Don't wanna be here? Send us removal request.

Text

How Better Payment Processing Creates More Satisfied Customers

As a small business owner, you’re probably juggling countless responsibilities, from inventory and staffing to marketing and customer service.

But one crucial area that’s easy to overlook is your payment processing system.

And if your checkout is slow, complicated, or outdated, you might unknowingly be frustrating your customers and hurting your bottom line.

Long lines, limited payment options, and concerns about security can send customers straight to your competitors, costing you valuable sales and damaging your reputation.

On the other hand, getting your payment processing right can dramatically improve customer satisfaction, boost customer loyalty, and help drive repeat business.

So, if you’re looking for better payment processing and you want to provide the absolute best experience you can for your customers at checkout, then this is an article you can’t afford to miss.

The Importance of Better Payment Processing

Over the past decade, how customers pay for products and services has dramatically evolved.

Today’s consumers expect transactions to be fast, convenient, and secure, regardless of whether they’re shopping online, at a retail store, or somewhere else altogether.

As a result, having a seamless checkout experience has become an integral element of the overall customer experience.

Slow, cumbersome, or outdated payment methods can frustrate customers, often driving them away to competitors who offer better payment processing.

But if you’ve got an efficient, reliable, and modern payment system, that can translate into much more satisfied customers.

All things considered, businesses that invest in better payment processing can expect to have much happier customers, and significantly more referrals, as satisfied customers are a lot more likely to recommend your services.

Speed: Accelerating Customer Satisfaction

Speed is one of the most noticeable and appreciated aspects of any checkout experience.

Quick transactions mean reduced waiting times, and this is incredibly important to your customers, particularly during peak shopping season.

Consider the difference between a customer swiftly tapping their card or smartphone, instead of having to manually go through the checkout process and deal with slow processing.

No matter how you slice it, the faster and smoother your transactions are, the more satisfied your customers will be.

What’s more, a swift checkout experience helps to make your business more efficient, as employees will spend less time managing individual transactions, giving them more time to focus on other things.

These benefits create a satisfying shopping atmosphere, which can contribute to repeat visits and positive word-of-mouth referrals.

Convenience: Meeting Customer Expectations

Having the flexibility to accept as many payment methods as possible has become another essential expectation of today’s consumers.

Offering multiple payment methods, including contactless cards, mobile payments like Apple Pay and Google Pay, and seamless online transactions, is no longer an option if you want to keep your customers.

Because if you limit yourself to traditional payment methods, you run the risk of appearing outdated and can easily lose potential sales to more forward-thinking competitors.

Moreover, a properly integrated POS system ensures accurate transaction data, which helps to reduce human error and streamline your operations.

And in addition to enhancing the customer experience, this can also improve your efficiency.

Security: Building Customer Trust Through Safer Transactions

Customers today are becoming increasingly concerned about the security of their payments.

With that in mind, if you’re looking for better payment processing, you should consider payment processing systems that prioritize robust security measures, including PCI compliance, encryption, tokenization, and sophisticated fraud detection tools.

Protecting customer data is incredibly important for maintaining and building trust, which is a crucial component of the relationships you have with customers.

In any case, if you clearly communicate your commitment to secure transactions, this makes you more trustworthy, and that means more customers will choose to keep giving you their business.

At the same time, breaches in security can cause lasting damage to your reputation and result in lost customers.

Staying Current: The Importance of Modern Payment Terminals

Because payment technology has been advancing so rapidly, if you want to remain competitive, you’ve got to make sure your payment processing systems remain fully updated.

Like it or not, investing in modern payment terminals is no longer a luxury but a necessity.

These state-of-the-art terminals facilitate faster and more secure transactions and accommodate all forms of payment, allowing you to keep pace with customers’ expectations, and ensure they remain satisfied.

And in addition to how this can benefit your customers, modern payment terminals often come equipped with digital receipts, integrated inventory management, and customer relationship management (CRM) tools, which allow you to collect valuable customer data.

Customer Loyalty and Retention: The Bottom-Line Benefits

Better payment processing does far more than just enhance the customer experience – it strengthens your relationships with customers, making them more likely to continue giving you their hard-earned money.

Loyal customers typically spend more, purchase more frequently, and will enthusiastically recommend your business to others. And ensuring you have a smooth and efficient payment process also helps to reduce cart abandonment rates, both online and in-store.

At any rate, offering a frictionless payment experience and simplifying every step in the purchasing process will inevitably lead to increased revenue, more satisfied customers, and greater loyalty.

Lucid Payments: Enhancing Your Customer Experience

Here at Lucid Payments, we understand the critical role payment processing plays if you want to have satisfied customers.

With that in mind, we provide comprehensive payment solutions that are specifically designed to help small business owners like you enhance the payment experience by focusing on speed, convenience, security, and ensuring we offer the most modern equipment.

If you decide to partner with Lucid Payments, you’ll gain access to:

Rapid Transactions: We ensure customers enjoy swift, efficient checkouts that enhance their overall shopping experience.

Advanced Security Measures: We protect customer data with robust encryption, secure payment methods, and PCI compliance.

Flexible Payment Options: We offer the convenience of a diverse array of payment methods, including contactless and mobile payment options.

Cutting-Edge Equipment: We regularly update our payment terminals to ensure you have access to high-quality equipment with all the latest bells and whistles.

Expert Customer Support: We provide 24/7/365 support, based in Canada, which ensures you’ll receive reliable and intelligible assistance whenever you need it.

Are you looking for better payment processing? Book a Rate Reduction Review today to find out how much you can save with Lucid Payments or contact us for more information.

0 notes

Text

5 Signs It’s Time to Switch Payment Processors

If you allow customers to pay with debit or credit, then your payment processor is like the backbone of your business.

Among other things, a great processor will ensure transactions are seamless, costs are kept to a minimum, and customers remain satisfied.

But if you’re with a payment processor that subjects you to things like frequent downtime, hidden fees, or outdated technology, it can severely impact not just your bottom line, but also your reputation, your relationships with customers, and your ability to grow your business.

And considering how common some of this stuff is today, it’s no surprise that business owners are becoming less and less satisfied with their payment processors.

According to a J.D. Power survey, which polled more than 4,800 U.S. small businesses, as of 2023, small business satisfaction with payment processors had gone down six points from the previous year, as the cost of services increased and issues with processing payments continued.

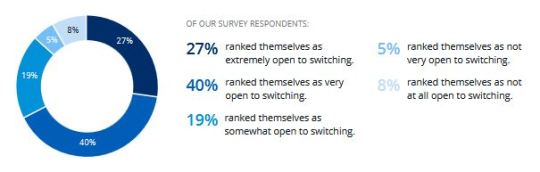

Interestingly enough, here in Canada, regardless of how satisfied businesses are with these services, the vast majority said they’d be willing to switch payment processors, if they’re given the right incentives.

As you can see from the graph below, a survey from Chase, which polled over 2,200 Canadian businesses, found that 86% of respondents were “at least somewhat willing to switch vendors.”

But in an industry that’s as convoluted as ours, it can be tough to know when it’s time to switch payment processors.

So, if you’re not happy with the services you’re currently getting, and you want to find a new payment processor, we want to help you make the best decision for your business by highlighting five signs it’s time to switch.

Is it Time to Switch Payment Processors?

If you don’t have a good grasp of how things work in our industry, then it’s going to be tough to tell if it’s time to switch payment processors.

