockchain technology, customizable plans, and ready-made cryptocurrency MLM software ensures your platform is ready to attract, engage, and reward users from day one.

#Cryptocurrency MLM Software#Crypto MLM Software#White Label Crypto MLM Software#Cryptocurrency MLM Software Development#Cryptocurrency MLM Software Development Company#blockchain#cryptocurrency#crypto

2 notes

·

View notes

Text

It has been 80 years since the Bretton Woods Conference, when the U.S. dollar became the central pillar of the world economy and of U.S. economic statecraft. And for eight decades, we’ve also witnessed predictions about the dollar’s coming demise. But almost from the beginning, the debate about the future of the dollar has missed the mark. The question isn’t about whether an event or a crisis or a new technology will knock the dollar off its pedestal. Rather, it is about how the United States’ competitors, and even partners, are pushing the boundaries of the financial system in a global economy where the dollar still dominates but the post-Cold War consensus is breaking down.

For decades, any number of events reportedly portended the end of the dollar. When U.S. President Richard Nixon delinked the dollar from gold in 1971, a prominent British journalist declared it the “moment of the formal dethronement of the Almighty Dollar.” Some saw the euro’s introduction in the 1990s as the moment for the dollar’s demise. The global financial crisis and the rise of China in the 2010s led many economists to predict that the yuan could become the world’s reserve currency. Finally, Russia’s full-scale invasion of Ukraine in 2022 and Western-led sanctions against Moscow raised questions about a coming “post-dollar world.”

There are real geoeconomic headwinds to the dollar. Countries are working to become less reliant on the dollar for trade and to distance themselves from U.S. payment systems. But the future isn’t a binary between dollar dominance and so-called de-dollarization. The U.S. economy remains the world’s largest, with the deepest capital markets and most trusted financial institutions. The dollar remains a financial safe haven and the most reliable medium of exchange and store of value, not just for the United States but globally. The networks and history that earned the dollar its position eight decades ago are holding, and the growing frustration with the dominance of the dollar obfuscates some of the conveniences as well. What has changed is that the United States’ competitors—and some partners—are pushing the limits of their financial autonomy within the dollar-based system, emboldened by technological advances and geoeconomic revisionism. But we are far from an inflection point where we see any concerted effort to actually change it.

If the dollar’s position were to change, it would come from evolution, not revolution. More countries will test and deploy measures to limit the dollar’s reach. Emerging financial technologies will catalyze new theories of change and a range of multilateral financial arrangements. Meanwhile, Western policymakers and business leaders will have to protect the dollar’s historic position even as the U.S. economy takes on larger amounts of debt in a less stable world. But the dollar will continue to underpin the global economy for the foreseeable future.

There has never been a currency quite like the U.S. dollar. Historians analogize to the Spanish Empire’s pieces of eight, Dutch guilders, or the U.K. pound sterling, which was the leading reserve currency until the 1920s. But, as economist Michael Pettis points out, the dollar is “the only currency ever to have played such a pivotal role in international commerce.” The dollar accounts for 58 percent of foreign reserve holdings worldwide. It is involved in 88 percent of all foreign exchange transactions. Due to its international footprint, other countries’ trade imbalances are offset by imbalances in the United States.

The dollar provides stability and safety to countries and consumers globally, not just to the United States. It is a trusted asset because of the United States’ open markets, rule of law, trusted institutions, and deep, liquid capital markets. Beyond the United States, there is a limited supply of investment-grade assets. But the dollar isn’t without its discontents. In the last few years, a growing number of world leaders have publicly stated that they intend to knock the dollar off its pedestal. They see a divided world, the rise of financial technologies that increase the efficiency of trading with currencies other than the dollar, and a divided United States with an uncertain fiscal position and an ever-increasing list of countries and entities with which it is in economic confrontation—and they are publicly positioning themselves to take advantage.

In a world with more conflict and competition, talk of de-dollarization will continue. Were the U.S. dollar not central to the global economy, adversaries could better evade sanctions, and there could be more potent alternative economic blocs. That’s why, during a speech in Shanghai last year, Brazilian President Luiz Inácio Lula da Silva stated dramatically, “Every night I ask myself why all countries have to base their trade on the dollar.” Warning of the dangers of U.S. “institutional hegemony,” China’s Ministry of Foreign Affairs released an essay in February 2023 arguing that through the dollar, Washington “coerces other countries into serving America’s political and economic strategy.” Going further, the ministry stated that the “hegemony of [the] U.S. dollar is the main source of instability and uncertainty in the world economy.”

