#valuation for tax purpose

Explore tagged Tumblr posts

Text

Valuation For Capital Gains Tax Purposes In Sydney

Identifying an asset's fair market value at the time of sale or transfer is known as valuation for capital gains tax purposes, and this data is necessary for figuring out the capital gains tax due.

0 notes

Text

If You Are Selling A Business Property, Do You Require A Valuation For Capital Gains Tax Purposes?

The valuation for capital gains tax purposes is required to estimate the cast of transactions between the buyer and seller. It can be either current or retroactive. Current valuation determines the value of your asset in the current market, whereas retrospective valuation determines the value at a previous date or time.

0 notes

Link

#Business valuation services#Company valuation methods#Company valuation consulting#Company valuation experts#Company valuation models#Company valuation for startups#Company valuation for mergers and acquisitions#Company valuation for financial reporting#Company valuation for tax purposes#Company valuation for business planning

0 notes

Text

Money, like writing, seems to have originated in the temples of the ancient world. The word money comes from the Roman Goddess Juno who in one of her forms was called Moneta meaning She Who Gives Warning. Her temple in Rome was the center for the finances of Rome and so her name Moneta became the word money. The same word became also mint because that same temple was the place where coins were minted. According to Barbara Walker silver and gold coins manufactured there were valuable not only by reason of their precious metal but also by the blessing of the Goddess herself which was believed to bring good fortune and healing magic.

Money was indeed a magical invention. Folk tales are full of magic lamps and genies and beanstalks, of magical ways to have our every wish granted. We would all like to be able to snap our fingers or twitch our noses and have our purposes accomplished. And that is almost exactly what happens with money. It can be exchanged for every conceivable kind of real wealth. Magic. Pure magic. So enamored were people of this magical invention that it became over time the primary measure of real wealth in Westem society.

Why then do three quite diverse philosophical or intellectual traditions agree on the idea that money is somehow unclean or something to be despised?

One of those traditions is Christianity. About one third of the parables of Jesus are about money. He is reported to have taught that being rich is a barrier to salvation and to have told the rich young man to sell everything and give his money to the poor. The one time he is depicted as angry is when he turns over the tables of the money changers at the temple. His advice on taxes is to render unto Caesar what is Caesar's, to separate money and worldly concerns from one's religion. Classical Christianity has preached, if not practiced, that money and this world are to be renounced in favor of an other-worldly kingdom of heaven. The love of money, said St. Paul, is the root of all evil.

Classical Marxism also renounces money as responsible for the alienation of human beings from their labor. People no longer work to create or produce, but only to make money. This situation Marx considered to be disastrous. He felt it was labor which was of essential value and that all monetary valuations were to be discarded. Those who seek only money he saw as exploiting those who work.

Finally there is Freud who thought money was anal. He equated money with feces, excrement. It is therefore filthy and messy. Withholding money is a kind of constipation. Money is related to the bowels and is dirty. And indeed, we do refer to money sometimes as "filthy lucre."

Christianity, Marxism and Freudianism all agree on despising money. As a psychologist I have learned to pay careful attention to those things another person protests most vehemently against. And as a woman I have learned to pay close attention to those things which our great patriarchs preach most loudly against. Because, of course, what is loudly despised is often what is covertly desired or feared or worshipped. So if Jesus, Marx and Freud are all in agreement on something, we women had better take a careful look.

Women are socialized to live out the Christian ideals of self-sacrifice and martyrdom and men are socialized to give lip service to them. The same hypocrisy would seem to apply to what is preached about money. Filthy, despicable, and barrier to salvation it may be, but the fact is that in general, men have money and women don't. According to the United Nations Labor Organization, women put in 65% of the world's work and get back only 10% of all income paid. The female half of the world's population owns less than 1% of world property. Women in our Western society may have access to money through their husbands or fathers, but until recently women rarely accumulated or controlled their own large fortunes.

Men may philosophize about the distinction between money, which is "merely" a measure, and "real wealth," the goods and services into which money can be changed. They can say that the pursuit of money leads to an unhappy, hollow existence. They can urge upon women the virtues of simplicity. But for most men the ultimate appeal is to the "bottom line," that is, to money. How much money will something cost? How much financial profit will be gleaned? Mae West cut through this hypocrisy with great clarity when she said "I've been rich and I've been poor, and rich is better."

-Shirley Ann Ranck, Cakes for the Queen of Heaven

15 notes

·

View notes

Text

((As my Queenie muse is hard, innuendo intended, more lore! This time for the fantasy verse.

Queenie is a monarch of her lands but she’s far from absolute. I’ve mentioned how she picks what regions are represented and by how many people. But then those people pass the main laws. She has a few exceptions where she’s in charge without parliaments authority.

1)Royal territories. As she is a literal immortal queen Queenie maintains a line of consistent rule. To this end certain institutions exist on a royal level. And while they recieve state budgets Queenie can supplement with her own budget as she wishes.

These institutions are the royal garrisons. In each of the major cites there are royal garrisons of professional soldiers. The largest are at the Western most city as it expands around the two forks and is most vulnerable to attack historically. However there are 6 historic garrisons (including the western one) which all have permanent garrisons. Though ironically the capital is the smallest. There are also 3 garrison towns. One at each the western river crossings. While the third is up in the Eastern mountains and is also the second largest garrison due to the dangers of mountain bandits, monster attacks and other problems.

