#what's ucc filing

Explore tagged Tumblr posts

Text

December 2-3, 1984

It's been forty years since a Union Carbide chemical plant exposed five hundred thousand people to methyl isocyanate in Bhopal, India. Thousands were killed in the initial event, thousands more died from complications months or years later, and at least a hundred thousand were permanently injured.

The cause of the incident was the introduction of water to a methyl isocyanate storage tank. This caused a runaway reaction, overpressurising the tank from 14 to 280 kPa over the course of two hours, at which point the tank cracked - but even with atmospheric escape of the gas, pressure continued to increase to nearly 400 kPa - at which point the gauge could no longer give an accurate reading.

After roughly 30 tonnes of gas escaped, employees triggered the plant's alarm system - which was originally designed to alert both workers in the plant and the people in the surrounding city. Company policy mandated that they not alarm the populace about "inconsequential" leakages, so the two alarms had been decoupled by the time of the release. For nearly an hour and a half, the plant's management continued to tell authorities that everything was fine and they had no idea what had happened. Hospital staff had to guess what gas was causing the symptoms. No shelter in place order was given; the public siren remained silent for an hour and a half.

Union Carbide had identified 61 hazards at the Bhopal plant in a 1982 audit, but never followed up on the inspection. Mere months before the incident, UCC discussed the possibility of a methyl isocyanate reaction similar to what occurred in Bhopal at one of their West Virginia plants - however, the report and its predictions were never forwarded to the Bhopal plant, despite the similar design and process.

The Union Carbide Corporation asserts that the incident was caused by sabotage performed by a disgruntled worker. They claim that workers conspired with the Indian government to hide evidence of sabotage in order to blame the company, claiming that the safety systems were sufficient to prevent the incident without human intervention.

On the night of the incident, the tank's monitoring equipment had been malfunctioning for years, reduced to a single manually operated backup. Management had shut off refrigeration of the tank, keeping it at more than 15 degrees Celsius above the recommended temperature. The emergency flare and gas scrubbers had been out of order for months - and even if they had been active, they had insufficient capacity. Deluge guns - a type of pressurised water cannon intended to dissolve escaping gas - lacked enough pressure to even reach the gas cloud.

No motive for the alleged sabotage was suggested.

Warren Anderson, CEO of Union Carbide, refused to answer homicide charges by the Indian government, with the US government denying repeated requests for extradition. He died in 2014, months before the thirtieth anniversary of the disaster in Bhopal.

Union Carbide have divested their stake in their Indian subsidiary UCIL, and refuse to fund any efforts to clean up the abandoned site, insisting that the fault lied with UCIL management and the alleged saboteur. The company paid $470 million dollars to the Indian government - which worked out to a cost of 43 cents per share of the company. Union Carbide's annual earnings were $4.88 per share after the Bhopal settlement.

The 2012 Global Intelligence Files leak revealed that Union Carbide's current owner, Dow Chemical, had employed the surveillance firm Stratfor to monitor activists seeking compensation for the Bhopal disaster.

Dow responded to the email leak that they were "required to take appropriate action to protect their people and safeguard their facilities" - an attitude that seems to have been very lacking in 1984.

500 notes

·

View notes

Text

Bhopal Gas Tragedy

No one can tell how many people died in the Bhopal Gas tragedy. All that the older generation remembers is a city strewn with corpses on that winter morning of cold December 1984. What they mistook for fog was toxic methyl isocyanate leaking from a pesticide factory in Bhopal. Over 5 lakh people were exposed to that gas. 40 tonnes of toxic gas. It was the world’s worst industrial disaster. Union Carbide India Limited owned by Warren Anderson. But the Bhopal factory, UCIL, was majority owned by Union Carbide Corporation, with Indian Government-controlled banks and the Indian public holding a 49.1 percent stake. In Bhopal probably tens of thousands died. America’s worst ever-industrial disaster was the Hawk’s Nest Tunnel disaster. That was also United Carbide Corporation’s. 1000 labourers died.

The estimated magnitude of disaster varies according to sources. More than 3,500 people died soon after. Authorities also say at least 15,000 people have died since the leak, although activists put the number at some 33,000. The official immediate death toll was 2,259.The government of Madhya Pradesh confirmed a total of 3,787 deaths related to the gas release. A government affidavit in 2006 stated that the leak caused 558,125 injuries, including 38,478 temporary partial injuries and approximately 3,900 severely and permanently disabling injuries. Others estimate that 8,000 died within two weeks, and another 8,000 or more have since died from gas-related diseases.

Five thousand deaths were quoted in the court case which the government itself revised to around 23,000. Over 5 lakh people were permanently disabled. Activists like N D Jayaprakash of the BGPSSS, have faced repression, arrests, denial of information and corruption to campaign against this fraud, where the numbers of affected were fudged and deaths arbitrarily counted. While the government claimed that only 3000 had died, the people’s organizations have proof of more than 20,000 dead and 5.7 lakh seriously injured.

Ten thousand people may have died immediately. Over the years may be 25,000 people would have died.

They never got punished. Civil and criminal cases were filed in the District Court of Bhopal, India. People of Bhopal never got justice. In June 2010, seven former employees, including the former UCIL chairman, were convicted in Bhopal of causing death by negligence and sentenced to two years imprisonment and a fine of about Rs. 1 lakh each.

Warren Anderson, the UCC CEO at the time of the disaster died, unpunished.

Union Carbide Corporation still exists bought over by Dow Chemicals now.

In 1989 Union Carbide paid around 47 crores as compensation to the victims. After that Dow says all its liabilities were resolved.They did not pay the money on their own. It was a Supreme Court ruling. They decided to settle at that money. The court decided to settle only on compensation, not punishment. Anderson had not shown up in Bhopal Court despite several summons through Interpol and is now dead, unpunished.

