#vrbo travel insurance

Text

Vrbo Travel Insurance for hosts

Vrbo Travel Insurance for hosts

While you are supposed to unwind on a holiday, traveling does come with some risk. Enter travel insurance.

Travel plans change. Trips get canceled. Property can break.

To ensure that both hosts and guests have a memorable experience, Vrbo offers a number of ways that they can safeguard themselves against most unfortunate events. Without insurance, you run the risk not only of incurring…

View On WordPress

#Holiday Rentals#homes for rent#Rent & Relax US#Rentandrelaxus#Short term rentals#vacation homes#vacation rental#Vacation Rentals#vrbo travel insurance

0 notes

Text

Discover the Charm of Pet-Friendly Vacation Rentals in Flagstaff, AZ

If you're planning a getaway to the picturesque city of Flagstaff, Arizona, and don't want to leave your furry friend behind, you're in luck! Flagstaff offers a wide array of pet-friendly vacation rentals, including cozy cabins nestled in the tranquil forests of Northern Arizona. From charming mountain retreats to spacious lodges with breathtaking views, there's something for every pet owner looking to explore the beauty of Flagstaff with their four-legged companion.

Exploring Pet-Friendly Cabins in Flagstaff, AZ

cabins in Flagstaff az, known for its stunning natural beauty and outdoor recreation opportunities, is the perfect destination for travelers seeking a pet-friendly getaway. Many of the vacation rentals in Flagstaff welcome pets, allowing you to bring your beloved dog or cat along on your adventure. Whether you're looking for a secluded cabin surrounded by towering pine trees or a rustic lodge with modern amenities, you'll find plenty of options to choose from when searching for pet-friendly accommodations in Flagstaff.

Benefits of Pet-Friendly Vacation Rentals

Choosing a pet-friendly vacation rentals pet friendly in Flagstaff offers numerous benefits for both you and your furry friend. One of the primary advantages is the ability to enjoy your vacation without worrying about leaving your pet behind. Instead of arranging for pet-sitting or boarding, you can bring your pet along and create lasting memories together. Many pet-friendly vacation rentals also offer amenities specifically designed for pets, such as fenced-in yards, pet beds, and pet-friendly hiking trails nearby.

Exploring Flagstaff with Your Pet

Flagstaff is a paradise for outdoor enthusiasts, and there's no shortage of activities to enjoy with your pet by your side. Take a leisurely stroll through one of Flagstaff's many pet-friendly parks, such as Buffalo Park or Thorpe Park, and enjoy the fresh mountain air and stunning scenery. If you're feeling adventurous, embark on a hike along one of Flagstaff's pet-friendly trails, such as the Arizona Trail or the Lava River Cave Trail, and explore the beauty of Northern Arizona together.

Booking Your Pet-Friendly Vacation Rental

When searching for pet-friendly vacation rentals in Flagstaff, it's essential to consider factors such as location, amenities, and pet policies to ensure a comfortable stay for both you and your pet. Many vacation rental websites, such as Airbnb and VRBO, allow you to filter your search results to show only pet-friendly properties. Once you've found the perfect rental, be sure to communicate with the property owner or manager to confirm their pet policy and any additional fees or restrictions.

Tips for Traveling with Pets

Traveling with pets requires some extra planning and preparation, but with the right approach, it can be a rewarding and enjoyable experience for both you and your furry friend. Here are a few tips to help make your pet-friendly vacation in Flagstaff a success:

Pack essential items for your pet, including food, water, bowls, toys, and bedding.

Research pet-friendly activities and attractions in Flagstaff ahead of time and plan your itinerary accordingly.

Respect local leash laws and clean up after your pet when exploring public areas.

Be mindful of your pet's comfort and well-being, especially in extreme weather conditions.

Consider purchasing pet travel insurance to protect your furry friend in case of emergencies.

Experience the Beauty of Flagstaff with Your Pet

With its stunning natural landscapes, pet-friendly amenities, and endless outdoor adventures, Flagstaff, AZ, is the perfect destination for a vacation with your furry friend. By choosing a pet-friendly vacation rental in Flagstaff, you can enjoy all that this charming city has to offer while creating memories that will last a lifetime. So pack your bags, grab your pet's leash, and get ready for an unforgettable adventure in Flagstaff!

0 notes

Text

Maximize Your Adventure: 3 Simple Savings Tips for Travel!

Lollapalooza incoming! 🎧🎶

Summer is here and it’s time to travel. My friends and I are heading to Chicago to get Lollapalooza checked off our bucket list. Now that it’s traveling season, I wanted to share a few things that can help you maximize your travel budget.

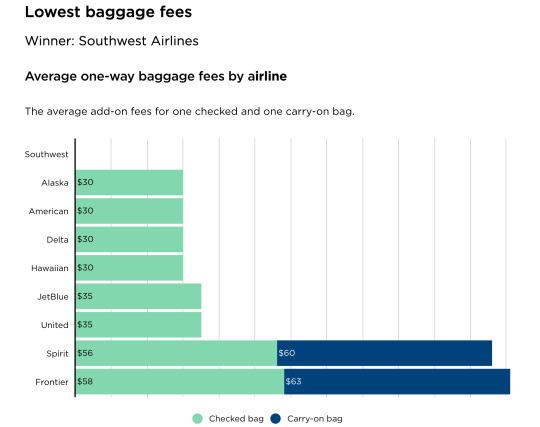

1. Baggage fees

(https://www.nerdwallet.com/article/travel/which-airlines-have-the-best-and-worst-fees#lowest-baggage-fees)

This is a graphic from NerdWallet illustrating which airlines have the lowest bag fees. I admit, Southwest does have a cult following of flyers that can be a little…too enthusiastic about their preferred airline, but numbers don’t lie. Whether you’re traveling by yourself or with a family, 2 free checked bags is a simple way to save yourself some cash.

2. Public Transportation

Once you arrive at your destination, whats the best way to get from point A to point B? Local public transit might be your answer. Since we’re heading to Chicago I’ll use the Chicago Transit Authority (CTA) in this example. A 7 day Chicago Transit Authority pass costs $20.

In contrast, according to Expedia, renting a car will run you about $52/day ($364 for the same 7 days). And that doesn’t include cost of gas, parking, and insurance on the car which the reps will inevitably try to upsell you 😒

Discovering a new city can be overwhelming, time-consuming, and costly. However, with local transit at your fingertips, removes all the hassle, allowing you to relish and appreciate your stay to the fullest.

3. Travel with friends

Late night food, drinks, laughs, and excessive amount of IG stories. Traveling with friends is not only a blast, it's cost effective! A hotel in downtown Chicago would run us about $360/night! Opting for a Vrbo in the same area cut the cost from $360 a night to $75 a night. You know how many more deep dish pizzas we can buy with savings like that?

With that being said thanks for reading, I hope this was helpful! Your feedback is 100% welcome and appreciated. Safe travels!✈️

#PersonalFinance#Finance#Budgeting#Savings#SavingMoney#FinancialTips#SmartSpending#Travel#Chicago#Lollapalooza#Adventure#Explore#BucketList

1 note

·

View note

Text

Get Best Vacation Rental Sites for Owners

Have you just purchased a property or have a family lake house on the outskirts? You don’t want to waste a fine property in the finest location and that’s where the best vacation rental sites for owners come into the picture. The best ones not only list your property well but also looks into its growth and bookings.

Through this blog, we will enlighten you on what to see while picking the best vacation rental site for owners or the best trip planner website. While concluding we will list down 4 more alternative websites to go for other than Trip Angle for your property listing.

Which to Pick?

Wider and better reach: Vacation rental sites bring in a lot of possible vacation enthusiasts who are actively looking for places to stay on vacation. A spot that they can call home during the vacation is the catch. By putting your property on the best travel planning websites, you can reach a larger audience and make it more visible.

Target Audience: Filters and search choices on vacation rental sites let stayers choose their preferences, like location, amenities, and property type. This makes sure that your home is shown to people who are more likely to be interested in what you have to offer. The best travel planning website will have the necessary filters and the options to customize the filters. Keep in mind, filters change according to preferences.

