#Advanced Persistent Threat Market

Explore tagged Tumblr posts

Text

Advanced Persistent Threat Market Share, Scope, and Growth Predictions for 2022 – 2030

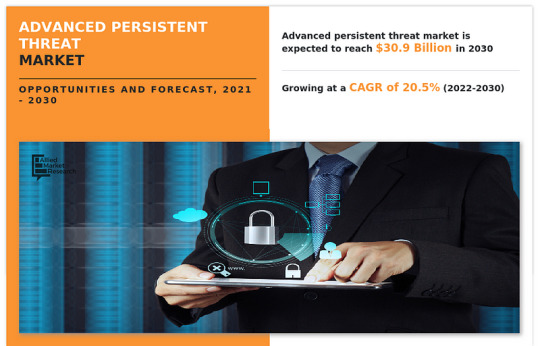

According to a new report published by Allied Market Research, titled, “Advanced Persistent Threat Market,” The advanced persistent threat market was valued at $5.9 billion in 2021, and is estimated to reach $30.9 billion by 2030, growing at a CAGR of 20.5% from 2022 to 2030.

An Advanced Persistent Threat (APT) is a network attack in which cybercriminals enter a computer or network and use it (its system) to conduct undetected operations. APT attacks are mostly directed at companies that handle highly secret data, such as governmental and financial institutions.

Since APT do not appear to be malware at first glance and can infiltrate themselves quite deeply in an administration’s IT systems, and are particularly difficult to identify and remove. The APT’s developers and designers are continuously keeping an eye on it and directing its actions by updating their code to evade detection and morph it into a changing set of characteristics. Moreover, a penetrated company won’t even be aware of it; they might not learn about it until much later through log analysis monitoring with Security Information and Event Management (SIEM) solutions or by outbound communication activities.

Cyber threats are not only affecting the productivity of businesses but also harming essential IT infrastructure and sensitive data of firms. There is a surge in the frequency of cybercrimes because of the quick growth of digital transactions across all industrial verticals. The market for cyber security goods and services is being driven by the rise in enterprise data breaches or data leaks. This increase is attributable to technologies such as Machine Learning (ML), which enable attackers to produce several variants of harmful code every day. Malware bytes also notes that state-sponsored APT organizations and online criminals have switched to using COVID-19 lures. Attacks include lure documents with links to malicious Microsoft Office templates, malicious macros, RTF exploits using OLEI-related vulnerabilities, and malicious LNK files.

Advanced persistent threats are diverse in nature, long-lasting, and highly targeted. Due to the emergence of several new zero day threats, the security needs are also changing as a result of changes in the business environment. Businesses are at danger due to this lack of knowledge about advanced security risks, which is also slowing the demand for advanced persistent threat prevention. Enterprises generally lack a lot of understanding regarding APTs and effective defense strategies.

Concerns about security have increased dramatically as a result of the rising trend of a gazillion gigabytes of sensitive data flowing to the cloud, since cyber attackers are now a serious threat. Companies that rely too much on cloud-based business models are now more vulnerable than ever to a variety of cyber threats. The goal of security is the continuous and continuing assessment of risks and uncertainties. Data breaches have become a very common occurrence due to the massive volume of data produced by IoT devices, data loss prevention technologies, and security information (security solutions) in industry 4.0. In order to deal with these data breaches, firms are choosing advanced analytics, strict access controls, and technology.

Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/31873

The global advanced persistent threat market share is segmented based on deployment mode, services, solutions, and region. By deployment mode, it is classified into cloud and on-premise. By services, it is classified into Security Information and Event Management (SIEM), endpoint protection, Intrusion Detection System/ Intrusion Prevention System (IDS/ IPS), sandboxing, Next-Generation Firewall (NGFW), forensic analysis and other. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the advanced persistent threat industry report include Cisco Systems, Inc., AO Kaspersky Lab., ESET spol. S r.o., Sophos Ltd., Forcepoint, VMware, Inc, Microsoft, Palo Alto Networks, McAfee, LLC, and F-Secure.

The report offers a comprehensive analysis of the global advanced persistent threat protection market trends by thoroughly studying different aspects of the market including major segments, market statistics, market dynamics, regional market outlook, investment opportunities, and top players working towards growth of the market. The report also sheds light on the present scenario and upcoming trends & developments that are contributing to the growth of the market. Moreover, restraints and challenges that hold power to obstruct the market growth are also profiled in the report along with the Porter’s five forces analysis of the market to elucidate factors such as competitive landscape, bargaining power of buyers and suppliers, threats of new players, and emergence of substitutes in the market.

The study provides a detailed global advanced persistent threat market analysis, advanced persistent threat market size, and global advanced persistent threat market forecast from 2022–2030.

Impact of COVID-19 on the Global Advanced Persistent Threat Protection Industry

Due to the COVID-19 pandemic outbreak, the world’s economies are currently experiencing a severe crisis

Coronavirus-based hacking has been used by a number of Advanced Persistent Threat (APT) groups, including those funded by governments and cybercriminals, to infect victims’ computers and spread malware

For instance, the North Korean-based threat group Kimsuky started employing spear-phishing emails with the topic COVID-19 in March 2020, as its first infection vector

The emails have malicious attachments and a bug that enables remote code execution by taking advantage of a weakness in the Microsoft Office OLE interface to spread malware

Key Findings of the Study

Based on deployment mode, the on-premise sub-segment emerged as the global leader in 2021 and the cloud sub-segment is anticipated to be the fastest growing sub-segment during the forecast period

Based on services, the managed services sub-segment emerged as the global leader in 2021 and the professional services sub-segment is anticipated to be the fastest growing sub-segment during the forecast period

Based on solutions, the Security Information and Event Management (SIEM) sub-segment emerged as the global leader in 2021 and the Next-generation Firewall (NGFW) sub-segment is predicted to show the fastest growth in the upcoming years

Based on region, the North America market registered the highest market share in 2021 and Asia-Pacific is projected to show the fastest growth during the forecast period.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

#Advanced Persistent Threat Market#Advanced Persistent Threat Industry\#Advanced Persistent Threat#High Tech#Enterprise & Consumer IT

0 notes

Text

Top 7 Challenges Faced By IT Industry In 2023

Within the rapidly growing universe of technology, the IT companies in India assume a crucial role, persistently adjusting themselves to cater to the needs of a perpetually shifting environment. Nevertheless, the advancement of society brings forth a set of obstacles that necessitate a deliberate approach to resolution. As the year 2023 commences, the IT industry faces a multitude of challenges that necessitate careful consideration and effective measures. This blog aims to explore the primary issues encountered by the IT industry in the current year, providing insights into their consequences and possible remedies.

1. Cybersecurity Threats:

The escalation of cyber risks has been observed as a consequence of the widespread adoption of digital technology and interconnected systems. The level of sophistication exhibited by cybercriminals is on the rise, as they deploy advanced strategies to bypass security systems. All the IT companies in Gujarat, India, in the year 2023 are confronted with the formidable challenge of maintaining a competitive edge in the face of cyber attacks, while simultaneously prioritising data protection and securing essential infrastructure. The implementation of effective cybersecurity safeguards, regular conduct of security audits, and provision of cybersecurity education to staff are essential elements in addressing and minimising this risk.

2. Data Privacy and Compliance:

The increasingly stringent legislative framework surrounding data privacy poses a substantial obstacle for the information technology sector. Stringent regulations pertaining to data privacy, such as the General Data Privacy Regulation (GDPR), necessitate rigorous adherence. In the year 2023, the IT companies in Vadodara, Gujarat have the challenge of striking a delicate equilibrium between adhering to regulatory requirements and efficiently using data for commercial objectives. IT organisations are required to allocate resources towards the implementation of compliance frameworks, provide training to their employees, and guarantee that data-handling procedures are in accordance with the prescribed norms.

