#BHIM app

Explore tagged Tumblr posts

Video

youtube

UPI Payment Through Credit Card | How to Link/Add Credit Card in Bhim Ap...

0 notes

Text

youtube

How UPI works for NRIs | Now NRIs Can Set Up UPI | Mint Primer | Mint

On 10 January, India’s retail payments umbrella body The National Payments Corp. of India (NPCI) issued a circular that paved the way for wider adoption of homegrown payments platform UPI. So far, only Indian phone numbers were allowed on UPI, leaving out non-resident bank accounts linked to their phone numbers abroad. In the first phase, phone numbers from 10 countries including Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the US, Saudi Arabia, United Arab Emirates, and the UK have been allowed to be used on UPI.

#upi#upi for nri#upi for nris#can nri use upi#can nre account use upi#upi on their international mobile numbers#upi app for nri#paytm for nri#google pay nri account#upi nro account#nre and nro account#nre account#upi for nre#upi for nro#upi payment#upi in other countries#world news on upi#upi for nri account#upi for nri customers#can nri use bhim app#npci#is upi available for nri account#does upi work outside india#upi payment in nre and nro account#Youtube

0 notes

Text

https://www.businessupside.in/top-upi-apps-in-india-and-why-should-you-use-them/

UPI is built on the Immediate Payment Service (IMPS) platform. With UPI apps, you can send and receive money from anyone with a UPI-enabled bank account. It is fast, convenient, and safe.

1 note

·

View note

Text

ADD QR CODE

What is ADD QR code? Its quick response code and define as the many terms to complete transaction quickly as well as clarifying all details with current transaction.

Similarly ,its describe fastest transaction mode services like email ,visiting card, identity card ,URL, social media etc. and scan with quick responsive code throughout the whole world because its the easiest mode to transfer money from one individual to another individual.

How its work? Its work on different ways are as follows:- Download search engine any site and apply all description with relevant information such as name, phone no., color , quick response code pattern and so on. Before, we scan quick response code download all the details and get the password while ,using quick response code. After that ,quick response code scan with android phone . Symbolize, with black and white color pattern. After, completion of payment scan with quick response code it shows lacking current information with total payment bill with green right sign.

Functions of ADD QR code? It works faster and transact currency anywhere. On the other hand ,it restore all data and work remotely with different logos. Consequently ,it scan currency remotely with in a second without any cash payment. It scan quick response code with different app mode such as UPI ,Aadhar pay ,BHIM ,Google pay ,Phone pay . Reliable source of medium easily scan quick response code any rural or urban area without any systemization. Work as low cost ,low range frequency ,minimum limit of time and so on.

Types of ADD QR code? Bharat QR UPI QR Proprietary QR Aadhar pay BHIM Google pay Phone pay

This is assured and reliable source of medium to work randomly with different services such as email , visiting card , identity card , URL , Social media etc. furthermore, it avoid times complexity ,and transfer highly cash with scan quick response code.

#ADD QR CODE#quick response code#email#visiting card#identity card#URL#social media#transaction#aadhar pay#bhim#Google pay#Phone pay

2 notes

·

View notes

Text

Paytm Hdfc Credit Card kaise banaye 2023

paytm hdfc credit card kaise banaye, paytm hdfc credit card customer care number, hdfc credit card login, how to activate paytm hdfc credit card, paytm credit card customer care, paytm credit card apply online, paytm hdfc credit card limit, paytm hdfc credit card verification process, paytm hdfc credit card kaise banaye टॉपिक को इंटरनेट पर सर्च कर रहे हैं हम आपको इसके बारे में पूरी जानकारी देंगे इसलिए निवेदन है कि आर्टिकल को पूरा पढ़ें पूरी बात समझ में आ जाएगी आज ऑनलाइन अगर आप कोई भी चीज करना चाहते हैं तो वहां पर आपको बिल पेमेंट करने के लिए क्रेडिट कार्ड का विकल्प जाता है कि कार्ड के माध्यम से आप घर बैठे कोई भी चीज ऑनलाइन से खरीद सकते हैं I सबसे बड़ी बात है कि उसे आप अपने मुताबिक किस्तों में तब्दील भी कर सकते हैं ताकि आपको खरीदी गई चीज के पैसे चुकाने में आसानी हो हम सभी लोग पेटीएम का इस्तेमाल करते हैं लेकिन आप क्या जानते हैं कि पेटीएम के द्वारा क्रेडिट कार्ड बनाने के ऑफर चलाए जाते हैं I ऐसे में आप पेटीएम एचडीएफसी बैंक क्रेडिट कार्ड बना सकते हैं कैसे बनाएंगे उसकी प्रक्रिया के बारे में अगर आप नहीं जानते हैं तो आर्टिकल को पूरा पढ़े ही जानते हैं

Paytm HDFC बैंक क्रेडिट कार्ड क्या है ?

Paytm hdfc credit card पेटीएम के द्वारा लांच किया गया क्रेडिट कार्ड इस कार्ड को पेटीएम कंपनी ने एचडीएफसी बैंक के साथ मिलकर लॉन्च किया है I इसके अलावा Paytm ने HDFC बैंक के साथ मिलकर अपने 5 क्रेडिट लॉन्च किए हैं इसका लाभ पेटीएम इस्तेमाल करने वाले कस्टमर उठा सकते हैं | इसे बनाने के लिए आपको अपने पेटीएम एप्स को ओपन करना होगा I

paytm hdfc credit card

Paytm hdfc credit card के प्रकार

क��ल मिलाकर पांच प्रकार के कार्ड लांच किए गए हैं इसका विवरण हम आपको नीचे बिंदु अनु��ार देंगे आइए जानते हैं - Paytm HDFC बैंक क्रेडिट कार्ड - Paytm HDFC बैंक मोबाइल क्रेडिट कार्ड - Paytm HDFC बैंक सेलेक्ट क्रेडिट कार्ड - Paytm HDFC बैंक बिज़नस क्रेडिट कार्ड - Paytm HDFC बैंक सेलेक्ट बिज़नस क्रेडिट कार्ड

