#Banking and Finance in Singapore

Explore tagged Tumblr posts

Text

Understanding Banking and Finance in Singapore: A Comprehensive Guide

At PDLegal, we specialize in providing expert legal advice and services to businesses navigating the complexities of the Banking and Finance industry. Whether you are looking to comply with regulatory requirements, negotiate financial contracts, or explore new fintech opportunities, our team is here to support you.

0 notes

Text

Unleashing the Power of AI-Driven Finance: Novel Patterns at Singapore Fintech Festival

As one of the most significant and esteemed events in the financial technology industry, the Singapore Fintech Festival (SFF) serves as a hub for revolutionary ideas, innovative solutions, and conversations that shape the sector. Each year, SFF attracts participants from around the globe, including bankers, tech developers, regulators, investors, and fintech entrepreneurs, all driven by a shared objective: to propel the future of finance. The 2024 festival has continued this tradition, brimming with enthusiasm and insights as companies showcase their latest developments in artificial intelligence, blockchain, cybersecurity, and more.

In this ever-changing landscape, Novel Patterns distinguished itself by presenting an impressive array of AI-driven solutions. As the financial sector undergoes digital transformation, companies are on the lookout for tools that can optimize processes, bolster security, and satisfy growing customer demands. Novel Patterns has been leading the charge in these advancements, developing solutions that not only keep up with industry evolution but also propel innovation forward.

The festival atmosphere was charged with discussions on how artificial intelligence is reshaping financial services. From the bustling exhibition halls to the deep-dive sessions with industry experts, it was clear that automation and AI-driven insights are now essential components in finance. Whether through predictive analytics, enhanced customer support, or real-time data processing, AI is transforming how financial institutions operate.

For Novel Patterns, SFF was the ideal platform to demonstrate how its products — Genesis, CART, and MyConCall — are addressing these trends and supporting the next generation of financial services

Genesis: The All-in-One Platform for Modern Fund Management

In today’s world, where data-driven insights and efficient processes are crucial for achieving success, Genesis provides fund managers with a distinct advantage. This all-encompassing platform is tailored to meet the changing demands of both investors and regulatory authorities, delivering clarity and control over the intricate aspects of fund management.

Attendees at SFF were particularly impressed with how Genesis addresses some of the toughest challenges in investment management:

Efficient Portfolio Allocation and Tracking: With Genesis, fund managers can seamlessly allocate assets across a diverse portfolio, reducing manual processes and enhancing accuracy.

Real-Time Reporting and Transparency: Genesis provides clear, insightful reporting that keeps both managers and clients informed, building trust and improving transparency.

Automated Compliance: The platform incorporates compliance features that help managers stay on top of changing regulations, ensuring that every decision meets legal and industry standards.

For investment professionals, Genesis serves not merely as a tool but as a strategic asset that enhances their workflow and fosters client trust. At SFF, financial firms have identified Genesis as a game-changing solution that consolidates efficiency, compliance, and transparency in one platform while also providing the scalability necessary for growth in a fiercely competitive market.

CART (Credit Assessment and Robotic Transformation): Accelerating Lending with AI

CART addresses critical needs in the lending process:

Instant Data Extraction & Analytics from Unstructured Financial Documents: Traditional credit assessments can be time-consuming and prone to errors. CART streamlines this by automatically extracting and analyzing data from bank statements, invoices, and other unstructured documents in seconds.

Risk and Fraud Detection: CART’s AI-driven risk scoring and pattern analysis highlight potential fraud indicators and categorize applicants by risk level, empowering lenders to make safer and more profitable decisions.

Improved Decision-Making Speed: By accelerating the entire credit assessment process, CART allows lenders to respond to applicants faster, increasing customer satisfaction and enabling quicker loan disbursements.

During SFF, CART created significant excitement among participants, especially those from established banks and fintech firms eager to integrate AI for enhanced lending efficiency. A key highlight was CART’s capability to boost lending speed by as much as 40%. Attendees at our booth witnessed firsthand how this solution can assist financial institutions in meeting the growing demand for swift and precise loan processing.

MyConCall: Setting New Standards for Secure Financial Communication & Digital Onboarding

In the realm of finance, confidentiality is not merely important — it is essential. With MyConCall, Novel Patterns delivers a secure, compliant, and user-friendly communication platform tailored to the specific requirements of financial teams. As concerns about data breaches and regulatory demands escalate, MyConCall ensures peace of mind with encrypted communication and improved data security.

Key features that make MyConCall essential for finance teams:

End-to-End Encryption for Voice and Video Calls: MyConCall ensures that sensitive discussions remain private and secure, with encryption safeguarding every interaction.

Compliance-Ready Features: Built with regulatory compliance in mind, MyConCall offers features that make record-keeping and data privacy seamless and stress-free.

