#united states stock market holidays 2023

Explore tagged Tumblr posts

Text

US Stock Market Holiday Schedule for the Year 2023: Plan Your Investments Accordingly

US Stock Market Holiday Schedule for the Year 2023 US Stock Market Holiday Schedule for the Year 2023: The US markets are closed on these days. Introduction: Investing in the US Stock market requires careful planning and consideration, and being aware of the holiday schedule is crucial for traders and investors. In 2023, the New York Stock Exchange (NYSE) and the NASDAQ stock market will observe…

View On WordPress

#united states stock market holidays 2023#US stock and bond market holidays 2023#US stock exchange bank holidays 2023#US stock exchange public holidays 2023#US Stock Market holidays 2023#US stock market holidays 2023 calendar#US stock market holidays 2023 list#US stock market holidays 2023 Nasdaq#US stock market holidays hours 2023#US stock market public holidays 2023

0 notes

Text

LETTERS FROM AN AMERICAN

December 30, 2023

HEATHER COX RICHARDSON

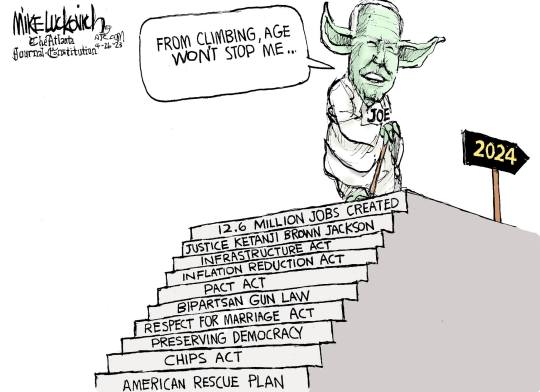

DEC 31, 2023

One day short of his first 100 days in the White House, on April 28, 2021, President Joe Biden spoke to a joint session of Congress, where he outlined an ambitious vision for the nation. In a time of rising autocrats who believed democracy was failing, he asked, could the United States demonstrate that democracy is still vital?

“Can our democracy deliver on its promise that all of us, created equal in the image of God, have a chance to lead lives of dignity, respect, and possibility? Can our democracy deliver…to the most pressing needs of our people? Can our democracy overcome the lies, anger, hate, and fears that have pulled us apart?”

America’s adversaries were betting that the U.S. was so full of anger and division that it could not. “But they are wrong,” Biden said. “You know it; I know it. But we have to prove them wrong.”

“We have to prove democracy still works—that our government still works and we can deliver for our people.”

In that speech, Biden outlined a plan to begin investing in the nation again as well as to rebuild the country’s neglected infrastructure. “Throughout our history,” he noted, “public investment and infrastructure has literally transformed America—our attitudes, as well as our opportunities.”

In the first two years of his administration, when Democrats controlled both chambers of Congress, lawmakers set out to do what Biden asked. They passed the $1.9 trillion American Rescue Plan to help restart the nation’s economy after the pandemic-induced crash; the $1.2 trillion Infrastructure Investment and Jobs Act (better known as the Bipartisan Infrastructure Law) to repair roads, bridges, and waterlines, extend broadband, and build infrastructure for electric vehicles; the roughly $280 billion CHIPS and Science Act to promote scientific research and manufacturing of semiconductors; and the Inflation Reduction Act, which sought to curb inflation by lowering prescription drug prices, promoting domestic renewable energy production, and investing in measures to combat climate change.

This was a dramatic shift from the previous 40 years of U.S. policy, when lawmakers maintained that slashing the government would stimulate economic growth, and pundits widely predicted that the Democrats’ policies would create a recession.

But in 2023, with the results of the investment in the United States falling into place, it is clear that those policies justified Biden’s faith in them. The U.S. economy is stronger than that of any other country in the Group of Seven (G7)—a political and economic forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States, along with the European Union—with higher growth and faster drops in inflation than any other G7 country over the past three years.

Heather Long of the Washington Post said yesterday there was only one word for the U.S. economy in 2023, and that word is “miracle.”

Rather than cooling over the course of the year, growth accelerated to an astonishing 4.9% annualized rate in the third quarter of the year while inflation cooled from 6.4% to 3.1% and the economy added more than 2.5 million jobs. The S&P 500, which is a stock market index of 500 of the largest companies listed on U.S. stock exchanges, ended this year up 24%. The Nasdaq composite index, which focuses on technology stocks, gained more than 40%. Noah Berlatsky, writing for Public Notice yesterday, pointed out that new businesses are starting up at a near-record pace, and that holiday sales this year were up 3.1%.

Unemployment has remained below 4% for 22 months in a row for the first time since the late 1960s. That low unemployment has enabled labor to make significant gains, with unionized workers in the automobile industry, UPS, Hollywood, railroads, and service industries winning higher wages and other benefits. Real wages have risen faster than inflation, especially for those at the bottom of the economy, whose wages have risen by 4.5% after inflation between 2020 and 2023.

Meanwhile, perhaps as a reflection of better economic conditions in the wake of the pandemic, the nation has had a record drop in homicides and other categories of violent crime. The only crime that has risen in 2023 is vehicle theft.

While Biden has focused on making the economy deliver for ordinary Americans, Vice President Kamala Harris has emphasized protecting the right of all Americans to be treated equally before the law.

In April 2023, when the Republican-dominated Tennessee legislature expelled two young Black legislators, Justin Jones and Justin J. Pearson, for participating in a call for gun safety legislation after a mass shooting at a school in Nashville, Harris traveled to Nashville’s historically Black Fisk University to support them and their cause.

In the wake of the 2022 Dobbs v. Jackson Women’s Health Supreme Court decision overturning the 1973 Roe v. Wade decision that recognized the constitutional right to abortion, Harris became the administration’s most vocal advocate for abortion rights. “How dare they?” she demanded. “How dare they tell a woman what she can and cannot do with her own body?... How dare they try to stop her from determining her own future? How dare they try to deny women their rights and their freedoms?” She brought together civil rights leaders and reproductive rights advocates to work together to defend Americans’ civil and human rights.

In fall 2023, Harris traveled around the nation’s colleges to urge students to unite behind issues that disproportionately affect younger Americans: “reproductive freedom, common sense gun safety laws, climate action, voting rights, LGBTQ+ equality, and teaching America’s full history.”

“Opening doors of opportunity, guaranteeing some more fairness and justice—that’s the essence of America,” Biden said when he spoke to Congress in April 2021. “That’s democracy in action.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters from An American#Heather Cox Richardson#Biden Administration#Biden's accomplishments#Election 2024#Mike Luckovich

10 notes

·

View notes

Text

Financialization & Zombie Neoliberalism

Paul Keating tells us that Australia is on its way to becoming the unofficial 51st state of America. The former PM is not being complimentary in his assessment of our current defence policies when saying this. No, Keating is issuing a warning about our docile behaviour in this space. The truth is that Australia does follow the United States in many ways when it comes to economic and political trends. Especially, those on the conservative side of politics are constantly looking to take our country down well-trodden American roads. Financialization and zombie neoliberalism is where the US finds itself with private equity investment firms gobbling up all areas of life and business in America.