And by the time you’ve noticed something’s not right, it may be too late, as the damage has already been done.

With that in mind, let’s explore five telltale signs that it’s time to switch payment processors.

1) You’re Paying Flat-Rate Pricing

In the payment processing industry, flat-rate pricing tends to be advertised as more convenient and affordable, but the truth is, it’s the most expensive way to pay.

Unfortunately, because of the way it’s advertised, and the fact that most business owners don’t know any better, many get fooled into thinking they’re getting a good deal.

But as we pointed out in our article on Why Interchange Plus Pricing Is the Best Way to Pay for Payment Processing, a CFIB survey found that 54% of respondents had trouble understanding the contract they signed with their payment processor, and 41% are unsure about their pricing.

That being said, it’s no surprise that business owners are being taken advantage of in this way.

What’s more, the average flat rate offered in our industry is currently 2.4%, with some processors charging up to 2.65% or even more.

But only a select few credit cards have an interchange rate of more than 2.4%.

So, while flat-rate pricing might sound great in a slick ad campaign, at the end of the day, it’s going to cost you more money.

With that in mind, if you’re paying flat-rate pricing, it’s time to switch payment processors.

And if you’re not sure what interchange rates are, or you just need a little refresher, you can read our article on What You Need to Know About Interchange Rates in Canada.

2) You’re Finding Hidden Fees on Your Statement

In addition to promoting misleading pricing, unscrupulous payment processors are also notorious for adding miscellaneous “hidden” fees to your statement.

Truth be told, these fees aren’t really hidden at all, if you know where to look.

But the problem is many business owners don’t know how to decipher what’s on their statements.

As a result, payment processors will often sell business owners on a “discounted rate” but then make up for those lower interchange rates, and then some, by tacking hundreds or even thousands of dollars in extra fees onto your monthly bill.

They’re also known to do things like charging different amounts for the same fee multiple times on the same statement or adding extra fees to cards for which you’ve already paid interchange.

If you’re not familiar with this sort of thing, it can be somewhat difficult to determine, but our article on What You Need to Know to Spot Hidden Payment Processing Feesexplains everything.

And if you do find these kinds of fees on your statement, you should definitely start thinking about switching payment processors.

3) You’re Unable to Accept All Forms of Payment

Today’s consumers expect convenience and flexibility, regardless of how they choose to pay.

And whether they’re making purchases using a credit card, debit card, digital wallet, or any other form of payment, if your payment processor doesn’t support these options, it can lead to lost sales, dissatisfied customers, and a ruined reputation.

Like it or not, the popularity of new forms of payment, including mobile payment options like Apple Pay and Google Pay, continues to grow, and if your processor doesn’t allow you to accept these forms of payment, you risk alienating a significant portion of your customers.

Similarly, if you operate internationally, being unable to accept foreign cards or currencies can limit your growth and deter potential customers.

With all that in mind, you’d be surprised how many processors are still using outdated technology that limits how customers can pay.

But the truth is, you don’t have to let limited payment options hold your business back, and there are many processors out there (us included) that support all major forms of payment.

So, if you’re turning customers away because they can’t pay the way they want, then it is definitely time to switch payment processors.

4) Your Payment Terminal Is Falling Apart

Believe it or not, there are many merchants out there who are still using old beat-up payment terminals.

This may not sound like a big deal, but the truth is a malfunctioning or outdated payment terminal can seriously harm your business.

At the end of the day, a functional, modern terminal is not just a convenience – it’s a critical part of your business’ reputation and revenue.

Because when customers encounter a slow, unreliable, or poorly functioning payment terminal, or they see that yours is falling apart, it makes you look unprofessional and unreliable, creating a negative impression that can lead to frustration and abandoned purchases.

And aside from the fact that they may not support the latest payment methods, older terminals might not comply with current security standards, which can expose your business – and your customers – to potential fraud or data breaches.

Frequent breakdowns or maintenance issues can also disrupt your operations, resulting in lost sales and time wasted on troubleshooting.

In any case, if your payment processor isn’t offering upgraded equipment or providing prompt technical support, it’s a clear sign that they’re not prioritizing your needs and it’s time to think about changing payment processors.

5) Your Provider Doesn’t Offer Online Integration

This doesn’t apply to all businesses, as some do all their sales in-person.

However, if you want to sell stuff online, but your provider can’t do eCommerce, then it’s probably time to switch payment processors.

Because if you’re unable to accept online payments, you could be missing out on a vast and growing market of customers who prefer the convenience of shopping from their devices.

And even if you primarily operate a physical store, offering an online option can help to boost sales, expand your reach, and provide a safety net during unexpected disruptions, like having to temporarily close your physical location.

At any rate, without seamless eCommerce integration, managing sales across different channels can be incredibly inefficient and prone to errors, and dealing with online transactions manually can lead to wasted time, accounting inaccuracies, and frustration for you and your staff.

Are you thinking about switching payment processors? Book a Rate Reduction Reviewto find out how much you can save with Lucid Payments or contact us for more information.

0 notes

Text

What You Need to Know to Spot Hidden Payment Processing Fees

The first few weeks of the new year are always a great time for reflection, no matter who you are.

And if you’re a business owner, it’s the perfect time to take stock of everything related to your business.

Whether it’s setting objectives for the coming year, determining whether you reached the goals you set last year, or just looking for the cheapest payment processing, those first few weeks of the new year are easily the best time to do this sort of thing.

And with the holiday shopping season coming to a close, and the new year just around the corner, you should start thinking about this stuff now.

Because the truth is there are still far too many business owners out there who are paying through the nose to process payments, and if you’re one of them, now is definitely the time when you should be weighing your options.

So, if you’re thinking about switching payment processors, but you’re not sure how to go about doing it, then you should definitely keep reading.

This article explores why the best time to switch payment providers is early in the new year, explains how smaller local providers like us may be able to give you the best possible deal, and offers advice on what to consider if you’re looking for the cheapest payment processing.

Why Is Now the Best Time to Find the Cheapest Payment Processing?

Typically, December and February are the months when businesses see the highest volume of sales, as people tend to spend more money during these months shopping for Christmas and Valentine’s Day.

That being said, if you’re looking for the cheapest payment processing, then early in the new year is the best possible time.

But why is that?

Well, for one thing, reviewing your statements during the months when you’re doing the highest volume of sales will give you a better idea of what you’re actually paying, and the kinds of cards your customers tend to use.

At the same time, our industry is extremely convoluted, so as the Christmas rush slows down, and January rolls around, you’ll have some downtime to really sink your teeth into this stuff and get a better understanding of how our industry works, which will make it easier for you to get a good deal.

What’s more, one of the ways we work to save money for business owners like you is by doing a Rate Reduction Review, where we’ll analyze your last statement from your current provider so we can see the volume of credit transactions you’ve had, what kinds of credit cards your customers tend to use, and the interchange rates and other fees attached to those cards.

This allows us to determine where you’re spending the most, and what we can do to save you money by adjusting our rates.

What’s more, once January is here, your last statement would be from December, when you probably had significantly higher sales.

And if we analyze that statement, it’ll allow us to figure out how much you’re spending during high-volume months, which will give us a much better idea of the kind of savings we’re able to offer.

At this point, if you do choose to switch, we’ll also know how to adjust our rates so you can see significant savings in February, when you’re likely to see much higher volume again.

