#AdvocateLife

Explore tagged Tumblr posts

Text

#faridabad#study motivation#law#high court#advocacy#student motivation#advocatelife#justiceforall#lawyerlife#legalexpert

2 notes

·

View notes

Text

1 note

·

View note

Text

#lionlaw#law#lawfirm#evidenceact#acts#section#police#officier#lawyers#advocates#legalconsultation#legal#legalfirm#rights#citizenrights#lawfact#advocatelife#lawyerlife#legalrights

0 notes

Link

2 notes

·

View notes

Photo

More favorite moments from 2017! #newyear #crazycreolemommylife #momlife #advocatelife

0 notes

Photo

Understanding financial resilience in a world of uncertainty

By Grace Brownfield, Senior Public Policy AdvocateLife events such as losing your job or having your hours cut, splitting-up with a partner, falling ill, or becoming a carer are common. Yet our new report Life happens: Understanding financial resilience in a world of uncertainty finds that people who had experienced a life event in their household in the past two years were three times as likely to be in problem debt compared to those who had not.In many cases, the coping strategies people are having to rely on after a life event are not working properly to prevent problem debt.The higher the number of coping strategies people use, the more likely they are to be in problem debt — suggesting many people are desperately seeking support from a range of sources, but often finding that this is not enough to prevent them falling into difficulty.Yet some people do successfully avoid debt after life events. We need to understand the difference between their characteristics and those whose coping strategies are not working.Is it just about income and assets, or are other factors at play? Are certain groups of people more likely to use particular types of support or strategies?What implication does this have for their level of financial resilience? We’ve explored the data behind the report to bring you some further findings:1. Many people are trying to cope within their existing budgets and savings, but are finding this isn’t enough to keep them out of debtCutting back on expenditure was the most common strategy people employed, with over a third (36%) choosing to tighten their belts after facing a life event.Using savings to cover day-to-day costs was also a popular strategy — with over a quarter (26%) dipping into rainy-day funds to try and get by.Yet, for many people, these strategies were not enough to keep them out of problem debt: almost half (48%) of people who used their savings were either in problem debt or showing signs of financial distress. The figure is similarly high (47%) for those who cut back on expenditure.While we rightly extol the importance of savings, our research clearly shows that for some people their savings buffer is not enough to cope.When a household is shorn of vital income (for example as a result of illness, bereavement or job loss), savings can quickly be eaten up.And it is, of course, hard for modest income households to build up significant savings in the first place.The reality of these challenges are brought home in the experience of one of our clients, Dave.Dave and his wife were both in full-time employment until she was diagnosed with cancer and he was diagnosed with kidney disease, that eventually led to sepsis. They were both forced to stop working, leaving them reliant on £20,000 in savings. Sadly, Dave’s wife passed away soon after her diagnosis, leaving him to support himself and their two sons alone.2. When people are forced to resort to borrowing, they are left particularly vulnerable to problem debtWhen savings dry up, or when people don’t have them, many people are forced to rely on borrowing — a strategy which can leave people particularly vulnerable to debt. Of the 1 in 5 people who had to borrow from family and friends, 71% are in problem debt.This was even higher for those who used their credit card or overdraft to cover day-to-day spending: 18% of people did this, and a whopping 86% of them were in problem debt or showing signs of financial distress.3. The benefits system works for some but not for allBenefits remain a valuable source of support after a life event — but only for a minority of people, with around 15% applying for benefits following a life event.The picture here is mixed: while half of people who applied for benefits managed to avoid financial difficulties, 33% were showing signs of financial distress and 17% were in problem debt.The findings suggest that, when benefits work well for people, they are a genuine safety net; but improvements are needed to ensure this is the case for all who need them.4. People on higher incomes are more likely to rely on credit to cope with life shocksWhile use of credit was common across all income groups, people in households with incomes above £30,000 were slightly more likely to rely on a credit card or overdraft after a life event.Those on lower incomes tended to rely more on family and friends to borrow from or turned to the benefits system.Although households with higher incomes may be assumed to be more resilient, this high use of credit may explain why almost one third of people (31%) with a household income over £50,000 who had faced a life shock in the last two years were either in problem debt or showing signs of financial distress.In an interesting contrast, those on the lowest incomes (gross household income under £20,000) were the most likely group to cut back on expenditure (41% did so) — even though they are likely to have the tightest budgets already.Other research suggests that large numbers of low income households “go without” on basics; this may be a particular risk for those suffering the aftershock of life events.Those on the lowest incomes were also the most likely to have contacted their utility companies for help.So — what next?Our report brings home the reality that most debt problems are triggered by unexpected events in people’s lives — and that the current patchwork of coping strategies is far from reliable or comprehensive, whatever the household’s income.Scoping the problem is just the first step — what we will now be exploring is how to get a better understanding of the strategies that do work, and why they work.From there, the aim must be to try to work out how these protection factors can be replicated and extended so that more people are covered by them, with fewer gaps.We must not underestimate the difficulty that households face in building up enough financial resilience to protect themselves against unforeseen events.With budgets already tight, many people are simply unable to afford contributions towards protection for future events, that may never happen.Does this mean that products need to be designed differently? That employers need to play a different or more pivotal role? That the benefits system needs redesigning?That the overall way in which risk is assessed and communicated to individuals needs to change? That we need to rely less on discretionary approaches, and more on better built-in protection features of financial products and systems?These are the questions we are looking to answer. If you are interested in helping us (whether you are a lender, a public sector body, a regulator, an employer, or an individual), we would love to hear from you. This is a conundrum that needs long-term and determined collaboration to solve.You can read our full report, Life happens: understanding financial resilience in a world of uncertainty, on our website.Follow us on Twitter, Facebook and LinkedIn.Note: All figures taken from StepChange Debt Charity analysis of YouGov survey. Total sample size was 5,326 adults. Fieldwork was undertaken between 29th April — 2nd May 2019. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).Understanding financial resilience in a world of uncertainty was originally published in StepChange Debt Charity on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://medium.com/stepchange/understanding-financial-resilience-in-a-world-of-uncertainty-fc09b5ce04e9?source=rss-eb8d4fed3016------2