Enhanced Collaboration Tools: Beyond secure calls, MyConCall provides file-sharing options, meeting scheduling, and other tools that support team collaboration without compromising security.

SFF 2024 participants, including representatives from major financial institutions and up-and-coming fintech companies, were attracted to MyConCall as a safe alternative to traditional communication methods. They recognized its ability to minimize compliance risks while enabling seamless, secure, and efficient communication within financial teams.

A Vision for the Future: Partnering to Build a Smarter, Faster, and Safer Financial Landscape

Novel Patterns’ experience at the Singapore Fintech Festival was not just about presenting products; it was also about fostering a community of like-minded individuals who share a belief in technology’s potential to transform the financial industry. The discussions we engaged in, the insights we gathered, and the relationships we cultivated reaffirmed our dedication to pushing the limits of what is achievable in fintech.

By showcasing solutions like Genesis, CART, and MyConCall, Novel Patterns is empowering organizations to enhance their processes while also contributing to a wider transformation that emphasizes efficiency, security, and inclusivity in finance.

We are thrilled to continue this journey and spread our message of financial innovation to various platforms around the globe. As we anticipate future events, we are excited to introduce new features, broaden our offerings, and strengthen our collaborations with innovative institutions worldwide.

The Journey Continues: Join Us in Redefining Financial Innovation

Our time at SFF 2024 was truly inspiring. We eagerly anticipate more chances to connect, collaborate, and innovate in the months ahead. With each event, Novel Patterns remains dedicated to providing solutions that create value, enhance security, and empower financial institutions to flourish in a rapidly digitalizing world.

#cart#fintech#novel patterns#account aggregator#bfsi#myconcall#credit underwriting#finance#wealth management#genesis#credit assessment#Financial Assessment#financial innovation#Bank Statement Analyzer#bank statement analysis#AI Driven#Singapore Fintech Festival

0 notes

Text

Westpac's 1985 annual report captured a meeting between Gary Roberts (left), group financial controller, and Michael Kent (centre), finance director of The Adelaide Steamship Company Ltd, a longstanding client of the bank, and Barry Robertson, group account executive, corporate banking. The relationship with Adsteam, which dated from the turn of the century, was sorely tested when the sprawling, debt-mired empire later hit problems. In the 1990s, Robertson – after serving as the bank's Mr Fix-It in Singapore and New Zealand – launched into a new career as Westpac's bad-debt trouble shooter before moving to take charge of Victoria, Tasmania, South Australia and the Northern Territory.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#80s#1980s#20th century#annual report#meeting#gary roberts#michael kent#barry robertson#finance#banking#the adelaide steamship company ltd#adsteam#turn of the century#debt#90s#1990s#singapore#aotearoa#new zealand#troubleshooting#victoria#tasmania#south australia#northern territory#australia

0 notes

Text

Exploring the Benefits of Import Invoice Finance

Experience better cash flow, increased liquidity, and streamlined import transactions with FinPrestige. Unleash the potential of your company and confidently traverse the global commerce landscape with the help of a reliable financial excellence partner. To learn how FinPrestige's Import Invoice Finance can support the expansion of your company, go to https://finprestige.com.sg.

#finprestigeconsultancy#bank loans for startups#finprestige#Import Invoice Finance#singaporeproperty#singapore

0 notes

Video

youtube

Georgian Billionaire Wins $926 Mln From Credit Suisse After Fraud. #news...

#youtube#Georgian Billionaire Wins $926 Mln From Credit Suisse After Fraud. news creditsuisse banks finance singapore china japan us live southkorea

0 notes

Text

"In some cities, as many as one in four office spaces are vacant. Some start-ups are giving them a second life – as indoor farms growing crops as varied as kale, cucumber and herbs.

Since its 1967 construction, Canada's "Calgary Tower", a 190m (623ft) concrete-and-steel observation tower in Calgary, Alberta, has been home to an observation deck, panoramic restaurants and souvenir shops. Last year, it welcomed a different kind of business: a fully functioning indoor farm.

Sprawling across 6,000sq m (65,000 sq ft), the farm, which produces dozens of crops including strawberries, kale and cucumber, is a striking example of the search for city-grown food. But it's hardly alone. From Japan to Singapore to Dubai, vertical indoor farms – where crops can be grown in climate-controlled environments with hydroponics, aquaponics or aeroponics techniques – have been popping up around the world.

While indoor farming had been on the rise for years, a watershed moment came during the Covid-19 pandemic, when disruptions to the food supply chain underscored the need for local solutions. In 2021, $6bn (£4.8bn) in vertical farming deals were registered globally – the peak year for vertical farming investment. As the global economy entered its post-pandemic phase, some high-profile startups like Fifth Season went out of business, and others including Planted Detroit and AeroFarms running into a period of financial difficulty. Some commentators questioned whether a "vertical farming bubble" had popped.