Paytm hdfc credit के फायदे

- इसके द्वारा आप मूवी अमोल जैसी जगह पर अगर पेमेंट करते हैं तो आपको 3% का कैशबैक मिलेगा - यूटिलिटी बिल पेमेंट कर पाएंगे - बैंक की तरफ से आपको जीरोकोड चला बेटी दी जाएगी या नहीं अगर आपका कार्ड कहीं खो जाता है तो आप कस्टमर सर्विस को तुरंत इसकी जानकारी दे आपका कार्ड वहां से ब्लॉक कर दिया जाएगा और कार्ड की जिम्मेदारी आपके ऊपर ही रहेगी - फ्यूल (fuel) के खर्चों पर 1% लगने वाले फ्यूल सरचार्ज को नहीं लिया जाएगा | यदि आप ₹400 का फुल यहां पर मरवाते हैं तो आपको ₹250 का कैशबैक दिया जाएगा I

Paytm HDFC Credit Card charges and Fee

- मेम्बरशिप के तौर पर आपको – 49 रुपए + GST चार्ज देना होता है | 1 महीने के लिए

Paytm hdfc credit card बनाने की Paytm Hdfc Credit Card योग्यता

- 21 साल से ऊपर होना चाहिए - पीएम का अकाउंट नंबर होना - Paytm Payment Bank में Saving Account होना चाहिए - क्रेडिट स्कोर अच्छा होना चाहिए - Income source - पैन कार्ड होना चाहिए Paytm मे आधार कार्ड से Upi कैसे बनाये | Create Upi pin in Paytm Through Aadhar Card 2023 Fastag Recharge Online: Fastag Online रिचार्ज कैसे करें | Axis Bank, Bhim App, Paytm कैसे करें

Paytm Hdfc Credit Card

Paytm Credit Card अप्लाई करने के लिए डाक्यूमेंट्स?

- Ration Card, Passport, Voter ID, Aadhar Card. निवास प्रम��ण पत्र के तौर पर - Salary Slip, ITR Copy - Driving Licence, Passport, Addhar Card पहचान पत्र के तौर पर

Paytm hdfc credit card बनाने की प्रक्रिया

- सबसे पहले आपको पेटीएम एप ओपन करना होगा और अगर आपके मोबाइल में नहीं है तो उसे डाउनलोड कर ली���िए - इसके होमपेज पर पहुंच जाएंगे यहां पर आपको Loans and Credit Cards’ वाले ऑप्शन दिखाई देगा उस पर क्लिक करेंगे - आपके सामने क्रेडिट कार्ड कार्ड वाला ऑप्शन आएगा उस पर आपको क्लिक करना है - अब आपके सामने आवेदन पत्र ओपन होगा जहां से जो भी आवश्यक जानकारी पूरी जाएगी उसका विवरण देंगे और उसके बाद आपको ‘Terms & Condition’ Agree करने के ऑप्शन पर क्लिक करेंगे - घर का पता और कितना पैसा महीने में कमाते हैं उसका यहां पर विवरण देंगे - सभी डिटेल्स भर देंगे आपको ‘Submit’ वाले बटन पर क्लिक करना है। - अब पेटीएम के अधिकारी योगिता की जांच करेंगे कि आप यहां पर लोन लेने के लिए योग्य है कि नहीं अगर है तो आपके मोबाइल में मैसेज आ जाएगा - उसके बाद आपको apply now के बटन पर क्लिक करना है - जिसके बाद आपके सामने एक नया पेज ओपन होगा जहां आप से कुछ आवश्यक चीजें मां की जाएंगे जिसका आपको सही ढंग से विवरण देना है - अब आपको Terms & Condition” को accept करके ‘Submit’ पर क्लिक करना है। - के बाद आपके स्किन पर एप्लीकेशन नंबर आएगा जिससे आपको कहीं पर लिख कर रखना है - अब बैंक के अधिकारी आपके आवेदन पत्र का वेरिफिकेशन करेंगे - जिसके बाद ही आपको क्रेडिट कार्ड मिल पाएगा - इस प्रकार आप आसानी से पेटीएम एचडीएफसी बैंक क्रेडिट कार्ड बना सकते हैं

Paytm Credit Card का Status कैसे check करे?

Paytm HDFC Credit Card के स्थिति का विवरण चेक करना बिल्कुल आसान है इसके लिए आपको अपने पेटीएम एप के credit card के ऑप्शन में जाना होगा वहां पर आपको क्रेडिट कार्ड अप्लाई स्टेटस का ऑप्शन दिखाई पड़ेगा उस पर क्लिक करके आप जान पाएंगे अपने क्रेडिट कार्ड का इसके बाद भी अगर आपको मालूम नहीं चल रहा है तो आप बैंक ऑफिशल वेबसाइट पर जाकर के टायर के स्टेटस का पूरा विवरण चेक कर सकते हैं इसके अलावा कस्टमर सर्विस में भी फोन कर कर आप जान पाएंगे

Paytm hdfc क्रेडिट कार्ड की लिमिट कितनी होती है?

आप पेटीएम एचडीएफसी बैंक एटीएम कार्ड इस्तेमाल करेंगे तो हम आपको बता दें कि इसकी एक निश्चित लिमिट तय की गई है जायदा का खर्चा करते है तो आपको 2.5 प्रतिशत के दर से अतिरिक्त fine जो कि ₹600 होती है इसके अलावा और भी कई प्रकार की चीजें आपको ध्यान में रखनी होंगी ताकि आप fine देने बच सके I Read the full article

2 notes

·

View notes

Text

#npjquiz #app #worldwide #largest #gk #bansi #mela #dham #school #Bihar #UttarPradesh #India

NPJ QUIZ

General Knowledge App

Bansi Dham Uttar Pradesh & Bihar Team...

Nagendra Prajapati, Nitesh Gupta, Jawahir Prajapati, Satish Verma, Bhim Chauhan, Sunil Sony & etc..

NPJ QUIZ App Features...

Quiz Zone, Contest Play, Group Quiz, 1 vs 1 Quiz , Self Challenge, Education, Exam, Audio Quiz, Math, True & False.

NPJ QUIZ ऐप की तरफ से आप सभी को बांसी धाम में स्वागत है। नि:शुल्क ठहरने की व्यवस्था उपलब्ध है 💐🙏🚩

NPJ QUIZ Install app :- https://play.google.com/store/apps/details?id=com.npjquiz.live

0 notes

Text

https://sfl.gl/yiryaBawaal hone wala hai, kyuki bonus episode aa raha hai 😎🔥

#MirzapurOnPrime, Bonus Episode, 30th Aug.

About Prime Video: Prime Video is a premium streaming service that offers Prime members a collection of award-winning Amazon Original series, thousands of movies & TV shows—all with the ease of finding what they love to watch in one place. Prime Video is just one of the many benefits of a Prime membership, available for just ₹1499/ year.

