#Automotive Motors Market 2024

Explore tagged Tumblr posts

Text

Automotive Motors Market 2024 will touch New Level in the Upcoming Year by 2030

Global Automotive Motors Market research report published by Exactitude Constancy reveals the current outlook of the global and key regions from the following perspectives: Key players, countries, product types, and end industries. The report studies the top companies in the global market and divides the market into several parameters. This Automotive Motors Market research report pinpoints the industry's competitive landscape to understand the international competition. This report study explains the expected growth of the global market for the upcoming years from 2024 to 2030. This research report is accumulated based on static and dynamic perspectives on business.

The global Automotive Motors market was valued at 34.79 billion in 2022 and is projected to reach 54.42 billion by 2029, growing at a CAGR of 6.6% from 2022 to 2029.

Browse the Complete Summary and Table of Contents @

https://exactitudeconsultancy.com/ja/reports/28375/automotive-motors-market/

#Automotive Motors Industry#Automotive Motors Market 2024#Automotive Motors Market Analysis#Automotive Motors Market Research Report#Automotive Motors Market Demand#Automotive Motors Market Growth#Automotive Motors Market Insights#Automotive Motors Market Revenue#Automotive Motors Market Share#Automotive Motors Market Size#Automotive Motors Market Trends

0 notes

Text

Did Elon Musk Really Buy Ford Motor Company? The Truth Behind the Rumors

In the world of business, few names resonate as powerfully as Elon Musk. The CEO of Tesla and SpaceX has made headlines for his ambitious ventures, from launching rockets into space to acquiring social media platforms.

In the world of business, few names resonate as powerfully as Elon Musk. The CEO of Tesla and SpaceX has made headlines for his ambitious ventures, from launching rockets into space to acquiring social media platforms. Recently, however, a new rumor has sparked interest: did Musk purchase the iconic Ford Motor Company? Let’s delve into this speculation and clarify the facts. The Origin of the…

#automotive industry speculation#BUSINESS#electric vehicle market trends#Elon Musk#Ford Motor Company acquisition rumors#news#technology#tesla#Tesla news 2024

0 notes

Text

Industrial Lubricants Market Forecasted to Hit $74.3 Billion by 2029: Regional Insights and Sectorial Demands

The report “Industrial Lubricants Market by Base Oil (Mineral Oil, Synthetic Oil, Bio-based Oil), Product Type (Hydraulic Fluid, Metalworking Fluid, Grease), End-use Industry (Construction, Power Generation, Food Processing), Region – Global Forecast to 2029″, size was USD 63.9 billion in 2024 and is projected to reach USD 74.3 billion by 2029, at a CAGR of 3.1%, between 2024 and 2029. The…

#automotive lubricants industry#automotive lubricants market#automotive motor oil market#bio-lubricants market#construction lubricants market#Industrial Lubricants#Industrial Lubricants Market#Industrial Lubricants Market 2024#Industrial Lubricants Market Opportunities#Industrial Lubricants Market Overview#Industrial Lubricants Price#lubricants market size#marine lubricants market

0 notes

Text

Excerpt from this story from Nation of Change:

China’s largest automaker, BYD, is selling its Dolphin hatchback EV for a low-low $15,000, complete with a 13-inch rotating screen, ventilated front seats, and a 260-mile range. Here in the U.S., you have to pay more than twice that price for the Tesla Model 3 EV ($39,000) with lower tech and only 10 more miles of driving range. In case $15K beats your budget, the Dolphin has a plug-in hybrid version with an industry-leading 74-mile range on a single charge for only $11,000 and an upgrade with an unbeatable combined gas-electric range of 1,300 miles. Not surprisingly, EVs surged to 52% of all auto sales in China last year. And with such a strong domestic springboard into the world market, Chinese companies accounted for more than 70% of global EV sales.

It’s time to face reality in the world of cars and light trucks. Let’s admit it, China’s visionary industrial policy is the source of its growing dominance over global EV production. Back in 2009-2010, three years before Elon Musk sold his first mass-production Tesla, Beijing decided to accelerate the growth of its domestic auto industry, including cheap, all-electric vehicles with short ranges for its city drivers. Realizing that an EV is just a steel box with a battery, and battery quality determines car quality, Beijing set about systematically creating a vertical monopoly for those batteries — from raw materials like lithium and cobalt from the Congo all the way to cutting-edge factories for the final product. With its chokehold on refining all the essential raw materials for EV batteries (cobalt, graphite, lithium, and nickel), by 2023-2024 China accounted for well over 80% of global sales of battery components and nearly two-thirds of all finished EV batteries.

Clearly, new technology is driving our automotive future, and it’s increasingly clear that China is in the driver’s seat, ready to run over the auto industries of the U.S. and the European Union like so much roadkill. Indeed, Beijing switched to the export of autos, particularly EVs, to kick-start its slumbering economy in the aftermath of the Covid lockdown.

Given that it was already the world’s industrial powerhouse, China’s auto industry was more than ready for the challenge. After robotic factories there assemble complete cars, hands-free, from metal stamping to spray painting for less than the cost of a top-end refrigerator in the U.S., Chinese companies pop in their low-cost batteries and head to one of the country’s fully automated shipping ports. There, instead of relying on commercial carriers, leading automaker BYD cut costs to the bone by launching its own fleet of eight enormous ocean-going freighters. It started in January 2024 with the BYD Explorer No. 1, capable of carrying 7,000 vehicles anywhere in the world, custom-designed for speedy drive-on, drive-off delivery. That same month, another major Chinese company you’ve undoubtedly never heard of, SAIC Motor, launched an even larger freighter, which regularly transports 7,600 cars to global markets.

Those cars are already heading for Europe, where BYD’s Dolphin has won a “5-Star Euro Safety Rating” and its dealerships are popping up like mushrooms in a mine shaft. In a matter of months, Chinese cars had captured 11% of the European market. Last year, BYD began planning its first factory in Mexico as an “export hub” for the American market and is already building billion-dollar factories in Turkey, Thailand, and Indonesia. Realizing that “20% to 30%” of his company’s revenue is at risk, Ford CEO Jim Farley says his plants are switching to low-cost EVs to keep up. After the looming competition led GM to bring back its low-cost Chevy Bolt EV, company Vice President Kurt Kelty said that GM will “drive the cost of E.V.s to lower than internal combustion engine vehicles.”

So, what does all this mean for America? In the past four years, the Biden administration made real strides in protecting the future of the country’s auto industry, which is headed toward ensuring that American motorists will be driving $10,000 EVs with a 1,000-mile range, a 10-year warranty, a running cost of 10 cents a mile, and 0 (yes zero!) climate-killing carbon emissions.

