#uk accounting

Explore tagged Tumblr posts

Text

Turning Point for the Accounting Industry: Unprecedented Growth in Outsourcing

Is the accounting industry on the cusp of a revolution? The rise in outsourcing suggests it might be. Over the past few years, international expenditure on outsourcing services has grown by an astounding 40%. This shift is driven by the need for cost efficiency, a global talent crunch, and the demand for business flexibility.

As Rajesh Velayuthasamy, Sr. VP Europe and Head of Marketing at Integra Global Solutions, puts it:

“The accounting landscape in the UK is evolving rapidly, and outsourcing has become a strategic solution for firms aiming to enhance value and maintain flexibility in a competitive market.”

What’s Driving the Growth in Outsourcing?

Cost Efficiency: Accounting firms operate in a low-margin environment. Outsourcing helps convert fixed costs into variable costs, allowing firms to scale operations as needed. Offshore service providers offer qualified talent at significantly reduced costs.

Technology Savings: Many outsourcing providers bring cutting-edge technology like cloud computing and AI, saving firms the need to invest heavily in their own infrastructure.

Addressing the Talent Shortage

The UK faces a shortage of skilled accounting professionals, particularly in specialized areas like tax compliance and auditing. Outsourcing provides a solution by tapping into a global talent pool, enabling firms to access expertise at competitive rates.

By outsourcing, firms overcome local talent constraints, enhancing their capabilities and competitiveness in a dynamic market.

How Technology Fuels Outsourcing Success

Technology is a game-changer for outsourcing. Advanced tools such as:

Cloud Computing enables real-time financial management.

AI and RPA automate routine tasks and improve accuracy. This empowers outsourcing providers to deliver timely insights, enabling firms to make strategic decisions faster and more effectively.

Prioritizing What Matters: Shifting Focus to High-Value Activities

Outsourcing routine tasks allows accounting firms to concentrate on critical strategic areas like client advisory and relationship management. By freeing up time and resources, firms can focus on activities that:

Drive operational efficiency.

Enhance client satisfaction and loyalty.

Build a stronger competitive advantage in the market.

This strategic shift allows accounting firms to unlock their full potential by concentrating on what truly matters to clients and their business.

Challenges to Consider Before Outsourcing

While outsourcing offers numerous advantages, firms must navigate potential challenges:

Data Security: Safeguarding sensitive financial information is critical. Ensure your outsourcing partner complies with strict security protocols.

Effective Communication: Maintain clear expectations and regular check-ins to ensure alignment between in-house and outsourced teams.

The Future of Accounting Outsourcing

“The future of UK accounting industry is embracing a new era, where outsourcing will not only be a cost-effective solution but a way to innovate and stay ahead,” says Rajesh Velayuthasamy.

With the acceleration of remote work and digital adoption post-COVID-19, outsourcing is now a strategic necessity. Firms planning to scale up outsourced services are setting themselves up for growth, innovation, and long-term success.

Conclusion: The Outsourcing Advantage

Outsourcing marks a pivotal turning point for the accounting industry. With nearly 40% growth in global spending, it’s clear that cost savings, access to talent, and cutting-edge technology are driving this shift.

Firms that embrace outsourcing will thrive by delivering better services, improving efficiency, and unlocking new growth opportunities.

Ready to transform your accounting firm?

Integra Global Solutions is here to help. With tailored solutions, we partner with UK accounting firms to streamline operations, access specialized expertise, and navigate industry changes.

Explore how we can support your growth. Contact us today at www.globalintegra.co.uk

1 note

·

View note

Text

Revolutionize Your Payroll Management with Corient's Seamless Payroll Services

In the ever-evolving landscape of business operations, effective payroll management is paramount to sustaining a healthy and thriving organization. Corient Business Services takes the helm in redefining efficiency with our Payroll Outsourcing services, ensuring precision, compliance, and peace of mind for businesses of all sizes.

Unleashing the Power of 720 Satisfied Clients

Corient's Payroll Outsourcing services have garnered acclaim from a diverse clientele, with 720 satisfied clients and counting. This speaks volumes about our commitment to excellence, accuracy, and the seamless payroll solutions we provide to businesses across various industries.

