#unit linked insurance policy

Explore tagged Tumblr posts

Text

Maximize Returns with a Unit Linked Insurance Policy (ULIP)

A Unit Linked Insurance Policy (ULIP) offers a perfect blend of investment and life insurance. With options to invest in equity, debt, or balanced funds, it provides flexibility to match your risk appetite while ensuring financial protection. Secure your future with potential market-linked growth and tax benefits.

#unit linked insurance plan#ulip plan#ulip policy#ulip insurance#unit linked insurance policy#best unit linked insurance plan#best ulip plans#best ulip plan in india#buy ulip online#ulip investment#online ulip plans#ulip plan in india

0 notes

Text

youtube

What is ULIP? The full form of ULIP is Unit Linked Insurance Plan. ULIP is the only investment option that combines the benefits of investment and life cover in one plan. Know more @ ICICI Pru Life.

0 notes

Text

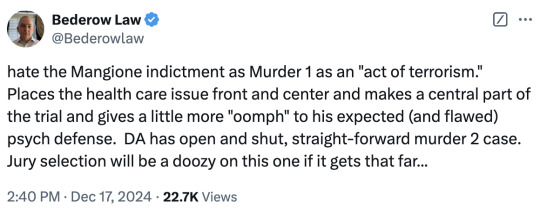

By Mark Bederow Mr. Bederow is a criminal defense lawyer and a former Manhattan assistant district attorney. The murder of the health care executive Brian Thompson on a Midtown sidewalk was shocking, brazen and seemingly methodical, but it wasn’t all that sophisticated. It didn’t take long for the authorities to identify Luigi Mangione as the likely murderer and arrest him. They had surveillance videos and various sightings. They are said to have forensic evidence linking him to the crime. A gun he had when he was arrested in Pennsylvania is said to be the same type of gun as the murder weapon. A notebook attributed to Mr. Mangione is said to have mentioned Mr. Thompson’s company, UnitedHealthcare, and that he planned to shoot a C.E.O. “These parasites had it coming,” he wrote, condemning health care companies for callous greed. In other words, Manhattan prosecutors have what looks to be a pretty straightforward case of second-degree murder, the charge that is almost always filed in New York State in cases of intentional murder.

But the Manhattan district attorney, Alvin Bragg, instead has charged Mr. Mangione with first-degree and second-degree murder in furtherance of terrorism (among other charges), which requires lifetime imprisonment in the event of a conviction. (The maximum sentence for second-degree murder without the terrorism charge would be 25 years to life.) By complicating a simple case, Mr. Bragg has increased the risk of acquittal on the most serious charge and a hung jury on any charge. Since Mr. Mangione is already being celebrated by some as a folk hero because of his rage against the American health care system, the terrorism charge, which alleges that Mr. Mangione “intended to intimidate or coerce a civilian population, influence the policies of a unit of government” and “affect the conduct of a unit of government,” almost certainly will turn the case into political theater. By charging Mr. Mangione as a terrorist, prosecutors are taking on a higher burden to support a dubious theory. In trying to prove that Mr. Mangione killed Mr. Thompson to “intimidate or coerce a civilian population,” prosecutors will presumably argue that the civilian population comprises health care executives and employees. But New York appellate courts have taken a very limited and fairly traditional view of what constitutes a civilian community under the terrorism law that was enacted within days of the Sept. 11 attacks.

The evidence appears to suggest that Mr. Mangione was bent on assassinating Mr. Thompson rather than intending “to sow terror,” as Mr. Bragg alleged in his news conference unsealing Mr. Mangione’s indictment. Mr. Mangione’s notebook reportedly says that he planned a targeted assassination because he did not want to “risk innocents.” So while this statement incriminates Mr. Mangione as a murderer, it appears to undermine the terrorism charge. By taking on the burden of trying to prove Mr. Mangione’s essentially political intent, prosecutors could amplify the criticisms of the American health care system that have made Mr. Mangione so alarmingly popular. The district attorney would provide Mr. Mangione a soapbox upon which he will be allowed to rail against the American health care system while trying to garner sympathy. Given the national debate over the role of insurance companies like Mr. Thompson’s, prosecutors will have a hard time, in any case, weeding out jurors who have some sympathy for the defendant. By turning Mr. Mangione’s supposed intent into a central element of the trial they invite juror nullification, in which jurors ignore their instructions to focus on the facts and instead let their points of view influence their verdict, leading to a hung jury, if not a full acquittal. At a standard second-degree murder trial, the jury would be instructed that the prosecution need only prove that Mr. Mangione committed the crime. Motive does not need to be considered. Perhaps Mr. Mangione’s most feasible defense would be a psychiatric one, alleging that he is not criminally responsible “by reason of mental disease or defect.” Unless there is persuasive evidence that has yet to be revealed, such a defense would be fairly easily undermined by evidence of Mr. Mangione’s detailed planning, concealment and flight. But the terrorism charge could slightly enhance such a defense if a jury is subjected to Mr. Mangione testifying about his grievances against the health care system and how it led a seemingly intelligent and grounded young man to assassinate an individual he didn’t know simply because he was a top executive at the nation’s largest insurance company.

And if the threat of life without parole is simply being used as a cudgel to leverage a plea to second-degree murder, how would Mr. Bragg justify wiping away the terrorism charge? It brings to mind the Daniel Penny case, in which Mr. Bragg brought a manslaughter charge, then dismissed it when jurors deadlocked, leading to an outright acquittal on even the lesser charge. The bottom line is that by choosing to make an open-and-shut murder case into a complicated debate on the health care industry, the district attorney risks highlighting the most troubling aspects of the case and making a conviction more difficult.

