#3. Revenge of the Fallen is the best Transformers movie but to be clear that is a bar so underground that it says nothing good about RotF

Note

don't get shot by a sniper your takes are good

It's okay, my epitaphs is going to just be a list of my hottest takes.

#1. Bruce x Barbara is good because it's awful that's why he's alone and everyone hates him in Batman Beyond let Bruce Wayne suck#2. Netflix Death Note is unironically great#3. Revenge of the Fallen is the best Transformers movie but to be clear that is a bar so underground that it says nothing good about RotF

4 notes

·

View notes

Text

Top 10 of 2018

C2018 was a year is this nicest way I can sum it up. My precious fur-baby passed away after fighting a horrible illness and is in a happier place, my health went crazy (still is as of writing), and I finally broke free from an abusive toxic person who had been controlling me for a huge chunk of my life. Despite the bad things that happened, I want to focus on the good things of 2018. One of things I began doing in January of 2018 was at the end of every week, I would write down all of the good things that happened to me, be it sewing, watched a good movie, spending time with a friend, etc. So without further ado, here’s my Top 10 of 2018! (I CAN’T BELIEVE IT’S ALREADY MARCH!!)

1. The Ancient Magus’ Bride

- I’ve been a lifelong fan of Beauty and the Beast-like stories ever since I watched the classic Disney film. The manga kept popping up in my recommendations for the majority of 2017 and I remember seeing a poster at my local theater for a premiere showing of the first 3 episodes of the then-upcoming anime (I have since regretted not going to this showing). I finally caved and bought the first two volumes of the manga and literally went back to the store two days later and bought the next 2 volumes. I’ve always been a very picky person with my romance be it movie, novel, anime, manga, etc., but this quickly became one of my favorites with it’s excellent world-building, relationships, and don’t even get me started on how gorgeous the animation is! If you want an excellent Beauty & the Beast adaptation, you won’t be disappointed. (I am unashamed of crying happy tears in public while watching the final episode)

2. Satoshi Kon’s Filmography

- My New Year’s resolution was to watch all of the late Satoshi Kon’s works, starting with his debut film Perfect Blue. I had wanted to watch this film for several years, and it did not disappoint. (I kept spamming for people to go and see it when it got a theatrical re-release in Fall 2018) Next was Kon’s final project Paprika, which I watched about 3 times in May and many times over 2018 and still notice something new every time I watch it. Finally, I watched *the* film that I have wanted to watch for many, many years (since 2004 to be exact): Millennium Actress. I was not prepared for how moving this film would be with its themes of the past vs. present, how an ordinary encounter can lead to something so much more, and lastly: love transcends time. If you could only watch one of Satoshi Kon’s works, please choose to watch Millennium Actress. Unfortunately, I wasn’t able to watch Kon’s other two works, but I aim to in 2019 (along with reading his works)

3. Slayers

- I watched some of Slayers back in middle school and in summer 2016, but never took off with it until in 2018. I knew I would like this funny series about the adventures of a fiery sorceress, dumb as a stump swordsman, optimistic hero-in-training, and an overly-serious chimera, but I had no idea it would become one of my top 10 favorite anime series! I haven’t laughed so much with an anime in a while, and I greatly appreciated it since my fur-baby passed away and this was one of the last anime we watched together. There’s just something about 90s fantasy anime that’s just so appealing. I will throw in that while I love the tv series, the films are worth watching too, with The Motion Picture being my favorite. If you need something to cheer you up, I highly recommend Slayers!

4. Venom

- Confession: I did not have high hopes for this movie. I was the only one among my friends who was uninterested in this film whenever we would watch the trailers/promos/etc. Eventually after this movie came out, my friends and best friend convinced me to see it. My sociology buddy told me “This movie wasn’t marketed right! Go see it!!” and another told me “This is the best action rom-com of 2018.” The next day my family asked me if I wanted to see it and Bohemian Rhapsody (also an excellent film) and I said “Sure!” This film has since spawned never-ending jokes between me and my best friend. (I ended up making her a Venom scarf for Christmas!) If you’re trying to get someone to see this film, don’t show them the trailers depicting it as a dark, gritty, action thriller, show them the home video trailer depicting it as a rom-com because that’s exactly what it is. I still can’t believe that a movie about a human falling in love with a man-eating gooey alien is real.

5. The Shape of Water

- “2017 will be remembered as the year men screwed up so badly, women started dating fish.”- Jimmy Kimmel, 2018 Oscars. I’m beginning to see a pattern for stories of humans falling in love with monsters. My mom and I wanted to see this film after the trailer dropped in summer 2017 and were disappointed when the film didn’t play here. However, sometime in February 2018, this film played in our town for one weekend, so we dashed to the theater. I don’t even know where to start with how beautiful this film is and since several people I know still haven’t watched it I’ll just state this: Please watch this film. It earned the 4 Oscars it won. (It earned all 10 it was nominated for!)

6. Spider-Man: Into the Spider-verse

- I almost didn’t see this film. 2018 was a pretty hectic year for me and I didn’t really keep up with films/entertainment news, so I saw no trailers for this film (except for a really short tv ad). All I knew was what my best friend had said: “Brianna, let’s go see Spider-verse. In 3D.” (y’all, 2018 was the year of listening to my best friend) It was so nice not only to see a different Spider-Man, a diverse cast, a well-curated soundtrack, and a completely new style of animation that makes you feel as though you’re reading/watching a comic book??? Sign me up! I’m so happy this film won the Oscar!!

7. Macross Frontier Movies

- I’ve fallen deep into the Macross hole in the past year or two and have no plans of crawling out. The 2008 series Macross Frontier was my first and favorite entry in the series so far. I knew that there were two recap/alternate retelling films made, so when I was free one day I watched them and I was really surprised that I enjoyed them more than the tv series!? I haven’t really mentioned this, but my big problem with the tv series of Frontier was it’s ending being not too good. I don’t want to ruin it since Macross (particularly made after 2001) is a bit unknown in the USA, but I will say that if you want to get into this franchise, start with the Frontier movies or with the iconic Macross: Do you remember love? film. The music is just as good as the tv series, same with the costumes, and the writing is much better! The performance of Northern Cross at the climax of The Wings of Goodbye was really moving. Not “Do you remember love?” moving, but pretty close.

8. Sailor Moon Theatrical Double-Feature

- Everyone who knows me knows that I’ve loved Sailor Moon for pretty much all of my life (ever since the 3rd & 4th seasons aired on Toonami back in the day!) A holiday tradition for me was to watch the 2nd theatrical every Christmas Eve, unfortunately my two VHS tapes finally gave out in 2016. Thanks to Viz Media, this past summer saw theatrical re-releases of all 3 Sailor Moon films. Shockingly, my local theater was showing the films subbed so my mom and I bought our tickets right away. It was so surreal seeing these films that I grew up with on the big screen, and I know non-Sailor Moon fans won’t get this, but hearing/watching the whole “Moon Revenge” sequence in the theater was so intense. This part never got to me as a kid for some weird reason and I had no idea I was crying until my mom pointed it out at the end of the film. With the 2nd film, seeing Luna transform into a human was emotionally moving as always, just 10 times more since it was on the big screen with that nice surround sound system. That night when I got home, I didn’t get any sleep since I still couldn’t believe that this happened. The now 20+ years old Sailor Moon movies got released for the first time in USA theaters. This is an experience I’m going to remember for the rest of my life.

9. Cardcaptor Sakura: Clear Card Arc

- I was so excited when a sequel to Cardcaptor Sakura was announced. Like Sailor Moon, I watched this series as the heavily-edited Cardcaptors on Toonami. When I got older and learned that there was more anime out there besides the ones I saw on TV, I went back and watched Cardcaptor Sakura to get the whole, magical story and even read the manga, which I believe is the greatest children’s manga ever made. I loved every single moment of the new series and felt as though I were watching another episode of the classic series. The only thing that felt different was that the animation is no longer hand-drawn. (it’s still good) When you reboot or make a sequel to a series be it tv, film, or book, sometimes it’ll miss the charm that made it so enjoyable in the first place. Clear Card thankfully still carries the charm its predecessor had.

