Best Credit tips & advice on money mattersWordpressOfficial Site

Don't wanna be here? Send us removal request.

Photo

“Workington man” needs the Government to deliver on problem debt

Written by Grace Brownfield, Senior Public Policy AdvocateThere’s a definite sense of déjà vu in Westminster today. Just over 60 days ago, the Queen was making her way to Westminster for the first Queen’s Speech of Boris Johnson’s Government. Today, we do it all again.We’re all used to seeing the Queen speak on Christmas Day, but a Queen’s Speech, as part of a State Opening of Parliament, is certainly a rarity this close to Christmas. However, if ever there was a year to challenge tradition, it seems 2019 is it.The Queen’s Speech gives an early chance for Boris Johnson to set out his priorities, particularly for the first 100 days. Of course, Brexit is going to feature highly but we should also see plans announced in other areas, building on what was in the Conservative manifesto.Many will be waiting to see exactly what the new make-up of Parliament will mean for the government’s priorities. Will the new swathe of Conservative MPs in the North and Midlands mean we see a shift in focus?Why “Workington man” (and woman) need action on problem debtMuch was made of “Workington man” (and woman) during the General Election campaign — a supposed proxy for the type of voter all parties needed to try and capture. Now the new Government needs to deliver for them, and for the country as a whole. Our data suggests that, to do so, tackling problem debt needs to be high up the priority list.According to the Money and Pensions Service, almost 1 in 6 people in Workington are over-indebted. This trend plays out across the country. In Great Britain, over 3 million people are in severe problem debt, and almost 10 million more are showing signs of financial distress.In 2019, StepChange saw the second highest number of people, relative to the population, seeking our help in the north west — where 79 people per every 10,000 of the population contacted us for help with their money worries. This was trumped only by the north east (90 people per every 10,000). Yorkshire and the Humber and the West Midlands see a similar rate to the North West.What should the Government prioritise?People living with the reality of debt every day need action now. The introduction of breathing space and statutory debt repayment plans would greatly reduce the harm people experience when they fall into financial difficulty.Much work was done under the previous Conservative Government to push forward with the schemes, which have cross-party support. Now it’s time to finish the job: We want to see regulations to introduce breathing space laid in Parliament as soon as possible, alongside legislation for statutory debt repayment plans.Enforcement by bailiffs is a particularly intrusive form of debt collection. Figures obtained by the Money Advice Trust show that Allerdale, the local authority in which Workington sits, sent over 1,400 debts to bailiffs in 2018/19. For those who simply do not have enough money to pay, this can be a particularly distressing experience.Before the election, the Justice Secretary Robert Buckland said the Government would release its long-anticipated response to a Call for Evidence on bailiff reform by the end of the year. While the election might have stretched that deadline somewhat, there’s no time to waste.The evidence is clear: the current regulation of the bailiff sector is broken. The Government must now set out clearly how they intend to go about setting up a new system of independent regulation.Beyond these initial priorities, the Government more broadly should focus on how to give people greater security, supporting them to build financial resilience and improving the safety net. Too many people are living on the edge: one life shock or unexpected bill away from serious financial difficulty. Changing that must be high up the Government’s to-do list.“Workington man” needs the Government to deliver on problem debt was originally published in StepChange Debt Charity on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://medium.com/stepchange/workington-man-needs-the-government-to-deliver-on-problem-debt-79e031cc2c0c?source=rss-eb8d4fed3016------2

0 notes

Photo

The Real Cost of Christmas

Christmas comes but once a year — yet the debt the typical UK adult expects to build up to pay for 2019’s looks set to take an average of over seven and a half months to clear, according to new consumer research undertaken for StepChange, as part of our “Real Cost of Christmas” campaign.When you work for a debt advice charity you begin to see the consumerist side of Christmas through different eyes.All those “heartwarming” Christmas TV adverts? Their real objective is to try to get you to believe the fairy tale that the “perfect Christmas” is out there waiting for you… with the unspoken subtext that you just need to spend money to achieve it.And as for those “helpful” adverts from all the glossy brands reminding you that you can now “slice it” or spread your payments to pay for those Christmas goodies? Make no mistake, this isn’t for your convenience, it’s because offering these kinds of facilities enables retailers to vastly increase their sales, as people feel able to buy more than they otherwise would.A third of under-35s surveyed said they expected to use buy now, pay later schemes this Christmas. So that’s a very Merry Christmas to the retailers, then.No-one likes a Christmas Scrooge. We’re hardwired and socially conditioned to believe that generosity is a virtue, and that demonstrative acts of giving are an essential part of being a good person.So it’s easy to see why the pressure to spend at Christmas, even if it isn’t truly affordable, is truly difficult to resist. Exacerbating this, the StepChange research also reveals how the role of social media shows its ugly side — for many, the positive side of sharing the good times is outweighed by a sense of personal inadequacy about not “matching up” to the airbrushed perfection of other people’s Insta Christmas.So while the Christmas message that StepChange, MoneySavingExpert, numerous financial bloggers and journalists are promoting — don’t get into debt for the sake of Christmas — is absolutely right, we also need to recognise that there are countervailing and seductive forces trying to encourage completely the opposite sets of behaviour in people.As we always emphasise, our role is to help, not to judge. And for every bah-humbug who harrumphs that people should “neither a borrower nor a lender be”, there’s a parent just wanting to give their child Christmas presents, or a student taking the expensive rail fare to get home for Christmas, or a loved-up couple influenced into believing that the key to true love lies in the gift.So what are we most hoping for in our own StepChange Christmas stocking? Something more precious than money can buy. An ever kinder, more empathetic, more understanding approach from public policy to the situation facing people in debt — now that would be a Christmas present worth having. And we wouldn’t object to a magic twinkle of regulatory fairy lights over that, to supplement the new rules about helping people in “persistent debt” with a good dose of helping more people to avoid building up unmanageable debt in the first place.

https://medium.com/%40StepChange/the-real-cost-of-christmas-b2537b0f89ce?source=rss-eb8d4fed3016------2

0 notes

Photo

What do the parties’ election manifestos offer for people in problem debt?

