#virtual currency india

Explore tagged Tumblr posts

Text

The standard legend of India’s Green Revolution centers on two propositions. First, India faced a food crisis, with farms mired in tradition and unable to feed an exploding population; and second, Borlaug’s wheat seeds led to record harvests from 1968 on, replacing import dependence with food self-sufficiency.

Recent research shows that both claims are false.

India was importing wheat in the 1960s because of policy decisions, not overpopulation. After the nation achieved independence in 1947, Prime Minister Jawaharlal Nehru prioritized developing heavy industry. U.S. advisers encouraged this strategy and offered to provide India with surplus grain, which India accepted as cheap food for urban workers.

Meanwhile, the government urged Indian farmers to grow nonfood export crops to earn foreign currency. They switched millions of acres from rice to jute production, and by the mid-1960s India was exporting agricultural products.

Borlaug’s miracle seeds were not inherently more productive than many Indian wheat varieties. Rather, they just responded more effectively to high doses of chemical fertilizer. But while India had abundant manure from its cows, it produced almost no chemical fertilizer. It had to start spending heavily to import and subsidize fertilizer.

India did see a wheat boom after 1967, but there is evidence that this expensive new input-intensive approach was not the main cause. Rather, the Indian government established a new policy of paying higher prices for wheat. Unsurprisingly, Indian farmers planted more wheat and less of other crops.

Once India’s 1965-67 drought ended and the Green Revolution began, wheat production sped up, while production trends in other crops like rice, maize and pulses slowed down. Net food grain production, which was much more crucial than wheat production alone, actually resumed at the same growth rate as before.

But grain production became more erratic, forcing India to resume importing food by the mid-1970s. India also became dramatically more dependent on chemical fertilizer.

According to data from Indian economic and agricultural organizations, on the eve of the Green Revolution in 1965, Indian farmers needed 17 pounds (8 kilograms) of fertilizer to grow an average ton of food. By 1980, it took 96 pounds (44 kilograms). So, India replaced imports of wheat, which were virtually free food aid, with imports of fossil fuel-based fertilizer, paid for with precious international currency.

Today, India remains the world’s second-highest fertilizer importer, spending US$17.3 billion in 2022. Perversely, Green Revolution boosters call this extreme and expensive dependence “self-sufficiency.”

108 notes

·

View notes

Photo

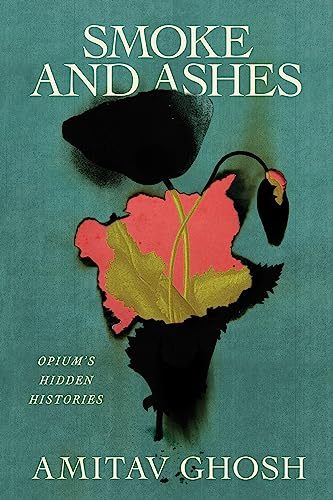

Smoke and Ashes: Opium's Hidden Histories

"Smoke and Ashes: Opium’s Hidden Histories" is a sweeping and jarring work of how opium became an insidious capitalistic tool to generate wealth for the British Empire and other Western powers at the expense of an epidemic of addiction in China and the impoverishment of millions of farmers in India. The legacy of this “criminal enterprise,” as the author puts it, left lasting influences that reverberate across cultures and societies even today.

Written in engaging language, Smoke and Ashes is a scholarly follow-up to the author’s famous Ibis trilogy, a collection of fiction that uses the opium trade as its backdrop. In Smoke and Ashes, the author draws on his years-long research into opium supplemented by his family history, personal travels, cross-cultural experience, and expertise in works of historical verisimilitude. Composed over 18 chapters, the author delves into a diverse set of primary and secondary data, including Chinese sources. He also brings a multidimensional angle to the study by highlighting the opium trade's legacy in diverse areas such as art, architecture, horticulture, printmaking, and calligraphy. 23 pictorial illustrations serve as powerful eyewitness accounts to the discourse.

This book should interest students and scholars seeking historical analysis based on facts on the ground instead of colonial narratives. Readers will also find answers to how opium continues to play an outsize role in modern-day conflicts, addictions, corporate behavior, and globalism.

Amitav Ghosh’s research convincingly points out that while opium had always been used for recreational purposes across cultures, it was the Western powers such as the British, Portuguese, the Spaniards, and the Dutch that discovered its significant potential as a trading vehicle. Ghosh adds that colonial rulers, especially the British, often rationalized their actions by arguing that the Asian population was naturally predisposed to narcotics. However, it was British India that bested others in virtually monopolizing the market for the highly addictive Indian opium in China. Used as a currency to redress the East India Company (EIC)’s trade deficit with China, the opium trade by the 1890s generated about five million sterling a year for Britain. Meanwhile, as many as 40 million Chinese became addicted to opium.

Eastern India became the epicenter of British opium production. Workers in opium factories in Patna and Benares toiled under severe conditions, often earning less than the cost of production while their British managers lived in luxury. Ghosh asserts that opium farming permanently impoverished a region that was an economic powerhouse before the British arrived. Ghosh’s work echoes developmental economists such as Jonathan Lehne, who has documented opium-growing communities' lower literacy and economic progress compared to their neighbors.

Ghosh states that after Britain, “the country that benefited most from the opium trade” with China, was the United States. American traders skirted the British opium monopoly by sourcing from Turkey and Malwa in Western India. By 1818, American traders were smuggling about one-third of all the opium consumed in China. Many powerful families like the Astors, Coolidges, Forbes, Irvings, and Roosevelts built their fortunes from the opium trade. Much of this opium money, Ghosh shows, also financed banking, railroads, and Ivy League institutions. While Ghosh mentions that many of these families developed a huge collection of Chinese art, he could have also discussed that some of their holdings were most probably part of millions of Chinese cultural icons plundered by colonialists.

Ghosh ends the book by discussing how the EIC's predatory behaviors have been replicated by modern corporations, like Purdue Pharma, that are responsible for the opium-derived OxyContin addiction. He adds that fossil fuel companies such as BP have also reaped enormous profits at the expense of consumer health or environmental damage.

Perhaps one omission in this book is that the author does not hold Indian opium traders from Malwa, such as the Marwaris, Parsis, and Jews, under the same ethical scrutiny as he does to the British and the Americans. While various other works have covered the British Empire's involvement in the opium trade, most readers would find Ghosh's narrative of American involvement to be eye-opening. Likewise, his linkage of present-day eastern India's economic backwardness to opium is both revealing and insightful.

Winner of India's highest literary award Jnanpith and nominated author for the Man Booker Prize, Amitav Ghosh's works concern colonialism, identity, migration, environmentalism, and climate change. In this book, he provides an invaluable lesson for political and business leaders that abdication of ethics and social responsibility have lasting consequences impacting us all.

Continue reading...

18 notes

·

View notes

Text

An indictment from the US Department of Justice may have solved the mystery of how disgraced cryptocurrency exchange FTX lost over $400 million in crypto. The indictment, filed last week, alleges that three individuals used a SIM-swapping attack to steal hundreds of millions in virtual currency from an unnamed company. The timing and the amount stolen coincides with FTX's theft. Meanwhile, in a letter obtained by WIRED this week, seven lawmakers have demanded the DOJ stop funding biased and inaccurate predictive policing tools until the agency has a way to ensure law enforcement won’t use them in a way that has a “discriminatory impact.”

In Florida, prosecutors say a 17-year-old named Alan Winston Filion is responsible for hundreds of swatting attacks around the United States. The news of his arrest was first reported by WIRED days before law enforcement made it public. It was the culmination of a multi-agency manhunt to piece together a trail of digital breadcrumbs left by the teenager. In Ukraine, unmanned aerial vehicles have been powerful tools since the Russian invasion began in February 2022. But as the war rages on, another kind of unmanned robot has increasingly appeared on the front-lines: the unmanned ground vehicle, or UGV.