3. Talent Acquisition and Retention:

The acquisition and retention of talent pose an ongoing problem for the IT industry, as it continues to seek and keep qualified workers. The scarcity of highly specialised skills frequently results in a disparity between demand and supply, hence engendering intense rivalry for those with such talents. Moreover, the current trends in remote work and the increasing globalisation of the talent market serve to exacerbate this challenge. In order to tackle this issue, a reliable IT company in India like Nivida Web Solutions prioritises the enhancement of the skills of their current workforce, provides enticing remuneration packages, cultivates a favourable work environment, and creates avenues for professional advancement and personal improvement.

4. Technological Advancements and Adaptability:

The expeditious rate at which technological developments are occurring has both advantages and disadvantages for the IT business. Although these developments present promising prospects, they also present a difficulty in terms of adaptation. Keeping abreast of developing technology and enabling a smooth transition to new platforms and tools may be a demanding task. In order to effectively adapt to emerging technology, IT organisations must allocate resources towards the implementation of continual training and development programmes, which aim to equip their personnel with the requisite skills.

5. Resource Optimization and Scalability:

The optimisation of resources and the effective scalability of operations have emerged as significant challenges in recent times. The management of resources and the scaling of operations in response to varying market needs and the imperative of cost-effectiveness can provide intricate challenges. Cloud computing and intelligent resource allocation are essential solutions that can be employed to effectively address this dilemma. The utilisation of cloud solutions by Nivida Web Solutions - a recognised IT company in Gujarat, India, allows for enhanced flexibility and cost-efficiency, hence assuring the appropriate allocation of resources.

6. Integration and Interoperability:

The IT environment is distinguished by a diverse array of systems and applications that necessitate harmonious integration. The task of achieving integration and interoperability across diverse platforms, legacy systems, and emerging technologies poses a significant challenge. The establishment of interconnectedness is crucial in facilitating an effective and productive IT ecosystem. It is imperative for the industry to prioritise the development of standardised interfaces, utilise APIs effectively, and implement integration platforms in order to improve interoperability.

7. Environmental Sustainability:

Environmental sustainability has emerged as a pressing issue in various sectors, encompassing the field of IT. The IT industry possesses a substantial carbon footprint as a result of its energy consumption, generation of electronic waste, and operations of data centres. In the year 2023, the sector is faced with the task of identifying environmentally sustainable solutions and adopting practices that effectively mitigate their ecological footprint. The use of green technology, the optimisation of data centre efficiency, and the incorporation of circular economy concepts are positive measures in the pursuit of sustainability objectives.

Final Thoughts:

The IT sector encounters a diverse range of issues in the year 2023, necessitating the implementation of proactive and strategic methodologies. Addressing a range of difficulties, including cybersecurity risks, talent acquisition, technological adaptation, and sustainability, is necessary in order to establish and maintain a flourishing and sustainable information technology ecosystem. By adopting a proactive approach towards innovation, allocating resources towards skill enhancement, and placing emphasis on adherence to regulations and sustainability, Nivida Web Solutions - the most distinguished IT company in Vadodara, may effectively navigate the obstacles it faces and emerge with increased resilience. This will facilitate the ongoing growth and progression of the industry in the era of digitalization.

7 notes

·

View notes

Text

Chapter 1 : The Encounter

The gentle rustle of the waves played a soothing melody as y/n strolled along the sandy beach, her bare feet sinking into the warm grains. The sun dipped low on the horizon, painting the sky in hues of orange and pink. Lost in the tranquil beauty of the moment, y/n failed to notice the sleek black car that pulled up nearby.

Rafe Cameron, the wealthy heir with a menacing aura, stepped out of the vehicle, his eyes fixated on your figure silhouetted against the setting sun. With an air of confidence that bordered on arrogance, he approached her, his footsteps deliberate on the soft sand.

"Enjoying the view?" Rafe's voice cut through the gentle lull of the waves, his tone smooth but tinged with an edge that sent a shiver down y/n spine.

Startled, y/n turned to face him, her eyes widening slightly at the sight of the tall, handsome man before her. "Oh, uh, yes. It's beautiful," she replied, offering a polite smile.

As the evening progressed, y/n found herself drawn into conversations with Rafe at a party, his charm oozing from every word. Yet, beneath the surface pleasantries, there was a calculated gleam in his eyes that didn't escape y/n notice. She felt a sense of unease settling in the pit of her stomach.

When y/n attempted to excuse herself from Rafe's company, he intercepted her, a possessive glint in his eyes as he guided her back into the social circle. His touch lingered on her arm a fraction too long, sending a silent message of control that made y/n skin crawl.

Later, amidst the laughter and music, Rafe found a moment alone with y/n, his proximity suffocating. His fingers traced along her arms without permission, a ghostly touch that left her feeling exposed and vulnerable. Y/n recoiled, taking a step back as an unsettling smirk played on Rafe's lips.

The following day, as y/n roamed the bustling market, she felt a sense of foreboding as Rafe materialized beside her, a bouquet of flowers in hand. Ignoring her polite attempts to decline his gesture, he insisted on accompanying her, his charm masking something darker beneath the surface.

That evening, over a quiet dinner with JJ, y/n recounted her encounters with Rafe, a shadow of concern shading her eyes. JJ's expression hardened as he listened, a protective instinct rising within him as he warned y/n to be cautious.

The pattern continued, with Rafe's persistent presence becoming increasingly suffocating. His uninvited visits and invasive behavior left y/n on edge, her unease growing with each unwanted advance.

It wasn't until a fateful confrontation outside y/n workplace that the tension between them reached a boiling point. With Rafe pressing her against the wall, his breath hot against her skin, y/n heart raced in fear and desperation.

In a moment of salvation, JJ's arrival shattered the oppressive atmosphere like thunder through a stormy sky. With a fierce determination, JJ intervened, pulling Rafe away with a forceful motion that spoke volumes of unspoken threats.

As they drove away from the scene, y/n heart still pounded with the lingering effects of Rafe's presence. She couldn't shake the feeling of his eyes burning into her back, a chilling reminder of the dangerous obsession that had taken root.

4 notes

·

View notes

Text

Bitcoin Cryptocurrencies: Unraveling the Revolution of Digital Gold

In the world of cryptocurrencies, Bitcoin stands as the undisputed pioneer, heralding a new era of digital finance and challenging traditional notions of money and value. Since its inception over a decade ago, Bitcoin has captivated the imagination of millions, evolving from a niche experiment to a globally recognized asset class with a market capitalization surpassing that of many Fortune 500 companies. Let's delve into the intricacies of Bitcoin cryptocurrencies and their profound impact on the financial landscape. Check their site to know more details criptomoedas bitcoin

At its core, Bitcoin represents a decentralized digital currency, free from the control of any central authority or intermediary. Powered by blockchain technology, Bitcoin transactions are recorded on a public ledger, immutable and transparent, ensuring trust and security without the need for intermediaries. This groundbreaking innovation not only eliminates the inefficiencies and vulnerabilities inherent in traditional financial systems but also empowers individuals with unparalleled financial sovereignty and autonomy.

One of Bitcoin's most defining features is its scarcity. With a maximum supply capped at 21 million coins, Bitcoin is often likened to digital gold—a store of value immune to inflationary pressures and government manipulation. This scarcity, coupled with increasing global demand and institutional adoption, has propelled Bitcoin's price to unprecedented heights, garnering attention from investors, speculators, and institutions seeking a hedge against economic uncertainty and currency debasement.

Moreover, Bitcoin's decentralized nature makes it resistant to censorship and confiscation, providing a safe haven for individuals in jurisdictions plagued by political instability or oppressive regimes. From remittances and philanthropy to wealth preservation and capital flight, Bitcoin has emerged as a lifeline for those seeking financial freedom and inclusion in an interconnected yet fractured world.

