#wallstreetbets

Explore tagged Tumblr posts

Text

Do you want to see the most incredible r/wallstreetbets post in history

That says 1 day ago as in literally only a few hours before the outage began lmfao.

1K notes

·

View notes

Text

“Dumb Money”, the upcoming movie about the Reddit GameStop event, is so surreal to me because I was literally following this on Reddit when it was happening. It’s a biopic for something that’s only two years old.

#dumb money#Reddit#gamestop#gamestop short squeeze#Wall Street#wallstreetbets#Reddit movies#reddit moment#paul dano#pete davidson#vincent d'onofrio#america ferrera#nick offerman#movies#2023 movies#2023 films#upcoming movies

37 notes

·

View notes

Text

MOASS

The Mother Of All Short Squeezes, or MOASS, refers to a fringe theory about the stock market. The general idea is that the GameStop short squeeze in Janaury 2021 can be reproduced with even more dramatic profits for memestock investors. Under this theory, it is possible to sustain a short squeeze indefinitely, with the share price of the affected companies rising to, um, infinity dollars.

[Above: A typical MOASS influencer explaining why it would happen soon. This was two years ago.]

True believers in MOASS have awaited this windfall for over three years--Dan Olson called it "Reddit's version of the Rapture." There was a false alarm last week, when the dormant Twitter account of Keith Gill (one of the big names from the 2021 squeeze) suddenly came to life, posting a bunch of hype videos. The price briefly shot up to $64 on May 15, but drifted back down to the low 20s within a few days. Nevertheless, as with failed Rapture predictions, the faithful are undeterred, and continue looking for new signs and evidence that MOASS is coming soon.

[Above: In the 2015 movie The Big Short, Margot Robbie explains how short selling works while sitting in a bubble bath. I figured this picture was close enough.]

In a normal short squeeze, investors who go "short" on a company get caught by an unanticipated rise in the share price. Short investors bet against the company, selling borrowed shares at today's prices, with the assumption that it'll be cheaper to buy back those shares later to reimburse the lender. If the price instead goes up, the short investor is left scrambling to close their position as soon as possible, to minimize their losses. But that scramble creates more demand to buy, driving the price up even higher, applying more pressure to more short sellers.

MOASS is based on the assumption that this cascade effect can go on forever, under the right circumstances. For this to work, you need to believe the financial world is run by evil hedge funds that have built up absurdly risky short positions on companies like GameStop or AMC Theaters. These evildoers, or "hedgies," expect this short attack to drive the targeted companies into bankruptcy, so they can afford to do illegal things like shorting shares that don't actually exist. What the hedgies could not have foreseen, however, is the rise of r/WallStreetBets (and related subreddits), which made a meme out of building absurdly risky long positions on failing companies.

As the 2021 short squeeze played out, memestock investors latched onto catchphrase "apes together strong." That is, much like the simians in Rise of the Planet of the Apes, they had the power to band together and drive their enemies to their knees. As long as the "Apes" keep buying and holding (against all conventional wisdom and common sense), then the hedgies can't control the share price. Eventually the hedgies have to start closing short positions that they can't afford to cover. Since the Apes refuse to sell, and since the hedgies allegedly owe more shares than there are to buy, the price would skyrocket and never come back down. The hedgies go bankrupt, and yadda yadda yadda, the Apes become rich beyond their wildest dreams.

[Above: In principle, achieving MOASS with GameStop's share price would potentially cause the collapse of the stock market, if not the entire global economy. As far as Apes are concerned, this would be a good thing.]

You may have some questions at this point! I know I certainly do. For one thing, after taking a beating in 2021, why would hedge funds go short on GameStop for three more years, instead of switching to some other, less volatile target? If the hedgies can't cover their naked shorts without paying millions per share, wouldn't it become easier to declare bankruptcy than pay a dime to the Apes? And since MOASS relies on ever-increasing demand for a fixed supply of floating shares, what happens if GameStop decides to issue, say, 45 million new shares, whenever they feel like it?

I'm not sure Apes have ever addressed these questions, or that they ever will. At this point, they're so committed to their crusade against Wall Street that they're suspicious of anyone who interrogates it. If you don't understand their cause, or their strategy, then you're either blind to what's really going on, or you're a fifth columnist sowing disinformation.

In this regard, the Apes aren't too different from Gamergate and QAnon. All three movements revolve around a Big Lie, and use Reddit/4chan culture to create a decentralized campaign to promote that lie. That campaign rests upon a populist mythology about how the establishment and the elites underestimated the resourcefulness of "anons," "gamers," "deplorables," "bakers," and/or "weaponized autism." When these groups think they're winning, it's undeniable proof that the Big Lie is true. When it looks like they're losing, it's because a vast conspiracy is desperate enough to stoop to any level to keep you from learning the Big Lie is true. So one way or another, they're constantly reassuring themselves that they're winning, and seeking that reassurance becomes their primary activity. This in turn enables grifters to shape these movements by finding creative ways to tell them what they want to hear.

Unfortunately we're probably going to be seeing more of this stuff going forward, not less. Since going public in March, Trump Media & Technology Group has behaved like a meme stock, pumped up by retail investors who are less interested in financial planning than in signaling their allegiance to Donald Trump. When the stock fell off, CEO Devin Nunes seemed to take a page from the apes' playbook, blaming the decline on naked short selling.