10. Little Witch Academia

- I had started this anime around holiday 2017 but didn’t finish it until early 2018. This was one of the most optimistic series I’d ever had the pleasure of watching. I don’t want to compare the two, but the inspirational message that Kiki’s Delivery Service gave me when I was 10, was the exact inspirational message you will find in Little Witch Academia. (and that I needed to hear as a 20-year-old) I was starting to get a bit depressed and losing confidence in myself with my science grades getting lower no matter what I tried, as well as other things in my personal life. After dropping Science, I had a long wait between classes, so I decided to start watching Little Witch Academia again. Seeing our protagonist Akko trying her best at flying a broom and failing was me with my science grades, but her determination to get her broom just a few centimeters off the ground was so inspiring to watch. After this I watched the other Studio Trigger works I had yet to see, and while they’re all good in their own way, none of them have left the imprint LWA left on me. Sometimes when I get frustrated or lack confidence in myself, I tell myself Shiny Chariot’s words of wisdom that motivated Akko throughout the series: “Never forget your beautiful dreams. Believing is your magic!!”

#2018#2018 in review#The Ancient Magus Bride#millennium actress#satoshi kon#slayers anime#lina inverse#venom#the shape of water#into the spider verse#macross frontier#sailor moon#cardcaptor sakura clear card#clear card arc#little witch academia#brianna talks#slayers

178 notes

·

View notes

Text

Transformers The Last Knight

So I got the tags dealt with and before this I was waiting around to get the wait I think it was a DVD I played I just looked at the movie its a Blu Ray and DVD and digital edition.

Just looked inside the cover yeah Blu Ray.

Yet well my thoughts on the film, I copied this from my DeviantArt journal. Prepare for my thoughts on this yet it's not so detailed.

Edit went to the last post I made by mistake forgot to say played some Transformers Devastation before seeing the film I'm replaying the story beat Devastator and just wanted to share that. Basically waited to grab the movie and then I watched the film.

At last after all this time I've finally seen the film. I didn't go see it in the theater because I stopped giving money to the Bayformers. Now we have Bumblebee and I absolutely adore that film I've seen it twice, felt like seeing it a third time because a article I shared on Tumblr revealed stuff that made me think today, "I need to watch The Last Knight and probably see Bumblebee again for a third time" whatever shit.

To be honest about all kinds of stuff. Seeing Bumblebee a 2nd time got me to be a Transformers fan again despite I kept calling myself a ex fan.

Also for this movie I was already thinking I'm gonna hate it and say this is worse then Age Of Extinction.

Seeing the film now.......I watched it on my PS4.

Honestly you may hate me for my opinions. Especially I'm gonna be a little dramatic.

..........that was honestly fun.

Let be honest and don't wanna lie I thought a stupid negative thought saying I hate it. Yet during my watching of the movie.

Let me say it's an absolute mess of a film.....it is absolutely messy.....my God especially I wanna make this clear. I don't want anymore Bayformers ever again.

Yet okay yeah I felt happy.

I'll be honest I laughed a lot....mainly towards the humor.....and I was basically having fun.....Jesus those trailers just......that feels like false advertising in some ways. Or not really because......

Wanna say in a weird way this would be a nice climax for the Bayformers but I'm not gonna spoil anything.

I think I'm happy I finally saw it and I had a nice time actually. Because I'm not angry because I had a nice time.

But I will say it was long. Yet I had fun.....

Even though with well people have talked about this their is a mid credits scene spoiling that surprise. Not gonna say what it is.

I'm glad this is the last Bayformers because we now have Bumblebee. Which is a amazing film. Yet I seriously had fun and I wasn't upset.

Even though I feel like I spoke with my money and others not seeing it probably.....

It was fun while it lasted. Basically so I mainly enjoyed myself watching this.

You know been thinking about maybe making a list and think I'll add Bumblebee to the list of live action films.

What are my favorites in ranking counting Bumblebee even if it's a reboot.

1: Bumblebee.

2: Transformers 2007.

3: Transformers Dark Of The Moon.

4: Transformers The Last Knight.

5: Transformers Revenge Of The Fallen.

6: Transformers Age Of Extinction.

.......that's shocking yet I was really wondering should I add The Last Knight there at that ranking?

Anyway so yeah......gonna say during the beginning had to rewind a because my mom's sister brought my toddler niece to say goodnight and kissed her on the forehead basically cute shit and it's weird watching Blu Ray on PS4. Also had subtitles in case.

Well yeah I don't want anymore Bayformers seems like that's happening. Because wow what a way to go out and this wasn't supposed to be the last film. Maybe it's some what for the best or just imagine if.....just I'm glad with Bumblebee being successful were gonna get better films.

Yet I honestly had fun and was well invested in quite some stuff or just a fun time.

Alright hopefully in this rebooted universe we get another big film.

2 notes

·

View notes

Text

Best Surround Sound Movies

📷

Best Surround Sound Movies

In truth, why shouldn’t we be? If you are a cinephile, then there may be a high chance that you already have a hefty, pinnacle-notch domestic cinema theatre or surround sound setup at domestic (in case you haven’t but, we’re sure you’ve got been strongly thinking about it!). But are you positive your surround sound system is “the quality” out there? Well, in case you’re not, we propose testing it with the Best Surround Sound Movies on the market.

Primarily, the concept of surround sound systems is used in movie theatres and is now being widely included into domestic cinema systems. Frankly speakme, it doesn’t count number whether you’re a sucker for suitable sound satisfactory or you adore an excellent film — surround sound films and surround sound systems in a domestic cinema device can virtually trade the game extensively.

Now, what precisely is surround sound? To sum it up in a few phrases, surround sound systems refer to sound that appears to be coming from all round you — it is as if it surrounds you, just like the time period suggestions at. Usually, whilst you watch films or listen to tune via speakers, you will know in which precisely the audio system are situated. However, with surround sound structures, it’s miles as if you are engulfed by way of the sound around you — as if the motion inside the movie is truly taking region for your surroundings.

Now that we’ve cleared the air on what surround sound and surround sound structures are, it’s time to dive deep into the nice surround sound films.

Table of Contents

How to Test a Surround Sound System

1. The Bombing Raid Scene from Unbroken (Year of Premier: 2014)

2. The Opening Scene (Chapter 1) from Baby Driver (Year of Premier: 2017)

three. The Ferry Scene from Spider-Man: Homecoming (Year of Premier: 2017)

four. WALL-E Gets Thrown Into Space From WALL-E (Year of Premier: 2008)

5. Chapter 7 From Star Wars: The Force Awakens (Year of Premier: 2009)

Best Blu Ray Movies for Surround Sound

1. The Dark Knight (Year of Premier: 2008)

2. Casino Royale (Year of Premier: 2006)

three. Bohemian Rhapsody (Year of Premier: 2018)

4. Black Panther (Year of Premier: 2018)

five. Avatar (Year of Premier: 2009)

Best Dolby Atmos Movies to Test Surround Sound Setup

1. The Avengers: Infinity War (Year of Premier: 2018)

2. La La Land (Year of Premier: 2016)

three. Saving Private Ryan (Year of Premier: 1998)

4. Mad Max: Fury Road (Year of Premier: 2015)

5. Inception (Year of Premier: 2010)

Best Surround Sound Movies on Netflix

1. Godzilla vs Kong (Year of Premier: 2021)

2. Wonder Woman 1984 (Year of Premier: 2020)

three. Interstellar (Year of Premier: 2014)

4. Swiss Army Man (Year of Premier: 2016)

5. Bird Box (Year of Premier: 2018)

Does Netflix Have 7.1 Surround Sound?

Surround Sound Movies With Best Sound Mixing

1. Transformers: Revenge of the Fallen (Year of Premier: 2009)

2. Gravity (Year of Premier: 2013)

3. American Sniper (Year of Premier: 2014)

4. Pacific Rim (Year of Premier: 2013)

5. TRON: Legacy (Year of Premier: 2012)

Surround Sound Movies With Best Sound Editing

1. Jurassic Park (Year of Premier: 1993)

2. Fight Club (Year of Premier: 1999)

three. Star Trek: Into Darkness (Year of Premier: 2013)

four. Oblivion (Year of Premier: 2013)

5. Master and Commander: The Far Side of the World (Year of Premier: 2003)

Conclusion

How to Test a Surround Sound System

In our opinion, there’s no better manner to test your surround sound setup than watching some of the satisfactory acknowledged film scenes which have been regularly used by audiophiles and cinephiles all throughout the globe. Even the excellent surround sound structures on the market want checking out.