Housing A Major Investment Commodity

We have a housing affordability crisis in Australia, as they do in America and in most Western nations around the globe. Shelter has become a major investment commodity globally, which has left large chunks of the population out in the cold. In Australia, our banks have grown incredibly wealthy on the back of the home loan business over the years. “Household net wealth sat at a record $16.2 trillion in the March 2024 quarter, boosted by a record level of property assets of $11.0 trillion as at 31 March 2024. As a proportion of net household wealth, residential property accounted for around 67.9%, up from 61.7% in December 2020.” (https://www.adviservoice.com.au/2024/06/household-wealth-rises-to-record-over-16-trillion-spurred-on-by-property/#:~:text=Householdnetwealthsatat,from61.7inDecember2020.) High levels of immigration into the country has exacerbated a housing shortage in combination with a proliferation of short term holiday rental properties draining the available stock further. Long term rents have sky rocketed in response to these market forces. Our timid governments still in thrall to zombie neoliberalism refuse to consider caps on things like rent increases despite the inflationary effect of these 20% and 30% increases.

Private Equity Investment In Residential Property In America

In America, Wall St hedge fund investors and private equity firms have been buying up residential property in cities around the nation. In a number of cities they have become the major landlords in town. They now own around 10% of properties nationally. This could be seen as a good thing economically if not for their behaviour. You would think cashed up corporations would be good landlords. No, in the extreme world of American financialization these landlords have not only pushed up rents more aggressively than ever, by around 30%, but they also skimp on fixing the property and maintenance for their tenants. Only in America! It is all about return on investment and screwing every dollar possible at the lowest cost. Rising rents are a major factor in sticky high inflation in economies everywhere. President Joe Biden, prior to stepping out of the race, promised to cap rent increases by corporate landlords to 5% annually. Even, the avaristic Americans are looking to cap rental increases but sleepy Australian governments leave the market to sort itself out. Zombie neoliberalism still stalks the halls of power in Oz. Most Aussie MPs are landlords by the way, including PM Anthony Albanese. More Australians get rich via property investment above and over everything else. “The latest data from the Australian Taxation Office (ATO) reveals that 2,245,539 Australians or around 20% of Australia’s 11.4 million taxpayers owned an investment property in 2020-21 – this is the latest data available at the time of writing and was released in June 2023.” (https://propertyupdate.com.au/how-many-australians-own-an-investment-property/)

Financialization Poses Further Wealth Inequality Opportunities Financialization is really a cannibalising of existing societal infrastructure. It feeds on the necessary stuff we have put in place to make our lifestyles possible. Shelter, a roof over our heads, is now commodified as the major investment opportunity for a section of our population. If Australia goes the way of America, with private equity financialization running rampant through everything we will see an increase in the already growing divide between the wealthy and the working poor. We don’t tax wealth in this country but income, mainly from workers. This means with the aid of tax minimisation arrangements, like family trusts and shifting profits to tax shelters, the wealthy avoid paying their fair share of tax in Australia. We learned this from our former British colonial masters. Conservative British billionaires contribute even less to annual tax revenues in the UK than their American counterparts. Capital gains tax contributes less than 2% to annual tax revenues in the UK, this is despite the enormous wealth within the financial sector operating in Britain. Many of the tax havens are British island territories and are a part of the web of tax minimisation established by the financial realm in the UK at the height of the Thatcher years. Stripping the state of assets and access to the wealth of private citizens are all aspects of the neoliberal playbook. Meanwhile, for everyone else at the bottom of the food chain neoliberals want the ‘user pays’ economic model to cover everything in life. You will notice already the plethora of fees, charges, subscriptions and rents being levied on everything you do in life in the 21C. In Australia, this means our hospitals and health system ultimately becoming privatised. This is already happening with private equity buying up hospitals in Australia. They promise greater efficiencies if the hegemony of capital markets reign, but ‘for profit’ ownership of health facilities invariably see cost cutting measures which do not put patient care first and foremost. Education under the LNP will see further neglect of the state school system and the prioritisation of looking after private schools. This occurred for the decade they were last in power and saw more parents leaving public education for the private sector with their kids. The best schools in the world are consistently those in the Scandinavian nations and they are public schools, where they fund them well to ensure top quality educational outcomes for their children. The split between public and private in Australia is a perennial canker displaying the century long tussle between models and ideological philosophies in our nation.

Choose An Independent Australian Future We do not want to become the unacknowledged 51st state of America because the US is a deeply divided and extreme nation. The China scare tactics of conservatives and US economic and defence policies must not box us in to the tacit support of everything America proposes in this space. Yes, we do not agree with the totalitarian regime underpinning China, but we should also be clear about the extremely unfair state of economic life in the US. The minimum federal wage in America is $7.24, whereas in Australia it is $24.10. The neoliberal economic policies which have proliferated in America since Ronald Reagan have produced a massively inequitable state of wealth among Americans. A land of billionaires boasting obscene levels of wealth and tens of millions of Americans living in abject poverty. Two speed economies have become the norm in neoliberal economies around the globe. The ‘trickledown effect’ never materialised and the economic theories of Hayek and Friedman made some very wealthy at the expense of the rest of us. It is time to redress this situation and rebalance the wealth distribution around the globe. Financialization and zombie neoliberalism must be rooted out from our governments and business sectors.

Biden Invested In American Manufacturing President Joe Biden has overseen the injection of trillions of dollars into American homegrown manufacturing. This contrasts the previous decades of financialization in the US and the growth of private equity. America had been putting all its eggs into the money market to the detriment of its millions of skilled workers, as manufacturing jobs flooded offshore. The rise of Trump as the king of grievance politics was borne on the back of this. Of course, Trump is a liar and conman and has never done anything for American workers but make them empty promises. President Biden has led the greatest investment in America by an administration ever. “$563.6 Billion in public infrastructure, semiconductor and clean energy investments in the United States under the Biden Administration, including: $303.4Bannounced for transportation investments in roads, bridges, public transit, ports and airports, as well as electric school and transit buses, EV charging, and more.” (https://www.whitehouse.gov/invest/#:~:text=563.6Billioninpublicinfrastructure,EVchargingandmore.) This is just some of the massive investment in American manufacturing for a clean energy and high tech future for American workers. Trump did next to nothing during his chaotic time in office, accept lower the tax rate for the wealthy and corporations. Investing In Australian Manufacturing? I remember the talk in Australia during the pandemic, as we realised our economic dependence upon China was a problem. However, since then I have heard little about investing in Australian manufacturing, apart from the solar panels plan. This plan copped criticism from economists who have grown up in an Australia committed to globalism. If we do not seriously invest in our manufacturing future we will continue to be vulnerable to headwinds of whatever nature be they economic or from warfare. Australia should be investing in its independent resilience. It is an opportunity to lay the economic groundwork for an economy capable of withstanding shipping blockades and being cut off from the global digital network if marine cables are damaged by acts of war. It is time to start doing things, building things, making things, instead of merely buying cheaper stuff from China. Tough Times Downunder Our construction sector is bleeding companies going into liquidation because their business models were designed around accessing cheap building materials from China. This all changed post pandemic with everything going up in price, including labour in response to high inflation reducing the buying power of workers’ wages. Australians have been forced to become entrepreneurs and small business owners because the well paid manufacturing jobs have disappeared over the last couple of decades. This results in a plethora of undercapitalised businesses who are the first to go bust when the economic cycle turns and interest rates are whacked up by the central bank to curb demand and high inflation. This is what we are seeing right now in the Oz economy.

