#whisky investment strategy

Explore tagged Tumblr posts

Text

Explore the dos and don'ts of whisky investment in 2024 to navigate the market with confidence.

Learn how to conduct thorough research, diversify your portfolio, avoid common pitfalls, and stay informed for successful whisky investments.

Download our comprehensive guide for expert advice today!

#whisky investment#whisky investment guide#whisky investment advice#whisky investment strategy#whisky cask ownership

0 notes

Text

The dinner table unites and divides, especially the question of what we eat and how we eat it. It is therefore not surprising that politicians frequently use food as a wedge issue to push their ideological agendas and define who belongs in a group and who doesn’t.

The recent political firestorm ignited by former U.S. President Donald Trump’s claim during a presidential debate that “In Springfield, they’re eating the dogs. The people that came in. They’re eating the cats,” has upended life in the small Ohio town—especially for its Haitian migrant population. The newly arrived refugees have been accused of eating their neighbors’ pets, leading to bomb threats to local schools and the suspension of in-person classes at nearby universities.

The repercussions of the event have been felt far beyond Springfield. On Sunday, vice presidential candidate J.D. Vance seemed to double down on the rumors he helped launch—telling CNN’s Dana Bash that “If I have to create stories so that the American media actually pays attention to the suffering of the American people, then that’s what I’m going to do.”

The baseless rumor Haitians immigrants eating pets in Springfield was promptly and summarily debunked by the town authorities. The soundbite was obviously meant to generate anxiety among voters who consider immigration a fundamental threat to the survival of the United States as we know it.

Whether it is truth or fiction does not matter. The Republican candidates’ divisive strategy has succeeded because of the symbolic meanings Americans—or any people—tend to attribute to certain foods that are seen to reflect and embody their identity as a community. These, in turn, generate strong emotional connections. Such reactions can easily bypass rational reflection. They feed instead off gut feelings. That’s why evidence negating Trump’s narrative may not actually change people’s knee-jerk reaction of revulsion.

The United States, due to its social and cultural diversity, is the perfect laboratory to test this kind of gastronativist messaging. Gastronativism can be activated not only via political affiliation, but also by class, religion, age, nationality, language and, of course, race and ethnicity. Throughout U.S. history, new immigrants have been accused of strange and disgusting culinary habits as a strategy to denigrate them and keep them at the margins of society.

German and Irish immigrants in the mid-19th century were identified with excessive consumption of beer and whisky, a habit that was considered with contempt in a society where anti-alcohol currents were strong and would, over time, originate legal arrangements such as prohibitionism.

The Chinese that settled on the West Coast to work in mining and in railway construction were frequently scorned for their consumption of rice as a main staple, which was considered a sign of their lack of civilization. As most of them were men, at least at first, rice was also interpreted as the explanation for their assumed lack of virility. They were also accused of eating rats, as well serving cats and dogs in their restaurants.

When new waves of migrations from Southern and Eastern Europe invested in the United States, it was the time for garlic and its smell to be derided as an inevitable trait of Italians. This time, well intentioned social workers tried their best to wean the newcomers from their excessive use of vegetables and spices and to convince them to increase their consumption of dairy and meat, which the nutritional theories of the time considered as indispensable to provide the necessary strength for those engaged in physical labor. As new populations arrived, it was their turn to see their food and culinary traditions disparaged as clear marks of their cultural and social inferiority.

The real issue, of course, was always who the “real Americans” were. And the specter of Black migrants eating pets has proved to be even more potent than old scare stories about the Chinese, Italians, and Irish.

Springfield, Ohio, has in recent years experienced a massive influx of refugees escaping political instability in Haiti. The new arrivals, who are there legally, have eased the local businesses’ need for workers, from agriculture to industrial plants. However, they have also have strained the city’s financial and welfare resources, eliciting strong reactions among locals.

While Ohio Republican Gov. Mike DeWine, acknowledging the inevitable growing pains that come with a sudden population increase, has pointed out the role of Haitians in the economic resurgence of Springfield, his fellow Republican, Vance, has ignored the migrants’ contribution to the town’s comeback in favor of spreading wild and incendiary rumors. The fact that Trump and Vance doubled down on a lie points to its usefulness in stirring apprehension among their supporters, with the goal of bringing them to the polls.

Haitian refugees have escaped a country devastated by gang violence and political disarray. Many of them are likely to have experienced food insecurity, an issue that has plagued the island of Haiti for decades and has intensified due to the recent instability. Moreover, Haitians are Black, which itself constitutes a threat for certain segments of the white electorate who feel that their way of life and their privileges are being unfairly usurped by non-white newcomers.

It is easy to project on foreigners who come from a poor country a readiness to feed themselves in any way possible, including consuming animals that better-off people would not consider food.

Haitians, in particular, are often portrayed as practitioners of voodoo, an Afro-Caribbean religion that syncretizes Catholic saints with West African deities. Born out of the culture of enslaved Africans in the New World as a form of resistance and transmission of their original culture, voodoo is connected with practices that include spiritual possession and, on occasion, animal sacrifices. American popular culture has played a central role in making these customs visible and, in many cases, terrifying—partly due to the connection between voodoo and zombie lore in films and horror literature.

The apprehension about the supposed religious practices of Haitians has deep roots in American culture. The anxiety about the mysterious habits of people of African descent has been a longstanding historical phenomenon in the United States since the colonial period. Such fears were intensified by the fact that enslaved people grew and cooked the food that their owners consumed.

Black women at times were tasked with breastfeeding white children and, in many cases, raising them. Against this background, tales about Black magic and juju abounded, indicating a clear ambivalence between the need for products and meals that came from Black hands and the awareness that those exploited in fields and kitchens may hold a grudge.

Given this history, the fake news regarding Haitians in Springfield is far from unexpected. It is through food that we distinguish “us” from “them.” And of course, “we” are inherently better than “them.”

Although Trump also mentioned wild geese being hunted, the fears about Haitian newcomers focused on pets, and in particular dogs. This particular phobia has a long lineage. Some native populations in North American did consume dog meat, causing disconcertment among European settlers. A 2018 regulation, the Dog and Cat Meat Trade Prohibition Act, was included in the Farm Bill, prohibiting the slaughtering of cats and dogs for human consumption, with the exception of native ceremonies.