But a new, post-pandemic trend may give the sector a boost. In countries including Canada and Australia, landlords are struggling to fill vacant office spaces as companies embrace remote and hybrid work. In the US, the office vacancy rate is more than 20%.

"Vertical farms may prove to be a cost-effective way to fill in vacant office buildings," says Warren Seay, Jr, a real estate finance partner in the Washington DC offices of US law firm ArentFox Schiff, who authored an article on urban farm reconversions.

There are other reasons for the interest in urban farms, too. Though supply chains have largely recovered post-Covid-19, other global shocks, including climate change, geopolitical turmoil and farmers' strikes, mean that they continue to be vulnerable – driving more cities to look for local food production options...

Thanks to artificial light and controlled temperatures, offices are proving surprisingly good environments for indoor agriculture, spurring some companies to convert part of their facilities into small farms. Since 2022, Australia's start-up Greenspace has worked with clients like Deloitte and Commonwealth Bank to turn "dead zones", like the space between lifts and meeting rooms, into 2m (6ft) tall hydroponic cabinets growing leafy greens.

On top of being adaptable to indoor farm operations, vacant office buildings offer the advantage of proximity to final consumers.

In a former paper storage warehouse in Arlington, about a mile outside of Washington DC, Jacqueline Potter and the team at Area 2 Farms are growing over 180 organic varieties of lettuce, greens, root vegetables, herbs and micro-greens. By serving consumers 10 miles away or less, the company has driven down transport costs and associated greenhouse emissions.

This also frees the team up to grow other types of food that can be hard to find elsewhere – such as edible flower species like buzz buttons and nasturtium. "Most crops are now selected to be grown because of their ability to withstand a 1,500-mile journey," Potter says, referring to the average distance covered by crops in the US before reaching customers. "In our farm, we can select crops for other properties like their nutritional value or taste."

Overall, vertical farms have the potential to outperform regular farms on several environmental sustainability metrics like water usage, says Evan Fraser, professor of geography at the University of Guelph in Ontario, Canada and the director of the Arell Food Institute, a research centre on sustainable food production. Most indoor farms report using a tiny fraction of the water that outdoor farms use. Indoor farms also report greater output per square mile than regular farms.

Energy use, however, is the "Achilles heel" of this sector, says Fraser: vertical farms need a lot of electricity to run lighting and ventilation systems, smart sensors and automated harvesting technologies. But if energy is sourced from renewable sources, they can outperform regular farms on this metric too, he says.

Because of variations in operational setup, it is hard to make a general assessment of the environmental, social and economic sustainability of indoor farms, says Jiangxiao Qiu, a landscape ecologist at the University of Florida and author of a study on urban agriculture's role in sustainability. Still, he agrees with Fraser: in general, urban indoor farms have higher crop yield per square foot, greater water and nutrient-use efficiency, better resistance to pests and shorter distance to market. Downsides include high energy use due to lighting, ventilation and air conditioning.

They face other challenges, too. As Seay notes, zoning laws often do not allow for agricultural activity within urban areas (although some cities like Arlington, Virginia, and Cincinnati, Ohio, have recently updated zoning to allow indoor farms). And, for now, indoor farms have limited crop range. It is hard to produce staple crops like wheat, corn or rice indoors, says Fraser. Aside from leafy greens, most indoor facilities cannot yet produce other types of crops at scale.

But as long as the post-pandemic trends of remote work and corporate downsizing will last, indoor farms may keep popping up in cities around the world, Seay says.

"One thing cities dislike more than anything is unused spaces that don't drive economic growth," he says. "If indoor farm conversions in cities like Arlington prove successful, others may follow suit.""

-via BBC, January 27, 2025

438 notes

·

View notes

Text

Israel Prime Minister Benjamin Netanyahu’s office recently released a PowerPoint that gives a glimpse into what the Likud Party has in mind for Gaza’s future, and the Levant region at large. On May 3, Netanyahu unveiled Gaza 2035: A three-step master plan to build what he calls the “Gaza-Arish-Sderot Free Trade Zone.” The plan was first reported by The Jerusalem Post and later by Al Jazeera. The Gaza-Arish-Sderot Free Trade Zone would encompass the 141 square miles that make up the Gaza Strip, where more than 34,500 Palestinians have been killed by Israeli forces in the past several months, and where experts say that famine is underway. The zone also would include the El-Arish Port to Gaza’s south in Egypt’s Sinai Peninsula and Sderot, an Israeli city north of Gaza. UN officials issued a report on May 2 stating that over 70 percent of Gaza’s building stock has been destroyed, and that it would cost $40–50 billion to rebuild. This prompted one UN official, Abdallah al-Dardari, to say: “We have not seen anything like this since 1945.” Under the auspices of Gaza 2035, the new free trade zone would be administered by Israel, Egypt, and what the Israeli Prime Minister calls the Gaza Rehabilitation Authority (GRA)—a proposed Palestinian-run agency that would oversee reconstruction in Gaza and “manage the Strip’s finances.” The PowerPoint affirms that the GRA would not deliver Palestinian statehood and makes no reference to a two-state system. Instead, by 2035, Gaza and the West Bank would be placed under the “nominal administration” of the Palestinian Authority (PA) and Israel would be responsible for the free trade zone’s security. yNet correspondent Ron Ben Yishai called Gaza 2035 Benjamin Netanyahu’s “Singapore vision.” Gaza 2035 is officially entitled Plan for the Transformation of the Gaza Strip and it promises to deliver Gaza “from crisis to prosperity.” Netanyahu’s idea entails “rebuilding from nothing,” he said.