Not only did President Biden extend the critical $7,500 tax credit for the purchase of an American-made EV, but his 2021 Infrastructure Act helped raise the number of public-charging ports to a reasonable 192,000, with 1,000 more still being added weekly, reducing the range anxiety that troubles half of all American car owners. To cut the cost of the electricity needed to drive those car chargers, his 2022 Inflation Reduction Act allocated $370 billion to accelerate the transition to low-cost green energy. With such support, U.S. EV sales jumped 7% to a record 1.3 million units in 2024.

Most important of all, that funding stimulated research for a next-generation solid-state battery that could break China’s present stranglehold over most of the components needed to produce the current lithium-ion EV batteries. The solution: a blindingly simple bit of all-American innovation — don’t use any of those made-in-China components. With investment help from Volkswagen, the U.S. firm QuantumScape has recently developed a prototype for a solid-state battery that can reach “80% state of charge in less than 15 minutes,” while ensuring “improved safety,” extended battery life, and a driving range of 500 miles. Already, investment advisors are touting the company as the next Nvidia.

But wait a grim moment! If we take President Donald Trump at his word, his policies will slam the brakes on any such gains for the next four years — just long enough to potentially send the Detroit auto industry into a death spiral. On the campaign trail last year, Trump asked oil industry executives for a billion dollars in “campaign cash,” and told the Republican convention that he would “end the electrical vehicle mandate on day one” and thereby save “the U.S. auto industry from complete obliteration.” And in his victory speech last November, he celebrated the country’s oil reserves, saying, “We have more liquid gold than anyone else in the world.”

8 notes

·

View notes

Text

Adventuresses We Love – Bertha Benz Adventuress Bertha Benz was a woman with a vision, one she shared with her husband, Carl – to invent a practical “horseless carriage.” She believed in this vision so much that two years before their wedding, she used her dowry to bail out his failing company and invest in its future. The two of them would collaborate on the design and engineering of the car’s components, including its two-stroke engine, throughout the vehicle’s development. Progress was slow, but steady, and on New Year’s Eve1879 they finally got their engine to work. They continued to make improvements to the vehicle, until finally, in early 1886, Carl obtained a patent for their “motor car with gas engine operation.” The car made its public debut in Mannheim that summer, where… …nobody wanted it. There had been a few cars built before the Benz’s, enough to make everyone really, really nervous about them. Even the Vatican had spoken out against them, declaring the automobile to be a devil’s or witch’s carriage. Some localities in Germany had already outlawed the use of such vehicles, threatening to fine anyone operating them. Now, Carl was an engineering marvel, but a complete dunce at marketing. It would fall to Bertha to win people’s hearts and minds, and change the view of the automobile in their eyes. To accomplish this, she knew exactly what she had to do. She had to go visit her mom. At dawn on August 5, 1888, Bertha and her sons, Robert and Eugen, left Mannheim and headed towards Pforzheim, about 60 miles away. Today, we might not think of that as any big deal – that’s not much more than my commute to work – but in 1888, it was an Epic Road Trip. The first of its kind! The trip was fraught with challenges, not the least of which was that the car got 25mpg – but only carried about 1.3 gallons of fuel. To resolve this, Bertha bought the entire supply of ligroin – a petroleum-based cleaner – from a chemist in Wiesloch and used that to power the car. (The chemist’s in Wiesloch is still today recognized as the world’s first service station.) Bertha also found innovative solutions for some of the mechanical failures the car ran into on the way. For example, she used her hat pin to clear a clogged fuel line, and her garter to insulate a frayed spark plug wire. When the wooden blocks used in the brakes started to wear out, she stopped at a cobbler’s shop and had leather added to them – thereby inventing the world’s first brake pads. Another challenge – hills. The car had two gears – not quite enough to summit some of the hills on the route. Robert and Eugen got out and pushed it up a couple of them. Finally, after 13 hours on the road, Bertha and her boys arrived in Pforzheim. She telegraphed Carl to let him know, then enjoyed a few days with her mom before driving home. Bertha’s road trip started to change public opinion about the car, and led to her and Carl’s company being the automotive giant we know today. She also showed the importance of test drives – innovations were added to the design to overcome the issues she’d found on this trip (including adding a third gear which made hills much easier). Test drives are standard, essential practice for automobile manufacturers today, but had never been done before Bertha’s trip in 1888. Adventuress Bertha Benz died on May 5, 1944, two days after her 95th birthday. On May 3, 2024, Bertha’s 175th birthday, the German government issued a postage stamp honoring her and her contributions to automotive history.

18 notes

·

View notes

Text

1961 Ford Gyron Concept Car

The Ford Gyron was a futuristic two-wheeled gyrocar first shown to the world in 1961 at the Detroit Motor Show and designed by Syd Mead and McKinley Thompson. Like a motorcycle, one wheel was at the front and the other at the rear, and gyroscopes stabilized the car. The vehicle's two occupants were seated side by side, and when the vehicle was stationary, two small legs appeared from the sides to support it. The vehicle was created for research and marketing purposes, with no intention of putting it into production.

The gyroscopic system was based on Louis Brennan's theories and designed by Alex Tremulis, who started his career with the U.S. Air Force. In 1948, Tremulis worked at Wright-Patterson Air Force Base on the concept of Military Flying Saucers. He then became the chief designer for the ill-fated Tucker automobile before joining Ford. He was also involved with the Tuscan gyroscopic motorcycles and the Gyronaught XUI gyroscopic car.

The original fiberglass concept was destroyed in the Ford Rotunda fire of 1962. Only the studio model remains today, it was sold at an auction in December 2012 for $40,000. A second model was recently discovered in the collection of the Petersen Automotive Museum in Los Angeles and displayed as part of the 2024 exhibition, "Eyes on the Road." [Source: Wikipedia]

15 notes

·

View notes

Text

https://www.reuters.com/business/autos-transportation/tesla-lay-off-more-than-10-its-staff-electrek-reports-2024-04-15/

BERLIN, April 15 (Reuters) - Tesla (TSLA.O), opens new tab is laying off more than 10% of its global workforce, an internal memo seen by Reuters on Monday shows, as it grapples with falling sales and an intensifying price war for electric vehicles (EVs).

"About every five years, we need to reorganize and streamline the company for the next phase of growth," CEO Elon Musk commented in a post on X. Two senior leaders, battery development chief Drew Baglino and vice president for public policy Rohan Patel, also announced their departures, drawing posts of thanks from Musk although some investors were concerned.