Dog eating, however, was also a custom in China, South Korea, and the Philippines, among other countries, all of which have seen substantial migration toward the United States. The rapidly growing numbers of Asians in the United States intensified existing anti-Asian sentiments and racial intolerance, which increased during the coronavirus pandemic, attributed by many politicians to China. To emphasize its foreignness and blame Asians for it, Trump referred to the coronavirus as “kung flu.” The stereotype of the “dog-eating Asian” had a temporary resurgence, together with slurs and taunts that were often dug out from the past.

While dog eating is still legally practiced in some areas of China, it is in decline (Shenzhen became in 2020 the first city to outlaw it), and dog slaughtering as livestock has been banned in the Philippines since 1998, with an exception for rituals in indigenous communities and despite the persistence of some residual illegal consumption. In 2024, South Korea passed a law against the breeding and slaughter of dogs.

But reality does not seem to affect the circulation of food-related conspiracy theories, whose effectiveness is predicated on their capacity to strike emotional chords. The power of gastronativist fantasies grows precisely out of the centrality of eating in defining our identity and belonging. Facts end up losing relevance.

The incidents supposedly taking place in Springfield echo preexisting narratives with a long history, making the rumors feel familiar enough that lies begin to sound like truth. The emerging storyline of pet-eating Haitians responds to the needs of the politicians who peddle it while reflecting the ideological worldview of their followers. The victims—in this case a migrant community from a beleaguered country—are the collateral, calculated damage.

15 notes

·

View notes

Text

Harnessing Cultural Heritage for Economic Innovation in Scotland

The Interplay Between Scottish Culture and Economic Innovation Hello, dear readers! Today on "Perspectives Unbound," we explore the symbiotic relationship between Scottish culture and economic innovation, examining how cultural elements uniquely influence Scotland's economic strategies and contribute to global competitiveness. Scotland's rich cultural heritage, from its festivals and literature to its historical architecture and traditions, plays a crucial role in shaping its brand on the world stage. This cultural identity not only attracts tourists but also sets the stage for vibrant creative industries that contribute to the economy significantly. One of the standout examples of how culture drives economic innovation is the Scottish whisky industry. Rooted deeply in Scottish history, whisky has transcended its origins to become a global luxury commodity, significantly boosting Scotland’s exports. The industry's growth is nurtured by a combination of age-old artisan skills and cutting-edge technologies in distillation and marketing, showcasing the successful marriage of tradition and innovation. Moreover, Scotland’s cultural policies have aimed to extend beyond tourism by integrating cultural strengths into economic development strategies. For instance, the push towards "creative cities" sees places like Glasgow and Edinburgh investing in arts and technology sectors that fuel local economies while enhancing cultural vitality. However, the challenges remain in ensuring these cultural-economic synergies are sustainable. Issues like over-tourism, which can threaten the preservation of heritage sites, or the impacts of economic downturns on public funding for the arts, need careful management. Policies must be crafted to not only promote economic growth but also protect and promote Scottish culture. As Scotland continues to leverage its cultural assets to spur economic innovation, it exemplifies how deeply intertwined cultural identity and economic development are. This approach not only enriches the Scottish economy but also contributes to a broader understanding of how culture can be a driving force behind economic resilience and innovation globally. Thank you for joining today’s discussion on the dynamic interplay between Scottish culture and economic innovation. It's a fascinating lens through which to view the broader impacts of culture on economic strategies and outcomes. Warm regards, Alastair Majury *Perspectives Unbound* --- *Stay tuned to Perspectives Unbound for more insightful discussions on how global and Scottish narratives on freedom and thought influence economic and societal transformations.*

#ScottishCulture#EconomicInnovation#GlobalCompetitiveness#CreativeIndustries#ScottishWhisky#TourismScotland#CreativeCities#CulturalHeritage#SustainableDevelopment#CulturalPolicies#ArtsAndTechnology#EconomicStrategy#CulturalEconomics#HeritagePreservation#CulturalImpact

0 notes

Text

情報開発と利活用20241023

Profile

令和維新

2004年4月から企業を離れ、コンサルタントや情報起業を試行しなが ら、失われた20年を取り戻し、日本再生をめざす私の歩みをみて一人でも多くの後継者が出てくれることを祈りつつ友達から紹 介されたこのホームページの更新を続け、これまでの活動の記録と今やビッグデータ、AI,、IOT,ブロックチェーン、仮想通貨の時代になってしまいましたが、私の現状認識と関連技術を紹介していきたい。

フォローする

Recent Posts

暗号通貨の現物-先物アービトラージ戦略の説明(Cryptocurrency Spot -Futures Arbitrage Strategy Explained) ウイスキー販売業者がNFTとAIを活用して50年前のコレクションを販売(Whisky distributor uses NFTs and AI to sell 50-year-old collection) 国民民主党、参政党、れいわ新撰組と、真っ当な政策を掲げている政党の政策について紹介した。すると、各政党支持者が些細な違いや「嘘」に基づいていがみ合う。これもまた、言論の自由なのか。互いに撃ちあってどうする? 自民党を撃て! 先端技術情報20241023 (1)暗号通貨投資の初心者向けガイド Beginners Guide to Invest in Cryptocurrency

0 notes

Text

Spirits Training and Whisky Advisory Services

The world of spirits, especially whisky, is a complex and fascinating domain that continues to grow in popularity. For those looking to deepen their knowledge or enhance their business in this sector, spirits training and whisky advisory services provide essential expertise. These services are tailored to help both enthusiasts and professionals navigate the intricacies of whisky production, tasting, and marketing, ensuring they gain the skills needed to succeed in the ever-evolving spirits industry.

Spirits Training: Elevating Knowledge and Skills

Spirits training is designed for anyone interested in expanding their understanding of the diverse world of spirits, including whisky, rum, gin, and more. Whether you’re a bartender, a retailer, or simply a whisky enthusiast, formal training can provide a solid foundation in areas such as production methods, tasting techniques, and spirit classification.