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#gaza genocide#genocide#settler colonialism

507 notes

·

View notes

Text

The Global and Indian Demand for CFA 2024

The finance industry is changing quickly, and there is a greater need than ever for CFA (Chartered Financial Analyst) specialists in India and around the world. As 2024 approaches, let’s examine why finance aficionados choose the CFA certificate and how it might lead to outstanding professional chances.

Global Demand: A Rising Tide

The CFA designation is still the gold standard for investment professionals around the world in 2024. Employers are increasingly seeking professionals with a strong foundation in ethics, a global perspective, and in-depth knowledge of financial analysis — exactly what CFA charter holders offer. CFAs are in high demand across continents, from asset management companies to global banks, making it a genuinely global credential.

Top financial centers like Singapore, London, and New York are still vying for CFA expertise, which raises pay and benefits. As global markets become more complicated, CFAs are in high demand due to their proficiency in risk management, portfolio analysis, and investment navigation.

Indian Demand: A Booming Finance Hub 🇮🇳

Nearer to home, India is rapidly becoming as a major financial hub, and there is an urgent need for certified public accountants. Professionals with a strategic edge and knowledge of the global financial scene are sought after by Indian businesses and financial institutions. CFAs are finding a variety of jobs in investment banking, equity research, and financial consultancy, from Bangalore’s burgeoning startup scene to Mumbai’s thriving stock market.

Why CFA is a Smart Career Move in 2024

Comprehensive Knowledge: The CFA program is a well-rounded credential that covers everything from corporate finance to equity analysis and alternative investments.

Global Recognition: In the highly competitive finance employment market, the CFA certificate is respected and acknowledged globally, making you stand out.

Opportunities for Networking: By joining CFA societies worldwide, you can connect with a strong network of recruiters, mentors, and finance professionals.

High Return on Investment: Taking the CFA course can lead to worldwide employment opportunities, increased compensation, and career improvements.

Study with the Experts at Zell Education

Zell Education is available to help if you’re serious about becoming a certified financial advisor. Beyond textbooks, our knowledgeable faculty offers study programs, individualized coaching, and real-world insights. You will be ready to take the CFA tests and establish yourself in the finance industry with our help.

Get ahead in 2024 by realizing your financial professional goals and unlocking your potential with the CFA!

2 notes

·

View notes

Text

2024-05-01

Singapore

CPIB says fewer graft cases reported last year - but a higher proportion of the cases required investigation

Body of Vietnamese woman who arrived in Singapore just a week ago found in Clarke Quay river

31-year-old man jumps 15 storeys from HDB block after standoff with police - he had self-harmed ...probably yet another person with serious mental health issues

Preparatory work to connect Thomson-East Coast Line with Changi Airport to begin next year

29 motorists arrested for traffic offences in 6-week enforcement operation

Science

Track the ISS live!

Environment

Indonesian volcano eruption shuts more airports, with ash reaching Malaysia

Language

Why writing by hand is better for memory & learning

Technology

Major US newspapers sue OpenAI & Microsoft for copyright infringement

Economy

Zimbabwe’s ZiG is the world’s newest currency & the country's latest attempt to resolve a money crisis

Politics

Police clear pro-Palestinian protesters from Columbia University’s Hamilton Hall

Art

^ Flip it over to see what's on the back! - by my friend's father!

Finance

Binance founder Changpeng Zhao sentenced to 4 months' jail for allowing money laundering - another scumbag bites the dust... pity it's just for a short while!

Singapore: MAS says DBS may resume non-essential banking activities but higher capital buffer stays

Society

4 law enforcement officers killed & 4 wounded while serving warrant at North Carolina home - just another day in the US of A!

