#what is a good auto apr

Explore tagged Tumblr posts

Text

What is a Car Loan?

What is a Car Loan? Certainly! Car loans are a common way for people to finance the purchase of a vehicle. Here’s a brief overview: What is a Car Loan?: A car loan is a type of loan specifically designed for purchasing a vehicle. The borrower (you) receives a sum of money from a lender (usually a bank, credit union, or dealership) and agrees to repay it over time, plus interest. Terms and…

View On WordPress

#000 car loan?#Car Loan#car loans#car loans are stupid#car loans explained#getting a car loan#how can i get a loan if my credit is bad#how do i get a car if my credit is bad#how to get a car loan#i have a 24% interest rate on my car loan!#loans car#loans on cars#what does upside down in a car loan mean#what is a good auto apr#what is the easiest place to get an auto loan#what is the lowest your credit score can be to get a car loan#why getting a car loan is a bad idea

0 notes

Text

2024 Tumblr Top 10

thank you to @rcmclachlan @iphyslitterator and @screamlet for tagging me! It was absolutely amazing sharing a new fandom with you this past year, whether it was reuniting or meeting for the first time, and decompressing from a mentally rough year on here was THEE absolute highlight.

Share your top 10 tumblr posts from last year! Visit this site, scroll down to "Find your Tumblr Top 10," type in your username, and select 2024. When you get the results, simply click "Share to Tumblr" and you'll get an auto-generated draft for a post with links and previews. Make any adjustments you see fit.

5,775 notes (Jun 6 2024)

seeing a long text post that begins with “eddie” and scrolling down to cheat with the tags because it’s like, what if that’s not about MY eddie. is it 9-1-1 eddie. is it stranger things eddie. is it IT chapters one and two eddie. is it monsterfucker venom eddie. like, what eddie are we putting into gay little situations today.

the funniest part of this post is that i purposefully did not tag it, because i believed the right people would see it. i wasn't wrong.

2. 2,992 notes (Jun 21 2024)

the silliest fandom problem to have is curating my online space so carefully and so vigilantly that when mentions of a truly delusional post break containment and intrigue me, i have to use quantum physics and enter the fifth dimension just to find that post because i want to have a vicious little popcorn moment

this was 100% about buddie fandom. but i have a feeling it'll be relevant for the next 7,000 years. let the aliens find this one carved in stone.

3. 1,454 notes (Apr 1 2024)

Tomorrow when they log onto this webbed site they will see a post and like it But tonight Tumblr is alive It is a perfect spring day: there is a silly little button And when the girlies scroll past each post they will boop each mutual twice as much as usual

April Fools :')

4. 1,370 notes (Jun 8 2024)

my favorite line in the entire bucktommy saga is maddie’s reading of “wait, it’s the same tommy?” (...)

sometimes i can be funny. i love this post. i don't always write meta, but when i do, i'm hilarious.

5. 1,308 notes (May 1 2024)

lou ferrigno jr. scrunchy nose smile reblog if u agree

yeah 🥲

6. 1,138 notes (Oct 13 2024)

i love you hockey season i love you hockey narratives i love you old dogs senior sanctuary players in their 30s trying to make it count i love you rookies failing and fumbling and loving the game anyway with the weight of the world on your shoulders (...)

i came for the intricate rituals and i stayed for the game (but also still the intricate rituals)

7. 1,133 notes (Nov 3 2024)

you know that when everyone at harbor finds out tommy is dating someone from the 118, they start a joke gofundme called “tommy kinard inevitable injury fund,” but when they find out the person he’s dating is evan crushed-by-firetruck-struck-by-lightning buckley, they start all contributing to it monthly in earnest

i think this mostly got traction because myself and several others continued to riff on it, and it was delightful. example no. 5001 that bucktommy had unlimited fun potential as a ship.

8. 1,047 notes (May 21 2024)

me writing 9-1-1 fic: i have to know the exact make and model of this helicopter and 3 years from now i’ll have a pilot license in my quest to get every fact absolutely right just in case 9-1-1 the tv show: what if a house was alive and it would NOT stop calling the cops

i love this show bc ghosts are real in a way they never directly address head on but continually acknowledge

9. 1,026 notes (Jun 24 2024)

that’s how this scene happened, right

TELL ME I'M WRONG

10. 866 notes (Sep 28 2024)

“all bucktommy fans are over 30” yeah man why do you think all of our fic is so fucking good

lol. from the bottom of my heart: lmao.

tagging: @newtkelly @alchemistc @geddyqueer @middyblue @starryeyedjanai

21 notes

·

View notes

Text

Finance Loans 101: A Guide to Smart Borrowing

When it comes to financing, loans are often a practical solution for reaching financeonloans goals, whether it’s buying a home, starting a business, or covering emergency expenses. However, borrowing can quickly become costly if not approached wisely. This guide will help you understand the basics of smart borrowing and how to make finance loans work for you.

Loans come in many forms, with the most common types being personal loans, home loans, auto loans, and student loans. Each loan type serves a unique purpose and comes with different terms. Personal loans are typically unsecured, meaning you don’t need collateral, but they often come with higher interest rates to compensate for the lender's risk. Conversely, home and auto loans are secured loans, using the house or car as collateral, which generally results in lower interest rates. Understanding the purpose and structure of each type of loan can help you select the best one for your needs.

The true cost of a loan goes beyond the principal (the amount you borrow). Interest rates, loan fees, and repayment terms all contribute to the total cost. The interest rate can be fixed or variable, with fixed rates providing predictable payments and variable rates potentially saving money if market rates decrease. Annual percentage rate (APR) combines both interest and fees, giving a more comprehensive view of loan costs. Opting for a lower APR over a shorter term might seem ideal, but ensure it fits your budget to avoid missed payments, which can harm your credit score.

Before taking a loan, assess your current finances. Calculate your monthly income, expenses, and debt obligations to determine how much you can comfortably borrow. It’s recommended that your monthly debt payments (including any new loan) do not exceed 30% of your income, to avoid overextension. Many lenders also use this debt-to-income ratio as a key eligibility factor, so understanding it can help set realistic expectations.

Your credit score significantly impacts your loan eligibility and interest rates. A higher credit score can unlock lower rates, saving you money in the long run. Improving your credit score—by paying bills on time, reducing existing debts, and correcting any errors on your credit report—can make a substantial difference. Regularly monitor your credit score and consider postponing loan applications if your score could use improvement.

Choosing the right repayment plan is crucial to smart borrowing. A shorter repayment term usually means higher monthly payments but less interest paid over time, while a longer term reduces monthly payments but increases total interest. Some lenders allow flexible repayment options or early repayments without penalties, giving you more control over your loan.

A key to smart borrowing is understanding that a loan should support financial goals rather than cause financial strain. Avoid borrowing for non-essential expenses or luxuries, as interest payments on these loans can limit your ability to save and invest. By borrowing only what you need, planning repayments carefully, and seeking favorable terms, you can make loans a tool that supports rather than detracts from your financial well-being.

In summary, smart borrowing involves understanding loan types, assessing the total cost, evaluating your finances, maintaining good credit, and choosing a feasible repayment plan. With these strategies, you can use loans to empower your financial journey rather than limit it.

1 note

·

View note

Text

A hardened soul who finds solace in tinkering with cars and all sorts of machinery. Has spent his life running from the demons of his past and now finds himself in Briar Ridge, running out of places to hide.

STATS

- Name: Gabriel Braulio Vargas - Nicknames: Gabe - Neighborhood: Downtown - Occupation: Handy man & Mechanic at Kelly's Auto Repair - Age & Birthday: 35 years & apr 2, 1989 - Pronouns & Gender: He/him & cis-male - Ethnicity: Spanish-Chilean & Nicaraguan - Sexuality: Heterosexual - Hometown & Time in BR: Virginia, a few weeks

connections | pinterest | musings

BIOGRAPHY

trigger warning: alcoholism, drugs, child neglect, child abuse

CHILDHOOD:

Being the only child of problematic people who should never have brought a baby into the world was tough. Gabe was grateful no other child had to suffer what he lived daily, but he had always longed for solace in others to escape his “home.”

They were dirt poor and lived in a small two-bed apartment in a run-down complex. His father was an alcoholic who was fired from every job, and his mother worked as a grocer at the local supermarket, which just about covered the bills. Gabe learned to fend for himself young and not expect much from his parents. The further he stayed away, the less he felt the wrath of their problems.