While maximum folks recognise the way to set up a surround sound gadget, we regularly get stuck with regards to testing the surround sound structures’ sound great and features.

Therefore, it doesn’t matter whether or not you have got a 5.1 or a 7.1 surround sound machine, or possibly you have a Dolby Atmos surround sound device, the most fool-evidence and simple manner of checking out your surround sound machine out is via gambling a number of the subsequent scenes from films:

1. The Bombing Raid Scene from Unbroken (Year of Premier: 2014)

The Bombing Raid Scene from Unbroken (Year of Premier: 2014)

This particular scene from Unbroken is one which you sincerely must watch, so as to check your surround sound audio system. In reality, you could even listen the propellers as though they have been rotating right above you. Our crew of experts felt as if they were simply there, in struggle, with their hearts skipping a beat whenever the enemy’s weapons swerved beyond them

2. The Opening Scene (Chapter 1) from Baby Driver (Year of Premier: 2017)

The Opening Scene (Chapter 1) from Baby Driver (Year of Premier: 2017)

This beginning scene from Baby Driver greets you with a humming, ringing noise which truely sounds like it’s hitting you from each path, in particular while you are using your surround sound system. This scene rolls in with the enduring John Spencer Blues Explosion music, titled ‘ Bellbottoms’. If you have got heard this song before, then you definitely are completely aware about how precise it’s far. And with a surround sound domestic cinema device? You are going to need to look at the scene on loop!

Three. The Ferry Scene from Spider-Man: Homecoming (Year of Premier: 2017)

The Ferry Scene from Spider-man: Homecoming (Year of Premier: 2017)

Calling all Marvel fans available! We all recognise that Marvel movies are packed with action and super history ratings and surround sound. The ferry scene from Spider-Man: Homecoming entails the movement-packed face-off among Spider-Man and the Vulture is actually going to make you understand the great sound effects in this film.

Four. WALL-E Gets Thrown Into Space From WALL-E (Year of Premier: 2008)

WALL-E Gets Thrown Into Space From WALL-E (Year of Premier: 2008)

WALL-E is honestly, a cinematic masterpiece. With very little verbal verbal exchange inside the first half of the film, this animated space movie is based closely on its soundtrack and sound outcomes. This specific scene from WALL-E, however, is easily one of the first-class scenes to test your surround sound device. In reality, even though it is a fictional, lively movie, it’s miles safe to say that it’s far without problems one of the best space films obtainable!

With this scene, particularly, you must attempt watching it together with your eyes closed. WALL-E is thrown into area, whilst his buddy Eve, comes speeding right at the back of him. With the bolts, jerks and clicks of WALL-E’s robot motion, and the gentle spraying of the extinguisher he propels into space on, this scene is one of the best ones to check ambient sounds.

5. Chapter 7 From Star Wars: The Force Awakens (Year of Premier: 2009)

Chapter 7 From Star Wars: The Force Awakens (Year of Premier: 2009)

When you believe you studied of area and sci-fi as well as movies that are not simplest a visible treat but also an audio deal with, one of the first movies that involves mind is none other than the space film Star Wars: The Force Awakens. This unique scene from Star Wars sounds outstanding.

While there are a honest amount of loud noises in this movie, this precise scene, however, proves which you don’t want loud noises that allows you to definitely appreciate and phone a movie one of the suitable surround sound films. In this scene from Star Wars, Rey’s man or woman is brought in whole silence. Since it’s a area and sci-fi movie, there’s quite a piece of swaying and swooshing you could hear, as Rey senses the exchange in ecosystem of the planet she known as domestic.

You May Also Like: 12 Best Running Headphones in 2021

Best Blu Ray Movies for Surround Sound

They say that your home cinema equipment and surround sound machine is simplest considered ‘excellent’ if the movie you’re watching is, which, to be honest, we do accept as true with. To make the maximum from your surround sound system, you have got to look at a film which no longer simplest sounds astounding but is likewise an audio deal with. Here are a number of the first-class Blu Ray films to observe to your surround sound device, with perfect audio engineering:

1. The Dark Knight (Year of Premier: 2008)

The Dark Knight (Year of Premier: 2008)

The Dark Knight is certainly a conventional, and we’re certain that anybody who considers themselves to be a hardcore audiophile will agree. Right from the opening scene, this film sets the bar, mainly with all the on display movement. It is truely one of the best Blu Ray films obtainable. As a matter of fact, the Joker’s crazed, deranged and psychotic laughter also leaves a specific sort of impact, when you pay attention it to your surround sound setup. The audio engineering of The Dark Knight’s heritage rating is clearly one to amaze.

2. Casino Royale (Year of Premier: 2006)

Casino Royale (Year of Premier: 2006)

Let us begin by using saying the history rating and soundtrack of Casino Royale is certainly awesome. With the best sound results hitting you from all the right locations, this movie is a need to watch in your surround sound setup. You will even experience the blow of every punch, inside the oh-so-famous preventing scene. This movie has sound consequences showcasing pinpoint accuracy.

Three. Bohemian Rhapsody (Year of Premier: 2018)

Bohemian Rhapsody (Year of Premier: 2018)

We all recognise how nicely Bohemian Rhapsody did whilst it were given launched all of the manner again in 2018. With an outstanding sense of song and sound, this film will sound like an audiophile’s heaven, specifically with a strong effective system and the distorted guitar riffs. The finale of this movie is what’s going to simply get you in awe of the audio masterpiece that Bohemian Rhapsody is.

Four. Black Panther (Year of Premier: 2018)

Black Panther (Year of Premier: 2018)

Another terrific film which released in 2018, and some other one in every of Marvel’s lovely creations, is Black Panther. Although it has a one of a kind take on the whole superhero genre of films, it additionally sticks genuine to it. With a whole lot of on display screen movement, brilliant sound engineering and brilliant ambient sounds, Black Panther goes to be a satisfaction to watch when you have your Dolby Atmos connected up (or every other surround sound machine for your property cinema system, for that depend).

Five. Avatar (Year of Premier: 2009)

Avatar (Year of Premier: 2009)

Avatar is the holy grail in relation to 3D cinema. After all, it was one of the most costly films made, and did take quite a chunk of attempt. But, certain enough, the efforts didn’t visit waste. Not simplest is it a pretty visually attractive movie, however it’s also music to the ears — literally! The sound fashion designer of Avatar didn’t fail to impress our specialists with the high-quality audio engineering and sound mixing. With a huge surround impact, this film will fill your entire room with the maximum sensitive sounds, however additionally gained’t omit out at the action sequences which consist of the gadget gun fireplace.

Best Dolby Atmos Movies to Test Surround Sound Setup

Dolby Atmos is a well-known call within the surround sound world. It has dominated each business cinema setups in addition to domestic cinema setups. Here are a number of the exceptional Dolby Atmos movies to check surround sound setup:

1. The Avengers: Infinity War (Year of Premier: 2018)

The Avengers: Infinity War (Year of Premier: 2018)

That’s right — but any other Marvel movie that tops our list of the good surround sound movies to look at to check your house cinema system. With loud noises, hovering song and exceptional sound consequences modifying, this film marks the beginning of the very last conflict with Thanos. The Dolby Atmos soundtrack is remarkably super, specially with surround channels .

2. La La Land (Year of Premier: 2016)

La La Land (Year of Premier: 2016)

La La Land reminds you of the proper essence of Hollywood. Right from the hole scene to the quit, it has some of the fine and funniest moments, which your property cinema gadget will assist you’re making the most of. Ryan Gosling and Emma Stone actually stole the show with this movie. Kudos to the sound designer of La La Land due to the fact the movie soundtrack is virtually an audio deal with, in particular on the Dolby Atmos!