By Grace Brownfield, Senior Public Policy Advocate, StepChangeWe’re now just two weeks away from Election day and each of the main parties has published their manifestos. We take a look at what they did, and didn’t, offer for people in problem debt.By the time the Westminster Parliament is back in full swing in January, StepChange will be in the midst of our busiest month of the year. January tends to see more people than any other month getting in touch for debt advice. This is the result of a perfect storm of factors such as the pressures of Christmas spending, people desperate to use the new year to get out of debt, and other life changes that cause financial difficulty (unemployment and relationship breakdown, for example, are common reasons for debt among our clients).It doesn’t take a political genius to predict that this election is being fought primarily on a few key issues: primarily Brexit and public spending on the NHS and education. However, for the over 3 million people heading into the new year in severe problem debt and the further 10 million starting 2020 showing signs of financial distress, the big question is what will the next government do to help them?The answer is, unfortunately, that the picture is mixed.The good newsThere are some welcome commitments littered through the main parties’ manifestos to improve the social security system — an important safety net that can, when it works properly, help people cope with life shocks and avoid problem debt.Labour pledged to remove the Universal Credit five-week wait, which we know is an avoidable driver of financial difficulty and hardship, as part of a package of reforms with a view to scrapping and replacing the benefit in the longer term. The Liberal Democrats said they would reduce the wait to five days and set out other measures to build “a safety net that works��. The Conservatives pledged to “do more to make sure that Universal Credit works for the most vulnerable” while the SNP said they would push for a halt to the roll-out, among other measures.We would welcome greater clarity on key issues like how social security payments will meet and keep pace with the cost of living, and how vulnerable people will be protected against unaffordable deductions from benefits to repay debt, and we will keep pushing on these issues post-election — but it is positive that all of the main parties acknowledge the need for change.The bad newsGiven the millions of people in debt now, it is disappointing that there was not more in the manifestos about how the parties plan to support people to get out of debt and to reduce the harm that it causes.To give credit where it’s due (excuse the pun), Labour said they would cap the total amount that can be paid in overdraft fees or interest on a loan. The Liberal Democrats, meanwhile, highlighted the link between mental health issues and financial difficulty, pledging to end threatening debt collection practices (although they did not go into detail about exactly what this meant). In Scotland, the SNP has pledged that the party’s MPs in Westminster would push for the payday loan cap to be lowered, while also extending it to cover credit card interest and unauthorised overdrafts.Our verdict? All the parties need to go furtherWe’re disappointed not to see more in the manifestos, but it shows us how much more we still need to do to push problem debt up the policy agenda.We want to see clear commitments to push forward with changes that could make a huge difference to people in debt: most notably for England and Wales, implementing a statutory breathing space scheme — giving people time to get help with their debts without being chased for what they owe — and introducing an independent regulator for the bailiff sector.Good progress on both of these issues has been made during the course of the previous Parliament. Both have strong cross-party support. Yet there is now a real risk that they get lost somewhere between this government and the next. This must not be allowed to happen.Breathing space and bailiffs — top of our listWe know that regulations to create a statutory breathing space scheme in England and Wales (Scotland already has a similar scheme) are drafted and ready to go. The next government must introduce these into Parliament as soon as possible, alongside legislation for accompanying statutory debt repayment plans.On bailiffs, it has now been over a year since the Ministry of Justice launched a Call for Evidence on bailiff reform, but it’s time to announce action as a result. We call on the next Justice Minister to set out clearly how the government intends to go about setting up a new system of independent regulation.What about Scotland?Those two provisions mainly apply in England and Wales. The picture is different in Scotland where a number of areas related to debt and advice are devolved. The Scottish Parliament elections in 2021 will therefore be a key opportunity to commit to progress on these issues.We continue to call for the development of a coordinated action plan for Scotland that addresses the impact of problem debt and alleviates hardship. Crucial to this is how Scotland can unlock increased funding for all channels of free debt advice, as well as ensuring Scottish debt solutions administered by the Accountant in Bankruptcy are fit for purpose and accessible for those that need them.Of course, manifestos aren’t the only way for the parties to promise action. We’ll continue to look to all parties to commit to offering much needed help to those facing the difficulties of debt right now. Come December 13th, the New Year and beyond, we’ll continue to make the case to whichever party forms the next government about just why this is so important.To find out more about what we’re calling on the next government to do to help people in debt, read our manifesto.

https://medium.com/%40StepChange/what-do-the-parties-election-manifestos-offer-for-people-in-problem-debt-41c05a81316a?source=rss-eb8d4fed3016------2

0 notes

Photo

Next steps: working with partners to inform our future development

Vikki Brownridge, Director of Charity Development at StepChange Debt CharityOver the summer, we ran a three-month consultation with our partner organisations to establish how we can best work together to tackle problem debt and ensure more people get the support they need. This week, we held an event in London to share their feedback, and explore our next steps together.As demand for debt advice increases, it’s more vital than ever before that organisations work together to support the millions of people experiencing problem debt in the UK.On November 20, at our ‘Stepping Forward Together: Bigger, Bolder, Better’ event, we invited representatives from the organisations we work with to an event to share the feedback they gave us over the three-month consultation period, and explore how this will inform the charity’s development.Our guest speakersWe were delighted to welcome Soulla Kyriacou of a blueprint for better business, who gave an insightful keynote speech on the importance of fairness in business and explored her organisation’s five principles of a purpose-driven business. Gareth McNab of Open Banking for Good gave an entertaining presentation on how open banking technology can be used to help people in financial difficulty. Later in the day, we also heard from Amy, a StepChange client who shared her experience of problem debt and finding a solution in a powerful and moving speech.At the event we announced a number of developments which will be launched in Q1 2020 that have been designed to improve outcomes for clients and to make it easier for our partners to work with us to help them. These include ways to reach people earlier to prevent them from falling into problem debt, solutions to improve accessibility to our services and to deliver increased engagement, and new MI data that we will be sharing with our partners, all of which will deliver an improved client journey and better outcomes.We’d like to say a huge thank you to all partners who provided feedback throughout the consultation either at our workshop and roundtable events, or through our online survey.The suggestions we have received have been invaluable in informing our development, and it’s incredibly important that we continue to work with our partners in a collaborative way to tackle problem debt in the UK.If you’d like to work with us more closely in 2020, or if you’d like to find out more about becoming one, visit our website.

https://medium.com/%40StepChange/next-steps-working-with-partners-to-inform-our-future-development-fdb0a6246ae5?source=rss-eb8d4fed3016------2

0 notes

Photo

Credit Kudos named in Credit Connect’s Top 20 Company Power List

Credit Connect has named Credit Kudos in their newly announced Credit & Collections Technology company power list. The power list is the first edition of what will be an annual round-up of the most prominent innovating companies within credit and collections technology. Within the list, Credit Connect has identified the top 20 ‘Premier’ innovators highlighting the achievements and successes of the top-performing companies.Colin White Founder of the Awards and the new Power List said “The annual guide will provide a snapshot of the technology innovators within credit and collections — it will showcase who is leading the way with innovations and have backed up their status by entering the awards. Finalists and winners have provided measurable data within this process. The companies that have made the top 20 ‘premier’ list are now highlighted by their dedication to innovation. All the companies listed have provided solutions that have helped to enhance the best customer outcome through lending or collections processes.”The annual company power list will act as an index of technological innovation achievement recognising companies for the progression of industry standards and excellence. The list has been compiled from the Credit & Collections Technology Awards results from the past three years and is a culmination of research undertaken by Credit Connect to analyse the performance of finalists and winners of the Awards.You can see the full list here.Credit Kudos named in Credit Connect’s Top 20 Company Power List was originally published in Credit Kudos on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://blog.creditkudos.com/credit-kudos-named-in-credit-connects-top-20-company-power-list-ac0c7c1fcf69?source=rss----9d707c0983bb---4