For months lawyers affiliated with an India based hacker-for-hire firm called Appin Technology have used legal threats to censor reporting about the company’s alleged cyber mercenary past. The EFF, Techdirt, MuckRock, and DDoSecrets are now pushing back, publicly sharing details for the first time about the firm's efforts to remove content from the web. It’s a dangerous world out there, so we’ve also got a list of some major patches issued in January that you can use to update your devices to keep them secure.

And there’s more. Each week, we highlight the news we didn’t cover in-depth ourselves. Click on the headlines below to read the full stories. And stay safe out there.

China’s Hackers Keep Targeting US Water and Electricity Supplies

For years Western security officials have warned about the threat of China collecting data about millions of people and the country’s hackers infiltrating sensitive systems. This week, Federal Bureau of Investigation director Christopher Wray said hackers affiliated with the Chinese Communist Party are constantly targeting US critical infrastructure, such as water treatment plants, the electrical grid, and oil and gas pipelines. Wray’s testimony, at a House subcommittee on China, came as the FBI also revealed it removed malware from hundreds of routers in people’s homes and offices that had been planted by the Chinese hacking group Volt Typhoon.

“China’s hackers are positioning on American infrastructure in preparation to wreak havoc and cause real-world harm to American citizens and communities,” Wray said in the public appearance. “Low blows against civilians are part of China’s plan.” The FBI director added that China has a bigger hacking operation than “every other major nation combined,” and claimed that if all of the FBI’s cyber-focused agents were assigned to work on issues related to China, they would still be outnumbered “by at least 50 to 1.”

While concerns about the scale of China’s espionage and cyber operations aren’t new, the US intelligence community has been increasingly vocal and worried about critical infrastructure being targeted by Volt Typhoon and other groups. “The threat is extremely sophisticated and pervasive,” NSA officials warned in November. In May 2023, Microsoft revealed it had been tracking Volt Typhoon intrusions at communications and transportation infrastructure, among other critical infrastructure, in US states and Guam.

The FBI and DOJ, also revealed this week that they remotely removed the KV Botnet malware from hundreds of routers infected by Volt Typhoon. The impacted routers, from Cisco and Netgear, were mostly at the end of their life, but were being used as part of wider operations. “The Volt Typhoon malware enabled China to hide, among other things, pre-operational reconnaissance and network exploitation against critical infrastructure like our communications, energy, transportation, and water sectors,” Wray said. It isn’t the first time US officials have obtained a court order to remotely wipe devices infected by hackers, but the move is still rare.

‘Untraceable’ Monero Transactions Have Been Traced, Police Claim

Since the first cryptocurrencies emerged more than a decade ago, there has been the assumption that the blockchain-based digital currencies are anonymous and untraceable. They are, in fact, very traceable. Researchers have shown how people can be linked to the transactions they make and law enforcement have used the techniques to help bust illicit dark web markets and catch pedophiles. There are, however, still some privacy-focused cryptocurrencies that appear to be less traceable than Bitcoin. This includes Monero, which is increasingly being adopted by sellers of child sexual abuse materials.

This week investigators in Finland said Moreno-tracing helped reveal the identity of a hacker who allegedly attacked psychotherapy company Vastaamo in 2020, stealing thousands of patient records and threatening to leak them unless people paid a ransom. Investigators from the Finnish National Bureau of Investigation claim they used heuristic analysis to infer where funds were moved to. The investigators did not reveal the full methods of how they allegedly traced the Monero payments, however, they add to the growing body of evidence that cryptocurrency tracing firms and investigators may be able to track the currency.

Russia Likely Behind a Spike in GPS Interference, Officials Say

Planes flying over Europe have faced a spike in accuracy issues with GPS systems used for navigation in recent months. The head of Estonia’s Defense Forces has claimed that Russia is likely the source of this interference, according to an interview with Bloomberg. “Someone is causing it, and we think it’s Russia,” Martin Herem told the publication, adding that Russia may be testing its electronic warfare capabilities and “learning” the most effective tactics. Across Europe, and particularly the Baltics region, there has been a reported increase in GPS jamming, with Finland reporting large interferences in December and pilots repeatedly reporting issues with their navigation systems.

Vault 7 Hacking Tools Leaker Joshua Schulte Sentenced to 40 Years

In 2017, the Vault 7 leaks exposed some of the CIA’s most sophisticated hacking tools, including how the agency could compromise routers, phones, PC, and TVs. Joshua Schulte, a former CIA engineer in the agency’s Operations Support Branch who prosecutors identified as being behind the data breach and responsible for leaking the materials to Wikileaks, was convicted in numerous trials in recent years. Schulte, who denied the allegations, has been sentenced to 40 years in prison for the espionage and also for possessing thousands of child abuse images. Judge Jesse Furman, sentencing Schulte, said he had caused “untold damage to national security.” In June 2022, The New Yorker published this comprehensive investigation into the data breach and Schulte’s troubled history working at the agency.

2 notes

·

View notes

Text

ALEXANDRIA, Va. (AP) — A northern Virginia man arrested on terrorism charges has a husband-wife relationship with another American who was dubbed by authorities as an " empress of ISIS " for her work to establish an all-female battalion of the Islamic State, prosecutors said Wednesday.

Mohammed Chhipa, 33, of Springfield, Virginia, was arrested last week on charges that he provided support to a terrorist group. Prosecutors allege that he transferred nearly $200,000 in cryptocurrency, with some of that money traced back to the Islamic State, to support Chhipa's stated goal of helping smuggle female ISIS members from detention camps. Other funds remain unaccounted for.

At a detention hearing Wednesday, prosecutors also disclosed a relationship between Chhipa and Allison Fluke-Ekren, an American from Kansas who is serving a 20-year prison sentence. Fluke-Ekren pleaded guilty last year to organizing and leading the Khatiba Nusaybah, a battalion in which roughly 100 women and girls — some as young as 10 — learned how to use automatic weapons and detonate grenades and suicide belts.

Assistant U.S. Attorney Anthony Aminoff told the judge that Chhipa considers himself to be married to Fluke-Ekren, although the marriage was apparently conducted online and has no legal status in the U.S. He said Chhipa, a naturalized U.S. citizen originally from India, has been trying to adopt Fluke-Ekren's children.

Court documents in Fuke-Ekren's case do not mention Chhipa by name, but also indicate that Fluke-Ekren considered herself to be married to a man she met online. It is not clear that the two have ever met in person.

Whatever the relationship between Chhipa and Fluke-Ekren, the charges against Chhipa appear unrelated to that relationship. Prosecutors say that between November 2019 and July 2022, Chhipa used virtual currency to transfer more than $188,000 to accounts known and unknown. An FBI affidavit states that some money remains unaccounted for but that $18,000 went to wallets known to be used by ISIS women located in Syria, while $61,000 went to cryptocurrency wallets in Turkey. The affidavit states that money intended to arrive in Syria is often routed through Turkey.

The affidavit quotes text messages sent by Chhipa indicating he wanted the money to be used to bribe guards at detention camps where families of Islamic State fighters are still being held.

The affidavit says Chhipa also met with an FBI “controlled persona” — either an undercover agent or a confidential source — and accepted cash from the individual. Chhippa then transferred the money to Bitcoin and sent it directly to a known ISIS member, according to the affidavit.

Chhipa has been under investigation for years. Indeed, prosecutors say he fled to Egypt in August 2019, fearing he would be arrested after his home was raided. He was brought back to the U.S. after authorities contacted Interpol, but he was not charged until Monday. Prosecutors say Chhiipa continued to engage in illegal conduct after he returned to the U.S., even though he know he was drawing authorities' scrutiny.

Family members who attended Wednesday's hearing did not comment, but passed out a written statement supporting him. The statement described Chhipa “as tirelessly working for the betterment of women and children” and said he "has been targeted by false allegations.

U.S. Magistrate Judge John Anderson ruled at the conclusion of Wednesday’s hearing that Chhipa should remain jailed while he awaits trial.

5 notes

·

View notes

Text

Virtual Currency Games

Every little boy's (and plenty of grown guys's) dream of making a dwelling by way of gambling video video games is edging closer to truth. The recent launch of HunterCoin and the in-improvement VoidSpace, video games which reward players in virtual currency in preference to virtual princesses or gold stars point closer to a destiny in which one's ranking on a scoreboard might be rewarded in dollars, and sterling, euros and yen.

