#Avoiding Online Scams

Explore tagged Tumblr posts

Text

The Dark Side of Making Money Online: Hidden Risks

As an Indian entrepreneur online, I’ve learned that easy money and passive income are often lies. The real deal of making money online is much harder than what “Get Rich Quick” gurus say. The idea of making money online sounds great. It promises wealth with little effort from home. But, the truth is, success online takes at least 5 years of hard work, not the quick fixes some promise. Exploring…

#Avoiding Online Scams#Cyber Fraud Prevention#Digital Business Security#Earning Online Safely#Financial Scams#Internet Money-Making Threats#Internet Wealth Risks#Online Money-Making Risks#Scams in Internet Business#Secure Online Income

0 notes

Text

#QR code scams#Online fraud prevention#Cybersecurity tips#Avoiding online scams#Secure online transactions#Phishing prevention

0 notes

Text

youtube

Are you a FeetFinder creator or buyer? Don’t fall victim to scammers! In this video, we expose the latest tricks used by scammers to target FeetFinder users and share essential tips for verifying your account safely. Discover how to protect your info, avoid third-party scams, and use FeetFinder with confidence. Watch now to learn the steps to stay secure and keep your transactions scam-free!

#feetfinder scam prevention#how to prevent scams#feetfinder scams#online scams#how to avoid online scams#feetfinder verification#using feetfinder without getting scammed#Youtube

23 notes

·

View notes

Text

To whom it may concern,

Beware of people claiming to be interested in your photographs/artworks/drawings etc. They will feign interest in order to get your work, often time claiming to want to buy the rights to your work for some project they may have. They will usually offer you a large sum of money for your work, upwards of $10,000 dollars at times. However this is a ploy to scam you out of what is rightfully yours.

