#BUSINESS INCOME TAX

Explore tagged Tumblr posts

Text

Okay so after a very long consultation with my accountant, it turns out that I'm not stupid or hyperbolic. The system in greece is actually extremely hostile to people trying to work. Want to be a freelancer or run a business? There's such crazy tax, so many conflicting and confusing regulations, so many restrictions that it's almost impossible. Oh you're an artist? You're hugely fucked. You know how in other countries you can do both freelance commissions, and also sell like, keychains and prints and have a patreon and make money off YouTube and also maybe do a gallery show if you're lucky? You literally cannot do this here legally, unless for every different thing you want to do, you go apply for it, charge the correct tax, change your type of work etc. of course nobody really checks those things so most people do them anyway, but if you're trying to be safe and fully legal it's basically impossible.

if you want to sell anything physical, you need to have a "base", a physical location that is NOT your house to do so. It's ??,. You cannot be a craftsman from your house and make a living this way. You can only offer services from your house. The tax for selling physical goods is also a whole other can of worms.

Also just the tax percentage and what you have to pay regardless of income is basically designed to make sure you cannot live off of working for yourself unless you have some insane profit.

I mean, it's possible, sure, but it's so confusing and convoluted and difficult to make ends meet if you're trying to be as legal as possible.

#this is why this place will not go forward#you're sabotaging every young person who wants to start working unless they go work for someone else#or they have the preexisting capital to start a full business and even then#most people start their businesses in other countries where the tax isn't like 50% of your income#and the regulations are simpler and friendlier

51 notes

·

View notes

Text

I am so unbelievably pissed off. FUCK HOAs

Oh, my trash/recycling bin can't be visible except on pickup day? Ok whatever fine I hate you but I can deal with this

Weekly inspections?????? FU FU FU FU FU

SECOND NOTICE ALSO WE'RE CHARGING YOU MONEY TO SEND YOU CERTIFIED MAIL OF THIS TOTALLY LEGIT TOTALLY SECOND NOTICE OF WHAT IS ACTUALLY A VIOLATION cue me: checks notes. Hmm. My recycling bin was. on the curb. on recycling pickup day. You know. The day it has to be out. The day it is motherfucking ALLOWED TO BE FUCKING OUT AND VISIBLE.

so. 1) not a violation

I have sent them the trash AND recycling pickup schedules, which are DIFFERENT, btw

I have disputed the fact of the violation

I have disputed the linking of this "violation" to a previous violation MONTHS AGO--their "first notice" in this case was a "Courtesy Notice" LITERALLY 5 MONTHS AGO and they've done so many inspections since then and my bin CLEARLY WASN'T OUT IN THOSE INTERVENING MONTHS so WTMFH

So I am posting like a crazy person here instead of sending the absolutely deranged email I almost sent (I did send a slightly less deranged version with the disputes, and requesting a hearing)

OMG. It has been. Less than one hour since I learned this fun fun news. My bin was out YESTERDAY, y'all. YESTERDAY. I am going to blow a gasket

#it's a relatively privileged problem to have (omg i have a home truly i am grateful) but it's still a goddamned problem and i'm allowed#to fucking complain about it#in case it needs to be said#*rolling my eyes*#i advocate for free/actually affordable housing for everyone who needs it because we ALL deserve a safe secure stable home#whatever type of home that may be#it is absolutely goddamned ridiculous that megacorps can buy all the housing#rent it out at extortionate rates and evict people willy nilly#and we're talking about a “housing crisis” and not a “STOP LETTING CORPORATIONS AND BILLIONAIRES HOARD ALL THE HOUSING” crisis#goddamn.#ha elect me president (ahaha don't do this i am not a good public speaker) and I'll push congress to pass some really neat legislation#hey be more direct: elect me to congress (ahaha don't do this) and i'll WRITE some goddamn nifty legislation and yell about it as long and#as loud as i can until people start to just fucking say yes to make me shut the fuck up#(i know that's not how it works. again. don't actually elect me to a government position)#exemplia gratis:#No individual person shall own more than 6 homes UNLESS they pay a Housing Market Shrinkage Fee for removing viable housing from the market#why 6 and not 2? 2 is a lot! it's excessive! but having A vacation home shouldn't be a crime. Having 5 vacation homes is ridiculous and#awful and whatever but it's not likely to be the source of all our greatest “housing shortage” problems. no. I'm aiming for the absolutely#monstrously greedy and egregious motherfuckers who---ok#hang on. how many homes does the average min and max homeowner own? I would like to see data on that. but anyway#the next part of the legislation:#Homes owned >6 shall be charged X% Housing Market Shrinkage Fee UNLESS they are rented for affordable (15% or less than renter net income)#housing and are actively occupied by said renters. Rented out and charging more than 15% of renter's net? still gotta pay up.#EMPTY housing >6 shall be subject to an additional Y% Housing Market Shrinkage Fee (tax? should I call it a tax?) which increases with ever#month that the housing goes unoccupied. no one living in it? sell it rent it or pay the fuck up. and still pay the fuck up if you rent it#for way too goddamn much money#but like. less. we only REALLY hate you if you sit on empty houses that you don't even let anyone use#ok that's individuals. now onto BUSINESSES#ok so immediately it gets a little complicated cuz like presumably there's rental management businesses that don't own the rental propertie#that they manage BUT there are also companies that just outright own a shitfuckton of housing and THIS is the truly egregious monstrous sid