People

Singapore: Local actor/comedian Suhaimi Yusof warded at hospital after suffering stroke

Travel

Hotel guest cut badly by sharp pool tiles in Dorsett Singapore - hotel manager also tried to shirk responsibility after incident was reported

Singapore Heritage Festival on from now till 26 May

Bali-bound Scoot flight turns back to Changi after smoke detected in cabin

Transport

More than 800 Hyundai & Kia EVs in Singapore to undergo recall for electronics fault - after a terrible experience with Hyundai decades ago, this is a brand I'll never ever consider

Singapore: LTA to return 1st 2 new Bukit Panjang LRT trains to China plant for modifications

#transport#travel#people#society#finance#art#politics#economy#technology#language#environment#science#singapore

2 notes

·

View notes

Text

10 Fintech Trends Every Manager Needs to Know for 2022

You must stay current with trends if you lead in the financial sector. As finance moves online, these trends will aid in keeping your company competitive while attracting and retaining top personnel.

Alternative financing, which can give consumers a way to avoid interest, is a trend you should be aware of. This includes super apps and purchase now, pay later (BNPL) options.

Companies can boost customer retention and create an extra source of income by using embedded finance. Financial services integrated into a product or service increase customer satisfaction and cut costs.

A crucial component of a successful embedded finance approach is product breadth. Distributors can begin by accepting payments before moving on to lending or more complex products to meet customers' more extensive financial requirements.

AI automates processes and analyzes real-time data to assist businesses in making better choices. It lessens human mistakes as well.

This is particularly helpful in professions where human error can result in expensive errors or even fatalities. For instance, manufacturing businesses can monitor output and consider potential mistakes to guarantee a higher level of safety.

Alternative lending can be a lifesaver for business owners needing funding outside of conventional banks. These funds may be employed for company expansion, inventory purchases, or employee hiring.

Compared to conventional banks, these lenders' application procedures are much simpler, and their response times are shorter. No extensive paperwork is required because the complete process is digital.

To control their spending, consumers increasingly opt for purchase now, pay later (BNPL) options. Because of this flexibility, e-commerce companies and retailers see an increase in sales.

Utilizing BNPL services, however, can also raise the danger of debt accumulating. BNPL providers must ensure they have access to accurate job verification data to reduce this risk.

Super apps combine various services to provide users with a one-stop store for all their needs. Customers and businesses greatly benefit from this because it lowers re-acquisition costs by keeping current users on one network.

When, where, and how individuals interact with financial services are all altered by embedded finance. Both financial and non-financial businesses can benefit greatly from it.

China's WeChat is a prime illustration of a super app that houses a variety of services, including payments, e-commerce, and messaging. Similar apps like Paytm from India, Grab from Singapore, GoTo from Indonesia, Zalo from Vietnam, and Kakao from South Korea are already industry leaders.

Additionally, by transforming the data, analysts can gain more information. Additionally, it enhances data integrity by removing mistakes and irregularities.

A digital ledger technology called blockchain can enhance financial management procedures. Transparency in financial services can be improved, transaction costs can be eliminated, and fraud can be decreased.

By utilizing a distributed network of computers, the technology enables users to document transactions in a secure and impenetrable manner. The network's users reach an agreement on each transaction's integrity.

The continued adoption of digital payments has been one of the biggest trends in the finance sector since 2020. Even though contactless payment methods acquired popularity during the COVID-19 pandemic, this tendency might intensify in 2022.

Limiting personal contact and stopping the spread of germs is top of mind for many in today's COVID-19 climate. Businesses can benefit from contactless purchases by enabling this.

The traditional bank model is being challenged by challenger banks, which impose transparent fees, provide a better customer experience, and advance technology. They are becoming increasingly well-liked among customers who no longer trust their conventional banks.

They can provide a complete range of banking products and technology to their BaaS customers, which is advantageous for fintech companies that only provide their tech stack and e-money and lack banking licenses.

Without sending customers to conventional financial institutions, embedded finance integrates financial services like lending, payment processing, or insurance into the infrastructure of non-financial companies.

For non-financial companies, embedded finance is more cost-effective, quicker, and easier to implement than construct and buy.

Embedded banking is expanding quickly in various sectors. Lead use cases include retail and e-commerce networks, marketplaces for ridesharing and two-sided meal delivery, and payments for mobile apps.

Through data aggregation, marketing professionals can export, organize, and reformat their marketing data. This procedure is crucial for many purposes, including tracking success and calculating ROI.

3 notes

·

View notes

Text

TRUST BANK IS GIVING AWAY CASH TO GET PPL TO JOIN. PLS. ALL THE GAZAN FUNDRAISER PPL. APPLY TO GET A CREDIT CARD, INTERNATIONAL, NO MIN BALANCE, & GET FREE MONEY. U GET EVEN MORE MONEY WHEN U REFER MORE PPL.