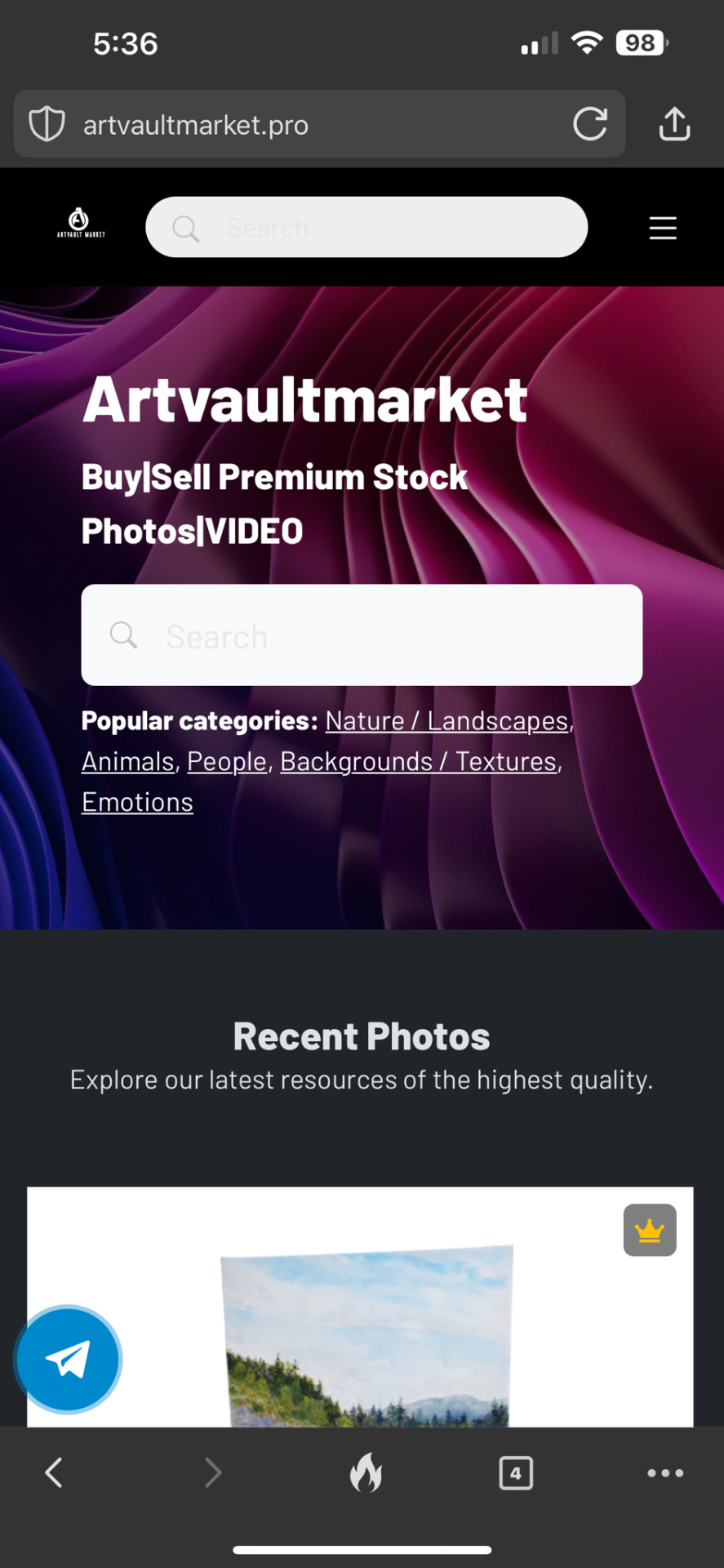

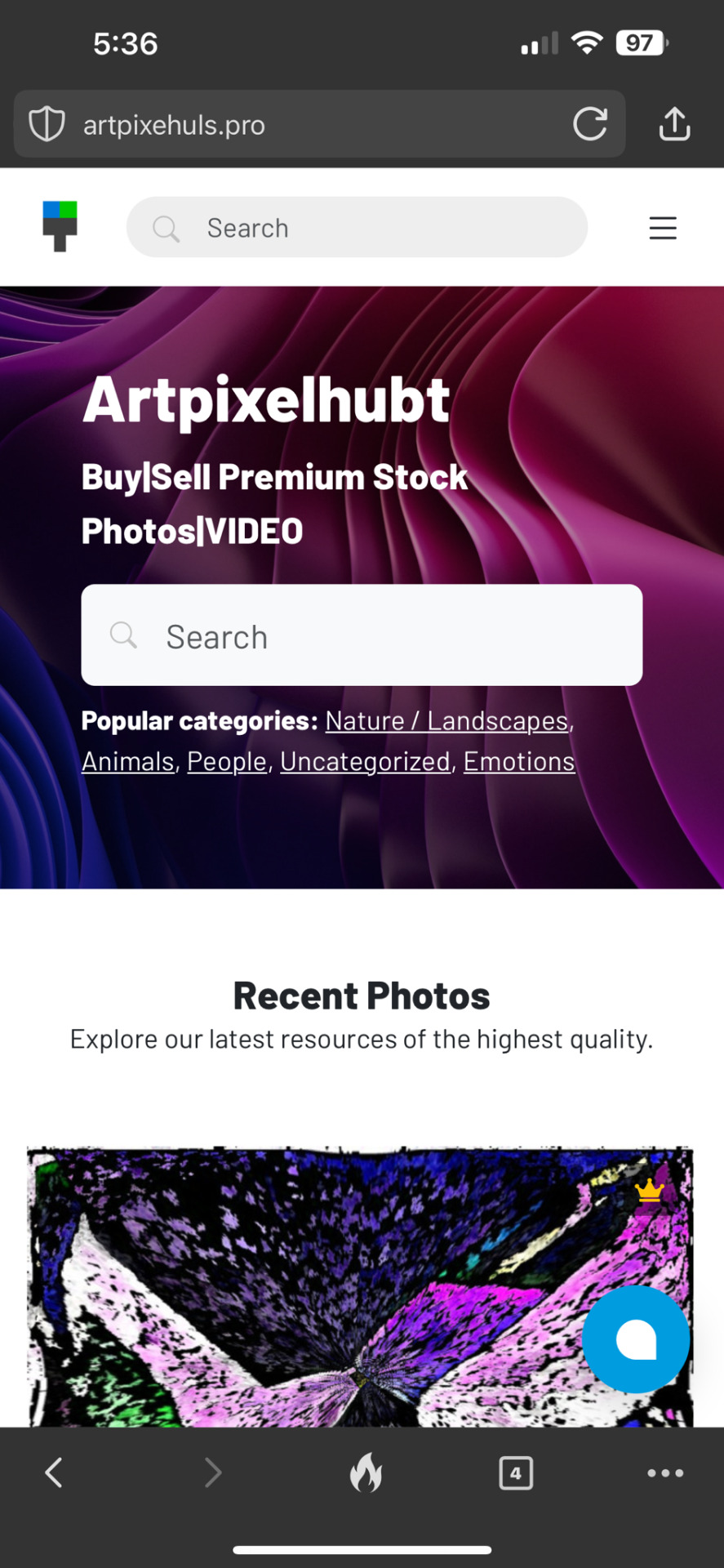

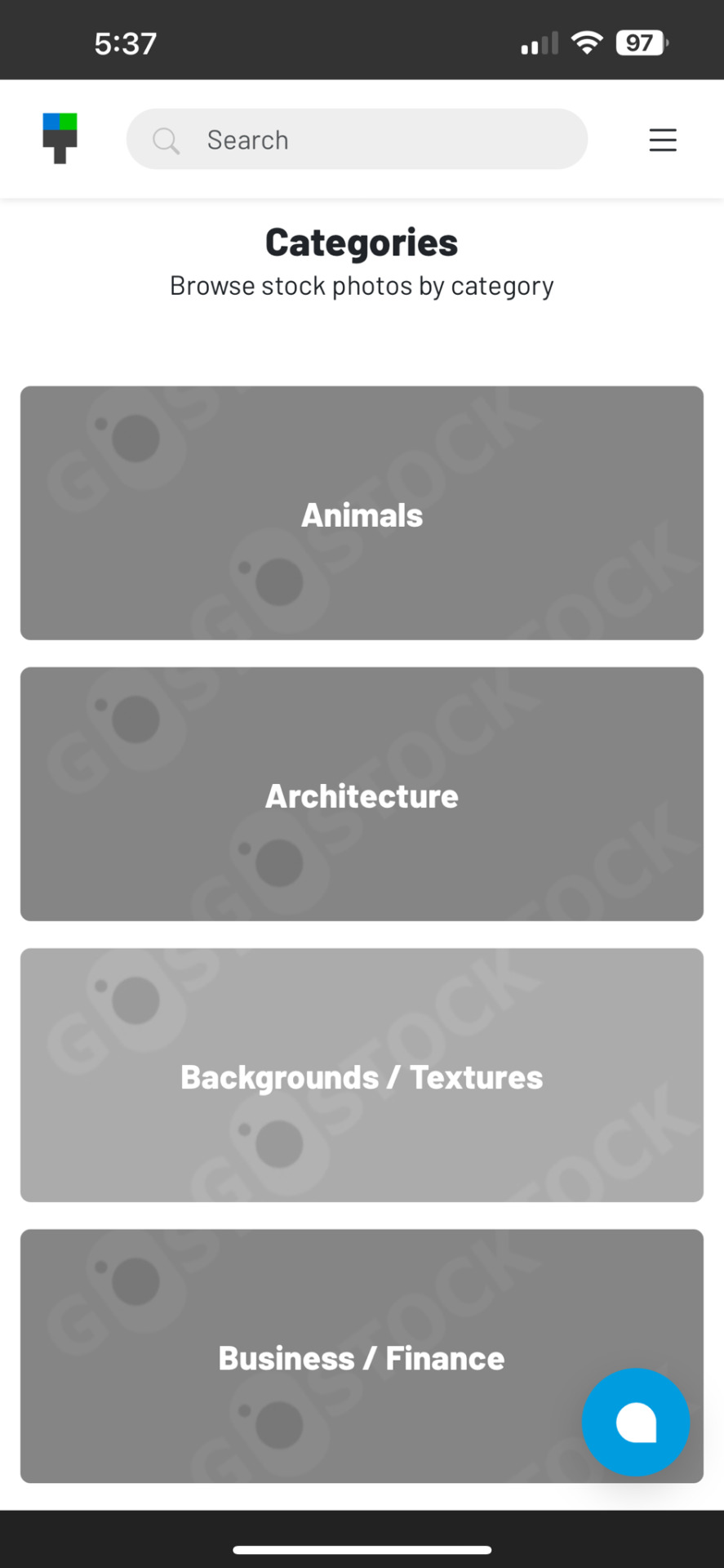

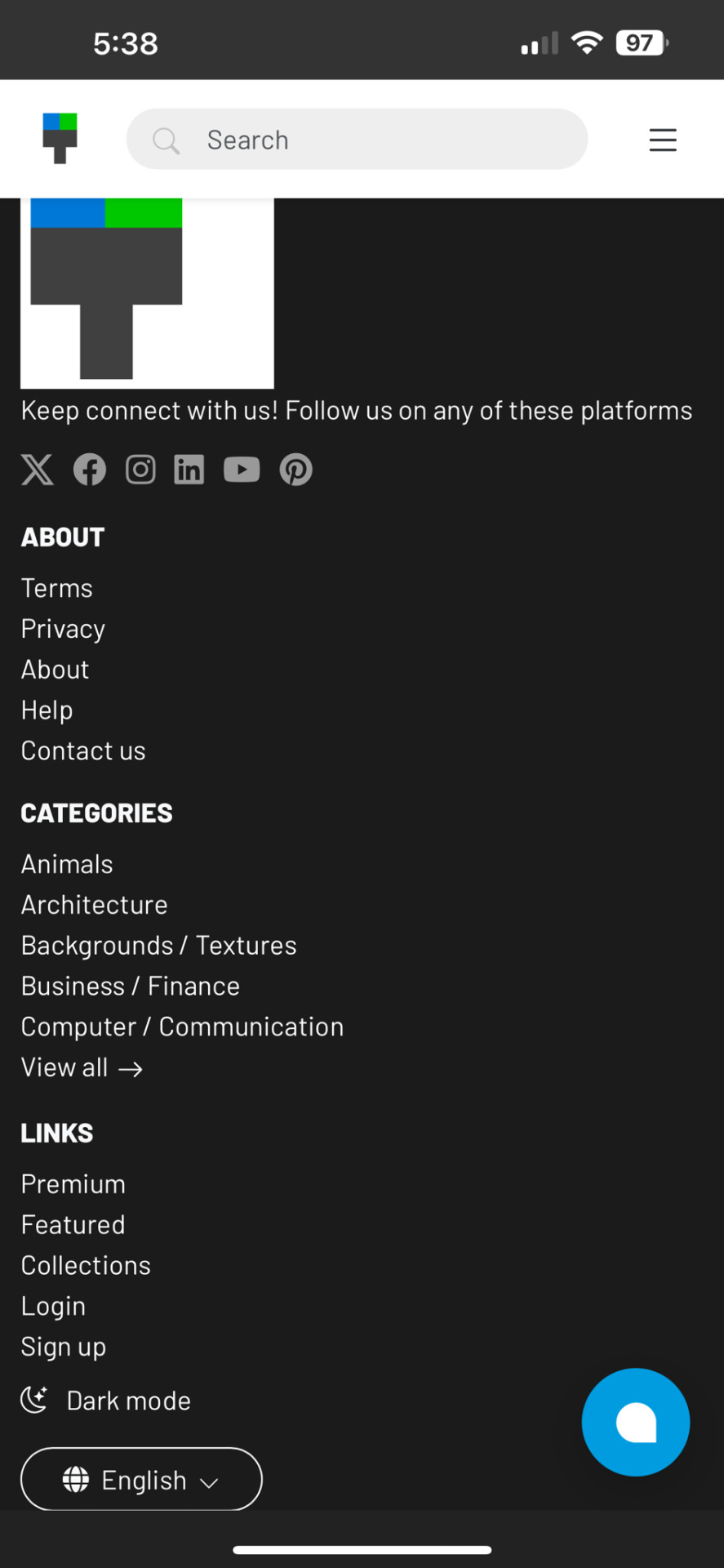

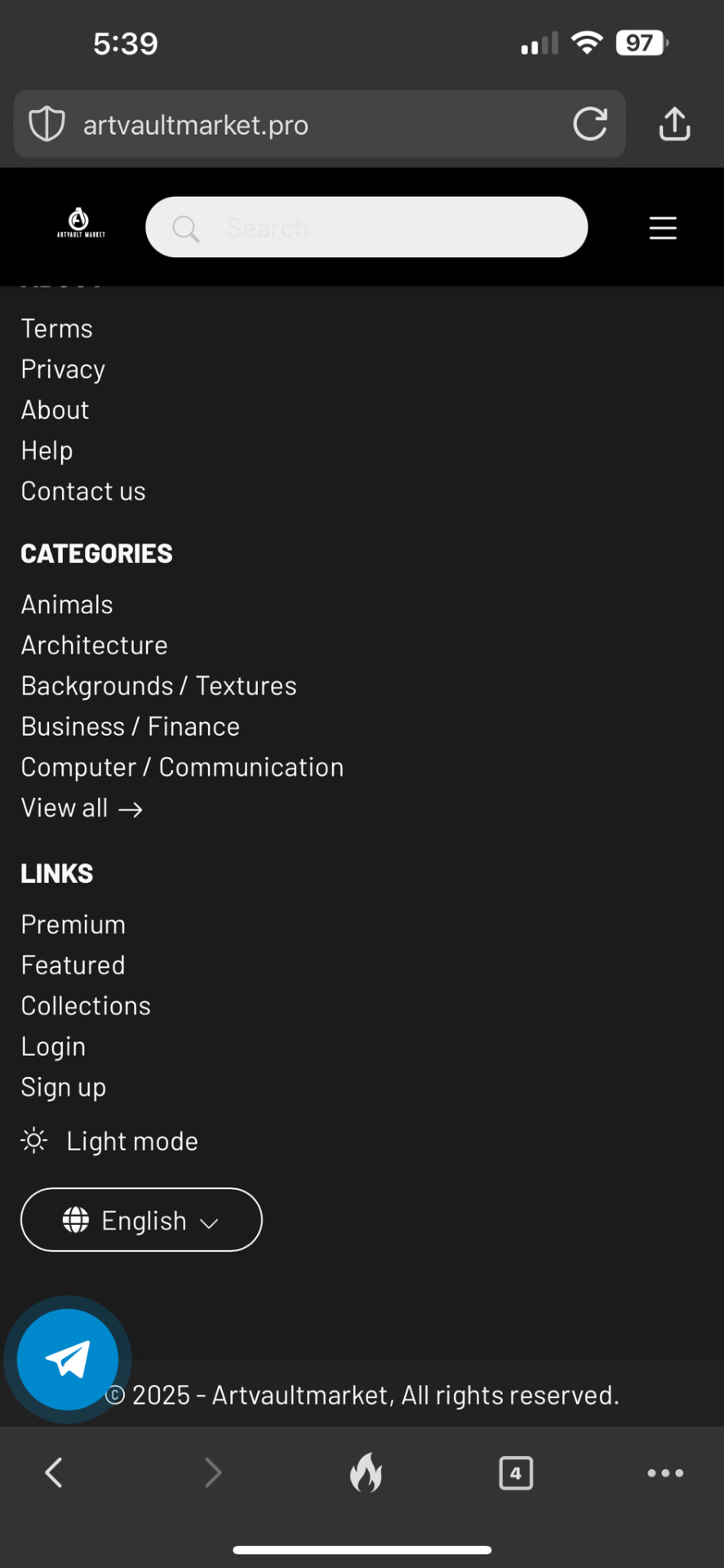

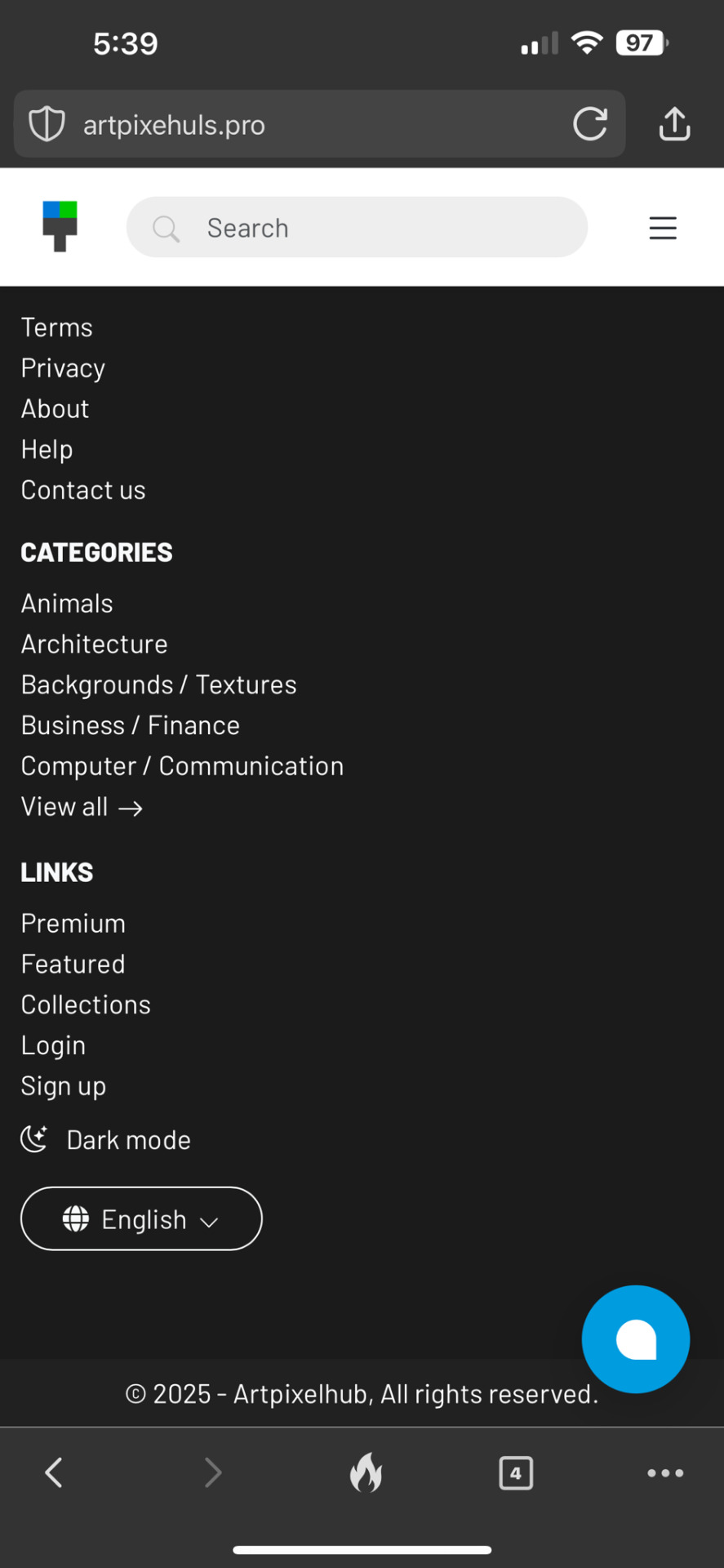

They will usually direct you to a website of their choosing, even if you have a way of taking payment. They will usually say that it’s for their convenience but it’s a lie. Take these two “different” websites that two different scammers will direct you to. One is called “Artvaultmarket” and the other “Artpixelhub”.

