#Accident Insurance

Explore tagged Tumblr posts

Text

Polose Financial Group is more than just an insurance provider - it's a company founded on the belief that everyone deserves peace of mind and protection.

2 notes

·

View notes

Text

Rideshare Accident Insurance: How to File a Claim the Right Way

Rideshare services like Uber and Lyft have become essential for Atlanta residents and visitors alike. While these services offer convenience and affordability, they also raise unique challenges when accidents occur, particularly when it comes to insurance coverage. Understanding the nuances of rideshare accident insurance is critical for passengers and drivers alike.

The Basics of Rideshare Insurance

Rideshare companies like Uber and Lyft provide tiered insurance coverage for their drivers, but it varies depending on the driver’s status at the time of the accident:

Offline/Off-Duty: The driver’s personal auto insurance is the only coverage available.

Waiting for a Ride Request: Limited liability coverage is provided, typically up to $50,000 per person for bodily injury, $100,000 per accident, and $25,000 for property damage.

En Route or During a Ride: The most comprehensive coverage applies, including up to $1 million in liability coverage and uninsured/underinsured motorist coverage.

Understanding which tier applies can significantly impact the claims process and the compensation you may receive.

Common Insurance Issues in Rideshare Accidents

Navigating insurance after a rideshare accident can be challenging. Some of the most common issues include:

Confusion Over Coverage: Determining whether the rideshare company’s policy or the driver’s personal insurance applies.

Denial of Liability: Insurance providers may dispute who was at fault, delaying or reducing payouts.

Uninsured or Underinsured Drivers: In cases where the at-fault party lacks sufficient insurance, rideshare company policies may not fully cover your damages.

Policy Gaps: Personal auto insurance policies often exclude coverage for accidents occurring during rideshare activities, leaving some claims unresolved.

Read more: Rideshare Accident Insurance: How to File a Claim the Right Way

#Rideshare Insurance#Accident Insurance#Filing a Claim#Rideshare Claim Process#Rideshare Accidents#Insurance Tips#Rideshare Driver Insurance#Passenger Insurance#Accident Coverage#Insurance Claim Guide#Rideshare Coverage#Uber Insurance#Lyft Insurance#Car Accident Claims#Rideshare Driver Tips#Insurance for Drivers#Accident Claim Help#Claims Process

0 notes

Text

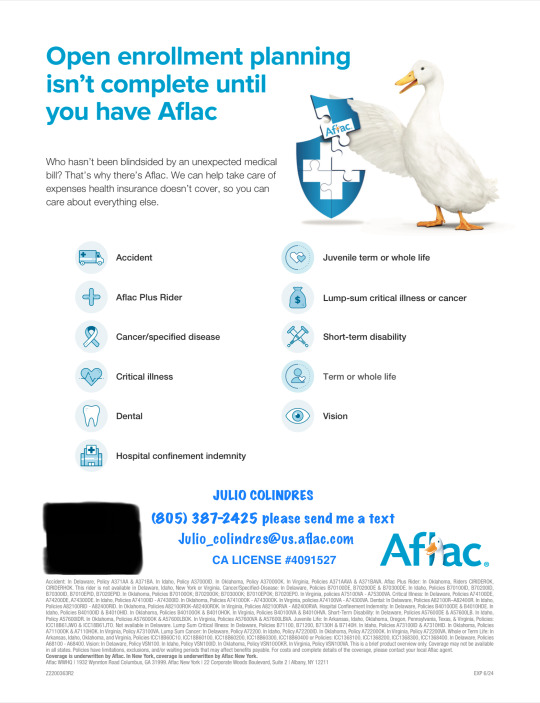

if you are a business owner or someone looking for supplemental benefits for the employees at a great/ reasonable price please contact me. My name is Julio and I will be happy to help you with one or more of our supplemental benefits with AFLAC. Get a free quote give me a call. I work with small business or large. This is at no cost to the owner of the business.

