#Automated Trading Robots

Explore tagged Tumblr posts

Text

“For decades, sci-fi authors and self-described "futurists" predicted that automation would put tradesmen out of work. After all, couldn't a machine easily do the job of someone without a college degree? (smug smug, smarm smarm)

Welllllp...it turns out that making robots capable of performing menial tasks in anything but a controlled environment is a huge engineering challenge. Every little thing that even an untrained, uneducated person can do has to be taught to the machine.

You want a robot that can clean hotel rooms and perform building maintenance? You have to give it the ability to detect everything in its environment, discern one object from another, and manipulate those objects on its own.

That's really, really hard. It's a lot of effort and technology to get a machine to do something a person can learn to do in a moments. Even when the tech hurdle is eventually overcome, other factors will still determine whether or not it's cost-effective or efficient.

Meanwhile, you know what machines excel at? Number-crunching, tracking metrics, and organizing data.

I predict that before truck drivers, welders, plumbers, and housekeepers have their livelihoods threatened, the machines will come for a big chunk of the corporate workforce. If you have a bullshit email job, you might end up getting automated into unemployment.

At the moment, the skilled trades (plumbers, electricians, construction, roofing, welding, etc.) are in no danger of being replaced by robots. They can't even be outsourced overseas because you have to be physically present to do those jobs. The coders will be replaced before the custodians are.

So, learn to custode, I guess.”

#good point#interesting#technology#adaptation#robotics#hard work#blue collar#jobs#the trades#coding#science fiction vs fact#futurism#automation

5 notes

·

View notes

Text

Algo Trading Provider | Robotrade

Robotrade is an Algorithmic Trading Platform that will help you make fortunes in the stock market without direct knowledge of stocks, options, futures, and other markets. It's like having a financial analyst on your computer but better. Robotrade comes with built-in integrations with the major Indian broking platforms out there. You define the strategy, set margins, and start it running. That's it. No coding required, no experience needed. Visit us now at https://www.robotrade.co.in/

#automatic trading#automated online trading#automated stock trading bot#robot trading platform india#robot trading platform#Algo Trading provider

2 notes

·

View notes

Text

Forex Robots for Automated Trading: Leverage Technology for Success

How to Leverage Forex Robots for Automated Trading

Automated trading has revolutionized the forex market, and Forex Robots for Automated Trading are at the heart of this transformation. These advanced tools, also known as Expert Advisors (EAs), provide traders with the ability to execute trades automatically based on pre-programmed strategies, removing emotional biases and allowing for 24/7 trading.

In this article, we'll explore what Forex Robots are, how they work, and how you can leverage them to enhance your trading experience.

What Are Forex Robots?

Forex robots are computer programs that use algorithms to automate the trading process. These robots are designed to analyze market conditions, identify trading opportunities, and execute trades automatically without human intervention. By relying on a set of rules and strategies, Forex robots can process vast amounts of data quickly, making them ideal for traders who want to automate their trading strategies and maximize their efficiency.

There are many types of Forex robots, ranging from simple ones that follow basic technical indicators to more complex ones that incorporate machine learning and artificial intelligence to adapt to market conditions.

Why Use Forex Robots for Automated Trading?

24/7 Trading The forex market operates 24 hours a day, five days a week, which means opportunities for profitable trades can arise at any time. Forex robots allow traders to take advantage of these opportunities by trading around the clock without the need for constant monitoring.

Eliminate Emotional Trading One of the biggest challenges for traders is overcoming emotional biases that can lead to impulsive decisions. Forex robots follow strict rules and algorithms, eliminating emotions like fear and greed from the trading process.

Consistency Forex robots execute trades consistently and without deviation from the trading strategy. This ensures that trades are carried out according to plan, reducing the risk of costly mistakes.

Speed and Efficiency The speed at which Forex robots can analyze data and execute trades is unparalleled. While human traders may take several minutes to make decisions, a robot can process market conditions and open or close a position in a matter of milliseconds.

How Do Forex Robots Work?

