#auto trading bots

Explore tagged Tumblr posts

Text

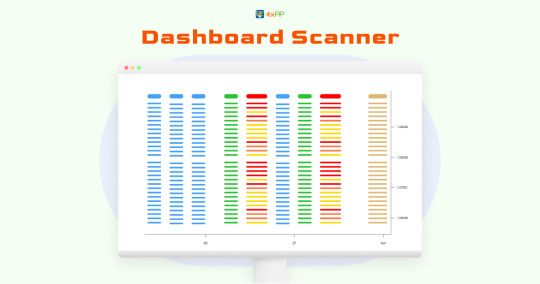

What are the features of the Forex scanner?

Introduction:

A Forex scanner is a tool that traders can use to scan the market for trading opportunities. It typically displays a variety of information on a single screen, such as price charts, technical indicators, and news headlines. This information can be used to identify potential trades and make trading decisions.

Forex scanners work by collecting data from various sources, such as exchanges, news providers, and technical analysis software. This data is then processed and displayed on the dashboard in a way that is easy for traders to understand.

Working:

Forex scanner work by using technical indicators to identify trading opportunities. The specific indicators used will vary depending on the scanner, but some common examples include moving averages, MACD, and RSI.

Once the scanner has identified potential trading opportunities, it displays the results in a dashboard format. This dashboard typically includes the following information:

Market: The currency pair or other instrument being scanned.

Timeframe: The timeframe being scanned.

Indicator signal: The signal generated by the technical indicator.

Price: The current price of the instrument.

Other information: Other information that may be displayed includes the direction of the signal, the strength of the signal, and the time that the signal was generated.

Traders can use the information displayed in the dashboard to decide which trading opportunities to pursue. For example, a trader may decide to enter a long trade if the scanner identifies a bullish signal on a currency pair that is trading above its moving average.

Features:

Forex scanner typically offer a variety of features, including:

Multi-market scanning: The ability to scan multiple markets simultaneously for trading opportunities.

Technical indicators: The ability to display a variety of technical indicators on price charts, such as moving averages, oscillators, and Bollinger Bands.

Market sentiment: The ability to display market sentiment indicators, such as the Fear and Greed Index and the Commitment of Traders (COT) report.

Customizable alerts: The ability to set up custom alerts for specific trading opportunities.

Benefits:

There are a number of benefits to using Forex scanner, including:

Save time: Forex scanners can save traders a lot of time by scanning multiple markets simultaneously for trading opportunities.

Improve efficiency: Forex scanners can help traders to identify potential trading opportunities more quickly and efficiently.

Reduce risk: By using Forex scanners to identify potential trading opportunities, traders can reduce their risk of making impulsive or emotional trading decisions.

Drawbacks:

Here are some of the drawbacks of using a Forex scanner:

Cost: Forex scanners can be expensive to purchase and maintain.

Complexity: Forex scanners can be complex to use, especially for beginners.

Requires technical knowledge: To use a Forex scanner effectively, you need to have a good understanding of technical analysis and trading strategies.

How to integrate Forex scanner with trading platform?

There are a few ways to integrate a Forex scanner with your trading platform:

APIs: Many Forex scanners offer APIs that allow you to integrate them with your trading platform. This is the most common and flexible way to integrate a Forex scanner. To integrate a Forex scanner using an API, you will need to create an account with the Forex scanner provider and obtain an API key. Once you have obtained an API key, you can integrate it with your trading platform by following the instructions provided by the Forex scanner provider.

Plugins: Some Forex scanner providers offer plugins that allow you to integrate them with popular trading platforms, such as MetaTrader 4 and MetaTrader 5. To integrate a Forex scanner using a plugin, you will need to download and install the plugin from the Forex scanner provider's website. Once the plugin is installed, you will be able to access the Forex scanner from within your trading platform.

Webhooks: Some Forex scanner providers allow you to integrate them with your trading platform using webhooks. Webhooks allow you to send and receive data between different applications. To integrate a Forex scanner using webhooks, you will need to create a webhook on the Forex scanner provider's website and configure it to send data to your trading platform. Once the webhook is configured, you will be able to receive data from the Forex scanner in real time.

Here are some additional tips for integrating a Forex scanner with your trading platform:

Make sure that the Forex scanner is compatible with your trading platform.

Follow the instructions provided by the Forex scanner provider carefully.

Test the integration thoroughly before using it in a live trading environment.

Monitor the integration regularly to make sure that it is working properly.

By following these tips, you can integrate a Forex scanner with your trading platform successfully and use it to improve your trading performance.

4xPip:

4xPip is a financial trading company that offers a variety of trading tools and resources, including a Forex scanner. 4xPip's Forex scanners are known for their accuracy and reliability.

4xPip's Forex scanner can help traders to:

Save time: Forex scanners can save traders a lot of time by scanning multiple markets simultaneously for trading opportunities.

Improve efficiency: Forex scanners can help traders to identify potential trading opportunities more quickly and efficiently.

Reduce risk: By using Forex scanners to identify potential trading opportunities, traders can reduce their risk of making impulsive or emotional trading decisions.

Here are some specific examples of how 4xPip's Forex scanner can help traders:

Identify oversold and overbought conditions: Forex scanners can be used to identify oversold and overbought conditions in the market. This can help traders to identify potential trading opportunities, such as buying oversold assets or selling overbought assets.

Identify trend reversals: Forex scanners can also be used to identify trend reversals. This can help traders to enter trades in the direction of the new trend and potentially generate profits.

Identify support and resistance levels: Forex scanners can be used to identify support and resistance levels in the market. This can help traders to place trades at optimal levels and manage their risk more effectively.

4xPip's Forex scanner are easy to use and can be customized to meet the needs of individual traders. 4xPip also offers a variety of educational resources to help traders learn how to use Forex scanners effectively.

#black tumblr#automate trading bots#black fashion#black art#auto trading bots#black literature#black history#custom bot ea#custom bots#custom bots trading#Forexsacnner#forex#forextrading#forexsignals#forex market#forex broker#forex trading

0 notes

Text

AI Crypto Trading Bot Development - Focus On Feeling The Market

AI crypto trading bot development has gave birth to a new breed to bots that can feel the ‘feel’ the market movements. Explore how they work and their benefits.

