#Automotive Motors Market Demand

Explore tagged Tumblr posts

Text

Automotive Motors Market 2024 will touch New Level in the Upcoming Year by 2030

Global Automotive Motors Market research report published by Exactitude Constancy reveals the current outlook of the global and key regions from the following perspectives: Key players, countries, product types, and end industries. The report studies the top companies in the global market and divides the market into several parameters. This Automotive Motors Market research report pinpoints the industry's competitive landscape to understand the international competition. This report study explains the expected growth of the global market for the upcoming years from 2024 to 2030. This research report is accumulated based on static and dynamic perspectives on business.

The global Automotive Motors market was valued at 34.79 billion in 2022 and is projected to reach 54.42 billion by 2029, growing at a CAGR of 6.6% from 2022 to 2029.

Browse the Complete Summary and Table of Contents @

https://exactitudeconsultancy.com/ja/reports/28375/automotive-motors-market/

#Automotive Motors Industry#Automotive Motors Market 2024#Automotive Motors Market Analysis#Automotive Motors Market Research Report#Automotive Motors Market Demand#Automotive Motors Market Growth#Automotive Motors Market Insights#Automotive Motors Market Revenue#Automotive Motors Market Share#Automotive Motors Market Size#Automotive Motors Market Trends

0 notes

Text

Automotive Induction Motor Market size is expected to reach USD 32.44 Bn. by 2030, at a CAGR of 4.8% during the forecast period.

Market Drivers

Due to strict regulations imposed on the car industry, which incorporate both active and passive safety systems, standards for road and automotive safety are becoming more severe. Every car must have ABS and ECS installed, which increased demand for electric vehicles. Vehicle ABS, EHC, and brake assist motors operate more reliably and with a higher power density thanks to motors. All vehicles, even hybrid and electric ones, have this technology installed.

#Automotive Induction Motor Market#Automotive Induction Motor Market size#Automotive Induction Motor Market growth#Automotive Induction Motor Market share#Automotive Induction Motor Market demand#Automotive Induction Motor Market scope

0 notes

Text

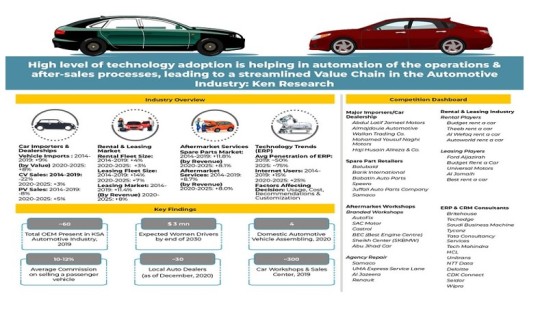

Future Outlook of KSA Automotive Industry: Ken Research

KSA Automotive Industry: Overview & Ecosystem

Kingdom of Saudi Arabia, currently enjoys a strategic position in terms of geography & development of industries with growing economy & improving trade participation in the world. Their automotive industry provides opportunity of high growth with the absence of domestic manufacturing & core dependence on imports for domestic vehicle needs. However, rapid digitization along with various government incentives are set to change the gears of development in the coming years.

KSA is looking forward to develop domestic manufacturing & exporting capabilities for South Africa & other African & gulf nations with stronger tax & driving policies, development of industrial hubs, efficient bilateral relationships & allies, technological competence & its enhancement.

Saudi Arabia Imports & Sales Industry

KSA Automotive industry imports& export volume for automotive vehicles is majorly driven by International OEMS from countries like USA, Japan, Korea, Germany, China & India. The overall ecosystem of KSA automotive industry includes global auto manufacturers like Toyota, Mazda, Hyundai & more, along with many sports & luxury car manufacturers. They are facilitated by local dealers & agents as there is a lack of domestic assembling & major vehicle needs are currently fulfilled via imports.

Largest importing country in terms of vehicles is Japan, home to Toyota, which amounts to the biggest share of vehicle sales in KSA. USA, Korea & china along with Germany, Thailand & India are the other major countries who imports vehicles in KSA. The development of various ports on east & west coast provides ease of importing & connected road network with other gulf countries, helps in providing cross country movements as well Sales & distributing efforts are undertaken by local trading partners in KSA like Abdul Latif Jameel (Toyota), Mohammad Yusuf Naghi (Hyundai) & more, who utilizes their local networks to provide the effeciency & optimization in sales.

Marker segmentation of KSA automotive industry explains the geographical consistency across the country. It was witnessed that Central, Eastern and western region of KSA dominate the market with more than 80% share of sales and are majorly driven by cities like Riyadh, Jeddah, Dammam and Medina/Makkah.

To learn more about this report Download A Free Sample Report

KSA Automotive Aftermarket Spare Parts & Service Industry

KSA Automotive spare parts industry is largely dominated by small retailers selling parts across the country. It was witnessed that there are ~7,000 small retailers in the country with majority of them situated around Jeddah, Dammam & Makkah/Medina.

In terms of car workshops, organized players cater to tier 1 & 2 cities, while other areas are dominated by local & unorganized crash repair & other service providers Value chain & busieness models further provides analysis of various entities available in the market & defines their roles, sourcing habits, retail & dealership networks along with revenue sharing & earning models/pathways & specifies margins at various intervals along with growth potential & strategic ways of diversifying into new business streams.

The Market size of KSA Spare Parts market grew by a CAGR of ~11% for 2014-2019, helping the market grow ~1.7X. It was also witnessed that imports made up more than 50% of the market in terms of volume. With increased ownership period and advanced used to new car ration of 2:1, total car parc in KSA is set to grow a north of 12 mn by the end of 2021.

KSA government is also making genuine efforts to kick start the domestic manufacturing process to include further entities in the ecosystem and sustain the current manufacturers as well to provide them various incentives to grow operations Import & Export analysis of the automotive industry in KSA gives a higher-level idea regarding the annual throughputs at all the major ports, identifies the major commercial hubs & areas of importance while indulging in to international trade.