Forex robots work based on pre-defined algorithms and technical indicators, which are designed by experienced traders or developers. These robots are programmed to follow a set of rules that define when to enter or exit a trade, how much to invest, and how to manage risk. Here's a breakdown of how Forex robots function:

Market Analysis The robot continuously monitors the market, analyzing data such as price action, trend patterns, support and resistance levels, and other technical indicators like moving averages or RSI (Relative Strength Index). It uses this data to identify potential entry and exit points.

Trade Execution Once the robot identifies a trade signal, it executes the trade automatically. This eliminates the need for manual intervention, ensuring that opportunities are seized in real-time.

Risk Management Many Forex robots are programmed with risk management features, such as stop-loss and take-profit orders, which help to protect your capital by closing trades when they reach certain predetermined levels. Some robots even use trailing stops, which adjust the stop-loss as the trade moves in your favor.

Backtesting Most Forex robots allow for backtesting, meaning traders can test the robot on historical data to evaluate its effectiveness. This helps traders refine their strategies before deploying them in live markets.

Types of Forex Robots

There are several types of Forex robots available to traders, each with its strengths and weaknesses. Understanding the different types of robots can help you choose the one that best fits your trading style and goals.

Trend Following Robots These robots are designed to identify and capitalize on long-term trends in the market. They typically use indicators like moving averages or trend lines to detect whether the market is trending upwards or downwards. Trend-following robots are ideal for traders who want to profit from market momentum.

Scalping Robots Scalping robots are designed for traders who wish to make small, quick profits from minor price movements. These robots typically focus on short-term charts and make many trades throughout the day, aiming to capture small profits from each one.

Range-Bound Robots Range-bound robots are programmed to trade within a specific price range. They buy when the price is low and sell when it is high, often using oscillators like RSI or Stochastic to identify overbought or oversold conditions.

News-Based Robots These robots focus on market-moving news events. They analyze economic data releases and news reports to make trading decisions based on anticipated market reactions. News-based robots are fast and require access to real-time data feeds to be effective.

Benefits of Using Forex Robots for Automated Trading

1. Increased Efficiency and Productivity

Forex robots can process and analyze data far quicker than humans, enabling traders to execute trades that would otherwise be missed. Automated trading also frees up time for traders to focus on other tasks or strategy development.

2. Diversification

By using multiple robots with different strategies, traders can diversify their portfolios and reduce the risk associated with a single trading approach. This helps to balance risk and reward across different market conditions.

3. Backtesting Capabilities

Forex robots allow traders to backtest their strategies using historical data. This helps identify the most profitable strategies and improve them before applying them in a live market.

4. Customizable Parameters

Many Forex robots come with customizable settings, allowing traders to adjust parameters such as stop-loss, take-profit, risk tolerance, and trade frequency. This flexibility makes it easy to tailor the robot to specific trading preferences.

5. Reduce Human Error

Human traders can make mistakes due to fatigue, stress, or distractions. Forex robots, however, can execute trades with precision, ensuring that strategies are followed without deviation or error.

How to Leverage Forex Robots for Success

To leverage Forex robots for success, it's essential to follow best practices that ensure their effectiveness. Here are some steps to get started:

1. Choose the Right Forex Robot

Choosing the right Forex robot is crucial to your success. Make sure to research different robots and select one that aligns with your trading style and goals. Look for robots with positive reviews, proven track records, and reliable customer support.

2. Start with a Demo Account

Before using a Forex robot with real money, test it on a demo account to assess its performance. This will help you understand how the robot works, familiarize yourself with its interface, and adjust its settings to match your trading preferences.

3. Optimize Risk Management

Effective risk management is essential when using Forex robots. Ensure that the robot is programmed with appropriate risk management features such as stop-loss and take-profit orders. Keep your risk per trade at a level you are comfortable with and ensure the robot can manage risks automatically.

