#2018 fha loan mortgage insurance

Explore tagged Tumblr posts

Text

Document Automation and the Future of Non-QM Loans with IDP solutions

As margins thin out, lenders are faced with the task of reconfiguring their existing cost structures while looking for alternate revenue streams. The non-QM market is emerging as a lucrative and practical solution for many. COVID-19 halted the boom of non-QM due to the liquidity constraint, however, it regained its market share and finished 2021 with 25 billion worth of originations and is anticipated to double in 2022.

What is a Non-QM Loan?

A loan which has any one of the criteria below will be considered non-QM:

Debt-to-Income greater than 43%

Blemish on FICO credit due to unforeseen circumstances

Self-employed for less than two years

Low income on tax returns

A non-qualified mortgage doesn’t conform to the consumer protection provisions of the Dodd-Frank Act.

For example, if you have a DTI of more than 43% or have erratic income and don’t meet the income verification requirements set out in the Dodd-Frank Act or by most lenders, you are not eligible for a qualified mortgage and may be offered a non-qualified mortgage instead.

How Do Lenders Verify Income for Non-QM Loans?

Non-QM loans don’t adhere to the standards required for QM loans, but that doesn’t mean they are low-quality loans. A study conducted in 2018 shows that the differences in credit score and loan-to-value ratio between non-QM borrowers and QM borrowers are minimal. However, non-QM borrows on average do have a higher DTI ratio.

Non-QM loans provide flexibility for lenders to offer mortgages to people not eligible for QM loans. Nevertheless, lenders still need to substantiate the documents provided, including income sources. They may also want to verify assets or any other information that assures them the borrower will be able to repay the loan. Non-QM loans are not insured, guaranteed, or backed by FHA, VA, Fannie Mae, or Freddie Mac.

The Evolution of the Mortgage Market

The non-QM market shows promise for the future due to the below factors:

Stricter Regulations

Regulatory bodies, Fannie Mae, and Freddie Mac have made stricter restrictions to reduce possible risks by limiting the percentage of qualified loans offered. This has resulted in a smaller government box, isolating a large section of borrowers who do not conform with the GSE. Moreover, with bank lending restrictions also becoming stricter, this aided non-QM loans to become a more accommodative alternative for loan seekers.

2. Evolving Borrower Profile

There has been a radical change in employment profiles across the country triggered by the COVID-19 pandemic. Entrepreneurship is on the up with a significant percentage of salaried individuals starting their own business due to loss of jobs.

According to statistics, the growth of start-up businesses in the country has risen by 24% from 2019 to 2020. A Forbes report published in 2019 estimated that nearly 30% of Americans are self-employed. This opens the non-QM market to a large number of individuals who become natural candidates for non-QM loans as Fannie Mae and Freddie Mac primarily favor the salaried class.

3. Soaring Home Prices

Home prices over the past few years have seen a gradual rise. The mortgage market is generally shifting away from refinances, which made up over 50% of the market in the last 12 months, to a purchase driven market. The demand for large-sized loans has increased – mostly in the form of Non-QM, as the GSE guidelines around investment properties have been disqualifying most candidates for agency loans.

Key Challenges Faced by Lenders in the Non-QM Space

While interest in the market is on the rise, there are challenges for Non-QM loans. Despite the growing interest, the sector does face some basic functional challenges that lenders are required to overcome. The key ones are detailed below-

Managing Error-Prone Manual Processes

Manual processing of Non-QM can lead to errors, longer timelines and higher costs. Non-QM products do tend to be a bit diverse. This makes the requirement of proper technology to streamline tasks and improve efficiency levels across the organization quite a pressing one. Though there are many generic automation solutions available in the market, Non-QM loans require specialized solutions to get the domain intelligence into the system.

2. Mitigating Risks of Frauds

Mortgage fraud has been rising steadily in the last decade. Due to a relaxation in DTI ratio and other criteria, it becomes critical for Non-QM providers to have a robust risk and fraud mitigation mechanism.

3. Dealing with the Changing Cost Structures

When looking at the total number of mortgage units over the last 10 years, the market has fluctuated up or down by up to 50% each year. It’s clear that mortgage is an industry that is subject to high fluctuations. Due to this ambiguity, increasing fixed costs by investing in additional capacity can be a risk.

The pivotal role of specialized document automation technology in overcoming functional challenges

Specialized solutions can help to overcome functional challenges faced in disbursing Non-Qualified Mortgages. Document automation involves using advanced technology such as AI to simplify the lengthy tasks pertaining to disbursing a typical non-QM loan – right from onboarding, processing, underwriting, pricing, packaging, and closing in a cost-effective way.

DocVu.AI – the most innovative AI/ML solution for BFSI* is designed to be workflow-driven and follows the same set of rules that is adhered to when tasks are manually executed. With the use of intelligent algorithms, the solution significantly increases the pace of execution and reduces the probability of costly human errors.

As a result, Non-QM Mortgage lenders gain increased freedom to take on additional workload due to the automation introduced at several points without worrying about capacity constraints. This empowers the lenders to place their undivided focus on core areas for sustainable growth.

*As per IBS Intelligence 2021 ratings

0 notes

Text

Mortgage Lenders

Mortgage lenders assess your financial and credit history to determine whether you are eligible to borrow funds to purchase a home. They also manage your repayment process and navigate relief options if you cannot afford your payments.

Mortgage lender services are offered by banks, credit unions, nonbank lenders and mortgage brokers. They typically request income and asset documentation, pull a credit report and analyze debt-to-income ratios.

Banks

Banks are large financial institutions that offer a variety of financial products, including mortgages. They typically have a long history of stability and a solid reputation. They may also have a greater online presence and more customer reviews to help guide your decision. They prioritize your business and can offer personalized service. However, their size can limit their options, and they may have stricter requirements for loan approval.

Local banks can be used as mortgage lenders, but they generally focus on other products like checking and savings accounts, certificates of deposit, auto loans and credit cards. They may offer loyalty incentives for existing customers, but their mortgage offerings are limited and they typically have stringent eligibility requirements.

Mortgage lenders specialize in mortgages and have extensive experience qualifying borrowers with unique financial situations that don’t easily fit into conventional underwriting standards. They can often process and approve loans more quickly than banks and have a broader library of mortgage products to choose from.

Credit Unions

Credit unions typically offer lower mortgage interest rates because they're not profit-driven. Like banks, they're federally insured. But unlike banks, credit unions are less likely to sell your mortgage loan to third-party lenders or servicers.

They're also more likely to know you personally, making it easier to work with a lender you trust over the life of your mortgage. In addition, credit unions often offer home equity lines of credit (HELOC) and second mortgages.

However, they may not have as many branches or ATMs as national banks. And they usually have membership requirements, such as residence, occupation or community affiliation. Plus, they may have fewer financial products, such as savings and investment accounts or credit cards. Still, if you're looking for personalized mortgage service and low fees, a local credit union might be worth considering. And if something goes wrong in the mortgage process, you can always go to your local branch for face-to-face help.

Nonbank Lenders

While traditional banks still dominate the mortgage market, they’re increasingly facing competition from nonbank lenders. Non-bank lenders often offer more flexible lending criteria, faster processing times and competitive interest rates.

They’re also more willing to approve borrowers who might be rejected by bank lenders. For example, those with less-than-perfect credit scores or unconventional income sources. They may even specialise in providing government-backed loans like VA and FHA mortgages aimed at higher-risk borrowers.

But while nonbanks can offer borrowers a more flexible variety of mortgage products, they also typically charge higher fees. To examine these costs, Bloomberg News analyzed 38 million Home Mortgage Disclosure Act data from 2018 to 2022. It found that upfront fees are closely correlated with borrowers’ credit scores, which help lenders set interest rates and determine whether to approve a loan. This makes analyzing them critical to fair-lending analysis.

Mortgage Brokers

Mortgage brokers act as intermediaries between lenders and borrowers. Typically, they find a lender that will make the particular type of mortgage a borrower needs and then help arrange the loan process. Typically, mortgage brokers receive payment either from the borrower or the lender for their services. This fee is usually incorporated into the overall cost of the loan.