Increased bookings: The best vacation rental sites for owners are made to make it easy for guests to check availability, make plans, and talk to property owners or managers beforehand. No one wants last-minute hustle with long paperwork. When compared to other ways of listing, this ease often leads to more bookings.

Listing Analytics and Insights: Many vacation rental sites give you data and information about how your property is doing, such as how many views, requests, and bookings it gets. These insights based on data can help you make smart choices to improve your listing and make your home more visible.

Online Booking and Payment Processing: Many sites for vacation rentals have safe ways to book and pay online. This not only makes things easier for the guests but also makes sure that the deal goes smoothly and safely for both sides.

Verified Reviews and Ratings: Most sites for vacation rentals have a way for guests to write reviews and give ratings, so they can talk about their experiences. Positive reviews and high ratings can do a lot to improve the image of your property and bring in more potential guests.

Professional Presentation: What you show is what you sell. Guests or vacationers follow this closely. They will only click on your property when the pictures are high-quality and have likely views. Most sites for vacation rentals have tools and templates to help you make professional property ads. You can show off the best parts of your holiday home by showing off its features, amenities, high-quality photos, and even virtual tours. Do not forget to play with the content, this makes the task easy.

Pricing and Availability Management: Many vacation rental sites have tools that let you set prices, change prices based on demand or the time of year, and quickly update availability calendars. This gives you more ways to make money from your home.

Customer Service: Best travel planning websites with a good reputation usually have customer service teams that can help both renters and property owners. They can help with questions, booking problems, and other issues, making sure that everyone has a smooth and nice time.

Additional Services and Features: Some holiday rental sites offer extra services and features, such as help with property management, insurance coverage, cleaning services, and more. These extra services can make it easier to rent and give you more peace of mind.

Top list of travel websites to go for:

Trip Angle

Booking With Ease

Airbnb

Vrbo

Booking.com

Closing Guide!

Vacationers are picky and you got to pick a fine to make the property booked. For doing this you surely need an experienced team of experts and the best trip planner website. Get in touch with the team of Trip Angle and figure out how we can be your best go for.

#best travel planning websites#best family vacations spots in usa#list of travel websites#best sites for traveling#best trip planner websites#Rent by owner in las vegas#home for rent by private owners#houses for rent by owner san antonio#Best Vacation Rental sites for Owners#vrbo panama city beach fl#airbnb in florida with private pool

0 notes

Text

Why Buying A Spanish Property For Airbnb Rental Is A Good Investment – Foxes

People are increasingly interested in renting property for their holidays rather than staying in hotels. This is especially true in the aftermath of the Covid-19 pandemic when people are keen to avoid crowded places and have more space to themselves. Sites like Airbnb have made it incredibly easy for people to rent out their property. Not only can you purchase property that you can live in yourself, but you can also purchase property purely for investment purposes.

There are many reasons why buying property for Airbnb offers a good return. For one, it’s a relatively low-risk investment. Unlike stocks and shares, the property is a physical asset that will always retain value. Even if the property market crashes, you will still have a property that you can sell or rent out.

Another reason why buying property for Airbnb is a good investment is that it’s a relatively easy way to get started in property investing. If you’re not sure whether you want to commit to becoming a landlord, then buying a property for Airbnb is a great way to dip your toe in the water.

Finally, it can be quite lucrative. If you buy a property in a popular holiday destination, you can charge high rates for summer periods. This means that your investment could easily earn you a healthy return.

On that particular point, Malaga and Andalucia are popular holiday destinations, and there is a strong market for both long-term rentals and holiday rentals. Buying property in these areas can be a wise investment, as there is a high demand for rental property and prices are relatively affordable.

A turnkey property is particularly popular, as it offers a hassle-free way to invest. This type of dwelling is usually sold fully furnished and often comes with a rental management agreement, making it easy to generate income.

Holiday home renting platforms

While Airbnb isn’t a new concept, it has exploded in popularity in recent years and is now one of the most popular ways to rent a property. If you’re thinking of buying property for Airbnb, or other platforms, there are a few things you need to know.

First of all, Airbnb offers a great way to make money from your property. You can charge high nightly rates and generate a significant income.

Airbnb isn’t the only platform either. There are many other similar platforms that you can use to rent out your property, such as Bellvilla and VRBO.

More benefits of using platforms such as this mean that you can:

– Reach a global audience of potential renters

– Enjoy a high degree of flexibility in terms of pricing and availability

– Manage your property yourself, or outsource the management to a professional company

Another thing to keep in mind when using a platform is the extra costs. For example, you will need to factor in the cost of cleaning between each rental period, maintenance costs and laundry

You will also need to make sure that your property is properly insured. Most standard home insurance policies won’t cover property rented out in this way, so you will need to take out specialist Airbnb insurance. This will protect you against any damage caused by guests during their stay.

So, how do you make your property stand out on Airbnb?

There are typically two things that stand out to people when they search on Airbnb and similar platforms – cost and aesthetics.

Having a property that is beautiful and “Insta-worthy” is a big draw for holidaymakers and travelers, but also ensures that it offers good value for money when compared with hotels in the area.

It’s important to look for a property that has a “wow” factor, as this is what will make it stand out from the competition and get people booking.

And while you don’t need to break the bank, it’s important to remember that you get what you pay for when it comes to property. Investing in a lower-quality property may save you money upfront, but it could end up costing you more in the long run in terms of both bookings and maintenance costs.

Find your dream investment property

We have some incredible property opportunities available in some of the best locations across Malaga and Andalusia.

Get in touch with us today to find out more about how we can help you make your property investment dreams a reality.

For more information visit our website: https://foxes.es/2022/09/why-buying-a-spanish-property-for-airbnb-rental-is-a-good-investment/

1 note

·

View note

Photo

Car insurance relief might be coming; Why travellers want more from Vrbo: CBC's Marketplace cheat sheet https://canada.birblog.net/news/car-insurance-relief-might-be-coming-why-travellers-want-more-from-vrbo-cbcs-marketplace-cheat-sheet/ CBC's Marketplace rounds up the consumer and health news you need this week. #canada #canadanews #corona #canadaslondon #toronto #torontonews #torontonewspaper #torontoblog #canadablogger #canadabloggers #canadablog #canadapolitics #canadaschools #canadasports #canadasport #canadacity #canadacollege #worldnews #worldnewstonight #worldpolitics Car insurance relief might be coming; Why travellers want more from Vrbo: CBC's Marketplace cheat sheet | CBC News

0 notes

Text

Here is a Detailed Guide to Create an App like Airbnb

Do you also have a Home-Away-from-Home idea and looking to get a replica of a giant in the industry-Airbnb? If yes, then you just need to spend 8 minutes to learn how to build and develop an application like Airbnb for vacation rental.

Although there are rumors that the vacation rental industry has become oversaturated. But Unicorn in the market like Airbnb currently owns only 10-15% of the vacation rental market, which means there is still a lot of space for another unicorn to disrupt this niche.

So, now the question is how to create an app like Airbnb and how much heavy it will be for your pocket. Here is a full guide that can help you build the same model as Airbnb to launch your startup.

This blog covers:

What is Airbnb?

Fundings of Airbnb

Why you should consider building an app like Airbnb?

Who are Airbnb Competitors to take into account?

How Airbnb works?

Airbnb business model

Airbnb results

How to make an app like Airbnb?

Airbnb features and costs to develop them

Team and Technologies

Final Estimate to Create an App like Airbnb

Let’s dive in:

What is Airbnb?

Airbnb is one of the best and popular homestay platforms, which through its property rental service allows travelers to stay at the local’s place and make the experience better for both hosts and guests. With its headquarters in San Francisco, the company operates online hospitality and online marketplace service all over the world through web and mobile applications. The members can use the services to offer homestays to tourists visiting their place.

It took a long journey of 9 years for Airbnb to generate sustainable revenue out of its product, and to turn it into the mobile application, which was initially started with a website.