He found a friend in Enzo Deluca, and the two young boys would run around the streets together, causing havoc and making up their little adventures. Gabe would soon turn to petty theft for candy and comic books, anything to make his miserable existence somewhat better and to impress Enzo.

When he started school, he found friendship with Benny Hellstrom. Benny lived on a ranch just outside of the city, and to Gabe, it felt so grand. “All the space in the world,” he exclaimed when he first saw it. The two young boys became inseparable, and Gabe spent more time with Benny than anyone. He felt safe there.

The problems at home only escalated into his teenage years. His mother began to self-medicate with OTC drugs and vodka, which led to more financial problems. His father grew more violent and abusive, angry that she was no longer providing for his addiction. Gabe was thirteen when his mother left. No note. No goodbye. Nothing.

That anger shifted from her to Gabe, and his father blamed him for everything. Gabe began to steal more valuable items to sell so he could impress his father. The young kid was the one paying the rent, but each month, it was a struggle. Once or twice, he was caught but escaped any real time in Juvie. The police were so overworked in the area that they didn’t have the time for a kid. However, he was known, and they watched him closely.

CHICAGO:

At sixteen, Benny suggested they run away together. Start a new life. Gabe jumped at the chance, and in a few days, the two found themselves in Chicago. Gabe was free, and you couldn’t have wiped the smile off his face.

They stayed there for a while. Gabe found a job at a local garage, where he realised he was very skilled with his hands. It was funny; as a kid, he loved to break things. Smashing old cars with rocks down at the waste yard or stomping on pumpkins sat proudly outside people’s homes on Halloween. Destruction was his release. However, the work of fixing up cars and tinkering with engines became a different kind of therapy for him. He had escaped his childhood home, so he no longer needed chaos to forget everything. Instead, he had an itch to fix everything, as if helping fix a cupboard door for a neighbour would help fix his past.

Gabe excelled as a mechanic and even started a side venture as a handyman. The money was good, and life began to really turn for him.

Despite the progress, the demons of his past did linger. Gabe liked to party… the problems he faced as a child of alcoholics didn’t seem to deter him. Unlike his father, he turned up to work and performed, but it still didn’t mean he didn’t have a problem. The weekends were spent wasted and hooking up with strangers. He never had time for rest, always on the go. Due to this, most of his twenties were a blur, and it only worsened when Benny left him.

One party weekend in Vegas, he was so drunk he swears he even married a stranger, but the two parted ways after the ceremony, and he has never seen her again. Life could be very messy for him. It was chaotic at times, and he understood it pushed some people away, but he had so much turmoil inside of him that he was too afraid to process. Partying was the easy way out.

BRIAR RIDGE:

It wasn’t until he was in his thirties and word got back to him about his father’s passing that he paused for a moment to consider his own choices. The partying eased up and was replaced with a search for spirituality: yoga and meditation. Sure, he still allowed himself one night a week to blow off steam, but he was slowly opening up to the idea of looking inward to deal with his childhood trauma.

He is still working on that today, and it is a slow process, but he’s trying.

After a few years of separation from Benny, he missed his best friend. Gabe needed his rock back. Gabe quit his job, packed everything he had into his truck, and left for Briar Ridge. He had no plan other than the need to see his old friend.

He’s been living in town for a few weeks in a rental and on his savings, which are quickly running out.

WANTED CONNECTIONS:

Buddies - gym, yoga, bar, and so on

Welcome wagon - someone who shows him the town and is super friendly

Neighbors - he’s in an Airbnb in downtown

Airbnb host - maybe they’re renting to him, and something strikes up between them? Friendship, Romantic, maybe they hate him??

Big brother - someone he grows protective of

Handyman - can fix anything, so after the recent storm, word gets around and he has helped or does help with something for your muse

Vegas Wife - The girl he married in vegas and has never seen again... messy but fun connect potentially. Are they still married??

“Seems like a married couple” but are not - they click instantly and give off that old married couple vibe but are strictly friends

TONIGHT YOU BELONG TO ME: MUSE A is MUSE B’s confidant and vice versa. for the most part, their interactions only happen after midnight. they run in completely different circles and their mutual friend count is low, but when the other sends an sos text at 12:45am the other is already getting dressed and willing to meet at their secret spot.

SMILING WHEN I DIE: MUSE A has lived, what many people may call, a pretty boring life. they never got to experience much growing up. now, they’re [ INSERT AGE ] and trying not to have a borderline mid-life crisis. MUSE B has a sense of adventure within them and is always inviting MUSE A along. they may not spend time together otherwise, but the two of them make lasting memories that will hopefully stick with them for awhile. — what if it's the type opf friendship where they tick things off a bucket list and do random shit together?????? Idk

WILL YOU COME FIND ME (AFTER THE PARTY?): a plot where MUSE A and MUSE B met at a friend of a friend’s party & instantly hit it off. MUSE A is immediately infatuated with MUSE B — they laugh, talk, drink; they even make an incredible beer pong team. at some point during the night, MUSE A decides to put the moves on MUSE B. however, after leaving to get them some drinks, MUSE A comes back to find MUSE B kissing someone else… and to make it worse? it’s their boyfriend/girlfriend/best friend/sibling etc.

0 notes

Text

The Ultimate Guide to Used Car Dealerships and Approved Auto Loans in Surrey, BC

Introduction

In Surrey, BC, navigating the world of purchasing a used car can be overwhelming. With numerous options available, it's essential to understand the benefits of choosing reputable used car dealerships and securing approved auto loans. This comprehensive guide will explore everything you need to know about finding the best-used car dealerships and auto loan providers in Surrey, BC.

The Benefits of Choosing Used Car Dealerships

Cost-effectiveness

Used car dealerships offer a budget-friendly alternative to buying brand-new vehicles. With depreciation already factored in, used cars are often significantly cheaper than their new counterparts.

Variety of options

Unlike purchasing from private sellers, used car dealerships offer a wide range of vehicles to choose from. Whether you're looking for a compact sedan, an SUV, or a luxury vehicle, you'll likely find what you need at a reputable dealership.

Quality assurance

Reputable used car dealerships conduct thorough inspections and refurbishments to ensure the quality and safety of their vehicles. This provides buyers with peace of mind knowing that they're investing in a reliable car.

Approved Auto Loans: Making Your Purchase Easier

Understanding approved auto loans

Approved auto loans are loans provided by financial institutions specifically for purchasing used vehicles. These loans typically come with fixed interest rates and manageable repayment terms.

Benefits of getting approved auto loans

Securing an approved auto loan simplifies the car buying process by providing buyers with a clear budget and financing options. Additionally, these loans often come with lower interest rates compared to traditional loans, saving buyers money in the long run.

How to qualify for approved auto loans

To qualify for an approved auto loan, buyers must meet certain criteria, including having a steady income, a good credit score, and a reasonable debt-to-income ratio. Lenders may also consider factors such as employment history and down payment amount.

Finding the Best Car Loan Provider in Surrey, BC

Researching reputable providers

When searching for a car loan provider in Surrey, BC, it's essential to research and compare different lenders. Look for providers with a solid reputation, competitive interest rates, and favorable terms.

Comparing interest rates and terms

Before committing to a car loan provider, compare interest rates and terms from multiple lenders. Pay attention to factors such as the APR, loan duration, and any additional fees associated with the loan.

Reading customer reviews

Customer reviews can provide valuable insight into the experiences of previous borrowers. Look for lenders with positive reviews and satisfied customers to ensure a smooth loan process.

Tips for Choosing the Right Used Car Dealership and Auto Loan Provider

Checking credentials and certifications

Before purchasing a vehicle or securing a loan, verify that the dealership and lender are licensed and accredited by relevant authorities. This ensures compliance with industry standards and regulations.

Examining the vehicle inspection process

Ask about the dealership's inspection process to ensure that vehicles undergo thorough evaluations for quality and safety. Look for dealerships that provide detailed inspection reports and offer warranties or guarantees on their vehicles.

Understanding loan terms and conditions

Review the terms and conditions of any loan agreement carefully before signing. Pay attention to factors such as interest rates, repayment schedules, and any penalties for early repayment or late payments.