Training courses often cover the entire production process, from grain selection and fermentation to distillation and aging. Participants learn to identify the key characteristics of different spirits, honing their tasting skills to differentiate between subtle flavors and aromas. In addition to theoretical knowledge, practical sessions help students gain hands-on experience in crafting and tasting spirits.

Professional spirits training is particularly valuable for those in the hospitality and retail industries. A deep understanding of spirits allows staff to provide better recommendations to customers, enhancing their overall experience. Moreover, this expertise can lead to improved sales and customer loyalty as clients feel more confident in their purchases.

Whisky Advisory Services: Expertise for Business Growth

For businesses involved in the whisky trade, whisky advisory services offer specialized guidance to optimize their operations. Whisky advisors work closely with distilleries, retailers, and hospitality businesses to provide insights into market trends, product development, and sales strategies.

Advisors typically have years of experience in the whisky industry, offering advice on everything from brand positioning and packaging to the selection of new products for bars and restaurants. They can also assist in organizing tastings and whisky events, creating a memorable experience for customers and clients alike.

In addition to business-oriented support, whisky advisory services often include consultation on building private collections or selecting investment-grade whiskies. This expert knowledge helps collectors make informed decisions on which whiskies are likely to appreciate in value over time.

In conclusion, spirits training and whisky advisory services are invaluable resources for both individuals and businesses. They provide the skills, knowledge, and expertise needed to excel in the competitive and dynamic spirits industry.

0 notes

Text

Crafting Brand Identity in the Alcoholic Beverages Market

The global alcoholic beverages market comprises a wide range of alcoholic drinks from beer, wine to spirits and mixed drinks. Beer is the most widely consumed alcoholic drink with lager being the dominant beer type. Wine is produced from fermented grape juice and comes in various varieties based on the region of origin and type of grapes used. Spirits are distilled alcoholic drinks made by distilling fermented grain, fruit or vegetables and include vodka, whisky, brandy and rum.

The Global Alcoholic Beverages Market is estimated to be valued at US$ 1,769.41 Bn in 2024 and is expected to exhibit a CAGR of 2.5% over the forecast period 2023 to 2030. Key Takeaways Key players operating in the alcoholic beverages market are Anheuser-Busch Inbev (BUD) (Belgium), Asahi Group (Japan), Bacardi (Bermuda), Brown Forman (U.S.), Carlsberg (Denmark), Constellation Brands (U.S.), Diageo (U.K.), Heineken (Netherlands), Pernod Ricard (France), Suntory (Japan). Key players focus on expanding their production facilities and product lines to meet the growing demand. New product launches specifically targeting female consumers and premiumization has been a key strategy adopted by leading players. The growing social drinking trend especially among millennials and generation Z has boosted the demand for alcoholic beverages. The rising disposable incomes and socialization in pubs, bars, clubs and restaurants has encouraged alcohol consumption globally. Economic development in emerging Asian and African countries is translating to higher spending power and Westernization driving the market growth.

Porter's Analysis

Threat of new entrants: There are significant barriers to entry in the form of high initial investments required and established distribution channels. Bargaining power of buyers: Buyers have moderate bargaining power due to the availability of substitutes. However, brand loyalty limits switching. Bargaining power of suppliers: Suppliers face low bargaining power due to the availability of substitute raw materials. However, for certain premium brands, suppliers wield more power. Threat of new substitutes: New non-alcoholic beverages pose a substitute threat. However, switching costs in terms of taste preferences limit this threat. Competitive rivalry: Fierce competition exists between established industry players.

Geographical Regions

The geographical region where the alcoholic beverages market is concentrated in terms of value is Europe. Countries like France, Italy, Germany, and the UK account for the lion's share of the global market. Mature markets in North America and Europe lead in per-capita consumption and contribute the most to overall market revenues.

The Asia Pacific region is expected to be the fastest-growing geographical region for the alcoholic beverages market during the forecast period. Rising affluence, changing lifestyles, and growing social acceptance are driving market growth in developing countries like China and India. Rapid urbanization and exposure to Western cultures are fueling alcohol consumption, especially among younger consumers in Asia.

0 notes

Text

Alcoholic Beverages Market Dynamics: Navigating Regulatory Landscapes

The global alcoholic beverages market comprises a wide range of alcoholic drinks from beer, wine to spirits and mixed drinks. Beer is the most widely consumed alcoholic drink with lager being the dominant beer type. Wine is produced from fermented grape juice and comes in various varieties based on the region of origin and type of grapes used. Spirits are distilled alcoholic drinks made by distilling fermented grain, fruit or vegetables and include vodka, whisky, brandy and rum.

The Global Alcoholic Beverages Market is estimated to be valued at US$ 1,769.41 Bn in 2024 and is expected to exhibit a CAGR of 2.5% over the forecast period 2023 to 2030. Key Takeaways Key players operating in the alcoholic beverages market are Anheuser-Busch Inbev (BUD) (Belgium), Asahi Group (Japan), Bacardi (Bermuda), Brown Forman (U.S.), Carlsberg (Denmark), Constellation Brands (U.S.), Diageo (U.K.), Heineken (Netherlands), Pernod Ricard (France), Suntory (Japan). Key players focus on expanding their production facilities and product lines to meet the growing demand. New product launches specifically targeting female consumers and premiumization has been a key strategy adopted by leading players. The growing social drinking trend especially among millennials and generation Z has boosted the demand for alcoholic beverages. The rising disposable incomes and socialization in pubs, bars, clubs and restaurants has encouraged alcohol consumption globally. Economic development in emerging Asian and African countries is translating to higher spending power and Westernization driving the market growth. The global alcoholic beverages market has witnessed steady expansion into new international markets over the past decade. Companies focus on capitalizing growth opportunities in Asia Pacific and Latin America with their large consumer base. Africa is also emerging as an attractive market supported by rapid urbanization. Manufacturers emphasis on market penetration through strategic collaboration with local distributors and contract brewing/packing arrangements to establish global footprint. Market Key Trends Rising health consciousness is driving the low and no-alcohol beverages trend in developed markets across North America and Europe. This has prompted leading alcoholic beverages companies to launch new products with low abv and innovative flavors to attract health-focused consumers. Experimentation and premiumization are other major trends with luxury drinks and craft varieties gaining popularity. Sustainable production practices and eco-friendly packaging is an increasingly important issue addressed by industry players to appeal environmentally conscious millennial shoppers. Industry adoption of blockchain, AI and IoT is also opening growth avenues through enhanced supply chain visibility, predictive analytics and personalized digital engagements.