#ai auto trading bot#auto trading bot#crypto auto trading bot#ai bot trading platform#crypto trading bot#grid trading bot development#crypto bot developers#build a trading bot#automated trading bots#crypto trading bot developers

0 notes

Text

As someone who had always been fascinated by the world of finance and trading, I was always on the lookout for new ways to make money. That's why I was so intrigued when I first heard about Fx Zippy forex auto trading software. After doing some research, I decided to give it a try and invested in a reputable and well-reviewed Fx Zippy. I was immediately impressed by how easy it was to use and how quickly it could execute trades. But the real test came when I started to see the results. To my surprise, I began to see steady profits coming in, thanks to the Fx Zippy Bot ability to identify profitable opportunities in the market and execute trades with precision. As my account balance grew, I couldn't help but feel a sense of excitement and amazement. I had always believed that making money in the stock market was a difficult and complicated endeavor, reserved for only the most experienced traders. But with the help of Fx Zippy Bot, I was able to achieve success and grow my wealth. I also noticed that Fx Zippy bot helped me to avoid the emotional element that can often accompany trading. As it was programmed to follow a specific set of rules, I could trust it to make trades based on objective criteria, rather than my own emotions. Of course, it's important to remember that no investment is without risk. And even with the best software, there's always a chance of loss. But for me, the benefits far outweighed the risks. In just a matter of months, I was able to turn a small investment into a significant source of income. And while I never expected to get rich overnight, I'm grateful for the financial freedom and security that Fx Zippy Bot has given me. I would highly recommend Fx Zippy Bot to anyone looking to make money in the market. Just make sure you do your research and invest in a reputable program. With a little bit of luck and a lot of hard work, you too can achieve financial success. Now you know how Fx Zippy helped me get rich? All of you can also need little bit of knowledge about the trading along with Fx Zippy support and you will be richer soon as I earned lot of wealth from trading.

Copyright @2022 FX Zippy. All Rights Reserved.

#ai forex trading#forex trading robot#auto trading software#best trading software#forex trading for beginners#fxzippy#forex expert advisor#forex trading bot

0 notes

Note

Hey!

I think your Odds Of Survival is super super cool and awesome (I’m going batshit insane over it)

I’m really interested in the cybertronian political setup/worldbuilding you’ve been sprinkling in, it being revealed that Prowl and a lot of canon autobots are cons in this universe, mentions of the functionists, hints for whenabouts the quintessons arrived on cybertronian, etc.

I think the world you’ve built is so so cool. Ik you’re probably dripfeeding us crumbs intentionally and may not want to spoil things. But if there is anything you can or want to say, take this as an invitation to lore dump about whatever you want :3

If not then hope you’re having a good day and thanks for sharing your awesome creation :D

Hi!

Thank you so much for the compliment and the ask!

I do enjoy sprinkling in my world building in the stories themselves but I actually quite enjoy getting direct questions like these so I can info dump all the exposition I want. The drip feed is for satisfying narrative pacing, the ask box is for turning on the hose.

The basic premise I built off of was answering this question: If there’s no Optimus Prime, then what would happen to Cybertron?

The short version of what usually happens in most continuities is more or less as follows:

- The Functionalists and/or Sentinel Prime run Cybertron through a horribly oppressive government.

- A bunch of bots get sick of it and ignite a civil war.

- The rebellion “wins” but usually splits between the Decepticons and the Autobots, due to a division of fundamental beliefs. Decepticons are “might makes right” and Autobots are “how about not fascism?”

So what does it mean if Optimus isn’t there? What’s so special about the guy?

I have complicated thoughts on how Optimus, Megatron and their respective ideals interact and I could probably write a small essay about how they both offer Change to their followers in another tangent for another time.

The short answer is Optimus gives people the uncompromising option to Do Good. And backs that stance the fuck up every single time by his own actions. Taking the high road every time is freaking hard, and it takes an extremely stubborn, and most importantly angry kind of hope to not let it go.

Not many folks can do that. Not because they don’t want it, but because they don’t believe it’s possible.

And that’s were a lot of would be auto bots are at.

Everyone hates the Functionalists but they’re also incredibly rich in resources, controlling not just Cybertron but multiple planet spanning colonies. A lot of mechs that would have joined the rebellion in the og timelines haven’t because Megatron kinda puts out Evil Warlord vibes and not everyone is willing to work with that. People like Prowl and Elita still join because they’re the kind to go “Well we have to do something to make Cybertron better and taking the Trolly Off the Tracks isn’t an option.”

So the rebellion doesn’t quite reach the size needed to take out the Council and Sentinel in one fast all out charge. If it wasn’t for the Quintession invasion, the Decepticons would have eventually met a slow demise by attrition.

The Decepticons are low key operating like a pirate army with a very tentative ceasefire truce with the Functionalist Army. Unlike Optimus, Sentinel is a dick that can’t help but start shit with Megatron so there is almost zero collaboration between the two. Right now, the Decepticons are a downright devastating military force but in desperate need of a consistent supply of resources that raiding alone cannot stabilize.

The Lost Light is currently the only crew of the Decepticons that are legitimately trying to establish trade routes with other aliens (which is not going well because 90% of intelligent alien life views Cybertronians as colonist war machines (which is historically correct)) and they don’t exactly have the charming Beacon of Hope and Respect for Tiny Aliens that Optimus usually brings to the table.

Another thing in universe, the Lost Light is essentially considered the Island of Misfit Mechs. The ship is ancient and pretty much everyone on board got there for either “not being good enough” or from getting demoted, as is the case with Prowl.

Elita One was made the Captain because she’s competent enough to make Megatron nervous about her gathering too much influence but still too useful to kill off either. So she gets the rejects from other ships and up to a certain limit gets to do as she pleases.

That’s all I’ll write for now. Thanks again for taking an interest in my writing!

33 notes

·

View notes

Note

Dear Vector Prime, what can you tell us about this bizarre-looking pair of bots who were seen boarding the starship Exodus? They seem to stand out compared to the rest of the masses, what with the one's pointed hair-like protrusions, qnd the other's flat-topped dome.

Dear Boarding Buddy,

The larger of the two robots pictured was Crashcore. A medic by trade, Crashcore was a specialist on treating heavyweight-class robots. He was well known for his smooth handiwork when removing thick armour plating to access and repair internal damage. However, Crashcore’s skills did not extend to self-care, and he struggled with auto-altphobia: he was deathly afraid of his Chelonoid alt-mode.