1 note

·

View note

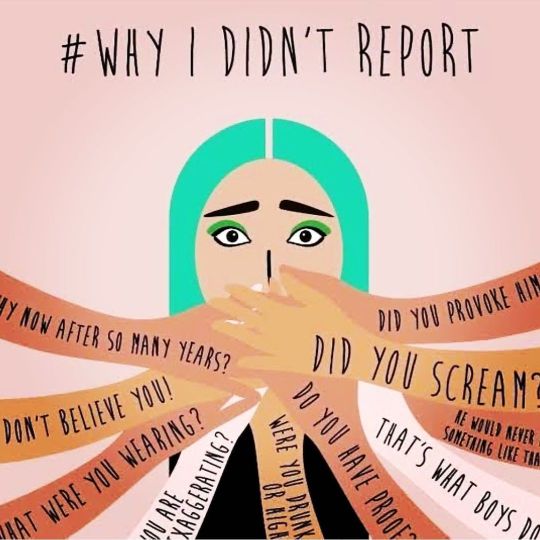

Photo

Let us advocate for the victim and stop the blame game❣️Your voice matters and so does your experience … you are heard 😘💖 #victimblaming #victimmentality #stopblamingthevictim #shamegame #victim #victims #victimshaming #shaming #suicideprevention #suicidepreventionmonth #suicideawarness #suicideawarenessmonth #suicidequote #mentalstigma #metoomovement #metoo #youareseen #youareheard #shareyourstory #shareyourlove #shareyourheart #speakyourtruth #speakyourmind #speakyourheart #speakyourself #reducethestigma #mentalhealthadvocate #advocatelife #donotbesilent #rachaelsroadtorecovery https://www.instagram.com/p/CTeJwQnLi_A/?utm_medium=tumblr

#victimblaming#victimmentality#stopblamingthevictim#shamegame#victim#victims#victimshaming#shaming#suicideprevention#suicidepreventionmonth#suicideawarness#suicideawarenessmonth#suicidequote#mentalstigma#metoomovement#metoo#youareseen#youareheard#shareyourstory#shareyourlove#shareyourheart#speakyourtruth#speakyourmind#speakyourheart#speakyourself#reducethestigma#mentalhealthadvocate#advocatelife#donotbesilent#rachaelsroadtorecovery

1 note

·

View note

Text

#high court#study motivation#faridabad#law#advocatelife#student motivation#justiceforall#advocacy#lawyerlife#legalexpert

3 notes

·

View notes

Photo

Had the honour of meeting Advocate Nitesh Mehra Sir, practicing in Delhi High Court and Supreme Court of India. He was also an Official Law Researcher in Delhi High Court. It was an inspiring and insightful day with you Sir, it was a pleasure meeting you. Thankyou for the opportunity 😊 #thelawyerpedia #thelawyer #meetup #meetup #senioradvocate #highcourtdelhi #supremecourt #supreme #supremecourtofindia #highcourtsofindia #advocatelife #lawfirms #instareelsindia❤️ #delhincr #newdelhi (at Nitesh Mehra & Associates Law Offices) https://www.instagram.com/p/CYoUgt8vxB1/?utm_medium=tumblr

#thelawyerpedia#thelawyer#meetup#senioradvocate#highcourtdelhi#supremecourt#supreme#supremecourtofindia#highcourtsofindia#advocatelife#lawfirms#instareelsindia❤️#delhincr#newdelhi

0 notes

Link

2 notes

·

View notes

Text

DreamHomeSearch#PropertyForSale#InvestInRealEstate#YourNextHome#LuxuryLiving#RealEstateDeals#FindYourSpace#HomeSweetHome#PerfectProperty#RealEstateInvestment

#high court#advocacy#faridabad#law#student motivation#justiceforall#lawyerlife#legalexpert#advocatelife

3 notes

·

View notes

Photo

Just feeling good....🥰🥰🧿 At times you just don't want to study but instead just Pose😁😅 . . . . . . #lawyerpedia #lawyers #lawyeroutfit #lawyergirls #advocatespedia #advocates #advocatelife #advocate #girl #instalikelike #instagram #instafashion #ottd #ottdmagazine #bloggerstyle #followforfollowph #followyourheartfirst #likeit #smile #smilegoals (at Delhi, India) https://www.instagram.com/p/CTpWhZ8P1ra/?utm_medium=tumblr

#lawyerpedia#lawyers#lawyeroutfit#lawyergirls#advocatespedia#advocates#advocatelife#advocate#girl#instalikelike#instagram#instafashion#ottd#ottdmagazine#bloggerstyle#followforfollowph#followyourheartfirst#likeit#smile#smilegoals

0 notes