The tale of the millionaire (virtual) real property agent…

Digital currencies have been slowly gaining in maturity both in terms of their capability and the financial infrastructure that enables them for use as a credible alternative to non-virtual fiat currency. Though Bitcoin, the 1st and most widely recognized of the crypto-currencies was created in 2009 there were sorts of digital currencies utilized in video video Top NFT Games for extra than 15 years. 1997's Ultima Online was the first exceptional try to comprise a big scale virtual financial system in a recreation. Players may want to collect gold cash by way of venture quests, fighting monsters and locating treasure and spend those on armour, guns or real property. This became an early incarnation of a virtual forex in that it existed only within the game though it did replicate real global economics to the volume that the Ultima foreign money experienced inflation because of the game mechanics which ensured that there was a in no way finishing deliver of monsters to kill and therefore gold coins to acquire.

Released in 1999, EverQuest took virtual currency gaming a step in addition, allowing players to alternate virtual goods among themselves in-recreation and although it become prohibited with the aid of the game's clothier to also promote virtual objects to each other on eBay. In a actual global phenomenon which became entertainingly explored in Neal Stephenson's 2011 novel Reamde, Chinese game enthusiasts or 'gold farmers' have been employed to play EverQuest and different such video games complete-time with the intention of gaining revel in points with the intention to degree-up their characters thereby making them more effective and favourite. These characters would then be bought on eBay to Western game enthusiasts who have been unwilling or unable to put in the hours to degree-up their own characters. Based at the calculated alternate rate of EverQuest's foreign money due to the real international buying and selling that happened Edward Castronova, Professor of Telecommunications at Indiana University and an professional in virtual currencies anticipated that in 2002 EverQuest become the 77th richest usa inside the international, somewhere among Russia and Bulgaria and its GDP per capita was more than the People's Republic of China and India.

Launched in 2003 and having reached 1 million everyday users by using 2014, Second Life is perhaps the most whole example of a digital economy thus far wherein it is virtual forex, the Linden Dollar which can be used to shop for or promote in-recreation goods and services can be exchanged for real international currencies through market-based totally exchanges. There were a recorded $3.2 billion in-sport transactions of digital goods inside the 10 years among 2002-13, Second Life having end up a marketplace where gamers and organizations alike have been able to design, promote and promote content material that they created. Real estate became a specifically beneficial commodity to exchange, in 2006 Ailin Graef have become the 1st Second Life millionaire whilst she grew to become an initial funding of $9.95 into over $1 million over 2.5 years via buying, promoting and trading digital actual estate to different players. Examples inclusive of Ailin are the exception to the rule of thumb but, simplest a recorded 233 customers making greater than $5000 in 2009 from Second Life activities.

1 note

·

View note

Text

As cooler weather arrives in even the warmest of places, drinking warm beverages increases. “Where iced tea reigns supreme as the way the majority of people consume tea in the United States, it’s during these cooler months that we see an increase of hot tea being consumed,” states Kelly Hackman, owner of The White Heron Tea & Gifts and Driftwood Tea Company in New Port Richey. Held each year in January (usually the coldest month of the year), National Hot Tea Month highlights the health benefits of drinking tea, as well as the history of tea, and the unique cultures and customs that exist for drinking tea from around the world. The legend behind the founding of tea is as unique as the plant itself. And it’s only fitting that the first tea ever drank was hot. We have Emperor Shen Nung to thank for this drink we enjoy so much. Legend has it that in 2732 B.C., the Emperor was boiling his water under a tree when several leaves fell into his pot. Rather than removing the leaves, he let them sit and then tried the water. He was pleasantly surprised at the aroma and taste of the resulting brew. In early days, tea bricks were traded as currency. Empires have been created and wars have been fought in the name of tea. “It’s fun to think about all of the ways tea has influenced our lives today and of those of the past,” states Hackman. “From Mr. Fortune’s mission to take tea from China and give England the opportunity to grow it in India, to the Boston Tea Party, tea has had its share of unique influences on history.” Ways to Celebrate National Hot Tea Month There are many ways to celebrate National Hot Tea Month. Here are a few ways to enjoy tea this month. - Share your favorite cup of tea with a friend. Do you have a favorite blend or brand of tea? Send some to your friend to enjoy. - Have a Virtual Tea Party. Invite your friends to a virtual tea party and enjoy a chat over a delicious cup of tea. With so many different online platforms to gather, it’s the perfect time to join your friends over a cuppa and catch up on the latest happenings with each of you. - If you live near a tea shop that offers Afternoon Tea to Go as The White Heron does, you can order all of your tea fare and enjoy a distanced Afternoon Tea with your friend. - Schedule a daily tea break, for the entire month of January. Taking time out of your afternoon every day to enjoy a nice cup of tea seems like a daunting task. Trust us, your mind and body will thank you for it later. It’s true: We all need a break, and even the 10-15 minutes it takes to enjoy a cup of tea can make all the difference in how the rest of your day goes. And you never know—you may just want to continue your daily tea breaks all year long. The White Heron Tea & Gifts has a huge selection of fresh teas in stock. Image by Diane Bedard. Events to Celebrate National Hot Tea Month 2025 - Tuesday, January 7, 2025 – Proclamation for National Hot Tea Month – 6 pmJoin us a City Hall at 6 pm for a presentation of the Proclamation declaring January 2025 as National Hot Tea Month in the City of New Port Richey. - Sunday, January 12, 2025 – Celebrate National Hot Tea DayStop into The White Heron and enjoy a hot tea-to-go for just $1.99. Our Tea Sommelier will be on-site to tell you all about tea and help you pick the perfect tea for you to enjoy. Special available from 11 am to 2 pm. - Friday, January 24, 2025 – Join Me for Tea – 2 pmCelebrate 9 years of tea at The White Heron by joining me for tea. We will enjoy traditional Afternoon Tea while we share memories of our tearoom and more. Bring your tea questions, learn about The White Heron, and enjoy some of my tea stories. Limited spaces available, advanced reservation required. The cost is $24.95 plus tax and gratuity (same as daily tea service). - Friday, January 24, 2025 – Tea Leaf Reading with Dawne – 4 pm – 7 pmHave you ever wanted to know what is in store for your future? What are tea leaves trying to tell you? Join our tea leaf reader, Dawne, as she looks into your destiny and answers your burning questions, by reading your tea leaves. Each guest will have a 15-minute one-on-one session. Guests need to arrive 15 minutes before their scheduled reading time to enjoy a cup of tea and prepare their leaves. $25 per person. Your tea leaf reading time will be provided to you when you register. Call (727) 203-3504 to reserve your tea leaf reading time. - Sunday, January 26, 2025 – Scone Sunday – 11 am – 1 pmJoin us for a relaxing Sunday afternoon in our Tea Parlour. Scone Sunday will feature our “Cream Tea” option, including a pot of tea of your choosing, and two scones (one flavored, one plain) with Devonshire cream. You can enjoy our Cream Tea for the original price from 2016, for $8.95 (plus tax and gratuity). No reservation is needed, just pop in from 11 am to 1 pm and enjoy this relaxing treat. About The White Heron Tea & Gifts The White Heron Tea & Gifts is proud to represent historic downtown New Port Richey and its thriving business community by being featured in online, print, television, and social media outlets. The White Heron Tea & Gifts has been featured in Tea Time Magazine, and seen on House Hunters, Day Time TV, Bay News 9, ABC Action News 28; has been featured in Tampa Bay Business Journal, Tampa Bay Magazine, Tampa Bay Times, Suncoast News, and NatureCoaster.com; mentioned in dozens of articles promoting New Port Richey and the tea industry overall; and has been named Best of the Best Tea Room by the Tampa Bay Times for the past five years (2020-2024). Read the full article

0 notes

Text

Web 3.0 Market: Key Drivers, Innovations, and Growth Predictions to 2030

The Web 3.0 market is poised for transformative growth, reflecting the shift toward decentralized technologies and blockchain-based applications. In 2023, the market was valued at USD 26.3 billion, and it is projected to surge at a compound annual growth rate (CAGR) of 33.2%, reaching an astounding USD 195.7 billion by 2030. This rapid expansion highlights the increasing adoption of decentralized platforms, cryptocurrency, and smart contracts. With Web 3.0 promising to redefine the internet’s architecture, its market growth signals a revolutionary era of user empowerment and digital innovation.