Key Segments Covered:

KSA Imports & Sales Industry (Distributors & Dealerships)

Import & Export Analysis

Competition Analysis of Major OEM Brands

Future Trends & Developments & Growth Factors

KSA Automotive Aftermarket Spare Parts & Service Industry

Spare parts Industry

Aftermarket Service Industry

Competition Analysis of Major Players via Cross Comparisons & Heat Maps

Visit This Link: - Request For Custom Report

KSA Automotive Leasing & Rental Industry

KSA Rental Industry (Market Size, Competition & Segmentation)

KSA Leasing Industry (Market Size, Competition & Segmentation)

Impact of Covid-19 on KSA Automotive Industry

Impact of Covid 19 on KSA Automotive Industry

Mobility Industry looks forward to Utilize Digital Platforms

Post Covid KSA Automotive Industry Outlook

Technology Adoption & Usage Trends in KSA Automotive Industry

Overview of Industry

KSA Automotive Technology Trends, Adoption & Recommendations

Key Target Audience

KSA Car Dealerships

KSA Automotive Industry

KSA Automotive Workshops

KSA Spare Parts Retailers

KSA Automotive Logistic Service Providers

KSA Car Rental Players

KSA Car Leasing Players

KSA ERP Service Providers

KSA Technology Consultants

KSA Foreign Relation Ministry

KSA Customs Department

KSA Ports Authority

KSA Automotive Industry

KSA Imports & Export Authority

KSA Hardware Technology Manufacturers

KSA Software Technology Manufacturers

KSA Cloud Storage Providing Enterprises

KSA Public Institutions

Request Free 30 Minutes Analyst Call

Time Period Captured in the Report:

Historical Period: 2014-2019

Forecast Period: 2019-2025

Companies Mentioned:

Importers/Car Dealership

Abdul Latif Jameel Motors

Almajdouie Automotive

Wallan Trading Co.

Mohamed Yousuf Naghi Motors

Haji Husain Alireza & Co.

(Mazda, MAN, Aston Martin)

Nissan Petromin

Manahil International

Aljomaih Automotive Company

Universal Motors Agencies

Kia Al Jabr

Al Yemni Motors

Alissa Universal Motors Co.

Bakhashab Brothers Co.

Alesayi Motor Company

Al Jazirah Vehicles Agency

Juffali Automotive Company

Spare Part Retailers/Wholesalers

Balubaid

Barik International

Babatin Auto Parts

Speero

Juffali Auto Parts Company (JAPCO)

Samaco

M S Almeshri & Bros Co.

AL-OLIAH Auto Spare Parts

Delmon Group of Companies

SNAM

Ubuy

Munif Al Nahdi Group (Mize)

Odiggo

Accidom

Bawazeer Auto Parts

Bin sahib

AHQ Parts

Danya Auto Parts

Rezayat Automotive

Saudi Parts Center Company (Al Khorayef Group)

Aftermarket Service Providers

Branded Workshops

AutoFix

SAC Motor

Castrol

BEC (Best Engine Centre)

Sheikh Center (SKBMW)

Abu Jihad Car Maintenance Center

Ac Delco Service Centres

Tyre Plus

3M Authorized Centre

Mize

AdinLub

Car Spa

Car Hub

Ezhalha

Petromin Express

Auto Hub

Exxon Mobil

Autoworld

Castrol Branded Workshops

Shell Fastlube

Fuchs One

NAFT

Ziebart

Grease Monkey

Quick Car Service

Morni

Agency Repair

Samaco

United Motors Express Service Lane

Al Jazeera

Renault

Kia Motors

Fast Auto Technic

Mohammed Yousaf Naghi Motors

Porsche

Land Rover

Quick lane

Nissan Petromin

Haji Husain Alireza & Co.

Universal Motors Agencies

Aljomaih Automotive Company Ltd.

Alesayi Motors

Al Yemni Motors

Alissa Universal Motors Co.

Bakhashab Brothers Co

Al Juffali & Brothers Automotive Ltd.

Wallan Hyundai

Un-Organized/ Independent Players

Middle East Auto Services

Carzzone

German Centre

Cartech

Alod Haib

Al-Aruba Sinnaiyah

Saudi Chinese Vehicle Repair

Al Shamel Car Maintenance Center

Al Nafie Car Maintenance Workshop

Alsajow Center for Car Maintenance

Red Car

Saudi Egyptian Center for Car Maintenance

SRT 8

Al Bayan Car Maintenance

Mujahid Garage

1 Check Car Services (One Examination Workshop)

Saudi radiators

Global Auto Maintenance

Mohammed Al- Tkhais Abu Rakan

Anwar Al Mamlaka Center

Quick Cars Service

Best Corner Car Maintenance

American Diamond Specialist Center

Cars electricity and air conditioning

Badr Sentop workshop BST

Grace Monkey (International Company)

Super Service Auto Center

XEOEX

German Centre

AutoGard

Rental & Leasing Industry

Rental Players

Budget rent a car

Theeb rent a car

Al Wefaq rent a car

Autoworld rent a car

Key rent a car

Avis rent a car

Hanco rent a car

Samara rent a car

Hertz rent a car

Autorent a car

Leasing Players

Ford Aljazirah

Budget Rent a Car

Universal Motors

Al Jomaih

Best rent a car

Al Tayyar rent a car

Enterprise rent a car

Hanco rent a car

Theeb rent a car

Shary rent a car

ERP & CRM Providing Technical Consultants

Britehouse

Techedge

Saudi Business Machine

Tyconz

Accenture

Tata Consultancy Services

Tech Mahindra

HCL

Unitrans

NTT Data

Deloitte

CDK Connect

Seidor

Wipro

Key Topics Covered in the Report:

Saudi Arabia Automotive Industry Overview

Saudi Arabia Imports & Sales Industry (Distributors & Dealerships)

Automotive Imports & Sales Industry Ecosystem, KSA

Value Chain Analysis of KSA Automotive Imports & Sales

Annual Automotive Imports Traffic for Major KSA Ports

Analysis of Imported Goods & Major Countries Importing in KSA

Value & Volume of Vehicles Imported, KSA

Segmentation of Imports on the basis of Vehicle Type, KSA

Automotive Vehicle Manufacturing Clusters Analysis, KSA

New Motor Vehicle Sales, KSA

Market Segmentation of Automotive Sales on the basis of Region, KSA

Demographics of KSA Citizens Supporting Automotive Industry, (2019)

Segmentation of Vehicle Sales on the basis of Brands & Vehicle Type, KSA

Market share of International OEMs in New Vehicle Sales, KSA (2019)

Competition Analysis of Automotive Imports & Sales Industry, KSA (2019)

Profiles of Major Dealerships & Distributors

Business Model & Revenue Stream of Importers/Distributors/Dealerships

Trends & Developments in Automotive Vehicle Industry

Future of Imports & Sales

KSA Automotive Aftermarket Spare Parts & Service Industry

KSA Aftermarket Industry Ecosystem

Aftermarket Spare Parts Industry

KSA Aftermarket Service Industry

Future Trends of Aftermarket Spare Parts & Service Industry

KSA Automotive Leasing & Rental Industry

Macroeconomic Overview of the Rental & Leasing Industry

KSA Automotive Leasing (Long Term) Industry

KSA Rental Industry

Future of Leasing & Rental Industry

For more information on the research report, refer to below link:

KSA Automotive Industry

Related Reports By Ken Research: -

Saudi Arabia Automotive & Spare Parts Logistics Market Outlook to 2025

Saudi Arabia Car Rental and Leasing Market Outlook to 2023

#Abdul Latif Jameel Car Market Share#Abdul Latif Jameel Car Sales#Al Jazirah Car Market Share#Al Jazirah Car Sales Saudi Arabia#Aljomaih Automotive Car Market Share#Aljomaih Automotive Car Sales#Audi Saudi Arabia Automotive Market Revenue#Automotive Demand in Saudi Arabia#Automotive Industry in KSA#Automotive Market in KSA#Automotive Market in Saudi Arabia#Changan Saudi Arabia Automotive Market Revenue#Chevrolet Car Sales Saudi Arabia#Commercial Vehicle Parc KSA#Dhiba Port Growth in Saudi Arabia#ERP Vendors in Saudi Arabia#Ford Car Sales Saudi Arabia#Ford Saudi Arabia Automotive Market Shares#General Motors Saudi Arabia Automotive Market Revenue#GMC Car Sales Saudi Arabia#Hyundai Car Sales Saudi Arabia#Hyundai Saudi Arabia Automotive Market Sales#Isuzu motors Saudi Arabia Automotive Market Shares#Jeddah Islamic Port Saudi Arabia#Jubail Commercial Port Saudi Arabia#Jubail Port Growth in Saudi Arabia#Kia Motors Saudi Arabia Automotive Market Shares#King Abdul Aziz Port Saudi Arabia#King Fahad Industrial Port Yanbu Saudi Arabia#KSA Automotive Aftermarket Repair Industry Growth

0 notes

Text

Ford Maverick

In the early 1970s, Ford Motor Company was producing the Maverick, a compact car marketed as an affordable and efficient vehicle. However, the demand for the Maverick was not as high as Ford had anticipated, and they found themselves with a surplus of unsold cars.

To deal with this surplus, Ford decided to store thousands of unsold Mavericks in the Subtropolis caves located in Kansas City, Missouri. Subtropolis is a man-made underground complex of limestone mines, covering over 55 million square feet, and is home to many businesses that use the caves for storage and other purposes.

Ford leased about 25 acres of the cave complex, which was ideal for storing the cars as the caves are naturally climate-controlled with temperatures ranging between 60-70 degrees Fahrenheit year-round. The cars were kept in the caves until they could be sold, which reportedly took several years.

The storage of the Mavericks in the Subtropolis caves became somewhat of a legend in the automotive world, with many car enthusiasts and historians fascinated by the idea of thousands of unsold cars sitting underground for years. Today, the Subtropolis complex is still in use, and while the Mavericks are no longer stored there, the story of their time underground remains a unique piece of automotive history.

148 notes

·

View notes

Text

What Industries Is Injection Molding(Moulding) Applicable To?

Injection moulding is a common manufacturing process by injecting molten plastic material into a mould so that it can be formed into the desired product shape upon cooling.

Injection moulding process has the advantages of low cost, high production efficiency and stable product quality to make it widely used in various industries. In this vast injection moulding market, there are three industries are particularly eye-catching, which are extensively used for production and manufacturing due to their specific needs and product characteristics.

1.Household Appliance Manufacturing Industry

As an indispensable part of people's daily life, the market demand for household appliances is stable and continuously growing. The injection moulding process plays a pivotal role in the manufacturing of household appliances, from the outer shell to the internal components, injection moulding technology provides key support. Most of the exterior and structural components of home appliances, such as TV remote controls, refrigerators, TV sets, air-conditioning panels, and washing machine shells, are manufactured by injection molding process.

2.Automotive Components Industry & Transportation Sector

With the booming development of the automotive industry, the auto components and parts market has ushered in unprecedented development opportunities. Components and parts such as automotive dashboards, door interior panels, bumpers, and lamp housings as well as a wide range of pipework and connections are made through the injection moulding process. These parts require not only high precision and good mechanical properties, but also need to meet the strict appearance requirements, which injection moulding process is precisely by virtue of its unique advantages, in this field to occupy a place. In addition, with the rise of new energy vehicles, injection moulded parts play an important role in the manufacturing of key components such as battery packs and motor housings.

3.Medical Device Industry

With the increasing emphasis on health, the market demand for medical devices continues to grow. In medical device manufacturing, the injection moulding process is used to produce disposable medical devices such as syringes, infusion tubes and surgical instruments. These products require strict quality control and hygiene standards, and injection moulding process ensures product safety and effectiveness.

In addition, the injection moulding process is also widely used in the electrical and electronic industry, consumer electronics, packaging industry, toy manufacturing, construction materials, industrial parts, furniture and household furnishings and agriculture, among many others.

4.Electrical & Electronic Industry

In the manufacturing process of electronic products, many components such as housings, cases, sockets, connectors, cables, switches and holders for electronic circuit boards need to be manufactured by injection moulding process. Injection moulding process can achieve precise control of product appearance, size and structure, to meet the requirements of electronic products for appearance quality, functionality and reliability.

5.Consumer Electronics Industry

In the electronics industry, injection moulded parts are equally widely used. From mobile phone housings, computer components including keyboards and mice to remote controls and battery cases, the injection moulding process offers a wide variety of appearance and structure options for electronic products. These components not only need to have good mechanical properties and appearance, but also need to have excellent electrical insulation properties to ensure the stable operation of electronic products. Injection moulding technology occupies an important position in the manufacture of electronic products due to its advantages of high precision and low cost.

6.Construction Sector

In the construction field, injection moulded parts also have a wide range of applications, the drainage systems, door and window frames, pvc pipes, valves, wire troughs, insulation materials and other construction materials and accessories are mostly manufactured by injection moulding process. These components are not only high-strength and corrosion-resistant, but also weather-resistant and easy to install, meeting the construction industry's requirements for material performance and ease of use and improve construction efficiency and aesthetics. The application of injection moulding technology in the construction field not only improves the performance and quality of construction materials, but also promotes the sustainable development of the construction industry.

7.Packaging Industry

The packaging and container industry is also one of the key application areas for injection moulding processes. Plastic bottles, food boxes, cosmetic bottles, plastic bags and other packaging containers are mostly manufactured by injection moulding process to meet food safety and aesthetic requirements. These containers need to be well-sealed, drop-resistant, retain freshness and recyclable to ensure that the products are safe and environmentally friendly. Injection moulding processes can offer flexible design and manufacturing options to adapt to different packaging needs and provide strong support for the development of the packaging industry.

