#underbanked population

Explore tagged Tumblr posts

Text

The Crucial Role of Fintech in Empowering India's Underbanked Population

In the vast landscape of India, where economic diversity is as pronounced as its cultural richness, there exists a significant portion of the population that remains underbanked. Despite the strides made in financial inclusion over the years, a considerable number of individuals still lack access to basic banking services. This underbanked segment faces numerous challenges, ranging from limited financial literacy to geographical barriers. In this context, the emergence of Financial Technology (Fintech) companies has proven to be a game-changer, offering innovative solutions to address the unique needs of the underbanked population.

Understanding the Underbanked

The underbanked population in India comprises individuals who, for various reasons, do not have full access to traditional banking services. This could be due to factors such as remote geographical locations, lack of proper documentation, or insufficient income levels. The consequences of being underbanked are profound, as it restricts opportunities for savings, access to credit, and participation in the formal economy.

Challenges Faced by the Underbanked

Limited Access to Banking Infrastructure: Many underbanked individuals reside in remote rural areas where traditional banking infrastructure is scarce. This geographical divide makes it challenging for them to access basic financial services.

Financial Literacy Barriers: A significant portion of the underbanked population lacks adequate financial literacy. This hinders their ability to make informed decisions regarding savings, investments, and accessing credit.

Documentation Hurdles: Traditional banks often require a plethora of documentation, which can be a significant barrier for the underbanked who may lack the necessary paperwork. Fintech companies, leveraging technology, have found ways to navigate these hurdles efficiently.

How Fintech Companies Bridge the Gap

Digital Payments and Wallets: Fintech companies have pioneered the adoption of digital payment solutions and mobile wallets. These tools empower the underbanked by providing a secure and convenient way to conduct transactions without the need for a traditional bank account.

Simplified Onboarding Processes: Unlike traditional banks, Fintech firms often employ simplified onboarding processes that reduce the need for extensive documentation. This facilitates the inclusion of individuals who may lack the paperwork required by traditional financial institutions.

Credit Access Through Alternative Data: Traditional credit scoring models may not accurately reflect the creditworthiness of the underbanked. Fintech companies are leveraging alternative data sources, such as utility bill payments and mobile phone usage, to assess creditworthiness and provide access to credit for those without a traditional credit history.

Customized Financial Products: Understanding the diverse needs of the underbanked, Fintech companies design products tailored to their requirements. This includes microloans, insurance products, and investment options that are more accessible and flexible than traditional offerings.

Conclusion

As India strides towards becoming a digital economy, the role of Fintech companies in addressing the financial needs of the underbanked cannot be overstated. By leveraging technology and innovation, these companies are breaking down barriers, making financial services more inclusive and accessible. The positive impact of financial inclusion extends beyond individual empowerment; it contributes to the overall economic growth of the nation. As Fintech continues to evolve, it holds the key to unlocking the full potential of every individual, regardless of their socio-economic background.

#banking#business ideas#finance#fintech#business#underbanked population#money#expert says#matm#aeps#DMT#money transfer services#prepaid cards#prepaid recharge

0 notes

Text

Blockchain Payments: The Game Changer in the Finance Industry

The finance industry has experienced a remarkable transformation over the past few years, with blockchain payments emerging as one of the most groundbreaking innovations. As businesses and individuals increasingly seek secure, transparent, and efficient transaction methods, blockchain technology has positioned itself as a powerful solution that challenges traditional payment systems.

Understanding Blockchain Payments

At its core, blockchain payments utilize decentralized ledger technology (DLT) to facilitate transactions without intermediaries such as banks. Unlike conventional payment systems, which rely on centralized institutions, blockchain operates through a distributed network of nodes that validate and record transactions in an immutable ledger. This decentralized approach ensures greater transparency, security, and efficiency in financial transactions.

Key Benefits of Blockchain Payments

1. Security and Transparency

Blockchain transactions are encrypted and recorded on an immutable ledger, making them highly secure and tamper-proof. The decentralized nature of blockchain ensures that no single entity can alter transaction records, increasing transparency and reducing the risk of fraud.

2. Lower Transaction Costs

Traditional payment methods often involve intermediaries such as banks and payment processors, which charge significant fees for transaction processing. Blockchain payments eliminate the need for intermediaries, resulting in lower transaction costs for businesses and consumers.

3. Faster Cross-Border Transactions

International transactions using traditional banking systems can take days to settle due to multiple intermediaries and regulatory approvals. Blockchain payments, on the other hand, enable near-instant cross-border transactions, enhancing financial inclusivity and reducing delays.

4. Enhanced Accessibility

Blockchain payments provide financial services to individuals and businesses without requiring a traditional bank account. This feature is particularly beneficial for underbanked populations, allowing them to participate in the global economy.

Real-World Applications of Blockchain Payments

E-Commerce and Retail: Merchants are integrating blockchain payment systems to accept cryptocurrencies, offering customers an alternative and secure payment method.

Remittances: Migrant workers can send money to their families without high remittance fees, ensuring more money reaches the recipients.

Supply Chain Management: Blockchain ensures secure and transparent payments between suppliers, manufacturers, and distributors.

Decentralized Finance (DeFi): DeFi platforms leverage blockchain payments for lending, borrowing, and yield farming, providing users with financial services without traditional banks.

How Resmic is Revolutionizing Blockchain Payments?

Resmic is at the forefront of enabling seamless cryptocurrency transactions, empowering businesses to embrace blockchain payments effortlessly. The platform provides a secure and user-friendly payment infrastructure, allowing businesses to accept multiple cryptocurrencies while ensuring compliance with regulatory requirements.

Key Features of Resmic:

Multi-Currency Support: Accepts various cryptocurrencies, enhancing customer flexibility.

Fast Settlements: Near-instant transactions for efficient cash flow management.

Secure Transactions: Robust encryption and decentralized validation for enhanced security.

Seamless Integration: Easy API integration with existing payment systems and e-commerce platforms.

Embracing the Future of Finance

Blockchain payments are reshaping the financial landscape, offering businesses and individuals a more efficient and secure way to transfer value globally. As adoption continues to grow, platforms like Resmic play a crucial role in facilitating this transition. By leveraging blockchain technology, businesses can stay ahead of the curve and unlock new opportunities in the digital economy.

3 notes

·

View notes

Text

What Are the Key Trends Shaping Domestic Money Transfers?

Domestic Money Transfers have evolved significantly in recent years, driven by advancements in technology, changing consumer preferences, and increasing regulatory oversight. The emergence of Digital Solutions, coupled with the integration of innovative financial tools, has reshaped the way individuals and businesses transfer funds within a country. This article delves into the key trends shaping Domestic Money Transfers, highlighting the role of technology, accessibility, and efficiency in this transformation.

1. Digital Transformation in Money Transfers

One of the most significant trends in Domestic Money Transfers is the widespread adoption of Digital Solutions. Traditional methods, such as bank drafts and money orders, are being replaced by mobile apps, digital wallets, and online banking platforms. These technologies allow for faster, more secure, and convenient transactions, catering to the growing demand for real-time payments.