29 notes

·

View notes

Quote

You've doubtless seen the outpourings of sarcastic graveyard humor about Thompson's murder. People hate Unitedhealthcare, for good reason, because he personally decided – or approved – countless policies that killed people by cheating them until they died. Nurses and doctors hate Thompson and United. United kills people, for money. During the most acute phase of the pandemic, the company charged the US government $11,000 for each $8 covid test: https://pluralistic.net/2020/09/06/137300-pct-markup/#137300-pct-markup UHC leads the nation in claims denials, with a denial rate of 32% (!!). If you want to understand how the US can spend 20% of its GDP and get the worst health outcomes in the world, just connect the dots between those two facts: the largest health insurer in human history charges the government a 183,300% markup on covid tests and also denies a third of its claims. UHC is a vertically integrated, murdering health profiteer. They bought Optum, the largest pharmacy benefit manager ("A spreadsheet with political power" -Matt Stoller) in the country. Then they starved Optum of IT investment in order to give more money to their shareholders. Then Optum was hacked by ransomware gang and no one could get their prescriptions for weeks. This killed people: https://www.economicliberties.us/press-release/malicious-threat-actor-accesses-unitedhealth-groups-monopolistic-data-exchange-harming-patients-and-pharmacists/# The irony is, Optum is terrible even when it's not hacked. The purpose of Optum is to make you pay more for pharmaceuticals. If that's more than you can afford, you die. Optum – that is, UHC – kills people: https://pluralistic.net/2024/09/23/shield-of-boringness/#some-men-rob-you-with-a-fountain-pen Optum isn't the only murderous UHC division. Take Navihealth, an algorithm that United uses to kick people out of their hospital beds even if they're so frail, sick or injured they can't stand or walk. Doctors and nurses routinely watch their gravely ill patients get thrown out of their hospitals. Many die. UHC kills them, for money: https://prospect.org/health/2024-08-16-steward-bankruptcy-physicians-private-equity/ The patients murdered by Navihealth are on Medicare Advantage. Medicare is the public health care system the USA extends to old people. Medicare Advantage is a privatized system you can swap your Medicare coverage for, and UHC leads the country in Medicare Advantage, blitzing seniors with deceptive ads that trick them into signing up for UHC Medicare Advantage. Seniors who do this lose access to their doctors and specialists, have to pay hundreds or thousands of dollars for their medication, and get hit with $400 surprise bills to use the "free" ambulance service: https://prospect.org/health/2024-12-05-manhattan-medicare-murder-mystery/

Pluralistic: Predicting the present (09 Dec 2024) – Pluralistic: Daily links from Cory Doctorow

8 notes

·

View notes

Text

Colleen Hamilton for Them (12.04.2024):

Today, the Supreme Court will hear oral arguments in a case that could have wide-ranging implications for the right to make decisions about one’s own body and restrict access to lifesaving healthcare for millions of vulnerable people. If that sounds like a form of nightmarish déjà vu, that’s because we’ve been here before. In 2022, the Supreme Court overturned the constitutional right to an abortion with their decision in Dobbs v. Jackson Women's Health Organization. Now, employing a similar strategy, right-wing organizations like the Alliance Defending Freedom and the Heritage Foundation have systematically undermined access to gender-affirming care for transgender youth, resulting in another high-stakes case at the court.

United States v. Skrmetti will decide whether bans on gender-affirming care for minors violate the Equal Protection Clause of the Fourteenth Amendment. (Dobbs also hinged on this question, with the court ultimately writing that rights not “deeply rooted in the nation’s history and traditions” are not protected.) The outcome of Skrmetti could decide if young people, in consultation with their doctors, can access care that has been safely available for decades and is supported by every major medical association and many global health authorities, as evidenced by several amicus briefs filed in this case. Beyond that, Skrmetti could pave the way for a broader rollback of trans rights, including bills that could restrict access to gender-affirming care for adults, prohibit insurance providers from covering gender-affirming care, and impose waiting periods before accessing treatment. With both Dobbs and Skrmetti, the conservative goal is as obvious as it is disturbing: to entrench rigid gender hierarchies and make it exceedingly difficult for people to make life-affirming choices about their own bodies.

Yet, while right-wing groups have united in their efforts to ban abortion and restrict trans rights, too many Democrats and cis women have failed — or lacked the courage — to acknowledge the connection. Instead, after running an unsuccessful Presidential campaign that promised to restore the already inadequate protections of Roe, they are trapped in a cycle of blame while abortion funds dry up and trans young people stare into a potentially terrifying future without care. This tension has become increasingly evident since Donald Trump’s re-election. Democrats have argued that the party has focused too much on “cultural issues” like queer and trans rights and not enough on "kitchen-table" policies like the economy. However, this analysis fails to understand that access to healthcare is an economic issue, for trans people and cis people alike. By failing to draw these connections and offer a dynamic vision of bodily autonomy for all, they cede ground to a unified conservative assault on human rights and quietly capitulate to the newest conservative talking point: your body, my choice.

The Democratic Party’s failure is particularly maddening given that right-wing groups have consistently recognized and weaponized the connection between movements for bodily autonomy. The parallels between their attacks on reproductive rights and gender-affirming care are striking and deliberate. Since Roe was decided in 1973, groups like the National Right to Life have taken a twofold approach: pass incrementalist state laws while reshaping the judiciary. Conservative groups have spent decades identifying and promoting judges with originalist interpretations of the Constitution, developing legal precedents (like Planned Parenthood v. Casey), and exploiting judicial vacancies — most notably through Mitch McConnell’s block of President Obama’s Supreme Court nominee Merrick Garland’s appointment to the Supreme Court and subsequent judicial-appointment blitz during Trump’s presidency. These efforts culminated in a conservative supermajority on the Supreme Court, bolstered by a flood of restrictive state-level bills ready and waiting to land on their desks.

United States v. Skrmetti is not distinct from these fights over reproductive rights — it’s their next phase. Before 2020, there was not a single law that banned access to gender-affirming care for trans people. Since then, nearly 36 states have attempted to restrict trans rights. This is not a coincidence. Recognizing the conservative turn of the courts, the Alliance Defending Freedom has drafted and promoted bills that restrict access to gender-affirming care. These model bills have been introduced in various state legislatures, contributing to a coordinated and successful strategy to limit transgender healthcare. These laws “are the result of an openly political effort to wage war on a marginalized group and our most fundamental freedoms,” writes Chase Strangio, Co-Director of the ACLU's LGBT & HIV Project.