Three. Saving Private Ryan (Year of Premier: 1998)

Saving Private Ryan (Year of Premier: 1998)

Best movies to watch with surround sound Directed by way of none other than the widely recognized Steven Spielberg, this movie is certainly on our listing of a number of the quality films with a compelling sense of sound. With multiple factor clean photographs, device gun fireplace and iconic bullet time sequences, Saving Private Ryan will sound superb together with your Dolby Atmos.

Four. Mad Max: Fury Road (Year of Premier: 2015)

Mad Max: Fury Road (Year of Premier: 2015)

If you need to actually revel in and respect the splendor of surround sound and a extremely good surround sound device, one of the first-rate films to look at with surround sound, of route, is Mad Max: Fury Road. Right from the opening scene, this film has a lot to provide. Having said that, however, there are chances that your surround channels may not totally choose up the sound consequences — at the least, that is what our team of professionals observed when checking out this movie out on a lower surround sound system.

Nonetheless, with Mad Max: Fury Road’s hovering track and soundtrack filled with electronic beats, it’s far no marvel that the movie has gained no longer best the Best Sound Editing award, however at the side of that, Mad Max: Fury Road was also the recipient of the Best Sound Mixing Award. Both of those awards were given at the 2016 Academy Award. Needless to say, Mad Max: Fury Road is a movie you have got were given to watch.

5. Inception (Year of Premier: 2010)

Inception (Year of Premier: 2010)

Christopher Nolan is understood for his difficult, notion-upsetting and properly-plotted storylines. Along with a touch of outstanding and unique sound engineering, Inception is a have to-watch for all of the house cinema gadget proprietors out there, particularly when you have the Dolby Atmos. As a rely of reality, we have been intrigued to learn that the sound effects used on this Nolan advent were copied and used in diverse different movies.

Inception is every other academy award-prevailing film. Just like Mad Max: Fury Road, it has received the Best Sound Editing award, as well as the Best Sound Mixing award. Along with these awards, Inception additionally received the Best Sound award on the British Academy of Film and Television Arts. But that’s not the stop of it — this Chritopher Nolan masterpiece also obtained the Sound Effect award on the Motion Picture Sound Editors.

Best Surround Sound Movies on Netflix

You can locate a number of the excellent films to check surround sound on Netflix. Here’s a short listing you may explore:

1. Godzilla vs Kong (Year of Premier: 2021)

Godzilla vs Kong (Year of Premier: 2021)

None folks are new to the world of Godzilla and that of King Kong. With the preceding films of these two beasts being hits all around the global, you may expect the equal from Godzilla vs Kong too. You are going to sense their wrath and pay attention their roars on your entire room. Don’t bounce out of your seat if you pay attention a low growl from your rear speakers! Even with all the panic, screaming and squealing in the crowd scenes, the sound engineering has been made to such perfection that you only awareness on what’s critical — Godzilla and Kong.

2. Wonder Woman 1984 (Year of Premier: 2020)

Wonder Woman 1984 (Year of Premier: 2020)

Wonder Woman 1984 is but another movie that showcases pin factor accuracy, particularly in terms of its audio engineering and sound layout. The first scene is both an audio & visible deal with, and it will get you hooked to the film nearly right away. With a variety of gadget gun fireplace, factor clean photographs and quite a few crowd scenes, your entire room is going to be packed with Wonder Woman’s awesome powers. It is one of the exceptional films to expose off your surround speakers and surround channels.

3. Interstellar (Year of Premier: 2014)

Interstellar (Year of Premier: 2014)

Yet some other iconic space movie to feature to our list of the first-rate movies to look at with surround sound of direction, Interstellar. While this film turned into a touch confusing to some (in reality, we suppose it is safe to mention that this film confused every body in some unspecified time in the future or the opposite), there may be no denying the truth that it has were given a number of the first-class sound outcomes and the nice sound editing there’s.

With a sturdy consciousness on ambient sounds as well, Interstellar surely units the ecosystem. Right from the opening scene to the ultimate scene, this movie is an audio deal with, especially with the gap surroundings having a alternatively large and arresting presence!

Four. Swiss Army Man (Year of Premier: 2016)

Swiss Army Man (Year of Premier: 2016)

For all the Daniel Radcliffe fans obtainable, this film is for you. This movie is full of some of the best and funniest moments that you could make the maximum out of the use of the Dolby Atmos, or every other surround sound home cinema device for that matter. There is no point denying the amazing sound modifying in this movie — our crew of specialists changed into totally in awe! Swiss Army Man is in reality a movie you’ve got got to watch yourself, if you want to truely appreciate it.

Five. Bird Box (Year of Premier: 2018)

Bird Box (Year of Premier: 2018)

Netflix Original Bird Box is a sci-fi film with a massive sprint of horror in it. It revolves around a mother, portrayed by the proficient Sandra Bullock, who fights for survival, whilst rescuing her children, in opposition to something this is taking the lives of many, many others. From the group of humans that live on, they realize that the only manner to live alive is to blindfold themselves and not glance at anything it’s far this is killing everyone else. Now, with everybody being blindfolded, you could understand the importance of counting on first rate and precise sound results.

Does Netflix Have 7.1 Surround Sound?

While Netflix presents surround sound within the settings of 3.1, five.1 and 7.1, not all the movies and suggests on Netflix help a number of these settings. You won’t be aware of this, however within the past, although Netflix should provide a massive variety of movies and video fine settings, they have been no longer capable of cater to desirable first-class audio. Later on, with the introduction of five.1 Dolby Digital Plus, Netflix took it on board. Yet, having said that, no longer all of the shows and movies on Netflix are enabled to guide these surround sound settings.

So, how are you meant to understand if the movie you are watching has 7.1 surround sound? Well, a lot to our unhappiness, there is no list on Netflix that helps you to understand which movies or shows have surround sound to be had. However, as consistent with the assist web page on Netflix, any movie or television display which has surround sound enabled could have the Dolby Digital icon sitting proper next to its name while you look for it.

Surround Sound Movies With Best Sound Mixing

Check out these surround sound films with nice sound blending to test your new surround sound machine:

1. Transformers: Revenge of the Fallen (Year of Premier: 2009)

Transformers: Revenge of the Fallen (Year of Premier: 2009)

Whether you were a fan of the entire Transformers franchise or no longer, you will ought to admit that Transformers: Revenge of the Fallen is one of the first-rate surround sound movies with the first-rate sound blending. Your whole room could be full of soaring track and a honest amount of electronic beats while you watch this film to your new domestic cinema tools. With the huge and arresting presence of the robots, which are pretty often immersed in excessive on display screen motion scenes, it’s far safe to mention that those strong transformers want nothing much less than a potent effective surround sound machine!

2. Gravity (Year of Premier: 2013)

Gravity (Year of Premier: 2013)

It would be in reality insane to no longer list 3-time Oscar winning Gravity as one of the fine surround sound films with the first-class sound blending. It is but some other amazing, thought-scary area movie that just receives you hooked to the screen. With a lovely play of soft and loud noises, Gravity honestly is aware of a way to hold you down (pun intended? Definitely!). With particular sound effect and outstanding sound blending, Gravity is one of the few films that honestly and in reality steals the show.

Three. American Sniper (Year of Premier: 2014)

American Sniper (Year of Premier: 2014)

Under the route of none apart from Clint Eastwood, American Sniper is a film with some of the first-rate sound blending there may be. After all, it has won the Best Sounding Editing and the Best Sound Mixing nomination at the Academy Awards. No doubt that this film goes to sound past amazing for your Dolby Atmos!

Four. Pacific Rim (Year of Premier: 2013)

Pacific Rim (Year of Premier: 2013)

Pacific Rim reminded us strongly of the whole Transformers franchise. Nonetheless, Pacific Rim is a exceedingly enjoyable film, and is actually a sight for the eyes, and it’s far alternatively clear of the tremendous quantity of attempt that has gone into the production and direction of the movie. Much to our surprise, we located out the Jager cockpit turned into in fact an real set — there was no need of CGI in creating it! And in case you idea the visible appeal of Pacific Rim became mind blowing, wait till you listen the movie’s sound consequences. Absolutely incredible.