They are absolutely the same, but will look professional to the untrained eye. On these websites they will seem to credit your account with payment, unfortunately the only way for you to withdraw those “funds” would be to deposit ethereum or bitcoin into a wallet they claim is the websites. Please beware, these people are devious and want nothing more than to get your hard earned money, time, attention, and most of all photographs/artworks/drawings/etc. Please be mindful when dealing with strangers on the internet. There is no direct way to report them due to them leading you off of Tumblr where the scam can happen. To the scammers and those that build these fake websites, your time will come.

Sincerely,

Silentlyinfamous

#scamartist#art scam#scam warning#scam alert#online scams#scam#scammers#commission scams#scams#crypto scams#donation scams#romance scams#gaza scams#avoid scams#tumblr help#tumblr staff#tumblr support

13 notes

·

View notes

Text

Personal Loan Pitfalls to Avoid in 2025

A personal loan can be a great financial tool when used wisely, offering quick access to funds for emergencies, home renovation, education, or debt consolidation. However, many borrowers make avoidable mistakes that lead to higher costs, financial stress, and repayment issues.

To ensure you make the most of a personal loan in 2025, let’s explore the common pitfalls to avoid and the best strategies to manage your loan effectively.

🔗 Looking for a Personal Loan? Apply Here: Check Personal Loan Options

1. Borrowing More Than You Can Afford

One of the biggest mistakes borrowers make is taking a loan amount higher than their repayment capacity.

✔ Solution: Always assess your finances and ensure your EMIs do not exceed 30-40% of your monthly income.

🔗 Check Affordable Loan Options:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

2. Ignoring Interest Rates & Loan Terms

Many borrowers overlook the actual cost of borrowing by not comparing interest rates, fees, and loan tenures.

✔ Solution: Compare interest rates, processing fees, and hidden charges before finalizing a lender.

🔗 Best Personal Loans with Low Interest Rates:

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

3. Overlooking the Impact of a Low Credit Score

Your credit score directly affects your loan approval and interest rates. A low credit score can lead to loan rejection or higher interest costs.

✔ Solution: Maintain a credit score of 700+ by making timely payments and avoiding unnecessary debt.

4. Falling for Pre-Approved Loan Scams

Many fraudsters send fake pre-approved loan offers that require advance payments before disbursing the loan.

✔ Solution: Always apply for loans through official bank websites or verified financial institutions.

🔗 Apply for a Personal Loan from Trusted Lenders:

Axis Finance Personal Loan

5. Not Reading Loan Terms & Hidden Fees

Many borrowers focus only on the interest rate and ignore charges such as: ✔ Processing Fees ✔ Prepayment Penalties ✔ Late Payment Charges

✔ Solution: Read the loan agreement carefully and ask about hidden charges before signing.

6. Choosing a Longer Tenure Without Considering Interest Costs

A longer loan tenure reduces your EMI, but it significantly increases the total interest paid over time.

✔ Solution: Choose the shortest tenure possible that allows comfortable EMI payments.

7. Defaulting on EMI Payments

Missing EMIs can lead to: ❌ Penalty charges ❌ A lower credit score ❌ Legal action in extreme cases

✔ Solution: Set up auto-debit for EMIs and maintain an emergency fund for loan repayments.

🔗 Learn How to Set Up Auto-Debit for Loan EMIs: Check Loan Repayment Options

8. Using Personal Loans for Non-Essential Expenses

Avoid using personal loans for: ❌ Luxury vacations ❌ Gambling or risky investments ❌ Unplanned shopping sprees

✔ Solution: Use personal loans only for necessary expenses like medical emergencies, home improvement, or debt consolidation.

9. Not Exploring Balance Transfer Options

If you already have a high-interest personal loan, you can transfer it to another lender offering a lower interest rate.

✔ Solution: Consider a personal loan balance transfer to reduce your EMI burden.

🔗 Best Lenders for Balance Transfers:

InCred Personal Loan

10. Applying for Multiple Loans Simultaneously

Multiple loan applications can: ❌ Lower your credit score ❌ Make lenders view you as a high-risk borrower

✔ Solution: Compare lenders carefully and apply for only one loan at a time.

11. Not Checking Prepayment & Foreclosure Charges

Some lenders charge high penalties for prepayment or foreclosure, making early repayment expensive.

✔ Solution: Choose a lender that offers low or no prepayment penalties.

12. Relying on Unverified Lenders or Loan Apps

There are many fraudulent loan apps that charge excessive interest rates and misuse borrower data.

✔ Solution: Apply only through recognized banks, NBFCs, or verified fintech platforms.

🔗 Apply Safely for a Personal Loan Here: Check Verified Loan Options

Final Thoughts: Avoid These Mistakes for a Smart Borrowing Experience

A personal loan is a valuable financial tool when used responsibly. Avoiding these common pitfalls will help you save money, protect your credit score, and reduce financial stress in 2025.

Key Takeaways:

✔ Borrow within your repayment capacity ✔ Compare interest rates & hidden charges before applying ✔ Pay EMIs on time to avoid penalties ✔ Beware of loan scams and fake lenders ✔ Use personal loans only for essential needs

🔗 Looking for a Reliable Personal Loan? Apply Here: Check Personal Loan Offers

By following these tips, you can make smarter financial decisions and ensure a hassle-free borrowing experience in 2025!

#Personal loan pitfalls to avoid in 2025#Common mistakes when taking a personal loan#Personal loan mistakes borrowers make#How to avoid personal loan scams in 2025#Things to check before taking a personal loan#finance#personal loan online#loan services#personal loans#nbfc personal loan#bank#fincrif#personal loan#personal laon#loan apps#fincrif india#Personal loan repayment mistakes#Hidden charges in personal loans#Best practices for personal loan management#Why personal loans get rejected#Personal loan EMI management tips#How to compare personal loan interest rates#Personal loan default consequences#Loan balance transfer benefits#How to reduce personal loan EMI burden#Personal loan credit score impact#Fake loan approval scams#Should you prepay a personal loan?#Personal loan tenure selection tips#Loan agreement hidden clauses

2 notes

·

View notes

Text

...so kindle's gonna be a No

#Bee reads AFTG#<- ehhhh still using this tag#Listed as “new release in lgbtq+ fiction” so I'm not even gonna try to buy that online (parents check any purchases)#I could probably find it in the library or in a store somewhere once it comes out in paperback or smth and they wouldn't care to check#But yeaaaaaah not trying that when they can look the series uhp bleh#Back to internet#And narrowly avoiding malware (already got the fake 60 second security alert!!!! Scam today)#Or patience#I fell for one of those security alert scams once actually freaked me out#Luckily it was just a calander virus so I could just block it and delete it without clicking on the link#I'm not very bright

7 notes

·

View notes

Text

#labor day#adventure time#homestar runner#90s#You can make money online by installing apps that offer rewards for your time and data. Participating in paid surveys#installing cashback browser extensions#or testing new mobile apps can be lucrative. Additionally#some cryptocurrency mining apps allow you to earn digital assets by utilizing your device's computing power. However#it's crucial to exercise caution and verify the legitimacy of these opportunities to avoid scams. Always prioritize your online security an

3 notes

·

View notes

Text

Sick of flakes, fakes, and ghosters on lifestyle apps? Here’s your no-BS guide to spotting fake profiles and serial time-wasters—plus our top Swingosphere tips to keep your energy protected and your vibe strong. Trust your gut. Use the tools. Connect smarter. #Swingosphere #LifestyleTips #CatfishProof #SwingerApps #SDCVerified #OpenLifestyle

#avoiding scams in swinger dating#catfish on dating apps#fake lifestyle profiles#how to avoid time wasters in the lifestyle#how to spot fake profiles on lifestyle apps#lifestyle app safety#lifestyle app validation feature guide#lifestyle dating red flags#safe swinger app communication tips#signs of catfish in swinger apps#swinger couple safety tips online#swinger safety tips#time wasters in lifestyle#using video chat to verify profiles

0 notes

Text

I tested out communicating with a commission scammer so you don’t have to.