0 notes

Photo

ClearScore & Credit Kudos Partner to Revolutionise Lending Market

ClearScore has selected Credit Kudos to develop its new open banking powered eligibility solution for products including mortgages, credit cards, and loans. The launch will make a significant difference to thousands of people that currently are either unable to access credit or loans, or are forced to use high cost options. Through the partnership with Credit Kudos, ClearScore will both open the market for underserved users and also present more personalised offers to all users by enriching the application with open banking data.The new solutions therefore presents UK lenders and borrowers with a win-win scenario.For lenders, it provides them with new decisioning models and product opportunities by allowing them to redefine their overall lending strategies and approaches. Using open banking data, lenders will have access to additional, more up-to-date information than was previously available to them such as real-time income and expenditure and also an indication of future liquidity. Importantly, it delivers more precise and refined risk and affordability measurements to lenders, thereby improving time savings and accuracy while also reducing operational costs.In turn, borrowers searching for new credit — including the traditionally underserved — will be able to source new, bespoke product offers by securely sharing data from their bank account in support of the application. This sharing of financial information will increase the chances of them being approved for credit when they previously may have been turned down.Andy Sleigh, COO of ClearScore, comments: “At ClearScore, our aim is to help everyone, no matter what their circumstances, achieve greater financial well-being. However it remains that a large proportion of the UK population are underserved by financial institutions and still held hostage by their circumstances. By partnering with Credit Kudos, we are aiming to change this.“By providing lenders with more information via our open banking integration to improve their decisioning process and affordability assessments, we will open up the credit market to thousands of underserved users who have previously been rejected. Plus, our research has shown that using open banking to open up lending to just 5% of ClearScore’s underserved population would result in an additional £30 million in lending per month. This could grow significantly in the following months and years as these users begin to use further forms of credit.”Freddy Kelly, Credit Kudos CEO and Co-founder comments: “Together, ClearScore and Credit Kudos will revolutionise how lenders are currently assessing prospective users — and particularly those who are currently overlooked or who are underserved borrowers. This is a significant development for the sector, and we’re excited about the potential that this new solution will deliver to both users and lenders.“Harnessing the power of open banking data will provide lenders with the means to better understand individual borrowers through valuable insights and personal data that are not currently available in the traditional credit score assessment. In turn, lenders will be able to re-evaluate their portfolios to create more personalised product offerings. We believe that the use of open banking data is the start of an important and positive change in the lending sector.”ClearScore & Credit Kudos Partner to Revolutionise Lending Market was originally published in Credit Kudos on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://blog.creditkudos.com/clearscore-credit-kudos-partner-to-revolutionise-lending-market-47a42435d790?source=rss----9d707c0983bb---4

0 notes

Photo

Mojo Mortgages announces partnership with Credit Kudos

Richard Hayes, Mojo Mortgages CEO and Freddy Kelly, Credit Kudos CEOOnline mortgage broker, Mojo Mortgages, has partnered with Credit Kudos to announce the launch of MortgageScore™, a market-first service for thousands of first time buyers who want to get on the property ladder.Bringing transparency and openness to a secret marketFor first time buyers, purchasing a home has never been harder, with barriers such as raising a deposit, poor credit ratings and house prices that have risen faster than incomes, making it nearly impossible for some people. At Mojo Mortgages, one in four of the site’s first time buyers weren’t eligible for a mortgage, and in the UK, around 35% of people who are looking to purchase a property are declined a mortgage due to the affordability criteria from lenders.There are several things a broker and lender must consider when determining if someone can get a mortgage, but those who are applying often don’t have access to this information and are kept in the dark. If they are declined the mortgage, they may get a vague reason as to why, but there’s very little guidance on what to do next.MortgageScore™, powered by open banking data from credit bureau Credit Kudos, will bring transparency and openness to a secret market. It will provide future customers with all the insight they need to get mortgage ready. It’s an evolution of the typical ‘credit score’ and combines credit and employment history, spending habits, deposit saved and income to provide users with an individual score for them. It will clearly show how your score is calculated, where it’s good and where it’s not, and will then give guidance on how to improve the score.Improving the score means that it’s more likely customers will get a better offer from a broader range of lenders.Getting mortgage ready with personalised coachingMost buyers have no idea why they were declined and have no idea what the lenders eligibility criteria is. MortgageScore’s coaching module will solve this issue as it will empower users with tailored coaching advice, based on their financial behaviour through open banking data, to tell them exactly what they need to do to get mortgage ready.Richard Hayes, CEO and Co-Founder of Mojo Mortgages, said: “We’re really excited to be able to work with Credit Kudos for MortgageScore™. When launched, it’ll help thousands of first-time buyers get on the property ladder by simply giving them personalised advice on getting mortgage ready. Interestingly. One in four first-time buyers who came to us weren’t eligible for a mortgage, so we want to change this and help as many people as possible to buy their first home.“When it comes to integrating open banking, this is an industry first. We’ll be the first online broker to successfully integrate open banking data, and this will allow for more streamlined and accurate methods of calculating affordability, making real time decisions a reality and meaning less delays for the customer when it comes to getting a mortgage offer, and ultimately, reducing lender cost of service. It also takes the onus off the customer to provide all these details which can be laborious and time consuming.”Freddy Kelly, CEO and Co-Founder of Credit Kudos, said: “Millions of people across the UK struggle to get a mortgage because they can’t meet the affordability criteria, yet often this is because lenders are using outdated, inaccurate information to assess affordability and credit risk. Credit Kudos exists to make it easier and fairer for people to access credit, whether that is a mortgage or a car loan, by providing lenders with accurate, real-time information on someone’s credit worthiness. We’re delighted to be partnering with Mojo Mortgages to help its mortgage lenders make better, fairer credit decisions and provide borrowers with actionable insights to improve their chances of being approved.”The partnership will be officially launched at an event in London this week which will bring high profile lenders together to discuss the opportunities new data brings to the mortgage industry: enabling instant income and expenditure verification, automated affordability assessments and advanced credit risk insights.To be the first to access MortgageScore™, please visit www.mojomortgages.com/mortgagescore to sign-up ahead of its official launch in early 2020. Those who sign-up will also be entered into a prize draw to win £1,000 towards their first home.Mojo Mortgages announces partnership with Credit Kudos was originally published in Credit Kudos on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://blog.creditkudos.com/mojo-mortgages-announces-partnership-with-credit-kudos-1a53dd267708?source=rss----9d707c0983bb---4