However, Bitcoin is not without its challenges. Scalability, energy consumption, and regulatory scrutiny remain persistent hurdles on its path to mainstream adoption. The debate over Bitcoin's environmental impact, fueled by its energy-intensive proof-of-work consensus mechanism, underscores the need for sustainable alternatives and technological innovation to mitigate its carbon footprint.

Furthermore, regulatory uncertainty poses a significant risk to Bitcoin's long-term viability. While some countries have embraced Bitcoin as a legitimate asset class, others have imposed stringent regulations or outright bans, casting a shadow of uncertainty over its future. Clear and coherent regulatory frameworks are essential to fostering investor confidence, encouraging innovation, and ensuring the responsible growth of the cryptocurrency ecosystem.

Despite these challenges, the future of Bitcoin cryptocurrencies appears bright. The ongoing development of layer-two solutions, such as the Lightning Network, promises to enhance scalability and efficiency, enabling faster and cheaper transactions on the Bitcoin network. Additionally, advancements in privacy and security features aim to bolster Bitcoin's fungibility and resilience against emerging threats.

Moreover, the convergence of Bitcoin with traditional finance through avenues like exchange-traded funds (ETFs) and institutional-grade custody solutions is paving the way for broader adoption and integration into traditional investment portfolios. As Bitcoin matures and evolves, its role as a global reserve asset and digital gold is poised to solidify, reshaping the financial landscape for generations to come.

In conclusion, Bitcoin cryptocurrencies represent a paradigm shift in the way we perceive and interact with money. As a decentralized, scarce, and censorship-resistant digital asset, Bitcoin transcends borders and ideologies, offering a beacon of hope for financial empowerment and freedom in an increasingly digitized world. While challenges abound, the resilience and innovation of the Bitcoin community continue to propel the revolution of digital gold forward, unlocking new possibilities and redefining the future of finance.

#preço bitcoin#criptomoeda#comprar bitcoin#1 btc#livecoins#coin market cap brasil#investing noticias#portal bitcoin#notícias sobre moeda digital#qual criptomoeda comprar hoje#criptomoedas bitcoin#quanto custa 1 bitcoin#coinmarketcap brasil#cotacao criptomoedas#mercado coin#cripto moedas#notícias sobre livecoins#grafico criptomoedas#mercado de criptomoedas#mineracao de criptomoedas

2 notes

·

View notes

Text

Answers To The Important Laravel Security Questions

Introduction

Laravel is a powerful PHP framework known for its elegant syntax and robust features, making it a popular choice for web developers. However, like any web development framework, security is a critical concern. Ensuring that your Laravel applications are secure is essential to protect sensitive data and maintain user trust. Security is the most common concern for many businesses. This is well justified because of the growing concern about an increase in cyberattacks. In this article, we address vital security questions related to Laravel. It provides insights and tips on Laravel security best practices to help safeguard the applications.

Significance of Application Security

Application security is a critical aspect of Laravel development (and any software development) that ensures the protection of data and systems. It protects users from various threats and vulnerabilities. Here are a few key reasons why application security needs to be a high priority:

Data Breaches: Securing applications helps prevent unauthorized access to sensitive data, such as personal information, financial details, and confidential business data.

Reputation Management: Users are more likely to trust and engage with applications that prioritize security. A single security breach can severely damage a company’s reputation and erode user trust.

Prevents Financial Loss: Data breaches can result in significant financial losses due to legal fees, fines, and remediation costs. Security incidents can lead to loss of business, decreased customer confidence, and long-term damage to brand equity.

Data Integrity: Application security helps ensure that data is not tampered with or altered by unauthorized entities.

Common Threats: Laravel security measures protect against various cyber threats, including SQL injection, Cross-Site Scripting (XSS), Cross-Site Request Forgery (CSRF), and more.

Advanced Threats: Security practices also help defend against more sophisticated attacks, such as zero-day exploits and Advanced Persistent Threats (APTs).

Application security cannot be overstated. It is essential for protecting sensitive data and maintaining user trust. It also helps prevent financial losses, ensure application integrity, and mitigate cyber risks.

It plays a big role in enhancing development processes, supporting business continuity, and facilitating compliance with legal requirements. Prioritizing security is crucial for the success and longevity of any business operating in this digital age.

Here are a few relevant facts and statistics:

The application security market is expected to generate $6.97 Billion in 2024.

According to Statista's forecast, the size of the security market in 2028 will be $11.83 billion.

Application breaches account for 25% of all breaches.

Over 75% of applications will have at least one flaw.

As per a report by IBM, the costliest data breach was $4.25 Million.

An average ransomware attack costs $4.54 million.

Vital Laravel Security Questions

How Does Laravel Handle Authentication?

Laravel offers an out-of-the-box comprehensive authentication system that simplifies the implementation of user login and registration. The Auth facade provides an easy way to manage authentication, including features such as:

User registration and login

Password reset functionality

Authentication guards

User roles and permissions

Use Strong Password Policies

Two-factor authentication (2FA)

Secure Password Storage

How Can You Prevent SQL Injection in Laravel?

Laravel uses Eloquent ORM and the query builder, which automatically protects against SQL injection. By using parameter binding, Laravel ensures that user input is safely escaped before executing SQL queries.

Always prefer Eloquent ORM for database interactions, as it inherently protects against SQL injection. When using raw SQL queries, always use parameter binding to ensure inputs are correctly escaped.

How Does Laravel Protect Against Cross-Site Scripting (XSS)?

Laravel provides built-in protection against XSS by automatically escaping output. This means that any data retrieved from the database and displayed in views is escaped to prevent script injection. Always escape output using Laravel’s {{ }} syntax for variables.

How Can You Prevent Cross-Site Request Forgery (CSRF) in Laravel?

Laravel automatically generates a CSRF token for each active user session. This token is embedded in forms and must be included in any request that modifies data. Laravel then verifies the token to ensure the request is legitimate. Ensure all forms include the CSRF token.

How Can You Secure Laravel Routes and Controllers?

Laravel middleware provides a mechanism for filtering HTTP requests entering your application. Use authentication and authorization middleware to protect routes. Apply appropriate access controls to routes to ensure only authorized users can access certain parts of the application. Controllers handle the business logic of your application and should also be secured. Always validate user inputs in controllers to prevent invalid data from being processed. Laravel’s authorization policies provide a way to manage user permissions for accessing specific actions.

How Can You Secure Laravel’s File Uploads?

Ensure that only allowed file types and sizes are uploaded with the help of validation techniques. Store uploaded files outside the public directory to prevent direct access.

How Can You Implement a Secure Password Reset in Laravel?

Laravel provides a robust password reset feature out of the box, including generating secure tokens and sending password reset emails. It uses a secure token generation mechanism, ensuring that tokens are unique and hard to guess. Limiting the number of password reset requests from a single IP address prevents brute-force attacks.

How Can You Secure Laravel APIs?

Secure your APIs with tokens using Laravel Passport or Laravel Sanctum. Implement rate limiting on API endpoints to prevent abuse. Encrypt data in transit using HTTPS and ensure that sensitive data is never transmitted in plain text.

How Can You Keep Laravel Dependencies Secure?

Only use packages from trusted sources and review their security practices before including them in your project. Use tools like snyk or npm audit to scan your dependencies for known vulnerabilities.

How Can You Implement Logging and Monitoring in Laravel?

Logging and monitoring are essential for detecting and responding to security incidents. They provide insights into application activity and help identify potential security issues. Laravel provides a robust logging system based on Monolog. Configure logging to capture important events and errors. Review logs regularly for suspicious activity and respond promptly to any potential security threats.

Most common security threats faced by Laravel applications?