Simultaneously, this also gives us the opportunity to determine whether or not your provider is inflating your rates during high-volume months and will also allow us to break down everything on your bill, so you can actually understand what you’ve been paying for.

How Can Smaller Providers Offer the Cheapest Payment Processing?

We can’t speak for every payment processor out there, but typically, it’s the smaller providers who are able to offer the cheapest payment processing.

The main reason for this is that the big players in this industry tend to be multi-billion-dollar operations, and that means they have thousands of employees and massive overhead.

This means that they really can’t afford to give you a good deal, and they also have very little incentive to even try to be competitive.

Because for years, these companies were the only options for payment processing, so they’ve built trust and familiarity in their brands, and as a result, they’re pretty much guaranteed a steady stream of customers and therefore have no incentive to lower their prices.

Moreover, smaller processors know what it’s like to be a small business, so they can relate to what you’re going through and are more likely to want to give you a better price.

If you’d like to learn more about why the big payment processors won’t give you a better deal, you should check out our article on Two of the Biggest Myths About Payment Processing.

What’s more, because providers like us are struggling to compete against the behemoths of the banking industry, we have much more appreciation for each and every one of our customers.

And although we can’t speak for other processors, unlike the big banks, who like to treat everyone with the same cookie-cutter approach, we take the time to do everything on a case-by-case basis, working with clients to provide a personalized service that addresses their unique needs.

For example, if you’re primarily doing business online, where the interchange fees tend to be higher, then we’ll look at how we can lower our markup on those transactions. Or, if you mainly accept debit payments, then we’ll see what we can do to reduce our markup on those.

Some Other Things to Consider

Aside from everything we’ve already mentioned, there are a couple of other things you’re going to want to take into consideration, including the type of pricing processors use and the quality of the payment terminals they provide for their customers.

With that in mind, let’s look at why these aspects are so important to consider when you’re looking for the cheapest payment processing and thinking about switching to a new payment provider.

Pricing

The payment processing industry is notoriously tough to understand, not least when it comes to the way companies charge for their services.

For instance, many companies will charge a flat rate, meaning you pay the exact same interchange rate on every card a customer uses, no matter what.

This is often advertised as a way to save money, and a more convenient way to pay, when compared to other pricing models.

Unfortunately, nothing could be further from the truth, and flat-rate pricing almost always ends up being the most expensive way to pay, as the flat rates companies charge tend to be considerably higher than what you’d pay on most credit cards.

Other processors will offer a “discounted” rate, but then tack a bunch of miscellaneous fees onto your bill to make up for it.

If you’d like to learn how to spot this sort of thing, you should read our article, which explains What You Need to Know to Spot Hidden Payment Processing Fees.

We, on the other hand, pride ourselves on using interchange plus pricing, which means that when credit card companies lower their rates, that will always be reflected on your bill, and we’ll never inflate our rates or use other deceptive ways to make up the difference.

If you’d like to learn more about interchange plus pricing, you should read our article on Why Interchange Plus Pricing Is the Best Way to Pay for Payment Processing.

Payment Terminals

Believe it or not, many payment processors provide payment terminals that are old, beat up, or about to become obsolete.

This is true of many providers, including the giant corporations that dominate this industry.

These machines are much slower than newer ones, and many of them can’t process popular forms of payment, like Apple Pay and even contactless payments.

So, if you’re thinking about switching payment processors, make sure to research the processors you’re considering and ensure their payment terminals are up-to-date, and can accept all the latest forms of payment.

This is incredibly important to look into, as it can have a significant effect on your business, not least because you may have to turn away some customers depending on what form of payment they want to use.

And no matter what rates a processor is charging, if you’re going to have to turn customers away, or have ongoing problems with your payment terminals, it’s not going to be worth it.

Over the years, we’ve been shocked to see how rundown and outdated a lot of these terminals are, and the effect that this is having on business owners.

That being said, we’ve made a commitment to always provide our clients with new, state-of-the-art equipment, which helps their businesses to be more productive, profitable, and flexible.

Are you still searching for the cheapest payment processing? Book a Rate Reduction Review to find out how much you can save with Lucid Payments or contact us for more information.

0 notes

Text

What You Need to Know to Spot Hidden Payment Processing Fees

No matter how you slice it, if you own a business, you’re going to need a payment processor.

But trying to decide which processor to choose can be incredibly confusing, not least because of how difficult it is to decipher their pricing.

The reality is, this stuff is often so convoluted, and processors can be so underhanded, that many business owners won’t know what fees they’re paying until after they get their first statement.

And even then, with all the hidden payment processing fees that tend to get tacked onto your bill, it can be tough to understand what you’re paying for.

It’s not uncommon for business owners to have no idea what they’re even looking at when reviewing all the fees on their bills, and their providers certainly aren’t doing much to make anything easier to understand.

We’ve seen this sort of thing happen far too many times, and had countless business owners come to us asking for help to understand what’s on their statements.

And this really is nothing new.

According to a Toronto Star article, back in 2019, the Canadian Federation of Independent Business (CFIB) surveyed about 12,000 of its members, asking them about their experiences with payment processors.

Unsurprisingly, 18% of respondents said these companies have misrepresented themselves, and 16% of them said they’ve used “deceptive sales practices”.

With that in mind, and in keeping with our commitment to providing absolute clarity, we want to explain what you can do to spot hidden payment processing fees that you might not know about.

So, if you want to avoid hidden fees in payment processing, or you just want to understand what you’re looking at on your statement, then this article is for you.

A Perfect Example of Hidden Payment Processing Fees

Before we go any further, let’s look at an example of a statement that contains these hidden payment processing fees.

For legal purposes, we’ll refrain from naming the processor or the client in question, but what you’ll see below is a real statement, brought to us by a business owner who was fed up with this sort of thing and looking to switch processors.

So, let’s break down this bill and look at what kinds of fees are hidden within.

Below is page three of this statement, which shows the total volume of sales for the month, and what cards this client’s customers were using.

If you look under the “Discount” heading, most of the cards on this list have a discounted rate of 1.36%, which is already suspicious, as that is a very low rate, and one which does not correspond to the non-qualified cards on the list, which we know tend to have a rate of 1.50% to 2% or more.

So, if this processor is only charging 1.36% on most of these cards, and taking a loss on the interchange fees, then how is it making its money?

Clearly, it’s not by marking up the interchange rates, but they’ve got to make their money somehow, so let’s dig a bit deeper.

If you take a look at page four of this statement, it’s obvious what this processor is doing.

When this business owner signed up with this processor, they probably sold them on their discounted interchange rate of 1.36% on most cards, but what they likely didn’t discuss was the litany of miscellaneous fees that would be on their bill.

Many of these fees are standard, but several of them stand out as fees that honest processors wouldn’t charge their customers.

For instance, the “DATASECFEE” is $447, and “SYSTEM MAINTENANCE” is another $65, not to mention the “PCI ADMIN” fee at $187 and $560 for a risk assessment.

Also, keep in mind that this isn’t some sort of annual thing – these are monthly fees!

What’s more, very few people know what these fees are for, so what’s on the statement is essentially meaningless, and a processor could put pretty much anything on there, as the majority of business owners wouldn’t know the difference.

But unfortunately, the hidden payment processing fees don’t stop here.

If you look at page five of this statement, which you’ll find below, there are two more lists of miscellaneous fees.