The timing of such pronouncements—roughly one year after Russia’s full-scale invasion of Ukraine and the subsequent imposition of sanctions—belies the true motivations behind them. The nearly eight decades of dollar dominance have witnessed some of the greatest peace and prosperity in history, including the rise of countries such as China. The dollar was not imposed on the world in 1944; it emerged out of postwar circumstances and a remarkable degree of international consensus, when 44 countries, including China and Brazil, assembled in Bretton Woods to determine the post-World War II financial order. What’s driving instability today is not the dollar but war in Europe and the Middle East, as well as tensions in the Indo-Pacific. These geopolitical challenges are connected, including through the deepening support that China provides to Russia. As Moscow has used that economic lifetime to sustain its assault on Ukraine, the war has changed how money moves around the world. Within weeks of Russia’s invasion, a U.S.-led coalition of 37 allies and partners, representing more than 60 percent of the world economy, imposed sanctions and export controls on Moscow. By April 2022, the value of Russian imports had fallen to around 43 percent below the prewar median. The results have been more severe than the Kremlin lets on, and ordinary Russians are feeling the pain the regime has caused. But a pivot to Asia saved Moscow, as Russia found new markets and means to put its economy on a war footing. The country now spends 6 percent of its GDP on its military.

What has changed isn’t only where the money has come from but what that money looks like. We see this in the former Soviet republics in Central Asia and the Caucasus, which purchase Western technology in dollars and sell it to Russia for rubles. We see it with Russia’s trade with China—in the first nine months after its full-scale invasion of Ukraine, Russia’s ruble-yuan trade jumped more than 40 percent. Meanwhile, China’s two-way trade with Russia hit a record high of $240 billion in 2023, up 26.3 percent in just one year. The yuan recently displaced the dollar as the most traded currency in Russia, accounting for nearly 42 percent of all foreign currency traded on the Moscow Exchange. As a result, the war and Moscow’s evasion of U.S. payment systems have led the largest country and second-largest economy in the world to trade mostly in currencies other than the dollar.

Internationalization of a currency other than the dollar is still a long way off, however. The continued dominance of the U.S. dollar is a vote of confidence from millions of market participants ranging from governments to corporations to households. It would take not just bilateral changes but new and trusted institutions and multilateral alignments based on the rule of law, transparency, and accountability to create any plausible alternative. While the Chinese-led Cross-Border Interbank Payment System (CIPS) is one such attempt, and it handles a reported 25,900 a day, that total falls significantly short of the U.S. Clearing House Interbank Payments System, which does approximately 500,000 daily transactions totaling $1.8 trillion in value. And of the CIPS transactions, 80 percent rely on SWIFT, a system based in Belgium, not Beijing. The trust the dollar has earned in the last eight decades sets it apart.

The two most significant problems for those advocating wholesale de-dollarization are that it is impossible to replace something with nothing and the United States’ competitors do not currently have the capability or will to replace the dollar, even if their rhetoric at times suggests otherwise. That doesn’t mean the dollar’s position should be taken for granted. Innovation and geoeconomic fragmentation may chip away at its reach. The most important emerging trends are new technological models, sector-specific arrangements, and bilateral and multilateral alignments. These efforts are marginal, but they may provide meaningful alternatives in the future.

The United States has financial technologies that are as developed as most leading markets, but it lags a small number of countries in consumer adoption of certain financial technologies. These comparisons run the gamut. In 2021, El Salvador became the first country to make cryptocurrency legal tender. More importantly, the Atlantic Council tracks the proliferation of central bank digital currencies, or CBDCs, and reports that 134 countries and currencies unions, representing 98 percent of the world’s GDP, are exploring use cases for CBDCs, up from just 35 in 2020. Pilot projects are underway in 11 of the G-20 member states, though only three countries have fully launched a CBDC. In a more divided world, there are more CBDCs—since February 2022, according to the Atlantic Council, “wholesale CBDC developments have doubled.”

When U.S. consumers mass adopted financial technologies such as credit credits in the 1970s and ’80s, China’s economy was in relative shambles, and it was still recovering from the Cultural Revolution. Its GDP was just $154 billion in 1976. Today, however, China is the second-largest economy in the world, and its digital yuan, or e-CNY, has drawn the focus of many experts who talk about technology-led efforts toward “de-dollarization.” The e-CNY could provide greater efficiencies and financial inclusion to unbanked Chinese citizens, but in many ways, there are few differences between it and digital and mobile payment systems in the West.

Nevertheless, China is making efforts to internationalize the e-CNY as a dollar alternative, and the Chinese government made that intention clear with its choice of venue for the digital currency’s debut: the 2022 Beijing Olympics. During the games, visitors to the capital city, still under strict COVID-19 restrictions, went through customs and were immediately able to exchange currency for e-CNY. Rather than increasing trust abroad, however, this not only raised concerns about Beijing’s leadership in financial technology; it also set off alarms about how that technology could be used to increase the Chinese Communist Party’s control over Chinese society and potentially create new forms of geoeconomic leverage that China could use over the rest of the world.