2 notes

·

View notes

Note

Isn't BJP trying to bring Uniform Civil Code for years now and muslim board is heavily against it?? As far as I know queer people will have equal rights to marry and all laws will be gender neutral. So if BJP is working towards the same thing then what is the use of opposing it in court right now? And Gov. itself decided to oppose this case or it's some kind of a rule that if someone has submitted a plea in supreme court and court decides to hear the case then someone has to be on the opposite side?? right?? I mean who decided to stand against who first? I don't get it?

Hey so it's a little complicated

UCC does not automatically mean gender neutral laws, they can still use the gender binary to describe the relationships. As far as I know there has been no proposition for gender neutral UCC and even if it's proposed, what we ultimately get will be a different thing. Such is the case with most laws. UCC definitely will make queer marriage much more easier because multiple laws will not have to be amended and expanding its scope will be easier for the courts too. It will also eliminate basing marriage on religion and will make marrying overall easier for everyone. But again doesn't mean it'll be gender neutral, that solely depends on the government

BJP government is pretty explicitly queerphobic so I don't have any hope from UCC too.

As for the petition question, no it doesn't mean someone have to yknow be on the opposite side. It's basically I filed a petition for queer marriage, the court will ask the government to submit a reply i.e., how do you justify your laws and are you willing to change them. If let's say the government showed their willingness to work for queer rights, then the matter will shift to parliament and it will make requisite laws. But typically the government will try to give some stupid justification like what happened with our petition. So it's not like someone is forcing them to oppose gay marriage, it's just their own prejudice.

3 notes

·

View notes

Text

Identity theft is often thought of as a problem that only affects individuals, but it’s important to know that business identity theft is also a reality. Businesses with a physical or online presence are at risk for identity theft, which can lead to financial loss and reputation damage.There are many ways to protect your business from identity theft, and the first step in doing so is knowing what to look out for. Here are some signs that you may be at risk of identity theft.Businesses Face an Uphill Battle Against Identity TheftThieves utilize a variety of tactics, similar to personal identity theft, to get corporate credentials and use them to submit bogus tax returns or open bogus lines of credit in the firm's name (business lines of credit are generally much higher than consumer lines of credit).When it comes to suspicious bank account activity, an individual might notice it quite immediately, but it may take a business a long time to uncover. This is especially true if your business does a high volume of transactions.It will help you to know exactly what is identity theft, the methods used, and how you can protect your business with outside help.Is Your Business at Risk? Consult this ChecklistThe information on your state's company registration should be safeguarded and maintained.Keep track of your company's bank accounts and credit lines to ensure their safety.Keep track of your company's credit and trade accounts.Your company's credit file should be safeguarded and checked on a regular basis.You must safeguard your company's data.Workplace computers and networks should be safeguarded.Your website and online presence should be safeguarded."Trust, but verify" is a smart strategy for protecting your company from fraudulent orders.Be on the lookout for strange activities.The Financial Consequences of Business Identity Theft Organizational income loss or financial theft may have a severe impact on your company and its employees, particularly in small and medium-sized businesses (SMBs). For example, the firm may be unable to pay its employees, pay employment and income taxes, or purchase new items.Furthermore, because these sorts of accounts frequently need a personal guarantee from one or more of the business's owners, you may be held accountable for false corporate debt and credit lines until you can show the accounts were fraudulent. If your credit score suffers as a result of your testimony, you may find it difficult to get fresh loans and funding.As a result, many small businesses operate on razor-thin margins and simply cannot afford the challenges caused by business identity theft, which is perhaps the most serious threat of all. Most small businesses collapse within six months of being hacked, and there are already so many mistakes that firms may make that will lead to failure.Additional Tips for Avoiding Business Identity TheftExamine your commercial and business banking contracts.The Uniform Commercial Code applies to business and commercial bank accounts (UCC). Businesses have shorter reporting timeframes, fewer safeguards, and a larger responsibility for fraud under the UCC than consumers do.Keep a record of all accounts and important contact information.Make a list of your company's accounts, including the creditor / financial institution, account number(s), card number(s) (including all staff cards), and essential contact information for the billing and fraud departments.Keep your personal and business funds separate.As much as possible, do not use your personal credit cards or bank accounts for business purposes. Financial institutions and card issuers remove business-related transactions done with personal cards from their "zero fraud liability" schemes, in addition to concerns of company separation, accounting, and correct tax reporting.Delete any information associated with domain names that are going to expire.Because of known security flaws in a domain, anybody who owns it can get access to the domain's applications,

such as email accounts and passwords, as well as other online credentials, such as social networking accounts and calendars.If your organization owns a domain name that is set to expire and will not be renewed, and you have used the domain for emails, calendaring, or other online services such as Google Apps, make sure you delete any information from these apps before the domain expires.

0 notes

Text

The Power of Asset Searches: Finding Hidden Accounts and Financial Assets

In today's complex financial world, people may hold assets across multiple banks and institutions. For individuals or businesses, locating these assets can be a challenge. This is where asset searches come in.

What is an Asset Search?

An asset search is a comprehensive investigation to locate the financial holdings of a person or business. Asset Searches can be a valuable tool in a variety of situations, including:

Debt collection: If someone owes you money and you suspect they are hiding assets, an asset search can help you track them down.

Pre-judgment discovery: Before filing a lawsuit, you may want to conduct an asset search to determine if it is worthwhile pursuing litigation.

Family law: In divorce proceedings, asset searches can help ensure a fair division of marital assets.

Background checks: Asset searches can be used as part of a comprehensive background check on a potential business partner, tenant, or employee.

What Do Asset Searches Find?