Some of them, like the risk assessment, were already tied to hundreds of dollars in other fees on page four, so why they’re here as well is anybody’s guess.

Another interesting thing to point out about this page is that it lists all the non-qualified cards that were processed, but there aren’t any rates listed for these cards, just more miscellaneous fees.

So, in order to see the real rates that you’re paying, you’d have to add up all the other charges on each individual card, which nobody would know to do anyway.

And here on page six is where the effective rates, or true rates, for each card are listed.

As you can see, all but one of these cards has a considerably higher rate than 1.36%, and some of them have a rate that’s more than twice that high.

Even a standard qualified Visa has an effective rate of 1.84%, so the question is, why are they offering a “discounted” rate of 1.36%?

Well, clearly this processor sells their pricing based on a discounted rate, and takes a loss on the interchange, but then adds hundreds of dollars of miscellaneous fees to clients’ bills to make up for it, and then some.

Finally, if you look at this client’s billing summary, which you’ll find below, the total cost for one month was nearly $1,700, which is insane for this amount of volume!

By our estimate, a business with this volume of credit and debit card sales should be paying less than a quarter of that amount.

But when your statements are this convoluted, and you use this kind of deceptive pricing, it’s easy to see why so many business owners get bamboozled by this sort of thing.

How to Spot Hidden Payment Processing Fees

The main problem with pricing in this industry is that it seems to all be based on interchange rates, and whether processors will discount those rates, or add a markup to them.

But with everyone being so focused on these rates, many business owners are forgetting that what matters is the overall cost of your bill.

Because if you’re getting discounted rates on every card that’s processed, but then paying hundreds of dollars in miscellaneous fees to make up for it, then you’re not saving anything.

Having said that, in addition to everything we’ve already covered here, if you want to spot hidden payment processing fees, you should stop focusing on the interchange rates and start scrutinizing the “other charges” and/or “other fees” sections on your bill.

If you see anything more than a $5-$10 statement fee, a fee for PCI, which should be $11 per month or less, or some equipment fees in these sections, then the truth is, you’re paying way more than you should.

Anything else is basically a hidden tacked-on charge, unless you’re subscribed to a point-of-sale system or something like that.

What’s more, the only time you should see a fee tied to a card is when there’s a rate included with that fee.

If you see fees being charged for cards with no corresponding rate, then they’re just tacking miscellaneous fees onto your bill because they can.

Now, to be fair, a lot of these fees aren’t technically hidden, and if anything, they’re more hidden in plain sight than anything.

But even though they’re listed on your bill, without the knowledge we’ve provided in this article, chances are you wouldn’t know what most of them are for, and that is essentially the same thing as them being concealed.

At any rate, hopefully this article has given you greater clarity on how to understand everything on your statement, including how to spot hidden payment processing fees.

And we encourage you to share this information with fellow business owners, as the more merchants know about this, the less payment processors will be able to get away with it.

Are you sick of paying so much for payment processing? Schedule a Rate Reduction Review to see how much you can save with Lucid Payments, or contact us today to learn more.

0 notes

Text

New Agreement Caps Interchange Fees for Some Small Businesses in Canada

As we’ve been saying since we started in this industry, Canadian businesses are paying way too much when it comes to interchange fees.

But an agreement between the feds, Visa, and Mastercard, which just came into effect last week, may be able to provide some relief, at least for some small businesses.

Truth be told, the Canadian government has been talking about regulating interchange fees for years now, but until recently, it didn’t seem like they were going to do anything about it.

We’ve been covering this specific story for about two years now, but our current federal government started talking about it way back in 2019, when the Liberals began leveraging this issue as part of their election campaign.

Back in 2022, we published our first article on this, which asked, Is the Canadian Government Really Going to Regulate Interchange Fees?

At the time, things were still very uncertain, and whether the government planned to actually bring in regulations was anyone’s guess.

But if you’d like some background on this story, that article is a good place to start.

Then, last year, after the government announced it had reached an agreement with Visa and Mastercard, we published a second piece on this story, Feds Finally Reach Deal With Visa and Mastercard to Lower Interchange Fees for Small Businesses in Canada.

This article goes into great detail on the ongoing fight to lower interchange fees in Canada and sums up the terms of the agreement, so if you want to know more about how this story has been unfolding, you should check it out, as well.

In any case, now that this agreement has come into effect, we want to make sure you’re aware of what’s happening and offer our take on it, as well.

So, if you want to learn more about these changes to interchange fees in Canada and get our honest opinion on what this actually means for your business, then you’re going to want to keep reading.

How Does This Agreement Affect Interchange Fees In Canada?

Earlier this month, the government published a press release outlining what it’s supposedly doing to help small businesses in Canada, including capping interchange fees for eligible businesses.

“The federal government is making life easier for locally owned businesses by introducing reduced credit card transaction fees,” said Minister of Public Services and Procurement Canada, Jean-Yves Duclos.

But how exactly is this going to work?

Well, according to the feds, as a result of these changes, over 90% of small- and medium-sized Canadian businesses will see their interchange fees slashed by up to 27%, and this is projected to save small businesses about $1 billion over the next five years.

With that in mind, here’s what Visa and Mastercard will be doing for eligible businesses as a result of this agreement:

Reducing domestic consumer credit interchange fees for in-store transactions to an annual weighted average interchange rate of 0.95%

Lowering domestic consumer credit interchange fees for online transactions by 10 basis points, offering reductions of up to 7%

Providing free access to “cybersecurity and online fraud resources” to help small businesses sell more online, while preventing fraud and chargebacks

However, only businesses and non-profits with annual Visa sales of less than $300,000 will qualify for lower interchange rates from Visa, and only those with annual Mastercard sales of less than $175,000 will qualify for lower rates from Mastercard.

It’s also important to point out that organizations will have to qualify with each credit card network individually.

The government even provided an example of how this could help, saying that if a business processes $300,000 in credit card payments, it could save $1,080 in interchange fees.

But is this an accurate representation of the interchange fees Canadian small businesses pay?

And is this agreement as good as the government’s making it out to be?

Let’s take a closer look and find out.

Our Take on These Changes to Interchange Fees in Canada

As we said in our last article on this, it’s great to know that small businesses in Canada may end up seeing some relief from the insanely high interchange fees they’ve been paying.

It would have been nice to see these fees reduced even further, but going from an average interchange rate of 1.4% down to 0.95% is nothing to scoff at either.

However, when it comes to this agreement, and this latest announcement, there’s a lot to criticize.

For one thing, the government’s being very disingenuous with its example of the interchange fees a business would supposedly pay.

In its latest press release, the government claims that if a business in Canada processes $300,000 in credit card payments, they’ll pay about $4,000 in interchange fees.

But we did the math on this, and they are really lowballing it.

Because in order to pay only $4,000 in fees on $300,000, the cards you’re processing would have to have a rate of no more than 1.33%, which is pretty much unheard of.

To put things in perspective, if you were to calculate the interchange fees paid on that same amount through Square, which charges rates of at least 2.65%, and is the processor of choice for many small businesses in Canada, it would come to $7,950, which is nearly twice as much as the government’s estimate.

What’s more, even though the government has published several press releases on this agreement, we’re still left with many unanswered questions.

For instance, while the government keeps talking about how businesses will have to qualify with each card network, there’s been no indication of how they can do that, either from the feds or the credit card companies themselves.

