#Battery Materials Market Trends

Explore tagged Tumblr posts

Text

Exploring Emerging Technologies: Battery Materials Market Dynamics

Battery Materials Market is Set to Exhibit Strong Growth Driven by Increasing Electric Vehicle Adoption The battery materials market encompasses a wide variety of materials such as cathode materials, anode materials, electrolytes, separators, and others that are used in manufacturing batteries for various applications. Key cathode materials include lithium cobalt oxide, lithium nickel manganese cobalt oxide, lithium iron phosphate, and lithium nickel cobalt aluminum oxide. Their key properties include high energy density and stability. Anode materials comprise natural and synthetic graphite and lithium titanate. Electrolytes like liquid and polymer are essential components that facilitate ionic transport between the cathode and anode. Separators ensure electrical insulation between the electrodes while allowing ion transportation. Batteries find extensive usage in consumer electronics, electric vehicles, grid storage, and other industrial applications owing to their advantages such as portability, long storage life, and high energy density.

The global battery materials market is estimated to be valued at US$ 50.6 Bn in 2024 and is expected to exhibit a CAGR of 6.0% over the forecast period 2023 to 2030. Key Takeaways Key players operating in the Battery Materials Market are Albemarle, China Molybdenum Co. Ltd., Gan feng Lithium Co., Ltd., Glencore PLC, Livent Corporation, Norlisk Nickel, Sheritt International Corporation, SQM S.A., Targray Technology International Inc., Teck Resources, Tianqi Lithium, and Vale S.A. Growing demand for electric vehicles is a major driver boosting the battery materials market. Key manufacturers are expanding their production capacities and supply chains to leverage the opportunity. For instance, Tesla signed agreements with several mining companies to ensure raw material supply for battery production. The global battery materials market is witnessing high growth on account of rising demand for consumer electronics and electric vehicles. Market players are investing in ramping up their production capacities to fulfil the escalating needs of lithium-ion batteries from various end-use industries. For example, China Molybdenum doubled its battery-grade lithium hydroxide production capacity to 60kt/y by 2022. Battery materials manufacturers are expanding their global footprint to serve wider markets. Many companies have announced plans for new production facilities, acquisitions, and investments across regions. For instance, Albemarle is expanding its lithium production in Australia and building a plant in Germany. Such initiatives will facilitate improved access to overseas customers and partners.

Porter’s Analysis Threat of new entrants: The battery materials market requires high initial investments in R&D, production facilities, and mining activities which poses significant barriers for new companies. However, growth in technology and demand offers opportunities. Bargaining power of buyers: Large battery and automobile manufacturers have significant bargaining power over battery materials suppliers due to the consolidated nature of demand. However, buyer power is balanced by supply constraints for critical materials. Bargaining power of suppliers: A few companies dominate the mining and production of critical battery materials like lithium, cobalt, and graphite. This gives significant power to suppliers. However, recyclers are expected to emerge as alternative suppliers. Threat of new substitutes: New battery chemistries and alternative energy storage technologies pose a long-term threat. However, battery technologies are production integrated and no substitutes currently satisfy all performance requirements. Competitive rivalry: The market is consolidated with a few large miners and producers. Intense competition exists for technological innovation, resource access, and market share. Geographical Regions China dominates in terms of value share due to its sizeable market for batteries and electric vehicles. It accounts for over 50% of the global lithium-ion battery demand and has a strong domestic supply chain for battery materials. South Korea and Japan are also major battery manufacturing hubs and have well established material suppliers. Together with China, East Asia accounts for over 70% of the global market value currently. The fastest growing region is expected to be Europe over the forecast period. Battery gigafactories are being set up across Germany, Poland, Sweden and other countries to cater to fast growing electric vehicle demand. Supportive regulations are also driving the regional battery materials market.

0 notes

Text

Battery Materials Market Expansion: Navigating the Landscape of Separator Materials

The Battery Materials Market is estimated for 2023 for the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

Battery materials play a pivotal role in energy storage solutions for applications across diverse end use industries. Key battery materials include cathode materials, anode materials, electrolytes, and separators that are suitable for lead-acid, lithium-ion and other advanced battery chemistries.

Market Dynamics:

The battery materials market is expected to grow tremendously over the forecast period owing to rising electric vehicle adoption across the globe and developments in grid-scale energy storage systems. According to recent estimates, electric vehicle sales have grown by over 40% year on year to reach 6.6 million units globally in 2021. Further, supportive government policies and regulations aimed at curbing vehicle emissions are encouraging automakers to invest aggressively in electric fleets. Additionally, advancements in lithium-ion battery technology have enhanced energy density and longevity favoring the use of lithium batteries in industries beyond transportation including consumer electronics and energy storage.

Increasing Demand for Electric Vehicles that Rely on Battery Storage is Driving Growth in the Battery Materials Market

The growing demand for electric vehicles (EVs) globally is one of the key drivers boosting the battery materials market. With governments across nations implementing stringent emission regulations and pushing for cleaner transportation, EV adoption rates are rising steadily. EVs run entirely on electrochemical storage batteries instead of fossil fuels. Various types of lithium-ion batteries are commonly used in EVs for energy storage. This growing reliance on battery power is translating to a spike in demand for the core materials like lithium, cobalt, graphite, and nickel that are required for manufacturing advanced lithium-ion batteries. Major automakers are aggressively expanding their EV lineups and production capacity to cater to the growing market. They are partnering with battery materials suppliers to ensure adequate availability of high-quality inputs. If EV sales continue rising at the current pace in the coming years due to policy support and falling battery pack costs, it will significantly drive the battery materials consumption.

Surging Demand from Consumer Electronics and Shift Towards Renewable Energy also Augmenting Needs in the Battery Materials Space

The battery materials market is further propelled by strong demand from other applications beyond EVs. Consumer electronics that extensively use various types of rechargeable batteries are another major end-use segment driving battery materials consumption. Drastic rise in sales of smartphones, tablets, laptops, portable power banks, wireless headphones, and other gadgets globally translates to higher demand for battery materials. Moreover, the shift towards renewable energy has led to growth in energy storage solutions like grid-scale battery systems that are supporting expansion of solar and wind power installations. Lithium-ion batteries find wide utilization in energy storage applications as they help balance power supply and demand more effectively. This growing reliance on battery-backed renewable energy infrastructure and energy storage systems is fueling requirements for raw materials in the battery sector.

Declining Ore Grades of Key Battery Minerals Pose a Threat

One of the key restraints faced by the battery materials industry is the declining ore grades of important minerals like lithium, cobalt, and nickel. Mining companies are encountering difficulty in obtaining high-quality reserves of these critical battery raw materials. Ore grades refer to the concentration of target minerals in the deposits. Many existing mining operations worldwide are now tapping reserves with lower grades than before. This means companies need to mine increasing amounts of ore and process larger volumes to extract the same quantity of valuable minerals. The declining quality of known reserves for battery materials pushes up production costs, threatens profit margins, and hampers reliable long-term supply planning. It becomes a challenge for battery suppliers to source critical feedstock at viable prices when ore grades deteriorate. The industry urgently needs to ramp up exploration activities to discover large, high-grade deposits that can economically meet long-term demand.

Recycling End-of-Life Batteries Presents Opportunity to Recover Strategic Materials

As the installed base of electric vehicles and energy storage applications continues expanding rapidly, a huge wave of retired lithium-ion batteries will emerge after reaching the end of their useful lives. Instead of treating these as waste, recovering strategic materials from spent batteries through recycling presents a major opportunity. Recycling technologies allow various battery materials like cobalt, lithium, nickel, manganese, and graphite to be extracted, processed, and reused. This helps stabilize supply security by generating secondary sources of raw materials. It also supports sustainability goals by reducing dependence on virgin mining. Battery recycling can significantly lower costs compared to fresh extraction and refining of raw materials. As recycling infrastructure matures in line with the market, it is expected to emerge as a multi-billion dollar business, providing an additional avenue to cater to the increasing battery materials demand. Overall, recycling offers viable solutions to challenges posed by declining ore grades and ensures a robust circular supply chain model for battery materials.