Customer Experience at Approved Auto Loan Dealerships

Importance of exceptional customer service

Reputable dealerships prioritize customer satisfaction by providing personalized assistance and transparent communication throughout the buying process. From vehicle selection to financing options, they strive to make the experience seamless and stress-free.

Testimonials from satisfied customers

Reading testimonials and reviews from previous customers can give insight into the level of service provided by a dealership. Look for dealerships with positive feedback and satisfied customers who praise their professionalism and reliability.

Additional services offered by reputable dealerships

Beyond vehicle sales and financing, many reputable dealerships offer additional services such as maintenance and repair, extended warranties, and trade-in options. These services enhance the overall customer experience and provide added value to buyers.

Conclusion

In Surrey, BC, navigating the used car market doesn't have to be daunting. By choosing reputable used car dealerships and securing approved auto loans, buyers can enjoy the benefits of cost-effective, high-quality vehicles with the added convenience of financing options tailored to their needs. Whether you're in the market for your first car or looking to upgrade, exploring options in Surrey, BC, opens up a world of possibilities.

0 notes

Text

Watch "The Downfall of Etsy" on YouTube

youtube

The Downfall of Etsy

Genre: video essay

Date posted: Apr 6, 2024

Closed captioning: auto generated

Runtime: 22:21

Youtube description: small summary and thanks, link to socials

Trigger warnings: dropshipping tehe

My rating: ⭐️⭐️⭐️⭐️

Full review below vv

DISCLAIMER!! I DID NOT DO ANY OUTSIDE RESEARCH ABOUT ETSY!

This is my first time watching a video from this channel, and all I saw was good vibes. Electro Honey goes *in depth* about Etsy, starting with the etymology of the company name, which I thought was fun. Going through the history of Etsy, she brings up her sources, and from what I can tell, it seems reputable enough; she cites first person accounts of Etsy sellers and The Insider among others. She's also super funny and relatable. Electro Honey brings up the things she wants to buy from Etsy, including a fanmade Five Nights at Freddy's poster, which, mood.

The only reason this isn't 5 stars is because the sources could be more reputable. Electro Honey mostly flashes the headlines of articles or screenshots of a paragraph or two for us to pause and read. She also doesn't link her sources, which we *could* find for ourselves, but will we? I didn't. Also, captions are super important to me, and auto-generated caps are a godsend to humanity.

This video was overall very informative and a fun watch. Definitely recommend.

1 note

·

View note

Text

AI WebProfit Review – Create SEO Friendly AI Blogs & Websites in One Click

Welcome to my AI WebProfit Review Post, This is a genuine user-based AI WebProfit review where I will discuss the features, upgrades, demo, price, and bonuses, how AI WebProfit can benefit you, and my own personal opinion. This is a brand new, cutting-edge, world-first AI WP Blogs Creator that auto-generates WordPress SEO-Optimized blogs that generate Effortlessly Free Google Traffic!

Imagine charging $300, $500, even $1000 or more for each project, all with the backing of an advanced AI that simplifies the entire process. This isn’t just a tool; it’s your gateway to becoming a sought-after professional in a booming online marketplace. Today, Ariel Sanders unveils a groundbreaking AI Bot that revolutionizes how we think about web design and content creation. It’s not just about making websites; it’s about crafting digital experiences that engage, convert, and provide value. AI WebProfit is not just a tool; it’s your partner in carving out a niche in the digital ecosystem. With features designed to make the complex simple and the tedious effortless, it’s time to redefine what you can achieve online.

AI WebProfit Review: What Is AI WebProfit?

AI WebProfits is a cloud-based website builder that disrupts the traditional approach with the magic of Artificial Intelligence (AI). Imagine a platform that caters to users of all technical backgrounds, transforming website creation from a daunting task into an achievable feat. That’s the core function of AI WebProfits.

The platform harnesses AI to generate website content, including text, images, and even videos. You simply select your niche and provide a few prompts, and the AI takes the reins, crafting the groundwork for your website. But AI WebProfits doesn’t stop there. It empowers you with a user-friendly drag-and-drop editor for further customization. This means you can personalize the layout, design elements, and overall aesthetic to bring your vision to life. And to sweeten the deal, AI WebProfits integrates various monetization tools, allowing you to explore income generation through your website.

AI WebProfit Review: Overview

Creator: Ariel Sanders

Product: AI WebProfits

Date Of Launch: 2024-Apr-04

Time Of Launch: 11:00 EDT

Front-End Price: $17 (One-time payment)

Official Website: Click Here To Access

Product Type: Software (Online)

Support: Effective Response

Discount: Get The Best Discount Right Now!

Recommended: Highly Recommended

Bonuses: Huge Bonuses

Required Skill: All Levels

Coupon Code: “ WEBPROFITS5” Get $5 OFF Instantly

Refund: YES, 30 Days Money-Back Guarantee

<<>> Click Here & Get Access Now AI WebProfit Discount Price Here <<>>

AI WebProfit Review: About Authors

Ariel Sanders is the creator of the AI WebProfit App. He is a dedicated inventor renowned for his unique goods and training programmers. Ariel enjoys simplifying the process of creating websites and maintaining information. That’s why he created AI WebProfit, which helps individuals earn a consistent income online.

Ariel intends to provide a comprehensive bundle for people who wish to keep ahead of the ever-changing internet environment.With Ariel’s assistance, AI WebProfit employs artificial intelligence to make website creation simple and keeps customers up to speed on new trends via a single dashboard.

Ariel has also created successful products such as AI ShortsMate, SkillPay AI, TrendsHunter AI, YouTubeJacker AI, GoofyShort AI, AIGoldRush, ProfitBot AI, AutoBlog GPT, and StreamStore, establishing his reputation in the industry.

AI WebProfit Review: Features

Launch Stunning SEO optimized Blogs & Websites within Minutes- 100% On Autopilot

AI Will Tell You Exactly How Much You Gonna Earn BEFORE Doing Any Work…

All SEO optimized Blogs & Websites Are Prefilled With Smoking Hot, AI, Human-Like Content

Instant High Converting Traffic For 100% Free

High Ticket Affiliate Offers For DFY Monetization

We Let AI Do All The Work For Us.

Instantly Tap Into $1.3 Trillion Platform

Promote Offers from ClickBank, W+, & JVZoo

Build a Huge List with Inbuilt Forms & Popups

100% SEO Optimized & Mobile Responsive

No Complicated Setup – Get Up and Running In 2 Minutes

ZERO Upfront Cost or Any Extra Expenses

30 Days Money-Back Guarantee

<<>> Click Here & Get Access Now AI WebProfit Discount Price Here <<>>

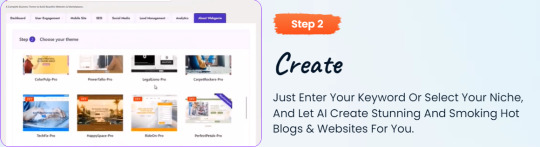

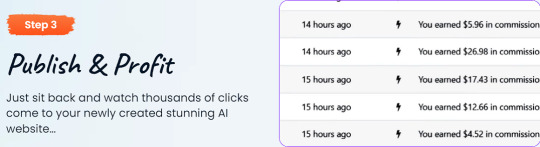

AI WebProfit Review: How Does It Work?

All It Takes Is 3 Fail-Proof Steps Start Dominating ANY Niche With DFY AI Blogs & Websites.

AI WebProfit Review: Can Do For You

Unique Content in 10000+ Niches

Create a Website in 25+ languages

Automatically Publish Own Content and Images Directly From ChatGPT

500+ DFY Themes

Connected OpenAI to Answers Visitor Questions Automatically

Hybrid Website Builder

100% Mobile Responsive

SEO Optimized Website

DFY Marketing Graphics & Templates

Royalty-Free Stock Images

Woo Commerce Integration

Feature Rich Slider

Appointment Booking Functionality

CTA Management

Inbuilt Social Media Tool

Analytics Ready

Advance AR Integration

Custom CSS for Design

Fully Customizable Typography

Fully Functional CMS

Inbuilt Lead Management

Ready to Use Short Code

Generate Graphics From AI Using Just One Keyword

Commercial License Included

World-class support

AI WebProfit Review: Who Should Use It?

