#variablerates

Explore tagged Tumblr posts

Text

Are you in need of extra funds for home renovations, debt consolidation, or other expenses? A second mortgage may be the solution for you!

At Woollam Mortgage Team, we understand that life can be unpredictable and sometimes you need extra financial support. That's why we offer second mortgage options to help you access the equity in your home and put it towards the things that matter most to you.

Our team of experienced mortgage specialists will work with you to find the best second mortgage option for your unique situation. Whether you need a fixed or variable rate, we'll help you understand the pros and cons of each so you can make an informed decision.

Don't let financial stress hold you back any longer. Contact Woollam Mortgage Team today to learn more about our second mortgage options and how we can help you achieve your financial goals.

#SecondMortgage#HomeEquityLoan#DebtConsolidation#HomeRenovations#FinancialSupport#MortgageSpecialists#FixedRate#VariableRate#InformedDecision#WoollamMortgageTeam.

0 notes

Text

What are the excelling features of the new metering devices?

► Electrically driven as a standardCan be universally used for precise grain singulation and the most different crops

► Metering of maize, sunflowers, sugarbeet, sorgum, Canola, soybeans other types of beans

► Simple handling: the scraper does not have to be adjusted

► Seed monitoring via grain sensor: information about the singulation accuracy

► Individual control of every row: individual row switch off, SectionControl, VariableRate, tramline control

read more here http://bit.ly/AirvacMaestroSV

0 notes

Photo

Word of the Day: Mutual Funds A mutual fund is a company that collects money from multiple investors and invests it in securities such as stocks, bonds, and short-term debt. The mutual fund's portfolio is made up of all of its holdings. Each share represents an investor's stake in the fund and the income generated by it. Need help with increasing your credit score, let's have a conversation and you may book an appointment with me for a Discovery Call: https://bit.ly/3rgz0hi. I partner with #MortgageLenders, #Realtors, and other #RealEstateProfessionals to help them close more homeowners! The more you know, the more you can grow! #RiseUpFinancialFreedomSolutions #BeAboutYourCredit #Bonds #FixedRate #401K #MutualFunds #MortgageBroker #Grants #IRAs #PredatoryLending #Points #VariableRates #SubprimeLending #Stocks #SelfEmployedRetirementPlan #RetirementIncome #Refinancing #CreditScoreIncrease #CreditScoreImprovement #BeAboutYourBusiness #CreditReport #CreditRestoration #Renters #Tenants (at Rise Up Financial Freedom Solutions LLC) https://www.instagram.com/p/CRxbPcSBRbL/?utm_medium=tumblr

#mortgagelenders#realtors#realestateprofessionals#riseupfinancialfreedomsolutions#beaboutyourcredit#bonds#fixedrate#401k#mutualfunds#mortgagebroker#grants#iras#predatorylending#points#variablerates#subprimelending#stocks#selfemployedretirementplan#retirementincome#refinancing#creditscoreincrease#creditscoreimprovement#beaboutyourbusiness#creditreport#creditrestoration#renters#tenants

0 notes

Text

Variable-rate mortgages are about to trigger payment increases

Variable-rate mortgages are about to trigger payment increases

There has been a lot of discussion recently about how variable-rate mortgage holders could face their “trigger point.” We’re going to explore what that means, and the implications for borrowers. Let’s first cover the basics. Most variable-rate mortgages have static monthly payments, which protect the borrower’s cash flow from fluctuations in the prime rate. Four of the Big Six banks offer fixed…

View On WordPress

8 notes

·

View notes

Photo

Started posting my comic in other places.

This is #1, which I have also posted at the following:

https://www.webtoons.com/en/challenge/variable-realities/1-opening-trope/viewer?title_no=211297&episode_no=2

https://tapas.io/episode/1319314

& of course the actual site:

https://www.variablerealities.com/1-1-openingtrope

3 notes

·

View notes

Link

#studentloans#refi#lowrates#review#fixedrate#variablerate#stafford#perkins#plusloan#@commonbond#@salliemae

1 note

·

View note

Photo

The benefit of the Lowest Margin throughout the life of your Home Loan 👇 Apply for your mortgage and get pre-approved on the same day! For more information, get in contact with us ✉ [email protected]. Visit our website www.lionmortgage.ae #mortgageinfo #mortgageadviser #mortgagetrends #rates #realestate #dubaiproperty #homefinance #preapproval #borrowing #homebuyertips #homeloans #lionmortgage #lionmortgageuae #variablerate #offers (at Dubai, United Arab Emirates) https://www.instagram.com/p/CBkJ333jUp6/?igshid=3obt093s0994