Musk last announced a round of job cuts in 2022, after telling executives he had a "super bad feeling" about the economy. Still, Tesla headcount has risen from around 100,000 in late 2021 to over 140,000 in late 2023, according to filings with U.S. regulators.

Baglino was a Tesla veteran and one of four members, along with Musk, of the leadership team listed on the company's investor relations website.

Scott Acheychek, CEO of Rex Shares - which manages ETFs with high exposure to Tesla stock - described the headcount reductions as strategic, but Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors, deemed the departures of the senior executives as "the larger negative signal today" that Tesla's growth was in trouble.

Less than a year ago, Tesla's chief financial officer, Zach Kirkhorn, left the company, fueling concerns about succession planning.

Tesla shares closed 5.6% lower at $161.48 on Monday. Shares of EV makers Rivian Automotive (RIVN.O), opens new tab, Lucid Group (LCID.O), opens new tab and VinFast Auto also dropped between 2.4% and 9.4%.

"As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity," Musk said in the memo sent to all staff.

"As part of this effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10% globally," it said.

Reuters saw an email sent to at least three U.S. employees notifying them their dismissal was effective immediately.

Tesla did not immediately respond to a request for comment.

MASS MARKET

The layoffs follow an exclusive Reuters report on April 5 that Tesla had cancelled a long-promised inexpensive car, expected to cost $25,000, that investors have been counting on to drive mass-market growth. Musk had said the car, known as the Model 2, would start production in late 2025.

Shortly after the story published, Musk posted "Reuters is lying" on his social media site X, without detailing any inaccuracies. He has not commented on the car since, leaving investors and analysts to speculate on its future.

Tech publication Electrek, which first reported, opens new tab the latest job cuts, said on Monday that the inexpensive car project had been defunded and that many people working on it had been laid off.

Reuters also reported on April 5 that Tesla would shift its focus to self-driving robotaxis built on the same small-car platform. Musk posted on X that evening: "Tesla Robotaxi unveil on 8/8," with no further details.

Tesla could be years away from releasing a fully autonomous vehicle with regulatory approval, according to experts in self-driving cars and regulation.

Tesla shares have fallen about 33% so far this year, underperforming legacy automakers such as Toyota Motor (7203.T), opens new tab and General Motors (GM.N), opens new tab, whose shares have rallied 45% and about 20% respectively.

Energy major BP (BP.L), opens new tab has also cut more than a tenth of the workforce in its EV charging business after a bet on rapid growth in commercial EV fleets did not pay off, Reuters reported on Monday, underscoring the broader impact of slowing EV demand.

WORKS COUNCIL

A newly elected works council of labour representatives at Tesla's German plant was not informed or consulted ahead of the announcement to staff, said Dirk Schulze, head of the IG Metall union in the region.

"It is the legal obligation of management not only to inform the works council but to consult with it on how jobs can be secured," Schulze said.

Analysts from Gartner and Hargreaves Lansdown said the cuts were a sign of cost pressures as the carmaker invests in new models and artificial intelligence.

Tesla reported this month that its global vehicle deliveries in the first quarter fell for the first time in nearly four years, as price cuts failed to stir demand.

The EV maker has been slow to refresh its aging models as high interest rates have sapped consumer appetite for big-ticket items, while rivals in China, the world's largest auto market, are rolling out cheaper models.

China's BYD (002594.SZ), opens new tab briefly overtook the U.S. company as the world's largest EV maker in the fourth quarter, and new entrant Xiaomi (1810.HK), opens new tab has garnered substantial positive press.

Tesla is gearing up to start sales in India, the world's third-largest auto market, this year, producing cars in Germany for export to India and scouting locations for showrooms and service hubs in major cities.

Tesla recorded a gross profit margin of 17.6% in the fourth quarter, the lowest in more than four years.

2 notes

·

View notes

Text

Racing News: Ford Unveils Mustang GT3 Race Car

By SEMA Editors Ford has unveiled the Mustang GT3 race car, based on the all-new '24 Mustang Dark Horse, during a special ceremony as part of this year's 24 Hours of Le Mans. The automaker also announced plans to enter the GT3 into the iconic endurance race's FIA GT3 category in 2024, along with an entry in the 2024 World Endurance Championship season under Proton Competition, the German team led by team principal Christian Ried. "It is not Ford versus Ferrari anymore. It is Ford versus everyone," said Jim Farley, CEO of Ford Motor Co. Multimatic will build and support the GT3s, while M-Sport will assemble the Ford Performance-developed 5.4 L Coyote-based V8 engines. The GT3 features a bespoke short-long arm suspension, rear-mounted transaxle gearbox, carbon fiber body panels, and an aero package developed to meet GT3 targets. In addition, the automaker announced a new Ford Performance branding described as a "cleaner, simplified look" that will be integrated across its racing vehicles. New E1 World Championship to Launch Inaugural Electric Powerboat Racing Season UIM E1 World Championship--the world's first all-electric powerboat racing championship--has unveiled the venues that will host the first-ever racing season beginning in January 2024. The season will launch in Jeddah, Saudi Arabia, followed by a to-be-determined location in the Middle East in February 2024. Two events--set for April and May 2024--will take place in the waters of Venice, Italy. Then, competitors will visit Monaco in July 2024, followed by Rotterdam, Netherlands, in September 2024. Teams will race RaceBirds boats near the shore, allowing fans to view the action from land. WyoTech Announces Inaugural Hall of Fame Class WyoTech--the U.S. automotive, diesel and collision trade school based in Laramie, Wyoming--has announced its inaugural Hall of Fame class, with alumni including the late trailblazer known as "The Fastest Woman on Earth, a John Deere master tech whose YouTube videos have garnered 8 million views, a custom car builder who returned as an instructor and more. "Each of the six alumni has achieved tremendous career success and demonstrates WyoTech's capability of training students to succeed across the entire spectrum of the trade industry," said Jim Mathis, president and CEO of WyoTech. "We're honored to recognize them as the first inductees of WyoTech's Hall of Fame and to show the public the kind of impact our graduates have on the trade industry and the world." To be eligible for the WyoTech Hall of Fame, alumni must be five years post-graduation and established in the industry. The inaugural WyoTech Hall of Fame Class is (in alphabetical order): - John Alonzo is the racing operations-marketing director for the race shop at Scoggin Dickey Parts Center in Lubbock, Texas, one of the world's leading dealers of high-performance engines and GM parts. - Jessi Combs (1980-2019): The late Combs broke stereotypes and records by joining the North American Eagle Supersonic Speed Challenger team and, in 2013, became "The Fastest Woman on Four Wheels" at 398 mph, with a top speed of 440 mph. In 2019, she set a new women's landspeed world record at 522.783 mph before the accident that took her life. That feat and her career were memorialized in the HBO Max documentary "The Fastest Woman on Earth." - Dave Gilley is the founder and owner of Gilleyfab Enterprises, near Salt Lake City, Utah, known for top-tier, fine-quality fabrication in the UTV industry. - Levi Green is the owner and instructor of HammerFab near Austin, Texas, which specializes in handcrafting upscale turnkey customs and industry-leading fabrication tools and parts. - Zeth Key is a Master John Deere service technician at a Sloan Implement location in Illinois. In April 2008, he launched a YouTube channel in honor of his late friend Jake to promote the trade they loved and to "inspire a younger generation to pick up a wrench and start a great career" keeping agriculture running. In two years, the channel grew to 63,000 subscribers and 8 million views. - Randy Svalina is a WyoTech specialties instructor who teaches students a curriculum and a way of life that helps their families and communities. "As a part of WyoTech, we help others reach their goals, their dreams, raise their families and succeed in their journey," he said. Read the full article