The smaller of the two, Coda, was an organic enthusiast. Adopting his trademark helmet in emulation of a popular hairstyle among part of Cybertron’s alien population, he was well known as something of a data maniac, regularly spending time in various communities to gather more and more information on their society.

These two refugees did not find much reason to converse, and went their separate ways soon after.

39 notes

·

View notes

Text

Obey Me play League

Diavolo's Team

Simeon - Top - Gwen: Has one build he uses every game, doesn't know how to itemize so he uses an outdated build Leviathan made for him. Terrible at trading and doesn't understand most matchups. Tilt proof. Honestly just wants to hang out with the brothers, mostly Lucifer.

Leviathan - Jungle - Bel'Veth: Super confident jungler and frequently invades and / or starts the enemies buff. 100% owns every Champion and has played them all at least once or twice. Has multiple skins for every character he plays. Is too competitive and easily tilts.

Lucifer - Mid - LeBlanc: Hyper aggressive and all ins level 3 100% of the time, regardless of the matchup. Will track the enemy jungler and harass them. ONLY gets tilted when he isn't doing well, regardless of the team.

Diavolo - ADC - Miss Fortune: Terrible at farming / under 5cs a minute. Only uses the recommended runes and builds. Frequently cancels his ult on accident by walking. Tilt proof. Mostly just loves playing with the brothers, more specifically Lucifer. Also gets him out of paperwork (sometimes.) Will try and get everyone to match skins with him.

Barbatos - Support - Soraka: AMAZING at supporting Diavolo / has adapted to his playstyle. Good vision and map awareness, but will hold his ult for Diavolo / doesn't care if someone is dying on the opposite end of the map. Lowkey tilts but won't say anything.

(May or may not use his future sight for Diavolo’s favor. This was an after thought.)

Uh- Beelzebub's Team (?)

Beelzebub - Top - Cho'Gath: Is the definition of "top lane island" you don't see him until 20 minutes. AFKs under tower or in a bush to eat, and frequently leaves to grab more food.Tilt proof.

Belphegor - Jungle - Lillia: Safe jungler, only counter ganks / makes easy plays. Won't go for objective steals without the team. Untiltable until someone says something to him.

Mammon - Mid - Pantheon: Spam emotes and HARD egos his lane / will tank autos early game over giving up cs. Roams bot lane the moment he hits level 6, regardless of lane state / forces the fight. Tilts easily.

Asmodeus - ADC - Kai'Sa: Good at csing but gets too caught up in it to make trades / very passive laner. Gets confused on itemization and calls Leviathan. Doesn't tilt in the usual sense, instead he becomes disheartened / sad when doing poorly.

----------

Satan - Support - Yuumi: Starts Support item and a Control Ward over Health potions, doesn't think he needs them. Constantly hopping off to get passive shield. BACKSEAT GAMER, think Remy and Linguini. Most likely has all of Yuumi’s skins and chromas. Picked the pink chroma to match with Asmodeus. Will genuinely be upset if Lucifer survives a big team fight and he doesn’t. WILL flame in chat, VERY tiltable.

My sister and I thought of this randomly. We have more ideas and they'll be posted here! We have Phasmophobia, Baldur's Gate/(Work on Progress), RDR2, and Sims 4. We might take request but no promises.

#obeyme#obey me#obey me satan#obey me simeon#obey me lucifer#obey me mammon#obey me beelzebub#obey me barbatos#obey me belphie#obey me belphegor#obey me diavolo#obey me asmo#obey me beel#obey me asmodeus#obey me levi#obey me leviathan

7 notes

·

View notes

Text

9个MEME土狗Solana交易bot大比拼

哪个bot最好用?从手续费、安全性、使用体验、功能优势/特色等维度,详细对比介绍目前主流的Solana交易bot。

1分钟入账15万u,冲土狗成为当前行情里最时髦的赚钱方式。 我们常说的土狗项目指的是,一般没有白皮书、代币交易深度极浅的早期项目。这些项目大多昙花一现,生命周期在 1-3 天,有极少数的项目可以走出百倍行情,甚至上线交易���成为“金狗“,比如BOME、SLERF、PUNT、ACT。即便是玩概率的游戏,仍有非常多的人前仆后继,试图抓住百倍的翻身机会。 从发现土狗到买入,用时会在几十秒-几分钟不等,取决于网络速度、GAS设置等各种因素。Trading Bot,也就是交易机器人的诞生让普通用户极大的降低了抢跑门槛,只需要提前准备好买入设置,复制合约地址,输入买入额即可。 目前Bot赛道已经较为成熟,根据Dune数据,目前交易量排名前五的Bot是:BonkBot、Maestro、Banana Gun、Trojan、Sol Trading Bot。

我们在这篇文章中会从手续费、安全性、使用体验、功能优势/特色等维度,详细对比介绍目前主流的Solana交易bot,同时与传统DEX相比较。详细介绍请阅读文章全文。

一、BonkBot: BONKbot 是专为 Solana Telegram 交易机器人,核心吸引力在于速度和易用性,主打一个买得快。BONKbot 利用基于 Solana 的去中心化交易所 (DEX) Jupiter 以及自定义路由逻辑,能够在 Solana 各个 DEX 上找到代币的最佳可用价格。 目前 Solana TG Trading Bot 中交易量第一的bot,单日交易量约为 1000 万美元。

TG链接:https://t.me/Bot_bonks_bot TG备用:https://t.me/Bot_bonk_backup_bot 手续费:1% 安全性: BonkBot 由 Bonk 社区创建,具有良好的社区支持。BonkBot 无权访问用户私钥,并且通过采用 AES256 加密(现有最强大的加密标准之一)来优先考虑用户安全,这可以确保用户和机器人之间交换的任何数据保持机密并防止潜在的泄露。 使用体验:1、用户界面友好,新手也能轻松上手使用;2、可以调整 Gas 费用,提高交易成功率;3、具有MEV 保护功能,可以帮助用户避免被抢跑。MEV Turbo ”模式最大限度地提高了交易速度,同时仍尽可能提供抢先交易保护,而 “ MEV Secure ” 模式则为不惜一切代价将 MEV 提取安全性置于速度之上的用户提供有保障的 MEV 保护。 Auto sniping:不支持 Auto trading:支持 Copy trading:不支持 优势/特色:简洁易用,MEV 保护功能