The same networks, legal precedents, and ideological tools used to overturn Roe are now being leveraged to erode trans rights. As Jules Gill-Peterson, a Professor at Johns Hopkins, writes, “Anti-abortion and anti-trans legislation are products of the same political coalition, using the same scripts and tactics.” The goal isn’t only to deny care to trans youth, though that is one potentially inevitable and devastating outcome. It is to reinforce a rigid gender ideology. As demonstrated by the millions spent on anti-trans political ads during the Presidential election, the goal is “to re-entrench old notions of what is the proper role of men and women in society,” says Strangio. This has sweeping implications for both trans and cis people alike who dream of a world where we all have the freedom to decide what happens to our own bodies.

[...] Public support exists, but we need to practice deeper forms of political courage and solidarity. Rather than capitulating to the right and abandoning the most vulnerable among us, we can demand a comprehensive vision of the world that protects everyone. Universal healthcare, for example, is widely popular and would materially improve millions of lives while ensuring access to gender-affirming care and abortion. According to a Pew study, 63% of Americans believe the federal government has a responsibility to provide healthcare for all. A robust defense of bodily autonomy isn’t just morally right. It’s politically savvy. Indeed, universal healthcare would also protect Americans with pre-existing conditions, who could see premiums spike if the incoming Trump administration repeals the Affordable Care Act. This is not just about trans youth or people seeking abortions—these fights shape a broader vision of a world where anyone, regardless of their gender or circumstances, can make decisions about their own lives. Restricting one group’s rights ultimately sets the stage for restricting everyone’s. Defending one group’s right to make decisions about their own bodies defends us all.

Colleen Hamilton wrote for LGBTQ+ publication them, detailing the reasons why attacks on trans rights should be viewed the same way as attacks on abortion: they are both violations of bodily autonomy.

#United States v. Skrmetti#Gender Affirming Healthcare#Abortion#Transgender Rights#Transgender#Bodily Autonomy#LGBTQ+#SCOTUS#OpEds#Dobbs v. Jackson Women's Health Organization#Abortion Access

5 notes

·

View notes

Text

Browsing through the official photos of the annual BRICS summit in the Russian city of Kazan last month yields intriguing surprises. In several of them, Russian President Vladimir Putin holds a mock-up banknote featuring the flags of the five core BRICS countries—Brazil, Russia, India, China, and South Africa. Looking at the pictures, one could be forgiven for assuming that the BRICS had just launched a common currency. This is exactly what Moscow would like the world to think as part of its bid to demonstrate that Russia is far from isolated on the global scene.

To the Kremlin’s chagrin, however, things did not go according to plan in Kazan. No BRICS currency was launched, and the official captions to Putin’s pictures do not even mention the banknote. The Kremlin also failed in its efforts to push for the adoption of BRICS Bridge, a financial mechanism that would help the group’s economies bypass Western channels. Interest from other BRICS members was so lukewarm that the scheme did not even make it into the final summit communiqué. Russia is unlikely to stop pressing, however: Developing non-Western financial mechanisms is an almost existential imperative for Moscow—and it highlights how finance has become a new arena for great-power competition.

In Kazan, the Russian summit hosts had a simple goal: to launch as many financial schemes as possible in order to mitigate the impact of Western sanctions on Moscow. Proposals include BRICS Pay (a scheme that would allow visitors from BRICS countries to make payments in Russia); BRICS Clear (an attempt to circumvent Euroclear, Clearstream, and the other Western firms that provide the global infrastructure for trading securities, such as stocks and bonds); BRICS (Re)Insurance (a bid to mitigate restrictions on the provision of insurance for Russian-owned aircraft and ships); a BRICS ratings agency (an alternative to the Western giants Standard & Poor’s, Fitch, and Moody’s); and the BRICS Cross-Border Payments Initiative (a scheme to facilitate payments between BRICS countries in their own currencies, such as the Russian ruble or the Brazilian real).

All five mechanisms matter, but attendees in Kazan quickly understood that Russia cared even more about a sixth scheme—BRICS Bridge. The project’s goal is both simple and ambitious: getting rid of intermediaries for international transactions made with central bank digital currencies (digital coins issued by central banks and stored on mobile phone wallets). To understand BRICS Bridge, picture a long-haul flight between, say, India and Brazil. Instead of having to go through an airport hub (a correspondent bank that is often located in the United States), these systems allow payments to make a direct trip between Indian and Brazilian banks. The benefits of going direct are obvious: Financial transactions do not need to make a stopover in a correspondent bank likely to be located in the United States or go through Swift, the Western-controlled global payment system between banks.

The symbolic dimension of BRICS Bridge is massive. As Brazilian President Luiz Inácio Lula da Silva said in 2023, “Every night, I ask myself why all countries have to base their trade on the dollar. Why can’t we do trade based on our own currencies?” This is not only about countries wondering why they need to settle cross-border trade using the greenback instead of their own currencies. Another aspect of the frustration is linked to the dollar being the currency of choice for issuing sovereign debt, putting developing economies at the mercy of the monetary policy of the U.S. Federal Reserve.

Bypassing Western financial channels also offers a layer of protection against sanctions from G-7 countries and their allies, since in most cases those sanctions only bite if the sanctioned country’s firms use Western currencies or have ties to G-7 economies. This highlights how BRICS Bridge is part of the effort by the West’s adversaries to sanctions-proof their economies by ditching Western currencies (in addition to reverting to old-fashioned barter, Russia now settles around 80 percent of its international trade in non-Western currencies) and building alternatives to Swift (like China’s homemade mechanism, CIPS). Dodging Western financial mechanisms also makes it easier to hide sensitive transactions that could trigger U.S. secondary sanctions, such as Chinese sales of military gear to Russia.

A final advantage of BRICS Bridge has to do with its digital nature. BRICS central banks could easily program a digital mechanism so that it blocks transactions that run counter to their interests or, in extreme scenarios, restricts Western access to their markets. Even short of these scenarios, the digital nature of BRICS Bridge would make it easier for surveillance-heavy dictatorships like Russia or China to track international transactions. By pressing ahead, BRICS economies could also be seeking a first-mover advantage in establishing a digitalized global financial architecture—betting that controlling emerging standards in the sector will enable them to weaponize global finance in the future.