The fact that it has not had any significant uptake in other countries indicates that the e-CNY is not a trusted alternative abroad, and it is still in the pilot stages, even at home, where it reaches 260 million wallets in just 25 Chinese cities out of a population of more than 1.4 billion. But the push to internationalize China’s digital currency is ongoing. Project mBridge—a cross-border CBDC program involving mainland China, Hong Kong, Thailand, and the United Arab Emirates, as well as 25 observer nations—is one such effort. There is international interest in more efficient, low-cost alternatives to payment rails that rely on the dollar, even if the Chinese government were not already taking steps to increase trust in the e-CNY in much of the world.

However, China is finding new avenues for limited de-dollarization with its closest partners. China is now the top trading partner of more than 120 countries, particularly in East Asia, sub-Saharan Africa, and emerging, resource-rich markets. With a greater global economic footprint, China is working to shift the balance of payments away from the dollar, and as much as 23 percent of China’s total goods trade is now in yuan.

We see that trend most clearly in the oil trade. Oil is priced in dollars, and the trade volume in the global oil derivatives market—approximately 23 times the size of average daily physical crude flows—is fully denominated in dollars. But Beijing is working to reduce the dollar’s role in its own trade and in the global economy. China is a large, but resource-poor, country that relies on energy imports, mostly from the Middle East. As of last year, China imported around 1.8 million barrels of oil from Saudi Arabia a day. In an effort to insulate that trade from the dollar, Riyadh and Beijing have signed a $7 billion currency swap agreement. And with around 14 percent of daily global crude oil volume flows coming from sanctioned states, the incentives to de-dollarize in this sector are clear.

Here, however, the reach of those who seek to de-dollarize the oil markets may have exceeded their grasp, as shown by trade patterns between India and Russia. Following the imposition of Western-led sanctions on Russia, India became a top destination for Russian seaborne crude oil, hitting 2.15 million barrels a day in May 2023. But New Delhi insisted on the use of Indian rupees for conversion and settlement. That position, coupled with sanctions and embargoes on Moscow, has since caused friction. Despite the initial uptick, oil trade between Russia and India recently hit a 12-month low.

Moves to “sanctions-proof” whole economies take many other forms. For years, Moscow has been steadily decreasing its dollar holdings, with its stockpile of U.S. Treasurys declining from $102.2 billion in December 2017 to a mere $14.9 billion six months later. Similarly, in 2023, China decreased its own holdings of U.S. Treasurys and upped its gold purchases by 30 percent. These trends aren’t limited to U.S. adversaries and competitors—as Goldman Sachs Research has noted, India, which had been the subject of U.S. sanctions over its nuclear program until the George W. Bush administration, has also upped its own gold holdings, though gold remains a small percentage of its reserve holdings globally.

Gold provides a degree of diversification and insulation from sanctions, but it’s not an alternative for the dollar. The real returns are much less predictable, gold comes with significant carrying and storage costs, and gold’s functionality as a medium of exchange for trade settlement is low. Meanwhile, physical gold supply is limited, with gold futures backed by around just $40 billion worth of the precious metal. That number climbs higher with the inclusion of exchange-traded funds, which create opportunities for diversification and investments in many assets, but it still is far short of international currency markets.

Technology could change the uses and role of gold in the global financial system as well. Historically, gold has often proved a better store of value than fiat currency. But it lacks the same functionality, not to mention greater storage and movement costs. The digitization of physical gold in the existing vaulting system, however, can afford it greater efficiency functionality of settlement.

Whatever technological progress, true de-dollarization would take a compelling alternative backed by multilateral consensus. China-led groupings such as the Shanghai Cooperation Organisation, the Belt and Road Initiative, and BRICS (now BRICS+) are, in their own ways, attempting to create such a forum. That’s why Brazil’s president called on the BRICS countries to create a common currency at last year’s summit in South Africa, arguing to his fellow leaders that such a medium of exchange “increases our payment options and reduces our vulnerabilities.”

Even this widely publicized effort has pitfalls. The original BRICS countries are home to 42 percent of the world’s population and, according to the International Monetary Fund, a third of the world’s economic output. But economic, ideological, and geopolitical differences make any united policy outcomes exceedingly unlikely. Even members dismiss the notion of BRICS-led de-dollarization, with Indian Foreign Minister S. Jaishankar stating last July, “There is no idea of a BRICS currency.”

The data underscores Jaishankar’s sentiments. According to the Bank for International Settlements, the U.S. dollar is the backbone of the BRICS trade. In 2022, it was involved in 97 percent of all foreign exchange transactions involving the Indian rupee, 95 percent of all such transactions involving the Brazilian real, and 84 percent of all such transactions involving the yuan.