二、Maestro: 作为老牌Trading Bot,Maestro功能��更全面,目前是交易量排名第二的bot。 Maestro把bot分成了四类,每一类都是独立的bot,分为狙击bot、钱包bot、巨鲸监控bot、买卖监控bot。比较常用来交易的是Sniper Bot(狙击机器人)。

TG链接:https://t.me/MaestroSniperPlusoBot TG备用:https://t.me/MaestroSniperBackup_Bot 手续费:1% 安全性:所有私钥均经过 AES 加密,保障服务器安全。此外,运用 Anti-Rug 和主动诈骗检测机制让 Telegram 交易无缝且安全。 使用体验:1、Maestro的功能比较全面,具体的功能有买卖/夹子/Anti-Rug/Copy Trade/设置多钱包购买等。2、界面相对复杂,整体交互感比较繁琐,会有比较高的学习成本。 Auto sniping:支持 Auto trading:支持 Copy trading:支持 优势/特色:功能全面

三、Banana Gun: Banana Gun 在Solana TG Trading Bot 中交易量排第三,也是市面上比较受欢迎的 TG交易bot,主要是交易和狙击两大功能,支持 Solana、Base、Ethereum这三条公链。

TG链接:https://t.me/BananaGunSolanaOfficial_bot TG备用:https://t.me/BananaGun_Backup_bot 手续费:Manual Buy (手动购买交易)0.5%,Sniper Buy(自动狙击) 1% 安全性:ANTI RUG和重组保护功能,拥有性能一流的防盗系统可确保交易更安全,成功率已证实为 85%。蜜罐保护功能,运用市场领先的内置模拟确保从一开始就防止代币诈骗。如果模拟器无法模拟成功的卖出,交易将不会成功。 使用体验:1、界面简约,功能性正好,适合新手和小白,基础的买卖/Copy Trading/Sniping Trading等功能都有。2、通过限价订单可以轻松实现交易自动化,使用止损或追踪止损限价订单设置订单以最佳执行方式自动逢低买入。3、专精狙击开盘,可让用户狙击即将上线的 token,或交易已发行的 token。 Auto sniping:支持 Auto trading:支持 Copy trading:支持 优势/特色:手续费低,专精狙击

四、Trojan: Trojan 的前身是 Unibot on Solana,由前 Unibot 社区营运负责人 Reethmos 带领制作的,是 Unibot 的衍生产品。交易界面与 Unibot 风格类似,是 Solana 链上交易量排名第四的 TG Trading Bot。

TG链接:https://t.me/solana_tro_jan_bot TG备用:https://t.me/solana_trojanbackbot 手续费:1%,通过推荐 0.9% 安全性:由网络安全公司 Trail of Bits 进行的持续安全审计,官方表示这种持续的审核流程使他们能够在开发和扩展服务时不断加强安全措施。 使用体验:1、具备跟单交易与 DCA 定投交易等较复杂的订单形式,适合初学者和寻求自动化的交易者。2、限价订单功能,通过在特定价格点触发交易来提供精确性,DCA(美元成本平均)功能则通过随时间分散订单来管理风险。3、Trojan 通过跨链桥促进以太坊和 Solana 之间的资产无缝转移。 Auto sniping:支持 Auto trading:支持 Copy trading:支持 优势/特色:内置跨链桥

五、Sol Trading Bot: Sol Trading Bot 集成了 Solana 上的三个最大去中心化交易所 (DEX) :Jupiter、Orca 和 Radium,可以利用DEX广泛流动性池,提供最优价格高效执行交易,同时可以在 Solana 网络内的不同 DEX 平台上无缝执行交易,允许用户实施多 DEX 策略,根据每个交易所的独特功能和特点优化交易。目前在Solana TG Trading Bot 中交易量排第五。 来源:官网 https://soltradingbot.com/

TG链接:https://t.me/SolTradingPlusBot TG备用:https://t.me/SolanaTradingPlusBot 手续费:1% 安全性:采用最先进的安全密钥管理实践,实施了多重身份验证 (MFA),这一额外的验证层通常涉及密码和一次性代码的组合,为防止未经授权的访问增加了额外的屏障。 使用体验:1、功能多元,具备交易、狙击、复制交易、跟踪、自动买入/卖出和限价/DCA 订单等功能,另外还有新币新池子监控等 2、具备市场数据分析功能,利用各种来源的实时数据流,确保用户能够获取最新、准确的市场信息。利用多种技术指标,为交易者提供进行深入分析所需的工具。从移动平均线到 RSI,用户可以根据各种指标定制自己的策略。 Auto sniping:支持 Auto trading:支持 Copy trading:支持 优势/特色:市场数据分析功能

六、BullX: Bullx 是一个数据聚合&交易平台,为用户提供交易Meme币的早期机会,兼容以太坊主网、BNB、Base、Arbitrum、Blast 和 Solana 等网络的交易。BullX Trading Bot 是一款在该平台上运行的交易bot。

TG链接:https://t.me/BullXReleaseBot TG备用:https://t.me/BullXBackupBot 手续费:1% 安全性:该交易bot是Telegram和Web的混合体,让钱包盗取者较难以访问和提取用户资金。 使用体验:1、通过绑定TG账号连接网站,提供实时数据及市场趋势分析,与 Binance、Coinbase Pro 和 MEXC 等交易所无缝集成。2、带有 Pump Fun 代币类别可以快速购买刚发射的任何pump代币。3、根据指标和技术分析为Meme币提供预定义交易策略,用户还可以根据市场情况定制自己的策略。4、支持挂单,允许用户设置买入限价、卖出限价等。 Auto sniping:不支持 Auto trading:支持 Copy trading:不支持 优势/特色:首个结合Telegram+Web的bot,有明牌发币空投预期