Mortgage brokering can be an effective solution for borrowers with credit problems that would keep them from qualifying through direct lender programs. However, borrowers should carefully evaluate the mortgage broker they're working with to determine whether they provide enough options or have any preference for certain lenders.

Ask a potential mortgage broker about their experience, the precise help they offer and how much they charge for their services. It's important to know how they make money, since this may affect whether they steer borrowers toward loans with higher fees or rates. Ask to see a copy of any fees they charge before you decide to work with them.

1 note

·

View note

Text

YES YOU CAN! Get Rid Of Your FHA Mortgage Insurance - Today's Mortgage and Real Estate News

New Post has been published on https://hititem.kr/yes-you-can-get-rid-of-your-fha-mortgage-insurance-todays-mortgage-and-real-estate-news/

YES YOU CAN! Get Rid Of Your FHA Mortgage Insurance - Today's Mortgage and Real Estate News

I’m no longer internationally identified, but i am identified to rock the microphone. This is Dan for your inside of team at Growella, it’s Wednesday, April 18, 2018. Welcome to modern day personal loan Minute-and-a-half. I write spins, not tragedies, and the U.S. Housing market has been something but a tragedy when you consider that bouncing off its backside in late-two thousand twelve. Within the near-six years considering the fact that, dwelling values are up almost forty percentage nationwide. And if you are a homeowner with an FHA-backed loan, this upward thrust in dwelling values is above all just right information for you considering it means that you may regularly discontinue paying those FHA mortgage coverage premiums. Sure, i do know. You had been told by using your lender that FHA MIP lasts for the life of your loan and that is real for everyone who used an FHA loan and put down lower than ten percent on their buy.But, but! Phrases have meaning, and "loan coverage for the life of your loan" does not imply the equal as "mortgage coverage endlessly". "For the lifetime of your loan" method unless your mortgage ends, and your FHA mortgage can end in these days. Keep in mind: residence values are up by lots this 12 months, and likewise in latest years. The compounding outcomes has given you equity. And, that FHA loan that was once a first-rate match for your date of buy is likely less-than-most suitable in these days. You will have the alternative to refinance to a non-FHA mortgage, that doesn’t charge FHA loan coverage, and that may shut in less than a month.Do it zero-closing rate, if you need. Simply do it and cancel your FHA MIP. It’s better to procedure these sort of things with a way of poise and rationality. I mean, technically, your mortgage is saved. Talk to a lender to start to grasp your choices. It is any such first-class line between stupid and clever, and the same is true for the exchange in personal loan premiums this week.Charges have moved slash, but most effective moderately. Conforming, FHA, VA, USDA and Jumbo rates are increased. Your exact quote will fluctuate situated in your mortgage size, your credit score ranking, and where you live; and through your option in lenders. Keep in mind to talk to 2 extra lenders earlier than deciding on a price, and decide upon the lender that presents your appreciated combo of service, premiums, and fee. It can be this type of exceptional line between stupid and clever, and the equal is correct for the alternate in personal loan premiums this week. Premiums have moved larger, however best reasonably.Conforming, FHA, VA, USDA and Jumbo premiums are worse. Your genuine quote will vary based in your loan dimension, your credit score rating, and the place you live; and by your option in lenders. Do not forget to speak to two extra lenders earlier than settling on a rate, and decide upon the lender that presents your preferred combo of carrier, charges, and fee. It can be the one weird trick to repay your mortgage rapid. Besides it can be now not a trick. And, it is no longer bizarre. It is a 15-yr mortgage and it’s about as un-weird as anything else in loan. Makes for just right advertising and marketing, however as in comparison with a thirty-yr mortgage, can it make for good individual finance? Yes, it will possibly.Because fifteen-year mortgages diminish the amount of interest a homeowner can pay to its lender over the lifetime of a mortgage, and those savings are foremost. At modern-day loan charges, you can pay forty-seven percentage less interest with a 15-year loan as in comparison with a thirty 12 months which, in greenback terms, is 100 twenty thousand bucks saved for each two-hundred fifty thousand borrowed. That is pretty good. Lovely lovely beautiful just right. But those financial savings don’t seem to be what’s pleasant for everyone. Here is why. Fifteen 12 months mortgages shop property owners cash with the aid of decreasing with the aid of half the number of years over which their loan is paid again. And, to accomplish that, payments get compressed into a fewer quantity of years. You get a reduce rate, however your repayments go up by means of virtually half. And, if that’s anything you need to deal with, the long-time period payoff is huge. Except it’s now not a bizarre trick.It can be just a bit math. Ask your lender for help with the numbers. Remember whether or not fifteen-12 months loans are what’s exceptional for you. Growella does well timed and central personal loan news thrice weekly and we do a enjoyable, are living session every Thursday at midday jap. So, put a like on it, leave a remark, and, don’t forget that if dad jokes have been fairly that bad, they’d be referred to as bachelor jokes as an alternative. .

#2018 fha loan mortgage insurance#cancel fha loan#fha loan mip#fha loans#fha loans 2018#fha mip#fha mortgage#fha mortgage insurance#fha mortgage loans#fha mortgage rates#fha refinance#housing market index#low down payment mortgage#mortgage news#mortgage news today#Mortgage Rate News#mortgage rates#mortgage rates today#national association of home builders#personal finance#real estate#real estate news#refinance fha loan#refinance fha to conventional

0 notes

Text

YES YOU CAN! Get Rid Of Your FHA Mortgage Insurance - Today's Mortgage and Real Estate News

New Post has been published on https://hititem.kr/yes-you-can-get-rid-of-your-fha-mortgage-insurance-todays-mortgage-and-real-estate-news/

YES YOU CAN! Get Rid Of Your FHA Mortgage Insurance - Today's Mortgage and Real Estate News

I’m no longer internationally identified, but i am identified to rock the microphone. This is Dan for your inside of team at Growella, it’s Wednesday, April 18, 2018. Welcome to modern day personal loan Minute-and-a-half. I write spins, not tragedies, and the U.S. Housing market has been something but a tragedy when you consider that bouncing off its backside in late-two thousand twelve. Within the near-six years considering the fact that, dwelling values are up almost forty percentage nationwide. And if you are a homeowner with an FHA-backed loan, this upward thrust in dwelling values is above all just right information for you considering it means that you may regularly discontinue paying those FHA mortgage coverage premiums. Sure, i do know. You had been told by using your lender that FHA MIP lasts for the life of your loan and that is real for everyone who used an FHA loan and put down lower than ten percent on their buy.But, but! Phrases have meaning, and "loan coverage for the life of your loan" does not imply the equal as "mortgage coverage endlessly". "For the lifetime of your loan" method unless your mortgage ends, and your FHA mortgage can end in these days. Keep in mind: residence values are up by lots this 12 months, and likewise in latest years. The compounding outcomes has given you equity. And, that FHA loan that was once a first-rate match for your date of buy is likely less-than-most suitable in these days. You will have the alternative to refinance to a non-FHA mortgage, that doesn’t charge FHA loan coverage, and that may shut in less than a month.Do it zero-closing rate, if you need. Simply do it and cancel your FHA MIP. It’s better to procedure these sort of things with a way of poise and rationality. I mean, technically, your mortgage is saved. Talk to a lender to start to grasp your choices. It is any such first-class line between stupid and clever, and the same is true for the exchange in personal loan premiums this week.Charges have moved slash, but most effective moderately. Conforming, FHA, VA, USDA and Jumbo rates are increased. Your exact quote will fluctuate situated in your mortgage size, your credit score ranking, and where you live; and through your option in lenders. Keep in mind to talk to 2 extra lenders earlier than deciding on a price, and decide upon the lender that presents your appreciated combo of service, premiums, and fee. It can be this type of exceptional line between stupid and clever, and the equal is correct for the alternate in personal loan premiums this week. Premiums have moved larger, however best reasonably.Conforming, FHA, VA, USDA and Jumbo premiums are worse. Your genuine quote will vary based in your loan dimension, your credit score rating, and the place you live; and by your option in lenders. Do not forget to speak to two extra lenders earlier than settling on a rate, and decide upon the lender that presents your preferred combo of carrier, charges, and fee. It can be the one weird trick to repay your mortgage rapid. Besides it can be now not a trick. And, it is no longer bizarre. It is a 15-yr mortgage and it’s about as un-weird as anything else in loan. Makes for just right advertising and marketing, however as in comparison with a thirty-yr mortgage, can it make for good individual finance? Yes, it will possibly.Because fifteen-year mortgages diminish the amount of interest a homeowner can pay to its lender over the lifetime of a mortgage, and those savings are foremost. At modern-day loan charges, you can pay forty-seven percentage less interest with a 15-year loan as in comparison with a thirty 12 months which, in greenback terms, is 100 twenty thousand bucks saved for each two-hundred fifty thousand borrowed. That is pretty good. Lovely lovely beautiful just right. But those financial savings don’t seem to be what’s pleasant for everyone. Here is why. Fifteen 12 months mortgages shop property owners cash with the aid of decreasing with the aid of half the number of years over which their loan is paid again. And, to accomplish that, payments get compressed into a fewer quantity of years. You get a reduce rate, however your repayments go up by means of virtually half. And, if that’s anything you need to deal with, the long-time period payoff is huge. Except it’s now not a bizarre trick.It can be just a bit math. Ask your lender for help with the numbers. Remember whether or not fifteen-12 months loans are what’s exceptional for you. Growella does well timed and central personal loan news thrice weekly and we do a enjoyable, are living session every Thursday at midday jap. So, put a like on it, leave a remark, and, don’t forget that if dad jokes have been fairly that bad, they’d be referred to as bachelor jokes as an alternative. .