Queenie has historically had 6 forges, however she has reduced it down to 4. The capital and Eastern city forge have become centers of industry, and now mostly make tools and such and are points where a developing Industrial Revolution is starting. While the twin fork city and the Mountain Garrison town hold the two armament forges. The western river city is the largest weapon forge in the kingdom by far, and the Eastern one also does help make general purpose tools.

The eastern mountains also hold her traditional mines. With a pair of gemstone seams being the marker of her furthest traditional eastward expansion. However Iron, Mythril and other valuable metal and stone veins have been discovered in the hills and lead to an expansion of the traditionally limited eastern economy.

She also holds the farmlands immediately to the west of the capital and is partially why urban development around the capital is restricted to the north, south and east.

Queenie is taxed on this, though she can pay up to half of her tax in delivered goods. The other half must be paid in cash. And is valued by state regulators not Queenie herself. Queenie has generally been complaint with any valuations recieved and seems likely to continue on that path.

9 notes

·

View notes

Text

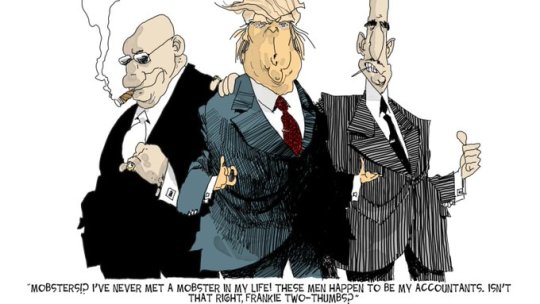

No! Legislators should know better. The job of the county assessor is to assign a reasonable valuation for a property. Assessment is not to be used to punish people.

DJT has paid a reasonable amount of property tax on the property given the independent valuations which took into account the covenants restricting its use and occupancy as an Historical Landmark as well as those additional restrictions allowing Donald to use it as a private club or whatever.

DJT’s fraud in the New York case is that he and his organization deliberately misrepresented the nature of the covenants and restrictions when validating the property for purposes of obtaining a loan. Repeatedly. For 20+ properties.

DJT lost the Summary Jusgment because Statute and Case Law were the basis of rejecting each and every counter argument of caveat emptor his attorneys presented. Counter arguments were also denied on appeal. Twice.

Jeff Bezos could decide tomorrow that he can’t live without owning Mar-A-Lago or other Trump property and buys one for $2 billion.

It would not affect that the Trump organization committed fraud each and every time it knowingly FAILED TO DISCLOSE material facts.

If such a purchase occurred, Trump would walk away with a lot of cash but would not be able to do business in New York State.

Trump’s stupidity is that he kept ALL his properties in one New York based umbrella trust instead of incorporating separately in Delaware or in a bunch of different States. Which is how it’s the NY AG who is seizing his assets worldwide.

Not that he would have escaped litigation. All 50 States and the Federal government have these ‘blue sky laws’ like the one Trump is fighting and States/Federal are constantly prosecuting businesses for violating them.

We never hear about these cases because they just aren’t the kind of Infotainment that the Media covers…unless it’s infotainment celebrity like Trump.

25 notes

·

View notes

Text

The Bath School Disaster, 1927

August 13, 2023

The village of Bath was located just a short distance from the city of Lansing, Michigan. In 1922, the town voted for a school district, which also would lead to an increase in property taxes for the town to be able to afford the new school. The creation of the school was extremely controversial in the town.

When the school had opened there was 236 children that attended, all from grade one to grade twelve.

Andrew Kehoe was born in Tecumseh, Michigan on February 1, 1872. After graduating high school, Andrew studied electrical engineering at Michigan State College and worked as an electrician in Missouri for years.

During his time working as an electrician, Andrew had sustained a head injury from a fall and it was reported that he supposedly had been in a coma for several weeks after. He eventually healed somewhat and moved back to Michigan to live on his father's farm.

After Andrew's mother died his father married a woman who was younger than him, Frances Wilder, and the two had a daughter together.

On September 17, 1911, Frances had tried to light the family's oil stove, when it suddenly exploded and set her on fire. Andrew through a bucket of water on her but the fire being oil-based, it ended up spreading the flames quicker. Frances died the next day due to her injuries. Later on there was a rumour that Andrew had caused the stove explosion purposely.

The following year in 1912, Andrew married a woman named Nellie Price and a few years later they moved to a farm outside of Bath. Andrew was known by his neighbours as always doing favours and volunteering to help others. However, Andrew also had an impatient side, even killing a neighbour's dog who had annoyed him with it's barking. Andrew also beat one of his horses to death when it did not perform what he wanted it to do.

In 1924, Andrew was elected as a trustee on the school board and had even been the treasurer for a year. He argued a lot for lower taxes and was known to be difficult to work with, often voting against the board. He would claim he paid too much in taxes and tried to get the value of his property reduced so he would pay less.

In 1922, the school tax was $12.26 for every $1000 valuation of a property -- in 1923 the school board raised this to $18.80 per $1000, in 1926 it was $19.80.