#mortgageinfo#mortgageadviser#mortgagetrends#rates#realestate#dubaiproperty#homefinance#preapproval#borrowing#homebuyertips#homeloans#lionmortgage#lionmortgageuae#variablerate#offers

0 notes

Link

#buyingahome#financing#fixedrates#HomePurchase#homebuyers#interestrates#Local#mortgages#realestate#vancouver#vancouverrealestate#VariableRate

0 notes

Text

Global Variable Frequency Drive Market to See Massive Growth by 2021-2028

In 2021, the Global Variable Frequency Drive Market’s size was valued at USD 19,709.81 million and is estimated to reach USD 25,680.34 million by 2028 and is expected to be growing at a CAGR of 4.2 % throughout the forecast period. In this report, 2021 has been taken as the base year while 2020 is the historical year. The forecast year for the report is 2028 to approximate the size of the market for Variable Frequency Drive..

Complete Report is Available @ https://iconmarketresearch.com/inquiry/sample/IMR1404

The top players in the market are:

· ABB Ltd.

· CG Power and Industrial Solutions Limited

· Danfoss A/S

· Eaton Corporation

· Fuji Electric Co. Ltd.

· Hitachi Ltd.

· Inovance Technology Europe GmbH

· Larsen & Toubro Limited

· Mitsubishi Electric Corporation

· Nidec Corporation

· Parker-Hannifin Corporation

· Rockwell Automation Incorporated

· Schneider Electric SE

· Shenzhen INVT Electric Co. Ltd.

· Siemens A

· TMEIC

· Weg SA

· Yaskawa Electric Corporation

Overview of Report

The Variable Frequency Drive market report provides information and statistics on market shares, size, restraining factors, and driving factors for the forecast period 2021 to 2028. It also mentions the role of main market players in the manufacturing and construction industry. The report on Variable Frequency Drive market evaluates the value of the market report, keeping in mind the application and regional segments, market share, and size while forecasting the market for each product type and application of the Variable Frequency Drive market in different segments of the report. The research report also mentions some sections of the Variable Frequency Drive market including opportunities, growth, trend, size, demand, and technology used by prominent players of the market. Then, it gives detailed profiles of the key players as a part of the competitive landscape of the Variable Frequency Drive market.

The Report Provides Insights on The Following Pointers:

· It gives a forecast analysis of factors that are driving or restraining the development of the Variable Frequency Drive market.

· The report gives a seven-year forecast value evaluated on the basis of the current market performance of the manufacturing and construction industry.

· It helps in understanding the main segments of the products and their future.

· The report gives a deep analysis of changing competition in the market which keeps you ahead of your competitors.

· The report gives the market definition of the Variable Frequency Drive market along with the analysis of different factors influencing the market such as drivers, opportunities, and restraints.

#variable #variableY #variables #variableactionheroes #variablebushviper #variableyserum #variablerate #variableplayerpowers #variableNDfilter #variablecontracts #VariableCosts #variablerideheight #variableymurah #VariableCosplay #variableweather #variablewattage #variablevalvetiming #variablestars #variableserum #variablelife #variableresistance #variablerates #variablefonts #variablepulsedlight #VariableProjects #variablekettle #variableperformancesystem #variableopticlife

0 notes

Photo

Word of the Day: Points A mortgage point equals 1 percent of your total loan amount — for example, on a $100,000 loan, one point would be $1,000. ... Typically, you would buy points to lower your interest rate on a fixed-rate mortgage. Need help with increasing your credit score, let's have a conversation and you may book an appointment with me for a Discovery Call: https://bit.ly/3rgz0hi. I partner with #MortgageLenders, #Realtors, and other #RealEstateProfessionals to help them close more homeowners! The more you know, the more you can grow! #RiseUpFinancialFreedomSolutions #BeAboutYourCredit #Bonds #FixedRate #401K #MutualFunds #MortgageBroker #Grants #IRAs #PredatoryLending #Points #VariableRates #SubprimeLending #Stocks #SelfEmployedRetirementPlan #RetirementIncome #Refinancing #CreditScoreIncrease #CreditScoreImprovement #BeAboutYourBusiness #CreditReport #CreditRestoration #Renters #Tenants (at Rise Up Financial Freedom Solutions LLC) https://www.instagram.com/p/CRvD4GQhN4d/?utm_medium=tumblr