1 note

·

View note

Text

Our debt ‘manifesto’ for the General Election

By Grace Brownfield, Senior Public Policy Advocate, StepChangeIt’s official — the UK is in now in The Thick Of It (the General Election campaign, that is).As a charity, we’re of course bound to be scrupulously apolitical and neutral. However, that doesn’t mean we don’t have strong views about what the next Government — of any persuasion — needs to do to fix the problems caused by debt.Today we’re publishing our own ‘manifesto’, in which we ask the political parties to commit publicly to our key asks. In England and Wales, these are:Introducing an independent regulator for bailiffs (enforcement agents)Committing to continue the implementation of a breathing space scheme and statutory debt repayment plans to help people recover from problem debtCreating binding good practice standards for public sector debt collection and enforcementCommitting to pilot a no-interest loan scheme in the UK to support those who might otherwise have to turn to high-cost credit or go without essentialsStrengthening the hand of the Financial Conduct Authority with a clear mandate and responsibility to deliver a safe and fair credit market for consumersSetting out a strategy to reduce the number of people using credit for essential household bills, emergency expenses and essential household goodsStrengthening the safety net, by improving the benefits system and making it more responsive to crisis needs — including ending the five-week wait for Universal Credit.In Scotland, the legislation governing how debt advice operates means that there are significant differences. So we’ve also published a Scotland-specific version which you can read here.One of the points that we want to make most strongly is that some of the work-in-progress currently under way but not yet completed does risk falling over and failing to reach fruition if it gets lost in the cracks between one Government and the next. Important elements that could be affected include bailiff regulatory reform, the implementation of a statutory debt Breathing Space and statutory debt repayment plans, the reform of public sector debt collection and enforcement, and the move towards piloting a No Interest Loan Scheme. We urge everyone involved to make strenuous efforts to ensure this doesn’t happen.Throughout the life of the previous Parliament, we’ve received outstanding support for some of our most important campaigning points from a number of MPs of all persuasions. We thank them all. Now, we look forward to working with the new Parliament and the new Government to make progress in tackling the many issues in the debt landscape that will await them when the campaign is over.

https://medium.com/%40StepChange/our-debt-manifesto-for-the-general-election-df84c16fb591?source=rss-eb8d4fed3016------2

0 notes

Photo

Time for the MoJ to require High Court bailiffs to refund people wrongly charged for VAT

By Peter Tutton, Head of Policy, Research and Public AffairsWe’ve blogged a number of times now on problems with bailiff firms, calling out the pressing need for effective independent regulation.This week’s issue is the clarification that perhaps as much as £36 million in VAT has been wrongly charged by High Court Enforcement Officers (HCEOs) to people who should never have been charged for it in the first place.In 2014 regulations were introduced to control the fees that bailiffs (including HCEOs) can charge people they recover debt from. The regulations do not include an explicit power for HCEOs to add VAT to these fees, but HCEOs have continued to do so in the absence of a clear policy statement to the contrary.Five years on and the Government has now issued the clearest and most unequivocal statement, via a response to a Parliamentary Question in the House of Lords, that it is creditors who should be charged for and pay the VAT on fees, not the people subject to HCEO enforcement. This should put to bed once and for all the ambiguity and misinterpretation that had been allowed to persist since the regulations in 2014 made this practice non-compliant.Clarifying the rights of people in debtIt’s important that anyone who’s wrongly paid 20% more on the enforcement fees they were charged by High Court bailiffs since 2014 should now be refunded by the firms who have wrongly charged it. But there’s no guarantee that these people will be aware or able to seek a refund by themselves.The Ministry of Justice must insist that HCEOs go back through their books and pro-actively identify people wrongly charged and make the necessary refunds.We should also reflect that this isn’t the way that regulation should work. When rules exist, they should be properly monitored and properly enforced. It’s not good enough for firms to mark their own homework or for consumer protection to be left to ambiguous legislation for so long.This is particularly true in the case of a highly intrusive and expensive form of debt enforcement which has real potential to cause harm to highly vulnerable people.We strongly urge the next Government to to move forward quickly and introduce the effective independent regulation of the bailiff sector that’s needed. As this latest episode testifies, the systems and processes aren’t currently in place to ensure that bailiff enforcement achieves the standards of fairness and consumer protection demanded by public policy in other areas of debt recovery.

https://medium.com/%40StepChange/time-for-the-moj-to-require-high-court-bailiffs-to-refund-people-wrongly-charged-for-vat-72f153b9c94a?source=rss-eb8d4fed3016------2

0 notes

Photo

Well done Google for taking action against the debt advice impersonators

by Richard Lane, Director of External AffairsYou may recall that earlier this year we kicked up a big public fuss about the rise in so called ‘lead generator’ firms advertising on search engines in ways that we felt were deeply manipulative and deceptive to people in debt. You may have heard us talking about this on BBC Radio 4 You & Yours and featured in coverage in The Telegraph and The Sun.We’re delighted that the search engine giant Google is now taking action to reduce the risk of this happening in future.Imitation is not the most sincere form of flatteryMore than a million people a year search online for reputable debt advice — like that given by StepChange to hundreds of thousands of clients each year. All too often however, some of them were being siphoned off through pernicious advertising into sharing their personal data with commercial data harvesting sites masquerading as legitimate debt advice providers.Not only were some of these providers using misleading advertising copy and names very similar to real debt advice charities, but they were bidding against specific search terms associated with reputable debt advice charities to appear at the top of Google’s search engine results page shown to people searching for debt advice from charities like us — like the example below.Examples we’ve seen of impostor firms listed on Google search resultsWe’ve since heard from scores of people who genuinely thought they were dealing with StepChange, only to realise later that they had effectively been tricked into sharing their data, often subsequently being contacted by organisations using aggressive marketing tactics to sell fee-charging debt solutions or other financial products.This matters not only to us as a charity but, more importantly, to the people looking for debt advice. It’s shocking that people who thought they had found their way to impartial, free and reputable advice have found themselves taken advantage of, sharing their personal data with firms they did not understand, and sometimes incurring costs they did not need to as a result.Google’s actionsGoogle has now decided that enough is enough — globally. We’re delighted that it’s taking steps to limit the types of organisations from whom it’ll accept advertising for debt advice and debt management services. In the UK, if an organisation does not have relevant FCA authorisation or does not have regulated Insolvency Practitioner status, it’ll no longer be allowed to advertise debt services.This is a step in the right direction. While there are still things that we think regulators including the Financial Conduct Authority, the Insolvency Service and the Advertising Standards Authority need to do to tighten up the rules that apply to what firms can do and say in public, Google’s step is a tangible example of what can be done to improve the situation in the meantime.Regulatory whack-a-mole is not a fun gameWe’ll be watching closely for any signs of displacement activity, though. Will the impersonators simply find another way to reach people — through other search engines, or social media platforms? Keeping on top of manipulative activity in the financial services arena is all too often like regulatory whack-a-mole — you deal with one problem, only to find it popping up somewhere else.We’ll be keeping our eyes peeled to try to ensure that our clients, and would-be clients, are protected from these opportunists. Having successfully complained about and tackled 83 instances of misleading search engine advertising so far this year, we’re hoping this particular area of our activity may now reduce.But there’s no room for complacency — and our “Make sure it’s us” information is still something we’d urge anyone looking for debt advice to be alerted to.Well done Google for taking action against the debt advice impersonators was originally published in StepChange Debt Charity on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://medium.com/stepchange/well-done-google-for-taking-action-against-the-debt-advice-impersonators-a74152fd4961?source=rss-eb8d4fed3016------2