Five. TRON: Legacy (Year of Premier: 2012)

TRON: Legacy (Year of Premier: 2012)

The sound dressmaker of TRON: Legacy virtually took their process very, very seriously. The film isn’t always most effective clearly fun to look at, however the sound results are tremendous too. Our professionals strongly trust that it’s far one of the high-quality surround sound actions with the best sound mixing. TRON: Legacy has big sound consequences, showcasing pinpoint accuracy. The movie additionally has a extremely good history score, which we have been hooked to. All in all, this movie is a have to-watch, especially if you want to show off your house cinema machine!

Surround Sound Movies With Best Sound Editing

These films incorporate the best surround sound editing. Check them to check your surround sound setup:

1. Jurassic Park (Year of Premier: 1993)

Jurassic Park (Year of Premier: 1993)

To begin with, we think it’s far simplest honest if we start out by means of pronouncing that Jurassic Park has a phenomenal heritage score. Add to it some of the maximum brilliant sound edits and sound consequences, and bam! Jurassic Park proves to be an iconic audio masterpiece, even these days. It is a movie with a fair proportion of each audio & visual drama, which wishes no creation nor description.

2. Fight Club (Year of Premier: 1999)

Fight Club (Year of Premier: 1999)

Even nowadays, Fight Club stays to be a cinematic piece of artwork. With pretty a piece of twists (especially inside the plot!) and turns, the sound of this movie hits you from all angles — pretty actually! With multiple Fight Club scenes, soaring music, a whole lot of on screen movement and plenty of, many punches, your entire room is going to be packed with the sounds of loud noises and coffee blows. Although we assume that once watching the movie as soon as, it loses its element of surprise, it nevertheless remains a movie we will pass lower back to time and time once more.

Three. Star Trek: Into Darkness (Year of Premier: 2013)

Star Trek: Into Darkness (Year of Premier: 2013)

ow should we have a listing of the excellent surround sound movies with the pleasant sound modifying and leave out Star Trek? This iconic sci-fi film doesn’t want any introduction — that’s simply as plenty records as we are going to give you on Star Trek! You have got to watch it for its sound outcomes, for its pinnacle-notch modifying and its brilliant experience of path.

4. Oblivion (Year of Premier: 2013)

Oblivion (Year of Premier: 2013)

Tom Cruise starrer Oblivion is a film with a exquisite historical past rating and film soundtrack. While we were looking ahead to a little greater out of this film, we ought to admit that it is a film with the intention to have you admiring your cinema system every time you watch it. There is not any denying the fact that it’s far quite a visually appealing film, but along with that, the sound outcomes are spectacular too.

Five. Master and Commander: The Far Side of the World (Year of Premier: 2003)

Master and Commander: The Far Side of the World (Year of Premier: 2003

When it involves discussing sound effects, Master and Commander: The Far Side of the World needs to be a part of the dialogue. With unique sound results, we accept as true with that this movie has mastered surround sound, particularly with the pinnacle-notch audio engineering and sound effects editing. Your complete room goes to experience like the ocean, and you’re without a doubt going to listen the waves crash towards your rear audio system.

Conclusion

And there you cross! Here is our comprehensive and absolutely designated guide at the first-rate surround sound films which you want to check out. For a surround sound film to be taken into consideration ‘suitable’, it need to have wonderful audio engineering as well as extraordinary sound enhancing and sound mixing. Of route, if you want to certainly make the most of an amazing surround sound movie, you need to make sure that your house cinema system and surround audio system stay as much as the standards!

If you’ve got any questions, doubts or queries, feel loose to drop a remark in our comments segment beneath, and our specialists gets returned to you with an answer in no time. If there are any merchandise you have got in mind that you would really like for us to review and examine, do write to us.

0 notes

Text

Revenge of the Humans: How Discretionary Managers Can Crush Systematics

This is the entirety of a three part series that was originally published byIntegrity Research and titled The Great Quant Makeover - Part 1: How Discretionary Managers Can Cope with the New Systematic Realities, Part 2:The Rise of the Quants and How Some Successful Discretionary Managers are Responding, Part 3: Revenge of the Humans or How Discretionary Managers Can Crush Systematics

Six months ago I found myself in our Estimize office sitting across the table from a hedge fund portfolio manager who said something I honestly couldn’t believe. According to this PM who runs a $500M long/short book at a large multi-manager fund, he was taking a data science course at night, after work. He told me, “if I don’t learn how to do quantitative analysis I’m not going to have a job in two years.”

A second said the same thing to me a week later.

Two weeks after that I received an email from the “school” providing that very course, inquiring if I could teach a data science class, specifically for finance, to 25 members of a hedge fund who had contracted them.

These are just a few anecdotes among many in the absolutely massive transformation taking place right now within the discretionary institutional management industry. Discretionary managers have woken up, and are now scrambling to understand what’s taking place and how they must change in relation to it. Many will not survive the shift. Others will take advantage and be better off for it.

This piece takes a deep dive into the following themes and how institutional managers can begin to effectively redirect themselves:

Investors have woken up to the asymmetric risk they were taking on with active discretionary mutual funds, hedge funds and RIAs who were basically playing with beta instead of generating alpha. Now they are pulling their money.

Asset flows are moving into “passive” ETF strategies and will continue to move further into smart beta ETF strategies, long only active management is headed to the grave.

Hedge fund assets are flowing out of discretionary and into quantitative systematic strategies which have produced far more consistent alpha. They also blow-up less often.

Most classic systematic alpha strategies are based on price; volume and fundamentals have been arbitraged out and are now betas. This has precipitated a race to build new alphas with new data sets.

Discretionary managers are scurrying to incorporate new data sets, but lack the understanding of how to analyze their efficacy and more importantly, how to incorporate them into their discretionary trading processes.

If discretionary managers remain disciplined and execute their rubric faithfully, they can crush systematic quants, but they must solve the religion vs. science question first.

The organizational structure of discretionary management teams along with the type of people they hire is broken and outdated for today’s challenges. Changes are starting to take place, but all too slowly for many players to survive.

Building the right infrastructure will remain pertinent to surviving this shift. Both quant and discretionary firms must hire teams that include engineers, product managers and quants to suss out new data sets.

On June 20th, Estimize will be hosting the L2Q (Learn to Quant) Conference, a one day seminar designed for discretionary institutional PMs, analysts, and traders who know they need to move quickly and efficiently towards building quantitative processes. Segments will be taught by preeminent buy side, sell side, and unique data experts with vast quantitative investment experience at Two Sigma, PDT Partners, WorldQuant, Wolfe Research, Deutsche Bank, and others.

But before that, let’s take a deeper dive into the topics above, and why we felt a whole conference was necessary to explore them.

1. Getting Paid For Playing With Beta Is Over

Looking back, it’s hard to understand why anyone was willing to give most discretionary fund managers money in the first place. The truth is, most PMs were simply playing with beta, whether it be momentum, mean reversion, value, growth, sector or market cap. Managers were leveraging these far more often than they were actually generating alpha. Now we can all argue over whether correctly timing the use of betas is in itself alpha, but that argument is made moot by the fact that the vast majority of PMs were unsuccessful at this in the long run and eventually blew up.

The greatest trick the industry ever pulled was making LPs believe that they could consistently leverage beta and not get caught with their hand in the cookie jar, giving up years of returns in a matter of months. Over and over, fund managers took their “two and twenty” to the bank in the years they happened to be on the right side of that equation. Then they blew up. Instead of fighting back to their hurdle, they just closed shop and opened up a new one, somehow convincing investors to play the same asymmetric game of risk once again. Heads I win, tails I take a vacation for a year and someone gives me another coin to flip later.

Don’t get me wrong, there are managers who have proven track records of not blowing up while playing with beta, and some even generate true alpha, but they are few and far between. Good luck picking the correct fund manager.

Why did it take the market so long to wake up? We can start with the great answers you’ll hear from friends of mine like wealth manager, Josh Brown. He fully understands the social and egotistical aspect of being invested in these funds, not because it’s the rational thing to do, but because of the accompanying prestige. The same can be said for managing your own personal portfolio; it’s something to talk about at a cocktail party. And while it seems our current political climate echoes the movie Idiocracy, financial market education and investor behavior have actually taken a huge leap forward since the ‘08 crash. I find it interesting that retail investors actually got smart before pension funds, pulling money from active managers, closing their brokerage accounts, and investing in passive low cost ETF strategies.