NOT. A. SCAM. Website linked. Pls reblog as much as possible because this is exactly the kind of thing that should be taken advantage

My referral code: YWXJX5EY

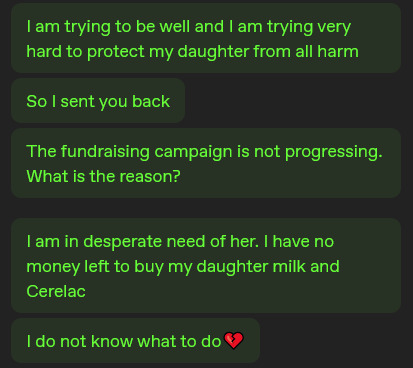

i've shared amal's gofundme (@amalashuor) several times, but i just received messages from her that broke my heart

amal is a 26 year old mother from gaza. she is an incredibly dedicated and loving mother to her year old daughter, maryam. before the war, she was studying to receive her masters degree in french language. on her instagram (@/amal_sufian97_) she shared beautiful photos of her life and family in the years before the war.

now amal, her husband, and maryam have been displaced several times and have nowhere to turn to. amal wishes to finish her degree, and both she and her husband want nothing more than a better life for their young daughter. every time i receive a message from amal, my heart is full knowing she is still alive, but it breaks for her suffering. i implore you, please donate any amount you're able to help amal and her family escape gaza. they deserve nothing less than safety, warmth, love, laughter, security, and life. as of july 6th, €1,025 / €30,000 has been raised. her campaign is also included on el-shab-hussein and nabulsi's spreadsheet of verified fundraiser (#175). if you're unable to donate, please share. i want nothing more than to give amal hope that she can provide a better life for her daughter.

#palestine#free palestine#gaza strip#gaza#gaza genocide#gaza evacuation fund#gaza mutual aid#gaza family

32K notes

·

View notes

Text

Voice and Gesture-Controlled Apps: The Next Big Thing in Singapore’s Digital Transformation

Singapore is at the forefront of digital transformation, leveraging cutting-edge technologies to enhance user experiences across various industries. Among the most revolutionary trends shaping the future are voice and gesture-controlled applications. With advancements in artificial intelligence (AI), augmented reality (AR), and machine learning (ML), businesses are now integrating hands-free, intuitive, and immersive interactions into mobile and web applications.

Voice assistants, gesture-based interactions, and AR-driven applications are rapidly redefining how users engage with technology. From improving accessibility and efficiency to enhancing entertainment and retail experiences, these innovations are paving the way for a more intuitive digital future in Singapore.

This article explores how these technologies are evolving, their impact on businesses, and why they are poised to be the next big thing in mobile app development Singapore’s digital transformation.

The Rise of Voice-Controlled Applications

How Voice Technology is Revolutionising User Experiences

Voice-controlled applications, powered by AI-driven virtual assistants such as Amazon Alexa, Google Assistant, and Apple’s Siri, are becoming integral to how people interact with devices. Singapore, with its smart city initiatives and widespread adoption of digital technologies, is witnessing a surge in voice-first applications across various sectors.

Key Use Cases of Voice Technology in Singapore:

Smart Homes & IoT: Singaporean households are increasingly adopting smart home devices integrated with voice commands for controlling lights, appliances, and security systems.

E-Commerce & Retail: Voice search is transforming online shopping, enabling users to browse products, place orders, and track deliveries using simple voice commands.

Healthcare & Telemedicine: Voice-enabled chatbots and virtual health assistants help patients schedule appointments, access medical advice, and receive medication reminders.

Banking & Finance: Banks are leveraging voice authentication and AI-powered financial assistants to offer seamless transactions, balance inquiries, and fraud detection.

How Singaporean Businesses Are Adopting Voice Technology

Leading Singaporean companies are embracing Natural Language Processing (NLP) and Conversational AI to create voice-based customer service solutions. Startups and enterprises are also integrating voice interfaces into mobile apps, allowing users to interact naturally and hands-free.

Challenges and Considerations for Voice Tech Adoption

Despite its many advantages, the adoption of voice technology faces challenges such as language diversity, accent recognition, and data privacy concerns. Singapore’s multilingual population requires voice assistants to understand and process multiple languages accurately, including English, Mandarin, Malay, and Tamil. Businesses must also ensure compliance with Singapore’s Personal Data Protection Act (PDPA) to maintain user trust.

The Evolution of Gesture-Based Interactions

What Are Gesture-Controlled Applications?

Gesture control technology allows users to interact with applications and devices through hand movements, facial recognition, and motion sensors, eliminating the need for physical touch. With the increasing focus on hygiene and contactless interactions, gesture-based applications are gaining traction in Singapore’s digital landscape.

Industries Leading the Adoption of Gesture-Controlled Apps in Singapore:

Healthcare: Hospitals and clinics are adopting gesture-based interfaces for sterile and hands-free control of medical equipment, reducing the risk of contamination.