These areas above are just a few examples of the application areas of the injection moulding process. In the toy industry, injection moulded parts are used to manufacture a variety of plastic toys; In the textile and clothing industry, injection moulded parts are used to manufacture accessories such as zips and buttons; In the agricultural sector, injection moulded parts are used to manufacture agricultural tools and equipment such as sprayers and watering cans; Even in the aerospace sector, injection moulded parts are also used to manufacture parts for aircraft and spacecraft. It can be said that injection moulded parts have penetrated into almost every corner of our life.

In summary, injection moulded parts play an important role in several industries by virtue of their high precision, low cost and wide applicability. The application of injection moulding process in these areas not only improves production efficiency, but also meets the needs of product diversification and individualisation. With the continuous progress of science and technology and the continuous improvement of people's requirements on product quality, injection moulding technology will continue to be widely used and developed in various fields.

#design#autos#business#prototyping#prototype#prototype machining#rapid prototyping#cnc machining#precision machining#machining parts#injection molding#plastic injection molding#injection moulding machine#injection moulding#plastic injection#injection molded#injection molding parts#injection molded parts

2 notes

·

View notes

Text

https://www.reuters.com/business/autos-transportation/tesla-lay-off-more-than-10-its-staff-electrek-reports-2024-04-15/

BERLIN, April 15 (Reuters) - Tesla (TSLA.O), opens new tab is laying off more than 10% of its global workforce, an internal memo seen by Reuters on Monday shows, as it grapples with falling sales and an intensifying price war for electric vehicles (EVs).

"About every five years, we need to reorganize and streamline the company for the next phase of growth," CEO Elon Musk commented in a post on X. Two senior leaders, battery development chief Drew Baglino and vice president for public policy Rohan Patel, also announced their departures, drawing posts of thanks from Musk although some investors were concerned.

Musk last announced a round of job cuts in 2022, after telling executives he had a "super bad feeling" about the economy. Still, Tesla headcount has risen from around 100,000 in late 2021 to over 140,000 in late 2023, according to filings with U.S. regulators.

Baglino was a Tesla veteran and one of four members, along with Musk, of the leadership team listed on the company's investor relations website.

Scott Acheychek, CEO of Rex Shares - which manages ETFs with high exposure to Tesla stock - described the headcount reductions as strategic, but Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors, deemed the departures of the senior executives as "the larger negative signal today" that Tesla's growth was in trouble.

Less than a year ago, Tesla's chief financial officer, Zach Kirkhorn, left the company, fueling concerns about succession planning.

Tesla shares closed 5.6% lower at $161.48 on Monday. Shares of EV makers Rivian Automotive (RIVN.O), opens new tab, Lucid Group (LCID.O), opens new tab and VinFast Auto also dropped between 2.4% and 9.4%.

"As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity," Musk said in the memo sent to all staff.

"As part of this effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10% globally," it said.

Reuters saw an email sent to at least three U.S. employees notifying them their dismissal was effective immediately.

Tesla did not immediately respond to a request for comment.

MASS MARKET

The layoffs follow an exclusive Reuters report on April 5 that Tesla had cancelled a long-promised inexpensive car, expected to cost $25,000, that investors have been counting on to drive mass-market growth. Musk had said the car, known as the Model 2, would start production in late 2025.

Shortly after the story published, Musk posted "Reuters is lying" on his social media site X, without detailing any inaccuracies. He has not commented on the car since, leaving investors and analysts to speculate on its future.

Tech publication Electrek, which first reported, opens new tab the latest job cuts, said on Monday that the inexpensive car project had been defunded and that many people working on it had been laid off.

Reuters also reported on April 5 that Tesla would shift its focus to self-driving robotaxis built on the same small-car platform. Musk posted on X that evening: "Tesla Robotaxi unveil on 8/8," with no further details.

Tesla could be years away from releasing a fully autonomous vehicle with regulatory approval, according to experts in self-driving cars and regulation.

Tesla shares have fallen about 33% so far this year, underperforming legacy automakers such as Toyota Motor (7203.T), opens new tab and General Motors (GM.N), opens new tab, whose shares have rallied 45% and about 20% respectively.

Energy major BP (BP.L), opens new tab has also cut more than a tenth of the workforce in its EV charging business after a bet on rapid growth in commercial EV fleets did not pay off, Reuters reported on Monday, underscoring the broader impact of slowing EV demand.

WORKS COUNCIL

A newly elected works council of labour representatives at Tesla's German plant was not informed or consulted ahead of the announcement to staff, said Dirk Schulze, head of the IG Metall union in the region.

"It is the legal obligation of management not only to inform the works council but to consult with it on how jobs can be secured," Schulze said.

Analysts from Gartner and Hargreaves Lansdown said the cuts were a sign of cost pressures as the carmaker invests in new models and artificial intelligence.

Tesla reported this month that its global vehicle deliveries in the first quarter fell for the first time in nearly four years, as price cuts failed to stir demand.

The EV maker has been slow to refresh its aging models as high interest rates have sapped consumer appetite for big-ticket items, while rivals in China, the world's largest auto market, are rolling out cheaper models.

China's BYD (002594.SZ), opens new tab briefly overtook the U.S. company as the world's largest EV maker in the fourth quarter, and new entrant Xiaomi (1810.HK), opens new tab has garnered substantial positive press.

Tesla is gearing up to start sales in India, the world's third-largest auto market, this year, producing cars in Germany for export to India and scouting locations for showrooms and service hubs in major cities.

Tesla recorded a gross profit margin of 17.6% in the fourth quarter, the lowest in more than four years.

2 notes

·

View notes

Text

The Rise of Peugeot Electric Vehicles in Kuwait

The transition to electric vehicles is rapidly reshaping the global automotive landscape, and Kuwait is no exception to this transformative trend. As the world grapples with the imperative of sustainable mobility, Peugeot has emerged as a key player in ushering in the era of electric vehicles in Kuwait.

The introduction of Peugeot's electric vehicle lineup, including the innovative e-208 and e-2008 models, has sparked considerable interest and anticipation within the Kuwaiti market.

Embracing Sustainable Mobility

Peugeot's foray into electric vehicles represents a significant step towards embracing sustainable mobility in Kuwait. The e-208, an all-electric city car, has garnered attention for its eco-friendly design and advanced electric propulsion system.