4 notes

·

View notes

Text

Power Electronics Market to Reach $51.3 Billion by 2034 with Steady 5.3% CAGR

At a compound annual growth rate (CAGR) of 5.3%, the power electronics market is expected to develop significantly over the next ten years, from USD 30.7 billion in 2024 to USD 51.3 billion by 2034. Power electronics, which uses semiconductor devices to manage and convert electrical power, is becoming more and more popular across a range of sectors, especially in industrial automation, electric vehicles (EVs), and renewable energy.

With the ongoing shift towards clean energy and the rapid expansion of the EV market, power electronics are playing a critical role in improving energy efficiency and managing electrical power across multiple sectors. The market’s growth is underpinned by technological advancements in power semiconductor devices such as IGBTs and MOSFETs, as well as the growing demand for high-efficiency power solutions.

Request a Sample of this Report: https://www.futuremarketinsights.com/report-sample#5245502d47422d31303234

Key Takeaways from the Market Study

The Power Electronics Market is projected to grow at a CAGR of 5.3% from 2024 to 2034, reaching a valuation of US$ 51.3 billion by 2034.

The increasing penetration of renewable energy systems and electric vehicles is significantly boosting demand for power electronics.

Asia-Pacific is expected to dominate the market, driven by rapid industrialization and strong growth in the automotive and renewable energy sectors.

The energy & power and automotive segments will likely be key contributors to market growth over the forecast period.

Drivers and Opportunities

Several key factors are driving the growth of the Power Electronics Market. One of the primary drivers is the global push for renewable energy sources such as solar and wind power, which require power electronic devices to convert and manage energy efficiently. With many countries aiming to reduce carbon emissions, the installation of renewable energy systems is expected to surge, creating a significant demand for power electronics in inverters, converters, and power management systems.

The rise of electric vehicles (EVs) is another major growth driver. Power electronics are essential for the functioning of EVs, playing a critical role in battery management, motor control, and charging infrastructure. As EV adoption accelerates globally, the demand for power electronics is expected to rise sharply.

Additionally, the growing trend of industrial automation and the adoption of smart grids are presenting lucrative opportunities for market players. As industries increasingly adopt energy-efficient systems, power electronics are becoming essential for optimizing electrical power use in smart manufacturing and grid systems.

Components Insights

The Power Electronics Market is segmented based on components, including power discrete, power modules, and power ICs. Among these, power modules are expected to witness significant growth due to their widespread use in high-power applications such as solar inverters, EV powertrains, and industrial motor drives.

Power integrated circuits (ICs) are also gaining traction, particularly in consumer electronics and telecommunication devices, where compact and efficient power solutions are required. The demand for power discrete components, including diodes, transistors, and thyristors, is expected to remain strong in various industrial and automotive applications.

Application Insights

The Power Electronics Market finds extensive applications in industries such as automotive, energy & power, consumer electronics, and industrial automation. The automotive sector, especially in the context of electric and hybrid vehicles, is expected to be one of the largest contributors to market growth. Power electronics are used in electric vehicle charging systems, battery management systems, and traction inverters, all of which are vital for EV performance.

In the energy & power sector, the growing adoption of solar and wind energy solutions is driving the need for power converters and inverters, which manage the conversion of renewable energy into usable power. Additionally, the rise of smart grids is fueling the demand for advanced power electronics that improve energy distribution and efficiency.

The consumer electronics segment also represents a growing market, as power electronics are increasingly used in portable devices, smartphones, and laptops to improve battery performance and energy efficiency.

Deployment Insights

The Power Electronics Market is witnessing both on-premise and cloud-based deployments, with on-premise solutions dominating sectors like automotive and energy, where high power efficiency and reliable control are essential.

Cloud-based deployment is becoming increasingly popular in smart energy management systems and industrial automation, enabling real-time monitoring and control over power systems remotely. This trend is expected to grow, particularly in smart city projects and the integration of IoT-enabled devices.

Key Companies & Market Share Insights

Leading companies in the Power Electronics Market include Infineon Technologies AG, ON Semiconductor Corporation, Texas Instruments Incorporated, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., and Toshiba Corporation. These companies are focusing on developing innovative solutions that cater to the rising demand for high-efficiency power devices across multiple industries.

The competitive landscape is characterized by strategic partnerships, mergers, and acquisitions. For example, Infineon Technologies AG expanded its product portfolio by acquiring Cypress Semiconductor, which enhanced its capabilities in power management solutions. ON Semiconductor has been investing heavily in research and development to produce energy-efficient devices aimed at the automotive and industrial sectors.

Recent Developments

Mitsubishi Electric introduced a new line of SiC (silicon carbide) power modules aimed at improving the efficiency of power inverters in EVs and renewable energy systems.

Texas Instruments launched an innovative range of GaN (gallium nitride) power transistors that offer superior performance in high-power applications, including EVs and industrial automation systems.

Fuji Electric expanded its production capacity for IGBT modules, which are in high demand for solar power installations and electric vehicles, to address the increasing global demand for energy-efficient solutions.

