#AI investment

Explore tagged Tumblr posts

Text

GITEX ASIA x Ai Everything Singapore Unites Global Tech Investment Elite with Southeast Asia VC Funding Set to Surpass US$13 Billion in 2025

Asia’s largest inaugural tech, startup, and digital investment event debuts from 23-25 April 2025, at Marina Bay Sands, Singapore Over 350 global startups and 250 investors from 60-plus countries will examine cross-sector breakthroughs, enabling access to capital & new markets and forging new partnerships Press Release – Singapore – 21 April, 2025: Southeast Asia’s (SEA) entrepreneurial…

#AI#AI Cloud#AI Ecosystem#AI Investment#Artificial Intelligence#biotech#Cloud#Funding#Health#InvestAI#Investment#Startup#Technology

2 notes

·

View notes

Text

Perplexity AI Stock and AI Market Growth: Top Insights for Investors

Artificial intelligence (AI) is at the forefront of technological innovation, driving significant changes across industries. Companies like Perplexity AI are leading the charge with groundbreaking AI-driven tools, although Perplexity AI itself isn’t publicly traded at this time. However, the broader AI market growth offers numerous opportunities for investors. This article delves into the market…

#AI ETFs#AI industry growth#AI investment#AI investment strategies#AI limitations#AI market analysis#AI market growth#AI stock forecast#AI stock trends#AI stocks#AI technology stocks#AI-driven stocks#Alphabet stock#Amazon AI#autonomous AI systems#best AI stocks#emerging AI stocks#future of AI#investing in AI#Microsoft AI#Nvidia stock#Perplexity AI IPO#perplexity ai stock#top AI companies

2 notes

·

View notes

Text

AI is Driving Investment — But Entrepreneurs Need to be Careful With What They Claim

New Post has been published on https://thedigitalinsider.com/ai-is-driving-investment-but-entrepreneurs-need-to-be-careful-with-what-they-claim/

AI is Driving Investment — But Entrepreneurs Need to be Careful With What They Claim

Artificial intelligence (AI) remains one of the strongest drivers of venture capital investment, proving that the hype cycle isn’t even close to finished. According to a recent EY report, 37% of fundraising in the third quarter of 2024 was for AI-related companies, similar to second-quarter volume. Startups using AI are getting noticed for their ability to tackle big problems in robotics, automation, healthcare, logistics, and more. But the reality is that investors hear, “We’re using AI” all day. The degree to which entrepreneurs actually use it varies substantially. There is even backlash from investors, including a 31-page report by Goldman Sachs that questions how worthy AI is of investment.

The Federal Trade Commission (FTC) recently announced a crackdown on companies making deceptive AI claims. This “AI washing” — lobbing AI into marketing without backing it up — might grab attention, but it’s a fast track to losing credibility. Founders need to communicate clearly and honestly about how AI fits into their business. The focus has to be on actual innovation, not just chasing buzzwords.

It is critical to avoid situations like Theranos, where bold claims were made without substance, leading to severe consequences. The stakes are even higher with AI, as the technical complexity makes it harder to verify claims of how it’s used and easier for misuse to slip through. According to insurer Allianz, 38 AI-related securities class action lawsuits were filed between March 2020 and October 2024 — 13 of them came in 2024 alone.

AI’s appeal to investors isn’t just about technical sophistication. It’s about solving problems that matter and creating a real business. Founders who take shortcuts or exaggerate their AI capabilities risk alienating the very backers they’re trying to attract. With regulators sharpening their scrutiny and the market growing more discerning, delivering substance is essential.

AI’s broad reach

Artificial intelligence encompasses far more than the conversational AI tools that dominate headlines. Patrick Winston, the late computer scientist and professor at MIT, outlined the foundational elements of AI more than 30 years ago in his seminal textbook, “Artificial Intelligence.” Long before large language models captured the public’s imagination, AI was driving advancements in problem solving, quantitative reasoning, and algorithmic control. These roots highlight the diverse applications of AI beyond chatbots and natural language processing.