In 1926, Andrew's tax liability was $198.00 and he found out that the family member who held the mortgage on his property was starting foreclosure proceedings. It was later on said from a local sheriff who had served the notice to Andrew, he had muttered, "If it hadn't been for that $300 school tax I might have paid off this mortgage."

In 1925, Andrew was appointed as temporary town clerk, but was defeated the following year -- this public rejection made him angry.

One of Andrew's neighbours noticed he had stopped working on his farm in 1926 and had believed he was possibly planning to end his own life. Andrew had given this neighbour one of his horses in April 1927, but the neighbour returned it. Andrew had also cut all his wire fences, seemingly preparing to destroy his farm. He also put lumber and materials in a tool shed and later destroyed it with a bomb.

At the time the bombing happened, Nellie, Andrew's wife had symptoms quite similar to tuberculosis. She often was in the hospital, which could have added to the family debt. Andrew had stopped making mortgage and insurance payments months before.

It is believed that Andrew had begun his plan of bombing the school after being defeated as towns clerk in 1926. During that summer he had access to the school building. He had bought pyrotol, an explosive as well as dynamite. Both of these were frequent things farmers used so it did not seem odd he would be purchasing them.

Neighbours even called him "the dynamite farmer" because they would often hear the sounds of explosions on his property. After the bombing occurred police found that dynamite had been stolen from a bridge construction site, Andrew was suspected as having stolen it.

Andrew spent a considerable amount of time buying explosives, going in between his house and the school with them. On May 16, 1927, Nellie was discharged from the hospital and it was in between this day and the day of the bombings, May 18, that her husband Andrew murdered her.

Andrew put her body in a wheelbarrow behind the chicken coop where it was later found very charred. Around the wheelbarrow he had placed silverware and a metal cash box that banknotes could be seen in it. Andrew had wired homemade pyrotol firebombs in his home and the farm's buildings.

Around 8:45 am on May 18, 1927 the bombs exploded in Andrew's house and farm buildings. Neighbours noticed the fire and volunteers rushed over. As people were going over to the property to help, Andrew drove off in his truck, stopping to tell them they better head over to the school.

Classes began at the school at 8:30 am, and Andrew had made sure the bombs would begin going off at 8:45 am. Rescuers heading over to Andrew's farm heard the school explosion and turned back. Many people were killed initially, 38 of them and most were children.

The scene was chaos, with many people rushing to help remove debris to look for wounded children. Many witnessed mother's moving extremely heavy bricks on their own, frantically searching for their babies.

One mother, Mrs. Hart, was sitting on a bank near the school and had two little dead girls on either side of her. She was holding a little boy named Percy, and right then Andrew blew his car up on the street, wounding little Percy, Mrs. Hart's oldest child. He later died in the hospital.

The north wing of the school collapsed, where the roof was on the ground and there was about 5-6 children under the roof in a pile. One man even volunteered to grab some heavy rope to be able to pull the roof off of the children. The man later stated on his way back to his farm for rope he saw Andrew drive by him and he waved and had the biggest grin on his face.

Andrew drove up to the school about 30 minutes after the first explosion. Andrew got out of his truck and detonated the explosives he had stored in there, killing himself, 3 other men and one second grader named Cleo Clayton who had wandered out of the school building in the initial explosion.

The explosion from Andrew's truck spread debris over a big area, and many cars parked in the area had damage, including several roofs catching on fire.

During the search for more survivors and victims, it was found that 500 more pounds of dynamite that had not been detonated was in the south wing of the school. It is believed that the initial explosion caused a short circuit in the second bombs, preventing them from going off.

Police searched Andrew's farm, looking for Nellie and eventually found her charred remains the following day. All of the farm buildings had been destroyed and two of Andrew's horses had been burned to death. Their legs had been tied together with wire, preventing them from being able to escape.

There was a wooden sign wired to the farm's fence that Andrew had stenciled "Criminals are made, not born."

The Red Cross had received many donations that were sent in to pay for medical expenses for the survivors and burial costs of those who did not make it.

Andrew's body was claimed by his sister and was buried in an unmarked grave in the pauper's section of Mount Rest Cemetery in St. Johns, Michigan. Nellie's family buried her in a Landing cemetery under her maiden name.

It was no question that Andrew Kehoe was the perpetrator of the bombings, however at the coroner's inquest the jury needed to determine whether the school board or employees were guilty of criminal negligence. After more than a week, the jury exonerated the school board and employees. This was determined as Andrew had hidden his plan quite well from everyone around him.

It was determined that Andrew murdered superintendent Huyck, as he had asked him to come over by his truck right before it exploded. Andrew had also been determined to have acted alone, and murdered 43 people in total, including his wife Nellie. Andrew's own suicide was considered the 44th causality.

On August 22, 1927, 3 months after the bombing, Beatrice Gibbs, a 4th grader at the time of the bombing died following a hip surgery. Her death was considered the 45th death attributed to the Bath School disaster. This makes it the deadliest attack to ever occur in an American school.

Richard Fritz was injured in the explosion and died almost a year later from myocarditis at 8 years old. His older sister, Marjorie, had died in the explosion. Richard is not listed as one of the victims, however his death is thought to be directly caused by an infection from his injuries.