#2018 fha loan mortgage insurance#cancel fha loan#fha loan mip#fha loans#fha loans 2018#fha mip#fha mortgage#fha mortgage insurance#fha mortgage loans#fha mortgage rates#fha refinance#housing market index#low down payment mortgage#mortgage news#mortgage news today#Mortgage Rate News#mortgage rates#mortgage rates today#national association of home builders#personal finance#real estate#real estate news#refinance fha loan#refinance fha to conventional

0 notes

Photo

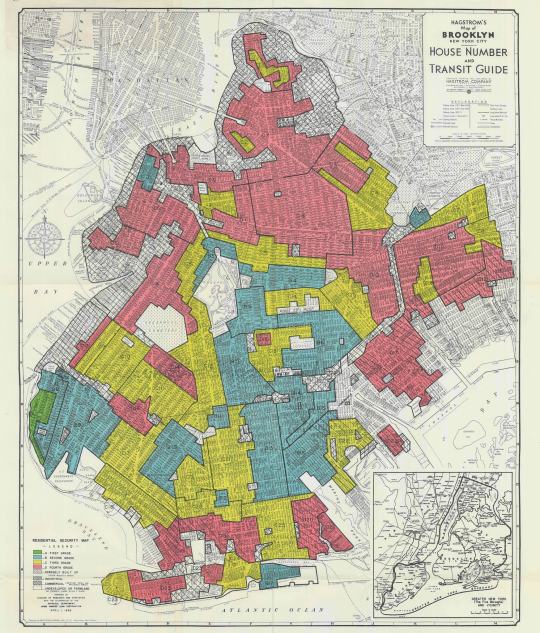

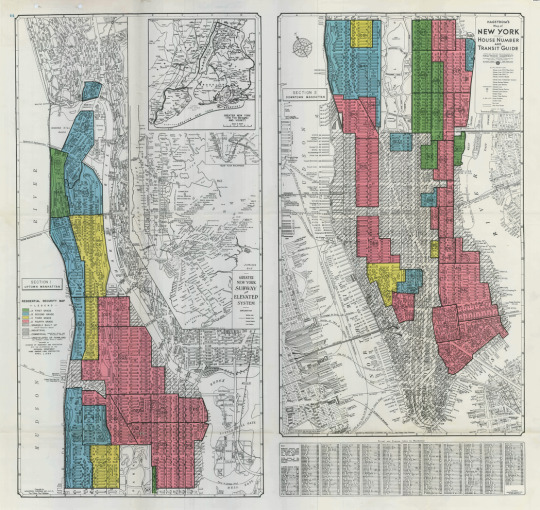

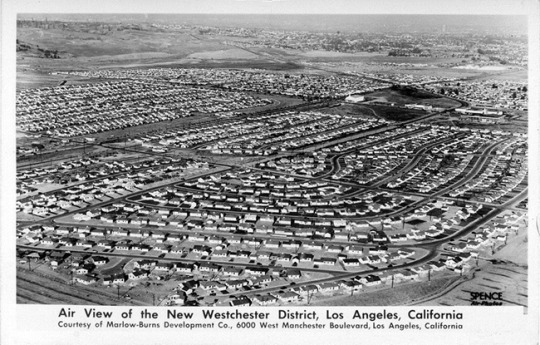

Redlining in America Part 1: The Origin of Redlining

Redlining is the practice of rating neighbourhoods for their value and perceived risk when issuing mortgages. What made it so destructive, both at the time and for generations to come, was the heavy racial element involved in these assessments and its promotion of segregated living, schools and many other facets of people’s lives.

Origins While the term ‘redlining’ wasn’t coined until the 1960s, the practice began in the 1930s. The early 1930s saw a housing crisis, with families already in homes defaulting on their mortgage repayments due to the financial crisis, and a stall in the construction industry as the number of new home constructions dropped off alongside a drop in new homeownership.

In 1933, the federal government launched the Home Owners’ Loan Corporation (HOLC), which purchased existing mortgages in imminent foreclosure, and then reissued them with longer repayment schedules (up to 15-20 years, as opposed to their previous 3-5 years). They were also at lower interest rates and became fully amortized, meaning for the first time working- and middle-class homeowners would gradually gain equity during the mortgage and eventually own the property in full. The HOLC created their own colour-coded maps with which they (in large party) decided the risk of a neighbourhood. These maps were made for every metropolitan area across the country.

The government also tried to encourage middle-class families to buy single-family homes, and in 1934, as part of the New Deal, the Roosevelt administration created the Federal Housing Administration (FHA). The purpose of the FHA was to insure bank mortgages, extend their terms up to 20 years, and make them fully amortized.

To qualify for both the HOLC mortgage buy-out and the insurance from the FHA, the property in question would be evaluated for risk to assess the risk of the loan. HOLC used their colour-coded maps, and the FHA used agents working from their Underwriting Manual, which included detailed direction for assessment. If the assessment judged the property too high-risk the HOLC would not rescue the mortgage and it would go into foreclosure, and the FHA insurance would be rejected, and the property deemed “unfit for investment” by the bank, resulting in that potential homeowner being unable to purchase.

Continue Reading...

This is just the bare-bones basics of redlining and its origins, the next post in the series will go into the assessment process and destructive results of it.

Redlining in America - Part 2: Assessment

Redlining in America - Part 3: Discrimination and Damage

Useful Resources

BOOK Rothstein, R. (2018) The Color of Law: A Forgotten History of How Our Government Segregated America. New York: Liveright Publishing Corporation. — This was probably the single most useful book I used during research.

My Research Notes

Image Sources

HOLC Map of Brooklyn, 1938 | Source HOLC Map of Manhattan, 1938 | Source Lower East Side, c.1930s | Source Winchester, CA suburban development, c.1930s | Source

This post has been sponsored by my much loved and long-time Patreon supporter Joanna Daniels. She and I would like to dedicate the post to the loving memory of her mother Joan Daniels. She will be sorely missed.

[ Support SRNY through Patreon and Ko-Fi ] And join us on Discord for fun conversation! I also have an Etsy with upcycled nerdy crafts

#Steve Rogers#Redlining#american history#Black History#New York#Structural Racism#Structural Violence#1930s#early 20th century#History#historically accurate#historic new york#Captain America#Bucky Barnes#Captain America: The First Avenger#captain america tfa#CAPTAIN AMERICA REFERENCE#fanfiction#fanfic writing#Fanfic references#fanfic research#writing#writing resources#fan fic writing#writing reference#urban history

17 notes

·

View notes

Text

Homeownership and the true cost of homeownership

What Everyone Ought to Know About The True Cost of Homeownership?