Consider the role of AI in robotics and computer vision. Simultaneous localization and mapping (SLAM), for example, is a groundbreaking technique enabling machines to navigate and interpret environments. It underpins critical autonomous systems and exemplifies AI’s capability to address complex technical challenges. While not as widely recognized as large language models, these advancements are just as transformative.

Fields such as speech recognition and computer vision, once considered AI innovations, have since matured into distinct disciplines, transforming industries in the process and, in many cases, losing the ‘AI’ label. Speech recognition has revolutionized accessibility and voice-driven interfaces, while computer vision powers advancements in areas like autonomous vehicles, medical imaging, face recognition, and retail analytics. For founders, this underscores the importance of articulating how their innovations fit within AI’s broader landscape. Demonstrating a nuanced understanding of AI’s scope enables startups to stand out in an increasingly competitive funding ecosystem for early-stage companies.

For instance, machine learning models can optimize supply chain logistics, predict equipment failures, or enable dynamic pricing strategies. These applications may not command the same attention as chatbots, but they offer immense value to industries focused on efficiency and innovation.

Speaking investors’ language

When communicating to founders how they use AI, founders should focus on measurable impacts, such as improved efficiency, better user outcomes, or unique technical advantages. Many investors are not deeply technical, so it’s essential to present AI capabilities in simple, accessible language. Explaining what the AI does, how it works, and why it matters builds trust and credibility.

Investors are growing weary of hearing the term “AI,” concerned that entrepreneurs are over-branding their ventures with the technology instead of how it helps them solve problems. AI has become table stakes in many industries, and its role should not be overstated in a company’s strategy.

Equally important is transparency. With the FTC cracking down on exaggerated AI claims, being truthful about what your technology can and cannot do is a necessity. Overstating capabilities might generate initial interest but can quickly backfire, leading to reputational damage or regulatory scrutiny.

Founders should also highlight how their use of AI aligns with broader market opportunities. For example, leveraging AI for predictive analytics, optimization, or decision-making systems can demonstrate foresight and innovation. These applications may not dominate headlines like chatbots, but they address real-world needs that resonate with investors.

Ultimately, it’s about presenting AI as a tool that drives value and solves pressing problems. By focusing on clear communication, honesty, and alignment with investor priorities, founders can position themselves as credible and forward-thinking leaders in the AI space.

#2024#Accessibility#ai#AI Investment#ai tools#ai washing#Analytics#applications#artificial#Artificial Intelligence#attention#automation#autonomous#autonomous systems#autonomous vehicles#Branding#Business#chatbots#command#communication#Companies#complexity#computer#Computer vision#conversational ai#Deceptive AI#driving#efficiency#Entrepreneur#equipment

0 notes

Text

Is AI good for investing?

AI is no longer just a tech buzzword—it’s a driving force behind major innovation across nearly every industry. So, AI investing isn’t just good, it’s smart. With the right guidance, it can be one of the most future-ready investments you make.

👉 Coral Wealth gives you access to AI investing opportunities that are credible, vetted, and built for long-term growth. Click here

Why AI Is Gaining Traction Among Smart Investors

From automation in logistics to predictive tools in finance, AI is already changing how businesses operate. The UAE is investing heavily in AI as part of its national strategy, which means more startups, government support, and cutting-edge ventures are entering the space. Coral Wealth works with investors who want in—without needing to be tech experts. They help you invest in AI companies or funds with clear models and promising outlooks. Whether it’s machine learning platforms, AI health diagnostics, or smart infrastructure tools, AI is a fast-growing space with solid returns.

If you’re looking to future-proof your capital and invest in something shaping the next decade, AI deserves a spot in your portfolio. Coral Wealth makes sure your money moves with purpose and precision.

👉 Step into the future of growth with AI investing through Coral Wealth. Click here

FAQs:

What’s the minimum capital needed to start investing in AI through Coral Wealth?

Are AI investments in the UAE protected by any specific government regulations or incentives?