School resumed on September 5, 1927 and was held in the community hall, town hall and two retail buildings for the year. Many donations were given to help rebuild, and the damaged portion of the school was demolished, with a new wing being built. The new school, James Couzens Agricultural School was dedicated on August 18, 1928.

In 1975, the building was demolished and was then rebuilt as the James Couzens Memorial Park, dedicated to the victims. In 1991, a Michigan State Historical Marker was installed. In 2002, a bronze plaque with the names of those killed was placed near the entrance.

On May 1, 2022, weeks away from the disaster's 95th anniversary, Irene Dunham who was the last Bath School student from the time of the bombing died at the age of 114.

The Bath School disaster is regarded to some as an act of terrorism. Medical experts wrote it was "the largest pediatric terrorist disaster in U.S. history."

24 notes

·

View notes

Note

Bestie would you please link to your posts explaining wealth wrt to taylor? I'm poor but interested in the concept of how having that much money like... works

i think i only talked in depth once about the intricacies of the super wealthy and how they manage money to stay richer than all of us, and it took me FOREVER to find it so you're welcome.

Here you go

It's all speculation in terms of what she is and isn't participating in, but like the post says that obscurity of any provable net worth is on purpose! also another reminder that Forbes and whoever else that do their Net Worth articles are GUESSING!!! they don't know, nobody does. they guess based on a lot of what's in that post, valuations of businesses, etc etc. and many times they're wayyyyyyy off. I think the most notable was Forbes' proclamation that Kylie Jenner was a billionaire way back when when in fact she was not! not even close! They were duped by estimations of her company's valuation and properties and other stuff i don't remember.

Also another huge thing to remember is a lot of wealthy people's money at that level, like my post touches on, isn't liquid. liquid meaning like cold hard cash in a bank that you can take out of an ATM. liquid cash is heavily taxed, so most of a rich person's money is invested, making it untouchable, but also inaccessible to the person. Taylor proooooobably can't go to an ATM and take out 10 Mil. she's gotta pull that out of her portfolio where it's distributed across many investments or dip into several funds that are earmarked for other business related things. So the CRAZY part is their money like.... doesn't actually exist a lot of the time. it's in stocks or investments which change value all the time, and are totally arbitrary in value. She may earn what are called "dividends", which is any cent over the value of your original investment, but those are usually re-invested if they exceed a certain amount cuz they're taxable "income". (blah blah it all comes down to avoiding taxes).

alllllll of this is also totally obscured to people below a certain wealth threshold because they don't want icky yucky poor people like us participating in their moneymaking and investments to improve our own financial standing! many wealth managers and accountants know how to cheat just about anything, including taxes and loans (see the oceangate submersible "loan forgiveness" info if you wanna scream). once you reach that threshold, you will have insane resources at your fingertips to turn your large sums of money into even bigger sums, and to get out of paying taxes of any kind if you don't want to! This also applies ACROSS THE WEST not just america so if you think it's not happening in your western country, surprise! it is!!!

#just a huge reminder that it doesn't make her a BAD PERSON#so guys don't send me those weird hateful messages about her#it's just how wealth works it's a system of oppression not taylor swift cracking the whip so relax#tax the rich!!!!!!! Get rid of loopholes!!!!#AT THE VERY LEAST WE CAN DO THAT!!!!

7 notes

·

View notes

Text

youtube

Business Name: Compare My Equity Release

Street Address: Airport West, Lancaster Way

City: Leeds

Zip Code: LS19 7ZA

Country: United Kingdom

Business Phone: 0800 246 5228

Website: https://comparemyequity.co.uk/compare-my-equity-release/

Business Description: Lifetime mortgages for the over 60s can provide a tax free cash injection for financial security. Interest rates can be fixed for life for peace of mind and you can raise money for any purpose.

Compare My Equity puts you directly in touch with a qualified expert who will explain your options, with no obligation.

We take the hassle out of the process by cutting out the call centres.

You deal with a fully qualified adviser, who will speak ‘plain English’ and tell you what you need to know, without any hassle.

Straightforward information, guaranteed!

Request Your Mortgage Quotes And Access Your Free Home Valuation & Review With An Expert.

Google My Business CID URL: https://www.google.com/maps?cid=224167832296737327

Business Hours: Sunday Closed Monday 9am-6pm Tuesday 9am-6pm Wednesday 9am-6pm Thursday 9am-6pm Friday 9am-6pm Saturday 9am-3pm

Services: Compare Equity Release

Keywords: best equity release interest rates, equity release comparison, compare equity release Yorkshire, equity release interest calculator, equity release comparison uk, best equity release calculator, equity release calculator interest, equity release near me, best equity release companies, equity release martin lewis, lifetime mortgages martin lewis, equity release and inheritance taxs

Location:

Service Areas:

9 notes

·

View notes

Text

What are commercial real estate services?

Commercial real estate services refer to a range of professional services and activities related to the buying, selling, leasing, managing, and investing in commercial properties. Commercial properties include office buildings, retail spaces, industrial facilities, hotels, warehouses, and other income-producing real estate assets. These services are typically offered by real estate professionals, companies, and organizations specializing in the commercial real estate sector. Here are some of the key components of commercial real estate services:

Brokerage Services: Commercial real estate brokers help clients buy, sell, or lease commercial properties. They facilitate transactions, negotiate terms and conditions, and provide market insights to help clients make informed decisions.