The rise of digital banking has made it easier for consumers to transfer money with just a few taps on their smartphones. Mobile apps, have become household names, enabling peer-to-peer transfers with minimal fees and instant confirmation. These platforms not only enhance user experience but also reduce the dependency on cash, making transactions more efficient and traceable.

2. The Role of Fintech Companies

Fintech companies play a pivotal role in revolutionizing Domestic Money Transfers. By leveraging cutting-edge technologies like artificial intelligence (AI) and blockchain, they are addressing common challenges such as high transaction costs, delays, and lack of transparency. Companies like Xettle Technologies, for instance, have developed innovative platforms that streamline domestic payments, offering features like instant transfers, robust security protocols, and user-friendly interfaces.

These fintech solutions are particularly valuable for small businesses, freelancers, and gig economy workers who rely on seamless and affordable payment methods to manage their finances. By integrating Digital Solutions into their operations, fintech companies ensure that users can access fast and reliable money transfer services without the limitations of traditional banking systems.

3. The Shift Toward Real-Time Payments

Real-time payments (RTP) have emerged as a game-changer in Domestic Money Transfers. Consumers and businesses increasingly expect instant fund availability, whether for payroll, bill payments, or peer-to-peer transfers. Real-time payment systems eliminate the delays associated with traditional methods, ensuring that funds are credited within seconds.

Governments and financial institutions worldwide are investing in RTP infrastructure to meet these demands. In the United States, for example, the Federal Reserve’s FedNow Service aims to provide a nationwide RTP platform by facilitating instant transfers between banks. Similarly, other countries have implemented systems like India’s Unified Payments Interface (UPI) and the United Kingdom’s Faster Payments Service, highlighting the global push for faster domestic transactions.

4. The Growth of Mobile Money and Digital Wallets

Mobile money and digital wallets are becoming integral to the domestic payments ecosystem. These Digital Solutions provide a secure and convenient way to store and transfer money, especially for unbanked or underbanked populations. Platforms like Apple Pay, Google Pay, and Cash App offer seamless integration with smartphones, enabling users to make transfers, pay bills, and shop online without the need for physical cash or cards.

This trend is particularly prominent in emerging markets, where mobile penetration is high but access to traditional banking infrastructure remains limited. By bridging this gap, digital wallets are fostering financial inclusion and empowering users to participate in the digital economy.

5. The Influence of Open Banking

Open banking is another trend shaping Domestic Money Transfers by fostering collaboration between traditional banks and fintech companies. Through secure APIs (Application Programming Interfaces), open banking allows third-party providers to access customer data (with consent) to create tailored financial services. This innovation promotes competition and encourages the development of more efficient and customer-centric money transfer solutions.

With open banking, users can link multiple accounts to a single platform, making it easier to manage funds and initiate transfers. For businesses, open banking streamlines payment processing, enhances cash flow management, and provides real-time insights into financial transactions.

6. Enhanced Security and Fraud Prevention

As Domestic Money Transfers become increasingly digital, ensuring security is paramount. Advanced fraud prevention measures, such as biometric authentication, tokenization, and encryption, are being integrated into money transfer platforms to protect user data and prevent unauthorized access.

AI and machine learning play a crucial role in detecting suspicious activities and mitigating risks. These technologies analyze transaction patterns in real time, flagging anomalies and preventing fraudulent transfers before they occur. For consumers and businesses alike, enhanced security builds trust and encourages wider adoption of digital money transfer solutions.

7. The Push for Financial Inclusion

Digital Solutions for Domestic Money Transfers are also driving financial inclusion by reaching underserved populations. In rural areas and low-income communities, mobile money platforms and agent networks provide access to basic financial services, allowing individuals to send and receive money with ease. This democratization of financial services helps reduce economic disparities and fosters greater participation in the formal economy.

8. Regulatory Support and Standardization

Supportive regulatory frameworks are facilitating the growth of Domestic Money Transfers. Governments and regulatory bodies are working to create standards for interoperability, data security, and compliance, ensuring that digital payment systems operate seamlessly and transparently. Initiatives like regulatory sandboxes allow fintech companies to innovate while adhering to legal requirements, creating a balanced ecosystem for growth and innovation.

Conclusion

The landscape of Domestic Money Transfers is undergoing a profound transformation, fueled by the adoption of Digital Solutions, technological advancements, and evolving consumer expectations. Trends such as real-time payments, mobile money, open banking, and enhanced security measures are redefining how individuals and businesses manage their financial transactions.

Fintech companies like Xettle Technologies are at the forefront of this revolution, delivering innovative tools that simplify domestic payments and enhance user experience. As these trends continue to shape the market, the future of Domestic Money Transfers promises to be faster, more inclusive, and more secure than ever before.

2 notes

·

View notes

Text

Bitcoin as a Tool for Financial Freedom in Developing Nations

In many developing nations, financial freedom is a distant dream for millions of people. With limited access to banking, unstable local currencies, and high remittance fees, the financial systems in these regions often fail to meet basic needs. But Bitcoin, the world’s first decentralized cryptocurrency, offers a powerful alternative. By providing low-cost transactions, a secure store of value, and global access, Bitcoin has the potential to revolutionize financial systems in developing nations and empower individuals in ways previously unimaginable.

Access to Banking and Financial Services

A significant portion of the population in developing nations is unbanked or underbanked, meaning they don’t have access to traditional banking services. For these individuals, managing and transferring money is often both expensive and difficult. However, with Bitcoin, all you need is a smartphone and an internet connection to securely store and transfer value across borders.

Bitcoin’s decentralized nature removes the need for intermediaries like banks, allowing people to take control of their finances without requiring expensive infrastructure. This opens up opportunities for financial inclusion for millions who have been left out of the traditional banking system.

Fighting Inflation and Currency Instability

Countries like Venezuela, Zimbabwe, and Lebanon have experienced severe hyperinflation, leading to the rapid devaluation of their local currencies. In these situations, saving money in the local currency becomes a losing game, as purchasing power evaporates. Bitcoin, with its fixed supply and decentralized control, presents a unique solution. Unlike fiat currencies, Bitcoin’s value cannot be inflated by governments printing more money.

By holding Bitcoin, individuals in developing nations have a way to preserve their wealth, even in the face of rampant inflation. Bitcoin acts as a hedge against these unstable financial systems, offering a reliable store of value.

Low-Cost Remittances

Many developing countries rely heavily on remittances—money sent home by family members working abroad. Traditional remittance services like Western Union often charge high fees, eating into the money being sent. With Bitcoin, remittances can be sent instantly and at a fraction of the cost. This ensures that families receive more of the money being sent, helping to improve their financial situation.

For example, Bitcoin’s Lightning Network allows for near-instantaneous transactions with minimal fees, making it an ideal tool for cross-border payments. This has already started to reshape the remittance landscape in several countries, allowing people to keep more of their hard-earned money.