Considering the potential benefits of BRICS Bridge, it may look surprising that Russia’s push for the mechanism’s adoption was met with lukewarm reception in Kazan. Moscow’s initial plans were to trial the scheme in 2025 before fully launching it around 2027. The fact that this timeline now looks unrealistic did not come as an entirely unexpected development for Moscow. A few weeks before the summit, China, India, and South Africa had already skipped a BRICS finance ministers’ meeting that was supposed to talk about the scheme.

The reluctance of other BRICS economies to get on board highlights three reasons why the development of non-Western financial mechanisms is unlikely to prove straightforward.

The first obstacle has to do with BRICS members’ diverging views of the urgency of such plans. At one end of the spectrum, Russia is the most enthusiastic backer of BRICS Bridge; the country has nothing to lose as Western sanctions already restrict its access to Western payments schemes. Other BRICS members are less convinced. China is doing preemptive work to have backup plans in case it were to be cut off from Swift or Western currencies, but it has no interest in ditching the dollar or Western financial channels any time soon. Meanwhile, Brazil’s plans to de-dollarize appear to have more bark than bite. South Africa and India are even less eager to connect to BRICS Bridge; bankers in both countries are uneasy about getting too cozy with non-U.S. financial initiatives for fear of antagonizing their Western partners.

A second factor hindering the development of BRICS Bridge is that the system can work only if all BRICS countries issue their own digital currencies. They are far from that point. Among them, only China has both a pilot digital currency in circulation—the digital renminbi—and the infrastructure in place for cross-border payments—through mBridge, a scheme that appears to have inspired the architecture of BRICS Bridge. (Shortly after the Kazan summit, the Bank of International Settlements, which led the development of mBridge, announced that it was withdrawing from the project after media reports suggested the scheme could help dodge sanctions.) Yet China’s extensive capital controls that restrict cross-border transactions will hamper the global rollout of the digital renminbi, including for use among the BRICS grouping. Without China on board, the mechanism is unlikely to have much global clout.

Basic economic theory highlights a final difficulty. With BRICS countries registering trade imbalances among themselves, it is hard to imagine how, say, Russian oil firms would not end up with huge piles of digital rupees for their sales to India. The issuance of a common BRICS currency would prevent such an issue. However, plans for what has been dubbed the “R5” (a potential joint currency replacing the rand, real, renminbi, ruble, and rupee) or for the “unit” (a potential gold-backed digital currency) can be dismissed as far-fetched for now if BRICS countries cannot even agree on launching BRICS Bridge. This looks a bit like a chicken-or-egg problem: BRICS Bridge is unlikely to launch before the five major BRICS economies have a common digital currency, but launching such a currency is useless if BRICS Bridge is not operational. As long as the BRICS countries do not come to a political agreement on the need for BRICS financial systems, these debates could last for a while.

Should Western policymakers lose sleep over BRICS Bridge? Russia’s invasion of Ukraine in February 2022 has turbocharged the fragmentation of the global trade landscape between geopolitically aligned blocs. It is therefore no surprise that financial systems are becoming increasingly geopolitical, as well. The threat posed by such schemes may be overestimated in the short term, since the dollar and Swift are nowhere near losing their global hegemony. However, we can bet that non-Western financial mechanisms will become more mainstream in the long run, further fueling the fragmentation of the global financial landscape. Perhaps the only certainty is that Russia will continue to pretend that it is successfully leading efforts to launch BRICS financial schemes—even when there are none to write home about for now.

4 notes

·

View notes

Text

Climate change impacts Brazil's insurance market

Extreme weather events alter risk models and will affect policy pricing

Insurance coverage for damage caused by disasters may not be new to the market, but climate change has added complexities to this equation. The increasing frequency and severity of extreme weather events have raised alarms in the sector regarding coverage and risk classification models, prompting companies to adjust to this new reality. Natural disasters resulted in losses of $120 billion in just the first half of the year, according to reinsurer Munich Re, with 68% stemming from extreme weather events like storms, floods, and wildfires.

Insured losses during this period amounted to $62 billion, significantly higher than the $37 billion average over the past decade. Brazil typically accounts for 1.5% of this figure. The country, historically not prone to significant disaster-induced losses, is now seeing more intense catastrophes, such as the floods in Rio Grande do Sul, which incurred nearly R$6 billion in losses, according to industry sources.

A separate study by the Swiss Re Institute highlighted that 27 disasters resulted in $5.1 billion in insured losses and nearly $16 billion in economic losses in Latin America in 2023.

The majority of global insured losses (76%) are linked to extreme weather events. Examples include severe storms and tornadoes in the United States, causing $45 billion in losses, and historic rainfall in the Persian Gulf, with $8.3 billion in losses due to flooding in Dubai, United Arab Emirates. Despite the year already nearing its end, the reinsurer states that estimating 2024 losses is challenging due to the world’s peculiar circumstances. This is exemplified by Hurricane Milton in Florida, considered one of the worst in terms of size and speed, yet its impact was less severe than anticipated.

Continue reading.

#brazil#brazilian politics#politics#environmentalism#economy#climate change#environmental justice#image description in alt#mod nise da silveira

3 notes

·

View notes

Text

Water Damage

Written for @augustwritingchallenge day 8: Robots & Androids Buck/Eddie (9-1-1), 1k AO3 link

Eddie hates it here.

It’s his own fucking house, but he hates it.

Ever since that… thing crossed the threshold, thanks to Christopher casually mentioning it in front of Eddie’s folks a year ago, and them deciding it was the perfect thing to surprise him with for Christmas.

A robot.

A fucking robot. In Eddie’s home.

He hates it here.

He’s lasted a solid five years since the first iteration of these so called “Household Assistants” became mainstream, even though everyone he knew sang their praises, even though Chris had begged for one so he didn’t have to do chores.

“We’ve gotten along just fine without one all my life, Chris, we don’t need one.”

“But everyone’s got one!”

It hadn’t worked, even when Chris was seven years old with carefully honed puppy dog eyes, Eddie had resisted. So, naturally, his kid got clever and went over his head.