Property Management: Property management companies oversee the day-to-day operations of commercial properties on behalf of owners. This includes tasks such as rent collection, maintenance, tenant relations, and financial reporting.

Leasing and Tenant Representation: Commercial real estate agents and brokers specializing in leasing help property owners find suitable tenants for their spaces. Tenant representation services assist businesses in finding suitable properties to lease.

Investment Services: Investment firms and professionals provide guidance on real estate investment strategies. They may help investors acquire, manage, or divest commercial properties to optimize returns.

Appraisal and Valuation: Appraisers determine the market value of commercial properties, which is crucial for financing, taxation, and decision-making purposes. Valuation services help property owners understand the worth of their assets.

Development and Construction: Developers and construction companies focus on creating new commercial properties or renovating existing ones. They handle the design, permitting, and construction phases of commercial real estate projects.

Financing and Mortgage Services: Lenders and financial institutions offer loans and mortgage products tailored to commercial real estate projects. These services help property buyers secure the necessary capital for their investments.

Market Research and Analysis: Real estate research firms provide market data, trends, and analysis to assist clients in making informed decisions. This includes information on vacancy rates, rental rates, and demand trends.

Consulting and Advisory Services: Real estate consultants offer strategic advice and planning services to property owners, investors, and developers. They may help clients optimize property portfolios, assess market risks, or formulate investment strategies.

Legal and Regulatory Services: Real estate attorneys specialize in handling legal aspects of commercial real estate transactions. They ensure that contracts, leases, and other legal documents comply with local laws and regulations.

Environmental Assessment: Environmental consultants assess commercial properties for environmental risks and compliance with environmental regulations. This is particularly important for properties with potential contamination issues.

Property Tax Services: Property tax consultants assist property owners in managing and minimizing property tax obligations by evaluating assessments and pursuing tax appeals when necessary.

Overall, commercial real estate services encompass a wide range of activities aimed at facilitating the acquisition, management, and optimization of commercial properties, with the goal of maximizing returns and minimizing risks for property owners, investors, and businesses.

2 notes

·

View notes

Text

Barbie and Ken In Action (Figuratively)

With the Barbie movie set for this summer, seems like an opportunity to consider how Barbie (Mattel 1959) was marketed as a doll and G.I. Joe (Hasbro 1964) was marketed as an action figure. Other competitors to Hasbro's G.I. Joe around that time used the term boy's doll, which fell out of use.

Marketing and collectibles aside, interesting to observe people's reactions when one uses the terms doll and action figure interchangeably and even more interesting when gender is brought into the picture. To me, they're toys and makes no difference who plays with what; toys are aids to a child's imagination and creativity and that type of play should be allowed to be free from adult hang-ups. If collectors and the IRS want to get into the weeds for valuation and import tax purposes they can have at it.

That being said, Ken (Mattel 1961) really is a doll. Literally. In more ways than one. Ryan Gosling do your thing.

#Barbie#Barbie movie#greta gerwig#barbie 2023#barbie and ken#barbie the movie#Margot Robbie#Ryan Gosling

4 notes

·

View notes

Photo

LETTERS FROM AN AMERICAN

March 16, 2023

Heather Cox Richardson

Yesterday, Tamar Hallerman and Bill Rankin of the Atlanta Journal-Constitution reported that the special grand jury in Fulton County, Georgia, investigating the attempt to overturn the 2020 presidential election in that state, heard yet another recording of former president Trump pushing a key lawmaker—in this case, Georgia House speaker David Ralston—to convene a special session of the legislature to overturn Biden’s victory.

One juror recalled that Ralston “basically cut the president off. He said, ‘I will do everything in my power that I think is appropriate.’ … He just basically took the wind out of the sails.” Ralston, who died last November, did not call a special session.

This is the third such recorded call. One was with Georgia secretary of state Brad Raffensperger, and another was with the lead investigator in Raffensperger’s office. Ralston had reported the call, but it was not public knowledge that there was a recording of it.

Hallerman and Rankin interviewed five members of the grand jury, which met for 8 months and heard testimony from 75 witnesses. The jurors praised the elections system, and one said, “I tell my wife if every person in America knew every single word of information we knew, this country would not be divided as it is right now.” Another said: “A lot’s gonna come out sooner or later…. And it’s gonna be massive. It’s gonna be massive.”

The special grand jury recommended Fulton County district attorney Fani Willis indict people involved in the attempt to overturn the election. The cases are now in her hands.

Yesterday, prosecutors in New York met with Stormy Daniels, the adult film actress whom Trump allegedly paid $130,000 to keep their sexual liaison quiet. Also yesterday, Trump fixer Michael Cohen testified before a grand jury about the hush-money payment. Cohen’s testimony suggests that Manhattan district attorney Alvin L. Bragg is considering an indictment on a felony charge for misrepresenting the nature of that payment.

Trump has a new lawyer in that case, Joe Tacopina, who has been making the rounds on television shows to insist that Trump isn’t guilty. Tacopina’s job isn’t easy, and he is not necessarily helping, telling MSNBC’s Ari Melber that Trump didn’t actually lie about the hush payment when he lied about it because he was not under oath and he didn’t want to violate a confidentiality agreement.