Download Sample Report @ https://intentmarketresearch.com/request-sample/web-30-market-3096.html

Key Growth Drivers

1. Rise of Decentralized Applications (dApps)

Decentralized applications (dApps) are at the heart of Web 3.0, enabling users to interact directly without intermediaries. These apps offer enhanced security, transparency, and control, making them popular in sectors like finance, gaming, and supply chain management. The growing ecosystem of dApps is propelling the Web 3.0 market forward.

2. Blockchain Adoption Across Industries

Blockchain is a cornerstone of Web 3.0, providing the foundation for decentralized solutions. Industries like healthcare, finance, and real estate are leveraging blockchain to improve processes, reduce fraud, and enhance trust. As blockchain adoption increases, it fuels the market growth for Web 3.0 technologies.

3. Popularity of Cryptocurrency

Cryptocurrency plays a crucial role in the Web 3.0 ecosystem, acting as both a means of transaction and an incentive mechanism. The rising popularity of digital currencies like Bitcoin, Ethereum, and emerging tokens is driving investment in Web 3.0 platforms, pushing the market toward unprecedented heights.

4. Focus on Data Privacy and Ownership

Web 3.0 shifts data control from centralized entities to individuals, addressing growing concerns about data breaches and misuse. With greater emphasis on privacy and ownership, users are increasingly adopting platforms that empower them to manage their own data, driving the market further.

Key Segments of the Web 3.0 Market

1. Blockchain Platforms

Blockchain platforms provide the infrastructure for decentralized applications and services. Leading platforms like Ethereum, Polkadot, and Solana are enabling seamless dApp development, making them pivotal players in the market.

2. Decentralized Finance (DeFi)

DeFi is one of the fastest-growing segments of Web 3.0, offering financial services without traditional intermediaries. Lending, borrowing, and trading services powered by smart contracts are gaining momentum, creating substantial market opportunities.

3. Non-Fungible Tokens (NFTs)

NFTs have gained significant traction in the creative and entertainment industries. These digital assets, powered by blockchain, enable unique ownership of art, music, and virtual assets. The popularity of NFTs is bolstering the Web 3.0 market by creating new avenues for monetization and engagement.

4. Metaverse Integration

The metaverse is intertwined with Web 3.0, offering immersive experiences through decentralized virtual worlds. By leveraging blockchain and virtual reality, the metaverse is expected to play a critical role in the market’s growth trajectory.

Regional Market Insights

1. North America

North America is currently leading the Web 3.0 market, driven by innovation hubs in the US and Canada. The region’s focus on blockchain research, startup ecosystem, and regulatory advancements positions it as a frontrunner in market adoption.

2. Asia-Pacific

Asia-Pacific is emerging as a key player in the Web 3.0 market. With countries like China, India, and Japan investing heavily in blockchain and crypto infrastructure, the region is set to see exponential growth.

3. Europe

Europe remains a stronghold for Web 3.0 adoption, with significant contributions from Germany, Switzerland, and the UK. A robust regulatory framework and active participation from enterprises accelerate its regional growth.

Access Full Report @ https://intentmarketresearch.com/latest-reports/web-30-market-3096.html

Future Trends in the Web 3.0 Market

1. Integration with Artificial Intelligence (AI)

AI integration will redefine Web 3.0 platforms, making interactions more dynamic and intelligent. From enhanced user personalization to predictive analytics, AI will be a game-changer.

2. Cross-Chain Solutions

As the Web 3.0 ecosystem grows, cross-chain solutions allowing different blockchains to interact seamlessly will become critical. Interoperability will help create a more connected and efficient Web 3.0.

3. Energy Efficiency Innovations

Concerns about blockchain’s energy consumption are driving innovations in energy-efficient consensus mechanisms. This trend will make Web 3.0 technologies more sustainable and accessible.

4. Expansion of Decentralized Storage

Decentralized storage solutions like IPFS and Filecoin are expected to gain widespread adoption. These solutions offer secure, low-cost data storage, addressing the limitations of centralized servers.

Challenges and Barriers

While the market outlook is promising, Web 3.0 faces challenges such as regulatory uncertainty, lack of awareness, and technical complexity. Educating businesses and users about Web 3.0’s benefits will be crucial to overcoming these barriers.

FAQs

What is Web 3.0? Web 3.0 refers to the next-generation internet, emphasizing decentralization, user control, and blockchain technology.

Why is the Web 3.0 Market growing so fast? Its rapid growth is driven by increasing adoption of decentralized applications, blockchain, and cryptocurrency.

Which industries benefit the most from Web 3.0? Finance, gaming, real estate, healthcare, and entertainment are leading adopters of Web 3.0 technologies.

What role do NFTs play in Web 3.0? NFTs offer a way to tokenize digital assets, creating opportunities for ownership, trading, and monetization in the Web 3.0 ecosystem.

What are the major challenges for Web 3.0 adoption? Challenges include regulatory uncertainty, energy consumption concerns, and the need for better user education.

About Us

Intent Market Research (IMR) is dedicated to delivering distinctive market insights, focusing on the sustainable and inclusive growth of our clients. We provide in-depth market research reports and consulting services, empowering businesses to make informed, data-driven decisions.

Our market intelligence reports are grounded in factual and relevant insights across various industries, including chemicals & materials, healthcare, food & beverage, automotive & transportation, energy & power, packaging, industrial equipment, building & construction, aerospace & defense, and semiconductor & electronics, among others.

We adopt a highly collaborative approach, partnering closely with clients to drive transformative changes that benefit all stakeholders. With a strong commitment to innovation, we aim to help businesses expand, build sustainable advantages, and create meaningful, positive impacts.

Contact Us

US: +1 463-583-2713

0 notes

Text

Crypto a Digital Asset: A Legal Perspective

INTRODUCTION

In the present time Crypto currencies has emerged as a person-to-person electronic payment system that allows online payments to be sent directly from one party to another, without the need for a financial institution. In traditional currencies, a central authority issues a currency that all parties are required by law to accept as payment. This makes the issued currency legal tender. Most of the cryptocurrencies are not backed by a sovereign guarantee and are therefore not considered a legal tender. For legal tender, transaction records are generally held centrally at financial institutions like Reserve Bank Of India; rather, cryptocurrency transactions are recorded and shared with all users on the network. Cryptocurrencies are used for payment if the recipient is willing to accept them, because their value fluctuates against other currencies, such as the US dollar, they are also traded. They are also used as utility tokens that grant their holder access to goods and services of a company.

CRYPTO A CURRENCY OR AN ASSET?

Money has three main characteristics: it is used as a unit of account, as an accepted medium of exchange, and as a store of value. In most countries, the money is issued by a government-backed authority (like RBI in India) and has a sovereign guarantee[1]. Entities authorized to hold funds and facilitate payments (such as banks, credit cards, and payment wallets) which are licensed by a government agency. This means that there is a centralized system regulated by the government to validate transactions and track the flow of money and keep the record of the same.

Crypto differs from this system in several aspects. There are four basic characteristics of a crypto like bitcoin, they are only in digital format. Second, there is no central authority to validate and guarantee transactions. Instead, transactions are validated by other users and then securely stored. Crypto is a digital representation of value that can be digitally traded, or transferred, and can be used for payment or investment purposes[2].

Unlike a physical currency, a digital item is easy to copy, steal and transfer. Therefore, a digital currency has the inherent challenge of ensuring that there is no double payment with the same currency. Cryptocurrencies address this problem with the help of “blockchains”. All users of the system have access to the account balances of all other users (code names may be used to protect confidentiality). When a series of payments are made, they are grouped into a “block”. Other users verify the block by verifying that the person who made the payment had sufficient funds. The block is considered valid if all the transactions it contains are validated by the majority of users. At this point, the block is connected to the previous block using cryptography and is released into the system. A chain of such transaction blocks is called a blockchain.