Eddie hates the fucking thing. It does the work just fine, cleans the dishes before Eddie has a chance to, makes the bed with crisper lines than he’d seen even in the army, it even cooks, though it only has a couple of pre-programmed recipes.

So, maybe Eddie has taken to sabotaging it, just a little.

Nothing awful, but he’s “accidentally” left magnets in his bed more than once now, and he’s become much clumsier than normal, his morning coffee spilling just as the robot happens to be passing by.

He just wants it gone. Every time he sees it out of the corner of his eye, the unnatural movements, the subservience, it makes his skin crawl.

Eddie wants to look after himself. He likes looking after himself.

So, he sabotages the robot.

Unfortunately, his parents had sprung for a pretty fancy insurance policy, on top of a tight warrantee, which means that every time the robot experiences a malfunction, no matter how small or obviously deliberate, it automatically pings the manufacturer, and they send out a repairman.

The repairman is Eddie’s second problem.

He obviously knows what Eddie is doing, but he refuses to just let the damn thing die.

The first time he showed up, he stuck his hand out to shake Eddie’s, grinned and introduced himself as Buck, then immediately turned his attention to the robot. “Seems this poor little guy had a run in with some water damage! Let's get you fixed up, huh?”

The next time, it was “A magnet? Damn, buddy, you’ve got the worst luck!”

After that, he’d started shooting Eddie knowing looks. “How did you get spaghetti in there? You’re the most accident prone unit I’ve ever serviced!”

It doesn’t help that Chris has taken a liking to him, actually looking forward to his visit whenever Alfred breaks down — because of course he’s named the damn thing after Batman’s butler.

Chris sits himself at the kitchen table every time Repairman Buck, Eddie’s sworn enemy with unfairly nice arms, is over, and he regales him with stories about school and his friends, all while Buck undoes whatever sabotage Eddie hopes might be the final straw.

“You know, you don’t have to do this, man,” Buck says to him one day, after cleaning dish soap out of Alfred’s control panel.

“Do what?” Eddie answers, trying to look innocent. He does feel a little bad, dragging Buck out here every time. Alfred doesn’t even bother him all that much anymore, since Eddie has started cleaning as he goes, leaving very little for the machine to sweep out from under him. It’s mostly a habit by now, and he can’t say he hates how much Chris seems to enjoy Buck’s visits.

“Cut the poor machine a break, okay? If you wanna see me so much, just ask me out for coffee instead of pouring it on Alfred.”

Eddie turns red. “I don’t— That’s not why I—”

Buck just grins, folding his arms across his (large, bulging) chest, like he’s just waiting for whatever excuse Eddie will come up with.

Eddie sighs. “Look, it’s— I never wanted Alfred. He entered this house against my will, and I really wish you were worse at your job so I could’ve done away with him a month in.”

Buck’s face fell. “Oh, I— I’m sorry, man, I thought…”

Buck thinks Eddie has been doing all of this for him. He thinks Eddie likes him. And Buck seems… disappointed, to hear that’s not true.

“I should um… I should go. I’ll send the apprentice next time, he’s terrible with water damage.”

Buck starts to leave, and Eddie is frozen, not knowing what to do.

He hears a sizzle behind him, and turns to see Christopher with an empty, upturned glass in his hand.

Alfred is smoking.

“Buck, wait!” Eddie shouts, running to the front door.

There’s Buck, just sitting on the top step. He turns, and Eddie drops to sit next to him.

“You know, it’s the wildest thing — he’s already broken again. Maybe you should come back in and take a look?”

Buck frowns. “It’s—”

“And then maybe… Once Alfred’s up and running, we could get him to set an extra spot at the table for dinner? If you—”

Buck nods. “Yeah. Yeah, okay.” He stands and they go back inside.

“Actually,” Buck says, halfway through yet another service. “I should admit something, before I’m done here.”

“Yeah?” Eddie asks, from where he’s sitting next to Chris, watching Buck work.

“I think these things are absolutely terrible cooks,” Buck says with a grimace.

“Not as bad as dad!” Chris insists.

Buck laughs. “How about I get him fixed up, then I’ll cook for you.”

“You want to cook for us? After spending so much time working?”

“I like cooking. Besides, you guys are definitely my favourite clients.”

Eddie meets Buck’s eyes, sees the slight hesitation in his expression. He’d been nervous to ask this, Eddie realises.

“Whatever you want, Buck.”

And he means it. He isn’t even annoyed when Alfred makes his stupid fucking whirring startup sound, because Buck jumps to his feet and asks if he can look around the kitchen.

“Admit it, dad,” Chris whispers. “You’re kind of glad we got Alfred, aren’t you?”

Eddie messes up his kid’s hair and scoffs, but he can’t deny it.

The annoying robot servant is worth it, for bringing him Buck.

16 notes

·

View notes

Text

Palestinians are asking for boycotts of several specific companies which benefit from the crimes of Israel. From BDS' website:

HP

Hewlett Packard helps run the biometric ID system that Israel uses to restrict Palestinian movement. For more information, see https://bdsmovement.net/boycott-hp.

Siemens

Siemens is complicit in apartheid Israel’s illegal settlement enterprise through its planned construction of the EuroAsia Interconnector. This will link Israel’s electricity grid with Europe’s, allowing illegal settlements on stolen Palestinian land to benefit from Israel-EU trade of electricity produced from fossil gas.

AXA

AXA invests in Israeli banks, which finance the theft of Palestinian land and natural resources. Do not buy insurance policies with AXA, or if you currently have an insurance policy with them, try cancelling it. For more information visit: https://bdsmovement.net/axa-divest

Puma

Puma sponsors the Israel Football Association, which includes teams in Israel’s illegal settlements on occupied Palestinian land. For more information, see: https://bdsmovement.net/boycott-puma

Israeli Fruit and Vegetables

Fruits, vegetables and wines from Israel are often wrongly labelled as “Produce in Israel” when they come from stolen Palestinian land. Boycott all produce from Israel in your supermarket and demand they are removed from shelves.

SodaStream

Soda Stream is actively complicit in Israel's policy of displacing the indigenous Bedouin-Palestinian citizens of Israel in the Naqab (Negev). SodaStream have a long history of mistreatment of and discrimination against Palestinian workers.