0 notes

Text

Comprehensive Lithium-ion Battery Material Market Forecast: 2024-2034 Insights

Lithium-ion Battery Material Market: Growth, Trends, and Future Prospects 2034

The global lithium-ion battery material market is expected to increase at a compound annual growth rate (CAGR) of 23.8% between 2024 and 2034. Based on an average growth pattern, the market is expected to reach USD 315.36 billion in 2034. It is projected that the global market for lithium-ion battery materials would generate USD 43.78 billion in revenue by 2024.

The world moves towards cleaner, more sustainable energy sources, lithium-ion batteries (Li-ion) have become essential in powering various applications, ranging from smartphones to electric cars and energy storage systems. This surge in demand is positively influencing the market for materials used in lithium-ion batteries, including cathodes, anodes, electrolytes, and separators.

Request Sample PDF Copy:

https://wemarketresearch.com/reports/request-free-sample-pdf/lithium-ion-battery-material-market/1609

Overview of the Lithium-ion Battery Material Market

A lithium-ion battery consists of several key components that determine its efficiency, lifespan, and performance. These components include:

Cathodes: Typically made from lithium cobalt oxide, lithium iron phosphate, or nickel-cobalt-manganese (NCM) alloys.

Anodes: Mostly composed of graphite, but other materials like silicon and lithium titanate are being researched for future applications.

Electrolytes: Usually a liquid or gel made of lithium salts that enable the flow of ions between the anode and cathode.

Separators: Thin membranes that prevent short circuits by keeping the anode and cathode from touching while allowing ion flow.

The growing demand for these materials is fueled by advancements in technology and increasing investments in research and development for more efficient, long-lasting, and environmentally friendly battery systems.

Lithium-ion Battery Material Market Segments

By Material Type

Cathode

Anode

Electrolytes

Separators

Binders

Others

By Battery Type

Lithium cobalt oxide (LCO)

Lithium iron phosphate (LFP)

Lithium Nickel Cobalt Aluminum Oxide (NCA)

Lithium Manganese Oxide (LMO)

Lithium Titanate

Lithium Nickel Manganese Cobalt (LMC)

Others

By Application

Automotive

Consumer Electronics

Industrial

Energy Storage Systems

Key Market Players

BYD Co., Ltd.

A123 Systems LLC

Hitachi, Ltd.

Johnson Controls

LG Chem

Panasonic Corp.

Saft

Samsung SDI Co., Ltd.

Toshiba Corp.

GS Yuasa International Ltd.

Key Drivers of Lithium-ion Battery Material Growth

Electric Vehicle Market Expansion

One of the primary drivers of the Lithium-ion Battery Material Market is the booming electric vehicle industry. As governments around the world implement stricter emission regulations and offer incentives for EV purchases, the demand for high-capacity and efficient batteries is soaring. Lithium-ion batteries are the preferred choice due to their higher energy density, longer lifespan, and lighter weight compared to traditional lead-acid batteries.

Rise in Renewable Energy Applications

Another significant factor contributing to market growth is the increasing deployment of renewable energy sources such as solar and wind power. Lithium-ion batteries are crucial in energy storage systems, helping to store surplus energy generated during peak production hours for use when demand exceeds supply. As renewable energy continues to gain traction, the demand for lithium-ion batteries and their materials will likely continue to rise.

Lithium-ion Battery Material Market Trends

Increasing Focus on Sustainability

As environmental concerns grow, there is a strong focus on the sustainable production and recycling of lithium-ion battery materials. Companies are investing in technologies to recycle battery components and reduce the environmental impact of mining raw materials. This trend is expected to lead to the development of a circular economy in the battery material supply chain, helping to address issues related to resource depletion and pollution.

Price Volatility and Supply Chain Challenges

Despite the growing demand for lithium-ion batteries, the market faces challenges such as the volatility in the prices of raw materials, including lithium, cobalt, and nickel. The extraction of these materials is often concentrated in a few regions, making the supply chain vulnerable to geopolitical risks and environmental concerns. As a result, there is growing interest in securing alternative sources and developing synthetic materials to stabilize prices and supply.

Emerging Markets and Geographies

The Asia-Pacific region currently dominates the lithium-ion battery material market, primarily due to the presence of major battery manufacturers in countries like China, Japan, and South Korea. However, other regions such as North America and Europe are expected to witness significant growth as they ramp up efforts to localize production and reduce reliance on imports. Investments in local manufacturing facilities and supply chains will support this growth and further bolster the market.

Challenges and Restraints

Environmental and Ethical Concerns

The extraction of raw materials for lithium-ion batteries, particularly lithium and cobalt, has raised environmental and ethical concerns. Mining operations can lead to habitat destruction, water pollution, and adverse effects on local communities. Additionally, cobalt mining has been linked to child labor and human rights violations in some regions, raising calls for greater transparency and responsible sourcing practices within the industry.

High Production Costs

The cost of producing lithium-ion batteries remains relatively high, which limits their widespread adoption in certain sectors. Although battery prices have been decreasing over time, manufacturers still face high material and manufacturing costs. Reducing the cost of key materials, improving production efficiencies, and developing new battery chemistries will be essential to making these technologies more affordable and accessible.

Future Prospects

The future of the Lithium-ion Battery Material Market looks promising, with continued growth driven by advancements in electric vehicles, renewable energy, and consumer electronics. In the coming years, the industry is expected to see innovations that improve battery efficiency, sustainability, and affordability. The rise of solid-state batteries, which offer greater safety and energy density, could further disrupt the market.

Conclusion

In summary, the Lithium-ion Battery Material Market is poised for significant growth in the coming years. The rise of electric vehicles, the expansion of renewable energy applications, and the increasing demand for portable electronics are all contributing to this growth. However, challenges such as price volatility, environmental concerns, and ethical issues related to raw material sourcing remain. As the market continues to evolve, innovations in battery materials and technologies will drive the transition towards cleaner, more sustainable energy solutions.

#Lithium-ion Battery Material Market Share#Lithium-ion Battery Material Market Demand#Lithium-ion Battery Material Market Scope#Lithium-ion Battery Material Market Analysis#Lithium-ion Battery Material Market Trend

0 notes

Text

Unlocking Growth in the Battery Coating Market: A Path to Innovation and Sustainability

The Rapid Evolution of Battery Coatings

As the global demand for cleaner energy and sustainable technologies escalates, the battery coating market has emerged as a pivotal enabler of next-generation energy solutions. Battery coatings, essential for enhancing the performance, longevity, and safety of energy storage systems, are increasingly in demand across industries such as electric vehicles (EVs), consumer electronics, and renewable energy.

From ensuring the durability of lithium-ion batteries to improving thermal management and conductivity, advanced coatings are revolutionizing the way energy storage systems function. These coatings help mitigate key challenges such as overheating, degradation, and electrolyte leakage, making them critical in scaling up battery applications in modern industries.

The surge in electric vehicle (EV) adoption has further catalyzed innovation in the battery coating space. Governments and corporations globally are setting ambitious goals for net-zero emissions, driving demand for innovative, efficient, and safe battery technologies. In this context, the battery coating market is not just evolving; it is transforming industries.

Opportunities and Challenges in the Battery Coating Market

The global battery coating market is poised for exponential growth. According to MarketsandMarkets, the market is projected to expand from USD 604.7 million in 2024 to USD 1,613.6 million by 2030, registering a CAGR of 17.8% during the forecast period. Let’s explore the key factors driving this growth and the challenges the industry faces.

