#American Express Card Balance

Explore tagged Tumblr posts

Text

Best Balance Transfer Credit Card: The Ultimate Guide

Best Balance Transfer Credit Card: The Ultimate Guide:- In today’s fast-paced world, managing credit card debt can be a challenging task. If you find yourself burdened with high-interest credit card balances, a balance transfer credit card can provide a viable solution. In this comprehensive guide, we will explore the concept of balance transfer credit cards, their benefits, factors to consider…

View On WordPress

#0 balance transfer#0 balance transfer card#0 balance transfer credit cards#0 interest balance transfer#0 interest credit cards balance transfer#amazon credit card#american express credit card#amex platinum#apple card#axis bank credit card#balance transfer#balance transfer cards#balance transfer credit card no fee#barclays credit card#best balance transfer cards#Best Balance Transfer Credit Card: The Ultimate Guide#best balance transfer credit cards#best credit cards#capital one balance transfer#chase credit card#credit card apply#credit card balance transfer offers#credit card transfer#credit card transfer to bank account#credit cards#credit cards for bad credit#discover balance transfer#discover credit card#hdfc my card#home depot credit card

0 notes

Text

ok it’s so annoying when places don’t take certain cards so you get all the way through and then they’re like ohhh you have American Express? absolutely not

#this is another sign that I should switch credit cards#I also find American Express to be extremely duplicitous about what I actually owe#very difficult to get a straight answer on my balance#so I want to get a different main credit card because just trying to Remember how much I owe is not working

1 note

·

View note

Text

Smugly muttering “watch and learn” as he opened his Chase app and pressed the “pay balance” button, local genius Todd Garett reportedly outsmarted his bank Monday by using a credit card to pay off another credit card. “Well, well, well—looks like I did make my payments this month,” said Garett, who rubbed his hands together, threw back his head, and cackled as he deftly moved over $16,000 in expenses between several high-interest Visa, Mastercard, and American Express credit cards.

Full Story

354 notes

·

View notes

Text

teach please me — tutor!reader x soccer player!rafe

reader's life is meticulously planned, from high school to becoming president of the country—she knows exactly where she's headed and every step to get there. but her airtight plan hits a snag when the principal ropes her into tutoring rafe cameron, the school’s star soccer player, who’s failing algebra and at risk of being benched next season. the team needs him on the field, and reader needs the principal’s glowing recommendation to secure her spot at her dream school. balancing her ambitious goals with rafe’s chaotic charm might just throw her perfectly crafted plan off track.

word count — 6.1 chapter index — prev. chap. — next chap. masterlist

nineteen

saturday, march 1st

"okay, ready?" ivy’s voice broke the quiet of the library, her sharp gaze narrowing as she held up the next flashcard. you nodded, settling your hands neatly in your lap, trying to shake off the tension in your shoulders.

"main causes of the american revolution?" she asked, her tone brisk but encouraging.

"taxation without representation, british military presence, proclamation of 1763, and acts like the stamp act and tea act," you rattled off, your voice low but steady. she gave a quick nod, flipping to the next card with a satisfied mutter.

"what was the significance of the monroe doctrine?"

"it stated that european powers should not interfere in the western hemisphere and established u.s. influence in the americas," you answered, nodding slightly as if to confirm your own words. ivy hummed in approval, her eyes scanning the card before moving on.

"what triggered the united states’ entry into world war one?" she asked, her voice laced with expectation.

you opened your mouth, ready to reply, but the answer danced just out of reach. blinking, you sifted through your mental notes, coming up blank. "the…" you hesitated, brows furrowing as you scrambled to connect the dots. "the sinking of the lusitania?" you ventured, your voice tinged with uncertainty.

ivy nodded, her expression urging you on.

"oh!" the memory clicked into place. "the unrestricted submarine warfare by germany and the zimmerman telegram!" you finished with a triumphant grin.

"ten out of ten," ivy whispered, punching the air subtly in celebration.

"moreee! i need to get this information printed into my brain," you pleaded, leaning forward with an exaggerated look.

ivy gave you a pointed look, crossing her arms. "we’ve been at this since one, and it’s almost six," she said, the corners of her mouth twitching upward in a laugh. "i think we could both use a break."

“fine,” you reluctantly agree.

she stood, grabbing her bottle off the table. "i’m gonna refill this. we’ll pick it back up in five, okay?"

you sighed but nodded, watching as she walked toward the water fountain. the moment she was out of sight, you slid your notebook aside and switched over to your imessage conversation with rafe, your lips curving into a soft smile as you read over his last message.

a couple of seconds after you send your last text, your phone lights up with a facetime call from rafe. the ringing feels louder in the quiet library, and you scramble to answer before ivy—or worse, the librarian—shoots you a glare. the call connects, and the screen fills with rafe sitting in his car, the faint golden light of the setting sun casting a warm glow over his sharp features. he’s fiddling with his phone, adjusting it against the dashboard, the camera wobbling slightly before he settles it.

“—coming back?” a voice crackles faintly in the background, pulling rafe’s attention toward his window. his brow furrows, lips twitching in a mix of amusement and confusion.

“dude, you sound drunk,” rafe says with a laugh, shaking his head as he adjusts his seatbelt. his smile tugs at the corner of his lips, easy and familiar.

“i didn’t drink!” the voice protests indignantly, and rafe’s face twists with exaggerated disbelief as he glances toward the source.

“kelce,” he drawls, his tone dripping with mockery, “you had four corona lights.”

“there’s alcohol in corona lights?” kelce’s voice is so genuinely confused that you can’t help but snort quietly, covering your mouth to stifle the sound.

rafe hears it and turns to the camera, his grin widening at the sight of you laughing. his gaze lingers for a beat longer before he shakes his head and looks back at kelce. “kelce, back up. i’m about to drive off, and i actually can’t deal with you right now.”

“i thought they called it ‘light’ because there’s no alcohol in it!” kelce yells, his tone insistent, and rafe groans, dragging a hand down his face.

“you’re an idiot,” rafe mutters, throwing the car into reverse as kelce finally stumbles out of the way.

“are you sure he should be in our grade?” you tease, watching as rafe navigates out of the parking lot, the golden hour light catching in his hair and softening the edges of his jawline.

“no,” rafe deadpans, his eyes flicking toward the camera briefly. “i’m really not.”

your grin widens as you reach up to undo your claw clip, letting your hair fall loose around your shoulders. you shake it out slightly, the strands catching the soft light spilling through the windows. rafe’s gaze flickers back to the screen for a split second, his expression softening as his eyes follow the motion, but he quickly refocuses on the road ahead.

“what are you craving?” he asks casually, one hand resting on the steering wheel, the other draped over the gear shift.

“what’s around?” you counter, leaning back in your chair, your voice playful as you tuck a strand of hair behind your ear.

his eyes narrow slightly, his lips pressing into a stubborn line. “what are you craving?” he repeats, his tone insistent, though there’s a hint of amusement dancing in his expression.

“fine,” you relent with an exaggerated sigh, though a smile creeps onto your face. “chipotle? like, a bowl with rice, guac, chicken...” you lean your chin on your hand, practically drooling at the thought.

rafe hums, glancing at the GPS on his dash. “there’s one close. i could grab it and be at the library in, like, half an hour—assuming they don’t take forever.”

“perfect,” you murmur, already mentally calculating how much more studying you and ivy could squeeze in before the food arrived.

a few quiet moments pass, the hum of the car filling the space before rafe leans back in his seat at a red light. “so,” he starts, his voice casual but with a note of deliberation. “i was just with the boys, and they wanna come by mine later. my dad got this new grill, and they’re all obsessed with trying it out. my parents are gone for the weekend, and the girls are coming, too. you should come.”

the suggestion hangs in the air for a moment, and your chest tightens, a swirl of emotions tumbling through you. you hadn’t talked about the bonfire yet—the memory of him with adriana still lingered, raw and unresolved, and the image of their lips together was one you couldn’t quite shake, but you stupidly had been pushing it aside. you didn’t want to have this stupid conversation, didn’t want to risk anything breaking this beautiful little bubble you were both in. surely, there was an explanation—there had to be. so, just ask him.

maybe they used to have a thing? you honestly didn't really like to think about it all because the image alone upset you but if they did have a thing, it was probably over. right?

and the new girl every day thing had to be made up though the valentine's day letters did stir something up in you.

rafe was so gentle, so soft, so loving and caring. he could never treat girls as disposable as cora made it out to be.