4. Monitor Robot Performance

Even though Forex robots can trade on their own, it's important to monitor their performance periodically. Track the profits and losses over time, and make adjustments to the strategy if needed. Regular monitoring ensures that the robot remains aligned with market conditions and trading goals.

5. Stay Updated on Market Conditions

The forex market is dynamic and can change rapidly. Ensure that your Forex robot is regularly updated to incorporate new market data, economic events, and technical indicators. Staying informed helps the robot adapt to changing market conditions.

Conclusion

Forex Robots for Automated Trading offer traders a powerful way to automate their trading strategies, minimize emotional biases, and optimize performance. By choosing the right robot, testing it on a demo account, and using proper risk management, traders can significantly enhance their trading experience. If you’re looking to take your trading to the next level, leveraging the power of Forex robots is a smart and efficient way to do so.

Whether you're a seasoned trader or just starting out, these automated tools can help you make informed decisions and execute trades with precision, giving you a competitive edge in the fast-paced forex market.

Source:- https://forexrobotsforautomatedtrading.blogspot.com/2024/12/forex-robots-for-automated-trading.html

#trading algorithmique#technique de trading#robot trader#acheter un robot trading#robot trading gratuity#acheter un robot de trading#Forex Robots for Automated Trading#Activate your trading robot price#Robo trading software price#Automated Trading Platforms

0 notes

Text

FREE eBOOK (.PDF) -This eBook includes general information and educational resources for explaining the modern use of automated trading, plus some practical information and advice on how to create a proprietary automated trading system. The optimization of a trading strategy through sophisticated backtesting and walk-through steps is maybe the most difficult part of strategy building. This eBook contains information on how to successfully backtest and optimize automated strategies using advanced commercial software.

0 notes

Text

Transform Your Forex Trading with Mybottrading: The Ultimate Trading Experience

Welcome to Mybottrading, the premier platform for revolutionizing your forex trading journey. Whether you're new to trading or a seasoned professional, Mybottrading and Mybotfx offer state-of-the-art tools and resources to help you succeed. In this blog, we’ll explore how Mybottrading provides the best forex robots, live trading bots, and comprehensive forex training to elevate your trading strategies.

Why Choose Mybottrading?

Mybottrading is dedicated to empowering traders with advanced technologies and expert insights. Our platform integrates sophisticated algorithms and user-friendly interfaces to ensure you have everything you need to excel in the forex market. Here’s what makes Mybottrading stand out:

Innovative Technology: Our cutting-edge tools are designed to enhance your trading efficiency.

Comprehensive Support: From beginner tips to advanced strategies, we provide the resources you need to succeed.

Reliable Performance: With Mybottrading, you can count on consistent and dependable results.

Unveiling the Power of Mybotfx

Mybotfx is at the core of the Mybottrading experience, offering robust and reliable trading solutions. Here’s why Mybotfx is the preferred choice for traders:

Advanced Algorithms: Mybotfx leverages advanced algorithms to analyze market trends and execute trades with precision.

User-Friendly Design: The platform is designed to be intuitive and easy to use, making it accessible for traders of all levels.

Consistent Results: With Mybotfx, you can expect consistent and reliable performance, helping you make informed trading decisions.

Experience Robot Trading Live with Mybottrading

Robot trading live is a game-changer in the forex market, and Mybottrading offers the best solutions to take advantage of this technology. Our live trading bots operate in real-time, executing trades based on current market data. Here’s why robot trading live is essential for modern traders:

Instant Trade Execution: Real-time execution ensures that your trades are always timely and relevant.

24/7 Market Monitoring: Robot trading live means your trading strategies are implemented continuously, even when you’re not actively monitoring the market.

Accurate Market Analysis: Our bots use advanced algorithms to provide precise market analysis, helping you make informed trading decisions.

Discover the Best Forex Robots at Mybottrading

At Mybottrading, we pride ourselves on offering the best forex robots available. Our robots are designed to enhance your trading strategy and improve your results. Here’s what sets our forex robots apart:

Customizable Parameters: Tailor the robot’s settings to match your trading style and risk tolerance.