Expanding Internet Access with Starlink

While Bitcoin can offer financial freedom, it does rely on internet access, which can be a significant barrier in many remote areas of developing nations. Enter Starlink—Elon Musk’s satellite internet project. Starlink aims to provide high-speed internet access to even the most underserved regions of the world. By deploying a vast network of satellites, Starlink is bridging the connectivity gap and bringing the internet to areas that traditional infrastructure cannot reach.

As Starlink continues to expand, it will play a critical role in enabling the widespread use of Bitcoin in developing nations. With reliable internet access through Starlink, individuals in even the most remote areas will be able to access global financial services, store their wealth securely in Bitcoin, and participate in the global economy without relying on a failing banking system.

The combination of Starlink and Bitcoin represents a game-changer for financial inclusion. People who have long been cut off from the digital economy will soon have the tools to connect, transact, and thrive.

Case Studies of Bitcoin Adoption

We are already witnessing the potential of Bitcoin in countries like El Salvador, where it has become legal tender. Citizens and businesses are using Bitcoin to conduct transactions, save money, and escape reliance on the U.S. dollar. In Nigeria and Argentina, where inflation has eroded the value of local currencies, Bitcoin adoption has surged as people look for a more stable alternative.

These examples highlight how Bitcoin is not just an investment asset—it’s a lifeline for those in volatile economies. Real-life stories from these regions demonstrate the transformative impact that Bitcoin can have, providing a way out of the cycle of poverty and financial instability.

Challenges to Bitcoin Adoption in Developing Nations

While the potential for Bitcoin is massive, there are still challenges to widespread adoption. Access to reliable internet, government regulations, and a general lack of education about how to use Bitcoin safely are significant barriers. However, with increasing mobile internet access, thanks to initiatives like Starlink, and the growing number of educational programs focused on Bitcoin, these challenges are gradually being addressed.

In many countries, grassroots organizations are working to teach people how to use Bitcoin securely, helping to accelerate adoption. As awareness grows, so too will the use of Bitcoin as a tool for financial empowerment.

The Future of Bitcoin in Developing Nations

Looking ahead, the future of Bitcoin in developing nations appears promising. As technology continues to improve, and access to the internet becomes more widespread, Bitcoin adoption will likely continue to rise. Bitcoin’s potential to create financial inclusion, protect wealth from inflation, and reduce the cost of remittances can drastically improve the lives of millions.

With governments and corporations beginning to see the value of Bitcoin, there is an opportunity for developing nations to leapfrog traditional financial systems and adopt a decentralized alternative that benefits the global population.

Conclusion

Bitcoin offers more than just a new form of currency; it presents a path to financial freedom for millions of people in developing nations. By providing access to financial services, protecting against inflation, and enabling low-cost remittances, Bitcoin has the potential to reshape economies and empower individuals like never before. And with innovations like Starlink bringing internet access to even the most remote corners of the world, the barriers to Bitcoin adoption are falling fast. The future is decentralized, and Bitcoin is leading the way toward financial inclusion for all.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#FinancialFreedom#DevelopingNations#Starlink#DecentralizedFinance#Blockchain#CryptoForGood#BitcoinAdoption#GlobalEconomy#DigitalCurrency#BitcoinRevolution#BitcoinAndTechnology#EmpowermentThroughCrypto#Cryptocurrency#financial empowerment#unplugged financial#financial education#financial experts#finance

3 notes

·

View notes

Text

Bitcoin's role in the future of finance

In the ever-evolving landscape of finance, one digital currency has captured the world's attention like no other: Bitcoin. Since its inception in 2009, Bitcoin has transcended from being a mere experimental concept to a transformative force, challenging traditional financial systems and reshaping our perception of money. As we navigate through the complexities of the modern financial world, it's imperative to understand Bitcoin's role in shaping the future of finance.

Bitcoin's Rise to Prominence: Bitcoin's journey from obscurity to prominence has been nothing short of remarkable. Introduced by the pseudonymous Satoshi Nakamoto, Bitcoin was envisioned as a decentralized digital currency, free from the control of central authorities such as banks or governments. Its underlying technology, blockchain, revolutionized the way transactions are recorded and verified, offering transparency, security, and immutability.

Initially met with skepticism and skepticism, Bitcoin gradually gained traction among tech enthusiasts, libertarians, and early adopters seeking an alternative to traditional fiat currencies. As its utility and acceptance grew, Bitcoin's value soared, attracting mainstream attention and investment from institutional players and retail investors alike.

Bitcoin's Role in the Future of Finance: Now, as we stand on the precipice of a new era in finance, Bitcoin's significance cannot be overstated. Here's how Bitcoin is poised to shape the future of finance:

Decentralization and Financial Inclusion: At the heart of Bitcoin lies its decentralized nature, which empowers individuals to take control of their financial destinies. Unlike traditional banking systems, where intermediaries dictate transactions and impose fees, Bitcoin allows for peer-to-peer transactions without the need for intermediaries. This decentralization fosters financial inclusion by providing access to banking services for the unbanked and underbanked populations worldwide.

Hedge Against Inflation and Economic Uncertainty: In an era marked by economic volatility and uncertainty, Bitcoin offers a hedge against inflation and currency devaluation. With a finite supply of 21 million coins, Bitcoin is immune to the whims of central banks and government policies that often erode the value of fiat currencies. As central banks continue to print money to stimulate economies, Bitcoin's scarcity and deflationary nature make it an attractive store of value and a hedge against economic downturns.

Innovation in Financial Services: Bitcoin's underlying technology, blockchain, has paved the way for innovative financial services and applications. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs) and smart contracts, Bitcoin's ecosystem continues to expand, offering new avenues for investment, lending, and asset management. These innovations have the potential to democratize finance, making it more accessible and inclusive for individuals worldwide.

Global Payments and Remittances: As a borderless digital currency, Bitcoin facilitates fast, low-cost cross-border payments and remittances. Unlike traditional banking systems, which are plagued by high fees and long processing times, Bitcoin enables instant transactions without the need for intermediaries. This has significant implications for global commerce, enabling businesses to streamline payments and expand their reach to new markets.

Institutional Adoption and Mainstream Acceptance: In recent years, we've witnessed a surge in institutional adoption of Bitcoin, with major corporations and financial institutions incorporating Bitcoin into their investment portfolios. This institutional endorsement not only lends credibility to Bitcoin but also paves the way for mainstream acceptance. As more businesses and individuals embrace Bitcoin, its role in the future of finance is poised to become even more pronounced.

Conclusion: In conclusion, Bitcoin's role in the future of finance is multifaceted and profound. From decentralization and financial inclusion to innovation and global payments, Bitcoin has the potential to reshape the way we perceive and interact with money. As we embrace the digital revolution, Bitcoin stands at the forefront, offering a glimpse into a future where financial empowerment and freedom reign supreme. As we embark on this journey, one thing is clear: Bitcoin is not just a digital currency; it's a catalyst for change, ushering in a new era of finance for generations to come.

How will Bitcoin be used in the future?