Asset searches can uncover a variety of financial assets, including:

Bank accounts

Real estate

Investment accounts

Vehicles

Businesses

Tax liens

Judgments

How Asset Searches Work

Asset searches are conducted by professional investigators who have access to a variety of public and private databases. These databases may include:

Public records, such as property records, court records, and UCC filings

Credit reports

DMV records

Death records

Professional licenses

The Importance of Using a Reputable Asset Search Company

When conducting an asset search, it is important to use a reputable company that has a proven track record and adheres to all applicable laws and regulations. Asset [invalid URL removed] is a leading provider of asset search services. They have a team of experienced investigators who can help you locate the assets you are looking for.

Legal Considerations

It is important to note that there are some legal restrictions on asset searches. For example, you cannot conduct an asset search for personal reasons, such as trying to find a friend or relative. Asset searches can only be conducted for legitimate business purposes.

Conclusion

Asset searches can be a valuable tool for individuals and businesses alike. If you need to locate hidden assets, Asset https://assetsearches.com/bank-account-asset-search/ can help.

#asset investigation services#hidden asset search#finding hidden assets after divorce#asset search company

0 notes

Link

0 notes

Text

It has come to our attention that former President of the United States, Inc., Donald John Trump, has filed a Uniform Commercial Code claim to own the Municipal franchise named after him and also to discharge all the tax debts of the franchise via assignment to the Secretary of the Treasury (Puerto Rico, we are assuming).

This leaves the question of what capacity is he acting in? He still isn't acting as a living man, but as a franchise of some other corporation. The answer as to which corporation has, at least apparently, been revealed. In the UCC filing attached, he describes himself as a member of One Heaven, which is a weird, quasi-religious Secret Society, that has once again, established a corporation calling itself "The United States of America, Incorporated" and at last report, filed for incorporation in India.

This is just a repeat of what we have seen ever since the so-called American Civil War --- a group of British Territorials forming a commercial or municipal corporation --- naming it after us or our government, and then promoting this impersonation scheme as a means to access our credit and commit crimes of personage and barratry. They must be stopped.

If indeed Donald Trump has chosen to align himself with The Reign of the Heavens Society, this is very bad news for sane people everywhere.

The Reign of the Heavens Society and its "One Heaven" offshoot, represents a group of plagiarists who are not only trying to usurp upon the identity and trademarks of the American Federation of States, our unincorporated Public Instrumentality which has been doing business under the name The United States of America since 1776, but which has liberally plagiarized the work of Frank O'Collins, a once-very-high ranking Catholic priest, who left the Church and developed a utopian model for a new social order that he called "Ucantia" and published on the internet for several years.

We became aware of Frank and his work circa 2005 and read it with great interest; he established, in theory, a new Canon Law, three new forums of government --- One Heaven, One Purgatory, One Hell --- that basically correspond to the three jurisdictions of the old system --- Air, Land, and Sea --- and adopts new time and weights and measures standards, etc., but, at the end of the day, is actually a rehash of the Roman Catholic Church and the Unam Sanctam Trust hierarchy into a more secular forum, albeit, still presided over by a group of quasi-religious elitists.

The Reign of the Heavens Society took Frank's Ucantia model, almost verbatim, plagiarizing vast quantities of it to create it's version of Ucantia --- which they call "One Heaven", and apparently, Donald John Trump counts himself a "member" of this absurd, criminal group of quasi-religious elitists.

Let us further explain that on the evening of December 20th 2012, I received a communication from this group saying that if I didn't sign up by midnight and assign all value of my personal life estate to them, I would be forever classed as a lesser being and be unable to participate as one of the "144,000" disciples of their movement who were destined to rule the world.

I wrinkled my nose as any sane person should. I also "failed" to choose a noble name for myself, such as "Lady" Hepzibah Willow Moon Doggie Starlight. And I kept my assets, too, instead of donating them to The Reign of the Heavens Society.

If this is what Donald Trump is believing in and following as his guide, spiritual or material, and trying to promote, as a "member of One Heaven" --- he is not mentally competent and must be removed from office, just as the Government of India must do it's Due Diligence and remove "The United States of America, Incorporated" or any similar corporation infringing on our identity --- such as "the American Government, Inc." --- from its registry.

Every sane person worldwide is hereby provided with Due Notice and Process that this gang of thieves, plagiarists, and co-conspirators has, apparently, numbered Donald John Trump among its members, and that he is now attempting to use their methods to discharge the tax obligations of the Municipal franchise named after him, against the very corporation that he is purportedly the "President" of, a conflict of interest if there ever was one.

All countries that maintain corporate registries are forewarned that this identity theft is being attempted against our lawful national government and our country as a whole. The same kind of identity theft by incorporated entities infringing on the names and trademarks of actual nations has led to widespread credit hacking and crimes of state by these international pirates and the banks are fully liable for allowing this to go on.

ALL banks in the central bank system are forewarned that the commercial banks were foreclosed by our actual government and these Bounders do not represent us; as a result, their claims to "own all US Banks" are invalid and False Claims in Commerce. We are the Creditors and they are not our Representatives.

This revelation of Donald John Trump's affiliation with a dreadful secret society of criminals attempting to form a rehash of the old Roman Catholic Unam Sanctam Trust structure under their own control is repugnant and frightening to say the least.

No doubt they can find 144,000 elitists willing to rule over the rest of humanity and no doubt they imagine that they can plagiarize Frank O'Collins and propose all manner of legal chicanery as an excuse for their venal activities, but the rest of us are not deaf, dumb, or blind and must take immediate action to put an end to their organization and its pretenses.

Please consider The Reign of the Heavens Society and its corporations and names, including "One Heaven" to be a national security threat against our country and all countries on Earth.

Until further notice, consider Donald John Trump to be one of the members of this dreadful Secret Society and take appropriate action.

We are attaching proof of the Uniform Commercial Claim validating our position and Mr. Trump's admission of being a "member of One Heaven". Mr. Trump should, of course, be allowed to further elaborate, confirm, or deny that he made this filing. We are dealing with pirates here, people who have no moral compass, and anything --- including a claim made "for" Donald John Trump --- is possible.