Artists/Content Creators

Affiliate Marketers

eCom Store Owners

Blog Owners

CPA Marketers

Video Marketers

Product Creators

Personal Brands

Freelancers

AI WebProfit Review: OTO’s And Pricing

Add My Coupon Code “WEBPROFITS30” – Get 30% OFF Discount All Funnel!

Front End Price: AI WebProfits ($17)

OTO 1: AI WebProfit Pro ($47)

OTO 2: AI WebProfit Done For You ($97)

OTO 3: AI WebProfit Traffic Edition

Personal: $37

Commercial: $47

OTO 4: AI WebProfit Agency

100 License: $47

Unlimited Licenses: $67

OTO 5: AI ShortsMate Reseller

100 License: $47

Unlimited Licenses: $64

OTO 6: AI WebProfit Whitelabel ($197)

<<>> Click Here & Get Access Now AI WebProfit Discount Price Here <<>>

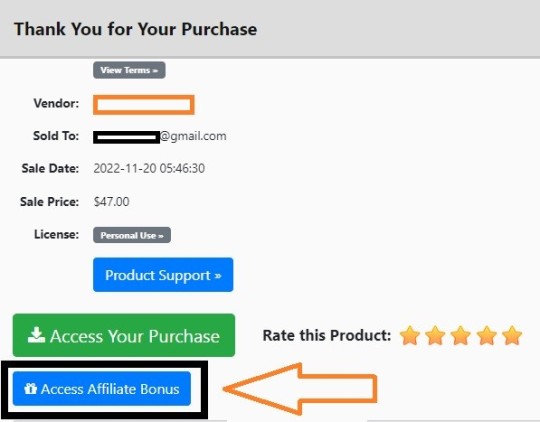

AI WebProfit Review: Special Bonus Bundle

My Special Bonus Bundle will be visible on your access page as an Affiliate Bonus Button on WarriorPlus immediately after purchase.

And before ending my honest AI WebProfit Review, I told you that I would give you my very own unique PFTSES formula for Free.

AI WebProfit Review: Free Bonuses

Bonus #1: WordPress Automation Secrets

Automation is the key to success for every successful marketer today. If you’re able to save your time and use it for other productive tasks, then you’re on the right track. This 8-part video course is designed to show you how to free up your time by quickly and easily automating tedious tasks within your WordPress site!

Bonus #2: Lead Generation On Demand

It doesn’t matter what kind of business you’re in, if you aren’t able to generate new leads and turn them into paying customers, your company will never succeed. So, to help you build your leads and make the max from them, this comprehensive guide lays down proven tips and tricks on creating lead generation on demand.

Bonus #3: Video Training on How To Create a Profitable Authority Blog in Any Niche

Want to learn how to create a profitable authority blog in any niche that converts, then you’re at the right place. This useful package helps boost your authority by giving useful tricks on creating a profitable blog the right way. Use it and scale your business to the next level.

Bonus #4: Social Media Traffic Streams

Social media is a popular way for businesses to engage with their target audiences. But getting people to your website through social media engagement can be tricky. So, don’t hang around! This stunning guide will teach you how you can successfully drive traffic from social media to your website.

<<>> Click Here & Get Access Now AI WebProfit Discount Price Here <<>>

AI WebProfit Review: Money Back Guarantee

Your purchase is covered by a 30-day money-back guarantee! In case you have even the smallest question, we want you to know that our 100% money-back promise is here for you. Try it out for 30 days, and if you decide that our technology isn’t meeting your needs, we’ll give you all of your money back, no questions asked.

AI WebProfit Review: Pros and Cons

Pros:

Effortless Website Creation: AI handles content generation, streamlining website creation for beginners.

Time-Saving: Get your website up and running faster compared to traditional methods.

Cost-Effective: Potentially cheaper than hiring a web developer or designer.

Monetization Options: Built-in tools to explore earning income through your website.

Mobile-Friendly Design: Ensures your website adapts seamlessly across devices.

Cons:

You cannot use this product without an active internet connection.

In fact, I haven’t yet discovered any other problems with AI WebProfit.

Frequently Asked Questions (FAQ’s)

Q. Do I need any experience to get started?

None, all you need is just an internet connection. And you’re good to go

Q. Is there any monthly cost?

Depends, If you act now, NONE. But if you wait, you might end up paying $997/month It’s up to you.

Q. How long does it take to make money?

Our average member made their first sale the same day they got access to AI webProfit.

Q. Do I need to purchase anything else for it to work?

No, AI webProfit is the complete thing. You get everything you need to make it work. Nothing is left behind.

Q. What if I failed?

While that is unlikely, we removed all the risk for you. If you tried AI webProfit and failed, we will refund you every cent you paid And send you $300 on top of that just to apologize for wasting your time.

Q. How can I get started?

Awesome, I like your excitement, All you have to do is click any of the buy buttons on the page and secure your copy of AI webProfit at a one-time fee.

AI WebProfit Review: My Recommendation

AI WebProfits offers an intriguing solution for website creation, particularly for those seeking an AI-powered shortcut. While it boasts ease of use and built-in monetization, consider the trade-offs between customization and convenience. Weighing the potential benefits against the limitations will help you determine if AI WebProfits is the key to unlocking your online potential. Remember, even with AI’s assistance, success often hinges on your marketing efforts and content quality.

<<>> Click Here & Get Access Now AI WebProfit Discount Price Here <<>>

Check Out My Previous Reviews: Ai Money Sites Review, Coinz App Review, AcquireWeb AI Review, EcoverPalAi Review, Comet App Review, WebWise Review, ProfitCell Review, Gen AI Review.

Thank for reading my AI WebProfit Review till the end. Hope it will help you to make purchase decision perfectly.

Disclaimer:

This review is based on publicly available information and is not intended as an endorsement or promotion of AI WebProfits. Users should conduct their own research and due diligence before making any purchasing decisions.

Note: Yes, this is a paid software, however the one-time fee is $17 for lifetime

#AI WebProfits#AI WebProfits App#AI WebProfits Upgrades#AI WebProfits Overview#AI WebProfits Features#AI WebProfits Review#AI WebProfits Works#What Is AI WebProfits#Buy AI WebProfits#AI WebProfits Price#AI WebProfits Demo#AI WebProfits Discount#AI WebProfits Honest Review#AI WebProfits Pricing#AI WebProfits FE#AI WebProfits Pros#AI WebProfits OTO#AI WebProfits Preview#AI WebProfits Scam#Get AI WebProfits#AI WebProfits Reviews#Purchase AI WebProfits#AI WebProfits Legal#AI WebProfits By Ariel Sanders#Artificial Intelligence#AI#AI WebProfits Benefits#AI WebProfits Bonus#AI WebProfits Bonuses#AI WebProfits Software

0 notes

Text

Purchasing an older used car typically means securing financing from specialized lenders, as most mainstream banks shy away from loans for aged vehicles. Certain financial institutions recognize the demand for financing higher mileage autos and offer loan programs to fit borrowers in this niche. This guide examines banks, credit unions and other lenders to consider when seeking financing approval for older used cars. We’ll outline what factors they evaluate, recommended institutions to research, loan terms to expect, and tips to strengthen your old car loan eligibility. Challenges Facing Old Car Financing Securing any auto loan gets harder once vehicles pass 10 years or 100,000 miles. Approval obstacles include: Limited loan amounts due to slower depreciation Higher interest rates due to increased risk Shorter maximum terms such as 36 months Stricter credit score requirements These factors lead fewer traditional lenders to offer loans on older vehicles. But institutions recognizing this consumer need do provide more flexible aging auto financing options. Vehicle Age Limits for Loan Eligibility Most standard banks cap their auto lending at around 6-8 years old. Specialty finance companies focused on older vehicles may approve loans up to: 10-12 years for mainstream used lenders 15 years for buy-here, pay-here dealerships Over 20 years for classic/collector car lenders Vehicle condition, mileage, and maintenance records also impact maximum qualifying age thresholds. Credit Score Needs for Old Car Loans Credit standards are heightened when financing aged autos to account for higher risk. Typical minimum scores required are: 650-699 for lenders financing vehicles 8-10 years old 600-649 for loans on 10-12 year old vehicles 500-599 for buy-here, pay-here dealers approving loans up to 15 years old A 30-60 point score boost can mean access to better lenders and interest rates. Specialty subprime lenders may work with applicants having scores in the 500s. Top Banks Providing Old Car Financing Banks recognized for their willingness to finance older vehicles include: PenFed Credit Union - Ages up to 12 years Alliant Credit Union - Finances up to 10-year-old vehicles Bank of America - 10 year age limit on standard loans Capital One - Age limit of around 8-10 years Local credit unions - More flexibility on vehicle age Compare auto loan offerings from local credit unions and community banks as well, which aim to serve members. Other Lenders That Offer Old Car Loans Along with banks and credit unions, these private lenders finance older vehicles: AutoCreditExpress - Network of lenders finance up to 12-year-old vehicles Car.Loan.com - Loans up to 10 years old with flexible credit requirements Auto Credit Bank - High mileage car loans up to 8 years old Complete Auto Loans - Ages cars up to 12 years old CarsDirect - Large lender network approves loans for older vehicles Marketplace sites like LendingTree allow you to complete one application form which they submit to multiple included lenders to save time. Typical Loan Terms on Old Car Financing Older vehicle loans often come with less ideal rates and terms compared to newer car loans: Interest rates - 8-16% APR for borrowers with good credit, over 16% for subprime Lengths - 24-36 months maximum, some up to 60 months Amounts - $4,000 - $15,000 based on vehicle age/value Down payment - At least 10%, 20% or more recommended Walking in pre-approved makes it easier to negotiate favorable loan terms. Apply with multiple lenders to compare loan offers. Tips for Improving Old Car Loan Eligibility If you have fair or poor credit, take these proactive steps when seeking aged auto financing: Shop at credit unions where you’re a member Put down at least 20% as a down payme