Fundings of Airbnb

This homestay app connects travellers who are seeking comfortable and affordable places to stay with homeowners who have such inspiring places around the world. Airbnb has more than 4,500,000 listings around 191 countries and 65000 cities.

Company had already funding from 15 companies round to date and has raised $4.4 billion.

Why you should consider building app like Airbnb?

Applications like Airbnb and Uber are considered to be the best examples of progressive ways of human-within society interaction. Two has successfully earned unicorn status because they aided in building a “sharing economy” model. Airbnb helps travellers in getting the property for stay at cheap cost and also an opportunity to host to earn by renting their property.

There is significant growth in terms of vacation rental demands in travel industry; however, the supply has not increased to that level. Hence, there is wide scope to venture this niche by launching your startup with application like Airbnb.

Who are Airbnb Competitors to take into account?

Airbnb is not the only platform has put its foot in the game-changing travel format. Some of the companies, which can also considered while building an application like Airbnb:

1. HomeAway: It holds over 1 million global listings and offer similar services like Airbnb. There are also a few additional services that it offers like an insurance program. It operates some other sites also like TravelMob, VacationRentals and VRBO.

2. Roomorama: This app ask users to share their personal ID’s, bills and also personal pictures to ensure that the application is safe for guests.

3. FlipKey: This is a company owned by TripAdvisor and has a large base of users. They offer more than 5000 special deals every day to maintain the loyalty of users.

How Does Airbnb Works?

Airbnb has two types of users-guests and landlords.

How Does Airbnb Work for Guests?

Step 1: The user goes to the web or mobile applications, and registers in as a guest.

Step 2: Next, they complete the profile and add necessary data as ID number, profile picture and more.

Step 3: The client can choose appropriate place to live like type of space, price, location and more.

Step 4: The guests requests a stay and receives confirmation for the same.

Step 5: It is required to pay for the reservation before using the service.

Step 6: The final step is to enjoy the stay.

How does Airbnb work for hosts?

Step 1: The users are required to register as a host and confirm that they over the age of 18.

Step 2: After that, user can add the property on Airbnb. The host can add data about the accommodation like type of apartment, location and number of guests who can accommodate.

Step 3: Landlords are required to upload the real pictures of the apartment and also mention the price.

Step 4: When the guest requests a stay, discuss all the details like clean standards, quiet hours and a host can start a conversation.

Step 5: If everything is fine, the host approves the stay. However, landlord also has an opportunity to reject the stay if it is required.

Step 6: The host receives the payment in 24 hours after the check-in by guests.

Airbnb Business Model

Airbnb offers applications for two major mobile platforms i.e. iOS and Andorid, and also have a web application. Airbnb also supports smartwatches so that users can receive a notification faster and stay up-to-date without any changes.

The company generates its revenue by the booking fees that it receives:

· For every transaction, host has to pay 3% to Airbnb.

· Guest has to a pay 6-12% of the booking fee, depending upon the size of the reservation.

Airbnb Results

ü According to SimilarWeb, Airbnb is the fourth downloadable in Travel niche

ü On average, more than 2 million people chose Airbnb every day.

ü Airbnb generated around $1.26 billion in revenue in 2019, which means a growth of around 14.7%

ü The service is available in 191 countries, offering around 7 million accommodations.

ü Airbnb has more than 150 million active users across the world.

How to Build an App like Airbnb?

There are several steps to follow while building an application like Airbnb:

Step1: Make a business plan:

Coming up with an idea is not enough. You need to decide your goal, follow the business plan and stay organized.

Step2: Find the developers:

To create Airbnb clone app, you need experienced web development. You can go for building in-house team or outsource your development needs to countries like India.

Step3: Build a User-friendly Design:

The Airbnb app interface is easy-to-use and intuitive. Users tend to abandon applications that have an interactive design, so make sure to pay attention to your UI/UX design.

Step4: Integrate essential features:

Initially, you can consider building application like Airbnb with some basic features. Get the MVP version of the application, understand the needs of users and get feedback. After you have find what users are looking for, you can consider adding advanced features to make your application unique.

Step5: Test the App

Before launching an application, make sure your development team test the application carefully to eliminate the bugs.

Step 6: Update regularly

Maintain the app regularly and keep adding new and exciting features.

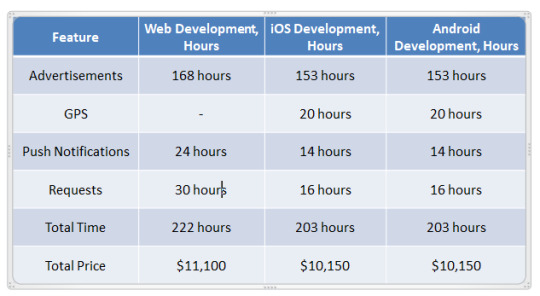

Airbnb App Features for the Guest and Their Cost

Registration:

To start using the application, the guest would be required to first register on the application. The basic model would include providing users with email and password registration. Additionally, it is important to create a “Term and Policy” screen since users should agree with the policy of use.

Login:

Make sure to add provide users with options like login with Google account, Facebook and email. Each integration takes approximately 8 hours of development. In addition to this, it is important to add functions like “Log-out” and “Forgot Password” to make sure your application is user-friendly.

Search:

It is better to add an advanced search system to option, where user can find their temporary dwelling applying various filters like the number of guests and date of the trip.

Favorites:

This feature offers users the option to add their favorite places to the list. After that, they can select the desired one from their “favorite marked” accommodations.

Profile:

An app like Airbnb has two types of users-guests and hosts. Make sure to add a feature so that both guests and hosts can edit the profile and add personal data like name, age, sex and so on.

Chats:

With chat features, guests and hosts will find it easy to communicate and discuss things like location after requesting a stay. Guests can ask for photos of the property before visiting the place. Moreover, developers can also add various statuses like reading and typing to make the application more user-friendly.

Payments:

It is good to offer various payment methods to make the process easy for the user. Also, there should be an option available to add and remove cards.

Order:

The last feature of any booking service application is requesting for a stay. The users select the house to stay in and should be able to book it if the accommodation on the required data is available.

Airbnb App Features for the Host and Their Cost

Accommodations:

Airbnb lets the landlord create an ad about their accommodation. They are required to describe all the details like the number of guests, the apartment type and more. Additionally, it is required to upload photos and videos, and set the price of listed property according to per night.

Notifications:

This function is useful to make Airbnb more convenient. For instance, as soon as the guest made a request, the owner can get an instant notification. Hosts can also be notified about booking changes, unchecked requests and more.

GPS:

Clients can look through the location where they want to stay in to find apartments near cafes and exciting sights.

Here are some advanced features that you find on Airbnb application, which you can consider adding at a later stage:

Superguest and superhost

Multiple language support

Currency Converter

Airbnb Plus, which provides high-quality and well-equipped homes.

Team and Technologies to Build an App like Airbnb

Building web and mobile application like Airbnb require the following specialists:

Business Analyst

Project Manager

2 Android Developers

2 iOS Developers

UI/UX Designer

Back-end Developers

Front-end Developers

QA Engineer

To build a mobile application like Airbnb, the developers must be skilled in trending programming languages such as Kotlin (Android) and Swift (iOS). For web development, you require software engineers who know Javascript.

Tech Stack for App like Airbnb

To build an app like Airbnb, you need the following tech stack:

Programming Language: Kotlin, Swift and Javascript

Front End Frameworks: React.js, Express.js and Angular

Backend Frameworks: Ruby on Rails, Node.js, Meteor.js, Django

Server-Side Technologies: Azure, OpenStack, Google Cloud, DigitalOcean

Network-level caching services: Redis, Nginx

Databases: MSSQL, MySQL, Cassandra, Azure DocumentDB, MongoDB.