Included with Prime Video: Thousands of acclaimed TV shows & movies across languages & geographies, including Indian films such as Shershaah, Soorarai Pottru, Sardar Udham, Gehraiyaan, Jai Bhim, Jalsa, Shakuntala Devi, Sherni, Narappa, Sarpatta Parambarai, Kuruthi, Joji, Malik, and HOME, along with Indian-produced Amazon Original series like Farzi, Jubilee, Dahaad, The Family Man, Mirzapur, Made in Heaven, Four More Shots Please!, Mumbai Diaries 26/11, Suzhal – The Vortex, Modern Love, Paatal Lok, Bandish Bandits, Guilty Minds, Cinema Marte Dum Tak, and Amazon Original movies like Maja Ma & Ammu. Also included are popular global Amazon Originals like Citadel, The Lord of The Rings: The Rings of Power, Reacher, Tom Clancy's Jack Ryan, The Boys, Hunters, Fleabag, The Marvelous Mrs. Maisel, & many more, available for unlimited streaming as part of a Prime membership. Prime Video includes content across Hindi, Marathi, Gujarati, Tamil, Telugu, Kannada, Malayalam, Punjabi, & Bengali.

Prime Video Mobile Edition: Consumers can also enjoy Prime Video’s exclusive content library with Prime Video Mobile Edition at ₹599 per year. This single-user, mobile-only annual video plan offers everyone access to high-quality entertainment exclusively on their mobile devices. Users can sign-up for this plan via the Prime Video app (on Android) or website.

Instant Access: Prime Members can watch anywhere, anytime on the Prime Video app for smart TVs, mobile devices, Fire TV, Fire TV stick, Fire tablets, Apple TV, & multiple gaming devices. Prime Video is also available to consumers through Airtel and Vodafone pre-paid & post-paid subscription plans. In the Prime Video app, Prime members can download episodes on their mobile devices & tablets & watch anywhere offline at no additional cost.

Enhanced experiences: Make the most of every viewing with 4K Ultra HD- & High Dynamic Range (HDR)-compatible content. Go behind the scenes of your favourite movies & TV shows with exclusive X-Ray access, powered by IMDb. Save it for later with select mobile downloads for offline viewing.

Video Entertainment Marketplace: In addition to a Prime Video subscription, customers can also purchase add-on subscriptions to other streaming services, as well as, get rental access to movies on Prime Video. Prime Video Channels: Prime Video Channels offers friction-free & convenient access to a wide range of premium content from multiple video streaming services all available at a single destination – Prime Video website & apps. Prime Members can buy add-on subscriptions & enjoy a hassle-free entertainment experience, simplified discovery, frictionless payments, & more. Rent: Consumers can enjoy even more movies from new releases to classic favourites, available to rent – no Prime membership required. View titles available by visiting primevideo.com/store. The rental destination can be accessed via the STORE tab on primevideo.com & the Prime Video app on Android smart phones, smart-TVs, connected STBs, & Fire TV stick.

https://sfl.gl/yirya

1 note

·

View note

Text

Tiranga Apps In: Empowering India Through Technology

Understanding the Concept of Tiranga Apps In

Tiranga Apps are a collective of mobile and web applications developed within India, aimed at fostering digital independence and security. The term gained prominence after the government of India began to emphasize the importance of creating and using Indian-made apps, particularly in the context of the “Aatmanirbhar Bharat” (Self-Reliant India) initiative. These apps cover a wide range of functionalities, from social media and communication to financial services, e-governance, and education. The idea is to reduce dependency on foreign applications, which may pose risks to data security and national sovereignty, and instead, promote apps that are designed, developed, and managed by Indian enterprises.

The rise of Tiranga Apps in the Indian market has been a strategic move to not only safeguard the country’s digital infrastructure but also to encourage homegrown talent and innovation. By investing in the development of these apps, India is paving the way for a more robust and secure digital ecosystem that aligns with its cultural and economic goals.

Key Sectors Impacted by Tiranga Apps In

1. Communication and Social Media

One of the most significant impacts of Tiranga Apps in has been observed in the communication and social media sector. With the growing concerns over data privacy and security, particularly with foreign-owned platforms, India has seen a surge in the development and adoption of indigenous communication apps. Platforms like Koo, an Indian alternative to Twitter, have gained popularity, offering users a localized experience that respects Indian values and legal frameworks.

Koo allows users to express themselves in multiple Indian languages, making it accessible to a broader audience across the country. This is a crucial aspect of Tiranga Apps in, as they are designed to cater to the diverse linguistic and cultural fabric of India. By providing a platform that is tailored to Indian users, these apps are fostering a sense of community and belonging, which is often missing in globalized platforms.

Additionally, messaging apps like Sandes, developed by the National Informatics Centre (NIC), provide a secure and government-approved alternative to popular foreign messaging services. Sandes is particularly important for government officials and agencies that require a reliable and secure communication channel within the country.

2. Financial Services and Digital Payments

The financial services sector has also witnessed a significant transformation with the advent of Tiranga Apps in. The Unified Payments Interface (UPI), developed by the National Payments Corporation of India (NPCI), is a prime example of how a homegrown digital payment system can revolutionize an entire industry. UPI has made digital transactions seamless and accessible to millions of Indians, contributing to the rapid adoption of cashless payments across the country.

Apps like BHIM (Bharat Interface for Money) have become household names, allowing users to send and receive money instantly using their mobile phones. These apps are designed with a focus on simplicity and security, ensuring that even those with limited technical knowledge can use them with ease. The success of UPI and related apps has not only strengthened India’s financial infrastructure but also showcased the potential of Tiranga Apps in driving financial inclusion.

Moreover, the Indian government’s emphasis on digital financial services has led to the development of several other Tiranga Apps in the fintech space, including apps for insurance, investment, and banking. These apps are helping to democratize financial services, making them accessible to people in even the most remote parts of the country.

3. E-Governance and Public Services

Another critical area where Tiranga Apps in have made a significant impact is in e-governance and public services. The Indian government has been actively promoting the use of digital platforms to improve the efficiency and accessibility of public services. Apps like UMANG (Unified Mobile Application for New-age Governance) bring various government services under one roof, allowing citizens to access services like paying utility bills, filing taxes, and applying for government schemes from the convenience of their mobile phones.