This model, along with the e-2008, exemplifies Peugeot's commitment to offering electric vehicles that are well-suited to the evolving needs of Kuwait's urban environment.

Adapting to Local Market Dynamics

The concentration of motor industry sales in Kuwait's coastal region underscores the potential for electric vehicles to thrive in urban settings, where the demand for efficient and environmentally conscious transportation solutions is on the rise.

Peugeot's electric vehicles are poised to address these dynamics, offering drivers in Kuwait a compelling combination of compact design, emission-free driving, and advanced technological features.

Official Support and Market Penetration

With an established presence in Kuwait, Peugeot is strategically positioned to support the growing adoption of electric vehicles in the country. The brand's official dealerships and service centers provide a solid foundation for introducing and servicing electric models, ensuring that customers have access to comprehensive after-sales support and genuine parts.

The introduction of the e-208 and e-2008 models signifies a new chapter in Kuwait's automotive industry, one that is defined by a commitment to environmental stewardship and forward-looking transportation technologies.

Peugeot's leadership in this space is set to redefine the driving experience in Kuwait, offering drivers a compelling vision of the future of electric mobility.

3 notes

·

View notes

Text

Zero Friction Coatings Market: Charting the Course for Enhanced Performance and Sustainable Solutions

The global zero friction coatings market size is estimated to reach USD 1,346.00 million by 2030 according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 5.6% from 2022 to 2030. Growth can be attributed to the fact that these coatings reduce friction and wear resulting in low fuel consumption and less heat generation. According to the European Automobile Manufacturers' Association, 79.1 million motor vehicles were produced across the globe in 2021 which was up by 1.3% as compared to 2020. Zero friction coatings can extend the time between component maintenance and replacement, especially for machine parts that are expensive to manufacture.

Zero Friction Coatings Market Report Highlights

In 2021, molybdenum disulfide emerged as the dominant type segment by contributing around 50% of the revenue share. This is attributed to its properties such as low coefficient of friction at high loads, electrical insulation, and wide temperature range

The automobile & transportation was the dominating end-use segment accounting for a revenue share of more than 35% in 2021 due to the rapid growth of the automotive industry across the globe

The energy end-use segment is anticipated to grow at a CAGR of 5.7% in terms of revenue by 2030, owing to the excessive wear on the drill stem assembly and the well casing during the drilling operations in the oil and gas sector

In Asia Pacific, the market is projected to witness the highest CAGR of 5.8% over the predicted years owing to the presence of car manufacturing industries in the countries such as Japan, South Korea, and China

For More Details or Sample Copy please visit link @: Zero Friction Coatings Market Report

Several applications in the automobile industry use wear-resistant plastic seals that require zero tolerance for failure and lifetime service confidence. Increasing demand for the product from the automotive industry across the globe for various applications including fuel pumps, automatic transmissions, oil pumps, braking systems, and others is expected to drive its demand over the forecast period.

Low friction coatings can be used in extreme environments comprising high pressure, temperatures, and vacuums. These coatings can provide improved service life and performance thereby eliminating the need for wet lubricants in environments that require chemicals, heat, or clean room conditions. The product containing molybdenum disulfide (MoS2) are suitable for reinforced plastics while those free from MoS2 are suitable for non-reinforced plastics.

Zero friction coatings are paint-like products containing submicron-sized particles of solid lubricants dispersed through resin blends and solvents. The product can be applied using conventional painting techniques such as dipping, spraying, or brushing. The thickness of the film has a considerable influence on the anti-corrosion properties, coefficient of friction, and service life of the product. Its thickness should be greater than the surface roughness of the mating surfaces.

ZeroFrictionCoatingsMarket #FrictionlessTechnology #CoatingInnovations #IndustrialEfficiency #ZeroFrictionSolutions #AdvancedMaterials #SurfaceCoatings #ManufacturingAdvancements #GlobalIndustryTrends #InnovativeCoatings #PerformanceOptimization #MechanicalSystems #SustainableTechnology #IndustrialApplications #FutureTech #InnovationInMaterials #EfficiencySolutions #ZeroFrictionMarket #TechnologyInnovation #EngineeringMaterials

#Zero Friction Coatings Market#Frictionless Technology#Coating Innovations#Industrial Efficiency#Zero Friction Solutions#Advanced Materials#Surface Coatings#Manufacturing Advancements#Global Industry Trends#Innovative Coatings#Performance Optimization#Mechanical Systems#Sustainable Technology#Industrial Applications#Future Tech#Innovation In Materials#Efficiency Solutions#Zero Friction Market#Technology Innovation#Engineering Materials

2 notes

·

View notes

Text

For now, Alex Lagetko is holding on to his Tesla stocks. The founder of hedge fund VSO Capital Management in New York, Lagetko says his stake in the company was worth $46 million in November 2021, when shares in the electric carmaker peaked at $415.

Since then, they have plunged 72 percent, as investors worry about waning demand, falling production and price cuts in China, labor shortages in Europe, and, of course, the long-term impact of CEO Elon Musk’s $44 billion acquisition of Twitter. After announcing his plans to buy the platform in April, Musk financed his acquisition with $13 billion in loans and $33 billion in cash, roughly $23 billion of which was raised by selling shares in Tesla.

“Many investors, particularly retail, who invested disproportionately large sums of their wealth largely on the basis of trust in Musk over many years were very quickly burned in the months following the acquisition,” Lagetko says, “particularly in December as he sold more stock, presumably to fund losses at Twitter.”

Lagetko is worried that the leveraged buyout of Twitter has left Tesla exposed, as interest payments on the debt Musk took on to fund the takeover come due at the same time as the social media company’s revenues have slumped.

But Tesla stock was already falling in April 2022, when Musk launched his bid for Twitter, and analysts say that the carmaker’s challenges run deeper than its exposure to the struggling social media platform. Tesla and its CEO have alienated its core customers while its limited designs and high prices make it vulnerable to competition from legacy automakers, who have rushed into the EV market with options that Musk’s company will struggle to match.

Prior to 2020, Tesla was essentially “playing against a B team in a soccer match,” says Matthias Schmidt, an independent analyst in Berlin who tracks electric car sales in Europe. But that changed in 2020, as “the opposition started rolling out some of their A squad players.”

In 2023, Tesla is due to release its long-awaited Cybertruck, a blocky, angular SUV first announced in 2019. It is the first new launch of a consumer vehicle by the company since 2020. A promised two-seater sports car is still years away, and the Models S, X, Y, and 3, once seen as space-age dynamos, are now “long in the tooth,” says Mark Barrott, an automotive analyst at consultancy Plante Moran. Most auto companies refresh their looks every three to five years—Tesla’s Model S is now more than 10 years old.