21 notes

·

View notes

Text

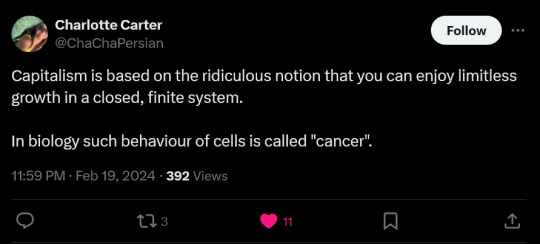

#leftism#anti capitalism#communism#socialism#anarchy#late stage capitalism#capitalism#financial#business#tweet#billionaires#economy#economics#taxes#eat the rich#fuck the rich#celebration#rich life#millionaire#income inequality#wealth inequality

33 notes

·

View notes

Text

i wonder what kind of money laundering scheme the Lynches had set up, cuz ain't nobody nowhere believed that that cattle farm would make them multi millions of dollars

#Niall Lynch#Declan Lynch#TRC#tags by me#i neeeeeeeed to know how Niall made his fairy market money look like normal legit income#and not illegal magical artifact trade and smuggling or whatever#cuz they ended up with $9 mil in trust for the kids and presumably a decent amount of money for regular usage and for Niall himself#a good amount in a business fund for whatever dealings needed dealing#how many off shore accounts did Niall have? did he pay taxes on anything?? how much can a herd of cows conceivably make???#he had to have had some shell companies and ''foreign investors'' and idk a bunch of laundromats in downtown henrietta or something#i'm already headcanoning that Declan ended up in charge of the operation by the time he was like 14#his eye for detail would be invaluable in washing that money i'm just saying#and he would need to know everything to be able to keep it going once Niall was dead so he had to have been deeply involved#i'm just saying

72 notes

·

View notes

Text

i wanna do a poll thats like. 'artists do u report commission earnings on ur tax report' but that would make me sound like a fed

#also what if we all got tried for tax evasion LMAO.#anyways ummm. ahgfdsbvgjbfdhg#ok just looked at the gov site. uh oh! ahifuhAFHSDFBDVBfb#well speaking as an unemployed person this is all very annoying lmao. as a sole trader your income would be subject to#the individual tax free threshold which is 18200 aud#im obviously not making anywhere near that amount. but if ur operating as a business then they still want u to report everything#which is -_-#hmm actually. im realising this is more of a problem as an unemployed person#because its the closest thing to income... meanwhile when i had a job its obvious#that i was just getting pennies and wasnt devoting time to it...

16 notes

·

View notes

Text

i wonder how fast we could clear the scammers and con-men out of religious organizations if we taxed them/made tax loopholes unprofitable

#like…. evangelical seed faith churches are literally just unethical.#‘plant your seed (money) in the holy ground of Jesus (my pocket) and watch it return twofold’#my guy. that is a scam 👁️👁️#you are legally scamming people tax-free rn#anyway…………..#more and more rich ppl are gonna create bogus churches/cults/charities to avoid income tax because it’s a successful business plan in the US#but that doesn’t make it right or ethical to manipulate the sick or elderly into giving you their life savings for salvation

29 notes

·

View notes

Text

#itr filing#income tax#business#capital gains#long-term#property#other income-tax#india#2024#july#pan car#gst#goods service tax

2 notes

·

View notes

Text

Our ITR Filing Plan Starting from for salaried person rs749 but now we offer only rs 499 , offer valid only 21 july 2024 so hurry up file your ITR with taxring Why choose taxring read Description Click here to choose the plan that suits you best! https://taxring.com/service/top-plan…

File your ITR with TaxRing and enjoy:

- Easy and quick filing process - Expert assistance from our team of CAs - Maximum refund guaranteed - Filing for last 3 years' returns - Tax planning and consultation - Refund claims and follow-up

Don't wait, file your ITR now and avoid unnecessary penalties and fees!

whatsapp now - +91 9711296343

Visit us - https://taxring.com

#itr filing#taxring#income tax#taxation#itr#taxes#taxation services#itr filing last date#itr filing for fy 2023-24#income tax filing#income tax calculator#income tax department#income tax return#income tax notice#file itr#capital gain#file itr for salaried#file itr for business#itr filing online#return filing

2 notes

·

View notes

Note

maybe i just don’t understand how the post works but why do you need to sign up for a bunch of stuff? can’t you just send stuff?? like if i wanted to send something to literally any country in the world i go to the postnord-app and select the country and pay for a label, print it, drop the package off and then it’s done, why does it need to be complicated? /gen

Hello! "Why does it need to be complicated" is a thing I'd LOVE to shake the shoulders of European countries about.

If I were mailing things to a friend, I would be able to do as you say--print a label, and send a package out.

The difference is that my online shop is A Business. You do not have to consider all these laws and regulations because the things you mail are considered 'gifts' as you are presumably not sending them with expectation of profit. International trade law forbids I mark things that I profit from (merchandise) as gifts, and I generally like to stay on the right side of tax laws because I would rather not be fined. Being a business for profit means I have to deal with All of the Everything™ when it comes to reporting income & volume of items that get moved.

The chances of being found out as a small scale seller aren't that high; I've just made too much effort to make my business legit to want to take the gamble.

Cheers!

#asks#ref#I feel like my small business is fairly small but also doing well enough that while I growl and curse my way through taxes every year#it is worth to keep going#to be able to have that side income if anything happened to my day job#Germany is happening again someday >:0 I know it#France is kinda a lost cause bc their fee starts at 80 euro yearly and I doubt I'd get enough sales to break even every year

23 notes

·

View notes

Text

the revenue from the rub and tug being the only reason that kev was able to pay alan the $1,000 he owed him for the last two months…svetlana was really keeping the alibi afloat from the beginning

#s4? her services are what generate the income that allows kev to pay alan#s5? v gets the idea to sell breast milk bc of svetlana#s6? svet is the one who comes up with all the creative ways to capitalize on the new hipster clientele#and arranges for v to talk to a successful bussineswoman#s7? she looks over all of the financials and oversees the bookeeping#as well as takes over managerial duties and gets them caught up on their taxes#s8? the bar is full when she’s the only one running it and when they’re back to individual shifts it’s her shifts that bring in three times#more money than kev and v’s combined#she SHOULD have been the one running that bar#like peace and love but kev and v were terrible business managers#without svetlana they would have lost the bar several times over#shameless#svetlana yevgenivna#shameless text

5 notes

·

View notes

Text

#accounting#income tax#incorporation#finance#company incorporation#business incorporation#trademark#bookkeeping#malaysia#singapore

2 notes

·

View notes

Text

One of the first bills floated by the new House GOP majority aims to get rid of the income tax and swap in a national consumption tax instead. It's a proposal that's attracted ridicule from President Joe Biden, and is highly unlikely to ever move forward.

Senator Jon Tester, a Democrat from Montana, particularly wants to make sure it never happens.

"Montana has no sales tax and we don't need the federal government imposing one on us," Tester wrote in a Thursday tweet. "House Republicans' plan to tack a 30% national sales tax on every good from gas to groceries would skyrocket costs for Montana's working families. I will defeat this awful plan."

Under Georgia Rep. Buddy Carter's Fair Tax Act, the income tax, alongside the payroll tax and estate tax, would be replaced by a 23% consumption tax on gross payments — and the IRS would be abolished.

"Armed, unelected bureaucrats should not have more power over your paycheck than you do," Carter said in a release.

A national sales tax would likely be more regressive than the current income tax, hitting lower- and middle-income Americans harder. As the nonpartisan Tax Policy Center notes, lower-income households spend a larger share of that income than higher-income households, so they'd be disproportionately shouldering the burden of a level tax.

It would also fall harder on the shoulders of parents. As the Tax Policy Center notes, "at any given income level, families with children have higher consumption requirements than those without, so switching to a consumption tax would present an inherent disadvantage for families with kids."

The Biden administration has essentially laughed off the GOP proposals, with the President saying he'd veto any legislation like it. White House deputy press secretary Andrew Bates said that it would "shift the federal tax burden onto the American middle class and working people."