Neoliberalism is a global economic order. It’s philosophy is based on market fundamentalism. It operates by shifting power from the state to private equity. Public assets are sold off and utilities are privatised and corporatised. National banks are privatised. National airline carriers are privatised. Telecoms are turned into Telstra’s. Power utilities become corporate power companies. Promises of cheaper prices never eventuate. Jobs disappear and wages are trimmed and tightly controlled. Shareholders and investors are kings. Consumers get shafted as competition in the sector is removed via takeovers and mergers all approved by the ACCC. You get Coles and Woolies. The big 4 banks. The big 4 consultancy firms replacing public service jobs. The disappearance of accountability and transparency. Duopolies everywhere you seek to do business. Welcome to modern Australia. Zombie Neoliberalism & Our Politicians “A politician needs the ability to foretell what is going to happen tomorrow, next week, next month, and next year. And to have the ability afterwards to explain why it didn’t happen.” Winston Churchill We are living in a time of financialization and zombie neoliberalism. The GFC and subsequent crises have discredited neoliberalism but it lives on zombie-like in the actions and policies of governments. Generations of politicians have grown up never having to actually do anything but talk on the TV. Never being truly responsible for any economic activity but commentating on it instead. Much of their role nowadays involves being talking head puppets making sage predictions with few consequences. Spending billions on endless reviews by PwC and Ey and legions of consultant lawyers and accountants. ‘Leave it to the market’ has been indelibly inked upon their foreheads – even those pollies on the left march to this same zombie neoliberalism beat. Housing crisis? The market will fix it! Cost of living crisis? Market forces will readjust eventually. Politicians learn to smile for the camera and to nod their heads whilst appearing wise. Photo opportunities are more important than getting one’s hands dirty in the 21C. Is it any wonder that the electorate quickly tires of the sound bites and fake smiles? That we end up despising our pollies for their failure to really engage with the business at hand? Robert Sudha Hamilton is the author of America Matters: Pre-apocalyptic Posts & Essays in the Shadow of Trump. ©WordsForWeb

Read the full article

#American#Australia#China#financialization#housingcrisis#neoliberalism#politics#power#privatewealth#propertymarket#publicgood#Trump#USA#zombieneoliberalsim

0 notes

Text

Stainless Steel Pricing Report, Trend, Chart, News, Demand, Historical and Forecast Data

The latest report by IMARC, titled " Stainless Steel Pricing Report 𝟐𝟎𝟐𝟒: 𝐏𝐫𝐢𝐜𝐞 𝐓𝐫𝐞𝐧𝐝, 𝐂𝐡𝐚𝐫𝐭, 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐍𝐞𝐰𝐬, 𝐃𝐞𝐦𝐚𝐧𝐝, 𝐇𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐚𝐧𝐝 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐃𝐚𝐭𝐚," delivers a comprehensive analysis of stainless steel prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Stainless Steel Prices December 2023:

United States: 3450 USD/MT

China: 1860 USD/MT

Germany: 3146 USD/MT

Report Offering:

Monthly Updates - Annual Subscription

Quarterly Updates - Annual Subscription

Biannually Updates - Annual Subscription

The study delves into the factors affecting stainless steel price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/stainless-steel-pricing-report/requestsample

Stainless Steel Price Trend- Q4 2023

Stainless steel (flat) refers to a category of steel known for its corrosion resistance, achieved through the addition of chromium and other alloying elements, which form a protective layer on its surface. It involves the process of melting the steel and alloying elements together, then casting the molten steel into a slab or bloom, which is subsequently hot-rolled into flat products of varying thicknesses. The stainless steel market in the fourth quarter of 2023 was characterized by a complex interplay of demand and supply dynamics across major regions, influenced by economic indicators, sector-specific demands, and geopolitical factors. In North America, the initial strong demand from the chemical and automotive sectors, driven by limited upstream material supplies, set a high price trend for stainless steel flat products. The redirection of investments to China to counteract the threat from affordable imports and the fluctuating demand influenced by winter holidays, weather conditions, and policy uncertainties, further shaped the market dynamics.

The global stainless steel market size reached US$ 155.41 Billion in 2023. By 2032, IMARC Group expects the market to reach US$ 251.80 Billion, at a projected CAGR of 5.51% during 2023-2032. In the Asia-Pacific region, the market experienced downward pressure on prices due to a combination of anti-dumping duties, shifts in demand, and raw material uncertainties. The Chinese market, in particular, saw a reduction in prices as steelmakers grappled with low iron ore stocks and sought alternatives amidst a predicted growth in steel demand. Despite an increase in nickel supply and the use of recycled materials, reduced consumption, and excess coal supply weighed heavily on the market. The impact of global oversupply, adverse weather conditions, and expanded mining operations, alongside disruptions in Indonesia and strategic moves by major companies like Tsingshan Holding Group, played significant roles in shaping the market landscape. The stabilization of prices in December, despite these challenges, underscores the volatile nature of the market and its sensitivity to global trade and macroeconomic factors.

Europe's stainless steel flat market maintained a stability, with fluctuations influenced by sectoral demand, raw material supply, and policy developments. The initial price increase in the German spot market, driven by demand from the automotive and chemical sectors, faced challenges from reduced raw material supply and concerns over future availability due to the EU Carbon Border Tax and potential export bans. As the quarter progressed, reduced demand from downstream industries and an oversupply situation led to a decline in prices. The end of the quarter saw further price reductions influenced by decreased domestic demand, increased production costs, and the impact of policy changes on sectors like electric vehicles. These factors, combined with strategic industry responses to environmental concerns, highlight the diverse influences on the stainless steel market and the intricate balance between demand, supply, and policy frameworks that define its trajectory.

Browse Full Report: https://www.imarcgroup.com/stainless-steel-pricing-report

Key Points Covered in the Stainless Steel Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

Stainless Steel Prices

Stainless Steel Price Trend

Stainless Steel Demand & Supply

Stainless Steel Market Analysis

Demand Supply Analysis by Type

Demand Supply Analysis by Application

Demand Supply Analysis of Raw Materials

Stainless Steel Price Analysis

Stainless Steel Industry Drivers, Restraints, and Opportunities

Stainless Steel News and Recent developments

Global Event Analysis

List of Key Players

Regional Price Analysis:

Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

North America: United States and Canada

Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐈𝐌𝐀𝐑𝐂 𝐆𝐫𝐨����𝐩:

Soybean Oil Pricing Report

Base Oil Pricing Report

Citric Acid Pricing Report

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

1 note

·

View note

Text

Polybutylene Adipate Terephthalate Prices Trend, Monitor, News, Analytics and Forecast | ChemAnalyst

Polybutylene Adipate Terephthalate (PBAT) Prices: During the Quarter Ending December 2023

In the fourth quarter of 2023, prices of polybutylene adipate terephthalate (PBAT) in the North American market showed a mixed trend. With a moderate supply and high demand from downstream industries, the quarter began positively. However, destocking storage in Asian markets following the holiday season and lower demand in downstream packaging markets contributed to bearish market sentiment.