0 notes

Text

Global Tools Market Growth: Trends, Challenges, and Opportunities

The global tools market size is expected to reach USD 61.84 billion by 2030, registering a CAGR of 5.7% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market growth is attributed to increasing construction spending in developing countries around the world. Manufacturers are continuously introducing new and improved tools equipped with advanced features, such as enhanced performance, durability, and user-friendly designs. For instance, power tools now come with brushless motors for increased efficiency, lithium-ion batteries for longer runtime, and ergonomic designs for improved comfort during prolonged use. These technological advancements make power and hand tools more attractive to both professionals and DIY enthusiasts, leading to increased demand. The construction & infrastructure sectors are experiencing significant growth worldwide, driven by urbanization, population growth, and government investments in infrastructure development.

These projects require a wide range of power tools and hand tools for tasks, such as excavation, concrete work, carpentry, plumbing, and electrical installations. As construction activity intensifies, the demand for tools used in building, renovation, and maintenance projects increases, contributing to the overall market growth. The growing preference for DIY is particularly prompting power tool vendors to introduce affordable and easy-to-use power tools featuring long-lasting batteries for household usage. Home improvement activities typically call for power tools, such as power drills, circular saws, impact wrenches, hammer drills, and grinders. These power tools are available in the market in a diverse range and can be used for various applications, such as roofing, kitchen and bathroom remodeling, and landscaping, among others. As the trend of undertaking these activities is expected to continue over the next few years, the demand for power tools is also anticipated to gain traction over the forecast period.

At the same time, an upsurge in technical jobs, particularly at professional contractors undertaking home improvement and remodeling projects, has also paved the way for the growth of the power tools market. In various industries, such as construction, manufacturing, and automotive, there is a growing emphasis on improving productivity and efficiency. Power tools and hand tools play a crucial role in achieving these goals by enabling workers to complete tasks more quickly and accurately. For instance, power drills, saws, and impact drivers allow for faster assembly, cutting, and fastening, while hand tools like wrenches and pliers facilitate precise adjustments and repairs. As businesses seek to streamline their operations and meet tight deadlines, the demand for tools that enhance productivity continues to rise.

Tools Market Report Highlights

The power tool segment led the market with a share of 69.0 in 2023. Power tools are generally more efficient than hand tools, allowing users to complete tasks more quickly and with less physical effort. For instance, a power drill can quickly bore holes through various materials with precision and ease, whereas using a manual drill requires more time and effort. This efficiency is particularly important in industries, such as construction, manufacturing, and woodworking. This increases the adoption of power tools over hand tools

The construction application segment led the market with a share of 48.6% in 2023. The increasing complexity of construction projects, particularly in commercial developments, necessitates the use of specialized tools and equipment. As construction projects become more complex, the demand for specialized tools grows to meet the evolving needs of builders and contractors

The aerospace & defense segment is expected to register the fastest CAGR from 2024 to 2030. Globalization of the aerospace & defense industry has led to increased competition and collaboration among manufacturers, suppliers, and service providers worldwide. As companies seek to gain a competitive edge & access new markets, they are investing in cutting-edge technologies and innovative tools to improve efficiency, reduce costs, and enhance capabilities

Collaborative partnerships and joint ventures between aerospace & defense companies further accelerate technology development and adoption, driving innovation and fueling demand for advanced tools

The market is highly competitive on account of the presence of many large-scale manufacturers, functioning at a regional or global level with extensive product portfolios. To gain a competitive advantage, these companies undertake strategies, such as expansions, product launches, collaborations, M&As, and R&D

Tools Market Segmentation

Grand View Research has segmented the global tools market based on product, application, and region:

Tools Product Outlook (Revenue, USD Million, 2018 - 2030)

Power Tools

Hand Tools

Tools Application Outlook (Revenue, USD Million, 2018 - 2030)

Oil & Gas

Automotive

Rail

Aerospace & Defense

Construction

Others

Tools Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Asia Pacific

China

India

Japan

Central & South America

Brazil

Middle East & Africa

Saudi Arabia

Key Players in Tools Market

Emerson Electric Co.

Hilti Corporation

Zhejiang SALI Abrasive Technology Co., Ltd.

Apex Tool Group

Makita Corporation

Stanley Black and Decker Inc.

Robert Bosch GmbH.

Husqvarna AB

Snap-on Incorporated

KOKI HOLDINGS Co., Ltd.

Armstrong Tools Inc,

Falcon Garden Tools Ltd.

Bully Tools

Order a free sample PDF of the Tools Market Intelligence Study, published by Grand View Research.

0 notes

Text

Automotive Electric Motor Market 2024 is Blossoming Worldwide by 2030

The Automotive Electric Motor Market Research Report 2024 begins with an overview of the market and offers throughout development. It presents a comprehensive analysis of all the regional and major player segments that gives closer insights upon present market conditions and future market opportunities along with drivers, trending segments, consumer behaviour, pricing factors and market performance and estimation and prices as well as global predominant vendor’s information. The forecast market information, SWOT analysis, Automotive Electric Motor Market scenario, and feasibility study are the vital aspects analysed in this report.

The automotive electric motor market is expected to grow at a 6.5% CAGR from 106.3 USD Billion in 2023 to 182.7 USD Billion in 2030.

Access Full Report:

https://exactitudeconsultancy.com/reports/15567/automotive-electric-motor-market/

#Automotive Electric Motor Market Size#Automotive Electric Motor Market Share#Automotive Electric Motor Market Report#Automotive Electric Motor Market 2024-2030#Automotive Electric Motor Market Forecast#Automotive Electric Motor Market opportunity#Automotive Electric Motor Market Scope#Automotive Electric Motor Market Trends#Automotive Electric Motor Market 2024#Automotive Electric Motor Market 2030#Automotive Electric Motor Market Analysis#Automotive Electric Motor Market Technology#Automotive Electric Motor Market Business#Automotive Electric Motor Market South Korea#US Automotive Electric Motor Market#French Automotive Electric Motor Market#China Automotive Electric Motor Market#Italy Automotive Electric Motor Market#Europe Automotive Electric Motor Market#Automotive Electric Motor Market Outlook#Automotive Electric Motor Market Research

0 notes

Text

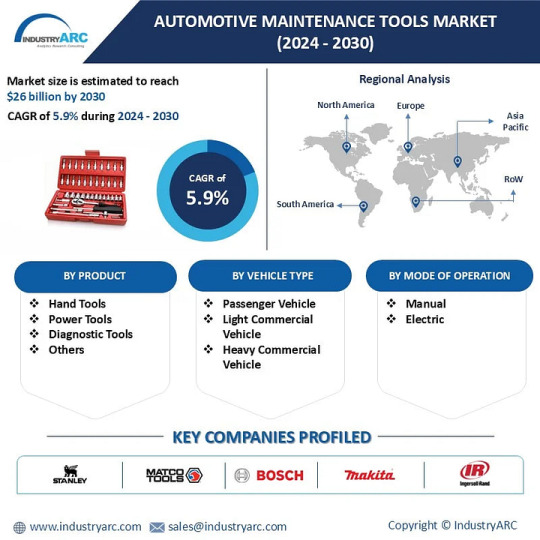

Automotive Maintenance Tools Market Global Opportunity Analysis & Industry Forecast, 2024–2030

Automotive Maintenance Tools Market Overview

Automotive Maintenance Tools Market is forecast to reach $26 billion by 2030, after growing at a CAGR of 5.9% during 2024–2030.

