#meme stock

Explore tagged Tumblr posts

Text

Remember when some redditors propped up Gamestop stock to prank Wall Street traders…

only to become an apocalyptic cult, appointing the failed CEO of a pet supply shop as their oracle

and themselves as the righteous faithful out to expose Wall Street corruption through the beleaguered vessels of Gamestop and Bed Bath and Beyond, whose second coming will crash the market and allow the real (not fake) stock owners to exploit a glitch that grants them infinite money, lets them hold the world monetary system to ransom, forces the US government to accede to all their demands, anoints them god-kings, and transforms the world.

No really. This is a comic, tragic, what-the-fuck-is-happening-you-can't-be-serious-oh-hell-they-are-serious video that I highly recommend, along the same lines as that "A BOOMERANG!" takedown of Sherlock. It's funny but it's long, good background for knitting, phone games, or doing chores.

youtube

(The author's "Line Go Up" vid on crypto and nfts is also amazing— but more sobering, as their cultists proponents really do have some impact on the real world.)

24 notes

·

View notes

Text

MOASS

The Mother Of All Short Squeezes, or MOASS, refers to a fringe theory about the stock market. The general idea is that the GameStop short squeeze in Janaury 2021 can be reproduced with even more dramatic profits for memestock investors. Under this theory, it is possible to sustain a short squeeze indefinitely, with the share price of the affected companies rising to, um, infinity dollars.

[Above: A typical MOASS influencer explaining why it would happen soon. This was two years ago.]

True believers in MOASS have awaited this windfall for over three years--Dan Olson called it "Reddit's version of the Rapture." There was a false alarm last week, when the dormant Twitter account of Keith Gill (one of the big names from the 2021 squeeze) suddenly came to life, posting a bunch of hype videos. The price briefly shot up to $64 on May 15, but drifted back down to the low 20s within a few days. Nevertheless, as with failed Rapture predictions, the faithful are undeterred, and continue looking for new signs and evidence that MOASS is coming soon.

[Above: In the 2015 movie The Big Short, Margot Robbie explains how short selling works while sitting in a bubble bath. I figured this picture was close enough.]

In a normal short squeeze, investors who go "short" on a company get caught by an unanticipated rise in the share price. Short investors bet against the company, selling borrowed shares at today's prices, with the assumption that it'll be cheaper to buy back those shares later to reimburse the lender. If the price instead goes up, the short investor is left scrambling to close their position as soon as possible, to minimize their losses. But that scramble creates more demand to buy, driving the price up even higher, applying more pressure to more short sellers.

MOASS is based on the assumption that this cascade effect can go on forever, under the right circumstances. For this to work, you need to believe the financial world is run by evil hedge funds that have built up absurdly risky short positions on companies like GameStop or AMC Theaters. These evildoers, or "hedgies," expect this short attack to drive the targeted companies into bankruptcy, so they can afford to do illegal things like shorting shares that don't actually exist. What the hedgies could not have foreseen, however, is the rise of r/WallStreetBets (and related subreddits), which made a meme out of building absurdly risky long positions on failing companies.

As the 2021 short squeeze played out, memestock investors latched onto catchphrase "apes together strong." That is, much like the simians in Rise of the Planet of the Apes, they had the power to band together and drive their enemies to their knees. As long as the "Apes" keep buying and holding (against all conventional wisdom and common sense), then the hedgies can't control the share price. Eventually the hedgies have to start closing short positions that they can't afford to cover. Since the Apes refuse to sell, and since the hedgies allegedly owe more shares than there are to buy, the price would skyrocket and never come back down. The hedgies go bankrupt, and yadda yadda yadda, the Apes become rich beyond their wildest dreams.

[Above: In principle, achieving MOASS with GameStop's share price would potentially cause the collapse of the stock market, if not the entire global economy. As far as Apes are concerned, this would be a good thing.]