Also in New York, Trump has asked a judge to delay the $250 million civil case against him, his three oldest children, and the Trump Organization, for manipulating asset valuations to get bank loans and avoid taxes. New York attorney general Letitia James, who brought the suit, said the defendants had had plenty of time to prepare and that Trump is trying to move the case into the election season, at which point he will insist it must be delayed again.

Katelyn Polantz, Paula Reid, Kristen Holmes, and Casey Gannon of CNN reported today that the federal grand jury investigating Trump’s handling of classified documents has interviewed dozens of Mar-a-Lago staff, from servers to attorneys. Special Counsel Jack Smith continues to try to get Trump lawyer Evan Corcoran to testify after prosecutors learned that on June 24, 2022, Trump and Corcoran spoke on the phone as Trump had been ordered to produce the missing documents and the surveillance tapes of the area.

Prosecutors want Corcoran to have to testify despite the attorney-client privilege he claims, using the “crime-fraud exception,” which means that discussions that aided a crime cannot be kept secret.

In the face of this mounting legal pressure, Trump took to video to demand: “The State Department, the defense bureaucracy, the intelligence services, and all of the rest need to be completely overhauled and reconstituted to fire the deep staters.” Then, he said, his people need to finish the process he began of “fundamentally revaluating [sic] NATO’s purpose and NATO’s mission.” “[T]he greatest threat to Western civilization today is not Russia,” he said, but “some of the horrible USA-hating people that represent us.”

This speech was not simply a defense of Russia and its unprovoked invasion of Ukraine. In his attempt to undermine the legal cases against him, Trump has endorsed the “post-liberal order” whose adherents reject the American institutions that defend democracy. In their formulation, American institutions they do not control—“the State Department, the defense bureaucracy, the intelligence services, and all of the rest,” for example—are corrupt because they defend the ideas of equality before the law, a free press, religious freedom, and so on. They must be torn down and taken over by true believers who will use the state to enforce their “Christian nationalism.”

In that formulation, the FBI and the Department of Justice are persecuting good Americans who were trying to protect the country on January 6, 2021. And yesterday, Zoe Tillman of Bloomberg reported that Matthew Graves, the U.S. attorney in Washington, D.C., sent a letter on October 28 last year to Chief Judge Beryl Howell warning that as many as 1,200 more people could still face charges in connection with the January 6 attack on the U.S. Capitol.

Today, the House Republicans announced an investigation, run by Representative Barry Loudermilk (R-GA), into the House Select Committee to Investigate the January 6th Attack on the U.S. Capitol. The January 6th committee asked Loudermilk to talk to it voluntarily to explain why he gave a tour of the Capitol complex on January 5, 2021, a time when the coronavirus had ended public tours. One of the people on that tour showed up on a video the next day threatening lawmakers.

Loudermilk told Scott MacFarlane and Rebecca Kaplan of CBS News that Americans have “very little confidence” in the report of the January 6th committee, “[a]nd there’s good reason. I mean, you even consider what they did to me, the false allegations that they made against me regarding the constituents that I had in my office in the office buildings—accusing me of giving reconnaissance tours.”

Loudermilk, who chairs the House Administration subcommittee on Oversight, says his committee will work “aggressively” to explain why Capitol security failed on January 6 and will seek interviews with people involved, including former House speaker Nancy Pelosi (D-CA). He says his panel will “be honest, show the truth, show both sides.” Representative Norma Torres (D-CA), the top Democrat on the panel, notes that Loudermilk has not informed the Democrats even of the dates on which the committee is supposed to meet.

Politico’s Heidi Przybyla today reported on a February 2023 “bootcamp” for Republican staffers to learn how to investigate the Biden administration. The camp was sponsored by right-wing organizations including the Conservative Partnership Institute, which is led by Trump’s former chief of staff Mark Meadows and other right-wing leaders and which raised $45 million in 2021 alone. Sessions included “Deposing/Interviewing a Witness” and “Managing the News Cycle.”

At one of those investigations yesterday, Representative Marjorie Taylor Greene (R-GA), who sits on the Homeland Security committee, said she intended to divulge classified information, saying: “I’m not gonna be confidential because I think people deserve to know.” She claimed that drug cartels had left an explosive device on the border; U.S. Border Patrol chief Raul Ortiz later posted a picture of the “device” and said it was “a duct-taped ball filled with sand that wasn’t deemed a threat to agents/public.”

Meanwhile, the Biden administration continues to administer.

Today, Sanofi, the third major producer of insulin in the United States, announced it will cap prices for insulin at $35 a month. Sanofi, Eli Lilly, and Novo Nordisk produce 90% of the insulin in the U.S. The producers have faced pressure after the Inflation Reduction Act lowered the monthly cost of insulin to $35 a month for those on Medicare.

—LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

[From comments :: “Wild how Putin just assumed Trump would win one way or another and Ukraine would have been an easy acquisition. NATO and our State Department would have been dismantled.Scary to think this evil is still so prevalent in our government with the help of Mark Meadows and Steve Bannon lurking around the back doors.”]