“you could bring ivy,” he adds, his voice softening, his gaze hopeful. “i’ll drive her home after, and maybe you could sleep over?”

his words are casual, but the implication lingers in the space between you. you’d been waiting for the right occasion to finally have sex and his parents not being home? that seemed like the perfect time and place. your heart races. the idea of staying over—of finally taking that step—sends a rush of heat to your cheeks, but at the same time, you can’t ignore the nagging voice in the back of your head urging you to bring up the bonfire first.

you nod slowly, “can we—“

“bring me where?” ivy’s voice cuts through your words. you glance up to see her standing behind you, her curious gaze flicking between you and the phone.

“oh,” you say quickly, trying to gather your thoughts. “rafe’s hosting this small thing at his house, and he asked if you’d want to come.”

ivy slides into the seat beside you, resting her head on your shoulder so her face pops into the frame. “what kind of thing?” she asks, her question clearly directed at rafe.

"a..barbecue but it's not outside—alcohol, but you don't have to drink—ultra casual friends thing. i can drop you off at home too." rafe explains, his voice steady but warm.

ivy hesitates for a moment, her brow furrowing slightly before she relaxes with a shrug. “why not? i’ve never been to that kind of thing,” she says lightly, her tone curious.

she turns to you, raising an eyebrow. “we can go, right?”

you glance between her and rafe, feeling the weight of their gazes. finally, you nod, a small smile playing on your lips. “yeah, we can go. rafe’s bringing us chipotle first,” you add, your tone brightening.

ivy’s eyes light up as she leans toward the phone. “wait, don’t joke with me. are you really getting us food?”

rafe chuckles, his voice warm and teasing. “yeah. what do you want?”

“hold on, i need my phone!” ivy scrambles, rummaging through her bag, and you laugh, shaking your head. “she has a very specific chipotle order,” you explain, already typing it out. “it’s easier if i just text it to you.”

rafe smirks, clearly entertained, but he doesn’t argue. a few minutes later, after you send the details, you’re subjected to twenty-eight excruciating minutes of ivy glancing toward the hallway every few seconds, her anticipation palpable. yes, you counted.

when rafe finally walks in, bags in hand, ivy practically leaps out of her seat. “you’re god-sent,” she declares dramatically, clutching the food like it’s a lifeline before digging in with record speed. you can’t help but laugh, your chest warming at the sight of her excitement and rafe’s quiet amusement.

rafe strolled over to you, his hands extended, palms up. you tilted your head, curious, before slipping your hands into his. his grip was warm and steady as he pulled you to your feet, and before you could say anything, he looped your arms around his neck. his hands settled lightly on your waist, and then he dipped his head to kiss you. it was slow and gentle, the kind of kiss that left you dizzy, though you fought to keep yourself grounded, sighing softly against his lips as he pulled you deeper into the moment.

“missed you, baby.” he murmured, his voice low and warm as he pulled back just enough that your breaths mingled between you.

“i missed you,” you echoed, your voice barely above a whisper before you pressed a quick kiss to the tip of his nose. his grin was soft but immediate, the corners of his mouth twitching upward as his hands slid lower to steady you.

“thanks for the food,” you said, glancing briefly toward ivy, who was blissfully absorbed in her chipotle bowl, completely oblivious to the exchange.

rafe followed your gaze, chuckling under his breath. “no need to thank me.” he stepped back and dropped into the chair you’d been sitting in, only to tug you down onto his knee.

you settled against him, adjusting slightly to get comfortable. “you always tell me not to thank you,” you said with mock exasperation, tilting your head to look at him. “that’s really rude, you know? who doesn’t say thank you?”

he pulled a bag from beside his chair and started unpacking it, his movements casual. “you don’t need to thank me for things that go without saying,” he replied simply, not looking up.

you hummed thoughtfully, the familiar spark of debate flaring in your chest. “i get what you’re saying, but i think some things do need acknowledgment. like, i agree there are certain actions that people do in relationships—whether romantic, familial, or platonic—that don’t need constant recognition. but still, a little appreciation never hurts. like when my parents put food on the table—it’s their job, sure, but i still say thank you because it shows I value their effort. it’s about gratitude, not obligation.”

rafe placed your bowl in front of you, a fork and napkin neatly folded beside it. “i get that,” he said, leaning back slightly as you dug into your food. “but i think a lot of things are just part of being in someone’s life. like, it’s not a task or a burden for me to do something for you. it’s automatic—like brushing my teeth. you don’t thank someone for brushing their teeth, do you? it’s just… normal.”

you chewed slowly, considering his point, before shifting on his knee to face him better. the bowl rested on your lap as you studied his expression. “that’s an interesting perspective,” you said finally, nodding a little. “but i’m still going to say thank you.”

his lips curved into a soft smirk as he raked his fingers through his hair. “and i’m still going to tell you not to.”

you rolled your eyes playfully but couldn’t fight the smile tugging at your lips. picking up the flashcards from the table, you plopped them into his hands. “fine, if you won’t accept my thanks, you can at least make yourself useful. quiz me.”

rafe huffed dramatically as he fanned through the colorful cards. “wow, i’m really just a tool to you, huh?”

from across the table, ivy piped up between bites of her food, her voice dripping with dry humor. “not just a tool, also a bank card.”

rafe’s laughter was immediate, shaking his head as he glanced at you.

“okay,” he said, flipping to the first card with a grin. “what was the purpose of the patriot act?”

you don’t linger too long at the library—just long enough for you and ivy to finish your food. once the bowls are empty and the conversation fades, rafe gathers you both and drives you home so you can drop off your bags and check in with your parents. the plan is simple: tell them you’re sleeping over at ivy’s, grab a few essentials, and head out again.

once inside, you catch a whiff of the lingering chipotle smell on your clothes, and it’s enough to make you grimace. after a quick change into fresh, comfortable clothes, and brushing your teeth to erase the last traces of cilantro-lime rice, you’re back in rafe’s car.

he’s quiet when you slide into the passenger seat, his head down as he types something on his phone. the faint glow illuminates a frown etched into his features. you buckle your seatbelt and glance at him, concern stirring. “you okay?” you ask softly.

he doesn’t look up or respond, his focus still glued to his screen.

“rafe?” you try again, your voice a little firmer this time. his head snaps up, eyes meeting yours as if pulled from deep thought.

“hmm?” he hums, blinking.

“are you okay?” you repeat, studying him closely.

he exhales, the frown softening but not entirely disappearing. “yeah,” he says quietly, slipping his phone onto the console. “just… haven’t heard much from sarah lately. i’ve been trying to get ahold of her.”

you nod, your hand brushing against his arm in a small, reassuring gesture. “i’m sure she’s fine. maybe reach out to your aunt in the morning, just to check in? but it’s probably nothing to worry about.”

his lips quirk into a faint smile as he nods. “yeah, you’re probably right. i’ll text her tomorrow.”

ivy clambers into the back seat, breaking the moment, and soon rafe is pulling out of your driveway. the car hums softly, the headlights cutting through the dark as ivy peppers rafe with questions about anything and everything that pops into her head. her curiosity is endless.

you smile faintly at their banter, but your mind drifts, your fingers fidgeting with the edge of your sleeve. it wasn’t fear—not exactly—but the thought of being around rafe’s friends again brought a weight to your chest. the last time had ended badly, leaving you walking home alone in the dark, tears blurring your vision.

time had passed since that night, though, and things were different now. rafe had been nothing but perfect—kind, attentive, funny, the kind of person who made your heart skip and your stomach flutter. your parents adored him, your friends approved, and he had done nothing to make you doubt his feelings. it should be fine. everything should be fine. but still, a flicker of unease clung to you.

you’d talk to him tonight, when everyone left. that was the only quiet moment you’d get.

“you okay?” ivy’s voice broke through your thoughts as you approached rafe’s front door.

you glanced at her, startled, and nodded quickly. “yeah, of course. why?”

she studied you for a moment, her brow furrowed. “you just seem a little… nervous.”

“nope, not nervous,” you said with a forced smile, shaking your head as if to convince yourself as much as her.

she didn’t press further, but the shadow of doubt lingered in her eyes as you both stepped inside behind rafe.

the faint murmur of voices floated from the living room, punctuated by occasional laughter, as you crossed the foyer. the sound made your stomach tighten, but you squared your shoulders and followed rafe’s lead, determined to make it through the evening.