Market Drivers

Surge in EV and Hybrid Vehicle ProductionThe proliferation of Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Electric Vehicles (FCEVs) has created a robust demand for advanced battery technologies. As the EV market continues to flourish, the need for high-performance coatings that ensure safety and enhance energy efficiency is skyrocketing.

Expanding Consumer Electronics and Renewable Energy StorageThe rapid growth of consumer electronics and renewable energy projects has increased the emphasis on battery reliability and efficiency. Coatings that enhance conductivity, reduce resistance, and prevent degradation are key to meeting the demands of these industries.

Market Restraints

High Costs of Advanced TechnologiesThe implementation of cutting-edge battery coating solutions comes with a steep price tag, often making it a barrier for companies aiming to adopt these technologies. This challenge calls for cost-effective innovations without compromising quality and performance.

Opportunities

Innovations in Battery MaterialsTechnological advancements in materials science are creating unprecedented opportunities for the battery coating market. From nanotechnology-based coatings to solid-state innovations, these breakthroughs promise safer, longer-lasting, and more efficient batteries. Companies investing in R&D have the potential to redefine industry standards.

Challenges

Preference for Solid ElectrolytesAs the industry increasingly transitions to solid-state batteries, which rely on solid electrolytes, the demand for traditional liquid-electrolyte-based coatings is facing competition. Adapting coating technologies to suit solid-state systems is critical for sustained growth.

Industry Players Shaping the Market

Several key players are at the forefront of innovation in the battery coating market, driving growth and shaping industry trends. These include:

Arkema (France)

Solvay (Belgium)

Asahi Kasei Corporation (Japan)

PPG Industries, Inc. (US)

SK Innovation Co. Ltd. (South Korea)

Mitsubishi Paper Mills, Ltd. (Japan)

Tanaka Chemical Corporation (Japan)

Targray (Canada)

These companies are investing heavily in research and development to create cutting-edge coating technologies that address industry challenges while capitalizing on opportunities.

For More Insights Download PDF Brochure :

The battery coating market is a dynamic space where innovation meets necessity. As industries pivot toward sustainability, battery coatings will continue to play a critical role in enabling high-performance energy storage systems. Companies and decision-makers investing in advanced coating solutions today are poised to lead the energy transition tomorrow. Whether you are an executive exploring sustainable solutions or a professional seeking cutting-edge technologies, now is the time to align your strategies with the evolving trends of the battery coating market.

#Battery Coating Market#Advanced Battery Technology#Electric Vehicles#Energy Storage Solutions#Sustainable Innovation#Battery Materials#EV Industry Trends

0 notes

Text

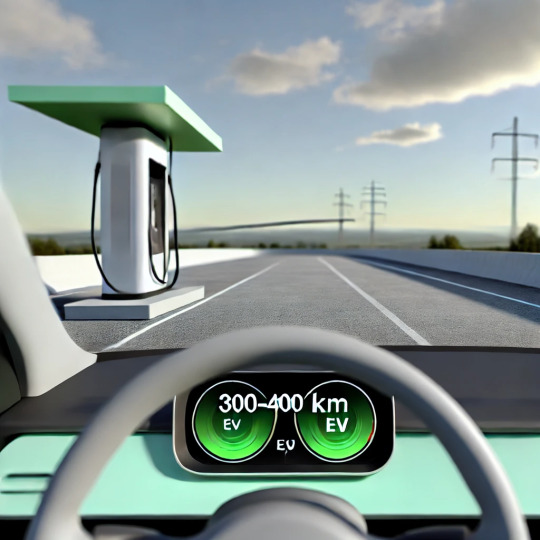

What is the Average EV Range in 2024?

As we move into 2024, electric vehicles (EVs) are no longer just for early adopters. They’re becoming a common sight on the roads, thanks to advancements in battery technology that have boosted their range. The average EV today can go anywhere between 300 to 400 kilometers (186 to 248 miles) on a single charge, with some premium models going well beyond that.

High-Range EVs in India

In India, we’re seeing some exciting developments in the EV space, with both upcoming and current models pushing the limits of range:

BYD eMAX 7: Set to launch in October 2024, it’s expected to offer a range of around 500 kilometers.

Mercedes-Benz EQS: This luxury option tops the charts with an impressive 770 kilometers of range.

Tata Avinya: Coming in 2026, it's expected to provide about 500 kilometers of range, catering to the demand for long-range EVs.

Hyundai Ioniq 6: Expected to offer a range of up to 614 kilometers, showing Hyundai’s commitment to electric mobility.

With these impressive ranges, managing charging stations becomes more important. That’s where tools like Tecell’s charging management software come in handy. Tecell makes it easy to manage charging stations, providing access to EV drivers with flexible pricing models. Whether you’re a small business or a large enterprise, Tecell’s software can scale to your needs. Plus, their free tier makes it accessible to smaller companies, and the roaming feature offers cost-effective options for EV drivers and charge point operators alike.

#2024 EVs#Aerodynamics#automotive industry#battery life#battery technology#charging infrastructure#charging stations#Clean Energy#consumer demand#Eco-Friendly#electric mobility#electric power#electric vehicles#emissions#energy density#energy management#energy storage#Environmental Impact#EV adoption#EV efficiency#EV Market#EV range#EV trends#fast-charging#Ford Mustang Mach-E#future of mobility#government policies#green technology#innovation#lightweight materials

1 note

·

View note

Text

Lithium and Copper: The Metals That Will Shape the Future

🔋🌍 Lithium and copper are set to revolutionize the economy as the demand for electric vehicles and renewable energy soars! 🌱✨ With innovations in battery tech and sustainable materials, the future looks bright for clean energy.

In the coming years, certain metals are poised to fundamentally change the global economy—foremost among them are lithium and copper. These two raw materials are becoming increasingly indispensable for the energy and transportation industries as the world shifts towards renewable energy and electric vehicles. Lithium: The Fuel of the Energy Transition Lithium plays a central role in the…

#battery technology innovations#climate change solutions#copper demand forecast#eco-friendly materials#electric vehicle batteries#electrification of transportation#energy efficiency technologies#energy transition strategies#environmental impact of mining#future of electrification#innovations in renewable energy#Lithium market trends#Make money online#market analysis of lithium#metals for clean energy#nickel applications in batteries#Online business#Passive income#perovskite solar cells#renewable energy investment#renewable energy sources#sustainable metals#sustainable resource management

0 notes

Text

The Electric Vehicle Market: Current Trends, Challenges, and Future Outlook

The electric vehicle (EV) market is experiencing an unprecedented boom. As global awareness of climate change intensifies, the shift from internal combustion engines to electric powertrains has accelerated. With advancements in battery technology, policy support from governments, and growing consumer demand, the EV market is poised for remarkable growth. This comprehensive analysis delves into the current state of the EV market, its key drivers, challenges, and future outlook.

Market Overview

Current State of the Electric Vehicle Market

The global EV market has witnessed substantial growth over the past decade. In 2023, EV sales reached a record high, with over 10 million units sold worldwide. This represents a significant increase from just 2 million units in 2018. The rise in sales is driven by a combination of technological advancements, decreasing battery costs, and robust government incentives.

Key Market Players

Several automakers have emerged as leaders in the EV market. Tesla, often regarded as the pioneer in the modern EV revolution, continues to dominate with its innovative models and expansive Supercharger network. Other notable players include Nissan, Chevrolet, BMW, and Volkswagen. In addition, traditional automakers like Ford and General Motors have made significant strides in electrifying their vehicle lineups.