Please also bear in mind that our Commercial Claims to own and hold in trust all American Assets and to bypass all assertions of British Territorial Citizenship are fully cured and vastly pre-date all commercial claims made by anyone else. Please also bear in mind that the assets of the former Confederate States, that is, States-of-States, belong to the States of the Union, which are members of our unincorporated Federation of States.

#blacklivesmatter#blackvotersmatters#donald trump#joe biden#naacp#blackmediamatters#blackvotersmatter#news#ados#youtube

1 note

·

View note

Text

UCC FILE 4324 THE INVOLVEMENT OF NOW PAST ADMIRAL ARIN KLAXTON

ATTENTION SENSITIVE MATERIAL ENCLOSED IN SAID DOCUMENT, DETRIMENTAL TO SECURITY AND LONGEVITY OF COMMAND PROCEED WITH ONLY ADMINISTRATIVE ALLOWANCES OR CORRECT SECURITY CLEARANCE: 24TH heavy company and fleet command structure guideline 03 prohibits any and all under the clearance code to access or view the document/s of said person/s and their involvement in, during, before and or after their service to the UCC and its structure

Proceed?)

Y: *

N:

CLEARANCE ACCEPTED WELCOME: admiral

“Terminal allow admin- access”

“PROCEED”

“I’d like to make this knowledge public across all terminals, stations, and subsequent networks within the next 24 hours earth standard time.”

“MUST INPUT ACCESS CODE VERIFICATION”

“Right…”

The admiral clears his throat begins to speak to the terminal microphone slowly

“Stal…tachit…ether…engram…lumen”

“CODE VERIFIED PROCEDURE WILL COMMENCE WITHIN THE NEXT EARTH STANDARD TIME 24 HOURS, STEEL SHARPENS STEEL”

“Good…that’s taken care of”

Heels clicked and clacked behind the admiral, he knew those heels by now how could he not

“I hope you know what this means Michovanovich.”

“I do…it means the glinting knives in the dark will either suddenly strike-“

Mochiva took out a small quarter burnt cigar and lit it leaning against the terminal

“Or they’ll be illuminated enough to dodge and weave.”

“It also means you’ll have to admit he’d been executed without proper procedure?”

“I am aware. Commissioner humor me a question would you?”

She looked puzzled the commissioner, but Josephine waved her hand as the sign to continue

“Why did YOU shut your eyes in his moments of power?”

“Is this a-“

“Are you avoiding my question?”

Josephine was beside herself and appalled, but she did not look incredulous, she knew the admiral was right

“I- I cannot lie to you, I made the mistake many did when he rose to your position…I sat back and didn’t know what to do. Then again remember he had overwhelming power?”

“That is true yes…this file NEEDS to go public our nations have a right to know the deserve the truth and no less from the admiral himself…”

“Is this a personal score?”

“Far from it, who knows how many folks had been displaced by his improper management of resources hell it’s why the fringe has gone full on fascist against us…people need to know what went on behind the scenes Josephine”

“…in that case, then you’re not doing it alone michova.”

#writing#original character#world building#40k inspired#scifi#writing process#sci fi and fantasy#outer space#origonal character#original characters#top secret#why can’t this write itself

0 notes

Text

E Recording Services: Simplifying Document Filing for Everyone

Introduction

Have you ever felt overwhelmed by the tedious process of filing important documents? You're not alone. Many people find traditional document recording to be time-consuming and cumbersome. But what if I told you there's a way to simplify this process? Enter e recording services. In this article, we'll dive into what e recording services are, how they work, and why they might just be the solution you've been looking for. Let's get started!

What Are E Recording Services?

So, what exactly are e recording services? Simply put, e recording (or electronic recording) is the process of submitting, receiving, and processing documents electronically. This means you can file your important documents online, without having to visit a physical office. It's like sending an email instead of mailing a letter – faster, more efficient, and hassle-free.

The Evolution of Document Filing

To appreciate the convenience of e recording services, let's take a quick trip down memory lane. Traditionally, recording documents involved physically traveling to a government office, standing in line, and manually submitting paperwork. This process was not only time-consuming but also prone to errors and delays. With the advent of digital technology, e recording services emerged as a game-changer, revolutionizing the way we handle document filing.

How E Recording Services Work

You might be wondering, "How do e recording services actually work?" Here's a simple breakdown:

Preparation: You prepare your document just like you normally would, ensuring all necessary information and signatures are included.

Submission: Instead of mailing or hand-delivering the document, you upload it to the e recording service platform.

Processing: The platform then sends the document to the appropriate government office electronically.

Confirmation: Once the document is processed and recorded, you receive a confirmation notification.

It’s like ordering takeout – you place your order online, and the restaurant handles the rest, delivering it right to your door.

Benefits of E Recording Services

Why should you consider using e recording services? Here are some compelling reasons:

Convenience

With e recording services, you can file documents from the comfort of your home or office. No more waiting in long lines or dealing with office hours.

Speed

E recording significantly reduces the time it takes to record a document. What used to take days or even weeks can now be done in a matter of hours.

Accuracy

Electronic submissions reduce the risk of errors that can occur with manual processing. Digital records are also easier to correct and update.

Cost Efficiency

Think of all the money you'll save on printing, postage, and transportation. Plus, many e recording services offer competitive pricing compared to traditional methods.

Types of Documents You Can E-Record

E recording services aren’t just for one type of document. You can e-record a variety of documents, including:

Deeds

Mortgages

Liens

Leases

Affidavits

UCC filings

This versatility makes e recording services an invaluable tool for real estate professionals, attorneys, and business owners alike.

Setting Up Your E Recording Account

Getting started with e recording services is straightforward. Here's how you can set up your account:

Choose a Service Provider: Research and select an e recording service that meets your needs.