By contrast, this year Ford plans to boost production of both its F-150 Lighting EV pick-up, already sold out for 2023, and its Mustang Mach-E SUV. Offerings from Hyundai IONIQ 5 and Kia EV6 could threaten Tesla’s Model Y and Model 3 in the $45,000 to $65,000 range. General Motors plans to speed up production and cut costs for a range of EV models, including the Chevy Blazer EV, the Chevy Equinox, the Cadillac Lyric, and the GMC Sierra EV.

While Tesla’s designs may be eye-catching, their high prices mean that they’re now often competing with luxury brands.

“There is this kind of nice Bauhaus simplicity to Tesla’s design, but it’s not luxurious,” says David Welch, author of Charging Ahead: GM, Mary Barra, and the Reinvention of an American Icon. “And for people to pay $70,000 to $100,000 for a car, if you’re competing suddenly with an electric Mercedes or BMW, or a Cadillac that finally actually feels like something that should bear the Cadillac name, you’re going to give people something to think about.”

While few manufacturers can compete with Tesla on performance and software (the Tesla Model S goes to 60 mph in 1.99 seconds, reaches a 200-mph top speed, and boasts automatic lane changing and a 17-inch touchscreen for console-grade gaming), many have reached or are approaching a range of 300 miles (480 km), which is the most important consideration for many EV buyers, says Craig Lawrence, a partner and cofounder at the investment group Energy Transition Ventures.

One of Tesla’s main competitive advantages has been its supercharging network. With more than 40,000 proprietary DC fast chargers located on major thoroughfares near shopping centers, coffee shops, and gas stations, their global infrastructure is the largest in the world. Chargers are integrated with the cars’ Autobidder optimization & dispatch software, and, most importantly, they work quickly and reliably, giving a car up to 322 miles of range in 15 minutes. The network contributes to about 12 percent of Tesla sales globally.

“The single biggest hurdle for most people asking ‘Do I go EV or not,’ is how do I refuel it and where,” says Loren McDonald, CEO and lead analyst for the consultancy EVAdoption. “Tesla figured that out early on and made it half of the value proposition.”

But new requirements for funding under public charging infrastructure programs in the US may erode Tesla’s proprietary charging advantage. The US National Electric Vehicle Infrastructure Program will allocate $7.5 billion to fund the development of some 500,000 electric vehicle chargers, but to access funds to build new stations, Tesla will have to open up its network to competitors by including four CCC chargers.

“Unless Tesla opens up their network to different charging standards, they will not get any of that volume,” Barrott says. “And Tesla doesn’t like that.”

In a few years, the US public charging infrastructure may start to look more like Europe’s, where in many countries the Tesla Model 3 uses standard plugs, and Tesla has opened their Supercharging stations to non-Tesla vehicles.

Tesla does maintain a software edge over competitors, which have looked to third-party technology like Apple’s CarPlay to fill the gap, says Alex Pischalnikov, an auto analyst and principal at the consulting firm Arthur D. Little. With over-the-air updates, Tesla can send new lines of code over cellular networks to resolve mechanical problems and safety features, update console entertainment options, and surprise drivers with new features, such as heated rear seats and the recently released full self-driving beta, available for $15,000. These software updates are also a cash machine for Tesla. But full self-driving features aren’t quite as promised, since drivers still have to remain in effective control of the vehicle, limiting the value of the system.

A Plante Moran analysis shared with WIRED shows Tesla’s share of the North American EV market declining from 70 percent in 2022 to just 31 percent by 2025, as total EV production grows from 777,000 to 2.87 million units.

In Europe, Tesla’s decline is already underway. Schmidt says data from the first 11 months of 2022 shows sales by volume of Volkswagen’s modular electric drive matrix (MEB) vehicles outpaced Tesla’s Model Y and Model 3 by more than 20 percent. His projections show Tesla’s product lines finishing the year with 15 percent of the western European electric vehicle market, down from 33 percent in 2019.

The European Union has proposed legislation to reduce carbon emissions from new cars and vans by 100 percent by 2035, which is likely to bring more competition from European carmakers into the market.

There is also a growing sense that Musk’s behavior since taking over Twitter has made a challenging situation for Tesla even worse.

Over the past year, Musk has used Twitter to call for the prosecution of former director of the US National Institute of Allergy and Infectious Diseases Anthony Fauci (“My pronouns are Prosecute/Fauci”), take swings at US senator from Vermont Bernie Sanders over government spending and inflation, and placed himself at the center of the free speech debate. He’s lashed out at critics, challenging, among other things, the size of their testicles.

A November analysis of the top 100 global brands by the New York–based consultancy Interbrand estimated Tesla’s brand value in 2022 at $48 billion, up 32 percent from 2021 but well short of its 183 percent growth between 2020 and 2021. The report, based on qualitative data from 1,000 industry consultants and sentiment analysis of published sources, showed brand strength declining, particularly in “trust, distinctiveness and an understanding of the needs of their customers.”

“I think [Musk’s] core is rapidly moving away from him, and people are just starting to say, ‘I don’t like the smell of Tesla; I don’t want to be associated with that,’” says Daniel Binns, global chief growth officer at Interbrand.

Among them are once-loyal customers. Alan Saldich, a semi-retired tech CMO who lives in Idaho, put a deposit down on a Model S in 2011, before the cars were even on the road, after seeing a bodiless chassis in a Menlo Park showroom. His car, delivered in 2012, was number 2799, one of the first 3,000 made.

He benefited from the company’s good, if idiosyncratic, customer service. When, on Christmas morning 2012, the car wouldn’t start, he emailed Musk directly seeking a remedy. Musk responded just 24 minutes later: “...Will see if we can diagnose and fix remotely. Sorry about this. Hope you otherwise have a good Christmas.”

On New Year’s Day, Joost de Vries, then vice president of worldwide service at Tesla, and an assistant showed up at Saldich’s house with a trailer, loaded the car onto a flatbed, and hauled it to Tesla’s plant in Fremont, California, to be repaired. Saldich and his family later even got a tour of the factory. But since then, he’s cooled on the company. In 2019, he sold his Model S, and now drives a Mini Electric. He’s irritated in particular, he says, by Musk’s verbal attacks on government programs and regulation, particularly as Tesla has benefited from states and federal EV tax credits.

“Personally, I probably wouldn’t buy another Tesla,” he says. “A, because there’s so many alternatives and B, I just don’t like [Musk] anymore.”