(A warning guide for other newer artists!)

Yesterday, I got a comment on a recent post of mine asking if I took commissions. At first, I was excited! Commissions are few and far between for me, but I enjoy doing them (and I could use the money, as most artists could).

I began corresponding with this person over DM, and at first all seemed well—while the “pet portrait” scam thing is known in some circles, the post this person had commented on was legitimately a series of pet portraits. If someone was going to seek out an actual pet portrait, contacting through a post tagged “pet portrait” doesn’t seem unreasonable.

The first red flag came when this person offered me what was way, way more money than the price point I set out for the commissions. I was suspicious—but admittedly hopeful. There are cases where commissioners want to pay an artist more than their set rate if they think an artist is undervaluing their work (I’ve been one of those commissioners myself in better financial times!), and while this is extreme… that money would be huge for me right now, especially as I don’t live in the USA and the currency conversion would almost double the dollar amount I’d receive in my own country’s currency. That’s a week’s rent for me. I was also, admittedly, flattered by this person’s compliments of my art—like many newer artists I don’t have a foothold on social media yet, and the validation of compliments is easily seductive (Of course, that’s the point).

I pressed on, cautious but optimistic. If this was a real commission, that money would help me out a lot.

I’ve heard of commission scams where a commissioner offers to pay by (phony) check. Like many artists, I prefer PayPal. When this commissioner suggested PayPal, and was open to going through invoices (the best way to protect yourself in the event of a PayPal dispute as you have strict evidence of the terms of the transaction, in my opinion!), I retained my cautious optimism. What the hell, I thought. If this is real, they’ll pay. If it’s fake, they won’t.

Of course, this person did a good job setting things up to look legitimate. They sent convincing-looking screenshots showing they’d paid my invoice. Great, I thought! This is a real commission, how lucky am I!

Of course, that’s when things quickly took a turn. They immediately started harping on about the money already being deducted from their account before I’d received anything (which, yes, that’s how PayPal works).

They commented twice on the money being already deducted, and the repetitive language is when I was finally like “yeah, okay, definitely probably a scam, huh?” Until now, this person had done a good job seeming normal—they’d sent relatively plausible messages, hadn’t spammed me even if I took a while to reply, and of course had provided reference photos and screenshots of their “payment.”

When I checked my email spam folder, though, the game was then predictably obvious—

This email is obviously spam. The language, odd spacing and grammar, and general tone are clear indicators. So is the email address it came from—I know what the actual PayPal contact email addresses are, and this one was obviously fake (for one, it came from an @gmail account, rather than an @paypal account).

I put my foot down when the “commissioner” next emailed me. They, of course, went silent after this.

I looked at their profile after, which provided more clues to their being bullshit in hindsight. They didn’t have a profile picture, and all their reblogs were generic photo sets. These aren’t necessarily indicators an account isn’t real—some people like the default profile pic and photo sets!—but they are things I think I’ll definitely be looking out for with future commissioners.

The real thing I noticed, though, was when I went through this person’s (unlocked) likes. Small art post after small art post—all with the exact same comment I received. Dozens in a single day.

So, uh, if you receive a commission inquiry that seems a bit sketchy, maybe check their likes haha.

So what did I learn here? Maybe it’s obvious, but to be cautious lol. I took a gamble engaging with this person from the start, and I probably should have broken off contact the second that impossible amount of money was set down. The seductive quality of compliments, and how much that money would do for me as a young person struggling to pay my bills each month (like many others!), overrided my suspicions temporarily. But I still took precautions I’m glad for—using an invoice, monitoring through PayPal itself for a payment, and, obviously, not engaging with a spam email. In the end, no damage done other than someone having my dump email account… and like, I get so much spam to that account already haha, because I’ve been using that email for over a decade since I was a kid and that’s just what happens.

But I wanted to write this post because I thought others might benefit. There’s stuff out there about commission scams, but a lot of it can feel abstract—or you can think “well this person talks more organically than that example description, so maybe this is real”. For newer, younger, or hungrier artists the gamble can feel worth it, but take precautions—and know when to pull the plug!

(Oh, and go ahead and block @optimisticdefendorluminary —who is still active, but unsurprisingly quickly blocked me when I called them on the scam—just to be safe).

3 notes

·

View notes

Text

Dark Patterns: How They Work, How to Spot Them, and How to Stay Safe.

Sanjay Kumar Mohindroo Sanjay Kumar Mohindroo. skm.stayingalive.in Learn how to identify and protect yourself from dark patterns in digital spaces. Discover common deceptive tactics and practical solutions. In today’s digital world, users interact with countless websites and applications daily, expecting a seamless and trustworthy experience. However, not all digital experiences are built with…

#Avoiding Scams#Consumer Protection#Dark Patterns#Deceptive Design#Digital Ethics#Ethical Design#Manipulative UX#News#Online Safety#Privacy Protection#Sanjay Kumar Mohindroo#User Rights

0 notes

Text

হ্যাকারদের নতুন ফাঁদ! Avoid Scams, Protect Your Data & Stay Safe Online

youtube

0 notes

Text

Scam Advisor

If you want to check if a website/online service isn't a complete scam, you can try something like Scam Advisor. They help safeguard others, quickly check for frauds and report them with a single click.

You can check them out at https://www.scamadviser.com/

#online tool#safety#security#tools#web tool#check if a website is safe#avoid scams#background#communities#reading

0 notes

Text

To whom it may concern,

If you come across this account or are contacted by this account beware. This is a scam artist who will try to collaborate with you claiming to have a client interested in your work. They claim to want to use your work as “inspiration” for a project. This will happen over the course of a couple of days. They will produce a sketch of your photograph or artwork to make you think that they are working on the project. They will ask for your information so that their “client” can send you payment. They will send you a photocopied check in whatever amount was agreed upon and tell you to print it out and deposit it in your account. All the while claiming to be fair, friendly, and wanting you to get paid. When you deposit the check it will actually clear and credit your account for a while and this is when they will pressure you to send them “their” cut immediately. DO NOT DO THIS!!!! Always wait a couple of days for the bank to actually clear the check. If the check is actually legit then the money should stay there, no problem. But it always bounces and you will be left responsible for whatever amount you withdraw. Also, you look complicit. If you try to contact them to get payment or rectify the situation, they will play stupid or just be outright disrespectful. Again be aware. There is no way to report this account for scamming, but your day will come.

Sincerely,

SilentlyInfamous

#scamartist#scam#art scam#online scams#scam warning#scam alert#scammers#tumblr support#tumblr staff#tumblr help#scams#crypto scams#commission scams#avoid scams#gaza scams#romance scams#donation scams

11 notes

·

View notes

Text

How to Protect Yourself from Personal Loan Phishing Scams

In today’s digital world, personal loans have become more accessible, allowing borrowers to apply online and receive funds quickly. However, this convenience has also led to a rise in phishing scams, where fraudsters attempt to steal your personal and financial information by posing as legitimate lenders. These scams can result in identity theft, financial loss, and fraudulent loan applications in your name.

If you’re planning to apply for a personal loan, it is essential to understand how phishing scams work, the warning signs to look for, and the best ways to protect yourself.

1. What Are Personal Loan Phishing Scams?

A phishing scam is a fraudulent attempt to trick individuals into providing sensitive information such as bank details, Aadhaar number, PAN card, OTPs, or login credentials. Scammers typically impersonate banks, NBFCs, or online lending platforms and contact borrowers via emails, phone calls, SMS, or fake websites.

