#(huh)

Explore tagged Tumblr posts

Text

MATPAT?????

pick one. this is your new roommate

1 2 3 4 5

6 7 8 9 10

11 12 13 14 15

16 17 18 19 20

21 22 23 24 25

26 27 28 29 30

39K notes

·

View notes

Note

Getting Lost

(part 1...maybe?)

-----------------------------------------

He gets lost. He dives into the ocean of color and sound that is his mind. Here there is no crowd, no little hands tapping on the windows for his attention, no loudspeakers announcing what humans called a "show" or monitors giving him orders to do somersaults to entertain the audience. Here there was only him and infinity.

Nothing was limited, in this space that belongs only to him, he is free. Then he thinks, he sees the world, thinks back to the past. He sees the water again, not the one in his pool, but the one that tastes like salt, the one that is never still, the one that like him does not stop, the one that forever holds the memory of his childhood. It is over there that his cradle is, over there that the world begins, because here it is not the world, because here is limited, here his body fits between four walls, immersed in filtered water and rocked by the sound of the pump hidden behind the concrete.

So in this small part of infinity, he opens a new door and loses himself in his own universe. He tells himself that if he thinks hard enough, if he gets lost far away, the sound of the pump will become that of the whales, that if he continues to dive, the tiles at the bottom of his prison will start to move like the algae of yesteryear... To stop being bored, to drown his sorrow and forget the heaviness of his fins, he gets lost.

In his world of noise and lights, nothing was and everything was at the same time, human languages were refined and distorted into familiar clicks and songs that made him think that maybe home wasn't so far away.....

And then he was taken out again, infinity moved away through an invisible harness that was once very real and left only the cage.

The day had just begun, and an uncomfortable feeling crept into him. The atmosphere was heavy, waiting for something, the humans seemed more excited than usual and they posted on the windows of his pool: "Jazz the orca will be absent today but will return soon with brand new tricks!".

Absent? Absent why? Did they want to make him undergo medical examinations? Make him learn new pirouettes so that the entries increase? No matter the plan of the humans, it made his mind disturbed and troubled. He could not get lost, not return to his world where time no longer counts. No, here he was waiting, he was spinning, he knew that his part of infinity would change for maybe the best, but more likely for the worst.

-----------------------------------------

-🦇🐧

(First time doing something like this hope you like it!)

"He knew that his part of infinity would change for maybe the best, but more likely for the worst."

#...............YOU KNOW WHAT#Just take my heart and eat it already /j#rlkrnfnfbrkfmrkor#oh god the descriptions are so#what is even the right word???#I read them and I can freaking feel them#this is amazing#anon you signed as uh...bat penguin? Imma call you bat penguin#just saw your other ask#gasped and immediately went on a search mission to find this fic#thank you for writing it#I love it I love it I love it with all my heart#I wonder if tumblr search system would break if I tag things with emojis.....#huh#🦇🐧#let's find out I guess#apocalyptic ponyo#jazz#ponyo jp writing

160 notes

·

View notes

Text

I need you to know that right now I'm at work, sitting in a craft closet next to a big Pete the Cat stuffed animal, debating if I should read Muddle and Mo's Rainy Day or Peep and Ducky for family storytime tomorrow morning.

Gonna leave in a minute and go home to my silly little horror story about demons and monsters.

#just zoomed out of my body for a second there and was like#huh#though to be fair#if anything makes you interested in demons#it's probably working with children#albie's corner#will delete later

59 notes

·

View notes

Text

do u guys think haibara, nanami, gojo and geto are switching body parts while laughing rn

#zai's random shit#jjk#yu haibara#kento nanami#gojo satoru#geto suguru#jujutsu kaisen#do u get me#BE REAL WITH ME#friend reunite wowww#poor shoko bro#wait ain't she dead rn#HUH

47 notes

·

View notes

Text

[BALS?????]

what the fuck did i missed LMAOOOOOOOOOOOOOOOOOo

#my art#great god grove#ggg#artwork#ggg fanart#ggg click clack#click clack#BALLS?????#HUH#my bals#click clack ggg

47 notes

·

View notes

Text

has anyone done this yet

(click for higher quality)

#dungeon meshi#delicious in dungeon#dungeon meshi fanart#senshi of izganda#laios touden#digital art#meme redraw#100#500#1k#!?#5k#10k#HUH#thanks guys this is wild#50k

56K notes

·

View notes

Text

24K notes

·

View notes

Text

“I once knew a girl… Amber…”

“…for me… her name was Maria…”

#do you ever stop and think about how similar these guys are?#cause I do.#huh#my art#sonic the hedgehog#sonic fanart#shadow the hedgehog#pokemon#mewtwo

11K notes

·

View notes

Text

#minecraft#minecraft movie#minecraft the movie#wtf was thay#tgat#that#like what#huh#im in shambles#wtf#wtf wtf

12K notes

·

View notes

Text

Lil kisses with simon are always a must. The man's been alone most of his life so when he somehow hounds a sweet thing like you he's keeping his back hunched, uncomfortable, but if you can reach his cheek then its all worth it.

He's acting all sly as if he wasn't the one that wanted kisses each time. Blushing and stammering when you hold him down to drown his eyes and heart in kisses.

"Lovie, ain't fair, caught me by surprise."

And yet he's still keeping the lipstick marks on his cheeks. Like a token when he decides to sit down so you can reach into him even more.

#huh#guess who lied#valo saved me so praise thee that cursed game#cod#call of duty#hcs#simon riley#simon ghost riley#simon riley x reader#simon riley x you#simon ghost x reader#simon ghost riley x reader

3K notes

·

View notes

Text

we, russians, are very nice people. deep down

That's a happy sign right there

12K notes

·

View notes

Text

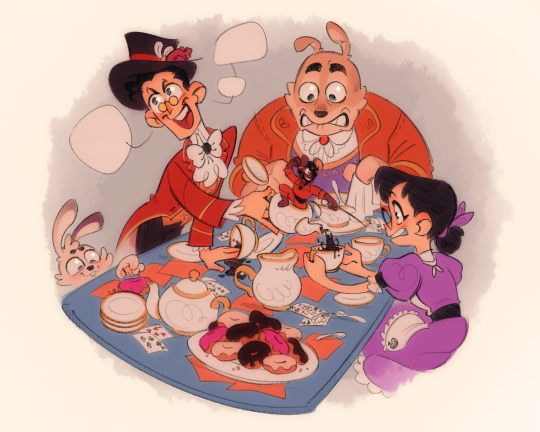

Well, for no actual reason, tf2 × Alice in Wonderland AU!!

also this ans this🤏

#tf2#team fortress 2#tf2 scout#tf2 soldier#tf2 pyro#tf2 demoman#tf2 heavy#tf2 engineer#tf2 medic#tf2 sniper#tf2 spy#tf2 scouts ma#tf2 miss pauling#does it need a title#and what title#wonderfortress#....??#uh#huh

4K notes

·

View notes

Text

Is this anything

#star wars#hondo ohnaka#obi wan kenobi#anakin skywalker#star wars incorrect quotes#clone wars#the clone wars#star wars tcw#sw tcw#tcw#incorrect quotes#all tags I haven't used in so long wow haha#huh#1k#I forgot the star wars fandom is massive#2k#I repeat my previous statement

2K notes

·

View notes

Text

CA!!!!!!!!!!!!!!!!!!!!!!! 1000 BEARS ATTACK 🐻🐻🐻🐻🐻🧸🐻🐻🐻🧔♂️🐻🐻🐻🐻🐻🐻🐻🐻

899 notes

·

View notes