Battery Technology and Advancements

Battery technology is a critical factor in the EV market's growth. Lithium-ion batteries, the most common type used in EVs, have seen considerable improvements in energy density, charging speed, and cost reduction. The introduction of solid-state batteries promises even greater advancements, with the potential for higher energy densities, faster charging times, and enhanced safety.

Key Drivers of the EV Market

Environmental Concerns and Regulations

One of the primary drivers of the EV market is the growing concern over environmental sustainability. Governments worldwide are implementing stringent regulations to reduce greenhouse gas emissions and combat air pollution. For instance, the European Union has set ambitious targets to phase out internal combustion engine vehicles by 2035. Similarly, China has introduced a quota system for automakers, mandating a certain percentage of their sales to be electric vehicles.

Government Incentives and Subsidies

To encourage the adoption of electric vehicles, many governments offer incentives and subsidies. These can include tax credits, rebates, reduced registration fees, and exemptions from tolls. For example, in the United States, the federal government provides a tax credit of up to $7,500 for the purchase of an electric vehicle. In Norway, EV owners benefit from exemptions on value-added tax (VAT), reduced tolls, and free parking.

Technological Innovations

Advancements in technology are also propelling the EV market forward. Innovations in battery technology, such as increased energy density and faster charging capabilities, have addressed some of the primary concerns of potential EV buyers. Additionally, the development of autonomous driving technologies and smart grid integration further enhances the appeal of electric vehicles.

Consumer Awareness and Demand

Consumer awareness and demand for sustainable transportation options are at an all-time high. As more people become conscious of their carbon footprint, the preference for electric vehicles over traditional gasoline-powered cars has increased. This shift in consumer behavior is evident in the rising sales figures and the expanding variety of EV models available in the market.

Challenges Facing the EV Market

Charging Infrastructure

One of the significant challenges in the widespread adoption of electric vehicles is the availability of charging infrastructure. While urban areas often have a relatively robust network of charging stations, rural and remote areas still lack sufficient coverage. To address this issue, governments and private companies are investing heavily in expanding the charging infrastructure network.

Battery Supply Chain and Raw Materials

The production of batteries for electric vehicles relies on raw materials such as lithium, cobalt, and nickel. The supply chain for these materials is often complex and subject to geopolitical risks. Ensuring a stable and ethical supply of these materials is crucial for the sustainable growth of the EV market.

High Initial Costs

Despite the decreasing cost of batteries, the initial purchase price of electric vehicles remains higher than that of traditional internal combustion engine vehicles. This price disparity can deter potential buyers, especially in markets where government incentives are limited or nonexistent. However, as battery prices continue to fall and economies of scale are achieved, the cost difference is expected to narrow.

Future Outlook

Market Projections

The future of the electric vehicle market looks promising. According to industry analysts, global EV sales are projected to reach 30 million units annually by 2030. This growth will be driven by continued technological advancements, increased consumer demand, and supportive government policies.

Emerging Markets

Emerging markets present a significant growth opportunity for the EV industry. Countries such as India and Brazil are witnessing rapid urbanization and a growing middle class, creating a substantial demand for affordable and sustainable transportation options. Automakers are increasingly focusing on developing low-cost electric vehicles tailored to the needs of these markets.

Technological Innovations on the Horizon

The EV market is set to benefit from several technological innovations in the coming years. Wireless charging, vehicle-to-grid (V2G) technology, and the integration of renewable energy sources into the charging infrastructure are some of the advancements that will further enhance the appeal and feasibility of electric vehicles.

Policy and Regulatory Support

Continued policy and regulatory support will be crucial for the sustained growth of the EV market. Governments need to maintain and expand incentives, invest in charging infrastructure, and implement regulations that promote the adoption of electric vehicles. International collaboration on setting standards and sharing best practices can also play a vital role in accelerating the transition to electric mobility.

Conclusion

The electric vehicle market is undergoing a transformative period, driven by a combination of technological advancements, environmental concerns, and supportive government policies. While challenges such as charging infrastructure and high initial costs remain, the overall outlook for the EV market is highly positive. With continued innovation and investment, electric vehicles are set to become a mainstream choice for consumers worldwide, contributing significantly to the global efforts to reduce carbon emissions and combat climate change.

#electric vehicle market#EV market#electric vehicles#battery technology#environmental sustainability#government incentives#charging infrastructure#raw materials#market projections#emerging markets#technological innovations#policy support#climate change#sustainable transportation#electric mobility#automotive industry#future of EVs#electric car trends#Tesla#autonomous driving#vehicle-to-grid technology

0 notes

Text

What is the Average EV Range in 2024?

Electric vehicles (EVs) have seen remarkable advancements over the past few years, making them more viable for everyday use. As of 2024, the average EV range has become a critical factor for consumers considering the shift from traditional combustion engines to electric power. In 2024, the average EV range is approximately 300 miles (483 kilometers) on a single charge. This is a significant…

View On WordPress

#2024 EVs#Aerodynamics#automotive industry#battery life#battery technology#charging infrastructure#charging stations#Clean Energy#consumer demand#Eco-Friendly#electric mobility#electric power#electric vehicles#emissions#energy density#energy management#energy storage#Environmental Impact#EV adoption#EV efficiency#EV Market#EV range#EV trends#fast-charging#Ford Mustang Mach-E#future of mobility#government policies#green technology#innovation#lightweight materials

1 note

·

View note

Text

Anode Material for Automotive Lithium-Ion Battery Market To Reach USD 1,348.6 Million by 2030

The anode material for automotive lithium-ion battery market will grow at a rate of 5.7% in the years to come, to reach USD 1,348.6 million by 2030, as mentioned in one of its reports by P&S Intelligence.

The growing sales of EVs, accompanied by the incessant decrease in the prices of anode materials, are the main factors powering the growth of the industry.

The artificial graphite category led the industry, and the situation will be like this in the years to come. This is credited to the benefits of this material over other anode materials. For example, improved power output and/or energy density, decreased cost, and advanced recycling performance.

The commercial vehicle category will power at the fastest rate in the anode material for automotive lithium-ion battery market in the years to come, with regards to revenue.

Furthermore, the category will be the second-largest, following passenger cars, in the future. This is because the battery being used in E-commercial vehicles, as well as buses and trucks, requirement to have a high battery capacity, and energy density.

BEV had the highest revenue in the industry in the recent past. The ascendency of the category is chiefly credited to the fact that different from HEV and PHEV, BEVs have only one power source, which contributes to the higher acceptance of lithium-ion batteries in BEVs, therefore generating the highest requirement for anode material.

APAC led the anode material for automotive lithium-ion battery market in the recent past, and it will remain the largest in the years to come. Its dominance is powered by the enormous requirement for EVs in China.

This large size of the Chinese market is because government authorities have been providing infra support for example charging station spaces, providing subsidies and incentives, and pouring enormous sums in the EV industry.

Europe will advance at the highest rate in the market by the end of this decade.

This has a lot to do with the fact that the EU has planned joint efforts with battery producers and commercial lenders for building an ecosystem, with an enormous investment, for becoming self-reliant in battery production for powering EVs.

The inflow of investments is a key trend in the industry. Throughout the charging process, the anode engrosses a large count of lithium-ions. Graphite can grip them well, but a silicon anode waves over 300%, producing its surface for cracking and the energy storage performance for dropping rapidly.

The increasing sales of electric vehicles, happening all over the world has a positive impact on the demand for anode material for automotive lithium-ion battery.