Register: Sign up for an account on the service provider’s platform.

Verify Your Identity: Complete any necessary identity verification steps to ensure security.

Start Filing: Once your account is set up, you can start submitting documents electronically.

The E Recording Process

Let’s break down the e recording process into easy steps:

Document Preparation: Ensure your document is complete and meets all legal requirements.

Upload: Log in to your e recording account and upload the document.

Submission: Submit the document for processing.

Review: The service provider reviews the document for accuracy and completeness.

Recording: The document is sent to the appropriate government office for official recording.

Confirmation: Receive a notification once the document is successfully recorded.

It’s as simple as that!

Security Measures and Data Protection

One of the biggest concerns with online services is security. Rest assured, e recording services prioritize the protection of your data. Here are some common security measures:

Encryption: Ensures that your documents are securely transmitted.

Authentication: Verifies the identity of users to prevent unauthorized access.

Audit Trails: Keeps a detailed log of all activities, providing transparency and accountability.

Common Challenges and Solutions

Despite its many benefits, e recording services can come with a few challenges. Here’s how to overcome them:

Technical Issues

Sometimes, technology doesn’t cooperate. If you encounter technical issues, contact the service provider’s customer support for assistance.

Document Rejection

If your document is rejected, review the rejection reason provided and make the necessary corrections. Ensure all required information is included and resubmit.

Security Concerns

Choose a reputable e recording service provider that uses robust security measures. Always keep your login credentials secure and update your passwords regularly.

Choosing the Right E Recording Service Provider

Not all e recording services are created equal. When choosing a provider, consider the following:

Reputation: Look for providers with positive reviews and a solid track record.

Features: Ensure the platform offers the features you need, such as multiple document types and user-friendly interfaces.

Support: Reliable customer support is crucial for resolving any issues that may arise.

Future of E Recording Services

The future of e recording services looks promising. As technology continues to evolve, we can expect even more improvements in efficiency, security, and accessibility. Innovations such as blockchain technology and artificial intelligence may further streamline the process, making e recording services an integral part of everyday document management.

Conclusion

E recording services are transforming the way we handle document filing. They offer a convenient, fast, and secure alternative to traditional methods, saving you time and money. Whether you're a real estate professional, attorney, or simply someone looking to streamline your paperwork, e recording services are worth considering. Embrace the digital age and discover the benefits of e recording services for yourself.

FAQs

What is an e recording service?

An e recording service is an online platform that allows users to submit, receive, and process documents electronically, eliminating the need for physical document filing.

2. Are e recording services secure?

Yes, reputable e recording services use encryption, authentication, and audit trails to ensure the security and protection of your documents.

3. Can I e-record any type of document?

You can e-record various documents, including deeds, mortgages, liens, leases, affidavits, and UCC filings. However, check with your service provider for specific document types.

4. How long does it take to e-record a document?

E recording significantly reduces processing time. Documents that previously took days or weeks to record can now be processed in hours.

5. What should I do if my e-recorded document is rejected?

Review the rejection reason provided by the service provider, correct any issues, and resubmit the document.

#e recording companies#e recording services#lis pendens online#e filing portal#efile lis pendens#judgment renewal#efile renewal of judgement#efile and erecord renewal of judgement#erecord renewal of judgement#efiling judgement renewal

0 notes

Text

Asset Checks: Unveiling the Financial Landscape

Whether you're a business conducting due diligence, a lawyer strategizing a case, or an individual seeking debt recovery, understanding someone's financial standing can be crucial. This is where asset checks, also known as asset searches or investigations, come into play.

What is an Asset Check?

An asset check is a comprehensive investigation aimed at uncovering an individual's or company's financial holdings. This process involves scouring public and, in some cases, private records to identify assets like:

Real estate property (land, houses, apartments)

Vehicles (cars, boats, motorcycles)

Business ownership

Investment accounts (stocks, bonds, mutual funds)

Bank accounts

Tax liens and judgments

Why Conduct an Asset Check?

There are numerous reasons why someone might need an asset check. Here are some common scenarios:

Debt Collection: If someone owes you money and refuses to pay, an asset check can help locate assets that can be used to satisfy the debt. Companies like US Collection Services, which specialize in debt recovery, often utilize asset checks as part of their collection process.

Business Due Diligence: Before entering into a business partnership, merger, or acquisition, it's wise to assess the financial health of the other party. An asset check can reveal potential liabilities or hidden assets that could impact the deal.

Legal Proceedings: In lawsuits involving financial matters like divorce, child support, or personal injury, an asset check can help determine a fair settlement by uncovering all relevant assets.

Fraud Investigations: If you suspect someone is being dishonest about their finances, an asset check can help expose hidden assets and bolster your case.

Heir Locating: If you're an heir to an estate, an asset check can help locate the deceased's assets and ensure you receive your rightful inheritance.

How is an Asset Check Conducted?

Asset check companies, like many private investigators, employ a multi-pronged approach to uncover an individual's or company's financial holdings. Here are some common techniques:

Public Record Searches: This involves scouring various public databases, including property records, court filings, business filings, and UCC filings (Uniform Commercial Code), to identify assets registered in the subject's name.

Database Searches: Asset check companies often have access to specialized databases that aggregate information from various sources, including public records, credit reports, and social media.

Skip Tracing: If the subject's whereabouts are unknown, skip tracing techniques are used to locate them and identify any assets linked to their new location.

Interviews: In some cases, investigators may interview people who know the subject, such as neighbors, former colleagues, or associates, to gather information about their assets.

Important Considerations

While asset checks can be a valuable tool, there are some important things to keep in mind:

Legality: Asset checks must comply with all applicable laws and regulations. Reputable asset check companies will only access information that is legally obtainable through public records or with the subject's consent.

Accuracy: Information gleaned from public records may not always be entirely accurate or up-to-date. It's crucial to verify the information obtained through an asset check.