Ahava

Ahava Cosmetics has its production site, visitor center and main store in an illegal Israeli settlement.

Sabra

Sabra hummus is a joint venture between PepsiCo and the Strauss Group, an Israeli food company that provides financial support to the Israeli army.

These are the brands and products that we are being directly asked to boycott and not support!

With that said... as a resident of the United States myself, if you are in another country and you want to start boycotts of American products to send a message to my government, I'm not going to decline the support in that endeavor. I don't have any information right now on direct supply lines or what would be most impactful, but lots of Americans are really horrified by what our government is doing right now. They're hoping we've all forgotten about it by the election next year, or that we'll be too afraid of The Other Guy to not vote for the folks in power (and they might be right on that one).

Boycott Disney. Boycott McDonald's. Boycott Starbucks. "Oh but it won't work, it won't do anything" Yes it will. Boycotts have worked before and they will again. Think of the Montgomery bus boycotts. Think about American women boycotting imported British goods during the revolution.

Why do you think popular media is so quick to discount boycotts as ineffective? Could it possibly be because they work? Could it be because major corporations understand that they work and are scared? Could it be because boycotts have historically been utilized by marginalized groups to assert their views and fight for change within a conflict in which they have no power?

Do not have give in to the apathetic nihilism of "nothing I do matters, so why bother?" That is exactly what oppressors count on. Be critical of the media you consume. Ask questions. Look to history. Boycott.

14K notes

·

View notes

Text

Best ULIP Plan in India | Ageas Federal Life Insurance

Ageas Federal ULIP plans online to enjoy the dual advantages of investment and life insurance. Benefit from the amalgamation of investment opportunities and life coverage while also receiving tax advantages. Explore the details of ULIP policies and plans to make an informed decision.

#unit linked insurance plan#ulip plan#ulip policy#ulip insurance#unit linked insurance policy#best unit linked insurance plan#best ulip plans#best ulip plan in india#buy ulip online#ulip investment#online ulip plans#ulip plan in india

1 note

·

View note

Text

FD vs. Life Insurance: Apples and Oranges of Financial Planning

When it comes to securing your financial future, two common options often surface: Fixed Deposits (FDs) and Life Insurance. While both offer a sense of stability, they serve fundamentally different purposes. This blog post will dissect the core differences between FDs and Life Insurance, helping you understand which one (or both) aligns with your unique financial needs.

Fixed Deposits (FDs): Growing Your Savings Steadily

A Fixed Deposit is a straightforward investment tool where you deposit a lump sum of money with a bank or financial institution for a predetermined period at a fixed interest rate. Upon maturity, you receive your initial investment plus the accumulated interest.

Key Features of FDs:

Safety and Predictability: FDs are generally considered low-risk investments, especially those offered by reputable institutions. The fixed interest rate provides predictable returns.

Variety of Tenures: You can choose from a range of tenures, from a few months to several years, allowing flexibility based on your financial goals.

Ease of Access: Opening an FD is typically a simple process, and some offer premature withdrawal options (though often with penalties).

Advantages of FDs:

Stable Returns: You know exactly how much interest you'll earn, making it easy to plan your finances.

Low Risk: FDs are relatively safe compared to market-linked investments.

Liquidity (in some cases): Some FDs offer premature withdrawal facilities, providing access to funds in emergencies.

Disadvantages of FDs:

Lower Returns Compared to Equities: FDs generally offer lower returns than investments in the stock market or mutual funds.

Tax Implications: Interest earned on FDs is taxable as per your income tax slab.

Inflation Risk: The purchasing power of your returns can be eroded by inflation over time.

Life Insurance: Protecting Your Loved Ones' Future

Life insurance is a contract between you and an insurance company. In exchange for regular premium payments, the insurer promises to pay a lump sum (the sum assured) to your beneficiaries in the event of your death during the policy term. Some life insurance plans also offer maturity benefits.

Key Features of Life Insurance:

Financial Protection: The primary purpose is to provide financial security to your family in your absence.

Different Types of Policies: Various types of life insurance are available, including term insurance (pure protection), endowment plans (savings and protection), and unit-linked insurance plans (ULIPs) (investment and protection).

Tax Benefits: Premiums paid towards life insurance are often eligible for tax deductions under Section 80C of the Income Tax Act.

Advantages of Life Insurance:

Financial Security for Dependents: It provides a crucial safety net for your family in case of an unforeseen event.

Tax Benefits: Offers tax deductions on premiums paid and tax-free maturity benefits (in most cases).

Long-Term Savings (in some plans): Endowment and ULIP plans offer a savings component along with insurance coverage.

Disadvantages of Life Insurance:

Cost of Insurance: Premiums can be a significant expense, especially for higher coverage amounts or older individuals.

Lock-in Periods (in some plans): Some plans have lock-in periods, restricting access to your funds for a certain time.

Lower Returns Compared to Pure Investments (in some plans): Endowment and ULIP plans may offer lower returns compared to pure investment products like mutual funds.

FDs vs. Life Insurance: A Clear Distinction

Feature

Fixed Deposit (FD)

Life Insurance

Primary Purpose

Savings and wealth accumulation

Financial protection for dependents

Risk

Low

Low (Term Insurance), Moderate to High (ULIPs)

Returns

Stable and predictable, but generally lower

Varies depending on the plan, primarily protection

Tax Benefits

Interest earned is taxable

Premiums are tax-deductible, maturity benefits are often tax-free

Liquidity

Relatively high (with some exceptions)

Low to moderate (depending on the plan)

Focus

Growing your own wealth

Protecting your family's financial future

Which One Should You Choose?

The answer is not "either/or" but rather "both, depending on your needs."

Choose FDs if: You have short-term financial goals, need a safe place to park your emergency fund, or prefer low-risk, predictable returns.

Choose Life Insurance if: You have dependents and want to ensure their financial security in case of your untimely demise.

A Holistic Approach:

A well-rounded financial plan often includes both FDs and Life Insurance. FDs can help you achieve short-term goals and build a financial cushion, while Life Insurance provides essential protection for your loved ones.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor to determine the best financial strategy for your individual circumstances.