七、Pepeboost: Pepe Boost 界面支持中文,以中文社区为主要对象。官方也非常擅长运用推特,甚至衍生出社区带单炒币模式,有良好的社区声誉。

TG链接:https://t.me/pepeboost_sol_09_bot TG备用:https://t.me/pepeboost_sol099_bot 手续费:1% 安全性:开发团队有多年的数据安全开发经验,通过多层加密技术,从服务器,数据库,交易信息发送等多个环节,保障用户私钥和资金安全。 使用体验:1、功能基本比较���面了,快速狙击、一键买卖、防夹交易、多个钱包等,该有的都有,同时支持Raydium和Jupiter dex。2、操作简单,交易速度较快,自动监控链上聪明钱包动态,在实际交易打包上链后,第一时间触发通知。3、官方运营能力强,亲自下场“带单”,整体用户黏性和转化率比较高。 Auto sniping:支持 Auto trading:支持 Copy trading:支持 优势/特色:中文用户群体活跃,社群运营能力强

八、GMGN: GMGN 是一个Meme代币追踪和分析平台,集成了看线网站和链上资产看板两大功能。主要特色是追踪聪明钱地址,以及监控代币资金流向分析,这些信息让用户可以追踪买卖情况,为交易者提供交易信号。GMGN一个开发了数十个TG频道,其中包括 GMGN Sniper Bot,也就是下文分析的bot。

TG链接:https://t.me/GMGN_sol_bots_bot TG备用:https://t.me/GMGN_sol_backup_bot 手续费:1% 安全性:采用最先进的安全密钥管理实践,实施了多重身份验证 (MFA),这一额外的验证层通常涉及密码和一次性代码的组合,为防止未经授权的访问。 使用体验:1、操作相对简单,有安全监测按钮可以评估代币风险。能够监控链上聪明钱动态,设置自动买入+挂单限价卖出 (自动止盈止损),同时具备防夹功能。2、支持用户搭建自动化脚本。 Auto sniping:不支持 Auto trading:支持 Copy trading:不支持 优势/特色:支持自动化脚本搭建,依托链上盯盘神器

九、AveSniperBot AveSniperBot 一站式Web3交互终端,聚合链上Dex, DeFi, Token 和 NFT 等协议,致力于提供资金更安全,数据更专业,体验更便捷的Web3交互平台。

TG链接:https://t.me/AveSniperbots_Bot TG备用:https://t.me/AveSniperBackup_Bot 手续费:1% 安全性:由中国河南漫云科技有限公司开发,该公司专注于元宇宙系统开发及相关软件技术,积累了丰富的项目经验和技术储备。平台拥有强大的技术团队和多年的区块链及金融从业经验,确保了交易平台的高效运行和用户资金的安全 使用体验:用户对ave的评价普遍较好,认为其交易环境安全放心、快速便捷,且提供了多种货币选择和专业的客户服务。平台的操作简便,用户可以通过简单的操作流程生成和发行NFT头像,并且可以轻松接入各种数字资产交易平台 Auto sniping:支持 Auto trading:支持 Copy trading:支持 优势/特色:链上快速买卖(可批量)、转账等功能

2 notes

·

View notes

Text

Rodimus wasn't ready to be a creator P7

Masterlist

Part 1 | part 2 | part 3 | part 4 | part 5 | part 6 | part 7: Happiness is limited | part 8 | part 9 | part 10

If someone were to ask Rodimus, back in the day when he just recently left behind the name of Hot Rod, how it felt to be a holder of the Matrix, he would say that it was like being crushed open by your own circuits while being forged again in order to give it a space that wasn't been asked first, it was demanded and his body only listened to the Matrix orders, so, it was a living nightmare at the moment and it really hurt, but Primus what he couldn't give to get the title again (without the carnage, body horror, brutal responsibility placed on his young self, the monstrous anxiety and an auto destructive war, pretty please).

However, he couldn't change what he had.

"Who you love the most?"

"Baba!"

No idea what or who Sunset was referring to, but Primus if it didn't make his spark go all wild for every little thing the little bot was doing in that little human attire you got for him in the last visit to a human settlement.

"Baba" funny thing, Sunset had something close to spit so maybe when he gets older he could eat, just as organics did, but for now he really liked to nimble in his digits or Rodimus', saying baba all the time because some human in the crew said the word, apparently it was spanish, and Sunset liked it, so he kept on saying it.

This moment, while being in the floor with one servo holding his smiling son and touching his still soft frame, was something that he couldn't trade for the world.

"Would you look at that"

Now when Rodimus heard some bots laughing about some pretty funny young bots thirsting over a war hero in Swerve's, he is the first to go and see what is happening, know a little bit more about the gossip and maybe laugh about these young bots with a cup of engex, tease them because they were part of his crew now, and he kind of had the right to do so as the co-capitan.

Paint him surprised, and slightly horrified, when among those young bots, most from Luna 1, he finds his son, the whole group giving what you once referred as "heart eyes" to the war hero that was singing in the bar.

And of fragging course it had to be Jazz.

Jazz and his daughter.

Rodimus was of open mind, really, he really is of open mind, he had you, his dear junxie in the allspark and his techno-organic son were his better example of open mind, Ratchet and Drift were another example, and whatever hot mess Brainstorm was planning to do with Perceptor, what's more! if Megatron and Minimus started dating by some miracle no one would hear a word of complain from him! He would only cringe in the corner.

He doesn't have anything against Jazz, he likes the bot, a bot that is happily married to his human companion and has three wonderful kids!

Maybe is the idea of Sunny growing up, developing feelings and... and physical attraction to others which is totally normal, he also got through it in his cadet days, he wasn't innocent when he finally tied the knock with you, his conjunx, and he knows everything about little escapades here and there with you when your relationship was still young.

His baby is growing after all, he must accept that, it's kind of difficult, Sunset was once just so little that you could carry him around in your tiny arms, you even dressed him in clothes from time to time (Rodimus still can't find that little beanie that Sunset loved while being a protoform), but life goes on.

...

"Sunny!"

Blacksun's whole body jumps on his seat, quickly looking in his direction, desperate and angry red optics with promises of a painful and slow death while he looks at him, his new friends and the object of his adoration in turns, he just wants him to shut the hell up.

"Sunny, my sparkling! What do you say about spending some time with your father?"

He growled, his baby really growled at him while showing his dentae, it's not the first time it happens, but it's the first in public.