These e-governance apps have been instrumental in bridging the gap between the government and citizens, especially in rural and remote areas where access to physical government offices may be limited. By digitizing public services, Tiranga Apps in are helping to reduce corruption, improve transparency, and ensure that benefits reach the intended recipients more efficiently.

In addition to UMANG, there are several other Tiranga Apps in the e-governance space, such as Aarogya Setu, which played a crucial role during the COVID-19 pandemic by enabling contact tracing and providing real-time information on the spread of the virus. These apps are examples of how technology can be leveraged to address pressing public health and governance challenges.

4. Education and E-Learning

The education sector in India has also been transformed by Tiranga Apps in, particularly in the wake of the COVID-19 pandemic, which necessitated a rapid shift to online learning. Apps like DIKSHA (Digital Infrastructure for Knowledge Sharing) and ePathshala have become essential tools for students and teachers, offering a wide range of digital resources and interactive learning materials.

These educational apps are designed to cater to students across different age groups and educational levels, providing content in multiple languages and formats. By making high-quality educational resources accessible to students across the country, Tiranga Apps in are playing a vital role in bridging the digital divide and ensuring that every child has the opportunity to learn and grow.

In addition to government-backed platforms, there are several privately developed Tiranga Apps in the edtech space, such as Byju’s and Unacademy, which have gained international recognition for their innovative approaches to online learning. These apps are not only enhancing the learning experience for students in India but also positioning the country as a leader in the global edtech industry.

The Future of Tiranga Apps In India

The future of Tiranga Apps in India looks promising as more sectors recognize the value of homegrown digital solutions. With continued government support and increasing awareness among consumers, the adoption of Tiranga Apps is likely to grow further, making India more self-reliant in the digital domain. As these apps evolve, they will continue to play a crucial role in shaping India’s digital future, promoting innovation, and ensuring that the country remains at the forefront of technological advancement.

Moreover, the success of Tiranga Apps in has the potential to inspire other countries to develop their digital ecosystems, leading to a more decentralized and secure global digital landscape. By prioritizing national interests and supporting local innovation, Tiranga Apps in can serve as a model for other nations seeking to enhance their digital sovereignty.

Conclusion

Tiranga Apps in represent a significant step towards achieving digital self-reliance in India. By focusing on the development and adoption of indigenous apps across various sectors, India is not only enhancing its digital infrastructure but also fostering innovation and security. From communication and social media to financial services, e-governance, and education, Tiranga Apps in are making a profound impact on the lives of millions of Indians.

As we move forward, it is crucial to continue supporting and promoting Tiranga Apps in to ensure that India remains a leader in the global digital arena. We invite you to share your thoughts on Tiranga Apps in the comments section below. Have you used any of these apps? What has been your experience? Let’s continue the conversation and explore how these apps can further contribute to India’s growth and development.

0 notes

Text

The Future of Open Banking

Introduction

Open banking is a system where banks and financial institutions share customers’ financial data with authorized third parties. This data sharing, previously not allowed, enables the making of innovative financial services and products, such as comparison tools and personal finance management apps.

To understand this system, let us look into the essentials crucial for its working. Open Banking involves sharing data among banks, credit card providers, and Data Requestors like Fintechs, retailers, and insurers. Managing this connectivity is complex for many organizations that view data management as peripheral. AISPs aggregate and share data from various sources, reducing costs and allowing businesses to focus on core operations. Middleware and Value-Added Services monitor data exchanges, manage volumes, and reduce outage risks. Strong Customer Authentication (SCA) and multi-layered fraud controls ensure secure customer transactions. Tools like consent receipts and dashboards facilitate effective consent management in Open Banking and GDPR, ensuring transparency and trust. AI, machine learning, and data science validate income and expenses, enhancing personalized lending decisions. Using transactional data throughout a loan’s lifecycle allows proactive monitoring of financial circumstances, supporting responsible lending practices and enhancing customer trust.

Benefits of open banking

Open banking enhances customer satisfaction by decentralizing systems and enabling secure data sharing among institutions, improving convenience in tasks like bank switching and product selection. It empowers lenders with detailed consumer insights for better loan terms and supports informed financial decisions. Additionally, it drives competitive pricing, enhances product offerings, and fosters industry innovation, providing customers with comprehensive financial insights and customized tools for effective financial management.

Real-world applications of open banking

Peer-to-peer payments :

India’s Unified Payments Interface (UPI) exemplifies Open Banking by enabling third-party payments through a centralized API, capturing nearly 80% of all digital payments in India by 2023. Similarly, Bahrain’s BenefitPay app, which uses Open Banking, saw a 73% CAGR over three years.

Account aggregation :

Platforms like Plaid aggregate financial data from multiple sources, simplifying account management and financial analysis.

Instant payments :

Innovations like GoCardless’s Inst a Bank Pay offer instant payment confirmation for bank-to-bank transactions, bypassing the traditional 2-3 day wait.

Leading Open Banking API providers

Salt Edge :

Salt Edge offers open banking API solutions to help businesses create smart services. Their universal platform eases the burden on businesses, enabling diverse use cases built on Salt Edge’s solutions.

Plaid :

Plaid provides a suite of APIs that connect fin-tech applications to users’ bank accounts, integrating Payment Initiation Services (PIS) and Account Information Services (AIS) to manage budgets, track investments, and streamline payments securely.

TrueLayer :

TrueLayer’s APIs, including AIS, Payments Initiation, and Data API, enable secure access to financial data, allowing fin-tech companies to develop applications for finance management, payments, and financial insights.

Advantages of Open Banking APIs in Indian Fin-tech

Open banking APIs enhance customer services with competitive financial products, quick and secure transactions, and broader access to diverse financial products. For Fintech companies, APIs enable rapid innovation, leverage established banks’ customer trust, and allow a specialized focus on core strengths, enriching the financial ecosystem. for banks, open banking increases efficiency, reduces costs, creates new revenue streams, and improves customer engagement and loyalty through personalized financial insights.

BHIM UPI: Integrating Open Banking with Fin-Tech Innovation

BHIM UPI, developed by NPCI, is a revolutionary platform using open APIs for instant bank transfers via mobile devices. Launched in 2016, it has transformed India’s digital payments landscape, accounting for 75% of retail digital transactions in 2022-23, and is projected to handle 1 billion transactions daily by 2026-27. BHIM UPI democratizes digital payments, especially in rural and semi-urban areas, promoting financial inclusion. Its open API architecture fosters third-party payment app development, driving Fintech innovation and competition, and exemplifying how open banking simplifies finance and enhances accessibility.