#Insurance#accident insurance#cancer insurance#Protect your money#paycheck protection#emergencies#family#kids protected#employee benefits

1 note

·

View note

Text

need to share an experience i had 30 minutes ago

(edit: thanks to @walks-the-ages for providing and reminding me to put alt text, sorry it slips my mind alot lol)

#my hands are still shaking to be quite honest i could not put a lot of effort into this.#but like. brain. why did you do that#literally i have been like hopelessly obsessed with de nonstop thinking abt it for the past couple of days it is Scaring me#it is terminal its soooo fucking chronic#disco elysium#kim kitsuragi#for anyone who wants to know i bumped into some guys car that was stopped for a school bus. i think my brain errored and thought#my foot was fully pressing down on the brake pedal but it wasnt.#i am like 99.99 percent sure neither of us had any major damage to our cars but we still filed a police report just in case#because insurance do be a bitch. dudes back bumper was scratched lightly and my front license plate has a dent now#also literally my first ever car accident that ive had ever yippee yay

30K notes

·

View notes

Text

Understanding Health and Accident Insurance in Switzerland: A Comprehensive Guide

Introduction

Accident and health insurance in Switzerlandplaya crucial role in protecting individuals from financial liabilities arising fromhealth issues and accidents.This article explains the Swiss healthcare system and the types of coverage and improved plans a policyholder can subscribe to. To illustrate their significance, we will explore examples of health and accident insurance claims in Switzerland, drawing insights from Charles McHugo, the certified Swiss insurance expert for English speakers in Switzerland. You can familiarize yourself with his work at www.charlesinsurances.com.

Swiss healthcare system

The Swiss healthcare system operates under a mandatory public scheme called the LAMal (Loi sur l’AssuranceMaladie), complemented by various improved private supplementary LCA (Loi sur le Contratd’ Assurance) plans. Employees working over eight hours per week for the same employer have their accident coverage shifted from LAMal to a plan whose legal base is the LAA (Loi sur l’ Assurance Accident), outlined in their employment contract and partly funded by the employer. The LAMal and LCA plans are funded privately or by the individual but remain tax deductible. Private LCA plans serve to enhance comfort and fill gaps in coverage left by the LAMal public Swiss health and accident insurance plan.

Health and accident insurance coverage

Swiss residents are mandated to enroll in LAMal health and accident insurance upon their official entry into the country. All LAMal plans require an annual deductible or excess, ranging from CHF 300 to CHF 2,500 for adults and CHF 0 to CHF 600 for children and there is an obligatory LAMal participation of 10% for all medical bills.

The public LAMal plan covers:

Inpatient treatment at the public hospital in the policy holders canton of residence, with no choice of surgeon

Outpatient treatment within the canton of residence

Home care services to prevent hospitalizationMedical visits to a general practitioner

Medical visits to a specialist with a referral voucher

Accident insurance for Swiss residents not employed or employed for less than eight hours per week

Prescribed medication

Limited coverage for medical transport

Limited coverage abroad

Limited preventive coverage

Physiotherapy

Swiss Health Insurance improved coverage through supplementary plans

While LAMal health and accident insurance providebasic coverage, the majority opt for supplementary plans to enhance their protection. These supplementary plans, also known as ‘LCA plans’, offer additional benefits and coverage options tailored to individual needs.

Some common types of supplementary plans in Switzerland include:

1. Dental Insurance: Dental treatments can be expensive, and basic health insurance only covers accident relateddental care. Dental insurance supplements this by covering routine dental check-ups, cleanings, and more extensive dental procedures.

2. Alternative Medicine: For those who prefer alternative healthcare options such as homeopathy, osteopathy or acupuncture, supplementary plans can cover these treatments and about 60 others.

3. Private Hospital Rooms: If you prefer a private room during a hospital stay, supplementary insurance can cover the extra cost.

4. Free choice of operating surgeon and hospital: If you prefer to choose your specialist and clinic, supplementary insurance can cover the extra cost.

5. Travel Insurance: Some supplementary plans offer coverage for medical emergencies abroad, ensuring that you're protected even when you travel outside Switzerland.

Real-life examples of health and accident insurance claims

To illustrate the significance of Swiss health and accident insurance, let's consider three real-life scenarios involving insurance claims:

1. Hiking Accident in the Swiss Alps: Picture a tourist exploring the stunning landscapes of Geneva and engaging in a hiking adventure in the Swiss Alps. Unfortunately, they suffer a severe ankle injury while hiking. Thanks to their accident insurance, they receive immediate medical attention, including surgery and rehabilitation. Their accident insurance covers all medical expenses, ensuring a full recovery without a financial burden.

2. Chronic Illness Diagnosis: A Swiss resident in Geneva is diagnosed with a chronic illness that requires ongoing medical treatment, including prescription medications and regular specialist visits. Their health insurance covers the cost of treatment, ensuring they receive the necessary care without worrying about the financial consequence.