nt Have a co-signer with better credit co-apply Provide proof of sufficient income to handle payments Look at loan terms from 48-60 months for lower payments Consider including a warranty to offset repair risks Taking these actions sets you up for the best shot at affordable loan approval from institutions financing higher mileage vehicles. Alternatives If You Can’t Get Approved for Loan If unable to secure financing for the older used car you need, consider these options: Pay cash upfront if funds allow Look at private party sellers who may finance directly Improve credit score for better rates down the road Save up a bigger down payment amount Adjust budget for a newer used car with lower mileage With some diligence, there are ways to get into an affordable used vehicle through careful research and preparation. FAQs What is your maximum vehicle age for loans? Different lenders have varying age thresholds, such as 10 or 12 years old. Know their limits. What are the APR ranges for your old car loans? Interest rates are higher for aged cars. Ask for the specific rate ranges you qualify for. How large of a loan do you provide on older vehicles? Loan amounts for old cars may be restricted to $5,000 - $7,000. Confirm loan sizes. Do you require a down payment? How much? Many want at least 10% down or higher on older vehicles. Get their specific requirements. What credit score minimums do you have for older car loans? Each lender sets different credit cutoffs, such as 500, 600 or higher scores. While finding financing for older vehicles takes more effort, targeted research into lenders specializing in high mileage loans can connect you with approvals and reasonable terms. Keeping an open mind on vehicle condition and loan restrictions also widens available financing options. With persistence and creativity, access to a quality used car can be achieved. Use this guide as a starting point for locating financing institutions catering to your particular old car loan needs. #Wiack #Car #CarInsurance #CarRental #CarPrice #AutoLoans

0 notes

Text

Purchasing an older used car typically means securing financing from specialized lenders, as most mainstream banks shy away from loans for aged vehicles. Certain financial institutions recognize the demand for financing higher mileage autos and offer loan programs to fit borrowers in this niche. This guide examines banks, credit unions and other lenders to consider when seeking financing approval for older used cars. We’ll outline what factors they evaluate, recommended institutions to research, loan terms to expect, and tips to strengthen your old car loan eligibility. Challenges Facing Old Car Financing Securing any auto loan gets harder once vehicles pass 10 years or 100,000 miles. Approval obstacles include: Limited loan amounts due to slower depreciation Higher interest rates due to increased risk Shorter maximum terms such as 36 months Stricter credit score requirements These factors lead fewer traditional lenders to offer loans on older vehicles. But institutions recognizing this consumer need do provide more flexible aging auto financing options. Vehicle Age Limits for Loan Eligibility Most standard banks cap their auto lending at around 6-8 years old. Specialty finance companies focused on older vehicles may approve loans up to: 10-12 years for mainstream used lenders 15 years for buy-here, pay-here dealerships Over 20 years for classic/collector car lenders Vehicle condition, mileage, and maintenance records also impact maximum qualifying age thresholds. Credit Score Needs for Old Car Loans Credit standards are heightened when financing aged autos to account for higher risk. Typical minimum scores required are: 650-699 for lenders financing vehicles 8-10 years old 600-649 for loans on 10-12 year old vehicles 500-599 for buy-here, pay-here dealers approving loans up to 15 years old A 30-60 point score boost can mean access to better lenders and interest rates. Specialty subprime lenders may work with applicants having scores in the 500s. Top Banks Providing Old Car Financing Banks recognized for their willingness to finance older vehicles include: PenFed Credit Union - Ages up to 12 years Alliant Credit Union - Finances up to 10-year-old vehicles Bank of America - 10 year age limit on standard loans Capital One - Age limit of around 8-10 years Local credit unions - More flexibility on vehicle age Compare auto loan offerings from local credit unions and community banks as well, which aim to serve members. Other Lenders That Offer Old Car Loans Along with banks and credit unions, these private lenders finance older vehicles: AutoCreditExpress - Network of lenders finance up to 12-year-old vehicles Car.Loan.com - Loans up to 10 years old with flexible credit requirements Auto Credit Bank - High mileage car loans up to 8 years old Complete Auto Loans - Ages cars up to 12 years old CarsDirect - Large lender network approves loans for older vehicles Marketplace sites like LendingTree allow you to complete one application form which they submit to multiple included lenders to save time. Typical Loan Terms on Old Car Financing Older vehicle loans often come with less ideal rates and terms compared to newer car loans: Interest rates - 8-16% APR for borrowers with good credit, over 16% for subprime Lengths - 24-36 months maximum, some up to 60 months Amounts - $4,000 - $15,000 based on vehicle age/value Down payment - At least 10%, 20% or more recommended Walking in pre-approved makes it easier to negotiate favorable loan terms. Apply with multiple lenders to compare loan offers. Tips for Improving Old Car Loan Eligibility If you have fair or poor credit, take these proactive steps when seeking aged auto financing: Shop at credit unions where you’re a member Put down at least 20% as a down payme

nt Have a co-signer with better credit co-apply Provide proof of sufficient income to handle payments Look at loan terms from 48-60 months for lower payments Consider including a warranty to offset repair risks Taking these actions sets you up for the best shot at affordable loan approval from institutions financing higher mileage vehicles. Alternatives If You Can’t Get Approved for Loan If unable to secure financing for the older used car you need, consider these options: Pay cash upfront if funds allow Look at private party sellers who may finance directly Improve credit score for better rates down the road Save up a bigger down payment amount Adjust budget for a newer used car with lower mileage With some diligence, there are ways to get into an affordable used vehicle through careful research and preparation. FAQs What is your maximum vehicle age for loans? Different lenders have varying age thresholds, such as 10 or 12 years old. Know their limits. What are the APR ranges for your old car loans? Interest rates are higher for aged cars. Ask for the specific rate ranges you qualify for. How large of a loan do you provide on older vehicles? Loan amounts for old cars may be restricted to $5,000 - $7,000. Confirm loan sizes. Do you require a down payment? How much? Many want at least 10% down or higher on older vehicles. Get their specific requirements. What credit score minimums do you have for older car loans? Each lender sets different credit cutoffs, such as 500, 600 or higher scores. While finding financing for older vehicles takes more effort, targeted research into lenders specializing in high mileage loans can connect you with approvals and reasonable terms. Keeping an open mind on vehicle condition and loan restrictions also widens available financing options. With persistence and creativity, access to a quality used car can be achieved. Use this guide as a starting point for locating financing institutions catering to your particular old car loan needs. #Wiack #Car #CarInsurance #CarRental #CarPrice #AutoLoans

0 notes

Text

How To Increase Your Credit Score Quickly

Your credit score can have a significant impact on your life, from the terms of your auto loan to your ability to get new credit cards. If you want to raise your credit score as quickly as possible, there are some best practices you should follow to ensure it happens as soon as possible. In this article, we’ll show you how to increase your credit score quickly and give you tips that will help you keep that score up over time.