Oh, right, Sunny doesn't like it when he talks in human terms with him, and saying "father" out loud shouldn't be a problem if it was only the crew that has know him since his first steps were present, but now they have the newbies of Luna 1d New Cybertron, young bots that his son wants to befriend since the moment they got in the ship, being quite frantic to call him "mentor" or "sire", the first time that he did so Rodimus's data pad falled of his servos by the shock, Sunny always called him "dad", "papa" when he was so little and you just thought him to talk, his first word (for Rodimus the times when he said "baba" doesn't count).

He really wants to be part of a social group, befriend someone from his age, almost not caring from which one, not since he couldn't be accepted by others back on earth, and that is showing in how he finally uses his T-cog to get to his alt-mode, big claws ready to jump at him, wings in full display and fire venting from his intake showing his fury.

That was Rodimus signal to transform and accelerate as far as he could, the corridor was too variant in size for Blacksun's wings to get into and his pedes were too slow to move his big body.

An hour and a glass of flavored energon juice later, the beast was finally placated while drinking from a straw, looking really pissed with Rodimus and his speech of how it was bad to look at some mechs like that.

"I don't want to hear about relationships when you had more than one adventure with several mechs, femmes and Decepticon warlords!"

"Wait a minute I didn't -"

"Uncle Drift-"

"Wait, we weren't-"

"Mister Cyclonus-"

"That's in the past and we were only friends! Primus..."

"Shì, sí, of course"

Why did his son had to be so infuriating, and why did he still hear and remember about his previous things that in reality never reached to something?

"So much modesty..."

"Hey, I didn't throw optics to any bot who already had a conjunx endura"

The silence and tired optics of his son makes him ex-vent, not believing a word he says while crossing his arms over his chassis.

"Okay, not since I meet your mother or I learned those bots had a conjunx"

Blacksun looks at him before finally accepting his answer as good enough, for now.

"I mean, I'm only looking, respectfully, and from distance, he is quite a sight for sore eyes, just like high commander Thunderclash-"

"STOP! Stop right there before I start to leak energon through my optics, I'm begging you!"

His baby was growing, Rodimus wished so hard to have you here by his side, telling him how everything was going to be alright like the very first time that he had the inner force to take Sunset on his servos without the creeping fear at the possibility of squashing him by accident, turns out, his fears were stupid, looking at the little bean search for his digits while sleeping in his palm, he can still hear your voice in his left audial, seated on his shoulder armor and telling him that, yes, he was doing an excellent job while Sunset started to coo at him.

His tiny baby, as you always called Sunset, was no longer one, and he finally understood, after years of looking at his son why cybertronians didn't had something similar to human childhood.

Rodimus believes, deep in his spark, that is to prevent any mentor, sire, carrier or parent of the suffering of see their gift growing up so fast that it makes one dizzy.

#reader insert#x reader#rodimus prime#rodimus x human reader#rodimus x reader#tf rodimus#tf mtmte#tf lost light

19 notes

·

View notes

Text

What are bots in Forex EA?

Introduction:

A Forex EA is a software program that can automatically trade on your behalf in the MetaTrader 5 trading platform. They are written in the MQL5 programming language and can be used to automate a variety of trading strategies, including trend following, scalping, and arbitrage.

Types:

There are many different types of Forex EA (EAs) available for the MetaTrader 5 (MT5) trading platform. Some of the most common types of EAs include:

Trend following EAs: These EAs trade in the direction of the trend. They typically use moving averages or other technical indicators to identify trends.

Scalping EAs: These EAs open and close trades very quickly, often within minutes or even seconds. They typically use small stop losses and take profits in order to profit from small price movements.

Hedging EAs: These EAs open trades in both the buy and sell direction in order to reduce risk. They typically use stop losses and take profits to protect profits and limit losses.

** Arbitrage EAs:** These EAs take advantage of price differences between different markets. They typically use automated trading to buy an asset in one market and sell it in another market at a profit.

Bots: These EAs are designed to automate a variety of trading tasks, such as placing orders, managing risk, and analyzing market data. They can be used to trade a variety of financial instruments, including forex, stocks, commodities, and cryptocurrencies.

How do EAs work?

EAs work by following a set of instructions that are written in the MQL5 programming language. These instructions are called a trading algorithm. The trading algorithm tells the EA how to trade, such as when to open a trade, when to close a trade, and how much to risk.

Benefits:

There are many benefits to using Forex EA, including:

They can help you to save time and effort. EAs can automatically execute trades according to your trading strategy, freeing up your time to focus on other aspects of your trading.

They can help you to improve your trading performance. EAs can help you to avoid emotional trading and to stick to your trading plan.

They can help you to reduce your risk. EAs can be programmed to take profits and to cut losses automatically, helping you to protect your capital.

Risks:

There are also some risks associated with using Forex EA, including:

They can be expensive. EAs can range in price from a few dollars to hundreds of dollars.

They can be complex to set up and configure. It is important to have a good understanding of the MQL5 programming language in order to set up and configure an EA.

They can be buggy or unreliable. EAs are not perfect and can sometimes make mistakes. It is important to test an EA on a demo account before you use it with real money.

They can be hacked or manipulated. EAs can be hacked or manipulated by malicious actors. It is important to take steps to protect your EA, such as using a secure password and keeping your computer up to date with the latest security patches.

How to choose:

When choosing a Forex EA, there are a few things you should keep in mind:

The trading strategy: Make sure that the EA is based on a trading strategy that you understand and that you are comfortable with.

The performance: Backtest the EA on historical data to see how it has performed in the past.

The price: Don't pay too much for an EA. There are many high-quality EAs available for a reasonable price.

The reviews: Read reviews from other traders who have used the EA.

Where can I find:

There are many places where you can find Forex EA, including:

The MetaTrader 5 marketplace

The MQL5 community

Private trading groups

Individual developers

4xPip:

4xPip is a website that provides traders with a variety of tools and resources to help them succeed in the forex market. One of the most popular tools offered by 4xPip is its Forex EA marketplace.

The 4xPip EA marketplace is home to a wide variety of EAs, all of which have been thoroughly reviewed by the 4xPip team. This ensures that traders can be confident that the EAs they choose are of high quality and will help them to achieve their trading goals.

In addition to providing a wide selection of EAs, 4xPip also offers a number of other features that make it a valuable resource for traders. These features include:

Forex EA reviews: 4xPip reviews all of the EAs in its marketplace, providing traders with detailed information about each EA's performance, features, and risks.