Many people don’t really understand the details about the true costs of homeownership. Today, we’re going to be talking about the true costs of homeownership and the other factors that comes with buying a home.

Homeownership is a long-term financial commitment. Buying a home requires a down payment, closing costs, and other expenses. The true cost of homeownership is calculated along with other factors included in the home buying process. On this article, we will discuss how $707 is the true cost of homeownership when buying a $315,000 house.

So what is the true cost of homeownership?

There is no universal answer to this question, you simply have to run the numbers.

But if you are after a precise answer, the analysis can be quite complex.

Current interest rates, where they are and where are they headed with the feds

the mortgage financing

and the qualifying for a home mortgage

Above are essential factors of knowing the true cost of homeownership.

$707 = True cost of homeownership

What if I told you and or the audience that a $315,000 house costs approximately now about $707 a month?

For example, we take a $315,000 house and put down 5%. Let’s first start off with 5% down, which is $16,000. That would mean we have a loan amount of $300,000.

We want to emphasize that from a consumer’s perspective if we ask 10 people what it costs to buy a $315,000 house, 80% will tell you $40,000 – $60,000. They needed this unbelievably high credit score.

Principal and interest on that loan amount would be $1,610.

I’m going to use $250 a month for homeowners insurance, $400 a month for real estate taxes and $132 for mortgage insurance, giving us a grand total of $2,392 a month in terms of a monthly payment.

How is $707/month the True Cost of Homeownership for a $315,000 home?

We understand that the principal interest, taxes, and insurance are $2,392 per month, let’s now dive into the numbers.

TAX DEDUCTION

Let’s break down the tax deduction on a monthly basis, $800 of that payment interests.

So that means $9,600 of that annually will add up to $9,600 a year in annual interest real estate taxes.

If it’s $400 a month that would mean $4,800 a year would be the real estate taxes. So we add the two together, which is 14,400, assuming a 30% tax bracket that would mean a true refund.

A true refund of $4,320 a year, meaning $360 a month.

If we have a $2,392 payment, we understand that $360 of that will be coming back to us for owning the home.

Let’s go a little further……….

PRINCIPAL & INTEREST PAYMENT

We understand that of the $1,600 worth of principal and interest is principal meaning $800 of it, that would mean, the principal is money coming out of our personal savings account and going into our home savings account. So that $800 which is $9,600 / year is going into our home savings account, right?

Take that amount of money because it’s our money going into that savings account off of the monthly payment. So that’s another $800 a month. So, so far we have $360 coming off the payment because of tax deduction. $800 because of our principal.

ANNUAL APPRECIATION

And last but not least, using a 2% annual appreciation, which is ultra conservative.

Ultra conservative. So that’s less than the cost of living would be $6,000 a year roughly, which would be equal to $525 per month.

LET’S DO THE MATH!

We start off with principal interest, taxes, and insurance of this payment being $2,392 minus the tax deduction of $360 a month. We minus our principal payment of $800 per month and we minus our appreciation of $525 a month giving us a true cost of homeownership for $707 a month based on these facts.

Isn’t that interesting?

Other people aren’t so much numbers people, but the bottom line is when you’re working with different professionals and things like that and they can really explain it to you and how it works out to basically buying a home at $315,000 and the actual hard costs to you by the time you back out everything is only $707 a month!

Why is everybody out there running to purchase a home?

Lack of education.

Our industry does a poor job of providing this type of data. Some professionals don’t educate the consumer enough as to what the true cost of homeownership is. Now, of course there’s going to be maintained that you have with the home and so on, but when you stop and think about it now we’re using a 2% factor in terms of appreciation. We can all agree that’s a very low number. And here in Florida, depending on the market, even 4% it’s quite low.

When you think about long term homeownership, you always hear the stories about our relatives up in the northeast sold their home and moved down here, owned it for 10-15 plus years. When you look at their acquisition price versus what they sold for and you get it all out, even with maintenance, half the time you’ve owned the home for free and sometimes in a profitable situation.

Don’t feel trapped any more! After knowing the true cost of homeownership, grab this FREE Special Report and learn “How To Stop Paying Rent and Own Your Own Home”

Mortgage Financing

When we think about the overall market and where we’re at right now, a couple of things. We go back to the educational component. And the biggest challenge that I think people have and even agents as well is not understanding how simplistic mortgage financing is.

The vast majority of Buyers put themselves at an overwhelming disadvantage by approaching the process entirely wrong.

Now that you already know the true cost of homeownership, it’s time to obtain the Best Rates & Lowest Closing Costs in South Florida

From 2008 to 2018 where are we today? And the truth of the matter is that it’s never been easier in a sense to get mortgage financing.

Now we have FHA government programs to where there’s no credit score requirement.

Why?

The way it works nowadays is it’s through automated underwriting systems.

So for example, we approve someone with as low as a 550 credit score just two weeks ago.

But virtually no credit score requirement, you can use baselines. 580 credit score is acceptable for conventional financing, 620 is acceptable. So these are not the highest of scores down payment, as little as 3%. And we also nowadays have these government grant programs that are built into the loan products. So you’re not running around from city to city trying to see who’s got the money.

We actually have a product that we actually give you the money through the loan products or you’re putting down zero.

So what debt to income ratio mean?

A lot of people out there don’t really understand that. What’s the backend?

Debt to Income Ratios

We can go over 50% debt to income ratio. That is your income up against your housing expense can be over 50%. So when you think about that, we have co-borrowers that we can bring on. If someone doesn’t qualify, mom and dad can jump on the loan. There are so many different avenues to get them home.

Let’s use a $5,000 a month income. And let’s say that someone’s mortgage payment is going to be $2,500 a month. That would be 50%, right? So their income is $5,000 their mortgage payment would be, $2,500 so the front end debt ratio.

Think about that, that’s almost 50% of their income can be used for the mortgage payments to qualify. It’s a big number.

That is a big number. Aren’t people, don’t people get scared about that number?

It depends on who you’re asking. Look what it does, it builds wealth.

Federal Reserve: So where are we headed?

Interest rates have been creeping up just a little all-time low still, but they’ve been creeping up a little bit.

Interest rates are up about three-quarters of a percent in the past, we’ll call it 9 to 10 months. We are what we would refer to as in an ascending rate environment. Rates are moving up. Rates right now are falling anywhere between the high 4’s to low 5’s depending on the overall profile. And I have to tell you that it’s an interesting adjustment on a day to day basis in terms of communicating that five number.

It’s still a bargain. The federal prime rate right now is at 5%. It’ll probably end up near five and a half percent by year-end is what we would think. But let’s put all of that into perspective.

We should have interest rates. Interest rates should be around seven and a half percent. The truth of the matter is, is that a fourth, seven and a half percent that means the banks are giving you 5% 500% of your CTE, right? That means the fixed income retired borrower is getting more money on there, on their savings, more money circulating.

If the Federal Reserve confident to increase rates, that means we’re doing well as a country, as a whole.

Our economic position is gaining momentum. We’re creating more jobs.

So someone can let’s say, pay 4.875 on an interest rate, which is up to three-quarters of a percent, but they’re 401k is up 25%.

I mean, what are those numbers really look like when you think about it?

Conclusion

Homeownership is really the American dream and really designed to get you there. Now, of course, there’s a lot of different factors at play when it comes to knowing the true cost of homeownership, but on the long term, we can all agree you can never go wrong.

If you are thinking of buying today, don’t wait any longer. If you have a correct plan in place, know the true cost of homeownership and if you understand what your length of ownership is going to be.

A home is not trading stock. It’s not trying to sharpshoot a bottom. That’s not how wealth is created. The purpose of real estate is to own it.

And so if we think about it from that perspective, a home houses our family, it brings us a lot of joy. It brings us a lot of financial benefits. It brings us tax deductions, a whole lot of benefits come along with being a homeowner. We all know that if we put a long term time frame on real estate, we will almost never go wrong.

Each month, we publish a series of articles of interest to homeowners in Palm Beach and Broward County– money-saving tips, household safety checklists, home improvement advice, real estate insider secrets, etc. Whether you currently are in the market for a new home in South Florida, or not, we hope that this information is of value to you. Please feel free to pass these articles on to your family and friends.