The PBAT industry was further impacted by the strengthening of the US dollar and economic uncertainty, which resulted in a decrease in overseas orders for packaging markets. The market's uncertainty was exacerbated by the ongoing conflict in West Asia and rising energy costs. However, a price decrease was supported by lower freight costs and a decrease in upstream petrochemical production and stock. Opportunities for PBAT manufacturers in the downstream packaging industries were created when the US government provided the National Advanced Packaging Manufacturing Program (NAPMP) with a funding of USD 1668 billion.

For the fourth quarter of 2023, Polybutylene Adipate Terephthalate CFR Los Angeles was valued at USD 1668 per MT in the United States.

Get Real Time Prices of Polybutylene Adipate Terephthalate (PBAT): https://www.chemanalyst.com/Pricing-data/polybutylene-adipate-terephthalate-resin-1219

Prices of APAC Polybutylene Adipate Terephthalate (PBAT) have performed varyingly in the fourth quarter of 2023. Upstream prices for PTA, adipic acid, and butane diol have remained stable, despite slowing growth in petrochemical capacity as a result of uncertainty in the crude oil market. Downstream demand was muted at the beginning of the quarter, and a decrease in overseas orders pushed up prices despite the stability of upstream prices. The overall price drop was also influenced by the fall in freight rates. Energy prices could rise as a result of the West-Asia conflict's escalation, but China's recovering economy could support a PBAT price increase. The market in China has been bearish due to a moderate supply, particularly in the packaging sector, which experienced low demand following the holiday season. A decrease in freight costs and an increase in upstream petrochemical production and stock were anticipated to support a price drop. When compared to the same quarter last year, the correlation price percentage in Q4 2023 was -34%. There was no change in percentage between the current quarter and the previous quarter. In China, the price percentage difference between the first and second quarters was -5 percent. USD 1589/MT is the most recent price of PBAT FOB Qingdao in China in Q4 2023.

Europe Several factors will have an impact on the European Polybutylene Adipate Terephthalate (PBAT) market in Q4 2023. After the holiday season, the downstream food packaging industry's lackluster demand has weighed on the market. Prices have also been affected by the dollar's weaker position in relation to the euro. Energy costs may rise as a result of the West-Asia conflict's escalation. However, as China's economy has recovered, downstream industry demand has increased, which may support a price increase for PBAT. Germany has played a significant role in reducing plastic waste and maintaining the sustainability of the packaging industry. Biodegradable packaging materials like PBAT have been produced by German manufacturers instead of single-use packaging production lines. In Germany, the price percentage changed by -33% from the same quarter last year and by -9% from the current quarter to the previous quarter. In Germany, the price percentage difference between the first and second quarters is -3%. In Germany in Q4 2023, the most recent/quarter-ending price of PBAT FOB Hamburg is USD 1825/MT.

Get Real Time Prices of Polybutylene Adipate Terephthalate (PBAT): https://www.chemanalyst.com/Pricing-data/polybutylene-adipate-terephthalate-resin-1219

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Glyoxal Prices, Demand & Supply | ChemAnalyst

In the fourth quarter of 2023, Glyoxal prices in the USA rose due to increased demand and supply dynamics. Although feedstock Ethylene glycol prices declined in production, this did not significantly impact Glyoxal pricing. The region's supply chain faced challenges, including concerns over overall supply levels.

The downstream construction sector, a major Glyoxal consumer, showed little improvement compared to the previous month, keeping demand moderate and stable. According to Fred's data, the Producer Price Index (PPI) for cement remained unchanged at 240.35 in October, affecting goods consumption in November. Despite the stable PPI for cement, Glyoxal prices increased due to a significant rise in production costs.

Furthermore, private sector output expansion accelerated, marking the fastest growth since July, which further propelled Glyoxal prices through October and November. Globally, Glyoxal prices rose independently of downstream demand, driven primarily by sustained high production costs and specific supply chain challenges, shaping the market dynamics in the fourth quarter of 2023.

Track Real Time Glyoxal Prices: https://www.chemanalyst.com/Pricing-data/glyoxal-1568

During the fourth quarter of 2023, the Glyoxal market experienced a significant shift, with prices decreasing after a consistent rise in the previous quarter. In Germany, merchants adjusted operations based on existing stock levels, which led to a reduction in new orders. Downstream sectors such as cement, paints and coatings, and textiles saw a major decline in activity toward the end of the quarter, with sharp drops across all areas. The manufacturing Purchasing Managers' Index (PMI) in Germany stayed below the threshold limit, reflecting low Glyoxal consumption during this period.

Domestic key players tried to raise product prices due to long-standing high production costs and inflation, which eased as demand fell in both domestic and international markets in November. Nonetheless, the last month of the quarter saw a significant decrease in Glyoxal prices in Germany, mainly due to lower demand in the downstream construction industry amid economic challenges and subdued purchasing. Additionally, security concerns increased in mid-December following attacks on commercial vessels in the southern Red Sea, raising global fears about potential supply chain disruptions. This crisis, occurring just before the Christmas holidays, notably affected market dynamics.

About Us:

Welcome to ChemAnalyst, the future of chemical and petrochemical market intelligence, where innovation meets insight. Awarded the prestigious titles of ‘The Product Innovator of the Year, 2023’ and recognized among the "Top 100 Digital Procurement Solutions Companies," we stand at the forefront of the digital transformation in the chemical industry. Our cutting-edge online platform revolutionizes the way companies approach the volatile chemical market, offering an unparalleled depth of market analysis, real-time pricing, and the latest industry news and deals from around the globe. Dive into the future with us, where tracking over 500 chemical prices across more than 40 countries is not just possible—it's effortless.

With ChemAnalyst, you gain a strategic advantage. Our expansive database covers over 500 chemical commodities, providing detailed insights into Production, Demand, Supply, Plant Operating Rates, Imports, Exports, and beyond. Our forecasts stretch up to a decade, offering not just historical data analysis but a glimpse into the future of the chemical markets. Supported by local field teams in over 40 countries, we ensure the data you receive is not only comprehensive but also meticulously verified, offering you reliability unmatched in the industry.

Contact US:

420 Lexington Avenue, Suite 300

New York, NY

United States, 10170

Email-id: [email protected]

Mobile no: +1- 3322586602

#Glyoxal#Glyoxalprices#Glyoxalmarket#Glyoxaldemand#Glyoxalsupply#Glyoxalpricetrend#Glyoxalpriceforecast#Glyoxalnews#Glyoxalmarketprice#priceofGlyoxal

1 note

·

View note

Text

Peso Strengthens: Latest Philippine Currency Update

Peso's Resilience Against the Dollar

The Philippine peso displayed remarkable strength at the beginning of November, touching the 55 level during Friday's trading. Simultaneously, local shares saw a positive trend. Peso's Surge The peso saw a notable increase of 0.63 against the US dollar, closing the day at 56.1, a substantial improvement from Tuesday's closing rate of 56.73.