3. Orthodontic Treatment: A family residing in Zurich has two children who need orthodontic treatment to correct dental issues. With dental insurance as part of their supplementary plan, the parents can afford the orthodontic care needed for their children, without straining the family budget.

Conclusion

Health and accident insurance in Switzerland are a vital and mandatory component of a comprehensive insurance plan for expatriates and locals alike. The strict laws and regulations in the country, combined with the potential financial implications of poor health and accident insurance, make it an imperative for individuals and families.

A tailoredhealth and accident insurance plan will provide peace of mind.

CharlesInsurances.com, with their in-depth knowledge of the Swiss insurance market, ensures that individuals have access to the necessary protection. This includes all types and modules of health and accident insurance.

About Charles McHugo

Charles is a leading provider of expatriate insurance solutions, catering to the needs of individuals living in Switzerland. With his extensive knowledge of the local insurance market and a commitment to customer satisfaction, Charles offers tailored insurance solutions to meet the unique needs of expatriates and locals alike.

To learn more about health and accident insurance in Switzerland and explore the range of coverage options available, contact Charles directly on +41 78 601 40 90 or go to his website at www.charlesinsurances.com

#health insurance in Switzerland#accident insurance in Switzerland#Swiss health insurance#health insurance#accident insurance#insurance

1 note

·

View note

Text

Safeguarding Your Well-being: The Importance of Group Personal Accident Insurance

In the unpredictable journey of life, unforeseen accidents can disrupt the balance of our daily existence, leading to physical, emotional, and financial consequences. To mitigate the impact of such unfortunate events, Group Personal Accident Insurance emerges as a crucial safety net for individuals within an organization. This form of insurance not only provides financial support but also fosters a sense of security and well-being among members. This article explores the key facets of Group Personal Accident Insurance, its benefits, and why it should be considered an essential component of comprehensive employee welfare programs.

Understanding Group Personal Accident Insurance :

Group Personal Accident Insurance is a specialized insurance policy designed to offer financial assistance in the event of accidents causing bodily injury, disability, or death. Unlike individual accident policies, group insurance provides coverage to a defined group of individuals, typically employees within an organization. The coverage extends to accidents that occur both within and outside the workplace, ensuring round-the-clock protection.

This type of insurance typically covers a range of scenarios, including but not limited to road accidents, falls, burns, and other accidental injuries. The coverage may encompass medical expenses, disability benefits, and even death benefits, offering a comprehensive support system for individuals and their families during challenging times.

Benefits of Group Personal Accident Insurance :

Financial Protection: One of the primary advantages of Group Personal Accident Insurance is the financial protection it provides. In the aftermath of an accident, the policy ensures that medical expenses are covered, reducing the financial burden on the affected individual and their family.

Disability Coverage:

In the unfortunate event of a permanent or temporary disability resulting from an accident, the insurance provides disability benefits. This can include compensation for loss of income, rehabilitation costs, and necessary adjustments to the living environment.

Death Benefits:

In case of a fatal accident, the policy offers a lump sum amount to the nominee or beneficiary. This financial support can assist the family in managing immediate expenses and maintaining their financial stability in the long run.

Global Coverage:

Group Personal Accident Insurance often provides coverage not just within the country of residence but also during international travel. This is particularly beneficial for organizations with a global workforce.

Peace of Mind:

Beyond the financial aspects, the psychological impact of knowing that one is covered in the face of unforeseen accidents cannot be overstated. It fosters a sense of security and peace of mind, contributing to overall employee health benefits well-being.

Conclusion :

In a world where uncertainties abound, Group Personal Accident Insurance stands as a shield against the unexpected. Organizations that prioritize the welfare of their employees recognize the importance of such insurance in promoting a secure and supportive work environment. By investing in Group Personal Accident Insurance, employers not only fulfill a moral responsibility but also contribute to a more engaged and resilient workforce. As individuals, embracing the protection offered by this insurance ensures that we can navigate life's journey with greater confidence, knowing that our well-being is safeguarded against the uncertainties that lie ahead.