Request Sample :

A growing trend in the automotive maintenance tools market is the integration of smart and connected tools. New vehicles, complete with 100 or more electronic control units (ECUs), have become highly complex networks and this increases the pressure to develop more efficient tools and systems to effectively diagnose the ECUs. Due to the complexity of modern vehicle electronics, automotive professionals now rely on advanced diagnostic tools. Sophisticated scanners, oscilloscopes, and software applications are essential for accurately identifying and resolving vehicle problems. Multi-functional tools have become increasingly popular in the automotive maintenance tools market due to their versatility, efficiency, and space-saving benefits. For instance, tools like multi-bit screw drivers, ratchet and socket sets and multi-function pilers allow technicians to quickly switch between different tasks without having to find and retrieve multiple individual tools. This efficiency can significantly reduce the time spent on maintenance and repairs.

Automotive Maintenance Tools Market Report Coverage

The report: “Automotive Maintenance Tools Market — Forecast (2024–2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the Automotive Maintenance Tools Market.

AttributeSegment

By Product

Hand Tools

Power Tools

Diagnostic Tools

Others

By Vehicle Type

Passenger Vehicle

Light Commercial Vehicle

Heavy Commercial Vehicle

By Mode of Operation

Manual

Electric

By Sales Channel

Online

Offline

By Geography

North America (U.S, Canada and Mexico)

Europe (Germany, France, UK, Italy, Spain, Netherlands, Belgium and Rest of Europe),

Asia-Pacific (China, Japan, South Korea, India, Australia, Indonesia, Thailand, Malaysia and Rest of Asia-Pacific),

South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

Rest of the World (Middle East and Africa).

COVID-19 / Ukraine Crisis — Impact Analysis:

The COVID-19 pandemic disrupted the global automotive industry impacting the demand for automotive maintenance tools. Reduced vehicle production and sales coupled with supply chain disruptions led to a decline in the demand for tools used in vehicle maintenance and repair. However, as several service centers and repair shops remained shut due to lockdowns, there was a demand for DIY tools as consumers themselves began maintenance and service of their vehicles.

The Russia-Ukraine war disrupted supply chains for certain components but the overall impact on the automotive maintenance tools industry has been relatively minimal. However, the war indirectly affected the demand for maintenance tools through inflation and economic uncertainty.

Inquiry Before Buying:

Key Takeaways

Hand Tools is the Largest Segment

The Hand Tools segment held the largest share in Global Automotive Maintenance Tools Market. Hand tools can be used for a wide range of tasks from simple repairs to more complex repairs. Compared to power tools, hand tools are generally more affordable, making them accessible to a wider range of users. Hand tools are generally more reliable and less prone to breakdowns than power tools, making them a dependable option for automotive maintenance. As per the International Organization of Motor Vehicle Manufacturers (OICA), globally nearly 9.3 million vehicles were sold in 2023 compared to 8.2 million vehicles in 2022. As the number of vehicles on the roads continues to rise, the need for maintenance and repair activities also increases thereby driving the demand for automotive maintenance tools.

Passenger Vehicles Dominate the Market

The passenger vehicle segment held the largest share in the Global Automotive Tools Maintenance Market. According to The European Automobile Manufacturers’ Association (AECA), passenger cars account for 83% of EU motor vehicle production, with almost 10.9 million units built per year. Over the coming years, the Automotive Maintenance market is expected to be dominated by passenger vehicles due to their high demand, the increasing number of vehicles on the road including the adoption of EVs, Passenger vehicles make up the majority of the Automotive Maintenance Tools industry. The expanding global vehicle fleet, including passenger cars leads to a higher demand for automotive tools. More vehicles on the road translates to more frequent maintenance and repairs, sustaining the market for automotive tools.

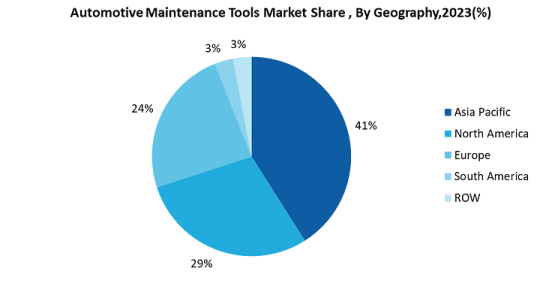

APAC Leads the Market

Asia Pacific held the dominant share in the automotive maintenance tools market up to a share of 41% and the region is expected to register the fastest growth rate in the near future. Increasing passenger vehicles sales across Countries like China, India, Japan are fuelling the market growth. As per the Global EV Outlook 2024 by the International Energy Agency (IEA), the market share of electric cars in China could reach up to 45% in 2024. Moreover, rapid growth in the automotive aftermarket industry due to aging vehicles and increasing use of second-hand cars is also driving the market growth in this region. For instance, sales of used vehicles in China surged 14.54% year on year in the first seven months of 2023, data from the China Automobile Dealers Association shows.

Growth in Automotive Production and Advancements in Technology Boosts the Growth

The global increase in automotive production and sales driven by economic growth and rising consumer demand fuels the need for automotive tools. The market is being fueled by the ongoing need for regular vehicle maintenance. Continuous advancements in automotive technology including the development of electric vehicles (EVs), hybrid vehicles and advanced driver-assistance systems (ADAS) necessitate specialized tools for diagnostics, repair and maintenance. ADAS technologies offer a range of features designed to enhance driver safety and assist in avoiding collisions. In July 2024, the EU’s New Vehicle General Safety Regulation (GSR2) came into force which requires the installation of several advanced driver assistance systems (ADAS) in order to update the minimum performance standards for motor vehicles. These required systems include intelligent speed assist (ISA), autonomous emergency braking (AEB), driver drowsiness and attention warning (DDAW) and emergency lane-keeping systems (ELKS). Such technologies contribute to the growth of maintenance tools market.