#mortgagelenders#realtors#realestateprofessionals#riseupfinancialfreedomsolutions#beaboutyourcredit#bonds#fixedrate#401k#mutualfunds#mortgagebroker#grants#iras#predatorylending#points#variablerates#subprimelending#stocks#selfemployedretirementplan#retirementincome#refinancing#creditscoreincrease#creditscoreimprovement#beaboutyourbusiness#creditreport#creditrestoration#renters#tenants

0 notes

Photo

Starting posting my comic in various places. Here is issue 2.

https://tapas.io/episode/1319376

https://www.webtoons.com/en/challenge/variable-realities/2-double-take/viewer?title_no=211297&episode_no=3

& of course on my main comic site

https://www.variablerealities.com/1-2

1 note

·

View note

Photo

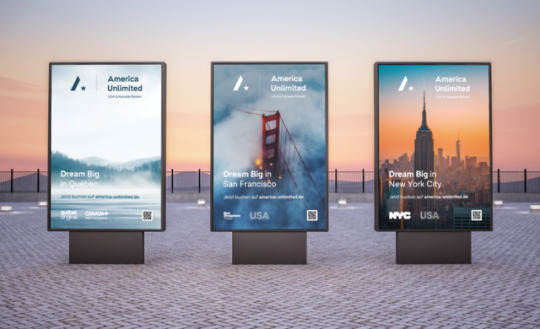

America Unlimited mit neuem Markenauftritt Modernes Logo, individueller Look, klare Positionierung

München, 24. April 2019. Der Spezialreiseveranstalter America Unlimited geht ab sofort mit neuem Markenauftritt an den Start. Die Änderungen des Erscheinungsbildes umfassen ein neues Logo mit moderner Schrift und einem neu gestalteten Signet. Auch Reisekataloge, Plakate, Poster sowie die Außenwerbung erhalten einen frischen, lässigen Look. America Unlimited präsentiert sich modern, minimalistisch, hochgradig digital und modular. Das neue, hochwertige Layout unterstreicht die Individualität und den Lifestylecharakter des Experten für USA- und Kanada-Reisen. Es stärkt die Position von America Unlimited als einer der Marktführer im Reisesegment. Die Anpassung der Website www.america-unlimited.de erfolgt in einem zweiten Schritt.

„Unser altes Logo hat uns seit der Firmengründung im Jahr 2006 begleitet“, so Timo Kohlenberg, Geschäftsführer von America Unlimited. „Immer am Puls der Zeit und auf der Suche nach innovativen Ideen für unsere Produkte war das Logo, im Gegensatz zu uns, in die Jahre gekommen. Wir waren uns im Team einig: wir benötigen ein vielseitig einsetzbares, einfaches, lebendiges und starkes Logo, mit dem wir uns identifizieren können und das stellvertretend für all das steht, was wir anbieten“, ergänzt Kohlenberg. Weitere wichtige Gründe für den Neuauftritt der Marke waren das fehlende Signet und damit der Wiedererkennungswert in der Außenwerbung, die nun deutlich verbesserte Lesbarkeit sowie die variablere digitale Anwendung des Logos.

Über America Unlimited:

Der 2006 unter der Leitung der innovativen Geschäftsführer Julia Kurz und Timo Kohlenberg gegründete Spezial-Reiseveranstalter America Unlimited mit Sitz in Hannover gehört zu den führenden Anbietern von individuell ausgearbeiteten Reisen in die USA (inklusive Hawaii, Bahamas und Alaska) und Kanada. www.america-unlimited.de

0 notes

Text

Hidden Facts about Discount Factoring

Factoring isn't only for businesses that are in financial trouble. Factoring can be a valuable service for start-up companies and businesses that are simply growing fast. However, discount factoring can be a bit confusing at times. The fees that are shown aren't typically going to be the final fees calculated for your company. Why is that, and what should you look for in discount factoring? Continue reading for hidden facts about discount factoring.

A Flat Discount

You may be offered a flat discount for the first 30 days, and then an adjusted discount for every 30 days following that initial period. Typically, this will be charged on the gross amount of factored receivables. This could potentially be a good deal, but you need to remember that a flat discount may end after a certain period of time, or at least be reduced after an initial introductory period. Much like cable providers will offer an introductory discount, some factoring companies will do the same thing. If you're only looking to use factoring for a short period of time, this might be a good deal, but for long-term service this might not be your best option.

The Prime Rate

In the US banking system, the prime rate is the short-term interest rate used. This is a variablerate, so obviously, it will vary from time to time. The prime rate may be added to a flat invoice discount fee structure. You may also receive a prime rate plus margin offer. This will be the prime rate plus the margin (a stated percentage), which will be calculated together annually.