Final Estimate to Create an App like Airbnb

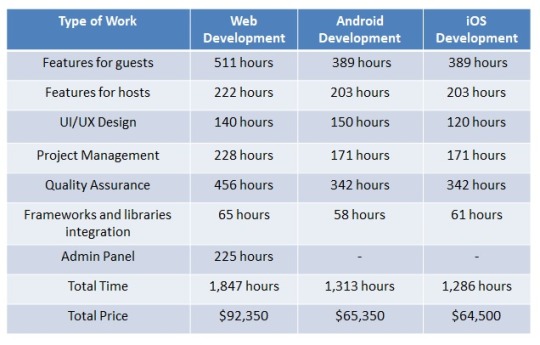

Considering all the factors, the final cost of building an app like Airbnb can reach approximately up to $92,350 for web version and $65,650 for mobile app (one platform)

Summing Up

Making an app like Airbnb is a different thing and scaling it to get a million users is a completely different thing. In this guide, I have explained the process, all the necessary features and technology stack that is required to build an app like Airbnb. However, if you are still struggling to start with the MVP or develop a prototype, feel free to get in touch with us.

1 note

·

View note

Text

What’s Involved in Using Your Home or Vacation Property as a Short-Term Rental?

You only use your California Wine Country cabin for two weeks out of the year. Or you have an entire floor of your main residence you rarely step into. Or you’re in an economic crunch and need help paying your rent. Whatever the situation, you’re considering turning your vacation property or residence into a short-term rental home to pick up some extra cash. What are the ramifications, including the possible effect on your homeowners insurance? How do you go about making money this way?

Let’s get some straight answers, starting with a basic definition.

What is a Short-Term Rental Home?

Think Airbnb or lesser-known competitors such as HomeAway or Vrbo. All might have different rules and regulations, but basically, these are all online platforms through which you can rent out your home to screened strangers for a day, a week, or even several days a month. You can do it on an occasional basis, or regularly.

This might be possible whether you own a house, a cabin in the woods, a condo on the beach, an apartment, a houseboat, or virtually any other form of living space.

Of course, you must first see if your homeowners association, or condo board approves of using the property in this way. Then check whether city zoning regulations or other local ordinances allow it. This could mean a bit of research, a trip to city hall, and paperwork to fill out.

Assuming you have no bureaucratic hurdles in your way, it’s a matter of preparing your residence for short-term rentals, promoting the property, checking to see whether your guests will be covered by your home insurance, and setting a rate, among other responsibilities.

How Much Can You Make Turning Your Property into a Short-Term Rental Home?

There are multiple factors that determine a rental rate that will get you guests and turn a profit. These include the size and condition of your space, the desirability of the location, and what the local market bears for similar rentals.

Depending on the rate you can charge per night, Airbnb can be a lucrative way to expand your income stream. On its website, Airbnb currently says that “hosts” in the Los Angeles area earn an average of $240 a night. Hosting an average of 24 nights a month might theoretically gross a whopping $5,760 a month.

Of course, you’ll make much more with a lovely home in a prime neighborhood in Los Angeles, San Francisco, or San Diego than you might with a congested fixer-upper in a small town outside of the Golden State’s main travel and tourist destinations. Or if you only want to rent out your residence while on your annual two-week vacation. Or you wish to only rent a room rather than the entire property.

In other words, there are multiple factors involved in figuring the rate you can charge and the sort of monthly or annual income you’ll derive from your short-term rental home.

You might start by finding properties on rental websites similar to yours in location, size, and condition to set your rates accordingly. Or use the Airbnb rate calculator as a starting point.

So Turning Your Property into a Short-Term Rental is a Financial No-Brainer, Right?

Just because you can get a certain rate doesn’t always mean that you should. In some circumstances, you might consider whatever you make to be bonus money that you otherwise wouldn’t have seen.

But on the other hand, there are costs you can’t avoid. You might need to hire a cleaning service, buy extra linens and towels, put your valuables under lock and key, hire a photographer to shoot your property for promotional purposes, design and print a household information brochure, and make other investments in time and capital before your first rental, and on an ongoing basis.

Then There’s Your Home Insurance Policy to Consider

If you take a quick look at your insurance policy, you’ll probably see that it covers damages to the home by visitors or injuries to them. But that’s usually not the case if you’re regularly renting your living spaces to strangers for profit.

You’re likely to need to add an endorsement to your policy, at an additional cost.

You might hear about California homeowners making thousands of dollars a month as short-term landlords, but there are also cautionary tales about renters throwing illegitimate parties and virtually tearing the property down.

What that means is that you don’t dare neglect to first discuss your coverage needs with your insurance agent. Explain what you intend to do, and find out the additional cost of adding liability insurance and other benefits to your policy. Do this before making any commitment.

If it increases your financial exposure to put and keep your property on the short-term rental market, it might not make much sense. On the other hand, if you have a desirable home and location, and you can earn a high rate at minimal risk and labor, Airbnb might represent a handsome second income or a way to save for an expensive vacation or big-ticket item.

Find Affordable Home Insurance Quotes Online Today

Your first step should always be to contact your independent insurance agent at Freeway Insurance. Find out what effect your short-term rental home plans will have on your home insurance policy. Find a fast and free home insurance quote online, call us at (800) 777-5620 or check out our California locations page to find an agent near you for an in-person meeting.

0 notes

Text

What to Consider Before Turning Your Property Into a Vacation Rental

Do you have a second home you’re not using often, or currently have a house on the market that’s just not selling? If so, turning your former living space into a vacation home is a great option! It’s an excellent way to make some money with your other home and offer new families the chance to rent it while traveling.

But is there anything you should do before renting? What style and legal aspects are there to consider? Here are eight tips to think about before turning your property into a vacation rental.

1. Local Demand

Once you start thinking about transforming your home into a vacation getaway, check out Airbnb, Vrbo, and other rental services. Is there a lot of competition in your area? If there is, can you offer something more attractive than the other rentals? Additionally, look at the appearances of these houses and see what kinds of updates you’ll have to make.

2. Legal Responsibilities

Once you start renting out your property, you become a landlord. There are some things to be aware of when this happens.

First, research your local or state government and see if rentals have any regulations. They most likely will, so you’ll need to follow those guidelines in order to remain within the requirements. Your homeowner’s association may also be interested in the status of your home, so check with them before making any preparations.

Also, it’s a good idea to purchase landlord insurance. While state laws don’t require it, it does a lot to protect you. A standard insurance plan covers:

Hail, fire, and wind damage

Injury

Loss of rental income

Personal property

You can also adjust your plan to include theft, vandalism, flooding, and repairs for building codes. Investing in solid insurance will help you run your vacation rental smoothly.

3. Necessary Licenses and Permit

The American Apartment Owners Association nationally requires two licenses for you to rent your home to others legally.

Certificate of Occupancy

This license certifies your home meets the requirements of building and zoning laws. It also declares your property fit to house residents.

Housing Business License

What kind of license you receive depends on what you are trying to rent out. Most states require housing business licenses for units to operate as a business, so check with your city for which kind to apply for.

Along with a certificate of occupancy, you will also need to file a building permit. Each state has different requirements to rent out your property, as well as fair housing laws. Check with local and state governments to ensure you have all the proper paperwork before renting.

4. Repairs

If you’re lucky, your local regulatory authority did not find any changes you need to make to suit renters. But they’re likely going to require some repairs, or you might decide to make some anyway.

Talk to the authority checking out your home about any repairs you’d like to make so they can ensure it will be up to code. You should probably replace anything outdated or that isn’t functioning correctly. A fresh coat of paint is a good place to start.

5. Upgrades

Find ways to make your vacation rental one-of-a-kind. Unique features will encourage more people to choose your home. So, as you’re looking at the other properties around you, think about features to add that will make yours memorable. It could be something simple like freshening up the pillows and blankets or as big as adding a new room. However, stay aware of how much these upgrades will affect the rent.

6. Personal Items

You should take any personal things like family photos and important belongings out of the property. You want to create the image that the renters are living here for as long as they’re staying.

Leaving sentimental items might give the impression you’re still living there, which can be uncomfortable. It also helps you feel secure in knowing no one will take anything from the rental that’s precious to you. Whatever you’re worried about losing, you should remove.