Since this ledger is available and validated by all users, it is a form of distributed ledger technology (DLT). The cryptography method used makes it very difficult to modify transactions in a validated block. Furthermore, a change to one block will require changes to all subsequent blocks, an almost impossible task. Also, since multiple copies of the records are kept, it would be very difficult to manipulate them at the same time. These properties help maintain trust in the system.

INDIAN LAWS AND CRYPTO

Now as the law in India currently stands, a new provision (47A) is inserted into Section 2 of the Income Tax Act of 1961 to define the term “Virtual Digital Asset.” According to Section 2(47A), Virtual Digital Asset (VDA)[3] means––

(a) any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having inherent value, or functions as a store of value or a unit of account including its use in any financial transaction or investment, but not limited to investment scheme; and can be transferred, stored or traded electronically;

(b) a non-fungible token or any other token of similar nature, by whatever name called;

CRYPTO AS A SECURITY

Further in India virtual currencies like Bitcoin and Ether are unlikely to be subject to securities regulation as they cannot be called ‘security[4]’. The Securities Contracts (Regulation) Act of 1956 (SCRA) provides a non-exhaustive definition of securities and there is currently no regulatory guidance for its application in the context of virtual currencies. Virtual currencies are not included in the listed elements of the definition. Additionally, items covered by the definition derive their value from an underlying asset. However, virtual crypto like Bitcoin and Ether have no underlying assets. Instead, the value is determined solely on the basis of supply and demand. Furthermore, virtual currencies such as Bitcoin often do not have an identifiable issuer, contrary to elements of the definition of security under Indian law. Even taking into account the common meaning of the word “value”, the word is defined in Black’s Law Dictionary as an instrument that demonstrates a proprietor’s property rights in a business.

Virtual currencies, including Bitcoin and Ether, have no such ownership rights, credit relationships, or joint venture investments. Therefore, these virtual crypto are unlikely to be included in the definition of securities. However, some (but not all) tokens issued through Initial Coin Offerings (ICOs) may fall within the scope of SCRA if they are issued by an Indian entity and meet the above tests[5]. This is likely to be the case if they are issued by an identifiable issuer and backed by the issuer’s underlying assets. These tokens must be subject to regulation under the Companies Act 2013 (the Companies Act) (in relation to requirements surrounding the issuance and transfer of securities) and the SCRA (in relation to securities that cannot be listed only on recognized stock exchanges)

CONCLUSION

Crypto today do not do a good job at fulfilling the main functions of money or currency, they may be favored by some for ideological, technological or monetary policy reasons. Crypto may have some attributes in common with what we commonly refer to as money, but differ in many important aspects. While Crypto can be exchanged for items of value, they are not a commonly used means of exchange. They are accepted by some but not by all merchants or service providers, with such volatility they have a limited ability to act as a store of value, another important attribute of money, hence crypto assets will be taxed at 30 per cent and over and above that, there is a 1 per cent tax deduction at source which is also imposed on every transaction as crypto are no currency. Crypto has a long way to go before it is equivalent of money or security.

[1] https://main.sci.gov.in/supremecourt/2018/19230/19230_2018_4_1501_21151_Judgement_04-Mar-2020.pdf

[2] Glossary of the FATF Recommendations (updated on October 2018) available at https://www.fatf-gafi.org/glossary/u-z/ (Last accessed on 27-07-2022

[3] BILL No. 18 OF 2022 THE FINANCE BILL, 2022 (AS INTRODUCED IN LOK SABHA) https://www.indiabudget.gov.in/doc/Finance_Bill.pdf accessed on, 29-07-20222

[4] Cryptocurrencies – An assessment (Keynote address delivered by Shri T Rabi Sankar, Deputy Governor, Reserve Bank of India – February 14th, 2022 – at the Indian Banks Association 17th Annual Banking Technology Conference and Awards) https://rbi.org.in/Scripts/BS_SpeechesView.aspx?Id=1196

[5] Writ Petition (Civil) No.528 of 2018 INTERNET AND MOBILE ASSOCIATION OF INDIA Versus Reserve Bank Of India https://main.sci.gov.in/supremecourt/2018/19230/19230_2018_4_1501_21151_Judgement_04-Mar-2020.pdf, accessed on 29-07-2022

0 notes

Text

[ad_1] The Indian real estate market is witnessing a surge in interest from Non-Resident Indians (NRIs), driven by favorable economic conditions, regulatory reforms, and evolving buyer preferences. With the festive season adding to the momentum, NRIs are increasingly viewing Indian real estate as a secure and high-yield investment opportunity. Indian market experiencing robust inflow from NRI investments NRI Investments on the Rise A mix of emotional and financial motivations is behind the growing NRI interest in Indian real estate. Favorable currency exchange rates have amplified their purchasing power, while government initiatives like RERA and GST have added transparency and credibility to the sector. "India’s real estate market has matured significantly over the last few years, with reforms like RERA fostering greater trust among NRI buyers. Today, NRIs are not just looking for homes; they are seeking high-value investment opportunities that align with global standards of living. Our projects at Motiaz Group cater to this demand with offerings that combine luxury, sustainability, and long-term growth potential. Chandigarh Tricity, with its exceptional infrastructure and growth trajectory, has emerged as a top choice for these buyers," shares Mr. Mukul Bansal, MD of Motiaz Group. Tricity’s Unique Appeal to NRIs Chandigarh Tricity, encompassing Chandigarh, Mohali, Zirakpur, and Panchkula, has become a favored destination for NRI investors. The region offers a unique mix of world-class amenities, high-quality healthcare, educational institutions, and proximity to key commercial hubs, making it an attractive option for residential and commercial investments alike. Regulatory and Technological Advancements Regulatory changes have significantly enhanced the real estate investment climate in India. Tools like blockchain-based property registration, AI-driven analytics, and virtual property tours are making it easier for NRIs to invest remotely. "NRIs today are looking for more than just a home; they want assurance of quality, timely delivery, and compliance with legal norms. As a developer deeply rooted in transparency and innovation, we at Royale Estate Group focus on delivering value through meticulously planned projects. The Tricity region, with its clean environment and smart city initiatives, perfectly aligns with the aspirations of NRI buyers seeking long-term value and emotional connection," says Mr. Piyush Kansal, ED of Royale Estate Group. Catering to Diverse Needs From luxury homes to smart offices, developers are tailoring their offerings to cater to the diverse needs of NRI buyers. The preference for gated communities with advanced security, green spaces, and smart home technology is particularly pronounced. Mr. Tejpreet Singh Gill, MD of Gillco Group, explains, "Over the years, we’ve seen a remarkable shift in the expectations of NRI buyers. They seek a perfect blend of luxury, convenience, and connectivity. At Gillco Group, we’ve embraced technology to offer virtual site visits and digital transaction processes, making it easier for NRIs to invest from anywhere in the world. Chandigarh Tricity’s serene yet modern environment resonates strongly with them, offering the perfect balance of urban sophistication and cultural familiarity. We’re committed to delivering homes that not only meet but exceed their expectations." The NRI investment season is shaping up to be a transformative phase for the Indian real estate market. With developers innovating to meet global standards and buyers exploring India as a reliable investment destination, the future looks promising. "Indian real estate today is synonymous with growth, trust, and innovation. As NRIs explore opportunities back home, they’re not just investing in property but in a vision of India’s future. Chandigarh Tricity is at the forefront of this revolution, offering unparalleled opportunities for residential and commercial growth.