Intraday Fluctuations

The day opened with a stronger peso at 56.60 compared to the previous trading's starting point at 56.80 against the greenback. The local currency exhibited a fluctuation from 55.93 to 56.60 during the day, resulting in an average level of 56.25. Rizal Commercial Banking Corp. (RCBC) chief economist Michael Ricafort pointed out that the intraday trading at 55.93 marked a new low in nearly three months, dating back to August 7, 2023. Ricafort attributed the stronger peso to "seasonal increases in OFW remittances to finance holiday-related spending, especially during this extended holiday weekend" and "the recent decline in global crude oil prices, hitting a three-month low, which could reduce the country's oil import bill and narrow the trade deficit." Surge in Trade Volume Trade volume surged to USD1.84 billion, significantly surpassing Tuesday's volume of USD860.9 million. "For Monday, the peso exchange rate is expected to range between 56 to 56.20 levels," added Ricafort.

Positive Momentum in the Stock Market

Simultaneously, the Philippine Stock Exchange index (PSEi) experienced gains over the two trading days of the week. PSEi's Gains On Friday, PSEi advanced by 15.49 points, although it fell short of the 6,000 mark, closing the day at the level of 5,989.27. All Shares also registered an increase of 8.88 points, reaching 3,263.05. Most sectoral indices ended positively, except for Financials, which declined by 8.20 points. Advancers outnumbered decliners at 106 to 59, with 49 remaining unchanged.

The Philippine Peso's Recent Trends

Factors Contributing to Peso Depreciation The Philippine peso has seen a weakening trend against the US dollar since Ferdinand Marcos Jr. assumed the presidency in June 2022. The Bangko Sentral ng Pilipinas (BSP) reported an average peso-dollar exchange rate of 52.239 in June 2022, which increased to 55.728 in May 2023. This reflects a depreciation of approximately 7% in the peso's value against the dollar since Marcos's inauguration.

Factors Behind Peso Depreciation

Several factors have contributed to the peso's depreciation. One significant factor is the global economic slowdown, which has led to reduced demand for Philippine exports. Additionally, rising interest rates in the United States have made the dollar more appealing to investors.

BSP's Measures

In response to the peso's decline, the BSP has taken various measures to support the local currency, including raising interest rates and intervening in the foreign exchange market. However, the effectiveness of these measures has been limited thus far.

Peso-Dollar Exchange Rate Trends

Exchange Rate Fluctuations The peso-dollar exchange rate has shown fluctuations over time, reflecting the evolving economic landscape. Here are some key data points: - June 2022: 52.239 - July 2022: 53.306 - August 2022: 54.406 - September 2022: 55.498 - October 2022: 56.595 - November 2022: 57.689 - December 2022: 58.787 - January 2023: 59.889 - February 2023: 60.996 - March 2023: 62.109 - April 2023: 63.222 - May 2023: 55.316 It is essential to note that the peso-dollar exchange rate constantly fluctuates, making future predictions challenging. Nevertheless, the current trend suggests that the peso is likely to continue weakening against the dollar in the near term. Sources: THX News & Philippine News Agency. Read the full article

#BSPmeasurestosupportpeso#BSP'sroleincurrencystability#Economicfactorsbehindpesodecline#Factorsimpactingpeso'svalue#Pesostrengthensagainstdollar#Peso-dollarexchangeratetrends#Philippinepesoexchangeratenews#Philippinestockmarketupdate#PSEigainsandlosses#USdollartopesorate

0 notes

Text

Stock Market Trading Holiday List 2023

Introduction: Introduction: Stock Market Trading Holiday List 2023 :India (Bombay Stock Exchange – BSE and National Stock Exchange – NSE):United States (New York Stock Exchange – NYSE and NASDAQ Holidays 2023):China (Shanghai Stock Exchange – SSE and Shenzhen Stock Exchange – SZSE):Japan (Tokyo Stock Exchange – TSE):Australia (Australian Securities Exchange – ASX):FAQs For stock market Trading…

View On WordPress

#indian stock market holidays 2023#nasdaq holidays 2023#nse holidays 2023 list pdf#share market holiday list 2023#stock market holidays list 2023#stock market Trading holiday list 2023

0 notes

Text

4/9/2023

The Hong Kong stock market was closed last Friday due to the arrival of Typhoon Sulla signal 10. Looking at August, the HSI fell by 1,696 points or 8.45%, the largest decline since February, ending two consecutive months of gains. HS Technology index fell 370 points or 8.14% in August.

Hong Kong stocks rose first and then retreated on the last trading day of August. After the HSI opened 97 points higher, the gain once expanded to 184 points, reaching a high of 18,667 points. Later, selling pressure emerged, and it fell 100 points throughout the day to 18,382 points. The HS technology index fell 15 points to 4,179. The turnover of the Main Board was HK$136.5 billion.

Last week, the HSI showed a black candlestick gyro scrambling to wait for a change signal. Although the market rebounded, trading volume did not increase significantly. The HSI was subject to the resistance of the falling gap (18,792 to 19,049) on August 14. The 10-DMA (18,086) is not far from the current HSI. If the Hong Kong stock market fluctuates around 300 points in September, it will fall below the 10-DMA, then covering the rising gap at the end of November last year (17,364 to 17,536 ). If there is a short-term rebound, it must first break through the 20-DMA (18,477), with resistance at last Thursday's high of 18,667 points.

After the performance period, the focus will return to macroeconomic data. If the performance is not as good as expected, the market will be under pressure to fall repeatedly. The market's expectation of interest rate hikes has cooled, and the US 10-year bond yield and the US dollar have fallen from their high levels. This is good news for the stock market. However, Hong Kong stock investors focus on the mainland economy. A more pessimistic view of the macroeconomic outlook. The current situation is not technically or morphologically unfavorable to the development of the stock market, so investors should do a good job in risk management.

European stock markets developed individually, with British stocks rising 0.34%, French stocks and German stocks closing down 0.27% and 0.67% respectively.

At the close last Friday, the Dow rose 115 points to 34,837; the S&P 500 rose slightly by 8 points to 4,515; the technology-heavy Nasdaq dropped 3 points to 14,031. U.S. stocks performed well last week, recovering some of the losses from August's decline. Among the three major indexes, the Nasdaq performed best, rising 3% cumulatively, the S&P 500 rose 2.5%, and the Dow Jones Industrial Average rose 1.4%.

Looking back at last week, the driving forces that drove the market, including last Friday’s announcement that the increase in non-agricultural jobs in the United States in August was better than expected, but the rising unemployment rate further weakened the possibility of the Fed raising interest rates.

Looking ahead to this week, Monday is the Labor Day holiday in the United States and financial markets are closed. According to market participants, the main focus this week is the regional economic report released by the Federal Reserve Board, commonly known as the Beige Book, and the quarterly performance of many blue chips is also an important reference factor.

0 notes

Text

Print on Demand Business Methods for a Successful Holiday

Every holiday shopping season, eCommerce businesses of all shapes, sizes, and industries anticipate increasing sales. According to Adobe Analytics data, e-commerce sales for the previous holiday season increased by two years, reaching $188.2 billion, a 32 percent increase year over year. Because so many purchases are made online at this time of year, businesses are under a lot of pressure to get their names and products in front of customers. As an eCommerce business, it is critical to maximizing demand during the holiday season, and print on demand fulfillment is the key to success during this season.