In the ever-evolving landscape of digital currencies, Bitcoin stands tall as a pioneer, offering a glimpse into the future of finance. But how will Bitcoin be used in the future? Let's delve into the possibilities and potential of this groundbreaking cryptocurrency.

Global Transactions and Remittances: Bitcoin's borderless nature makes it ideal for facilitating international transactions and remittances. As traditional banking systems struggle with high fees and lengthy processing times, Bitcoin offers a faster, more cost-effective alternative. In the future, we can expect to see Bitcoin used as a primary means of transferring value across borders, empowering individuals and businesses alike.

Store of Value: With its finite supply and decentralized nature, Bitcoin has emerged as a reliable store of value akin to digital gold. As economic uncertainty looms and traditional fiat currencies face inflationary pressures, Bitcoin offers a hedge against depreciation. In the future, we may witness a significant portion of wealth stored in Bitcoin, safeguarding against currency devaluation and economic downturns.

Mainstream Adoption: While Bitcoin has already gained widespread recognition, its adoption is poised to skyrocket in the future. As more merchants accept Bitcoin as a form of payment and financial institutions integrate it into their services, Bitcoin will become increasingly accessible to the masses. This mainstream adoption will fuel its use in everyday transactions, from purchasing goods and services to receiving salaries.

Financial Inclusion: Bitcoin has the potential to bridge the gap between the banked and unbanked populations, particularly in developing countries. individuals who have been excluded from the formal financial system, fostering greater financial inclusion and economic empowerment.

Smart Contracts and Decentralized Finance (DeFi): Bitcoin's underlying technology, blockchain, enables the creation of smart contracts and decentralized finance applications. In the future, we can expect to see Bitcoin utilized in a variety of DeFi platforms, offering innovative financial services such as lending, borrowing, and trading. These decentralized applications will revolutionize traditional financial systems, providing greater accessibility and transparency to users.

Hedging Against Geopolitical Risks: As geopolitical tensions rise and governments impose sanctions, Bitcoin provides a means of circumventing restrictions on capital flows. In the future, we may see individuals and businesses turn to Bitcoin as a hedge against geopolitical risks, preserving their wealth in a borderless and censorship-resistant asset.

Integration with Central Bank Digital Currencies (CBDCs): While Bitcoin operates independently of central banks, it may complement the emerging trend of central bank digital currencies (CBDCs). In the future, we could see interoperability between Bitcoin and CBDCs, facilitating seamless exchange between digital and traditional currencies.

In conclusion, the future of Bitcoin is filled with promise and potential. From facilitating global transactions to fostering financial inclusion, Bitcoin is poised to revolutionize the way we think about money. As we embrace this digital frontier, Bitcoin will continue to shape the future of finance, empowering individuals, businesses, and economies worldwide.

What is the future of long term Bitcoin?

In the ever-evolving realm of cryptocurrencies, Bitcoin stands as the pioneer, the trailblazer that ignited a digital revolution. From its inception in 2009 by the mysterious Satoshi Nakamoto to its current status as a trillion-dollar asset, Bitcoin has captured the imagination of investors, tech enthusiasts, and economists alike. But what does the future hold for long-term Bitcoin? Let's embark on a journey to unravel the mysteries and explore the potential trajectory of this digital gold.

As we gaze into the crystal ball of cryptocurrency, one thing becomes clear: Bitcoin's long-term future is intricately tied to its ability to adapt and overcome challenges. Like any revolutionary technology, Bitcoin has faced its fair share of hurdles, from scalability issues to regulatory scrutiny. Yet, with each obstacle, Bitcoin has emerged stronger, more resilient, and more ingrained in the fabric of our digital economy.

So, what can we expect from long-term Bitcoin? Let's delve into the key factors that will shape its future:

Adoption and Integration: The widespread adoption of Bitcoin as a mainstream asset class is perhaps the most crucial determinant of its long-term success. As more institutions, corporations, and individuals embrace Bitcoin as a store of value and hedge against traditional financial systems' uncertainties, its long-term viability strengthens. With the recent trend of institutional adoption and the emergence of Bitcoin-based financial products, such as ETFs, the path towards mainstream acceptance becomes clearer.

Technological Advancements: The underlying technology behind Bitcoin, the blockchain, continues to evolve at a rapid pace. From scalability solutions to privacy enhancements, ongoing developments in blockchain technology promise to address Bitcoin's current limitations and unlock new possibilities. Layer 2 solutions like the Lightning Network offer faster and cheaper transactions, making Bitcoin more practical for everyday use.

Regulatory Clarity: Regulatory uncertainty has been a lingering shadow over Bitcoin's journey. However, as governments worldwide grapple with the complexities of cryptocurrency regulation, clarity begins to emerge. Clear and balanced regulatory frameworks can provide legitimacy and stability to the Bitcoin market, paving the way for greater institutional involvement and investor confidence.

Market Dynamics: The dynamics of the cryptocurrency market play a pivotal role in shaping Bitcoin's long-term trajectory. Price volatility, market sentiment, and macroeconomic factors all influence Bitcoin's price movements. However, as Bitcoin matures and its market cap grows, it becomes less susceptible to manipulation and wild price swings, leading to a more stable long-term outlook.

Global Socioeconomic Trends: Bitcoin's future is intertwined with broader socioeconomic trends, such as the shift towards digitalization, the erosion of trust in traditional financial institutions, and the quest for financial sovereignty. As individuals seek alternative forms of money and value preservation, Bitcoin's role as a decentralized, censorship-resistant asset becomes increasingly relevant.

In conclusion, the future of long-term Bitcoin is a tale of resilience, innovation, and adaptation. While challenges remain, Bitcoin's journey from obscurity to ubiquity reflects its intrinsic value and disruptive potential. As we navigate the ever-changing landscape of cryptocurrency, one thing is certain: Bitcoin's legacy will endure, shaping the future of finance and technology for generations to come.

3 notes

·

View notes

Text

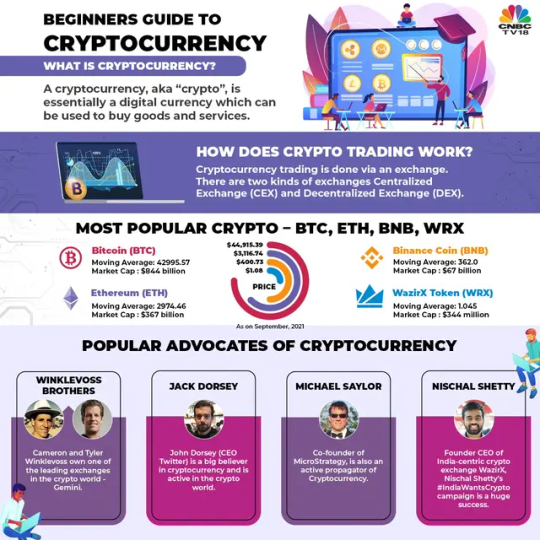

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

How AI is Transforming Financial Decision-Making in 2025

In the ever-evolving financial landscape, 2025 marks a tipping point in how decisions are made. Artificial Intelligence (AI) is no longer a buzzword—it's a strategic asset. From banks and hedge funds to insurance and retail finance, AI is transforming the speed, accuracy, and intelligence of financial decision-making. This post explores how AI is reshaping finance in 2025 and what it means for institutions, investors, and customers alike.