#Anode Material for Automotive Lithium-Ion Battery Market Share#Anode Material for Automotive Lithium-Ion Battery Market Size#Anode Material for Automotive Lithium-Ion Battery Market Growth#Anode Material for Automotive Lithium-Ion Battery Market Applications#Anode Material for Automotive Lithium-Ion Battery Market Trends

1 note

·

View note

Text

R&D Spotlight: Pioneering Research Transforming the Battery Materials Landscape

Battery materials provide the means to store energy and enable key technologies, such as mobile phones, electric vehicles, and renewable energy storage. Battery materials include cathode materials such as lithium cobalt oxide, lithium nickel manganese cobalt oxide, lithium iron phosphate or lithium nickel cobalt aluminum oxide, and anode materials such as natural or synthetic graphite and lithium metal oxides. The increasing demand for electric vehicles and energy storage necessitates the development of improved battery materials to enable higher energy density, longer lifecycles and reduced cost.

The global Battery Materials Market is estimated to be valued at US$ 50.6 billion in 2024 and is expected to exhibit a CAGR of 6.0% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights. Market Opportunity: The opportunity for new battery technologies presents a major market opportunity for battery materials manufacturers. Advancements in battery chemistries have the potential to significantly boost battery performance. For example, solid-state batteries provide a promising alternative to liquid lithium-ion batteries by allowing for faster charging times and higher energy densities. Solid electrolytes could enable the development of lithium metal batteries with energy densities over 500 Wh/kg, which would revolutionize electric vehicles. Extensive research is currently underway to address challenges with stability and lifetime for commercialization. As battery technology evolves to meet growing demand, it will require new cathode and anode materials optimized for new chemistries. This represents a major growth area for battery materials companies focused on innovating to support next-generation batteries. Porter’s Analysis Threat of new entrants: New entrants face high capital requirements for setting up manufacturing plants and need to attain economies of scale to compete with existing large players.

Bargaining power of buyers: Buyers have high bargaining power due to presence of several suppliers and undifferentiated products.

Bargaining power of suppliers: Suppliers have moderate bargaining power due to availability of alternate material suppliers.

Threat of new substitutes: Threat of new substitutes is high with continuous R&D in battery technologies.

Competitive rivalry: Intense competition exists among existing players to gain market share. SWOT Analysis Strength: Strong R&D capabilities and technological leadership.

Weakness: High initial investments and volatility in raw material prices.

Opportunity: Growing demand for electric vehicles and energy storage systems.

Threats: Slow adoption of e-mobility in emerging markets and downturn in automobile industry. Key Takeaways The global Battery Materials Market is expected to witness high growth. The global Battery Materials Market is estimated to be valued at US$ 50.6 billion in 2024 and is expected to exhibit a CAGR of 6.0% over the forecast period 2023 to 2030. Regional analysis: The Asia Pacific region accounts for over 50% of the global market share due to presence of large battery and automotive manufacturers in countries like China, Japan and South Korea. China dominates the battery materials demand in the region. Key players: Key players operating in the battery materials market are Albemarle, BASF SE, SQM, Sumitomo Chemicals, Toray Industries, Umicore, LG Chem, Samsung SDI, and Johnson Matthey.

#Battery Materials Market Share#Battery Materials Market Growth#Battery Materials Market Demand#Battery Materials Market Trend#Battery Materials Market Analysis

0 notes

Text

Navigating Regulatory Frameworks in the Battery Materials Market

The Battery Materials Market will grow significantly owing to rising demand for lithium-ion batteries The battery materials market comprises materials such as cathode materials, anode materials, electrolytes, and separators that are used in the manufacturing of batteries. Cathode materials play a vital role in determining the energy capacity of batteries. The global battery materials market is estimated to be valued at US$ 50.6 billion in 2024 and is expected to exhibit a CAGR of 6.0% over the forecast period of 2023 to 2030. Key Takeaways Key players operating in the battery materials market are Albemarle, China Molybdenum Co. Ltd., Gan feng Lithium Co., Ltd., Glencore PLC, Livent Corporation, Norlisk Nickel, Sheritt International Corporation, SQM S.A., Targray Technology International Inc., Teck Resources, Tianqi Lithium, and Vale S.A. Technological advances are helping reduce costs and improve performance of lithium-ion batteries. Emergence of new cathode chemistries and development of high-nickel and nickel-rich NMC alternatives to lithium cobalt oxide are allowing batteries to store more energy while lasting longer on each charge. Additives and new production methods are also enhancing battery safety and lifespan. Market Trends Growing adoption of lithium-ion battery technologies in applications such as consumer electronics and electric vehicles is a major trend driving the battery materials market. Manufacturers are expanding production capacities of cathode and anode materials to match the robust demand from the lithium-ion battery sector. Market Opportunities Rising demand for energy storage solutions based on large-scale lithium-ion batteries is opening up opportunities for materials companies. Battery energy storage plays a vital role in the expansion of renewable energy by solving intermittency issues. The COVID-19 pandemic has significantly impacted the battery materials market. Supply chain disruptions due to lockdowns imposed severe restrictions on transportation which affected the supply of key raw materials like lithium, cobalt, graphite and nickel. This led to a decline in production of batteries used in various applications including consumer electronics and EVs. However, with the resumption of transportation and lifting of lockdowns, the supply chain is recovering. There is also rising demand for lithium-ion batteries from the healthcare sector for vaccines storage. This is likely to drive market growth in the coming years. Geographically, Asia Pacific accounts for the major share of global battery materials market in terms of value, with China being the largest consumer as well as producer. With massive investments and government support for local battery production and EV manufacturing, China dominates both demand and supply of battery materials globally. Europe is another major regional market, led by Germany due to its large and growing automotive industry and positive policy environment for EVs. The global battery materials market has demonstrated resilience despite challenges posed by COVID-19 related disruptions. With governments accelerating actions to address climate change and curb pollution, the longer term demand prospects powered by electric mobility transition remain optimistic. The industry is making coordinated efforts to secure raw material supplies through stake acquisitions, mining projects and trade agreements while boosting recycling abilities in tandem with circular economy goals.

0 notes

Text

Lithium Ceramic Battery (LCB) Market Consumption Analysis, Business Overview and Upcoming Key Players,Growth factors, Trends 2032

Overview of the Lithium Ceramic Battery (LCB) Market:

The Lithium Ceramic Battery (LCB) market involves the production, distribution, and utilization of batteries that utilize a ceramic electrolyte in combination with lithium-based materials. LCBs are a type of solid-state battery technology that offers potential advantages such as high energy density, improved safety, and longer cycle life compared to traditional lithium-ion batteries. LCBs are being developed for various applications, including electric vehicles, renewable energy storage, and portable electronics.

The Global Lithium Ceramic Battery (LCB) Market Size is expected to grow from USD 1.02 Billion in 2017 to USD 2.48 Billion by 2030, at a CAGR of 10.5% from 2022to2032

Here are some key drivers of demand for LCBs in the market:

High Energy Density: LCBs offer higher energy density compared to traditional lithium-ion batteries, which is especially appealing for applications where compact and lightweight energy storage is crucial.

Safety and Stability: LCBs are known for their improved safety features, including resistance to thermal runaway and reduced risk of fire or explosion. This makes them a preferred choice for applications where safety is a primary concern.

Long Cycle Life: LCBs have demonstrated longer cycle life and calendar life compared to some conventional lithium-ion batteries. This characteristic is valuable in applications where longevity and durability are essential.

Temperature Performance: LCBs perform well in a wide range of temperatures, from extreme cold to high heat. This makes them suitable for applications in diverse environments, such as aerospace and automotive industries.

Fast Charging: As demand grows for faster-charging solutions, LCBs are being explored for their potential to support rapid charging without compromising safety or longevity.

Sustainability and Environmental Concerns: The shift towards sustainable energy storage technologies has led to increased interest in LCBs due to their potential to reduce environmental impact and reliance on fossil fuels.