Precision at Every Step: Corient's Payroll Approach

At the core of our Payroll Outsourcing service is a commitment to precision. We understand that payroll is more than just disbursing salaries; it's about meticulous attention to detail, compliance with regulations, and ensuring accuracy in every transaction. Corient's approach guarantees that your payroll processes are not only efficient but also aligned with the latest industry standards.

Tailored Solutions for Every Business

Recognizing the unique payroll challenges faced by different businesses, Corient crafts personalized solutions that fit seamlessly into your operations. Whether you are a small startup or a large enterprise, our Payroll Outsourcing services are designed to scale with your business, providing flexibility and adaptability.

Technology-Driven Efficiency

Corient leverages cutting-edge technology to streamline payroll processes. From automated calculations to secure and efficient payment methods, our technological infrastructure ensures that your payroll is not just a routine task but a well-oiled and error-free process.

Compliance: A Cornerstone of Corient's Payroll Commitment

Navigating the complex landscape of payroll regulations can be daunting, but with Corient, you can rest assured. Our experts stay up-to-date with the latest changes in payroll legislation, ensuring that your payroll processes remain compliant with local and international regulations.

Seamless Integration with Your Workflow

Corient understands that disruptions to your workflow can be costly. Our Payroll Outsourcing services are designed for seamless integration with your existing systems, minimizing downtime and ensuring a smooth transition to more efficient payroll management.

Conclusion: Elevate Your Payroll Experience with Corient

In the realm of payroll services, Corient Business Services stands as a beacon of efficiency, precision, and client satisfaction. Partner with us to revolutionize your payroll management, unlock operational efficiencies, and focus on what matters most – the growth and success of your business. Learn

0 notes

Text

December 31, 2014: Looking back, 10 years later... I think he did just that! ❤️🥠

#dan#daniel howell#danisnotonfire#y:2014#via:instagram#10yearsofdnp#ok technically he posted this at 1am uk time but i'm in america so the caption says 2014 OH WELL#anyway i think this is a really nice sentiment for the new year#and it's wild to think of all the ways he actually accomplished this#thank you for sticking with me for these past few weeks btw!!#i cannot WAIT to celebrate all of 2015's anniversaries with y'all#it's gonna be my 10th anniversary as a phannie too which is INSANE#who knows - maybe dnp will even acknowledge this blog?#i'm completely fine with them finding it now that all the 2009 stuff is far behind us#i know they're never on here but maybe they'll see the twitter account at least!

38 notes

·

View notes

Text

just a little bit of fun because while the show is amazing the marketing has been interesting to say the least

#there are few people I want to meet more than whoever is/was running those accounts#next to normal#next to normal uk#next to normal west end

45 notes

·

View notes

Text

this is so fucking cute

164 notes

·

View notes

Text

the west end newsies cast performing king of new york at the big night of musicals

#mostly posting this because I know they'll take it off iplayer in a month#also for the sake of american fans who might struggle to watch it because of how iplayer works#like don't you need a uk postcode to make an account now#newsies#uksies#west endsies#katherine plumber#katherine pulitzer#davey jacobs#david jacobs#les jacobs#racetrack higgins#racetrack newsies#albert dasilva#specs newsies#jojo newsies#mush newsies#elmer newsies#(I’m really bad at remembering the newsies' names and I’m definitely missing a lot of them I’m sorry I’m such a bad newsies fan guys)#mercury posting

996 notes

·

View notes

Text

After five years of adoring Hadestown, I had the privilege of seeing the West End Version of the show and I WOULD DIE FOR DÓNAL FINN'S ORPHEUS.

That man had me physically shaking with anxiety during Doubt Comes In. His Wait for Me bridge at the end of Act 1...I have NEVER been rendered unable to speak ever before. I was unable to breathe. No other media has impacted me this way before.

Also Dónal is such a sweetheart and got 110% more Irish when he asked at stage door were we were from and said Ireland.

#dónal finn#hadestown west end#hadestown uk#hadestown#This is a Dónal Finn stan account now#orpheus#hadestown musical

105 notes

·

View notes

Text

Understanding the 15% Global Minimum Tax: What Firms Need to Know

One of the most revolutionary moments in international taxation has been reached with the introduction of a global minimum tax at 15%. This effort is initiated by the OECD’s Inclusive Framework on Base Erosion and Profit Shifting to bring an end to aggressive tax avoidance and create a fairer environment for global tax. For accounting firms in the UK, knowledge of this policy is an essential requirement to inform its clients and assimilate its implications. This guide unpacks the essentials and provides actionable insights.

