#(she OWNED A HOME and was able to use that investment to fund her grad school and she thinks that's the same?? vom)

Explore tagged Tumblr posts

Text

in a ~fun~ turn of events I think this year I hate my job not because of the *gestures to conservative catholic institution* everything but because the ratio of direct coworkers whom I like vs. dislike has gone from 2:1 to 1:2 and I am LOSING IT

#like that post about how much time you spend with your coworkers vs. friends and family over the course of your life?#that's been making the rounds on instagram?#crying bc why do I spend 8 hours a day with people who I DO NOT LIKE PERSONALLY and have NOTHING IN COMMON WITH#even the coworker I do like is in thin fucking ice okay!!#like it would be more accurate to say that I dislike her the least of my coworkers#I mean we get along but also she's very fatphobic and not as liberal as she thinks she is and so privileged & unaware of it#(the problem with all my coworkers tbh)#(violently flashing back to the time I pointed out that one coworker was lucky her sons wouldn't have to take out student loans for college)#(and she tried to tell me she understood how I felt bc she'd had to take out a second mortage ON HER HOUSE to avoid grad loans)#(she OWNED A HOME and was able to use that investment to fund her grad school and she thinks that's the same?? vom)#anyway this post is brought to you by the fact that one of my coworkers put up a starbucks tree#and I've decided that it's representative of everything I dislike about her#and all our ideological differences#it is mere feet away from my computer I have to see it all. day.#I want to smash every ornament on that tree is 2g#sorry if I sound violent I had to bite my tongue today while someone told me they use amazon for the convenience#even though jeff bez0s is shit!!#just like I bite my tongue all! day! every! day!#brb screaming forever

1 note

·

View note

Text

My Money Snapshot

[Inspired by Corporette]

Location: Ohio, small college town

Age: 29

Occupation: PhD candidate (English)/half-time instructor

Income: $16,000 before deductions

Net worth: $588 (I’m crying)

Current Debt: $12,844

Living situation: Renting with a roommate

Money Philosophy:

I grew up in the “working poor” category. My parents are divorced and my father never contributed much financially. Mom made around $21,000 per year at work and she cleaned houses “under the table” to supplement that. Somehow, we never went hungry, what we ate was relatively fresh and healthy, and she managed to put two of us through Catholic schools for a total of 14 years. I know now that mom is still paying some of those loans and credit card debts and that part of her strategy included not contributing more than the 3% that her employer matched in her 401k. Every time I complain about the financial stress I feel at my salary level, I have to remind myself how comparatively unstressful my financial life is.

I’ve always been poor and I always knew that graduate school/academia is not a lucrative career. I tell myself that if I can make things work at this pay grade, then I’m ready for just about anything. My main strategy is to have a budget, stay in the budget, and save every bit that I can.

Monthly budget

$1000-1100 for the necessities each month. Monthly spending on eating out, entertainment, shopping and other categories varies widely. I also won’t lie... dating someone who makes 4x more money than me helps... I’m fairly frugal on all of these fronts: I buy most of my clothes second hand and I tend to shop seasonally. Spikes in spending occur around the winter holidays when I’m buying gifts and when I am doing traveling. And I also have totally weak, impulsive moments - like the $3 soap sales at Bath & Body works, or that time I spent $110 on bras and underwear on a whim. Anyway:

Rent: $272.50/month

Other living expenses: $130-170/month (electric, internet, phone, renter’s insurance - lower in summer, higher in winter)

Transportation: $332/month (gas, insurance, car payment)

Healthcare: $162/month (health+dental insurance, no vision coverage)

Groceries: $120-150/month ($30/week)

Debt Picture

Student loan: $2000

Car loan: $10,488

I’m a career student & my motto for all the years I’ve been in school has been “follow the money.” I went to college on very hefty scholarships and I only had to take out the $2000 loan to cover housing costs during my first year. For the subsequent three years, I was an RA, so I never had to take loans again. I applied to graduate programs based on the research fit, and when I got my offers, money weighed heavily in the decision. I would have loved to live in Boston as a wee 22-year old, but I wasn’t about to take out loans for a year’s worth of tuition and the living expenses. And to get a PhD while living in Minneapolis, my very favorite city in the US? It would have been such a dream, but for the quite steep difference in stipends and the significant disparity in cost of living compared with Ohio. My only regret on this front is that I haven’t started paying back my tiny student loan. I’ve been able to defer it since I’m in graduate school, which was a great idea when I was a master’s student who didn’t know the first thing about budgeting. But if I had just paid $25/month from the start of grad school the balance would be $0 about the same time I graduate from this PhD program this August. Instead, I’ll be scrambling to pay off the whole balance before my 6 month grace period ends.

The car loan is less than a year old. I finally broke down and bought a new (by which I mean used) car last summer after really pushing it with the car my parents had bought me in high school. Repairing that car put me into credit card debt more than once and I was getting so stressed about it. It was time. I have a very good credit score, so I qualified for a nice loan rate with my credit union, and to get a better rate I got my mom to co-sign my loan. It’s a popular rental fleet model so there were tons of them on the market, but average miles were high - so when I saw one that was two years old with only a years worth of miles on it at $1000 less than the average price for that make, model, and year, I jumped on it. My payments are $231/month on the 5-year plan. Currently, I’m paying that minimum, but I plan to escalate my payments as my income goes up (I’m on the academic job market now, pray for me). I folded this car payment into my existing budget by giving up solo-living and finding a roommate. When I had my own apartment, very spacious with a huge kitchen and tons of windows/natural light, I was paying about $585 for monthly rent. I hate living with people, but I hated the idea of being trapped in this college town without a car even more - one of my other mantras is “you can do anything for a year.”

A note on credit cards: I love them. I’m one of those responsible people that charges everything and pays the balance like clockwork every month. This is the only way to make sure you’re actually taking advantage of the cash back/reward perks! Currently, I’m using Capital One’s Venture card and stockpiling airline miles for travel (it has a 40,000 mile sign-on bonus). If you’re good for it, I also recommend one card with a great balance transfer program. For me, when I get into an emergency situation, it makes me feel like I have options. It’s been about 4 years since I’ve had to use my balance transfer card to cover costs ($1400 in car repairs, summer 2015), but at my level, I can’t afford to not have back up plans.

Savings and Investments

$5,517 Cash

$7,861 Roth IRA + employer mandated retirement account

Retirement: The biggest financial mistake I've made in grad school is that I did not opt into the retirement account offered by the university when I started my M.A. in 2012. When they ask me that “what I wish I had known before I went to grad school” question, this is near the top of the list. I did, eventually, open a Roth IRA and slowly I started to build something. This year, when my graduate funding dried up and they made me a “half-time instructor” the retirement account for public school teachers was mandatory and the contributions are high: 14% of every pay check (annoying, yes, but on the flipside, there is an equally high employer match). While I’m contributing to this, I’ve paused my contributions to the IRA. I’ll roll this money over, either into the IRA or into another state/employer retirement fund when I move on from here.

Personal savings: I strive for a minimum of $100 per month and frequently do a little more, but each month is different and I consider it a win if I break even. Through most of grad school, I’ve taken on “second jobs” to bolster what I can save (and boost my resume). Both jobs have been through the university, so they limit me to five hours a week. When I max them out, this can be an extra $200-250 each month.

I took up a new savings challenge this academic year to build on my “play money” savings account (a high yield savings account which my bank labels a “goal setter” account). The challenge involves tallying the “total savings” printed on my receipts each month (i.e. when the grocery store is like “you saved $6″ because of sales and coupons). So, At the end of the month, I put that running total into my goal setter account. Sometimes the total savings are like $26, but others its as much as $171. It’s an interesting challenge because it encourages me to do tedious things, like scroll through all the digital coupons on the grocery store app; but at the same time, I know that the higher that number is usually coincides with a lot of shopping which encourages some self-regulation.