Privacy: Asset checks can raise privacy concerns. It's essential to ensure the asset check company you choose has a strong track record of ethical conduct and data security.

The Role of Asset Check Companies

Asset check companies offer a valuable service by providing individuals and businesses with the information they need to make informed decisions. They have the expertise and resources to navigate the complex world of public records and uncover hidden assets.

However, it's important to choose a reputable asset check company with a proven track record. Look for companies that are licensed, insured, and adhere to strict ethical guidelines.

Conclusion

Asset checks can be a powerful tool for anyone who needs to understand someone's financial picture. Whether you're collecting a debt, conducting due diligence, or involved in a legal proceeding, an asset check can provide valuable insights to help you achieve your goals. By working with a reputable asset check company, you can ensure the process is conducted legally, ethically, and effectively.

0 notes

Text

5 Key Factors Affecting Your Business Credit

What exactly influences your business credit score? And how can you improve your chances of securing a loan? Let's break down the five key factors that impact your business credit so you can optimize them for your benefit:

• PaymentHistory:This is a cornerstone of your business credit profile, especially your D&B PAYDEX score. What can you do? Pay your bills on time or even early to show lenders you're reliable. This positive payment history reassures vendors and lenders about your creditworthiness. So, to improve your chances of getting credit, consistently pay your bills on time or ahead of schedule.

• BlanketUCCFilings:When you take out certain loans, lenders might file a UCC (Uniform Commercial Code) filing against your assets. A blanket UCC filing means a lender claims an interest in all your assets, which can limit your ability to secure more credit. What can you do? Plan your credit strategy carefully. If possible, negotiate with lenders to exclude specific assets from blanket UCC filings if you need them as collateral for future loans. Alternatively, consider securing loans or accounts that require specific UCC filings simultaneously to avoid one having precedence over the others.

• CompanyFinancials:Keeping your financial information current on your D&B credit file is vital. This is because the outdated financials can negatively impact your business when lenders review your data. What can you do? Regularly update your financial statements to reflect your current situation accurately. This transparency ensures lenders have the most up-to-date picture of your business's financial health, increasing your credibility.

• Company Legal Structure: The structure of your business (LLC, corporation, partnership, sole proprietorship) influences your ability to secure credit. Lenders prefer working with corporations and limited liability companies (LLCs) over sole proprietorships and partnerships. What can you do? If you are not already incorporated, you should be. This way, it will be easier to obtain credit and benefits, such as liability protection and potential tax advantages.

• Debt and Investment Levels: The amount of debt your business carries and how much you're financially invested in your company also affect your creditworthiness. Lenders will look at your debt-to-income ratio and your equity in the business to assess risk. What can you do? Maintain a healthy balance between debt and investment to show lenders that you manage your finances responsibly. Optimize these five key factors to enhance your business credit score and improve your likelihood of approval.

About the Author

Robert Jackson is currently the CEO of Alln4fam Consulting Inc.

At Alln4fam Consulting, he specializes in helping business owners establish excellent business credit scores and then leverage those scores to access cash and credit for their businesses.

For more information on business credit scoring, business credit, visit: https://alln4businesscredit.com/

0 notes

Text

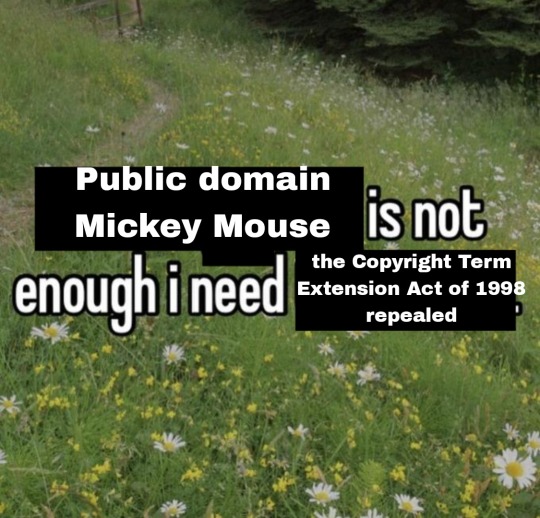

Honestly the length of copyright is just stupid, but just repealing the 1998 Copyright act is not enough; no we need to overhaul the Berne Convention (which the US joined in 1989) which is what stipulates a requirement of the authors life + 50 years for all works* so music for example is 50 years after the death of the creator. The the UCC also sets minimums for Life + 25 years for anything that wasn’t included in the Berne Convention. The US is also part of the UCC.

Personally I think we should go back to the original 1909 copyright act; you by default get 28 years for your work and then can extend the copyright an additional 2 time for an extension of 14 years each time giving a maximum of 54 years. You get 1 or 2 nostalgia cycles before it becomes the rights of everyone, you got to cash in multiple times and it doesn’t stop you from still distributing copies yourself or for artists it doesn’t stop you from touring with your early music. It would basically only hit one hit wonders artists and if they were using just one song from their early days to pass them through retirement then they probably should have gotten a better financial advisor.

There is a real risk to letting copyright go on forever, even for popular shows/movies/music there’s risks that the works can become lost to time and for less popular works it happens all the time. A popular example is Doctor Who which is now 60 years old and has about 11% of its 875 episodes missing, there is 97 episodes with no known complete copy, there are whole story lines that can’t properly be watched anymore, some of the re-releases just have someone explain to people what they missed in the skipped episodes, some have had audio recordings recovered and were able to be reanimated but the live action version is gone. The problem with forever copyrights that go into “the vault” is what happens when cost cutting measures occur, historically this has been getting rid of the original tape reels and audio recordings to recover physical space or depending on the media type overwrite them for reuse, in the modern era what happens if say HBO wanted to save money so they shut down one of the servers holding the copies of shows removed from streaming and wiped them, after all in the cloud era it costs money to store data even if your not using it. Maybe HBO loses the original copies and are just left with the compressed video files or maybe they only have some of the episodes or maybe they just lose the show entirely and there isn’t a guarantee that a data horder kept a copy.