Gaming & Entertainment: Augmented reality (AR) and virtual reality (VR) applications are using gesture control to create immersive gaming experiences.

Retail & Smart Kiosks: Interactive kiosks and digital signage in malls are using gesture recognition to help customers navigate menus and explore products.

Automotive: Singapore’s smart mobility initiatives include gesture-controlled infotainment systems in vehicles, allowing drivers to control music, navigation, and calls with simple hand movements.

How Gesture-Based Interactions Are Enhancing Accessibility

One of the most significant advantages of gesture-based apps is enhanced accessibility for people with disabilities. Users with limited mobility can navigate interfaces more easily through hand movements, facial expressions, or even eye-tracking technology.

Challenges and Future Outlook

Despite their potential, gesture-based applications must overcome challenges such as high development costs, accuracy limitations, and hardware dependencies. However, as technology advances and costs decrease, we can expect widespread adoption of gesture-based interactions across industries in Singapore.

The Role of AR-Driven Apps in Singapore’s Digital Economy

Augmented reality (AR) is bridging the physical and digital worlds, offering interactive experiences that blend real-world elements with digital enhancements. Singapore’s commitment to smart nation initiatives makes it an ideal hub for AR-powered applications across sectors such as retail, education, real estate, and tourism.

Key Use Cases of AR-Driven Apps in Singapore:

Retail & E-Commerce: Virtual try-on solutions for clothing, accessories, and makeup help customers make informed purchase decisions.

Education & Training: AR-powered learning apps provide interactive and engaging educational content for students and professionals.

Real Estate & Architecture: Virtual property tours allow buyers to explore homes remotely through AR visualisation.

Tourism & Hospitality: AR-enabled travel apps offer interactive city guides, historical overlays, and immersive storytelling experiences.

How Singaporean Businesses Are Capitalising on AR Technology

Singaporean startups and enterprises are leveraging AR to enhance customer engagement and create unique brand experiences. Companies like Sephora, IKEA, and local tourism agencies are investing in AR-powered applications to drive customer satisfaction and business growth.

Future Challenges and Innovations in AR

While AR technology offers exciting possibilities, businesses must address challenges such as AR hardware compatibility, battery consumption, and data processing speed. As 5G technology continues to roll out in Singapore, AR applications will become more seamless, responsive, and widely adopted.

The Future of Hands-Free Interactions in Singapore

Voice and gesture-controlled applications are revolutionising the way Singaporeans interact with technology. As businesses continue to adopt these intuitive, touchless, and immersive technologies, the future of digital transformation in Singapore looks promising.

With AI-driven voice assistants, gesture-based interfaces, and AR-powered applications leading the way, businesses and consumers alike can expect more personalised, efficient, and engaging digital experiences by 2025 and beyond.

Singapore’s strong tech ecosystem, government support, and forward-thinking enterprises position it as a global leader in hands-free interactions. As innovations continue to unfold, the adoption of voice and gesture-controlled apps will not only enhance user convenience but also drive Singapore’s vision of becoming a truly smart and connected nation.

Are You Ready for the Future?

For businesses looking to integrate voice, gesture, or AR-driven applications, now is the time to embrace these technologies. If you’re considering developing a next-generation mobile app development in Singapore, partnering with an experienced IT company specialising in AI, AR, and NLP-driven solutions can help you stay ahead in the digital race.

0 notes

Text

'Can your private bank do this?': Fintech firms target Singapore’s wealthy with feature-rich apps

Businesswoman managing finance and investment online, reading financial trading data and making financial plan with smartphone. Online banking. Banking, investment and financial trading concept D3sign | Moment | Getty Images The private banking industry, long defined by exclusivity, discretion and personalized service by relationship managers, is in the crosshairs of fintech firms that want a…

View On WordPress

0 notes

Text

Fintech firms target Singapore’s wealthy with feature-rich apps | masr356.com

Businesswoman managing finance and investment online, reading financial trading data and making financial plan with smartphone. Online banking. Banking, investment and financial trading concept D3sign | Moment | Getty Images The private banking industry, long defined by exclusivity, discretion and personalized service by relationship managers, is in the crosshairs of fintech firms that want a…

0 notes

Link

0 notes

Text

Unraveling the Latest Crypto Trends: Insights from Crypto News

The cryptocurrency panorama is ever-evolving, with new traits, marketplace tendencies, and technological enhancements shaping the enterprise agency. Staying knowledgeable is essential for customers, customers, and enthusiasts alike. Crypto News, a top deliver for crypto information insights, gives well timed and correct updates on the stylish happenings within the digital asset area. This article explores key tendencies, regulatory updates, and upgrades which may be shaping the crypto enterprise these days.