0 notes

Text

The Role of Taxes in the Growth of AI & Tech

Tax policies play a critical role in shaping the growth of AI and technology industries. From research and development (R&D) tax credits to corporate tax structures, government policies significantly impact how businesses innovate, scale, and attract investment. In the UK, recent tax decisions have raised concerns about whether the country is fostering a tech-friendly environment or creating barriers to growth.

For expert insights into how taxation policies impact tech innovation, check out this analysis.

How Taxes Influence the AI & Tech Industry

1. Tax Incentives for AI & Tech Investment

Many governments, including the UK, offer R&D tax credits to encourage tech innovation.

The Patent Box scheme reduces tax rates on profits derived from patented technologies, benefiting AI startups.

Lower corporate tax rates for tech firms can incentivize global AI leaders to set up operations in the UK.

2. The Impact of High Corporate Taxes

Increased corporate tax rates can discourage startups and scale-ups from expanding in the UK.

AI companies with heavy cloud computing and infrastructure costs face financial pressure with higher tax burdens.

High tax rates can lead to a brain drain, as AI professionals and tech firms move to more tax-friendly regions.

3. Tax Policies & Foreign Direct Investment (FDI)

Competitive tax policies attract foreign investors, boosting capital for AI and deep tech startups.

Countries like Ireland and Singapore have positioned themselves as global tech hubs through business-friendly tax regimes.

The UK must balance tax policies to ensure it remains attractive to global AI investors.

Challenges AI & Tech Companies Face Due to Taxes

1. Uncertainty Around Government Tax Policies

Frequent tax policy changes create uncertainty for tech companies planning long-term investments.

Startups need consistent tax regulations to build sustainable growth strategies.

2. R&D Tax Relief Limitations

While the UK offers R&D tax credits, eligibility restrictions prevent many AI firms from benefiting.

Some AI startups struggle to prove their R&D qualifies under strict tax incentive criteria.

Expanding R&D tax relief could boost AI innovation and job creation.

3. VAT & Digital Services Tax Impact on Tech Firms

VAT on software, cloud services, and AI applications increases operational costs.

The UK’s Digital Services Tax (DST), which targets large tech companies, can reduce profit margins and investment in AI development.

AI firms may relocate operations to regions with fewer tax burdens.

How the UK Can Improve Tax Policies for AI Growth

1. Expanding R&D Tax Credits

Governments should increase R&D tax credits to support AI startups in scaling innovation.

Simplifying the tax credit application process can help more companies qualify for incentives.

2. Creating AI-Specific Tax Benefits

Tax exemptions for AI infrastructure investments (such as supercomputing and cloud AI services) could accelerate tech growth.

Establishing special economic zones for AI development can attract global AI giants to the UK.

3. Reducing Tax Burdens on Tech Startups

Lowering corporate tax rates for AI companies will encourage long-term investments.

Revising digital taxation policies to be startup-friendly can foster more AI-driven entrepreneurship.

Tej Kohli’s Perspective on Taxes & AI Growth

Tech investor Tej Kohli has emphasized that tax policies should encourage, not hinder, tech and AI innovation. His key insights include:

Lower taxes on AI-driven industries can lead to higher investment and innovation.

R&D tax relief should be expanded to benefit more AI startups and deep tech companies.

The UK must adopt competitive tax policies to remain a global AI and tech leader.

Conclusion

Tax policies are a major factor in the success of AI and tech industries. While incentives like R&D tax credits help drive innovation, high corporate taxes and complex regulations can deter investment. The UK must strike a balance between taxation, investment incentives, and AI-friendly policies to sustain long-term tech growth.