"rafe! there you are, i seriously need—" kiara's voice echoed down the stairs but stopped abruptly when her eyes landed on you and ivy. her surprised expression melted into a wide, welcoming smile. "hey! you came!" she exclaimed, practically skipping down the last few steps.

jj was close behind her, bounding down the stairs like a golden retriever before leaping onto rafe’s back in a chaotic greeting. rafe stumbled forward slightly, muttering something about jj needing a leash, but you were too focused on kiara approaching you and ivy.

"hey, kiara," you said warmly, gesturing toward your friend. "this is ivy."

ivy offered a polite smile and a small wave. "hi, nice to meet you."

"i’m kiara," she said, grinning at the both of you. "so glad you came." without missing a beat, she looped an arm through yours and started tugging you forward. jj threw a quick, cheerful “hi” your way before he and rafe disappeared behind the corner.

"since you don’t drink, i got you something special!" kiara announced with an excited sparkle in her eyes. she practically beamed as she gestured toward the kitchen island, where cleo and pope were deep in the throes of concocting something that resembled a science experiment more than a drink.

pope held up a glass, swirling it like a sommelier, while cleo smirked beside him, her fingers busy mixing something else.

"look!" kiara reached for a six-pack of sleek, colorful cans and held them up like a prized trophy. you stared at them, blinking in confusion.

"they’re virgin mojitos!" she said proudly, her voice practically dripping with enthusiasm.

it clicked a moment later, and you couldn’t help but smile. "so, i can kind of pretend i’m drinking the same as you guys? how thoughtful!" you laugh and kiara nods.

"of course! no one gets left out here," she said with a grin.

pope had already grabbed one of the cans, cracking it open with a flourish and pouring its contents into a glass. he added some questionable-looking ingredients from the assortment on the counter, finishing it off with a dramatic sprinkle of sugar.

"boom!" pope declared, sliding the drink toward you. "virgin cocktails à la cleo and pope. tell me that’s not perfection."

with cautious determination, you took a small sip. immediately, your face scrunched up as the overpowering sweetness hit you. you squeezed your eyes shut, trying to swallow without gagging.

"oh my god," you croaked, handing the glass to ivy, who was already laughing at your reaction.

ivy hesitated, then took a brave sip herself. the second the liquid touched her tongue, her eyes went wide, and she practically spat it back into the glass. "oh, god! what is that? did you dump an entire bag of sugar in here?"

pope and cleo were doubled over with laughter, clearly amused by your suffering.

as ivy hunted for water, muttering something about "instant diabetes," john b strolled into the kitchen, eyebrow raised. "guys, seriously? already throwing up?"

ivy, still laughing through her sputtering, waved him off as she grabbed a glass of water. "i think i just shaved ten years off my life," she mumbled dramatically, taking long gulps.

cleo crossed her arms, looking offended. "you two clearly don’t appreciate our craftsmanship."

"yeah," pope added, nodding in agreement. "this is an art form."

you glanced at kiara, who was biting her lip to hold back laughter. your shared look was enough to set both of you off.

you weave through the place, scanning for rafe in the sea of familiar faces, but he’s nowhere in sight. a few steps in, you collide with jj, his lazy grin revealing he's had more than just a few drinks. "hello," he greets, his voice light and teasing.

"hi," you reply, smiling politely, though his glassy eyes and slight sway make you wonder if he’s entirely steady on his feet.

you glance back to see him watching pope and cleo, who are hunched over the kitchen counter, laughing as they concoct a drink that looks less like a cocktail and more like a dare. jj turns back to you, ignoring your question entirely. "looking for rafe?" he asks, his tone casual.

"yeah," you nod, and his grin widens.

"i’ll take you to him." before you can protest, he drapes an arm over your shoulder, steering you toward the garden.

outside, the air is cooler, and the faint glow of string lights illuminates the yard. rafe stands by the grill with topper and cora. topper is manning the grill, flipping meat with practiced ease, while cora plates the freshly cooked food. rafe, on the other hand, leans casually against the table, contributing absolutely nothing.

"rafe! i brought you a peace offering," jj announces with exaggerated theatrics, gripping your shoulders and nudging you forward.

"peace offering?" you echo, a soft laugh escaping your lips as you glance between jj and rafe.

rafe’s brows lift as he looks at you, his lips twitching into a smirk. "oh, yes. a peace offering because jackson here threw up on my carpet yesterday," he says dryly.

jj lets out an indignant noise, ducking as rafe chucks a nearby towel at his head. "dude! i cleaned it up, and you love me, so stop holding grudges and just forgive me already."

jj moves toward the table, hand reaching for a freshly grilled sausage, but cora smacks his fingers without missing a beat. "it just came off the grill, idiot. you’ll burn yourself."

"you didn’t clean it up," topper chimes in, laughing. "you wiped it. there’s a difference. he’s gonna have to get the carpet professionally cleaned."

"and who’s paying for that?" rafe asks, his tone pointed as he slides an arm around your waist.

jj shrugs, lips pressing together in mock thought. "your rich-ass parents," he answers shamelessly.

"or yours," rafe counters, raising a brow.

jj grimaces, shoving a piece of sausage into his mouth before mumbling, "my dad hasn’t given me a dime since i took his lambo for that little joyride."

"you didn’t even crash it. what’s the issue?" kelce’s voice cuts in as he steps out from the house, joining the growing group.

their conversation continues, laughter and banter spilling into the cool night air. but your focus shifts, the voices fading into the background. you can feel cora’s eyes on you, her gaze heavy and assessing. instead of meeting her stare, you focus on the comforting warmth of rafe beside you, the way his chest rumbles when he laughs, the scent of his cologne grounding you. you twist one of his fingers absently, letting the small act ease your nerves.

after a few moments, you lean closer to rafe. "i’m gonna go get a drink," you murmur softly.

his attention snaps to you, his blue eyes searching yours. "you good?" he asks, concern flickering across his face.

you nod quickly, offering him a reassuring smile. "uh-huh. you want anything?"

"whatever beer’s in the fridge," he replies, and you nod, brushing a kiss against his cheek before heading back toward the house.

as you step inside, the warmth and noise envelop you again, and your gaze lands on adriana making her entrance. she glides through with a confidence that borders on arrogance, her knowing smile is a little unsettling and when she catches your eye, her expression twists into something mocking, though she doesn’t say a word. instead, she brushes past you, heading straight for the garden—and for rafe.

you bite the inside of your cheek, willing yourself to shake off the unease bubbling in your chest. moving toward the kitchen, you find ivy perched at the island, her laughter mingling with the chatter of kiara, cleo, pope, and john b.

you rest your chin on ivy’s shoulder, your voice soft as you ask, "you good?"

she turns to you, her smile bright and reassuring. "very good. you?"

the question is simple, but the answer feels anything but. you hesitate, searching for the right words, though none seem to fit. "yeah," you say finally, forcing a smile. it’s what you should say because nothing is wrong. but deep down, something feels off. something you can’t quite place.

the whole evening, you kept waiting for something to go wrong. you could feel it hovering like a storm cloud, an almost tangible weight pressing on your chest. but nothing happened. cora and adriana barely acknowledged you, and rafe’s friends were as welcoming and warm as the first time you’d met them. you ate, you laughed, and for a moment, you almost believed the night could stay perfect.

but then you glanced at the clock—nine p.m.—and instinctively reached for your phone, only to realize it wasn’t in your pocket. you patted the other one, frowning as the absence unsettled you. rafe, ever attentive, noticed immediately.

“do you know where my phone is?” you asked him, voice light despite the knot forming in your stomach.

he paused, thoughtful. “in your jacket? jackets are on my bed upstairs. want me to grab it?”

you shook your head quickly, forcing a smile. “no, that’s okay.” before he could respond, you were already moving, eager to retrieve it yourself.

the familiar grey door to his room was ajar, and inside, a mountain of jackets sprawled across his bed. you rifled through them, finally locating yours. slipping your phone from the pocket, you glanced at the screen. just a couple of messages—school group chats and your mom wishing you a good night.

you were still typing a reply to your mom when you turned and gasped, startled to find yourself face-to-face with adriana.

“adriana, hi.” your voice wavered as you took a step back, your heart hammering in your chest.”

“hey, teach.” she smiled and took a strand of your hair, flicking it between her fingers. “isn’t he great with his fingers?”

you frowned. “what?” the word barely escaped your lips before they continued.

“didn’t i tell you next time, it’d be you?” cora mused, from behind her, her usual saccharine smile firmly in place. "right as always."