I initially set my goal at $2500 when I opened the goal setter account in 2014. When I had to dip into the account in April 2018 to pay $930 in car repairs, I finally set plans in motion to buy my car. Since I bought used, I only put 10% down on the car (just over $1200). When I sold my old car for $1000, I put that money right back into the account to start saving for new things...

What I’m saving for now:

travel: to celebrate finally finishing this PhD, I’m hoping to pull off a trip to Europe. Later this year, I’m also turning 30 around the same time that one of my regular professional conferences is meeting in Hawaii. If I can do one or both in the next year, that’d be grand. (As I mentioned, I'm saving up airline miles with my credit card program, too!)

a multicooker: think InstantPot...but more expensive because my dreams all revolve around small appliances that match my stand mixer.

What I do to be frugal...

I’ve been frugal my whole life, but a couple of major habits I’ve formed include:

Meal planning and home cooking (read my guide to meal prep here). The money part of that means planning what I eat around maximizing the ingredients I have to buy. I plan meals that use the same ingredients so I’m not spending on an entire bunch of celery and then throwing out 75% of it. Routinization also helps, so my grocery lists stay about the same week to week and the bill relatively predictable - for example, I eat avocado egg salad almost every day for lunch. I know, avocados are not cheap, but I also believe in spending on the things that nourish you––literally and “spiritually.” Roxane Gay once said that she never bought avocados or blueberries when she was a “poor grad student.” Once she started making money, she realized she would buy them because she could afford them, but she also threw them out all the time because she didn’t plan her meals right to actually eat them. The point is, buy the foods that you like/feel good about and build habits around them. It’s not wasted money. That said, I won’t pay more than $1.25 for an avocado!

Second hand clothes shopping, especially for my business casual (it’s amazing what people donate to the Goodwill, barely worn!)

31 notes

·

View notes

Photo

FML: Why millennials are facing the scariest financial future of any generation since the Great Depression.

Huffington Post Highline

Part II

What Scott remembers are the group interviews.

Eight, 10 people in suits, a circle of folding chairs, a chirpy HR rep with a clipboard. Each applicant telling her, one by one, in front of all the others, why he's the right candidate for this $11-an-hour job as a bank teller.

It was 2010, and Scott had just graduated from college with a bachelor’s in economics, a minor in business and $30,000 in student debt. At some of the interviews he was by far the least qualified person in the room. The other applicants described their corporate jobs and listed off graduate degrees. Some looked like they were in their 50s. “One time the HR rep told us she did these three times a week,” Scott says. “And I just knew I was never going to get a job.”

After six months of applying and interviewing and never hearing back, Scott returned to his high school job at The Old Spaghetti Factory. After that he bounced around—selling suits at a Nordstrom outlet, cleaning carpets, waiting tables—until he learned that city bus drivers earn $22 an hour and get full benefits. He’s been doing that for a year now. It’s the most money he’s ever made. He still lives at home, chipping in a few hundred bucks every month to help his mom pay the rent.

In theory, Scott could apply for banking jobs again. But his degree is almost eight years old and he has no relevant experience. He sometimes considers getting a master’s, but that would mean walking away from his salary and benefits for two years and taking on another five digits of debt—just to snag an entry-level position, at the age of 30, that would pay less than he makes driving a bus. At his current job, he’ll be able to move out in six months. And pay off his student loans in 20 years.

There are millions of Scotts in the modern economy. “A lot of workers were just 18 at the wrong time,” says William Spriggs, an economics professor at Howard University and an assistant secretary for policy at the Department of Labor in the Obama administration. “Employers didn’t say, ‘Oops, we missed a generation. In 2008 we weren’t hiring graduates, let’s hire all the people we passed over.’ No, they hired the class of 2012.”

You can even see this in the statistics, a divot from 2008 to 2012 where millions of jobs and billions in earnings should be. In 2007, more than 50 percent of college graduates had a job offer lined up. For the class of 2009, fewer than 20 percent of them did. According to a 2010 study, every 1 percent uptick in the unemployment rate the year you graduate college means a 6 to 8 percent drop in your starting salary—a disadvantage that can linger for decades. The same study found that workers who graduated during the 1981 recession were still making less than their counterparts who graduated 10 years later. “Every recession,” Spriggs says, “creates these cohorts that never recover.”

By now, those unlucky millennials who graduated at the wrong time have cascaded downward through the economy. Some estimates show that 48 percent of workers with bachelor’s degrees are employed in jobs for which they’re overqualified. A university diploma has practically become a prerequisite for even the lowest-paying positions, just another piece of paper to flash in front of the hiring manager at Quiznos.

But the real victims of this credential inflation are the two-thirds of millennials who didn’t go to college. Since 2010, the economy has added 11.6 million jobs—and 11.5 million of them have gone to workers with at least some college education. In 2016, young workers with a high school diploma had roughly triple the unemployment rate and three and a half times the poverty rate of college grads.

Once you start tracing these trends backward, the recession starts to look less like a temporary setback and more like a culmination. Over the last 40 years, as politicians and parents and perky magazine listicles have been telling us to study hard and build our personal brands, the entire economy has transformed beneath us.

BOOMER: 306

MILLENNIAL: 4,459

Hours of minimum wage work needed to pay for four years of public college

For decades, most of the job growth in America has been in low-wage, low-skilled, temporary and short-term jobs. The United States simply produces fewer and fewer of the kinds of jobs our parents had. This explains why the rates of “under-employment” among high school and college grads were rising steadily long before the recession. “The way to think about it,” says Jacob Hacker, a Yale political scientist and author of The Great Risk Shift, “is that there are waves in the economy, but the tide has been going out for a long time.”

The decline of the job has its primary origins in the 1970s, with a million little changes the boomers barely noticed. The Federal Reserve cracked down on inflation. Companies started paying executives in stock options. Pension funds invested in riskier assets. The cumulative result was money pouring into the stock market like jet fuel. Between 1960 and 2013, the average time that investors held stocks before flipping them went from eight years to around four months. Over roughly the same period, the financial sector became a sarlacc pit encompassing around a quarter of all corporate profits and completely warping companies’ incentives.

The pressure to deliver immediate returns became relentless. When stocks were long-term investments, shareholders let CEOs spend money on things like worker benefits because they contributed to the company’s long-term health. Once investors lost the ability to look beyond the next earnings report, however, any move that didn’t boost short-term profits was tantamount to treason.

The new paradigm took over corporate America. Private equity firms and commercial banks took corporations off the market, laid off or outsourced workers, then sold the businesses back to investors. In the 1980s alone, a quarter of the companies in the Fortune 500 were restructured. Companies were no longer single entities with responsibilities to their workers, retirees or communities.

They were Lego castles, clusters of distinct modules that could be separated, optimized, sold off and put back together.

Businesses applied the same chop-shop logic to their own operations. Executives came to see themselves as first and foremost in the shareholder-pleasing game. Higher staff salaries became luxuries to be slashed. Unions, the great negotiators of wages and benefits and the guarantors of severance pay, became enemy combatants. And eventually, employees themselves became liabilities. “Corporations decided that the fastest way to a higher stock price was hiring part-time workers, lowering wages and turning their existing employees into contractors,” says Rosemary Batt, a Cornell University economist.

Thirty years ago, she says, you could walk into any hotel in America and everyone in the building, from the cleaners to the security guards to the bartenders, was a direct hire, each worker on the same pay scale and enjoying the same benefits as everyone else. Today, they’re almost all indirect hires, employees of random, anonymous contracting companies: Laundry Inc., Rent-A-Guard Inc., Watery Margarita Inc. In 2015, the Government Accountability Office estimated that 40 percent of American workers were employed under some sort of “contingent” arrangement like this—from barbers to midwives to nuclear waste inspectors to symphony cellists. Since the downturn, the industry that has added the most jobs is not tech or retail or nursing. It is “temporary help services”—all the small, no-brand contractors who recruit workers and rent them out to bigger companies.