#Heather Cox Richardson#Letters From an American#TFG#Gangster Trump#Fulton Co. Ga.#House Republicans#Corrupt GOP#Criminal GOP#January 6 2021#January 6 Commission

4 notes

·

View notes

Text

Unlocking Assets True Valuation For Capital Gains Tax Purposes

Any profit or gain that results from the sale of a "capital asset" is referred to as valuation for capital gains tax purposes. Investments like homes, lands, stocks, mutual funds, jewellery, trademarks, etc. are considered capital assets. Since the gain or profit is regarded as "income," pay taxes in the same year.

0 notes

Text

Even better, let the government take them with eminent domain, spending $0, especially for former big box stores.

Many of these retailers and developers have already used the dark store theory to zero out their land or property tax valuations. The theory is that if the business were to leave and go down the road to a neighboring town, the building would be worthless since the buildings are so single purpose and often cheaply made/have a limited life span such that they have no value without the business. It’s absurd, but it has sadly worked in some jurisdictions.

So make them eat their words. Oh, it’s useless? Then we’ll take it off your hands for you! For $0, the fair market value!

Return these buildings to the community these corporations have exploited, and make them useful.

Fun fact- my apartment building used to be a highschool back in the 50s

It is EXTREMELY liminal

#dark store theory#eminent domain#power to the people#community land use#repurposing#fuck capitalism#fuck corporations

51K notes

·

View notes

Text

The Complete Guide to Professional Valuation Services in Australia

Valuation services are essential for understanding the true value of your assets, whether you're planning for retirement, resolving legal disputes, or making business decisions. With the expertise of Local Valuers, you can access accurate, professional valuations for a wide range of property types and purposes. In this guide, we’ll explore the key services offered by Local Valuers and how they can support your specific needs.

Superannuation Valuations: Planning for a Secure Future

As part of your retirement planning, it’s essential to accurately assess the value of your assets, including property. Superannuation valuations ensure that you have an accurate financial picture for your retirement plans, helping you make informed decisions about your superannuation fund. With a precise understanding of asset values, you can feel confident in your retirement strategy.

Pre Mediation Valuations: Resolving Disputes with Confidence

In cases of legal disputes or negotiations, having a professional property valuation can provide a solid foundation for discussions. Pre Mediation valuations are designed to offer impartial and accurate property assessments, supporting fair outcomes in mediation. This service ensures all parties have a clear understanding of the asset’s value, reducing conflicts and facilitating smoother resolutions.

Business Valuation: Knowing the Worth of Your Business

Understanding the value of your business is crucial for various purposes, such as selling, merging, or securing investments. Business Valuation services provide a comprehensive analysis of a business's worth, considering assets, revenue, market conditions, and other essential factors. With accurate business valuations, you can make strategic decisions with confidence.

Commercial Property Valuers: Supporting Investment and Management Decisions

Investing in commercial property requires in-depth knowledge of its value and potential returns. Commercial Property Valuers specialize in assessing properties for businesses, retail spaces, and other commercial assets. Accurate valuations help investors and managers make data-driven decisions, whether they're buying, selling, or leasing commercial properties.

Residential Valuers: Providing Insights into Home Values

Whether you’re buying a new home or refinancing an existing mortgage, knowing the precise value of your residential property is essential. Residential Valuers offer detailed property assessments that consider factors such as location, market trends, and property features. This service is valuable for homeowners, buyers, and real estate agents who need reliable property valuations.

Land Valuers: Unlocking the Potential of Your Land

Land valuations are crucial for development, investment, or legal purposes, as they provide a clear picture of the land’s worth. Land Valuers specialize in assessing both vacant land and land with structures, considering zoning regulations, land use potential, and environmental factors. Accurate land valuations are key for developers, investors, and landowners seeking insights into their property’s potential.

Building Valuation: Ensuring Your Building's Value is Accurate

Whether for insurance, tax, or sales purposes, understanding the value of your building is essential. Building Valuation services provide detailed assessments, evaluating the structure, materials, location, and market conditions. Accurate building valuations are crucial for investors, property managers, and owners to make informed financial decisions.

Defence Housing Authority Valuations: Specializing in Defence Properties

The Defence Housing Authority (DHA) offers unique housing for Australian Defence Force personnel, and valuing these properties requires specialized knowledge. Defence Housing Authority valuation services focus on the particular needs and regulations associated with DHA properties. These valuations help support fair pricing and provide assurance for buyers, sellers, and DHA itself.

Industrial Property Valuations: Supporting Industrial Investments

Industrial properties, such as warehouses and factories, require specific valuation criteria to account for factors like location, infrastructure, and functionality. Industrial Property Valuations offer specialized insight into the value of industrial assets, helping investors and business owners make strategic decisions with confidence. Accurate valuations are essential for buying, selling, or expanding industrial operations.

Insurance Valuations: Protecting Your Assets

Insurance valuations ensure you’re not over- or under-insured by providing a precise estimate of your property’s worth. Insurance Valuations focus on determining replacement costs and actual cash values for buildings and assets. These valuations are invaluable for setting appropriate insurance coverage and ensuring you’re fully protected in the event of loss or damage.

Why Choose Local Valuers?