📈 The Rise of AI in Financial Decision-Making

Financial decisions once relied heavily on static models, historical data, and human intuition. Today, AI introduces real-time adaptability, pattern recognition, and predictive insight.

AI technologies—particularly machine learning (ML), natural language processing (NLP), and deep learning—allow firms to process massive data sets, detect complex trends, and automate decisions faster than ever. In 2025, AI is embedded into everything from credit scoring algorithms to automated trading systems.

🔍 Key Areas Where AI is Making an Impact

🔹 Predictive Analytics and Forecasting

AI models are now used to forecast market behavior, predict client churn, and optimize pricing strategies with remarkable precision. By analyzing both structured and unstructured data (e.g., news, social sentiment), financial institutions can better anticipate risks and opportunities.

Example: Hedge funds are leveraging AI to adjust portfolios in real time based on news feeds and geopolitical trends.

🔹 Credit Risk and Underwriting

Gone are the days of static credit models. AI can analyze thousands of variables to assess a borrower’s creditworthiness, including non-traditional data like payment behavior or digital footprint. This is especially helpful in underbanked or thin-file populations.

Example: Fintech lenders use AI to underwrite loans in minutes, not days—reducing defaults while expanding access.

🔹 Investment Strategy Optimization

AI-powered robo-advisors are guiding personalized portfolio decisions using individual risk profiles and market dynamics. Meanwhile, algorithmic trading uses AI to execute split-second trades based on predictive models.

Example: Wealth management firms now use AI to rebalance portfolios dynamically based on behavioral patterns and macroeconomic signals.

🔹 Fraud Detection and Compliance

AI enables real-time monitoring of transactions to flag unusual patterns and detect fraud. In 2025, AI-driven compliance tools (RegTech) automatically adapt to new regulations, helping firms stay audit-ready.

Example: Banks use AI to flag suspicious activity within milliseconds, improving fraud prevention while reducing false positives.

✅ Benefits of AI in Finance

Speed: AI accelerates decision-making, often in real time.

Accuracy: Reduces human error and improves forecasting precision.

Cost Efficiency: Automates routine tasks and streamlines operations.

Scalability: AI systems handle growing volumes of data effortlessly.

Customer Experience: Enables personalized financial services.

⚖️ Ethical and Regulatory Considerations

While AI offers powerful capabilities, it raises questions around transparency and fairness.

Explainability: Many models are "black boxes" with unclear reasoning—leading to calls for explainable AI (XAI).

Bias: Algorithms may unintentionally reinforce discrimination if trained on biased data.

Compliance: Regulatory frameworks (like GDPR, Basel III) are evolving to address AI’s influence in finance.

Governance: Institutions must adopt responsible AI practices—balancing innovation with oversight.

🚧 Challenges to Adoption

Despite its promise, AI adoption isn’t frictionless:

Data Silos: Poor-quality or inaccessible data hampers model performance.

Legacy Infrastructure: Many firms struggle to integrate AI into outdated systems.

Skills Gap: There's high demand for data scientists and AI specialists.

Cultural Resistance: Traditional finance teams may resist automated decision-making.

🔮 The Road Ahead: AI’s Future in Financial Strategy

Looking beyond 2025, we can expect:

Autonomous Finance: Systems making low-risk decisions independently.

AI-Human Collaboration: Finance professionals augmented—not replaced—by AI insights.

AI-Driven Governance: Intelligent compliance that adapts in real time.

Hyper-Personalization: Tailored products and strategies based on behavioral data.

Those who invest in AI readiness today will lead the financial world tomorrow.

🧾 Conclusion

AI is no longer on the sidelines—it's central to the future of financial decision-making. From improving credit models to enabling predictive risk management, AI is unlocking new possibilities for speed, accuracy, and strategic agility in finance. But with great power comes great responsibility.

As AI continues to transform finance in 2025 and beyond, the winning institutions will be those that pair innovation with transparency, governance, and a deep commitment to ethical use.

#credit underwriting in banks#credit risk underwriting#credit risk management tools#credit risk management software solutions#credit risk management software for banks

0 notes

Text

In-Depth Study of Embedded Finance Market Dynamics: Evaluating Market Size, Share, Growth Forecast

The global embedded finance market size is anticipated to reach USD 588.49 billion by 2030, expanding at a CAGR of 32.8% from 2024 to 2030, according to a new report by Grand View Research, Inc. The increasing integration of financial services into non-financial platforms, creating seamless and personalized experiences for consumers, is a significant factor contributing to the growth of the market. This convergence of industries, commonly referred to as "banking-as-a-service," allows businesses outside the traditional financial sector to embed financial products directly into their offerings.

Furthermore, the rise of Application Programming Interfaces (APIs) is transforming how financial services are accessed and consumed. The accessibility and interoperability provided by APIs enable businesses to integrate diverse financial functionalities effortlessly, thereby contributing to the growth of the market.

Advancements in technologies like artificial intelligence and machine learning are propelling the development of sophisticated algorithms for risk assessment, fraud detection, and customer personalization, thereby enhancing the overall efficiency and security of embedded financial solutions. As the Embedded Finance ecosystem continues to evolve, collaboration between fintech innovators, traditional financial institutions, and various industries will play a pivotal role in driving innovation and expanding the scope of embedded financial services.

Governments across the globe have given high importance to fostering financial inclusion, especially in developing economies characterized by substantial unbanked and underbanked populations. With the rapid increase in internet and smartphone adoption, several nations aim to emphasize the shift toward a cashless economy while ensuring that it doesn't compromise the delivery of convenient and accessible financial services to their residents. Embedded finance emerges as a pivotal tool in simultaneously addressing both of these objectives.

For More Details or Sample Copy please visit link @: Embedded Finance Market Report

Embedded Finance Market Report Highlights

Based on type, the embedded payment segment dominated the market in 2023. The growth of the segment can be attributed to the growth in adoption of digital payment across the globe

Based on business model, the B2B segment dominated the market in 2023. The B2B embedded finance provides businesses with new revenue streams, helping them improve their financial performance

Based on end-use, the retail segment dominated the market in 2023. The growth of the segment can be attributed to the rising demand for seamless and integrated financial solutions within retail ecosystems

North America dominated the regional market in 2023. The growth can be attributed to the increasing collaboration between fintech firms, traditional financial institutions, and diverse industries. This collaborative ecosystem facilitates the embedding of financial services seamlessly into various non-financial platforms, enhancing customer experiences. Additionally, the rising prevalence of digital wallets, contactless payments, and mobile banking services underscores a growing consumer preference for convenient and tech-enabled financial solutions

In February 2023, Transcard Payments announced a partnership with Coforge Limited, a global digital services and solutions provider. Under this partnership, as a Transcard Payments value-added reseller, Coforge Limited leveraged Transcard Payments’s suite of embedded payment solutions

#EmbeddedFinance#EmbeddedBanking#FinanceAsAService#BankingAsAService#FintechInnovation#DigitalFinance#FintechEcosystem#FinancialAPIs#FintechMarket

0 notes

Text

Why AEPS Is Key to Financial Inclusion in India

A large portion of India’s population remains underbanked, with limited or no access to formal banking institutions. AEPS helps bridge this gap by allowing users to access financial services with minimal requirements — just their Aadhaar number and biometric verification. It ensures last-mile delivery of banking, supporting the government’s vision for financial inclusion.