8 notes

·

View notes

Text

Maintaining your vehicle’s performance and appearance has never been easier with STP’s extensive range of car care solutions. Known for innovation and quality, STP offers products tailored to meet the demands of auto enthusiasts and everyday drivers alike. Whether it’s the Insect Remover Spray for exterior care or premium solutions for internal maintenance, STP has set the standard for autocare products in Pakistan.

The Legacy of STP in Pakistan

STP has become synonymous with quality and performance in the automotive industry. Since its inception, the brand has consistently delivered innovative products designed to enhance vehicle maintenance. Their introduction to Pakistan has revolutionized the accessibility of premium car care solutions, offering options that cater to both professionals and casual users.

Diverse Product Range for Every Vehicle Need

STP’s product lineup in Pakistan is impressively diverse, addressing every aspect of vehicle care. From cleaning agents to performance enhancers, STP ensures that car maintenance is efficient and effective. For instance, their Insect Remover Spray is a must-have for combating stubborn bug stains that often tarnish a car’s exterior. This product not only ensures a spotless finish but also protects the paint from potential damage caused by insect residues.

Other standout products include the STP Air Con Cleaner, which improves air quality inside the vehicle, and the STP Fuel System Cleaners designed for both petrol and diesel engines. These cleaners enhance engine efficiency by removing deposits that accumulate over time, ensuring a smoother and more economical driving experience.

Moreover, STP’s advanced lubricants, like the Motor Oil 20W-50 SL/CF, provide superior protection for engine components, particularly in Pakistan’s challenging driving conditions. The versatility and effectiveness of these products have cemented STP’s reputation as a leader in the autocare products Pakistan market.

0 notes

Text

Due to strict regulations imposed on the car industry, which incorporate both active and passive safety systems, standards for road and automotive safety are becoming more severe. Every car must have ABS and ECS installed, which increased demand for electric vehicles.

#Automotive Induction Motor Market#Automotive Induction Motor Market size#Automotive Induction Motor Market growth#Automotive Induction Motor Market share#Automotive Induction Motor Market demand#Automotive Induction Motor Market analysis

0 notes

Text

The Evolution of Conveyor Systems: How UK Manufacturers Have Adapted Over Time

Conveyor systems have become a cornerstone of modern industry, facilitating the seamless movement of goods in warehouses, factories, and distribution centers. Over the decades, these systems have undergone significant transformations, driven by technological advancements, changing industry needs, and environmental considerations. UK manufacturers, in particular, have played a pivotal role in this evolution, blending innovation with tradition to stay ahead in the global market.

The Beginnings: The Industrial Revolution

The origins of conveyor systems can be traced back to the Industrial Revolution in the late 18th and early 19th centuries. During this era, mechanized production processes began to take shape, and rudimentary conveyor belts made of leather or canvas were introduced to transport materials. These early systems relied heavily on manual labor and were limited in capacity and efficiency.

UK manufacturers were quick to adopt and refine these systems, leveraging their strong engineering heritage. Innovations in steam power and mechanization allowed for the development of more robust conveyors, setting the stage for widespread industrial use.

Mid-20th Century: The Rise of Automation

The mid-20th century marked a significant turning point for conveyor systems. The advent of electricity and advancements in motor technology enabled automated conveyor systems, drastically reducing the need for human intervention. In the UK, this period coincided with the post-war economic boom, leading to increased industrial activity.

Manufacturers began integrating conveyor systems into assembly lines, revolutionizing industries such as automotive production, food processing, and mining. The introduction of rollers and modular systems further enhanced flexibility and efficiency, allowing for the customization of conveyors to suit specific applications.

Late 20th Century: The Digital Revolution

The digital revolution of the late 20th century brought about groundbreaking changes to conveyor systems. Programmable logic controllers (PLCs) and computer-aided design (CAD) software enabled manufacturers to design and control highly sophisticated systems. UK-based companies embraced these innovations, developing conveyor solutions that could handle complex tasks with precision.

During this time, the UK saw a shift towards lean manufacturing and just-in-time (JIT) production. Conveyor systems were tailored to minimize waste and improve efficiency, aligning with the global push for sustainable manufacturing practices.

21st Century: Smart and Sustainable Solutions

In the 21st century, conveyor systems have become smarter and more sustainable than ever before. The integration of Industry 4.0 technologies—such as IoT sensors, artificial intelligence, and robotics—has transformed conveyors into intelligent systems capable of self-monitoring and predictive maintenance.

UK manufacturers are at the forefront of this revolution, developing conveyors that optimize energy use, reduce downtime, and enhance productivity. For example, many systems now feature energy-efficient motors and regenerative braking to minimize environmental impact. Additionally, modular designs and recyclable materials are increasingly being used to create eco-friendly conveyor solutions.

Adaptation to Market Demands

The UK’s ability to adapt to changing market demands has been a key factor in the evolution of its conveyor systems. Recent trends, such as the rise of e-commerce and the need for rapid order fulfillment, have driven the development of high-speed conveyors and sortation systems. Similarly, the growth of the pharmaceutical and food industries has led to the creation of hygienic, easy-to-clean conveyors that meet stringent safety standards.

Post-Brexit, UK manufacturers have faced challenges in sourcing materials and maintaining export relationships. However, these challenges have also spurred innovation, with companies investing in local supply chains and advanced manufacturing technologies to remain competitive.

The Future of Conveyor Systems

Looking ahead, UK manufacturers are poised to continue leading the way in conveyor system innovation. Emerging technologies like 5G connectivity, machine learning, and collaborative robots (cobots) are expected to play a significant role in the next generation of conveyors. Sustainability will also remain a top priority, with further advancements in renewable energy-powered systems and closed-loop recycling processes.

Conclusion

The evolution of conveyor systems is a testament to the resilience and ingenuity of UK manufacturers. From the rudimentary belts of the Industrial Revolution to the intelligent, sustainable systems of today, these innovations have continually adapted to meet the needs of a dynamic industrial landscape. As new challenges and opportunities emerge, the UK’s conveyor system manufacturers are well-equipped to drive the industry forward, ensuring efficiency, sustainability, and global competitiveness for years to come.

0 notes

Text

Product-Based Companies in Chennai

Chennai, the capital of Tamil Nadu, is not only known for its vibrant cultural heritage but also for being a rapidly growing industrial and tech hub. The city has emerged as a key destination for product-based companies that are at the forefront of technological innovation, making significant contributions to India's economic growth. These companies are instrumental in developing cutting-edge products, providing employment to a skilled workforce, and driving advancements in technology.