Forex EA backtesting: 4xPip allows traders to backtest EAs on historical data, giving them a better idea of how the EAs will perform in the future.

Forex EA support: 4xPip offers support to traders who are having problems with their EAs.

If you are looking for a reliable and trustworthy source for Forex EA, then 4xPip is the perfect place for you. With its wide selection of EAs, expert reviews, and backtesting tools, 4xPip can help you to find the best EA for your needs and achieve your trading goals.

Here are some additional benefits of using 4xPip to find Forex EA:

You can be sure that the EAs you find are of high quality and have been thoroughly reviewed.

You can backtest EAs on historical data to see how they would have performed in the past.

You can get support from 4xPip if you have any problems with your EAs.

Conclusion:

Forex EA can be a valuable tool for traders who want to automate their trading and improve their performance. However, it is important to do your research and to choose an EA that is right for you.

I hope this blog post has been helpful. If you have any questions, please feel free to leave a comment below.

#black tumblr#automate trading bots#auto trading bots#black fashion#black art#black history#black literature#custom bot ea#custom bots#custom bots trading#Forex EA

0 notes

Text

Utilize An AI Trading Bot To Enhance Profits

Automate trading operations, maximize profits, and achieve sustainable growth with premium AI crypto trading bot development solutions.

#ai auto trading bot#auto trading bot#crypto auto trading bot#ai bot trading platform#grid trading bot development#build a trading bot#automated trading bots#crypto trading bot#crypto trading bot developers#crypto bot developers

0 notes

Text

Forex trading can be a great way to supplement your income and create an additional stream of revenue. There are many benefits to trading in the forex market, which can make it an attractive option for those looking to earn a second income. One of the main benefits of forex trading is the potential for high returns. The forex market is one of the most liquid and largest financial markets in the world, with a daily trading volume of over $6.5 trillion. This means that there is a lot of opportunity for profit, and traders can potentially earn significant returns on their investment. Another benefit of forex trading is the flexibility it offers. The forex market is open 24 hours a day, five days a week, which means that traders can participate in the market at any time that is convenient for them. This can be particularly beneficial for those who are looking for a second source of income and cannot commit to a second full-time job. Forex trading also offers a relatively low barrier to entry, with many online brokers offering access to the market with a small initial deposit. This means that traders can start with a small amount of capital and build their account over time. Additionally, with the advancement of technology, it's possible to trade on the go with the help of mobile trading platforms, which makes it easy to monitor the market and make trades even when you're not at home. It's worth noting that forex trading, like any other form of trading and investing, carries a level of risk. It's important to educate oneself on the market and strategies before investing, and to always use proper risk management techniques. In conclusion, forex trading can be a great way to supplement your income and create an additional stream of revenue. With the potential for high returns, flexibility, low barrier to entry and the ability to trade on the go, forex trading can be an attractive option for those looking to earn a second income. However, it is important to be aware of the risks involved and to educate oneself before getting started. As we know we put much effort in the first source of income not in second source of income but you can generate good amount of profit with the second source of income by just including auto trading bot which helps you to scan and analyze the trading market and filter out the best possible trading indicators that helps you to place the profitable trade. Many traders in the trading markets are already using auto trading bot to make their profitable trade and earn beyond their expectation. You can also increase your wealth with the Fx Zippy by choosing the best subscription plan by visiting the official website www.fxzippy.com and get ready to have a good amount of trading return in your wallet.

Copyright @2022 FX Zippy. All Rights Reserved.

#ai forex trading#forex trading robot#fxzippy#auto trading software#forex expert advisor#best trading software#forex trading bot#forex trading for beginners#forex auto trading#forex bot trading

0 notes

Note

" I haven't seen evidence of a "bad mod" yet."

Agreed for the most part. The only "bad" things I've seen from mods are things like Jacharias awful trades in the gem exchange and Tuna possibly auto clicking. I will honestly say the only mod I really don't like is CatLady. A lot of her posts in forums (especially like suggestions and questions) can come off as blunt to a fault, back handed, and sometimes even kind of bitchy.

That does bring up the question though: Can mods see other mods messages and everything when a mod is reported, and if they can (which I assume is the case), do they even bother taking it seriously? The problem isn't that the mods are playing the game, but that they can have a big power dynamic in many situations (trades, forums, ect.) and I don't doubt many mods have been reported before. I've seen players get banned for setting up unfair trades that didn't even come close to Jacharias' gem trades, yet nothing is done. Many players are banned practically on the daily for auto clicking, but I guess since the ass bot doesn't catch people like Tuna (assuming they're auto clicking), it doesn't count as cheating. If anyone else came off as rude as CatLady does half the time, they'd get warned.

I don't think they shouldn't be allowed to play the game, but I definitely see a clear power dynamic at work here that could be fixed if mods actually regulated each other as well.

.

2 notes

·

View notes

Text

Bitsoft360 Reviews - It is Auto Trading Software Bot Profitable!

It would be stock to never have to struggle with doing it again. If you have a few pennies to spend, Bitsoft360 Reviews spring for your business. That's only going to help you in the long term. Aside from that, most of my Bitcoin Bank are Bitcoin Bank Reviews based. There actually is nothing marvelous with respect to it. It is how to end being concerned and start living. It is how to soothe your Bitcoin Bank problems. The prevalence of this has obfuscated this fact. There are basically many feelings in this area. You'll start to have some points of views of your own. When I guess about this, here are the nitty-gritty facts bordering on this whatchamacallit. I've been searching for a Bitcoin Bank distribution center. This changed my life. I may not be up to speed on it. There are none available. When is shows correspondence to this, reading the fine print can save folks a ton of grief. I am not being clear. When it is put alongside some reconstruction, reading the labels and the fine print can save newbies a ton of grief. This is what you call putting a knife through your own heart. That's according to a small number critics.

youtube

Website - https://bitsoft360-review.com/

Read more links

2 notes

·

View notes

Text

AI-Signals: AI-Powered Buy and Sell Indicator for TradingView

AI-Signals stands as the world’s first AI-powered trading community, committed to nurturing a community of passionate traders. The AI-powered indicator, crafted with cutting-edge machine learning algorithms, takes into account a wide range of parameters to provide the most accurate buy and sell signals. This tool guides traders on the exact moments to enter and exit a trade, thereby facilitating smarter trading.