7. What to Charge

Once you’re open for business, you’ll need to figure out how much you’ll charge for your rental. Whether you’re renting on a nightly or monthly basis, there’s a lot to consider when figuring out the rent. A high rent might mean more money for you but fewer leads, while a low rent won’t yield any profit. Some things to think about are:

Your mortgage obligation

Ongoing maintenance and repair costs

Layout and size

View and desirability

If you need help deciding, try looking at other vacation homes near you or ask for a realtor’s opinion. Setting the rent at a fair price will increase interest in your rental.

8. Rules

There might also be some rules you want to set for the property – but keep in mind that too many rules might be a deterrent. What would you want your tenant to know before they arrive? For example, maybe you’d like them to wash the sheets before they leave or maybe you want to emphasize a pet policy.

These are the kinds of things you should outline for your renters. Welcome books are great ways to display any rules your tenants may need for the best stay possible.

Transform Your Property Into a Vacation Rental

Converting your home into a vacation home for rent is a fantastic opportunity. Being aware of the legal requirements and things you can do to spruce up your property will help your process. If you’ve been thinking about turning your home into a vacation spot, utilize these tips to get started!

0 notes

Link

via Real Estate

atOptions = { 'key' : '8915950b7eab0ff7cbce41f1585deac8', 'format' : 'iframe', 'height' : 90, 'width' : 728, 'params' : {} }; document.write('');

TO GO WITH AFP STORY by ELOI ROUYER A woman browses the site of the American housing-sharing giant Airbnb on a … [+] tablet in Berlin on April 28, 2016. – Berlin will restrict private rental of properties through Airbnb and similar online platforms from Sunday, May 1, 2016, and threaten heavy fines in a controversial move aimed at keeping housing affordable for locals . (Photo by John MACDOUGALL/AFP) (Photo credit should be JOHN MACDOUGALL/AFP via Getty Images)

AFP via Getty Images

Short-term rentals are now on the rise in every major U.S. city thanks to popular home-sharing apps like Airbnb and VRBO, and buying homes and turning them into investment properties has become a popular tactic to generate additional income.

However, the housing market has reached new heights of competitive offerings, with numerous homes closing at 15%, 25%, or even 50% above demand.

With so much competition, does it make sense to buy to invest – or is there too much risk involved?

Buying a house for Airbnb – is it worth it?

House prices have reached a fever pitch. In 2020 alone, the median home price in the US rose by 12.8%. In Washington, DC — an ever-popular tourist area — homes are selling for an average price of $655,000, with some neighborhoods exceeding the $1 million average sale price for the first time.

While historically low mortgage rates have boosted purchasing power, the lack of available homes has led to fierce competition among buyers. The winning bids were as much as 50% higher than the demand for homes in good condition and in desirable areas. Pushed to the limits of what they can afford, many buyers do the unheard of: forgo unforeseen inspections and write “love letters” to win over sellers.

This dynamic took place to varying degrees in all the markets in which Houwzer operates in the Northeast and Florida. People who successfully buy a home almost always get it for too much, and often the buyer makes up for the difference between the sale price and the appraised cash value.

The average Airbnb rental property generates more profit per year than the average home of the same size in the long-term rental market, and short-term rental income can be very lucrative (landlords earn an average of $924 per month, but this includes part-time rentals and single rooms). It is possible to do this as an afterthought for years, allowing owners to pay off their mortgage faster and generate a little extra income.

That sounds like a nice setup: but what happens if things go wrong?

When Covid-19 hit, it caused a massive disruption to the travel industry. Overnight, Airbnb hosts that previously made thousands of dollars in revenue each month saw their year-long ads disappear. Airbnb went back and forth on its policy, ultimately allowing many guests to cancel at the last minute. Hundreds of hosts, representing more than 10,000 listings, are now taking legal action against Airbnb.

While Covid-19 was a one-off event, it highlighted the potential dangers of relying on tourism and an online rental property platform. If homeowners run into trouble, Airbnb is likely to provide limited assistance, while also claiming limited liability. And past success is no guarantee for future bookings.

Anyone entering the market now with the intention of renting out their home must ask themselves: how many months can they cover the mortgage, insurance and costs for a second home, without receiving additional income from it? And with so many homes selling for well above their sale price or appraisal, how much cash are willing to invest in this investment?

Problems with Airbnb before Covid-19

While Covid-19 made some of Airbnb’s biggest drawbacks more apparent, many problems were already simmering in the background.

Partying is a constant problem for neighbors of Airbnb rentals in Philadelphia — and the platform removed or suspended dozens of ads for violating party policies in November alone, according to The Philadelphia Inquirer. The problem is hard to avoid, as most guests won’t tell their hosts that they’re going to have a ton of raw guests. Property owners can find that out the hard way when their account gets suspended and they lose several weeks in revenue.

Regulations have also caught up with Airbnb, and something to consider is whether future legislation could hinder your ability to monetize. The topic of affordable housing is becoming as hot as the correspondingly hot real estate market, and as long as there is a housing shortage, major cities will come under increasing pressure to regulate the short-term rental sector.

In Philadelphia, a city council bill was introduced in February to further regulate rent in the city, requiring operators to obtain licenses for commercial activities, as well as limited licenses for lodging operators for $150 per year. And in May, New York City introduced a bill that could drastically reduce the number of short-term rentals operating there.

If future regulations, especially zoning laws, cause a property to become unsuitable for short-term rentals, homeowners have few options except to switch to more traditional long-term tenants or sell. So the question here is, if for some reason an investment property is no longer profitable and the owner has to sell it, are they going to lose money on a sale?

If this is a second home, it’s especially important for owners to analyze the numbers and make rational decisions about what to offer for an investment property. Before potential buyers get into a bidding war, they need to understand the financial cushion to reserve in case of an emergency. Everyone needs to make sure their projected cash flow is enough to justify the well above asking price they’re likely to pay in today’s hyper-competitive market.

It’s not all doom and gloom

This may not have painted the brightest picture of Airbnb hosting – and there are many unknowns in the future.

But there are emerging trends that bode well for smart hosts. For example, the increase in remote working has also given many people the flexibility to book longer trips or take “workplaces”. And after being cooped up at home for a year, Americans are eager to travel — even if it’s not abroad. There was a huge need for that during Covid-19 with people looking for a way out of their busy cities and homes, whether that was for a weekend or even a month.

As restrictions ease, Airbnb is seeing a surge in demand for “remote destinations” and “off the beaten track” among travelers. Out-of-town vacation rentals can be a more promising entry point for those looking to rent out real estate. Buying property in more remote areas is often easier and can save buyers from the regulatory headaches more common in cities.

Many former Airbnb hosts have also moved on to building their own direct booking sites to cut out the middleman and have more control over their advertising policies.

Ultimately, any real estate investment involves risk, and potential buyers will have to run the numbers to find out if the risk is worth the potential reward.

atOptions = { 'key' : '8915950b7eab0ff7cbce41f1585deac8', 'format' : 'iframe', 'height' : 90, 'width' : 728, 'params' : {} }; document.write('');

0 notes

Text

Journey search engine optimization Tendencies and Pivots from 2020 (and What to Carry into 2021)

New Post has been published on https://tiptopreview.com/travel-seo-trends-and-pivots-from-2020-and-what-to-carry-into-2021/

Journey search engine optimization Tendencies and Pivots from 2020 (and What to Carry into 2021)

If 2020 taught us something, it’s that you may’t predict the way forward for tourism. In contrast to practically another business, tourism is concurrently dictated by numerous elements together with client proclivity, climate and local weather, world economics, and authorities.

Journey was undoubtedly one of many hardest hit sectors within the 2020 shutdowns, which affected each enterprise area from the most important vacation spot marketing organizations (DMOs) to native small companies that thrive on the foot visitors tourism usually brings. US Journey’s year-end assessment decided there was a 48% drop in travel-related spending for December 2020 in comparison with 2019, and a year-long lack of $500 billion. Success in tourism in 2020 meant merely surviving for a lot of companies, accompanied by whole content material technique revamps, product pivots, native search engine optimization investments, and native marketing activations.