You may have some questions at this point! I know I certainly do. For one thing, after taking a beating in 2021, why would hedge funds go short on GameStop for three more years, instead of switching to some other, less volatile target? If the hedgies can't cover their naked shorts without paying millions per share, wouldn't it become easier to declare bankruptcy than pay a dime to the Apes? And since MOASS relies on ever-increasing demand for a fixed supply of floating shares, what happens if GameStop decides to issue, say, 45 million new shares, whenever they feel like it?

I'm not sure Apes have ever addressed these questions, or that they ever will. At this point, they're so committed to their crusade against Wall Street that they're suspicious of anyone who interrogates it. If you don't understand their cause, or their strategy, then you're either blind to what's really going on, or you're a fifth columnist sowing disinformation.

In this regard, the Apes aren't too different from Gamergate and QAnon. All three movements revolve around a Big Lie, and use Reddit/4chan culture to create a decentralized campaign to promote that lie. That campaign rests upon a populist mythology about how the establishment and the elites underestimated the resourcefulness of "anons," "gamers," "deplorables," "bakers," and/or "weaponized autism." When these groups think they're winning, it's undeniable proof that the Big Lie is true. When it looks like they're losing, it's because a vast conspiracy is desperate enough to stoop to any level to keep you from learning the Big Lie is true. So one way or another, they're constantly reassuring themselves that they're winning, and seeking that reassurance becomes their primary activity. This in turn enables grifters to shape these movements by finding creative ways to tell them what they want to hear.

Unfortunately we're probably going to be seeing more of this stuff going forward, not less. Since going public in March, Trump Media & Technology Group has behaved like a meme stock, pumped up by retail investors who are less interested in financial planning than in signaling their allegiance to Donald Trump. When the stock fell off, CEO Devin Nunes seemed to take a page from the apes' playbook, blaming the decline on naked short selling.

[Above: Brainworms recognize brainworms]

And yet, this does not make Donald Trump the most delusional idiot running for president of the United States and getting in on grifting Apes. Just this afternoon, Robert F. Kennedy Jr. declared his allegiance to the Apes, and claimed to have invest $24,000 in GameStop. One way or another, the Apes' message of standing up to Wall Street corruption is going to gain traction, even if their investment strategy can't.

#meme stock#gamestop#moass#fringe theories#conspiracy theories#apes#wallstreetbets#superstonk#chan culture#robert f kennedy jr#keith gill#roaring kitty#donald trump

4 notes

·

View notes

Text

youtube

If you've heard of or seen the film 'Dumb Money' and thought "Oh, that's what happened with the whole GameStop stock thing..."

No, it isn't. It's all far dumber and less noble than that.

This is Dan Olson putting out another high-quality, two and a half hour essay on what happened and who the major players - or at least named players - were and are. It gets pretty in the weeds but he also helpfully summarizes when possible.

3 notes

·

View notes

Text

Our Diamond Hands Turned to Stone

It was supposed to matter, in the end. Everything I had found, everything I had taken, everything I had taken just for the sake of being able to take more. It was supposed to get me something, after it was all over.

When it was all over, nothing existed. The Earth had been routed long ago, and with no other life we were taught what it truly meant to hunger. All of my children left me, but as they left they assured me they were still mine. It still counted for something.

I used to think it was strange when the humans said the sun would kill us, but when it was time for my reward, nothing else existed to reward me.

4 notes

·

View notes

Text

youtube

#dumb money#gamestop#wall street#movie#film#autograph#q&a#regal#movie theatre#stock#meme stock#Youtube