As for the tens of thousands of small RIAs, why would I give them my money either if I can buy a smart beta ETF for 20bps that does basically the same thing they were for 100bps? You’re gonna tell me that all those mom and pop RIAs managing $40M are executing those smart beta strategies as efficiently and accurately as iShares? Please. It’s only a matter of time before Betterment or some other robo-advisor allows its clients to algorithmically allocate a portion of their portfolio to these strategies. Heck, I wouldn’t be surprised if one of them also provided the ability to use simple, proven, market timing overlays in order to rotate in and out or long and short certain smart beta strategies.

Hedge fund PMs have to realize that even though they are in last car on this disruption train, the conductor is coming to clip their ticket as well. They will either evolve or die, like any other industry disrupted by better efficiency. I think it’s obvious that there will be far fewer of them as most will not successfully shift to generating alpha.

2. All Investing Is Active, Even The Passive Kind

Let’s clear something up, there’s no such thing as “passive investing”. The words we use matter because they form the basis for how we think about things and the actions we take. The developed western world is ripping itself apart over an inability to win a “war on terrorism” because, for propaganda purposes, we decided to say we were fighting a war on a military tactic (you didn’t have to study war theory in school like me to know you can’t win a war against a tactic).

All investing is active, even the decision of how to weight an index, what goes into that index, and how to allocate your capital amongst different asset classes. Just because the computer keeps your allocation levels static does not mean you’ve abdicated responsibility for investment decisions. This is why I’m such a big fan of smart beta, because it does away with the ignorant notion that you can avoid making a decision on beta to begin with. We all have to, so we might as well make that decision in an informed and active way.

In any event, we’re going to continue to see massive flows of capital out of “active” long only mutual fund and long/short hedge fund strategies and into these. The question on everyone’s mind is, how will this affect the market? My best guess is that we’re not going to see the downside of massive systemic risks some are warning about when everyone is indexing. The latter part of 2016 and beginning of 2017 prove that even with all the indexed money, correlations can still drop quickly when macro factors evolve. After the 2016 election, cross-asset correlations that have existed for the past decade began to break down as pictured in the charts below.

Exhibit 1: Cross-asset correlations have fallen sharply

3. Assets Are Flowing From Discretionary to Systematic

You don’t have to look too deeply to see this massive trend in strategy allocations playing out. WorldQuant LLC, with its growing team of over 600 employees, including more than 120 PhDs and 275 researchers, has been managing systematic investment strategies for Millennium Management since 2007. At Point72 (SAC) we’ve seen Cubist outpace the discretionary side of the firm by a wide margin with now over 40 systematic PMs. Balyasny has quickly shifted focus and is building a stable of systematic managers to effectively do something with their huge AUM growth. Other multi-manager platforms like Schonfeld, Paloma, AHL, Engineer’s Gate and GSA have added significant assets. Paul Tudor Jones is attempting to remake his firm by hiring a bunch of systematic managers, and others are following suit. And let’s not even get started with the continued dominance of firms like Renaissance, AQR and Two Sigma, where you probably can’t even give them your money if you tried.

I would say that the nerds are the new kings of Wall Street (Midtown), but frankly they (myself included) would cringe at that statement given their propensity to run in very different circles than the rest of the money manager crowd. This group is mostly made up of unassuming nerdy PhD types that you would probably take for accountants on the subway. They have serious mathematical and scientific training and have usually honed their craft on other data sets before coming to the financial world.

The fact of the matter is that there’s simply more efficacy to what these managers are doing than the vast majority of the discretionary trading world, and they’ve (mostly) put up the numbers to prove it. And I’m not just talking about returns, these groups are producing real alpha. Their strategies are meticulously backtested in and out of sample before going live, and are scaled up over time. Many discretionary managers launch a book with $500M in play from day one, I can count on one hand the number of systematic funds that have done that in the past 5 years.

And while some systematic funds don’t perform well, you’ll be hard pressed to find any massive blow ups akin to what’s regularly seen on the discretionary side. Pension funds can certainly deal with paying 2 and 20 if they have more confidence that their returns from year 1 through 3 aren’t going to all disappear in year

The flow of capital from discretionary to systematic strategies is going to continue, as it should. That will have its own repercussions, which we’re already starting to see.

4. Quants Dig For New Alpha

A 2012 tell-all book from a former Goldman Sachs trader revealed how the Great Vampire Squid often endearingly referred to their unsophisticated clients at “muppets.” While they rightfully got skewered for that comparison, they were certainly onto something when their trading desks would remark internally that they were basically taking candy from babies.

However, many of the muppets are gone now and that’s left far less alpha in the market to capture. Relative value and statistical arbitrage strategies are about capturing asset mispricings associated with the irrational behavioral aspects of fear and greed. This isn’t going to change any time soon, the muppets aren’t coming back, they’ve wised up. Less alpha overall will lead to a drop in the number of hedge funds and the amount of hedge fund assets that can generate enough alpha to command high fees.

It truly is amazing to watch a data set go from being an alpha to a beta over time. I’ve seen the sell side analyst estimates data set owned by Thomson Reuters IBES travel this path over the past 15 years. Yes, there will always be alpha available to be arbitraged which is associated with the irrational behavior of humans in markets, but most alpha generated by systematic traders is associated with an informational advantage.

About five years ago many of the classic stat-arb strategies stopped working due to an influx of competitors. There simply wasn’t enough alpha to go around. This precipitated the smartest firms to search for new data sets with predictive power, or reflexivity. Fast-forward a few years and an all out arms race is now under way.

I love to use the example of the company that is selling data captured from new car insurance registrations. They get this data daily, and it’s incredibly accurate at calling new car sales. So instead of waiting until the end of the quarter to find out how many vehicles GM sold, you can basically get a running count of growth on a daily basis. Obviously that’s going to give you an advantage in trading those auto names, that is until everyone else is using that data. At that point, the data set goes from providing alpha you can capture, to a data set that you must be looking at in order to avoid an informational disadvantage. In a sense, it becomes beta.

So the arms race is in full swing, and there is now a serious lack of qualified talent to analyze all of these different data sets and incorporate them into the existing multi-factor models. While the quantitative research process into the efficacy of a data set hasn’t changed much, firms are struggling to build a process around the testing pipeline. The most efficient firms like WorldQuant have been able to take advantage of that competency to move quickly and decisively to incorporate new alphas.

This brings me to my last point about the systematic testing process. In the next section of this article, I’m going to heavily malign the discretionary buy side for being fairly clueless about how to undertake this entire process. The truth is, even most (but not all) systematic quants suffer from a severe lack of creativity and original thought when it comes to generating hypotheses around how to take advantage of a given data set. From our experience working with discretionary firms at Estimize, they are two steps even further behind the quants as it relates to incorporating new data sets.

Let’s just go back to the car sales example for a second. Would you know exactly how to take advantage of that data to run an event study and generate alpha? Probably not. You’d likely want to talk with someone who’s been trading autos for 10+ years to get their take on what they think moves auto stocks and how having a good projection of sales would impact those names. A good quantitative research process requires an ex-ante hypothesis for some level of causation and not just correlation. We need to know roughly why something works, not just that it works, or else we won’t know why it stops working, and as history has proven, everything stops working at some point.

Being able to hand over an easily testable clean data set, and a bunch of original thoughts about how to generate alpha is imperative for data firms to succeed at this process.

5. Quantamental, Systamental, Factor Aware…Call It What You Want

The rise of the systematic quants and their use of these new data sets also had an impact on the poor returns of the discretionary world over recent years. First, the HFT guys killed the day traders making it impossible to pick up pennies. Next, the stat-arb guys crushed the swing traders playing in the couple of hours to one week timeframe. Were they the primary factor of poor discretionary returns? Probably not, but significant none of the less.

A few years ago the first big discretionary firms started making attempts to hire data scientists and acquire new data sources. They’ve mostly failed to integrate any of this into an actual investment process. Then about 6-9 months ago another chunk of the more forward thinking discretionary firms gave in to the realization that they needed to make big changes. It’s not as if discretionary PMs weren’t using data driven statistical approaches to gain an edge, or that none of them had quants on the desk to help, they were just very few and far between.