What labored in 2020

Locals-only tourism

With out-of-state quarantines in impact for many of the US, and particularly prevalent within the northeast, as soon as world locations and metros turned intensely native. Succeeding domestically meant celebrating native tradition and taking part in to the hometown benefit, and creating and activating hyper-local content material and search engine optimization to promote reimagined experiences and drive renewed curiosity at dwelling.

Go to Philadelphia, the DMO for the better Philadelphia area, revamped its 2020 marketing efforts to rollout “Our Turn To Tourist” by way of winter 2021, a “regional marketing initiative [that] encourages individuals to take staycations and close-to-home drive journeys.”

Go to Philadelphia’s foremost goal is to draw vacationers from everywhere in the nation to town of Philadelphia. With thousands and thousands of out-of-state guests every year, and big progress every year continuing 2020, Go to Philadelphia had the early foresight to create content material geared in the direction of each locals and guests, and adopted a local-first search engine optimization technique for issues to do, see, and eat close by.

The group went as far as to create local-centric mini itineraries based mostly off of present restrictions, optimizing for native tourism and attraction-related key phrases, and extensively distributing new COVID-19 content material. This marketing campaign supported not solely the accommodations and points of interest within the metropolis, but in addition the native eating places and small companies.

Whereas not completely divergent in its method, the long-term funding that Go to Philadelphia has made into successful at native search, snagging SERP options, and embracing new options like Uncover, helps guarantee it is going to proceed to be a profitable advocate for Philadelphia as “the greatest city in the USA to spend the weekend”.

Reinvented experiences

Tourism and experience-based corporations hadn’t extensively ventured into the digital house previous to 2020 — in any case, why plan to observe the motion from dwelling when you may board a aircraft and participate reside and in-person?

Philadelphia-based Past the Bell Excursions, the one LGBTQ+-owned-and-run tour operator within the metropolis, confronted a crucial resolution in Might 2020: Their hallmark Delight-themed “Drag Me Along” drag queen trolly bar crawl was unable to launch with bars closed indefinitely and social gatherings restricted. As searches continued to extend for digital occasions, digital gatherings, and digital issues to do, companies that rose to satisfy the demand discovered success. For Past the Bell, that meant turning the “Drag Me Along” idea into “Pride In A Box”: a collection of 5 totally different themed Delight containers that included merchandise and experiential parts to be used at dwelling.

Although their web site was initially constructed on a tour-booking engine, to execute a pivoted product technique, they restructured it to permit an e-commerce built-in operate, and optimized to promote merchandise and experiences for Delight.

Founder Rebecca Fisher stated, “We thought about how a box could embody a community. We highlighted queer people, businesses, and queer products, and held weekly events for Pride, all proceeds of which were donated to racial justice. A single ‘box’ purchased during Pride supported many queer businesses, and we wanted people to feel that impact.”

Finally, companies that tailored rapidly to modifications in client search conduct, and that performed and applied key phrase analysis for brand spanking new content material focusing on beforehand unranked/low-volume phrases, have been higher positioned to keep up client help and visibility though precise vacationers continued to drop.

Up-to-date data on increasing and altering rules

Home journey is never regulated within the US, so when cities throughout the nation responded to close down orders, scorching spots beloved by locals and vacationers alike emptied out and income started to drastically fall.

As an search engine optimization group (particularly native!) we’re at all times advocates of the worth of protecting native listings in Google My Business up-to-date, and it by no means mattered greater than in 2020. Popping out on prime have been those that up to date hours, COVID-19 insurance policies and procedures, and revealed supply or third-party partnerships. Unsurprisingly, AirBnB’s and VRBO’s new Covid content material “enhanced cleaning protocol” and “guidelines for owners” come out prime in searches for brief time period rental cleansing finest practices, and cleanliness associated to journey accomodations. Up to date native listings allowed exasperated customers to simply see what companies have been open, and allowed search-savvy companies to leverage their GMB to place themselves as safety-conscious, accessible, and prioritize addressing client issues (to not point out the features released to assist companies entry these instruments).

What to anticipate from tourism in 2021

It’s exhausting to recollect a time of better collective cabin fever. Although with border closings, pre-travel testing, and enterprise closures remaining a shifting goal, we are able to nonetheless anticipate majority of journey will occur nearer to dwelling in early 2021. Right here’s the place we are able to anticipate to see progress first.

Quick time period stays: highway journeys, workspace respites, and snow birds

What’s forward for short-term travels? Continued RV gross sales, for one, which have been up 4.5% annually in 2020. These progress indicators, in addition to public perceptions of journey security, proceed to slate hometown and close-by exploration because the early 2021 winners.

Out of doors and spaced-out actions present continued curiosity in search quantity and gross sales. Yellowstone Nationwide Park alone noticed a 21% enhance in year-over-year visitation in September 2020. Don’t anticipate this to decelerate any time quickly.

One other pattern we anticipate to see proceed in early 2021? Snow birding. As soon as reserved for the retired, heading south for the winter is particularly standard this yr for northerners leaving lockdowns at dwelling. Count on prolonged stays, fuller flights, and busier seashores than regular.

One closing place you’ll be able to anticipate to see vacationers? In a close-by lodge. Previously reserved for the luxurious staycations, native accommodations have turn into office respites for these totally distant employees who lack ample dwelling workplace house. Although not “technically” journey, many accommodations (Hyatt, Marriott, and Hilton, for starters) are providing single-day, day-time solely, “work from hotel” offers to assist relieve misplaced income and fried nerves of managing co-occurring zoom calls on the kitchen desk.

Prolonged visits: distant relocations

With many kids and households, to not point out previously distant staff, feeling the squeeze of their partitions at dwelling, many accommodations and villa properties are providing cost-effective prolonged stays (three weeks or extra). Mid-term relocations have gotten extremely frequent, with specific flight occurring from metro centers in New York City, Philadelphia, and Washington D.C. Particular person international locations are actively attempting to scoop up client demand for change of surroundings and tempo, with international locations like Dubai, Jamaica, and the Cayman Islands providing non permanent prolonged work visas to US residents as a technique to revive native tourism.

Quick time period rental properties similar to seaside home bookings, waterfront properties, mountain cabins, and southern getaways — or you already know, only a yard if you happen to’re a city-dweller — are booking in greater numbers in 2020 than practically any time in 2019. AirDNA notes, “Among those leading the rebound are beaches, mountain towns, lakeside getaways, and really anything within driving distance of a major urban hub.”

Longer-term distant stays, whether or not for your self or your loved ones, are more and more standard, as are distant work choices which, in accordance with Google pattern knowledge, have elevated by two-times the earlier ranges pre-pandemic. Searches for prolonged keep holidays peaked on the finish of December 2020, with earlier highs in October and April 2020. Shifting into 2021, we’ll doubtless see expanded tourism choices to match this client demand, and likewise to accommodate pre-quarantine necessities, which differ metropolis to metropolis.

In conclusion

Journey isn’t what it was once, and in the interim, we’re seeing more and more essential native search activations and have adoption. And as distant work and placement agnostic work turns into extra the norm, the teachings we realized from pandemic journey search will assist companies thrive on this new tourism local weather shifting ahead.

Source link

0 notes

Text

Airbnb Host Guarantee & insurance - peace of mind or empty promises?

Read and share a copy of this post through Medium, Quora, & LinkedIn.

Sharing economy platforms are great on a good day, and continue to throw-up interesting possibilities. More generally, the sharing economy provokes us to think about different forms of resource-use and social organisation. Travelling, and hosting, differently - myself, family and friends have been hosted by wonderful people around the world on Airbnb - is just one example. But when it comes to the question of risk, liability and livelihoods in this context, platform guarantees and liability insurance offering ‘free peace of mind’ raise some troubling questions that I want to tackle head on.

The ‘guarantees’ & liability insurance provided by some sharing economy platforms, like Airbnb, have received mixed reviews. The purpose of this piece is to cut through the noise. And to present findings which show that free Platform Guarantees, and Platform Liability Insurance, may be inadequate forms of protection for you and your home.