Porter's Analysis Threat of new entrants: There are significant barriers to entry in the form of high initial investments required and established distribution channels. Bargaining power of buyers: Buyers have moderate bargaining power due to the availability of substitutes. However, brand loyalty limits switching. Bargaining power of suppliers: Suppliers face low bargaining power due to the availability of substitute raw materials. However, for certain premium brands, suppliers wield more power. Threat of new substitutes: New non-alcoholic beverages pose a substitute threat. However, switching costs in terms of taste preferences limit this threat. Competitive rivalry: Fierce competition exists between established industry players. Geographical Regions The geographical region where the alcoholic beverages market is concentrated in terms of value is Europe. Countries like France, Italy, Germany, and the UK account for the lion's share of the global market. Mature markets in North America and Europe lead in per-capita consumption and contribute the most to overall market revenues. The Asia Pacific region is expected to be the fastest-growing geographical region for the alcoholic beverages market during the forecast period. Rising affluence, changing lifestyles, and growing social acceptance are driving market growth in developing countries like China and India. Rapid urbanization and exposure to Western cultures are fueling alcohol consumption, especially among younger consumers in Asia.

0 notes

Text

Invest in Tradition: Unlock the Potential of Whisky Barrel Investment

Discover the allure and potential of whisky barrel investment with our expert guidance and unparalleled expertise. At Vintage Acquisitions, we offer investors the opportunity to participate in one of the most lucrative and prestigious alternative investment markets available today. From the storied distilleries of Scotland to the emerging whisky regions around the world, our whisky barrel investment program provides a unique avenue for diversification, appreciation, and long-term wealth preservation.

Services:

Whisky Barrel Acquisition: Gain access to a curated selection of premium whisky barrels from renowned distilleries, carefully chosen for their quality, rarity, and investment potential, allowing you to build a diversified portfolio of whisky assets.

Portfolio Management: Our team of whisky investment experts provides comprehensive portfolio management services, including barrel selection, storage, insurance, valuation, and sales strategies, ensuring that your investment is managed professionally and profitably.

Whisky Market Insights: Stay informed and ahead of the market with our in-depth whisky market analysis, industry trends, and expert insights, providing you with valuable information and guidance to make informed investment decisions.

Secure Storage Facilities: Rest assured that your whisky barrels are stored in secure, climate-controlled facilities under optimal conditions to preserve their quality and value, with comprehensive insurance coverage and regular monitoring to safeguard your investment.

Exit Strategies: When the time is right, we offer tailored exit strategies to maximize the return on your investment, whether through private sales, auctions, or bottling partnerships, ensuring liquidity and flexibility to capitalize on market opportunities.

Key Features of Whisky Barrel Investment:

Tangible Asset: Whisky barrels are tangible assets with intrinsic value, offering investors a unique and tangible alternative to traditional financial instruments, such as stocks, bonds, and real estate, and serving as a hedge against market volatility and inflation.

Appreciation Potential: Whisky has a proven track record of long-term appreciation, with rare and limited-edition releases fetching premium prices at auctions and private sales, offering investors the potential for significant capital appreciation over time.

Global Demand: With whisky consumption on the rise worldwide, driven by growing demand from emerging markets and a burgeoning collector's market, the whisky industry offers a compelling investment opportunity with strong fundamentals and global appeal.

Heritage and Prestige: Investing in whisky barrels allows you to participate in the rich heritage, craftsmanship, and prestige of the whisky industry, aligning your investment with a time-honored tradition and cultural icon that transcends borders and generations.

Passion and Enjoyment: Beyond financial returns, whisky barrel investment offers enthusiasts the opportunity to immerse themselves in the world of whisky, exploring different distilleries, regions, and flavor profiles, and enjoying the thrill of owning a piece of whisky history.

Unlock the potential of whisky barrel investment with Vintage Acquisitions. Contact us today to learn more about our investment opportunities and start building your whisky portfolio with confidence and expertise.

Contact Us

Vintage Acquisitions

📍Business Address : office 2, 5 Lee Rd, Blackheath, London SE3 9RQ, United Kingdom

📞 Phone: +44 208-057-2001

🌐 Website: https://www.vintageacquisitions.com/

💼E-mail: [email protected]

1 note

·

View note

Text

Allied Blenders And Distillers Share Price Advancing Upwards

Introduction In the dynamic landscape of the alcoholic beverages industry, Allied Blenders and Distillers Limited (ABDL) has been making significant strides, as evidenced by the notable advancement of Allied Blenders and Distillers Share Price. This article delves into the factors driving the upward trajectory of Allied Blenders and Distillers Share Price and explores the implications for investors and stakeholders. Allied Blenders and Distillers Limited (ABDL) stands as a prominent player in the Indian alcoholic beverages industry, recognized as one of the largest Indian-owned companies specializing in Indian Made Foreign Liquor (IMFL). The Group is actively involved in the manufacture, procurement, and distribution of a diverse range of alcoholic beverages.

As of March 31, 2022, ABDL boasts a robust product portfolio comprising 10 major IMFL brands spanning whisky, brandy, rum, and vodka categories. Notably, esteemed brands such as Officer's Choice Whisky, Sterling Reserve, and Officer's Choice Blue have attained the esteemed status of "millionaire brands," indicating their impressive sales of over one million 9-liter cases within a single year. Furthermore, the company extends its product offerings to include packaged drinking water under the Officer’s Choice, Officer’s Choice Blue, and Sterling Reserve brands.

ABDL's global footprint extends across 29 countries, encompassing regions such as the Middle East, North and South America, Africa, Asia, and Europe. Through strategic export initiatives, the company has successfully penetrated diverse international markets, showcasing its commitment to global expansion and market diversification.