STEPS FOR A SUCCESSFUL 2023 HOLIDAY SEASON WITH PRINT ON DEMAND FULFILLMENT

1. Get ready for incoming traffic.

Increased traffic to your online store during the holidays is exhausting, especially on peak shopping days. In addition, nothing is worse than a site outage during one of these critical times. One thing to do this is to ensure that your inventory is well-stocked. However, increased traffic necessitates increased inventory requirements. Check-in with suppliers now to ensure you’re adequately stocked, especially for likely gift items. It will help to avoid long wait times and frustrated customers finding out their must-have gift is out of stock or on back-order.

2. Make the customer experience as simple as possible.

Today’s holiday shopper wants to get what they need as quickly and easily as possible. That means your website must offer options tailored to their specific needs as well as a smooth path to checkout. In addition to dependability, you must ensure that your site is fast. According to one survey, 70% of consumers believe that page speed influences their decision to buy from an online retailer. Improve your storefront experience. Use your website design to bring your brand to life and create a unique visitor experience.

3. Update your merchandising strategy.

Display your holiday merchandise. Begin by deciding which print-on-demand products you will sell to your target audience this holiday season. Good merchandising persuades them to buy the product and, ideally, suggests opportunities for upselling and cross-selling. Next, think about how you’ll present these seasonal items on your website. For example, in your site navigation, you could include a holiday-specific category. Make shopping easier by gathering all of your gifts in one place.

4. Customize the customer experience.

Give your customers a one-of-a-kind experience. Personalization resulted in increased revenue for 90 percent of marketers. You can surface relevant print on demand products to inspire customers and encourage them to purchase. Moreover, analyze behavioral and contextual customer data and business-related data such as margin and inventory. Based on customer data, product recommendations result in a significant increase in conversion rates and a decrease in cart abandonment. You can also use previous browsing history insights to surface relevant content to shoppers. For instance, reminding them of the gift they browsed last time they visited or highlighting something related to previous purchase.

5. Optimize the checkout process.

When customers reach the checkout page, they’ve already decided they want to buy something. Optimizing your checkout page entails making the process simple so that the customer does not abandon the purchase. According to one survey, 21% of online shoppers in the United States abandon their shopping carts due to a lengthy and complicated checkout process. You can create a streamlined checkout experience by using a single checkout page, allowing guest checkout, and providing multiple payment and shipping options.

6. Decide how you will handle shipping and fulfillment.

To put a great customer experience strategy into action, you’ll need a clear plan for where to sell your products and how to ship and fulfill orders. Your online store isn’t the only place where you can spread holiday cheer. Think about expanding your sales channel. More importantly, connect these channels for a unified experience. You will most likely see an increase in orders during the holiday season. To prepare for the increased traffic, you’ll need a professional print on demand service provider who can handle shipping for you.

WRAPPING UP

Businesses and consumers are looking forward to the holiday season more than ever this year. Shoppers may shop in-store, online, and across all channels and marketplaces to find the perfect gift for everyone on their list. Creating a shopping experience that entices them and provides a straightforward path to purchase gives them a compelling reason to choose your store over the competition. Make it simple and quick for them to shop with you in whatever way they prefer. Take holiday preparations with a print on demand provider, and you’ll be well on your way to welcoming jolly shoppers with ease in no time.

OUTSOURCE SHIPPING AND FULFILLMENT WITH A TOP ECOMMERCE FULFILLMENT COMPANY

Working with a top eCommerce fulfillment company like Fulfillplex for shipping and fulfillment means that this aspect of your business will be handled by someone else. You will be able to benefit from bulk shipping discounts and advanced tracking technology. Using a print on demand expert also means that customers will receive their packages faster, and if they have any questions or concerns about the shipment, they can contact them. All of this frees you and your team to concentrate on other aspects of the business that require your attention. Contact us now to learn more.

#print on demand#print on demand fulfillment#print on demand service provider#print on demand products#top eCommerce fulfillment company#eCommerce fulfillment#print on demand provider#fulfillplex

1 note

·

View note

Text

Stainless Steel Round Bar Prices Online

North America

In the North American region, the pricing trend for Stainless-Steel Round Bar varied over the three months in the first quarter of 2023. Initially, there was a stagnancy in the pricing trend for SS Round Bar due to consistent downstream inquiries. However, stocks available in the spot market increased significantly as stainless-steel factories increased product distribution. In February, the rates for SS Round Bar increased by more than 1.2% despite a lack of forward visibility and persistent recessionary concerns that continue to erode buyer confidence in the United States. However, the prices for SS Round Bar declined in March due to fewer spot sales or purchases owing to slow demand amid plentiful inventory available in the domestic market. Furthermore, weak orders from end-user industries were observed as they were wary of purchasing it at offered prices in such a volatile market. Therefore, prices of Stainless Steel Round Bar for Ex Philadelphia settled at USD 7480/MT on March 31.

Asia- Pacific

In the Asia-Pacific region, the Stainless Steel Round Bar Prices declined in the first quarter of 2023 due to high inventory levels and subdued downstream demand. Market participants reported that both stainless steel and nickel prices fell during this quarter, which eased cost pressure on finished products. Stainless steel mills resumed production after the Chinese New Year holiday, but the increased production resulted in low demand and high inventory. Despite prices falling further in March, they were still higher than spot transaction prices, and buyers were waiting for further price drops. Spot transactions were slow, and overseas demand was weak, making it a difficult quarter for sellers. As a result, the price of the Stainless Steel Round Bar for Ex Dainan settled at USD 2468/MT on March 31.

Europe

In the European region, Stainless-Steel Round Bar showcased a mixed-price trend during the first quarter of 2023. Initially, the prices increased in Germany as the downstream inquiries and demand from service centers, and re-rollers were strong. There was positive momentum, but because so much restocking occurred in December, market activity was stable in January, especially with the Chinese New Year approaching. Also, a lack of competitive imports contributed to price increases. However, the prices approached a downward trend entering February as a result of declining demand and a lack of clarity over the direction of the market for stainless steel consumption. The trading in the European SS Round Bar market remained dull as purchasers had a wait-and-see attitude and avoided large bookings. Long-product Stainless steel Prices makers were eager for sales amid high stockpiles, due to which they decreased the prices of SS Round Bar in the final month of a quarter. Therefore, prices of Stainless Steel Round Bar for Ex Ruhr settled at USD 3917/MT on March 31.

ChemAnalyst tackles the primary difficulty areas of the worldwide chemical, petroleum, pharmaceutical, and petrochemical industries, empowering decision-makers to make informed decisions. It examines and analyses geopolitical risks, environmental concerns, raw material availability, supply chain functioning, and technological disruption. It focuses on market volatility and guarantees that clients manage obstacles and hazards effectively and efficiently. ChemAnalyst's primary expertise has been data timeliness and accuracy, benefiting both local and global industries by tuning in to real-time data points to execute multibillion-dollar projects internationally.

0 notes

Photo

New Post has been published on https://coinprojects.net/sbf-sent-home-and-binance-gets-voyager-assets-hodlers-digest/

SBF sent home and Binance gets Voyager assets: Hodler’s Digest

Top Stories This Week

SBF sent home after his parents put up their house to cover his astronomical bail bond

Sam Bankman-Fried will spend the holidays with his family in Palo Alto, California, after his parents secured $250 million in bail funds with the equity in their home. Among the conditions of the bail are home detention, location monitoring and his passport surrender. The former FTX CEO signed surrender documents on Dec. 20, allowing his extradition from the Bahamas to the United States, where he faces eight charges that could keep him behind bars for the rest of his life. Bankman-Fried will now wait for his sentence at home with his family.