So, even as these new changes have come into effect, it’s yet to be seen how businesses will be able to qualify.

Moreover, neither the government nor the credit card companies have given any indication as to where businesses can access the free “cybersecurity and online fraud resources” they’ve committed to provide.

Furthermore, as we’ve learned over the years, many small businesses in Canada are with payment processors outside of Canada, but because this agreement was made solely between the Canadian government, Visa, and Mastercard, there’s no reason to think that these changes will apply to foreign payment processors.

As we outlined above, these reductions are only for “domestic consumer credit interchange fees”, so we can only assume that this applies to Canadian payment processors only.

As a result, many small businesses in Canada will never see these rate reductions, not least because this agreement doesn’t apply to their processors.

Also, in a press release on this agreement published last year, the government said it expects “that payment processors will pass these reductions on to small businesses.”

But if you know anything about our industry, you’d know that many payment processors are notorious for refusing to pass interchange rate reductions on to their customers, instead choosing to obscure these savings by padding people’s bills with miscellaneous fees.

Moreover, the payment processors and the banks are not part of this agreement with the government, so they can continue to do whatever they want, and they will.

Sadly, all of this shows just how out of touch our federal government is with the frustrations of small business owners in this country.

And as far as we’re concerned, this agreement is much too convoluted, it leaves way too many questions unanswered, and it doesn’t go nearly far enough, as it’s not applicable to so many small businesses in Canada.

Unfortunately, there’s nothing we can do to stop the government from being so unclear about this.

But we will continue to cover this ongoing story, making you aware of any new updates, and breaking it down as best we can to help you gain greater clarity on your payment processing.

Are you tired of paying so much for payment processing? Schedule a Rate Reduction Review to see how much you can save with Lucid Payments, or contact us today to learn more.

0 notes

Text

11 Tips on How to Grow Your Business on Social Media

In today’s world, if you want to build a successful company, you’ve got to know how to grow your business on social media.

Like it or not, these platforms are an essential aspect of any modern marketing strategy, and if you choose to ignore them, you’re doing so at your own peril.

No matter how you slice it, there is no denying that social media platforms offer a ton of benefits for your business, allowing you to build brand recognition, forge meaningful relationships with customers, foster trust and loyalty, drive sales, and achieve substantial growth.

For instance, in an Ipsos poll, which explored the impact of Messenger, Instagram, and Facebook on Canadian businesses, 33% of respondents said these platforms helped them start their companies, and 46% said their businesses are stronger today because of them.

What’s more, 36% of exporters said using Instagram has helped them increase sales, and 35% said Facebook has helped them sell more.

As you can see, these kinds of platforms can have a significant impact on your ability to grow your business, and that’s because consumers are increasingly using them to connect with companies, research products, and make purchases.

For instance, a PwC survey, which polled more than 20,000 consumers across 31 countries, found that 46% of them have purchased products on social media, up from 21% in 2019, 67% of them use social media to find new brands, and 70% of them read reviews on social media before choosing to make a purchase.

All things considered, it’s undeniable that consumers are increasingly using social media to do their shopping, so if you avoid these platforms, you could be leaving a lot of business on the table.

With that in mind, we want to provide some advice on growing your business through social media.

So, if you’re wondering how to grow your business on social media, and you’re looking for some tips, then this article is for you.

Our Top Tips on How to Grow Your Business on Social Media

At this point, it should be obvious that social media offers one of the best ways to connect with customers, make more sales, and grow your business.

But growing your business on social media is about more than just posting regularly. It requires a deep understanding of these platforms, and how to use them to your advantage.

Luckily for you, below we’ve offered 11 tips on how to grow your business on social media, so you can take full advantage of these platforms and avoid getting left in the digital dust.

1) Understand Your Audience

The foundation of any successful social media strategy is a deep understanding of your audience.

Knowing who they are, what they like, and how they interact with content is crucial, and this involves analyzing demographic data like age, location, gender, and interests.

Tools like Google Analytics, Facebook Insights, and Instagram Analytics can provide this information, and this will allow you to tailor your content to meet the specific needs and preferences of your audience.

This ensures your messaging will resonate with consumers, which will help you to maximize your return on your efforts.

2) Choose the Right Platforms

Although you may be tempted to use every platform out there, the truth is, not all social media platforms are suitable for every business.

That being said, it’s crucial for you to focus on platforms where your ideal customers are most active.

For instance, if your target audience includes professionals, then LinkedIn is probably the most appropriate platform.

On the other hand, if your focus is on a younger demographic, platforms like TikTok and Instagram are more preferable.

This strategic selection is very important, as it prevents you from wasting time and effort on platforms that do not house your target audience.

3) Develop a Strong Brand Voice

Ensuring consistency when it comes to your brand’s voice is key, and this is true across all marketing channels, including social media.

Aside from just being consistent, this voice should reflect your brand’s values and resonate with your ideal customers.

And whether it’s professional, friendly, informative, or playful, a distinct and consistent brand voice helps to make your content recognizable and relatable, which strengthens your brand identity, and builds trust with your audience.

4) Engage Rather Than Broadcast

Social media should be interactive, which means you’re going to have to engage your audience.

You can do this by responding to comments, messaging followers directly, and participating in discussions, all of which can transform passive followers into active participants.

This engagement not only enhances your relationships with customers, but also boosts your visibility through increased interactions, which platforms like Facebook and Instagram favour in their algorithms.

5) Create Visual Content

Visuals are key when it comes to capturing people’s attention on crowded social feeds.

That being said, high-quality images, engaging videos, and eye-catching graphics can help you to significantly increase engagement.

Platforms like Instagram and Pinterest, for example, are highly visual and require strong imagery if you want to stand out.

With that in mind, you might want to consider using tools like Canva or Adobe Spark to help you create professional-looking visuals that will attract more views and shares.

6) Leverage User-Generated Content

Encouraging your customers to share their experiences with your brand can provide social proof and enhance your credibility, and social media offers a great place to do this.

What’s more, user-generated content not only offers authentic insight into your brand from a consumer’s perspective but also helps in building a community around your products or services.

In any case, featuring user-generated content on your social media accounts can help you to increase trust and foster a stronger connection with your audience, making it more likely that they’ll want to do business with you.

7) Social Media Advertising

Social media ads allow for targeted advertising based on specific demographics, interests, behaviours, and more.

These tools give you the ability to precisely target potential customers and drive conversions by serving your ads to the right audiences at the right times.

But when you’re creating your ads, make sure that you understand your audience first, and then set clear objectives, choose the right platforms, and make sure to use high-quality, enticing visuals.

Retargeting is also something to consider, as it allows you to serve ads to those who’ve already interacted with your brand but haven’t made a purchase.

8) Post Regularly But Not Obsessively

If you want to keep your audience engaged, and avoid annoying them, you’ve got to post regularly, but not obsessively, otherwise you’ll risk overwhelming them.

Too much content can make people want to unfollow you, while too little can cause your audience to forget about your brand, so you’ve got to find the right balance.

In any case, you should think about creating a content calendar, as it can help you organize and schedule your posts, so you can ensure consistent engagement without spamming your followers.

9) Monitor Trends and Adapt

Social media trends can shift rapidly, so you’ve got to stay up to date on things as much as you can.

This is extremely important, because staying updated with these changes and adapting your strategy accordingly is what’s going to help you keep your content relevant and engaging.