“listen,” you started, trying to keep your voice steady as you shifted to step past them, “i don’t want any problems with either of you. if there’s a problem with rafe, you should really just talk to him.” the words felt forced, but you hoped they’d end this confrontation.

cora chuckled, the sound low and condescending. “there is no problem with rafe,” she said breezily. “that’s what we’re trying to tell you. no girl has ever had any complaints.”

“this says as much,” adriana chimed in, and your stomach dropped as you turned to see her holding a stack of letters. valentine’s day letters. rafe’s valentine’s day letters.

your chest tightened painfully. “those are just crushes,” you said quickly, your voice firmer now. “they don’t mean anything.”

“really?” cora tilted her head, her brows arching in mock curiosity. “well, i’m curious.”

you had no interest in entertaining their games, so you moved to leave, muttering, “okay, you two have fun. i’m gonna go.”

but adriana grabbed your arm, pulling you back with a laugh that grated against your nerves. “no, no, hold on, teach!” she sang, flipping open one of the letters with deliberate glee.

“this one’s good,” she began, her voice dripping with amusement. she cleared her throat. “‘rafey, the other night was so fun. i left you a little gift in your sock drawer. same time, next friday? love, lexi.’”

next friday? had he really been seeing girls while he was seeing you?

your breath caught as cora, with a sickening familiarity, moved to the dresser. she opened the drawer without hesitation, rummaging through the neatly folded socks until she produced something bright red.

“and would you look at that?” cora said, holding up a pair of red lace panties. “pretty sexy.”

“wait, those are actually cute,” adriana giggled, inspecting them like they were a trophy. “wonder where she got them.”

you stared at the fabric dangling from her fingers, the blood draining from your face. this had to be manipulation. some twisted attempt to mess with you. but then, why did he have those panties?

cora snatched another letter, her grin widening. “okay, another one! ‘remember our beach day? you said you love me. can’t stop thinking about you. happy valentine’s day. s.’”

you felt a sharp sting behind your eyes, and when cora turned to you, her expression almost pitying, the first tear slipped free. you aggressively wiped it away.

“she’s so sweet! isn’t she sweet?” she taunted, and her gaze made something inside you snap.

you clutched your jacket tightly, desperate to leave, but adriana wasn’t finished. “hold on, teach!” she laughed, grabbing yet another letter. “this one’s even better! ‘i still remember when you took my v-card in the back of your car—‘“

no no no.

no.

your heart strings pulled tightly and you stopped listening. you shoved past adriana, the world around you blurring as tears filled your vision.

you felt a hand grip your arm and tug you back. “hey?” cora’s ‘concerned’ face, “we’re just trying to help you. i’m a girl’s girl, y/n. i just don’t want to see you get hurt since clearly you aren’t smart enough to see through him yourself.”

you tugged your arm away and behind you, their laughter echoed like a cruel melody. “how sad,” adriana laughed, her voice chasing you down the hallway as your chest heaved with silent, choked sobs.

you rush down the stairs, the sound of your footsteps muffled by the pounding in your ears. tears blur your vision, and the lump in your throat feels like it’s choking you. you don’t stop, you can’t stop. your heart is in free fall, shattering with every breath. you dart past rafe's friends, kiara's concerned look, topper saying something you don't quite catch, their faces a blur, until you find ivy.

her eyes meet yours instantly, wide with concern, like she can sense the storm inside you. “i’m gonna go,” you manage to choke out, your voice trembling. before you can say another word, she’s at your side, her hand brushing against your arm. “y/n?”

rafe is suddenly there too, his brows furrowed, confusion etched into his face. “y/n, baby?” his voice is soft but urgent, and when he reaches for your wrist, you yank it away, shaking your head violently.

“what's wrong, talk to me?” he pleads, moving to block your path. his blue eyes are frantic, clouded with worry, the same eyes you adored only minutes ago. now all you could think about was how you sat in his car, the same car he used to bring you to the retirement home, the one he used to pick you up and take you to school, the one where you'd laughed the most you'd ever laughed and you'd kissed him over and over. the same car you'd given him your first freaking blowjob in was the same car he used to take some girl's virginity and who knows who else's? yours was next. clearly.

“please, just let me g-go.” your voice cracks, trembling with barely-contained sobs as you try to push past him because the thoughts of 'next friday' won't leave you. the picture of him with another girl right after your seeing you or even right before. who knows?

rafe doesn’t let up. his hands find your arms, his grip firm but careful, his touch begging you to stay. “what happened? y/n, please—please talk to me,” he implores, his voice breaking as he tries to steady you, to calm you and it feels like such bullshit, it all feels like a slap in the face and it feels like being deceived and betrayed and you can’t think, don’t care about all the eyes on you, watching you cry—you can’t care because you have this ugly picture playing in your head of him sleeping with girls after touching you and kissing you and him telling a girl he loves her and that girl isn’t you. that girl is not you. it was never you. it all sort of becomes clear. this illusion, dream-like state that you refused to burst out of because of how blissful it felt was really just that, a far-fetched dream.

“don’t touch me! stop!” you cry, your voice rising, panic taking over.

adriana’s voice slices through the tension like a blade, smooth and cruel. “you should leave her alone, rafe. i think she’s had enough.”

his head snaps toward her, his body stiffening. “what? what did you say to her? what the fuck did you two do?” his voice is sharp, his tone teetering on the edge of fury as he glares at adriana and cora.

cora shrugs, her smile dripping with feigned innocence. “we? we didn’t say anything to her. your many, many conquests, though? they were a lot more talkative.”

you watch as the words register, as rafe freezes, his anger shifting to something like dread. his gaze swings back to you, wide and pleading. “you read the letters?” he whispers.

you don’t answer. the tears in your eyes say enough. they won’t stop, pouring down your cheeks as you stare at him, your chest heaving with sobs you can’t control. his momentary hesitation gives you just enough time to slip out of his grasp, to make a desperate break for the door.

“no! no, wait—” his voice is desperate, and his hand finds your wrist again, pulling you into his chest. his grip trembles as much as his voice. “it’s not true—” he stammers, then falters. “well, it’s—i swear, i promise, the moment this became real, the moment i realised you didn't just see me as a friend, i was yours. you know me,” he pleads, his words rushing together, his forehead pressing against yours in a futile attempt to anchor you. “look at me, baby. look at me. you know me.” he begs.

you don’t wipe the tears away. there’s no point. they fall faster than you can stop them, burning hot trails down your cheeks. “is that you? a new girl every couple of days? you—” your voice cracks, broken and raw, “you told a girl you love her?"” the words feel like poison on your tongue, and you pray, beg silently for him to deny it, to give you anything to make this nightmare go away.

“you took another girl’s virginity… in your car?” the words taste bitter on your tongue, your voice breaking on the last syllable. your chest is so tight it hurts to breathe.

you try to pull away from him, to rip yourself from his grasp, but his fingers cling desperately to you. the nausea rises so violently you think you might actually throw up.

rafe’s head shakes frantically, his own eyes filling with tears, the panic setting in. “i don’t—i don’t have the best track record, i know that! but you—you brought out the best in me. i know i fucked up, i know the shit i did wasn’t okay, but i’m sorry,” he pleads, his voice cracking under the weight of his guilt.

you barely hear him. your pulse is roaring in your ears, your vision blurring with tears.

“do you remember her name?” you whisper. your voice is so quiet, so fragile, but it cuts through the air like a blade.

his breath catches. his whole body goes still, like he doesn’t understand the question. his blue eyes dart across your face, searching desperately for something—an out, an answer, a way to fix this.

“what…?” his voice is hoarse.

you swallow back a sob, forcing yourself to meet his gaze. “you were her first,” you repeat, and your voice is deadly soft now. “do you even remember her name?”

the silence that follows is unbearable.

he doesn’t speak. doesn’t even breathe for three whole seconds.

and that’s all it takes.

your stomach lurches. a cold, sickening wave crashes over you, and suddenly his hands on you feel wrong, like they’re scorching your skin, leaving burns behind.

“no, please—please, baby, don’t—” rafe’s voice is raw, wrecked. he reaches for you again, his hands desperate, his entire body pleading, but you stumble back, chest heaving, tears slipping down your face in hot, relentless streams.

he chokes on a breath. his whole face is crumbling, his own tears spilling over now, but you can’t bear to look at him. you can’t breathe around the ache in your chest, around the betrayal weighing down your limbs like lead.