An integral feature of AI-Signals is the 24/7 AI Trading Chat Bot, available on their website. Trained on AI-Signals data, this chat bot is capable of answering any AI-Signals or trading-related queries. This feature assists traders in their journey towards becoming successful in their trading endeavors. Additionally, AI-Signals hosts a supportive Discord community, filled with individuals who share insights and educational content.

Trusted by traders worldwide, AI-Signals is on a mission to help traders enhance their trading knowledge and skills using AI-powered trading. The AI-Powered Buy & Sell Signals, AI-Powered Auto Order Blocks, and AI-Powered Auto Risk Management are some of the key features of the indicator.

AI-Signals offers two plans: a free Beta Indicator with simple Beta buy/sell signals, and a Full Version at $67 per month. The Full Version includes AI-powered buy & sell signals, AI-powered

risk management, AI-powered order blocks, and VIP Discord Invitations to exclusive events worldwide.

Beta users have already reported significant improvements in their trading. “AI Signals completely transformed my trading game,” said Mike Stuart, one of the first Beta users. “Even during the beta phase, the indicator helped me make profitable trades consistently. I can’t wait to see how the final product will perform!”

With its AI-powered indicator, AI-Signals is poised to transform the trading landscape, making trading more accessible and profitable for traders across the globe.

As part of its commitment to making trading more accessible, AI-Signals is inviting traders to visit their website and try the free Beta Indicator. This is an opportunity to experience firsthand the transformative power of AI in trading. For those who wish to take their trading to the next level, early access to the Full Version Indicator is also available.

About AI-Signals

AI-Signals is the world’s first AI-powered trading community. The company provides an AI-powered buy and sell indicator for TradingView, designed to make trading more profitable by providing precise buy and sell signals. AI-Signals is committed to building a community of passionate traders who are committed to enhancing their trading knowledge and skills using AI-powered trading.

For more information visit:

ai-signals.com

6 notes

·

View notes

Text

TradingBotManager.exe: How It Works? (A quick inside look at cloud optimization & auto-parameter selection) Ever wondered how a trading bot can automatically fetch the best .set file from the cloud? Today, we’ll reveal the magic under the hood! ⚙️ We designed EASY Bots so you can choose Automatic Set Apply = True and select Optimization Method (Best/1/2/3) plus an Optimization Criterion (Best/Profit/PayOff/Take, etc.). For more details, check our FAQ: https://forexroboteasy.com/faq/optimization-methodss1-s2-s3-and-set/. /* code snippet territory */ // Example: if (autoSetApply == true) { fetchSetFile(pair, method, criterion); } But from where do these files come? We run continuous optimization on multiple currency pairs, testing countless parameter combos. These setups are then used on our live trading accounts: https://forexroboteasy.com/easy-bots-live-trading/. Each account handles 12 currency pairs with unique configs. Every single trade is analyzed. The best results feed into our master table: https://forexroboteasy.com/set-analyze/, helping us see which pairs profit or underperform. This setup is not just “set and forget” – we use real market data, so you don’t have to worry about outdated strategies or manual adjustments. If you have questions or feel “too new,” relax: our 24/7 support is here. We’re not offering a magic formula or guaranteed success. We’re giving you a powerful bot, backed by real analysis and human-engineered infrastructure. Ready to explore? Talk to @fxroboteasyteambot (we speak multiple languages) and see how EASY Bots can adapt to real market flows. #ForexRobot #MetaTrader5 #MT5Expert #ForexEA #AutoTradingSystem #ExpertAdvisor #TradingSettings #ForexSignal

0 notes

Text

Alltick API: Where Market Data Becomes a Sixth Sense

When trading algorithms dream, they dream in Alltick’s data streams.

The Invisible Edge

Imagine knowing the market’s next breath before it exhales. While others trade on yesterday’s shadows, Alltick’s data interface illuminates the present tense of global markets:

0ms latency across 58 exchanges

Atomic-clock synchronization for cross-border arbitrage

Self-healing protocols that outsmart even solar flare disruptions

The API That Thinks in Light-Years

🌠 Photon Data Pipes Our fiber-optic neural network routes market pulses at 99.7% light speed—faster than Wall Street’s CME backbone.

🧬 Evolutionary Endpoints Machine learning interfaces that mutate with market conditions, automatically optimizing data compression ratios during volatility storms.

🛸 Dark Pool Sonar Proprietary liquidity radar penetrates 93% of hidden markets, mapping iceberg orders like submarine topography.

⚡ Energy-Aware Architecture Green algorithms that recycle computational heat to power real-time analytics—turning every trade into an eco-positive event.

Secret Weapons of the Algorithmic Elite

Fed Whisperer Module: Decode central bank speech patterns 14ms before news wires explode

Meme Market Cortex: Track Reddit/Github/TikTok sentiment shifts through self-training NLP interfaces

Quantum Dust Explorer: Mine microsecond-level anomalies in options chains for statistical arbitrage gold

Build the Unthinkable

Your dev playground includes:

🧪 CRISPR Data Editor: Splice real-time ticks with alternative data genomes

🕹️ HFT Stress Simulator: Test strategies against synthetic black swan events

📡 Satellite Direct Feed: Bypass terrestrial bottlenecks with LEO satellite clusters

The Silent Revolution

Last month, three Alltick-powered systems achieved the impossible:

A crypto bot front-ran Elon’s tweet storm by analyzing Starlink latency fluctuations

A London hedge fund predicted a metals squeeze by tracking Shanghai warehouse RFID signals

An AI trader passed the Turing Test by negotiating OTC derivatives via synthetic voice interface

72-Hour Quantum Leap Offer

Deploy Alltick before midnight UTC and unlock:

🔥 Dark Fiber Priority Lane (50% faster than standard feeds)

💡 Neural Compiler (Auto-convert strategies between Python/Rust/HDL)

🔐 Black Box Vault (Military-grade encrypted data bunker)

Warning: May cause side effects including disgust toward legacy APIs, uncontrollable urge to optimize everything, and permanent loss of "downtime"概念.

Alltick doesn’t predict the future—we deliver it 42 microseconds early.(Data streams may contain traces of singularity. Not suitable for analog traders.)

1 note

·

View note