Certainly, here's an overview of the Lithium Ceramic Battery (LCB) market trends, scope, and opportunities:

Trends:

High Energy Density: Lithium Ceramic Batteries (LCBs) offer higher energy density compared to traditional lithium-ion batteries, making them attractive for applications requiring longer-lasting and more powerful energy sources.

Enhanced Safety: LCBs are known for their improved safety characteristics, including resistance to thermal runaway and reduced risk of fire or explosion. This makes them appealing for applications where safety is a critical concern.

Wide Temperature Range: LCBs exhibit excellent performance across a broad temperature range, making them suitable for applications in extreme environments, such as aerospace and military applications.

Durability and Longevity: LCBs have demonstrated longer cycle life and extended calendar life compared to some conventional lithium-ion technologies, reducing the need for frequent replacements.

Fast Charging: Emerging technologies within the LCB category are showing potential for faster charging capabilities, catering to the growing demand for quick charging solutions.

Solid-State Design: Some LCB variants use solid-state electrolytes, eliminating the need for flammable liquid electrolytes and enhancing overall battery stability and safety.

Scope:

Electronics and Consumer Devices: LCBs could find applications in smartphones, laptops, tablets, and other consumer electronics due to their high energy density and improved safety.

Electric Vehicles (EVs): The EV industry could benefit from LCBs' fast charging capabilities, extended cycle life, and resistance to temperature fluctuations.

Aerospace and Aviation: LCBs' ability to operate in extreme temperatures and provide reliable power could make them suitable for aerospace applications, including satellites and unmanned aerial vehicles.

Military and Defense: The durability, safety, and reliability of LCBs could be advantageous for defense applications, such as portable electronics and military vehicles.

Medical Devices: LCBs' safety features, longevity, and potential for high energy density might make them valuable for medical devices requiring stable and efficient power sources.

Grid Energy Storage: LCBs could play a role in grid-scale energy storage due to their high energy density, longer cycle life, and safety features.

Opportunities:

Advanced Materials Development: Opportunities exist for research and development of new materials to further improve the performance, energy density, and safety of LCBs.

Commercialization: Companies that can successfully develop and commercialize LCB technologies could tap into various industries seeking high-performance, safe, and durable energy storage solutions.

Partnerships and Collaborations: Opportunities for partnerships between battery manufacturers, research institutions, and industries seeking reliable energy solutions.

Customization: Tailoring LCB technologies to specific applications, such as medical devices or defense equipment, can open up opportunities for specialized markets.

Sustainable Energy Storage: LCBs' potential to enhance the efficiency of renewable energy storage systems presents opportunities in the transition to clean energy.

Investment and Funding: Investors and venture capitalists interested in innovative battery technologies could find opportunities to support the development of LCB technologies.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/lithium-ceramic-battery-(lcb)-market/12035/

Market Segmentations:

Global Lithium Ceramic Battery (LCB) Market: By Company

• Evonik

• ProLogium(PLG)

Global Lithium Ceramic Battery (LCB) Market: By Type

• Laminate Type

• Cylindrical Type

Global Lithium Ceramic Battery (LCB) Market: By Application

• Transportation

• Energy Storage System

• Telecom and IT

• Industrial Equipment

• Others

Global Lithium Ceramic Battery (LCB) Market: Regional Analysis

The regional analysis of the global Lithium Ceramic Battery (LCB) market provides insights into the market's performance across different regions of the world. The analysis is based on recent and future trends and includes market forecast for the prediction period. The countries covered in the regional analysis of the Lithium Ceramic Battery (LCB) market report are as follows:

North America: The North America region includes the U.S., Canada, and Mexico. The U.S. is the largest market for Lithium Ceramic Battery (LCB) in this region, followed by Canada and Mexico. The market growth in this region is primarily driven by the presence of key market players and the increasing demand for the product.

Europe: The Europe region includes Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe. Germany is the largest market for Lithium Ceramic Battery (LCB) in this region, followed by the U.K. and France. The market growth in this region is driven by the increasing demand for the product in the automotive and aerospace sectors.

Asia-Pacific: The Asia-Pacific region includes Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, and Rest of Asia-Pacific. China is the largest market for Lithium Ceramic Battery (LCB) in this region, followed by Japan and India. The market growth in this region is driven by the increasing adoption of the product in various end-use industries, such as automotive, aerospace, and construction.

Middle East and Africa: The Middle East and Africa region includes Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of Middle East and Africa. The market growth in this region is driven by the increasing demand for the product in the aerospace and defense sectors.

South America: The South America region includes Argentina, Brazil, and Rest of South America. Brazil is the largest market for Lithium Ceramic Battery (LCB) in this region, followed by Argentina. The market growth in this region is primarily driven by the increasing demand for the product in the automotive sector.

Visit Report Page for More Details: https://stringentdatalytics.com/reports/lithium-ceramic-battery-(lcb)-market/12035/

Reasons to Purchase Lithium Ceramic Battery (LCB) Market Report:

• To gain insights into market trends and dynamics: this reports provide valuable insights into industry trends and dynamics, including market size, growth rates, and key drivers and challenges.

• To identify key players and competitors: this research reports can help businesses identify key players and competitors in their industry, including their market share, strategies, and strengths and weaknesses.

• To understand consumer behavior: this research reports can provide valuable insights into consumer behavior, including their preferences, purchasing habits, and demographics.

• To evaluate market opportunities: this research reports can help businesses evaluate market opportunities, including potential new products or services, new markets, and emerging trends.

• To make informed business decisions: this research reports provide businesses with data-driven insights that can help them make informed business decisions, including strategic planning, product development, and marketing and advertising strategies.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#Lithium Ceramic Battery#LCB Technology#Solid-State Batteries#High Energy Density Batteries#Battery Innovation#Advanced Energy Storage#Battery Safety#Battery Durability#Long Cycle Life Batteries#Fast Charging Batteries#Sustainable Energy Storage#Solid Electrolyte Batteries#Battery Materials#Battery Research#Battery Applications#Electric Vehicle Batteries#Aerospace Batteries#Renewable Energy Storage#Battery Trends#Battery Market Growth#Battery Industry#Battery Efficiency#Battery Manufacturing#Battery Performance.

0 notes

Text

Week in Review

October 23rd-29th

Welcome to Fragile Practice, where I attempt to make something of value out of stuff I have to read.

My future plan is to do longer-form original pieces on interesting topics or trends. For now, I'm going to make the weekly reviews habitual and see if I have any time left.

Technology

OpenAI forms team to study ‘catastrophic’ AI risks, including nuclear threats - Tech Crunch; Kyle Wiggers

OpenAI launched a new research team called AI Safety and Security to investigate the potential harms of artificial intelligence focused on AI alignment, AI robustness, AI governance, and AI ethics.

Note: Same energy as “cigarette company funds medical research into smoking risks”.

Artists Allege Meta’s AI Data Deletion Request Process Is a ‘Fake PR Stunt’ - Wired; Kate Knibbs

Artists who participated in Meta’s Artificial Intelligence Artist Residency Program accused the company of failing to honor their data deletion requests and claim that Meta used their personal data to train its AI models without their consent.

Note: Someday we will stop being surprised that corporate activities without obvious profit motive are all fake PR stunts.

GM and Honda ditch plan to build cheaper electric vehicles - The Verge; Andrew J. Hawkins

General Motors and Honda cancel their joint venture to develop and produce cheaper electric vehicles for the US market, citing the chip shortage, rising costs of battery materials, and the changing market conditions.

Note: What are the odds this isn’t related to the 7 billion dollars the US government announced to create hydrogen hubs.

'AI divide' across the US leaves economists concerned - The Register; Thomas Claburn

A new study by economists from Harvard University and MIT reveals a significant gap in AI adoption and innovation across different regions in the US.