I also think their should be a benefit given if a company releases the copyright to a work early and makes it public domain, like we remember the whole Warner Brothers merger debacle that had a ton of shows permanently pulled from streaming and movies like Batgirl that was basically finished stored away for a tax break. Well if we’re living in corporate America and we need to also “have the corporations best interests in mind” then having a system where corporations could trade old forgotten works and put them in the public domain and they in return get a tax break at least then the public gets a benefit for them not paying as much taxes instead of them just them getting a tax break and the public getting nothing. Heck maybe Zaslav would slip up and trade the Loony Toons for a tax break on his Discovery live action shows.

*technically for photography and movies under the Berne Convention the rules are a minimum of 25 years for photography and 50 years after the first showing or 50 years after creation if it is not shown within those 50 years making the theoretical max 99 years. However these are just minimums and are sort of expected to be regulated in the local country.

16K notes

·

View notes

Text

Digital currency trading platform, Gemini has issued its latest update with respect to its ongoing feud with Genesis, one of the subsidiaries of the Digital Currency Group (DCG). Highlights of the Gemini Update While the past month was filled with a lot of drama that saw what Gemini called a “misinformation campaign” orchestrated by DCG, it noted that it has been hard at work to improve the sufficiency of the DCG contribution contemplated in Genesis’s “agreement in principle” with DCG. In its explanation, Gemini highlighted that back in August, it reached an “agreement in principle” with DCG and the Unsecured Creditors Committee (UCC) regarding DCG’s contribution to the Genesis estate. The firm said this agreement in principle has not received the full backing of the broader industry because it has been deemed insufficient by experts. With this deal already tagged a dead-end at birth, creditors are now pressing on DCG to introduce a plan that can help return as much value to those Genesis owe as much as possible. With the firm now compelled by its creditors, Gemini said DCG is yet to accept the revised terms whose terms are bound to expire by October 6. Looking ahead, the crypto exchange indicated that Genesis is looking at pushing out a new proposal that will see more contribution from DCG or permit the distribution of assets within the Genesis Estate and allow creditors to pursue the remaining deficit through litigation against DCG. Ultimate Goal in Gemini vs DCG Conflict While many are keenly following the trend in the Gemini vs DCG case, it is important not to lose sight of the ultimate goal which is to make Gemini Earn users whole. About $900 million was owed by Genesis to Earn customers when it filed for bankruptcy earlier this year. The implosion of Genesis and the liquidity strain has forced Gemini to wind down the Earn program. While the timeline for the resolution of the current legal feud is unknown at this time, Gemini has reiterated its commitment to remain steadfast in its recovery plans and to update its community every step of the way.

0 notes

Text

10 Largest Factoring Companies Within The Us

Keeping your service company solvent, worthwhile, and productive could be a lot more difficult without bodily merchandise to sell. There are many different factoring companies in Canada; however, many of them ought to be avoided. Vetting potential partners is a crucial component of your due diligence; however, you'll need to know what areas to base your choice on. With the most obvious benefit out of the way, it’s time to take a glance at a few of the much less visible ones, including those that you'll not discover with generalist factors. To request details about the private information we maintain about you, please submit a written request through the Contact page on our website. Upon receipt of your request, we'll present a comprehensive response, including an in-depth copy of your private information that we've on file.

Working with a factoring firm helps businesses access money quickly, particularly if they've had issues acquiring financing from conventional sources like banks. Factoring in Nova Scotia is fast and handy, enabling a quick cash injection at affordable rates. Conventional banking institutions merely do not provide this kind of service, especially to smaller businesses or those battling poor credit scores. Factoring empowers companies to get around these obstacles by promoting their receivable invoices.

We look forward to offering a money-circulated answer to your Canadian-primarily-based firm. Some factoring companies are geared toward long-term contracts, whereas others are extra versatile. For instance, you’ll want to search for an organization that provides montreal factoring companies spot factoring when you only need to factor in one invoice. If you suppose you’ll factor greater than as quickly as, however, your wants will be inconsistent, otherwise, you intend to reduce your advances. Search for companies with no minimums or nominal volume requirements.

The services sector plays a leading role in the development of the financial system, along with manufacturing, oil and gas, biotech, transportation, schooling providers, and health care. If your trade requires capital to keep up with a competitive and demanding market, factoring companies can help. We attract new prospects by providing easy, clear factoring charges with no hidden fees. Our prospects stay with us due to our quick and responsive customer support and our integrity.

Present across a number of places in North America, their numerous stocks, competitive pricing, and devoted gross sales staff guarantee they promptly cater to all customers’ trucking wants. The automotive business continues to face huge challenges in meeting international demand, particularly in the wake of the pandemic. This resilient business has overcome quite an invoice factoring companies montreal a few speed bumps, from supply challenges and manufacturing shutdowns to semiconductor shortages, global supply chain bottlenecks, and labor shortages. Plus, buyer demand has never been harder to predict than it is at present. Here are a few of the high monetary challenges in the automotive trade.

Riviera Finance provides financing to most B2B businesses, no matter how long they’ve been in business or their monthly income. If you turn to a different factoring firm but nonetheless have excellent receivables, you must prepare a buyout in which the brand-new factor purchases the remaining invoices. Additionally, the UCC liens have to be changed so the new factoring firm establishes the first right. Switching factoring companies could be a costly process, particularly if you sign a long-term contract with the original firm. The finest providers have a fast turnaround time for approval and funding. Many of the companies we evaluated will review your application and notify you of their decision within 24 hours, and all can transmit funds within 24 hours from the time you submit an invoice to be factored.