Paysprint is enabling this vision with its enterprise-ready AEPS API, helping agents and institutions extend banking to the doorstep of every Indian.

0 notes

Text

The Role of Bank of America in Accelerating Financial Inclusion in the U.S

In today’s rapidly evolving financial landscape, financial inclusion remains a critical issue across the United States. Despite the country’s highly developed banking infrastructure, millions of Americans still find themselves underbanked or completely unbanked. In this context, large financial institutions are stepping up to bridge the gap. Among them, Bank of America has emerged as a transformative force. Through targeted programs, strategic partnerships, and technological innovation, BofA is making financial services more accessible and inclusive for all.

Understanding Financial Inclusion in the U.S.

Financial inclusion refers to providing individuals and businesses access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit, and insurance—delivered responsibly and sustainably. According to the Federal Deposit Insurance Corporation (FDIC), approximately 4.5% of U.S. households were unbanked in 2021, translating to around 5.9 million households. This issue disproportionately affects low-income communities, minorities, and rural populations.

Bank of America’s Commitment to Financial Inclusion

BofA has long recognized the critical need for financial inclusion. As one of the largest banking institutions in the United States, it wields both the resources and reach to implement initiatives at scale. Over the past decade, Bank of America has launched numerous programs aimed at empowering underserved communities and providing broader access to the banking system.

1. Affordable Banking Solutions

In response to the needs of underbanked populations, the leading banking giant introduced its SafeBalance Banking® account. This low-cost, no-overdraft-fee account is designed to help customers avoid high banking fees and manage their finances responsibly. According to the bank, over 3 million people have enrolled in this program, which has significantly contributed to reducing the number of unbanked individuals.

2. Expanding Digital Access

[Source - GOBankingRates]

Technology is central to Bank of America’s inclusion strategy. Through its award-winning mobile and online banking platforms, the bank makes financial services accessible to those in remote or underserved areas. In 2023, the bank reported that over 73% of its consumer households were actively using digital channels. These tools not only offer convenience but also provide financial education and personalized insights, enabling users to make informed decisions.

3. Community Investments

Another major pillar of the banking giant’s strategy is investing directly into communities. The bank has committed over $1.25 billion to advance racial equality and economic opportunity. This funding supports small businesses, job training programs, and affordable housing initiatives. In 2022 alone, the bank deployed $250 million to community development financial institutions (CDFIs) and minority depository institutions (MDIs), which play a crucial role in serving marginalized communities.

4. Financial Literacy Programs

Bank of America understands that access to services must be paired with education. The bank’s Better Money Habits® program is a free financial education platform that provides practical advice on budgeting, saving, and credit management. With millions of users, the initiative is helping to build financial capability across age groups and income levels.

5. Support for Minority Entrepreneurs

Entrepreneurship is a key pathway to economic mobility. Recognizing this, the Wall Street player supports minority-owned small businesses through funding, mentorship, and advisory services. It has partnered with organizations such as the National Urban League and the Hispanic Chamber of Commerce to ensure that Black, Latino, and Indigenous entrepreneurs receive the resources they need to thrive.

6. Enhancing Accessibility for People with Disabilities

[Source - Special Olympics]

In its drive for inclusivity, Bank of America has also taken significant steps to accommodate people with disabilities. From ADA-compliant ATMs to accessible digital tools and dedicated customer service, the bank is ensuring that all Americans can participate in the financial system with dignity and ease.

7. Disaster Relief and Crisis Response

Access to financial services becomes even more critical during times of crisis. The financial institution has consistently supported disaster relief efforts, offering payment deferrals, fee waivers, and emergency funding. During the COVID-19 pandemic, the bank played a pivotal role in distributing funds through the Paycheck Protection Program (PPP), particularly to small and minority-owned businesses.

8. Women and Financial Empowerment

Gender equity is another focus area. Through its Women’s Entrepreneur Program and strategic partnerships with organizations like Vital Voices, Bank of America helps women build businesses, gain access to capital, and develop leadership skills. These initiatives have supported thousands of female entrepreneurs across the U.S.

Statistical Impact

The measurable results of these programs underscore their significance. A 2022 report by the Urban Institute found that community investments made by BofA had directly improved credit access for over 500,000 low-income Americans. Furthermore, more than 70% of Better Money Habits® users reported feeling more confident in managing their finances.

Why It Matters to Business Leaders

For CEOs, startup founders, and corporate managers, Bank of America’s approach to financial inclusion is more than a case study in corporate social responsibility—it is a blueprint for sustainable business. By actively investing in underserved communities, the bank is expanding its customer base, building long-term loyalty, and reinforcing its brand reputation.

Moreover, as ESG (Environmental, Social, and Governance) metrics become more critical in assessing corporate performance, the banking giant’s commitment to inclusion offers a competitive edge. Investors and stakeholders are increasingly favoring organizations that demonstrate genuine social impact.

Conclusion:

In a nation as economically advanced as the U.S., the existence of financial exclusion is both a challenge and an opportunity. Bank of America has positioned itself at the forefront of addressing this gap, not only through charitable giving but through deeply integrated business strategies. By embedding financial inclusion into its core operations, BofA is not just changing lives; it is redefining what it means to be a responsible financial institution in the 21st century.

Uncover the latest trends and insights with our articles on Visionary Vogues

#Bank of America#Financial inclusion#Affordable banking solutions#Digital access#Community investments#Financial literacy programs

0 notes

Text

How Smart India Hackathon Fuels Innovation in the FinTech Sector

FinTech (Financial Technology) is one of the fastest-growing sectors in India, reshaping how individuals and businesses manage, invest, and move money. Smart India Hackathon (SIH) provides a perfect platform for innovators to create game-changing solutions that improve financial inclusion, enhance security, and optimize digital payments.

Let’s explore how Smart India Hackathon is driving FinTech innovation in India and contributing to the growth of this dynamic industry.

🎯 Addressing Key Challenges in FinTech

The Smart India Hackathon focuses on solving real-world FinTech challenges, such as:

Financial inclusion: Building solutions to provide banking services to underbanked populations, especially in rural areas, through mobile banking, digital wallets, and e-KYC (Know Your Customer) systems.

Digital payment systems: Innovating secure, fast, and scalable digital payment solutions that make it easy for businesses and consumers to transact online.

Security and fraud prevention: Developing tools to secure digital transactions, prevent cyberattacks, and enhance data privacy.

Micro-investing and lending: Creating platforms that allow individuals to make small investments or access microloans, promoting financial independence and growth.