Once they obtain your information, they can:

Steal money from your bank account

Take a loan in your name

Misuse your identity for financial fraud

Access and sell your personal data on the dark web

2. Common Types of Personal Loan Phishing Scams

2.1 Fake Loan Approval Emails & SMS

Fraudsters send emails or SMS messages claiming that your loan has been pre-approved or that you qualify for a low-interest personal loan. These messages often contain links leading to fake lender websites designed to steal your personal information.

2.2 Fake Loan Websites & Apps

Scammers create websites and mobile apps that look like real financial institutions. They trick users into entering personal and banking details, which are then used for fraudulent activities.

2.3 Fraudulent Customer Service Calls

You may receive a phone call from a scammer pretending to be a bank representative. They claim you must provide your OTP, Aadhaar, PAN, or bank details to complete your loan application. Once you share these details, scammers can withdraw money or take loans in your name.

2.4 Loan Processing Fee Scams

Fraudsters promise quick loan disbursal with no documentation but demand advance processing fees or a loan insurance fee. Once the fee is paid, the scammer disappears, and no loan is disbursed.

2.5 Social Media Loan Scams

Some scammers advertise fake loans on Facebook, Instagram, or WhatsApp and ask potential borrowers to contact them privately. Once engaged, they request confidential details, leading to identity theft.

3. Red Flags to Identify Loan Phishing Scams

3.1 Offers That Sound Too Good to Be True

If you receive an offer promising guaranteed loan approval with no credit check, zero documentation, or extremely low-interest rates, it’s likely a scam.

3.2 Unsolicited Loan Messages

Legitimate lenders do not send random SMS, WhatsApp messages, or emails offering personal loans. Be cautious if you receive messages from unknown numbers or email addresses.

3.3 Fake Loan Websites

Before applying for a loan online, always verify the website’s domain name. Scammers often create fake websites with slightly modified spellings of real lenders to trick borrowers.

3.4 Requests for Upfront Payments

No genuine lender will ask for advance processing fees before loan approval. If a lender insists on upfront payments via UPI, Paytm, or Google Pay, it’s a scam.

3.5 Pressure to Act Immediately

Scammers create urgency by saying things like, "Limited offer – Apply now!" or "Your loan will be canceled if you don’t act fast." A real lender will give you time to review the terms.

3.6 Request for Personal Information Over the Phone

A legitimate bank or NBFC will never ask you for OTPs, passwords, or CVVs over the phone. If someone does, hang up immediately.

4. How to Protect Yourself from Loan Phishing Scams

4.1 Apply for Loans Only from Trusted Lenders

Always apply for a personal loan through registered banks, NBFCs, or reputed online lenders. Here are some safe options:

🔗 IDFC First Bank Personal Loan 🔗 Bajaj Finserv Personal Loan 🔗 Tata Capital Personal Loan 🔗 Axis Finance Personal Loan 🔗 Axis Bank Personal Loan 🔗 InCred Personal Loan

4.2 Verify the Lender’s Website

Check if the website URL starts with "https://" (secure site).

Look for official lender details on the RBI website or lender’s official website.

Avoid websites with poor design, spelling errors, or unusual domain names (e.g., "axisbankloans.xyz" instead of "axisbank.com").

4.3 Never Click on Suspicious Links

Do not click on links in unsolicited emails or messages claiming to be from a bank or NBFC. Instead, visit the official website by typing the URL manually.

4.4 Avoid Sharing Personal Information Online

Scammers may ask for your Aadhaar, PAN, or bank details via email, phone, or WhatsApp. Never share sensitive information with unknown sources.

4.5 Enable Two-Factor Authentication (2FA)

Use 2FA on your banking and email accounts to protect against unauthorized access. This adds an extra layer of security if your password is compromised.

4.6 Check Reviews & Ratings Before Downloading Loan Apps

Before installing a loan app, check:

App permissions (Avoid apps that ask for access to contacts, photos, and messages).

Reviews and ratings on Google Play or App Store.

If the app is registered with an RBI-approved lender.

4.7 Monitor Your Bank & Credit Report Regularly

Check your credit report and bank statements for unauthorized loan applications or suspicious transactions. If you spot any fraudulent activity, report it immediately.

5. What to Do If You Are a Victim of Loan Phishing?

If you have fallen victim to a loan phishing scam, take these steps:

1️⃣ Contact Your Bank Immediately – Report any unauthorized transactions and request to block your account if necessary. 2️⃣ Change Your Passwords – Update your internet banking, email, and loan account passwords immediately. 3️⃣ File a Cyber Crime Complaint – Report the fraud to the Cyber Crime Portal (www.cybercrime.gov.in) or call the National Cyber Crime Helpline (1930). 4️⃣ Report to RBI & Consumer Forum – If you have been tricked into a fake loan scheme, report it to the RBI and National Consumer Helpline (1800-11-4000). 5️⃣ Monitor Your Credit Report – Check for unauthorized loans taken in your name and dispute them with credit bureaus like CIBIL and Experian.

Stay Alert & Borrow Safely

Personal loan phishing scams are on the rise, but you can stay protected by being vigilant. Always verify loan offers, apply only through trusted lenders, and avoid clicking on suspicious links.

For safe and secure personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By staying cautious and informed, you can protect yourself from loan fraud and ensure a safe borrowing experience.

#nbfc personal loan#bank#loan services#personal loans#fincrif#personal loan#personal laon#loan apps#personal loan online#finance#fincrif india#Personal loan phishing scams#Loan fraud protection#How to avoid loan scams#Safe personal loan application#Phishing scams in personal loans#Fake loan offers#Online loan scams#Fraudulent loan websites#Personal loan safety tips#How to identify loan scams#Signs of a loan scam#Avoiding personal loan fraud#Phishing emails from loan providers#Loan application fraud prevention#How scammers trick loan applicants#Secure loan application process#Fake personal loan SMS and calls#Online loan phishing protection#Tips to protect against loan fraud

3 notes

·

View notes

Text

How to avoid sharing Social Media Scams in the Wake of a Disaster

The world is full of disasters. It is also full of people who have learned to profit off of disaster. It is an unfortunate fact of life in the modern social media/online environment that in order to avoid spreading scams, you have to make a continuous effort and you have to be cynical.

There are a lot of wonderful, well-meaning people in the world who want to help everyone who asks for it. Unfortunately, those people are easy to scam.

These are some rules to prevent you from either falling victim to scams or from passing scams along to other people.

These are not suggestions, these are not things to take into consideration, the rules listed here are RULES that you need to adopt in order to keep from spreading scams on social media.

Rules:

Never, ever share screenshots of fundraisers or resources that you haven’t verified yourself. If you see a screenshot of, say, the Antelope Valley Fairgrounds Instagram announcing that they will be accepting evacuees with RVs, you go find the Antelope Valley Fairgrounds website, you find the social media linked on their website, and you check that the post you’re seeing actually came from the entity it’s claiming to. Once you have proved that the post actually came from the entity it’s claiming to, double check that entity with a couple of verifiable sources. So, for instance, if I was checking on the Guitar Center Music Foundation I’d check Guitar Center’s website and maybe I’d look for news articles about donations from the foundation. If I was looking up the Antelope Valley Fairgrounds, I’d look for a local newspaper calendar of events that linked to the fairgrounds or would check the city websites in the area and search “fairgrounds” on them. I would not share a link to a social media page for an organization until I was 100% certain that it was actually associated with the organization. You shouldn’t either. If you see a post that claims to come from a specific group but all you have is the screenshot of the post, go find the group’s website and if it all checks out you may share it IF AND ONLY IF you add the link to the post. And if a post has a link already, click through it and STILL check that everything looks okay.

Never give money or information to someone with a free email address. This sucks. I know. But if the group you’re looking at only has a gmail address or a protonmail you have no way of knowing if they’re legitimately associated with the organization at a glance. And even if they ARE associated with the organization, the free email account demonstrates a lack of planning/commitment that has troubling implications for the handling of your money or data.