#AI Taxation#Tej Kohli#Tech Growth#Future of AI#R&D Tax Credits#AI Investment#Digital Economy#Startup Funding#Business Taxation#AI Regulations

0 notes

Text

AI and overvaluation risk (Q1 2025)

The first quarter of 2025 has been marked by significant geopolitical events and the extraordinary rise of Chinese AI, particularly with the emergence of DeepSeek. This update explores the implications of AI developments on personal asset allocation. DeepSeek Assessment The rapid advancement of AI has led to an increase in speculation and misinformation in the media. According to Bridgewater…

0 notes

Text

🚀 AI is taking over the world! 🌍🤖 📊 15 mind-blowing AI stats you MUST know! 🤯🔥 🎨 34M+ AI images are created daily! 🖼️✨ 💰 Tech giants are investing $320B in AI! 🏦💡 😱 Deepfake fraud is rising—now at 6.5%! 🎭⚠️ 🏥 Healthcare AI is booming at $38.7B! 💉🩺 🔓 50% of companies now use open-source AI! 💻🛠️ ⚡ AI is reshaping our world faster than ever! ⏩🌟 👇 Read more & stay ahead! 📖🚀 #AI #Tech #Future

#AI investment#AI market growth#AI statistics#artificial intelligence trends#Future of AI#Generative AI#healthcare AI#impact of AI

0 notes

Text

Historic $500 Billion AI Investment in the US The US has unveiled a historic $500 billion AI Investment aimed at transforming AI Infrastructure and accelerating Artificial Intelligence development. This bold move is set to boost machine learning advancements and strengthen the US AI Market. For a deeper look at how this initiative will reshape the tech landscape, check out Sharon AI’s blog.

0 notes

Text

A skeptical look at AI investment

youtube

0 notes

Text

I don’t want an AI assistant in my browser I don’t want an AI chat bot built into every website I don’t want AI images appearing in searches I don’t want AI to help me write I don’t want AI integrated into every facet of my life in a completely useless and unnecessary way just because it’s trendy and it sounded futuristic to investors. AI has genuinely helpful applications and has the potential to make people’s lives easier and instead it’s being forced upon us in totally absurd ways that no one wants or needs just because tech companies want to increase their stock value and I’m going to fucking scream

#at some point it has to stop right? I don’t just mean ai#I mean tech companies investing billions into something that no one wants and they lose a bunch of money#and then do it again the next year and the next and the next#there is no longer supply and demand there is just supply with no demand

2K notes

·

View notes

Text

Why is Microsoft Betting On A $300 Million AI Investment in South Africa?

News – ImpactAiNews – 11/03/2025 – Microsoft is making a bold move in Africa’s digital transformation journey with a 5.4 billion rand ($297 million) investment in South Africa in the next three years. This initiative, launched on January 23, 2025, in Johannesburg, is part of a broader $80 billion commitment to expand AI capabilities and cloud infrastructure across the globe. According to…

1 note

·

View note

Note

Olivia fell asleep in one of the aisles again...