0 notes

Photo

Equiniti Credit Services and Credit Kudos Power Enhanced Credit Decisioning with Open Banking…

Equiniti Credit Services and Credit Kudos Power Enhanced Credit Decisioning with Open Banking PartnershipEquiniti Credit Services, the UK’s leading consumer credit technology and outsourced services provider, today announces it has partnered with FCA-authorised credit bureau and Account Information Service Provider (AISP), Credit Kudos.The partnership will enable Equiniti Credit Services to leverage Credit Kudos’ open banking APIs to deepen the credit affordability assessments that secured and unsecured lenders can perform via its platform, helping them to provide customers with fairer access to finance at a time of increased industry scrutiny and ensure that they are treated appropriately, and responsibly throughout the agreement lifecycleThe Credit Kudos solution will provide lenders with access to in-depth bank transaction data and analysis, offering additional credit risk metrics to complement the Equiniti Credit Services’ existing credit decisioning engine. This will enable lenders to further enhance creditworthiness and affordability decisioning, resulting in faster applications and increased acceptance rates.“Our platform enables lenders to hardwire responsible practices into the lifecycle management of their credit products,” comments Richard Carter, Managing Director, Equiniti Credit Services. “Deeper insights afforded by open banking data are game changing; they’re a fantastic basis upon which lenders can make fairer and more informed decisions about loan eligibility, both during the origination process, but also throughout the loan lifecycle. Our partnership with Credit Kudos gives lenders early access to these insights, via a credit bureau that uses open banking to its full potential. By combining our strengths, we are offering a credible solution to lenders which takes advantage of the latest advances in data and meets regulatory market requirements.”Freddy Kelly, CEO and co-Founder of Credit Kudos said: “The impact potential of this partnership on the UK market for credit is significant. Equiniti Credit Services supports some of the UK’s largest credit providers, many of whom are at the beginning of their open banking journey. Through the Equiniti platform, these providers can now leverage our status as both a credit bureau and an AISP to incorporate open banking insights into their creditworthiness assessments. Ultimately, this new level of sophistication will give consumers access to credit products that are more accurately aligned to their personal circumstances.”The partnership will also enable lenders to sharpen their picture of a customer’s financial status over time, enabling them to quickly detect and act on vulnerability. Automated collection of an applicant’s digital statements will also be introduced, to help remove the distress caused to applicants when they are required to manually submit evidence of their financial history.Equiniti Credit Services is transforming the future of lending by delivering flexible, agile solutions that support the entire lifecycle of a loan. It operates across a diverse range of financial services companies including banks, investment banks, building societies, motor finance, specialist finance and challengers.Credit Kudos is pioneering the use of open banking data in the assessment of credit risk and was one of the first FCA-authorized Account Information Service Providers (AISP) in the UK.Equiniti Credit Services and Credit Kudos Power Enhanced Credit Decisioning with Open Banking… was originally published in Credit Kudos on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://blog.creditkudos.com/equiniti-credit-services-and-credit-kudos-power-enhanced-credit-decisioning-with-open-banking-ef0c48497ff?source=rss----9d707c0983bb---4

0 notes

Photo

Credit Kudos Cofounder Named in London’s Most Influential People 2019: Fintech and Banking

Evening Standard’s Progress 1000 names Freddy Kelly in London’s Most Influential People 2019: Fintech and BankingThe full line-up for the Progress 1000, produced for the fifth year in partnership with the global bank Citi, was revealed last week ahead of their celebrations at the Design Museum, London.The theme of this year’s list is the future and technology, embracing whole new sectors including augmented and virtual reality and cyber security, as well as a wide range of activists challenging inequality and helping the environment.The names are curated by the Evening Standard editorial team led by Editor George Osborne, who said: “This year’s list is a celebration of the talent, diversity and energy of a future-facing London. Here are all the movers and shakers in our great capital. Prepare to be surprised!”Others named in Fintech and Banking list were Antonio Horta-Osario — Lloyds Banking Group, Alison Rose — RBS, Jes Stanley — Barclays, Nathan Bostock — Santander, Richard Gnodde — Goldman Sachs, James Bardrick — Citigroup Inc., Penny James — Direct Line, Christian Faes — LendInvestTech, Taavet Hinrikus — TransferWise, Daniel Hegarty — Habito, Samir Desai — Funding Circle: Making the Financial World better!, Tom Blomfied — Monzo, Nikolay Storonsky — Revolut, Rishi Khosla — OakNorth, and Anne Boden — Starling Bank.Credit Kudos Cofounder Named in London’s Most Influential People 2019: Fintech and Banking was originally published in Credit Kudos on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://blog.creditkudos.com/credit-kudos-cofounder-named-in-londons-most-influential-people-2019-fintech-and-banking-320719b98bfa?source=rss----9d707c0983bb---4