With a wide array of services, Local Valuers stands out as a trusted provider of expert property valuations across Australia. Their experienced team offers personalized service, deep industry knowledge, and a commitment to delivering accurate valuations that you can rely on. Whether you’re planning for retirement, preparing for mediation, or managing a commercial property investment, Local Valuers has you covered.

From superannuation planning to insurance coverage, Local Valuers offers tailored valuation services to meet your needs. Reach out to them today for reliable and professional valuation expertise.

0 notes

Text

A Complete Guide to Home and Construction Loans

Purchasing or constructing a home is one of the most significant investments many people make in their lives. For most, this endeavor is made possible through financial assistance, primarily in the form of home and construction loans. These loans can provide the necessary funds for purchasing a new home, building one from the ground up, or even renovating an existing property. However, each loan type has specific requirements, benefits, and processes that are essential for borrowers to understand before taking the plunge.

1. What are Home and Construction Loans?

Home and construction loans are financing options available to individuals looking to buy or build a property. While both types of loans serve the purpose of home ownership, they cater to different needs:

Home Loans: Primarily for purchasing pre-built homes or properties.

Construction Loans: Intended for those looking to construct a property, either as a standalone loan or as part of a transition to a mortgage once the construction is complete.

2. Benefits of Home and Construction Loans

Opting for a loan can make home ownership accessible by easing the financial burden. Key benefits include:

Financial Support: Cover substantial property-related expenses without draining savings.

Flexibility: Use the loan amount for various stages, whether buying, building, or renovating.

Increased Property Value: Enhancing or building a property can boost its market value.

3. Types of Home Loans

Several home loan options are available, each with unique characteristics:

Fixed-Rate Mortgages: The interest rate remains the same throughout the loan term, making EMIs predictable.

Adjustable-Rate Mortgages (ARMs): Interest rates fluctuate with the market, potentially starting lower than fixed rates but carrying the risk of increase.

Government-Backed Loans: These include FHA, VA, and USDA loans, which come with specific benefits and are often ideal for first-time buyers.

4. Types of Construction Loans

Construction loans cater to different phases and purposes, and knowing these types can help you choose the best fit:

Construction-Only Loans: Short-term loans to fund only the construction phase. They typically require refinancing after completion.

Construction-to-Permanent Loans: The loan initially funds construction and then converts to a mortgage upon completion.

Renovation Loans: Meant for major renovations or remodels, covering costs to enhance an existing property.

5. Eligibility Criteria for Home and Construction Loans

Lenders require that applicants meet specific criteria to ensure financial stability:

Credit Score: A higher credit score can improve your chances of approval and lower interest rates.

Employment and Income: Proof of stable income and employment is crucial for loan approval.

Down Payment: Typically, lenders require a down payment, which may vary depending on loan type and lender policies.

Property Valuation: Lenders assess the property value to determine loan feasibility and the loan-to-value ratio.

6. Interest Rates for Home and Construction Loans

Interest rates are a key factor in loan affordability and vary based on:

Fixed vs. Variable Rates: Fixed rates remain constant, while variable rates can change based on market conditions.

Credit Score and Loan Tenure: Higher credit scores and shorter loan tenures often result in better interest rates.

7. Loan Amount and Tenure

Loan amounts depend on factors like income, repayment capability, and property value. Construction loans typically come with short tenures during the building phase, while home loans can have tenures up to 30 years, giving borrowers flexibility in monthly repayments.

8. Documentation Required for Home and Construction Loans

Preparing the required documentation can streamline the application process. Common documents include:

Identity Proof: PAN card, Aadhaar card, or passport.

Income Proof: Salary slips, tax returns, or bank statements.

Property Papers: Documents proving ownership or property-related permissions.

9. How to Apply for Home and Construction Loans

Applying for a loan is a multi-step process that can be completed online or offline:

Research Lenders: Compare interest rates, loan terms, and eligibility.

Fill the Application: Provide personal details and upload the required documents.

Loan Processing and Approval: Lenders review the application and may request additional information.

Loan Disbursement: Once approved, funds are disbursed either directly to the applicant or contractor.

10. Common Myths about Home and Construction Loans

Several misconceptions surround home and construction loans, including:

High Down Payments Required: While some lenders have strict requirements, government-backed loans may allow lower down payments.

Perfect Credit Score Necessary: Although a good score helps, many lenders accommodate a range of credit scores.

Only for New Buyers: Home and construction loans can also support existing homeowners with renovation and improvement financing.

11. Repayment Options for Home and Construction Loans

Repayment structures for these loans include EMIs and interest-only payments during construction, with flexibility for borrowers based on their financial situation. Construction-to-permanent loans often offer interest-only payments during construction, switching to EMI once the mortgage phase begins.

Conclusion

Home and construction loans can make the dream of home ownership or property improvement attainable for many individuals. With the right loan type, eligibility criteria, and documentation, these loans provide financial ease, allowing people to build, buy, or renovate as needed. However, selecting the right loan requires careful consideration of each option’s features, repayment terms, and benefits. Armed with this guide, you’re now better equipped to make an informed decision about home and construction loans.

#home loan for land and construction#construction loan#home construction loan#property construction loan#interest rate for home construction loan#construction loan rate of interest#home construction financing#house construction financing#construction loan for land and house#LIC housing

1 note

·

View note