[Above: Brainworms recognize brainworms]

And yet, this does not make Donald Trump the most delusional idiot running for president of the United States and getting in on grifting Apes. Just this afternoon, Robert F. Kennedy Jr. declared his allegiance to the Apes, and claimed to have invest $24,000 in GameStop. One way or another, the Apes' message of standing up to Wall Street corruption is going to gain traction, even if their investment strategy can't.

#meme stock#gamestop#moass#fringe theories#conspiracy theories#apes#wallstreetbets#superstonk#chan culture#robert f kennedy jr#keith gill#roaring kitty#donald trump

4 notes

·

View notes

Text

Cinematic Moments - Dumb Money 2023

#film#sunyot#sunyotmedia#movies#filmmaking#classic film#movie stills#cinema#dumb money#wallstretbets#wallstreetbets#pauldano#seth rogan#gme#robinhood#robinhood stocks

3 notes

·

View notes

Text

Yumeko would have a field day on r/wallstreetbets

1 note

·

View note

Text

Think of the hedgefunds...

#society#CapitalismKills#ClassWar#workerrights#political#corporate#capitalism#SocialismNow#ClassWarfare#Communism#Communist#statusquo#marxism#GDP#debt#wallstreet#wallstreetbets#GDPgrowth#stockmarket#internationalcommunity#europe#unitedstates#MainstreamMedia#corporateparty#corporatemedia#usa#Neoliberal#socialismnow#communist#capitalismkills

5 notes

·

View notes

Text

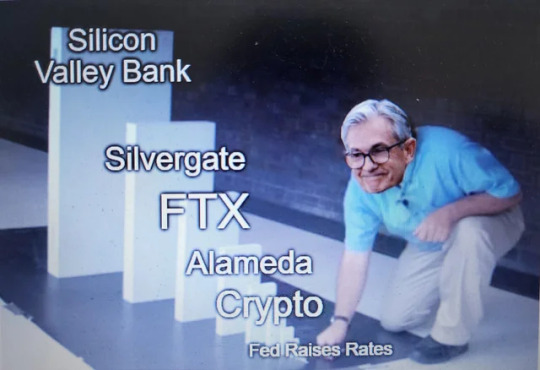

#wsb#memes#economics#bank run#recession 2023#svb collapse#svbcollapse#wallstreetbets#finance#shamelessly stolen from wsb but who gives a shit

4 notes

·

View notes

Text

What else would you do in that time though? The plane is going down. They should appreciate you helping them with stonks instead of taking that precious moment to call them and tell them you love them.

wsb is so fucking funny actually

33K notes

·

View notes

Text

Did this meme just roast your portfolio? 💀🍟 👉 Join PEPO – LinkTree in bio! 🔗

#PEPO #PEPOISFUN #wallstreetbets #eth #wallstreet #tradingstrategies #stockmarketmemes #optionstrader #optionstrading #stonks #profit #digitalassets #stockstowatch #trade #gme #altcoins #btc #memestocks #money #stocks #tesla #bitcoin #crypto #tradingforex #financialmarkets #bitcoins #gamestop #solana #memecoin #memes

#PEPO#PEPOISFUN#wallstreetbets#eth#wallstreet#tradingstrategies#stockmarketmemes#optionstrader#optionstrading#stonks#profit#digitalassets#stockstowatch#trade#gme#altcoins#btc#memestocks#money#stocks#tesla#bitcoin#crypto#tradingforex#financialmarkets#bitcoins#gamestop#solana#memecoin#memes

1 note

·

View note

Text

#keith gill#roaring kitty#gamestop#gme#gme price stock#investing#hodl#kitty#cat#wsb#wallstreetbets#reddit

0 notes

Text

#meme stock#gamestop#diamondhands#roaring kitty#keith gill#t shirts#investing#options trading#yolo#apes#WSB#wallstreetbets

0 notes

Text

Cinematic Moments - Dumb Money 2023

#film#sunyot#sunyotmedia#movies#filmmaking#classic film#movie stills#cinema#dumb money#paul dano#gme#gamestop#wallstreetbets

2 notes

·

View notes

Text

#gme#gamestop#$gme#update#amc#AMCtheatres#$amc#best memes#dank memes#relatable memes#funny memes#tumblr memes#meme#dankmemes#dank#memes#lol memes#keithgill#stonks#stocks#investment#investing#wsb#wall street#wallstreetbets

0 notes

Text

Reddit Stock: The Truth About Reddit going public

#RedditIPO#WallStreetBets#MemeStocks#SocialMedia#Technology#IPO#Investing#Finance#OnlineCommunities#InternetCulture#Gaming#TechInvesting#Disruption#PopCulture#News#Discussion

0 notes

Text

#society#CapitalismKills#ClassWar#workerrights#political#corporate#capitalism#SocialismNow#ClassWarfare#Communism#Communist#marxism#statusquo#GDP#GDPgrowth#wallstreet#wallstreetbets#Neoliberal#debt#britain#unitedkingdom#uk#UKnews#UKJobs#strike#strikers#StrikeHard#communist#capitalismkills#classwar

0 notes