Do not share screenshots of “resources,” headlines, social media posts, or news articles. I’m done with screenshots. Screenshots are easy to fake and almost always remove context from the discussion. A standalone screenshot isn’t information, it’s a trap to get you to share something without thinking. Do not *trust* screenshots of “resources,” headlines, social media posts, or news articles. Always assume a screenshot is faked unless you have found the original post yourself. A screenshot isn’t a “resource” it is an un-source, it is intentionally removing information from the viewer and we are well past the time when people should have understood that sharing screenshots without a link to the original text in context is never, every trustworthy.

Do not give money or information to accounts without a history. This may mean individual social media accounts, or it may mean a shiny new mutual aid project that popped up near your house. It’s unfortunate that people have their accounts deleted, it’s unfortunate that new orgs have trouble finding support, but the likelihood that a new account is a scam is simply too high to trust your money or information with it. If someone is asking for money or offering help on an account that hasn’t posted for years, or that suddenly changed all its content, or that has only existed for a month with no links to other, older sites and socials, you shouldn’t trust that account.

Okay, those are the RULES. Those are the lines you draw in the sand. The TL;DR version is this:

Don’t share posts you haven’t personally verified

Don’t give money or information to accounts with generic email accounts like gmail

Don’t share or trust screenshots that have no links or further context

Don’t give info or money to brand new accounts

I absolve you of any guilt you have surrounding this. You want to share that post to help a stranger but they have only had an account for a week. You want to spread that resource, but unfortunately it is only available as screenshots of an anonymous instagram account. You think that perhaps that mutual aid group really can help people, but the only way contact them is to put your info into a google form and send an email to their gmail account. That post seems really helpful, but actually you can’t find anything that suggests that the Mt. Pacifico Aquatic Center exists outside of this twitter account. No more guilt! Guilt be gone! You do not have to feel bad for not sharing these things, or not reaching out, or not giving money because doing so would be irresponsible and would put other people at risk of being tricked by scammers or wasting what money they can donate on a potential fraud.

Now, some tips:

Always, always, always take at least ten minutes to think about giving someone money or your information online. Read the post that moved you, then re-read it, then go sit away from it for ten minutes and think about it. There’s a good chance you will still want to give, or sign up, but ten minutes away will give you a chance to consider if there are any red flags in the post that inspired you.

Independently search everything you’re going to share. Go outside of social platforms and check on search engines. Check Wikipedia. Look up the website and send a while clicking around. Go on a *different* social media platform and check their account.

Just straight up search “[SUBJECT] Scam” before you do anything. See if this thing you’re looking at is actually an old scam that’s revamped for a new disaster. See if you can find an explanation of how something might be a scam or risk in a way that you didn’t understand before.

Get used to getting away from social media. Go check websites.

Learn domain name syntax. “musicfoundationguit.arcenter.com” is a bullshit scam. “guitarcenterfounditaon.org” is a bullshit scam. “guitarcenter-foundation.org” is a bullshit scam. The actual domain is “guitarcenterfoundation.org” and the link to the correct page isn’t going to be “guitarcenter.foundationfires.org” it’s going to be “guitarcenterfoundation.org/fires”

Tips for Orgs:

If you do not want your org to look like a scam you are going to have to put some effort into it. Unfortunately this will probably also require at least a little bit of money; I know it’s hard to get money together at the beginning, but it will pay off in the long run.

Invest in a domain and hosted email. You can get relatively inexpensive hosted email through most domain registrars and even if you only get one email address for your domain you can forward it to all the free gmail and protonmail accounts you want. But buy a domain, set up a simple website, and get an info@[yourdomain].com email set up because you don’t want people emailing “[email protected]” because it’s super fucking easy for a 1337 hax0r like me to set up “[email protected]” and scam the people who want to reach out to you.

Make a blog on your actual website, not on a social media site. A blog means that you can make regular posts and establish a history to prove that you are real and you do real stuff; it will also help with SEO and help to ensure that when people search for your org YOU are what comes up. Keeping up calendars of previous activities with links to those activities is also good.

Set up social handles on all the sites you use, make a “socials” page on your website, and link to your handles so that people can verify if you’re the one posting something. If you don’t make it extremely easy to find your socials, that means it’s extremely easy to set up fake accounts claiming to be you. Then put the link to your website in the bio on your socials.

If you are offering something or holding a fundraiser or doing anything on your social media page, link it back to your website. If you have an IG post offering resources, you should include a url for your site in each image. If you share a photo on twitter with the info for a march, that should link back to your website with more info about the march. If you post a fundraiser on tumblr you need to link the fundraising page of your website on that post.

If you absolutely positively cannot set up a website and a real-ass email address, set up a linktree, choose a primary social media to post on that all the others refer back to, and very explicitly state what your email address is and that you do not have other email addresses somewhere that's difficult to miss. Build a history of posts and link to other orgs that you work with or any writeups or stories about your events or projects. The point of all of this is making yourself easy to verify. "[email protected]" sucks but it sucks a lot less if it's in the bio of "@northfulltertonfnb" and that page has a two year history of posting meal share schedules and menus.

In conclusion, don't share things that you haven't personally checked. When in doubt, it is always safer not to share.

5K notes

·

View notes

Text

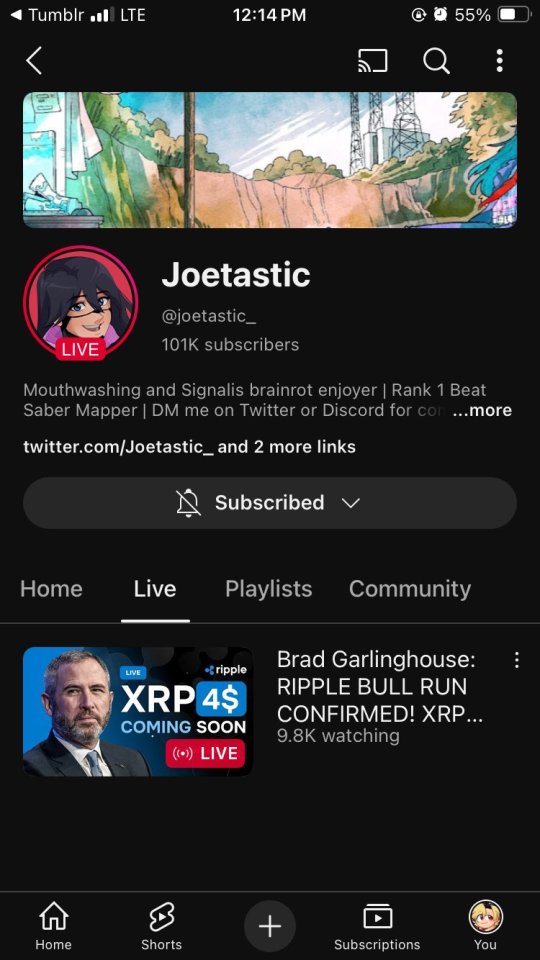

Someone accessed my Gmail 2 days ago, compromising my linked accounts like Twitter and YouTube. Here's how it happened, why I fell for it, and what you can learn to avoid making the same mistake:

The scam I fell victim to was a cookie hijack. The hacker used malicious software to steal my browser cookies (stuff like autofill, auto sign in, etc), allowing them to sign in to my Gmail and other accounts, completely bypassing my 2FA and other security protocols.