Easy Ways to Increase Your Credit Score

If you’re looking for ways to increase yourcredit score quickly, there are several things you can do. First, check your free credit report at least once a year. You can get one free copy of your report every year from each of the three major credit bureaus. This is an important step because it helps you see what information is on file with each bureau so that you know which companies need updates. To increase your score quickly, be sure to list all of your accounts and stay current on any payments. This includes medical bills and utility bills since these factors heavily influence your score as well.

Do not apply for new credit unless absolutely necessary – preferably wait a minimum of six months before applying – to ensure that you’re not sabotaging yourself by opening up new lines of debt. Finally, consider working with a financial advisor who specializes in helping people build their credit scores. In addition to providing advice based on your unique situation, many professionals work directly with lenders and other potential creditors to make sure issues don’t arise during loan processes or after they’ve been approved. These small steps will help you take control over where your score goes from here!

Tips to Improve Your Credit Score

Improving your credit score takes a lot of work, but it’s worth it. Here are some tips for improving your credit score: Make payments on time. Paying bills and loans on time is one of the best ways to increase your credit score over time. When you make payments on time, you prove that you can handle responsibility and make good decisions about money management. Overpay your debt. If you have any debt at all—and especially if it’s high-interest—overpaying just a little bit can have a big impact on your credit score.

In fact, as much as 35% of your FICO score is based on how much available debt you use compared to how much available debt you have access to at any given time. So if there are credit cards or other forms of debt with which you have an open balance, pay them off as much as possible so they don’t take up so much room in comparison to everything else.

What is a Good Credit Score?

A good credit score is one that allows you to get loans at favorable interest rates. Having a high credit score can mean big savings on your mortgage or car loan, as well as lower costs for utilities and insurance. Since money is usually borrowed with these types of loans, it makes sense that having a higher credit score could help you save a significant amount of money over time. In general, there are five main factors that go into calculating your credit score Payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and type of credit used (10%). Start by paying off debt in full every month; set up automated payments if necessary.

Then look into how long you’ve had an account open; while old accounts don’t necessarily give you a boost, they may make up part of your score if closed accounts might appear risky to lenders. Next, consider making small charges every few months so you’re most recent accounts aren’t left out altogether when potential creditors check your profile. And finally—as tempting as it might be—avoid opening too many cards at once, even if they have enticing sign-up bonuses or low introductory APRs.

Steps Towards Improving your Credit Rating

Once you realize how important it is to have a good credit score, you’ll want to do what you can to improve your own. The first step in doing so understands what factors influence your credit scores.

There are many of them, but some of the most common include:

1) Amount owed on revolving accounts (like credit cards).

2) Length of credit history.

3) New inquiries on your report.

4) Types of credit used (or not used).

As you can see, there are lots of things that go into determining whether or not lenders will give you money—and your score will be based heavily on that information. Once you know these factors, though, there are plenty of things you can do toward improving them. One way to do so is by making sure all of your bills get paid every month. If they don’t, creditors could mark it as late, which will negatively impact your credit rating for years to come.

Another way to boost your score is by spending less than you make each month and keeping balances low across all lines of credit. This may seem counterintuitive since high scores require low debt-to-credit ratios, but more importantly having a high amount owed relative to what’s available from lines of credit means potential creditors won’t trust you with more money down the line.

Lastly, if you ever want a big loan, such as a mortgage or auto loan for example—it’s smart to open at least one new line of revolving credit before approaching creditors about borrowing bigger sums.

Contact Us:

Address - 18930 HWY 18 STE 101 Apple Valley CA 92307

Email - [email protected]

Phone - +1 909-329-4882

Website - The Credit Score King

Blog - How To Increase Your Credit Score Quickly

0 notes

Text

Payment Calculator: Interest Rate, APR, Calculating Monthly Payments, Secure and Unsecured Loans

What is the difference between the Interest Rate and APR?

The Payment Calculator helps calculate the Interest and APR of a loan. While looking at any loan, it is important to understand the difference between the interest rate and APR.

In large mortgage loans, the interest rate is the cost of the borrowed amount. APR is the additional cost of the principal and interest rate on the borrowed amount. It can be in the form of discount points, administrative fees, and more.

So instead of an upfront payment, the APR value has added to the cost of the borrowed amount. However, the interest rate equals the APR if the loan does not have any additional fees,

However, a borrower can input both values in the calculator and get a different result.

What is a Variable Rate?

The Payment Calculator gives a variable rate. Most loans have a fixed interest rate and are student or personal loans. At the same time, the Variable interest rate is dependent on the market rate. It can go high or low as per the market value.

They are also called the adjustable rate on home equity of credit.

The Variable rate loans may change depending on inflation and central bank rate.

U.S. Federal Reserve sets the determining factor for variable rates. The variable rate may fluctuate over time and can alter payment. Some lenders keep a cap on variable loan rates. It is the maximum amount of interest charged, no matter how much the index rate differs. Lenders or Banks update the interest rate periodically. It is also disclosed in the contract.

How to calculate interest and monthly payments with the Payment Calculator?

The AllCalculatot.net’s Payment Calculator calculates an approximate monthly payment for the loan. The Payment Calculator also considers the annual salary to avoid any financial issues.

The Payment Calculator can be used for Federal Educational Loans. It can also calculate student and personal loans and give out a monthly payment concerning the financial condition.

To calculate the Monthly interest, the Payment Calculator keeps the interest rate as a constant value. It is constant throughout the loan. As per Standard Federal Loan, the interest rate has to be 2.75%. Hence the Payment Calculator can be used for mortgages and auto loans.

The Payment Calculator assumes the loan to be repaid in monthly installments. However, the Payment Calculator may need to give accurate payment for alternate plans.

What is the difference between a Secured and an Unsecured Loan?

There are two types of Loans: one is secured and unsecured loans. The Secured loans require you to put an asset as collateral. It is in the form of a house or any vehicle. It involves a higher risk as the asset can be lost if the loan is not paid back.

Although these loans come with lower interest rates, loans come with lower interest rates and better terms. Even home equity loans and auto loans are secured loans.

Unsecured loans are without any collateral. It is a safe and better option. A person with a good credit score can opt for this loan. It does have some strict borrowing requirements. It has a high-interest rate. A personal loan is a type of unsecured loan.

The Payment Calculator can help determine the monthly payment for the security and consider the financial condition.

0 notes

Text

Payday Cash Loans - ATD Money

A payday loan is a high-cost short-term loan that is typically repaid with your next paycheck. They are one of the most costly types of loans and can be a major source of debt for many people.

To avoid a cycle of debt, consider alternatives to payday loans. Look for alternative loans with lower interest rates and a repayment plan that fits your budget.

Payday loans are a type of short-term loan

A payday loan is a type of short-term unsecured personal loan that typically must be paid back in full (plus fees) by the borrower's next paycheck. They are a last-ditch option for borrowers who don't have the credit or income to qualify for other types of loans.

Payday loans are often available through storefront payday lenders or online. They typically have a maximum lending limit of $500. However, limits may vary from lender to lender.

To get a payday loan, you'll need to provide proof of identification, income, and a bank account. Some payday lenders accept postdated checks, while others will provide cash as soon as you submit a debit card number or another form of payment.

When you apply for a payday loan, it's a good idea to read all the fine print, including any hidden fees or penalties. Also, find out the annual percentage rate, or APR. It's an important way to compare costs and decide which loan is best for your situation.

In addition to payday loans, you can also get a line of credit through a bank or financial institution. This is similar to a business credit card, but instead of using the money from your bank account as collateral, you use a line of credit, which can be tapped in and out as needed.

Another way to obtain a loan is by borrowing against an item of value, such as an automobile. Some pawnshops offer short-term auto title loans that don't require credit checks but can be costly.

Alternatively, you can tap into your credit card's cash advance limit. Some banks even offer a separate cash credit line that's limited to a small fraction of your actual credit limit.

These loans come with hefty interest rates, though they can be used to make ends meet until your next check arrives. They're not recommended for long-term borrowing because they can easily trap you in a cycle of debt.

If you're looking for a safe alternative to payday loans, consider applying for a personal loan. These have lower interest rates than payday loans and a longer repayment period, making them a better choice for many people.