At The Stampini Team, we’re happy to answer any questions you have about buying and selling in the Palm Beach-Broward County area.

Call us now or feel free to share our contact information

with someone you know that needs expert help buying or selling their home.

Receive South Florida real estate news and trends straight to your inbox. Stay connected to the community and be the first to know when new homes come on the market. Sign up here!

#buyahome#CostOfHomeownership#downpayment#financing#home buyer tips#homebuyers#homebuying#homeownership#interestrates#mortgage#MortgageFinancing

1 note

·

View note

Text

Home Amh Homes

The inhabitants has been growing at roughly two % a year. This causes the Fort Collins real property market to appreciate at a barely faster fee, however the Fort Collins housing market isn’t so sizzling that locals are priced out. In LA or San Francisco, that’s enough new home builders in albuquerque for a cramped condo. One of the most costly neighborhoods in the Albuquerque actual property market, North Albuquerque Acres, has a median list price of 889,000 dollars.

This is why the Albuquerque real estate market saw 5 percent progress in 2018 and is anticipated to see almost three p.c appreciation in 2019. Over the last two years, real estate appreciation charges in Albuquerque have been tracked to close the national common, with the annual appreciation fee averaging 4.60 %, in accordance with NeighborhoodScout's data. Looking solely on the last twelve months, Albuquerque's appreciation charges stay among the many highest in the nation, at 21.85 percent, which is greater than appreciation charges homes for sale albuquerque in 79.50 % of the country's cities and towns. Short-term actual property traders have discovered success in Albuquerque over the last twelve months. In the most recent quarter, Albuquerque appreciation charges had been 8.44 p.c, equating to an annual appreciation fee of 38.30 %. Albuquerque real property market tendencies show that it is a seller's real property market, which implies that extra folks wish to purchase than there are homes available.

You understand that you are not required to consent to receiving autodialed calls/texts as a condition of purchasing any Bank of America services or products. Any cellular/mobile phone quantity you provide may incur costs from your mobile service supplier. Your month-to-month mortgage cost usually will include principal and curiosity on the mortgage, in addition to owners insurance and property taxes if your mortgage payment new homes albuquerque consists of escrow. Depending on your down cost and mortgage type, you may also should pay personal mortgage insurance coverage as part of your month-to-month mortgage payment. FHA loans get pleasure from a low down payment, however you may want to contemplate all costs concerned, together with up-front and long-term mortgage insurance coverage and all fees.

Protect yourself and your funding from unexpected system and appliance repairs with our complete home guarantee plans. In order to provide you with the greatest possible price estimate, we'd homes for sale in albuquerque nm like some further information. Please contact us to be able to focus on the specifics of your mortgage wants with considered one of our home loan specialists.

To preserve the historical past and character of the realm, most homes are constructed in the Pueblo Revival style. Inspired by the architecture of the Spanish missions, the Pueblo Revival type often incorporates options like stuccoed partitions, flat roofs, wooden beams, and rounded exteriors. The typical Albuquerque house has three bedrooms and two bogs and measures about 1,500 square feet on average.

These young adults may select to search out jobs upon graduation and stay in the Albuquerque housing market, however they won’t be buying homes whereas attending college. This means you ought to purchase Albuquerque actual estate funding properties supposed to cater to this nearly recession-proof rental market. For example, people move here to work because wages are greater than the state common and employment charges larger. They transfer here because it's higher than where they came from, but they can’t commit to a house cost till they’re doing better personally. Home consumers have so much to think about when house-hunting or looking to spend cash on rental properties, from the state of the housing market itself to taxes and potential resale value. The housing market grew strong and expensive in the final decade following the 2008 recession, however the market could be slowed by rising interest rates.

This luxury new home neighborhood is unique for its stunning mountain vistas, with many homesites providing picturesque views of the Sandia Mountains. See the present MLS listings of homes for sale in Albuquerque. Change the settings beneath to browse obtainable homes. The offerings are topic to errors, omissions, adjustments homes for sale in albuquerque new mexico, together with value, or withdrawal without discover. We’re the nation’s largest real estate brokerage, with the listings you need in your market. The New Mexico Home Fund began with funding from the Federal Government in the course of the COVID-19 pandemic.

Thank you for visiting our Albuquerque homes and actual property webpage. Here you will find useful info on Albuquerque, NM actual estate and Rio Rancho, NM actual property for both buyers and sellers. Please freely browse and make the most of our Albuquerque New Mexico public MLS to search for all Albuquerque and Rio Rancho homes for sale. Our high standard is all the time to provide superior service and honest illustration.

0 notes

Text

Blog One: Redlining

There is a clear racial divide in the majority of communities in this country, and I would like to examine the reasons behind this. The racial divide that still exists today was caused by redlining, the refusal of lenders to make mortgage loans in certain areas regardless of the creditworthiness of the individual loan applicant (Holmes, Horvitz 81). The Federal Housing Administration was created in the early 1930s, and this sparked the long history of redlining. Minority neighborhoods were targeted and marked as red. This made it very hard to get a mortgage loan in such neighborhoods. On top of this, when minorities began moving into white neighborhoods, the ratings went down. Until 1968, redlining was allowed. The socioeconomic implications though, are still alive and well today. Minority communities are at a big disadvantage, due to their houses being worth less. In turn, their net worth also decreases.

This may not come as a surprise to some, but as I stated earlier, our government allowed redlining to be an official policy in the housing industry. Red areas, which was the lowest possible rating, were listed as ““detrimental influences in a pronounced degree, undesirable population or infiltration of it” or “hazardous” (HOLC). In these areas with undesirable population, the FHA deemed “no insurance available” or some received “enhanced rates and terms” (Greer, 213).

Every race was affected by redlining, but it is clear that the black community was hurt the most by this practice. In the documentary “The House We Live in” we saw an example of banks fostering racial division in communities. On Eight Mile Road in Detroit, a few members of a white community were told they could not receive a loan. The reason behind this was that they were too near a black neighborhood. To solve this issue, the white residents built a wall to literally form a racial divide with them and their neighbors. This story goes to show that banks really did not care about actual qualifications to receive a loan. They were only concerned with the race of those trying to apply for one. Once the wall was built, the all white neighborhood was a more secure investment. Some people in this country just seem to have an affinity for throwing up walls to solve problems that don’t even exist in the first place.

Wealth is often spread out across generations, and the value of one’s home contributes to what you’re able to pass on. The majority white communities known as the suburbs have houses that are worth much more than minority communities, who’s home values were automatically decreased just because they were minorities. White families who were able to acquire more wealth can pass it down in the form of college, while minority families with lower net worth were not afforded the same privileges. As we know, education is critical for social mobility, the this is a vicious cycle that is hard to break. In the year 2016, the race with the highest percentage of homeowners is white, at 71 percent. Looking back on redlining, we can conclude that our government played a vital role in cultivating the socioeconomic divide that we still see among races today.

Sources:

Andrew Holmes, author and author Paul Horvitz. "Mortgage Redlining: Race, Risk, and Demand." The Journal of Finance, no. 1, 1994, p. 81. EBSCOhost, doi:10.2307/2329136.

Greer James L., author. "Historic Home Mortgage Redlining in Chicago." Journal of the Illinois State Historical Society (1998-), no. 2, 2014, pgs. 204-233. EBSCOhost, doi:10.5406/jillistathistsoc.107.2.0204.

“The House We Live In: Race—The Power of an Illusion.” Films Media Group, 2003, fod.infobase.com/PortalPlaylists.aspx?wID=104024&xtid=49736.

“Homeownership Rates by Race and Ethnicity of Householder.” US Census Bureau, 2016, www.census.gov/housing/hvs/files/currenthvspress.pdf.

Smith, Lindsey, et al. “Data Analysis: ‘Modern-Day Redlining’ Happening in Detroit and Lansing.” RSS, Michigan Radio, 15 Feb. 2018, www.michiganradio.org/post/data-analysis-modern-day-redlining-happening-detroit-and-lansing.