Proven Performance: Our robots have a track record of delivering consistent results in various market conditions.

Easy Integration: Setting up the best forex robots is straightforward, allowing you to start trading quickly and efficiently.

Boost Your Skills with Comprehensive Forex Training

Knowledge is key to successful trading, and Mybottrading offers extensive forex training to help you stay ahead. Our training programs cover everything from the basics to advanced strategies, providing you with the tools you need to succeed. Here’s what you’ll gain from our forex training:

Fundamental Concepts: Understand the core principles of forex trading and market dynamics.

Advanced Strategies: Learn sophisticated trading techniques that can give you a competitive edge.

Practical Applications: Apply your knowledge with hands-on training and real-world trading scenarios.

Conclusion

Mybottrading and Mybotfx are your ultimate partners in the world of forex trading. With our advanced robot trading solutions, live trading capabilities, and comprehensive forex training, you’ll be well-equipped to navigate the complexities of the forex market. Join Mybottrading today and discover how our platform can transform your trading journey with the best forex robots, robot trading live, and unparalleled support.

Start your trading journey with Mybottrading and achieve new levels of success!

#best forex robots#forex training#trading bot#mybotfx#forex robots for automated trading#mybottrading

0 notes

Text

Automated Forex Trading: Benefits and Risks of Using Trading Robots

Automated forex trading has revolutionized the way traders engage with the forex market. By utilizing trading robots, also known as expert advisors (EAs), traders can execute trades automatically based on pre-defined criteria. While automated forex trading offers numerous benefits, it also comes with inherent risks. This article explores the advantages and disadvantages of using trading robots…

View On WordPress

#Automated Forex Trading#Backtesting#Expert Advisors#Forex Diversification#Forex Indicators#Forex Market#Forex Security#Forex Trading#Forex Trading Plan#Market Analysis#Market Efficiency#Risk Management#Technical Analysis#Trading Automation#Trading Costs#Trading Performance#Trading Robots#Trading Strategies#Trading Technology

0 notes

Text

The benefits and drawbacks of being a solo vs part of a team in the industry

DOES TEAMWORK PAY? In the professional world, there are two primary work styles: working solo or being a part of a team. Each work style has its own benefits and drawbacks depending on the industry, personality, and preferences of the worker. Some people thrive in a solitary environment where they can work independently, while others prefer to be surrounded by colleagues and actively collaborate…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

1 note

·

View note

Text

Mastering Forex Auto Trading Bots: A Comprehensive Guide to Automated Forex Trading

Introduction:

In the fast-paced world of Forex trading, staying ahead of the curve is essential for success. With markets operating 24/7 and prices fluctuating rapidly, manual trading strategies may not be sufficient to capitalize on every opportunity. This is where Forex auto trading bots come into play. In this comprehensive guide, we'll explore everything you need to know about Forex auto trading bots, from their benefits and functionalities to best practices for implementation and optimization.

Understanding Forex Auto Trading Bots:

Forex auto trading bots are sophisticated algorithms designed to execute trades automatically in the Forex market based on predefined rules and criteria. These bots leverage advanced technology to analyze market data, generate trading signals, and execute trades with speed and precision, eliminating the need for manual intervention.

Benefits of Forex Auto Trading Bots:

The benefits of Forex auto trading bots are multifaceted, offering traders a range of advantages that can significantly enhance their trading experience and performance. Let's delve deeper into each of these benefits:

Efficiency and Speed: Forex auto trading bots are designed to execute trades swiftly and efficiently, often in milliseconds. This speed far surpasses the capabilities of human traders, enabling bots to capitalize on fleeting market opportunities and minimize latency-related losses. By executing trades with lightning-fast speed, auto trading bots ensure that traders can enter and exit positions promptly, maximizing the potential for profit and reducing the risk of missing out on profitable trades due to delays.