2 notes

·

View notes

Text

Knuckle tattoos of meme stocks you got in your sleep

@thewritersline

2 notes

·

View notes

Text

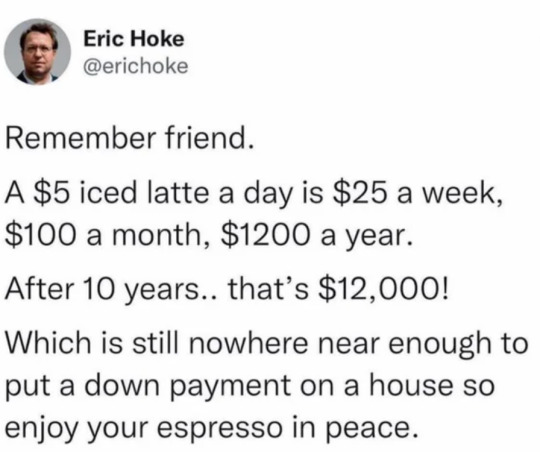

14K notes

·

View notes

Text

Many short sellers have pulled back in recent years, with stocks climbing to new highs and the potential for meme-stock traders to defy financial logic.

-- GameStop Burned Andrew Left in 2021. He’s Betting Against the Stock Again. https://www.wsj.com/articles/gamestop-burned-andrew-left-in-2021-hes-betting-against-the-stock-again-4377cecb

0 notes

Text

Meme stock traders come to the country’s premier venue for corporate litigation on a mission to—well, there’s a lot going on here.

Tesla Inc. superfans vow to protect Elon Musk from the judge who doesn’t think he’s worth $56 billion. Retail investors want a reckoning for the movie theater chain they say treats them like “a piggy bank.”

They’re little guys saving their beloved brands from “a broken system” perpetuated by “bad actors” on Wall Street. They do their own research. They’re an online army. They want their money back. They don’t care so much about winning.

The movement converging on Delaware’s Court of Chancery is an “eruption of human passion and emotion,” said one such investor, Brian Tuttle, a 44-year-old disc jockey from Sarasota, Fla. “Sometimes participation is more important.”

#tesla#elon musk#AMC#meme stock#journalism#news#delaware#legal news#investors#do your own research#trump media

0 notes

Text

#meme stock#gamestop#diamondhands#roaring kitty#keith gill#t shirts#investing#options trading#yolo#apes#WSB#wallstreetbets

0 notes

Text

Bottom left a dragon with a ball in mouth

A crocodile just above a tree

And a soaring bird above

Upper left left the feedings

To capture

#wordsbymm#MMybsDroW#mmybsdrow|wordsbymm#(wordsbymm||mmybsdrow)#a feeding from hashtags#hungry#bird crocodile dragon#crocodile dragon bird#dragon bird crocodile#meme stock

0 notes

Text

youtube

Keith "RoaringKitty" Gill returned to YouTube on June 7, three years after he spearheaded the 2021 GameStop short squeeze, inspired a major motion picture, and rode off into the sunset. The video above, from Atrioc, summarizes all the reasons this didn't go well.

June 7 was a rough day for "Apes," the subset of memestock investors who care less about turning a profit than in winning a war against some imaginary conspiracy of evil hedge funds. For three years they've been rationalizing why they're not getting rich, and convincing themselves that the great RoaringKitty would agree with all their absurd theories if he was still around. When he announced his comeback livestream, the hype was that a) he would confirm their beliefs and b) the stock price would go to the moon. Neither of these things happened.

One of the wackier Ape concepts is that you can own a share in GameStop and refuse to sell, but the evil "hedgies" can still illegally borrow that share to use in a nefarious short attack. So many Apes have exalted the practice of moving your shares from trading platforms, like Robinhood and E-Trade, to the Direct Registration System (DRS) as a defense against this non-existent threat. In April about 75 million GameStop shares--roughly 25% of all the company's floating shares--were registered with DRS, and almost all of those probably belong to Apes. Apes who swear by DRS have always assumed RoaringKitty would be on board with this strategy, as would GameStop CEO Ryan Cohen, whom they believe is sympathetic to their cause.