Caroline Ellison and Gary Wang plead guilty to fraud charges

Former Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang have pleaded guilty to federal fraud charges. Ellison, however, is working on a plea deal with the Office of the United States Attorney for the Southern District of New York, which would evade all the seven charges against her, resulting in a $250,000 bail bond and prosecution only for criminal tax violations. The agreement doesn’t provide protection against any other charges that Ellison might face from any other authorities. Wang and Ellison are reportedly cooperating with U.S. authorities on investigations related to FTX’s collapse.

Read also

Features

Is Ethereum left and Bitcoin right?

Features

Are You Independent Yet? Financial Self-Sovereignty and the Decentralized Exchange

Genesis and DCG seek path for the recovery of assets amid liquidity issues

Global investment bank Houlihan Lokey has proposed a plan to resolve the liquidity issues at crypto lender Genesis and its parent company, Digital Currency Group (DCG). The plan, devised by Houlihan on behalf of a committee of creditors, would further provide a path for clients of crypto exchange Gemini to recover assets owed by Genesis and DCG. Genesis platform withdrawals have been suspended since Nov. 16, days after the company disclosed that nearly $175 million of its funds are stuck in an FTX account.

Binance.US set to acquire Voyager Digital assets for $1B

With a bid of $1.022 billion, Binance.US will acquire the assets of bankrupt crypto lender Voyager Digital. The sale, however, is subject to a creditor’s vote and closing requirements. A hearing will also be held by the presiding bankruptcy court to approve the purchase agreement on Jan. 5, 2023. In good faith, Binance has agreed to deposit $10 million and reimburse Voyager for certain expenses up to a maximum of $15 million.

Twitter adds BTC and ETH price indexes to search function

In its latest move into the crypto space, Twitter has added price indexes for Bitcoin and Ether to its search function. The new feature allows users to simply search for the ticker symbol, whether for a stock or crypto, and check price’s graph. Other cryptocurrencies, including Dogecoin, did not make the list. The company plans to expand its coverage in the coming weeks.

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $16,835, Ether (ETH) at $1,218 and XRP at $0.35. The total market cap is at $811.38 billion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are XDC Network (XDC) at 14.04%, Ether (ETH) at 2.13%, and Pax Dollar (USDP) at 1.47%.

The top three altcoin losers of the week are Chain (XCN) at -39.75%, Filecoin (FIL) at -21.77%, and Trust Wallet Token (TWT) at -19.43%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Read also

Features

Australia’s world-leading crypto laws are at the crossroads: The inside story

Features

Blockchain Startups Think Justice Can Be Decentralized, but the Jury Is Still Out

Most Memorable Quotations

“Regulation should focus on intermediaries (the centralized actors in cryptocurrency), where additional transparency and disclosure is needed.”

Brian Armstrong, CEO of Coinbase

“This is why you have situations like the Mango exploit happen where the exploiter will first steal the funds and then start negotiating. There’s no proper incentive to report.”

Web3 developer

“If you can make a wallet that a billion people use — that’s a huge opportunity.”

Vitalik Buterin, co-founder of Ethereum

“Decentralization will include blockchain as a foundational element, but other technologies will expand the potential in new ways that blockchain was never designed to do.”

Alex Page, CEO of Nillion

“Argentina is becoming a hub for bringing tech development and resources to Latin America from the rest of the world.”

Ryan Dennis, senior manager at the Stellar Development Foundation

“The most challenging thing for [blockchain analytics] firms working on this today is when money moves off chain and into the banking system because they’re no longer able to track it.”

Peter Smith, founder and CEO of Blockchain.com

Prediction of the Week

Bitcoin dips below $16.7K as US GDP meets fresh BTC price ‘death cross’

Bitcoin prices dip below $16,700 at the end of the week, after recovering some ground on the previous day.

A Santa Claus rally for Bitcoin is unlikely to happen, as the mood among some pundits is firmly bearish.

Pseudonymous Twitter user Daan Crypto Trades called attention to Bitcoin’s yearly close, which is likely to be Bitcoin’s third negative performance year. “The percentage loss this year is sitting right in between the other two negative years, being 2014 and 2018,” he noted on Twitter.

FUD of the Week

Crypto platform Paxful removes ETH from its marketplace

Ethereum’s native token, Ether, is no longer available on Paxful, a peer-to-peer cryptocurrency exchange. Ray Youssef, CEO of Paxful, announced the move in a message to the roughly 11.6 million users of the platform. Among the reasons to unlist the token, Youssef mentioned Ethereum’s switch from a proof-of-work to proof-of-stake consensus, claiming the transition has turned ETH into a “digital form of fiat.”

California regulators order MyConstant to cease crypto-lending services

Over alleged violations of state securities laws, the California Department of Financial Protection and Innovation has ordered crypto lending platform MyConstant to cease operating. Mentioning peer-to-peer lending services and “unlicensed loan brokering,” the authority said MyConstant offered and sold unqualified non-exempt securities.

South Korean court freezes $92M in assets related to Terra tokens

South Korean authorities continue to investigate and freeze funds of the people involved with the Terra ecosystem. By order of the local court, several assets of Kernel Labs, a Terraform Labs affiliate, valued at $92 million have been frozen. Kernel Labs CEO Kim Hyun-Joong reportedly holds the largest amount of illegal proceeds from Terra. In November, assets worth over $104 million were also frozen following a request from South Korean prosecutors in the case.

Best Cointelegraph Features

What it’s actually like to use Bitcoin in El Salvador

Cointelegraph’s reporter Joe Hall attempted to spend two weeks in El Salvador living on Bitcoin. Spoiler alert, he failed.

The Metaverse is awful today… but we can make it great: Yat Siu, Big Ideas

We spend half our lives on the Internet, so we’re already in an early version of the Metaverse. But Animoca co-founder Yat Siu tells Magazine there’s a much better way forward.

The most eco-friendly blockchain networks in 2022

This year saw the realignment of the crypto industry toward greener, more energy-efficient blockchains.

Subscribe

The most engaging reads in blockchain. Delivered once a week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.

Source link By Cointelegraph By Editorial Staff

#Altcoin #Binance #Bitcoin #BlockChain #BlockchainNews #BNB #Crypto #CryptoExchange #ETH #Etherium #RippleNetwork #XRP

#Altcoin#Binance#Bitcoin#BlockChain#BlockchainNews#BNB#crypto#CryptoExchange#ETH#Etherium#RippleNetwork#XRP#Blockchain#CryptoPress

0 notes

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2021/04/amazon-earnings-are-poised-to-surge-further

Amazon Earnings Are Poised to Surge Further

Amazon. AMZN 0.50% com Inc. is expected to post a strong start to the year, with results driven by continued demand for the company’s e-commerce services and sales gains at its cloud-computing and advertising businesses.