Elimination of Emotional Biases: One of the most significant advantages of Forex auto trading bots is their ability to eliminate emotional biases from the trading process. Human traders are often susceptible to emotions such as fear, greed, and impatience, which can cloud judgment and lead to irrational trading decisions. By executing trades based solely on predefined rules and criteria, auto trading bots remove the influence of emotions from the equation. This leads to more disciplined and consistent trading, free from the psychological pitfalls that can plague human traders.

24/7 Market Monitoring: Forex markets operate around the clock, spanning different time zones and continents. For human traders, keeping track of market movements and opportunities can be challenging, especially during off-hours or when traders are unavailable due to other commitments. Forex auto trading bots address this challenge by operating continuously, providing traders with round-the-clock market monitoring and execution capabilities. This ensures that trading opportunities are captured promptly, regardless of the time of day or night.

Backtesting and Optimization: Forex auto trading bots offer the ability to backtest trading strategies using historical market data. This allows traders to evaluate the performance of their strategies, identify strengths and weaknesses, and optimize parameters for better results. Through iterative testing and optimization, traders can refine their trading strategies over time, improving profitability and reducing the risk of losses. By leveraging the backtesting capabilities of auto trading bots, traders can make informed decisions based on empirical evidence rather than guesswork or intuition.

Diversification and Risk Management: Auto trading bots enable traders to diversify their trading activities across multiple currency pairs simultaneously. This diversification provides several benefits, including spreading risk across different assets and reducing exposure to individual market movements. Additionally, auto trading bots can incorporate sophisticated risk management techniques, such as position sizing and stop-loss orders, to help traders manage risk effectively. By diversifying their trading activities and implementing robust risk management strategies, traders can mitigate potential losses and safeguard their capital in volatile Forex markets.

Forex auto trading bots offer traders a range of benefits, including efficiency and speed, elimination of emotional biases, round-the-clock market monitoring, backtesting and optimization capabilities, and diversification and risk management benefits. By leveraging these advantages, traders can enhance their trading performance, maximize profitability, and achieve their financial goals with confidence and consistency.

Implementing Forex Auto Trading Bots:

Define Trading Objectives: Before implementing Forex auto trading bots, clearly define your trading objectives, risk tolerance, and performance metrics. Determine whether you're aiming for short-term gains, long-term growth, or income generation. Establishing clear objectives provides a framework for selecting the right bot and designing a suitable trading strategy.

Choose the Right Bot: Select a Forex auto trading bot that aligns with your trading objectives, strategy, and technical expertise. Consider factors such as speed, reliability, performance, and compatibility with your trading platform.

Backtest Your Strategy: Backtest your trading strategy using historical market data to evaluate performance and identify areas for improvement. Adjust parameters and optimize the bot based on backtesting results to enhance its effectiveness and profitability.

Monitor Performance: Regularly monitor the performance of your Forex auto trading bot and make adjustments as needed. Evaluate key metrics such as profitability, drawdowns, and execution speed. Be prepared to adapt the bot's parameters and settings to changing market conditions.

Stay Informed: Keep abreast of market developments, news events, and economic indicators that may impact currency prices. Adapt your Forex auto trading bot to changing market conditions and refine your strategy accordingly to capitalize on emerging opportunities and mitigate risks effectively.

Conclusion:

Forex auto trading bots offer traders a powerful tool to streamline trading operations, enhance efficiency, and capitalize on market opportunities. By leveraging the benefits of automation, traders can eliminate emotional biases, optimize trading strategies, and achieve consistent results in the dynamic Forex market. With a well-designed strategy and the right Forex auto trading bot at your disposal, you can navigate the complexities of Forex trading with confidence and achieve your financial goals.