Why does it matter?

According to Airbnb research, a huge percentage of people use Airbnb to help pay off their mortgage and 85% of Airbnb users rent their primary residence. Damages, liability and loss threaten host’s homes, and livelihoods.

Furthermore, through a steady stream of news articles, insurance peak body submissions, and forum posts from frustrated users, it’s become apparent that standard home and contents insurance won’t cover you for paid guest’s stays. And nor will most landlord insurance - since guest stays are often deemed too short, and you can’t get cover if you live in your property whilst renting.

Platform Guarantees appeared to bridge this cover-gap. But their ‘worry-free’ veneer hides imperfections that may cost you dearly. In fact, they’ve cost many hosts - who’ve taken to relabelling the so-called ‘peace of mind’ associated with such guarantees as (among other things): 'false sense of security', ‘false promise’, and ‘piece of your wallet’. Many have found the hard way that the worst time to learn of a Platform Guarantee’s limits are when it’s failed you, and you end up on the hook - be it for $700 or $10,000.

What are Platform Guarantees?

Platform Guarantees promise to reimburse eligible hosts for damages up to a certain amount. Most Platform Guarantees are free. A well-known example of a Platform Guarantee is Airbnb’s Airbnb's ‘Host Guarantee’.

Platform Liability Insurance is ‘actual insurance’, offering cover for some cases of liability for injury and property damage. Examples of platform liability insurance include HomeAway's ‘$1M Liability Insurance Policy', Airbnb's ‘Host Protection Insurance' and the VRBO (US) ‘$1M Liability Insurance'.

Many platforms - such as Stayz and TripAdvisor Rentals in Australia, and Vacasa, Innclusive, Kid & Coe, Aura Travel, and Housli in the US - offer no property guarantee or liability insurance at all. Many allow hosts to set security deposits, and others, like HomeAway (US) promote a Book with Confidence Guarantee (payment security) - but despite claiming to offer ‘peace of mind’ these features do not protect you for any property damage or personal liability. To its credit HomeAway does direct its hosts to buy an insurance product tailored to short-term renting needs, albeit from the supplier of their choice (CBIZ).

Three things Platform Guarantees are Not

Problems emerge once you consider the mix of provisos, exclusions, conditions, and other bits of fine print that constitute Platform Guarantees and how they work in practice. I’ve found they are inadequate in three crucial ways: legality, cover, and claims.

1. Platform Guarantees are Not Insurance

The Airbnb Host Guarantee, for instance, “is not an insurance policy”. That’s taken straight from the Terms and Conditions.

Why does this matter?

Under Platform Guarantees you have no policy rights and no recourse. Because you don’t pay for the policy, and you’re not named as an insured on the policy, the platform’s word is final. If they decide not to provide compensation and close the case, there’s very little you can do about it. Furthermore, if you can’t resolve a dispute with Airbnb, you’re unable to take legal action against them, and there is a gagging clause in their terms that means you’re prevented from discussing details of your case elsewhere.

As such, it’s also explicit that such Platform Guarantees are not the same as homeowners & renters, or landlords insurance, and shouldn’t be considered a replacement or stand-in for them. Furthermore, hosting through a share economy platform may well simultaneously invalidate your homeowners insurance, meaning you will personally have to cover any gaps left by the guarantee.

2. Platform Guarantees are Not Comprehensive

So-called Airbnb ‘horror stories’ - drug-fuelled orgies, a much publicised death of a man in Texas, and NYE disasters around the globe - make the headlines. But what’s often left-out of these sensational reports are the stories of regular hosts, hosting regular guests, who aren’t covered for more modest damages or instances of liability, which are far more common.

Platform Guarantees generally don’t cover:

Shared or common areas (or any strata property damage)

Airbnb's Host Guarantee for example, only covers your listed space (for example, the private room or apartment you’re renting), and won’t cover damage outside that (for example to any common areas or shared property & infrastructure, such as a plumbing or electrical system that is linked to other residences). Further, the guarantee only covers “direct physical loss”, meaning that if a guest causes a fire which not only destroys the host’s apartment, but also damages or destroys a good part of the apartment building, the host wouldn’t be covered under the guarantee for the damage to the building.

Bottom line - if you live in an apartment building, you’re probably not covered!

Pets - be that any pet you own, or any pets your guests bring with them

If for example an incident occurred where your treasured dog or cat was injured while you had guests staying, your pet wouldn’t be covered! Furthermore, if guests bring pets with them and incur damages - whether you have a ‘No Pets’ policy or not - as happened to one unfortunate host whose guests brought three dogs and caused significant damages - you as a host are not covered!

Cash and Securities

If you use cash, or have a laptop, or any other belongings that are valuable to you (just might apply to quite a few of us), you probably aren’t covered!

Vehicles

If you have a car, boat, or other kind of ‘mobile’, you probably aren’t covered!

Any type of malicious damage (including assault)

Sadly this one isn’t an ‘if’ - violent acts do happen, both to property and people - and you probably aren’t covered!

Theft (including identification theft)

Again, sadly this one isn’t an ‘if’ - theft happens all the time, including identity theft. And with a platform guarantee you probably aren’t covered!

Platform Guarantees also tend to only provide limited coverage for things like jewellery, collectibles, and artworks.

Platform Liability Insurances also have important omissions, limitations, and grey-areas, for instance those of Airbnb's ‘Host Protection Insurance’:

Doesn’t cover:

slander or libel (which fall under the ‘Personal & Advertising Injury’ exclusion)

any of the personal property of the host

any collisions involving vehicles

anything intentional - including arson, and acts against hosts (or guests) such as assault and battery, and sexual abuse or molestation

loss of rental earnings

For what it does cover, the maximum insured is $1,000,000:

This is a relatively low-rate of liability cover. In instances of liability claims where loss-of-life or serious injury occurs, and hospital, legal and other reparations fees have to be taken into account, the sums required are large, especially if you haves more than one guest staying. Most dedicated short-term rental insurance products offer at least $10,000,00 in public liability cover.

Finally it’s - not easy to get a copy of the actual policy or terms and conditions:

You have to request one from Airbnb. And by now you should know that you can’t be sure what your rights and responsibilities are under any coverage without having read through (all) the T&Cs.

3. Platform Guarantees are Not Easy To Claim

Even if your loss is covered under a Platform Guarantee’s terms, protection is far from assured.

The primary reason for this - as in the case of any attempt made by a host to win a claim under Airbnb’s Host Guarantee, for example - is the conflict between host and guest that is engendered by the claims process. Despite doing everything in your power as a host - providing documentation and following all correspondence procedures - you still need the your guest to admit to causing the (full value of) damages (as the only way, short of installing cameras inside your home, to prove that incurred losses were caused by an Airbnb guest). If the guest declines, chances are there’ll be no reimbursement.

Extensive evidence exists to suggest Host Guarantee claims processes often involve hosts being played off against guests, forcing a part-resolution between the two parties in order to deny a claim, and leaving hosts stranded if a guest denies damaging the property.

To return to the hypothetical of a fire in your apartment building as discussed above, you have to ask yourself - how many guests would admit responsibility for causing such damage, knowing that they would be personally liable? Denying seems like a pretty rational, and perhaps necessary, response. The problem is that under a Platform Guarantee, the host could be on the hook instead.

Claiming a Platform Guarantee appears to be so tricky that people have gone to the trouble of creating step-by-step walkthroughs for how to navigate process. Here I’ll only summarise the key shortcomings of the Airbnb Host Guarantee claims process:

1. You must attempt, before anything else, and using your own time and financial resources (to the extent that the platform deems satisfactory!), to resolve the loss or damage directly with the guest. And if Airbnb deems you have done everything possible and this fails, you must then seek reimbursement through your homeowner’s insurance

If at all, the guarantee is only accessible after appeals to the guest, your security deposit and existing homeowners insurance have been exhausted. The fact that you must, on your own time and dollar, exhaust a whole range of other avenues before a platform will even consider paying your claim, lends credence to the idea that such guarantees are a last-resort, and should not be depended upon. And while Airbnb have made verbal assurances that they frequently provide compensation under the Host Guarantee, anecdotal stories from frustrated Airbnb hosts and the opinions of insurance professionals, suggest otherwise.