The effect of all this “domestic outsourcing”—and, let’s be honest, its actual purpose—is that workers get a lot less out of their jobs than they used to. One of Batt’s papers found that employees lose up to 40 percent of their salary when they’re “re-classified” as contractors. In 2013, the city of Memphis reportedly cut wages from $15 an hour to $10 after it fired its school bus drivers and forced them to reapply through a staffing agency. Some Walmart “lumpers,” the warehouse workers who carry boxes from trucks to shelves, have to show up every morning but only get paid if there’s enough work for them that day.

“This is what’s really driving wage inequality,” says David Weil, the former head of the Wage and Hour Division of the Department of Labor and the author of The Fissured Workplace. “By shifting tasks to contractors, companies pay a price for a service rather than wages for work. That means they don’t have to think about training, career advancement or benefit provision.”

This transformation is affecting the entire economy, but millennials are on its front lines. Where previous generations were able to amass years of solid experience and income in the old economy, many of us will spend our entire working lives intermittently employed in the new one. We’ll get less training and fewer opportunities to negotiate benefits through unions (which used to cover 1 in 3 workers and are now down to around 1 in 10). Plus, as Uber and its “gig economy” ilk perfect their algorithms, we’ll be increasingly at the mercy of companies that only want to pay us for the time we’re generating revenue and not a second more.

(Continue Reading)

251 notes

·

View notes

Text

Robert Kiyosaki's Rich Dad Poor Father

April 20 17 declared twenty years given that Robert Kiyosaki's Rich Dad Poor father to begin with manufactured waves at the personal-finance discipline. It's since converted in the number-one personal-finance publication at any time... interpreted in to a lot of dialects and offered the whole world above. The publication, Rich Dad Poor Dad, is Robert's narrative of climbing just two fathers -- his own biological dad and also the father of his closest friend companion, his abundant daddy -- and also the paths at which the 2 men modeled his contemplations regarding investing and money. At age 9, the young Kiyosaki decided to shoot following the exhortation of their 'affluent daddy,' and also this publication may be your orgasm of prosperous daddy's courses. The publication detonates the dream which you need to secure a higher income to become abundant and explains the comparison between doing work for the money along with getting your hard earned money work foryou personally. Two Decades... 20/20 Hindsight From the Twentieth Anniversary version with this masterpiece of design, Robert provides an overview of that which we have found inside the duration of modern times identified as investing, money, and also the worldwide market. Sidebars throughout the publication can require subscribers "swift ahead" -- from 1997 to now -- since Robert assesses the way a standards taught by his own rich daddy have survived the demo of period. From several factors of perspective, the communications of Rich Dad Poor father, messages which were inspected and analyzed 2 years ago, are far somewhat more significant, more important and crucial now compared to the twenty decades past. As-usual, audience may get that Robert is going to remain receptive, informed, too, carry on stirring over the usual couple of of water-crafts within their own critique. Can there be really be a few astonishments? Be Dependent on it. Rich Dad, Poor father, should be considered a worldwide start point -- a speculation/startup run-down, rather than a listing of special matters todo so as a firm visionary. Robert Kiyosaki enriches the corresponding secret attracts up outside this publication. It is the differentiator involving his "bad" father (his actual daddy), along with also the "abundant" daddy that aided him to realize firm and end-up apparently affluent. Simply Take Responsibility For the Economic Future No matter getting written twenty decades ago, '' I hope that this is far more crucial today than in there. I have discovered it regularly stated that if my partners and that I reach retirement era, '' there wont be described as a retirement era plus also there will not be some condition advantages. Well if that's finished that you simply acknowledge, exactly what exactly are you really going to take action? My FB station is filled with yelling at our upsetting long run and complaining that the federal government could not care much less. No person is expecting that foreseeable future. Regardless of your governmental outlook, you can not pay your thoughts from the sand. We've to admit the total truths that are relevant to every one as well as adapt. About the off possibility that you just accept possibly you may probably be with no wholesome web from your boss or government afterward you better obtain the chance to begin assembling your specific security web site. We've got hardly any sway on exactly what every other specific chooses todo. Our supervisor, '' the us government, our neighbors. We do possess a substantial amount of control on how exactly we commit our power and income. The very optimal/optimally thing you might do is obtain the occasion to do the job out. Be Performed Educated This really is among the most significant things I've extracted from Robert Kiyosaki. He states most men and women invest quite a while in faculty nonetheless obtain the hang of just nothing regarding money or even financing. He targets on the amount of dollars is some thing accomplished in your house and can be usually educated by your own folks, perhaps not during the faculty or instruction frame. We being a complete want to bring it up on us to wind-up apparently monetarily educated and educated. One particular rationale why the rich becoming richer, poor people becoming poorer, and also the workingclass struggles from the crimson would be because the field of dollars is taught in your home, maybe not in faculty. An important section of people discovers out of dollars from our clients. What exactly can a bad parent tell their child viewing dollars? They simply state "Stay in faculty and also concentrate tricky." The little one may possibly grad using amazing tests nonetheless using a bad man's money connected mindset and programming. It had been discovered out whether the child had been still young. Dollars is not educated in educational institutions. Schools pay attention to proficient and educational skills, but although maybe not to money-related aptitudes. This explains how excited shareholders, expert, and bookkeepers who made fantastic tests in faculty can also now struggle most of these lifestyles fiscally. Among the very adored segments of this publication may be that the point in which he discusses mastering yet far as can logically be likely along with construction your ranges up of talents within a variety of zones. To find out areas, as an instance, earnings, advertisements, correspondence, management, and so on... and just how crucial they're. He teased a narrative on the way he had been met at Japan with way of a female. This girl has been a deeply proficient essayist and'd written a lot of novels, whatever the scenario, not one of them'd divide into the success record. At this time when Robert was speaking with her, then he inquired her to get exactly what valid reason will not she find earnings? She claims "Gracious; I abhor earnings. I'd prefer never to function as just one of the men and women, " and that she remains indefinitely. Robert Kiyosaki said, "There is motive behind why I am a crush strike writer as opposed to the usual best-composed author." The lesson out of this will be always to work out howto offer you. Earnings is a more profitable useful resource and are certain to enable you to get much better. You might write the optimal/optimally publication on Earth, nevertheless in case you fail to give it, at the time what is exactly the idea? This can be really something that I will picture with, like I disperse a significant amount of novels on everything and Kindle boils into the boosting of these novels. Have Currency Work with You A Lot of People Benefit Dollars, instead of getting cash Work with THEM. The inferior and also the white-collar class function to get cash. The rich have money work in their opinion. The huge majority expend their lifestyles undergoing faculty and receiving training using all the goal that they are able to do the job for the money. They spend of their energy employed by one more individual. For example, they benefit a pay check and also therefore are generating the proprietor/investors wealthier. At there, they operate to your own us government, that chooses its own deal by their pay check until they even celebrate it. Additionally, evidently, the tougher that they work along with additional income they create, the more larger volume of this really is removed out of the us government. Last but most certainly not least, they benefit your own financial institution to cover off their homeloan and also Mastercard duty. Instead of getting resources which make cash is really a technique for getting cash work foryou personally. Illustrations are automatic earnings (property), portfolio cash flow (bonds, stocks, etc forth... ), or even organizations. A part of the motive behind why I am really huge to online boosting is the fact that I have owned the capability to produce mechanized loopholes of earnings via it. Look in my own website entry to the very skillful approach to create uncomplicated earnings. Gain Property, Not Heard Robert states that we ought to be aware of the differentiation between an advantage and also a hazard, and also buy resources. Loaded people acquire resources. The white and poor collar category secure obligations, nevertheless they believe that they truly are resources. Below would be far more instances of resources which Robert Kiyosaki indicates people profit: • Firms which do not call for your character. • Shares • Mutual-funds • Income-producing property • any such thing which delivers earnings or admits or gets respect. A responsibility is some thing that's a price or deteriorates in regard. Your House Could Be No Asset How usually are you ever heard folks state that their home is the most notable speculation? A home and also their manager' positive aspects are regularly the key ventures which the huge majority possess. Once they've spared enough, they may go as much as and including larger dwelling. Nicely from the wealthy Dad Poor father definition, your home is not an advantage and extends in the obligations section. Surviving in-house fees you dollars plus will not profit you whatever. Without regard to the risk that you never own a homeloan you're as yet paying for duties and upkeep. The increased house which you might have, the longer it can charge. We want a refuge and also to call home everywhere. But do not fool yourself to believing that acquiring the best house that you are able to is an adequate enterprise. A residence you've purchased being a partnership to rent will be a advantage. A residence you've obtained to dwell in is not. If a home is not a partnership what exactly is? Kiyosaki prevents revealing to people exactly what resources to get (that's very good since I can not aid contradicting a substantial step of their ventures). Rather highlights getting trained in buying and also carrying in 'the recreation.' He claims that your most dominant advantage can be your own mind and also you should ceaselessly put funds in to boosting it. Some thing else I agree with! He's gained from speculation attributes along with little high shares and sold nonetheless will not say that could be the very first or many appropriate strategy. The important issue will be to be certain which you're restricting your obligations, making your resources along with receiving cash associated disabilities. Get an Organization Still another fantastic matter Robert discusses would be that the test details of curiosity about having a small business. He claims the way the business might perform as lots of such matters that someone can not. Just like, cover costs ahead of it pays prices. Agents protected and receive tired, plus so they attempt to call home on that which exactly is eliminated out. A venture drops, spends everything it may, and also can be drained on whatever that's eliminated out. It truly is certainly one among many most important legitimate appraisal provisos that the wealthy usage. An Wonderful synopsis he's for it's: The Prosperous using Corporations Inch. Earn Pay Pay off Individuals Working with Corporations Inch. Earn Pay off 3. Pay The Rich Invent Income Right here, the mistrust profits once the writer relates a narrative of a good property bargain manufactured around the "court-house ventures" by which Kiyosaki asserts to get earned £40,000 in 5 hrs. I've spent a few energy myself seeing exactly what types of structures have been obtainable from sheriff's earnings and these as well as at most truth that the most important time you will find a agreement such as this can be when each property business while in the land is sleeping in the worst possible moment -- also that isn't occurring within this age. That isn't to discredit the overall lesson with the portion; you could see right now cash. Be that as it could, probably the very effortless way to mint your very own particular profit today discipline is via generating your special authorized invention. Together with the internet you can find quite a lot of techniques to distribute and accommodate your own secure creation: offer you artworks you may create, create blogs from your own ideas, and offer you your new music or exhibitions. Ideas Your Own Personal Company The target with the section is really that the economically solid particular person should spend their excess energy never shelling out their pay checks, but instead investing yet a lot of this as may fairly be likely from resources (as distinguished via this publication). That really is just another lesson that I emphatically agree with: cover off your duties and start investment in case you possibly can in to matters which may earn money. This lesson has been speedy and painless. Operate to Know -- Do not Do the Job with Currency Everyone need to aim to know as far because they'd as soon as in a position to that they work as it might modify your understanding of earth and perhaps incorporate using processes for commencing your own personal company and behaving inherently employed. Whatever the situation, to check down in those that are properly used professionally as "hamsters" is bizarre. Is Jack Welch a "hamster"? He had been utilized by General Electric for quite a lengthy moment. Summary We've noticed it stated that the inventory will be pushed by 'greed and fear.' Robert Kiyosaki claims this, for its overwhelming bulk of people, concern could be your vital influence inside our own monetary own lives. We're modeled with our nation of the mind to funds, and also our mindset to cash is directly organized by our own fear. When we can transform our conditions of the mind to danger and wealth, we can begin to consider, behave and live as those loaded. Whatever the scenario, very first, we must prove to become more financially smart. A part of the various thoughts in Rich Dad, Poor father, was depicted right here, nonetheless merely afew. Should you aren't thinking of a life threatening shift of one's financial position and certainly will pretend that you understand not quite nothing, then you ought to get this publication.