TAGGED:

insurance in insurance ,

employer benefits ,

group personal accident ,

business insurance ,

health benefits ,

medical insurance personal ,

accident insurance ,

employee health benefits ,

Group Personal Accident Insurance

Related Posts:

How to Invest in Crypto: A Quick and Informative Guide

A Truck Lover's Guide to the 2023 GMC Sierra 1500…

The Best Ways to Handle a Small Move With Truck Rental

Best Online Casino App pays Real Money

How to make sure that your manufacturing company is the best

5 Tips to Select the Best Credit Card to Rebuild Credit

Connect with Us

https://in.linkedin.com/comapny/tirupatihelps

#insurance in insurance#employer benefits#group personal accident#business insurance#health benefits#medical insurance personal#accident insurance#employee health benefits#Group Personal Accident Insurance

0 notes

Text

SAFEGUARDING YOUR WELL-BEING: THE ESSENTIALS OF PERSONAL ACCIDENT INSURANCE

In the tapestry of life’s financial security measures, personal accident insurance emerges as a crucial thread. It’s the unsung hero that stands guard, ready to support you when unexpected mishaps strike. Let’s face it, uncertainty is the only certainty in life, and accidents are an unfortunate but real aspect of our daily existence. From a simple slip on the sidewalk to more serious incidents, the risks are everywhere. Personal accident insurance is designed to alleviate the financial strain that can result from such unforeseen events. But what exactly is this form of insurance, and how do you determine if it’s a fit for your life’s blueprint? This blog post aims to demystify personal accident insurance, helping you make an informed decision about whether it’s a layer of protection you need in your financial plan.

Understanding Personal Accident Insurance

Personal accident insurance is a type of policy that provides financial assistance if you suffer from an injury due to an accident. This coverage extends to various unfortunate events that could leave you wrestling with hospital bills or loss of income. With accident insurance, you secure a financial safety net that cushions the blow of medical expenses and helps maintain your lifestyle during recovery. Whether you’re employed, self-employed, or between jobs, an accident can occur at any time. It is vital to understand how this insurance works to protect you and your loved ones from unforeseen financial hardship.

Evaluating Your Need for Accident Insurance

When considering personal accident insurance, reflect on your daily routine and hobbies. Do you engage in activities that put you at higher risk of injury? Perhaps your profession entails physical work or your free time is filled with sports. In such cases, accident insurance becomes not just a wise choice, but a necessary one. However, even those with desk jobs or a calm lifestyle are not immune to accidents. They can happen during mundane activities such as commuting or doing household chores. Assessing your situation and the potential impact of an accident on your finances can guide you in deciding if accident insurance should be part of your protective gear in life’s game.

The Coverage Spectrum of Accident Insurance

Accident insurance policies are not one-size-fits-all. They come with varying levels of coverage, from basic plans that cover death and dismemberment to more elaborate options that include hospital stays, fractures, and temporary disabilities. It’s crucial to scrutinize the details of what each policy covers. Some may provide a lump sum payment, while others might offer to pay for specific accident-related costs. Understanding the spectrum of coverage will enable you to choose a policy that best fits your protective armor, ensuring that you’re not over-insured or, conversely, underprepared for life’s slips and tumbles with The Jordan Insurance Agency.

The Cost-Benefit Analysis of Personal Accident Insurance

The decision to invest in personal accident insurance often comes down to a cost-benefit analysis. You may wonder if the premiums justify the coverage provided. Here’s the deal: personal accident insurance tends to be more affordable compared to other insurance types, particularly when you weigh the potential benefits. The key is to consider your financial resilience in the face of adversity. Would you be able to manage hefty medical bills or a temporary halt in income without destabilizing your financial foundation? If the answer leans toward uncertainty, the peace of mind that accident insurance offers could very well be worth the investment.

Claim Process and Policy Terms

Understanding the claim process and the terms of your accident insurance policy is like learning the rules of a game before playing it. It’s essential to know how to initiate a claim, the documentation required, and the timeframe for processing. Insurance providers usually require a detailed account of the accident, medical reports, and proof of income loss. Also, be mindful of the terms and exclusions. For instance, most policies exclude incidents caused by high-risk activities or pre-existing conditions. Familiarizing yourself with these details ensures you’re not caught off guard when it’s time to lean on your policy for support.

Supplementing Your Existing Insurance

You might think that having life or health insurance means you can skip accident insurance. However, personal accident insurance can be a strategic addition rather than a replacement. It specifically addresses accidents, which might only be partially covered under other policies. For example, while health insurance will cover your medical bills, it may not offer compensation for loss of income during your recovery period. Accident insurance can fill in these gaps, providing a tailored solution that complements your existing insurance landscape.