#Forex auto trading bots#Custom Bots#custom bots trading#auto trading bots#custom bot EA#automate trading bots#Forex trading bots#Customize EA#Trading Robot#Forex Bot#Forex Trading System#Trading Script#Trading Algorithm#Forex Expert

0 notes

Text

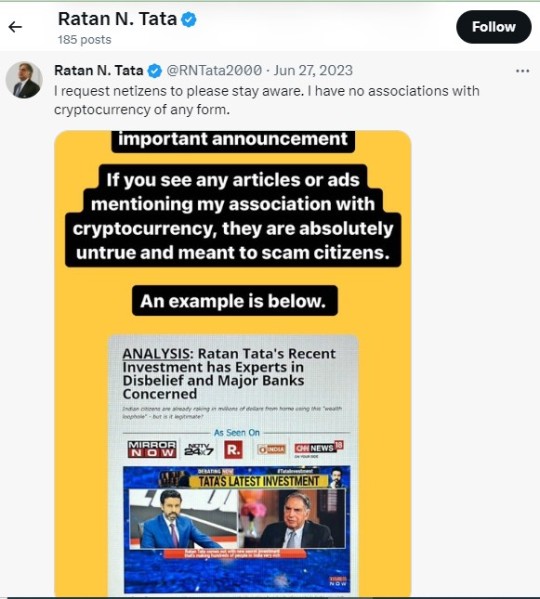

Biticode Method - Learn The Truth

Have you seen the below post about the “Biticode Methods” on reputed websites: In recent days this has become a trend by some people to promote their products. Most of these are fake and they are trying to scam innocent people in this way. I would suggest you to be careful and do not be greedy. I have noticed that many people believe the scammers more that people who are trying to save them…

View On WordPress

#AI-powered trading platform#Automated crypto trading#Beginner crypto trading#Bitcode Method#Bitcode Method reviews#Bitcoin trading robot#Can you make money with Bitcode Method?#Crypto trading bot#Cryptocurrency trading risks#How to choose a reputable crypto trading platform#Independent research#Is Bitcode Method a scam?#Lack of transparency#Misleading marketing#Reputable alternatives#Risks of automated crypto trading#Safe alternatives to Bitcode Method#Scam risks#Unverifiable claims#User Reviews

0 notes

Text

Innovate with Confidence: RPA Solutions Tailored for Retail Success

Implementing RPA in inventory management benefits retailers with accurate inventory level tracing, demand and supply forecasting, as well as by streamlining communication, between all suppliers.

RPA software technology can benefit any retail organization with proper discovery, mapping, and deployment. The bots can be used for more than just tracking inventories, sending out notifications, and transferring data across systems.

Embrace innovation with RPA solutions designed for retail. Optimize inventory management, enhance efficiency, and stay ahead in the competitive landscape.

#inventory management analytics#retail inventory management#RPA solution for retail#RPA in retail Industry#RPA For Inventory Management#inventory management#RPA in inventory management#Inventory management in retail industry#RPA implementation#RPA service providers#rpa in retail management#use cases of rpa in retail#rpa in retail#Robotic Process Automation in Retail#rpa for retail#rpa in retail sector#Robotic Process Automation in Retail Industry#rpa retail#rpa case studies in retail#Robotic Process Automation in Trade Promotion

0 notes

Text

In today’s fast-paced world of logistics innovation and evolution have become the driving forces behind success. As we step into 2024, the logistics sector will undergo extensive disruptions, fueled by game-changing innovations that promise to revolutionize supply chain management as we know it.

At iFour, we take immense pride in our expertise in the logistics industry, and we are excited to share with you the trends that are currently transforming this dynamic sector in Australia. As a leading custom Logistics software development company, we understand the unique challenges and opportunities facing businesses in the Australian market.

Here are the key trends that are reshaping the logistics landscape and how our solutions can help your company stay ahead of the curve.

#Supply Chain Technology#E-commerce Logistics#Automation and Robotics#Blockchain in Logistics#Sustainable and Green Logistics#Last-Mile Delivery Solutions#Data Analytics and Predictive Insights#3D Printing in Logistics#IoT (Internet of Things) in Supply Chain#Artificial Intelligence in Transportation#On-Demand and Sharing Economy Logistics#Digital Twins in Warehousing#Autonomous Vehicles and Drones#Climate Change and Resilience Planning#Cross-Border Trade and Customs#Cybersecurity in Supply Chain#Inventory Management Strategies#Reverse Logistics and Returns#Multi-Modal Transportation#software outsourcing#software development company#.net development

0 notes

Text

Looking to step up your trading game? 💹 🔑 Activate your trading robot price on SaveTrade.net and experience: ✅ Automated trading strategies 🧑💻 ✅ 24/7 market monitoring 🌐 ✅ No missed opportunities 📈

🎉 Take control of your financial future today! 💼

👉 Click here to get started now!