Future insights: open banking APIs in Indian Fintech

Open banking is set to grow significantly with global users expected to reach 132.2 million by 2024. AI will enhance personalization through tailored financial advice and predictive analytics. Blockchain integration promises improved security and transparency in transactions, benefiting cross-border payments and regulatory compliance. Open banking APIs democratize financial services, expanding access to underserved populations with innovative solutions like micro-loans. India’s evolving regulatory environment supports open banking, promoting a secure and dynamic Fin-tech ecosystem.

Conclusion

Protecting user data and privacy is vital, achieved through strong security measures and secure consent frameworks. Standardizing APIs and ensuring they work well together requires collaboration among regulators, financial institutions, and Fin-tech companies. Adapting to changing regulations is essential to managing legal and operational risks successfullyIndia’s fin-tech sector is poised for transformative changes with open banking APIs, leading in innovation, security, and financial inclusion. By embracing collaboration and technological advancement, India can set a global benchmark for financial services.

Author : Exito

0 notes

Text

Mahadev satta scandal: 800 branches flourish despite enforcement crackdown

New Delhi : The Mahadev online betting is going on across the country. Police and ED are continuously taking action. After so much strictness, there has been no impact on it. Like before, the system of Mahadev Book is still working. About 800 branches are operating worldwide. This information is released in the advertisement of the betting app. About 10 thousand people are connected to this network. Of these, about nine thousand people are working in different branches and panels. During the operation, big Khaiwals have left the city. Some are in Dubai and some are living in Goa, Hyderabad and Pune.

According to the information, every month 70 youth from across the country including Chhattisgarh go to Dubai, who are given training for different jobs. After this they are sent back. He comes here and conducts betting. Give training to new youth.

Mobile numbers of Mahadev Book are given in the advertisements. As soon as you send a message on WhatsApp, you are first asked to select a panel to get the ID. As soon as the panel is selected, the process of sending the money is explained. After this, name is asked for making ID. As soon as the name is sent, the ID is generated within a minute. Betting starts as soon as the ID is logged in. You get a token only for the amount of money deposited. After winning, the player can ask for the amount whenever he wants. Within half an hour the money is credited to the player’s account.

It is also mentioned in the ED’s FIR that the promoters of Mahadev Book App have invested the illegal money earned from online betting in many companies. The money has also been invested in shell companies and stock market. Promoters have spent huge amounts of cash on betting websites to promote online betting. For this, annual star studded programs were organized every year, in which the celebrities involved were paid with the illegal money received from betting.

EOW has named Bhupesh Baghel, Ravi Uppal, Shubham Soni, Chandrabhushan Verma, Asimdas, Satish Chandrakar, Nitish Diwan, Saurabh Chandrakar, Anil Aggarwal, Vikas Chhaparia, Rohit Gulati, Vishal Ahuja, Dheeraj Ahuja, Anil Dammani, Sunil Dammani, Bhim Singh in the FIR. Yadav, Harishankar Tibarwal, Surendra Bagri, Suraj Chokhani have been made accused.

Branches are available at 20 to 40 percent discount. More than 800 branches of Mahadev Book are still running across the world. A branch is available for 20 to 40 percent commission. The settling amount of each branch is also different. There is a system of settling every week. Presently settling is happening twice a week. An amount of Rs 15 lakh to Rs 25 lakh is also being taken as guarantee for providing the branch.

Talking about the settling amount of the branch, the settlement is ranging from Rs 15 lakh per week to more than Rs 2 crore per week. There are 1200 to 2000 players in a branch. If the branch is profitable, then the branch operator keeps 20 to 40 percent of the profit amount with himself and deposits the remaining amount in the account specified by the promoters or passes it on to the promoters through Hawala.

#ED#Scandal#Mahadev satta scandal#breakingnewsglobal#delhi news#india news#hindi news#indian express#world news

1 note

·

View note

Text

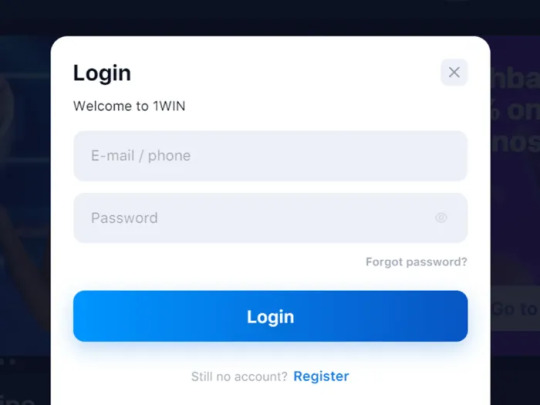

How to deposit in 1win in india

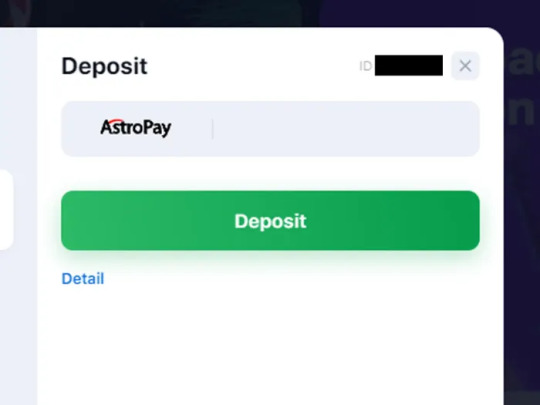

1Win Deposit Methods for India

1Win has made it easy for customers to deposit and start betting on sports or playing casino games. It offers a variety of payment options to choose from, including popular e-wallets, debit cards and bank transfers. Since 1Win officially operates in India, it accepts the local currency - rupees. Thus, Indian players don't need to spend extra time and money on currency conversion.

There are the following popular deposit methods at 1Win:

UPI;

Google Pay;

Visa;

Mastercard;

PhonePe;

Bank Transfer;

BHIM;

Skrill;

Neteller;

RuPay;

Cryptocurrency.

It is worth noting that it is safe to make deposits at 1Win. Since the bookie reliably protects all card details and personal data from third parties and uses safe protocols and certificates to mask online money transactions of customers.

What Is the Minimum Deposit at 1Win?

The minimum amount for all deposits at 1Win site is only Rs. 300. This applies to all e-wallets, debit cards and bank transfers supported by the bookie. You must have at least a minimum deposit in your account to place bets. Nevertheless, deposit as much as you want unless you have set a maximum limit for yourself.