2 notes

·

View notes

Text

Howling Wolf Farm

I first visited Jenn Colby with Sterling College’s Livestock Systems Management intensive course in the fall of 2016. I felt really lucky to be able to join her at her home again a year later for a conversation about raising her registered Katahdin sheep, how she juggled child-rearing, two jobs, and grad school at the same time, and the authenticity of real work. It was amazing to see how much the land has changed in such a short period of time. It gives me great hope to see what can be done with pasture that has been long neglected.

Jenn’s vibrant personality is reflected by her animals: good-natured, friendly, and charismatic. Our interview was held on the grazing grounds of her ram’s enclosure.

Based in Northfield, Vermont, Howling Wolf Farm is a diversified meat operation raising primarily lamb and some breeding stock. Jenn and her husband, Chris, are now semi-retired from their Howling Hog Barbecue business while they focus on investing on their new property and work off farm jobs to supplement income, but it was a good, ten-year long run on the competition circuit. I can attest that their food is amazing, because our class was lucky enough to sample it during our visit (don’t despair -- Jenn said they might like to have BBQ events on the farm some day! I highly recommend you subscribe to their newsletter and keep an eye out for future developments). Since they purchased their property in the summer of 2016, Jenn has been focused on improving the pasture since. Her goal is to make meat on their hill farm with as little inputs as possible, and Katahdins are a good choice for that goal, since they can gain weight on mediocre forage, and are good for brush management.

What Katahdins lack in luxurious wool, they more than make up for with their inquisitive personalities and impressive land-clearing skills.

Jenn was raised in somewhat of a farming family, growing hogs and rabbits in the Woodstock area, and she’s always loved working with animals. She went to UVM for animal science assuming she would be going to vet school, but eventually became disenchanted with that work. And her environmental science minor didn’t really mesh with her studies at that time (the year she graduated was also the year UVM opened their Center for Sustainable Agriculture). But her current work stems from a feeling of being disconnected to the food they were buying at the time. It’s a familiar feeling to a lot of people who become disillusioned with the ease of our industrialized food system. Chris and Jenn wanted to start growing their own food and started small with poultry, eventually adding pigs to their repertoire. Though they have always been small scale, it’s been a serious business - keeping records about yields and costs were particularly helpful when Jenn began drafting their business plan. Again, the economical nature of small ruminants comes up - though she wants to custom graze cattle, or finish beef on grass in the future, she can’t make it pay to overwinter them at the moment. Pigs and sheep are a different story, an easier one.

Even though they aren’t growing wool, the stunning colors of the pelt from hair sheep can add an extra income stream to a farmer’s balance sheet - something Jenn is just getting into now. She’d likely send them to Vermont Natural Sheepskins, a company just a few miles from her house.

The farm is currently in growth mode, so the goal is to grow the flock out with 35 breeding ewes, with somewhere between 50 and 70 marketable lambs a year. Some will be kept for breeding stock, others will be sold as starter flocks for other people looking to get closer to their food. And some will go to auction to be harvested for meat. There’s a lot in my interview with Jenn that reminded me of talking to Katie - focusing on grazing plans, adjusting soil pH for more grazeable materials and improving the soil in general, and being a little more self-reliant. Jenn wants her farm to be an example of intentional living - and her Instagram page helps show that to the world.

Jenn also uses Instagram to help plan grazing charts for the future. It gives her a physical record of where the sheep are every day to be drawn on her map. The photos help fill out the chart and catalyze the process of planning for next year.