0 notes

Photo

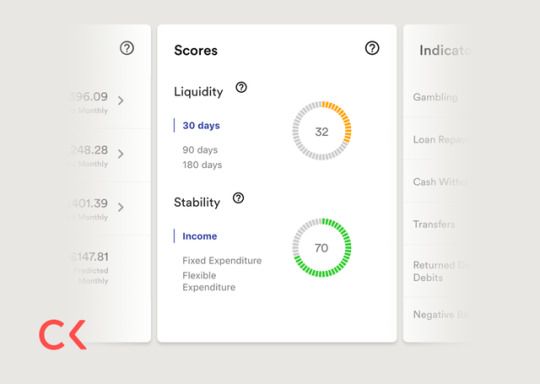

Credit Kudos Introduces New Credit Risk Score

Credit Kudos recently announced their newest credit risk scoring metric, the ‘Liquidity Score’. Using Open Banking data, the newly introduced Liquidity Score predicts how liquid an individual will be in the future, i.e. the likelihood an individual will remain above £0 or above their unarranged overdraft across all bank accounts. The Liquidity Score supports a holistic affordability decision taking into account an individual’s current financial situation and their likely future trajectory. It aims to both protect individuals against financial distress and provide lenders with richer insights into the financial prospects of borrowers. This is just the latest example of Open Banking technology helping consumers get better outcomes using the latest technological innovations.Imran Gulamhuseinwala OBE, Trustee of the Open Banking Implementation Entity (OBIE), commented: “We are delighted to see how companies like Credit Kudos are using Open Banking technology to deliver products and services that help consumers better manage their finances. Open Banking’s secure APIs enable lenders to make enhanced affordability checks — mitigating the risks of financial distress and making a real difference to the financial well-being of millions of consumers.”To build the Liquidity Score, Credit Kudos analysed hundreds of thousands of transactions, using advanced modelling techniques to uncover trends and patterns highly predictive of future outcomes. The Liquidity Score encapsulates two years of complex financial patterns in one interpretable number to help lenders more accurately assess affordability to prevent financial distress for those borrowers who have a likelihood of being less liquid in the future.Credit Kudos offers three Liquidity Scores: 30 days, 90 days and 180 days. Each represents the likelihood that the applicant’s account balance will remain above zero — or above their unarranged overdraft, if an arranged overdraft is present — within the given time period. For example, if an applicant’s “30 Day Liquidity Score” is 90, we predict that it is highly likely that a borrower’s balance will be above zero (or above their arranged overdraft) within the next 30 days.Credit Kudos Introduces New Credit Risk Score was originally published in Credit Kudos on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://blog.creditkudos.com/credit-kudos-introduces-new-credit-risk-score-cbbbefd5e582?source=rss----9d707c0983bb---4

0 notes

Photo

5 things we learned at the party conferences

By Luke Chapman, External Affairs Co-ordinatorOver the last few weeks, we’ve been out and about at the Conservative and Labour Party conferences, talking to policymakers about debt. Now that conference season is over, here are our five main takeaways.1. Support for independent bailiff regulation in England and Wales is growingWe ran events at both Labour and Conservative conferences on bailiff reform, in collaboration with the Money Advice Trust. We were hugely grateful for the support at these events of Tracey and Nat Rogers, the mother and brother of Jerome Rogers, whose experiences of bailiffs were the subject of the BBC’s docu-drama Killed by my Debt and have resulted in tireless campaigning for reform by his family.It’s clear that pressure on the Government to change the system is growing. Many party members raised concerns about bailiffs at events, and we saw yet more MPs from across both sides of the party divide coming out in support of change. We’ll be keeping up the pressure back at Westminster.2. Universal Credit remains a hot topicLots of the press headlines were dominated by Labour’s announcement that they would significantly reform Universal Credit, with a view to scrapping it in the longer-term. Many of these changes would help people like our clients, so we’ve welcomed this — although we cautioned against scrapping it without a clear replacement.Universal Credit was never far from discussion at the Conservative conference either, with growing consensus on the need for urgent reforms. This included changing the way debt is collected from benefits, ending the five-week wait and introducing the option for fortnightly rather than monthly payments, as has been done in Scotland.We’ve been supporting the Trussell Trust’s 5 weeks too long campaign on Universal Credit and at their event we raised our concerns with Conservative MP, Nigel Mills, who’s been looking at what changes should be made as part of his role on the Work and Pensions Select Committee.At Labour, our CEO Phil Andrew spoke at an event with Ruth George MP, the Chair of the All-Party-Parliamentary Group on Universal Credit, sharing the experiences of our clients receiving it and highlighting where we think changes need to be made.3. The age of Austerity “is ending”Austerity has been part of British politics for over 10 years now, and with the Chancellor, Sajid Javid, announcing a raft of spending commitments as part of his Spending Review in early September, we’re now seeing the beginnings of politics after Austerity. Across both Labour and Conservative Party conferences, the consensus was that Austerity as a policy was coming to an end.The messages were obviously different. The conversation at the Conservatives conference revolved mainly around additional money being available because Austerity helped balance the books and created some headroom to spend responsibly and that it was very important to spend in order to bolster the economy ahead of Brexit. At the Labour conference, we saw calls for wider spending and more money for public services such as the NHS.4. It’s still all about BrexitAcross both conferences, Brexit was mentioned at almost every single event we attended.Both parties believe that there is an economic downturn as a result of Brexit on the way — even if exactly what kind, for how long and the longer term impact is hotly debated.Given that we are already working at full tilt to up our capacity to deliver debt advice to a greater number of the people who need it, for us this looks set to mean one unsurprising thing: we can only expect to get busier.5. Safety nets and financial resilience are on the menuThe consensus at both conferences was that the current safety nets provided by the state need to be updated to reflect the reality of the modern world. However, there is no clear picture or wide agreement on what it is that needs to change.We hosted private roundtables on the subject of financial resilience — one of our key long-term policy themes — at both Labour and Conservative Party conferences.John Glen MP, the minister responsible for issues relating to problem debt, highlighted that he wanted to see quicker progress towards implementing breathing space in England and Wales; committed to investing more to promote the Help to Save scheme to help people build financial resilience; and reiterated his desire to pilot a no-interest loan scheme across the UK. These are all things we have been campaigning for, so it was positive to hear the Minister being ambitious about his plans for them.At Labour, we were joined by the Shadow Minister, Anneliese Dodds MP, to discuss what a Labour Government would do to tackle problem debt. She reiterated Labour’s support for breathing space in England and Wales. Labour’s also keen to prioritise measures to tackle financial exclusion and improve people’s resilience, and to ensure people have access to more affordable forms of credit.************************All in all, we had a productive and energising round of conference engagement, and we’ll be using what we learnt to push forward these agendas in Westminster and beyond.

https://medium.com/%40StepChange/5-things-we-learned-at-the-party-conferences-8662494a93c?source=rss-eb8d4fed3016------2