The inception of Allied Blenders and Distillers Limited (ABDL) can be credited to Indian entrepreneur Kishore Rajaram Chhabria, whose visionary leadership has propelled the company to new heights. Commencing his professional journey within a modest liquor distillery, Chhabria's aspirations for expansion and diversification led him to venture into various sectors, including tea and electronics. In 1988, he laid the foundation for ABDL, which flourished under his stewardship to emerge as a prominent player in the IMFL industry.

Established by Kishore R. Chhabria in 1988 in Kolkata, ABDL currently operates from its headquarters in Mumbai, India. The company's journey from its humble beginnings to its current stature as a leading player in the Indian alcoholic beverages market is a testament to its resilience, innovation, and unwavering commitment to excellence.

A Leading Player in the Alcoholic Beverages Industry ABDL emerges as a prominent player in the alcoholic beverages sector, renowned for its exceptional portfolio of products and innovative strategies. With a focus on quality and consumer satisfaction, the company has carved a niche for itself in both domestic and international markets, setting the stage for its share price to soar.

Strategic Expansion and Market Penetration The upward movement of ABDL's share price can be attributed, in part, to its strategic expansion initiatives and successful market penetration efforts. The company has consistently expanded its product offerings and geographical presence, tapping into new markets and demographic segments. By diversifying its portfolio and leveraging consumer preferences, ABDL has positioned itself for sustained growth and increased market share.

Commitment to Quality and Innovation At the core of ABDL's success lies its unwavering commitment to quality and innovation. The company continuously invests in research and development, exploring new technologies and techniques to enhance its product offerings. By staying ahead of industry trends and consumer preferences, ABDL maintains its competitive edge, driving positive sentiment among investors and fueling the upward movement of its share price.

Resilience Amidst Challenges Despite facing challenges such as regulatory hurdles and market volatility, ABDL has demonstrated resilience and adaptability. Through strategic planning and prudent risk management, the company navigates obstacles effectively, mitigating potential downturns and capitalizing on opportunities for growth. This resilience contributes to investor confidence and supports the upward trajectory of ABDL's share price.

Financial Performance and Investor Confidence ABDL's robust financial performance serves as a key catalyst for the advancement of its share price. With impressive revenue figures, strong profitability metrics, and prudent financial management practices, the company garners trust and confidence from investors. Moreover, transparent communication and proactive investor relations initiatives further bolster investor sentiment, reinforcing the positive momentum of ABDL's share price.

Looking Ahead: Opportunities and Challenges As ABDL continues on its upward trajectory, it faces both opportunities and challenges on the horizon. The company must remain vigilant in navigating evolving market dynamics, regulatory landscapes, and consumer preferences. By capitalizing on emerging opportunities and leveraging its strengths, ABDL is well-positioned to sustain its growth momentum and further enhance shareholder value.

Conclusion The advancing share price of Allied Blenders and Distillers Limited reflects the company's resilience, strategic vision, and commitment to excellence. With a solid foundation, innovative strategies, and a strong market position, ABDL is poised for continued success in the alcoholic beverages industry. As investors and stakeholders monitor the company's progress, the upward movement of ABDL's share price signals promising prospects for the future.

#Allied Blenders And Distillers Share Price#Allied Blenders And Distillers Pre IPO#Allied Blenders And Distillers IPO#Allied Blenders And Distillers Unlisted Shares#Allied Blenders And Distillers Upcoming IPO

0 notes

Text

Art of Collecting: Building Your Whiskey Collection and Investment Tips

Embark on a journey into the captivating world of whiskey collecting an art that combines passion, knowledge, and investment savvy. We'll explore the intricacies of building a whiskey collection, from selecting rare bottles to maximizing investment potential. Whether you're a seasoned collector or just starting, discover the joys and strategies of whiskey collecting.

Collecting whiskey

Take a journey into the exciting world of whiskey collecting, an art form that mixes love, expertise, and investment acumen. In this article, we'll go over the subtleties of creating a whiskey collection, from choosing uncommon bottles to optimizing financial potential. Whether you're an experienced collector or just getting started, learn about the delights and methods of whiskey collecting.

Selecting your focus

When creating a whiskey collection, it's useful to have a certain emphasis or theme in mind. Some collectors may specialize in a certain type of whiskey, such as Scotch, bourbon, or Japanese whisky, whilst others may concentrate on specific distilleries, vintages, or areas. By establishing your focus, you may limit your options and build a cohesive collection that matches your interests and preferences.

Researching and educating yourself

To become a successful whiskey collector, you must first educate yourself about the world of whiskey. Take the time to study various styles and manufacturing processes, become acquainted with well-known distilleries and brands, and remain updated on industry trends and releases. Attend tastings, join whiskey groups, and look for ways to broaden your knowledge and palate.

Building your collection

Building a whiskey collection is a long process that demands perseverance and commitment. Begin by purchasing bottles that fit your focus and budget, keeping in mind that quality is sometimes more essential than quantity. Seek out bottles with unusual packaging, restricted availability, or historical importance, since they may add depth and value to your collection over time.

Storage and display

Proper storage is essential for preserving the quality and value of your whiskey collection. Store bottles upright in a cool, dark area away from direct sunlight and temperature variations. Purchase a nice whiskey cabinet or display case to showcase your collection, allowing you to appreciate your bottles while keeping them safe from harm.

Investment tips

While whiskey collecting may be a gratifying hobby, it can also be a profitable financial option for those who are prepared to be patient. To optimize your collection's financial potential, consider the following tips:

Invest in limited-edition releases

Limited-edition or uncommon bottlings from respected distilleries tend to appreciate with time, especially if they are highly valued by collectors and reviewers.

Pay attention to market trends

Keep track of market trends and variations in whiskey pricing, since they might affect the value of your collection. Keep a watch out for developing distilleries, new releases, and industry news that might affect the market.

Buy low, sell high

When purchasing whiskey for investment purposes, search for opportunities to get bottles at a good deal, such as during sales or auctions. Be patient and intelligent in your sales technique, waiting for the appropriate moment to capitalize on market needs.