We’re proud to be a part of this journey, creating spaces that NRIs can proudly call their own," concludes Mr. Umesh Bhati, Director of Operations at Bayside Corporations. This season, as NRIs reconnect with their roots through real estate investments, the focus remains on creating value and building trust, hallmarks of India’s evolving property market. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

[ad_1] The Indian real estate market is witnessing a surge in interest from Non-Resident Indians (NRIs), driven by favorable economic conditions, regulatory reforms, and evolving buyer preferences. With the festive season adding to the momentum, NRIs are increasingly viewing Indian real estate as a secure and high-yield investment opportunity. Indian market experiencing robust inflow from NRI investments NRI Investments on the Rise A mix of emotional and financial motivations is behind the growing NRI interest in Indian real estate. Favorable currency exchange rates have amplified their purchasing power, while government initiatives like RERA and GST have added transparency and credibility to the sector. "India’s real estate market has matured significantly over the last few years, with reforms like RERA fostering greater trust among NRI buyers. Today, NRIs are not just looking for homes; they are seeking high-value investment opportunities that align with global standards of living. Our projects at Motiaz Group cater to this demand with offerings that combine luxury, sustainability, and long-term growth potential. Chandigarh Tricity, with its exceptional infrastructure and growth trajectory, has emerged as a top choice for these buyers," shares Mr. Mukul Bansal, MD of Motiaz Group. Tricity’s Unique Appeal to NRIs Chandigarh Tricity, encompassing Chandigarh, Mohali, Zirakpur, and Panchkula, has become a favored destination for NRI investors. The region offers a unique mix of world-class amenities, high-quality healthcare, educational institutions, and proximity to key commercial hubs, making it an attractive option for residential and commercial investments alike. Regulatory and Technological Advancements Regulatory changes have significantly enhanced the real estate investment climate in India. Tools like blockchain-based property registration, AI-driven analytics, and virtual property tours are making it easier for NRIs to invest remotely. "NRIs today are looking for more than just a home; they want assurance of quality, timely delivery, and compliance with legal norms. As a developer deeply rooted in transparency and innovation, we at Royale Estate Group focus on delivering value through meticulously planned projects. The Tricity region, with its clean environment and smart city initiatives, perfectly aligns with the aspirations of NRI buyers seeking long-term value and emotional connection," says Mr. Piyush Kansal, ED of Royale Estate Group. Catering to Diverse Needs From luxury homes to smart offices, developers are tailoring their offerings to cater to the diverse needs of NRI buyers. The preference for gated communities with advanced security, green spaces, and smart home technology is particularly pronounced. Mr. Tejpreet Singh Gill, MD of Gillco Group, explains, "Over the years, we’ve seen a remarkable shift in the expectations of NRI buyers. They seek a perfect blend of luxury, convenience, and connectivity. At Gillco Group, we’ve embraced technology to offer virtual site visits and digital transaction processes, making it easier for NRIs to invest from anywhere in the world. Chandigarh Tricity’s serene yet modern environment resonates strongly with them, offering the perfect balance of urban sophistication and cultural familiarity. We’re committed to delivering homes that not only meet but exceed their expectations." The NRI investment season is shaping up to be a transformative phase for the Indian real estate market. With developers innovating to meet global standards and buyers exploring India as a reliable investment destination, the future looks promising. "Indian real estate today is synonymous with growth, trust, and innovation. As NRIs explore opportunities back home, they’re not just investing in property but in a vision of India’s future. Chandigarh Tricity is at the forefront of this revolution, offering unparalleled opportunities for residential and commercial growth.

We’re proud to be a part of this journey, creating spaces that NRIs can proudly call their own," concludes Mr. Umesh Bhati, Director of Operations at Bayside Corporations. This season, as NRIs reconnect with their roots through real estate investments, the focus remains on creating value and building trust, hallmarks of India’s evolving property market. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

whether the Swiss franc can become a virtual global currency

gas and oil trading need a small but strong currency as a purely virtual global currency

The potential for the Swiss franc (CHF) to emerge as a virtual global currency in the oil and gas trade hinges on several factors, including its current status as a safe haven, geopolitical dynamics, and the evolving landscape of international trade currencies. Current Status of the Swiss Franc The Swiss franc is widely recognized for its financial stability, supported by Switzerland's low debt-to-GDP ratio and a robust economic framework. This stability has attracted significant demand from emerging markets, particularly from BRIC nations (Brazil, Russia, India, and China), which are diversifying ...

more

0 notes

Text

Affordable Online Sales & Investment Multi-level Marketing (MLM) Software in Kuwait

Live Demo MLM Software: https://mlmtrees.com/free-demo/

International MLM Services Providers Switzerland, Japan, the United States, Canada, India, Australia, Sweden, Germany, the United Kingdom, and others.

MLM Software (Multi-Level Marketing Software) is a specialized digital platform designed to manage and automate the operations of multi-level marketing businesses. MLM businesses operate on a network marketing model, where members earn commissions through direct sales as well as recruiting new members into their network. MLM software streamlines these processes, making it easier for businesses to handle their operations, track member activities, calculate payouts, and manage commissions effectively.

Key Features of MLM Software:

Admin Dashboard:

Centralized control panel for administrators to manage members, commissions, payouts, and reports.

Provides insights into network growth and performance.

User Dashboard:

A personalized interface for members to track their earnings, view their network, and access affiliate links.

Genealogy Tree:

A visual representation of the network hierarchy, showing uplines, downlines, and overall structure.

E-Wallet:

A secure virtual wallet for members to manage their commissions, bonuses, and withdrawal requests.

Payout Management:

Automated calculation and distribution of commissions, bonuses, and incentives.

Member Management:

Tools to manage member profiles, sponsor details, and downline performance.

Commission & Bonus Settings:

Flexible configuration of referral commissions, level commissions, rank-based rewards, and regular bonuses.

Ecommerce Integration:

Integration with e-commerce platforms for selling products and services within the MLM network.

Affiliate Link Management:

Unique links for each member to track referrals and earn commissions.

Multi-Currency & Multi-Language Support:

Essential for international MLM businesses.

Types of MLM Plans Supported:

Binary Plan: Members recruit two people, forming a binary tree structure.

Unilevel Plan: Members can recruit unlimited people directly under them.

Board Plan: Members progress through different boards based on recruitment and performance.

Force Matrix Plan: Members recruit up to a fixed number of people per level.

Monoline Plan: A single-line structure where members join sequentially.

Benefits of MLM Software:

Automation: Reduces manual effort in managing commissions, payouts, and member data.

Accuracy: Minimizes errors in calculations and reporting.

Scalability: Supports businesses of all sizes, from startups to large enterprises.

Transparency: Builds trust by providing clear insights into earnings and network performance.

Customization: Tailored solutions to meet specific business needs and MLM plans.

Industries Using MLM Software:

Health & Wellness

Cosmetics & Personal Care

Technology & Gadgets

Cryptocurrency & Investment Plans

Education & Training

MLM software is a vital tool for modern network marketing businesses, enabling them to operate efficiently and scale globally.

Contact us: Skype: jks0586, Call us | WhatsApp: +91 9717478599, Email: [email protected] | [email protected] Website: www.letscms.com | www.mlmtrees.com

#Investment #InvestmentMLM #MLMsoftware #MLM #MultilevelMarketing #InvestmentMLMsoftwareKuwait #onlinesalesMLMsoftware #cheapMLMsoftwareKuwait

#Investment#Investment MLM#MLM software#MLM#Multi level Marketing#MLM plans#Investment MLM software Kuwait#online sales MLM software#Affordable MLM Software#cheap MLM software Kuwait#Australian MLM system#Binary MLM software Kuwait#Board MLM solutions#Single Leg MLM system#Matrix MLM software#Unilevel MLM e-commerce#E-Pin MLM system Kuwait#Laravel MLM software#WordPress WooCommerce MLM#Next.js MLM solutions#Python Flask MLM software#earn money online Kuwait#investment-free MLM opportunities#Affordable MLM

0 notes

Text

The Hidden Complexities of Managing Substantial Wealth in India

[A comprehensive guide to understanding how wealth management services help high-net-worth individuals in India]

Understanding Why Professional Wealth Management Services Matter

Managing significant wealth in India poses challenges that are more complex than standard financial planning. Leading wealth management firms offer specialized expertise to navigate complex tax regulations, family business succession, and investment strategies. High-net-worth individuals increasingly turn to professional wealth management services to handle these distinct hurdles.