“oh, god..” you shake your head, wrenching yourself out of his arms. “no, please, please.” he tries to pull you close, tries to get you to look at him. “baby—“

“no. no, please, stop. let me go,” you beg him, your voice shaking as you push him away, desperate to escape.

“no, y/n, please—please don’t go,” he begs, his hands reaching for you again, trembling with desperation. “i’m so sorry. i swear, i swear on everything, i’m not that person anymore. i can't lose you. you know me!”

but you can’t listen. you can’t hear another word, not when your heart is breaking like this. the air feels too heavy, the walls too close, and all you know is that you need to get out of this house.

you yank the front door open, but your escape halts when you see her—sarah cameron, standing there with a suitcase in hand. even through the haze of your tears, you recognize her.

“sur…prise,” she says hesitantly, her eyes darting between you, rafe, and the onlookers scattered around the foyer. the scene before her—a girl sobbing uncontrollably, rafe pleading, their friends frozen in stunned silence—leaves her wide-eyed and unsure.

you only look at her for a fleeting moment before stepping past her, out into the cold night. rafe’s voice carries after you, cracking with disbelief. “sarah?”

ivy’s hand slips into yours as she catches up, her grip warm and grounding. you squeeze it tightly, the tears still flowing, unstoppable and endless, as you walk away.

chapter index — prev. chap. — next chap.

a.n — um ya.. what IM surprised abt is that she was gonna let him hit it when he hasnt even made it official..? girl? standardsss??

taglist — @rafeysworldim19 @my-name-is-baby @pogueprincesa @fveapplestall @chalametlover444 @slutglimreqpers @uarmyhopeworldwide @junxe3 @bakuhoethotski @kinderwh0r3 @wintercrows @magicalflowerstranger @bigjuli444 @singlethreadofivy @stylestarkey

let me know if you'd like to be added to the taglist & interact with post to remain tagged <3

#rich jj maybank bc my boy suffered enough in the real show#novawrites#teachme#soccerplayer!rafe#tutor!reader#rafe cameron#rafe cameron x reader#rafe x you#fluff#angst#rafe obx#rafe x reader#rafe cameron x female reader#rafe cameron x you#rafe cameron imagine#rafe fic#rafe cameron fanfiction#rafe outer banks#eventual virginity loss#rafe cameron fluff#john b routledge#pope heyward#kiara carrera#sarah cameron#outer banks#obx#dividers by cafekitsune

297 notes

·

View notes

Text

tarot reading for scavenger hunt item 8

One day, before the big snooze, Frank did tarot readings for some of her girlfriend's mysterious coworkers with her special lovers' deck. Here is what she found:

Three of Lydia's coworkers visited me that day to ask about their work crushes. Without giving away anything about what they do of course. Just like Lydia, honestly! For all of them though, I used my lovers' deck to do a reading with one card for their perspective on the relationship, one for the crush's perspective, and one for their relationship and future overall.

My first visitor was a shy, sweet American named Felix. The poor boy told me he was in love with his best friend. I've seen plenty like him before, pining for someone who only ever notices them in the wrong way. At least as far as they can tell. But we're here to see what the cards can tell, so let's consult them.

The nine of cups shows us Felix's feelings about the relationship. Cups are an emotional suit and the nine is a strong expression of that emotion. But even just from speaking with him I could tell Felix has strong feelings for this person. He shouldn't worry about whether the friend will turn him away if he confesses because his love for them is already obvious, even if they don't realize its nature. This is also the only non reversed card in the spread, showing that although Felix's feelings are certain, his friend's and their future are weaker at the moment and will depend on what actions he takes.

The eight of staves reversed represents a sudden change that is being delayed or held back. This suggests that Felix's friend is waiting for him to make the first move, after which he will make a decisive choice.

The two of coins represents balance, especially in work or practical matters. Knowing that this is a work friend especially makes me think this represents how well Felix and his friend balance each other out and work well together. Because it's reversed however, there's an aspect of that relationship they have yet to unlock, perhaps a romantic one.

My overall advice to Felix is that his friendship is strong and his friend knows they're very loved, so this is just the right time to try to take that friendship further. If he takes the right actions, there could be a big change in his relationship which makes it more complete.

My next customer was a man named Alec. I do hope he found some peace in his life, he seemed very wound up. But the cards do predict some possible romantic success in his future.

The five of cups is a card that represents great turmoil, but the fact that it is reversed means Alec is beginning to move past those troubles. In this card, someone looks only at the negatives in life and never sees the possibilities. Being reversed in this position suggests that by considering a new relationship, Alec is starting to find the paths to happiness in his life and recover from a time of despair.

The prince of coins is someone who works hard and has a materially successful future ahead of them. In this reading, we can assume this diligent person will put that same effort into a relationship with Alec and their mutual wealth. They are also someone who enjoys the physical pleasures of this world, another positive in a romantic partner.

In the lovers' deck, Arthur and Guinevere represent the archetype of power. Like King Arthur and his queen of myth, this also comes with the wisdom to wield that power together, building on each other's strengths. I can only say that if Alec lands his crush the world had better watch out!

My advice to Alec is that this seems like a great relationship to pursue which will bring him great happiness and out of a dark time, but first he should make sure he's ready to move on from his past regrets in order to be a fulfilling partner.

My last guest only introduced himself as Q. He seemed doubtful of the tarot, but willing to ask for its advice in a trying relationship. Love and hate are not always so different from each other, and like many before him, he spoke of someone he had at first hated but frustratingly come to love. Despite his lack of faith, the cards gave him this sound answer.

Arrows in this deck represent the importance of communication in relationships and (like the traditional swords) knowledge. Both being reversed here suggests there is some knowledge lacking on both sides of this relationship. The ten of arrows or swords can also represent a decisive ending. Combining these two, when Q improves his communication with his crush, an end will come to this difficult phase of the relationship.

The queen of arrows is the feminine culmination of this suit, suggesting that Q's crush has the potential to be an open and eloquent communicator. However, its reversed position and Q's comments about this person's aggravating communication style (or lack thereof) tell me something is preventing them from sharing the interpersonal expertise they possess.

Despite these roadblocks, the final card is the famous lovers Romeo and Juliet, representing tradition. This means their relationship may take on a traditional structure like marriage. However it may also be that societal tradition is the issue constraining their relationship at the moment. Most relationships flourish when people let go of societal expectations while also creating their own forms of structure.

My advice to Q is that he try to open up to his crush and encourage them to be open with him. I would also recommend they try to find the traditions that are important to them without worrying about what other people think, just like Romeo and Juliet. Although that story is a tragedy, with the right choices, this one won't be!

After all that, I discovered that despite the secrecy, Lydia's job does have the usual workplace drama! I'm sure all these men will find happiness with their crushes. (through the power of multishipping, all of Frank's positive predictions can come true!)

#007 fest 2024#station atlantic#james bond#felix leiter#alec trevelyan#q(uartermaster)#00leiter#0013#00q

22 notes

·

View notes

Text

Geto’s parents were on demon time when they made him. Face card giving American express Centurion with an unlimited balance

24 notes

·

View notes

Text

Don't

Liladrien Week 2024 | Day Four: Solitude

Lila’s heels clatter against the cobblestone as she walks. When she brings her left foot down at an awkward angle, the stiletto point of her shoe dives into a crevice in the ground and nearly brings her off balance. But, elegantly, surely, Lila throws her weight in the opposite direction, manages to regain her balance, manages to not break her angle, and continues on.

It’s a cool night, not a cold one, but the brisk wind and the light rain make it feel as if it should be chillier than it really is. Along Lila’s arms, goosebumps are raised. Her dark red backless minidress looks good and costs a pretty penny, but doesn’t really do anything against the elements. Along Lila’s flank is an embossed black mini bag, containing her phone, her wallet, cosmetics, and nothing else.

Her reflection drifts alongside her in darkened windows and the glossy hoods of cars as she walks. Above, the sky is the shade of David Lynch’s Blue Velvet (1987). Lila could see cars in the distance. Lampposts flicker in and out.

Lila is far from the heart of Paris.

Ah, Paris, this lonely, dark, arrogant city. With its enviable history and funny people. Lila will never get over the way they pronounce gin . Seriously, walk up to a French person and ask them to pronounce gin.

Lila hasn’t been back in Paris for a long, long time, and she plans to thoroughly enjoy her temporary sojourn.