Schedule A Call :

Do-It-Yourself (DIY) Automotive Repair Drives the Market

The growing trend of do-it-yourself (DIY) automotive repair among consumers encourages the purchase of automotive tools. Access to online tutorials and resources empowers vehicle owners to perform basic maintenance and repairs at home boosting the sales of automotive tools. DIY enthusiasts typically require tools that are easy to use, affordable and suitable for home garages. This has led to a growing demand for consumer-oriented tools such as basic hand tools, simple power tools and diagnostic scanners. To cater to the DIY market, manufacturers have introduced new tool categories such as home mechanic kits and simplified diagnostic tools. In November 2023, Gearwrench launched two new floor jacks and four new jack stands for the automotive maintenance. Gearwrench’s jack stands will be available in 2 Ton, 3 Ton, 6 Ton and 12 Ton capacities and are built with a heavy-duty all steel construction. The jack stands have an adjustable ratcheting bar that locks in place with a double lock pin, which helps to prevent accidental height adjustments during use.

Buy Now :

High Initial Investment and Tool Costs to Hamper the Market

For more details on this report — Request for Sample

Automotive Maintenance Tools Market Key Players

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the Automotive Maintenance Tools Market. The top 10 players in the Automotive Maintenance Tools Market are 1. Stanley 2. Matco Tools 3. Bosch 4. Makita Corporation 5. Ingersoll Rand 6. Stahlwille 7. Apex Tool Group 8. Hitachi 9. Einhell Service 10. Tolsen Tools Scope of the Report:

Report MetricDetails

Base Year Considered

2023

Forecast Period

2024–2030

CAGR

5.9%

Market Size in 2030

$26 Billion

Segments Covered

By Product, By Vehicle Type, By Mode of Operation, By Sales Channel and By Geography.

Geographies Covered

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Belgium and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, New Zealand, Thailand, Malaysia and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

Key Market Players

1. Stanley

2. Matco Tools

3. Bosch

4. Makita Corporation

5. Ingersoll Rand

6. Stahlwille

7. Apex Tool Group

8. Hitachi

9. Einhell Service

10. Tolsen Tools

For more Automotive Market reports, please click here

#AutoTools 🔧#CarMaintenance 🚗#DIYMechanic 🛠️#GarageGear 🏎️#ToolTime ⚙️#MechanicLife 🔩#FixItFast ⏱️#CarRepairEssentials 🚘

0 notes

Text

Light-Emitting Diode (LED) Mounter Market Growth and Industry by 2024-2032

The Reports and Insights, a leading market research company, has recently releases report titled “Light-Emitting Diode (LED) Mounter Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Light-Emitting Diode (LED) Mounter Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Light-Emitting Diode (LED) Mounter?

As per Reports and Insights analysis, the light-emitting diode (LED) mounter market is expected to grow at a CAGR of 9.7% during the forecast period of 2024 to 2032.

What are Light-Emitting Diode (LED) Mounter Market?

A light-emitting diode (LED) mounter, also known as an LED pick-and-place machine, is an automated device used in electronics manufacturing to precisely place LED components onto printed circuit boards (PCBs). Equipped with advanced vision systems and precision robotic arms, the machine picks LEDs from feeders and positions them accurately on the PCB as per design specifications. This process ensures high-speed and precise placement of small, delicate LEDs, essential for producing LED displays, lighting solutions, and various electronic devices. Automation by the LED mounter significantly reduces manual labor, enhances production efficiency, and minimizes assembly errors.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1909

What are the growth prospects and trends in the Light-Emitting Diode (LED) Mounter Market industry?

The light-emitting diode (LED) mounter market growth is driven by various factors and trends. The light-emitting diode (LED) mounter market is rapidly growing, fueled by the increasing demand for LED displays, lighting solutions, and advanced electronic devices. The expanding automotive, consumer electronics, and telecommunications industries drive the need for efficient, high-speed, and precise LED assembly. Innovations in LED technology and advancements in automation and robotics further accelerate market growth. The trend towards miniaturizing electronic devices also requires highly accurate placement machines. The Asia-Pacific region, especially China and Japan, leads the market due to its strong electronics manufacturing presence, while North America and Europe show robust demand driven by technological advancements and high adoption rates. Hence, all these factors contribute to light-emitting diode (LED) mounter market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Product Type:

High-speed LED mounters

Medium-speed LED mounters

Low-speed LED mounters

By Application:

Consumer electronics

Automotive

Aerospace and defense

Industrial

Healthcare

Others

By End-use Industry:

Electronics manufacturing services (EMS)

Original equipment manufacturers (OEMs)

By Organization Size:

Small and Medium Enterprises (SMEs)

Large Enterprises

Market Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

The U.K.

France

Spain

Italy

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

India

Japan

South Korea

Australia

New Zealand

ASEAN

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa:

Saudi Arabia

United Arab Emirates

South Africa

Egypt

Israel

Rest of MEA.

Who are the key players operating in the industry?

The report covers the major market players including:

ASM Pacific Technology Ltd.

Fuji Machine Mfg. Co. Ltd.

Juki Corporation

Panasonic Corporation

Mycronic AB

Yamaha Motor Co., Ltd.

Hanwha Precision Machinery Co., Ltd.

Nordson Corporation

Kulicke & Soffa Industries, Inc.

HAN'S Laser Technology Industry Group Co., Ltd.

Hitachi High-Tech Corporation

Nordson Corporation

Essemtec AG

OMRON Corporation

ITW EAE

Discover more: https://www.reportsandinsights.com/report/light-emitting-diode-led-mounter-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

#Light-Emitting Diode (LED) Mounter Market Size#Light-Emitting Diode (LED) Mounter Market Share#Light-Emitting Diode (LED) Mounter Market Demand#Light-Emitting Diode (LED) Mounter Market Analysis

0 notes

Text

The automotive cabin air quality sensors market is projected to grow from USD 1065 million in 2024 to USD 2732.56 million by 2032, reflecting a compound annual growth rate (CAGR) of 12.5% during the forecast period. The automotive cabin air quality sensors market is witnessing rapid growth, driven by increasing consumer awareness of health and air quality issues, as well as the rising adoption of advanced automotive technologies. These sensors, which monitor and regulate the quality of air inside vehicle cabins, have become essential components in modern vehicles. With their ability to detect harmful pollutants, ensure passenger comfort, and enhance overall vehicle performance, these sensors are shaping the future of automotive innovation.