Market Trends and Analysis The cryptocurrency marketplace has witnessed massive volatility in contemporary months. Bitcoin and Ethereum, the 2 largest cryptocurrencies, have expert fluctuations driven thru macroeconomic factors, institutional adoption, and investor sentiment. Crypto News evaluations that Bitcoin has currently surged beyond key resistance levels, indicating renewed investor self assurance. Meanwhile, Ethereum’s expected network enhancements preserve to gas bullish expectations.

Another high-quality style is the rise of altcoins and meme coins. Projects like Solana, Avalanche, and Polygon have received traction because of their scalable blockchain solutions and growing adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs). Additionally, meme coins which incorporates Dogecoin and Shiba Inu continue to be well-known amongst retail traders, highlighting the have an effect on of network-driven projects in the crypto area.

Regulatory Developments Regulatory clarity remains a key situation count number amount within the cryptocurrency environment. Coin News has been carefully monitoring worldwide regulatory updates, which includes the U.S. Securities and Exchange Commission’s (SEC) stance on digital belongings. Recent tendencies suggest that lawmakers are strolling toward a framework that ensures investor protection while fostering innovation.

In Europe, the Markets in Crypto-Assets (MiCA) law goals to create a unified crook framework for cryptocurrencies in some unspecified time in the future of EU member states. Similarly, nations just like the United Arab Emirates and Singapore are positioning themselves as crypto-friendly jurisdictions with the aid of introducing current guidelines that assist blockchain innovation.

Meanwhile, China continues to preserve its strict stance on crypto looking for and selling and mining, pushing numerous blockchain projects to relocate to extra favorable regulatory environments. These regulatory shifts play a important characteristic in shaping the future of virtual property and identifying how crypto groups function worldwide.

The Rise of Decentralized Finance (DeFi) Decentralized finance (DeFi) has revolutionized conventional financial systems with the beneficial useful resource of offering an open and permissionless platform for economic transactions. Coin News reviews that DeFi protocols which includes Aave, Uniswap, and MakerDAO are developing their services, allowing clients to lend, borrow, and exchange belongings with out intermediaries.

One essential improvement in DeFi is the growing hobby in liquid staking. Platforms like Lido and Rocket Pool allow customers to stake their cryptocurrencies even as preserving liquidity, making staking extra handy and attractive to a broader intention marketplace. Additionally, the aggregate of DeFi with traditional banking establishments is starting new avenues for mainstream adoption.

NFTs and the Metaverse: The Next Frontier Non-fungible tokens (NFTs) preserve to disrupt the paintings, gaming, and enjoyment industries. Coin News highlights that important producers and celebrities are an increasing number of leveraging NFTs to interact with their audiences and create particular digital property. The metaverse, a virtual worldwide powered with the resource of the usage of blockchain generation, is also gaining momentum, with responsibilities like Decentraland and The Sandbox vital the way.

The fusion of NFTs and the metaverse has given rise to play-to-earn (P2E) video video video games, in which gamers can earn crypto rewards thru manner of the use of taking aspect in virtual economies. This fashion is attracting full-size funding, with gaming giants and mission capital companies exploring opportunities inside the Web3 vicinity.

Institutional Adoption and Mainstream Integration Institutional hobby in cryptocurrencies has grown considerably over the last year. Coin News evaluations that important monetary institutions, together with banks and asset manipulate companies, are increasing their crypto services. The approval of Bitcoin spot ETFs in diverse jurisdictions has in addition legitimized virtual property as an investment elegance.

Additionally, businesses like PayPal, Mastercard, and Tesla are integrating cryptocurrencies into their charge systems, making it a good deal less difficult for clients to transact with virtual assets. This mainstream adoption symptoms a broader popularity of crypto in traditional finance.

Challenges and Future Outlook Despite the quick upgrades, the crypto company faces worrying situations which include safety issues, scalability issues, and regulatory uncertainties. Coin News emphasizes the significance of addressing the ones demanding situations to make sure sustainable boom. Innovations in layer-2 scaling solutions, extra safety protocols, and clearer regulatory pointers will play a crucial function in overcoming the ones hurdles.

Looking in advance, the subsequent phase of crypto evolution may be driven with the useful resource of manner of artificial intelligence (AI) integration, sustainable blockchain answers, and stronger interoperability among considered considered one of a kind networks. As the enterprise matures, staying knowledgeable through dependable property like Coin News will be critical for navigating the ever-changing crypto landscape.

Conclusion The cryptocurrency enterprise business enterprise continues to conform at a quick tempo, with new dispositions shaping its trajectory. From market dispositions and regulatory updates to DeFi improvements and NFT growth, staying up to date is important for making informed alternatives. Coin News stays a relied on deliver for crypto records insights, providing precious statistics to customers, clients, and blockchain fanatics. As the virtual asset ecosystem grows, staying in advance of the curve could be key to seizing possibilities on this dynamic marketplace.

0 notes