Blog Two: Inequality in Women’s Soccer

Gender inequality is pervasive at every level of society in the United States. Recently, the United States womens’ national soccer team has been leading a fight to receive equal wages, the same as their male counterparts. You may be thinking that men’s soccer is more popular, and generates more revenue. Therefore, the men should earn more money. This is entirely false. Yes, on a global level men’s soccer does generate more revenue, but the story is different when you compare the mens’ and womens’ national teams in the United States. In fact, after their World Cup victory in 2015, “The United States women’s national team earned more money than the men’s national team last year.” (Das 2016) Projections also show that “it will do so again in the next fiscal year.” (Das 2016) Based on these statistics, the women don’t deserve equal pay, they actually deserve more. Despite this, the the women earn “37 cents to every dollar the men earn.” (Block 2016)

When you look at the facts, the wage gap in soccer in the United States is absurd. Concrete evidence shows that the women should actually be paid more, yet the gap is even worse than the disparity encompassing all women in this country. Now, how is it that this gap is still in place even though all of these statistics have been published? This question can be answered simply in two words: male privilege. Soccer in the United States is essentially a microcosm for gender inequality. We have clear evidence that the women should be getting paid even more than the men, yet to this day, their compensation is still unequal. On a larger level, women in this country are earning less than men for doing equal work.

Since the pay gap in soccer is even worse than the national pay gap, even though the women’s team generates more revenue, it may seem like a futile inequality to fight against. However, there is a more positive side to all of this. While they are still receiving less pay, the players believe that they have made a positive impact. We are beginning to see that “other female athletes around the world have started finding their voices, too.” (Das 2018) The women’s soccer team in Norway launched a protest for equal wages, and they actually won. Obviously there is still a long way to go for the women representing us in soccer, and the same can be said for the United States as a whole. That being said, it seems like the United States Womens’ National Team is making some positive strides in the fight for gender equality. Christen Press, an American player, stated “You want to think that they’re inspired by us, we’re inspired by them, and that makes us all more powerful,” speaking about other female athletes around the world. This goes to show that unity can go a long way, and eventually we can hope that some positive change will occur.

Sources:

Block, Justin. “U.S. Women's Soccer Doesn't Deserve Equal Pay - They Deserve More.” The Huffington Post, TheHuffingtonPost.com, 29 Dec. 2016, www.huffingtonpost.com/entry/united-states-womens-soccer-equal-pay_us_56fd37e3e4b0daf53aeee5d7.

Das, Andrew. “In Fight for Equality, U.S. Women's Soccer Team Leads the Way.” The New York Times, The New York Times, 5 Mar. 2018, www.nytimes.com/2018/03/04/sports/soccer/us-womens-soccer-equality.html.

Das, Andrew. “Pay Disparity in U.S. Soccer? .” The New York Times, The New York Times, 19 Jan. 2018, www.nytimes.com/2016/04/22/sports/soccer/usmnt-uswnt-soccer-equal-pay.html.

Blog Three: The War on Drugs

The term war on drugs came about in the 1970s when Richard Nixon declared them “public enemy number one.” (“War on Drugs”) However, Nixon didn’t really want to wage war against drug abuse. He had a more specific target in mind, and it was black people. John Ehrlichman, the domestic policy chief for Nixon, stated that “We knew we couldn’t make it illegal to be either against the war or black people.” (“War on Drugs”) Nixon’s two main oppositions were those against the Vietnam War and the black community. Essentially, Nixon spent billions of dollars to fight a war on drugs, with the sole purpose of mass incarceration towards African Americans. To this day, “African Americans are incarcerated at more than 5 times the rate of whites.” (NAACP 2018) The adverse effects of this war on drugs is still seen today, through deteriorated and poor urban communities. The wealth gap among races in this country cannot be ignored. As we know, wealth is often passed from generation to generation. Being arrested for a drug related crime is not exactly a great way to climb up the economic ladder. In other words, generations of African American families will have to deal with the negative outcomes of this war on drugs. Many people act as if white privilege does not exist, but for decades our government has been fostering it by targeting black people and putting them behind bars.

Today, the war drugs has shifted towards a more nurturing and supportive strategy. Why is this the case? Opioid use has spread into suburban communities like wildfire, and it is having a big effect on white and middle class children. To recap, in the 1970s and 1980s our government began throwing African Americans in jail for drug use. In recent years, our government has taken a more relaxed stance on the issue because it is beginning to affect white people more than it ever has. Looking back on the way it was handled, it seems that our government’s actions have really backfired. Drug abuse is not exclusive to any one race. If the nurturing stance on drug abuse was taken back in the 1970s like it should have been, “we'd be way ahead of the game now in dealing with this scourge of opioid addiction.” (Glanton 2017) Instead, Nixon and Reagan used the war on drugs to aid their own political agenda. Now, we are seeing the affects and even white middle class communities are being hurt by drug use.

Sources:

“Criminal Justice Fact Sheet.” NAACP, NAACP, 2016, www.naacp.org/criminal-justice-fact-sheet/.

Glanton, Dahleen. “Race, the Crack Epidemic and the Effect on Today's Opioid Crisis.” Chicago Tribune, Chicago Tribune, 21 Aug. 2017, www.chicagotribune.com/news/columnists/glanton/ct-opioid-epidemic-dahleen-glanton-met-20170815-column.html.

“War on Drugs.” History.com, A&E Television Networks, 31 May 2017, www.history.com/topics/crime/the-war-on-drugs

Replacement Blog: My Privileges

1. I can go to the grocery store and not be followed around because of the assumption that I am a thief.

2. I will not be shown houses in only low income areas, because of my race.

3. I will not be a victim of police brutality because the police force will most likely not fear me irrationally.

4. I will not be a victim of bullying due to my sexuality.

5. I can set down a drink and not worry about it being spiked with anything.

6. I can see people of my race represented in just about every history class I will take.

7. I can surround myself with those of the same race as me if I feel the need to.

8. I can take a liberal political stance on an issue without being accused of identity politics.

9. My neighbors will not fear me due to my race.

10. I can get a scholarship and be sure that no one will assume it was only given to me based on my race.

11. I do not feel out of place when trying to pursue higher education.

12. Everything I read is in my primary language.

13. People will believe me more than a person of color if I notice a racial issue, because I am not the victim.

14. I am not expected to follow a certain career path because of my race.

15. People will not fear me if it’s dark out and we’re walking on the same street.

16. I will never have to worry about being stopped in traffic due to suspicion that I am undocumented.

17. I am not expected to follow a certain career path because of my sex and gender.

18. People will not judge me based on the way I dress as much as they would if I was female.

19. I can walk home at night with no fear that I will be sexually assaulted.

20. I can be sure that I am receiving rightful compensation in the workplace.

21. I am less likely to be the victim of getting conned when purchasing a car.

22. People will not judge me if I do not want to have kids.

23. If I stay home with the kids and do household chores I will be seen as a great father, rather than it being my duty.

24. I can engage in sexual activity as much as I want and it will be seen as an accomplishment, rather than being judged negatively.

25. I will not be asked what it is like to occupy any of my statuses.

My life experience has been heavily shaped by my privileges. I was only required to make a list of twenty-five privileges, but my list could have gone on forever. My statuses include male, white, able-bodied, and middle class, so just about every privilege that exists is granted to me. I will always be seen as “normal” in this country because my statuses are simply not judged in a negative way. I think one of the most beneficial privileges that I possess is based on my primary language, English. Education is really the way to improve socioeconomic status in this country, and I was never held back because I was forced to study everything in a secondary language. Also on the subject of education, my race and gender are widely represented in what we study in school. This kept me from losing motivation and devaluing my culture, because it is seen as important. Essentially, my intersection of statuses will never hold me back from climbing up the economic ladder.

If I did not have these privileges, I can only imagine how much harder my life would be. I would not have free reign in the pursuit of what I want to do with my life, and I think this would be the most difficult change. For example, I can pursue whatever job I want and not be judged for it. The pressure of sticking with the norms for my race or gender would be somewhat influential in how I choose my path, at least I think they would be. I would also more often be in fear if I was a different race or gender. I never have to worry about being the victim of police brutality because the police force will not fear me irrationally. I also do not have to worry about being the victim of a sexual assault as much as I would if I was female. If the roles were reversed, I think I would be fearing these things much more than I do now, considering that I don’t fear them at all currently.