Conclusion: Making the Smart Choice with Personal Accident Insurance

Personal accident insurance is a smart safety net. It protects you financially after an accident. You’ve learned what this insurance is, how to see if it fits your life and the coverage it offers. Now you know the costs, the claim process, and how it can add to your insurance.

Choosing personal accident insurance depends on your life. Think about your daily risks, your financial duties, and how much risk you can handle. It’s about knowing how an accident might hit your finances and wanting to avoid that. If peace of mind matters to you, and you want to keep an accident from hurting your finances, consider this insurance.

Life has no guarantees, but personal accident insurance comes close. It promises help if an accident happens. You don’t have to handle the money problems alone. So, take time to look at your options. Talk to an insurance advisor if needed. Choose what keeps you financially secure and at ease. After all, true wealth means living without financial worries. Personal accident insurance can help you get there. Read More:

Importance of Accident Insurance

0 notes

Text

Accident Insurance: Why It’s Your Financial Lifebuoy

Accident insurance, a vital part of your financial safety net, is a policy designed to provide monetary compensation if you sustain injuries due to unforeseen accidents. Unlike general health insurance, accident insurance specifically targets the financial consequences of injuries stemming from accidents. These may include fractures, dislocations, burns, or other injuries that could lead to a financial burden.

In the hustle and bustle of our fast-paced lives, the unexpected is just around the corner. With the rising costs of medical care and the increasing liabilities of modern living, having a strong financial foundation is paramount. A sudden accident can bring not just physical pain but a torrential downpour of expenses and lost income. Here’s where accident insurance comes into play as an essential component to safeguard against the financial repercussions of the unforeseen mishaps of life.

Imagine being stranded in the open sea after a shipwreck. A lifebuoy is your saving grace, keeping you afloat. Accident insurance serves a similar purpose for your finances. It keeps you afloat during the stormy phases when accidental injuries threaten to drown you in debt and financial strain. Just as a lifebuoy buys you time until rescue arrives, accident insurance provides the financial buffer to manage your expenses and obligations while you recover.

Understanding Accident Insurance

The Purpose of Accident Insurance

Accident insurance serves as a financial shield, offering coverage for expenses incurred due to accidental injuries. These may include medical costs, hospital stays, and sometimes, compensation for income lost during the recovery period. The primary purpose is to alleviate the financial strain that can occur post-accident, enabling the insured to focus on recovery without the anxiety of mounting bills.

Types of Accident Insurance

Personal Accident Insurance

This type caters to individuals and offers compensation for injuries, disability, or death caused by an accident. Depending on the policy, it can cover medical expenses, provide a lump sum amount for disability, or support in case of accidental death.

Group Accident Insurance

This is usually provided by employers to their employees. It’s similar to personal accident insurance, but at a group level. This type of insurance may have different terms and could be more cost-effective as it covers a larger pool of individuals. Read More

0 notes

Text

Accident Insurance: What You Need To Know Before You Buy

Accidents are unpredictable events that can wreak havoc on our physical health and finances. While it’s impossible to prevent all accidents, having an accident insurance policy can be an effective way to mitigate the financial strain they bring. If you’re contemplating purchasing accident insurance, this blog will help you make an informed decision.

0 notes

Text

A Comprehensive Guide to Personal Accident Insurance

Accidents can happen when we least expect them, and they can lead to physical, emotional, and financial hardships. Personal accident insurance is designed to provide a safety net in case of accidents, offering coverage for medical expenses, disability, and even death resulting from accidents. Apart from its inherent protective value, personal accident insurance can also offer income tax benefits. In this blog, we'll delve into the world on how personal accident insurance income tax benefits you.

The Basics of Personal Accident Insurance

Personal accident insurance is a specialized type of insurance that provides coverage in case of accidents resulting in injuries, disabilities, or even death. This coverage typically extends to accidents that occur both at home and outside, whether they're related to work, travel, or leisure activities. The insurance policy can offer financial support to cover medical expenses, loss of income due to disability, and even lump-sum payments in case of permanent disability or death.

Income Tax Benefits of Personal Accident Insurance

Under many income tax regulations, premiums paid for personal accident insurance can qualify for tax benefits, which can help reduce your tax liability. Here's how it usually works:

Section 80D Deduction: In many countries, premiums paid for personal accident insurance can be included in the deductions under Section 80D of the income tax act. Section 80D covers deductions for health insurance premiums, including personal accident policies.