At the edge of an industrial complex, constructed at the mouth of a sprawling car park, is a closed travel agent’s office. Lila approaches the dim stairs that lead to the second floor above it and climbs.

Upstairs, it’s much warmer and sightly.

Lila sighs, relishing in the heat and the classy décor. Marble pillars and an under-lit bar table. Small clusters of plush armchairs are granted the veneer of privacy by their fences of giant potted leaf figs. A waterfall wall bubbles merrily on the far side from the entrance, glowing with neon light fixtures.

As Lila walks, her heels clatter on black-and-white chequered floor tiles before becoming muffled on scarlet carpet. She approaches the bar, clenching the edge of it coquettishly while the well-dressed and reticent bartender looks up from the silverware he is polishing.

“So, um…” Lila says, scanning the shelves of alcohol lined by along the glass shelves. “Could I have an…espresso martini, please?”

The bartender puts down his silverware. He starts up the espresso machine, which purrs like an awakening leopard. Lila leans on her elbows upon the bar, watching him work.

He stamps freshly-ground coffee into a filter, fitting it tight into the grouphead . He lays a tiny glass cup beneath the drip and presses a button Lila can’t see. The espresso machine buzzes and dark, aromatic liquid flows down. Meanwhile, the bartender has obtained a bottle of Belvedere vodka and a bottle of Mr Black Cold Brew coffee liqueur from the shelf behind him. He adds ice into a silver cocktail shaker, then measures in two shots of vodka and one shot of coffee liqueur. A drizzle of golden honey syrup, the espresso shot is dumped in, and the entire thing is shaken economically and intently.

The final cocktail is poured into a crystal-clear martini glass; alcohol the shade of Lila's hair lightening and puffing into a foam the colour of her skin.

The bartender drops three whole coffee beans on top in the pattern of a trillium and slides the cocktail over the counter to Lila.

“Thank you!” she coos, tapping her black American Express card against the EFTPOS scanner.

After she tucks her wallet back into her bag, she drops it, letting her purse hit her flank. In the same instance, she picks up her cocktail and turns around, leaning on the bar while she sips.

Lila can hear the sound of the bartender cleaning behind her. Ahead, she could see the entirety of the demure, sophisticated little bar.

The wafts of cold and mist drifting up the stairs, losing the battle with the establishment’s artificially produced heat. The glimmer of the lustrous, dim lightning reflecting off metallic surfaces. The few patrons gathered at this hour talking to each other in low voices inside cushioned alcoves. At a table to Lila’s right, a silver fox conversing with an enchantingly sweet-looking minx.

Over by the lone table facing an entire wall of floor-to-ceiling glass, is a singular man staring down at his drink.

Lila takes a sip of her martini while taking in the back of this man. She's interested because he appears to be her age, financially-comfortable , and stylish. Then, Lila pauses. And moves closer.

Adrien Agreste is nursing a half-drunk whiskey. One fingerpad circling the rim of the glass over and over again in hypnotic circles while the amber liquid glimmers like topazes. His eyes are misty and he appears to be deep in thought. He wears a black leather jacket with a white V-neck shirt, dark jeans, and YSL Wyatt Harness boots. The Tiffany & Co. silver dog-chain necklace dangling at the crux of his sternum is blank and innocent.

“Hi,” Lila says.

Adrien startles and looks up.

“…hey,” he says.

Read the rest on Ao3

5 notes

·

View notes

Text

[ harry shum jr., genderqueer, he/they ] — whoa! KIAN ZHANG just stole my cab! not cool, but maybe they needed it more. they have lived in the city for THEIR WHOLE LIFE, working as the HEAD STYLIST AND OWNER OF KIAN ZHANG HAIR. that can’t be easy, especially at only 41 YEARS OLD. some people say they can be a little bit DRAMATIC and BLUNT, but i know them to be INNOVATIVE and ACCEPTING. whatever. i guess i’ll catch the next cab. hope they like the ride back to MANHATTAN!

IN A NUTSHELL; a smudge of eyeliner, vintage clothing, piano solo's when the sun's gone down, the slight scent of hairspray, an extensive collection of disney pins, willing to do anything for their son.

tw: bullying

ABOUT.

Name: Kian Zhang Nicknames: Ki Age: Forty-one Date of birth: 21st February 1983 Birth place: Manhattan, New York Occupation: Head Stylist and owner of Kian Zhang Hair Romantic/sexual orientation: Panromantic/pansexual

Kian was born in Manhattan, New York, along with his twin sister, his best friend from the word go.

He’s second-generation Chinese-American.

As the years ticked by they found themselves not entirely happy in their own skin, they started dressing differently, wearing the occasional smudge of eyeliner, something they attempted to embrace in high school.

It didn’t go well, the bullying soon followed; accepting apparently himself was frowned upon. Despite the multicultural city he lived in, his expression was limited in his youth.

He didn’t really listen, continued on in private, with close friends he made… with a boyfriend, someone who meant the world to him as time went on. He was someone who stayed a close friend long into his thirties, despite the break-up in senior year.

It was shortly after high school that they began to go by both he and they pronouns, something that has stayed the same ever since.

Their creativity came out over time and they embraced it, choosing in the end to make their way into the beauty industry and the Carsten Institute of Cosmetology was the place to do it.

He eventually chose to specialise in hairdressing, becoming a stylist to the stars within a couple of years of graduating.

Shortly after that they found themselves caught up in a new relationship, something that was difficult to balance, but he tried his hardest.

Within a year or so a wedding was on the cards, each detail planned out meticulously. It was to be the beginning of a new chapter for him and when they found out only six months later that she was pregnant, he realised it really, really was.

Somehow, at some point during all of this he managed to open up his own salon in the Upper East Side —- somewhere that ended up with a three-month wait for appointments at all times of the year.

Not long after their 30th birthday, the family of three relocated to London, UK, a decision that was made for her work. Kian chose to work on opening a salon there instead, a small franchise that they intended to let someone else run, but with their ethics and style.

As their time in London ticked on, cracks in the relationship began to show, attempting a slower lifestyle ( despite the location ) wasn’t working —- they were both so used to being rushed off their feet.

Two years later a divorce was finalised and Kian moved back to New York. A rocky few years followed, the pair attempting to handle parenting from different continents.

He soon met someone who changed things for him, someone who made them want to try again. A couple of years passed, they moved in together, they were complete opposites in a way, yet that only seemed to make their bond stronger. They complimented one another and it was as simple as that.

But then that ended, too, abruptly and painfully. Kian did all they knew how to do, focus on work and ignore everything else going on around them. Thankfully his son is back in the States now, his ex-wife's job changing a couple of years ago, meaning she could return.

HEADCANONS.

Their wardrobe is a rather eclectic mix of things, although their most colourful side comes out when they’re working and less so at home. At home they really are about being comfortable and nothing else.

There’s always the slightest hint of eyeliner with them, they’ve never been able to let that go.

He’s been playing piano since he was small and he’s pretty damn good at it now —- can definitely give Beethoven a run for his money.

He’s got a bit of thing for 80′s music and are playing it constantly, especially in the salon.

Can’t play sports to save their life, although they like to think they were an amazing high-jumper in high school ( they weren’t, but still mention it if anyone ever brings sports up ).

They collect Disney pins and have never been particularly shy about it.

Once got stabbed with their own scissors by an unhappy client.

3 notes

·

View notes

Text

Alternative Payment Methods (APMs) for Online Transactions

In the past decade, the world of online payments has witnessed a significant transformation. With the rise of e-commerce and the increasing preference for mobile shopping, customers now have more choices than ever when it comes to payment methods. This shift has led to the emergence of alternative payment methods (APMs) that offer customers greater convenience and flexibility. In this article, we will explore the different types of APMs, their popularity across the globe, the benefits of accepting these methods for businesses, and how to choose the best APMs for your business.

Understanding Alternative Payment Methods

Alternative payment methods refer to any form of payment that does not involve cash or traditional credit card systems like Visa, Mastercard, or American Express. These methods include domestic cards, digital wallets, bank transfers, prepaid cards, and more. Unlike traditional payment methods, APMs offer unique advantages such as enhanced security, faster processing times, and ease of use. They have become particularly popular for online transactions, with many countries seeing a significant shift towards APM usage.

Types of Alternative Payment Methods

Prepaid cards: Prepaid cards are loaded with funds by consumers and can be used for purchases until the balance is depleted. They are not directly linked to a bank account and are a popular choice for individuals who want to control their spending.