And Biden, when asked about the sales tax proposal, said: "Go home and tell your moms, they're going to be really excited about that."

#us politics#news#business insider#fair tax act#fair tax#national consumption tax#income tax#internal revenue service#president joe biden#biden administration#sen. Jon Tester#montana#2023#Rep. Buddy Carter#us house of representatives#118th congress#Tax Policy Center

10 notes

·

View notes

Text

youtube

8 notes

·

View notes

Text

#Tax preparation services#Income tax filing#Tax return help#Tax planning advice#Tax deductions#IRS audit assistance#Tax deadline reminders#Small business taxes#Self-employed taxes#and E-filing services.

2 notes

·

View notes

Text

65/100.

Finished my taxes! Submitted it yesterday.

Last time we talked, I was trying to figure out my business-use-of-home expenses for the pet boarding part of my business. It was making my head hurt trying to figure out how I should calculate this.

I finally decided I should treat pet boarding like a bed and breakfast for the purposes of filing taxes. So to that end, I had to figure out what percentage of my home I use for boarding and for what percentage of the time.

First I considered what percentage of my house is used for boarding. The thing is, all dogs and some cats have free range of the home 24 hours a day. That translates to 100% of the home 100% of the time. But I'm pretty sure that's not gonna fly for deducting business-use-of-home expenses. The CRA wants a "reasonable" prorating of the expenses.

So I thought about what parts of my house I actually use for boarding. Generally, I confine cats to one bedroom. Two cats from the same household stay together in the same room, so it's not one room per cat, it's one room per booking.

For dogs, even though they have free range, they generally follow me around the house, which means that during the day they rarely go upstairs at all. Mostly they are in the two rooms I use the most during the day: the living room and the kitchen. If I leave the house, I'm pretty sure they just nap in the living room the whole time I'm gone. At night, some dogs sleep in the living room, others follow me upstairs to my bedroom and sleep next to my bed. However, if cats are boarding in my room and can't coexist with dogs, then the dog is shut out of my bedroom and lopes back down to the living room, or sleeps outside the bedroom. At this point I was considering dogs as using half the house for calculating purposes.

But then I thought about the times I've had multiple dogs from different households boarding at the same time. Often they just all nap in the living room, but sometimes I have to physically separate them, especially during mealtimes. At those times, I generally either put up physical barriers, or I tether the dogs in different rooms, usually one in the kitchen and one in the living room. I also thought about the fact that I sometimes block off the living room or the kitchen in order to keep a boarding dog away from my own two cats. Furthermore, nobody really hangs out in the dining room, which separates the kitchen and living room. It's more of just a pass-through. So in the end, I decided to consider dogs as using one room per booking as well, as per cats.

I then had to figure out what percentage of my home "one room" constitutes. I didn't want to use square footage, because honestly then I'd have to measure and that would be a huge pain in the butt. But also because it doesn't really matter what size the rooms are, it's the doors and barriers that are important. So I mentally divided my house up into the usable rooms or areas for keeping pets separated, safe and comfortable. Upstairs there's three bedrooms. The bathroom doesn't count because I don't put pets in there. The main floor is open, no doors, but not "open-concept"--there are walls and doorways, so I am able to put up barriers. I considered the main floor as consisting of three rooms.

Now the basement, I mostly just use it for storage, and also I keep the basement door closed, so no one goes down there. However, in high-season when it's super busy with multiple bookings, I do use the basement bathroom as over-flow to house cats. And when it has been super super busy, I have had one cat in the bathroom and another cat outside of the bathroom. There are no rooms in the basement other than the bathroom and the tiny boiler room/washer & dryer nook, where I do NOT house cats. So essentially there are two spaces in the basement cats can be housed: in the bathroom, or outside the bathroom. So for pet boarding purposes, I consider this to be two rooms.

That makes 8 rooms in total: 3 upstairs, 3 on the main floor, and 2 in the basement.

So the portion of my house that a pet/two pets from the same household use when they board with me is 1/8.

Phew!

Next, I had to figure out what percentage of the time a pet uses 1/8th of my house. A pet uses their portion of the house 100% of the time they are staying with me, but I don't have pets staying with me 100% of the time. To figure this out, I needed to add up how many days of the year I had a pet staying with me. I'll walk you through that calculation in the next post.

#100 days of productivity#100dop#taxes#tax deductible#tax deductions#filing taxes#income tax#business use of home#business expense#home business#pet boarding#petsitting#dog sitting#dog boarding#cat sitting#cat boarding#side hustle#side gig#gig workers#canada revenue agency

3 notes

·

View notes