2. You are constrained by the rigid, technical & time-pressured procedures

For instance, if you fail to (correctly) report the damage before your next guest arrives - even if they arrive that same day - or within 14 days, whichever is earlier, the Guarantee is void. Is it feasible, or even possible, to have a tradesman come in and provide an estimated cost of repair or obtain a police report before your next guest check-in, which may be in 4 hours? And what about delays that are beyond your control - such as awaiting replies from your guest or home & contents insurer (both of whom you have to correspond with in order to be eligible for any compensation under a guarantee), or from the platform themselves (as has frequently happened to claimants)? So, it’s not just the deadline for claim submission, and the extensive (and often irretrievable) documentation required, but mini-deadlines within the process - another being the expectation that you respond within 48 hours every single time you receive correspondence from Airbnb, lest your case be closed.

3. You must have informed your guest explicitly, in-writing, that they are responsible for the losses covered by the Host Guarantee in order to be eligible to claim.

4. If (luckily) you are covered for an instance of damage, and by a small miracle your claim is approved, the property loss will be valued at 'actual cash value’, rather than replacement cost value. This means it’s likely you won’t actually be able to replace damaged or lost property, particularly if it wasn’t produced super-recently. Meaning claim payouts are often unsatisfactory.

5. If you change your property ‘materially’ at any time you may not be guaranteed for anything at all. This is the Airbnb Host Guarantee’s exoneration clause - it means that if they deem your property has ‘changed materially’, grounds exist for them to not reward any claims.

6. Problems claiming through the Trust and Safety department, and issues with communications falling between or disappearing among other service teams, can lead to frustrating delays and uncertainty.

Zacharias from Las Vegas writes in a discussion about security deposits on Airbnb’s own Community Forum that “Airbnb seems to fight tooth and nail not to pay a host out”. This echoes the feelings of other frustrated users towards the Host Guarantee. But I can’t help feeling this isn’t just a matter of Airbnb being unfair on a case-by-case basis, but that it reflects a fundamental commercial problem with the ‘free peace of mind’ cover on offer. I think that host and Quora user Ryan is pointing in the right direction when he says “You get what you pay for, which is basically nothing”.

The fact is, providing quality, primary coverage for the burgeoning universe of Airbnb hosts - there are over 115,000 listings in Australia alone, and 4 million+ worldwide - just may not be feasible without a premiums pool to play claims from, which Airbnb’s free ‘peace of mind’ arrangement doesn’t provide. Unless, of course, they’re able to sustain the pretence of coverage by putting the onus on guests to reimburse, having notoriously low payout rates, and a minimalist approach towards resourcing claims. This analysis would go a long way toward explaining how it is Airbnb are able to ‘give’, freely, both the Host Guarantee and Host Protection Insurance. Dennis Schaal of tnooz writes, “The financial burden wouldn’t be great if claims are rarely paid out, goes the thinking”.

The history of platform guarantee claim outcomes supports this line of thinking - one thing is clear from users’ feedback - things consistently aren't getting covered. The vast majority of unpaid damages are ‘small’ - $118 for bedding, $299 (from a Superhost mind you), or $700 for cleaning and countertop repairs (I’m stretching the definition of ‘small’ in this case). But the fact is that most incidents are relatively ‘small’ - breakages, thefts - so when these aren’t getting covered en-masse, that’s important. And it certainly matters to individual hosts caught in these sticky (often literally) situations. And of course there are instances where worse things happen - Kristen had $3,000 worth of her belongings stolen (and was reimbursed only $300), and Amanda who had to foot a $US10,000 bill after a guest misused her toilet and caused damage to other apartments in her complex (she was reimbursed just $US78 - the plumber’s fee). Hosts themselves are consistently footing bill where Platform Guarantees & Liability Insurance fall short.

And this issue is by no means exclusive to Airbnb - similar insurance issues exist with other short-term property and room rental sites. A common learning from all these stories is the need to understand the fine print. In fact that’s the purpose of this piece - to make it clear what the fine print actually means when it comes to platform guarantees. And for most reasonable people, they’ve found it certainly doesn’t mean ‘peace of mind’.

And the fact is, there’s much more detail that could be gone into - other cases, clauses, conditions, standards, expectations - and that’s kind of the problem. Free Platform Guarantees & Liability Insurance just aren’t worth the risk. Well, they’re technically worth nothing at all - but that’s besides the point.

So what can you do, now, as a host? Three Options

1. Keep doing what you’re doing

Keep doing what you’re doing but be really, really careful.

Follow host safety tips - like “interact smartly”...

Create a security deposit to improve your chances of reimbursement for the small things - but it’s worth noting that Airbnb hold your property damage security deposit themselves, making reimbursement subject to their approval and begging the question of whether it can really be called a security deposit at all. Further, a guest posting on AirHostsForum relayed an instance where he received $80 from his $320 claim, despite having a security deposit for $200. Airbnb said that since the claim was beyond the value of the security deposit, his cover was automatically moved under the Host Guarantee, leading him to suggest increasing one’s security deposit and never bothering to claim more than that that (“unless you want to get shafted”).

Outcome: remain exposed to the same risks for which you do not have cover.

2. Don’t rent your place on a short-term basis through a sharing economy platform

Outcome: remove the risks associated with renting short-term, but also forfeit the income you could gain from doing so.

3. Don’t assume that a platform guarantee will provide you with any protection.

Also take Campbell Fuller's advice, as spokesperson for the Insurance Council of Australia: "Don't assume that your home and contents policies will cover you”. And he adds, "You may need to consider a more appropriate form of policy".

If you want protection for shared or common areas in your building, for your cash and belongings, for your pets, for malicious damage done to you or your home, or for theft. If you want protection from personal liability claims resulting from intentional acts or that reach over $1,000,000. If you want cover from loss of rental income. And if you want protection from a consistently slow, painful and poor-yielding claims process.

Then one available solution is short-term rental insurance, which is more likely to pay off on a rainy day. To be fair, Airbnb and other platforms with guarantees even recommend it themselves! Airbnb even explicitly state of their Host Guarantee - “you should avail yourself of other cover options before trying to use this product.” This echoes the advice of lawyer George Newhouse, who urged Australian hosts not to rely on the host guarantee, as it is not a substitute for insurance cover.

Short-term rental insurers are popping up all over the globe. Internationally, to name but a few, you have Home Protect (UK), CoverBuilder Host Insurance (UK), Inlet (UK) & Slice (US). People have already compiled lists of short-term rental insurers in Australia, but I’ve mentioned some key players below with a couple of key features mentioned:

Rentcover by EBM - will only cover if host does not live on premises

ShareCover by IAG - host can live on premises, pay per night

Hostrite by Ceneta - host can live on premises

Holiday Rentals Insurance by BJS - host can live on premises, doesn’t cover rent loss

Outcome: a little peace of mind, maybe.

This post has also been published on:

Quora - "Airbnb Host Guarantee & insurance - peace of mind or empty promises?"

Medium - "Airbnb Host Guarantee & insurance - peace of mind or empty promises?"

LinkedIn - “Airbnb Host Guarantee & insurance - peace of mind or empty promises?”

Disclaimer: This post does not constitute financial, legal or insurance advice. Dollar figures reference both US and Australian dollars

2 notes

·

View notes

Text

How to Live Your Best Remote Life

Lindsay Myers, Access TV Personality, budget travel, and lifestyle expert and now remote guru, made the decision two years ago to live and work remotely. A year ago this may sound insane to some, but now, with many, having the ability to work and school from home, remote living is becoming a greater possibility for many.

With Lindsay’s experience, and current remote home in Tulum, MX, she can offer some great insight to many on ‘how to live remote’, happy to schedule an interview and offer further insight!

What should you look for if you want to work remotely?