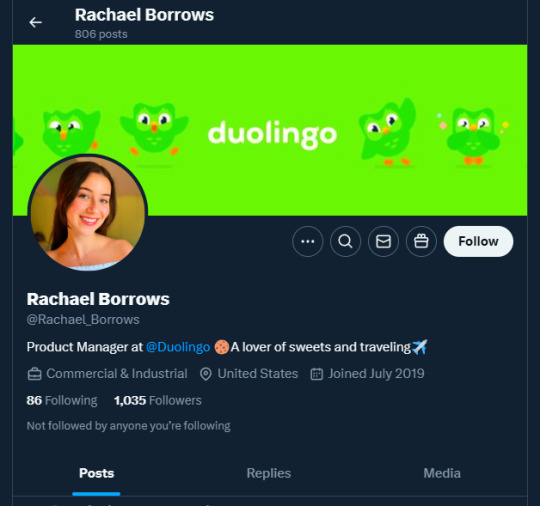

A few days ago, I received a DM from @Rachael_Borrows, who claimed to be a manager at @Duolingo. The account seemed legitimate. It was verified, created in 2019, and had over 1k followers, consistent with other managers I’d seen at the time n I even did a Google search of this person and didnt find anything suspicious.

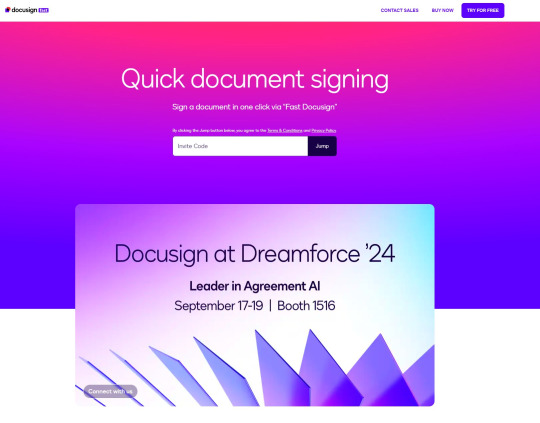

She claimed that @Duolingo wanted me to create a promo video, which got me excited and managed to get my guard down. After discussing I was asked to sign a contract and at app(.)fastsigndocu(.)com. If you see this link, ITS A SCAM! Do NOT download ANY files from this site.

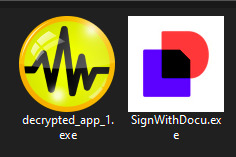

Unfortunately, I downloaded a file from the website, and it downloaded without triggering any firewall or antivirus warnings. Thinking it was just a PDF, I opened it. The moment I did, my console and Google Chrome flashed. That’s when I knew I was in trouble. I immediately did an antivirus scan and these were some of the programs it found that were added to my PC without me knowing:

The thing about cookie hijacking is that it completely bypasses 2FA which should have been my strongest line of defense. I was immediately signed out of all my accounts and within a minute, they changed everything: passwords, 2FA, phone, recovery emails, backup codes, etc.

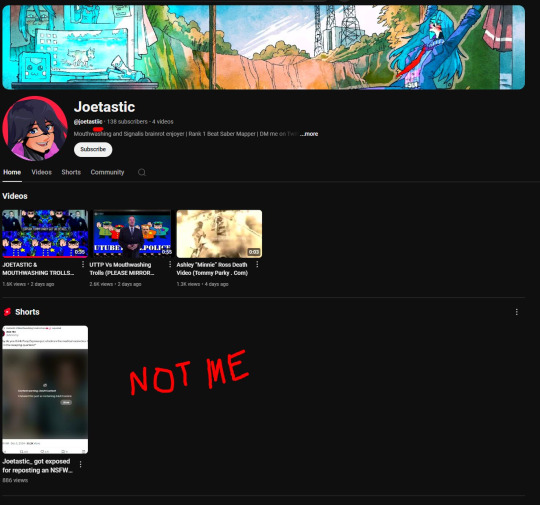

I tried all methods but hit dead ends trying to recover them. Thankfully, my Discord wasn’t connected, so I alerted everyone I knew there. I also had an alternate account, @JLCmapping, managed by a friend, which I used to immediately inform @/TeamYouTube about the situation

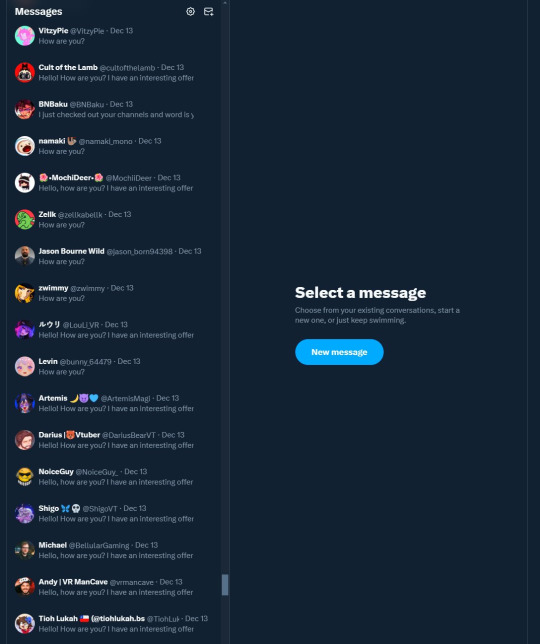

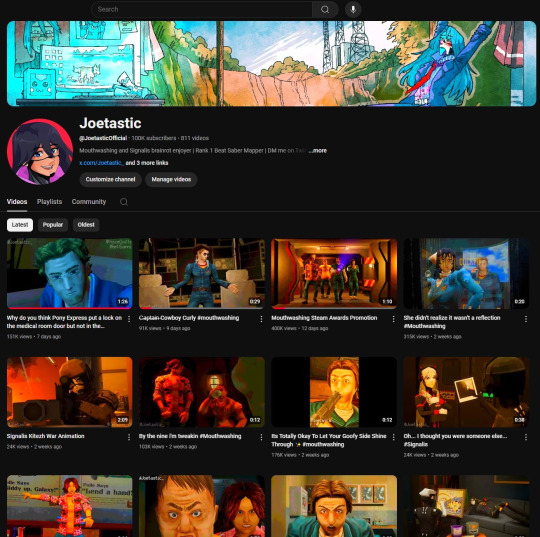

Meanwhile, the hackers turned my YouTube channel into a crypto channel and used my Twitter account to spam hundreds of messages, trying to use my image and reputation to scam more victims

Thankfully, YouTube responded quickly and terminated the channel. Within 48 hours, they locked the hacker out of my Gmail and restored my access. They also helped me recover my channel, which has been renamed to JoetasticOfficial since Joetastic_ was no longer available.

Since then, I’ve taken several steps to secure my accounts and prevent this from happening again. This has been a wake-up call to me, and now I am more cautious around people online. I hope sharing it helps others avoid falling victim to similar attacks. (End)

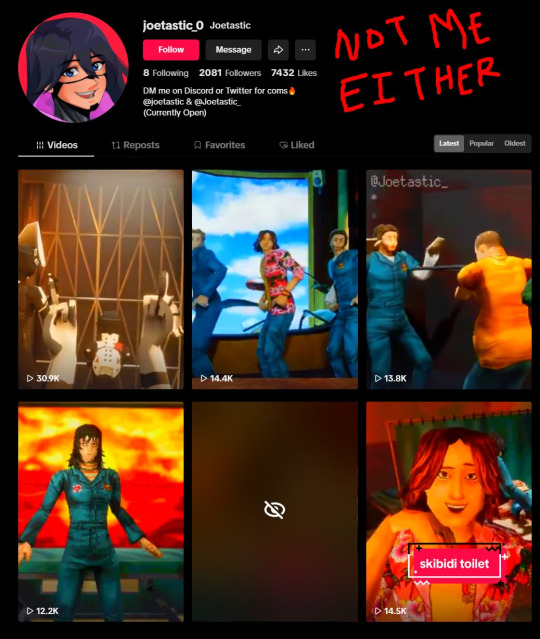

(side note) Around this time, people also started to impersonate me on TikTok and YouTube. With my accounts terminated, anyone searching for "Joetastic" would only find the imposter's profiles. I’m unsure whether they are connected or if it’s just an unfortunate coincidence, but it made the situation even more stressful.

3K notes

·

View notes