What is the 15% global minimum tax, and why does it matter?

The global minimum tax is the pioneering effort to ensure multinationals pay a tax of at least 15% of their profit irrespective of the location of their headquarters or where they operate. The new law will end the arms race in cutting corporate tax rates of countries, thereby addressing the long-standing issue of tax competition.

This tax matters because it:

It helps in curbing profit shifting to low-tax jurisdictions.

It levels the playing field for businesses worldwide.

It also gives governments extra tax revenue, estimated to be £125 billion per annum.

The policy will redefine how UK-based firms working with international clients advise on tax planning.

How does the global minimum tax work?

It works off primarily with two critical rules:

Income Inclusion Rule (IIR): The parent companies have to pay the difference if subsidiaries in low-tax jurisdictions pay less than 15%.

Undertaxed Payment Rule (UTPR): Applied whenever the IIR cannot be applied, to redistribute taxes to other jurisdictions.

These rules aim at big MNCs whose annual revenues exceed EUR 750 million; most jurisdictions, including the UK, are going to see an effective start in 2024. Accounting firms must be aware of these mechanisms to advise clients on compliance.

Who will feel the impact of a global minimum tax of 15%?

This tax will impact most significantly in:

Multinationals: Especially those operating out of low-tax jurisdictions.

High-profit business: Especially technology and pharmaceutical, where intellectual property changes profits to tax havens.

UK businesses: Especially those with global operations or subsidiaries in countries where tax rates are less than 15%.

SMEs are exempt, but firms assisting MNCs must be prepared to face a concomitant increase in demand for compliance and advisory services.

Why should UK accountancy practice care about the global minimum tax?

The global minimum tax policy is an issue that brings several challenges and opportunities to UK accountancy practice.

Challenges include:

Complex compliance landscape: New rules mean multi-jurisdictional tax calculations must be adapted.

Increase in reporting requirements: Groups will need detailed information on their global operations.

Opportunities include:

Growth in advisory: Positioning groups as global tax compliance experts.

Digital solutions: Using technology to help simplify reporting and compliance

What steps can accounting firms take to prepare for the global minimum tax?

Preparation is key to managing the complexities of this new tax regime. Firms should consider the following strategies:

Invest in technology and training:

Adopt tax software with global compliance capabilities.

Train staff on the nuances of international taxation.

Strengthen cross-border expertise:

Build partnerships with tax advisors in other jurisdictions.

Stay updated on OECD and UK-specific developments.

Review client portfolios:

Identify clients affected by the policy.

Develop tailored strategies for compliance and minimising tax liabilities.

How will the global minimum tax change tax planning strategies?

The era of aggressive avoidance is over. The firm has to shift towards sustainable tax planning in all of the following areas:

Substance over form: Operations should align with economic activities within each jurisdiction.

Alignment at a global level: Tax policies of all countries of operation to be coordinated properly.

Transparency: Open reporting with avoidance of penalties.

Would a global minimum tax be good news for UK accountancy?

Despite the challenges, a 15% global minimum tax might aid the UK accountancy sector in the following ways:

Higher expertise: Position the UK firms as leaders of global tax advisory practice

Higher revenues: Increase new services on compliance and reporting

Make firms innovate: Forcing firms to get involved with complicated tax technologies.

With such opportunities, the industry is sure to flourish in today’s fast-paced tax landscape.

What next for the future of global taxation?

The global minimum tax is just the beginning of a shift toward more equitable, transparent, and fair taxation. In this respect, firms should get ready for:

More cooperation: Between countries with the aid of closing loopholes.

Digital tax reforms: Addressing issues thrown up by digital businesses.

Ongoing adjustments: To ensure that the policy remains effective in an era of changing global economies.

UK accounting firms will have to be visionary and proactive in a highly dynamic environment.

Conclusion

The 15% global minimum tax is a landmark shift in international taxation with significant implications for UK accounting firms and their clients. If the mechanics of the new tax are understood, if preparation for compliance is made, and the opportunities that now arise through the new tax are seized on, firms can turn this challenge into a growth opportunity.

We, at Integra Global Solutions, provide expert support to accounting firms and guide them through the complexities of the tax landscape. With our bespoke solutions, you can be assured of compliance, reduced risk, and exploration of new opportunities. Discover our services and start your journey toward thriving in this new era of global taxation.