Jenn and Chris are big fans of pre-sales marketing, or getting people familiar with the farm and what they do before they necessarily buy anything. It’s worked favorably for her so far - their Kickstarter campaign they began in the spring helped build more awareness of them in the local community. Although they did not get the funding to purchase their yurt, it helped develop a newsletter and e-mail list for friends, family and customers. It also seemed like a lot of fun, as they created a video and subsequent blooper vids as well as a lamb naming program - which was a really popular way to get people familiar with what they were producing.

Impressive.

In the world of farming, Jenn says that self-censoring is a common habit she notices in her conversation. Though she is extremely knowledgable and experienced, she may not feel comfortable voicing her opinion a lot of the time. There are studies that show that a woman needs to be really confident about a topic to speak to it, whereas a man will sort of wing it, even if he doesn’t really know what he’s on about. I’ve experienced this regularly, especially in the classroom. During discussion a male student might casually monopolize airtime and push the conversation off course, whereas a brilliant female student may feel the need, subconsciously or not, to justify speaking out about a topic.

The rams of Howling Wolf declined to comment when I inquired about gender relations amongst the herd.

Jenn spoke about living for a while on one income when her husband couldn’t balance working and going to grad school at the same time. She smiled and described raising her son while juggling a full time job, farming, and her grad school experience. Even though her son is long out of school, she still volunteers at his old high school because she believes in the value of education and cares about how the school contributes to shaping the future. “Women decide to take on everything! There’s so much to do in the world!” She exclaimed. “I support women because they give back to their community over and over again. Women are going to save the world.” I would have to agree! Jenn notes that self-confidence is a huge barrier to beginning women farmers, but not to be discouraged. There are lenders out there if you need capital - Jenn said she didn’t find an overt bias against women farmers, but the system is just unfair if you want to farm on a small scale and work with smaller livestock (see Katie Sullivan’s Hierarchy of Seriousness). There are services and educational opportunities if that’s what you need. The Women’s Agriculture Network is a good place to start. Financial literacy in school is also a good place to start. “Can we just have one class on compound interest?!” she asked. Financial illiteracy is rampant in Vermont and in our country. It was a topic recently addressed in a VT Digger article. There absolutely needs to be more financial planning for women. We need to know how to pay off debt, build equity, and learn about the basis on which banks decide to lend money (hint: you need assets. A tractor might be a nice place to start, if you can make the numbers work in your favor. Jenn can’t just now, but it’s in the books for the future. In case you were wondering!)

Jenn and I were watching her ewes graze contentedly as the foliage was starting to light up the hills behind us. It felt good to see her healthy and beautiful animals and to hear her talk about them with such care. She says she sometimes struggles to get to work in the morning because watching her sheep is so immensely satisfying. Humans are meant to work with our hands, to produce significance, to create tangible objects that can feed us in more than one way. “It’s amazing,” she said, “how meaningful work is coming back to us.”

#howling wolf farm#farming#vermont#802#katahdin sheep#jenn colby#agriculture#women#women in agriculture#feminism

1 note

·

View note

Text

Some say bypassing a higher education is smarter than paying for a degree (Washington Post)

Across the region and around the country, parents are kissing their college-bound kids -- and potentially up to $200,000 in tuition, room and board -- goodbye.

Especially in the supremely well-educated Washington area, this is expected. It's a rite of passage, part of an orderly progression toward success.

Or is it . . . herd mentality?

Hear this, high achievers: If you crunch the numbers, some experts say, college is a bad investment.

"You've been fooled into thinking there's no other way for my kid to get a job . . . or learn critical thinking or make social connections," hedge fund manager James Altucher says.

Altucher, president of Formula Capital, says he sees people making bad investment decisions all the time -- and one of them is paying for college.

College is overrated, he says: In most cases, what you get out of it is not worth the money, and there are cheaper and better ways to get an education. Altucher says he's not planning to send his two daughters to college.

"My plan is to encourage them to pursue a dream, at least initially," Altucher, 42, says. "Travel or do something creative or start a business. . . . Whether they succeed or fail, it'll be an interesting life experience. They'll meet people, they'll learn the value of money."

Certainly, you'd be forgiven for thinking this argument reeks of elitism. After all, Altucher is an Ivy Leaguer. He's rolling in dough. Easy for him to pooh-pooh the status quo.

But, it turns out, his anti-college ideas stem from personal experience. After his first year at Cornell University, Altucher says his parents lost money and couldn't afford tuition. So he paid his own way, working 60 hours a week delivering pizza and tutoring, on top of his course load.

He left Cornell thousands of dollars in debt. He also left with a degree in computer science. But it took failing at several investment schemes, losing large sums of money and then studying the stock market on his own -- analyzing Warren Buffett's decisions so closely he ended up writing a book about him -- for Altucher to learn enough about the financial world to survive in it. He thinks he would have been better off getting the real-world lessons earlier, rather than thrashing himself to pay for school and shouldering so much debt.

It's cold comfort, but the loans put him in good company: Hundreds of billions of dollars of national student-loan debt has now overtaken American credit-card debt, the Wall Street Journal recently reported, using numbers compiled by FinAid.org, a Web site for college financial aid information.

"There's a billion other things you could do with your money," Altucher says. One option: Invest the money you'd spend on tuition in Treasury bills for your child's retirement. According to Altucher, $200,000 earning 5 percent a year over 50 years would amount to $2.8 million.

Few families have that kind of money lying around. But if you can give your child $10,000 or so to start his own business, Altucher says, your child will reap practical lessons never taught in a classroom. Later, when he's more mature and focused, college might be more meaningful.

* * *

The hefty price tag of a college degree has some experts worried that its benefits are fading.

"I think it makes less sense for more families than it did five years ago," says Richard Vedder, an economics professor at Ohio University who has been studying education issues. "It's become more and more problematic about whether people should be going to college."

That applies not just to astronomically priced private schools but to state schools as well, where tuitions have spiked. Student loans can postpone the pain of paying, but they come due when many young adults are at their most financially vulnerable, and default rates are high. Even community colleges, while helping some to keep costs down, prompt many to take out loans -- which can land them in severe credit trouble.

According to a report in the Chronicle of Higher Education, 31 percent of loans made to community college students are in default. (The same report found that 25 percent of all government student loans default.) Default on a student loan and face dire consequences, beyond a bad credit record -- which can tarnish hopes of getting a car, an apartment or even a job: Uncle Sam can claim your tax refunds and wages.

Now, take a key argument in favor of getting a four-year degree, the one that says on average, those with one earn more than those without it. Education Department numbers support this: In 2008, the median annual earnings of young adults with bachelor's degrees was $46,000; it was $30,000 for those with high school diplomas or equivalencies. This means that, for those with a bachelor's degree, the middle range of earnings was about 53 percent more than for those holding only a high school diploma.

But a lot of college graduates fall outside the middle range -- and many stand to make considerably less.

"If you major in accounting or engineering, you're pretty likely to get a return on your investment," Vedder says. "If you're majoring in anthropology or social work or education, the rate on return is going to be a good deal lower, on average.

"I've talked to some of my own students who've graduated and who are working in grocery stores or Wal-Mart," he says. "The fellow who cut my tree down had a master's degree and was an honors grad."

The unemployment rate among those with bachelor's degrees is at an all-time high. In 1970, when the overall unemployment rate was 4.9 percent, unemployment among college graduates was negligible, at 1.2 percent, Vedder says, citing figures from the Bureau of Labor Statistics. But this year, with the national rate of unemployment at 9.6 percent, unemployment for college graduates has risen to 4.9 percent -- more than half the rate of the general population. The bonus for those with degrees is "less pronounced than it used to be," Vedder says.