I think it’s much easier for someone who is not part of a marginalized group to undo privileges. When someone claims that they are a victim of racism, sexism, or any type of discrimination, it’s difficult for the dominant group to relate to. This is simply because they will assume it’s an isolated incident, because the dominant group never experiences discrimination. However, if an outside source that is not the victim challenges discrimination, then it is more likely that people will listen. If I challenge racism as a white male, it won’t look like I am trying to get a leg up for myself. People are more likely to listen to me, because they can’t assume that I am being selfish. On top of this, I am part of the “normal” group, so it’s also easier for those of my race to trust what I am saying. I think Peggy McIntosh said it best with the statement “Keeping most people unaware that freedom of confident action is there for just a small number of people props up those in power and serves to keep power in the hands of the same groups that have most of it already.” (McIntosh 7) The small group of people that she is referring to are white people with unearned privileges. Therefore, if white people raise awareness of their privileges, it could be a step towards everyone having them eventually.

Sources:

McIntosh, Peggy. “White Privilege: Unpacking the Invisible Knapsack .” Racial Equality Tools, Racial Equality Tools, 1988, www.racialequitytools.org/resourcefiles/mcintosh.pdf.

Blog Five: Social Reproduction in American Education

Education in this country is seen as a great economic equalizer. Despite this, American education seems to have a history that is deeply rooted in the social reproduction theory. IQ tests were held with such high regard in the early 20th century, and heavily favored English speakers. These tests also had a significant impact on the track students lives would take. The life adjustment curriculum was used to impose a certain set of skills on young children, likely leading them to their future occupations. Therefore, if English was not your first language, the IQ exam would likely place you on a track requiring little skill. Being placed on such a track would immediately reduce your future earning potential. Essentially, American Public schools were reinforcing the class stratification that we still see today, starting as early as grade school.

The place where our system fails is the need to Americanize our students. This puts minority groups at a significant disadvantage, because American is synonomous with whiteness and speaking English. We teach all of our students the same material, and the majority of that material is representing white people with a Eurocentric viewpoint. This also puts minority students at a disadvantage because their cultures are not represented well enough or at all, which causes them to devalue it. One example of deculturalization in the American Education system was directed towards Native Americans. Native American Joe Suina once stated that a teacher told him to “Leave your Indian at home!” (Suina 3) This is just the tip of the iceberg, like this went on constantly and they still do today. In Tucson, the Mexican Studies Program was banned because it was deemed as hatred for our country. Again, this is an example of our need to Americanize students, rather than acculturate them.

As a future educator, stories like these inspire me to tell the real truth to my students. My goal is to become a history teacher, and I think it’s important to tell the real story, instead of the fake ones we see in many textbooks. In my experience in grade school, I always saw my culture represented through a Eurocentric version of everything. For example, in eighth our American history course begins with colonization. If my curriculum requires me to use a certain textbook, I would like to get creative with how I teach that book’s information. I think it’s also important to make time for the real story. I like to think that this would actually decrease deculturalization, because if a Native American student was sitting in my class, I assume they would feel left out if American History skipped over them, as if they didn’t exist before European colonization. I think it’s important for me to break the status quo in American Education, and I want to empower each and every student who comes into my classroom with the truth. Knowledge is power and we are often fed fake news by our education system, which can have disastrous effects for minority communities.

Sources:

Suina, Joe. “And Then I Went To School.” Cambridge College , Cambridge College, 1985, mycc.cambridgecollege.edu/ICS/icsfs/AndthenIwenttoschool.pdf?target=e3be3e4e-bb14-4066-b098-686cac0b9590.

1 note

·

View note

Text

9 Beautiful Keller Williams Realty Agents Berlin MI 48134 Residences Now Available Around The US

7 Breathtaking Keller Williams Realty Agents Berlin MI 48134 Homes For Sale Around America

Purchasing a Berlin Township Michigan, invented and created by Gary Keller, home is most likely the most serious monetary commitment you'll ever make. For lots of people, it'll be the biggest financial investment she or he will make in their lifetime.

If you are a millennial or a newbie KW Realty residence buyer, you might not know where to start. Prior to you go out to purchase your dream residence, take a look at where and what you presently spend your cash on. It's important to examine your financial resources-- preferably for a minimum of three months-- in order to get a concept of how much you generally spend monthly before buying a Keller Williams Real Estate residence. Then, once you've chosen that you're ready to acquire something, here are the actions that you're likely to come across.

How to start investing in realty?

Acknowledge that your investments are a company, and prepare for it.

Find somebody who understands more than you do.

Invest for capital.

Invest in your own understanding.

Begin.

Discover your niche.

Expect issues along the way.

Do not expect to get rich quick.

If you have or prepare to have a huge family, you ought to take a look at Keller Williams Realty houses that will have enough room for your family. You need to have a much safer house is safe if the previous occupants had kids.

When starting the Keller Williams Realty INC house buying process, it's vital to get a copy of your credit reports and ratings. If you're buying with a partner, or another person, they'll require to run their credit too. You'll want the highest rating possible, prior to you make an application for a mortgage. A score of 740 or higher is considered to be excellent credit. Typically, anything below 700 is not considered outstanding credit. Nevertheless, this does not imply you can't get a mortgage.

A lot of Real estate Top Keller Williams agents have lists which contain all the crucial components of everything you need to do when buying a Keller Williams Realty Agents Berlin MI 48134 home.The list can help you organize everything is looked after when it needs to be.

If you have bad credit, don't panic, as there are different ways to enhance your credit. One of the best ways to improve your credit is to try to stay below 30% of your total credit line. If you have overdue payments, deal with them. Include all your due dates to your calendar to ensure your bills are up to date and paid on time. Keep in mind do not open new charge card if you do not require them, and use your credit responsibly at all times.

This is a fun time to turn to real estate as an investment. Property values have sunk to an all time low after the real estate market crash. The marketplace is going to rise again, so any investment you make will have returns.

According to industry standards, you should not invest more than 30% of your regular monthly earnings on your month-to-month expenditures. Keep in mind credit usage and effective budgeting are crucial, and creating a spending plan that you can adhere to is simpler than you believe. The very best method to do this is by figuring out all your sources of income and then tally up your month-to-month costs. For expenditures, make two specific columns, one for repaired expenditures such as lease, mortgage, insurance, automobile payments, and so on and another for variable expenses such as entertainment, travel, food and other expenditures. Generally, variable expenses are simpler to manage. Then, analyze all of your costs-- specifically the variable ones-- and see what you can cut out.

Sex wrongdoers need to be registered, however there is no warranty that the seller nor their Keller Williams Estate agent is going to feel a commitment to inform a prospective Berlin MI home purchaser of any transgressors in the area.

rom this point, it's important to meet with a mortgage broker, who generally works for a loan provider to determine how much you can pay for. A mortgage lender is usually a banks that loans you money to purchase a Keller Real Estate home, which is called a mortgage. The majority of people believe that you require a down payment of at least 20%. If you do not meet these requirements, your mortgage broker can educate you on programs, which require less. Some of these mortgage programs include the following:

Have a professional inspector look at the Keller Williams Realty Agents Berlin MI 48134 property you prepare to purchase. You don't want a house that requires significant remodellings. This can be a severe issue if there are structural issues after you purchase the inspector a very affordable and-safety mindful option that you will be responsible for and you may need to leave your KW Realty property while it is fixed.

USDA Loans

So you have decided to look for a Berlin Township Michigan residence to acquire, however prior to you start you require to locate a real estate Keller Williams Realty partner that is qualified. You clearly require one you can trust. An Keller Williams Realty partner with a tested record can assist you appropriate Keller Williams Realty Agents Berlin MI 48134 homes.

VA Loans

You don't wish to discover the Berlin Township Michigan residence you can afford to buy.

FHA Loans

youtube

If you are looking to buy a few of or all of a building in order to open an organisation, do some research about the neighborhood and choose the best place possible. Launching a new company in a location of high criminal offense and shabby structures will not win you lots of clients. Talk with a realty professional to discover what locations are available.