The Growing Need for Expert Wealth Management Services

Take, for instance, a third-generation successful business owner in Mumbai who partnered with a wealth management company to diversify from the traditional family business into multiple ventures. Here, net worth has gone up manifold, but complexities have also increased - from compliance with multiple states' regulations to overseas investment opportunities and succession planning within a joint family structure.

How Wealth Management Firms Shape the Indian Financial Landscape

High net worth individuals in India face unique challenges that top wealth management firms help address:

Family Business Dynamics

Most Indian wealthy families rely on wealth management services to balance their family-owned businesses with personal wealth management needs.

Real Estate Holdings

Property traditionally constitutes a large part of Indian portfolios, where wealth management companies provide expertise in commercial and residential real estate management.

Gold and Alternative Investments

The cultural affinity for gold and emerging alternative investment options require specialized wealth management services to optimize returns while respecting traditional preferences.

Strategic Benefits of Professional Wealth Management Companies

Wealth management firms in India provide crucial services that transcend traditional financial planning. A full-fledged wealth management service includes:

NRI Investment Management

Leading wealth management companies excel in managing investments and compliance across borders for families with members abroad.

Tax Optimization

Professional wealth management services help navigate India's constantly changing tax scenario while maintaining compliance across jurisdictions.

Succession Planning

Experienced wealth management firms design wealth transfer strategies aligned with Indian inheritance laws and family dynamics.

Local Expertise of Indian Wealth Management Companies

The best wealth management services in India combine global best practices with deep knowledge of local markets. They offer specialized solutions for:

Traditional Business Families: Modernizing investment approaches while respecting values

First-Generation Entrepreneurs: Managing sudden wealth creation

Professional CXOs: Handling complex compensation structures

Risk Management Through Professional Wealth Management Services

Indian wealth management firms address special risk factors:

Political and Regulatory Risk

Wealth management companies protect assets from policy changes and regulatory shifts.

Currency Risk

Expert wealth management services manage exposure to rupee fluctuations.

Family Disputes

Professional wealth management firms structure wealth to prevent family disagreements.

Digital Innovation in Wealth Management Services

The contemporary wealth management company leverages technology while maintaining personal relationships:

Digital Portfolio Access: Real-time information access

Research and Insights: Market analysis through digital platforms

Virtual Consultation: Easy access to wealth advisors

Cultural Awareness in Professional Wealth Management

Indian wealth management services understand cultural nuances:

Philanthropic Planning

Wealth management firms design charitable giving aligned with Indian customs.

Marriage Planning

Professional wealth management companies balance traditional needs with modern investment strategies.

Religious Considerations

Expert wealth management services respect religious preferences in wealth distribution.

Choosing the Right Wealth Management Partner

For high-net-worth individuals in India, selecting a wealth management company means choosing a partner who understands both global practices and Indian dynamics. The ideal wealth management services bring together:

Local Market Knowledge: Understanding of Indian regulations

Global Expertise: International investment opportunities

Cultural Understanding: Appreciation of Indian values

Professional wealth management firms are essential for long-term success in India's complex financial landscape. By partnering with experienced wealth management companies, Indian high-net-worth individuals can preserve and grow their wealth while navigating unique challenges.

#wealth planning#tax regulations#wealth firms#NRI wealth#succession plans#Indian wealth#family business#real estate#gold investment#risk management#currency risk#digital wealth#Indian markets#financial planning#asset growth#wealth advisors#investment ideas#compliance tips#portfolio tools#tax savings

1 note

·

View note

Text

Bounty Game – Unlock Endless Opportunities to Win Big in India!

Bounty Game is India’s premier online platform for exciting lottery games, casino betting, and innovative gaming features that offer real cash rewards. If you’re someone who loves the thrill of betting, the excitement of winning, and the satisfaction of real money payouts, then Bounty Game is your go-to destination.

With an unmatched collection of games, generous bonuses, quick withdrawals, and world-class security, Bounty Game isn’t just a gaming app—it’s a complete online gaming experience that’s designed to provide non-stop fun, entertainment, and massive rewards. Ready to get started? Let’s dive into everything Bounty Game has to offer!

Why Choose Bounty Game?

At Bounty Game, we’ve created a platform that blends excitement, innovation, and rewards seamlessly, giving players the ultimate gaming experience.

1. Real Money Rewards – Play & Win Real Cash!

At Bounty Game, every game you play brings you closer to a real cash prize. Unlike other platforms where winnings are virtual or in-game currency, Bounty Game rewards you with REAL MONEY that you can withdraw directly into your bank account or digital wallet, instantly. This means the fun doesn’t just stop at the game—you get to keep what you win!

2. A Vast Selection of Games – From Lottery to Casino to Color Prediction!

Bounty Game offers a wide variety of gaming options designed to cater to different tastes, skill levels, and preferences. Whether you're a newbie or an experienced player, there's something for everyone:

Lottery Games: Play exciting lottery games with affordable ticket prices and the chance to win big! Multiple prize tiers and frequent draws mean the action never stops.

Casino Games: Immerse yourself in the heart of the casino world with classics like blackjack, roulette, poker, and baccarat. The high-quality graphics and seamless gameplay will make you feel like you're in a real casino!

Slots: Spin the reels and chase massive jackpots with our exciting slots collection, featuring both classic and new-age themes.

Color Prediction Trading: Experience a fast-paced and innovative game where you predict the outcome and earn huge rewards. It's a thrilling way to multiply your winnings, and with its simple rules, it’s accessible to all players.

3. Exclusive Bonuses & Promotions – More Ways to Win!

At Bounty Game, we believe in rewarding our players generously. That’s why we offer a range of bonuses and promotions to ensure you get the best value every time you play. Here’s what you can expect:

Welcome Bonus of up to ₹3,000: When you sign up for the first time, we welcome you with a generous bonus to give your gaming journey a head start.

Daily Bonuses: We have exclusive daily promotions and offers to keep the excitement going for our loyal players. Whether it's cash bonuses or free spins, there's always something extra waiting for you.

Referral Rewards: Invite friends to join Bounty Game and you can earn additional rewards. For every successful referral, both you and your friend get bonuses. The more you refer, the more you earn!

Loyalty Programs: As a loyal player, you’ll be treated to exclusive bonuses, VIP rewards, and personalized offers. The more you play, the more rewards you unlock!

4. Instant Withdrawals – Fast & Secure!

We understand how important it is to get your winnings quickly. With Bounty Game, you can enjoy instant withdrawals—cash out your winnings with a simple click, and your money will be transferred directly to your account without delay. We offer a variety of secure payment options, ensuring you can always access your funds when you need them.

5. Top-Notch Security – Play with Peace of Mind

Your security is our top priority. Bounty Game uses state-of-the-art encryption technology to safeguard your personal information and financial transactions. We comply with all relevant security regulations to provide a safe, secure environment for all players. Play with confidence, knowing that your data and funds are protected at all times.

How to Get Started with Bounty Game

Getting started with Bounty Game is quick and easy. Simply follow these steps, and you’ll be playing in no time!

Step 1: Download the Bounty Game App

Visit the official Bounty Game website at bountygame.pro and download the app directly to your iOS or Android device. The app is lightweight, user-friendly, and optimized for all devices.

Step 2: Register Your Account

Sign up in minutes with a simple registration process. Provide basic details, verify your account, and get ready to claim your ₹3,000 Welcome Bonus as a new player.

Step 3: Choose Your Game

Browse through our wide range of gaming options—whether you're in the mood for lotteries, spinning slots, or challenging casino games, you’ll find it all at Bounty Game.

Step 4: Play, Win, and Withdraw

Start playing your favorite games, earning real money rewards, and enjoying the excitement of winning. Once you’ve accumulated enough winnings, simply request an instant withdrawal—your money will be transferred securely and promptly.

Why Bounty Game Stands Out in India

1. A Game for Every Player

No matter what type of player you are, Bounty Game has a game that suits you. Whether you’re into traditional lotteries, high-stakes casino games, or innovative color prediction trading, we offer a complete range of options.