Browse the full report at https://www.credenceresearch.com/report/automotive-cabin-air-quality-sensors-market

Market Overview

Automotive cabin air quality sensors are designed to detect various pollutants such as carbon dioxide (CO2), carbon monoxide (CO), nitrogen oxides (NOx), particulate matter (PM), and volatile organic compounds (VOCs). By providing real-time data on air quality, these sensors enable advanced air purification systems to filter out harmful pollutants and maintain a clean cabin environment.

The growing concerns about environmental pollution and its impact on health have significantly boosted the demand for these sensors. Moreover, stringent government regulations on vehicle emissions and air quality standards are compelling automakers to integrate advanced air quality monitoring systems into their vehicles.

Key Market Drivers

Increasing Awareness of Air Pollution With urbanization and industrialization on the rise, air pollution levels have reached alarming heights. Consumers are increasingly prioritizing clean air and comfort while traveling, driving demand for vehicles equipped with cabin air quality sensors.

Stringent Regulatory Standards Governments worldwide are implementing stringent regulations to control vehicular emissions and improve air quality. For instance, the European Union's Euro 6 and China's CN-6 standards emphasize reducing pollutants inside and outside vehicles, fostering the adoption of air quality sensors.

Rise in Electric and Autonomous Vehicles The growing adoption of electric and autonomous vehicles has further fueled the market. These advanced vehicles often feature cutting-edge technologies, including sophisticated cabin air quality monitoring systems, to provide a premium experience.

Health and Wellness Trends Post-pandemic, there is heightened focus on health and hygiene. Automakers are incorporating features like air purifiers, ionizers, and advanced filtration systems alongside air quality sensors to meet consumer demands for wellness-oriented features.

Challenges in the Market

Despite its promising growth, the market faces certain challenges. High initial costs of advanced air quality systems may deter adoption in budget-friendly vehicle segments. Additionally, technical limitations in detecting specific pollutants and maintaining sensor accuracy over time remain key concerns.

Future Outlook

The automotive cabin air quality sensors market is poised for significant growth, with increasing investments in R&D and advancements in sensor technology. The integration of artificial intelligence (AI) and the Internet of Things (IoT) is expected to revolutionize air quality monitoring systems, enabling predictive maintenance and smarter filtration systems.

Key Player Analysis:

Paragon GmbH & Co. KGaA

Sensata Technologies

Sensirion AG

ams AG

SGX Sensortech

Standard Motor Products

Valeo SA

Figaro Engineering Inc.

UST Umweltsensortechnik GmbH

Prodrive Technologies

Segmentations:

By Type

Pressure Sensors

Temperature Sensors

By Technology Type

Active Sensors

Passive sensors

By Sales Channel Type

OEM

Aftermarket

By Vehicle Type

Passenger Cars

Commercial Vehicles

By Geography

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/automotive-cabin-air-quality-sensors-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

Global High Performance Electric Vehicles Market — Forecast(2025–2031)

𝐓𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞 𝐢𝐬 𝐄𝐥𝐞𝐜𝐭𝐫𝐢𝐜: 𝐇𝐢𝐠𝐡-𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐄𝐕𝐬 𝐓𝐚𝐤𝐢𝐧𝐠 𝐎𝐯𝐞𝐫!” 🔋🚀 IndustryARC™

The global electric vehicle market size was estimated at USD 1,328.08 billion in 2024 and is projected to grow at a CAGR of 32.5% from 2025 to 2030.

👉𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 :

The Global High-Performance #Electric_Vehicles (#EVs) Market refers to the segment of electric vehicles designed for superior #speed, #acceleration, handling, and overall driving performance. These EVs combine cutting-edge technology with sustainability, catering to #automotive enthusiasts and consumers seeking high-speed, luxury, and eco-friendly transportation.

The expansion of the transportation and logistics sectors significantly drives the rising demand for EVs. As global trade and e-commerce continue to surge, there is an increased need for efficient and sustainable transportation solutions. Electric vehicles offer a promising alternative to traditional internal combustion engines, as they produce lower emissions and reduce operational costs.

𝐊𝐞𝐲 𝐂𝐡𝐚𝐫𝐚𝐜𝐭𝐞𝐫𝐢𝐬𝐭𝐢𝐜𝐬 𝐨𝐟 𝐇𝐢𝐠𝐡-𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐄𝐕𝐬:

✅ Powerful Electric Drivetrains — Delivering high torque and rapid acceleration

✅ Advanced Battery Technology — Enabling extended range and fast charging

✅ Lightweight & Aerodynamic Designs — Enhancing efficiency and speed

✅ Smart Connectivity & AI Integration — Offering enhanced driver experience

𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 & 𝐓𝐫𝐞𝐧𝐝𝐬:

📈 Increasing Demand for Performance & Sustainability — Consumers want speed without compromising on environmental impact 🌱

🏭 Major Automakers Investing Heavily — Companies like Tesla, Porsche, Rimac, Lucid Motors, Ferrari, and legacy brands like BMW & Mercedes-Benz are entering the space 🏎️

🔋 Battery Innovations — Solid-state and high-capacity lithium-ion batteries are enhancing range & efficiency 🔥

📊 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 :

𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐮𝐭𝐥𝐨𝐨𝐤:

With advancements in EV infrastructure, battery tech, and government incentives, the high-performance EV market is expected to grow exponentially, redefining the future of high-speed, zero-emission mobility.

Get this Report on discount of $1000 on purchase of Credit Card

✅ 𝗞𝗲𝘆 𝗖𝗼𝗺𝗽𝗮𝗻𝗶𝗲𝘀 𝗣𝗿𝗼𝗳𝗶𝗹𝗲𝘀 𝗚𝗶𝘃𝗲𝗻 𝗶𝗻 𝘁𝗵𝗶𝘀 𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗲𝗽𝗼𝗿𝘁: Volvo Finland Ab | Byd Company Limited | BYD Electronic (International) Company Limited | Ford Motor Company | General Motors | American Honda Motor Company, Inc. | Honda Motor Europe Ltd | Kawasaki Motors Corp., U.S.A. | Mercedes-Benz Group AG | Mitsubishi Motors Corporation | Nissan Motor Corporation | Renault Group | Tesla | Toyota Motor Corporation | Volkswagen Group | Zero Motorcycles Inc. | Zero Motorcycles Australia |

#EVRevolution#HighPerformanceEVs#ElectricSupercars#SustainableMobility#FutureOfDriving#ZeroEmissions#EVInnovation#AutomotiveTech#GreenEnergy#FastAndElectric#BatteryTechnology#SmartMobility#EVPerformance

0 notes