However, between pickup and delivery, there are so many actions and bills the transporter should meet. These bills have to be incurred whether the consumer pays or not, and even after delivering the service, they've got to wait 30 to 60 days before receiving payments. This can jeopardize the continued operations of the trucking enterprise, particularly for a small owner-operator business. Quebec plays an important role in Canada’s manufacturing output, with 20.36% of the entire GDP of Canada coming from the province.

Unlike most factoring companies, Fundbox advances 100% of the value of the invoice. However, you repay the corporation a prorated portion of the invoice each week, plus a charge. Fundbox is the most effective factoring companies montreal invoice financing service for startups because, as an end result, it has few minimal requirements and advances 100 percent of the value of an invoice.

0 notes

Text

Dive into a reality where banks harness the power of combined internal and external data for decisive action.

Think of a place where banks can take decisive action based on comprehensive, transparent information, derived from both internal and external data sources. And not just relying on the age-old method of "eeny, meeny, miny, moe." This isn't a fantastical dream; it's a tangible reality we need to strive for. Integrating internal and external data sources is not just about creating a data pool. It's about forging a powerful information tool, one that empowers decision-makers in the banking industry to make informed and effective choices. What does this look like in practice? • Applications that search for customer UCC filings, checking the validity of the customer's eligibility for credit. • Tools that identify participating banks for loans, allowing for a comprehensive comparison of performance against competitors. This fusion of data sources and the subsequent applications that they fuel are more than just practical, they address a broader need in the banking industry for efficient processes. Processes that are no longer bogged down by opaque or insufficient data. So, what is the solution? How can the banking industry effectively implement applications that enable action based on data integration? The answer lies in embracing change and investing in technologies that can integrate data sources, fostering an environment where informed decisions are the norm. In a world that is more and more reliant on data, the banking industry needs to be at the forefront of this shift. It's about concise and transparent decision-making processes, and this can only be achieved through the integration of internal and external data sources. The future of banking depends on it; let's make that future a reality. 🔔 Follow Brian on Linkedin: Brian Pillmore Related links: - The Financial Industry’s Emerging Embrace of Open Source Banking - I recently had a customer ask if they could have a copy of all our underlying data.I didn’t even hesitate to say yes. - Wells Fargo Settles Class Action Lawsuit for $300M - Class Action Suit Alleges BofA Misled Paycheck Protection Program Borrowers - I got over 50 Colombian data scientists to come drink beer at a bar with me. Read the full article

0 notes

Text

FTX Modifies Settlement Motion After US Trustee Objection in Bankruptcy Case – What's Going On?

FTX Modifies Settlement Motion After US Trustee Objection in Bankruptcy Case – What's Going On?

Source: Adobe / Александр Поташев

Bankrupt crypto exchange FTX submitted a “Reply” on Sunday, August 20, to back its Settlement Plan and address the US Trustee’s objection to the Motion.

On August 16, FTX Trading and its associated debtors submitted a court filing titled “Motion of Debtors for an Order Authorizing Procedures for Settling Certain Existing and Future Litigation Claims and Causes of Action.”

The docket outlines a settlement procedure for addressing “Small Estate Claims” totaling approximately $176 million.

This procedure enables them to settle these claims without needing to file motions or give notice to creditors or other parties, except the Official Committee of Unsecured Creditors and the international customer ad hoc committee. Additionally, court approval for settlement terms would not be required.

The same day, the Official Committee of Unsecured Creditors of FTX (UCC) objected to the proposed FTX settlement plan due to dissatisfaction among FTX creditors.

Andrew R. Vara, representing the United States Trustee for Regions Three and Nine (US Trustee), presented the objection filing, citing three independent reasons for the denial.

The US Trustee highlighted that FTX’s notification of eligible claims for Settlement Procedures lacks adequacy. The Motion’s vague definition of “Small Estate Claims” could encompass a wide range, leaving creditors and relevant parties uninformed. The Trustee insisted on precise claim type definitions and resubmission for a new hearing.

Furthermore, FTX needs more information about the nature and amounts of claims under Settlement Procedures. This information gap prevents the Court from evaluating fairness, reasonableness, and alignment with estate interests—prerequisites for Court-approved settlements.

According to the US Trustee’s objection, the Motion proposes Settlement Procedures for Small Estate Claims Up to $10 Million, an excessively high threshold for a “small” claim settlement without broader notice.

The $10 million limit only covers the settlement payment, allowing for potential inflation of claim values. The Motion lacks a proportional stipulation between the settled claim value and payment.

FTX Response to US Trustee’s Objection and Proposed Revisions to Address Concerns

On August 20, FTX Trading countered the UCC’s objection by submitting a “DEBTORS’ REPLY IN SUPPORT OF SETTLEMENT PROCEDURES MOTION,” addressing the sole complaint to the Motion raised by the US Trustee.

The FTX and its debtors, in the “Reply” filing, while criticizing the US Trustee’s opposition to the Motion, expressed their intention to address concerns by proposing revisions. They aimed to accommodate the US Trustee’s input, even though the settlement process is already well guarded by two creditor committees.

In response to the US Trustee’s objection, FTX plans to integrate the US Trustee as a “noticed party” in the settlement process.

“The US Trustee—the sole objector to the Motion—seeks to inject itself into a routine settlement process already adequately safeguarded by two creditor committees. The UCC and the AHC have both provided input into and support the proposed Settlement Procedures. Unlike similar procedures, those proposed by the Debtors provide notice to the Noticed Parties of every settlement, no matter how small. ”

Additionally, they will lower the maximum settlement value for claims under the procedures from $10 million to $7 million.

To enhance transparency, FTX will submit monthly reports detailing executed settlements. Any objections these “noticed parties” raise will need resolution via a court order before the claims process can proceed.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/ftx-modifies-settlement-motion-after-us-trustee-objection-bankruptcy-case-whats-going-on-htm/

0 notes