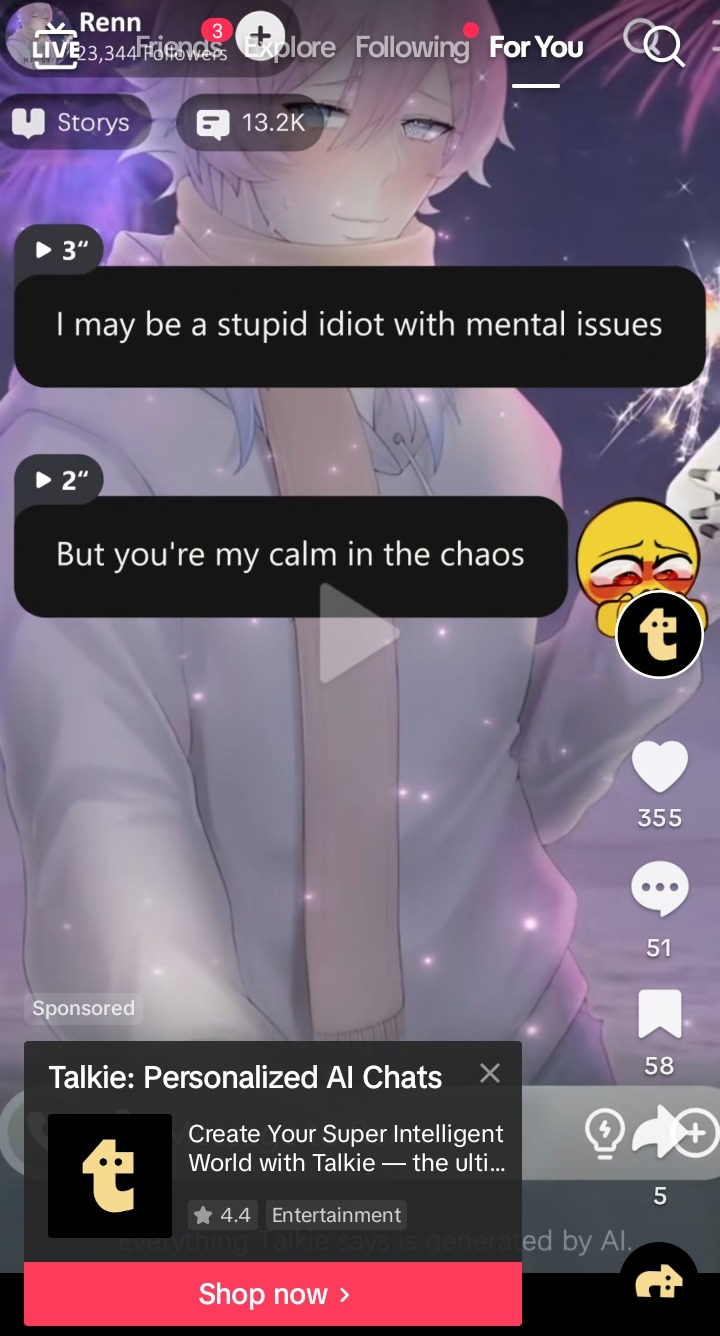

how do you feel about ren being used in an ai chatbot advertisement?

⌞♥⌝ Thank you for bringing this to my attention. I genuinely despise everything about this so much, and if anyone comes across this ad on TikTok (or anywhere else), I'd really appreciate it if you could report the video and not give it any further engagement.

I'm vehemently against the use of AI that negatively impacts artists, writers/authors, developers, creators, etc., and I don't condone the use of my art and IP without my knowledge and explicit consent — especially when it's being used in a paid ad/sponsorship. It's extremely disrespectful and I have no respect for those who do it.

#💌 — answered.#💖 — 14 days with queue.#🖤 — shut up sai.#yuus3n#This is so annoying but I fear Copyrighting my IP would be way too costly and not worth the investment /lh#I'm also gonna give the text messages the benefit of the doubt because it's AI + looks like it's been translated from another language#But even then?? Why would Ren ever say that??? T_T I know it's AI but???????#''I may be a stupid idiot'' ....Ren Stand UP!!! King this isn't you#Also not him downplaying and talking about having ''mental issues'' in a negative light??? Gross actually 🧍 I'm being so serious#Only I can make Ren OOC!!!! Gods... smite this ad 🫵

639 notes

·

View notes

Text

stupidest people on gods green earth

#i mean take away all the buzzwords here and what are you left with. 'public rollout of ai' what does that even fucking mean#'ai' vague. what do you mean by that kier. i don't think you know either do you#excellent idea boys. lets invest the nation's economy into a volatile hyped up tech bubble and wait till it collapses. couldn't go wrong#even more insane is they want to build 'mini nuclear reactors' to power this. not to like.....shift us away from fossil fuels#but this government has already as much as stated they dgaf about the environment. so.#ukpol#uk politics

500 notes

·

View notes

Text

its an aisvere kinda day, im absolutely inconsolable over them. my loverboys. please let them kiss and be happy.