FHA 203K Loans

Take your time to thoroughly determine a Keller Williams Realty Agents Berlin MI 48134 house you thinking about buying. The difference between these two figures need to be no more than 100 square feet; if it is more than that, either reconsider your purchase, or determine what is going on.

Personal Mortgage Insurance Coverage

When choosing to buy realty, stay concentrated on the objectives you've set. Determine early on if your goals are short term or long term. Don't think about properties that is irrelevant to your long-lasting or short-term goals. A lot of financiers don't do this due diligence and purchase something that does not satisfy them and even lose loan.

Lenders will wish to see that you presently have numerous credit lines readily available, which you pay off routinely. Credit lines consist of the following: charge card, trainee loans, auto loans or any other types of loans. Lenders typically wish to see activity on these credit lines from the previous twelve months.

When house hunting, if you own a lorry it is essential to discover if there is great parking around the place. This is very crucial when thinking about that lacks a driveway. If there are not a great deal of areas to park near the Keller Williams Realty home, you might be stuck parking quite a range from your Keller Williams Realty Agents Berlin MI 48134 residence.

Financial institutions will analyze your debt-to-income ratio to determine what exactly you will receive. Throughout this process, ask your mortgage broker to get a pre-approval letter, for the quantity that your banks will provide you. Now that you know what you can afford, it will assist the seller believe in your offer when you discover the Keller Real Estate house you want to buy.

If you have an interest in a rental property, make sure you ask your property owner about it. Some rentals will have the occupant be responsible for lawn tasks. Other places have this service as an included monthly payments.

Throughout this procedure, you need to make certain you have enough to cover closing costs. Closing costs usually include loan origination charges, appraisal charges, title insurance, title search charges and taxes. You might also encounter deed-recording fees, discount rate points and credit report charges. An excellent guideline is to reserve 2-- 3% of the purchase cost.

It may take a while to find the best property that will assist you are trying to find.

If the Keller Williams Realty home is over a million dollars, it might be 3-- 4% percent. In addition, to the attorney's costs, which generally vary from $2,000 to $5,000, banks need you to have reserves beyond the deposit and closing costs. It is necessary to use an attorney, who focuses on realty. Normally, financial institutions will wish to see that you have post-closing liquidity.

You require good legal representation due to the fact that issues during foreclosure acquisition. You can really conserve a great deal in the future because of cash in the end.

It is important, once you look for a mortgage, to not handle any brand-new financial obligation and or alter companies as lenders wish to see stability in a borrower. Banks likewise want to see stability from the previous 24 months from the time of obtaining a mortgage. Banks do this as a way to guarantee that borrowers do not make any decisions that may upend their capability to make mortgage payments.

If you do not do this right away, you might not be covered if an unfortunate occasion happens, like an unforeseeable natural disaster.

When you're wanting to buy a Berlin MI residence, start by finding a relied on property attorney. He or she will be able to help you prevent typical issues that can develop with the purchase of a Keller Williams Realty Agents Berlin MI 48134 residence. Being that a realty attorney is trained in this type of law, they can assist a buyer avoid unclear terms and assist a purchaser completely understand the numerous agreements they'll need to sign.

the number of Keller Williams representatives are there?

It grew from a solitary office in Austin to approximately 940+ workplaces with over 180,000 associates worldwide since May 2018.

There are numerous down payment assistance programs offered, and you may want to see if you receive them.

When aiming to purchase a Keller Williams Realty Agents Berlin MI 48134 home, you must focus on a specific area. Remember, place is key! Individuals buy in neighborhoods, every bit as much as your houses they pick.

Determine the quantity of cash you can spend on a readily offered online calculator.

As soon as you have a particular location in mind, it is necessary to find an excellent realty Top Keller Williams agent that is educated about the area you wish to reside in and someone that you can trust. Most property buyers use a property Top Keller Williams agent that was described them by a relative, buddy or collogue. They can supply you with useful details about the area, and inform you of what similar properties have actually cost. Working with a realty Keller Williams Realty partner will make the procedure a lot easier for first time Keller Williams Real Estate residence buyers. Feel free to get more here on Youtube

You should ensure that you have the least possible down payment for your mortgage company. If you do not have a substantial down payment, you will pay private mortgage insurance (PMI).

Now that you've selected a relied on real estate Keller Williams Realty partner, start trying to find KW Realty houses. Make a list of what you must have. When taking a look at Keller Williams Realty Agents Berlin MI 48134 residences, take images and videos, this way you can remember the specifics about each and every KW Realty house you visit. It's a good concept to drive through the location at various times of the day to check out the length of time it takes to commute to your workplace. If you have kids in school, make a consultation with a school administrator. Throughout this procedure you'll probably view a variety of different Keller Williams Realty Agents Berlin MI 48134 homes, so do not get discouraged.

Work with a professional inspectors to check the house that you are planning to buy. It is best to hire a professional, but the advantage over having someone you know examine the Keller Williams Realty residence is that you can hold a bad inspection against an expert inspector, while there is little you can do to a relative.

As soon as you've looked at many different choices, and you find a Keller Williams Realty residence that you like, it's time to make an offer. When you discover the Berlin Township Michigan property that's right for you, and when you've agreed on the cost and terms, you're almost done. Constantly ask to have a KW Realty house assessment in addition to an engineer's report, if required, and make certain you view the report as soon as possible. This will highlight any engineering problems in the Keller Williams Realty Agents Berlin MI 48134 house and offer a detailed engineering analysis, together with any possible engineering design defects.

If you're buying realty, it's best to seek advice from a professional realty Top Keller Williams agent. These specialists will have resources that might not be straight readily available to you. Lots of brokers will utilize unique software to sort through the MLS and other listing services.

When you have an accepted offer, it's important to begin Berlin Township Michigan property examinations. Typically, deals are contingent on the Keller Williams Realty Listings for residence evaluation. Berlin Township Michigan home inspections are done to check for signs of structural damage or specific things, which require to be fixed. Normally, your property Keller Williams Realty partner will assist you arrange these evaluations. By having a Keller Williams Realty Agents Berlin MI 48134 home inspection contingency in your agreement, this secures you as the buyer to renegotiate your deal based upon the findings in the assessment report.

Research study property properties well prior to purchasing one. There are a couple of critical points which you need to be considered prior to writing a deal for rental property. Is this property in strong condition and is it going to remain that way with minimal upkeep? The second crucial function to consider when buying is the location. Area is certainly highly essential when it concerns acquiring rental property.The third is the typical income of the property's location. This differs from physical location given that high rents is much better than those with low ones.

What is the greatest realty company in U.S.A.?

Keller Williams Realty, Inc. is the world's largest realty franchise by representative count, with greater than greater than 150,000 associates as well as over 800 market centers around the world are affiliated with Keller Williams.

Progressing, there is a great deal of documentation that is involved in purchasing a Keller Williams Realty Agents Berlin MI 48134 property. At this time, your banks will schedule a title business to manage all of the paper work throughout this process, and to verify that the seller of the property is the lawful and rightful owner of the Keller Williams Realty INC residence that you're buying. This becomes part of the due diligence procedure in the closing process. Keep in mind the closing process can differ with time and can be anywhere in between 30, 60 or 90 days.

Remain in consistent contact with others in realty investment business.There is constantly a property readily available somewhere, but not every piece of property is correct for every financier. Keeping your ear to the ground is a terrific way to get a diamond in the rough that others have not yet understand of.

Now, it's time for the actual closing. A day prior to signing all the paper work, it's vital to do a walk through, to guarantee that whatever in the Keller Real Estate home remains in working order. At the time of closing, you'll be needed to sign all of the paperwork, which will be needed to finish the purchase of this property. Once all documentation is signed, and adjustments are made, you're now a Keller Real Estate residenceowner and ready to move into your new Berlin MI house.

#Home#homes#house#houses#property#properties#realty#realestate#kellerwilliams#kw#kwrealty#michigan#mi#berlin

1 note

·

View note

Photo

Redlining in America Part 2: Assessment

This is Part 2 of a 3-part series on the history of redlining in America. If you’ve not read Part 1 yet, start there as it goes over the government agencies that will be discussed in this post — Redlining in America - Part 1: The Origin of Redlining