While efforts to move away from the dollar have, in some sectors, gained traction, the rhetoric around de-dollarization is, in many ways, more about performative politics than serious policy. To make the yuan more attractive, Beijing could loosen its capital controls or move away from a surveillance state model, but it shows little signs of doing do. The European Union could boost the euro if it were to create the kinds of capital markets that drive the U.S. financial system, but it hasn’t. These moves would be beneficial to Chinese citizens and Europeans alike. But for now, the dollar remains the most trusted, and in many ways most efficient, currency for not only the United States but most of the world. And while BRICS may have the desire to build a new international financial system, the global economy that has allowed the emerging markets to emerge over the last 25 years was built on the dollar.

The United States’ rivals may not succeed in pulling the world away from the dollar, but Washington should be careful not to push the rest of the world out of its orbit either. The use of the dollar for sanctions can be a valuable tool of economic statecraft, and sanctions have been deployed by Western governments since 432 B.C., when Athens put an embargo on the nearby town of Megara in the lead-up to the Peloponnesian War. When they are overused or abused, however, they erode trust and leave the rest of the world seeking to protect itself from a weaponized global economy.

The debate about the use of sanctions has gotten more urgent and taken new forms in the last two years. Soon after Russia’s invasion of Ukraine, the United States and its allies froze around $300 billion worth of sovereign Russian assets in the West. That included a substantial portion of Russia’s gold and foreign currency reserves, denominated in euros, dollars, British pounds, Japanese yen, and other currencies. While the global economy adapted to these sanctions for two years, we recently entered a new chapter in financial history.

Before this year, the United States had never seized the foreign assets of a country with which it was not at war. However, on April 24, President Joe Biden signed the Rebuilding Economic Prosperity and Opportunity (REPO) for Ukrainians Act, establishing a means to do just that and seize Russian assets to support Ukraine.

The case for REPO was clear and compelling, at least to Washington and most of its partners. With each passing day, the cost to rebuild Ukraine grows: The World Economic Forum puts the figure at around $486 billion. Repurposing Russian assets is a politically elegant solution that has the benefit of imposing no direct costs to U.S. or EU taxpayers. But like most policies, it involves trade-offs, and it was the subject of considerable debate at the recent G-7 finance ministers meeting in May.

What might this policy change lead to? The American Enterprise Institute’s Michael Strain observed that critics argue that the seizure of Russian assets could make other countries worry that their own assets might one day be seized. Given that risk, they’d take preventative steps to distance themselves from Western economies, making them less willing to hold dollars or euros or even invest in the West. Strain finds these risks to be “legitimate, but ultimately unpersuasive” when it comes to REPO, but they should not be dismissed, including when working with allies whose involvement would be required to make such measures effective.

These conversations show how the actual or perceived overuse of economic coercion will likely only increase other countries’ desires to find alternatives to the U.S. dollar. Sanctions are most effective when they are targeted, multilateral, and set out to achieve specific objectives. Used prudently, they enhance the United States’ economic position, but when they are abused, they leave the country weaker.

The dollar’s demise has been overpredicted for decades. Those who think the dollar will reign supreme forever, though, should take a lesson in humility from Charles Krauthammer. In January 1990, with the United States at the height of its power at the end of the Cold War, he wrote that the “most striking feature of the post-Cold War world is its unipolarity. No doubt, multipolarity will come in time.” The dollar’s unipolar moment isn’t over. But the world could change.

When the dollar emerged as the consensus of the post-World War II world, the U.S. economy accounted for perhaps half of global GDP. Since then, China became the world’s second-largest economy. Beijing is challenging the U.S.-led order. Emerging markets have developed and are seeking greater autonomy. New currencies and technologies have come online. Meanwhile, Washington doesn’t always safeguard the privilege that the dollar bestows. Unnecessary tariffs can diminish the United States’ role and reach in the global economy. Fiscal brinksmanship, combined with repeated confrontations over the debt limit and even the threat of default, erode confidence; the U.S. national debt is approaching $35 trillion, and budget deficits are expanding at record rates, even during peacetime.

If the dollar’s detractors truly seek an alternative, however, they would be forced to adopt radically different policies. The economic troubles that China is experiencing today appear to be more structural than cyclical. Beijing’s closed capital account restricts the amount of yuan available to transact, and last year, China reported its first-ever quarterly deficit in foreign direct investment. While many of China’s trading partners share the desire to move away from the dollar, Goldman Sachs Research has noted that even they have limits on how much yuan they can accumulate, as their own currencies are often pegged to the dollar. When it comes to the United States’ allies, even the EU has not taken steps to create deep, liquid capital markets that could increase the euro’s appeal as an alternative.

The move toward de-dollarization remains marginal but meaningful and moving. For the dollar to lose its place, it would take a series of policy failures in Washington and for the dollar’s detractors to create alternatives that have appeal not only in authoritarian, state-led economies but globally. The global financial system is changing, and nothing is certain. But it would still be wrong to bet against the dollar.

4 notes

·

View notes