Minimum Deposit Amount at the 1Win App

Mobile users can freely deposit their accounts through the 1Win app for Android and iOS to start betting right on the go. The software has all the functionality of depositing funds, as in the main version of the site. This means the minimum deposit amount you can make in the 1Win mobile app is the same and amounts to Rs 300 for all payment options.

First Deposit Bonus

Indian customers who have just joined 1Win can benefit from a sign-up offer of a 500% bonus up to INR. 80,400. The bonus is automatically credited to the gaming account in the form of bonus money after making a deposit. With the welcome bonus, you can not only learn the mechanism of betting in practice but also win more.

Familiarize yourself with the main terms and conditions of the 1Win welcome bonus so you won't have any trouble using it:

The welcome bonus is available once for new 1Win customers;

The minimum deposit amount is Rs. 300;

The maximum bonus amount is INR. 80,400;

Bets with odds of 3 or higher are accepted when wagering the bonus;

The offer is valid for 30 days after its activation.

Remember, the bigger your deposit, the bigger your final bonus will be. Take advantage of the 1Win welcome offer to get the most out of your online sports betting experience!

Exclusive 1Win Promo Code for the First Deposit

A great way to start betting at 1Win with maximum profit is to apply our promo code "CATHERS777" for the first deposit. It will reward you with a welcome bonus and additional rewards to make your betting experience even better. Here's what you can get by using the 1Win promo code:

500% deposit bonus up to INR. 80,400;

Cashback;

Free bets;

Weekly rewards and more.

To activate the promo code, simply enter "CATHERS777" in the registration form when you create your 1Win account and then top up it with at least Rs 300. The promotional offer is valid only once for customers who haven't played at 1Win before.

How to Deposit Money to the 1Win Account?

Depositing at 1Win is an uncomplicated process that has been optimized so that customers can fund their accounts quickly and efficiently. You can use any of the payment systems listed on the site and transfer money in just a couple of

1) Visit the official 1Win website and sign in to your account using your credentials. If you don't have an account yet, create one by entering promo code "CATHERS777" during registration.

Click on this text to visit

2) Click on the "Deposit" button in the upper right corner of the home page.

3) Choose payment method. From the list of provided deposit options, select the one you want to use for the payment.

4) Make the transfer. Enter the amount of the deposit and specify the necessary details of an e-wallet or a bank card, and then confirm the transaction.

As soon as everything is done, the money will be automatically transferred to your gaming account. Now you can bet on sports events or enjoy playing at the casino!

Deposit 1win casino With Debit Cards

Debit cards are the most popular payment methods that all Indian players can easily use to make deposits at 1Win. We have prepared a simple instruction, following which you can quickly top up your account with debit cards:

Login to your 1Win account through the official website or mobile app.

Go to your personal profile and click on the "Deposit" button.

Select Visa or Mastercard as a deposit method.

Enter the desired amount and provide the necessary card details.

Confirm the transaction.

Your 1Win account is successfully funded! With a positive balance, you can enjoy betting on sports or casino games and receive winnings.

Deposit 1win casino With Crypto

You can watch this video guide:

youtube

What Is the Standard Deposit Time at 1Win?

Deposit processing time at 1Win may vary slightly depending on the payment method you choose. Nevertheless, almost all 1Win deposit methods are instant. This means that you can access your deposited funds within minutes, perhaps even seconds, and then start playing and winning!

1Win Deposit Limits

As in the case of withdrawals, the 1Win deposit limit depends on the payment system you choose and in most cases is from Rs 50,000 to Rs 100,000. You can also set a daily or weekly limit in your account settings, to avoid overdoing it in sports betting. It should be noted, the bookie doesn't charge any commission for transactions, but there may be fees from the bank or the payment system.

1Win Deposit Summary

In conclusion in our Sportscafe review, we can mention the excellent 1Win deposit system. The site gathers all popular payment systems in India with the help of which it is simple to conduct money transactions in rupees. There are no complicated steps to make a deposit, as 1Win is all about simplicity, reliability and security. All deposits are processed quickly and the bookie doesn't charge any fees. You don't have to worry about the security of your personal data during transactions as 1Win uses SSL encryption and doesn't share data with third parties.

FAQ

If you still have questions about 1Win deposits, you can check out the short FAQ below. You may also get all the answers to your questions related to deposit problems by contacting 1Win support via live chat or email.

Can I Use the 1Win Deposit Bonus Twice?

No, you can't. The 1Win welcome bonus is eligible only once for new customers who haven't been registered on the site before. To qualify for the sign-up offer, open a new account with promo code "CATHERS777" and then make a deposit of at least Rs 300.

Can I Make Deposits in Rupees in 1Win?

1Win tries to meet the needs of absolutely all its customers, for this reason, Indian users can deposit money with maximum comfort and without problems in rupees. However, you will need to select INR as your account currency when registering your account.

Can I Make Deposits in Any Currency and Then Convert Them to Rupees in My 1Win Account?

Being an international company, 1Win accepts multiple currencies. The payment services the site uses to make it easy to convert different currencies into INR. So you don't need to worry if your account is opened in USD, EUR or other currencies.

Do I Need to Use the Deposit Method Only In My Own Name at the 1Win Account?

1Win is a reliable site that operates under a license agreement. For this reason, only the owner of the account can use the deposit method in his own name. Besides, 1Win uses the latest encryption technology to ensure your personal data is protected no matter which of the many available payment methods you choose.

Can I Add More Than One Debit Card at 1Win?

1Win provides many payment options and you can use any of them. To add another debit card, you first need to go to your personal profile. Then, in the deposits section, click on the arrow next to your current card number and select the option to add a card.

#casino#1win#1win deposit#how deposit 1win#1win casino#stake#stake casino#slots#online slots#crazy time#Youtube

1 note

·

View note

Text

How Foreigners Can Set Up and Use UPI Accounts?

In recent years, the Unified Payments Interface (UPI) has revolutionized the way payments are made in India. Its seamless, instant, and secure transactions have made it a favorite among residents. But what about foreigners or Non-Resident Indians (NRIs) who wish to take advantage of this convenient payment system? The good news is that setting up and using a UPI account is easier than you might think. In this guide, we'll take you through the step-by-step process to help you get started with UPI.

Step 1: Choose a UPI App

The first step in utilizing CheqUPI for seamless transactions is selecting a UPI-enabled mobile app. There are several popular options available, including Google Pay, PhonePe, Paytm, and BHIM (Bharat Interface for Money). Download your preferred app from the Google Play Store or Apple App Store.