They are unsecured

A payday loan is an unsecured loan, which means that the lender does not require you to provide collateral like you would at a pawn shop. The loan is typically based on your paycheck, so the amount you receive depends on your income. This makes it a common way to get quick cash for emergencies, such as unexpected expenses or medical bills.

While a payday loan can be an excellent way to get cash quickly, it is important to understand the risks involved. The first step is to determine whether you can afford the loan and what fees and interest rates are associated with it. You can also ask a credit counselor to review your financial situation and find solutions that might prevent you from taking out a payday loan.

Payday lenders often charge a fee for every payment that is late, which can add up to significant amounts. If you don't pay your bill on time, your lender may report it to the credit bureaus and lower your credit score. In addition, you may be charged a fee each time you roll over the loan.

You can protect yourself from high-interest rates and other fees by shopping around for the best deal. Make sure to read the terms and conditions carefully, and be careful when signing up on an online lending site. You can also contact a non-profit agency that offers credit counseling at no or low cost.

Another risk is that your bank account information can be shared with a payday lender without your permission. This can lead to identity theft. It is also possible for a lender to collect and sell your information to other companies.

Many payday loan consumers have poor credit, and they are likely to be people who lack access to a traditional deposit bank account. These people are disproportionately Black or Hispanic and are least able to secure normal, lower-interest-rate forms of credit.

Fortunately, ATD Money offers instant personal loans that are a convenient alternative to payday loans. They are easy to apply for, and funds can be disbursed within 30 minutes of approval. You can apply for an ATD Money loan online or at a retail location.

They are based on future income

A payday loan is a type of short-term loan that is based on your future income. This makes it a viable option for people who need a quick source of cash to cover unexpected expenses, such as an emergency medical bill or an auto repair. It also allows you to avoid a trip to the bank or a credit card company, which can be time-consuming and frustrating.

ATD Money is a leading online lender that offers a wide range of loans, including cash loans and business loans. They have several features to help make the application process easier, including an online payment processor and a mobile app. You can also talk with a loan expert to discuss your options and get more information.

The loan process is fast and easy, but you do have to pay attention to the details. ATD Money will review your income, assets, and other financial details before approving your loan. Then, you can choose to pay it off in one lump sum or spread the payments over some time. ATD Money will also provide you with a loan calculator to help you estimate your monthly payments.

Although payday loans can be a smart way to meet your short-term financial needs, they can also come with serious consequences. The most notable is that they can cause credit issues for those who have poor or no credit. Additionally, they can hurt your health and well-being.

For example, it's estimated that the amount of stress caused by payday loans can increase your risk of heart disease. And even if you do manage to repay your debt on time, you may be paying a lot of fees along the way.

The interest rates and fees for these types of loans can be so high that they are not a sound financial choice for many consumers. In addition, they can hurt other areas of your life, such as your mental health or your relationships.

The most important thing to remember about payday loans is that they are unsecured, so you must be sure to read all the fine print before you agree to take out one. In addition, payday loans should only be used for emergencies and should not be relied upon as a long-term source of funding.

They are costly

Payday Cash Loans: ATD Money

There are many reasons why payday loans are costly. They come with high fees and interest rates, which can quickly add up to more than you can afford. You could also find yourself in a cycle of debt by taking out more than you can handle and then rolling the loan over, leading to even higher fees.

According to Pew, more than half of borrowers use payday loans on repeat occasions. These users use the money to pay for recurring bills, including rent and utilities.

If you are thinking about a payday loan, consider these alternatives to find a better way to finance your next emergency. One option is a personal loan from a bank or credit union. These small-dollar loans typically have lower interest rates and higher approval standards than payday loans, but you must have good credit to qualify for them.

Another option is to build an emergency fund, which you can access whenever you need it. A few hundred dollars saved up over time can help you avoid taking out a payday loan in the future.

You might also consider a secured personal loan, which is less risky for lenders because you have collateral. A secured loan can also increase your credit score by showing that you can manage debt responsibly.

A third option is to use a credit card to pay for your immediate needs. Credit cards usually have lower interest rates than payday loans, and you can often get a promotional rate when using your card to pay for items.

It's also worth checking with your local credit union to see if they offer payday alternative loans (PALs). These small-dollar loans can be a great alternative to payday loans and have lower interest rates than other forms of short-term financing.

The best way to avoid paying high fees and interest on a payday loan is to repay it on time, says Zhou. A borrower who pays the loan back in full on its due date will improve his or her credit score and be less likely to take out another payday loan in the future.

0 notes

Note

Uhh is it just me or had the APR for every credit card gone way the heck up?? The lowest I've seen is 17% and it's always variable like 17-28%. I'd like to do a balance transfer but I'm afraid any new card is going to give me an even higher interest rate than what I'm paying now! I have a credit score of 744 which I *thought* would've been good enough to find lower APR offers..

I read your ask and was like "that can't be right..." So I fact-checked it. And you're absolutely right. Even NerdWallet's list of the best low APR credit cards this month has STAGGERING interest rates! The lowest is 14.99%-24.99%, but you can bet you need at least a credit score of at least 800 to get the bottom of that range.

There are a couple explanations for this:

We're entering a recession and lenders are scared shitless about people's abilities to pay their bills. So they're trying to disincentivize you from getting a credit card.

The Fed is effectively raising interest rates across the board. I didn't initially expect this to affect credit cards (because that lending model is intentionally predatory), but I was wrong.

tl;dr It's real hard to get a loan right now, whether that's a line of credit, a credit card, an auto loan, or a mortgage. Good luck out there, babies. Here's some more info:

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

A Hand-holding Guide To Getting Your First Credit Card

151 notes

·

View notes

Photo

my most anticipated 2022 fiction releases, in order of current release date

tagged by @earlymodernlesbian

okay i “understand” that i am just supposed to pick “nine” for this and also that there is a picture limit here on tumblr dot com but jokes on you i am including a runners up list of considerable length after my main ones

dead silence by s.a. barnes (feb. 8): in space no one can hear you scream etc etc. the premise is very classic horror (exploring somewhere a tragedy took place and discovering there’s still!! something there!!) and it’s been blurbed by a lot of horror writers i trust. possibly gay? but i could be misremembering

last exit by max gladstone (feb. 22): max gladstone hive!!! empress of forever and this is how you lose the time war are both all-time faves so auto-buy. definitely gay.

end of the world house by adrienne celt (apr. 19): am i being sucked in by a great title and visually arresting cover?? very possible. but i’m (obviously) a time loop bitch and there’s a very good kristin arnett blurb so here we are. not gay as far as i know

siren queen by nghi vo (may 10): i have not yet read my copy of the chosen and the beautiful but i loved the empress of salt and fortune and old hollywood but with disquieting magic as a concept is catnip to me!! no idea if gay??

the final strife by saara el arifi (june 21): okay some author i really love was talking about reading an arc and loving it and i thought it was amal el-mohtar on twitter but now i can find no evidence of that so maybe i am losing my marbles. anyway this seems like it will be excellent company to the trio of meaty adult sapphic fantasies from last year, so i’m excited!! enthusiastically gay.

our wives under the sea by julia armfield (july 12): kristin arnett blurb strikes again!!! i love gothic fiction and have been anticipating this one for over a year. titularly gay!!

high times in the low parliament by kelly robson (aug. 9): this seems almost like a farcical cousin to the goblin emperor?? anyway i always want to read about fairies and politics and tor dot com has me in a chokehold. the inciting incident is gay!!

the old place by bobby finger (sept. 20): i am a who! weekly listener first and a human second so i am legally obligated to support. but genuinely i love stories about old ladies and texas settings and expect this to be both funny and tender. unclear if gay but seems distinctly possible?

the golden enclaves by naomi novik (sept. 27): thrilled and terrified to see the scholomance trilogy conclude!! cannot recommend these books enough as both genuinely nerve-wracking YA romps and deeply moving explorations of teens choosing compassion in an environment that actively discourages that behavior. side characters gay romance real, protagonist romance gay in my head

!!! releases i am thrilled about but i felt could not qualify for the main list!!!

fevered star by rebecca roanhorse (apr. 19): sequel to black sun, which i own but have not read yet! gay!

i kissed shara wheeler by casey mcquiston (may 3): have already read this and guess what?? it fucks!! about some truly insufferable girls (affectionate) and made me laugh out loud and also cry about growing up queer and religious in the south. multi-directionally gay!!