The study finds that AI usage is highest in California's Silicon Valley and the San Francisco Bay Area, but was also noted in Nashville, San Antonio, Las Vegas, New Orleans, San Diego, and Tampa, as well as Riverside, Louisville, Columbus, Austin, and Atlanta.

Nvidia to Challenge Intel With Arm-Based Processors for PCs - Bloomberg; Ian King

Nvidia is using Arm technology to develop CPUs that would challenge Intel processors in PCs, and which could go on sale as soon as 2025.

Note: I am far from an NVIDIA fan, but I’m stoked for any amount of new competition in the CPU space.

New tool lets artists fight AI image bots by hiding corrupt data in plain sight - Engadget; Sarah Fielding

A team at the University of Chicago created Nightshade, a tool that lets artists fight AI image bots by adding undetectable pixels into an image that can alter how a machine-learning model produces content and what that finished product looks like.

Nightshade is intended to protect artists work and has been tested on both Stable Diffusion and an in-house AI built by the researchers.

IBM's NorthPole chip runs AI-based image recognition 22 times faster than current chips - Tech Xplore; Bob Yirka

NorthPole combines the processing module and the data it uses in a two-dimensional array of memory blocks and interconnected CPUs, and is reportedly inspired by the human brain.

NorthPole can currently only run specialized AI processes and not training processes or large language models, but the researchers plan to test connecting multiple chips together to overcome this limitation.

Apple’s $130 Thunderbolt 4 cable could be worth it, as seen in X-ray CT scans - Ars Technica; Kevin Purdy

Note: These scans are super cool. And make me feel somewhat better about insisting on quality cables. A+.

The Shifting Web

On-by-default video calls come to X, disable to retain your sanity - The Register; Brandon Vigliarolo

Video and audio calling is limited to anyone you follow or who is in your address book, if you granted X permission to comb through it.

Calling other users also requires that they’ve sent at least one direct message to you before.

Only premium users can place calls, but everyone can receive them.

Google Search Boss Says Company Invests to Avoid Becoming ‘Roadkill’ - The New York Times; Nico Grant

Google’s senior vice president overseeing search said that he sees a world of threats that could humble his company at any moment.

Google Maps is getting new AI-powered search updates, an enhanced navigation interface and more - Tech Crunch; Aisha Malik

Note: These AI recommender systems are going to be incredibly valuable advertising space. It is interesting that Apple decided to compete with Google in maps but not in basic search, but has so far not placed ads in the search results.

Reddit finally takes its API war where it belongs: to AI companies - Ars Technica; Scharon Harding

Reddit met with generative AI companies to negotiate a deal for being paid for its data, and may block crawlers if no deal is made soon.

Note: Google searches for info on Reddit often seem more effective than searching Reddit itself. If they are unable to make a deal, and Reddit follows through, it will be a legitimate loss for discoverability but also an incredibly interesting experiment to see what Reddit is like without Google.

Bandcamp’s Entire Union Bargaining Team Was Laid Off - 404 Media; Emanuel Maiberg

Bandcamp’s new owner (Songtradr) offered jobs to just half of existing employees, with cuts disproportionately hitting union leaders. Every member of the union’s eight-person bargaining team was laid off, and 40 of the union's 67 members lost their jobs.

Songtradr spokesperson Lindsay Nahmiache claimed that the firm didn’t have access to union membership information.

Note: This just sucks. Bandcamp is rad, and it’s hard to imagine it continuing to be rad after this. I wonder if Epic had ideas for BC that didn’t work out.

Surveillance & Digital Privacy

Mozilla Launches Annual Digital Privacy 'Creep-o-Meter'. This Year's Status: 'Very Creepy' - Slashdot

Mozilla gave the current state of digital privacy a 75.6/100, with 100 being the creepiest.

They measured security features, data collection, and data sharing practices of over 500 gadgets, apps, and cars to come up with their score.

Every car Mozilla tested failed to meet their privacy and security standards.

Note: It would be great if even one auto brand would take privacy seriously.

EPIC Testifies in Support of Massachusetts Data Privacy and Protection Act -Electronic Privacy Information Center (EPIC)

Massachusetts version of ADPPA.

Note: While it may warm my dead heart to see any online privacy protections in law, scrambling to do so in response to generative AI is unlikely to protect Americans in any meaningful way from the surveillance driven form of capitalism we’ve all been living under for decades.

Complex Spy Platform StripedFly Bites 1M Victims - Dark Reading

StripedFly is a complex platform disguised as a cryptominer and evaded detection for six years by using a custom version of EternalBlue exploit, a built-in Tor network tunnel, and trusted services like GitLab, GitHub, and Bitbucket to communicate with C2 servers and update its functionality.

iPhones have been exposing your unique MAC despite Apple's promises otherwise - Ars Technica

A privacy feature which claimed to hide the Wi-Fi MAC address of iOS devices when joining a network was broken since iOS 14, and was finally patched in 17.1, released on Wednesday.

Note: I imagine this bug was reported a while ago, but wasn’t publically reported until the fix was released as a term of apple’s bug bounty program.

What the !#@% is a Passkey? - Electronic Frontier Foundation

Note: I welcome our passkey overlords.

#surveillance#tech#technology#news#ai#generative ai#machine vision#electric vehicles#evs#hydrogen#futurism#Apple#iphone#twitter#bandcamp#labor unions#digital privacy#data privacy#espionage#passkeys

11 notes

·

View notes

Text

The Rise of 3D Printing in Prosthetics and Orthotics Market

The global prosthetics and orthotics market plays a vital role in improving quality of life for millions worldwide. Worth an estimated $7.2 billion in 2024, the market facilitates mobility for those with limb differences or injuries through highly customized external limb replacements and braces. The market introduces prosthetics and orthotics—Medical devices that enhance or assist impaired body parts and mobility. Orthotics are braces or supports for joints, spine, and limbs; prosthetics externally replace missing limbs. Together they improve functionality and quality of life for users. Major players in the prosthetics and orthotics space utilizing advanced manufacturing include Ossur, Steeper Group, Blatchford, Fillauer, Ottobock, and WillowWood Global. These industry leaders increasingly deploy cutting-edge 3D printing and customized design software to produce state-of-the-art prosthetics and braces. Current trends in the prosthetics and orthotics market include growing utilization of 3D printing and advanced manufacturing techniques. 3D printing enables on-demand production of complex, customized devices. It reduces manufacturing costs and wait times while improving fit and comfort. Expanding material options also allow more lifelike prosthetics. As technology evolves, the market is positioned for continued growth through 2031 in facilitating mobility worldwide. Future Outlook The prosthetics and orthotics market is expected to witness significant advancements in the coming years. Manufacturers are constantly focusing on developing innovative technologies such as 3D printed prosthetics that provide a better fit, enhanced comfort, and unrestricted movement. There is also a rising trend of using lightweight, highly durable and comfortable materials like carbon fiber and thermoplastics to manufacture prosthetic devices. Advancements in myoelectric prosthetics with touch and motion sensors are making them more dexterous and responsive. Using pattern recognition and machine learning techniques, next-gen prosthetics could gain functionality approaching that of natural limbs.