What Are Product-Based Companies in Chennai?Product-based companies are firms that design, develop, and market products either directly to consumers or other businesses. Unlike service-based companies that provide custom solutions tailored to client needs, product companies focus on creating scalable and market-driven products.

Characteristics of Product-Based Companies:

Creation of in-house products

Focus on ongoing innovation and product enhancement

Emphasis on customer experience and addressing market needs

Advantages of Product-Based Companies in Chennai:

Contribution to Economic Growth: Product-based companies play a key role in driving Chennai's industrial and economic development.

Job Creation and Technological Advancement: These companies generate a wide range of job opportunities in fields such as software development, design, engineering, and marketing.

Innovation Potential: With a strong focus on research and development (R&D), product-based companies in Chennai lead technological innovation and open up new market avenues.

Chennai as an Innovation Hub: The presence of renowned global companies has solidified Chennai's position as a center for technological breakthroughs.

Leading Product-Based Companies in Chennai:

IT & Software:

Zoho Corporation: A provider of cloud-based business tools.

Freshworks: A global leader in customer engagement software.

Chargebee: Specializes in subscription billing and revenue management.

Automotive & Manufacturing:

Hyundai Motors India Ltd.: A prominent automobile manufacturer in India.

Royal Enfield: A renowned motorcycle brand with a storied legacy.

Healthcare & MedTech:

Visionary RCM: Specializes in healthcare analytics and revenue cycle management.

Philips Healthcare: Known for developing innovative medical devices and solutions.

Why Chennai is a Hub for Product-Based Companies

Skilled Workforce: Chennai is home to top educational institutions that produce highly talented engineers, designers, and tech professionals.

Strategic Location: Proximity to ports and excellent connectivity make Chennai ideal for global trade and exports.

Good Infrastructure: Modern tech parks, industrial zones, and innovation centers support the growth of product-based companies.

Government Support: Business-friendly policies and government incentives encourage investments and foster growth.

How to Join a Product-Based Company in Chennai

Tips for Job Seekers:

Develop relevant skills such as software development, product design, data analytics, and machine learning.

Build a strong portfolio showcasing your work and projects.

Network actively by attending tech meetups, job fairs, and networking events.

Roles in Demand:

Software Engineers

Product Managers

UX/UI Designers

Data Scientists

Internship Opportunities: Many product-based firms offer internships that serve as stepping stones to full-time employment.

Future of Product-Based Companies in Chennai

Recent Trends:

Expansion into artificial intelligence, machine learning, and cloud computing

Growth in sectors such as fintech, MedTech, and e-commerce

Beyond Traditional Businesses: As technology evolves, companies continue to innovate and develop new products to meet market demands.

Conclusion

Chennai's product-based companies are flourishing, presenting abundant opportunities for both professionals and entrepreneurs. With its strategic location, skilled talent pool, and strong culture of innovation, Chennai is set to play a key role in shaping India's technological future. Whether you're seeking a career or looking to start a business, the city's dynamic business environment offers a path to success and growth.

Explore more franchises and companies Visit MarketingHack4U

0 notes

Text

Japanese Auto Sales Drop In Southeast Asia As Chinese Autos Gain Market Share

Manufacturing Innovation: Lessons From The Japanese Vehicle Industry No vendor shares information in producing methods in advance as a result of competitive bidding process competition. Toyota Motor Sales, United States, Inc was produced in 1957, while the Toyopet sedan was introduced right into the marketplace the following year in the USA. Toyopet was after that revamped in 1965 and rereleased as Toyota Corona, which was the very first significant achievement in the USA. The firm obtained quick growth throughout the 1960s and 70s and started venturing into foreign markets. Michael A. Cusumano is Aide Teacher of Monitoring at the MIT Sloan College of Management. Level from Princeton University and the Ph.D. degree in Japanese language and company background from Harvard University. Japanese Automobile Brand Names In The Worldwide Car Market Last year, the Japanese auto brands counted for 54% of the Asian brand names offering autos in Europe. They were followed by the Koreans, that made up 36% of the Asian team; and finally, China with 10%. In regards to overall market share on auto enrollments, the Japanese OEMs counted for 13% of the overall market, adhered to by the Koreans with 9% share, and China with 3%. Confronted with boosted competitors, American vehicle firms initially underestimated the danger from Japan's automobile invasion. The postponed response to the changing customer demands caused a decrease in market share and compelled a reevaluation of their product. Progressively, American manufacturers adapted by improving the high quality and effectiveness of their cars to match Japanese criteria, resulting in increased competitiveness and innovation.

Which cars and truck business dominates the market?

General Motors, Ford, and Toyota are the leading automotive suppliers based upon market share in the USA.

In the supply chain phase, we have actually discussed Toyota's production process, consisting of JIT (just in time method). Jidoka is a system for immediately recognizing and fixing any issues that might cause defective manufacturing. JIT is all about refining and coordinating every manufacturing treatment to just manufacture what is required by the following development in the sequence. To enhance its manufacturing and supply methods for cars across the globe, Toyota initiated its strategy of Cutting-edge International Multi-purpose Car (IMV). This is to satisfy its ever-growing market need in over 142 countries worldwide. JIT Production, along with lean production, is the major success element of the company, which assists it keep its leading setting in the car sector worldwide. In China, where sales of electrical and prolonged array EVs are growing, the Japanese business have no similar versions of their own, which has actually caused a 9 percent drop in sales for Japanese brands. All 6 Japanese car manufacturers tracked by Bloomberg have actually shed ground in China-- even Toyota, which as soon as was a leading force in that country's new auto market. The strong development in automobile sales in Japan in 2023 was greatly due to the solid healing of Toyota. Toyota's supremacy of the Japanese car market proceeded with sales up by 26.5% for a market share of 33%. The top 3 (and ei

youtube

1 note

·

View note

Text

Electrical Steel Market Outlook: From $29.60 Billion in 2023 to $43.42 Billion by 2032

The global electrical steel market, valued at $29.60 billion in 2023, is projected to grow to $43.42 billion by 2032, at a CAGR of 4.4%. This growth is fueled by increasing demand for electrical steel in the automotive, energy, and electrical sectors, particularly for use in electric motors, transformers, and generators. The ongoing shift towards renewable energy and electric vehicles is expected to further accelerate the market's expansion.

Click here to get sample copy of report

#electricalsteelmarket#energysector#automotiveindustry#renewableenergy#globalmarketgrowth#electricvehicles#industrialinnovation#marketforecast#steelindustry#manufacturingtrends

0 notes