Amazon’s success in the past year has catapulted the company to new heights, after consumers flocked to online shopping during pandemic lockdowns. The tech giant’s dominant grip over e-commerce and continued expansion into new industries have strengthened its power, although the company continues to face challenges from regulators and some employees.

Seattle-based Amazon is set to report first-quarter earnings after markets close on Thursday. Analysts polled by FactSet on average predict $104.5 billion in quarterly revenue and per-share earnings of $9.54. The company said in February that it expects first-quarter sales between $100 billion and $106 billion—sharply higher than the $75.5 billion it posted a year earlier—and operating income between $3 billion and $6.5 billion.

Newsletter Sign-up

Technology Alert

Major news in the technology sector.

Amazon’s first quarter is typically slower than its preceding end-of-year results, which are aided by holiday shopping sales. Yet the company has exceeded expectations in recent quarters. It shattered sales records last year as homebound Americans turned to its delivery services. The company’s stock price rose 76% in 2020.

Amazon’s dominance in online retail also parallels the strength of Amazon Web Services, the business line that rents server capacity and software tools to other corporations. AWS is Amazon’s main profit center, though its recent growth has slowed as the cloud units of Microsoft Corp. MSFT -1.32% and Google have moved aggressively to sign up new customers. AWS Chief Executive Andy Jassy is set to take over as Amazon’s CEO in the third quarter after Jeff Bezos said in February that he would depart the role to become executive chairman.

The company’s advertising business has also become a major player in its industry. The fast-developing unit has put Amazon in competition with Google’s and Facebook Inc.’s FB 5.63% leading ad businesses.

The coronavirus pandemic helped Amazon, Facebook and Google grow even stronger, with the tech titans for the first time collecting the majority of all ad spending in the U.S. last year, The Wall Street Journal reported in March. Amazon also recently said it will begin streaming the National Football League’s Thursday-night games by 2023, a deal that will expand Amazon’s ad dollars and compete more directly with traditional television broadcasters.

SHARE YOUR THOUGHTS

Have you been ordering more from Amazon during the pandemic? Why, or why not? Join the conversation below.

“What we always get back to with Amazon is the optionality—they have multiple businesses firing off,” said John Blackledge, an analyst with investment firm Cowen Inc. Mr. Blackledge said with the pandemic’s end in sight, investors are eager to see Amazon ramp up its one-day shipping offerings.

Amazon’s earnings follow strong performances by its big tech peers this week. Google parent Alphabet Inc. GOOG 1.35% set sales records for the first quarter, fueled by a surge in digital ad spending, while Microsoft posted a 19% increase in quarterly sales because of strong demand for its cloud and videogame services. Apple Inc.’s AAPL 0.16% profit more than doubled to $23.6 billion because of surging sales of new, higher-price iPhones and pandemic-induced buying of products such as Mac computers and iPads.

The nation’s largest tech companies recorded staggering growth last year as consumers and businesses relied more on online shopping, software and cloud services, as well as their smart devices and video streaming. The combined revenue for Amazon, Google, Facebook, Apple and Microsoft grew by one-fifth, to $1.1 trillion. Their collective market capitalization soared to almost $8 trillion at the end of 2020, compared with about $5 trillion at the end of 2019.

How will the pandemic affect America’s retailers? As states across the nation struggle to return to business, WSJ investigates the evolving retail landscape and how consumers might shop in a post-pandemic world.

Amazon’s achievements have come as regulators increase their focus on the company’s market power. Congress has considered significant changes to antitrust laws that could make it easier for the government to challenge certain business strategies and practices or force tech giants to separate lines of business. Last year, a congressional panel found Amazon had amassed “monopoly power” over sellers on its site, bullied retail partners and improperly used seller data to compete with rivals. Amazon has said that it is wrong to presume that success can only be the result of anticompetitive behavior and that it is focused on keeping prices lower for consumers.

The company has also dealt with activism from employees. It said Wednesday that it is raising wages for its hourly workers, providing more than 500,000 of its employees with pay increases of between 50 cents and $3 an hour. The higher wages were announced after workers at an Amazon warehouse in Alabama voted this month not to form a union. More than 70% of workers who voted at the facility rejected unionization, ensuring for now that Amazon would retain full control over how it manages and pays employees as well as what it expects from workers in warehouses.

Despite the victory at the Alabama warehouse, Mr. Bezos said the company aims to improve how it handles its workforce. In his last annual letter to shareholders as CEO, released this month, Mr. Bezos said Amazon is working to invent solutions to reduce the number of injuries at warehouses. He defended the company against accusations by critics that it treats its workers unfairly.

Write to Sebastian Herrera at [email protected]

Copyright ©2020 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

0 notes

Text

0 notes

Text

0 notes

Text

6/7/2023

The Sino-US technology war escalated, and the RMB was weak. Hong Kong stocks rose nearly 500 points for two consecutive days in July and then retreated. The HSI opened 60 points lower, and the decline was reduced to 36 points, reaching a high of 19,378. However, after the mainland announced that the PMI of the service industry was worse than expected, the market’s selling pressure increased, and it once jumped 320 points, reaching a daily low of 19,095. The HSI finally closed near the day's low, down 305 points to 19,110. The HS Tech index closed at 4,016, down 57 points. The full-day turnover increased to HK$86.8 billion .

The Hong Kong stock market retreated yesterday after two consecutive gains. It regained the 20-DMA (19,328) and then fell back a day later. It shows that the resistance of the 250-DMA(19,451), which is the boundary between bulls and bears, is strong. Fortunately, the 10-DMA(19,090) has taken over. It is expected that the short-term fluctuation range of the market will be 18,600 to 19,500 points. However, the view on July will not be too pessimistic. According to historical statistics, July has always been "more ups than downs." It is believed that the decline in the market was due to the fact that the Caixin PMI was worse than market expectations. The domestic banking, domestic demand, and consumption sectors were obviously under pressure. In addition, some major banks downgraded the ratings of domestic banking stocks, which all dragged down the performance of the domestic banking sector. Trading in Hong Kong stocks was sluggish, reflecting that the previous uptrend was not comprehensive and the strength of the uptrend was insufficient. The relationship between China and the United States will still be "talking while fighting, fighting without breaking." Even if the US Treasury Secretary Yellen visits China, no specific measures are expected. In the coming period, we should pay attention to whether the mainland will introduce economic stimulus measures, as well as the development of Sino-US relations.

European stocks fell across the board, with British, French and German stock markets falling 1.03%, 0.8% and 0.63% respectively.

The poor data of China's service industry has exacerbated global worries about the economy. The Fed released the June interest rate meeting records, saying that almost all officials involved in decision-making expected to raise interest rates several times this year, but the pace of interest rate hikes was lower than that since the beginning of last year. A series of rapid actions slowed down, and the news had little impact on US stocks.

The U.S. stock market resumed trading after the holiday on Wednesday. After the Dow opened 73 points lower, the decline immediately expanded to 191 points, it once fell as low as 34,226, and the closing decline narrowed; the S&P index once fell 0.43%; the Nasdaq fell by as much as 0.38%, and then turned around and recovered.

At the close of the US market, the Dow fell 129 points to 34,288; the S&P 500 dropped 8 points to 4,446; the Nasdaq dropped 25 points to 13,791.

1 note

·

View note