Step 2: Installation and Account Setup

After downloading the CheqUPI app, follow these steps to set up your UPI account:

Open the App: Launch the CheqUPI app on your smartphone.

Select Language: Choose your preferred language for the app's interface.

Verify Your Mobile Number: Enter your mobile number, and the app will send an OTP (One-Time Password) for verification.

Create a PIN: Set a secure UPI PIN. This PIN will serve as your key for all future transactions.

Select Bank: Link your non-resident bank account to the CheqUPI app. Most major Indian banks support UPI, allowing you to select your bank from the provided list.

Step 3: Adding a Bank Account

Once the initial setup is complete, proceed to add your foreign bank account to the CheqUPI app:

Go to Bank Accounts Section: Navigate to the "Bank Accounts" or "Add/Link Bank Account" section within the app.

Select Your Bank: Choose your foreign bank from the list of available options. If your bank is not listed, utilize the search feature.

Enter Account Details: Input your foreign bank account number, IFSC code (Indian Financial System Code), and other required information.

Verify Bank Account: The CheqUPI app will initiate a verification process, often involving a small amount sent to your foreign bank account for confirmation. Follow the app's instructions to complete this step.

Step 4: Set Up CheqUPI ID

Once your foreign bank account is successfully linked, proceed to set up your unique CheqUPI ID:

Navigate to the CheqUPI ID Section: Locate the option to create or manage your CheqUPI ID within the app.

Choose a CheqUPI ID: Select a distinctive CheqUPI ID, such as your name followed by "@chequpi" or any other preferred format.

Verify CheqUPI ID: The app will verify the availability of your chosen CheqUPI ID. If it's available, proceed to save it for use.

Step 5: Making Transactions

With your CheqUPI account fully set up, you're now ready to conduct transactions effortlessly. Here's a simple guide to sending and receiving money using CheqUPI:

To Send Money:

Open the CheqUPI app and log in.

Select the "Send Money" or "Transfer" option.

Enter the recipient's CheqUPI ID, mobile number, or bank account details.

Input the desired amount and include a remark if necessary.

Confirm the transaction by entering your CheqUPI PIN.

To Receive Money:

Share your CheqUPI ID with the sender.

The sender can then use your CheqUPI ID to initiate the payment.

You'll receive a notification regarding the incoming transaction.

Enter your CheqUPI PIN to accept the payment securely.

With these simple steps, foreigners and NRIs can easily set up and use UPI accounts for seamless transactions in India. Whether you're sending money to family members, paying bills, or shopping online, UPI offers a convenient and secure payment solution at your fingertips. Embrace the digital revolution of UPI and enjoy hassle-free banking experiences from anywhere in the world!

Step 6: Security Tips

While utilizing CheqUPI, it is paramount to prioritize security. Here are essential tips to safeguard your transactions:

Protect Your PIN and OTP: Never share your CheqUPI PIN or OTP with anyone.

Create a Strong PIN: Use a robust and unique CheqUPI PIN for added security.

Verify Transaction Details: Before confirming any transaction, carefully review the details provided.

Monitor Transaction History: Regularly check your transaction history to identify any unauthorized activities.

Keep Your App Updated: Ensure your CheqUPI app and mobile device are regularly updated with the latest security patches.

Conclusion:

The Unified Payments Interface (UPI) opens doors to a world of convenient and secure digital transactions for foreigners and Non-Resident Indians (NRIs) in India. By following the step-by-step guide outlined above, setting up and using a UPI account becomes a straightforward process.

With UPI, users can send and receive money instantly, pay bills, shop online, and more, all with just a few taps on their smartphones. The flexibility, speed, and security of UPI make it a preferred choice for individuals looking to manage their finances seamlessly, whether they are residing in India or abroad.

As the digital landscape continues to evolve, UPI stands out as a revolutionary payment system that simplifies financial transactions and empowers users with greater control over their money. So, whether you're a foreigner visiting India or an NRI wanting to stay connected with finances back home, UPI offers a reliable and efficient solution at your fingertips.

FAQs (Frequently Asked Questions):

Can I use UPI with my foreign bank account?

Yes, you can use UPI with your foreign bank account. Many UPI-enabled apps allow users to link their non-resident bank accounts to make transactions in India.

Is there a limit on the amount I can transfer using UPI as a foreigner or NRI?

The transaction limits for UPI users, including foreigners and NRIs, are set by the individual banks and may vary. Typically, there are daily and per-transaction limits imposed for security purposes.

How can I change my UPI PIN if I forget it?

If you forget your UPI PIN, most UPI apps have an option to reset or change the PIN. This usually involves verifying your identity through your registered mobile number and email.

Can I use UPI to pay bills and make online purchases?

Absolutely! UPI offers a wide range of services, including bill payments, online shopping, ticket bookings, and more. You can conveniently use your UPI account for various transactions within India.

Is UPI safe for making transactions?

Yes, UPI is considered a safe and secure payment method. It uses multi-factor authentication, including PINs and OTPs, to ensure the security of transactions. However, it's essential to keep your UPI PIN and account details confidential and avoid sharing them with anyone.

Can I link multiple bank accounts to my UPI ID?

Yes, many UPI apps allow users to link multiple bank accounts to a single UPI ID. This feature provides added flexibility for managing finances across different accounts.

What should I do if a UPI transaction fails or gets stuck?

In case of a failed or stuck transaction, most UPI apps have a customer support helpline or a "Transaction History" section where you can check the status of your transaction. You can also reach out to your bank for assistance in resolving any issues.

Is there a fee associated with using UPI?

UPI transactions are generally free of charge for users. However, some banks or apps may levy minimal charges for certain transactions or services. It's advisable to check with your bank or the UPI app for any applicable fees.

Can I use UPI for international transactions?

No, UPI is primarily designed for domestic transactions within India. For international transactions, other methods such as SWIFT transfers or international cards are typically used.

How long does it take for a UPI transaction to reflect in the recipient's account?

UPI transactions are usually instant, and the funds should be reflected in the recipient's account within a few seconds. However, in some cases, it may take a few minutes depending on the bank's processing time.

0 notes

Text

4 Reasons Why You Should Get a King Exchange Cricket ID

Are you a cricket betting enthusiast looking for the best online experience? Getting a King Exchange cricket ID should be your top priority! As India's premier cricket betting platform, King Exchange offers members exclusive odds, huge bonuses and secure payment methods.