Whether it’s a new type of content, a viral challenge, or a change in user behaviour, staying on top of this stuff and being agile and responsive to these trends gives you a competitive edge, which can help you to grow your business.

10) Analyze and Optimize

If you want to be able to compete in the ever-changing world of social media marketing, continuous improvement is a must.

This involves regular analysis of what types of posts perform best, which times yield the most engagement, and where the majority of traffic comes from.

With that in mind, you should look into tools like Hootsuite, Sprout Social, and Buffer, as they offer comprehensive analytics, which allow you to measure performance across multiple platforms and improve your overall social media strategy.

11) Collaborate with Influencers

Influencer marketing is a great way to amplify your reach and lend credibility to your brand, not least on social media.

That being said, if you collaborate with influencers who share your target audience, you can introduce your brand to a broader, yet highly targeted audience that’s already interested in what you’re offering.

This strategy is particularly effective for gaining rapid visibility and traction for new products, services, or campaigns, as they’ll be promoted by people whom your target audience already knows and trusts.

Are you ready to simplify your payment processing? Why not contact us today and find out how we can help?

#social media for business#grow your business with social media#social media strategy#social media tips#business social media pages

0 notes

Text

9 Inventory Management Tips to Help You Stay on Top of Your Stock

Owning a business requires you to deal with a seemingly never-ending array of challenges.

From dealing with finances, to managing employees, ensuring compliance with regulations, and everything in between, today’s business owners have a million and one things to worry about.

And when you’re dealing with something with this many moving parts, it’s easy to overlook things.

But while you can get away with overlooking some things, inventory management is something you just can’t afford to mess up, or you could end up dealing with some severe financial consequences.

For example, according to estimates from a Coresight Research survey, poor inventory management accounts for 53% of unplanned markdowns for retailers, and in 2018, markdowns cost U.S. non-grocery retailers approximately $300 billion.

What’s more, 50% of survey respondents said “inventory misjudgments” act as a barrier to selling their products at full price.

As you can see, this is not something you can afford to overlook. But trying to wrap your head around inventory management can also be incredibly overwhelming.

With that in mind, we want to offer some inventory management tips so you can stay on top of your stock and avoid the pitfalls of poor inventory management.

So, if you’re dealing with issues related to your inventory, and you’re looking for some inventory management tips and tricks, then you’re going to want to keep reading.

What Are Some Common Inventory Management Issues?

Before we start offering inventory management tips, we also want to explore some of the most common inventory management challenges.

This knowledge will help put things in perspective for you and offer even greater context for how you can apply the advice we’re about to give.

Having said that, here are some of the most common inventory management issues:

Inaccurate Inventory Tracking

One of the most common inventory management issues is inaccurate tracking of stock levels.

Errors in data entry, miscounts during stock audits, and discrepancies between physical stock and recorded inventory are all too common.

These inaccuracies can lead to stockouts, where items are unavailable when customers want them, or overstocking, where excess inventory takes up valuable space and ties up capital.

Both scenarios are detrimental, as stockouts can result in lost sales, dissatisfied customers, and many other problems.

Overstocking and Stockouts

Overstocking occurs when a business orders more stock than necessary, which can lead to high storage costs and an increased risk of inventory becoming obsolete.

On the flip side, stockouts happen when inventory levels are too low to meet customer demand, and this can result in missed sales opportunities and damage to customer relationships.

Both of these situations are costly and highlight the importance of accurate demand forecasting and efficient inventory management practices.

Inefficient Supply Chain Management

As we’ve all learned over the last few years, supply chain disruptions can severely impact inventory management.

Things like delays in receiving goods and unreliable suppliers can all contribute to inventory shortages or excesses.

Inefficient communication between supply chain partners can further exacerbate these issues, making it difficult to forecast your inventory needs accurately.

This can lead to a situation where you either overstock to mitigate the risk of stockouts or understock due to uncertainty, both of which are certainly not ideal.

Poor Demand Forecasting

Poor demand forecasting can also lead to either overstocking or stockouts.

And without reliable demand forecasting, businesses risk either tying up too much capital in unsold inventory or losing sales due to insufficient stock.

That being said, accurately predicting consumer demand for the products you carry is vital for maintaining the right inventory levels.

But in order to do this, you’ve got to analyze historical sales data, market trends, and other relevant factors, otherwise you’ll be more likely to misjudge demand.

This issue is also particularly challenging in industries with seasonal fluctuations or rapidly changing consumer preferences.

Lack of Real-Time Data

The absence of real-time inventory data can leave businesses operating on outdated information, leading to poor decision-making when it comes to inventory management.

Without these real-time insights, businesses may struggle to respond quickly to changes in demand or supply chain disruptions, and this lag in information can result in missed opportunities for restocking or unnecessary purchases of slow-moving items.

With that in mind, implementing systems that provide real-time inventory tracking can help businesses make more informed decisions and improve their overall inventory management efficiency.

High Carrying Costs

Inventory carrying costs, which include expenses related to storage, insurance, and the risk of obsolescence, can significantly impact your business’ profitability.

If you overstock inventory or fail to move products quickly enough, you’ll face higher carrying costs, which are often compounded by the need to discount or write off obsolete inventory, and these issues can significantly reduce your profitability.

With that in mind, effective inventory management practices, such as just-in-time (JIT) inventory, can help minimize carrying costs by reducing the amount of inventory held at any given time.

Ineffective Inventory Management Systems

Many businesses today still rely on outdated or inadequate inventory management systems that lack the sophistication needed to handle modern inventory challenges.

These systems may not integrate well with other business processes or may require manual input, which increases the risk of errors.

In any case, a failure to modernize your inventory systems can lead to inefficiencies that hinder your business’ ability to compete.

Luckily, modern inventory management solutions, particularly those that leverage automation and real-time data, can significantly enhance your ability to efficiently manage your inventory.

Our Top Inventory Management Tips

As you can tell by now, there is no shortage of issues when it comes to inventory management.

These may not all apply to your business, but if you fail to address the challenges that do, it could have far-reaching consequences from which you may never recover.

Fortunately, below we’ve provided a comprehensive list of inventory management tips and tricks, so you can avoid falling prey to the pitfalls of poor inventory management.

1) Understand Your Inventory

One of the best inventory management tips we can offer is to make sure you have a solid understanding of your inventory.

This involves categorizing your inventory based on things like how quickly your company can sell a given item, along with its value, and how quickly people will be looking to replace that item.

Employing an ABC analysis is useful here, and this involves segmenting your inventory into A-items (high-value products with low sales frequency), B-items (moderate-value products with moderate sales frequency), and C-items (low-value products with high sales frequency).

This classification can help you evaluate your inventory and then concentrate your resources on the most impactful items.

2) Leverage Technology

Incorporating technology into your inventory management process through things like inventory management software can significantly streamline your operations.

These tools provide features like real-time tracking, automated reordering, and detailed analytics, among many other benefits.

What’s more, this kind of technology allows you to integrate your inventory system with other aspects of your business, like accounting, procurement, and sales, which helps to ensure the consistency of your data and the efficiency of your operations.

3) Optimize Your Inventory Levels

When it comes to inventory management, optimizing your inventory is arguably one of the toughest challenges you’ll face.

With that in mind, setting Periodic Automatic Replacement (PAR) levels is crucial for maintaining sufficient stock so you can meet demand without overstocking.

