Photo

We know the name of the guy who killed 58+ people. Let’s memorize the name of the guy who SAVED 30 people!

Jonathan Smith. Salute!

59K notes

·

View notes

Photo

s12 gag reel

2K notes

·

View notes

Photo

“God… we… we need your help.”

Supernatural S13 Promo

7K notes

·

View notes

Photo

incorrect destiel quotes

24K notes

·

View notes

Conversation

Destiel Evolution:

Season 4: I raised you from Hell, I can throw you back in.

Season 5: You know what? Blow me Cas.

Season 6: Dean and I do share a more profound bond.

Season 7: I'd rather have you, cursed or not.

Season 8: I need you.

Season 9: You gave up an entire army for one guy.

Season 10: If there’s even a small chance that we can save you, I won’t let you walk out of this room.

Season 11: I could go with you.

Season 12: I love you.

11K notes

·

View notes

Text

Dean Winchester once wore pink panties, is a Dr. Sexy MD junkie, reads Vonnegut, is inventive, highly intelligent, compassionate, thinks women deserve better than shitty men, hates double standards, rocks out to Taylor Swift, and nobody can take those things away from me.

32K notes

·

View notes

Photo

Chris Evans meets Mini Thor

28K notes

·

View notes

Text

The opposite of grimdark is hopepunk. Pass it on.

61K notes

·

View notes

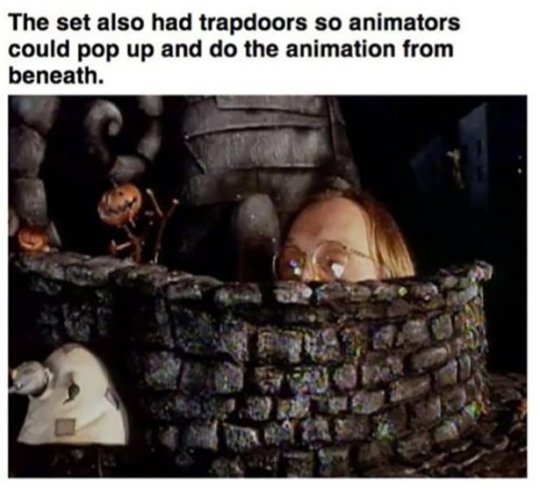

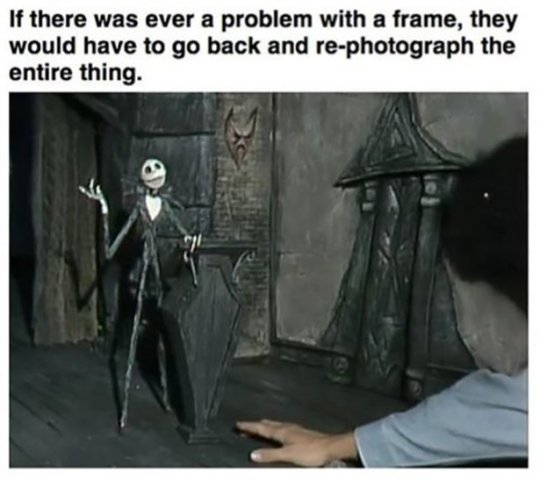

Photo

Fun Facts About The Nightmare Before Christmas Movie pt 1

475K notes

·

View notes

Text

Gentle reminder that the human eye is naturally drawn by noise and movement, so the next time you walk into a crowd or a bit late into a lecture or something like that, they’re not staring at you or judging; it’s just an instinctive reaction that has nothing to do with you doing anything wrong.

575K notes

·

View notes

Link

I’m trying to get through this but with every paragraph I finish the screaming in my head gets louder.

5K notes

·

View notes

Photo

An anti-gun agenda in Batman being controversial.

Anti gun.

Batman.

Gun.

Bat.

Man.

179K notes

·

View notes

Text

I guess I had so completely absorbed the prevailing wisdom that I expected people in bankruptcy to look scruffy or shifty or generally disreputable. But what struck me was that they looked so normal.

The people appearing before that judge came in all colors, sizes, and ages. A number of men wore ill-fitting suits, two or three of them with bolero ties, and nearly everyone dressed up for the day. They looked like they were on their way to church. An older couple held onto each other as they walked carefully down the aisle and found a seat. A young mother gently jiggled her keys for the baby in her lap. Everyone was quiet, speaking in hushed tones or not at all. Lawyers – at least I thought they were lawyers – seemed to herd people from one place to another.