seasonal fears by seanan mcguire (may 3): sequel to middlegame, which i own but have not read yet! seanan mcguire hive never loses. i assume gay in at least some small way bc of her track record as an author?

the grief of stones by katherine addison (june 14): sequel to the witness for the dead, which i own but have not read, which is a standalone sequel to the goblin emperor, which i have read and am obsessed with. gay!

lockland by robert jackson bennet (june 21): final book in the founders trilogy which okay i do not “own” and have not “read” at all but amal el-mohtar has definitely glowingly reviewed the previous two entries in the series and i trust her with my life so i will be purchasing them all i fear. gay!

don’t fear the reaper by stephen graham jones (aug. 2): sequel to my heart is a chainsaw, which i own but have not read yet! not gay to my knowledge

the oleander sword by tasha suri (aug. 12): sequel to the jasmine throne, which i own but i am licherally going to start reading today!!! famously gay

nona the ninth by tamsyn muir (sept. 13): i am not bothering to write what this is a sequel to, you freaks!!! you know!!!! being unable to talk about this book with people keeps me up at night. the [redacted] of it all... september cannot come soon enough!!!! GAY

a restless truth by freya marske (nov. 1): sequel to a marvellous light, which i own but have not read yet! gay!

!!! general runners-up !!!

the thousand eyes by a.k. larkwood (feb. 15): sequel to the unspoken name, which i didn’t really feel needed a sequel??? but i am v happy to revisit these characters. gay!

extasia by claire legrand (feb. 22): i’m reading less and less YA these days but i loved sawkill girls and weird saint shit is always up my alley. gay!

dead collections by isaac fellman (feb. 22): eternally horny for new spins on vampires and also narratives about archives!! trans, idk if gay!

all the white spaces by ally wilkes (mar. 29): the terror-adjacent, with a trans protag!!! strong blurbs from other horror authors!! unknown if gay

sea of tranquility by emily st. mandel (apr. 5): i never got around to reading the glass hotel but i am a station eleven bitch. presumed straight?

when women were dragons by kelly barnhill (may 3): absolutely the sickest premise of all time?? unknown if gay

misrule by heather walter (may 10): sequel to malice, which i liked but did not love?? very curious if the duology sticks the landing. gay!

this time tomorrow by emma straub (may 17): listen any type of time travel or distortion is interesting to me!!! presumed straight?

yerba buena by nina lacour (may 31): have never read anything by this author but obvi know her excellent reputation! gay!

mistakes were made by meryl wilsner (oct. 11): own but have not read this author’s previous romance, something to talk about. this is being sold as “the milf book” so. gay!

ocean’s echo by everina maxwell (nov. 1): in the same universe of winter’s orbit which i loved!! gay!

even though i knew the end by c.l. polk (nov. 8): have not read any of this author’s work bc i am dumb but all her shit is extremely up my alley! noir AND vampires. gay!

#obvi some of these release dates might shift and there are many books i have not heard about yet but will end up loving!!!#book blogging on main

85 notes

·

View notes

Text

New and used car buyers often want to know - what are the average 2023 car loan interest rates and APRs they can expect to see? Interest rates impact the monthly payment and total loan cost. This guide examines current auto loan APRs, factors that influence rates, and how to secure the best financing in 2023. What is APR? What is the Current Average New Car Loan APR in 2023? For new cars in 2023, average APRs by credit score are: 800+ credit score (prime) - 3% to 5% APR 700-799 credit score (prime) - 4% to 6% APR 620-699 credit score (non-prime) - 6% to 10% APR 600-619 credit score (subprime) - 10% to 14% APR Under 600 credit score (deep subprime) - 14% to 20% APR Shop prime lenders to access interest rates below 5% for new cars based on a strong 700+ credit score. Those under 640 may pay double digit rates from subprime lenders. What is the Current Average Used Car Loan APR in 2023? For used car purchases in 2023, average APRs are: 800+ credit score (prime) - 4% to 7% APR 700-799 credit score (prime) - 5% to 8% APR 620-699 credit score (non-prime) - 8% to 12% APR 600-619 credit score (subprime) - 12% to 16% APR Under 600 credit score (deep subprime) - 16% to 24% APR Used car interest rates run 1-2% higher than new currently. Strong credit still nets rates under 8% from prime lenders. Subprime buyers pay significantly more. How to Secure a Good APR for a Car Loan Prime Car Loan Rates vs Subprime Rates in 2023 Prime borrowers (700+ credit) generally see: New car rates from 3% to 7% APR Used car rates from 4% to 8% APR Subprime borrowers (under 640 credit) generally see: New car rates from 8% to 20% APR Used car rates from 10% to 24% APR Having prime credit saves thousands over the auto loan term by qualifying better rates. Subprime terms carry expensive risk premiums. How Does Credit Score Impact Auto Loan Interest Rates? Credit score influence on APR: 800+ scores offer the lowest rates due to representing ultra prime borrowers. 700-749 scores see minor impacts, with rates 1% higher than 800+. 640-699 scores classify as non-prime with rates 2-4% above prime. Under 640 are subprime with significant rate increases. Scores below 600 see drastic jumps. Improving credit from good to excellent can save 1% or more, while falling from prime to subprime can double rates. Average Auto Loan Term Lengths Typical loan terms and impact on APR: 36 months - Lower rates but higher monthly payment. 48 months - Allows lower payment with slight rate increase. 60 months - Average term length with moderate rates. 72 months - Lowest payment but higher rates from risk. 84 months - Riskiest term with highest rates but lowest payment. Aim for 60 months or less to keep rates down. Budget appropriately to avoid very long terms unless necessary. Understanding Car Loan Terms Do Auto Loan Rates Vary by State? 2023 auto loan rates don’t vary significantly by state, but factors in specific locations can have some influence: State maximum interest rate caps on loans impact rate ceilings. But most are above 15%. Regional economic factors like unemployment may account for small variations. Credit score distributions and financial trends in local areas move rates. Promotions and incentives from lenders in a given state can create minor variances. But any state-level differences amount to less than 1% typically. National lender rates are broadly similar. Down Payment Percentage Effect on Interest Rates Typical down payment tiers and impact on APR: 0-4% down - Highest rates; risky for lender 5-9% down - Slight rate improvement 10-19% down - Lower rates in prime territory 20%+ down - Maximum rate incentive; best terms Larger down payments signal lessened risk and commitment from borrowers. This earns lower interest rates from lenders. How Auto Loan Rates Have Changed 2022 average new car rate - 5.2% APR

2021 average new car rate - 4.1% APR Rates rose over 1% due to: Federal interest rate hikes High inflation Tighter lending restrictions Supply chain constraints Expect rates above 5% for the near term until inflation cools in 2023-2024. Pre-Approval for Lower Rates Getting pre-approved for financing helps: Lock in current rates before future hikes Compare multiple lender rates Focus searches only on approved loan amount Negotiate from a position of strength at the dealership Don’t wait - secure favorable rates now before further increases. FAQs How much does auto loan interest vary from month to month? Very little variance monthly. Market-wide shifts lead to adjustments every few months in 0.25 to 0.5% increments based on macro factors. Which lenders offer the lowest interest rates right now? Online lenders, credit unions, and community banks often offer the most competitive rates versus large national banks. How much does the length of the loan change interest rates? Going from a 60 month term up to 72 or 84 months can increase rates around 0.5% typically. What’s better - longer term with lower payment or higher rate? Go for the shortest term you can afford the monthly payment on. Lower rates save thousands over the life of the loan. How much can improving my credit score reduce rates? Each 100 point credit score increase reduces rates by around 1.5% - Excellent credit unlocks huge savings. Key Takeaways on 2023 Auto Loan Rates and APRs Credit score heavily influences loan rates - prime borrowers get far lower APRs 2023 new car rates range from 3% for prime buyers up to 20% for subprime Used cars are 1-2% higher than new currently 20%+ down payments maximize rate incentives Pre-approval locks in current rates before future hikes Improving credit by 100+ points before applying generates big savings Understanding current rate trends helps set expectations and budget accurately as you take out a 2023 auto loan. Position yourself to access the best rates for your situation before buying. #Wiack #Car #CarInsurance #CarRental #CarPrice #AutoLoans

0 notes

Text