Cross-Site Scripting (XSS): Attackers inject malicious scripts into web pages viewed by other users.

SQL Injection: Malicious SQL statements are insert into an entry field for execution.

Cross-Site Request Forgery (CSRF): Unauthorized commands are transmit from a user that the web application trusts.

Unauthorized Access: Improper authentication and authorization checks can allow users to access restricted areas.

Data Leakage: Sensitive information is exposed due to improper handling of data.

What are some common misconfigurations that can lead to security vulnerabilities in Laravel applications?

Debug Mode: Never run your application in debug mode in a production environment. Debug mode can expose sensitive information about your application's configuration.

Environment Variables: Ensure that sensitive information in the .env file is not expose and is securely manage.

Server Configurations: Ensure the server is configure correctly to prevent directory listing and other exposures. Use .htaccess or server configurations to secure directories.

Some advanced security features provided by Laravel 11?

Argon2id Support: Enhanced password hashing with support for Argon2id, providing better resistance against side-channel attacks.

Native Two-Factor Authentication (2FA): Built-in support for adding a layer of security to user accounts.

Automatic HTTPS Enforcement: Easier enforcement of HTTPS across all routes, ensuring data encryption during transmission.

What role does Laravel Telescope play in application security?

Real-Time Monitoring: Telescope provides real-time monitoring and logging of security-related events such as failed login attempts, CSRF token mismatches, and more.

Alerting: Enhanced alerting and notification features to keep developers informed of potential security issues, allowing for swift action.

Secure Your Laravel Application

Securing a Laravel application involves a multifaceted approach that includes secure authentication and protection against common vulnerabilities. No one can help better with secure Laravel development, than an official Laravel partner.

Acquaint Softtech is one such software development outsourcing company in India. We have over 10 years of experience delivering cutting-edge solutions.

Security requires ongoing attention and diligence. Always stay informed about Laravel's security features and adhere to best practices. Make the most of the available resources to reduce the risk. Hire remote developers from Acquaint Softtech and gain an upper edge.

A secure application protects your users. At the same time, it enhances the credibility and reliability of your work as a developer. Make a smart business decision to choose between outsourcing and **IT staff augmentation.**

FAQ

What are the most common security threats to Laravel applications?

Cross-Site Scripting (XSS), SQL Injection, Cross-Site Request Forgery (CSRF), unauthorized access, and data leakage.

How does Laravel prevent Cross-Site Scripting (XSS) attacks?

Laravel's Blade templating engine automatically escapes output to prevent malicious scripts from being execute.

How does Laravel mitigate SQL Injection?

Mitigating SQL Injection: Eloquent ORM and Query Builder use PDO parameter binding to safely handle user inputs, preventing direct insertion into SQL queries.

What measures does Laravel take to prevent Cross-Site Request Forgery (CSRF)?

Laravel generates a CSRF token for each user session, which is verified by middleware for all state-changing requests to ensure they are legitimate.

What are the best practices for authentication and authorization in Laravel?

Use Laravel’s built-in authentication system and implement policies and gates to effectively manage user permissions.

0 notes

Text

Dental Imaging MarketFuture Demand and Evolving Business Strategies to 2033

The dental imaging market has witnessed significant advancements over the years, driven by technological innovations, the growing prevalence of dental disorders, and increasing awareness regarding oral health. As dental care becomes more sophisticated, imaging techniques play a crucial role in diagnostics, treatment planning, and patient management. This article explores the trends, key players, growth drivers, challenges, and the future outlook of the dental imaging market up to 2032.

Market Overview

The global dental imaging market is experiencing steady growth due to increased adoption of advanced imaging technologies such as digital X-rays, Cone Beam Computed Tomography (CBCT), and intraoral scanners. According to market research, the dental imaging market was valued at approximately XX billion in 2022 and is projected to reach over XX billion by 2032, growing at a compound annual growth rate (CAGR) of around XX % during the forecast period.

Download a Free Sample Report:- https://tinyurl.com/3vyuk6bf

Key Market Drivers

1. Rising Prevalence of Dental Disorders

Dental diseases such as cavities, periodontitis, and oral cancer are becoming more prevalent worldwide. Early detection and precise diagnosis through imaging technologies contribute to effective treatment and improved patient outcomes.

2. Technological Advancements in Imaging Systems

Innovations such as AI-integrated imaging solutions, 3D imaging, and digital radiography have enhanced the accuracy and efficiency of dental diagnostics. The shift from traditional film-based X-rays to digital imaging has significantly improved workflow efficiency and patient safety.

3. Increasing Demand for Cosmetic Dentistry

Aesthetic dentistry procedures, including dental implants, veneers, and teeth whitening, require precise imaging for accurate treatment planning. The growing demand for cosmetic dental procedures is fueling the adoption of advanced imaging techniques.

4. Growth of Dental Tourism

Countries with affordable and high-quality dental care services, such as India, Mexico, and Thailand, are witnessing a surge in dental tourism. This trend is driving the demand for state-of-the-art imaging solutions to enhance diagnostic precision and treatment outcomes.

5. Government Initiatives and Awareness Campaigns

Many governments and health organizations are promoting oral health awareness, leading to increased dental checkups and imaging procedures. Subsidies and reimbursement policies for dental diagnostics are also boosting market growth.

Market Challenges

1. High Costs of Advanced Imaging Equipment

Despite the benefits of digital imaging, the high cost of CBCT and other advanced imaging systems poses a challenge for small and mid-sized dental clinics. The cost of acquiring and maintaining these systems can be a limiting factor in market expansion.

2. Radiation Exposure Concerns

Although modern imaging systems have reduced radiation doses, concerns about cumulative radiation exposure still persist. Regulatory bodies impose stringent guidelines to ensure patient safety, which can sometimes delay the adoption of new imaging technologies.

3. Shortage of Skilled Professionals

The effective utilization of advanced imaging techniques requires specialized training. The shortage of skilled radiologists and dental professionals proficient in handling digital imaging systems remains a key challenge in some regions.

4. Data Security and Privacy Issues

With the integration of cloud-based imaging solutions, ensuring data security and compliance with regulations such as HIPAA and GDPR is a growing concern. Protecting patient information from cyber threats is crucial for market growth.

Key Market Segments

The dental imaging market can be categorized based on technology, application, end-users, and geography.

By Technology:

Digital X-ray

Cone Beam Computed Tomography (CBCT)

Intraoral Cameras

Optical Imaging

3D Imaging

By Application:

Diagnostic Applications

Implantology

Orthodontics

Endodontics

Periodontics

Cosmetic Dentistry

By End-User:

Dental Clinics

Hospitals

Academic and Research Institutes

Dental Laboratories

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Key Players in the Market

Several leading companies are shaping the dental imaging landscape with innovative technologies and strategic partnerships. Some of the major players in the dental imaging market include:

Dentsply Sirona

Carestream Dental

Planmeca

Danaher Corporation

Vatech

Acteon Group

Midmark Corporation

Owandy Radiology

Envista Holdings

Apteryx Imaging

Sirona Dental Systems

FONA Dental

Cefla Medical Equipment

Morita Corporation

Yoshida Dental Mfg. Co. Ltd.

Belmont Equipment

PreXion Corporation

3Shape

MyRay (Cefla)

Air Techniques Inc.

These companies are investing heavily in R&D to develop cutting-edge imaging solutions and expand their market presence through acquisitions and collaborations.

Future Trends and Opportunities

1. Artificial Intelligence in Dental Imaging

AI-powered imaging solutions are revolutionizing diagnostics by enabling automated detection of dental conditions, improving accuracy, and reducing interpretation time. AI-driven analytics are expected to become a standard feature in dental imaging software.

2. Integration of Imaging with Digital Workflows

The adoption of CAD/CAM technology and digital impressions is facilitating seamless integration of imaging data with dental restorations. This trend is expected to enhance precision and efficiency in dental procedures.