0 notes

Photo

More clients, more distress, more action needed

By Josie Warner, Senior Research and Insight OfficerOur latest mid-year statistics update may be dominated by the headline record number of 331,337 people contacting the charity in the first half of this year, but there are many other worrying statistics lurking under the surface. They throw into sharp relief where the problems lie that urgently need solving.The overall debt landscapeWe’ve seen worrying trends becoming entrenched, such as increases in certain client groups such as younger people and single parents. However, the reasons why people are falling into debt reflect longstanding concerns.Our latest statistics show that people most often require help with their debt situation due to experience of income or life shocks, such as unemployment or redundancy, injury or illness or a reduced income, which have long been among the top recorded reasons for debt for our clients. This is why we’re undertaking work concentrating on what could break the logjam to increase financial resilience in the wake of unforeseen events.Council taxAlmost one third (31%) of all new clients in the first half of 2019 with a responsibility for paying a council tax bill were behind on at least one council tax payment. The charity saw an increase in clients with this arrears type between 2013 and 2014 (25% to 28%), which coincides with the removal of the national scheme of Council Tax Benefit. Since 2014, council tax has continued to be the most common arrears type among StepChange clients.Use of aggressive and intimidating bailiff action is commonplace for council tax collection, which is why the high proportion of clients in council tax arrears is alarming.Earlier this year the Government announced, as an interim measure following its review of bailiff regulation, that enforcement agents will have to wear body cameras to reduce the risk of intimidating tactics. However, we’re still awaiting a full response from the Ministry of Justice on what other measures will be taken. In our view, anything short of the proper, independent regulation of bailiff firms (which is currently non-existent), and a clear and effective complaints and redress scheme will not be good enough.While it goes without saying that local authorities also need to up their game in terms of sensitive and appropriate debt collection practice, this needs to go alongside appropriate regulation of bailiff firms and cannot be a substitute for it.Clients in vulnerable situationsWe’re also worried by the proportion of new clients whose situations make them vulnerable, in addition to their financial difficulty. Our latest stats reveal that 43% of our new clients are in a vulnerable situation.These situations include mental health conditions, which affect half (50%) of all clients in vulnerable situations, as well as physical health difficulties, learning disabilities, hearing or sight impairment, inability to speak or read English and anything else which may make dealing with a debt problem additionally challenging for a client to handle.We do see some notable differences between our vulnerable clients and all clients. Vulnerable clients are more likely to have lower debts, be in arrears and be single and without children compared to the full client population. Compared to just 21% in 2017 and 36% in 2018, the proportion of clients we identify as vulnerable has increased dramatically. However, this rise is likely to reflect previous under-reporting, rather than a seismic shift in the vulnerability profile of clients seeking advice.We’re improving our ability to identify who is in a vulnerable situation during a debt advice session, in line with practice reflected across the debt, utilities and financial services sectors. Providing the appropriate support for consumers in vulnerable situations is becoming a higher priority for many organisations and regulators, which can only be a good thing, but our data suggests that vulnerability is still far too closely associated with problem debt.Single parentsOver the past five years, the proportion of our clients who are single parents has increased by 6%, a higher percentage increase than any other family compositional group. In the first half of 2019, one quarter (24%) of new clients were single parents, which is far higher than the UK average of just 6% (ONS) of all GB adults.Although single parent clients have on average lower debt amounts than the average for all clients, this group are far more likely to be renters (90%) than any other family group and are more likely to be in a deficit budget. It seems likely that these characteristics will be contributing to why this group is over-represented when compared to the wider population. Additionally, 85% of single parent clients are women, which is potentially driving the increasing proportion of women (61%) among our clients.We need a more comprehensive understanding of why we see such a large proportion of single parents contacting us for advice, and we’ll be working with single parent charity Gingerbread to explore this in more depth. This will help us understand why there has been a substantial increase in the proportion of single parent clients, and what the main debt issues surrounding this group are, so that we can better identify what changes might be needed to mitigate their problems.Credit cardsAlmost seven in ten clients (68%) have at least one credit card debt and the proportion of clients with this debt type has been increasing over the past few years. Credit cards are easily accessible forms of credit for many. The flexibility, availability and generally low repayments can make them seem an appealing option for those who are financially stretched, but as our recent research identified they can be a trap.The FCA’s rules on persistent credit card debt have now taken effect, and from early next year some people will find that they are no longer able to borrow on their cards — so we’re keeping a particularly close eye on this part of the market. It may well bring to light hidden debt problems that are currently being juggled by people unable to claw their way out of persistent credit card debt without help as a result of underlying financial difficulty.Energy arrearsWe’ve seen the proportion of clients with electricity arrears increase in the first half of this year (18%) compared to 2018 (16%). The proportion of clients with gas arrears has also increased from 12% in 2018 to 13% in the first half of 2019.This is in line with what others elsewhere have been seeing, with Ofgem also reporting increases in levels of arrears in gas and electricity bills across the sector. Ofgem has also reported that the proportion of customers across the sector setting up payment plans has been falling.It’s therefore vital that people who fall behind are supported to set up affordable cases, and it’s alarming that Ofgem aren’t seeing this in a number of cases. As a charity, we’re looking at how we can help streamline our clients getting more affordable energy repayment plans.Debts to family and friendsWe’ve seen an 11% increase in the proportion of new clients with debts to family or friends over the past five years. In the first half of 2019, one third of clients (33%) owe money to at least one family member or friend, compared to just 22% in 2014. As our recent report Life Happens reported, when a life shock occurs — such as becoming unemployed, bereavement, or experiencing an injury or illness — many people turn to financial support from family or friends.However, not only does the financial support from family and friends often fail to fully address the problem, it can also leave the person who has offered the financial support vulnerable themselves to financial difficulty. Recent data from the Financial Ombudsman Service about the prevalence of problems in the guarantor loans market is another manifestation of this problem.What are the solutions?Data can be hugely valuable in identifying the problems, and pointing the way towards possible solutions. All the trends we’re currently seeing through our data are reflected in policy work that we’re doing to help identify not only how we as a charity can extend or improve or services, but also what regulators, government and creditors can do to reduce the risk and harm of problem debt.Specifically, our data has helped to make the case for the new Breathing Space scheme that now needs regulations to be finalised so that it can begin to make a positive difference from 2021. Our data has also helped to inform the approach being taken by the FCA on high cost credit, credit cards and overdrafts. We now need the government to take notice of our data (and that of others) to improve government debt collection practice and, urgently, to put in place proper bailiff regulation.In the meantime, no one should forget that behind the data sit hundreds of thousands of real people, every year, each grappling with problem debt. Their stories, individually and collectively, help to frame our campaigning work as well as our own services.More clients, more distress, more action needed was originally published in StepChange Debt Charity on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://medium.com/stepchange/more-clients-more-distress-more-action-needed-98cdfa2f3307?source=rss-eb8d4fed3016------2