These challenges help create inclusive and efficient financial ecosystems, giving millions of people easier access to essential financial services.

💡 Building Secure and Scalable Payment Solutions

India’s digital payment ecosystem is rapidly growing, and hackathons like SIH contribute by creating secure, scalable solutions:

Blockchain for secure transactions: Many hackathons focus on developing blockchain-based payment solutions that are tamper-proof, transparent, and decentralized.

Contactless payments: Innovations in contactless payment systems, including QR codes, NFC-based payments, and digital wallets, ensure secure and user-friendly payment experiences for consumers and businesses.

Cross-border transactions: Creating solutions for international payments, enabling seamless money transfers across borders without high fees or lengthy processing times.

These innovations in payment systems are essential for India’s cashless economy, providing a robust foundation for the future of digital payments.

🚀 Empowering Financial Literacy and Inclusion

A key goal of Smart India Hackathon is to promote financial literacy and ensure that everyone has access to the tools they need to manage their finances effectively:

Financial education apps: Developing apps that teach people about budgeting, investing, and saving to improve their financial well-being.

Inclusive banking solutions: Creating digital platforms that offer affordable financial services to underserved populations, empowering them with access to credit, savings, and insurance products.

Microloans: Innovating platforms that allow small loans to be disbursed directly to individuals or businesses, enabling economic empowerment for low-income communities.

These financial literacy tools are key to ensuring that digital transformation benefits everyone, regardless of their financial background or location.

💼 Career and Networking Opportunities in FinTech

Hackathons are not just about building solutions—they are also great for career growth:

Networking with investors: Many Smart India Hackathon participants meet investors who are looking for innovative FinTech solutions to fund.

Job opportunities: Companies in the FinTech sector often scout hackathon winners for internships or full-time positions.

Entrepreneurial support: Winning hackathon projects often gain access to incubators or accelerators, helping participants take their solutions to the next level as FinTech startups.

These networking opportunities can significantly boost your career or help you launch your own FinTech venture.

📘 Resources from Hack4Purpose

To help participants in the FinTech space, Hack4Purpose provides:

FinTech-specific problem statements for hackathons.

Guides on creating secure and scalable payment systems.

Mentorship and networking opportunities with industry leaders in the FinTech sector.

With these resources, hackathon participants can turn their innovative FinTech ideas into fully functional products and services.

💡 Final Tip

Smart India Hackathon is the perfect place to accelerate your journey in the FinTech industry. Whether you're developing solutions for digital payments, financial literacy, or micro-lending, hackathons offer you the opportunity to build, test, and scale ideas that could transform the financial landscape in India.

Say “nxt” for Sub-blog #81! Keep g

0 notes

Text

Revolutionizing Money Transfers: Smart Remittance Kiosks by Panashi !!

In today’s fast-paced world, seamless and secure money transfer is essential— especially for unbanked and underbanked populations. Our Remittance Kiosk Solutions offer a smart, self-service platform that simplifies cross-border transactions with ease and efficiency. Designed for high performance and user-friendly interactions, these kiosks ensure 24/7 availability and reduce operational bottlenecks. Empower your customers with financial freedom—anytime, anywhere.

1 note

·

View note

Text

What Are Micro ATM Services and How Do They Revolutionize Banking in Rural Areas?

In the age of digital transformation, access to financial services is more critical than ever. Yet, for millions in rural and semi-urban areas, traditional banking facilities remain out of reach due to the lack of infrastructure and logistical challenges. This gap is where Micro ATM Services come into play, bridging the divide and empowering communities with financial access.

What Are Micro ATM Services?

Micro ATM services refer to a portable and user-friendly banking solution that allows basic banking operations to be conducted in areas with limited or no access to traditional banking infrastructure. Micro ATMs are compact, mobile devices operated by banking correspondents (BCs), often in local shops or community hubs, where they act as an extended arm of the bank.

These devices are designed to perform essential banking functions such as:

Cash withdrawal

Cash deposit

Balance inquiry

Fund transfers

Aadhaar-enabled payment services (AEPS)

Micro ATM services are linked to the user’s bank account and utilize biometric authentication or debit card verification to ensure secure transactions. They operate through mobile or internet connectivity, making them ideal for rural and remote regions.

The Working of Micro ATM Services

A Micro ATM device is equipped with a card reader, fingerprint scanner, and sometimes a small display screen. Here’s how it typically works:

Banking Correspondent Role: A banking correspondent operates the Micro ATM. They connect with individuals who need banking services but lack access to traditional ATMs or branches.

Authentication: Customers authenticate themselves using biometric data (such as Aadhaar fingerprint verification) or by inserting their debit/credit cards.

Transaction Processing: The device connects to the customer’s bank account via a secure network, enabling transactions like withdrawals or deposits.

Transaction Completion: After processing, a receipt is generated, and the customer receives real-time updates, ensuring transparency and trust.

Revolutionizing Banking in Rural Areas

1. Accessibility and Convenience

For people living in remote areas, traveling to the nearest bank branch can be time-consuming and expensive. Micro ATM services eliminate this need by bringing banking to their doorstep. Villagers can perform financial transactions conveniently without leaving their communities.

2. Financial Inclusion

One of the main objectives of Micro ATM services is to promote financial inclusion. By offering banking services to the unbanked and underbanked populations, these devices empower people to participate in the formal economy. They also help in disbursing government subsidies directly to beneficiaries under schemes like DBT (Direct Benefit Transfer).

3. Cost-Effective Banking Solution

Building and maintaining traditional bank branches in rural areas is costly and often unfeasible. Micro ATMs provide a cost-effective alternative for banks to expand their reach without significant infrastructure investments.

4. Boosting Rural Economy

With access to banking services, rural residents can save money, avail loans, and invest in small businesses, which collectively contribute to the growth of the rural economy. Micro ATM services also enable merchants to accept digital payments, further driving economic activity.

5. Enhancing Digital Literacy

By exposing rural populations to modern financial tools, Micro ATM services play a role in improving digital literacy. As people become familiar with using these services, they are more likely to adopt other digital payment methods, contributing to India’s vision of a cashless economy.

Role of Technology in Micro ATM Services

Advanced technologies have made Micro ATM services reliable and efficient. Features such as biometric authentication, real-time transaction updates, and integration with Aadhaar ensure secure and smooth operations. The portability and simplicity of these devices allow them to function even in low-connectivity areas.

Xettle Technologies, a leading innovator in the financial technology sector, has made significant strides in enhancing the efficiency of Micro ATM services. By developing user-friendly and secure solutions, Xettle Technologies ensures that financial services reach every corner of the country, fostering greater inclusion and economic empowerment.

Challenges in Implementing Micro ATM Services

While Micro ATM services have been transformative, there are challenges to address:

Connectivity Issues: Rural areas often face inconsistent mobile and internet connectivity, which can hamper device functionality.

Awareness and Trust: Many rural residents are unfamiliar with digital banking tools and may hesitate to use them due to concerns about fraud or complexity.