Setting PAR levels involves using software to set the minimum levels of inventory you need to fulfill demand for a specific product.

Once this is done, the software will then notify you of the need for the item to be reordered and can even be set to automatically reorder stock when the minimum level is reached.

Moreover, the Just-In-Time (JIT) inventory strategy can also be effective for optimizing your inventory levels, as it involves keeping minimal inventory on hand and ordering more only as needed.

However, while this strategy can help to reduce carrying costs, it requires accurate demand forecasting and reliable suppliers.

4) Improve Your Forecasting

Effective inventory management relies heavily on accurate forecasting, which you can do by using historical sales data and considering factors like seasonal fluctuations and market trends.

In any case, it’s essential to regularly update your forecasts based on new sales data and external factors, such as economic shifts or changes in consumer behaviour.

5) Manage Your Relationships

Developing strong relationships with your suppliers can help you negotiate better deals and help to improve the reliability of your supply chain.

And if you’re able to successfully negotiate better terms by leveraging volume, loyalty, and payment history, it can yield significant benefits, including discounts and priority delivery schedules.

6) Monitor and Audit

Regular audits can help you verify that your physical inventory matches your inventory records, allowing you to promptly address any discrepancies.

Making use of cycle counting, for instance, which involves counting a subset of inventory on a rotating schedule, may help you pinpoint issues more efficiently than a full inventory count.

7) Properly Train Your Staff

Properly and regularly training your staff in the best inventory management practices and how to operate the systems you’re using is crucial.

What’s more, encouraging accountability by implementing performance metrics and involving your staff in planning and decision-making processes can also help to improve your inventory management.

8) Optimize Your Storage

Designing an efficient warehouse layout allows you to easily access frequently picked items, ensuring smooth and unobstructed movement of goods.

Utilizing vertical space for storage by implementing a racking system, for instance, can also help by more efficiently using your space and decreasing rental costs.

Not all businesses can afford to rent out warehouse space, but even if you’re storing your inventory in your garage, the same rules apply.

Whatever space you have should be used as efficiently as possible, and should allow for an easy flow of goods, particularly for your most popular items.

But if you are running out of room and you’re looking to scale without heavy investment in warehousing and distribution, outsourcing inventory management to a third-party logistics (3PL) provider can be advantageous, as it can help to reduce costs and improve operational efficiency.

9) Pick the Right Platform

Unfortunately, a lot of companies in our industry are still offering older payment terminals, most of which have no inventory management capabilities.

And if your device doesn’t offer these features, then you’re either going to have to have someone manage your inventory manually, which costs time and money, and can be subject to human error, or you’ll have to pay a third-party to take care of it for you, neither of which is ideal.

Fortunately, our platform offers online inventory management through an all-in-one, easy-to-use, centralized system that syncs with all your devices.

For example, if you do ten sales on your physical terminal, and five sales using your point-of-sale system, and then you log into our online platform, you’ll see all those sales in one place, and the products in question will immediately be deducted from your inventory.

So, ask yourself, when it comes to inventory management, is your payment processing platform working for you, or are you working for it?

Because if you are the one doing most of the work, then maybe it’s time for a change.

Searching for a payment processing platform that works as hard as you do? Why not contact us today and find out how we can help?

0 notes

Text

Why Interchange Plus Pricing Is the Best Way to Pay for Payment Processing

If there was an award for the most convoluted industry on the planet, payment processing would probably win by a landslide.

And if we had to choose the most needlessly complex aspect of our industry, it would have to be how processors choose to charge for their services.

Whether they’re using interchange plus pricing, tiered pricing, or flat-rate processing, typically, payment processors aren’t making things any easier for their customers to understand.

What’s more, business owners don’t seem to have any idea what these various fee structures are, how they work, or which one is going to give them the best deal.

As a result of all this confusion, it seems many businesses are just picking a processor at random without even bothering to look into their pricing.

For instance, a Canadian Federation of Independent Business (CFIB) survey found that 54% of respondents have difficulty understanding the contract they have with their payment processor, and 41% are unsure about their pricing model.

The survey also found that credit card processing fees are unaffordable for 78% of respondents.

However, many business owners are unwittingly choosing to partner with processors whose pricing is deceptively expensive, and the reality is they don’t need to be paying this much.

But given the abject lack of clarity in this industry, it’s no surprise that business owners are getting bamboozled like this.

With that in mind, this article will explain the most common pricing models for payment processing, including interchange plus pricing, tiered pricing, and flat-rate processing.

We’ll break down everything in no uncertain terms, exploring the various types of pricing, comparing them, and explaining why interchange plus pricing is your most affordable option.

If you’re new to this topic, and you’re not sure what the term interchange means in this context, you should start by reading our article, What You Need to Know About Interchange Rates in Canada.

And if you’d like a bit of a refresher on how interchange fees are calculated, you should check out our article, What Determines the Cost of Interchange Fees?

Why Is Interchange Plus Pricing the Best Way to Pay for Processing?

This seems like an easy question to answer, but as you may already suspect, it’s not as simple as you might think.

If you want to understand why interchange plus pricing is your best option, first you’ve got to understand the most common methods of paying for payment processing and compare them.

With that in mind, let’s explore the three most common ways to pay for payment processing, so you can understand why your best option is interchange plus.

Tiered Pricing

Tiered pricing is a pricing model where transactions are categorized into different tiers, each with its own interchange rate. The tiers include these three rates:

Qualified Rate: This is the lowest rate, applied to the most standard and secure transactions, such as swiped or chip-inserted debit or credit card payments.

Mid-Qualified Rate: A higher rate than the qualified rate, applied to transactions that pose a slightly higher risk, such as those involving rewards cards or manually entered card information.

Non-Qualified Rate: This is the highest rate, applied to the riskiest transactions, such as those made with corporate or international cards, or transactions that don’t meet certain security criteria.

This model allows payment processors to charge different rates based on the risk and processing requirements of each transaction.

If you’re being charged based on tiered pricing, that means you’ll have to pay a set qualified rate on every transaction, plus a mid- or non-qualified rate that applies to any transaction that doesn’t meet the requirements of the qualified rate.

So, for example, if a customer is paying with a qualified Visa and actually inserting their card into a physical machine, you’ll probably get a rate of around 1.45%.

Then for every transaction that’s mid- or non-qualified, that corresponding rate will get stacked on top of the qualified rate.

In theory, this model could offer some pretty decent pricing if the company gives you a good deal, but unfortunately, that’s rare.

Typically, providers will set their mid- and non-qualified rates high enough to ensure they’ll make the most profit they can, so you’re not likely to get a very good price.

In these situations, businesses will end up paying something like 0.85% on a non-qualified card, plus the qualified rate, which means they’ll be paying a total of 2.30% (1.45% + 0.85%).

But compared to what you’d be charged based on interchange plus pricing, this is a higher rate than what you’d pay for almost any card that’s available to consumers today.

So, as you can see, not only is this pricing model difficult to understand, but it’s also going to cost you more, as well.

Flat-Rate Pricing

One of the most common complaints we hear from potential customers is that they never know how much they’re going to pay in interchange fees each month.

As a result, many business owners choose to partner with a processor that offers flat-rate pricing, as this type of pricing tends to be advertised in a way that makes it seem like it’s more convenient and easier to understand.

But despite the clever marketing, the truth is that this is the most expensive pricing in our industry.