"The return on investment is clearly lower today than it was five years ago," he says. "The gains for going to college have leveled off."

Before hackles are raised about boiling the salutary effects of higher education down to its cost, there are obvious disclaimers: Education is a priceless thing. Many high-school graduates are not ready for independence and adult responsibilities, and college provides a safe place for them to grow up -- for a fee.

But what about the lessons offered by the success stories that have unspooled along a different path? Dropouts are the toast of the dot-com world. To the non-degreed billionaires' club headed by Microsoft's Bill Gates (Harvard's most famous quitter) and Apple's Steve Jobs (left Oregon's Reed College after a single semester), add: Michael Dell (founder of Dell Computers, University of Texas dropout), Microsoft co-founder and Seattle Seahawks owner Paul Allen (quit Washington State University) and Larry Ellison (founder of Oracle Systems, gave up on the University of Illinois).

Success sans sheepskin isn't only for the technology set.

David Geffen, co-founder of DreamWorks, bowed out of several schools, including the University of Texas.

Redskins owner Daniel Snyder dropped out of the University of Maryland.

Barry Gossett, chief executive of Baltimore's Acton Mobile Industries, builders of temporary trailers, also left Maryland without a degree. (No hard feelings, apparently: In 2007, he donated $10 million to the school.)

Perhaps these are unique individuals in whom a driving entrepreneurial spirit outstripped the plodding pace of book learning.

Or perhaps they point to a new model.

"There's nothing you can't do on your own," Altucher says. A provocative idea -- and a liberating one. Even if it's not entirely true.

But you don't have to agree with Altucher to concede that the debt-stress many graduates or their parents -- or both -- are left with after tossing off the cap and gown works against the merits of the degree.

Even if a kid doesn't party his way through college, chances are he or his family has plowed a boatload of money into a few memorable classes and a lot of boredom.

On top of that, you don't know how big a boatload it'll be. For many college students, four years of anticipated tuition payments grows to five years or six -- or more. Government statistics show just 57 percent of full-time college students get their bachelor's degrees in six or fewer years.

And the rest . . . don't.

* * *

In her youth, Toni Reinhart, 55, owner of Comfort Keepers Reston, a licensed home-care agency in Northern Virginia, abandoned hopes of completing a business degree at George Mason University. There was that C in accounting, and then trigonometry. . . .

"My problem was not being able to put the time in to learn things I wasn't interested in," she says.

Has dropping out held her back?

"Oh sure," says Reinhart, a self-described late-bloomer. "But maybe that's good. Maybe it held me back from things I shouldn't have been doing anyway."

Now she manages 56 employees and in recent years hit the million-dollar mark in gross revenue.

"I understand the case for finishing, because you've proven you can stick with something," she says. "But wouldn't it be nice if we did have another path that didn't put people in debt for . . . $100,000? Isn't there another way to instill those kinds of lessons in people that would be cheaper?"

Nelson Cortez, 20, wishes there were. The Napa resident starts his third year this month at the University of California at Santa Cruz. He's received state grants and works 15 hours a week while school is in session, but with the loans he's taken out, he estimates he's already about $25,000 in debt. This is why, when the California Board of Regents last year announced a 32 percent increase in fees, he joined protests that galvanized students around the state -- and set off similar protests around the country.

Cortez helped shut down the Santa Cruz campus and traveled to the District to rally outside the U.S. Capitol. (On Oct. 2, students will demonstrate on the Mall for affordable education as part of the One Nation march, organized by civil rights and youth groups and unions.)

"Rent was due yesterday, and I was $20 short, and I'm running around the house looking for $20," Cortez says. His money problems have caused him to question whether he's made the right decision: "Am I going to be able to afford it, should I take a semester off? . . . I do have in the back of my mind, would it be better not to have those loans and just work?"

According to the Education Department, between 1997-98 and 2007-08, prices for undergraduate tuition, room and board at public institutions of higher education rose by 30 percent, and prices at private institutions rose by 23 percent -- after adjustments for inflation. "The reason colleges have been getting away with raising their fees so much is that loans allow parents to tough it out," Vedder says.

Federal government moves, such as tuition tax credits, allow those paying college costs to subtract a certain amount from their tax bills. But it does little to alleviate the financial burden, Vedder says, adding that it gives colleges an excuse to raise costs further.

* * *

The cost of college is putting the financial screws to an entire generation, say student activists.

"I think it's absolutely despicable that students are asked to pay that much," says Lindsay McCluskey, president of the United States Student Association. "In terms of public education, you can't even call that public when students are taking out an average of $25,000 to complete college and then are paying off student loan debt until they're 50 or 60 years old."

A recent graduate of the University of Massachusetts Amherst, where she majored in anthropology, McCluskey is paying down a $20,000 student loan. She thinks it will probably take her a decade to dig out of that hole -- while the balance is accumulating interest -- because she can't afford to make more than the minimum monthly payments.

"For my generation," McCluskey, 23, says, "that loan debt is taking the place of the house we could be buying or a number of other investments we could be making in our lives. The loan debt just sucks a lot of that out."

Now consider Jeremiah Stone, 25. The graduate of Rockville's Thomas S. Wootton High School is living in Paris, pursuing a drool-worthy international career as a chef. After high school, he took a job as a barback in a Houston's Restaurant, worked up to kitchen assistant, took a nine-month cooking course at the French Culinary Institute in New York and finally landed in France, where he has freelanced as a chef throughout the country. Eventually he hopes to open his own restaurant in New York.

"People I meet for the first time, they're always saying, 'Oh, if I had another career, I'd be a pastry chef instead of becoming a lawyer,' " Stone says. In the eyes of some of his friends, he says, he's become emblematic of simply doing what you love. In his case, it turns out that not following the herd was the best investment of all.

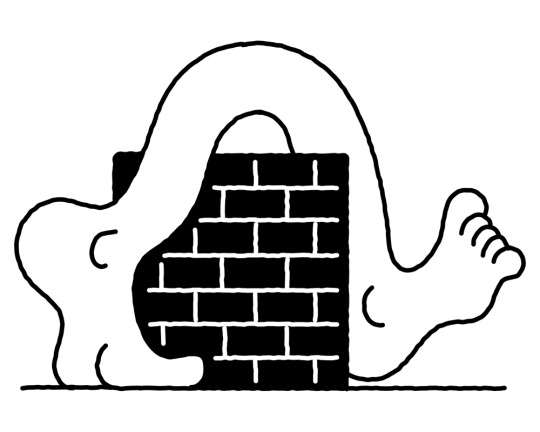

Source: Washington Post / Sarah Kaufman. Link: Bypassing a higher education Illustration: Tim Lahan. Moderator: ART HuNTER.

#propaganda#contemporary world#postmodern thinking#neoliberal capitalism#economy#washington post#tim lahan#brainslide bedrock education talk#education#knowledge#article#free your mind

4 notes

·

View notes

Photo

Tuition Insurance | Here’s How It Works http://bit.ly/2RN5iOb

I was recently asked a question by a reader about the drawbacks of getting a private student loan.

She asked why she shouldn’t get a private student loan, when interest rates are so low right now. She would need to cosign with her daughter on the loan in order to get the best rate.

My advice was as follows: the biggest danger of a private student loan is that the cosigner is also liable for the debt. So, should something happen to her daughter, and she can’t graduate and earn income, she will be on the hook for the debt.

However, there are options to protect parents when it comes to paying their children’s tuition – tuition insurance.

Below, we’re giving you our best insights into tuition insurance and sharing our top picks for tuition insurance providers.

Quick Navigation

What Is Tuition Insurance?

What Does Tuition Insurance Cover?

Companies Who Offer Tuition Insurance

Should College Students and Parents Purchase Tuition Insurance?