Limited Cash Flow: Banking correspondents operating Micro ATMs may run out of cash, limiting the ability to meet customer demands.

The Future of Micro ATM Services

The future of Micro ATM service is promising, with advancements in technology poised to overcome existing challenges. Some trends include:

Improved Connectivity: The expansion of mobile networks and internet infrastructure in rural areas will ensure uninterrupted service.

Enhanced Features: Newer Micro ATM models may include multilingual support, better biometric scanners, and integration with advanced payment systems.

Policy Support: Government initiatives like the Jan Dhan Yojana and Digital India will continue to drive the adoption of Micro ATM services.

Conclusion

Micro ATM services are a game-changer in the quest for financial inclusion, particularly in rural and underserved areas. They bring banking closer to the people, foster economic activity, and pave the way for a more inclusive financial ecosystem.

Companies like Xettle Technologies are at the forefront of this revolution, developing solutions that make banking accessible, secure, and efficient for everyone. By addressing challenges and embracing innovation, Micro ATM services are set to play a vital role in shaping the future of banking in India and beyond.

2 notes

·

View notes

Text

How Bitcoin is Revolutionizing Financial Freedom

In today's world, financial freedom is a dream many aspire to but few achieve. Traditional financial systems, with their inherent limitations and inefficiencies, often stand as barriers to true financial autonomy. Enter Bitcoin: a revolutionary tool that promises to redefine our understanding of money and financial independence. As we embark on this journey, we'll explore how Bitcoin is not just a digital currency but a catalyst for a new era of financial freedom.

Understanding Financial Freedom

Financial freedom is more than just having enough money to meet your needs; it's about having control over your finances without being shackled by external constraints. It means the ability to make choices that are best for you and your loved ones without constant financial stress. However, the current financial system poses significant obstacles: inflation erodes the value of savings, banking restrictions limit access to financial services, and high fees eat away at hard-earned money. These issues highlight the need for an alternative, and Bitcoin offers a compelling solution.

Bitcoin's Role in Achieving Financial Freedom

Decentralization

Bitcoin operates on a decentralized network, meaning it doesn't rely on a central authority like banks or governments. This decentralization removes intermediaries from financial transactions, reducing costs and increasing efficiency. With Bitcoin, individuals can send and receive money directly, anywhere in the world, without the need for approval from a third party.

Security

The security of Bitcoin lies in its blockchain technology. Every transaction is recorded on a public ledger, which is virtually tamper-proof due to its decentralized nature. This transparency ensures trust and reliability, making Bitcoin a secure store of value. Unlike traditional currencies, which can be manipulated or devalued, Bitcoin's supply is fixed, providing a hedge against inflation and monetary instability.

Accessibility

One of the most transformative aspects of Bitcoin is its accessibility. In many parts of the world, people lack access to basic banking services. Bitcoin opens up financial opportunities for the unbanked and underbanked populations, providing a way to save, invest, and transfer money without the need for a traditional bank account. All that is required is an internet connection and a digital wallet.

Control and Ownership

Bitcoin empowers individuals with true ownership of their assets. When you hold Bitcoin, you are in complete control of your funds. There are no banks that can freeze your account or governments that can seize your assets. This level of control is unprecedented and a key component of financial freedom.

Dollar-Cost Averaging (DCA) into Bitcoin

Dollar-Cost Averaging (DCA) is a strategy that involves investing a fixed amount of money into Bitcoin at regular intervals, regardless of the price. This approach mitigates the impact of market volatility, smoothing out the highs and lows over time. DCA is particularly effective in the volatile world of cryptocurrencies, making it a prudent strategy for those looking to build wealth steadily.

To implement a DCA strategy, start by determining how much you can comfortably invest on a regular basis, whether it's weekly, bi-weekly, or monthly. Then, set up automatic purchases of Bitcoin with that fixed amount. Over time, you'll accumulate Bitcoin at an average cost, reducing the risk associated with market fluctuations.

Real-world examples abound of individuals who have successfully used DCA to grow their Bitcoin holdings. For instance, those who began DCAing into Bitcoin years ago have seen substantial returns, demonstrating the power of this disciplined investment approach.

Real-World Examples

Consider the story of Alice, a school teacher in Argentina, where inflation has been rampant. By steadily converting a portion of her salary into Bitcoin, she has protected her savings from devaluation and gained financial stability. Or take John, a software developer in Nigeria, who used Bitcoin to bypass restrictive banking systems, enabling him to receive payments from international clients and support his family.

These stories are not isolated incidents; they represent a growing trend of people around the world leveraging Bitcoin to achieve financial freedom. The statistics are telling: as Bitcoin adoption increases, so does the number of individuals gaining economic independence.

Challenges and Considerations

While Bitcoin offers numerous benefits, it's important to be aware of potential challenges. The volatility of Bitcoin can be daunting for new investors. Regulatory uncertainties in different jurisdictions can also pose risks. However, these challenges can be mitigated with a thoughtful approach.

For instance, DCAing into Bitcoin helps manage the risk of volatility. Staying informed about the latest regulatory developments and understanding the legal landscape can help navigate potential pitfalls. As with any investment, it's crucial to do your research and make informed decisions.

Conclusion

Bitcoin is more than just a digital currency; it's a powerful tool for achieving financial freedom. By eliminating intermediaries, enhancing security, providing accessibility, and offering true control over assets, Bitcoin is revolutionizing the way we think about money. Dollar-Cost Averaging into Bitcoin is a practical strategy that can help individuals steadily build wealth and navigate the volatility of the cryptocurrency market.

As we move forward in this new financial era, Bitcoin offers a beacon of hope for those seeking independence and control over their financial destiny. Explore Bitcoin, understand its potential, and consider how it can be a part of your journey towards financial freedom.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialFreedom#CryptoRevolution#DigitalCurrency#Blockchain#BitcoinCommunity#Decentralization#CryptoInvesting#FinancialIndependence#DCA#BitcoinAdoption#CryptoEducation#EconomicEmpowerment#BitcoinLife#CryptoJourney#financial education#financial empowerment#financial experts#cryptocurrency#finance#globaleconomy#unplugged financial

3 notes

·

View notes

Text

API Banking Market Drivers: Uncovering Key Growth Factors Fueling Digital Transformation

The API banking market has witnessed remarkable growth over the past decade, fueled by rapid digitization and the ongoing transformation of the financial industry. API (Application Programming Interface) banking refers to a system where banks open their infrastructure to third-party developers, enabling them to build new services and applications on top of the bank's existing platforms. This model not only modernizes traditional banking but also fosters innovation and flexibility, becoming a vital part of digital finance strategies globally.

One of the major drivers behind the expansion of the API banking market is the increasing customer demand for digital experiences. Today’s consumers expect fast, personalized, and seamless interactions with their financial service providers. APIs enable banks to connect with fintech platforms, mobile apps, and other digital services, delivering on these expectations with improved functionality and user-friendly experiences. Whether it's instant payments, digital wallets, or budgeting tools, APIs allow banks to stay competitive by offering modern, on-demand services.