Seek expert advice

Consider obtaining counsel from whiskey specialists or investment professionals who can help you grow and manage your whiskey collection. They can provide significant information on market trends, investing strategies, and portfolio management. Building a whiskey collection requires passion, dedication, and knowledge. Whether you collect for personal enjoyment or investment, the art of whiskey collecting provides limitless chances for exploration and appreciation. If you are looking for a distillery near me, or 2 Brothers bourbon, James Two Brothers Distillery is the best option. They offer small boutique-style production of beverage-grade spirit alcohol with simple principles; hard work and honesty. Contact them by writing to [email protected] or call at 352-291-0585.

0 notes

Text

Understanding Mohan Meakin Share Price: Latest News & Updates

Introduction to Mohan Meakin Share Price:

Mohan Meakin Limited, a renowned name in the Indian alcoholic beverages industry, has a rich history spanning over 160 years. The company has witnessed numerous ups and downs, yet it has managed to retain its position as a significant player in the market. For investors and enthusiasts alike, tracking the Mohan Meakin Share Price is crucial for understanding the company's performance and market trends. In this article, we delve into the latest news and updates surrounding Mohan Meakin Share Price, exploring factors influencing its fluctuations and the outlook for the future.

Historical Perspective:

To comprehend the significance of Mohan Meakin Share Price movements, it's imperative to glance back at its historical performance. Established in 1855 by Edward Dyer, the company initially began as a brewery in Kasauli, Himachal Pradesh. Over the years, Mohan Meakin expanded its operations to include various segments such as breweries, distilleries, and malt houses. It introduced iconic brands like Old Monk Rum, Golden Eagle Beer, and Solan No. 1 Whisky, earning a loyal customer base.

Challenges Faced:

Despite its illustrious past, Mohan Meakin has confronted several challenges in recent times. Increased competition from domestic and international players, changing consumer preferences, and regulatory hurdles have posed significant obstacles. Additionally, economic downturns and the COVID-19 pandemic further strained the company's operations, impacting its revenue and profitability.

Recent Developments:

Amidst the challenges, Mohan Meakin has made efforts to adapt and revitalize its business strategies. The company has focused on product innovation, marketing initiatives, and operational efficiencies to enhance its competitiveness. Furthermore, strategic partnerships and collaborations have been explored to explore new markets and distribution channels.

Share Price Performance:

The Mohan Meakin Share Price has experienced fluctuations in response to various internal and external factors. Market sentiment, industry trends, financial performance, and regulatory announcements all influence investor perceptions and trading activities. Despite occasional volatility, the company's share price has displayed resilience, reflecting investor confidence in its long-term prospects.

Latest News & Updates:

In recent months, several developments have influenced Mohan Meakin Share Price dynamics. Expansion plans, new product launches, financial results, and regulatory approvals are among the key factors shaping investor sentiment. Additionally, industry-wide trends such as changing consumer preferences, evolving regulatory landscape, and macroeconomic conditions impact the company's performance and stock valuation.

Expansion Initiatives:

Mohan Meakin has announced ambitious expansion plans to capitalize on emerging opportunities and strengthen its market presence. The company has invested in upgrading its production facilities, enhancing distribution networks, and exploring new geographic markets. These initiatives aim to drive revenue growth, improve operational efficiency, and enhance shareholder value.

Product Innovation:

In response to evolving consumer preferences and market trends, Mohan Meakin has introduced new products and variants across its portfolio. From flavored spirits to premium offerings, the company seeks to cater to diverse consumer segments and capture niche market segments. Product innovation plays a crucial role in sustaining competitive advantage and driving revenue growth.

Financial Performance:

The financial performance of Mohan Meakin is closely scrutinized by investors and analysts to gauge its operational efficiency and profitability. Quarterly earnings reports, revenue projections, and profit margins are among the key metrics monitored. Despite challenges posed by the pandemic and economic uncertainties, Mohan Meakin has demonstrated resilience, with a steady recovery in sales and profitability.

Regulatory Environment:

As a regulated industry, Mohan Meakin is subject to various laws and regulations governing the production, distribution, and sale of alcoholic beverages. Changes in taxation policies, licensing requirements, and advertising regulations can significantly impact the company's operations and profitability. Therefore, staying abreast of regulatory developments is crucial for investors assessing the company's outlook.

Outlook & Conclusion:

In conclusion, the Mohan Meakin Share Price reflects a complex interplay of internal and external factors, including industry dynamics, company performance, market sentiment, and regulatory environment. Despite facing challenges, the company remains optimistic about its future prospects, driven by expansion initiatives, product innovation, and strategic partnerships. Investors should conduct thorough due diligence and monitor relevant developments to make informed decisions regarding Mohan Meakin stock.

In a dynamic market environment, staying informed and proactive is essential for navigating investment opportunities and risks effectively. As Mohan Meakin continues its journey in the alcoholic beverages industry, its share price will continue to be a subject of interest and scrutiny for investors seeking long-term value and growth potential.

0 notes

Text

Explore the world of whisky investment in our comprehensive blog.

Learn about long-term vs. short-term profit strategies the best whisky investments, and gain insights into the whisky investment market.

If you're a connoisseur or an investor, you can learn how to make the most of this unique opportunity.

#whisky investment#whisky investment strategy#whisky investment market#whisky investment guide#best whisky investment

0 notes

Text

How Johnnie Walker Emerged as the Premier Whisky Choice in India

Over time, whisky has garnered significant significance within India, a nation steeped in cultural heritage and tradition. Among the plethora of whisky brands available, Johnnie Walker stands out as a household name. What’s the secret behind the unparalleled success of this iconic Scotch whisky in India? Let’s delve into the history of Johnnie Walker in India and uncover the factors contributing to its popularity.

Johnnie Walker’s Rich Legacy in India

With a history spanning more than a century, Johnnie Walker has firmly entrenched itself in the Indian whisky market. Initially introduced during British colonial rule, whisky was once a luxury enjoyed solely by the elite due to its rarity and high price. However, post-independence, as India’s economy opened up, a burgeoning middle class fueled the demand for imported spirits, particularly Scotch whisky.

The Allure of Premium Quality

Central to Johnnie Walker’s appeal in India is its unwavering commitment to quality. Through consistent branding efforts featuring the iconic striding man logo, the company has successfully positioned itself as a symbol of sophistication and prestige. This association with refinement has resonated with whisky enthusiasts and socialites alike, bolstering the brand’s reputation across the country.