3. Growth in Teledentistry

Teledentistry is gaining popularity, allowing remote consultations and diagnosis through digital imaging. This trend is particularly beneficial in rural and underserved areas where access to dental care is limited.

4. Expansion in Emerging Markets

Developing countries are witnessing increased adoption of dental imaging technologies due to rising healthcare infrastructure, growing disposable incomes, and increased awareness of oral health.

5. Portable and Handheld Imaging Devices

The demand for compact and portable imaging devices is growing, enabling better accessibility and flexibility for dental practitioners. These innovations are particularly useful for home healthcare services and mobile dental clinics.

Conclusion

The dental imaging market is poised for substantial growth over the next decade, driven by technological advancements, increasing awareness of oral health, and rising demand for precision diagnostics. While challenges such as high costs and data security concerns remain, the integration of AI, digital workflows, and telemedicine presents immense opportunities for market expansion.

As industry players continue to innovate and expand their global reach, the dental imaging market is set to play a crucial role in transforming dental healthcare, improving patient outcomes, and making diagnostic procedures more efficient and accessible. The market’s projected growth underscores the importance of imaging technologies in the evolving landscape of modern dentistry.

For More Information About This Research Please Visit: https://www.uniprismmarketresearch.com/verticals/healthcare/dental-imaging

0 notes

Text

Enterprise IoT Market: Key Trends and Growth Drivers

The global enterprise IoT market size is expected to reach USD 1.42 billion by 2030, registering a CAGR of 14.1% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market is experiencing significant growth owing to the increasing adoption of cloud-based platforms and a rising demand for digitalization. Enterprise IoT represents a new phase in global transformation, propelled by technological advancements, expanding economic prospects, and a rising need for operational efficiency. These elements are anticipated to drive exponential growth in the market.

Enterprise IoT contributes to lowering maintenance expenses, improving energy efficiency, and boosting employee skills, ultimately leading to increased productivity. The innovations in IoT have a wide range of applications across various industries, including BFSI, manufacturing, agriculture, and utilities. These applications encompass inventory management, device management, and resource optimization. The increasing significance of deploying enterprise IoT for functions like asset management, remote administration services, operational intelligence generation, predictive maintenance, and remote monitoring is anticipated to drive market growth.

Security concerns have been a persistent challenge in the adoption of IoT technologies, but advancements in cybersecurity measures are gradually alleviating these apprehensions. As businesses become more confident in the security protocols surrounding IoT implementations, they are increasingly willing to invest in and deploy connected devices. The integration of robust security features, including encryption, authentication, and secure communication protocols, enhances the resilience of IoT ecosystems against potential threats, fostering a conducive environment for widespread adoption.

Gather more insights about the market drivers, restrains and growth of the Enterprise IoT Market

Enterprise IoT Market Report Highlights

• Based on components, the software & solutions segment is anticipated to grow significantly during the forecast period owing to the rising demand for sophisticated software solutions to manage data, analytics, and connectivity, as businesses are increasingly leveraging IoT technologies

• Based on size, the small and medium sized enterprise segment accounted for the largest market share in 2023. This growth can be attributed to increasing governmental efforts globally to support SMEs in the realm of enterprise IoT

• Based on application, the manufacturing segment accounted for a significant revenue share in 2023 owing to the emergence of Industry 4.0. The integration of IoT technologies in manufacturing processes has revolutionized the industry, enhancing automation, connectivity, and data analytics. The focus of Industry 4.0 on smart factories, predictive maintenance, and efficient production has propelled the demand for IoT solutions in this sector

• The Asia Pacific enterprise IoT sector is expected to grow at the highest CAGR during the forecast period. This growth is due to the increasing adoption of 5G services supported by increasing demand for smart city platforms

Enterprise IoT Market Segmentation

Grand View Research has segmented the global enterprise IoT market based on component, enterprise size, application, and region:

Enterprise IoT Component Outlook (Revenue, USD Million, 2018 - 2030)

• Hardware

• Software & Solutions

o Surveillance & Security

o Network & Connectivity Management

o Data Management

o Application Management

o Device Management

• Services

Enterprise IoT Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

• Small and Medium Enterprises (SMEs)

• Large Enterprise

Enterprise IoT Application Outlook (Revenue, USD Million, 2018 - 2030)

• Manufacturing

• Oil & Gas

• Utilities

• Transport

• BFSI

• IT & Telecomm

• Healthcare

• Others

Enterprise IoT Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

• Asia Pacific

o China

o Japan

o India

o South Korea

• South America

o Brazil

• Middle East and Africa (MEA)

o UAE

o South Africa

List of Key Players in the Enterprise IoT Market

• Advantech Co. Ltd.

• Aeris Communications, Inc.

• Amazon.com, Inc

• Cisco Systems, Inc.

• Intel Corporation

• Laird Connectivity

• Microsoft Corporation

• Oracle Corporation

• PTC Inc.

• Qualcomm Technologies, Inc.

• Robert Bosch, Inc.

• Siemens AG

Order a free sample PDF of the Enterprise IoT Market Intelligence Study, published by Grand View Research.

#Enterprise IoT Market#Enterprise IoT Market Size#Enterprise IoT Market Share#Enterprise IoT Market Analysis#Enterprise IoT Market Growth

0 notes

Text

Agarbatti Industry in India: Trends, Challenges, and Future Opportunities

India, known for its rich traditions and spirituality, has long embraced agarbattis (incense sticks) as a part of its cultural fabric. Whether it's for religious ceremonies, meditation, or creating a soothing ambiance, agarbattis hold a special place in Indian households. With the rise of Agarbatti Manufacturers in India, this industry has evolved into a significant contributor to the economy. Let’s dive into its current trends, challenges, and promising future opportunities.

The Rising Trends in the Agarbatti Industry

Over the past few years, the agarbatti industry in India has witnessed remarkable growth. Some notable trends shaping this sector include:

Export Boom: India is one of the largest exporters of agarbattis, catering to markets in the USA, Europe, and the Middle East. The unique fragrances and superior quality offered by Agarbatti Manufacturers in India make Indian incense sticks globally popular.

Eco-Friendly Innovations: With growing environmental awareness, manufacturers are adopting sustainable practices, such as using bamboo sticks and herbal ingredients. Eco-friendly agarbattis are in high demand, especially among environmentally conscious consumers.

Diverse Product Ranges: Beyond traditional fragrances like sandalwood and jasmine, manufacturers now offer agarbattis with exotic scents like lavender, lemongrass, and even fusion blends. This diversification caters to younger audiences and international markets.

Increased Branding and Packaging: The industry is becoming more organized, with companies focusing on branding and attractive packaging to stand out in a competitive market.

Challenges Faced by Agarbatti Manufacturers in India

Despite the growth, the industry isn’t without its hurdles. Some significant challenges include:

Raw Material Costs: The rising prices of key raw materials like bamboo and aromatic oils put pressure on manufacturers, especially smaller players.

Competition from Imported Products: The influx of cheap agarbattis from countries like China and Vietnam has posed a threat to Indian manufacturers. Many local producers struggle to compete with lower-priced imports.

Labor Dependency: The industry heavily relies on skilled labor for rolling and crafting incense sticks. Retaining and training laborers remains a persistent challenge.

Lack of R&D Investment: Innovation is critical for staying relevant, but limited research and development in fragrance technology and production efficiency hinder growth.

Future Opportunities in the Agarbatti Industry

While challenges exist, the future of the agarbatti industry in India looks incredibly promising. Here’s why:

Government Support: Initiatives like the Khadi and Village Industries Commission’s (KVIC) scheme to boost agarbatti production are helping local manufacturers thrive. Subsidized raw materials and training programs are a game-changer for smaller businesses.