0 notes

Photo

One year on from the launch of Help to Save, and the numbers are disappointing

By Grace Brownfield, Senior Public Policy AdvocateThe Help to Save scheme has the potential to transform the savings landscape for those on lower incomes, but the latest numbers suggest the Government isn’t doing enough to market the scheme to those who are eligible.It’s been a year since the Government launched the Help to Save scheme. In principle the scheme is good. It provides a strong incentive to save — eligible lower income working households can save up to £50 a month in a government account and, after two years, get a bonus of 50% of the highest balance they achieve during that period. For those who continue to save after this, there’s an additional bonus at the end of four years.We’ve long called for action to improve the financial resilience of UK households, and helping people build a savings safety net is a vital part of this. We supported the scheme from the start but have always been clear that having a good product means nothing if people don’t know about it or use it.While the scheme got off to a good start, a year on the numbers are disappointing. As of the end of August, 132,000 accounts had been opened[i]. Given the Government’s own target was for 500,000 people to have opened accounts in the first two years of Help to Save, it’s clear they’re falling well short of what is already a conservative target, given the 3.5 million people who could benefit from the scheme.[ii]There are some silver liningsThose who are using the scheme are making the most of it: over £31 million has been deposited since Help to Save began and 89% of deposits are for the maximum £50 a month. The average deposit across all account holders is £47.Some might argue that what we’re seeing are positive results from the small portion of those who can afford to save, and that low overall numbers simply reflect the fact many people cannot afford to save at all. This may well be a contributing factor, as we know that saving is a struggle for many people.However, this alone can’t explain the low take-up rates. We’re concerned many people either aren’t aware of it thanks to a lack of marketing; or don’t realise how the scheme can benefit them, even if they only make low value deposits.This has to fall at the Government’s door. It can’t expect to raise sufficient awareness with the very modest marketing budget it has allocated to the scheme. Officials at HMRC have been working hard to come up with creative ways to raise awareness, but with limited resources there is only so much they can do.If the Government is serious about getting people saving, they must invest in a proper budget to market the scheme as widely as possible to those who are eligible. The benefits of doing so would be far-reaching: we estimate that if every household in Britain had £1,000 in accessible savings, this would reduce the number of people in problem debt by half a million.If someone saves the maximum £50 a month into their Help to Save account, then after two years they’d have £1,200 saved (assuming they hadn’t made any withdrawals) and be in line for a £600 bonus. That’s before considering any further savings and bonus after four years.The scheme could therefore make a huge difference. But the numbers right now suggest it won’t. Let’s not waste all the work done to date by allowing the scheme to fade into the background. HMRC and DWP must invest urgently in a proper marketing campaign, so the benefits of Help to Save can really be felt by those who need it.[i] HMRC, Help to Save Statistics, 30 August 2019, Available: https://www.gov.uk/government/statistics/help-to-save-statistics[ii] Help to Save impact assessment, Available: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/560346/impact_assessment.pdf

https://medium.com/%40StepChange/one-year-on-from-the-launch-of-help-to-save-and-the-numbers-are-disappointing-fffff892f1d6?source=rss-eb8d4fed3016------2

0 notes

Photo

PSD2 is Here. These are the 3 Things You Need to Know.

The third iteration of the Open Banking specifications, released earlier this year, are now being adopted by the major UK banks. The Regulatory Technical Standards on Strong Customer Authentication and common and secure communication under PSD2 (commonly abbreviated to “the RTS”) came into effect on 14th September 2019, and many of the major banks in the UK have been funnelling their efforts into a “final” release of their APIs ahead of time.Since the APIs were released at the beginning of 2018, the specifications have undergone a number of iterations, with version 3 being the most significant. What makes version 3 more interesting than previous versions is, conveniently, threefold.App-to-App and Web-to-App give customers a low-friction consent journey.Faster Consent Process with A2A and W2AFirstly, the release of version 3 coincides with a number of version-agnostic improvements the banks have been making to their customer authentication and authorisation procedures. The biggest of which being App-to-App and Web-to-App (A2A and W2A, respectively) redirection as part of the customer consent journey. Practically, this means that if a customer is interacting with a TPP on a mobile device and wishes to connect to their bank, the redirection undergone by a customer would be straight to the mobile banking app on their device. This means authentication can be as easy as scanning a face or a finger, then tapping a button to confirm consent. This is a monumental enhancement over prior implementations. Despite customer conversion being much higher under Open Banking when compared with screen-scraping, this streamlining of the consent journey only serves to increase it further.New Types of Account Including Credit CardsSecondly, there are now new types of accounts that are in-scope that will be served via the APIs. So far the solitary inclusion of current accounts has limited the power offered to third parties by the Open Banking APIs. Most banks are now offering other kinds of payment accounts, like credit cards and savings accounts via the same rails. The inclusion of these accounts will make it possible to get a more complete picture of an individual and offer them greater levels of service. If a third party can understand how money flows between the accounts a customer holds, they have the ability to offer greater advice on how to get the most out of their money, where previously they would be unable to.Non-CMA9 Banks Like TSB Now AvailableThe final major change to coincide with the release of Open Banking version 3 is the number of non-CMA9 providers entering the Open Banking ecosystem. PSD2 affects not only banks but any account-servicing payment service provider (ASPSP). This includes credit card companies as well as smaller banks and building societies. The addition of these providers is valuable for a number of reasons. Firstly, it further enables TPPs to gain a more complete picture of a customer’s finances — a customer may use credit card facilities not offered to them by the major banks, for example — and, secondly, it advances financial inclusion. Too often in the world of FinTech are services geared towards relatively affluent, tech-savvy consumers living in a few east-London postcodes. The addition of smaller and challenger banks — who typically serve consumers the Big Nine overlook — to the Open Banking ecosystem allows companies to build services that serve customers who may have more nuanced needs. We hope this fuels a drive towards a more inclusive economy, with financial institutions large and small leveraging the insights Open Banking data can offer to provide more holistic, tailored services to their customers.With new accounts available through Open Banking APIs, enhancements to the existing Open Banking authentication journeys and a wide variety of non-CMA9 financial institutions joining the ecosystem, the release of the version 3 APIs presents an exciting opportunity for companies capitalising on the technical infrastructure the banks have provided.PSD2 is Here. These are the 3 Things You Need to Know. was originally published in Credit Kudos on Medium, where people are continuing the conversation by highlighting and responding to this story.

https://blog.creditkudos.com/psd2-is-here-these-are-the-3-things-you-need-to-know-a925064303bb?source=rss----9d707c0983bb---4

0 notes