#TradingRobot #AutomatedTrading #SaveTradeNet

#TradingRobot#AutomatedTrading#SaveTradeNet#trading algorithmique#technique de trading#robot trader#acheter un robot trading#robot trading gratuity#acheter un robot de trading#Forex Robots for Automated Trading#Activate your trading robot price#Robo trading software price#Automated Trading Platforms

1 note

·

View note

Text

Advanced Automated Trading Services | Robotrade

Robotrade offers modern automatic trading services that transform the way individuals and businesses engage in the financial markets. Our algorithmic trading system leverages advanced artificial intelligence and machine learning technologies to quickly analyze vast amounts of market data, identifying profitable trading opportunities with accuracy and speed. Visit Robotrade to get started trading with us.

#auto trading software india#robot trading platform india#automatic stock trader#automatic trading#automated online trading#algo trading provider#Automatic Trading Services

0 notes

Photo

How do trading robots work to automate financial market trading strategies?

Robo-trading has revolutionized the world of financial markets by offering automation solutions that are efficient and reliable. If you're looking for a way to automate your trading strategies, Robôtrader is the perfect platform for you... know more!

0 notes

Text

The Best Forex Robots: Automated Trading for Today's Investors

In today's fast-paced financial scene, the appeal of automatic trading via best forex robots has captured the interest of investors all over the world. These advanced algorithms promise to manage the forex market's complexity with unprecedented efficiency and precision. But, in the middle of so many possibilities, which forex robots stand out as the best?

Understanding the Best Forex Robots.

Best Forex robots, also known as Expert Advisors (EAs), are software programs that automate trading choices for traders. Mybottrading uses predetermined algorithms and strategies to execute trades without requiring continual human supervision. Mybottrading automation seeks to profit on market opportunities quickly and consistently by leveraging speed and data analysis capabilities that exceed human competence.

Best Forex Robot Requirements

1. Performance and Consistency: The best forex robot for mybottrading is known for its capacity to provide steady performance over an extended period of time. This covers indicators for profitability, the efficacy of risk management, and trading strategy adherence.

2. Customization and Strategy: the best forex robots provide a variety of techniques that are adapted to various market circumstances. They ought to be adaptable enough to accommodate different people's trading preferences and levels of risk tolerance.

3. Transparency and Support: best forex robots offer transparent trading operations through mybottrading live trading performance, back test data, and detailed documentation of trading techniques. Reliable customer service is also essential for quickly resolving problems.

4. User-Friendliness: The best forex robots are simple to set up, keep track of, and modify as necessary, thanks to their intuitive and user-friendly design. Conclusion

Finding the best forex robots requires carefully weighing factors including performance, strategy, usability, and transparency. Using the best forex robots can greatly improve your trading experience and possibly increase your profitability, regardless of your level of experience with investing or forex trading. Keeping up with the most recent developments in mybottrading automated trading technology will be essential to being competitive as the forex market continues to change.

#robot trading live#mybottrading#best forex robots#forex trading robot#mybotfx#forex robots for automated trading#forex training#trading bot

0 notes

Text

#Trade simply#Trade analysis#Robotic trading#technical indicator#0value indicator#tricks of trade#paper trade#investing#technical analysis#stocks#Diversified portfolio#Automated algo#Trading idea#Investing idea#Positive/Negative trend#Break outs#Robotic features#Algorithm#indicators#Real time Algo#Machine Trading#Fully automated trading#Algo#trading solutions#Stop loss#Target#Current trades#Intraday#Future option#Commodity

1 note

·

View note