If you're planning on using a factoring company for a longer period of time, this could be a better option for you. It's important to look at the long-term benefits of all offers before settling on a given discount.

The Final Verdict

No factoring company can give you real numbers until they've assessed your company and your clients. Rates will largely depend on risk factors, volume, and capital. For discount factoring in Kennesaw, GA, it's always recommended that you shop around and look for a factoring company that's excited to work with you and has experience with businesses like yours. The discount likely won't matter nearly as much as the dependability and professionalism of your factoring partner.

1 note

·

View note

Text

RATES ON HOLD AGAIN, AS HOUSING EXPECTED TO CONTINUE TO SLOW

19 JAN 2017

Great news for variable rate and LOC holders again - the Bank of Canada has held the overnight rate steady as expected.

This means that the prime rate on your mortgage or line of credit will not change and remains at 2.70%. This is great news, but don’t forget to make the most of the low payments you still have, as the rate will eventually increase in the future!

If you have a good discount on your variable rate, you are still in a good position as we do not expect any increases in the Bank of Canada rate in this coming year. This does not mean banks will not artificially increase their rate, but I would hold ground if you are comfortable with a variable and your discount is solid.

5 year fixed rates have increased slightly and are sitting between 2.69% and 2.89%, with varying new surcharges dependent upon whether a rental property or primary residence, loan to value, and whether an insured or conventional mortgage. If you were waiting for the right time to lock in a fixed rate, I would recommend you do it now,

If you know anyone with an interest rate over 3.00%, or anyone needing to refinance, please have them call me as I would highly recommend they revisit their mortage now in this ever-changing landscape!

Article below from DR. SHERRY COOPER, Chief Economist, Dominion Lending Centres, on this latest Bank of Canada announcement:

"It is no surprise that the Bank of Canada maintained its target overnight rate at 1/2 percent today, reaffirming its view that the Canadian economy is still operating with considerable slack despite strong employment growth and inflation remains below the 2 percent target. The policy statement highlighted that that "uncertainty about the global outlook is undiminished, particularly with respect to policies in the United States." Trump's ascendancy to the highest office in the US portends major policy changes, some of which could have a direct impact on Canada. For now, the Bank has chosen to incorporate assumptions about prospective tax policies only, resulting in a modest upward revision to its US growth outlook. US growth in 2017 was revised up only slightly, from 2.1 percent to 2.2 percent. The impact of the new administration's fiscal stimulus is more pronounced in 2018, increasing the Bank's forecast to 2.3 percent (up 0.3 percentage points from the October forecast). These are initial estimates, which include changes in tax policies only. Clearly, an important factor impacting Canada will be US trade policy. The impact of this and other fiscal measures will be updated in future Bank of Canada reports as more details become available. The Bank's forecast for US growth is above its estimate of the rate of potential US output expansion of about 1.8 percent in 2018. The economy is judged to be already at or near full capacity. Business investment in the US is expected to regain momentum as growth in demand remains above potential output. Bond yields around the world, including here at home, have risen in anticipation of more stimulative fiscal policies and deregulation in the US, though financial conditions remain accommodative.

Global crude oil prices have recently averaged about 15 percent higher than assumed in the October Monetary Policy Report (MPR). By convention, the Bank is now assuming oil prices will remain at near current levels of $55 for Brent, $50 for West Texas intermediate and $35 for Western Canada Select. The Bank believes that the risks to this forecast remain tilted to the upside over 2017-18, since prices are still below levels likely required to support medium-term market rebalancing. The Bank's new MPR, released today says that "the scope for sustained higher prices is limited, however, because technological advances have contributed to lower production costs for unconventional oil production, notably shale oil in the United States". And the Trump administration supports the fracking sector. Nevertheless, the worst is over for the Alberta economy, which we have already seen reflected in the housing sector, which has improved considerably in the most recent Canadian realtors report.

It would take a material negative shock to growth for the Bank to cut rates.

On the other hand, others recently have suggested the Canadian economy will benefit sufficiently from the fiscal boom in the US for the Bank to hike rates by the end of this year. I believe this is unlikely as market rates have already risen and the potential negative impact of a stronger Canadian dollar on trade, as well as a potential US harder line on trade--such as recent US saber rattling on a border tax--will keep the Bank on the sidelines through the rest of this year. "

Dr. Sherry Cooper Chief Economist, Dominion Lending Centres

Patricia Collins

Vancouver Mortgage Broker

www.patriciacollins.ca

604-996-7701

0 notes