0 notes

Text

Navigating Financial Excellence: Tailored Bookkeeping Solutions for Small Business

In the intricate world of small business operations, effective bookkeeping serves as the cornerstone of financial stability and growth. At Corient Business Solutions, we understand the unique needs of small enterprises, offering specialized bookkeeping services designed to empower your business with precision and efficiency.

Small Business Bookkeeping: A Strategic Imperative

Explore the strategic imperative of small business bookkeeping with Corient Business Solutions. Our dedicated team ensures meticulous recording of financial transactions, providing a solid foundation for informed decision-making. Small businesses can rely on our expertise to navigate the complexities of financial management with ease.

Bookkeeping Services Near Me: Local Expertise, Global Standards

Corient Business Solutions brings a global perspective to local businesses with our bookkeeping services near you. Benefit from the convenience of accessibility combined with the standards of excellence that our professionals uphold. Our local presence ensures that you have a trusted partner who understands the nuances of your business landscape.

Accounting Services for Small Business: Comprehensive Solutions

Experience the comprehensive approach of accounting services for small business at Corient Business Solutions. Our services go beyond basic bookkeeping, encompassing financial reporting, analysis, and proactive financial advice. Small businesses can rely on our tailored solutions to enhance financial efficiency and drive sustainable growth.

QuickBooks Bookkeeping: Streamlining Financial Processes

Corient Business Solutions integrates the power of QuickBooks bookkeeping to streamline your financial processes. Our experts leverage the capabilities of QuickBooks to ensure accuracy, efficiency, and seamless management of financial data. Say goodbye to manual bookkeeping challenges and embrace a technology-driven approach.

Bookkeeping Business: Your Partner in Financial Success

Corient Business Solutions is not just a bookkeeping service; we are your dedicated partner in financial success. Our commitment is to provide scalable, efficient, and customized solutions that align with the unique needs of your bookkeeping business. Focus on your core business activities while we take care of the intricacies of financial management.

Bookkeeping: Simplifying Complexity

Simplify the complexity of financial management with Corient Business Solutions' dedicated bookkeeping expertise. Our team ensures accuracy, compliance, and timely reporting, allowing you to make informed decisions with confidence.

Bookkeeping Services and Bookkeeper Near Me: Your Local Experts

Discover the advantage of having a reliable bookkeeper near you. Corient Business Solutions combines local expertise with global standards, offering personalized services that address the unique challenges faced by businesses in your vicinity.

Conclusion

In conclusion, Corient Business Solutions stands as your partner in navigating financial excellence. Explore our bookkeeping services, and witness the transformative impact of tailored solutions designed for small businesses. Embrace precision, efficiency, and growth with Corient, your trusted ally in the journey towards financial success.

0 notes

Text

Been there already haven't we

#I honestly don't know which is worst#between the uk account coming up with ideas and the us one reusing them a year later#les mis#les miserables#les mis twitter#les mis socials fucked up#les mis socials fucked up 2024

101 notes

·

View notes

Text

some donation links:

Gaza Funds (individual funds) https://www.gazafunds.com

Care for Gaza campaign https://www.gofundme.com/f/CareForGaza

Medical Aid for Palestinians https://www.map.org.uk

Daily click with proceeds going to UNRWA https://arab.org/click-to-help/palestine/

#free palestine#from the river to the sea palestine will be free#all eyes on rafah#other in the uk make sure to look up your local mp candidates' stances on palestine and if they havent published one then write to them#call them - meet with them - show them that their communities care and will hold them accountable no matter what the election outcome is#artists on tumblr#evandered

73 notes

·

View notes

Text

Girl help! The USA and UK are [redacted] again

#her' some rng psots#randomly generated tumblr posts#randomly generated posts#gimmick blog#gimmick account#into the gimmickverse#usa#us#uk#united states#united kingdom#[redacted]#meme#joyful cheer#joyus whimsy

20 notes

·

View notes

Text

REBLOG IF NETFLIX CUSTOMER SUPPORT IS GONNA BE YOUR NEW THERAPIST UNTIL THEY TAKE BACK THE CANCELLATION

#they will NOT hear the last of me#i will make as many email accounts as it takes#i will continue to tell them that I am never paying for their services again because they have treated me as a consumer with utter disregar#d#netflix#netflix uk#dead boy detectives#dead boy detective agency#dbda#bridgerton#stranger things#save daredevil#save shadow and bone