Diverse Product Range

Johnnie Walker’s extensive portfolio caters to a wide spectrum of consumers in India. From the accessible Red Label to the luxurious Blue Label, there’s a Johnnie Walker whisky suited to every palate and budget. This diverse range ensures that both casual drinkers and seasoned connoisseurs can find a whisky that aligns with their preferences, underscoring the brand’s accessibility in the Indian market.

Adaptation to Local Tastes

Recognizing the importance of understanding local culture and preferences, Johnnie Walker has tailored its marketing strategies and product offerings to resonate with Indian consumers. Ad campaigns themed around Indian festivals and traditions have struck a chord with the audience, fostering a sense of connection and familiarity with the brand.

Innovative Limited Editions

Johnnie Walker’s penchant for innovation is evident through its release of limited edition products commemorating significant events. These exclusive offerings generate excitement among whisky enthusiasts, further solidifying the brand’s appeal and staying power in the competitive Indian market.

Commitment to Social Responsibility

In a country where ethical considerations hold sway, Johnnie Walker’s proactive approach to social and environmental initiatives has garnered praise and support from conscientious consumers. By prioritizing corporate social responsibility and sustainability, the brand has earned the trust and loyalty of environmentally-conscious Indians.

Strategic Celebrity Endorsements

Utilizing influencer marketing and celebrity endorsements, Johnnie Walker has enhanced its brand image and credibility in India. Collaborations with sports personalities, Bollywood stars, and other prominent figures have amplified the brand’s visibility and resonance with the target audience.

Expanding Accessibility

Capitalizing on India’s burgeoning e-commerce landscape, Johnnie Walker has expanded its reach to remote regions through online platforms. Additionally, investments in an extensive distribution network have ensured widespread availability of the brand’s products across urban and rural markets alike.

Looking Ahead

As India’s whisky market continues to evolve, Johnnie Walker must remain agile and adaptive to stay ahead of the curve. By innovating, maintaining brand relevance, and embracing emerging trends, Johnnie Walker can continue to reign supreme as India’s whisky of choice, inviting consumers to embark on a journey of unparalleled taste and sophistication. And, of course, always ensuring that customers are well aware of the Johnnie Walker price in the Indian market.

visit us – https://dutyfreedelhi.blogspot.com/2024/02/how-johnnie-walker-became-indias-whisky.html

0 notes

Text

Scotland's New Trade Frontier: Embracing Opportunities and Overcoming Challenges Post-Brexit

Navigating Trade Post-Brexit: Opportunities and Challenges for Scotland Hello, dear readers! Today, we explore the shifting sands of trade relationships and economic interactions that Scotland faces in the post-Brexit era. The departure from the European Union marks a pivotal change, offering both potential opportunities and formidable challenges that will shape Scotland's economic landscape in the decades to come. Brexit has undoubtedly ushered in a period of uncertainty for traders and businesses across Scotland, accustomed as they are to the protocols and benefits of the Single Market and Customs Union. However, it also provides a unique chance for Scotland to redefine its trade policies and forge new international partnerships. One significant opportunity lies in the potential for negotiating bespoke trade agreements that are tailored to Scotland’s strengths and economic needs. Industries such as Scotch whisky, seafood, and textiles could benefit immensely from targeted trade agreements that reduce tariffs and open up new markets. Moreover, Scotland can enhance its attractiveness as a hub for green and digital technologies by leveraging its substantial expertise in these areas. However, these opportunities also come with challenges, particularly in navigating new trade regulations and customs processes that could increase costs and complexity for businesses. There is also the pressing issue of maintaining and enhancing trade relations with the EU, which remains a vital trading partner for Scotland. To address these challenges, Scotland needs a comprehensive strategy that includes robust support systems for businesses transitioning to new trade frameworks, increased investment in digital infrastructure to streamline customs procedures, and continuous dialogue with international partners to ensure Scotland’s interests are represented on the global stage. How can Scotland optimise these emerging trade scenarios to ensure a prosperous economic future? What steps should policymakers take to mitigate the challenges presented by the new trading conditions? Thank you for joining today's discussion on Scotland's post-Brexit trade landscape. Warm regards, Alastair Majury *Perspectives Unbound* --- *Follow Perspectives Unbound for more insights into how global shifts impact Scottish economic strategies and community outcomes.*

#PostBrexit#ScotlandTrade#EconomicLandscape#TradeAgreements#ScotchWhisky#ScottishSeafood#TextileIndustry#GreenTechnology#DigitalInnovation#TradeChallenges#CustomsProcedures#InternationalPartnerships#EUTradeRelations#GlobalEconomy#ScottishEconomy

0 notes

Text

IMFL Market Analysis, Growth and Key Players

The Indian Made Foreign Liquor (IMFL) Market is a dynamic and integral part of India's alcoholic beverage industry. This segment encompasses a diverse range of spirits produced domestically, drawing inspiration from foreign distillation techniques and recipes. The IMFL Market has witnessed substantial growth in recent years, fueled by changing consumer preferences, rising disposable incomes, and an expanding urban population. Let's delve into the key aspects of the IMFL Market, exploring its prominent companies and the factors driving its growth.

Overview of the IMFL Market:

The IMFL Market includes various types of liquors such as whiskey, rum, brandy, vodka, and gin. These beverages are crafted within India, incorporating both indigenous and foreign influences to create distinctive flavor profiles. Unlike country liquor, which is typically produced and consumed locally, IMFL represents a more sophisticated and diverse category catering to a broad consumer base.

IMFL in Focus: Indian Made Foreign Liquor

Within the Spirits Market, IMFL refers to a category of liquors produced in India but influenced by foreign distillation methods. This segment includes various types of spirits, each with its own characteristics:

Whiskey: Known for its diverse styles, including single malt, blended, and grain whiskey, offering a range of flavors from smoky to sweet.

Rum: Embracing sweetness and often featuring spiced variations, Indian rum brings its own flair to the global rum scene.

Brandy: Crafted from fermented fruit juices, Indian brandy offers a fruity and often smoother alternative to its international counterparts.

Vodka: Prized for its neutrality, Indian vodka is versatile and serves as a base for a wide range of cocktails.