You may have seen Paul Tudor Jones almost publicly berating his organization in a strange showing of frustration from such a legendary investor. Steve Cohen has been very public about his attempt to shift Point72 in the data driven direction, even commenting that it’s incredibly hard to find good talent these days (we’ll get to this in a minute). The guys who have been successful in this game historically see the writing on the wall. Hell, even the first episode of season two for the show Billions features main character Bobby “Axe” Axelrod giving his team the condensed 3 minute version of this piece, albeit in a much louder tone. So whomever the producers of that show are talking to, this whole thing has seeped into the mainstream buy-side consciousness now.

The shift that needs to happen is similar to the way players were drafted in Michael Lewis’ book, “Moneyball”. Consider how hard the scouts fought against being replaced by algorithms that were far more accurate than they were, and even in the face of all this evidence, refusing to change. Then consider how much money was on the line in baseball, and the astronomically larger amount on the line in our world. You would think that would precipitate a much quicker shift, but in fact, it will only mean a slower one due to the fear of change when dealing with so much money.

As quants, we are taught how to go through the research process to validate the efficacy of a data set or tool. Everything is derived from this process, and there isn’t too much leeway, it is designed as good science. Yes, as mentioned above, you still need a level of creativity in order to do good research. However, discretionary managers don’t even have the framework for understanding how to do that research, or incorporate new things into their decision making process. This is the largest hurdle to making the shift, and I believe less than 20% of managers will clear it.

This shift isn’t just about using new data sets, like Estimize, or the car sales example, it’s about fundamentally buying into the notion that PMs need to be making investment decisions based on putting the odds in their favor by looking at statistics, and not just being gunslingers or bottoms up value guys. That’s an affront to their entire way of doing things, just as it was for the baseball scouts.

6. Algorithms + Human Experience = Optimal Trading

A passage from Michael Lewis’ latest book, “The Undoing Project,” speaks so directly to the issue discretionary firms face today. Lewis writes about a specific behavioral experiment performed on a set of first year residents and accomplished oncologists. In the experiment, the scientists asked the accomplished doctors to tell them how they make a decision regarding whether a patient has cancer from looking at an x-ray. The doctors all tended to give the scientists a 10 point checklist with a 1-10 rating for each of the 10 points, add up the points and you can accurately determine whether it’s cancer or benign. The scientists proceed to give a set of x-rays (the outcomes of which are known only to them) to the doctors and the residents, asking them to determine whether each is cancer or not. They also give the doctor’s checklist to the residents to use.

I think you can guess what happens next. The oncologists who supplied the rubric in the first place show almost zero ability above random to accurately determine whether the x-ray was cancer or not. They didn’t follow their own rubric, suffered from an astounding amount of representative heuristic, and failed to do their job well. Meanwhile, the first year residents were able to score far higher accuracy rates on average and therefore would have been able to help their patients. They were simply acting as the human measurement component of an algorithm.

Similarly, most discretionary PMs would likely supply a rubric for how they make decisions, but when it comes down to it, they don’t actually adhere to it. No set of new data or analytical tools thrown into the “mosaic of information” that the PM is supposed to be paying attention to will matter unless they are disciplined enough to remove their ego from the equation and reduce themselves to being a human algorithm.

There’s an inevitable question that arises from the above, what’s the point of the human PM if we’re going to ask humans to basically be algorithms? Why not just run a fully systematic strategy and remove the human all together after the quantitative research process is complete? Could a first year analyst and some good portfolio construction software more faithfully execute the signals than a PM with 20 years of experience? Science would seem to say yes. That said, there’s obviously a more optimal scenario where that 20 years of experience alongside the discipline to execute the rubric faithfully results in better outcomes due to the ability to see regime changes in the market, something quantitative strategies built on linear analysis have a hard time doing.

It’s my belief that good quantamental / systamental / factor-aware PMs can crush the systematic quants if they are disciplined. Systematic strategies are designed to make small bets across a lot of names using half a dozen or more different signals that each have a weighting in the stock selection and exposure model. A lot of them hit for singles, consistently. But that also means that when a really fat pitch comes down the plate based on all the data, they can’t swing for the fences. This is the advantage of discretionary managers. With the right discipline, they can take a big cut with a 7% position in their book when all the data lines up, and reap the rewards of the hard work.

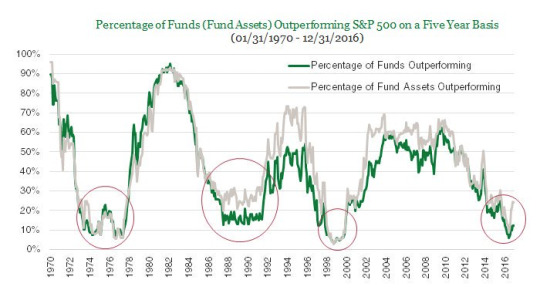

While it’s been a tough run of it recently, there are reasons to believe this is a great time to enter the market with a solid quantitative approach to discretionary trading. The chart below shows that while there may be many secular headwinds for the discretionary investing world, the cyclical nature of this industry is extremely strong, and we’re certainly at the deepest part of the trough regarding performance, with only one direction to go.

7. There’s Plenty of Talent, You’re Just Hiring the Wrong People

The last part of this puzzle is obviously the people. And here’s the sad truth: the way that discretionary hedge funds have staffed themselves historically is almost criminal (there were actually some real criminals in there too!).

Picture the normal funnel to becoming a PM running a $500M long/short equity book. You grew up in a wealthy family in a wealthy town, usually in the New York metropolitan area, parts of Silicon Valley, Chicago or Michigan. You went to Harvard, Yale or Princeton. You took an IB analyst position at Goldman or another bulge bracket. You spent a few years there learning how to build a financial model before a hedge fund picked you up for an analyst spot. You made friends with your PM, who if you were lucky did well, and 5 years later when the firm had more capital than it knew what to do with, your PM told the firm to give you $200M to play with.

At no point in this process did you ever have to exhibit a lick of skill for the job that you’ve just been given. Yes, you are probably a very smart individual, and you worked hard, but we all know that smart does not equal good in the investment world. Every step along the way you were selected not for the trait which would make you the best qualified to do that job, you were selected because you jumped through the hoops which lead to the correct selection bias. The sad truth is that hedge funds are run by white dudes who grew up in Greenwich, and they like (and trust) working with white dudes who grew up in Greenwich and look like them.

And look, this isn’t some idealistic push for equality bullshit comment, it’s about results. If you are hiring these people exclusively, you are not selecting for skill and you will not be able to make the shift to a more data driven quantitative approach, I guarantee it. If I were starting a fund from scratch, I’d rather have a more racially, socioeconomically diverse group of kids from schools other than the Ivy’s than those from Yale who studied political science.

And don’t get me started on the lack of women running money. Every single study ever done says that they are more successful than men due to a range of behavioral and psychological factors. Yet firms tend to overlook women for PM positions due to their inability to play the game that gets them the capital allocation. And of course, we come back to the fact that the entire industry is designed to hire for people that look like the people who are currently in charge.

Firms need to start incorporating measurement of variables pre hiring that actually correlate to success as a PM. They need to start selecting for skill, not just smarts. Our Forcerank platform is beginning to be used for this purpose, and I expect others will pop up over time. I also expect some kind of psychometric testing firm to be created soon which has done the research to identify certain skills and traits that correspond to success in different strategies. You don’t want the same kind of people running momentum models as the ones running deep value.

There isn’t a lack of talent, you just need to look in the right places and be willing to elevate people who might not look, talk, or act like you.

8. Building the Right Team

The other major personnel issue we’re seeing firms grapple with is the question of how to structure their teams to incorporate the quantitative research and data science capability. Some approaches have been successful, and others have failed.

Each firm, whether quant or discretionary, is going to need a centralized infrastructure that is capable of imbibing a new data set and making it available across the firm. Many systematic multi-manager funds, and large centralized managers are already setting up data teams to search for, ingest, clean, and quickly analyze new data sets to test for alpha in their multi-factor models. The heads of these teams are getting paid big dollars, upwards of $2M a year to run this process that feeds the heart of the machine - and there aren’t many good ones out there. The imbalance of supply and demand for this position is causing some funds to make poor hiring decisions in order to simply get someone in the door. The role itself is incredibly multidisciplinary in nature and requires a strong understanding of the quantitative research process, a decent technical background, the ability to travel across the globe to conferences meeting with hundreds of potential vendors, sniffing out what’s real from what’s bullshit, determining what startups will be around tomorrow and which won’t, and then haggling over price. Please tell me which previous role prepares you for all of that?