Cash-based payments: Cash-based payment methods allow customers to generate a barcode or unique reference number for their payment and then complete the transaction by paying in cash at a participating retail location. This method is particularly popular in regions with a large unbanked population.

Real-time bank transfers: Real-time bank transfers enable customers to make online payments directly from their bank accounts. This method offers instant settlement and minimal friction for customers, making it a convenient choice for many.

Direct Debit: Direct debit allows merchants to pull funds directly from customers' bank accounts for recurring payments. This method is commonly used for subscription-based services and offers a seamless and automated payment experience.

Domestic card schemes: Domestic card schemes operate similarly to global card schemes but are limited to specific markets. These schemes cater to the unique needs of consumers in their respective markets and often provide lower processing costs for merchants.

Electronic wallets (e-wallets): E-wallets allow customers to store funds digitally and use them for various transactions, both online and offline. They offer convenience, security, and often provide additional features like peer-to-peer transfers and cross-border payments.

Mobile wallets: Mobile wallets are digital wallets that are specifically designed to be used on mobile devices. Customers can load funds into their mobile wallets through various methods and make payments conveniently through their smartphones.

Digital wallets: Digital wallets are used to store payment card information securely and generate tokenized card numbers for each transaction. They offer a convenient and secure way to shop online without the need to enter card details repeatedly.

Buy now, pay later (BNPL): BNPL services allow customers to defer payments or split the cost of a purchase into installments. This method is gaining popularity for its flexibility and convenience, particularly for high-value purchases.

Cryptocurrencies and stablecoins: Cryptocurrencies like Bitcoin have gained attention in recent years, offering an alternative form of payment. Stablecoins, which are cryptocurrencies linked to fiat currencies or government bonds, aim to reduce volatility and make transactions easier.

Popular APMs Worldwide

The popularity of APMs varies across different regions and countries. Here are some notable trends:

North America

In North America, digital wallets have become the most popular payment method, surpassing credit and debit cards. Apple Pay and Google Pay are widely used, while services like PayPal and Venmo are gaining traction among the younger generation. APMs account for a significant portion of e-commerce transactions in the region.

South America

APMs are gaining ground in South America, with a projected increase in their usage for digital commerce transactions. Credit cards still dominate, but alternative online payment solutions, such as e-cash methods, are becoming more widespread. Cash on delivery is also popular, especially in countries with a large unbanked population.

Europe

In Europe, digital wallets have surpassed credit and debit cards as the preferred online payment method. Domestic debit cards, like Bancontact in Belgium and Cartes Bancaires in France, are popular alongside global card schemes. Bank transfer methods, such as iDEAL in the Netherlands and Przelewy24 in Poland, are also preferred by a significant number of consumers.

Africa

In Africa, mobile wallets have gained popularity due to the lack of bank branch infrastructure and a large rural population. Cash on delivery remains the preferred method, especially in Nigeria and South Africa. Digital wallets are also seeing growth, particularly in Kenya and Nigeria.

Middle East

Cash has traditionally been the dominant payment method in the Middle East. However, the region is experiencing a shift towards mobile wallets due to increased smartphone penetration and concerns over the transmission of cash during the pandemic. Mobile wallet adoption is supported by the expansion of international brands and government-backed payment networks.

Asia Pacific

China has its own domestic card scheme, UnionPay, which accounts for a significant portion of global card spending. Mobile payments, particularly through Alipay and WeChat Pay, are widely used in China. Other countries in the region, such as Singapore, Indonesia, and Thailand, have their own popular alternative payment methods, including GrabPay and OVO Wallet.

The Benefits of Accepting APMs for Businesses

Not accepting customers' preferred payment methods can have a negative impact on conversion rates and lead to shopping cart abandonment. Research shows that a significant percentage of consumers are deterred from completing a purchase if their preferred payment method is not available. By accepting a variety of APMs, businesses can improve customer satisfaction, increase conversion rates, and stay ahead of their competitors.

APMs offer several benefits for businesses:

Increased conversion rates: By offering a wide range of payment methods, businesses can cater to the preferences of different customer segments, leading to higher conversion rates and reduced shopping cart abandonment.

Improved customer experience: APMs provide convenience and flexibility for customers, allowing them to choose the payment method that suits their needs and preferences. This enhances the overall customer experience and fosters loyalty.

Expanded customer base: Accepting popular local and global APMs enables businesses to reach a wider customer base, including those who prefer alternative payment methods over traditional options.

Reduced fraud and chargebacks: Many APMs incorporate advanced security features, such as biometric authentication and tokenization, which help reduce the risk of fraud and chargebacks for businesses.

Access to valuable insights: APM providers often offer detailed transaction data and analytics, providing businesses with valuable insights into consumer behavior and preferences. This data can be leveraged to optimize marketing strategies and improve customer targeting.

Choosing the Best APMs for Your Business

Selecting the right APMs for your business requires a thorough understanding of your target market, customer preferences, and business requirements. Here are some steps to guide you in choosing the best APMs:

Research customer preferences: Conduct market research to identify the most popular payment methods among your target audience. Consider factors such as geography, demographics, and shopping habits to determine the most relevant APMs for your business.

Evaluate business needs: Assess your business requirements, including cost per transaction, setup and management complexity, regulatory compliance, and compatibility with your existing payment infrastructure. Choose APMs that align with your business goals and objectives.

Partner with the right providers: Work with payment service providers that offer comprehensive coverage of the APMs you wish to integrate. Ensure they have the necessary capabilities to support your business's growth and adapt to evolving customer preferences.

Test and optimize: Implement APMs in a phased approach and continuously monitor their performance. Analyze transaction data and customer feedback to identify any pain points or areas for improvement. Regularly optimize your APM strategy to maximize conversions and customer satisfaction.

By embracing the growing trend of APMs and selecting the right mix of payment methods for your business, you can enhance the payment experience for your customers and drive growth in your online sales.

Conclusion

Alternative payment methods have revolutionized the world of online transactions, offering customers greater convenience and flexibility. From digital wallets and mobile payments to real-time bank transfers and buy now, pay later services, APMs cater to a wide range of customer preferences. Businesses that embrace APMs can benefit from increased conversion rates, improved customer experience, and access to valuable insights. By understanding customer preferences, evaluating business needs, and partnering with the right providers, businesses can choose the best APMs to drive growth and success in the digital marketplace. Stay ahead of the competition by embracing the changing landscape of online payments and offering customers the payment methods they prefer.

#high risk merchant account#high risk payment gateway#offshore merchant account#payments#merchant account

3 notes

·

View notes

Photo

OneNETnews EXCLUSIVE: An arrest warrant from a Texan TikToker facing multiple charges in the Dallas County area due to a Suspicious Money Glitch

(Prepared by Ronnie Anne Santiago & Miko Kubota / Stringer Correspondent of Nickelodeon News & Radyo Bandera Patrol #4 news reporter of OneNETnews + Station Manager and President of ONC)

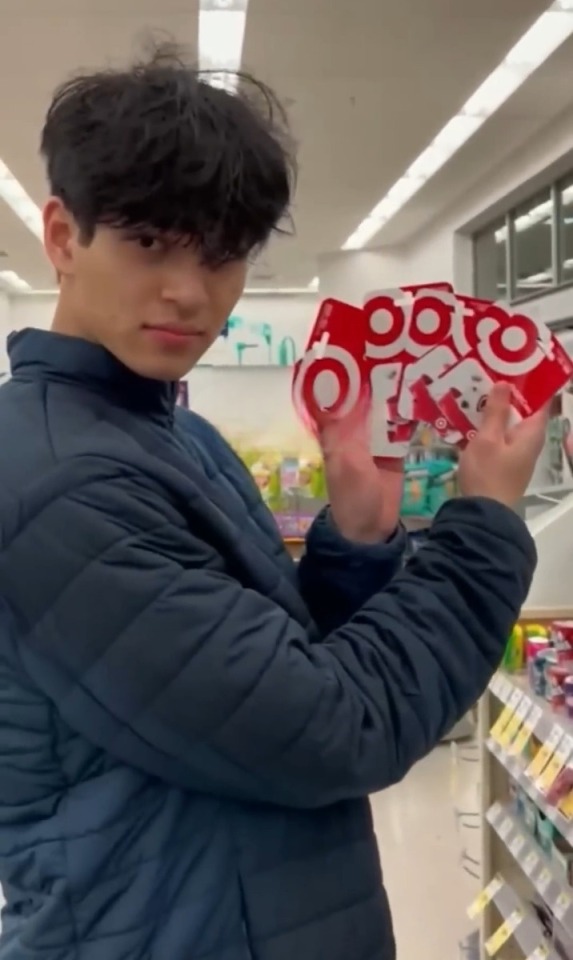

DALLAS, TEXAS -- A Texan-based TikToker named Krishna Sahay is facing controversy after allegedly utilizing an illegal money glitch found in American gift cards to purchase inexpensive items. Stronger allegations surfaced following a series of online video shorts posted exclusively on his own TikTok account, which is owned by Bytedance.