Gin: Exhibiting herbal and botanical notes, Indian gin has gained popularity as consumers explore craft and artisanal options.

Key Players in the IMFL Market

Several companies play a pivotal role in shaping the IMFL segment and contributing to the overall growth of the Spirits Market:

United Spirits Limited (USL): As one of the largest spirits companies in India, USL boasts an extensive portfolio that includes iconic brands like McDowell's No. 1, Royal Challenge, and Signature.

Radico Khaitan Limited: Known for its flagship brand, Rampur Indian Single Malt Whisky, Radico Khaitan has made a mark in the premium spirits segment.

Diageo India: A subsidiary of the global beverage giant Diageo, Diageo India has a strong presence with brands like Johnnie Walker, Black & White, and VAT 69.

Sazerac Company: While based in the United States, Sazerac has made significant inroads into the Indian market with its acquisition of Radico Khaitan's stake in their joint venture.

Factors Driving Growth in the IMFL Market:

Changing Consumer Preferences: The evolving tastes and preferences of consumers, especially among the younger demographic, are driving the demand for diverse and premium IMFL products.

Rising Disposable Incomes: Increasing disposable incomes, particularly in urban areas, enable consumers to explore and invest in higher-priced and premium IMFL offerings.

Marketing and Innovation: Intensive marketing strategies and innovative product launches by key players contribute to the overall growth of the IMFL Market. Brands often engage in promotional activities and introduce new variants to capture consumer attention.

Urbanization and Lifestyle Changes: The urbanization trend, coupled with changing lifestyles, has led to a shift in drinking patterns. Consumers are seeking more sophisticated and curated drinking experiences, contributing to the popularity of IMFL products.

Challenges and Future Outlook:

While the IMFL Industry continues to thrive, it faces challenges such as regulatory constraints, changing government policies, and increasing health consciousness among consumers. However, with a focus on innovation, responsible marketing, and catering to evolving consumer preferences, the IMFL Market is poised for sustained growth.

In conclusion, the IMFL Market in India is a vibrant and evolving landscape, with leading companies shaping the industry's trajectory. As consumers embrace diverse and premium choices, the IMFL segment remains a key player in the country's dynamic alcoholic beverage market.

0 notes

Text

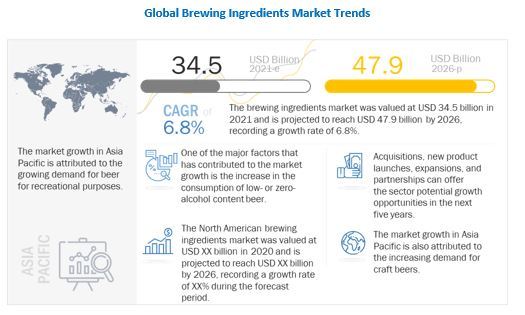

Sustainable Growth Opportunities in the Brewing Ingredients Market

The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to reach USD 47.9 billion by 2026, expanding at a growth rate of 6.8% during the forecast period. The market is segmented into source, brewery size, and form. By source, the market has been segmented into malt extract, adjuncts/grains, hops, beer yeast, and beer additives. The malt extract segment is projected to dominate the source segment due to increased demand for natural ingredients and was estimated at USD 17.6 billion in 2021. It is projected to reach USD 24.9 billion in 2026. The adjuncts/grains segment is projected to grow at the CAGR of 6.8% due to the increase in consumption of beers.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The key players in this market include Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK), among others.

Major players in the market are mainly focusing on rapid investments in developing economies to grab a greater number of customers in the coming years. Further, the companies are also focusing on a strategic partnership with the beer manufacturers to ensure the continuous workflow of inventories.

The core strength of the key players identified in this market is their growth strategies, such as new product launches, certifications, and expansions, among others. Undertaking new product launches and expansions has enabled market players to enhance their presence in the brewing ingredients market. Some of the key strategies followed by the leaders are mentioned below:

Cargill, Incorporated is one of the globally leading companies involved in the production of food ingredients. The company offers products for different markets such as agriculture, animal nutrition, beauty, bio-industrial, carbon solutions, food service, food & beverage, industrial, pharmaceutical, meat & poultry, transportation, and risk management. Based on application, the company has segmented its products under the food & beverage category into bakery, bev-alcoholic, beverages, confectionery, convenience foods, dairy, fruits & vegetables, infant & baby food, meat & fish, snacks & cereals, and others. The company actively operates in more than 70 countries and exports its products to customers in more than 125 countries. It is identified as a star player in the global brewing ingredients market, according to MnM analysis.

Angel Yeast Co. Ltd. is a leading producer of yeast. The company specializes in the production of yeast and yeast derivatives. It has segregated its product offerings into yeast & baking, yeast extract-savory, nutrition & health, and biotechnology. The biotechnology segment is further divided into distilled spirits & biofuels, microbial nutrition, and enzymes. The firm offers yeast through five brands: Angel, Eagle, Bakerdream, Gloripan, and Fubon. It has 10 international advanced production bases in China, Egypt, and Russia. The company is identified as a star player in the global brewing ingredients market, according to MnM analysis.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=248523644 Boortmalt is a world leader in the production of top-quality barley malt. The company offers different malts under its five brands: Pauls malt, minch malt, les maltiers, belgomalt, and badass barley malt. The firm is present in 5 continents with 27 malting plants located in Spain, Ethiopia, the US, Canada, Argentina, Australia, the UK, France, Germany, and Hungary, among others. It supplies malt to producers of beer and whisky across the globe. The company is identified as a star player in the global brewing ingredients market, according to MnM analysis.

The Asia Pacific market is projected to grow at the highest CAGR during forecast period. The high growth rate is supported by various factors such as growing urbanization, increasing disposable income and increasing population in countries such as India and China.

#Brewing Ingredients Market#Brewing Ingredients#Brewing Ingredients Market Size#Brewing Ingredients Market Share#Brewing Ingredients Market Growth#Brewing Ingredients Market Trends#Brewing Ingredients Market Forecst#Brewing Ingredients Market Analysis#Brewing Ingredients Market Research Report#Brewing Ingredients Market Scope#Brewing Ingredients Market Overview#Brewing Ingredients Market Outlook

0 notes