I didn’t stay long. I felt as if I knew everyone in that courtroom, and I wanted out of there. It was like staring at a car crash, a car crash involving people you knew.

Later, our data would confirm what I had seen in San Antonio that day. The people seeking the judge’s decree were once solidly middle-class. They had gone to college, found good jobs, gotten married, and bought homes. Now they were flat busted, standing in front of that judge and all the world, ready to give up nearly everything they owned just to get some relief from the bill collectors.

As the data continued to come in, the story got scarier. San Antonio was no exception: all around the country, the overwhelming majority of people filing for bankruptcy were regular families who had hit hard times. Over time we learned that nearly 90 percent were declaring bankruptcy for one of three reasons: a job loss, a medical problem, or a family breakup (typically divorce, sometimes the death of a husband or wife). By the time these families arrived in the bankruptcy court, they had pretty much run out of options. Dad had lost his job or Mom had gotten cancer, and they had been battling for financial survival for a year or longer. They had no savings, no pension plan, and no homes or cars that weren’t already smothered by mortgages. Many owed at least a full year’s income in credit card debt alone. They owed so much that even if they never bought another thing – even if Dad got his job back tomorrow and Mom had a miraculous recovery – the mountain of debt would keep growing on its own, fueled by penalties and compounding interest rates that doubled their debts every few years. By the time they came before a bankruptcy judge, they were so deep in debt that being flat broke – owning nothing, but free from debt – looked like a huge step up and worth a deep personal embarrassment.

Worse yet, the number of bankrupt families was climbing. In the early 1980s, when my partners and I first started collecting data, the number of families annually filing for bankruptcy topped a quarter of a million. True, a recession had hobbled the nation’s economy and squeezed a lot of families, but as the 1980s wore on and the economy recovered, the number of bankruptcies unexpectedly doubled. Suddenly, there was a lot of talk about how Americans had lost their sense of right and wrong, how people were buying piles of stuff they didn’t actually need and then running away when the bills came due. Banks complained loudly about unpaid credit card bills. The word deadbeat got tossed around a lot. It seemed that people filing for bankruptcy weren’t just financial failures – they had also committed an unforgivable sin.

Part of me still wanted to buy the deadbeat story because it was so comforting. But somewhere along the way, while collecting all those bits of data, I came to know who these people were.

In one of our studies, we asked people to explain in their own words why they filed for bankruptcy. I figured that most of them would probably tell stories that made them look good or that relieved them of guilt.

I still remember sitting down with the first stack of questionnaires. As I started reading, I’m sure I wore my most jaded, squinty-eyed expression.

The comments hit me like a physical blow. They were filled with self-loathing. One man had written just three words to explain why he was in bankruptcy:

Stupid. Stupid. Stupid.

When writing about their lives, people blamed themselves for taking out a mortgage they didn’t understand. They blamed themselves for their failure to realize their jobs weren’t secure. They blamed themselves for their misplaced trust in no-good husbands and cheating wives. It was blindingly obvious to me that most people saw bankruptcy as a profound personal failure, a sign that they were losers through and through.

Some of the stories were detailed and sad, describing the death of a child or what it meant to be laid off after thirty-three years with the same company. Others stripped a world of pain down to the bare facts:

Wife died of cancer. Left $65,000 in medical bills after insurance. Lack of full-time work – worked five part-time jobs to meet rent, utilities, phone, food, and insurance.

They thought they were safe – safe in their jobs and their lives and their love – but they weren’t.

I ran my fingers over one of the papers, thinking about a woman who had tried to explain how her life had become such a disaster. A turn here, a turn there, and her life might have been very different.

Divorce, an unhappy second marriage, a serious illness, no job. A turn here, a turn there, and my life might have been very different, too.

– A Fighting Chance by Elizabeth Warren, pg. 34 - pg. 36

(Bolding mine)

55K notes

·

View notes

Photo

4.01 / 12.23

2K notes

·

View notes

Photo

Rose Tyler confirmed not straight

16K notes

·

View notes

Photo

Okay, for one: heckin’ cute For two: heckin’ THIGHS

841 notes

·

View notes