0 notes

Text

How Does a Unit Linked Plan Works?

How ULIP work? ULIPs, or Unit Linked Insurance Plans, combine investment and insurance in a single product. Over time, your investments grow based on the market performance of the selected funds, which you can monitor using the NAV (Net Asset Value).

How do ULIPs Work? To understand how does ULIP work, think of it as a financial multi-tool combining life insurance with investments. Your premium is split, one part ensures life cover, while the rest is invested in equity, debt, or hybrid funds. This blend offers both protection and market-linked growth. You can adjust your portfolio over time and enjoy tax benefits, making ULIPs a flexible choice for long-term wealth building and security. Let’s dive deeper into its mechanics and advantages.

Begin by choosing your desired life cover, premium amount, and policy term. This decision should align with your financial goals, such as wealth creation, insurance coverage, or both. You can select the premium payment frequency—monthly, half-yearly, or annually—as per your convenience. You also have the option to pay the premium as a lump sum or through recurring payments. A part of your premium is allocated towards providing life insurance cover, ensuring financial protection for your loved ones. The remaining portion of your premium is invested in equity, debt, or hybrid funds based on your investment preferences. This is where the ULIP plan offers dual benefits of insurance and investment. Unlike equity and debt funds, ULIPs, a hybrid fund, strike a balance by combining equities and debt. You get significant returns after the mandatory ULIP lock-in period of five years. The value of your investment is determined by ULIP NAV (Net Asset Value), which reflects the performance of the funds you’ve chosen. ULIPs also provide tax benefits under Section 80C, and upon maturity, the returns may also qualify for tax exemptions, subject to prevailing laws. During the policy tenure, you have the flexibility of ULIP renewal to maintain your investment and life cover. You can also switch between funds to adjust your portfolio according to market conditions and financial goals. In the event of an unfortunate incident during the policy term, your nominee will receive the sum assured or fund value, whichever is higher, ensuring their financial security. Understanding what is ULIP plan and how ULIP plan works in India highlights its unique ability to combine insurance and investment in one powerful product. Leveraging the benefits of ULIP effectively can help you achieve your long-term financial aspirations.

0 notes

Text

I know we're all happy about the oligarch being taken out - I certainly have no sympathy for the man who's mountain of money sat atop a pile of corpses - but anthem rolling back that policy is actually a bad thing. I will link the article that has links to their sources at the end, but here is a summary;

Anesthesiologists are some of the most highly paid physicians in america and, according to medscapes 2024 report on Anesthesiologist salary in 2023, The average salary was $472,000 and that's a $70,000 increase from the average salary in 2022.

For reference, the average physician salary in germany is $160,000, In the United Kingdom, it's $122,000, and in France, it's $93,000.

On top that, When an anesthesiologist has a contract with anthem, Which they would need to have in order to accept that insurance, What is always in that contract is the clause that "You, the provider, accept the reimbursement rules in this contract as payment in full." What that means is that the provider cannot then turn to a patient and ask for more money. You would not wake up to a surprise bill because your surgery ran fifteen minutes over.

And if surgery does run fifteen minutes over, it does not mean they won't be paid for it, just that they would need to submit an appeal to get paid for the medically necessary extra time.

What this policy was actually intended to do was to disincentivize anesthesiologists from padding the bill, which they absolutely have incentive to do because anesthesia services are billed partially based off of how long a procedure will take.

The amount of time that they were going to pay for those services? It wasn't an arbitrary number like the ASA (association of anastheseologists) claimed. It was based on data from the centers for Medicare and Medicaid services.

I know that now, of all times, nobody is viewing health insurance companies in a favorable light, but this policy was not bad for consumers.

source: https://www.vox.com/policy/390031/anthem-blue-cross-blue-shield-anesthesia-limits-insurance

insurance companies and their policies are predatory, but I don't have any issue believing that some doctors - not all, but enough - Pad the bill that they send to the insurance company in order to get a higher payout.

Hell, it's a small thing, but my brother in law recently went to the doctors and when his EOB (explanation of benefits) came in the mail, the insurance company was billed for a flu shot that he never received.

It is why so many people recommend you ask hospitals and doctors for an itemized bill to make sure that you are not being overcharged or charged for services you did not receive.

I am not saying that Anthem is a good company, I do not believe that they are, but I am saying that everyone has misunderstood this policy. It was not a bad one.

So funny how Blue Cross basically went "You guys make a great point" and rolled back their anesthesia policy after the United CEO was killed

Seems like we might have found a form of protest that works

8K notes

·

View notes

Text

PNB MetLife 1 Crore Life Insurance: Secure Your Family's Future

Life insurance is a fundamental pillar of financial security, providing a safety net for your loved ones in the event of your untimely demise. Among the various life insurance plans available in India, a 1 Crore life insurance policy from PNB MetLife stands out as an attractive option. With a high coverage amount, this policy ensures that your family will have the necessary financial resources to maintain their lifestyle and achieve long-term goals, even in your absence. In this article, we will explore the features, benefits, and reasons to consider a PNB MetLife 1 Crore life insurance policy.

Why Choose a 1 Crore Life Insurance Policy?

A sum assured of 1 crore is a significant amount that can provide a substantial financial buffer to your family. Here are some key reasons why opting for a 1 crore life insurance policy makes sense:

Comprehensive Coverage: A 1 crore life insurance policy offers comprehensive coverage to meet major financial obligations such as paying off debts, home loans, and supporting your family's living expenses.

Inflation Protection: With rising costs of education, healthcare, and day-to-day living expenses, a 1 crore policy ensures that your family has enough resources to deal with inflation over time.

Long-term Financial Security: The payout from a 1 crore policy can help your family achieve long-term goals, such as funding your children’s education, marriage, or other life events.

Debt Clearance: If you have any outstanding loans, such as home loans, car loans, or business loans, the 1 crore payout can help clear these debts, ensuring that your family is not burdened with repayments.

Features of PNB MetLife’s 1 Crore Life Insurance Policy

PNB MetLife offers a range of life insurance plans that cater to different financial needs. Here are the notable features of a 1 crore life insurance policy from PNB MetLife:

High Sum Assured: The policy provides a large sum assured of 1 crore, ensuring adequate financial protection for your loved ones in your absence.