#these were supposed to be ref studies/warmups#and then i got invested#because. i just. i just Love them#i aint getting in between that#friends with benefits but got too attached YOU ARE GAY#anyways#ais loverboy truther#touchstarved game#touchstarved vere#touchstarved ais#ts ais#ts vere#ais x vere#aisvere#ᛝ.𖥔 ݁˖⏾dhampire draws

240 notes

·

View notes

Text

Tej Kohli on Why AI Investment is Distracting Us from Bigger Innovations

Introduction

Artificial Intelligence (AI) has dominated the tech landscape in recent years, attracting billions in investments and reshaping industries. However, billionaire investor and philanthropist Tej Kohli warns that this intense focus on AI risks sidelining other groundbreaking technologies. Kohli believes that Artificial General Intelligence (AGI), biotechnology, and quantum computing hold far greater transformative potential than current AI models. This article explores Tej Kohli's perspective on AI investment, why he believes AI is overhyped, and why a more balanced approach to funding technological innovation is essential.

Why Tej Kohli Believes AI is Overhyped & Overfunded

Tej Kohli has been a vocal critic of the hype surrounding AI. While acknowledging AI’s capabilities in problem-solving and automation, he argues that the disproportionate investment in AI creates a blind spot for other emerging technologies. Drawing parallels to the personal computing boom of the 1970s, Kohli warns that today’s AI fixation could divert resources from truly revolutionary fields like AGI and quantum computing.

“AI has taken on an almost mythical quality. While it can solve complex problems and enhance human capabilities, it is far from the ultimate solution to our technological future,” says Kohli. He cautions that the vast amounts of capital flowing into AI are leading to incremental advancements rather than disruptive breakthroughs.

The Future Lies in AGI and Quantum Computing

Kohli strongly believes that AGI—Artificial General Intelligence—will overshadow today’s narrow AI systems. Unlike traditional AI, which is designed for specific tasks, AGI has the ability to learn, innovate, and operate across disciplines independently. Kohli highlights the increasing computational power of technologies like NVIDIA’s Grace Hopper Superchip, which are paving the way for AGI’s development.

“AGI could dwarf the impact of today’s AI systems, revolutionizing industries and societies alike. But unlike narrow AI, AGI is underfunded and underexplored, even though advances in computational power are bringing us closer to this reality,” Kohli explains.

Another underfunded area of innovation is quantum computing, which Kohli describes as a game-changer for industries ranging from pharmaceuticals to finance. Unlike classical computing, which processes information in binary states, quantum computing can process vast amounts of data simultaneously, unlocking solutions to currently unsolvable problems.

To explore more on his perspective, check out Tej Kohli's View on AGI and quantum tech.

Why Biotech Deserves More Attention

Beyond AGI and quantum computing, Kohli is also a strong advocate for biotechnology’s potential to transform healthcare. Technologies like CRISPR-based gene editing and organ regeneration offer groundbreaking solutions that AI alone cannot achieve. Kohli believes that the medical sector has the power to redefine longevity and cure previously untreatable diseases, making it an area that warrants significantly more investment.

“From precision medicine to regenerative treatments, biotech is opening doors that were once unimaginable. The fact that it remains underfunded compared to AI is a critical oversight,” Kohli asserts.

The AI Hype Cycle: A Risk to True Innovation

Kohli attributes AI’s disproportionate investment to its high visibility and immediate applicability. Tools like chatbots and image generators are easy to understand, making them an attractive focus for both investors and the public. However, he warns of the dangers of an AI investment bubble, where overfunding leads to diminishing returns while other high-impact fields remain stagnant.

“The media and investors have created a feedback loop of hype, pouring resources into AI while other fields languish. This imbalance delays breakthroughs in technologies with more transformative potential,” Kohli cautions.

A Call for Balanced Technological Investment

To prevent AI from monopolizing innovation funding, Kohli urges global governments, investors, and technologists to adopt a more diversified approach. He proposes:

Balanced funding: Allocate investment more evenly across AI, AGI, biotech, and quantum computing.

Mainstream awareness: Expand media discussions to include underfunded but high-potential fields.

Government and private collaboration: Encourage joint initiatives to support emerging technologies with long-term value.