Now, Here's How Much It Costs

Tuition Coverage to Look For

What You Need to Apply for Tuition Insurance

How to File a Claim, When Needed

Bottom Line: Tuition Insurance Can Be A Great Value

What Is Tuition Insurance?

When you purchase a home, you buy homeowners insurance. When you buy a car, you protect it with an auto insurance plan.

While you don’t make these purchases expecting an accident to occur, you buy insurance to guarantee that if the unexpected happens, you’ll be protected.

As tuition rates continue to climb at both public and private institutions, college is one of the biggest investments that people make.

When you’re spending tens of thousands of dollars to fund your education, tuition coverage can provide you with peace of mind in case things don’t go as planned.

While your college or university may not reimburse you if you get sick and have to drop out mid-semester, a tuition insurance provider will.

Tuition insurance is a product offered by a handful of providers who safeguard your investment in a college education, covering the cost of your tuition if you must withdraw for one of the reasons agreed upon in the policy.

What Does Tuition Insurance Cover?

Tuition isn’t cheap. According to the College Board, the average cost of public university in-state tuition in 2018-2019 is $21,370, with a private education coming in at $48,510.

Without tuition insurance, if you have to withdraw from school for medical reasons, especially after the school’s withdrawal deadline (typically no more than a month) you can probably kiss that $20,000-$50,000 goodbye.

Tuition insurance is designed to help you avoid that scenario, with most policies covering up to around $50,000 per year.

While one provider might vary from the next, you can generally expect to find coverage for withdrawal due to the following reasons:

Medical Disability Withdrawal

Death of the Student

Other Disability Withdrawal, such as emotional, mental, or nervous disorders

Outside of those reasons, you’ll be on your own. Tuition insurance does not equate to dropout insurance, so you can’t get reimbursed if you voluntarily withdraw.

In other words, your tuition insurance policy will not pay out for academic withdrawals, like you failing out of your classes, expulsion, or transferring to another school.

Companies Who Offer Tuition Insurance

Tuition insurance is only offered by a few select carriers who specialize in this type of coverage. Let’s take a look at what each of them has to offer.

GradGuard

GradGuard is our top pick for tuition insurance, and it’s easy to see why.

GradGuard is designed specifically to help college students and their parents to protect their investment in a college education, offering coverage at hundreds of colleges and universities nationwide.

GradGuard offers two insurance products: tuition insurance and college renters insurance.

Partnering with Allianz Global, a reputable carrier, GradGuard markets 100% reimbursement for tuition and room and board, when you withdraw due to serious medical conditions, chronic conditions, or psychological reasons.

They also help with travel arrangements for parents to visit their hospitalized students and transportation arrangements for injured and ill students.

The company also touts an "A+" from credit rating agency A.M. Best, making them a reliable carrier.

Check Out Grad Guard

A.W.G Dewar

A.W.G. Dewar is another provider offering tuition insurance for both K-12 private schools and colleges and universities.

Dewar has offered its College Tuition Refund Plan for nearly a century, providing coverage for tuition and room and board for verified medical withdrawals.

Dewar’s plan works to first supplement the college or university’s step down refund (if there is one), then fully reimburse tuition beyond that amount for the rest of the semester.

The company has an "A" rating from A.M. Best, demonstrating its reputability as an insurance provider.

Dewar also claims to offer competitive low rates on its tuition insurance policies, which cover a significant amount of the tuition paid. If you’re looking for low premiums at the expense of slightly less expansive coverage, Dewar could be a good option.

Check Out The College Tuition Refund Plan

Education Insurance Plans

Education Insurance Plans is an insurance agency which offers riders and life insurance products tailored to college students rather than tuition insurance as defined above.

EIP markets itself as an agency who protects education lenders, students, and parents with more targeted needs than simply reimbursing tuition.

One unique offering from EIP is its InsureMyTrip plan, which is designed for college students studying abroad.

This plan, provided by Nationwide, does offer tuition protection if your academic study abroad trip is cancelled or interrupted due to evacuation or medical emergencies.

Some of these policies also come with additional benefits like luggage protection, emergency assistance, and travel assistance.

Beyond its study abroad tuition assistance, EIP offers access to affordable term life insurance with Haven Life and Ameritas disability insurance with student loan riders.

Should College Students and Parents Purchase Tuition Insurance?

Knowing what tuition insurance has to offer, your interest may be piqued.

Whether or not you need tuition insurance depends on you finding the peace of mind a policy offers worthwhile.

As you decide whether or not you need tuition coverage, here are a few factors to keep in mind:

Withdrawal period: Timing is everything. If you withdraw within the first few weeks of the semester, you may already be covered by the school’s policy. Withdraw at the very end, and you may be able to make arrangements with professors to receive a passing grade and gain credit for the course.

Coverage length: Typically, your policy will only cover the current semester. It’s up to you to decide if that time period is worth the risk.

What’s Covered: Tuition insurance only covers approved health issues, restricting its usefulness to a small timeframe with a limited area of coverage.

Cost: Compared to other types of insurance, tuition coverage is pretty affordable. You could be spending merely hundreds of dollars to cover a $50,000 tuition investment.

Your medical needs: If you have a medical condition and fear it could interfere with your education, and the condition is covered, you might want to consider a policy.

College tuition is costly, but tuition insurance is not.

You ultimately need to weigh the costs and the risks to decide if tuition insurance is the right call for you.

You should also see what your college or university’s refund policy is.

Just like your tuition itself, your insurance policy is an investment, and it generally has a low return.

Now, Here's How Much It Costs

Tuition insurance costs around 1% of the total tuition amount, on average.

If you took out a standard tuition semester-long protection plan with GradGuard for $20,000, your total cost would be $198.

That $198 would cover up to the full tuition amount for approved illnesses, injuries, psychological disorders, the death of the student, the passing of the student or tuition payer, and up to $1000 for housing, books, and other fees.

It’s great coverage for the cost, as long as your withdrawal is due to one of the policy’s covered conditions.

Another piece of good news is that policy amounts are flexible.

With GradGuard’s free quoting tool, you can enter your school and set the amount of coverage, meaning you can opt to cover only a portion of your tuition if you choose.

Tuition Coverage to Look For

With so few carriers offering tuition insurance, you can expect to find similar policies and premiums across the board.

At a base level, you should look for the most comprehensive policy within your budget that meets your needs.

If you have a pre-existing condition, make sure to read the fine print and be sure that a related incident during the semester will be covered.

A solid policy like the ones offered by Allianz will cover severe injuries, illnesses, including pre-existing ones, and anxiety and depression.

You can also find coverage the encompasses family emergencies for a higher cost, and for an even more heightened cost, you can opt into a policy that covers any unexpected incident leading to your withdrawal during the semester.

What You Need to Apply for Tuition Insurance

Applying for a tuition insurance policy is simple. With most tuition insurance policies, you aren’t required to undergo a medical exam to get coverage.

You simply input the coverage term and amount, enter your personal information, and select a policy that fits your needs.

After paying for your insurance policy, your coverage will take effect for the duration of the semester you determined in your application.

How to File a Claim, When Needed

GradGuard’s filing process involves the student or tuition payer, the school’s Registrar’s office, and the doctor involved in the case.

After consenting to a release of your medical and academic information, the Dean’s or Registrar’s Office fills in paperwork which verifies the reason for you withdrawal and the amount of the student’s tuition the school will reimburse, if applicable.

The physician then answers a series of questions confirming the circumstances of the student’s injury or illness and their recommendation that the student withdraw.

Bottom Line: Tuition Insurance Can Be A Great Value

If you are going to be paying for your child’s education, tuition insurance can be a worthwhile investment.

But if you are cosigning a loan for your child’s education, tuition insurance is a must to ensure that you are protected should something happen to your child.

If you’re a student paying your own way through college, tuition insurance can be an affordable solution to protecting your investment in case anything goes wrong.