2. Seamless User Experience

The Bounty Game app is designed for a smooth and enjoyable gaming experience. With a sleek, intuitive interface and fast performance, you can navigate through the app effortlessly and jump right into the action. Whether you're on the go or at home, enjoy uninterrupted gameplay at your convenience.

3. Real-Time Support

Need help? Our 24/7 customer support team is available at all times to assist you with any questions or concerns. Whether you need help with the app, a transaction, or gameplay, we’re just a message away.

Bounty Game Features – A Closer Look

Here’s a closer look at what makes Bounty Game stand out from the crowd:

1. Multiple Lottery Options

We offer multiple types of lottery games, from traditional lottery draws to new, innovative versions that keep the excitement alive. With multiple draws throughout the day, there’s always a chance to win big!

2. Progressive Jackpots & High Payouts

Our slots and casino games come with progressive jackpots, meaning the prizes keep growing with every spin. You could be the next big winner!

3. Quick Play & Instant Results

Many of our games, especially color prediction trading, offer quick rounds and instant results, meaning you don’t have to wait to find out if you’ve won. The pace is fast, the rewards are huge, and the fun never stops.

What Players Are Saying About Bounty Game

Here’s what our players are saying about their experiences with Bounty Game:

"I’ve been playing for a few weeks now, and I’ve already cashed out my winnings multiple times. The withdrawal process is seamless!"

"The lottery games are so much fun, and the payouts are real! I couldn’t ask for a better app to play on."

"The app is super easy to navigate. Whether I’m playing slots or betting on colors, I always feel in control."

Get Started Today!

Now that you’ve seen everything Bounty Game has to offer, it’s time to join the action! With exciting games, real money rewards, and instant withdrawals, Bounty Game is the perfect place for players looking to earn while having fun.

Download the App Now

Start your journey toward big wins, incredible bonuses, and exciting gaming by downloading the Bounty Game app today. Don’t miss your chance to experience India’s best online lottery and casino betting platform!

Download Now

0 notes

Text

MPL Live vs Other Gaming Apps: Why It Stands Out in 2024

The world of mobile gaming has evolved significantly, with millions of users enjoying different types of games on their smartphones. As one of the leading gaming platforms in India, MPL Live has gained tremendous popularity by offering an extensive selection of games where players can earn real money while having fun. But how does MPL Live compare to other gaming apps? In this blog, we will explore the reasons why MPL Live stands out in 2024, and why it remains the top choice for gaming enthusiasts who want to play, compete, and earn money.

What is MPL Live?

MPL Live (Mobile Premier League) is an online gaming platform where players can enjoy a variety of games, from casual board games like Ludo to competitive sports and card games like Fantasy Cricket and Poker. It is a mobile app that allows users to compete for cash rewards, turning casual gaming into a profitable activity. MPL Live has grown rapidly in popularity, particularly in India, due to its unique combination of entertainment, skill-based games, and the opportunity to win real money.

How Does MPL Live Compare to Other Gaming Apps?

When it comes to online gaming apps, there are plenty of options, but not all of them offer the same benefits. Here’s why MPL Live outshines the competition in 2024:

1. Wide Range of Games

Unlike other gaming apps that focus on just one or two types of games, MPL app offers a vast library of games. Whether you enjoy strategy games like Ludo and Rummy, action-packed games like Fantasy Cricket, or casual games like Pool and Carrom, MPL Live has something for everyone. Other gaming apps may only offer a limited selection of games or focus on a specific genre, but MPL Live gives you the flexibility to switch between different games and explore a variety of options.

2. Real Money Rewards

One of the biggest differentiators of MPL Live is its ability to provide real money rewards. You can compete in free or paid tournaments and win cash prizes based on your performance. Other gaming apps may offer rewards like in-game currency, virtual items, or points, but they often fall short when it comes to providing real cash. MPL Live, however, gives you the opportunity to withdraw your earnings directly to your bank account or digital wallet, making it one of the most rewarding gaming platforms out there.

3. Skill-Based Gaming

Many gaming apps rely purely on luck or random chance, but MPL Live puts a strong emphasis on skill-based gaming. Whether it’s Fantasy Cricket, Rummy, or Poker, success on MPL Live is determined by your strategy, skills, and gameplay. This creates a more competitive environment where you can actually improve and win based on your abilities. In contrast, other apps may rely too heavily on luck, which can lead to frustration for players who prefer games that require skill and strategy.

4. User-Friendly Interface

MPL Live has an intuitive, easy-to-use interface that makes navigating through games and features a breeze. Whether you’re a first-time user or a seasoned player, the app’s layout is simple and well-organized, allowing you to find your favorite games or check your earnings with just a few taps. Other gaming apps, on the other hand, may have complicated or cluttered interfaces, making it harder for users to enjoy a smooth gaming experience.

5. Social and Competitive Elements

MPL Live adds a social and competitive dimension to its games, allowing you to challenge your friends or compete with players from around the world. The app hosts daily, weekly, and special tournaments, giving you multiple opportunities to test your skills and win cash prizes. You can also chat with your friends or opponents, creating a more engaging social experience. While some other gaming apps allow you to play with friends, MPL Live takes it a step further by offering various competitive formats and rewards for top performers.

6. Regular Tournaments and Events

MPL Live keeps the excitement high with frequent tournaments and special events. Whether you’re a beginner or a professional, you can join different levels of tournaments based on your experience and skill level. These tournaments provide players with a chance to compete for bigger rewards, adding an extra layer of excitement. While other gaming apps may have occasional events, MPL Live is known for its consistent scheduling of tournaments, giving you more chances to win.

7. Safety and Security

MPL Live takes the safety and security of its users seriously. The platform is designed with advanced encryption and safety measures to ensure that all transactions, from game deposits to withdrawals, are secure. Many other gaming apps do not provide the same level of security, which can lead to concerns regarding privacy and financial transactions. MPL Live ensures that all your personal data and winnings are protected, giving you peace of mind while you enjoy your gaming experience.

8. Seamless Payments and Withdrawals

MPL Live allows you to withdraw your winnings through multiple payment options, such as bank transfers, Paytm, UPI, and other digital wallets. The payment process is quick, reliable, and transparent. Other gaming apps may have limited withdrawal options, or the process may take longer, making MPL Live’s seamless payment system one of its standout features.

Why MPL Live is the Future of Gaming

MPL Live has quickly become one of the most popular platforms in India, and its success can be attributed to its unique combination of fun, competition, and the opportunity to earn real money. In 2024, as more and more players seek interactive, skill-based games that offer rewards, MPL Live is poised to continue leading the way in mobile gaming.

With its wide range of games, real money rewards, easy-to-use interface, and competitive environment, MPL Live offers something that other gaming apps struggle to match. Whether you’re a casual player looking to pass the time or a serious gamer aiming to earn money, MPL Live provides the best of both worlds.

Conclusion

In comparison to other gaming apps in 2024, MPL Live stands out as the ultimate platform for skill-based gaming with real-money rewards. Its wide variety of games, user-friendly interface, secure payments, and social features make it a top choice for gamers who want to experience both fun and profitability. If you haven’t tried MPL Live yet, now is the perfect time to download the app and start competing for cash prizes while enjoying your favorite games.

0 notes

Text

Mobile Gaming Set to Hit $507.4 Billion by 2033 🎮

Mobile Gaming Market is on a remarkable growth trajectory, projected to expand from $286.5 billion in 2023 to an impressive $507.4 billion by 2033, reflecting a robust CAGR of 6.1%. This thriving sector, encompassing game development, publishing, and monetization, is fueled by technological advancements, increasing smartphone penetration, and innovative revenue strategies.

To Request Sample Report : https://www.globalinsightservices.com/request-sample/?id=GIS32405 &utm_source=SnehaPatil&utm_medium=Article

Casual gaming dominates the market due to its accessibility and appeal across various demographics, while action and adventure games capture significant user engagement and monetization potential. Augmented Reality (AR) and Virtual Reality (VR) technologies are reshaping the gaming landscape, offering immersive experiences that continue to attract developers and gamers alike.