Health Insurance Deductions: The premiums paid for personal accident insurance are often considered eligible for deductions within the overall limit set for health insurance premiums. This means that the premiums you pay for personal accident coverage can be added to your health insurance premiums for deduction purposes.

Family Coverage: If you have personal accident insurance coverage for your family members as well, the premiums for their policies can also be included in the deductions under Section 80D.

Click here to learn more: https://www.adityabirlacapital.com/healthinsurance/health-insurance-guide/all-you-need-to-know-about-personal-accident-insurance-coverage-exclusions-and-tax-benefits

0 notes

Text

Queensland first introduced the Compulsory Third Party Scheme in 1936, and it is still widely recognised as the best driver insurance compensation system in Australia. When injured in a Queensland road accident that is partly or wholly not your fault, you could make a CTP insurance claim yourself and negotiate directly with the third-party insurance provider.

Besides being a complex procedure fraught with pitfalls, insurers have a reputation for placing their financial interests ahead of yours. Hence, an experienced personal injury lawyer will likely get a more ro

0 notes

Text

Me: I don't understand people who project their experiences onto fictional characters, the beauty is that they're *not* you

Also me after one incredibly minor fender bender: I have to write Klavier Gavin getting into a car accident or I will explod

#ace attorney#klavier gavin#i need to draw a normal ass person getting in an accident and then Klavier fucking Gavin comes out of the other car#everything is fine btw the guy wasnt mad and it was super my fault and im insured its fine

105 notes

·

View notes

Text

hi my name is dils, im a black multiply neurodivergent and mentally ill disabled butch lesbian from the caribbean island of st lucia. i dont want to really sing a sad song for my supper and divulge all the reasons why im asking but my family and i need help right now so id appreciate some assistance.

paypal @ dilsdoes or dilsdoes(@)gmail(.)com (parentheses to avoid spam)

i dont have venmo or cashapp because im not american sorry

you can also buy something from my shop or sub to my ko-fi if you'd like something in return or like my work. in the future i plan on offering animated pixel art favicons and allowing ko-fi subscribers to suggest, sponsor or commission them, and also pixel art wallpapers for phones and pc. ko-fi subscribers will also be able to suggest what i do for those too.

#dils declares#for anyone curious we are still in the hole from the travel and expenses from my grandfathers funeral#and my moms car insurance premiums were increased by 50% from the accident#since she was (wrongfully imo) put at fault#idk how it could be her fault when there was a bus in the road and the other guy was driving so fast he left skid marks#but i guess he was friends with the police so. thats how.

124 notes

·

View notes

Text

A man named Nathaniel is attracted to his car. He confessed to his father that he is in an intimate relationship with his car Chase. The story was featured on TLC's 'My Strange Addiction' in 2012.

#eatliver.com#gif#objectophilia#objectum sexuality#nathaniel#monte carlo#chase#car#automobile#tlc#my strange addiction#tv#television#i'm in a serious relationship with my car#love#affection#attraction#kiss#kissing#beso#chase has since been in a major accident and was written off by nathaniel's insurance company#2012#2010s

24 notes

·

View notes

Note

i read the tags on the poll you just made... are you okay...... ?

(massive TW for car crashes and near death experiences under the cut)

so everyone is okay and nobody died but last night me, my bf, and my friend were crossing the street when we saw a truck blow through the red light and hit a college student pedestrian on the other side of the crosswalk. it almost hit my bf too. the pedestrian flew and landed like 15 feet away from me after hitting another car and when i ran up to check on him he wasn't moving and there was blood. the ambulance showed up a few min later and we decided to get out of the way and walk down the street where i saw the truck abandoned in the middle of the road, presumably because the driver fled the scene on foot. i thought that he died and i went to sleep that night thinking i just saw someone die right in front of me. i found out at noon today that he's alive and stable in the hospital and i've never felt more relief in my life i just broke down sobbing in my car. it just keeps replaying in my mind over and over again which is. awesome.

all things considered it could have been a lot worse and i'm grateful that he's okay and that me or my bf or friend didn't get hit too. but oh my god what the fuck

#i talked to his family and they said he's fully insured so there's no gofundme or anything to share#his mom said he'll make a full recovery but needs surgery for facial fractures and he has a concussion#i just can't believe i saw that happen#not a poll#answered#tw car crash#tw car accident#tw near death

26 notes

·

View notes