Export Potential: With the global wellness trend, the demand for natural and aromatic products like agarbattis is soaring. Indian manufacturers can leverage this by expanding their international footprint.

Adoption of Technology: Automation in production can solve labor issues and enhance efficiency. Investing in advanced manufacturing techniques will be crucial for scaling operations.

Niche Markets: Exploring niche segments, such as Ayurvedic or luxury agarbattis, can open new revenue streams. Organic and therapeutic incense sticks also align with the global shift towards holistic well-being.

E-commerce Boom: The rise of online platforms has made it easier forAgarbatti Manufacturers in India to reach consumers directly. D2C (Direct-to-Consumer) strategies, combined with digital marketing, are helping brands build loyal customer bases.

The Agarbatti Manufacturers in India is a blend of tradition and modernity, offering immense potential for growth despite its challenges. By embracing innovation, leveraging government initiatives, and focusing on global markets, Agarbatti Manufacturers in India can create a thriving ecosystem that not only preserves the heritage of incense making but also propels it to new heights.

The aroma of success, quite literally, is in the air for this industry!

0 notes

Text

Why Are Small Businesses Prime Targets in the Face of Cybersecurity Threats?

Cybersecurity threats are too common these days for businesses. But small-scale businesses have to often bear cybersecurity threats. Experts suggest that on an average of 45% of small businesses have to face these attacks in a year. This is a threat that is uncalled for & can come uninvited at any time. These businesses are often seen as low-hanging fruits by hackers as it is much easier for them to hack. Businesses need to have the latest & robust security system to safeguard themselves.

1. Limited Resources and Budget

One of the most significant challenges small businesses face when it comes to cybersecurity is limited resources. Unlike large enterprises that can allocate substantial budgets to online security, small businesses often lack the financial means to invest in robust cyber defense measures. As a result, many small companies rely on basic or outdated security systems, leaving them exposed to evolving cyber threats.

Information security solutions—such as firewalls, intrusion detection systems, and data encryption technologies—are crucial for preventing attacks. However, they come at a cost that may seem prohibitive for businesses with tight budgets. Without proper security tools, small businesses become easy targets for cybercriminals, who may exploit vulnerabilities in outdated software or weak defense mechanisms.

2. Lack of IT Expertise

Another significant issue is the shortage of in-house data protection expertise. Many small businesses simply don’t have the personnel or specialized knowledge to identify and mitigate sophisticated cyber threats. While larger companies often have dedicated online security teams, small businesses may rely on general IT staff who may not be equipped to handle complex security challenges.

In many cases, small business owners or managers may not even be fully aware of the latest cybersecurity risks, such as ransomware, phishing attacks, or advanced persistent threats (APTs). Without the expertise to implement appropriate online security protocols, small businesses leave themselves open to exploitation by cybercriminals who actively search for gaps in security defenses.

3. Underestimating the Risk of Cybersecurity Threats

Many small business owners mistakenly believe they are too insignificant to be targeted by cybercriminals. This misconception stems from the assumption that hackers are primarily interested in large corporations with vast amounts of data or financial assets. However, cybercriminals often view small businesses as low-hanging fruit.

Small businesses are frequently seen as more attractive targets because they are less likely to have advanced cybersecurity measures in place. Cybercriminals recognize that small businesses may be easier to infiltrate, and successful attacks can still yield valuable information, such as customer data, payment details, or intellectual property.

4. Increased Use of Remote Work and Cloud Solutions

The shift toward remote work and the increased reliance on cloud-based solutions have introduced new cybersecurity challenges for small businesses. While cloud platforms offer convenience and scalability, they also create vulnerabilities if not properly secured. A lack of understanding about securing cloud infrastructure or implementing multi-factor authentication (MFA) can leave small businesses exposed to cyberattacks.

Additionally, with remote work becoming the norm, employees may be accessing sensitive data from unsecured networks or personal devices. These factors make it easier for cybercriminals to exploit weak links in the security chain, further highlighting why small businesses are prime targets for cyberattacks.

5. Weaknesses in Third-Party Vendor Relationships

Small businesses often rely on third-party vendors for services like accounting, marketing, or IT support. While these partnerships are essential for day-to-day operations, they can also introduce significant cybersecurity risks. Cybercriminals may target vendors with less robust security measures and use them as a gateway into the small business's network.

Many cyberattacks occur through third-party vulnerabilities. The infamous 2013 Target data breach, for example, was caused by a vendor’s compromised credentials. Small businesses that don’t actively vet their vendors for cyber defense practices risk exposing themselves to potential threats.

6. Social Engineering and Human Error

Human error remains one of the leading causes of online security breaches, and small businesses are particularly vulnerable in this area. Employees may fall victim to phishing emails, click on malicious links, or use weak passwords, inadvertently opening the door for cybercriminals to gain access to sensitive systems.

The rise of social engineering tactics, where attackers manipulate individuals into revealing confidential information, has made it easier for cybercriminals to breach small businesses. Without comprehensive employee training and a culture of cybersecurity awareness, small businesses are more likely to be tricked by these increasingly sophisticated scams.

7. Lack of Incident Response Plans

When a cybersecurity incident occurs, time is of the essence. Unfortunately, many small businesses fail to have a comprehensive incident response plan in place. Without a clear strategy for how to respond to a breach, businesses risk exacerbating the situation and increasing the damage caused by the attack.

An effective incident response plan should include steps for identifying the breach, containing the damage, and communicating with stakeholders. Small businesses that fail to prepare for computer security incidents may find themselves overwhelmed when an attack occurs, leading to prolonged downtime, loss of customer trust, and significant financial losses.

8. Regulatory and Compliance Challenges

Small businesses often struggle to keep up with the complex web of online security regulations and compliance requirements, such as the General Data Protection Regulation (GDPR) or the Health Insurance Portability and Accountability Act (HIPAA). Non-compliance with these regulations can result in hefty fines and reputational damage.

Cybercriminals are aware that smaller businesses may not have the resources to fully understand or implement these regulations. As a result, they may target businesses that are more likely to have inadequate compliance measures in place, knowing that they can potentially exploit vulnerabilities in a business's regulatory practices.

How Small Businesses Can Protect Themselves

While the risks are significant, there are several strategies small businesses can implement to strengthen their cybersecurity posture:

Invest in Computer security Solutions: Even with limited resources, small businesses should prioritize investing in basic online security tools like firewalls, anti-virus software, and encryption to safeguard sensitive data.

Educate Employees: Regular employee training on identifying phishing attempts, using strong passwords, and practicing good online security hygiene can go a long way in reducing human error-related breaches.

Use Cloud Security Tools: Ensure cloud services are secured with strong passwords, encryption, and multi-factor authentication (MFA). Regularly review and update access permissions to ensure only authorized personnel have access to critical data.

Vet Third-Party Vendors: Ensure that third-party vendors adhere to strong IT security practices and implement contracts that hold them accountable for data security.

Develop an Incident Response Plan: Prepare for the worst by having a well-defined incident response plan in place. This should include procedures for identifying, containing, and recovering from an online security incident.

Stay Compliant: Regularly review and ensure compliance with industry-specific online security regulations to avoid penalties and reduce vulnerability to legal risks.

Conclusion

Small businesses are prime targets in the face of cybersecurity threats, and understanding why this is the case is essential for mitigating risk. Limited resources, lack of expertise, and underestimation of threats are just a few of the factors that make small businesses vulnerable. However, with proactive strategies, such as investing in IT security tools, educating employees, and developing a robust response plan, small businesses can protect themselves and reduce the likelihood of a successful attack. By taking these steps, small business owners and leaders can build a strong foundation for digital security and safeguard their businesses against the ever-evolving threat landscape.