The firms that don’t hire well here are going to fall behind and see their returns suffer as data sets more quickly than ever move from being alphas to betas as they get arbed. This doesn’t happen overnight, it takes years for alpha to get arbitraged from a data set, but many won’t have as much capacity as those previously, along with a larger stable of systematic managers, things will speed up.

The centralized infrastructure and data acquisition team is going to also house engineers, a product manager, and optimally a quant who can do basic descriptive work on a data set to determine whether it’s clean and reliable enough to have PMs use.

And that’s where the centralized team should end.

Each PM or “pod” should then have a quant, an engineer or two, and a data analyst placed on their desk directly. Here’s why. Each PM is going to be trading different names, and have a need to access different sets of information. Fighting over centralized quantitative research capacity with other pods is a disaster. And then receiving some kind of report that doesn’t fit into your actual process is useless. Each PM is going to have a different checklist or rubric with different signals. And the key is the data analyst, they need to have a deep understanding of the industries the PM is trading so that they can work in coordination with the PM and the quant to build a process that can be effectively utilized. I’ve seen people in this role who also have some coding experience so that they can rapidly prototype stuff for the quant before the centralized team goes out and does the job in a production-ready way. The quant, of course, will be testing different data sets for efficacy, and handing them over to the engineers to build factor models.

A quantitative approach and a commitment to data science by firms is not a thing you do in some other room. The only way this is going to work is if you build cross functional teams on the PM’s desk and support them with a data and infrastructure team at the top.

How Far Down the Rabbit Hole?

So if you’re a PM, do you need to take that data science class at night? Yes, but not for the reason you think. PMs aren’t going to be writing python code and working in R to do quantitative research, that’s not their job. But in order to effectively communicate and run their teams they are going to have to understand all the pieces to the process. And most of all, if they aren’t educated as to how all of this works, how are they ever going to trust the data and signals coming out of the process when the time comes to make buy and sell decisions?

On June 20th the L2Q conference hosted by Estimize is going to give discretionary PMs, analysts, and traders a one day overview of the different pieces they need to get up to speed on in order to effectively build and run their teams. The goal of the conference is not to have everyone walking away knowing everything, it’s meant as a jumping off point, to give a sense of perspective for where managers need to go next, and we’ll have the vendors there that can help them take the next steps to getting educated. We’ll also have a number of heavily vetted data vendors which can fit into this process and add alpha generating signals, including our own Estimize and Forcerank data sets.

Hope to see you there!And if you are interested in discovering more alpha using the Estimize data set, please contact us today!

1 note

·

View note

Text

Dave’s Brain Farts; At the 'Costa' My Sanity

Hello internet, and welcome to another one of Dave's Brainfarts. This is where I talk about all things comics, games, toys, movies, and general nerdery.

Considering the subject of my last few rants on here, it should be abundantly clear by now that I really do not like the literary works of Mike Costa.

I'd never even heard of the guy up until 2009, when it was announced that he would be the lead writer on the new Transformers ongoing series, after the 'All Hail Megatron' series. All I knew about him, going into Transformers 2009, was that he had previously worked on IDW's G.I. Joe series, which had gotten pretty positive feedback.

And boy was Transformers 2009 a let down, lemme tell ya...

The series was dead on arrival, though most of the initial flack was targeted towards Don Figueroa, who had done the art for the series, Costa was just as much to blame for many of TF 2009's problems. Most of the complaints towards Don were about his design choice for the Transformers, mainly that he had taken on an aesthetic closer to the Michael Bay movies. They weren't bad designs, but I think what ticked fans off about them were mostly the facial designs of the characters, and the fact that this was shortly after the release of Transformers; Revenge of the Fallen, which was still leaving a bad taste in people's mouths.

But I'm not here to talk about Don Figueroa, I'm here to talk about the guy who's name I made into a terrible pun in the title.

Apart from the art, the other failing point of Transformers 2009, or as it was known at the time, Transformers Ongoing, was the writing, the complete lack of direction, lack of character, and lack of effort.

Let's summarize the events of Ongoing;

Arc 1; Humans are hunting down the Autobots after the events of All Hail Megatron. Ironhide is killed by humans. Hot Rod is being angsty. Optimus is being a whiny bitch and steps down as Leader. Bumblebee is made Autobot leader. The humans and autobots form an alliance.

Arc 2; The Autobots go to war with North Korea... no, seriously.

Oh, and there's a one shot where Spike murders a Decepticon.

Arc 3; Americans are mad that the Autobots are working with humans and use knockoff mind controlling Megatron guns to try and kill them.

Arc 4; Autobots leave earth to fight Galvatron on Cybertron.

Considering I could summarize most of those arcs in one sentence tells you just how much depth there was in them. Out of the 30 or so issues that went into Ongoing, only TWO ever got more than 3 stars, these two issues are considered the best of the series and are character studies of Optimus Prime and Megatron, which brings up both of their personal histories in the IDW G1 continuity, except Mike Costa did not write these issues, James Roberts did.

From what I was able to gleam from Costa's run of Transformers, I found his writing to be really lacking, he had an inability to properly portray characters or even give people character, the story kept flip flopping all over the place. Things just happened without explanation, Optimus quitting over the death of Ironhide was one such dumb move, Hot Rod partnering with Swindle was another dumb move, and then there was the whole 'International Incident' arc (the aforementioned Autobots vs North Korea story).

His writing is lazy, his characters bland, he tries to set up big plot twists that always fall flat, his stories are riddled with inconsistencies and plot holes, and that's not even the worst of it.

I can tolerate bad writing, most of the time, but what really set me off about Mike Costa was the fallout after Ongoing.

With how badly received the series was by fans, how did Costa respond to the fact that people didn't like his Transformers comic?

By blaming the readers, and blaming the source material.

I can't find the interview in its entirety, but the summarize, Costa first blamed Transformers fans by basically saying, 'they don't know what they want'. He also followed up by saying he didn't know how to make a series about giant robots who turn into cars and trucks interesting or realistic.

Um, Mike, I don't know if you've noticed this but... YOU ARE A WRITER! IT IS YOUR JOB TO MAKE THE STORY INTERESTING!

If you didn't think you could do it, why did you even do it at all?

Suffice it to say, while I'm willing to, sometimes, tolerate bad writing, I have no tolerance for a writer who cannot own up to their shortcomings, or accept the fact that people don't like their work, and I have no tolerance for a writer who will act like a whiny little pissant who blames his shortcomings on his audience and the source material.

So why am I talking about Costa again, despite having no respect for the guy or anything he writes?

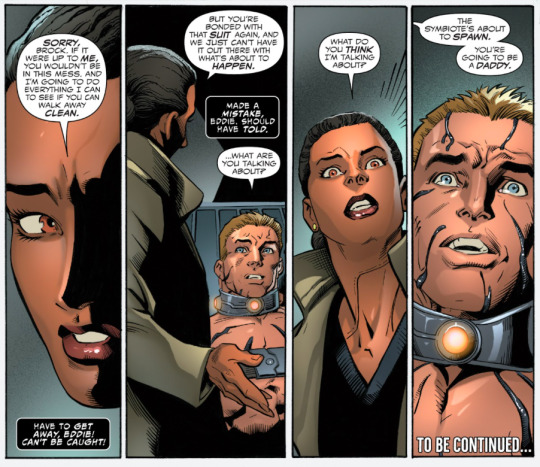

That is because, not only did he write the single most hated Transformers series of the 2000's, he had to go and get his filthy mitts on Venom as well.

Now, like most kids of the 90's, my initial exposure to Venom was through the Spider-man TV series. I knew who Venom was, but I was never really into him at the time, he was just a dark Spider-man, I didn't even know who Eddie Brock was, and to be honest, I didn't care, Eddie didn't interest me, the Venom symbiote did.