In this guide, we will highlight 4 compelling reasons why you should sign up for your King Exchange account right now before the highly anticipated IPL 2023 tournament. With lucrative odds, big welcome offers, fast deposits and round-the-clock support, King Exchange has everything you need to bet on cricket with confidence.

1. Wide Range of Cricket Games at Your Fingertips

One of the main reasons to get a King Exchange Cricket ID is the unlimited access it grants to cricket events taking place all over the globe. Whether it is international tournaments, local leagues, or T20 extravaganzas, the King Exchange has a wide range of coverage. With the advancement of technology, you can follow your favorite teams and players anywhere in the world and bet on match-related outcomes. The platform keeps its event updates frequently so you don't miss any of the fun. This wide coverage gives all cricket lovers an opportunity to enjoy the games in one platform.

2. Live Betting and In-Time Updates.

The live betting is real fun, and with a King Exchange Cricket ID you can make it happen. The platform features real-time updates, which enable you to make educated guesses and place bets while the game is live on the field. This function is a plus in terms of watching live cricket on the internet, since you can respond immediately to any ball bowled or shot played. Also, the King Exchange app helps you keep up with the market as long as you have your device. It is perfect for those who have a busy schedule to participate in live betting from anywhere, at any time.

3. User-Friendly Platform and the Registration Process Are Easy

The user-friendly interface of King Exchange is what sets it apart among its competitors and makes it suitable for both beginners and experienced bettors to navigate. King Exchange Cricket ID registration is a breeze, all thanks to the simple King Exchange registration process. The platform will take you through every step, and you won’t have to worry about the hassle of setting up. Having register, you can easily log in, deposit money, and begin betting in a matter of a few clicks. The user-friendliness is one of the good reasons King Exchange is often favored by users over other gambling platforms.

4. Utilize Fast, Safe Cricket Betting Payment Methods

Funding your account on King Exchange is simple, convenient and 100% secure. Leading payment options include:

UPI – Instant deposits via Google Pay, Paytm, PhonePe, BHIM & more

NetBanking – All major Indian banks supported

Paytm – Direct top-up facility

AstroPay – Secure global payment service

With quick processing and data encryption, you can bet on cricket safely in just minutes.

Conclusion

We hope we’ve highlighted why King Exchange is an essential cricket betting account. Sign up for your King Exchange ID today and unlock the ultimate cricket betting experience just in time for the IPL!

0 notes

Text

India Digital Payment Market size by value at USD 116.6 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the India Digital Payment Market size to expand at a CAGR of 10.09% reaching a value of USD 123.23 billion by 2030. The Digital Payment Market in India is propelled by the government’s increasing number of supportive initiatives, growing adoption of technological advancements, further deepening of internet and smartphone penetration, and the burgeoning e-commerce sector. Government policies, such as the demonetization policy of 2016 and initiatives like Digital India, Make in India, and Startup India, have significantly accelerated the adoption of digital payments. The introduction of the Unified Payments Interface (UPI) and the Bharat Interface for Money (BHIM) app has further revolutionized the digital payments landscape, enabling seamless real-time transactions. The rise in the number of internet users along with the widespread adoption of smartphones, has also fueled the growth of mobile wallets and other digital payment methods. The expanding e-commerce market has increased the demand for digital payments, while private sector contributions, including various digital payment solutions like mobile wallets and QR code-based systems, complement government efforts. Furthermore, targeted initiatives in rural areas have expanded financial inclusion, supporting the overall growth of the digital payment ecosystem in India. The dynamic environment underscores a promising future for digital payments, as the market continues to evolve and expand.

Opportunity – Innovations in digital payment solutions

Innovations in payment solutions have been a catalyst for the growth of India Digital Payment Market. Specialized banks like Airtel Payments Bank and Paytm Payments Bank have spearheaded financial inclusion and digital transactions. Simultaneously, the widespread adoption of digital payment apps, such as Google Pay and PhonePe, has revolutionized the payment landscape, offering secure and convenient options for various transactions. Integration of diverse online payment modes by e-commerce platforms has further fueled market expansion. Projections suggest substantial growth, with the sector expected to reach USD 2.3 trillion by 2026, underscoring the transformative impact of these innovations on India's financial ecosystem. This evolution signifies a major step toward a cashless society, driven by advancements in payment solutions and changing consumer behaviors.

Sample Request @ https://www.blueweaveconsulting.com/report/india-digital-payment-market/report-sample

0 notes

Text

BHIM app is giving total cashback of Rs 750; Know how you can make a claim

BHIM app is giving total cashback of Rs 750; Know how you can make a claim

0 notes

Text

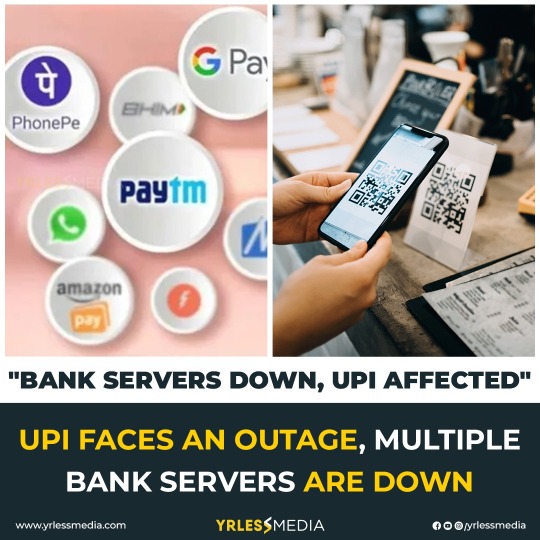

On Tuesday, multiple Unified Payments Interface (UPI) users took to social media to complain about an outage during transactions.

Netizens said making payments through UPI-enabled apps like Google Pay, PhonePe, Paytm, BHIM, etc was getting challenging, which the National Payments Corporation of India (NPCI) said was due to "internal technical issues" at a few banks.

"Regret inconvenience on UPI connectivity as a few banks have some internal technical issues. NPCI systems are working fine and we are working with these banks to ensure a quick resolution," said NPCI on the X platform (formerly Twitter).

X users complained most problems were faced when they tried making UPI payments through their HDFC Bank, State Bank of India, and Bank of Baroda accounts, among other banks.

#upi #downfall #serverbusy #bankservers #paytm #googlepay #phonepay #amazonpay #payments #onlinepayments #money #onlinetransactions #affected #notgettingmoney #hyderabad #yrlessmedia

1 note

·

View note