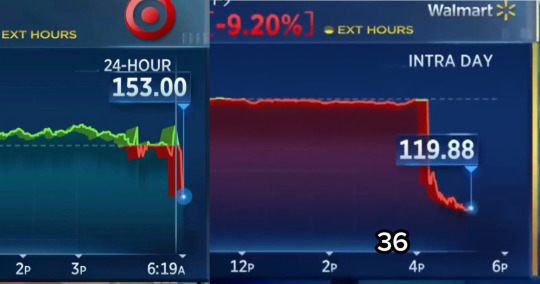

Supermarket and mall stock prices are all drop unexpectedly due to repetitious cyber money heist in Q2 2023.

In the videos, Sahay claims to have discovered a flaw in the system that allows him to buy hundreds or thousands of dollars worth of items as associated with a gift card that has no balance or had been used before. He detailed the process step by step, showing his TikTok followers how to replicate his actions professionally. The videos quickly gained attention, with many viewers expressing skepticism and shock at the money glitch. However, some expressed concern at the legality of Sahay's actions, pointing out that exploiting such a loophole could be seen as a totally fraudulent.

Several individuals reported their TikTok videos to relevant authorities in Texas, the Federal Bureau of Investigation (FBI) and the National Cyber Investigative Joint Task Force (NCIJTF), prompting an investigation into Sahay's activities. As a result, the TikTok user is now facing potential legal consequences.

Many TikTok users have condemned Sahay's actions, calling for him to be held accountable for his behavior and make amends. Some even called for his account to be later banned, citing concerns about his influence targeted to younger users. In response to affected controversy, Sahay issued a closed-door statement apologizing for his public actions online and acknowledging the legal ramifications. He is admitted that he had not fully understood the significant nature of his actions and expressed regret for any harm done.

Despite his apology, the ramifications of Sahay's actions could be significant. Experts have cautioned that taking advantage of gift card system flaws could cause additional security problems and expose consumers and businesses to fraud and other unlawful activities. The case also emphasizes the importance of spreading knowledge and encouraging responsible online behavior, particularly among the younger generation, which may be more vulnerable to such schemes than those that imitate him.

The investigation is underway as based from his activities of Sahay as it remains to be seen what the outcome will be, as according to Dallas Police Department (DPD). At this moment, Sahay will soon face publicly in court with a multiple charges of Cyber Money Heist, Money Laundering, Shoplifting and even violates policies online on TikTok.

The intense controversy serves as an unsettling cautionary tale that there are no shortcuts to success in money glitches when it comes to financial difficulties for those who might be tempted by the lure of easy money, rather than a traditional gambling point. We urgently reached out to Walgreens, Walmart and Target for a comment and to be turned over via E-Mail for this situation.

STOCK PHOTO COURTESY: Wall Street Journal BACKGROUND PROVIDED BY: Tegna

SOURCE: *https://www.youtube.com/shorts/JTPuWRHGKec [Referenced YT Shorts Relay #1 via Krishna Sahay] *https://www.youtube.com/shorts/YqjPyGpwXbw [Referenced YT Shorts Relay #2 via Krishna Sahay] *https://www.youtube.com/shorts/fq4XRQ0kupY [Referenced YT Shorts Relay #3 via Krishna Sahay] *https://www.youtube.com/shorts/8o8GGYgaYvo [Referenced YT Shorts Relay #4 via Krishna Sahay] *https://www.youtube.com/shorts/Fo6cWi43SaA [Referenced YT Shorts Relay #5 via Krishna Sahay] *https://www.youtube.com/shorts/g4gnC7Znc88 [Referenced YT Shorts Relay #6 via Krishna Sahay] and *https://www.youtube.com/shorts/VU9QAuiU4wY [Referenced YT Shorts Relay #7f via Krishna Sahay]

-- OneNETnews Team

#international news#dallas#texas#money glitch#krishna sahay#TikTok#tiktoker#money#stocks#Walgreens#Walmart#Target#awareness#money laundering#shoplifting#cyber#money heist#arrest warrant#exclusive#first and exclusive#OneNETnews

5 notes

·

View notes

Text

United Quest vs. Delta SkyMiles Platinum American Express

Mid-tier credit cards strike a balance between affordability and robust perks, with annual fees typically ranging from $100 to $350. In the world of airline credit cards, the most head-to-head competitor to the United Quest℠ Card (see rates and fees) — with a $350 annual fee — at this mid-tier level is likely the Delta SkyMiles® Platinum American Express Card, which comes with a $350 annual fee…

0 notes

Text

“Do they take American Express at the end of the world?”

I start the day at 7 in the morning, the daylight brings in the news of “what happened” after my own dread of “what could happen” exhausts me into a rest like state the night before.

Maybe the “what could happen” does happen; maybe it's better or worse than what could. But by the time I wake up, it's already happened and. One way or another, I become my own Nostradamus, a predictor of things that anyone with the slightest knowledge of history and pattern-recognition could predict. All seeing but knows nothing.

I check amex instead because I know the cycle ended mid month and the bill is due soon. Enter username, password, otp, remember device for future sign ins. And what a surprise, I qualify for more credit because I've been a good little consumer who knows how to pay bills.

I like to pretend that I have some sense of control, isn't that why I majored in business in the first place? Learn the basics of finance, investment, market segments and management. And all of that was helpful, sure. Even got a job straight out of school working in the securities industry. A good job to pay off my American Express card so I can eventually qualify for more credit.

A good job for my good credit to buy good food and any kind of booze, just to do it all again for the next paycheck and the next billing cycle.

And just like that, life becomes a balance of pay to get paid for every two weeks. And those two weeks turn to months turn to summers to fall to winters. And I get sick, my parents get sick, or the world gets sick. But I’m still charging that card back to back to back– until someone dies.

For just a moment, I see death for what it is.

It is unpayable, unchargeable.

No credit, no debit.

No reward points, no not yet.

Maybe when the funeral home pulls out the card machine so I can swipe for that 1% cash back on ten grand.

But I stare at a body and there is nothing I can do with a body that cannot swipe.

No one can.

Maybe that’s when someone's truly free, when there is nothing left to swipe for.

And I pause, because isn’t this something? Because people die everyday in the most mundane ways and the most tragic ways– but the sorrow I feel, is it for them or for myself?

1 note

·

View note

Text

Blog #7 Business Contexts

Business Culture in NZ

New Zealand’s business practices have much in common with many Western practices. While a lot is similar, there are still important things to know before doing business in NZ. Business protocols are direct, equal, and relational. NZ, unlike many Western societies, New Zealand doesn't have a hierarchy system in companies. While titles like partners, managers, and associates are still used and company structure is more or less the same, the belief of being better or more important than someone else is not backed by job titles.

Direct: Being 100% clear in business negotiations (like salary, PTO, compensation, and work responsibilities) is super important. They believe that if business isn’t done truthfully, then everyone ends up getting hurt.

Relationship-based: In NZ, it’s really important to be personable. A lot of the time in business deals, a meeting will take place where zero business is discussed—just to get to know the other person and gauge level of their trustworthiness. Then, maybe a day later, the actual business talk or negotiation will happen.

Meetings are like most of the Western world—firm handshake, eye contact. Business cards are exchanged, but it’s casual, more like a contact info swap than anything else.

When you're in a business setting, small talk is seen as necessary. These conversations usually start with non-controversial topics like sports, weather, local events, or family while avoiding politics, worldviews, or income. One unique thing is in job interviews: in the U.S. you’re expected to sell yourself almost to the point of bragging. In New Zealand, this can be seen as bragging. They believe in expressing experience in a more humble way.

Business dress is pretty similar. In law, finance, and other highly professional fields, suits are expected. In more casual environments, business casual is similar to the United States as well as looking sharp and put together for work is valued just like in the U.S.