Affordable Premiums: Despite the high coverage, the premiums for a 1 crore policy are generally affordable, especially if you purchase the policy at a younger age. Term life insurance plans from PNB MetLife offer competitive premium rates.

Flexible Payment Options: PNB MetLife provides flexibility in premium payment options, allowing you to choose from annual, semi-annual, quarterly, or monthly modes of payment.

Multiple Plan Options: PNB MetLife offers different variants of life insurance plans, such as term insurance, ULIPs (Unit Linked Insurance Plans), and endowment plans, allowing you to choose a plan that best suits your financial objectives.

Rider Benefits: PNB MetLife allows you to enhance your policy coverage with additional riders, such as critical illness cover, accidental death benefit, waiver of premium, and more.

Tax Benefits: Premiums paid for the policy are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the death benefit received by the nominee is tax-exempt under Section 10(10D).

Types of Life Insurance Policies for 1 Crore Coverage

PNB MetLife offers a variety of life insurance policies that provide 1 crore coverage, catering to different individual needs. Some of the prominent options include:

Term Insurance: A pure protection plan that offers a high sum assured at affordable premiums. In the event of the policyholder’s death, the nominee receives the 1 crore sum assured. This is the most popular option for those seeking substantial financial protection at a reasonable cost.

ULIP (Unit Linked Insurance Plan): ULIPs provide both life insurance and investment benefits. A portion of the premium is used for life coverage, while the rest is invested in equity or debt funds. This plan is suitable for individuals looking for long-term wealth creation along with life insurance.

Endowment Plan: This is a traditional life insurance policy that combines insurance coverage with savings. You receive the sum assured plus bonuses at maturity if you survive the policy term. In case of death, the nominee receives the 1 crore sum assured.

Money Back Plan: This type of policy offers periodic payouts during the policy term, along with life insurance coverage. It is ideal for individuals who require liquidity during the policy term, along with life insurance protection.

Eligibility Criteria for PNB MetLife 1 Crore Life Insurance

To purchase a 1 crore life insurance policy from PNB MetLife, you need to meet certain eligibility criteria:

Minimum Age: The minimum entry age is typically 18 years.

Maximum Age: The maximum entry age varies by plan, usually up to 65 years.

Policy Term: The policy term can range from 10 to 40 years, depending on the plan you choose.

Medical Examination: Depending on the policy and sum assured, a medical examination may be required to assess your health condition.

How to Apply for a PNB MetLife 1 Crore Life Insurance Policy?

Applying for a PNB MetLife life insurance policy is simple and hassle-free. You can follow these steps:

Online Application: Visit the PNB MetLife website and browse the available life insurance plans. Use the online premium calculator to get an estimate of the premium for a 1 crore sum assured.

Consultation with an Advisor: You can also contact a PNB MetLife insurance advisor for personalized advice on the best plan for your needs.

Complete Documentation: Fill in the application form, submit required documents, and undergo any necessary medical tests.

Payment of Premium: Once the documentation is completed and approved, you can pay the premium and the policy will be issued.

Conclusion

A 1 crore life insurance policy from PNB MetLife is an excellent way to secure your family's financial future. Whether you opt for a term plan, ULIP, or endowment plan, this coverage amount ensures that your loved ones can maintain their lifestyle, achieve long-term goals, and stay protected from financial burdens even in your absence.

0 notes

Text

Future Wealth: ULIP Insurance Plan.

Secure your financial future with FutureWealth, a Unit Linked Insurance Plan (ULIP) offering investment opportunities and insurance coverage. Customize your plan for wealth creation and protection. Click here to know more:

0 notes

Text

How Can an Insurance Agent in Rewa Help to Secure Your Family?

Financial security is a dream for many, and financial planning is important. Insurance experts play a huge role in helping individuals plan their future. These professionals offer insurance products and ensure that individuals understand the benefits of each plan.

Having access to a knowledgeable insurance agent in Rewa is invaluable. Investrack offers solutions that align with investors' aspirations; whether you’re considering life insurance, health insurance, or other plans, a trusted expert can simplify the process.

Understanding Life Insurance Policies

Life insurance is a critical financial tool that builds a safety net. Here are some popular types of life insurance policies in Rewa:

Term Insurance: Offers high coverage at affordable premiums. It is ideal for securing your family’s stability.

Endowment Plans: Combine insurance with savings, providing a lump sum upon maturity or to the nominee in case of an early demise.

ULIPs: Unit Linked Insurance Plans allow investors to enjoy both life coverage and market-linked returns.

Selecting the right life insurance policies depends on factors such as family size, goals, and risk tolerance. By working with a professional, you can customize a policy that suits your unique requirements. So you can protect your loved ones against unforeseen circumstances.

How Can Insurance Experts Help You?

They play a critical role beyond just selling policies. Here’s how they assist in comprehensive planning:

Customized Solutions: Every individual’s financial needs are unique. An insurance agent assesses your current situation, future goals, and risk tolerance.

Expertise: They simplify complex terminologies and clauses. They also make sure you fully understand the policy benefits and limitations.

Ongoing Support: Life situations change, and so do financial needs. They provide continuous support. They also help you adjust your plans as needed and ensure your policies remain relevant over time.

Convenience: Handling paperwork, renewing policies, and claiming benefits can be overwhelming. They manage these tasks, saving you time and effort.

Conclusion

Life insurance is a powerful tool for protecting your family and their future. A professional can guide you in selecting the most suitable policies. So that your decision aligns with your long-term goals. Take the first step toward financial freedom today.

#term life insurance policy in Rewa#whole life insurance for seniors in Rewa#life insurance policies in Rewa#life insurance agent in Rewa#insurance agent in Rewa#Best Life Insurance Companies in Rewa#insurance advisory services in Rewa#life insurance advisor in Rewa#insurance advisor in Rewa#money back policy lic plan in Rewa#money back insurance plan in Rewa#endowment life insurance policies in Rewa#endowment policy in Rewa#death cover in Rewa#endowment life insurance in Rewa#endowment plan in Rewa

0 notes