51 notes

·

View notes

Text

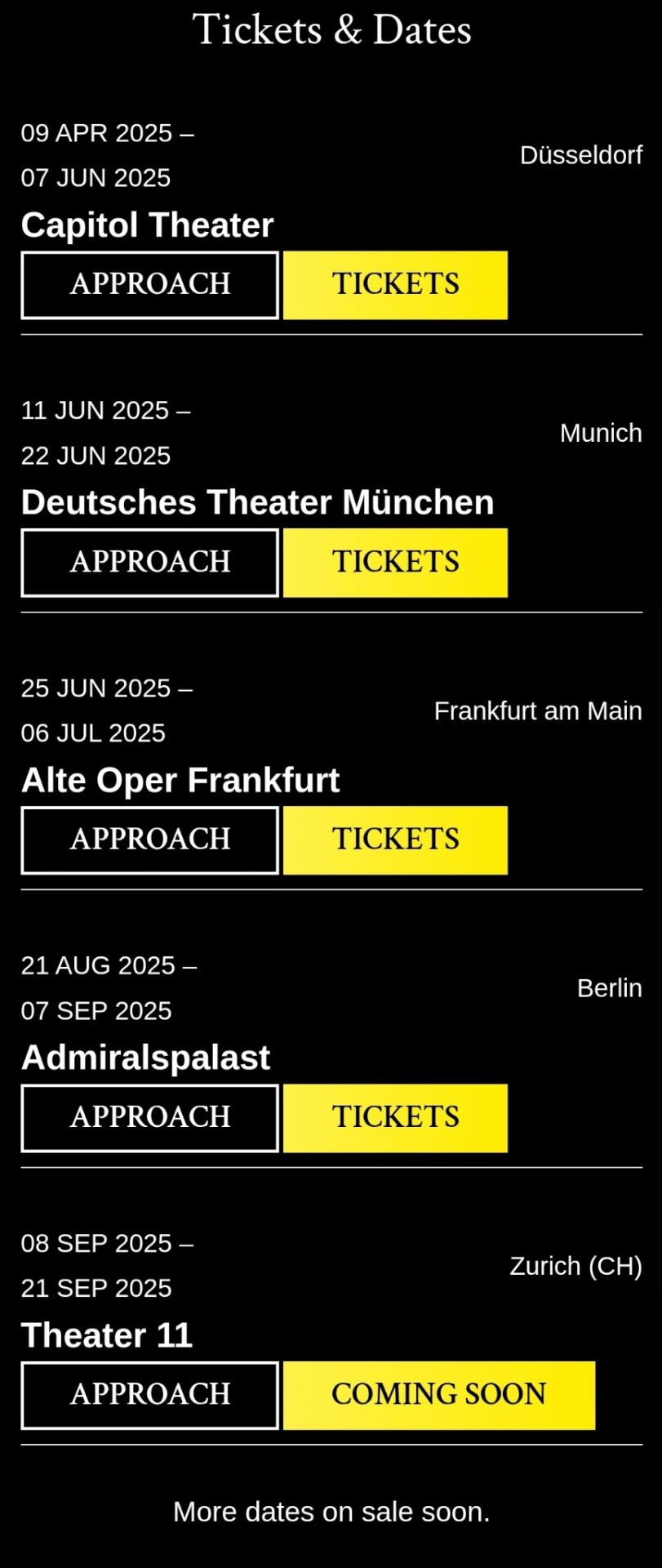

It seems like they have announced another leg of the International Tour, this one scheduled to start in April 2025 and tour Germany, Austria, and Switzerland.

We will see what else is next!

#CATS Musical#CATS the Musical#CATS International Tour 2025#CATS UK Tour 2025#(At this point these tags are going to be confusing will all the legs)#CATS European Tour 2025#As far as I can tell it will be the International Tour continuing#They have a link to the main CATS accounts and website#And nothing in regards to casting or creative team

33 notes

·

View notes

Text

gene genie 😵💫

#i forgot to post this on tumblr oops#life on mars#life on mars uk#lom#gene hunt#my art#first time drawing gene btw i had no idea what i was doing the entire time 😭#yes hes coatless i dont know i just like drawing characters without 'em sometimes#2nd art post in this account who cheered 😵

53 notes

·

View notes