Providers who offer flat-rate payment processing will typically charge a highly inflated rate to make sure that they’re able to turn a profit on most transactions.

For instance, the average flat rate offered in our industry is currently 2.4%, with some processors charging up to 2.65% or even more.

So, while it may sound great to know exactly what you’re going to pay on every transaction, in reality, what this means is that for the lower-end cards and less risky transactions, you’ll have to pay double what you’d pay with interchange plus pricing, or even more.

To give you an idea of how much more expensive this kind of pricing can be, below, you’ll see Visa’s current interchange rates for consumer cards in Canada.

As you can see, only two of the dozens of cards on this list have an interchange rate of 2.4% or higher. And if you look at Mastercard’s rates below, you’ll see that the list looks very similar.

Again, only two of the cards on this list have an interchange rate of 2.4% or more.

Judging by these numbers, if you’re paying a flat fee that’s anywhere above 2%, you could be costing yourself hundreds of dollars per month in extra fees, depending on your volume of sales.

Truth be told, there are only a couple of different card types that cost more than 2.2%, so no matter how you slice it, paying these higher flat rates will cost you more money.

Interchange Plus Pricing

Hands down, this is easily the best pricing in our industry.

You’re welcome to try, but we can guarantee you’re not going to find anything cheaper.

We use interchange plus pricing because it keeps us competitive, it’s transparent and easier to understand, and it aligns with our mission of putting our customers first and always acting in the best interests of business owners.

That being said, rather than having to charge a high enough flat rate to profit on all cards or creating a convoluted tier system, interchange plus pricing allows us to offer you the exact interchange rate set by credit card companies like Visa and Mastercard, plus a small markup (usually 0.20% – 0.40%), which is how we make our money.

This means if your customer pays with a qualified Visa, you’ll pay 1.25% plus a markup of no more than 0.40%. That adds up to 1.65% or less, which is considerably lower than the average flat-rate pricing in our industry.

And that’s it. It’s really that simple.

With interchange plus pricing, you’ll pay whatever the interchange rate is on the card your customer is using, plus our markup.

This allows you to not only save money but also have greater clarity and peace of mind when it comes to your payment processing.

Another great thing about interchange plus pricing is that when credit card companies like Visa and Mastercard lower their interchange fees, this will immediately be reflected on your bill, which isn’t the case with many providers.

But with Lucid Payments, you won’t have to call in to try and get a better deal, or make sure these savings will be reflected on your statement.

The savings will simply be passed on to you the second that rates are lowered.

Interchange plus is also much more transparent, as well, because you’ll be able to see on your statement which cards you processed, what the interchange rates were on those cards, and what our markup is.

Time to Compare

Using the three different types of pricing we’ve covered today, let’s run a scenario to see which one will offer the better deal.

Let’s say your customers purchased $5,000 worth of products this month, and they all paid with a Visa Infinite card, which has an interchange rate of 1.57%.

For the tiered pricing, you’d be paying 1.57% plus 0.85%, so each one of those transactions would cost you 2.42%.

If you were being charged based on interchange plus pricing, you would’ve paid that same 1.57% interchange rate plus our markup of 0.20%, which would cost you 1.77%.

And for flat-rate pricing, you would’ve paid at least 2.4% on each transaction, regardless of what the interchange rate is on the card the customer is using.

So, if we do the math here, the flat rate pricing would cost you $120 in fees for those $5,000 in sales, and the tiered pricing would cost you $115, but the interchange plus pricing would only cost $88.50.

As you can see from this example, clearly, interchange plus is much cheaper.

And if you’re with a processor who charges you anything but interchange plus, you are simply paying too much.

Want to learn how much you can save with Lucid Payments? Book a Free Statement Review or contact us today to find out how we can help.

#Interchange Plus Pricing#interchange rates#lower interchange fees#secure payment processing#payment processing

0 notes

Text

Lucid Payments vs. Square: Which One Is Best for Your Business?

As we’ve said countless times before, the payment processing industry suffers from a serious lack of clarity.

Business owners don’t understand it, processors aren’t making it any easier to understand, and unfortunately, they’re benefiting from maintaining that status quo.

We, on the other hand, have chosen to take a different approach by putting the best interests of business owners like you first and ensuring you have absolute clarity when it comes to your payment processing.

With that in mind, we’ve held our tongue for quite some time now, but we’re tired of beating around the bush while business owners get bamboozled, so we figured it was time to start doing direct comparisons between Lucid Payments and some of the giants of our industry.

But we’re not here to just give you a sales pitch, and we’re not looking to throw stones either.

All we want to do is provide an honest comparison of Lucid Payments vs. Square, so you can make up your own mind as to which processor will be best for your business.

So, if you’re looking for the best interchange rates, wondering what the difference is between interchange plus vs. flat rate pricing, or just want a direct comparison of Lucid Payments vs. Square, then keep reading to learn more.

Lucid Payments vs. Square: What’s the Difference?

If you want to choose the best payment processor for your business, then you need to compare what the various processors are offering.

And while that may seem simple, if you don’t have a firm grasp of how our industry works, particularly when it comes to interchange rates, then regardless of how much you compare, you’re probably not getting the whole picture.

With that in mind, below we’ve done a direct comparison of Lucid Payments vs. Square, and provided proper context, so you can come to your own conclusions.

Interchange Plus vs. Flat Rate Pricing

If there’s one thing business owners are most confused about when it comes to payment processing, it’s got to be interchange fees.

Hopefully, you’re aware of what they are and how they work, but if you want more information, you can check out our article on What You Need to Know About Interchange Rates in Canada.

In a nutshell, when you accept payments with credit cards or debit cards, you’ll have to pay a percentage of the cost of each transaction in what’s known as interchange fees.

The rates at which you’ll pay these fees are variable, and they’re based on things like the nature of the transaction, the industry in which you’re operating, and the type of card the customer is using.

That being said, one of Square’s perceived selling points is its flat rate pricing, which it refers to as being simpler, as you’re paying the same rate no matter what card a customer uses.

But as you can see below, according to an article from The Ascent, the average interchange rates on most credit card transactions are actually much lower than Square’s flat rate of 2.65% for an in-person transaction.

On average, three out of these four cards will cost you less than what you’d pay with Square, and when you start doing card-not-present transactions, that’s where things really start to get expensive.

For instance, for card-not-present transactions, like when someone buys something on your website, Square will charge you 2.9% plus a fee of 30 cents per transaction.

And if you’re keying in the information yourself, as you’d do when taking orders over the phone, it’s going to cost you 3.4% plus 15 cents per transaction, which is considerably higher than the rates on any of these cards, regardless of the nature of the transaction.

As you can tell, the issue with flat-rate pricing, despite it being advertised on its simplicity, is that the rates have to be high enough to cover the interchange rates on all possible cards.

But the truth is the rates on most cards will cost you far less than what Square’s charging.

So, while you may be able to make the argument that this is simpler, you can’t honestly say it’s more affordable.

With that in mind, our interchange plus pricing ensures you’ll be charged whatever the rate is on a given card, allowing you to avoid paying exorbitant flat-rate fees and ensure you’re always getting the best possible rate.

For example, if a customer makes a purchase with a Mastercard that has an interchange rate of 0.92%, with us you would pay 0.92% for that card, but with Square, you’d still be paying a whopping 2.65%.

Transaction Limits