PEST Analysis Political: Regulations regarding clinical trials and approvals of new prosthetic technologies may affect market growth. Favorable reimbursement policies for prosthetic devices can boost adoption. Economic: Rising disposable incomes allow more individuals to opt for higher-end prosthetics. Emerging markets present abundant opportunities for growth. Inflation and economic slowdowns can hinder market profitability. Social: Increasing incidence of amputations and disabilities due to aging population, accidents, war injuries etc. drive market demand. Growing awareness regarding prosthetics and orthotics aids adoption. Stigma associated with limb loss poses challenges. Technological: Advancements in materials, manufacturing techniques like 3D printing, sensors, computing power and battery technologies are enhancing functionality and usability of prosthetics/orthotics. Myoelectric and robotic prosthetics have vastly improved in recent years. Opportunity Rising aging population presents a huge opportunity for prosthetics and orthotics targeting mobility issues and disabilities. Over 630,000 amputations occur annually in the U.S. due to dysvascular conditions like diabetes, presenting a sizable patient pool. Expanding applications of prosthetics and orthotics beyond mobility impairment into sports and military could drive significant growth. Growing incidence of trauma and injuries globally increases the number of patients relying on these devices. Emerging markets like Asia Pacific and Latin America offer immense opportunities owing to increasing disposable incomes, expanding healthcare infrastructure and rising medical tourism. Technological advancements are constantly improving functionality and usability of prosthetic devices, fueling adoption rates. The lightweight, durable and comfortable characteristics of newer materials expand addressable indications and patient acceptance. Key Takeaways Growing demand from aging population: The rapid increase in aging population worldwide who are prone to mobility issues, disabilities and chronic diseases like diabetes is a key driver spurring sales of orthotic and prosthetic devices. Global expansion into emerging markets: Emerging markets like Asia Pacific, Latin America, Eastern Europe and the Middle East offer immense opportunities owing to their large population bases and improving healthcare penetration. Technological advancements: Constant R&D bringing advancements in areas such as 3D printing, lightweight materials,

4 notes

·

View notes

Photo

Handmade Wood Toy Bear Cutout Unfinished and Ready to Paint from my Itty Bitty Animal Collection

Buy Now

Itty Bitty Animal Collection

Are you tired of the plastic, battery-operated toys that flood the toy aisles? Do you want to introduce your child to toys made with natural materials and built to last? Look no further than handmade wooden toys!

One such toy is the adorable wooden bear toy cutout, available on Etsy. This toy is made from high-quality wood and is carefully cut and sanded by hand, ensuring a smooth and safe finish for your child to play with. The simple design of the bear toy cutout allows for open-ended play and encourages your child's imagination and creativity.

Handmade wooden toys are better for the environment and your child's health and provide a unique sensory experience. The natural texture and weight of the wood allow for a more tactile and satisfying play experience. Wooden toys also have a timeless appeal that transcends trends and fads, making them a classic and timeless addition to any toy collection.

But handmade wooden toys aren't just for kids. They make great gifts for adults too! A beautifully crafted wooden puzzle or game is a thoughtful and unique gift that will be cherished for years.

Another perk of purchasing handmade wooden toys is supporting small businesses and independent makers. Each toy is crafted with care and attention to detail, making it a unique piece you can feel good about purchasing.

In a world where cheap and disposable toys dominate the market, handmade wooden toys offer a refreshing alternative. They promote creativity, imagination, and a connection to nature, all while providing hours of entertainment. So why not add timeless charm to your child's toy collection with a handmade wooden toy?

#odinstoyfactory#madeinamerica#madeinusa#bear#bearlover#crafts#cutout#decor#ecofriendly#gifts#handcrafted#handmade gifts#handmade toy#handmade wooden toys#handmade#homemade#kids#playtime#sustainable#toys#woodart#woodcraft#woodentoy#woodtoys

10 notes

·

View notes

Text

Manifesto for an Ecosocial Energy Transition from the Peoples of the South

An appeal to leaders, institutions, and our brothers and sisters

More than two years after the outbreak of the COVID-19 pandemic—and now alongside the catastrophic consequences of Russia’s invasion of Ukraine—a “new normal” has emerged. This new global status quo reflects a worsening of various crises: social, economic, political, ecological, bio-medical, and geopolitical.

Environmental collapse approaches. Everyday life has become ever more militarized. Access to good food, clean water, and affordable health care has become even more restricted. More governments have turned autocratic. The wealthy have become wealthier, the powerful more powerful, and unregulated technology has only accelerated these trends.

The engines of this unjust status quo—capitalism, patriarchy, colonialism, and various fundamentalisms—are making a bad situation worse. Therefore, we must urgently debate and implement new visions of ecosocial transition and transformation that are gender-just, regenerative, and popular, that are at once local and international.

In this Manifesto for an Ecosocial Energy Transition from the Peoples of the South, we hold that the problems of the Global – geopolitical – South are different from those of the Global North and rising powers such as China. An imbalance of power between these two realms not only persists because of a colonial legacy but has deepened because of a neocolonial energy model. In the context of climate change, ever rising energy needs, and biodiversity loss, the capitalist centers have stepped up the pressure to extract natural wealth and rely on cheap labor from the countries on the periphery. Not only is the well-known extractive paradigm still in place but the North’s ecological debt to the South is rising.

What’s new about this current moment are the “clean energy transitions” of the North that have put even more pressure on the Global South to yield up cobalt and lithium for the production of high-tech batteries, balsa wood for wind turbines, land for large solar arrays, and new infrastructure for hydrogen megaprojects. This decarbonization of the rich, which is market-based and export-oriented, depends on a new phase of environmental despoliation of the Global South, which affects the lives of millions of women, men, and children, not to mention non-human life. Women, especially from agrarian societies, are amongst the most impacted. In this way, the Global South has once again become a zone of sacrifice, a basket of purportedly inexhaustible resources for the countries of the North.

A priority for the Global North has been to secure global supply chains, especially of critical raw materials, and prevent certain countries, like China, from monopolizing access. The G7 trade ministers, for instance, recently championed a responsible, sustainable, and transparent supply chain for critical minerals via international cooperation‚ policy, and finance, including the facilitation of trade in environmental goods and services through the WTO. The Global North has pushed for more trade and investment agreements with the Global South to satisfy its need for resources, particularly those integral to “clean energy transitions.” These agreements, designed to reduce barriers to trade and investment, protect and enhance corporate power and rights by subjecting states to potential legal suits according to investor-state dispute settlement (ISDS) mechanisms. The Global North is using these agreements to control the “clean energy transition” and create a new colonialism.

Governments of the South, meanwhile, have fallen into a debt trap, borrowing money to build up industries and large-scale agriculture to supply the North. To repay these debts, governments have felt compelled to extract more resources from the ground, creating a vicious circle of inequality. Today, the imperative to move beyond fossil fuels without any significant reduction in consumption in the North has only increased the pressure to exploit these natural resources. Moreover, as it moves ahead with its own energy transitions, the North has paid only lip service to its responsibility to address its historical and rising ecological debt to the South.

Minor changes in the energy matrix are not enough. The entire energy system must be transformed, from production and distribution to consumption and waste. Substituting electric vehicles for internal-combustion cars is insufficient, for the entire transportation model needs changing, with a reduction of energy consumption and the promotion of sustainable options.

In this way, relations must become more equitable not only between the center and periphery countries but also within countries between the elite and the public. Corrupt elites in the Global South have also collaborated in this unjust system by profiting from extraction, repressing human rights and environmental defenders, and perpetuating economic inequality.

Rather than solely technological, the solutions to these interlocked crises are above all political.

As activists, intellectuals, and organizations from different countries of the South, we call on change agents from different parts of the world to commit to a radical, democratic, gender-just, regenerative, and popular ecosocial transition that transforms both the energy sector and the industrial and agricultural spheres that depend on large-scale energy inputs. According to the different movements for climate justice, “transition is inevitable, but justice is not.”

We still have time to start a just and democratic transition. We can transition away from the neoliberal economic system in a direction that sustains life, combines social justice with environmental justice, brings together egalitarian and democratic values with a resilient, holistic social policy, and restores an ecological balance necessary for a healthy planet. But for that we need more political imagination and more utopian visions of another society that is socially just and respects our planetary common house.