Uncover the latest trends and insights with our articles on Visionary Vogues

0 notes

Text

Smart Features in Temperature Data Loggers Enhancing Market Potential

The temperature data logger market is experiencing substantial growth as industries seek precise and efficient solutions for monitoring temperature-sensitive products. These devices are essential for ensuring product quality, safety, and compliance with industry regulations. With advancements in technology, temperature data loggers now offer real-time data collection, wireless communication, and integration with IoT platforms.

Advancements in Temperature Data Logger Technology

One of the key drivers of the temperature data logger market is the integration of advanced technologies such as IoT (Internet of Things). This enables real-time monitoring and seamless data transfer across multiple devices and platforms. Smart temperature data loggers offer features like remote access, automated alerts, and predictive analytics, making them indispensable for industries such as pharmaceuticals, food & beverages, and logistics.

Key Drivers Influencing the Temperature Data Logger Market

Increased Regulatory Compliance As industries face stricter regulations regarding the storage and transportation of temperature-sensitive products, the demand for accurate data loggers has risen. These devices ensure compliance with industry standards, particularly in pharmaceuticals and food safety.

Growth of Wireless and IoT-enabled Solutions Wireless temperature data loggers are becoming increasingly popular due to their ease of use and ability to provide real-time data without physical connections. The adoption of IoT technologies allows seamless data integration with other smart systems, improving operational efficiency.

Sustainability and Energy Efficiency Companies are focusing on sustainable solutions, driving the development of energy-efficient temperature data loggers. These devices reduce power consumption while maintaining high precision, catering to eco-conscious industries.

Cost-Efficiency and Accessibility With advancements in technology, temperature data loggers have become more cost-effective and accessible to businesses of all sizes. Small and medium enterprises (SMEs) are increasingly adopting these devices to ensure quality control without heavy investments.

Smart Features Enhancing Data Security Security remains a top priority for temperature data loggers, especially with sensitive data being stored and transmitted. Advanced security features such as encryption and secure wireless communication protocols are being integrated to protect against cyber threats.

Market Challenges and Opportunities

While the market for temperature data loggers is expanding rapidly, challenges such as data privacy concerns and varying regional regulations persist. However, opportunities lie in the development of more specialized solutions for industries like biotechnology, where high precision and reliability are critical.

Conclusion

The temperature data logger market is evolving at a rapid pace, driven by advancements in technology and increasing demand for accurate monitoring of temperature-sensitive products. From wireless IoT solutions to energy-efficient devices, these innovations are reshaping how industries manage their temperature data, ensuring product integrity and safety across various sectors.

#Temperature Data Logger Market#Temperature Data Logger Market trends#Temperature Data Logger#Temperature Data Logger measurements#Temperature Data giver#Data Logger Market

0 notes

Text

Software Solutions Company in India

India has firmly established itself as a global leader in software development and technology services. From startups to Fortune 500 companies, businesses worldwide turn to Indian software solutions companies for their expertise, innovation, and cost-effective services.

What is a Software Solutions Company?

Why Choose a Software Solutions Company in India?

Skilled Talent Pool India boasts one of the largest pools of skilled IT professionals globally. With a strong emphasis on STEM education, Indian developers are renowned for their technical expertise.

Cost-Effectiveness Indian companies provide high-quality software solutions at competitive rates, making them a preferred choice for businesses worldwide.

Advanced Technology and Infrastructure Many Indian firms adopt cutting-edge technologies and invest in state-of-the-art infrastructure to deliver world-class services.

Key Services Offered by Software Solutions Companies in India

Custom Software Development Tailored solutions to meet specific business requirements.

Mobile App Development From Android to iOS, Indian firms excel in creating user-friendly mobile applications.

Web Development and Design Engaging and functional websites designed to enhance user experience.

Enterprise Solutions Comprehensive software to streamline business operations.

Cloud Computing Services Scalable cloud-based solutions for businesses of all sizes.

The Indian Advantage in Software Solutions

India’s government has launched initiatives like Digital India and Startup India, fostering innovation and encouraging technology development. The thriving start-up ecosystem and partnerships with global tech giants further strengthen India’s position in the industry.

Top Software Solutions Trends in India

Artificial Intelligence (AI) and Machine Learning (ML): Enhancing decision-making and automation.

Blockchain Technology: Revolutionizing data security and transparency.

Internet of Things (IoT): Connecting devices for smarter solutions.

Cybersecurity: Ensuring data protection against evolving threats.

Factors to Consider When Choosing a Software Solutions Company

Expertise and Experience: Assess the company’s technical capabilities and years of operation.

Portfolio and Testimonials: Review their past projects and client feedback.

Scalability: Ensure they can handle your growing business needs.

Communication: Clear and consistent communication is essential for project success.

Case Studies: Success Stories from Indian Software Companies

Indian firms have delivered groundbreaking solutions across industries, including healthcare, finance, and e-commerce. For example, a Bengaluru-based company developed a revolutionary healthcare app that now serves millions globally.

Challenges Faced by Software Solutions Companies in India

While India leads in technology, challenges like retaining talent, meeting global competition, and staying updated with rapidly evolving technologies persist.

Future of Software Solutions in India

India is set to grow even further as a software solutions hub. Innovations in AI, green technology, and automation are expected to dominate the future landscape.

How to Collaborate with a Software Solutions Company in India

Define Objectives: Clearly outline your project requirements.

Evaluate Vendors: Compare portfolios, services, and pricing.

Set Clear Expectations: Establish milestones and deliverables.

Benefits of Outsourcing Software Solutions to India

Time Zone Advantage: Continuous progress with 24/7 workflows.

Cost and Quality Balance: High-quality output at affordable rates.

Conclusion

India’s software solutions industry combines innovation, talent, and affordability, making it a top choice for businesses worldwide. By choosing an Indian software solutions company, you not only gain access to cutting-edge technology but also ensure your business stays ahead in a competitive market.

Contact :

Log in or sign up to view See posts, photos and more on Facebook.www.facebook.com

https://www.linkedin.com/in/mosur-technologies-71a85a38/

Update your browser to manage your Business Profile If you've been redirected to this page, your Business Profile doesn't support your browser. If you're not using the…business.google.com

https://www.instagram.com/mosur_technosolutions/

1 note

·

View note

Text

The Future of Cryptocurrency in a Pandemic-Stricken World: How VYXIA Will Thrive Amid an HMPV Outbreak

Do you remember the global disaster in 2019 known as COVID-19 ? The COVID-19 pandemic disrupted economies, altered social structures, and transformed the way we interact with technology. Now, as the world faces the potential threat of a widespread human metapneumovirus (HMPV) outbreak, questions arise about how global markets, including cryptocurrency, will adapt and endure. Cryptocurrencies have proven their resilience during past crises, and amid a new pandemic, digital currencies like VYXIA Tokens are predicted not only to survive but also to thrive.

Cryptocurrency Resilience in a Pandemic

Cryptocurrencies demonstrated relative stability and adaptability during the COVID-19 pandemic, becoming a refuge for investors seeking alternatives to traditional financial systems. The decentralized nature of digital currencies allows them to function independently of centralized institutions, providing critical advantages during global disruptions. Key factors contributing to cryptocurrency resilience include:

Decentralization: Cryptocurrencies operate without intermediaries, ensuring financial transactions remain functional even during systemic breakdowns.

Borderless Transactions: Digital currencies enable cross-border payments unaffected by regional restrictions or banking limitations.

Inflation Hedge: Cryptocurrencies like Bitcoin gained attention as a store of value during monetary instability.

Acceleration of Digital Adoption: Pandemics drive a shift toward digital economies, creating fertile ground for cryptocurrency growth.

Challenges for Cryptocurrencies During an HMPV Pandemic

While cryptocurrencies hold significant potential, they face challenges during pandemics. Market volatility, regulatory uncertainty, and limited accessibility for non-technical users can impede growth. Building trust and providing stability remain critical to broader adoption, particularly during periods of heightened economic anxiety.