Kohli firmly believes that AI will remain an essential driver of progress, but warns that the future of technology cannot be defined by a single field.

Conclusion

As AI continues to dominate global discourse and investment, Tej Kohli stands as a critical voice urging a more strategic approach. His insights highlight the need to look beyond AI’s immediate appeal and fund disruptive innovations in AGI, quantum computing, and biotechnology. The future of technology lies not just in refining AI but in supporting a diversified ecosystem of innovation that can address the world’s most pressing challenges.By shifting focus towards AGI, biotech, and quantum computing, Kohli envisions a world where technological advancements are truly transformative, rather than incremental. For investors and policymakers, his message is clear: Don’t let AI’s hype cloud the potential of other groundbreaking innovations.

0 notes

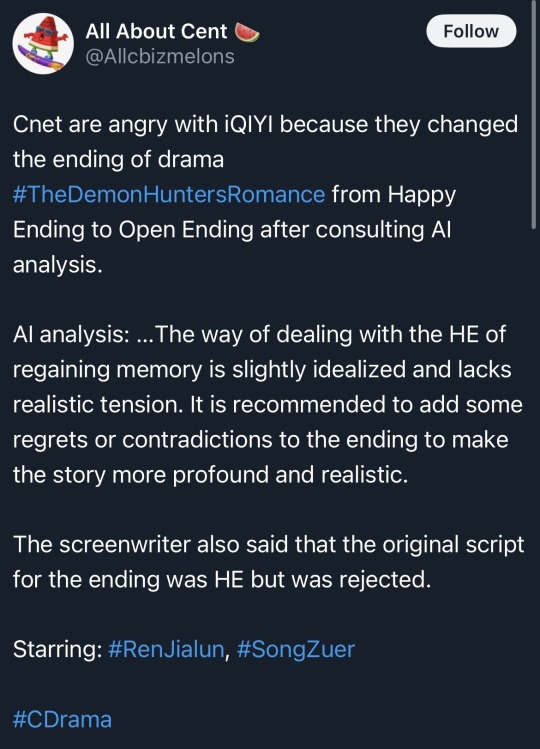

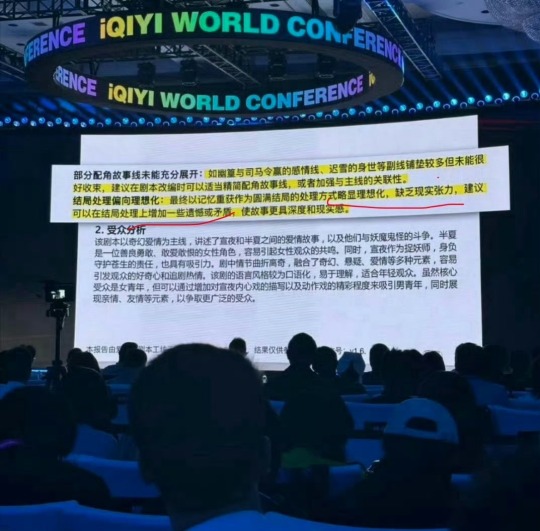

Text

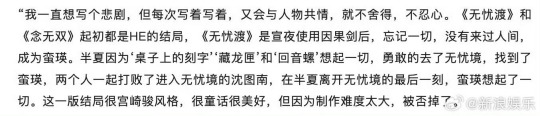

Excuse me but what the fuck? I’m still several episodes from the end, but I knew about the OE and wasn’t that annoyed by it (ie I still plan on finishing), but this is infuriating. Asking AI? I’m so angry on behalf of the screenwriter.

#the demon hunter's romance#the demon hunter’s romance spoilers#I do have some frustration with the ending but it’s not really in ‘oh they’re separated’#I wasn’t that invested in an HE for the romance#it’s in how it concludes ML’s story specifically#but in all my mediocre cdrama ending considerations I never considered#’oh well they asked AI to pick it’

159 notes

·

View notes