However, the entire strategy of locking the float in DRS, to keep shares out of the hands of short investors, falls apart if GameStop dilutes the stock by issuing new shares. Apes just assumed that Cohen wouldn't do that to them. But when RoaringKitty returned to Twitter in May, the stock price jumped, so GameStop issued 45 million shares to get some of that money. And on June 7, GameStop went out of its way to take advantage of the RoaringKitty livestream hype to issue another 75 million shares. It's basically a license to print money for the company, but it's bad for the stock price, which is bad for the Apes.

To a normal observer, it's pretty clear that Keith Gill created a situation where Ryan Cohen threw the Apes under a bus. So the Apes were sorting through a lot of cognitive dissonance on the morning of June 7. But they remained optimistic that RoaringKitty's livestream would salvage the day. All the facts on the ground that created fear, uncertainty, and doubt wouldn't matter. With the right words, RoaringKitty could instantly prove all that stuff was fake news to test their faith, and now that faith would be rewarded. After three years of enduring failed prophecy, cooking up fringe theories that fell flat, and digging for clues in all the wrong places, Apes had high expectations that Gill would issue a statement that finally hand them an unambiguous victory. They did not get it.

Gill opened his stream with this weird gag where he pretended to be injured and comatose for about two minutes. If you could figure out what the gag was--that he was being brought back to life or something--it was not funny. If you couldn't figure that out, he just seemed like a delusional idiot. When he finally dropped the act he just started rambling as if it was any other livestream, and he had nothing in particular to talk about. Gill's weird laugh reminded me of Tom Cruise's most unhinged moments. He reacted to the stock dropping as though he was supposed to care but really didn't.

During the stream, Gill shared a screen revealing his investment position. (I mean, he could have altered the numbers on the screen--he even demonstrated that he knows how to do that sort of thing--but to my knowledge he had no motive to do this.) His shares are all in E-Trade, not DRS, and he's made a substantial investment in short-term call options. Either of these facts would be considered heretical to most Apes, according to the canon they've built up since RoaringKitty was assumed into heaven logged off in 2021.

I've been following the fallout of June 7, as Apes try to cope with everything that happened. I've seen quite a few of them struggle to keep the faith, while saying things like "All Ryan Cohen had to do was not do this..." or "All RoaringKitty had to do was just say this..." They don't understand why these guys would take actions that don't make Apes rich. The simplest explanation, of course, is that each of them is in it for himself. (Also, perhaps neither of them is as clever as Apes would have you believe.) But considering that possibility would force Apes to admit that they've wasted a lot of money, and we can't have that! So it's quite a conundrum--it's hard work maintaining a cult when your idols actively work against you.

The most coherent new spin I've seen goes like this: "Shut up and stop complaining, Ryan Cohen and RoaringKitty have a business to run, they don't owe you an explanation." This is popular among the Apes who claim to be uninterested in sick gains, and simply want to invest in a company they love and believe in. They don't care if the stock price goes up. They don't care if they get a return on their investments. They just want to give money into GameStop, and expect nothing in return but GameStop's continued survival. At this stage, you can barely even call what they're doing "investment"--it's more like charity, or perhaps a religious offering.

#roaringkitty#keith gill#gamestop#fringe theories#conspiracy theories#meme stock#meme stock apes#ryan cohen#Youtube

0 notes

Text

Stock images but make it Veritas Ratio.

Stock images are just hilarious, Change my mind. like why are they even doing those things?! Now i have learned that redrawing stock images is my new favorite kind of art Reference used second picture.

#digital fanart#honkai star rail#veritas ratio#hsr#hsr ratio#dr ratio#stock image meme#zerohzart#digital art#star rail ratio#hsr fanart#my art#ratiorine#art

7K notes

·

View notes

Text

youtube

Dumb Money (2023) | Ending Credits

Title Design by Jeff Kryvicky @ COLLIDER STUDIO NYC

#Dumb Money#Movie#film#hollywood#day trader#investment#stocks#wall street#wallstreetbets#reddit#social networks#social media#internet#meme stock#penny stocks#day trade#Title Design#Youtube#typography#graphic design#motion graphics

1 note

·

View note