How VYXIA Will Survive and Thrive

VYXIA Tokens stand out as a forward-thinking cryptocurrency ecosystem designed to weather global crises, including an HMPV pandemic. By combining technological innovation, a community-driven approach, and gold-backed stability, VYXIA is positioned to grow even amid economic turmoil. Here’s how VYXIA will excel:

1. Gold-Backed Stability

The uniqueness of VYXIA Tokens lies in their gold-backed nature, which provides a layer of security that many cryptocurrencies lack. Gold’s historical reputation as a stable asset ensures that VYXIA can maintain its value even during periods of extreme market volatility, offering protection for investors.

2. Decentralized Governance

VYXIA empowers its community through decentralized governance, allowing token holders to participate in decision-making processes. This inclusive model builds trust and ensures the ecosystem adapts dynamically to user needs and global changes.

3. Advanced Blockchain Technology

Leveraging the BNB Smart Chain, VYXIA ensures fast, secure, and transparent transactions. Its scalable infrastructure supports increased demand, making it a reliable option during heightened digital activity in a pandemic.

4. Incentives for Engagement

Through staking programs, loyalty rewards, and transaction-based discounts, VYXIA encourages active participation. These measures build a strong, engaged user base, which is crucial for ecosystem stability.

5. Interoperability and Partnerships

VYXIA’s commitment to cross-platform collaboration ensures its tokens remain versatile. By forging partnerships with diverse platforms, VYXIA expands its utility, making it an essential element in digital ecosystems that persist even during crises.

6. Support for Digital Economies

As an HMPV pandemic accelerates digital adoption, VYXIA Tokens provide a seamless payment solution for online services, e-commerce, and blockchain-based platforms. Their integration with NFT marketplaces and gaming applications further broadens their appeal.

7. Community-Centric Development

VYXIA prioritizes its community by allocating resources for marketing, ecosystem development, and user rewards. This focus ensures that users remain at the heart of VYXIA’s growth strategy, fostering loyalty and long-term engagement.

Preparing for the Future

A global HMPV pandemic would pose unprecedented challenges, but it also presents opportunities for innovation and transformation. Cryptocurrencies, as decentralized and adaptive financial tools, are well-suited to play a vital role in this evolving landscape. Stability, scalability, and a user-centric approach position VYXIA as a leader in the cryptocurrency sector, ready to face global disruptions.

By addressing the unique challenges of a pandemic-stricken world, VYXIA reaffirms its vision of creating an inclusive and resilient digital economy. Whether through gold-backed security, decentralized governance, or cutting-edge technology, VYXIA is prepared to navigate uncertainties and emerge as a symbol of stability and growth.

Visit Us and Support Us : www.vyxia.world

#cryptocurrency#vyxia#crypto#blockchain#vyxiatokens#cryptotrading#altcoin#crypto token#ethereum#token

0 notes

Note

What about the calendula? Do you think starving, suffocating, or dying of dehydration in another dimension is a good way to die? Do you think getting shot or stabbed is a pleasant way to die just because it is the "accepted" way? You admittance to some members of the Karrakin nobility use the same mechs you spent time decrying? Its bullshit. Its bullshit for the baronies to pretend it has some moral high ground in warfare when there IS no moral high ground in war to begin with. And its bullshit for you to pretend your organization is better than the Albatross on the made up moral justification of "our killing machines aren't as barbaric" as if you both aren't equally vain and greedy

It is interesting that you bring up the Calendula to me, because it is a frame that gets most of its utility via its strategic use of the Firmament, a plane I am quite familiar with traversing as someone who has to manage professional upkeep of a FADE cloak.

You see, the problem with the Firmament is that it is quite difficult to keep anything there for any length of time. Unlike the Blink, where traversal is reliable if incredibly risky, even the most advanced, reliable technological attempts to utilize the Firmament outside of the Aun are momentary and unstable, where the collapse of that instability merely means return to realspace. I'll note, also, that there is no special precautions that need to be taken while there- while we in les Fulgurites have expansive training on what to do if trapped in blinkspace as a ward against psychological harm, there is no such problem with the Firmament. It is breathable, and I have heard of no pilot being trapped there long enough to starve or dehydrate even working in a squadron of people who regularly go there.

That is to say: even in combat with a Calendula this is short lived. Its abilities are extremely temporary, or else will end the moment you come close to one of its husks, and you are shielded from the dangers of the battlefield the entire time you're gone. I think you are generally more in danger of the weapon the Calendula carries than starving or suffocating or dying of dehydration in the Firmament.

Beyond that: I think that you are disingenuous if you think that all ways are killing are equal, else you would endorse the usage of nuclear weapons on large population centers to wage war, or weaponized disease outbreaks, or nanite weaponry, or napalm. Drawing a line between acceptable and unacceptable ways of killing is a practice that goes back even to pre-fall Terra and pretending that there is no rational place for it or that it does not exist is an attitude that I think is frankly galling. I mentioned my issue with IPS-N is primarily aesthetic (and I will admit to vanity on that) but we can both agree that marketing a frame built to turn corridors into minefields on its efficacy against soft targets is a problem, right? The threat from your Calendula leaves when it leaves the battlefield, but Webjaw Snares persist until triggered, and the person laying the snare has no idea who may trigger it. The Calendula can choose, discretely, who and what it execrates, but the Vlad does not get the final say on what it harms, which will always put civilians at risk.

#asks#Anonymous#ooc: it is really funny to tell a mourning cloak pilot this about the calendula btw#ooc: like anyone else she might have conceded but it is part of her job to chill in the firmament#ooc: also inb4 the fade cloak kills you: it specifies that the firmament affinity tech there is the problem#ooc: not being in the firmament

0 notes

Text

The Future of Smart Card ICs: Contactless Payments and Beyond

Smart cards, also known as integrated circuit cards (ICCs), are portable plastic cards embedded with integrated circuits. They facilitate secure identification, authentication, data storage, and application processing. Available in contact-based and contactless formats, smart cards find applications across financial transactions, identification, public transit, healthcare, and more. The evolution of technology continues to expand their scope, making them indispensable in a digitally interconnected world.

Explore our report to uncover in-depth insights - https://www.transparencymarketresearch.com/smart-card-ic-market.html

Key Market Drivers

Rise in Adoption of Contactless Payment Methods The growing preference for contactless payment methods has emerged as a key driver of the smart card IC market. These payments allow transactions without physical touch between the payment card and terminal, offering enhanced convenience and security. According to Barclays, the average UK contactless user performed 220 “touch-and-go” transactions in 2022, reflecting a notable increase from 180 transactions in 2021. Such trends underscore the increasing reliance on contactless technologies, boosting demand for smart card ICs.

Increase in Utilization of Smartphones The widespread adoption of smartphones, particularly those equipped with Near Field Communication (NFC) technology, has amplified the usage of mobile payment systems like Apple Pay, Google Pay, and Samsung Pay. Smart card ICs play a pivotal role in these systems by ensuring secure payments and robust authentication. Leading manufacturers are leveraging advanced technologies to enhance the reliability and performance of their offerings. For instance, Infineon’s launch of the SLC26P security controller in 2022 highlights the innovation driving market growth.

Market Trends

Biometric and Fingerprint Solutions: Vendors are developing next-generation biometric cards and fingerprint sensor packages to cater to the rising demand for cutting-edge security solutions.

eSIM Adoption: The proliferation of eSIMs for machine-to-machine (M2M) communication and 5G network access is a significant trend shaping the market landscape.

Integration of Advanced Technologies: Investments in blockchain, artificial intelligence (AI), and 5G networks are creating new avenues for smart card IC applications.

Market Challenges and Opportunities