What are your thoughts on tuition insurance? A value for cosigners?

The post Tuition Insurance | Here’s How It Works appeared first on The College Investor.

from The College Investor

I was recently asked a question by a reader about the drawbacks of getting a private student loan.

She asked why she shouldn’t get a private student loan, when interest rates are so low right now. She would need to cosign with her daughter on the loan in order to get the best rate.

My advice was as follows: the biggest danger of a private student loan is that the cosigner is also liable for the debt. So, should something happen to her daughter, and she can’t graduate and earn income, she will be on the hook for the debt.

However, there are options to protect parents when it comes to paying their children’s tuition – tuition insurance.

Below, we’re giving you our best insights into tuition insurance and sharing our top picks for tuition insurance providers.

Quick Navigation

What Is Tuition Insurance?

What Does Tuition Insurance Cover?

Companies Who Offer Tuition Insurance

Should College Students and Parents Purchase Tuition Insurance?

Now, Here's How Much It Costs

Tuition Coverage to Look For

What You Need to Apply for Tuition Insurance

How to File a Claim, When Needed

Bottom Line: Tuition Insurance Can Be A Great Value

What Is Tuition Insurance?

When you purchase a home, you buy homeowners insurance. When you buy a car, you protect it with an auto insurance plan.

While you don’t make these purchases expecting an accident to occur, you buy insurance to guarantee that if the unexpected happens, you’ll be protected.

As tuition rates continue to climb at both public and private institutions, college is one of the biggest investments that people make.

When you’re spending tens of thousands of dollars to fund your education, tuition coverage can provide you with peace of mind in case things don’t go as planned.

While your college or university may not reimburse you if you get sick and have to drop out mid-semester, a tuition insurance provider will.

Tuition insurance is a product offered by a handful of providers who safeguard your investment in a college education, covering the cost of your tuition if you must withdraw for one of the reasons agreed upon in the policy.

What Does Tuition Insurance Cover?

Tuition isn’t cheap. According to the College Board, the average cost of public university in-state tuition in 2018-2019 is $21,370, with a private education coming in at $48,510.

Without tuition insurance, if you have to withdraw from school for medical reasons, especially after the school’s withdrawal deadline (typically no more than a month) you can probably kiss that $20,000-$50,000 goodbye.

Tuition insurance is designed to help you avoid that scenario, with most policies covering up to around $50,000 per year.

While one provider might vary from the next, you can generally expect to find coverage for withdrawal due to the following reasons:

Medical Disability Withdrawal

Death of the Student

Other Disability Withdrawal, such as emotional, mental, or nervous disorders

Outside of those reasons, you’ll be on your own. Tuition insurance does not equate to dropout insurance, so you can’t get reimbursed if you voluntarily withdraw.

In other words, your tuition insurance policy will not pay out for academic withdrawals, like you failing out of your classes, expulsion, or transferring to another school.

Companies Who Offer Tuition Insurance

Tuition insurance is only offered by a few select carriers who specialize in this type of coverage. Let’s take a look at what each of them has to offer.

GradGuard

GradGuard is our top pick for tuition insurance, and it’s easy to see why.

GradGuard is designed specifically to help college students and their parents to protect their investment in a college education, offering coverage at hundreds of colleges and universities nationwide.

GradGuard offers two insurance products: tuition insurance and college renters insurance.

Partnering with Allianz Global, a reputable carrier, GradGuard markets 100% reimbursement for tuition and room and board, when you withdraw due to serious medical conditions, chronic conditions, or psychological reasons.

They also help with travel arrangements for parents to visit their hospitalized students and transportation arrangements for injured and ill students.

The company also touts an "A+" from credit rating agency A.M. Best, making them a reliable carrier.

Check Out Grad Guard

A.W.G Dewar

A.W.G. Dewar is another provider offering tuition insurance for both K-12 private schools and colleges and universities.

Dewar has offered its College Tuition Refund Plan for nearly a century, providing coverage for tuition and room and board for verified medical withdrawals.

Dewar’s plan works to first supplement the college or university’s step down refund (if there is one), then fully reimburse tuition beyond that amount for the rest of the semester.

The company has an "A" rating from A.M. Best, demonstrating its reputability as an insurance provider.

Dewar also claims to offer competitive low rates on its tuition insurance policies, which cover a significant amount of the tuition paid. If you’re looking for low premiums at the expense of slightly less expansive coverage, Dewar could be a good option.

Check Out The College Tuition Refund Plan

Education Insurance Plans

Education Insurance Plans is an insurance agency which offers riders and life insurance products tailored to college students rather than tuition insurance as defined above.

EIP markets itself as an agency who protects education lenders, students, and parents with more targeted needs than simply reimbursing tuition.

One unique offering from EIP is its InsureMyTrip plan, which is designed for college students studying abroad.

This plan, provided by Nationwide, does offer tuition protection if your academic study abroad trip is cancelled or interrupted due to evacuation or medical emergencies.

Some of these policies also come with additional benefits like luggage protection, emergency assistance, and travel assistance.

Beyond its study abroad tuition assistance, EIP offers access to affordable term life insurance with Haven Life and Ameritas disability insurance with student loan riders.

Should College Students and Parents Purchase Tuition Insurance?

Knowing what tuition insurance has to offer, your interest may be piqued.

Whether or not you need tuition insurance depends on you finding the peace of mind a policy offers worthwhile.

As you decide whether or not you need tuition coverage, here are a few factors to keep in mind:

Withdrawal period: Timing is everything. If you withdraw within the first few weeks of the semester, you may already be covered by the school’s policy. Withdraw at the very end, and you may be able to make arrangements with professors to receive a passing grade and gain credit for the course.

Coverage length: Typically, your policy will only cover the current semester. It’s up to you to decide if that time period is worth the risk.

What’s Covered: Tuition insurance only covers approved health issues, restricting its usefulness to a small timeframe with a limited area of coverage.

Cost: Compared to other types of insurance, tuition coverage is pretty affordable. You could be spending merely hundreds of dollars to cover a $50,000 tuition investment.

Your medical needs: If you have a medical condition and fear it could interfere with your education, and the condition is covered, you might want to consider a policy.

College tuition is costly, but tuition insurance is not.

You ultimately need to weigh the costs and the risks to decide if tuition insurance is the right call for you.

You should also see what your college or university’s refund policy is.

Just like your tuition itself, your insurance policy is an investment, and it generally has a low return.

Now, Here's How Much It Costs

Tuition insurance costs around 1% of the total tuition amount, on average.

If you took out a standard tuition semester-long protection plan with GradGuard for $20,000, your total cost would be $198.

That $198 would cover up to the full tuition amount for approved illnesses, injuries, psychological disorders, the death of the student, the passing of the student or tuition payer, and up to $1000 for housing, books, and other fees.

It’s great coverage for the cost, as long as your withdrawal is due to one of the policy’s covered conditions.

Another piece of good news is that policy amounts are flexible.

With GradGuard’s free quoting tool, you can enter your school and set the amount of coverage, meaning you can opt to cover only a portion of your tuition if you choose.

Tuition Coverage to Look For

With so few carriers offering tuition insurance, you can expect to find similar policies and premiums across the board.

At a base level, you should look for the most comprehensive policy within your budget that meets your needs.

If you have a pre-existing condition, make sure to read the fine print and be sure that a related incident during the semester will be covered.

A solid policy like the ones offered by Allianz will cover severe injuries, illnesses, including pre-existing ones, and anxiety and depression.

You can also find coverage the encompasses family emergencies for a higher cost, and for an even more heightened cost, you can opt into a policy that covers any unexpected incident leading to your withdrawal during the semester.

What You Need to Apply for Tuition Insurance

Applying for a tuition insurance policy is simple. With most tuition insurance policies, you aren’t required to undergo a medical exam to get coverage.